Clay vs Cognism (2026): Which One Fits Your Outbound Stack?

Most "clay vs cognism" debates go nowhere because people compare them like they're the same kind of tool. They aren't.

Clay is a workflow engine for enrichment: you build tables, run waterfalls across many providers, and add your own logic. Cognism is a proprietary database with a compliance-first posture and a "verified mobile" motion (especially strong in EMEA).

Here's the thing: if your average deal size is closer to SMB than enterprise and you aren't dialing hard into EMEA, you probably don't need a big platform database contract. You need verified emails, a few clean mobiles, and a repeatable list workflow.

30-second verdict

Clay wins if you're RevOps-led and want enrichment orchestration: multi-source waterfalls, custom routing, and "if/then" logic across your stack. Cognism wins if you're sales-led and need compliant prospecting + dialing in EMEA, with a strong verified mobile workflow. Skip both if you mainly need fresh, verified emails + mobiles with predictable self-serve pricing.

Clay vs Cognism: the real difference (it's architecture)

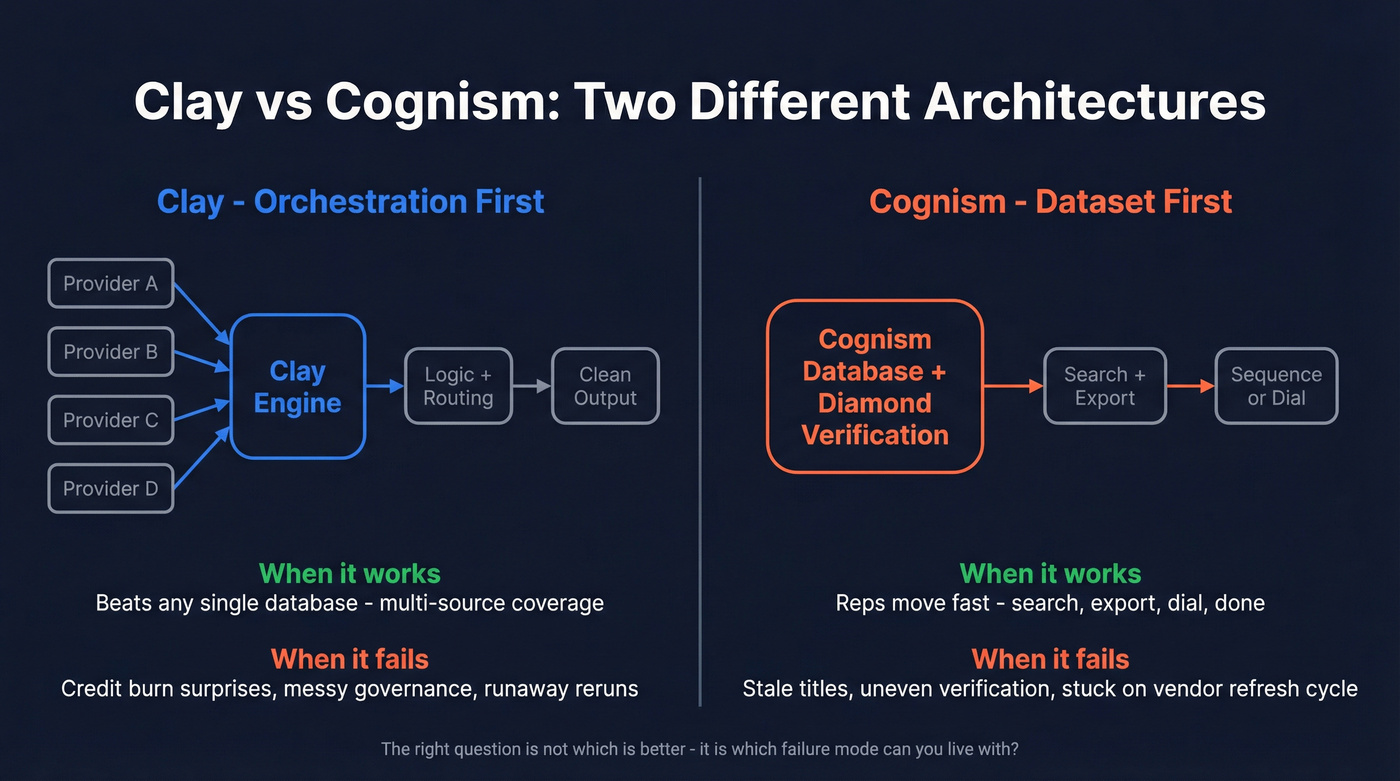

This isn't a head-to-head feature fight. It's two different architectures with two different failure modes.

Cognism is dataset-first. You're buying access to their database, their compliance posture, and their mobile verification program (Diamond). When it works, reps move fast: search -> export -> sequence/dial. When it doesn't, it fails like databases fail: stale titles, wrong numbers, missing coverage in your niche, and you're stuck waiting for the vendor's refresh cycle.

Clay is orchestration-first. You're buying a system to combine data sources, run logic, and enrich at scale. When it works, you can beat any single database because you're not betting on one source. When it doesn't, it fails like automation fails: credit burn surprises, messy governance, and "why did this table rerun 20,000 rows overnight?"

I've seen teams pick Clay expecting "a better database," then get frustrated when they realize they still need to choose providers, set rules, and measure outcomes. I've also seen teams buy Cognism expecting "verified direct dials everywhere," then get annoyed when verification is uneven by region and role.

