Lead Qualification Questions: A Stage-by-Stage System (Not Another Question Dump)

It's Tuesday morning. Your SDR team just wrapped 47 discovery calls last week. They asked all the right questions - or at least, all the questions on the script. And yet, 38 of those "qualified" leads are going nowhere. The AEs are frustrated. The pipeline looks full on paper but feels hollow in every forecast meeting.

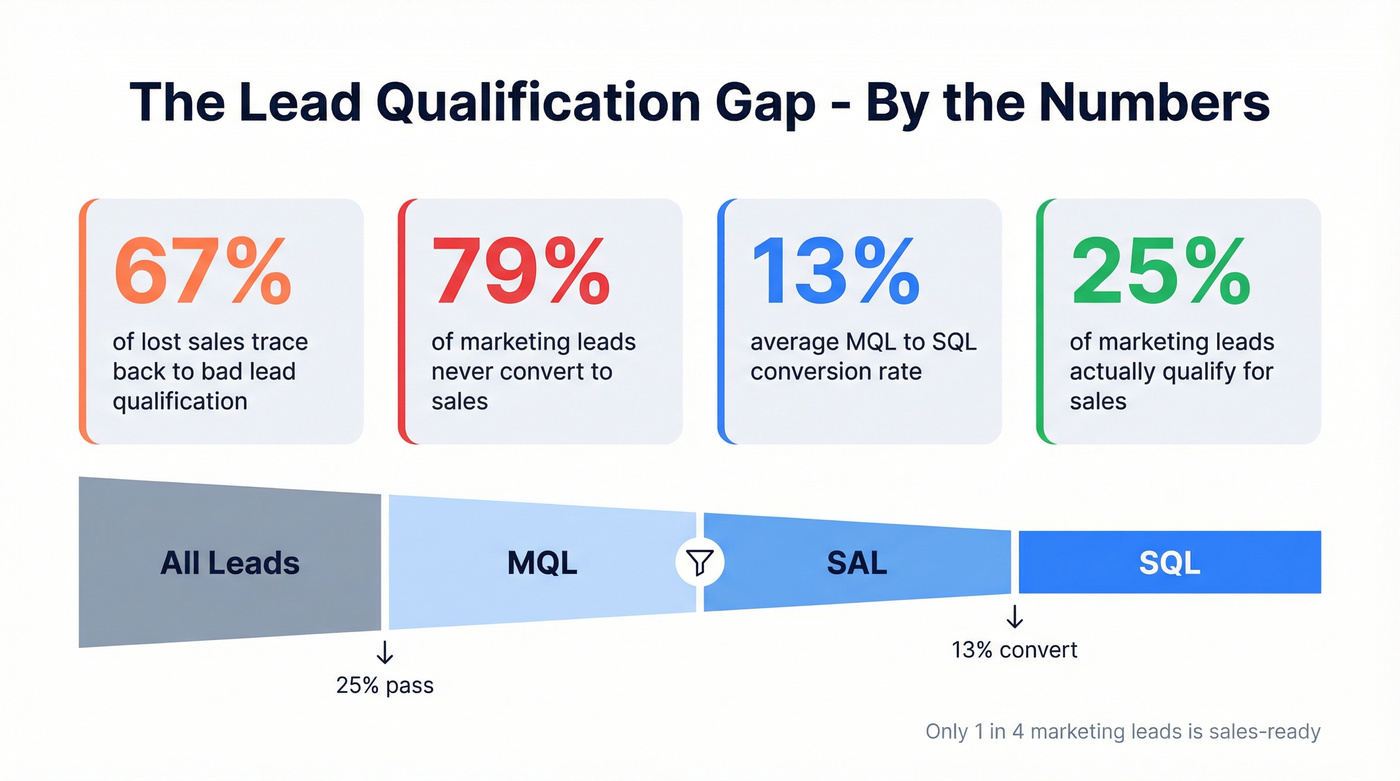

This is the cost of bad lead qualification questions - or more precisely, the wrong ones asked in the wrong order. 67% of lost sales trace back to inadequate lead qualification. Meanwhile, 79% of marketing-generated leads never convert to sales, and only 27% are ever sales-ready to begin with. The problem isn't that your reps aren't asking questions. It's that they're asking the wrong ones, in the wrong order, to the wrong people.

