Prospect in Marketing: Definitions, Qualification, and CRM Mapping

In B2B, "prospect in marketing" sounds simple right up until you try to report on it. Then it turns into a turf war between Marketing, Sales, and RevOps.

Here's the stance that ends most arguments: a prospect isn't a vibe. It's a routing + reporting decision you encode in your CRM so handoffs, SLAs, and dashboards stop contradicting each other.

And yes, the definition matters because your inbox reputation, your SDR team's time, and your forecast all pay the price when you get it wrong.

What you need (quick version)

- Pick one ladder and lock it: Lead -> Prospect -> Opportunity works for most B2B teams because Adobe and Salesforce both treat prospect as a qualified lead, and an opportunity as a qualified buying situation you track through a sales process.

- Define "prospect" as an operational gate: it must trigger ownership, a next step, and an SLA clock.

- Alignment matters: 42% of business leaders say alignment helps them connect with qualified leads faster (Gartner Digital Markets, 2023).

- Use 3 checks before you call it a prospect: Fit (ICP), Intent (signal), and Contactability (you can reach them).

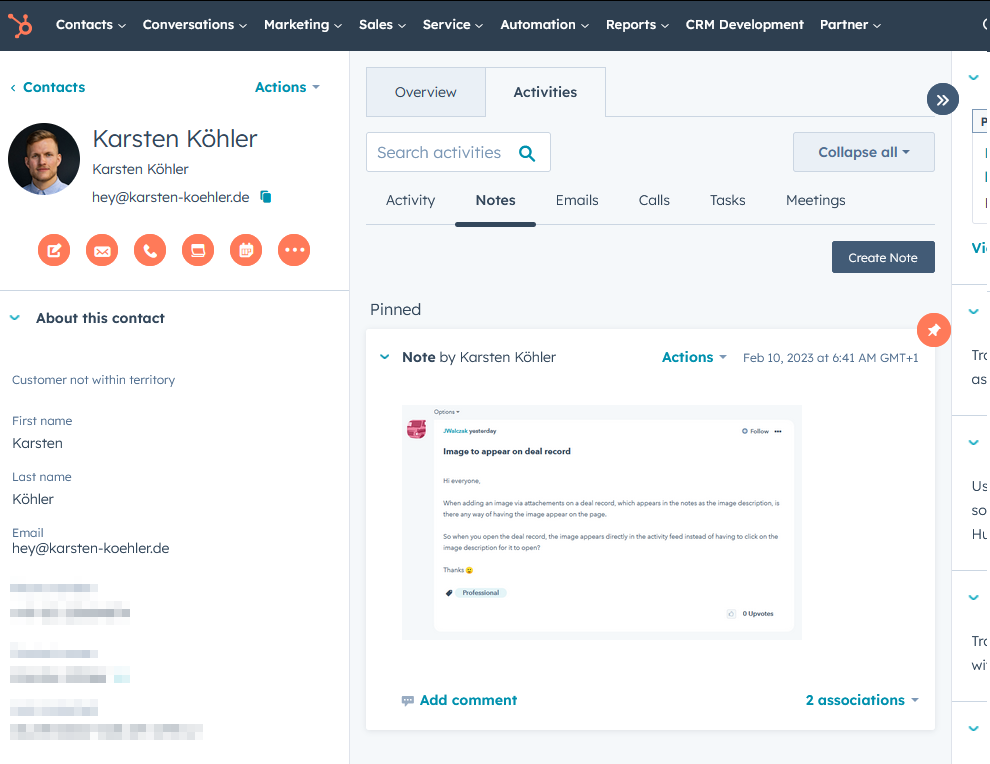

- Decide where "prospect" lives in your CRM: HubSpot = Lifecycle Stage + Lead Status; Salesforce = Lead/Contact conversion + reporting convention.

- Governance rule: Sales sets SQL, Marketing sets MQL, RevOps enforces fields/permissions.

- Scoring rule of thumb: 5-7 criteria, capture the top ~20% as MQL, and decay scores so old activity doesn't linger.

Why "prospect" causes chaos (and why it matters)

Picture the pipeline meeting. Marketing says, "We generated 1,200 prospects." Sales says, "No you didn't. We talked to 40 people." RevOps pulls a dashboard and everyone argues about which number is "real."

The root cause is almost always the same: teams mix contact stages (what a person is to you) with deal stages (where a buying process is). A contact can be "SQL" while the deal is still "Discovery." Or the deal can be "Proposal" while half the contacts are still "Lead."

