Sales Accepted Lead Rate: The Complete Benchmark & Improvement Guide

A recruitment agency generated 562 leads over four months. Sales contacted 29 of them. Twenty-nine. That's a 5.2% follow-up rate - and it's not even unusual. HBR found that 73% of marketing-generated leads never get contacted by sales. The SAL stage, and specifically your sales accepted lead rate, exists to make that impossible.

If You're Short on Time

Three bullets, then you can close this tab:

- A healthy MQL-to-SAL rate is 70-90%. Below 50% means your definitions are broken, not your leads.

- The single highest-leverage fix is speed. Respond within 5 minutes and you're 21x more likely to qualify the lead.

- Start with three things: agree on 5 acceptance criteria with sales, set a 24-hour review SLA, and track acceptance rate weekly for one quarter.

Everything below unpacks those three points with benchmarks, diagnostic frameworks, and the CRM setup to make it stick.

What Is a Sales Accepted Lead?

A sales accepted lead (SAL) is an MQL that sales has formally reviewed and agreed to pursue. Acceptance happens before the first outreach attempt - no contact has been made yet.

Forrester's Demand Waterfall framework defines SAL as "a formal process for acceptance of leads by inside, field, or channel sales." The key word is formal. Without a structured acceptance step, leads fall into a black hole between marketing's CRM and a rep's to-do list.

