The Best Lead Enrichment Tools in 2026: Real Pricing, Real Reviews, Honest Picks

A RevOps lead I know ran a 3-tool bake-off last quarter. The "best" database created 4,000 [duplicate contacts in Salesforce](https://help.salesforce.com/s/articleView?id=sales.managing_duplicates_overview.htm&language=en_US&type=5 in five days. The cheapest one had better phone connect rates. And the most expensive one - the $32K annual contract - couldn't find working mobile numbers for 40% of director-level prospects in their ICP.

That's the state of lead enrichment tools in 2026.

The data enrichment market hit $2.37 billion in 2023 and is growing at 10.1% CAGR through 2030. Yet most teams are still running sequences against phone numbers that ring into the void. B2B contact data decays at roughly 30% per year. People change jobs, companies get acquired, phone numbers get reassigned. Companies lose roughly 12% of revenue due to poor data quality, and 30-50% of CRM data is already outdated before anyone touches it.

You don't need 15 enrichment tools. You need 2-3 that actually work for your ICP, your budget, and your workflow.

Our Picks (TL;DR)

| Use Case | Pick | Why |

|---|---|---|

| Email accuracy & freshness | Prospeo | 98% email accuracy, 7-day refresh, free tier, no contracts |

| Free all-in-one platform | Apollo | 210M+ contacts, generous free tier, built-in sequencing |

| Workflow automation | Clay | 100+ data sources, native waterfall, powerful automations |

| European data / GDPR | Cognism | Diamond Data phone-verified numbers, built for EU compliance |

| Waterfall on a budget | FullEnrich | $29/mo, 15-20+ sources, pay only for valid results |

If you're spending less than $500/month, start with Prospeo for emails and Apollo for everything else. Spending $2K+/month and need workflow automation? Clay is the move. If your ICP is heavily European, Cognism is worth the premium.