That mismatch creates second-order damage: broken SLAs, broken attribution, and broken forecasting. It also slows speed-to-lead and tanks conversion because nobody trusts the system enough to follow it.

There's another cost operators feel immediately: over-persistence. When you label early leads as "prospects," you trigger aggressive sequences too soon, which means more unsubscribes, more spam complaints, and worse deliverability.

MQL volume's also losing status in 2026. The scoreboard that matters is SQL conversion and pipeline velocity, and your definition either supports that or quietly sabotages it.

Prospect vs lead vs opportunity (the ladder most teams should use)

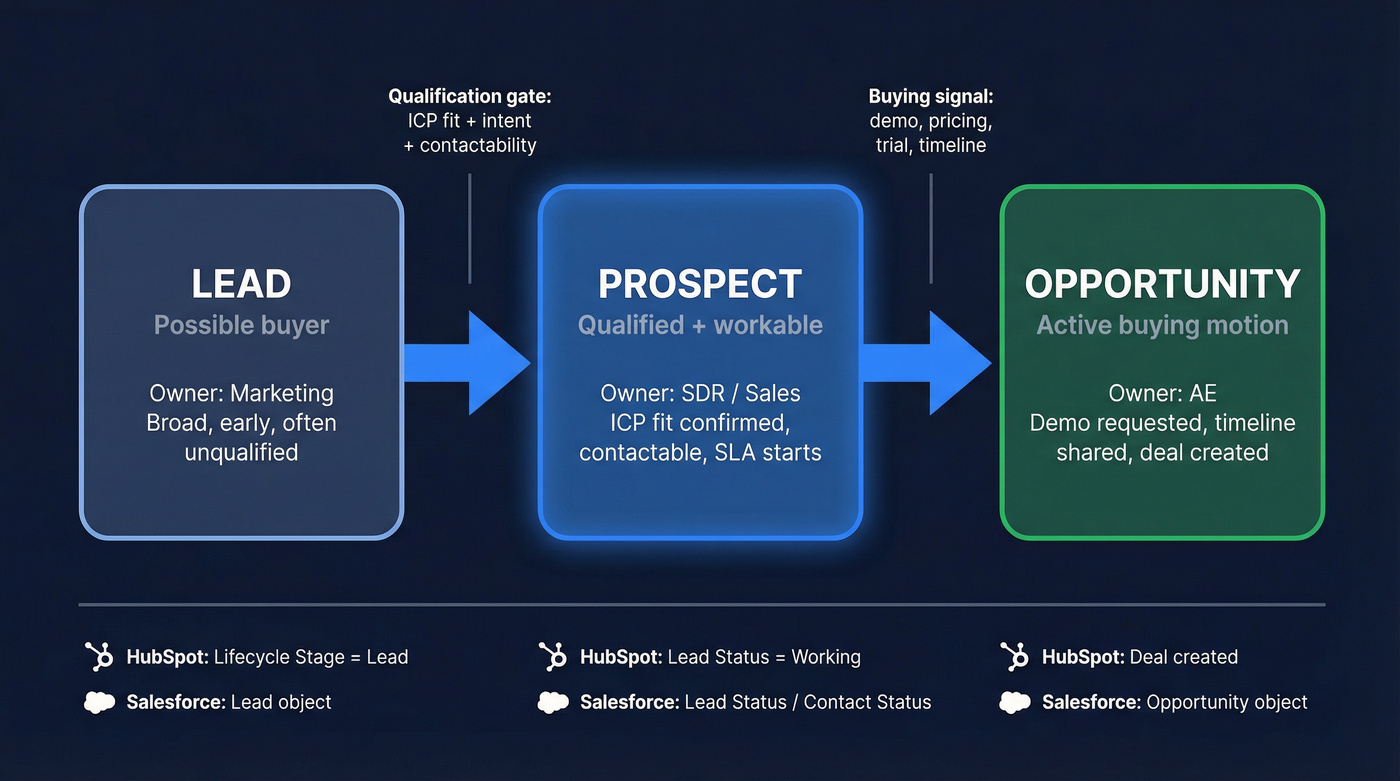

Most B2B orgs should use a simple ladder:

- Lead = a person who could become a customer (early, broad, often unqualified).

- Prospect = a qualified lead that matches your ICP and is worth human time.

- Opportunity = a prospect in an active purchase motion tracked as a deal.