What You Need (Quick Version)

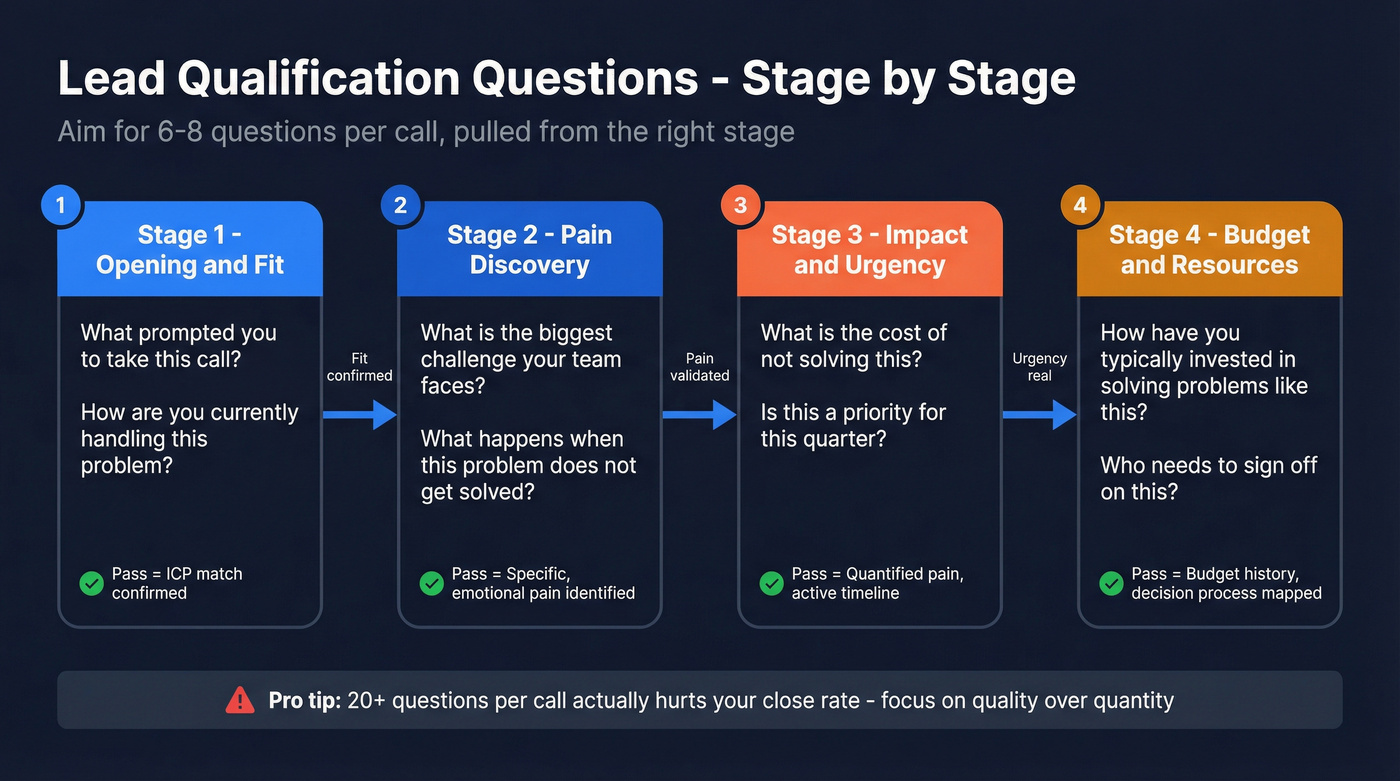

- You don't need 44 questions. Call analysis across millions of sales conversations shows 20+ questions per call actually hurts outcomes. Pick 6-8 from the right stage.