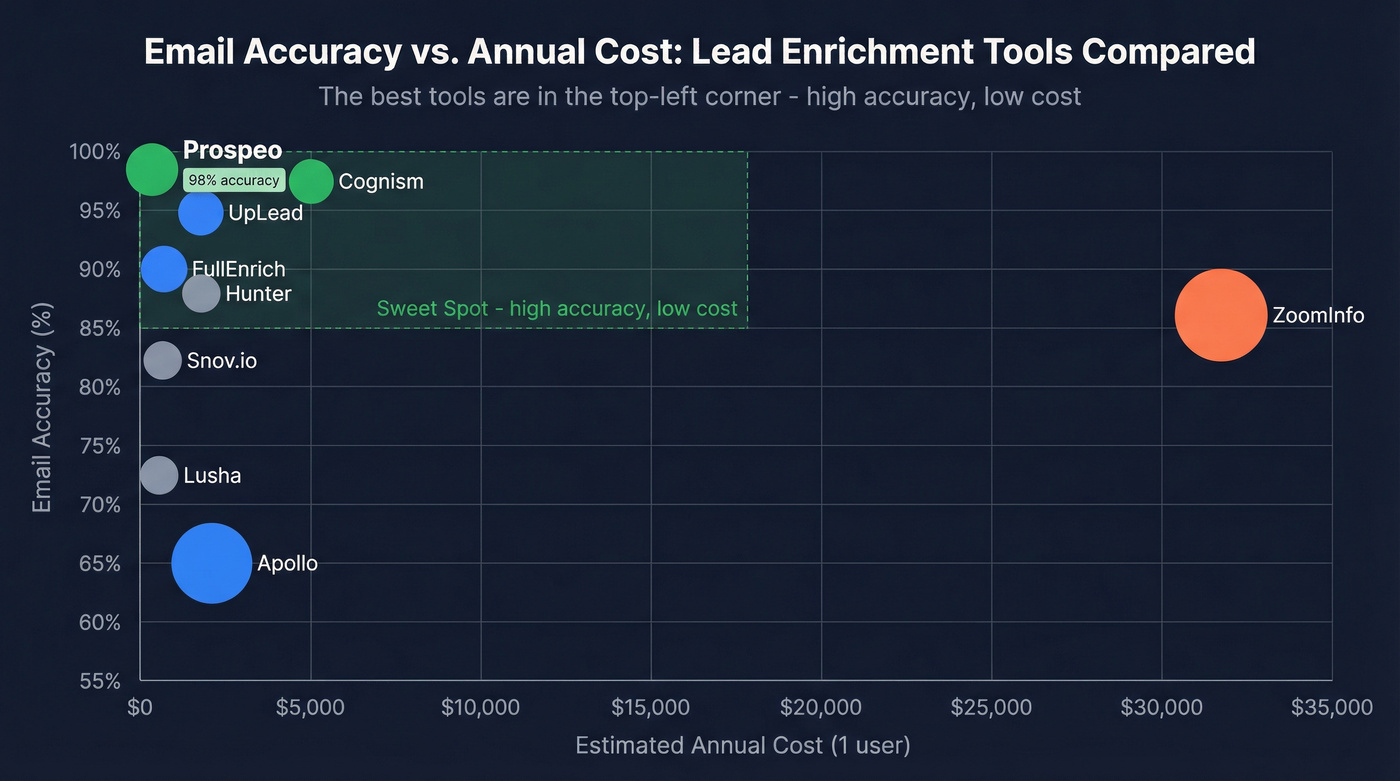

Here's the honest take nobody else will give you: most teams paying $30K+ for ZoomInfo would get better results from a $200/month two-tool stack. Every tool you add is another integration to maintain, another credit system to track, another vendor renewal to negotiate. Pick your stack deliberately.

Lead Enrichment Tools Compared (Master Pricing Table)

Every tool on this list has real pricing. Where vendors hide their numbers, we've used Vendr transaction data, community reports, and negotiation benchmarks to fill the gaps.

| Tool | Starting Price | Mid-Tier | DB Size | Email Accuracy | Best For |

|---|---|---|---|---|---|

| Prospeo | Free / ~$0.01/email | Pay-per-credit | 300M+ profiles | 98% verified | Email accuracy, freshness |

| Apollo | Free / $59/user/mo | $99/user/mo | 210M+ contacts | ~60-70% | Free all-in-one |

| ZoomInfo | ~$15K/yr | $31,875/yr median | 300M+ profiles | ~85-87% | Large US sales orgs |

| Cognism | ~$1,500/yr (1 user) | $22,513/yr (5 users) | 400M+ profiles | 95-99% | EMEA + GDPR |

| Clay | Free / $134/mo | $314-$720/mo | 100+ sources | Varies by source | Workflow automation |

| Lusha | Free / $29.90/user/mo | $69.90/user/mo | 280M+ contacts | ~70-75% | Quick phone lookups |

| FullEnrich | $29/mo | ~$79-$149/mo | 15-20+ sources | ~90% (waterfall) | Budget waterfall |

| LeadIQ | Free / $200/mo | Custom | Not disclosed | ~75-80% | Profile-to-CRM capture |

| Breeze (Clearbit) | $45/mo (100 credits) | ~$450/mo | 200M+ profiles | ~70-75% | HubSpot-native |

| Snov.io | Free / $30/mo | $99/mo | 60M+ contacts | ~80-85% | Budget email + outreach |

| Hunter.io | Free / $49/mo | $149/mo | Not disclosed | ~85-90% | Email-only, simple |

| 6sense | Free (50 credits/mo) | $15K-$60K/yr | Not disclosed | N/A (intent focus) | Enterprise ABM |

| UpLead | ~$99/mo | ~$199/mo | 160M+ contacts | 95% | Mid-market value |

| Datanyze | Free trial / $29/mo | ~$39/mo | Limited | ~75-80% | Technographics |

| Adapt.io | $49/mo | ~$99/mo | Not disclosed | ~80% | Niche verticals |

Pricing marked with ranges is based on Vendr transaction data, community reports, or negotiation benchmarks - not published rate cards.