Adobe's definitions are practical: lead is broad, prospect is ICP-qualified, and opportunity is when there's real purchase intent (demo/pricing/trial/timeline). Salesforce's framing lines up: prospect = qualified lead; opportunity = a qualified lead with potential to become a customer that you track through a sales process.

One nuance that fixes a lot of reporting: one opportunity can include multiple contacts (champion, economic buyer, security, procurement). Don't force "prospect" to mean "one person" if your deal is account-based.

Examples of "opportunity = active purchase motion":

- Requested a demo and confirmed evaluation criteria

- Asked for pricing or procurement steps

- Started a trial with a timeline to decide

- Shared a decision date, budget window, or implementation plan

The ladder in one table

| Stage | Meaning | Owner | CRM anchor (typical) |

|---|---|---|---|

| Lead | Possible buyer | Marketing | HubSpot: Lifecycle Stage = Lead; Salesforce: Lead |

| Prospect | Qualified + workable | SDR/Sales | HubSpot: Lead Status; Salesforce: Lead Status / Contact Status |

| Opportunity | Buying motion | AE | HubSpot: Deal; Salesforce: Opportunity |

Why definitions vary (and the one rule that ends the argument)

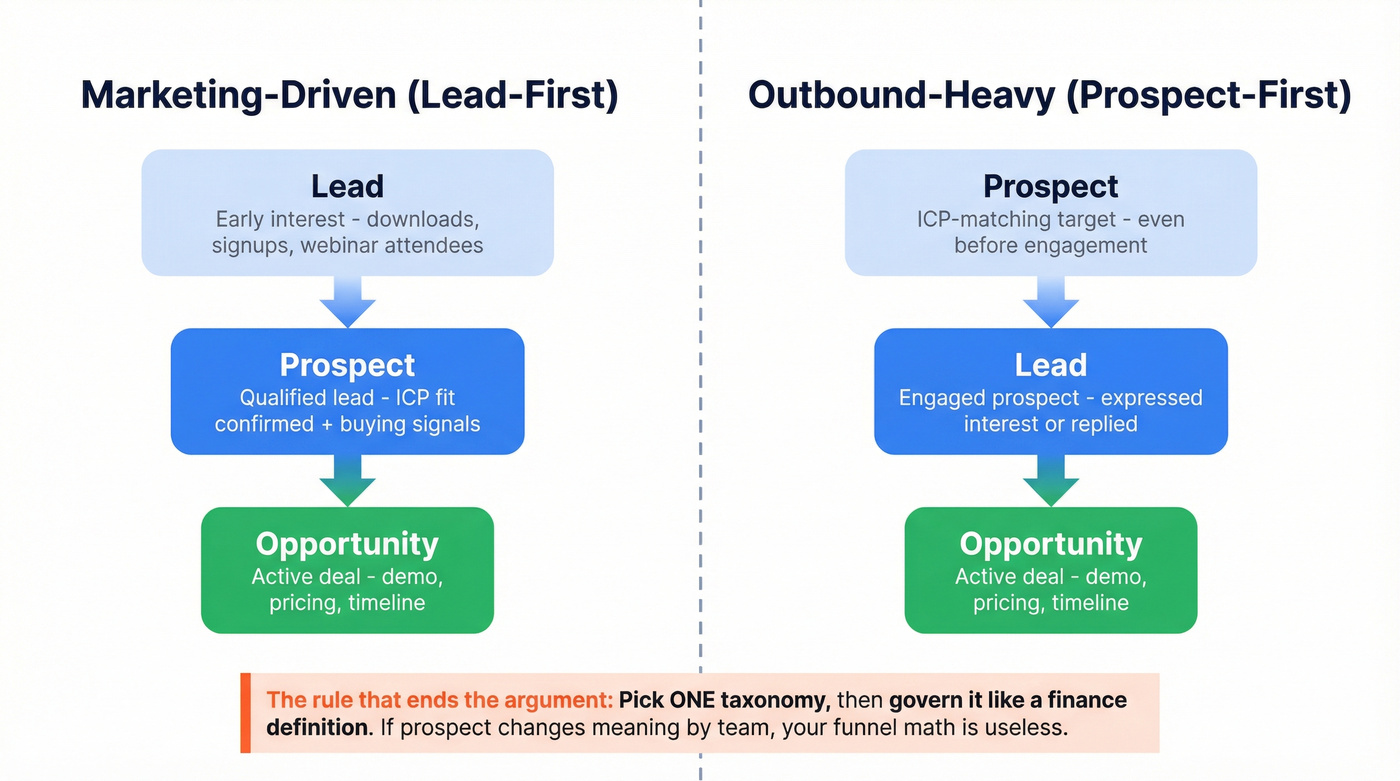

You'll see two common taxonomies in the wild.