The right question isn't "which is better?" It's "which failure mode can we live with?"

Comparison table (features, cost mechanics, compliance, time-to-value)

Clay vs Cognism (and Prospeo) at a glance

| Category | Clay | Cognism | Prospeo |

|---|---|---|---|

| Core model | Orchestration | Proprietary DB | Verified data layer |

| Best for | RevOps workflows | Sales prospecting | Fresh email + mobile |

| Pricing mechanic | Credits | Seats + packages | Self-serve credits |

| Public pricing | Yes | No | Yes |

| Time-to-value | Days to weeks | About a month | Same day |

| EMEA compliance | Source-dependent | Strong | GDPR + opt-out |

| Phone strength | Strong (if configured) | Diamond mobiles | 125M+ verified mobiles |

| Compared to ZoomInfo | More flexible | EMEA-first | Self-serve, fresher |

G2 snapshot (subratings + respondents)

From the Clay vs Cognism comparison on G2:

- Meets requirements: Clay 9.1 (158) vs Cognism 8.7 (1,061)

- Ease of use: Clay 7.8 (161) vs Cognism 9.0 (1,081)

- Ease of setup: Clay 7.6 (69) vs Cognism 9.1 (625)

Cognism's G2 profile also shows an average about 1 month time to implement.

What most comparisons miss (and what'll bite you later)

- Clay's trial doesn't include phone number enrichments. If dialing is your deciding factor, you can't "trial your way" into a phone verdict.

- Cognism's Diamonds-on-Demand isn't guaranteed. Verification requests often return "Improved" or "No improvement," not a verified mobile.

- Cognism packaging shapes rep behavior. List/export limits and contacts-per-list caps quietly dictate how your team prospects.

Who should choose Clay vs who should choose Cognism

A useful signal is who owns the motion: RevOps building systems vs sales executing plays.

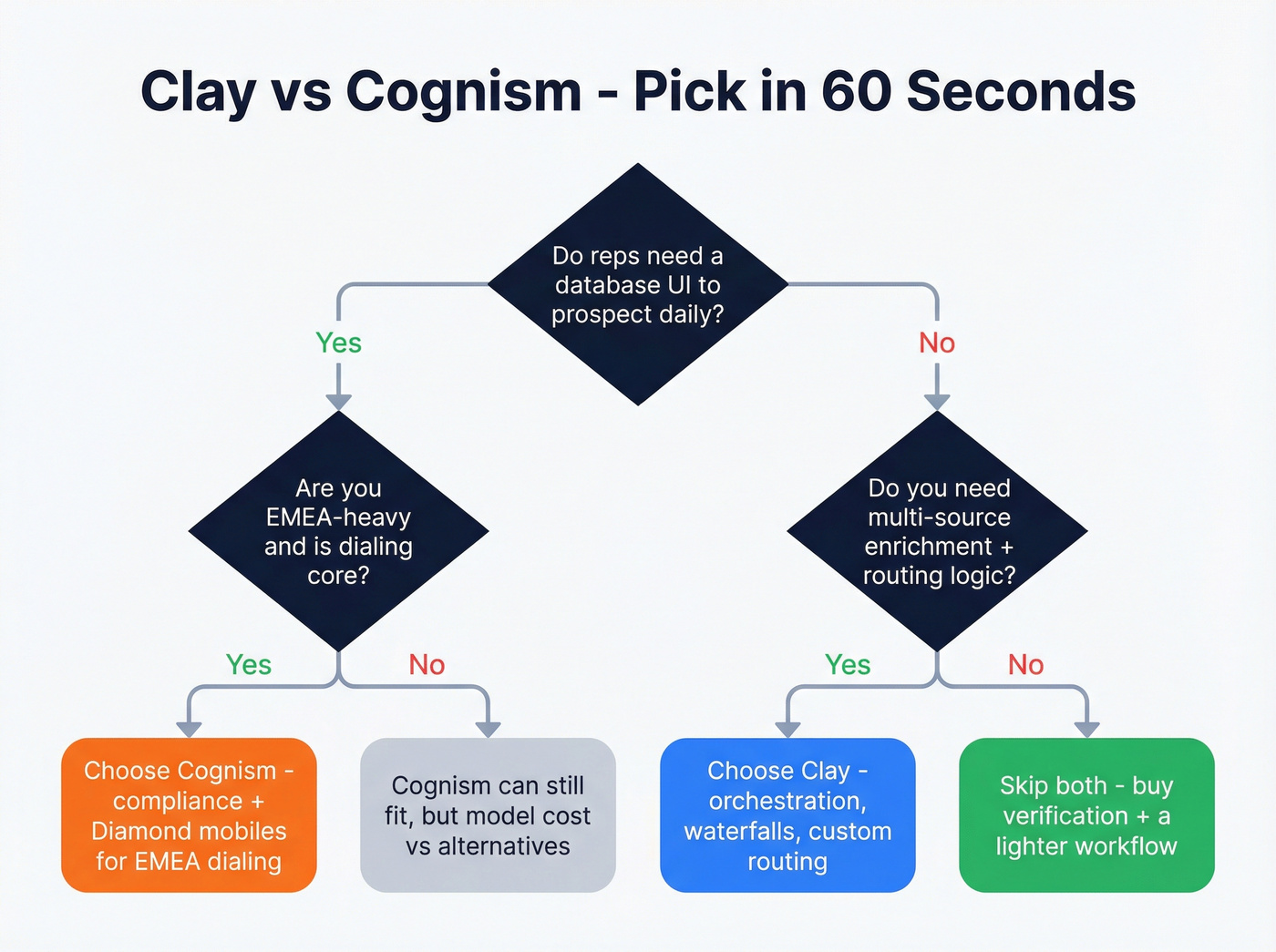

Mini decision tree (pick in 60 seconds)

Do reps need a database UI to prospect daily?