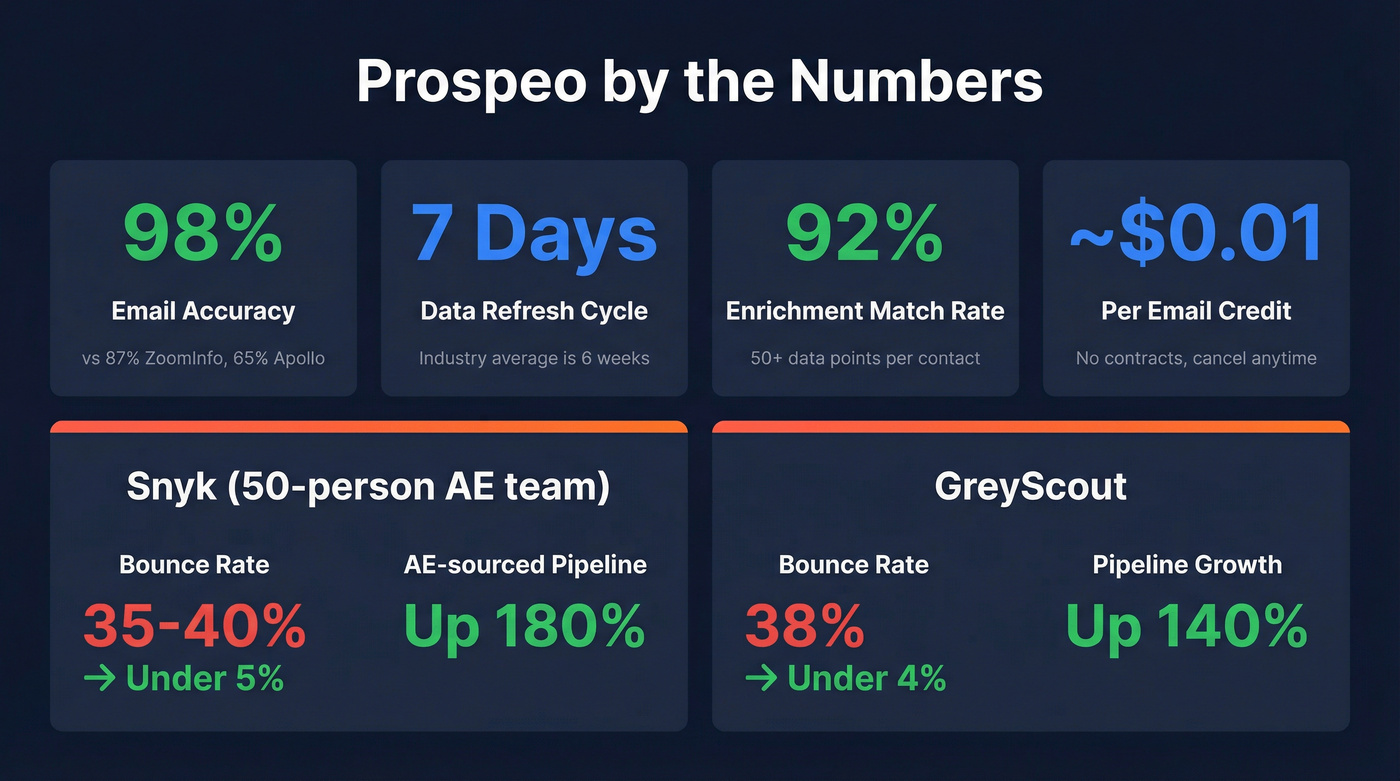

You just read that B2B data decays 30% per year. Prospeo refreshes every 7 days - not 6 weeks like the rest. 98% email accuracy, 92% enrichment match rate, 50+ data points per contact. No contracts, no $30K invoices.

Stop enriching your CRM with data that's already dead.

Full Reviews of the Best Lead Enrichment Tools

Prospeo

Use this if: You're tired of bounced emails destroying your domain reputation and want the highest email accuracy available without signing an annual contract.

Prospeo covers 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers with a 30% pickup rate - all refreshed on a 7-day cycle versus the six-week industry average. The proprietary email-finding infrastructure doesn't rely on third-party email providers, which is why accuracy holds at 98% compared to 87% from ZoomInfo and 79% from Apollo. Teams using Prospeo book 26% more meetings than ZoomInfo users and 35% more than Apollo users.

Snyk's 50-person AE team switched and watched their bounce rate drop from 35-40% to under 5%, with AE-sourced pipeline up 180%. GreyScout doubled their sales team and saw pipeline jump 140% - bounce rates dropping from 38% to under 4%.

The search interface gives you 30+ filters: buyer intent powered by 15,000 Bombora topics, technographics, job change signals, headcount growth, funding, revenue. The Chrome extension (40K+ users) works on any website or CRM, making it a strong lead enrichment Chrome extension for reps who prospect directly in-browser. CRM enrichment returns 50+ data points per contact at a 92% match rate, with native integrations into Salesforce, HubSpot, Smartlead, Instantly, Lemlist, Clay, Zapier, and Make.

Pricing is refreshingly simple: free tier gives you 75 emails per month. Paid plans run about $0.01 per email, 10 credits per mobile number. No contracts, cancel anytime.

Best paired with: Instantly, Lemlist, Outreach, or Salesloft for sequencing and dialing.

Apollo

Apollo is the obvious starting point for most SMB teams - and the most dangerous tool to rely on alone.

