How to Build a Social Sales Cadence That Actually Gets Replies in 2026

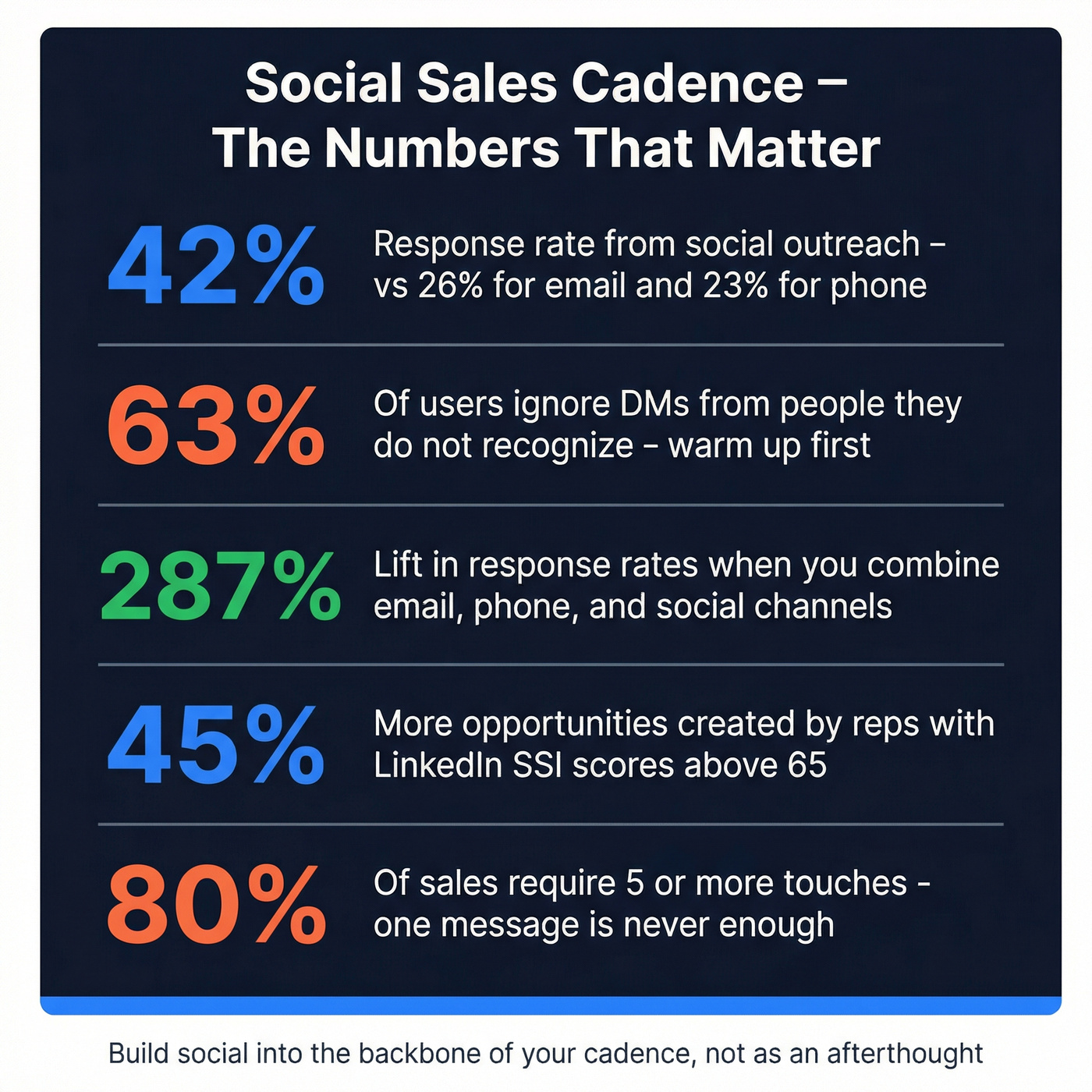

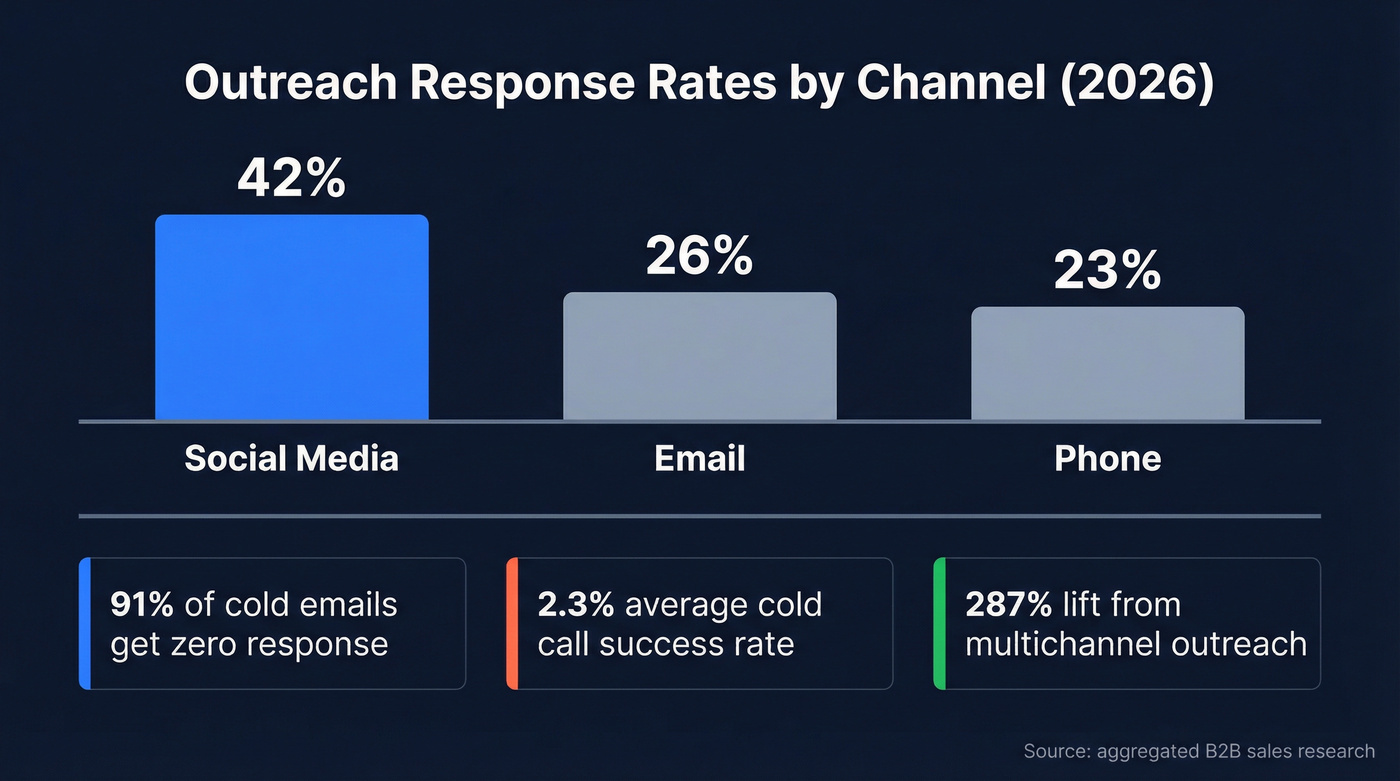

Cold DMs are dying. Templated personalization isn't fooling anyone, and the numbers prove it: social media outreach pulls a 42% response rate compared to 26% for email and 23% for phone. Meanwhile, 63% of users flat-out ignore DMs from people they don't recognize. Yet most social sales cadence designs still treat social as an afterthought - a single connection request wedged between seven emails. That's backwards, and it's costing you pipeline.

The reps crushing quota in 2026 aren't sending more emails. They're warming prospects on social before they ever type a subject line. Here's how to build a cadence that actually works - with day-by-day templates, example scripts, the data behind every recommendation, and the tools to execute it.

What You Need (Quick Version)

- Social is the backbone, not a checkbox. A 42% response rate vs. 26% for email means social touches should lead your cadence, not supplement it.

- Warm before you pitch. 63% of users ignore DMs from strangers. Profile views, content engagement, and genuine comments come first.

- Aim for 3-5 social touches in a 14-21 day cadence. Multichannel outreach combining email, phone, and social increases response rates by 287% compared to single-channel efforts.

- Your SSI score predicts pipeline. Below 50? You're invisible. Reps above 65 create 45% more opportunities.

- Your cadence is only as good as your contact data. Verify emails and phones before launching - a bounced email on Day 9 after a week of social warming is an unforced error.

That's the skeleton. Now let's build the muscle.

Why Social Is the Highest-ROI Channel in Your Cadence

The data here isn't subtle. Social media outreach generates a 42% response rate. Email sits at 26%. Phone at 23%. And yet most cadences are still 80% email.

Here's the thing: 91% of cold outreach emails get zero response. Cold calling success averages 2.3%. LinkedIn generates 277% more leads than Facebook and X combined. SDRs who follow defined cadences see 28% higher reply rates than those who wing it.

But response rates are only part of the story. The way buyers buy has shifted fundamentally. Between 80-90% of B2B buyers form their vendor shortlist before making formal contact, and 75% use social media to research vendors. Gartner found that 75% of B2B buyers now prefer a rep-free buying experience. They don't want to be sold to - they want to discover you on their own terms. Social is where that discovery happens.