├─ Yes → Are you EMEA-heavy and dialing is core?

│ ├─ Yes → Choose Cognism

│ └─ No → Cognism can still fit, but model cost vs alternatives

└─ No → Do you need multi-source enrichment + routing logic?

├─ Yes → Choose Clay

└─ No → Skip both; buy verification + a lighter workflow

Choose Clay if...

- RevOps owns outbound plumbing. You've got someone who enjoys building systems, not just using them.

- You need multi-provider waterfalls. "Try provider A, then B, then C" for email, firmographics, technographics, job changes, and more.

- You need custom routing. Example: "If company is hiring SDRs + uses Salesforce + headcount 200-1,000, route to Sequence X; otherwise Sequence Y."

- You're feeding multiple destinations. If you're pushing to Salesforce/HubSpot plus Outreach/Salesloft plus a warehouse, Clay's table-first model is a real advantage.

Clay's the obvious pick when "data" is really an ops problem: dedupe, enrichment, scoring, routing, and repeatable list production.

One warning, though.

If nobody owns governance, Clay turns into an expensive science project.

Choose Cognism if...

- Sales needs a clean prospecting experience. Reps want to search, build lists, export, and move on with their day.

- EMEA dialing is core to your motion. Cognism's compliance posture and TPS/DNC scrubbing coverage is built for this.

- You're buying "verified mobile" as a strategy. If your team's win rate depends on conversations, not just emails, Cognism's Diamond motion is the reason to pay.

If you're running a classic outbound pod (SDRs + AEs) and you want governed data with minimal ops overhead, Cognism's the safer bet.

Don't choose either if...

- You're tired of bounced emails and stale records and you mainly want freshness + verification with predictable self-serve economics.

- You don't want annual contracts or seat-minimum games.

- You want a verification benchmark you can trust across providers.

Clay charges you credits to orchestrate data you still need to verify. Cognism locks you into seat-based contracts for mobiles that aren't guaranteed. Prospeo gives you 98% verified emails, 125M+ direct dials, and a 7-day refresh cycle - all self-serve at $0.01/email with no annual commitment.

Stop paying for orchestration overhead or contract gates. Just get verified data.

Pricing & packaging reality (credits vs seats, and the hidden constraints)

Pricing is where this decision gets painfully real, because they punish different kinds of "scale."

Clay punishes volume + reruns + complexity. Cognism punishes headcount + contract structure.

Clay pricing (transparent) - what you actually get

Clay's pricing is clear on Clay's pricing page:

| Plan | Price (annual) | Credits/year | Rows per search |

|---|---|---|---|

| Free | $0/mo | 1,200 | up to 100 |

| Starter | $134/mo | 24K | up to 2,000 |

| Explorer | $314/mo | 120K | up to 10,000 |

| Pro | $720/mo | 600K | up to 25,000 |

| Enterprise | Custom | Custom | API unlimited |

Two details matter more than the sticker price:

- Unlimited users on all plans. That's rare, and it changes the math for RevOps-heavy teams.

- Annual billing is about 10% cheaper and gives all credits upfront. Great for planned projects. Dangerous if you don't put guardrails on who can run what.

Clay's trial is also specific: 14 days, 1,000 credits, and phone number enrichments aren't available during trial. If phones are your north star, plan your evaluation around that constraint.

Clay credits: why two teams pay wildly different amounts

Clay's credit system is the #1 reason teams love it and the #1 reason they rage-quit it.

What drives cost variance:

- Auto-update: great for freshness, brutal for budgets if you don't scope it.

- Reruns: re-running columns is basically re-paying for enrichment.

- AI columns: they feel cheap until you run them across 50,000 rows.

- Stopping mid-run still costs: you don't get a panic-button refund because you noticed a mistake late.

- Rollover caps: monthly unused credits roll over, but capped at 2x your monthly limit; annual rollover is limited (15% on renewal).

- Refunds exist, but they're not a strategy: you'll get credits back when providers refund Clay, but you can't plan a budget around refunds.