Use this taxonomy if you're marketing-driven (lead-first):

- Lead = early interest

- Prospect = qualified lead (fit + basic buying signals)

- Opportunity = active deal

Use this taxonomy if you're outbound-heavy (prospect-first):

- Prospect = ICP-matching person/account you're targeting (even before engagement)

- Lead = engaged prospect showing intent

- Opportunity = active deal

In prospect-first models, "prospect" can mean ICP-fit before interest, while a qualified lead is after expressed interest. Both can work. What breaks teams is mixing them.

Progression also isn't linear. People go dark, change jobs, get budget freezes, or resurface six months later, so handle that reality explicitly: move records to a Nurture/Dormant status, require a reason (no response, timing, budget, wrong person), and stamp a timestamp so re-qualification rules fire cleanly.

Here's the one rule that ends the argument: choose a taxonomy, then govern it like a finance definition. If "prospect" changes meaning by team, your funnel math becomes useless.

Document it and enforce it with:

- field definitions

- automation rules

- permissions (who can change what)

- one dashboard that everyone agrees is the source of truth (see Revenue Dashboards)

You just defined what a prospect is. Now make sure you can actually reach them. Prospeo's 300M+ profiles pass a 5-step verification process so your SDRs spend SLA time selling, not chasing bounces. 98% email accuracy, 125M+ verified mobiles, and a 7-day data refresh cycle - because a prospect without contactability isn't a prospect at all.

Fix the third check on your list - contactability - starting today.

A buyer-journey example (inbound + outbound) that makes "prospect" real

I've seen this exact scenario play out: Marketing celebrates a big webinar, SDRs get 400 "prospects" dumped into a sequence, and two weeks later deliverability's worse, reps are annoyed, and the only meetings came from the 15 people who actually replied.

That's not a lead gen problem. It's a definition problem.

Inbound path (HubSpot-style): A VP Ops downloads a template -> Lead (Lifecycle Stage = Lead). They visit pricing twice and request a demo -> score crosses your threshold -> MQL (Lifecycle Stage = MQL). An SDR accepts it (SAL) and connects on a call -> Prospect (Lead Status = Connected/Working; SLA clock starts). After discovery, the AE creates a deal with next steps and timeline -> Opportunity (Deal created; stage = Discovery).

Outbound path (Salesforce-style): You target an ICP account and add three stakeholders -> targeted contacts (Contact Status = Targeted; no SLA yet). One replies and books time -> now it's sales-actionable -> Prospect (worked) (Contact Status = Working; SLA starts). After qualification, the AE opens an Opportunity tied to the Account and relates the contacts -> Opportunity (stage + amount + close date).

The point: "prospect" is the moment you commit human time and measurement, not the moment you found a name.

The operational definition you can copy/paste (marketing ops version)

Most teams don't need a philosophical definition. They need a definition that triggers routing, SLAs, and reporting.

Checklist: what must be true for "prospect"

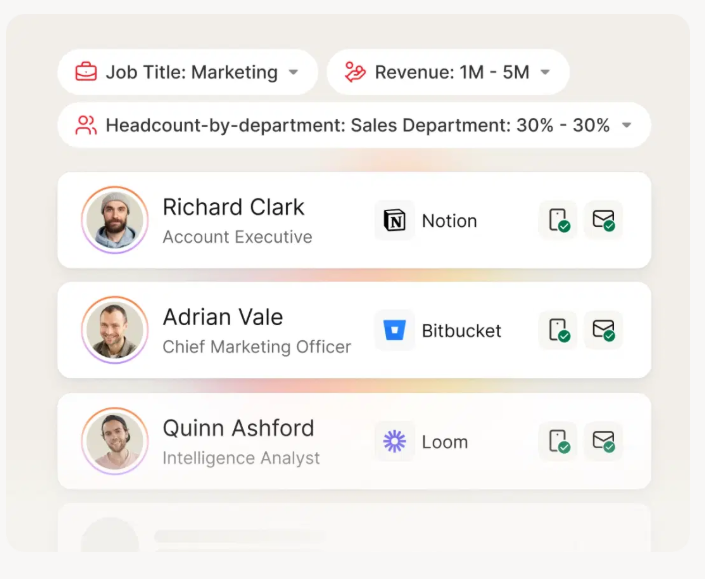

- ICP fit is confirmed (firmographics, role, geo, tech stack - your real ICP inputs)