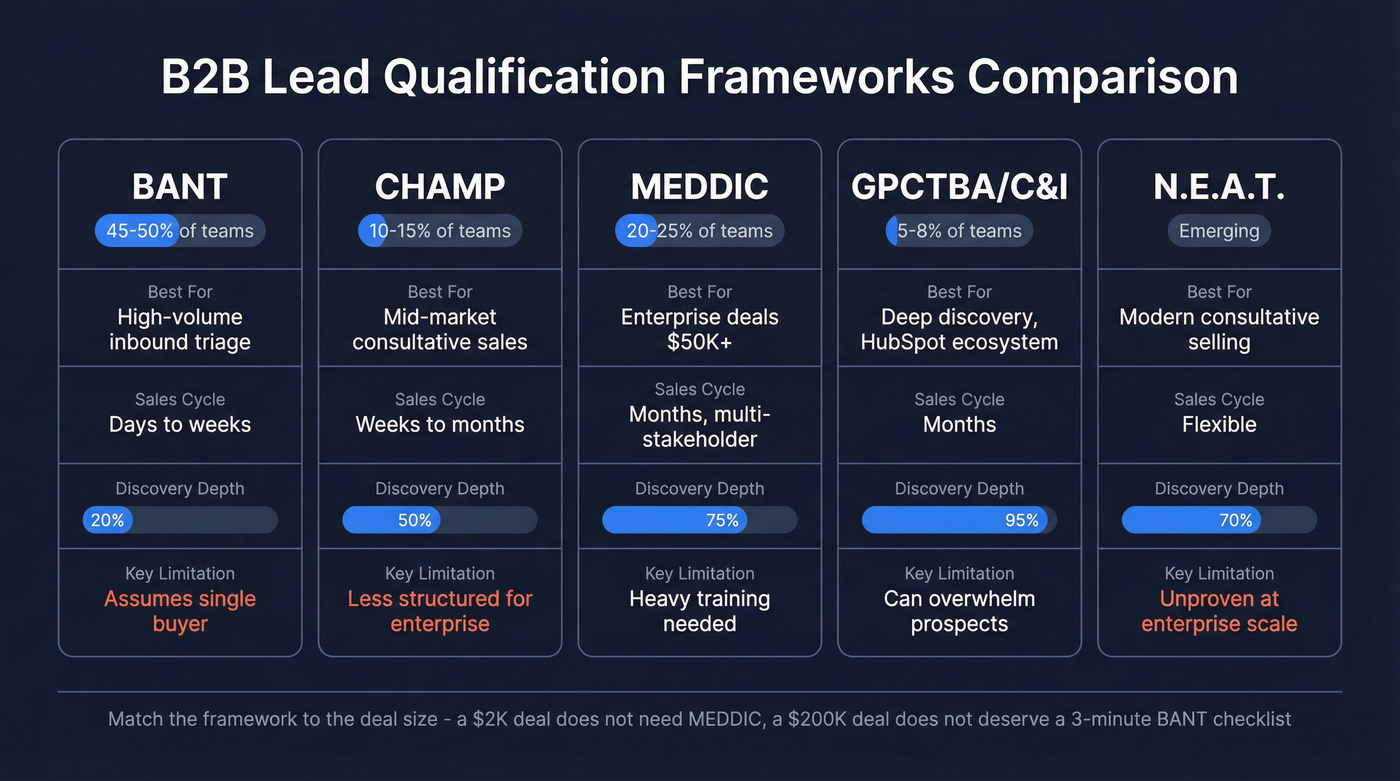

- Choose your framework first - BANT for triage, CHAMP for mid-market, MEDDIC for enterprise - then customize your qualifying questions around it (use a consistent lead qualification framework).

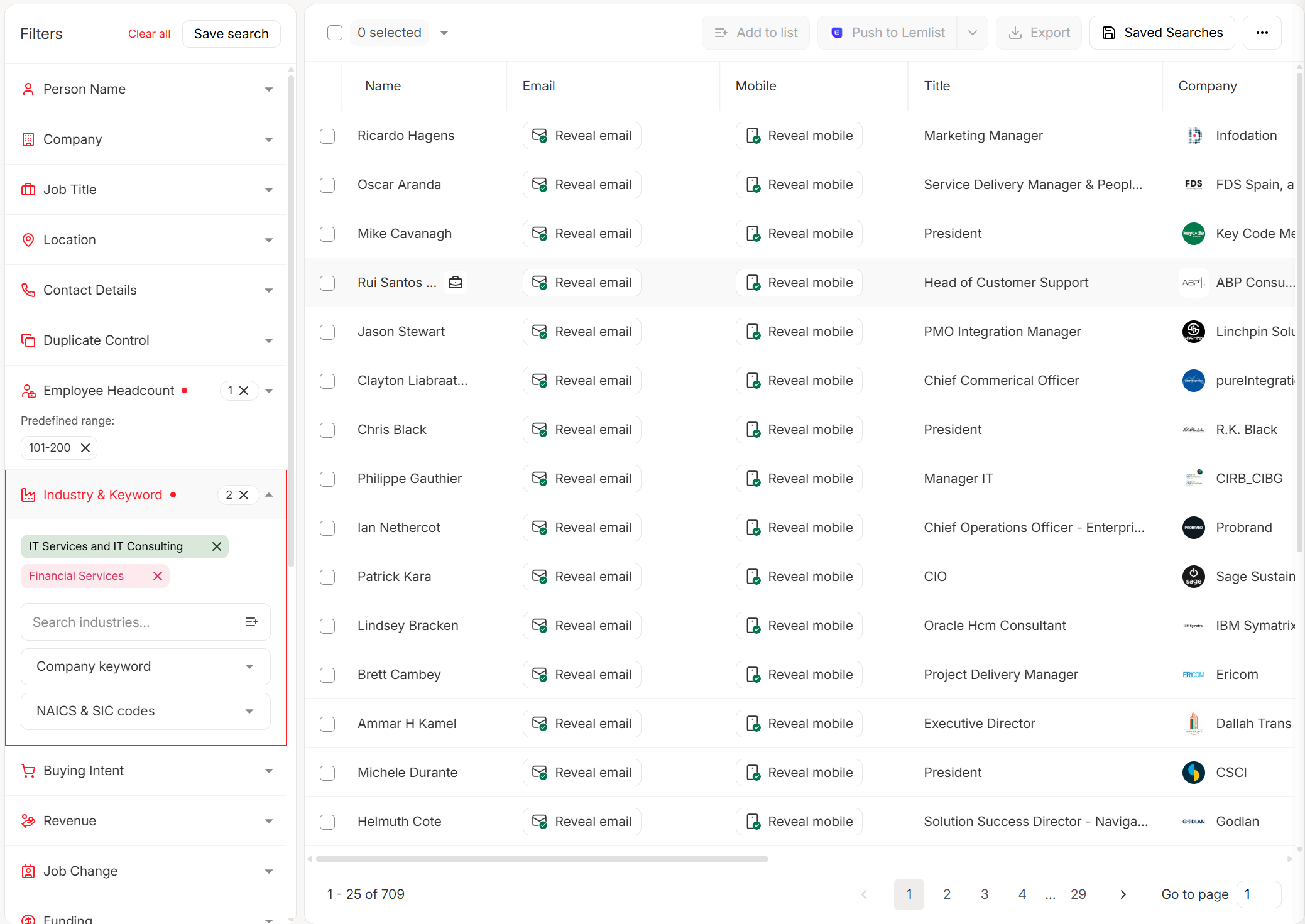

- Fix your data before you fix your questions. Half of bad qualification is qualifying the wrong people entirely. If your contact records are stale, no framework saves you (start with data quality).