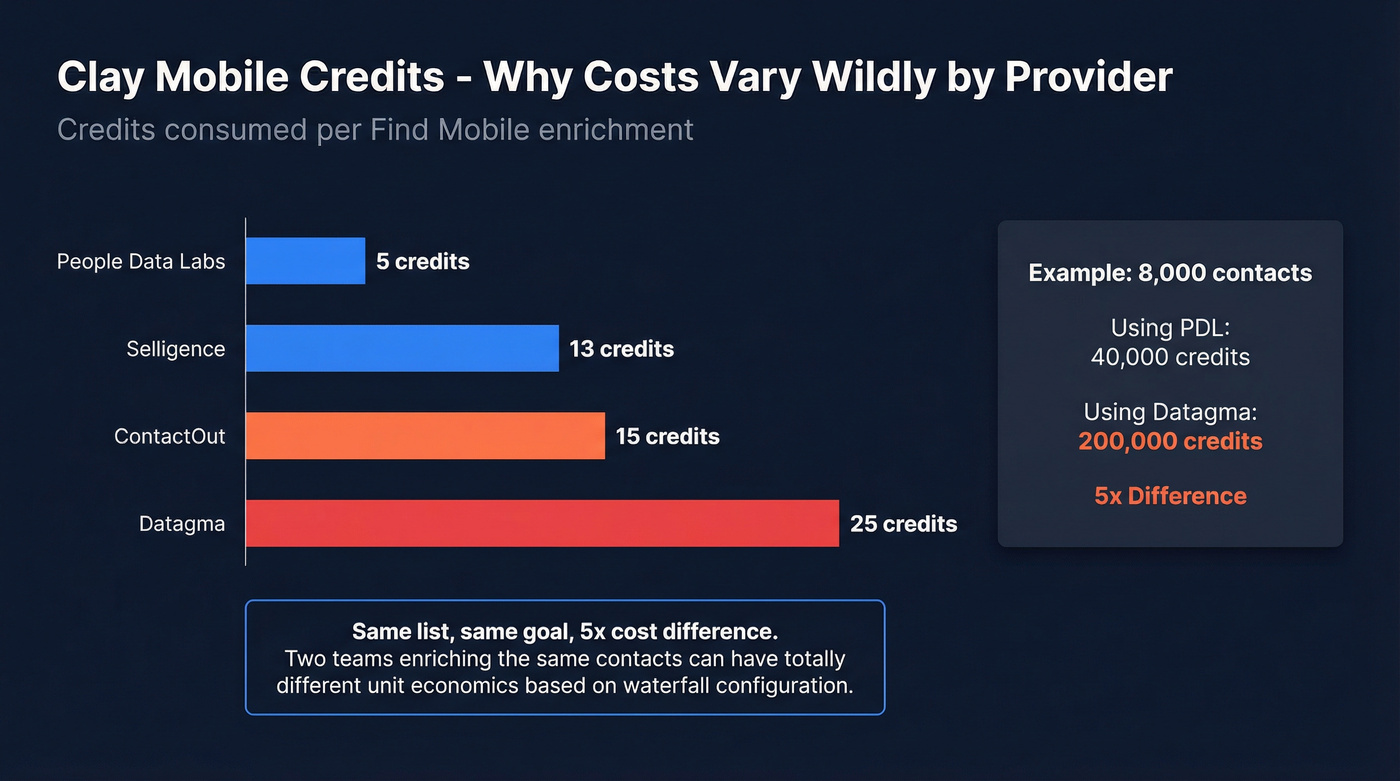

And yes, mobile numbers are where budgets go to die. Clay's own calculator shows "Find Mobile" starts at 2 credits, but jumps depending on provider:

| Provider | Typical credits (Find Mobile) |

|---|---|

| People Data Labs | 5 |

| Selligence | 13 |

| ContactOut | 15 |

| Datagma | 25 |

That means two teams enriching "the same" list can have totally different unit economics based on which providers they hit and how they configured the waterfall.

One more lever: BYO keys. Clay lets you bring your own API keys to certain providers. That's how advanced teams keep Clay as the orchestration layer while negotiating variable costs directly with vendors.

Cognism pricing (not public) - what you can model anyway

Cognism pricing is custom-quote. Annoying for spreadsheets, normal for this category.

What the packaging grid still tells you:

- Seat-based access, with unlimited admin access

- Two packages: Grow and Elevate

- Lists & exports: Grow = 3, Elevate = 10

- Contacts per list: Grow = 250, Elevate = 500

- Elevate adds signals like job changes, funding, hiring, M&A, plus intent and technographics

Important nuance: Cognism lets admins select 12 intent topics from 11,000+ options (Bombora Company Surge). That's plenty if you're focused, and a headache if every segment wants its own intent set.

Cognism also markets "no credit ceilings" plus unrestricted views and exporting. Your constraints are seats + packaging, not per-action credits. That's the cleanest contrast with Clay.

For a 5-10 seat team, it's common to see roughly $20k-$60k/year depending on region, modules, and mobile verification needs, usually on an annual contract with multi-seat minimums.