McKinsey found that buyers engage across an average of 10 channels during their journey. The 287% multichannel lift makes sense in that context - teams combining email, phone, and social see nearly 3x the response rates of single-channel efforts. That's not incremental. That's structural.

And there's a trust component email can't replicate. 92% of B2B buyers engage with salespeople recognized as industry thought leaders. 84% say thought leadership improves their perception of a company. You can't build thought leadership through cold emails. You build it by showing up consistently on social.

Hot take: If your average deal size is under $10K, you probably don't need a 12-touch email-heavy cadence. You need a tight social-first sequence that builds trust fast and gets to a conversation in under two weeks. The enterprise playbook doesn't scale down - it just annoys smaller buyers.

You just spent two weeks warming a prospect on social. Don't blow it with a bounced email on the cross-channel follow-up. Prospeo delivers 98% email accuracy and 125M+ verified mobile numbers - so when your cadence shifts from LinkedIn to inbox, every message lands.

Verify every contact before you launch your cadence. Starting at $0.01 per email.

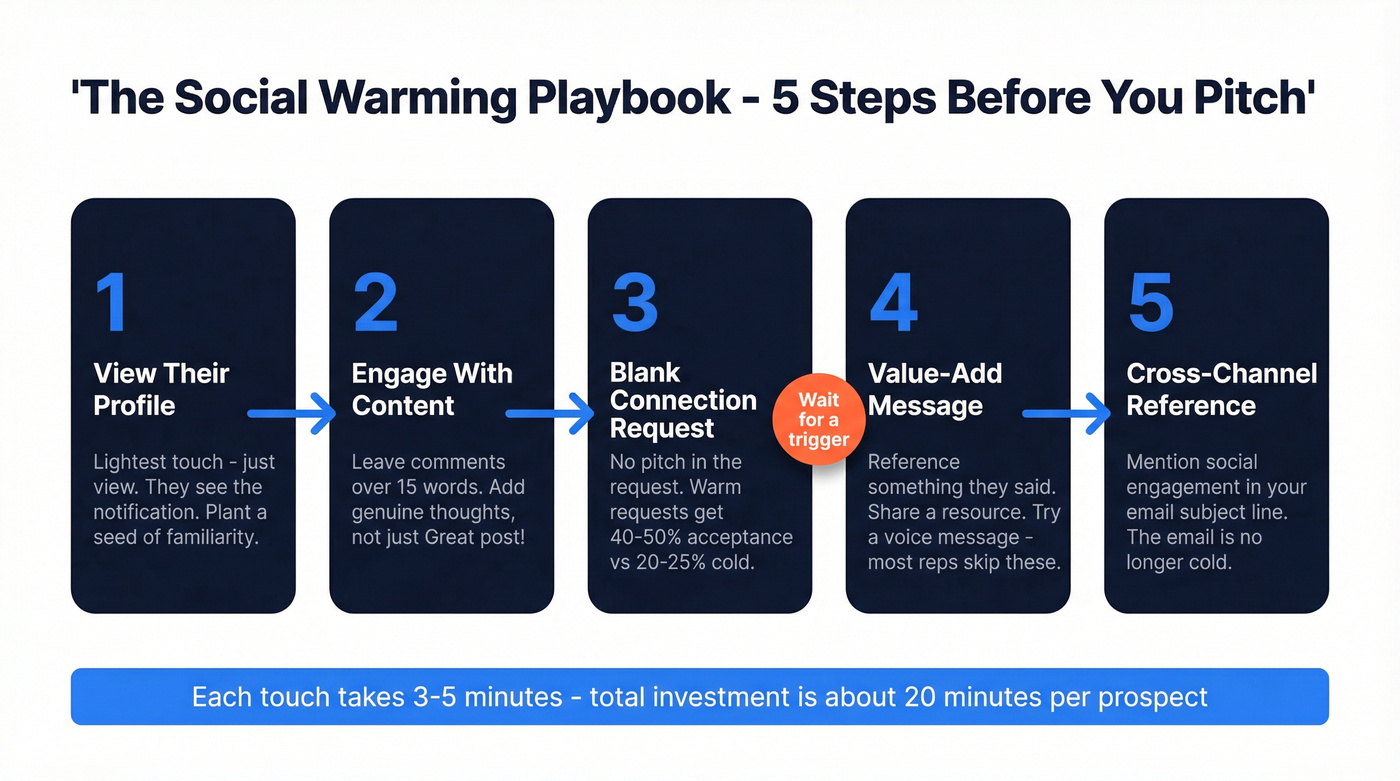

The Social Warming Playbook - 5 Steps Before You Ever Pitch

The biggest mistake in social selling is treating it like email with a different UI. It's not. Social is where you humanize yourself and put a face to a name. The selling happens later. Each social touch takes 3-5 minutes - this isn't a time sink, it's the highest-leverage 20 minutes in your day.