210M+ contacts with 65+ data points, built-in sequencing, dialer, and meeting scheduler. Pricing tiers at $0/$59/$99/$149 per user/month make it accessible for any budget. SOC 2 Type II certified. G2 rating of 4.7/5 across 8,800+ reviews.

The catch: Trustpilot rating is 2.3/5 - billing complaints and data privacy concerns dominate. Email accuracy runs about 60-70% in real-world testing. Phone numbers are a coin flip. One HubSpot community user put it bluntly: Apollo is "cheap, easy to connect, decent for emails, but enrichment quality dipped once we scaled."

A 10-seat Apollo setup on Professional runs about $12K/year. The same team on ZoomInfo is $30-50K. For early-stage teams, that difference is a hire. Just don't rely on it as your only data source - layer email verification on top and you'll catch the 30-40% of contacts Apollo gets wrong.

ZoomInfo

The deepest US B2B database, period. 300M+ profiles with strong coverage for enterprise and mid-market. Intent data, website visitor tracking, conversation intelligence, and workflow automation in one platform.

The median buyer pays $31,875/year based on 1,287 real purchases tracked by Vendr. The $14,995 base plan doesn't include phone numbers or intent data. Read that again. Two-year minimum commitments are standard. Auto-renewal traps are the #1 complaint on Reddit. Additional seats cost $1,500+/year each. Global data add-on: $9,995. Buyers save 22% on average through negotiation - which tells you how inflated the initial quote is.

I've seen teams spend $40K/year on ZoomInfo and only use the search bar. If that's you, you're paying enterprise prices for a glorified contact database. The only scenario where ZoomInfo's price makes sense: you're a 20+ person sales org that actively uses intent data, conversation intelligence, and workflow automation across the entire platform.

Cognism

Skip this if you're US-focused. Cognism's Diamond Data - phone-verified mobile numbers with 98% accuracy and a 22% call connect rate - is built for European markets. Compare that to ZoomInfo's roughly 14% connect rate in EMEA. If your SDRs are dialing into the UK, Germany, or France, that gap is the difference between 3 conversations per hour and 1.

The database covers 400M business profiles and 200M verified business emails. GDPR-first design means no extra charge for regional data across NAM, EMEA, and APAC. A 5-user Grow setup costs $22,513/year through Vendr; the Elevate tier with intent data runs $37,498/year. Expect 10-15% annual renewal increases.

Bottom line: For EMEA data quality, mobile verification, and GDPR compliance, Cognism is best-in-class. For US database depth and platform breadth, ZoomInfo still wins.