What Is Lead Qualification? (And What It Isn't)

Lead qualification is the process of determining whether a prospect has the need, authority, budget, and timeline to actually buy from you. It's not about filling the sales pipeline. It's about clearing it.

Here's the thing: only 25% of marketing leads qualify for direct sales engagement. That means three out of four leads your marketing team hands over aren't ready. Qualification is the filter that keeps your closers focused on the 25% that matter - and the right questions are what make that filter work.

Quick definitions so we're speaking the same language:

- MQL (Marketing Qualified Lead): Engaged with your content and fits your ideal customer profile. Marketing says they're warm.

- SQL (Sales Qualified Lead): Vetted through direct conversation. Confirmed need, budget, authority, timeline.

- PQL (Product Qualified Lead): Activated key features in a free trial or freemium product. Their behavior qualifies them.

- SAL (Sales Accepted Lead): Reviewed by sales as worthy of follow-up - the handoff checkpoint between MQL and SQL.

The average MQL-to-SQL conversion rate is just 13%. That gap between marketing's optimism and sales reality is where qualification lives.

67% of lost sales trace back to bad qualification - but half the problem is qualifying the wrong people entirely. Prospeo gives your SDRs 300M+ verified profiles with 30+ filters so every discovery call starts with a real buyer, not a dead end.

Fix your data before you fix your questions. Start free today.

Choose Your Qualification Framework First

Don't start writing questions until you've picked a framework. The framework dictates which questions matter, how deep you go, and when you disqualify. Skipping this step is like building a house without blueprints - you'll end up with rooms that don't connect.

Framework Comparison Table

| Framework | Best For | Sales Cycle | Discovery Depth | Key Limitation |

|---|---|---|---|---|

| BANT | High-volume inbound | Days to weeks | Light | Single-buyer assumption |

| CHAMP | Mid-market consultative | Weeks to months | Medium | Less structured for enterprise |

| MEDDIC | Enterprise $50K+ | Months, multi-stakeholder | Deep | Heavy training required |

| GPCTBA/C&I | HubSpot-ecosystem enterprise | Months | Very deep | Overwhelming for prospects |

| N.E.A.T. | Modern consultative | Flexible | Deep | Unproven at enterprise scale |

Which Framework Fits Your Team

BANT was invented by IBM in the 1950s. It's still the most widely used framework - roughly 45-50% of sales teams default to it, and 52% of reps trust it for reliability. But the average B2B purchase now involves 7 stakeholders. Modern buying committees run 6-10 people deep. BANT's assumption that there's one decision maker with a clear budget is a relic.

Use BANT as a bouncer at a nightclub. It's great for quick triage - high-volume inbound, short sales cycles, deciding in 90 seconds whether a lead deserves a second conversation. But don't use it as your entire qualification system.

CHAMP flips the script by starting with Challenges instead of Budget. If you're selling mid-market deals where the prospect doesn't have a pre-allocated budget line, CHAMP lets you build the business case before the money conversation. About 10-15% of teams use it, mostly in consultative SaaS sales.

MEDDIC is the enterprise workhorse. Roughly 20-25% of sales orgs run it, and it's the framework that reduces risk on six-figure deals. It demands significant training - you can't just hand reps an acronym and expect results. But for complex sales with multiple stakeholders, it's the most thorough system available (especially in enterprise sales).

GPCTBA/C&I was created by HubSpot to address BANT's limitations for consultative SaaS sales. It prioritizes discovery depth above everything else - Goals, Plans, Challenges, Timeline, Budget, Authority, Consequences & Implications. It's powerful but complex. About 5-8% of teams use it, mostly in the HubSpot ecosystem. If your reps can handle the depth, it produces incredibly rich qualification data.

Hot take: If your average deal size is a few thousand dollars annually, you don't need MEDDIC-level qualification. A small contract doesn't deserve a 45-minute deep-dive. A $200,000 enterprise deal doesn't deserve a 3-minute BANT checklist. Match the framework to the stakes.

Sales Lead Qualification Questions by Stage

Call analysis data is clear: 20+ questions per call hurts your close rate. The goal isn't to interrogate - it's to have a focused conversation that reveals whether this deal is real. Aim for 6-8 questions per call, pulled from whichever stage matches where the prospect is in their buyer journey.