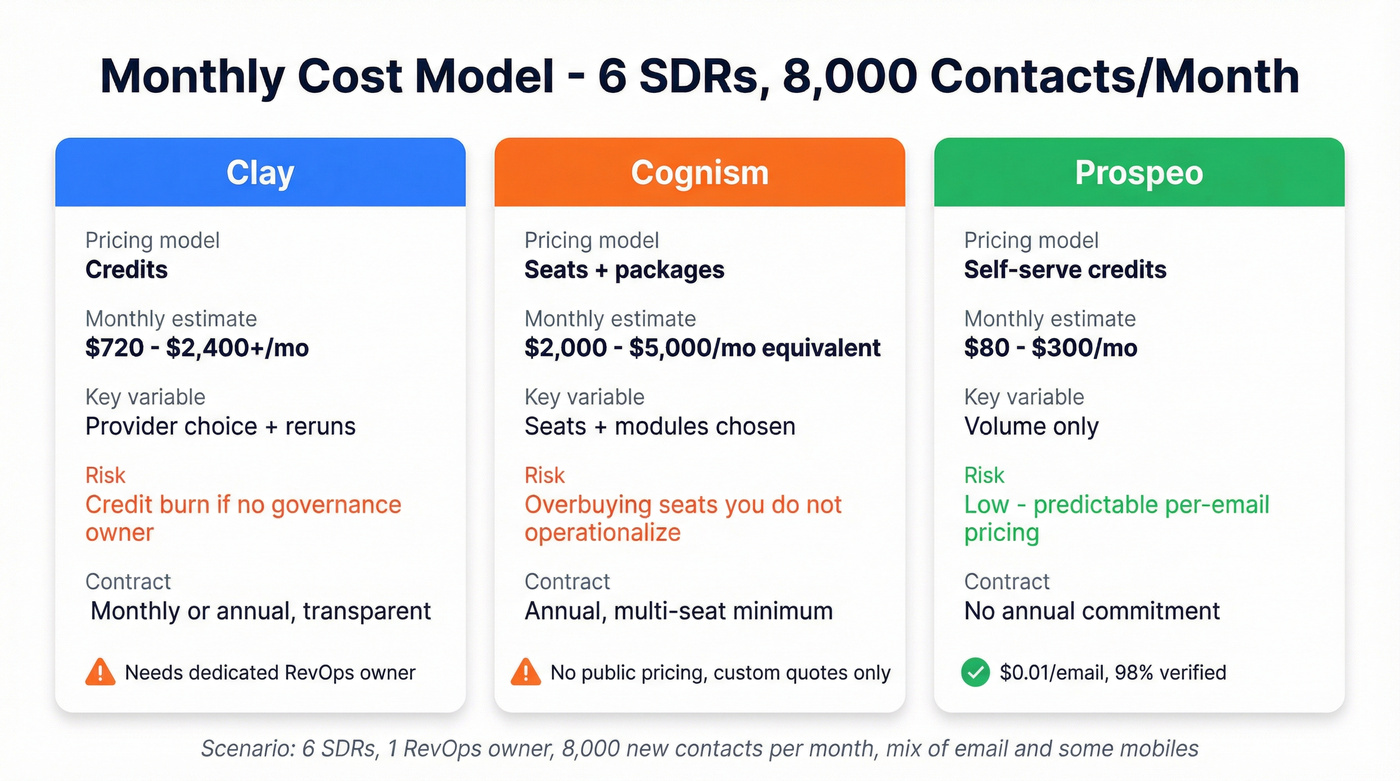

Sample cost model (so you can sanity-check fast)

Here's a simple way to model "what'll this cost me per month?" without pretending you can predict everything.

Scenario: 6 SDRs, 1 RevOps owner. You need 8,000 new contacts/month (mix of email + some mobiles).

- Cognism-style seat model: 6 seats + platform access often lands around $2k-$5k/month equivalent on an annual contract for teams in this range (varies a lot by region/modules). Unit cost is stable; your risk is overbuying seats/modules you don't operationalize.

- Clay-style credit model: monthly cost is credits burned, which depends on reruns + provider choice. If your workflow averages 2-6 credits per contact (easy to hit once you add multiple steps), 8,000 contacts becomes 16k-48k credits/month before you count mistakes, reruns, or auto-update.

My recommendation: if you can't name the person who'll own governance, don't buy a credit-based orchestration tool and hope it'll "just work."

Quick TCO heuristic

- Credits beat seats when you're ops-led and you can control runs. Enrich in batches, reuse data, avoid reruns, and Clay can be very cost-effective.

- Seats beat credits when you're rep-led and you want predictable usage. If 20 reps are prospecting daily, a seat model is easier to govern than "who burned the credits?"

- Phones flip the math. If direct dials are your core channel, Cognism's Diamond motion can justify the contract. If phones are nice-to-have, mobile enrichment costs in orchestration workflows can get silly fast.

Data quality (freshness & phone verification)

Data quality is where both tools get overhyped by people who don't run real outbound.

Cognism sells "verified mobiles." Clay sells "multi-source waterfalls." Both can be true and still underperform for your ICP, because your ICP is where coverage gaps and stale records show up first.

Cognism Diamond Data vs Diamonds-on-Demand (what you really get back)

Cognism reports 87% connect from an independent study of 1,000 mobile calls. Treat that as a directional vendor metric, not a universal guarantee.

The operational detail that matters more: Diamonds-on-Demand doesn't always return a verified mobile. On-demand verification results come back as:

- Diamond Verified (verified mobile)

- Improved (new data, not verified to Diamond standard)

- No improvement

Expected outcomes vary by region:

- UK: 10-15% verified + 10-15% improved

- US: 15-20% verified + 15-20% improved

If your reps think "request verification = guaranteed direct dial," you're going to have a bad quarter.