Step 1: View Their Profile

The lightest possible touch. View their profile. That's it. They'll see the notification, and it plants a seed of familiarity without any pressure. Do this 2-3 days before any other engagement.

Step 2: Engage With Their Content

Use Sales Navigator lead alerts to monitor when your ICP posts or comments. When they do, leave a relevant comment - not "Agree!" or "Great share!" Those are transparent and ineffective. Add a genuine thought. Reference something specific.

Comments over 15 words have double the impact of short ones. That's not a lot of words. But "Interesting point about pipeline velocity - we saw something similar when we shifted from monthly to weekly forecasting" is infinitely better than "Great post!"

Step 3: Send a Blank Connection Request

Blank connection requests outperform pitched ones. Acceptance rates with warm engagement run 40-50%, compared to 20-25% for cold requests. When they accept, send a simple "Thanks for connecting!" and stop.

Wait for a relevant trigger - a post about something related to their role and what you sell. That's your opening.

Step 4: Send a Value-Add Message

Now - and only now - you message. But you're still not pitching. You're referencing something they said, sharing a relevant resource, or asking a genuine question. Voice messages stand out here. Most reps don't use them, which is exactly why they work.

Sample DM after warming:

Hey Sarah - loved your post about ramping new SDRs faster. We ran into the same problem last quarter and found that pairing call recordings with live coaching cut ramp time by 3 weeks. Happy to share the playbook if useful. No pitch, just thought you'd find it interesting.

Sample voice message script (30 seconds):

"Hey Marcus, it's [Name] - we've been connected for a bit and I saw your post about outbound reply rates dropping. We just published some data on how multichannel cadences are pulling 3x the replies of email-only. I'll drop the link in your DMs. Would love to hear if you're seeing the same trends."

One practitioner on r/sales put it well: "Tag them in an article or another post asking them a question in the comments." That's engagement, not selling.

Step 5: Cross-Channel Reference

This is where the magic happens. Mention your social engagement in your email. Put it in the subject line or first sentence.

Sample cross-channel email:

Subject: Jake from LinkedIn - question about your pipeline post

Hey Jake,

We traded comments on your post about pipeline forecasting last week - your point about weekly vs. monthly reviews stuck with me.

Quick question: are you seeing the same drop in cold email reply rates that most teams are reporting this quarter? We just helped [similar company] shift to a social-first cadence and their reply rate jumped 40%.

Worth a 15-min call to compare notes?

I've seen teams double their email reply rates just by adding this one step. The prospect already recognizes your name. The email isn't cold anymore.

Three Social Sales Cadence Templates You Can Steal

Theory is great. Templates are better. Here are three cadences you can adapt to your sales cycle, deal size, and team structure. Remember: 80% of sales need 5+ touches, and defined cadences outperform ad-hoc outreach by 28%.