Stage 1 - Opening and Fit

These prospect qualification questions determine whether this prospect belongs in your sales funnel at all. If they don't pass Stage 1, nothing else matters.

"What does your company do, and what's your role in [specific function]?"

Confirms ICP alignment in the first 30 seconds. Phrase it specifically - "what's your role in demand gen?" beats "tell me about yourself." A good answer maps cleanly to your buyer persona. A bad answer reveals they're in the wrong department, wrong company size, or wrong industry.

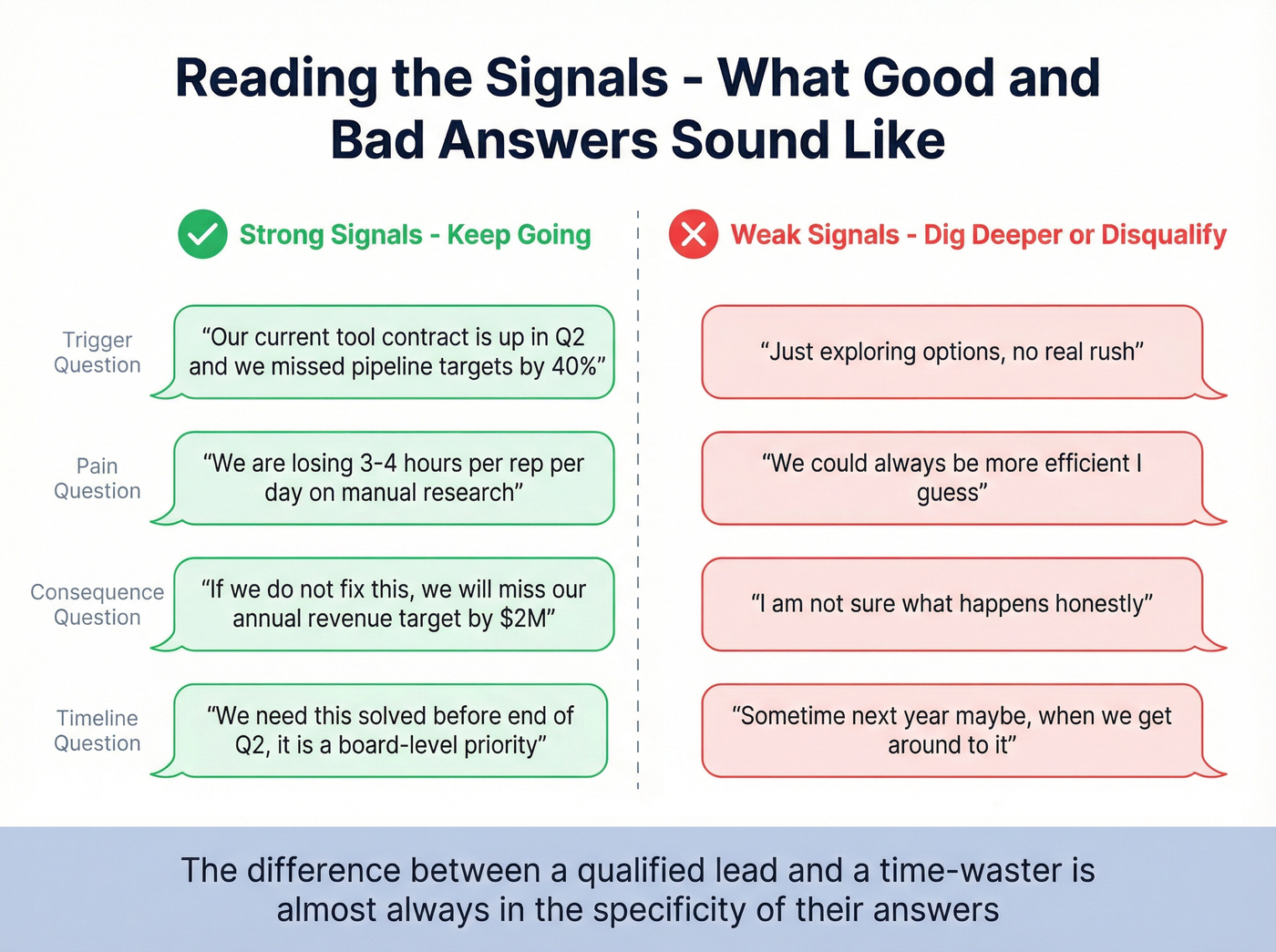

"What prompted you to take this call / fill out this form?"

The single most revealing opening question. It separates active buyers from tire-kickers. A good answer references a specific trigger - "our current tool's contract is up in Q2" or "we just missed our pipeline target by 40%." A bad answer is vague: "just exploring options."

"How are you currently handling [the problem your product solves]?"

Establishes the baseline. You can't sell change if you don't understand the status quo. A good answer describes a specific process with clear pain points. A bad answer is "we don't really have a process" - which could signal greenfield opportunity or zero urgency.

"Who else on your team is affected by this?"

Early cross-functional mapping. If the answer is "just me," you're either talking to a solo practitioner or someone who hasn't thought about implementation. Both are signals worth noting.