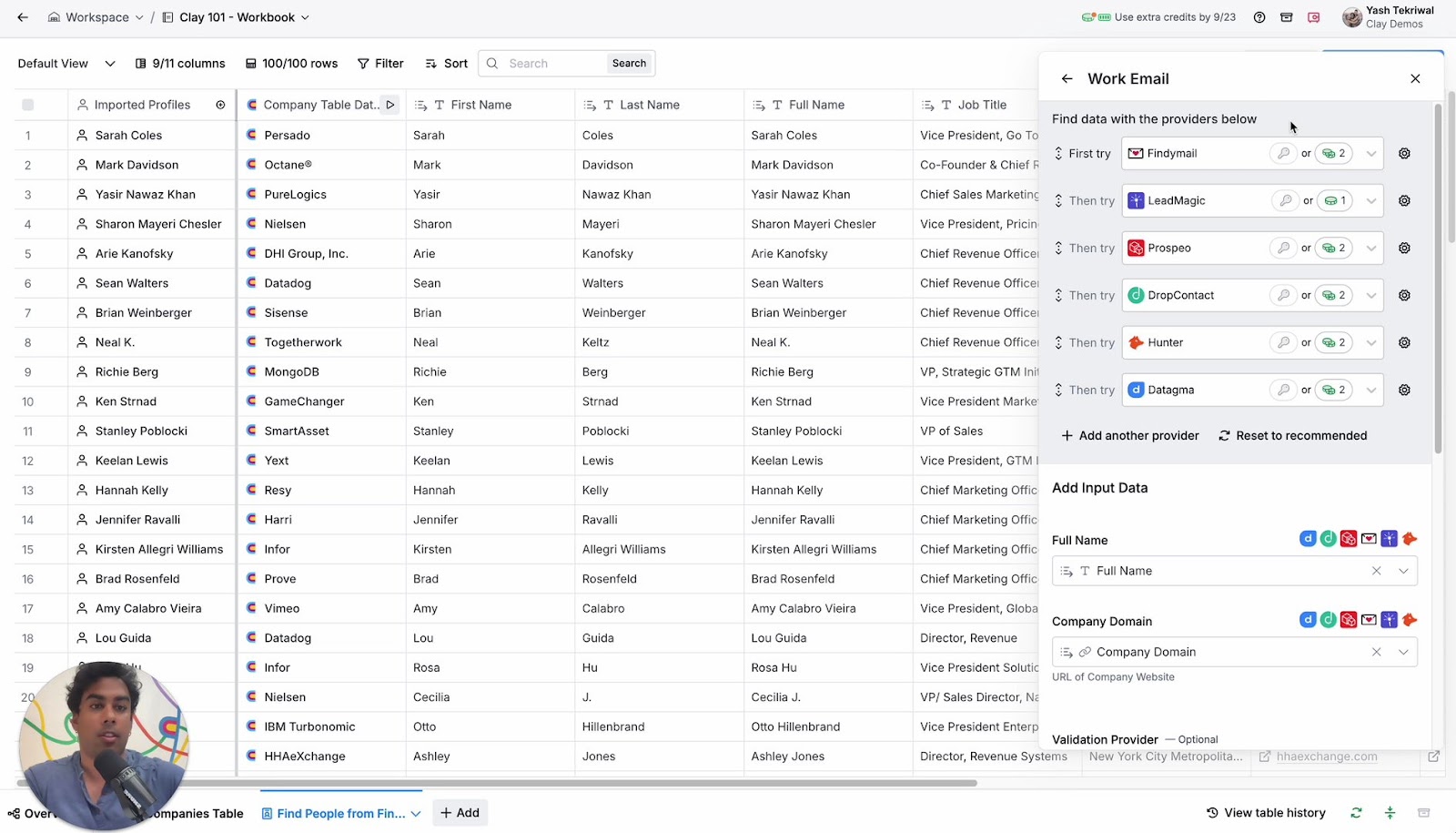

Clay's data reality: you're only as good as your providers + reruns

Clay's big promise is orchestration: multi-source waterfalls that often beat single-source coverage.

But Clay doesn't create truth. It creates process.

Pick weak providers and you'll get weak data faster; don't rerun and your data decays; rerun too often and you'll burn credits; skip governance and you'll push duplicates and junk into your CRM at scale, then spend Fridays cleaning up the mess you created on Tuesday.

Compliance & risk (especially EMEA)

If you're selling into the UK/EU, compliance isn't a legal checkbox. It's a go-to-market constraint.

Cognism puts real specifics on the page:

- GDPR and CCPA aligned

- ISO 27001 and ISO 27701

- SOC 2 Type II

- Lawful basis: legitimate interest (GDPR 6.1(f))

- "Notified database" approach (contacts are notified of inclusion within GDPR timeframes)

- 15 DNC/TPS scrubs across countries including UK (TPS/CTPS), US, Australia, New Zealand, Germany, France, Ireland, Canada, Spain, Portugal, Croatia, Sweden, Belgium

That's why Cognism wins so often in EMEA bake-offs. Compared to ZoomInfo, Cognism's compliance posture is clearer and more EMEA-native.

Clay is different: it's not "non-compliant," it's compliance-by-design only if you design it that way. Your risk depends on which providers you connect, what you store, how you handle opt-outs, and how you sync to your CRM/sequencer.

Workflow fit & time-to-value (ops overhead is the hidden cost)

Most teams mis-buy here. They compare feature checklists, then ignore the operating model: who runs it, who debugs it, and who gets paged when it breaks.

Cognism's average implementation time of about a month tracks with reality: CRM integration, permissions, governance, enablement, and getting reps to actually use it.

Clay can be useful in a day and fully operational in a month, depending on how ambitious you get.

Clay workflow reality (and the cap nobody mentions)

Clay is a table-first automation environment. You'll build enrichment columns, waterfalls, and logic that looks simple until it isn't.

One constraint that matters if you prospect in big pulls: Clay caps prospecting rows per search by plan. Pro increases the cap to 5,000 rows per search. If your motion relies on "pull huge lists then filter," that cap forces a different workflow.

My opinion: Clay's unbeatable when you treat it like a production system: versioned workflows, locked columns, and a clear owner. Treat it like a toy and it'll happily burn your credits and your week.

Cognism workflow reality (simple, governed, but packaged)

Cognism is built for sales execution: search, filters, list building, exports, and a governed dataset. It's easier for reps to adopt (G2 ease of use 9.0 vs 7.8).