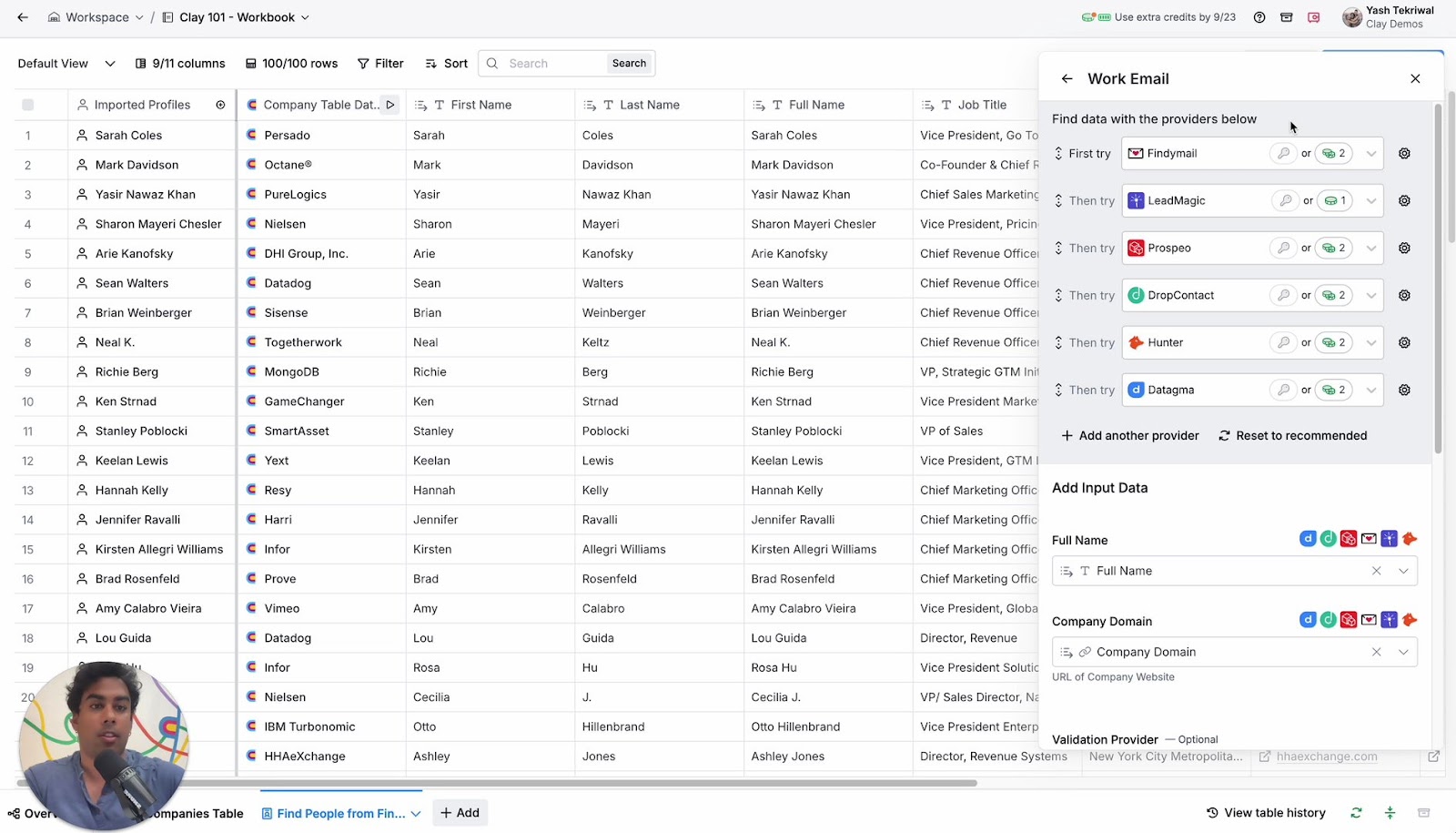

Clay

Clay is the most powerful enrichment tool on this list.

It's also the easiest to waste money on.

100+ data provider integrations, native waterfall enrichment, unlimited users on all plans, and a workflow builder that lets you create enrichment automations that would take months to code from scratch. Reddit's r/sales community loves it - it's the tool RevOps nerds recommend to other RevOps nerds.