Stage 2 - Pain Discovery

This is where most reps either win or lose the deal. Surface-level pain gets surface-level commitment. You need to dig.

"What's the biggest challenge your team faces with [specific area]?"

Opens the door to real pain. Phrase it around their team, not them personally - people are more honest about team problems than personal failures. A good answer is specific and emotional: "We're losing 3-4 hours per rep per day on manual research." A bad answer is generic: "We could always be more efficient."

"What happens when that problem doesn't get solved?"

Forces the prospect to articulate consequences. This is the question that turns "nice to have" into "need to have." If they can't describe what happens when the problem persists, the urgency isn't there.

"What have you already tried to fix this?"

Reveals sophistication level and competitive landscape. If they've tried three competitors and failed, you know the bar is high. If they've tried nothing, you need to understand why - lack of budget, lack of priority, or lack of awareness?

"If you could wave a magic wand and fix one thing about your current process, what would it be?"

Reveals the prospect's priority hierarchy. Their answer tells you which feature to lead with in your demo. A good answer is specific and actionable. A bad answer is "everything" - which means they haven't thought about it enough to prioritize.

Stage 3 - Impact and Urgency

85% of B2B buyers are ready to buy before they ever contact sales - which means by the time they're on your call, the real question isn't whether they want to buy, but whether they'll buy from you. These questions reveal where they actually are in that journey.

Scenario: Your SDR just finished a strong pain discovery. The prospect described a real problem, named specific consequences, and even mentioned a failed competitor. Everything sounds great - until you ask about timeline and get "sometime next year, maybe." Impact and urgency questions prevent you from investing 6 weeks of AE time into a deal that won't close for 12 months.

"What would solving this problem mean for your team in the next 6-12 months?"

Gets the prospect to paint a picture of success. If they can't articulate what "solved" looks like, they haven't internalized the problem deeply enough to buy.

"What's the cost of not solving this - in time, revenue, or headcount?"

Quantifies the pain. This is the number you'll reference in every follow-up conversation. A good answer includes a dollar figure or time metric. A bad answer is "I'm not sure" - which means you need to help them calculate it.

"Is this a priority for this quarter, or more of a 'when we get to it' initiative?"

Directly separates active deals from pipeline padding. Don't be afraid of the answer. A prospect who says "next year" is telling you the truth - and that's more valuable than a false "yes, this quarter" that wastes your AE's time for three months.

"What other initiatives are competing for the same budget or attention?"

Your biggest competitor is rarely another vendor. It's the other internal project fighting for the same dollars. This question reveals the real competitive landscape.

Stage 4 - Budget and Resources

Don't ask "What's your budget?" It's the fastest way to get a lowball number or a defensive non-answer. Budget is a value conversation, not a qualification checkbox.

"How have you typically invested in solving problems like this?"

Gets at budget history without triggering defensiveness. Past behavior predicts future behavior. A good answer references specific past purchases: "We spent about $40K on our last tool." A bad answer is "we haven't invested in this area" - which means you're building a business case from scratch.

"Do you have budget allocated for this, or would this need to go through an approval process?"

Separates "budget exists" from "budget needs to be created." Both are workable, but the sales motion is completely different. If budget needs approval, your timeline just extended by 4-8 weeks minimum.

"What would the ROI need to look like for this to be a no-brainer?"

Lets the prospect set their own success criteria. Now you're not selling a price - you're selling against their own benchmark. This is the N.E.A.T. approach to budget: focus on economic impact, not line items.

"Who else would need to sign off on this investment?"

Bridges naturally into the authority stage. Far more effective than "Are you the decision maker?" - which puts prospects in an awkward position where they either lie or feel diminished.

Stage 5 - Decision Process and Authority

The average B2B purchase involves 7 stakeholders. If you're only talking to one person, you're not selling - you're presenting.

Here's how the conversation should chain together:

Start broad: "Walk me through how your team has made similar purchasing decisions in the past."

This reveals the actual buying process, not the theoretical one. Every company has an official procurement process and an unofficial one. This question surfaces the unofficial one (and how B2B decision making actually works).

Then map the committee: "Who on your team would need to see a demo or review the proposal before moving forward?"

Maps the buying committee without asking "who's the decision maker?" We've seen reps lose deals because they never identified the CFO who had veto power - this question prevents that.

Then identify blockers: "Is there anyone who might push back on this, and what would their concerns be?"

If the prospect can name the skeptic and their objections, you can address them proactively. If they can't think of anyone, they either haven't socialized the idea internally (bad sign) or genuinely have buy-in (rare but great).

Then lock down criteria: "What criteria will your team use to evaluate options?"

If they say "integration with Salesforce is non-negotiable," you know what to lead with. If they say "lowest price," you know the deal dynamics you're working with.

Stage 6 - Timeline and Next Steps

A qualified lead without a timeline is just a warm contact.

This stage is a checklist - run through it before you hang up:

- Ask: "When do you need this up and running?" - Anchor the deal to a date. Work backward from their implementation deadline to determine your close date.