The hidden constraint is packaging mechanics: list/export limits and contacts-per-list caps shape how reps work. If your team lives in big lists, those caps will annoy them. If your team works account-by-account, it's fine.

Build vs buy (the n8n temptation)

You can rebuild a lot of Clay's logic in n8n.

I watched a team do the n8n rebuild after they got tired of Clay credit surprises. They saved money on run-rate, but they paid in engineering time and ongoing maintenance, and every "small change" turned into a mini project because requirements never sit still for long in outbound.

Cost control playbook (how teams stop surprises)

If you buy Clay or Cognism and don't put guardrails in place, you're choosing to be surprised later.

Clay: stop credit burn before it starts

Do:

- Turn off auto-update by default. Only enable it where freshness is worth the spend.

- Lock your waterfall order. Changing providers midstream is how you accidentally rerun everything.

- Use formulas before AI. AI columns are great, but they're the easiest way to rack up costs quietly.

- Batch runs. Enrich 500-2,000 leads, validate outcomes, then scale.

- Use BYO keys where it makes sense. It's the cleanest way to control unit costs.

Don't:

- Don't rerun columns casually. Reruns are the silent budget killer.

- Don't stop mid-run expecting it to be free. It still costs.

- Don't assume mobile enrichment is "2 credits." Provider choice can push it to 5/13/15/25 credits.

Cognism: control usage with packaging-aware workflows

Do:

- Design around list/export limits. Grow gives you 3; Elevate gives you 10. Map that to how many active segments your team runs.

- Keep lists small and intentional. 250 vs 500 contacts per list sounds minor until reps try to build weekly call lists.

- Centralize admin governance. Unlimited admin access is great; use it for naming conventions, suppression rules, and export hygiene.

Don't:

- Don't let every rep invent their own segmentation taxonomy. You'll get duplicate outreach and messy reporting.

- Don't buy Elevate "for intent" unless you already know your 12 topics and how you'll operationalize them.

7-day POC plan (run a fair bake-off)

A fair POC is the fastest way to stop arguing and start knowing.

Two gotchas to plan around:

- Clay's 14-day trial doesn't include phone number enrichments. Test Clay's email workflows and match rates, then model phone costs on a paid plan if phones matter.

- Use a verification benchmark. If you can't independently validate emails/mobiles, you're just comparing two marketing claims.

Day 1-2: Define ICP + sample set (200-500 leads)

- Pick one ICP (don't boil the ocean): region, industry, headcount, titles.

- Build a 200-500 lead sample from your current CRM + a net-new slice.

- Define success thresholds:

- Hard bounce rate target (example: under 3-5%)

- Mobile pickup/connect target (whatever's realistic for your motion)

- Ops time target (minutes per 100 leads)

Day 3-4: Run enrichment + verification tests

Run three passes on the same sample:

- Cognism export: emails + mobiles (where available), plus any signals you care about.

- Clay enrichment: email-only in trial, but test your waterfall logic, match rates, and ops time.

- Verification benchmark: validate emails/mobiles on the same sample so you can score usable leads, not just returned fields.

Track:

- Match rate by field (email, mobile, company, title)

- Invalid/unknown rates

- Duplicates created (if you sync to CRM)

Day 5: Run outbound micro-campaign (email + dial where possible)

- Send a small email sequence (same copy, same sending setup) to each cohort.

- Dial the mobile numbers you have (your Cognism cohort will be the most meaningful here).

- Measure:

- Hard bounces

- Reply rate (positive + negative)

- Connect/pickup rate

- "Wrong person/wrong company" complaints

Day 6: Score results (cost/lead, bounce, connect, ops minutes)

Build a simple scorecard:

- Cost per usable lead (email + correct title + correct company)

- Cost per dialable lead (mobile that connects)

- Ops minutes per 100 leads

- Compliance confidence (especially if you're EMEA-heavy)

Day 7: Decide using a simple rubric

Use weights so you don't over-index on one metric:

- Compliance/risk: 25%

- Phones (connect outcomes): 25%

- Freshness/verification: 20%

- Cost predictability: 15%

- Ops overhead/time-to-value: 15%

If Cognism wins phones + compliance, it's your answer. If Clay wins ops flexibility + multi-source coverage, it's your answer. If both feel expensive or inconsistent, a verification-first data layer is usually the cleanest reset.