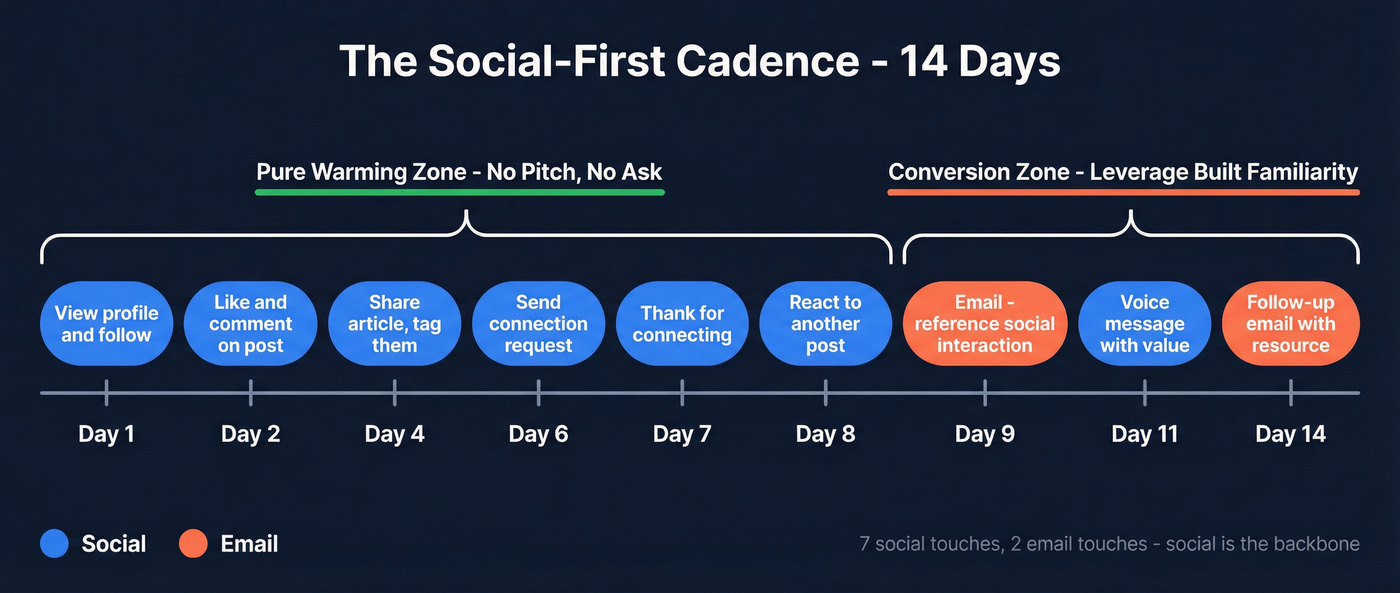

The Social-First Cadence (14 Days)

Best for selling to marketing leaders, founders, and anyone active on social. Social is the primary channel; email is the follow-up.

| Day | Channel | Action |

|---|---|---|

| 1 | Social | View profile, follow |

| 2 | Social | Like + comment on post |

| 4 | Social | Share article, tag them |

| 6 | Social | Send connection request |

| 7 | Social | Thank for connecting (if accepted; if not, re-engage with content) |

| 8 | Social | React to or comment on another post |

| 9 | Reference social interaction | |

| 11 | Social | Voice message with value |

| 14 | Follow-up with resource |

The key is patience. Days 1-8 are pure warming. No pitch. No ask. You're building familiarity so that when the email lands on Day 9, it's not cold. The prospect has seen your name five times already.

The Hybrid Multichannel Cadence (21 Days)

The workhorse cadence for most B2B sales teams. Eleven touchpoints across 21 days, interleaving email, social, and phone. LaGrowthMachine reports that multichannel sequences like this generate 3.5x more replies than email-only campaigns.

| Day | Channel | Action |

|---|---|---|

| 1 | Personalized cold email | |

| 2 | Social | View profile + follow |

| 4 | Social | Comment on their content |

| 6 | Phone | Call attempt #1 |

| 7 | Follow-up, new angle | |

| 9 | Social | Connection request |

| 11 | Social | DM with value-add |

| 14 | Case study or resource | |

| 16 | Phone | Call attempt #2 |

| 18 | Social | Voice message |

| 21 | Breakup email |

Notice the rhythm: no channel gets hit twice in a row. The social touches on Days 2 and 4 warm the prospect before the phone call on Day 6. The connection request on Day 9 comes after they've already seen your name in their notifications.