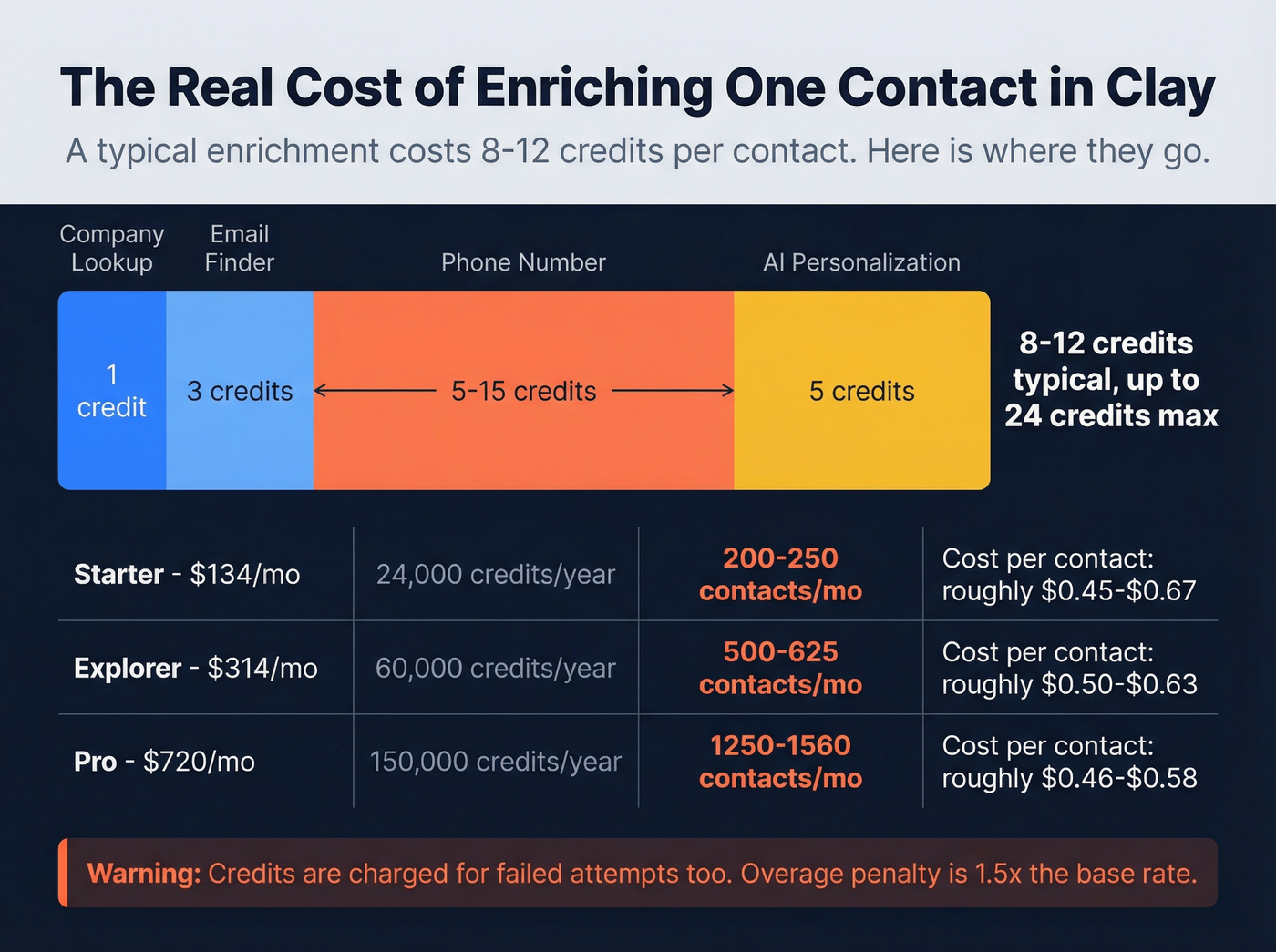

The credit math is brutal. A typical enrichment costs 8-12 credits per contact (company lookup 1 credit, email 3 credits, phone 5-15 credits, AI personalization 5 credits). Credits are charged for failed attempts too. Starter at $134/month gives you 24K credits/year - roughly 200-250 fully enriched contacts per month. Credit overage penalty: 1.5x the base rate. Plans run $134/mo (Starter), $314/mo (Explorer), $720/mo (Pro), custom Enterprise starting around $30K/year.

If you don't have someone on your team who enjoys building automations, you'll pay $314/month for a tool that sits unused. If you do, nothing else comes close to Clay's flexibility.

Lusha

Lusha looks affordable at $29.90/month until you do the credit math.

Free tier gives you 40 credits/month. Pro at $29.90/user/month gets 250 credits. Premium at $69.90/user/month gets 600 credits. Phone reveals cost 10 credits each - so your Pro plan buys exactly 25 phone numbers per month. That's barely one day of prospecting for an active SDR.

The "unlimited" Scale plan has a soft cap of roughly 2,000 contacts per month per Capterra reviews. API access and intent data are locked behind expensive tiers. Monthly billing runs about 25% more than annual.

Where Lusha beats Apollo: Simpler interface, better phone number coverage, transparent pricing with no billing surprises. Where Apollo beats Lusha: Database size, built-in sequencing, and a far more generous free tier.

FullEnrich

FullEnrich takes the waterfall enrichment approach and makes it accessible.

For $29/month, you get 15-20+ B2B data sources queried sequentially - and you only pay when a valid result is found. Credits roll over, no long-term contracts. One Reddit user testing FullEnrich against single-source tools reported roughly 90% accuracy versus 65% from Apollo and Lusha alone. Guideflow's case study showed a 37% pipeline increase, going from under 50% phone coverage to 85%+.

For teams that can't afford Clay's credit complexity but want multi-source enrichment, FullEnrich is the sweet spot.

LeadIQ

LeadIQ is built for one workflow: find a prospect on a professional profile, capture their data, push it to your CRM and sequencer. Free tier gives you 50 credits per month. Pro starts at $200/month with Universal Credits - 1 credit for emails, 10 for phone numbers, 3 for account enrichment.

Job change tracking is the standout feature. Knowing when a champion moves companies is worth the subscription alone.

Native integrations with Outreach and SalesLoft make it a natural fit for teams already in those ecosystems. But at $200/month, it needs to justify itself on workflow speed alone.

Breeze Intelligence (Clearbit)

Breeze Intelligence is a cautionary tale about ecosystem lock-in.

Clearbit was a solid standalone enrichment tool. Then HubSpot acquired it, rebranded it, and locked it behind a HubSpot subscription. Now you're paying $45/month for 100 credits - on top of your HubSpot subscription. Credits don't roll over. The full platform cost with HubSpot runs $1,184-$4,135/month. HubSpot community feedback is telling: coverage "felt really limited" with "no control outside of the HubSpot ecosystem."