- Contactability is verified (working email and/or phone)

- A routing rule applies (SDR queue, named AE, territory, partner)

- An SLA clock starts (time-to-first-touch and time-to-disposition)

- A next-step status exists (Accepted, Working, Nurture, Disqualified - with reasons)

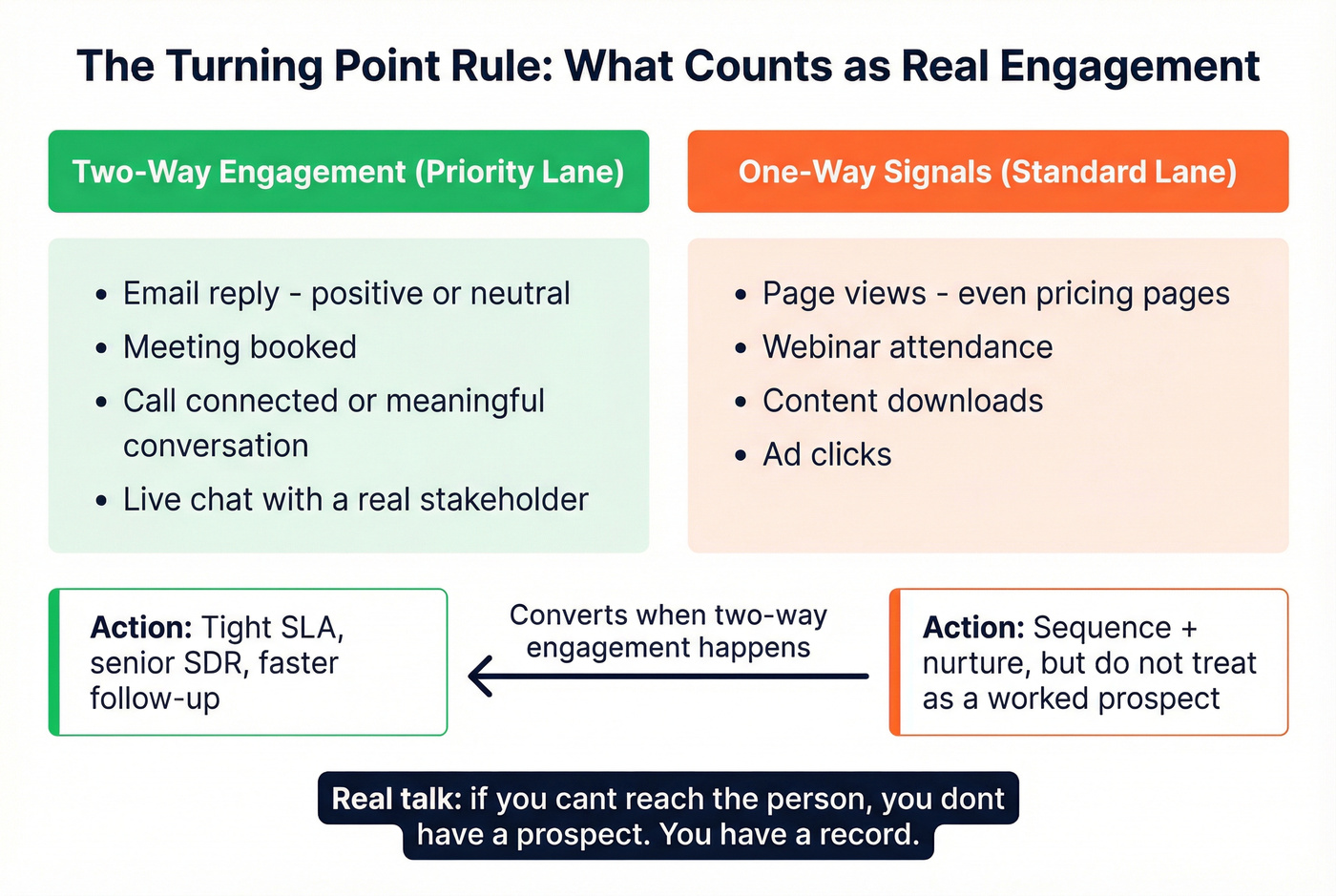

Turning-point rule: what "two-way engagement" means (and why it changes priority)

Treat "prospect" as a turning point: you've got fit, and you have two-way engagement or a signal strong enough to justify immediate outreach.

