The 12 Best Cold Email Outreach Tools in 2026: Pricing, Pros, and Honest Verdicts

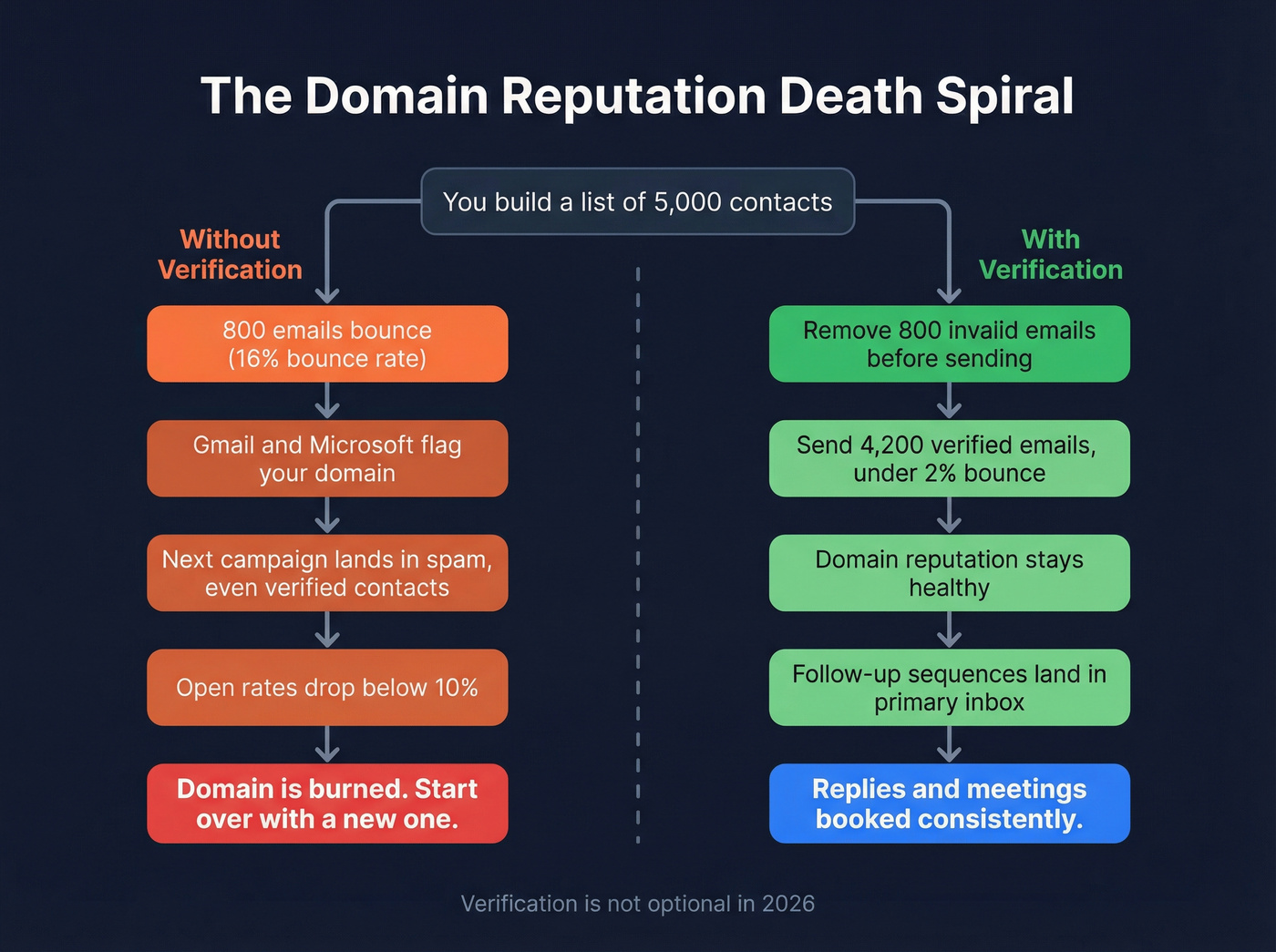

You sent 5,000 cold emails last month. 800 bounced. Your domain reputation tanked. Now even your warm prospects aren't seeing your follow-ups because Gmail decided you're spam. That spiral starts with bad data - and no sending tool on earth can fix it.

Here are the 12 best cold email outreach tools 2026 has to offer, ranked by what actually matters: data quality, deliverability, and what you'll really pay.