If you're already all-in on HubSpot and want native enrichment without another vendor, Breeze works. For everyone else, there are better options at every price point.

Snov.io

Budget email finder with built-in drip campaigns. Free tier available, paid plans from $30/month and $99/month. The database runs 60M+ contacts - smaller than the big players. Email accuracy sits around 80-85%, solid for the price but not enterprise-grade. The combination of email finding and outreach automation in one tool makes it attractive for solopreneurs and small teams who don't want to manage multiple subscriptions.

Hunter.io

The email-only specialist. Hunter does one thing - finds and verifies professional emails - and does it well. Free tier gives you 25 searches per month, paid plans at $49/month (1,000 credits) and $149/month (5,000 credits). The domain search feature is genuinely useful for mapping out an entire company's email structure.

If all you need is verified emails and you want a clean, simple tool, Hunter's hard to beat. But it's increasingly a point solution in a market moving toward platforms.

6sense

Enterprise ABM and intent platform, not a pure enrichment tool. Free tier gives you 50 credits/month. Paid plans range from $15,000-$100,000+/year. Best for large orgs already running account-based marketing who need predictive scoring and intent signals layered on top of their existing data stack. If you're under 50 employees, this isn't for you.

UpLead

160M+ contacts at roughly one-third of ZoomInfo's cost with a 95% email accuracy guarantee. Charges only for valid contacts - a model more vendors should adopt. Good mid-market alternative if ZoomInfo's pricing makes your CFO twitch. Expect to pay ~$99-$199/month.

Datanyze

90-day free trial with 10 credits/month, paid plans from $29/month. Technographic focus - useful if you're selling based on a prospect's tech stack. Very limited database compared to larger players. Niche use only.

Adapt.io

7-day free trial, paid from $49/month. Only 25 monthly credits on the base plan - barely enough to test the tool, let alone run a campaign. Niche use for specific industry verticals where their data happens to be strong.

What Waterfall Enrichment Is (and Why Single-Source Tools Aren't Enough)

Single-source enrichment typically achieves 40-50% contact discovery rates. That means for every 100 prospects you search, you're getting usable data on maybe 45 of them.

Waterfall enrichment fixes this by querying multiple data providers sequentially until verified contact info is found. Provider A can't find the email? Try Provider B. Still nothing? Provider C. The result: 80%+ discovery rates across most ICPs.

The logic is intuitive. Data vendors' databases rarely overlap completely. Apollo has strong coverage for US tech companies but misses European manufacturing. Lusha nails UK mobile numbers but whiffs on US direct dials. By cascading through multiple sources, you cover the gaps any single provider inevitably has.

Descript ran a 3-vendor waterfall via Cargo and achieved a 5-6x coverage uplift compared to their single-vendor setup - going from patchy coverage to 70%+ across their target accounts.

Tools with native waterfall support:

| Tool | Sources | Starting Price | Approach |

|---|---|---|---|

| Clay | 100+ | $134/mo | Build-your-own workflows |

| FullEnrich | 15-20+ | $29/mo | Automated, pay-per-valid |

| BetterContact | 20+ | ~$49-$199/mo | AI-powered sequencing |

Regional optimization matters. Cognism + Lusha dominate European phone data. ZoomInfo + LeadIQ lead in the US. If you're selling globally, your waterfall should route differently by region.

Building a DIY waterfall is expensive - $1,000-$10,000 in development time plus hundreds per month in Make or Zapier costs, with constant maintenance as APIs change. That's why tools like Clay and FullEnrich exist, and why many teams graduate from a single-source solution to a full B2B sales stack as they scale.

Lead Enrichment Mistakes That Kill Your Pipeline

Companies using enrichment properly see 25% more SQLs and 25% shorter sales cycles - but only if they avoid these seven mistakes.

1. Treating all data sources as equal. They aren't. Vet providers for update cycles, accuracy rates, and compliance certifications. A tool that refreshes monthly is fundamentally different from one that refreshes weekly. That difference shows up in your bounce rates.

2. Over-enriching (data hoarding). We've seen teams append 80+ fields to every contact record because they could. The result? CRM bloat, slower load times, and reps who ignore all of it. Focus only on fields that impact deal closure - title, company size, tech stack, intent signals, verified contact info. Everything else is noise.