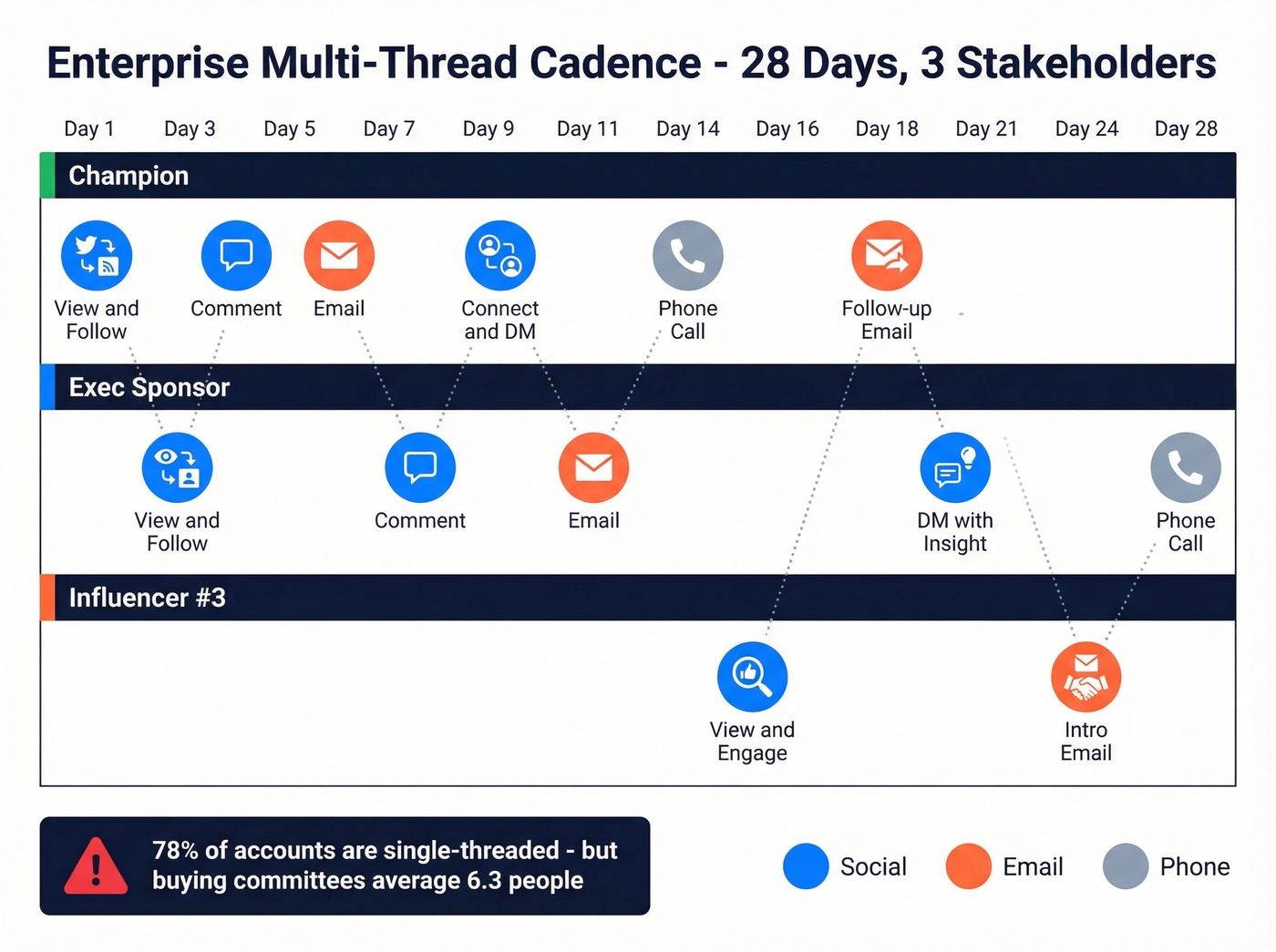

The Enterprise Multi-Thread Cadence (28 Days)

B2B buying committees now include about 6.3 stakeholders per deal, yet 78% of accounts are single-threaded. That's a massive blind spot. This cadence targets 2-3 contacts simultaneously, using social to map the buying committee before going direct.

| Day | Channel | Target | Action |

|---|---|---|---|

| 1 | Social | Champion | View + follow |

| 2 | Social | Exec sponsor | View + follow |

| 3 | Social | Champion | Comment on post |

| 5 | Champion | Personalized outreach | |

| 7 | Social | Exec sponsor | Comment on post |

| 9 | Social | Champion | Connection + DM |

| 11 | Exec sponsor | Personalized outreach | |

| 14 | Phone | Champion | Call referencing email |

| 16 | Social | Influencer #3 | View + engage |

| 18 | Champion | Follow-up | |

| 21 | Social | Exec sponsor | DM with insight |

| 24 | Influencer #3 | Intro email | |

| 28 | Phone | Exec sponsor | Call attempt |

The social touches here serve double duty: they warm individual contacts and give you intelligence about the account. When the exec sponsor posts about a challenge your product solves, that's a trigger for the entire account cadence.

Before your cadence sends a single email or dials a number, verify your contact data. A bounced email after 10 days of social warming is a pipeline-killing mistake. Prospeo's real-time verification runs 98% email accuracy across 143M+ verified emails - so when your cadence shifts channels, every touch actually reaches the prospect.

Your LinkedIn Posting Cadence - The Half of Social Selling Nobody Talks About

Most social selling advice focuses on outreach. But your prospects check your profile before they accept your connection request. If your last post was three months ago, you look like a ghost account.

Frequency: One substantial post per day. Not three. Not five. One good one beats three mediocre ones every time.

Timing: Tuesday mornings (7-10 AM) and Thursday around lunch are the sweet spots. The first hour after posting is crucial - that's when the algorithm tests engagement to determine reach.

Format mix:

- Carousels: Sweet spot is 8-15 slides. Past 20 slides, you lose ~30% of reach.

- Native video: 30-90 seconds. Uploading natively instead of linking quadruples reach.

- Text posts: Intentional line breaks outperform long formal paragraphs. Write like you talk.

Posts with employee perspectives earn ~9x higher engagement than curated corporate content. Your personal voice matters more than your company's content calendar.

Block 20 minutes every morning for posting and engaging. It compounds faster than you think. When a prospect sees your connection request, they check your profile. Consistent, valuable content gets you accepted. A barren feed and a sales-heavy headline gets you ignored.