Cold Email Is Harder in 2026 - Your Tools Matter More

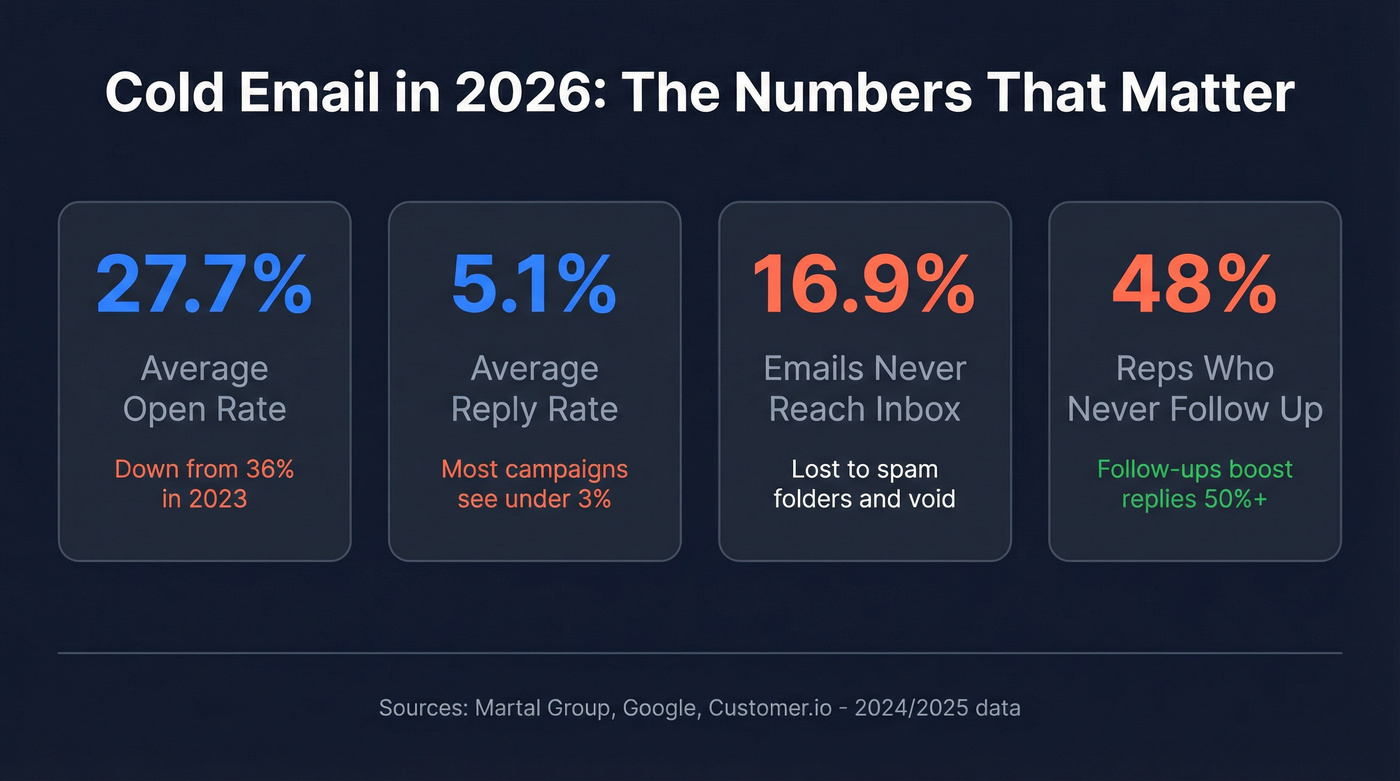

Average cold email open rates dropped from ~36% in 2023 to 27.7% by late 2024. Reply rates sit at 5.1%. Roughly 16.9% of cold emails never reach the inbox - they vanish into spam folders and void. And 48% of reps never send a second follow-up, even though follow-up sequences improve reply rates by 50% or more.

Gmail filters 99.9% of spam before it reaches users. Microsoft started enforcing SPF/DKIM/DMARC for Outlook bulk senders in May 2025. ISPs are smarter, spam filters are tighter, and the margin for error is razor-thin.

But here's what most cold email tool roundups get wrong: they focus entirely on the sending tool. The sequencer. The inbox rotation. The warmup. That stuff matters - but it's step three in a four-step process. Step one is data quality. If you're feeding garbage contacts into a best-in-class sender, you're just burning your domain faster and more efficiently.

The teams we've seen succeed aren't the ones with the fanciest automation. They're the ones with bounce rates under 2%, because they verified every email before it hit a sequence. They stopped chasing open rates (tracking pixels trigger spam filters - more on that later) and started measuring replies and meetings booked.