Two-way engagement (counts as turning point):

- email reply (positive or neutral)

- meeting booked

- call connected / meaningful conversation

- live chat conversation with a real stakeholder

One-way signals (useful, but not the turning point by themselves):

- page views (even pricing)

- webinar attendance

- content downloads

- ad clicks

Operationally, this is how you stop wasting SDR cycles:

- Two-way engagement -> priority lane (tight SLA, senior SDR, faster follow-up).

- One-way intent -> standard lane (sequence + nurture, but don't pretend it's already a worked prospect).

Real talk: if you can't reach the person, you don't have a prospect. You have a record.

Prospeo fits cleanly into this gate because it verifies emails at 98% accuracy, refreshes data every 7 days, and returns contact data for 83% of leads during enrichment (with a 92% API match rate). If your "prospect" definition includes "reachable," tools like this stop being a nice-to-have and start being basic plumbing.

Definition block (copy/paste)

Prospect (ops definition): A record that matches ICP fit, has verified contactability, meets a routing rule, and starts an SLA clock. It's the point where we treat the person as sales-actionable and measure outcomes.

How to qualify a prospect in marketing (3-layer model + frameworks)

A clean way to stop reps and marketers from talking past each other is qualifying at three levels.

Layer 1: Organization-level qualification (fit)

Mini-checklist:

- Industry / segment match

- Company size / maturity match

- Region match

- "Fundamental need" exists (they have the problem category)

If you fail Layer 1, stop. Don't "sequence harder."

Layer 2: Opportunity-level qualification (use case + desire)

Mini-checklist:

- Clear use case (not "nice to have")

- Trigger event (new hire, funding, tool change, compliance deadline)

- Evidence of intent (high-intent page views, demo request, trial start, event attendance)

Layer 3: Stakeholder-level qualification (who you're talking to)

Mini-checklist:

- Correct role / seniority

- Access to decision process

- Multi-threading plan (you'll need more than one person in B2B) - see multithreading in sales

Now pick a framework based on deal complexity.

BANT vs MEDDIC/MEDDPICC: when to use which

BANT works when:

- sales cycles are shorter

- buying committees are small

- you need to confirm viability fast

MEDDIC/MEDDPICC works when:

- deals are complex and political

- you need ROI proof and process control

- procurement/security reviews are real gates

My take: BANT's a great disqualification tool. MEDDIC's a great deal-execution tool. Use them at the right time and your "prospect" stage stops bloating.

Where "prospect" lives in HubSpot (Lifecycle Stage vs Lead Status vs Deal Stage)

HubSpot doesn't ship a default "Prospect" lifecycle stage. Good.

Skip creating a custom Lifecycle Stage called "Prospect" unless you've got a reporting requirement you can't solve with Lead Status, because it usually adds complexity to lifecycle automation and lifecycle-based reporting.

HubSpot's default Lifecycle Stages are:

Subscriber -> Lead -> MQL -> SQL -> Opportunity -> Customer -> Evangelist -> Other

Per HubSpot's lifecycle stage guidance, these are sequential and represent a contact's relationship to your company, not the steps of a deal.

The clean HubSpot mapping (most teams)

| Your concept | HubSpot field | Who sets it | Rule |

|---|---|---|---|

| Lead | Lifecycle Stage | Marketing | Workflow allowed |

| Prospect | Lead Status | Sales/SDR | Controlled picklist |

| SQL | Lifecycle Stage | Sales | Sales-only permission |

| Opportunity | Deal Stage | AE | Deal required |

The two HubSpot nuances that bite teams

1) Lifecycle Stage is forward-only in practice. If a contact gets promoted to SQL and later goes cold, you can't rely on "moving backward" cleanly. The rule that works: set Lifecycle Stage to SQL only after SAL + a connected touch, and use Lead Status (Nurture/Dormant + reason + date) for recycling.

2) HubSpot reporting breaks when you mix contact lifecycle with deal outcomes. We've tested this in real portals: teams chart Lifecycle Stage as if it's pipeline, then wonder why it doesn't reconcile with Deals. Keep Lifecycle Stage for relationship, Deals for revenue, and use SAL to make the handoff measurable.

If you want to wire enrichment into HubSpot routing, use native integrations rather than duct-tape imports: https://prospeo.io/integrations

Where "prospect" lives in Salesforce (Lead vs Contact reality + reporting implications)

Salesforce forces you to confront an uncomfortable truth: "prospect" isn't an object. It's a state you infer from Leads, Contacts, and Opportunities.