Your Social Selling Index - The Score That Predicts Pipeline

LinkedIn's Social Selling Index (SSI) is the most underused metric in sales. It's a 0-100 score based on four pillars, each worth 25 points:

- Establishing your professional brand - profile completeness, content publishing, engagement received

- Finding the right people - search activity, profile views, lead saves

- Engaging with insights - sharing content, commenting, participating in conversations

- Building relationships - connection growth, message response rates, network quality

Most sales reps score 40-50. Top performers hit 65+. Scores above 75 put you in elite territory. The performance gap is massive: high-SSI sellers create 45% more opportunities and are 51% more likely to hit quota. Social sellers overall generate 78% more opportunities than peers who don't use social.

LinkedIn's analysis of 150,000+ professionals found that high-scoring reps get promoted 17 months faster. That's not a typo.

How to improve your SSI fast:

- Brand pillar: Post daily. Optimize your headline for your buyer, not your title. "I help Series B SaaS companies fix pipeline leakage" beats "Account Executive at Acme Corp."

- Finding pillar: Use Sales Navigator searches daily. Save leads. View profiles intentionally. Sales Navigator delivers 312% ROI over three years and +42% larger deal sizes - it's the single highest-ROI tool investment for social sellers.

- Engaging pillar: Comment on 5-10 posts per day. Comments over 15 words have double the impact. Quality over quantity.

- Relationships pillar: Accept relevant connections. Respond to every message within 24 hours. Grow your network with ICP contacts, not random connections.

Your score reflects the previous 90 days of activity and updates daily. You can move the needle in weeks, not months. If you're below 50, start with the engaging pillar - it's the fastest to improve and has the most direct impact on outreach acceptance rates.

Seven Social Selling Mistakes That Kill Your Cadence

Forrester nailed it: most reps are "focused on the sales rather than the social." They shoehorn old-school hard-sell tactics onto digital platforms and wonder why nobody responds. Here are the seven mistakes I see most often - and how to fix each one.

1. Pitching too soon. You send a connection request with a pitch in the note, or connect and immediately DM your value prop. 63% of users ignore unknown DMs - pitchy ones get ignored at even higher rates. Fix: Follow the 5-step warming sequence. No pitch before Step 4.

2. Treating social as a promotional channel. Your feed is nothing but product announcements, webinar invitations, and company blog shares. Nobody follows a walking billboard. Fix: Follow the 80/20 rule - 80% insights, stories, and opinions; 20% company content.

3. Under-researching contacts. You're commenting on someone's post without checking their recent activity, company news, or role changes. Fix: Spend 5 minutes on research before every engagement. Check for buyer intent signals, recent funding, or job changes.

4. Sporadic posting. You post three times in one week, then disappear for a month. The algorithm punishes inconsistency, and so do prospects. Fix: One post per day, every day. Block 20 minutes each morning.

5. Generic engagement. "Agree!" "Great share!" "Love this!" These comments are invisible. Fix: Write comments over 15 words that add a genuine thought. Or don't comment at all.

6. Ignoring your SSI. If you don't know your score, you can't improve it. Fix: Check it weekly. Treat it like a pipeline metric. Target 65+.

7. Not connecting social engagement to email outreach. This one drives me crazy. You spend days warming a prospect on social, then send a cold email that doesn't reference any of it. All that effort, wasted. Fix: Always bridge social to email. Mention the post you commented on. Reference the conversation. Make the email feel like a continuation, not a cold start.

Quick Cadence Audit - Run This on Your Current Sequence:

- Does social appear in the first 3 touches?

- Are you warming before pitching (at least 2 passive touches before any ask)?

- Does your first email reference a social interaction?

- Are you hitting 3+ channels across the cadence?

- Is every email and phone number verified before launch?

If you checked fewer than 3, your cadence needs a rebuild.

Best Tools for Building a Social Sales Cadence in 2026

Your cadence needs a sequencing tool to orchestrate touches, a data layer to make sure those touches land, and optionally a social intelligence tool to identify the right moments to engage.

| Tool | Category | Channels | Starting Price | Best For |

|---|---|---|---|---|

| Prospeo | Data & Verification | Email, mobile, enrichment | Free; ~$0.01/email | Data accuracy for every touch |

| lemlist | Multichannel Cadence | Email + LinkedIn + Phone | $39/mo | SMB social-first sequences |

| HeyReach | LinkedIn Automation | LinkedIn campaigns | $79/mo | Scaling LinkedIn volume |

| LaGrowthMachine | Multichannel Cadence | Email + LinkedIn + Phone + X | ~$55/mo | Max multichannel coverage |

| Sales Navigator | Social Intelligence | LinkedIn prospecting | ~$99/mo | ICP monitoring + triggers |

| Salesloft | Revenue Orchestration | All channels | ~$100-150/user/mo | Enterprise tech stacks |