Our Picks - The Short Version

| Use Case | Tool | Starting Price | One-Line Reason |

|---|---|---|---|

| Best for data quality | Prospeo | Free (75 emails/mo) | 98% accuracy, 7-day refresh |

| Best all-around sender | Saleshandy | $69/mo (annual) | Flat-rate, unlimited accounts |

| Best for sending volume | Instantly | $37/mo | Unlimited accounts + warmup |

| Best for agencies | Smartlead | $78.30/mo (annual) | Unlimited seats, white-label |

| Best free starting point | Apollo | Free | 275M+ contacts, 10K credits |

| Best multichannel | Lemlist | $63/user/mo (annual) | Email + LinkedIn + calls native |

Hot take: If your average deal size is under $10K, you probably don't need a $500/month outreach stack. Grab a free verification tier, Saleshandy Pro for sending, and HubSpot's free CRM. Total cost: $69/month. That stack handles everything a 5-person team needs.

You just read that 16.9% of cold emails never reach the inbox. The fix isn't a better sequencer - it's cleaner data. Prospeo's 5-step verification and 7-day refresh cycle keep bounce rates under 3%, so your domain stays healthy and your sequences actually land.

Stop burning domains. Start with 75 free verified emails.

The Cold Email Stack (And Why Data Quality Is Step Zero)

The cold email stack looks like this: Data Sourcing → Verification → Enrichment → Sending → CRM. Most teams skip straight to "Sending" and wonder why their campaigns crater.

Here's what happens when you skip verification: Apollo users regularly report 15-20% bounce rates on certain segments. That's a database with 275M+ contacts, and some percentage will always be stale. But if you import those contacts directly into your sequencer and blast 5,000 emails, you've just told Gmail and Microsoft that you're a spammer. Your domain reputation drops. Your next campaign - even to verified contacts - lands in spam.

The cost of bad data isn't the bounced emails. It's the domain reputation spiral that follows.

Whatever data source you use - Apollo, Instantly's SuperSearch, a purchased list - run it through verification before it touches your sequencer. Verification isn't optional anymore.

The 12 Best Cold Email Outreach Tools in 2026

Saleshandy - Best All-Around Sending Tool

Use this if you're a team of 2+ that needs a sending tool without per-seat pricing anxiety. Saleshandy's flat-rate model is the story here: $69/mo on an annual plan gets you Outreach Pro with unlimited team members, 30,000 active prospects, 150,000 emails/month, and 100 email accounts per sequence rotation. For a 5-person SDR team, that's $69 total. Not $69 per seat.

The built-in B2B Lead Finder covers 700M+ contacts across 60M+ companies (separate credits). G2 rating sits at 4.6/5 across 710+ reviews. EmailToolTester called it "approachable from the start" with a 4-step campaign creation flow.

Skip this if you need native LinkedIn automation (Saleshandy is email-only) or you're a solo founder who'd be fine with the $9/mo QuickMail starter.

Pricing: Starter $25/mo annual ($36/mo monthly), Pro $69/mo annual ($99/mo monthly), Scale $139/mo annual ($199/mo monthly). The Pro tier is the sweet spot for 90% of teams.

Prospeo - Best for Data Quality and Email Verification

Every other tool on this list sends emails. Prospeo makes every other tool on this list work better.

The database spans 300M+ professional profiles with 143M+ verified emails. Every record goes through a 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering - all on proprietary infrastructure. The result: 98% email accuracy and a 7-day data refresh cycle, compared to the 6-week industry average. Plus 125M+ verified mobile numbers with a 30% pickup rate for teams running multichannel.

Real-world proof: Stack Optimize built from $0 to $1M ARR using Prospeo as their data layer, maintaining 94%+ deliverability and under 3% bounce rates across all clients - with zero domain flags. Meritt tripled their pipeline from $100K to $300K/week while dropping bounce rates from 35% to under 4%.

The platform integrates natively with Smartlead, Instantly, Lemlist, HubSpot, and Salesforce. Search with 30+ filters including buyer intent (15,000 topics via Bombora), technographics, job changes, and headcount growth.

Pricing: free tier gives you 75 verified emails + 100 Chrome extension credits per month. Paid plans run ~$0.01 per email credit. No contracts, cancel anytime.

Stack Optimize built a $1M agency with zero domain flags. Meritt tripled pipeline to $300K/week. Both started with Prospeo's 98% accurate data feeding the same sending tools on this list - Instantly, Smartlead, Lemlist. The difference was never the sequencer.

Plug verified data into your cold email stack for $0.01 per email.