Leads are a fishbowl of business cards. They're messy by design: students, competitors, partners, press, job seekers, and real buyers all land in the same bucket.

The object model reality (why reporting breaks)

- Leads aren't related by default. Multiple leads from the same company don't automatically roll up into one account view unless you build matching rules.

- Contacts live under Accounts and relate to Opportunities, Cases, and more. That's where "real pipeline" usually gets tracked.

- The Lead conversion moment changes reporting and ownership, so teams fight about when to do it.

A practical Salesforce mapping for "prospect"

- Lead = unqualified or not yet accepted

- Prospect = qualified Lead OR converted Contact with no open Opportunity yet

- Opportunity = Opportunity record exists with stage + amount

Mini-rule to avoid double counting (use this): Pick one reporting base for your "prospects" metric. Either report from Leads only (pre-conversion) or from Contacts only (post-conversion), and use a single "Prospect Status" field to unify the definition. If you report both without a hard rule, you'll double count.

In CRM cleanups, duplicate merges plus a stricter lead conversion policy routinely reduce "prospect" counts materially, because you stop counting the same human twice and stop promoting junk. (If you're fixing ops debt, use a CRM data clean SOP.)

The handoff model that reduces friction: MQL -> SAL -> SQL -> Opportunity

If your funnel feels like a blame game, add SAL. It's the simplest checkpoint that forces a real handoff.

Step-by-step handoff (with ownership)

- MQL (Marketing Qualified Lead)

Marketing: "This fits our ICP and shows enough intent to deserve sales time."

- SAL (Sales Accepted Lead)

Sales: "We accept responsibility to work it." This is the quality checkpoint. (Track it like a metric: sales accepted lead rate.)

- SQL (Sales Qualified Lead)

Sales: "This is a real sales conversation worth pursuing." Apply BANT/MEDDIC here.

- Opportunity A deal exists with stage, next step, and forecast logic.

SLA callout: responding within 5 minutes is a strong default rule-of-thumb for inbound unless your own data proves otherwise, and if your team can't hit it, that's a staffing/routing problem, not a "lead quality" problem. (See speed-to-lead metrics.)

Lead scoring template (Fit + Engagement, thresholds, negatives, decay)

Lead scoring is where "prospect" becomes enforceable. Without scoring (or at least rules), you're just negotiating definitions in Slack.

The setup that works in real teams is splitting scoring into:

- Fit Score (ICP match)

- Engagement Score (behavior/intent)

Then route based on the matrix:

- High Fit + High Engagement -> route to SDR now

- High Fit + Low Engagement -> nurture (don't burn the list)

- Low Fit + High Engagement -> self-serve/partner/content path

- Low Fit + Low Engagement -> suppress or deprioritize

If you're on HubSpot, confirm whether you're using legacy scoring or the newer Fit/Engagement scoring tools. Migration often means rebuilding logic, not flipping a switch.

Scoring rules you can copy/paste

Keep it tight:

- Start with 5-7 criteria

- Set MQL threshold to capture the top ~20% of leads

- On a 100-point scale, MQL is typically 50-75 points

- Apply 25% monthly score decay if there's no new activity

Example scoring table (100 points total)

| Category | Rule | Points |

|---|---|---|

| Fit | ICP industry match | +15 |

| Fit | Company size in range | +10 |

| Fit | Target role/seniority | +20 |

| Fit | Non-target geo | -10 |

| Engagement | Pricing page view | +15 |

| Engagement | Demo request | +40 |

| Engagement | Email reply / meeting | +35 |

Negative scoring rules (use these to protect deliverability)

Add a small set of "hard negatives" that prevent bad records from becoming prospects:

- Personal email domain (gmail/yahoo/etc.) for B2B-only motions: -15

- Competitor / vendor / recruiter / student: -50

- Unsubscribed: -30

- Invalid email / hard bounce: -100 (and suppress from outreach)

My opinion: hard-bounce suppression is non-negotiable.

If your system allows bounced contacts to re-enter sequences, your scoring model's just theater.

Score-to-stage automation (the part most teams forget)

Make the score actually change fields:

- Score >= 50 -> set MQL (Lifecycle Stage = MQL; assign to SDR queue)

- Score >= 75 AND contactability verified -> set Prospect (Lead Status = Working; start SLA clock)

- Score drops below 50 (decay) -> recycle to Nurture (Lead Status = Nurture; pause sequences)

This is also where you enforce a strong position: if you can't verify contactability, don't start an SLA. Route to enrichment first. (Related: lead qualification process.)