- Ask: "What would need to happen between now and a decision?" - Creates a mutual action plan. The prospect tells you exactly what steps remain.

- Ask: "Are you evaluating other solutions right now?" - Reveals competitive pressure. If they're actively comparing three vendors, the timeline is real.

- Book the next meeting on this call. Responding within 1 minute increases conversions by 391%. Booking the next step before you hang up is even better. If a prospect won't commit to a next step, they're not qualified - no matter how good their answers were to everything else.

Quick Reference: One Key Question Per Stage

| Stage | The One Question That Matters Most |

|---|---|

| Opening & Fit | "What prompted you to take this call?" |

| Pain Discovery | "What happens when that problem doesn't get solved?" |

| Impact & Urgency | "What's the cost of not solving this - in time, revenue, or headcount?" |

| Budget & Resources | "How have you typically invested in solving problems like this?" |

| Decision Process | "Walk me through how your team has made similar purchasing decisions." |

| Timeline | "When do you need this up and running?" |

Industry-Specific Variations

The questions above work across B2B. But the best reps adapt phrasing to their vertical. Here are variations for three common ones:

SaaS / Technology:

- Pain discovery: "What's your current tech stack for [function], and where does it break down?"

- Budget: "Is this coming from an existing software line item, or would it need a new budget category?"

Professional Services:

- Pain discovery: "How are your consultants currently spending their non-billable hours?"

- Impact: "What's the revenue impact of one additional billable hour per consultant per week?"

Manufacturing / Industrial:

- Pain discovery: "Where in your supply chain or production process does this bottleneck hit hardest?"

- Timeline: "Is this tied to a production cycle, seasonal demand, or a specific contract deadline?"

Questions You Should Never Ask (And What to Say Instead)

Some questions feel natural but actively damage your qualification process. Skip this section if you're already past the "Are you the decision maker?" phase of your career - but if your team still has reps asking that on calls, read on.

Don't ask: "What's your budget?"

Say instead: "How have you typically invested in solving problems like this?" or "What would the ROI need to look like for this to be worth the investment?"

The direct budget question causes buyers to lowball or disengage entirely. Lead with impact, and the budget conversation becomes collaborative instead of adversarial.

Don't ask: "Are you the decision maker?"

Say instead: "Walk me through how your team has made similar purchasing decisions" or "Who else would need to review this before moving forward?"

Nobody wants to admit they're not the decision maker. Indirect authority mapping gets you the same information without the awkwardness - and often reveals stakeholders the prospect wouldn't have mentioned otherwise.

Don't ask: "When are you looking to buy?"

Say instead: "When do you need this up and running?" or "What's driving the timeline on your end?"

"When are you looking to buy?" is seller-centric. It frames the conversation around your pipeline, not their problem. Flipping to implementation timeline makes the question about their success.

Don't ask situation questions about information already on their profile.

This is the SPIN Selling trap in 2026. Asking "How many employees does your company have?" when it's on their website makes you sound unprepared. Do your research before the call. Your discovery time is precious - don't waste it on questions Google can answer (use a pre call research checklist).

Five Qualification Mistakes That Kill Your Pipeline

Mistake 1: Relying on Stale or Missing Data

You can't qualify leads if your contact data is wrong. If the VP of Sales you're targeting left the company six months ago, no framework saves that call. If the email bounces, the phone is disconnected, or the job title is outdated, your reps are qualifying ghosts.

This is where most qualification breakdowns actually start - before the first conversation ever happens. Tools like Prospeo refresh contact records every 7 days (the industry average is 6 weeks) and verify emails at 98% accuracy, so when your reps pick up the phone, they're calling real people with current titles at companies that actually match your ICP (see B2B contact data decay).

Mistake 2: Prioritizing Lead Volume Over Lead Quality

More leads isn't better. More qualified leads is better.

In our experience, teams that celebrate hitting 500 MQLs in a month while their AEs close 3 deals are fooling themselves. The math doesn't work when 79% of those leads were never going to convert. The fix: tighten your ICP criteria and accept a smaller, higher-quality pipeline. A 50-lead pipeline with 40% conversion rate beats a 500-lead pipeline with 2% close rate - and your reps won't burn out chasing dead ends (protect pipeline quality).

Mistake 3: Using Unclear or Inconsistent Qualification Criteria

Only 40% of firms consistently apply their qualification criteria. That means 60% of sales teams are making it up as they go - each rep has their own mental model of what "qualified" means. Without a shared set of qualifying questions, every handoff becomes a guessing game.

The fix: document your qualification criteria, tie them to your framework, and review them in pipeline meetings. If two reps can look at the same lead and disagree on whether it's qualified, your criteria aren't clear enough (use a standard lead qualification process).

Mistake 4: Ignoring Buyer Intent Signals

Website visits, content downloads, pricing page views, event attendance - these are all signals of readiness that most teams ignore in their qualification process. Only 44% of companies use lead scoring at all. And 87% of marketers report higher ROI when layering intent data into their targeting compared to relying on demographics alone.