Instantly.ai - Best for Pure Sending Volume

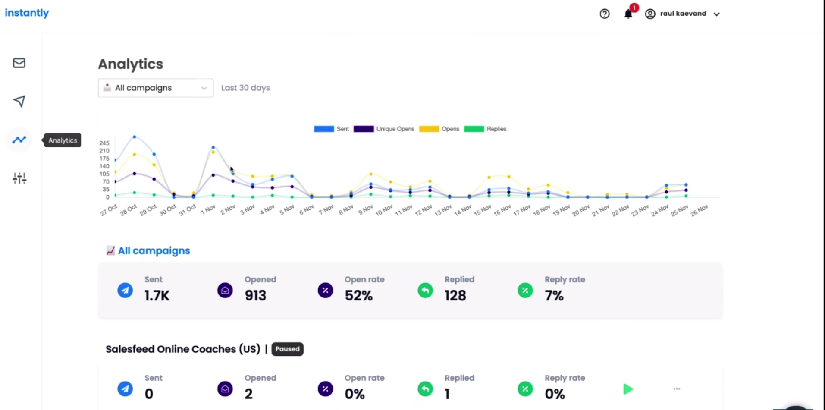

Instantly is the tool everyone recommends for volume. Unlimited email accounts, unlimited warmup, and plans starting at $37/mo - genuinely hard to beat for raw sending capacity. The Growth plan gets you 5,000 emails/month with unlimited accounts and warmup baked in.