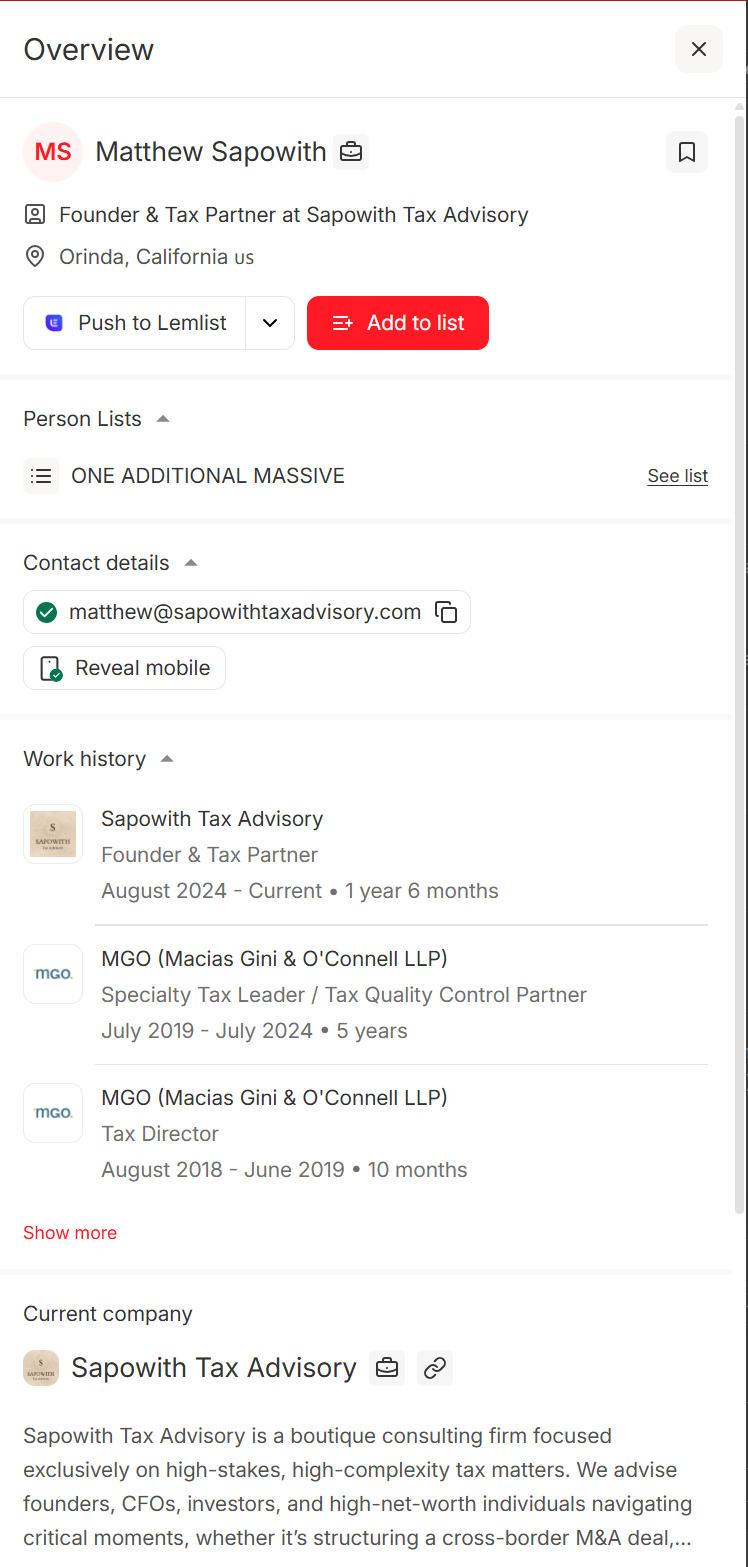

Skip-both option: Prospeo as the verified data layer

Look, a lot of teams don't need "more data." They need fewer bad records.

Prospeo is the publisher's product, and it's built for that exact job: verified emails and verified mobile numbers with a 7-day refresh cycle and self-serve pricing. You get 300M+ professional profiles, 143M+ verified emails with 98% accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, plus CSV/CRM enrichment that returns 50+ data points and hits an 83% enrichment match rate (and 92% API match rate) across typical B2B lists.

Skip this route if you want a rep-facing database UI with deep native prospecting workflows and you're happy signing a bigger annual contract. If you want accuracy, freshness, and predictable costs, this is the simpler path.

If your outbound motion doesn't need waterfall complexity or EMEA-only dialing, you're overpaying with Clay or Cognism. Prospeo delivers 300M+ profiles, 30+ search filters, intent data, and fresher records than either - refreshed every 7 days, not 6 weeks.

Same-day setup. No sales calls. Data that actually connects you to buyers.

FAQ: Clay vs Cognism (2026)

Is Clay a replacement for Cognism?

No. Clay's an orchestration layer, while Cognism's a prospecting database. Clay can output "contacts to message" only after you connect providers and build waterfalls; Cognism works out of the box for rep-led prospecting, especially for EMEA compliance and dialing.

Why does Clay get expensive at scale?

Clay gets expensive when workflows rerun, auto-update is enabled broadly, AI columns process large tables, and mobile enrichment hits higher-credit providers (often 5/13/15/25 credits, not the 2-credit starting point). The fix is governance: lock waterfalls, batch runs, and track cost per usable lead by segment.

Is Cognism worth it for EMEA outbound?

Yes, when compliance and dialing are core to your motion. Cognism's GDPR posture, certifications (ISO 27001/27701, SOC 2 Type II), and TPS/DNC scrubbing coverage reduce risk, and Diamond workflows can improve connect outcomes; it's less compelling if you mainly need verified emails at the lowest possible cost.

What's a good self-serve alternative if I want verified emails and mobiles?

Prospeo is a strong pick if you want accuracy and freshness without contracts: 143M+ verified emails at 98% accuracy, 125M+ verified mobiles with a 30% pickup rate, and a 7-day refresh cycle. The free tier includes 75 emails plus 100 Chrome extension credits per month, and paid plans stay credit-based and predictable.

Summary: how to decide

Decide based on operating model, not vibes.

Choose Clay when RevOps needs orchestration and multi-source enrichment. Choose Cognism when reps need a governed database for EMEA prospecting and dialing. And if your real requirement is simply verified, fresh contact data with transparent self-serve pricing, skip the platform contract and run a verification-first stack instead.