The fix: layer behavioral signals into your qualification model. A prospect who visited your pricing page three times this week is warmer than one who downloaded a whitepaper six months ago. Intent data turns qualification from a point-in-time judgment into a continuous signal (see intent signals).

Mistake 5: Poor MQL-to-SQL Handoff

Marketing says the lead is qualified. Sales disagrees. The lead sits in limbo for two weeks. By the time someone follows up, the prospect has gone with a competitor.

This handoff failure is one of the most expensive problems in B2B sales - and it's entirely preventable. Define the handoff criteria in writing. What specific actions or attributes move a lead from MQL to SQL? Both teams need to agree, and the criteria need to be reviewed quarterly.

Your reps get 6-8 questions per call. Don't waste them on prospects with outdated titles or wrong departments. Prospeo refreshes every 7 days - so your ICP data is current when your team picks up the phone.

Qualify faster with contacts that are actually accurate at $0.01 each.

How AI Changes Lead Qualification in 2026

The manual qualification model is breaking. Here's why:

| Metric | Manual Qualification | AI-Enhanced Qualification |

|---|---|---|

| Time per lead | 15-20 minutes | Seconds |

| Accuracy | 60-70% | 75-90% |

| Monthly capacity | ~800-1,000 leads | 15,000+ leads |

| Consistency | Varies by rep | Standardized |

Manual qualification breaks down predictably around 800-1,000 leads per month. Past that threshold, reps start cutting corners - shorter calls, fewer questions, gut-feel decisions instead of framework-driven ones.

AI doesn't replace your qualification framework. It supercharges it. AI-driven lead scoring increases deals closed by 36% and lead volume by 129%. And 67% of organizations using AI in marketing and sales saw revenue growth over the previous 12 months, according to McKinsey's research.

What AI actually does well in qualification: it automates the signal collection that frameworks require. Instead of a rep manually checking whether a prospect has budget, AI can analyze funding data, tech stack signals, hiring patterns, and content engagement to pre-score that indicator before the first call. The rep still asks the qualifying questions - but they walk in knowing which ones matter most for this specific prospect (compare AI lead scoring vs traditional lead scoring).

The teams we've seen get this right don't treat AI as a replacement for human judgment. They treat it as a research assistant that does the first 80% of qualification automatically, so reps can focus their limited call time on the 20% that requires human conversation.

The nuanced pain discovery, the relationship building, the objection handling - no algorithm replicates those. But the data gathering that makes those conversations productive? That's where AI earns its keep.

What to Do After You Qualify

Qualifying a lead is the beginning, not the end. Here's the post-qualification playbook that keeps deals moving:

- Score the lead immediately. Assign a numerical score based on framework criteria, behavioral signals, and fit. If you're not scoring, you're guessing at pipeline priority (build repeatable lead scoring systems).

- Build in decay scoring. A lead that was hot 90 days ago isn't hot today. Scores should decrease over time without new engagement. A 10% reduction per week of inactivity is a reasonable starting point.

- Enrich the record before routing. Once a lead is qualified, enrich it with job title, department headcount, tech stack, and funding status before handing it to your AE. Your closer needs context before the first meeting, not after.

- Route based on segment, not round-robin. Enterprise leads go to enterprise AEs. Mid-market goes to mid-market. Routing by segment instead of random assignment increases close rates because reps work deals that match their expertise.

- Recalibrate quarterly. Review your lead scoring model every quarter. Compare scores against closed-won and closed-lost data. If high-scoring leads aren't closing, your model is wrong.

- Watch for stage signals. Early-stage buyers engage with educational content broadly. Late-stage buyers revisit key resources, share materials internally, and respond to ROI and pricing content. These behavioral shifts tell you when a qualified lead is ready to close.

FAQ

How many lead qualification questions should I ask per call?

Aim for 6-8 per conversation, organized by stage. Call analysis across millions of sales conversations shows 20+ questions per call hurts close rates. Pick questions based on where the prospect is in their journey, not a rigid script.

What's the difference between MQL and SQL?

An MQL fits your ICP and has engaged with your content. An SQL has been vetted through direct conversation with confirmed need, budget, authority, and timeline. The average MQL-to-SQL conversion rate is just 13%, which is why structured qualification matters.

Is BANT still relevant in 2026?

Yes, but only as a triage tool - not a complete qualification system. BANT works for high-volume inbound and short sales cycles. For enterprise deals with 6-10 stakeholders, use MEDDIC or GPCTBA/C&I to go deeper than BANT allows.

Should I ask about budget on the first call?

No. Asking "What's your budget?" early causes prospects to lowball or disengage. Lead with pain and impact questions first, then approach budget as a value conversation. Past investment history is a better indicator than a stated number.

How do I make sure I'm qualifying the right people?

Start with data quality. If your contact records are outdated - wrong titles, disconnected numbers, people who've left - no framework saves you. Use a data platform that refreshes records weekly and verifies emails before building your qualification pipeline.