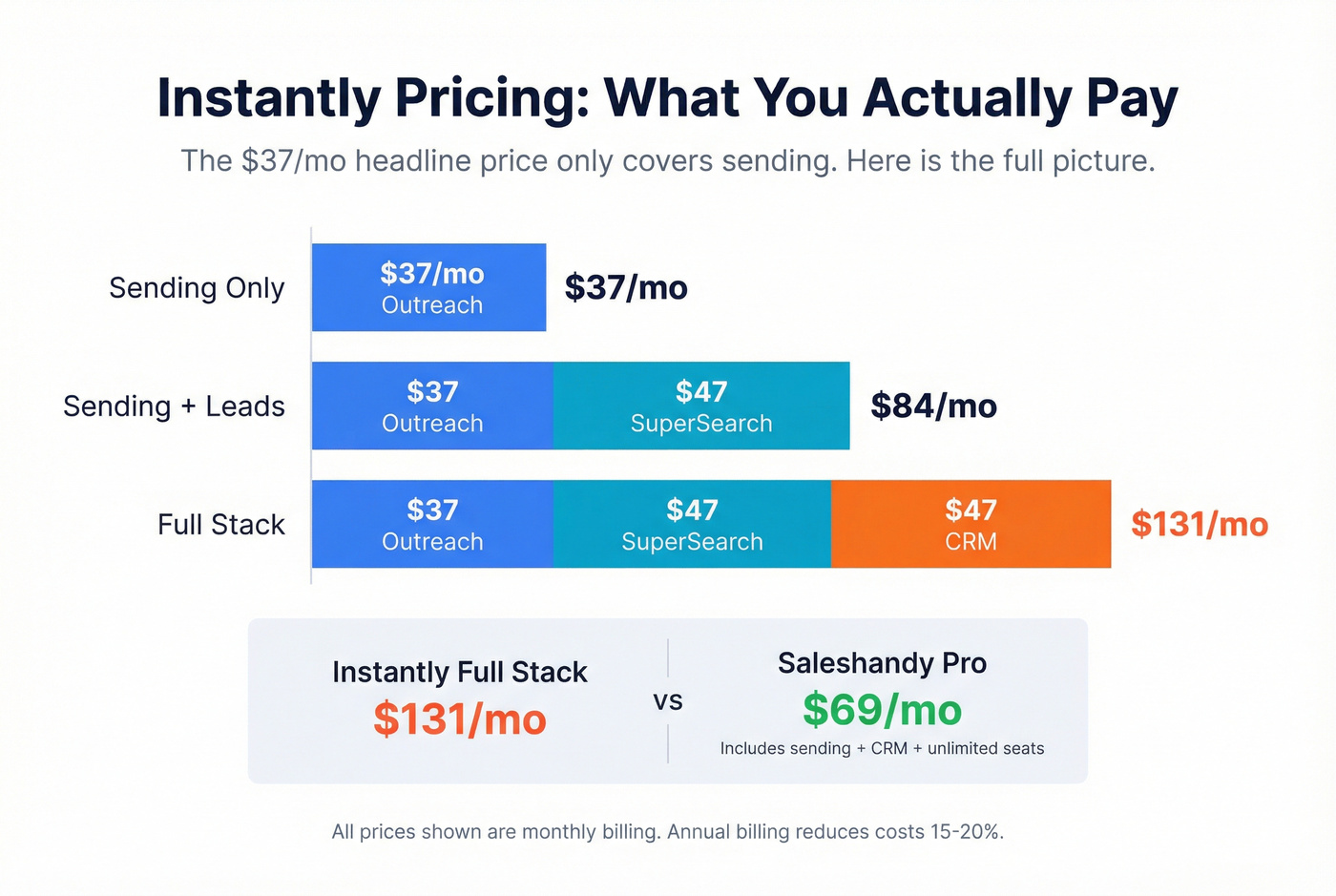

Here's the thing: Instantly's pricing is misleading if you don't read the fine print. The $37/mo Outreach plan is just sending. Want the lead database? That's SuperSearch - another $47/mo. Want CRM functionality? Another $47/mo. The full Instantly stack runs $131/mo minimum on monthly billing, and that's before you scale up contact limits.

| What you get | What it costs |

|---|---|

| Sending only | $37/mo |

| Sending + leads | $84/mo |

| Full stack (sending + leads + CRM) | $131/mo |

Pros: Unlimited email accounts and warmup on every plan. 450M+ B2B leads in SuperSearch. Light Speed plan ($286.30/mo annual) includes dedicated IP pools.

Cons: Three separate product lines billed independently. Reddit users on r/coldemail have raised concerns about data accuracy and shared infrastructure risk at lower tiers. CRM integrations require Zapier on lower plans.

For pure sending at scale, Instantly is hard to beat. Just budget for the full stack, not the headline price.

Smartlead - Best for Agencies (With Caveats)

Smartlead's Pro plan at $78.30/mo (annual) is the agency sweet spot: unlimited seats, 30,000 contacts, 90,000 emails/month, API access, and webhook integrations. Over 100,000 businesses use it. The white-label options and workspace management make it purpose-built for agencies running multiple client campaigns.

But here's the elephant in the room. Multiple users on r/coldemail have reported that Smartlead's SmartServers use blacklisted IP addresses, tanking domain reputation even when SPF/DKIM/DMARC are properly configured. Support responsiveness during these incidents has been poor. This is a deliverability-first tool that's had deliverability problems - and that's a serious concern.

If you're running Smartlead, monitor your inbox placement obsessively. Use Google Postmaster Tools. And pair it with a dedicated verification tool to keep bounce rates under control.

Apollo.io - Best Free Starting Point

Apollo's free plan is the best no-cost entry point in cold email: 275M+ contacts, 10,000 email credits per month, 5 mobile credits, and basic sequences. Enough to test whether outbound works for your business before spending a dollar. G2 rating of 4.7/5 - users love the data breadth.

The catch: The credit system is a hidden cost. Exporting leads, viewing mobile numbers - everything eats credits. A 5-person team on Professional ($79/user/mo annual) with typical credit overages runs ~$7,140/year. Email bounce rates hit 15-20% on some segments per G2 reviews - you need to verify externally. EmailToolTester called the interface "quite overwhelming."

Apollo is a data platform with outreach bolted on. It's great for prospecting and list building. For actual sending, pair it with a dedicated tool that handles warmup, rotation, and deliverability better.

Lemlist - Best for Multichannel Outreach

Lemlist is the only tool on this list with native LinkedIn automation, email sequences, and a built-in dialer in one platform. The Multichannel Expert plan ($87/user/mo annual) covers all three channels plus WhatsApp as an add-on. The 600M+ leads database and image/video personalization features are genuine differentiators.