3. The set-and-forget trap. B2B contact data decays at 30% per year. That enrichment you ran in January? By July, a third of it is stale. Here's the re-enrichment schedule that actually works:

- Critical contacts (active deals, target accounts): Monthly

- Active opportunities: Bi-monthly

- General database: Quarterly

- Cold leads: Annually

4. Enriching at the wrong funnel stage. Not every lead needs 50 data points on day one. Use tiered enrichment: basic firmographic data at capture, full contact details when a lead hits sales-accepted, and real-time triggers (job changes, funding events) at the opportunity stage. This saves credits and keeps your data relevant.

5. Ignoring GDPR and CCPA. Data enrichment can be GDPR-compliant, but you need to document legitimate interest, implement consent mechanisms, and maintain data source records. "We didn't know" isn't a defense when the fine hits.

6. Manual export/import workflows. If you're downloading CSVs from your enrichment tool and uploading them to your CRM, you're introducing errors at every step. Use native integrations. Every major enrichment provider connects to Salesforce and HubSpot natively. There's no excuse for manual data entry in 2026.

7. Not validating enriched data. Enrichment tools give you data. They don't guarantee it's correct. Always run a verification pass - especially on emails - before launching sequences. We've run bake-offs where the "best database" produced a 23% bounce rate on the first send. One bad batch can tank your domain reputation for months. Verification isn't optional.

Which Tool Is Right for Your Team (Decision Framework)

Stop comparing feature lists. Start with three questions: how big is your team, what's your monthly budget, and where are your prospects located?

By Team Size and Budget

| <$500/mo | $500-$2K/mo | $2K+/mo | |

|---|---|---|---|

| 1-3 reps | Prospeo + Apollo free | FullEnrich + Apollo Pro | Cognism (if EMEA) |

| 4-10 reps | Apollo Pro + Hunter | Clay Explorer | ZoomInfo or Cognism |

| 10+ reps | Apollo Professional | Clay Pro or ZoomInfo | ZoomInfo + Cognism |

The $2K+/mo column assumes you're running a sizable outbound team where data quality directly impacts revenue. At that scale, the ROI math works.

By Compliance Needs

If GDPR matters to your business:

- Cognism - Built in the UK specifically for EU compliance. Diamond Data is phone-verified. Strongest GDPR story in the market.

- Lusha - GDPR and CCPA aligned. Transparent about data sourcing.

- Apollo - SOC 2 Type II certified. GDPR compliance is there but it's not the primary selling point.

Smaller tools like Hunter.io and Snov.io are GDPR-aware but lack the dedicated compliance infrastructure of the top three.

The ZoomInfo Reality Check

Look, if you're spending $30K+/year on ZoomInfo and only 6 of 15 reps actually log in, you're burning money. That's $5,000 per active user per year. You could give each of those 6 reps an Apollo Professional seat ($99/month = $1,188/year) plus a dedicated email verifier tool and still save $20K+ annually.

Teams running $200/month stacks are outperforming $32K ZoomInfo contracts. Prospeo users book 26% more meetings than ZoomInfo and 35% more than Apollo - because 98% accuracy means reps reach real people.

Enrich 75 emails free this month and see the difference yourself.

FAQ

What is lead enrichment?

Lead enrichment appends missing data - emails, phone numbers, firmographics, technographics, intent signals - to existing lead records using third-party sources. It transforms a name and company into an actionable prospect profile. Teams using enriched data see 20-30% higher conversion rates versus working raw, incomplete records.

How much do lead enrichment tools cost?

Free tiers exist from Apollo, and Hunter. Mid-market teams typically spend $100-$500/month on credit-based plans. Enterprise platforms like ZoomInfo and Cognism run $15,000-$50,000+/year, with emails costing less per credit than phone numbers across every vendor.

What's the most accurate B2B lead enrichment tool?

Prospeo leads email accuracy at 98% verified with a 7-day refresh cycle. For European phone numbers, Cognism's Diamond Data delivers 98% phone-verified accuracy. No single tool wins across every data type and geography - which is exactly why waterfall enrichment matters.

What is waterfall enrichment?

Waterfall enrichment queries multiple data providers sequentially until verified contact info is found. Single-source tools achieve 40-50% discovery rates; waterfall approaches reach 80%+. Clay (100+ sources), FullEnrich (15-20+ sources), and BetterContact (20+ sources) all support native waterfall workflows.

How often should I re-enrich my CRM data?

B2B contact data decays at roughly 30% per year. Re-enrich critical contacts (active deals, target accounts) monthly, active opportunities bi-monthly, your general database quarterly, and cold leads annually. Skip this cadence and your reps are dialing dead numbers within months.