| Outreach | Sales Productivity | All channels | ~$100-150/user/mo | AI-driven workflow automation |

| Klenty | CRM-Integrated Cadence | Email + Phone + LinkedIn | $50/user/mo | Tight CRM integration |

| Apollo | All-in-One | Email + Phone + LinkedIn + Data | Free; ~$49/user/mo | Budget data + sequencing |

lemlist - Best for SMB Social-First Teams

Use this if: You're an SMB team running social-first sequences and want email, LinkedIn, and phone in one tool. lemlist's multichannel sequencing is intuitive - you build a flow that starts with a LinkedIn connection request, moves to a personalized message, then drops into email. At $39/mo, it's the most accessible entry point for teams that want social baked into their cadence from Day 1.

If you're evaluating sequencing platforms, compare options in our guide to cold email outreach tools.

Skip this if: You need enterprise-grade reporting or complex branching logic.

HeyReach - Best for LinkedIn Volume

Built specifically for LinkedIn campaign scaling. HeyReach auto-rotates sender accounts to bypass daily invite limits, which matters if you're running volume. At $79/mo, it's a focused tool - LinkedIn only, no email or phone. Pair it with an email sequencer and a data verification tool, and you've got a full stack.

Skip this if: You need an all-in-one solution. HeyReach does one thing well, but only one thing.

LaGrowthMachine - The Multichannel Maximalist's Pick

LaGrowthMachine covers email, LinkedIn, phone, voice messages, and X/Twitter in one platform. They report 3.5x more replies than email-only campaigns, which tracks with the 287% multichannel lift data. At ~$55/mo, it's competitively priced. The AI voice cloning feature is worth experimenting with - early reports are promising for personalized voice messages at scale.

If you're pricing shopping, see our breakdown of LaGrowthMachine.

Quick Mentions

Sales Navigator (~$99/mo) deserves special attention. LinkedIn's own data shows 312% ROI over three years and 42% larger deal sizes. It's the foundation for identifying triggers and monitoring ICP activity. If you're serious about social selling, this is non-negotiable.

Salesloft and Outreach are the enterprise incumbents. Both handle all channels, both cost ~$100-150/user/month, and both require significant implementation effort. They're overkill for a 5-person team.

Klenty ($50/user/mo) is worth a look if tight CRM integration is your priority - it plays well with HubSpot and Salesforce out of the box.

Apollo is the budget all-in-one. Free tier, paid plans from ~$49/user/mo, and it bundles data with sequencing. The data quality isn't best-in-class - we've run head-to-head comparisons where Apollo's email accuracy came in noticeably lower - but for teams that need everything in one place on a tight budget, it's the obvious starting point. If you're vetting it, start with our deep dive on Apollo.io accuracy.

Multichannel cadences pull 287% more replies - but only if you have real phone numbers and emails to pair with your social touches. Prospeo's 30+ search filters let you build lists by buyer intent, job changes, and tech stack, then export verified contacts straight to your sequencer.

Build your social sales cadence list in minutes, not hours.

FAQ

How many social touches should a social sales cadence include?

Aim for 3-5 social touches within a 14-21 day cadence, starting with passive warming (profile views, content engagement) before any direct outreach. The 287% multichannel lift comes from combining social with email and phone - not from blasting DMs. Space touches 2-3 days apart and escalate gradually from passive to active engagement.

What's a good Social Selling Index (SSI) score?

Average reps score 40-50; top performers hit 65+. Scores above 75 put you in elite territory. High-SSI sellers create 45% more opportunities and are 51% more likely to hit quota. Focus on the "engaging with insights" pillar first - it moves fastest and directly improves outreach acceptance rates.

Should I send a connection request with or without a note?

Without. Blank connection requests outperform pitched ones, with 40-50% acceptance after warm engagement vs. 20-25% cold. Connect, say thanks, wait for a relevant trigger, then message. A blank request after you've liked two of their posts feels natural; a pitch-stuffed note from a stranger feels like spam.

How do I verify contact data before launching my cadence?

Use a real-time email verification tool with 98%+ accuracy before loading contacts into your sequencer. This ensures that when your cadence moves from social to email on Day 9, the message actually lands instead of bouncing. A single bounce after a week of social warming wastes every touch that came before it.

What's the best cadence tool for social selling in 2026?

For social-first sequences, lemlist ($39/mo) handles email, LinkedIn, and phone in one flow. For LinkedIn-specific scaling, HeyReach ($79/mo) auto-rotates sender accounts. For maximum multichannel coverage, LaGrowthMachine (~$55/mo) delivers 3.5x more replies than email-only. Pair any sequencer with verified contact data underneath - that's the foundation everything else depends on.