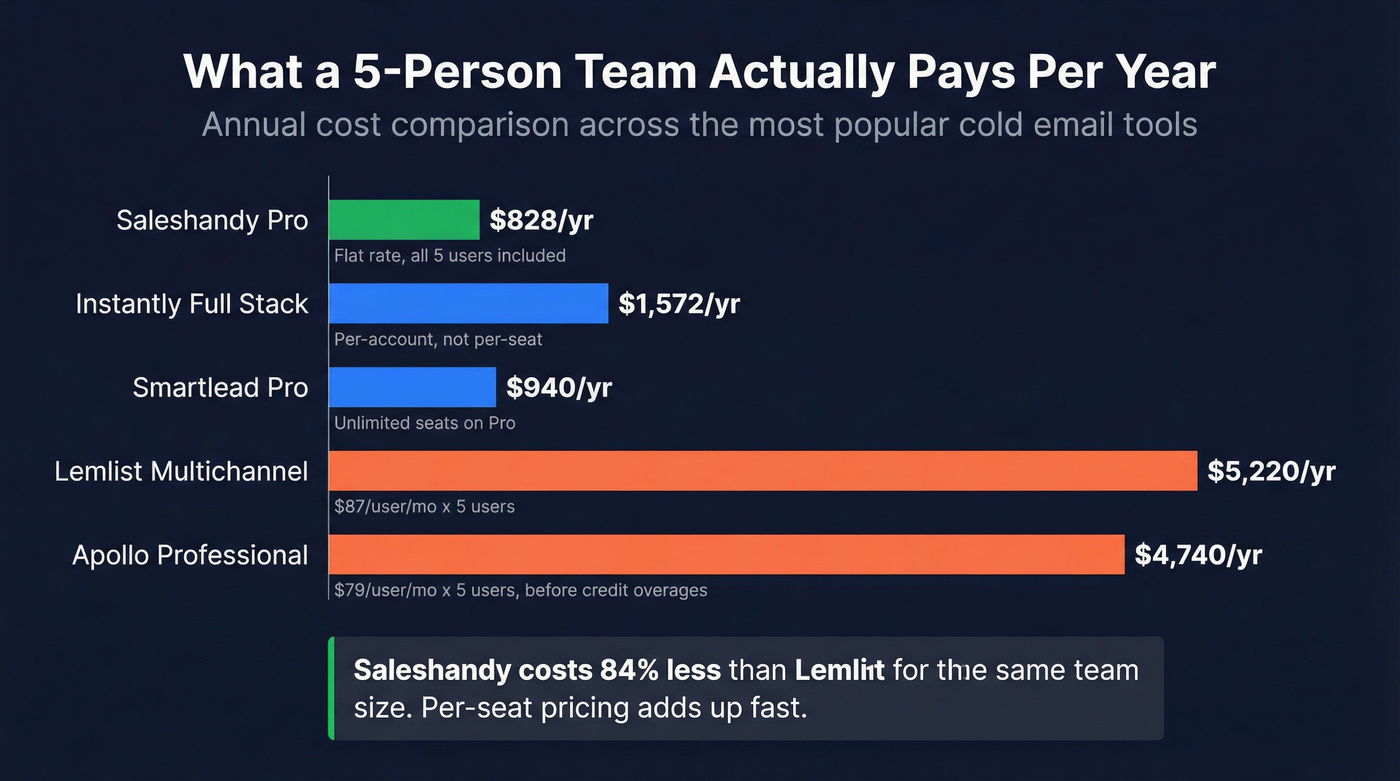

The problem is cost. Lemlist increased pricing by $10/user/month in February 2025, and the per-user model means a 5-person team on Multichannel Expert pays $435/mo. Compare that to Saleshandy's $69/mo flat rate. That's a 6x difference.

If multichannel is your strategy - and the data says it should be, with 287% better results than email-only - Lemlist is the most integrated option. Email Pro starts at $63/user/mo annual if you don't need LinkedIn automation.

Reply.io - Best AI-Powered Outreach

Reply.io has three distinct products at three very different price points, and the confusion is the main problem. The Email Volume plan starts at $49/mo for 1,000 active contacts with unlimited mailboxes - competitive with Instantly and Saleshandy. The Multichannel plan jumps to $89/user/mo. And Jason AI SDR starts at $500/mo - essentially a different product.

The 1B contact database is the largest on this list by raw numbers. Start with the Email Volume plan and upgrade only if you need multichannel or AI automation.

Woodpecker - Best for Deliverability-First Teams

Woodpecker charges per contacted prospect, not per seat or per email. The Starter plan runs $29/mo ($24/mo annual) for 500 prospects and 6,000 emails. The real differentiator: free catch-all email verification powered by Bouncer - no other tool on this list includes that. The Adaptive Sending feature automatically reduces output volume when you're approaching ISP limits.

No built-in lead database, so you'll need a separate data source. But if deliverability is your #1 concern and you're willing to bring your own data, Woodpecker is purpose-built for that.

QuickMail - Cheapest Entry Point

At $9/mo, QuickMail's Starter plan is the cheapest option in the market: 1 email sender, 1,000 contacts, 3,000 emails/month. No annual discount - what you see is what you pay. The Growth plan at $99/mo unlocks unlimited senders and users with 30,000 contacts.

In a real campaign test, QuickMail delivered a 17.8% open rate and 1.5% bounce rate across 994 leads - solid numbers for a budget tool. Warmup is handled externally via MailFlow (free but separate signup). No built-in prospect database. Best for solo founders testing outbound on a shoestring.

Hunter.io - Email Finder With Basic Sequences

Hunter is an email finder first and a cold email tool second. The free plan works for light prospecting, and paid plans start at $49/mo. If you need to find and verify emails for a small list and send a basic sequence, Hunter handles it. For serious cold email automation - inbox rotation, A/B testing, multichannel - you'll outgrow it fast.