Recycle rule (prevents "zombie prospects")

Define a recycle policy that's the same for everyone:

- After 6-8 touches over 10-14 business days with no response -> set Nurture/Dormant

- Require a disposition reason

- Reduce score (for example, -20) so it doesn't bounce right back into MQL next week

Consistency beats cleverness here. Your goal's a funnel you can measure and improve, not a scoring model that "feels smart."

Benchmarks: what "good" looks like in 2026 (and where bottlenecks hide)

Benchmarks are sanity checks, not goals. If you're wildly off, your definitions or routing are usually the culprit.

From First Page Sage's B2B SaaS benchmarks (2026 report):

- Lead -> MQL: 39%

- MQL -> SQL: 38%

- SQL -> Opportunity: 42%

- SQL -> Closed: 37%

Digital Bloom's compiled benchmarks (2026 compilation) add useful directional context:

- Lead-to-customer: 2-5%

- MQL -> SQL bottleneck: 15-21%

- Median sales cycle: 84 days

- Channel delta: SEO MQL->SQL 51% vs PPC 26%

Benchmark table (quick scan)

| Metric | "Good" range |

|---|---|

| Lead->MQL | ~39% |

| MQL->SQL | 15-38% |

| SQL->Opp | ~42% |

| Lead->Cust | 2-5% |

| Sales cycle | ~84 days |

Where bottlenecks hide:

- Low Lead->MQL: targeting or Fit scoring is off

- Low MQL->SQL: SAL discipline is missing, or marketing's over-promoting

- Low SQL->Opp: qualification's sloppy, or you're calling "SQL" too early

- SEO crushing PPC: inbound intent's higher, or PPC targeting's too broad

Common mistakes + governance checklist (so reporting matches revenue)

This is the unsexy part that makes everything else work.

Do / don't checklist

Do:

- Define prospect as a routing + reporting gate, not a synonym for "lead"

- Keep Lifecycle Stage separate from Deal Stage

- Lock field permissions (Marketing vs Sales vs RevOps)

- Require SAL acceptance before you count sales follow-up as "happening"

- Track disqualification reasons (bad fit, no need, no response, competitor)

Don't:

- Don't let marketing set SQL (you'll inflate volume and lose trust)

- Don't mix lifecycle with deal stage in the same chart

- Don't allow reps to free-type statuses (use controlled picklists)

- Don't measure "prospects" without defining whether you're counting Leads, Contacts, or both

Skip the fancy stuff if you're early-stage or low ACV. A clean gate + fast follow-up + verified contact data will beat a complicated qualification rubric almost every time, and it's a lot easier to coach.

FAQ

What's the difference between a prospect and an MQL?

An MQL is marketing saying a lead meets scoring and fit thresholds, while a prospect is the sales-actionable state where the record is owned, routed, and an SLA starts. In practice, treat MQL as the input and "prospect" as the moment Sales commits time and you measure outcomes.

Can a prospect exist before they engage with you?

Yes. On outbound teams, a prospect can be an ICP-matching person/account before engagement, but you should only start an SLA after a strong signal like a reply, a booked meeting, or a connected call. If you don't separate "targeted" from "worked," your counts inflate and sequences get too aggressive.

Who should be allowed to change SQL in the CRM?

Sales only, with RevOps enforcing permissions and required disposition fields. SQL's an accountability decision tied to pipeline creation and forecasting, so letting Marketing set it typically inflates volume and breaks trust. A clean rule is: SAL acceptance + one connected touch before SQL.

What's a good free tool to verify prospect contact details?

Prospeo's free tier includes 75 email credits plus 100 Chrome extension credits per month, with 98% email verification accuracy and a 7-day refresh cycle. That's enough to validate a small outbound list before you route records to SDRs and start SLAs.

Summary: the definition that makes reporting sane

If you want one line to align everyone: prospect in marketing is a CRM-defined gate where a record is ICP-fit, reachable, routed to an owner, and measured with an SLA. Lock that into fields + automation, and your dashboards will finally match what Sales experiences in the real world.

Your CRM ladder only works when the data behind it is clean. Teams using Prospeo cut bounce rates below 4% and book 26% more meetings than ZoomInfo users. Enrich HubSpot or Salesforce contacts with 50+ data points at 92% match rate so your Lead → Prospect → Opportunity progression reflects reality, not hope.

Stop routing garbage data through a perfect funnel.