Gmass - Gmail-Native for Solopreneurs

Gmass lives inside Gmail, which is both its strength and its ceiling. Starts at $25/mo, includes a Spam Solver deliverability tool, and requires zero learning curve if you already live in Google Workspace. No lead finder, no warmup, no inbox rotation. It's for solopreneurs sending 50-100 personalized emails a day, not for teams running outbound at scale.

Mailshake - The Legacy Option

Mailshake starts at $58/mo with an annual commitment required and no free trial.

G2 rating is 4.7/5, so existing users are happy. But the lack of a trial, combined with annual lock-in, makes it hard to recommend when every competitor offers monthly billing and free tiers. Skip this unless you're already locked in and satisfied.

Cold Email Outreach Tools Pricing - What You'll Actually Pay

The headline price on a pricing page is never what you actually pay. Here's the real picture across all 12 tools (all prices shown as annual billing):

| Tool | Entry Price | Mid-Tier | Model | Database |

|---|---|---|---|---|

| Saleshandy | $25/mo | $69/mo | Flat-rate | 700M+ |

| Prospeo | Free | ~$0.01/email | Credit-based | 300M+ |

| Instantly | $37/mo | $97/mo | Per-plan | 450M+ (extra $47/mo) |

| Smartlead | $32.50/mo | $78.30/mo | Flat-rate | Add-on |

| Apollo | Free | $79/user/mo | Per-user | 275M+ |

| Lemlist | $63/user/mo | $87/user/mo | Per-user | 600M+ |

| Reply.io | $49/mo | $89/user/mo | Hybrid | 1B+ |

| Woodpecker | $24/mo | $126/mo | Per-prospect | None |

| QuickMail | $9/mo | $99/mo | Flat-rate | None |

| Hunter | Free | $49/mo | Credit-based | Email only |

| Gmass | $25/mo | $55/mo | Per-user | None |

| Mailshake | $58/mo | $83/mo | Per-user | None |

Now here's the table that actually matters - total monthly cost by team size for the top 6 senders:

| Tool | Solo Founder | 5-Person Team | 10-Person Team |

|---|---|---|---|

| Saleshandy Pro | $69 | $69 | $69 |

| Instantly (full stack) | $131 | $131 | $131 |

| Smartlead Pro | $78.30 | $78.30 | $78.30 |

| Apollo Professional | $79 | $395 | $790 |

| Lemlist Expert | $87 | $435 | $870 |

| Reply.io Multichannel | $89 | $445 | $890 |

Look at those numbers. Saleshandy Pro at $69/mo for unlimited users vs. Lemlist at $435/mo for 5 users vs. Apollo at $395/mo for 5 users. The per-user model is a tax on growing teams. If you're scaling past 3 people, flat-rate tools save thousands per year.

Deliverability Setup Checklist - The Part Most Guides Skip

Remember the 800-bounce scenario from the top of this article? Here's exactly how to prevent it. Your sending tool doesn't determine deliverability. Your setup does.

Authenticate everything. SPF, DKIM, and DMARC are non-negotiable. Gmail requires From: domain alignment with either SPF or DKIM. If you haven't set this up, nothing else on this list matters.

Microsoft joined the party. Outlook.com now requires SPF, DKIM, and DMARC for anyone sending 5,000+ messages/day, enforcement starting May 2025. If you're only sending to Gmail, you might've missed this - but a significant chunk of B2B inboxes are Outlook. Ignore this at your peril.

Set up a custom tracking domain. Use a branded CNAME to isolate your reputation from shared tracking domains. If you're using the default shared tracking domain, you're inheriting the reputation of every other user on that server.

Warm up properly. Start at 5-10 emails per day per inbox. Scale over 4-6 weeks. Never exceed 50 per inbox at maximum. Scale by adding inboxes, not cranking volume on existing ones. (If you want the full SOP, see how to warm up an email address.)

Verify your list before sending. Run every list through a verification tool before importing to your sender. Target a bounce rate under 2%. Hard bounces should be as close to zero as possible. For a full workflow, use this email verification list SOP.

Keep spam complaints under 0.3%. Monitor this in Google Postmaster Tools. If you're above 0.3%, stop sending and fix your targeting.

Stop tracking open rates. This is the contrarian take most guides won't give you: tracking pixels trigger spam filters. Every open-tracking pixel is a tiny image loaded from a tracking server, and ISPs know exactly what they are. Focus on reply rates and meetings booked instead. (More detail: best email open tracker.)

Monitor weekly. Check Google Postmaster Tools, review bounce rates per domain, and audit your suppression list. The teams that maintain 90%+ inbox placement treat deliverability as an ongoing process, not a one-time setup.

What Real Users Say - Reddit Complaints and Praise

The best product research happens on r/coldemail, not on G2. Here's what real users are saying:

Smartlead's blacklisted IP controversy is the biggest story. Multiple users reported that after Smartlead introduced SmartServers, emails started landing in spam despite proper authentication. The complaint isn't just about deliverability - it's that support wasn't responsive or transparent. For a tool that sells itself on deliverability, that's a credibility problem.

Apollo's bounce rates are a recurring theme. G2 reviewers and Reddit users both report 15-20% bounce rates on certain segments. The database is massive, but size and accuracy aren't the same thing. The consensus: Apollo is great for list building, but verify externally before you send. (If you're using Apollo specifically, follow this Apollo cold email setup.)

Instantly's data accuracy gets questioned regularly. Users on r/coldemail have raised concerns about the accuracy of reported open rates, reply rates, and spam rates within the platform. Shared infrastructure at lower tiers also makes some users nervous about reputation isolation.

Lemlist's price hike frustrated loyal users. The $10/user/month increase in February 2025 pushed an already-expensive tool further out of reach for small teams.

Saleshandy gets consistent praise for its UX and flat-rate model. Users on Reddit appreciate not having to do per-seat math every time they add a team member.

One Reddit user ran a head-to-head test across five platforms and ranked them: SmartReach > Lemlist > Apollo > Instantly > Reply/Saleshandy. Their criteria: timezone sending, multichannel capabilities, and in-tool domain buying. Different priorities produce different rankings - which is exactly why the "best" tool depends on your workflow, not someone else's listicle.

How to Choose the Right Cold Email Outreach Tools in 2026

Here's the contrarian thesis of this entire article: you need a maximum of three tools. A data source, a sender, and a CRM. That's it. Every tool beyond three adds integration complexity, data sync issues, and monthly costs that compound faster than you'd expect. (If you want a blueprint, start with a lean B2B sales stack.)

The $69/month stack that actually works: a verified data source + Saleshandy Pro at $69/mo for sending + HubSpot's free CRM. Total: $69/month with unlimited team members, 150,000 emails/month, and verified data feeding every sequence. That's not a theoretical recommendation - it's the stack I'd hand to any Series A team starting outbound tomorrow.

Solo founder, under $50/mo: QuickMail Starter ($9) + free verification tier + HubSpot free CRM. Total: $9/month.

Growing team, $100-200/mo: Saleshandy Pro ($69) + paid verification credits (~$30/mo) + HubSpot free CRM. Total: ~$99/month.

Agency running multiple clients: Smartlead Pro ($78.30) + dedicated verification + client CRMs. Total: ~$110/month. Monitor Smartlead's deliverability closely.

Enterprise with multichannel needs: Lemlist Multichannel Expert + Salesforce. Budget $500+/month for deals north of $50K ACV.

A smart approach: run a 14-day bake-off using the same domains and contact sets across your top 2-3 candidates. Most of these email outreach platforms offer free trials or free tiers - use them simultaneously, not sequentially. Two weeks of parallel testing beats two months of sequential trials every time.

FAQ About Cold Email Outreach Tools

Is cold email legal in 2026?

Yes - cold email is legal in the US under CAN-SPAM and in the EU under GDPR's legitimate interest basis. You need accurate sender headers, a physical mailing address, a clear unsubscribe mechanism, and must honor opt-outs within 10 business days. Cold email is legal; spam isn't.

What's a good reply rate for cold email?

The average cold email reply rate is 5.1%, while top performers hit 15-25%. The biggest lever isn't your sending tool - it's targeting accuracy and personalization beyond first-name tokens. The average conversion rate is roughly 0.2% (about 1 deal per 500 emails), so data quality determines ROI.

Do I need a separate email verification tool?

Yes, if your bounce rate exceeds 2%. Built-in databases from Apollo, Instantly, and Saleshandy have varying accuracy. A dedicated verification tool catches spam traps and honeypots that built-in verification misses, protecting your domain reputation before damage starts.

How many emails can I send per day per inbox?

Cap at 50 emails per inbox per day for cold outreach. Scale by adding inboxes, not increasing volume per inbox. A 10-inbox setup at 50/day gives you 500 sends daily with much better deliverability than 500 from a single inbox.

What's the cheapest cold email setup that actually works?

Prospeo's free tier (75 verified emails/month) for clean data + Saleshandy Outreach Pro at $69/mo (annual) + HubSpot's free CRM. Total: $69/month with unlimited team members, 150,000 emails/month, and verified contact data feeding every sequence.