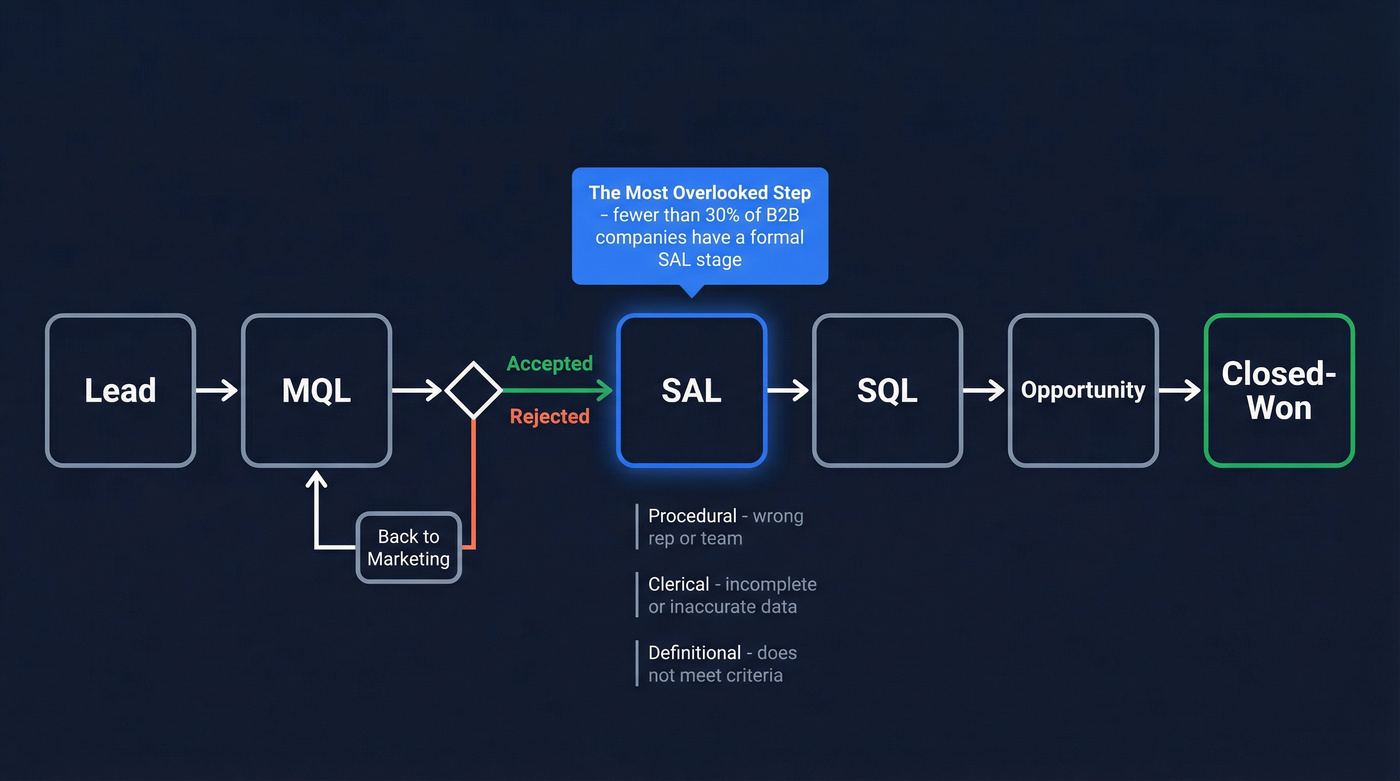

The funnel flow looks like this:

Lead → MQL → SAL → SQL → Opportunity → Closed-Won

At the SAL stage, a rep can do one of two things: accept the lead or reject it. Rejection should only happen for three reasons:

- Procedural - the lead was routed to the wrong rep or team

- Clerical - the record is incomplete or inaccurate (wrong email, missing company name)

- Definitional - the lead doesn't meet agreed-upon target market, activity, or lead-level thresholds

Rejection vs. disqualification - these aren't the same thing. Rejection happens at the SAL stage, before any contact. Disqualification happens later, after a rep has actually spoken with the lead and confirmed there's no interest, budget, or need. Conflating the two will wreck your reporting.

Rejected leads should route back to marketing or teleprospecting automatically. They're not dead - they just weren't ready or were misrouted.

We estimate fewer than 30% of B2B companies have a formal SAL stage - Forrester calls it "the most overlooked step," and neither HubSpot nor Salesforce includes it by default. But the review itself should take a rep a few minutes, not a meeting. The payoff is that every lead past this point has a name on it and a clock ticking.

Behavioral signals that should trigger acceptance include requesting a demo, visiting the pricing page 3+ times in a week, asking about integrations in a live chat, or downloading a pricing sheet. These map cleanly to qualification frameworks like BANT or MEDDIC - the SAL stage is where you confirm the lead exhibits enough of these signals to warrant a conversation.

Clerical rejections - wrong emails, missing phone numbers - are the most preventable reason reps reject leads. Prospeo's 5-step verification delivers 98% email accuracy and 125M+ verified mobile numbers, so every MQL that hits your SAL stage has real, reachable contact data attached.

Stop losing SALs to bad data. Start with 100 free credits.

How to Calculate Your Sales Accepted Lead Rate

The formula is straightforward:

SAL Rate = (Number of SALs / Number of MQLs) x 100

If marketing passes 200 MQLs in a month and sales accepts 160, your lead acceptance rate is 80%. That's healthy.

Back-Calculating from Revenue

Say your revenue target is $1M. Average deal size is $10K, so you need 100 closed deals. If your SAL-to-sale conversion rate is 10%, you need 1,000 SALs. If your MQL-to-SAL rate is 80%, you need 1,250 MQLs to hit the number.

Work the math backward from revenue, and suddenly this metric isn't abstract - it's the multiplier that determines how many MQLs marketing needs to generate.

Watch for Definitional Variance

You'll see wildly different "SAL benchmarks" depending on where the measurement starts. Lead-to-SAL rates (starting from raw leads) run 5-30%. MQL-to-SAL rates (starting from marketing-qualified leads) run 70-90%. The gap is enormous, and it's purely definitional. When someone quotes a "SAL rate," always ask: SALs as a percentage of what?

This article uses MQL-to-SAL unless stated otherwise.

For context, the median B2B conversion rate across all industries is just 2.9% per Ruler Analytics' analysis of 100M+ data points. That makes every percentage point at the SAL stage disproportionately valuable - small improvements here compound through the entire funnel.

What's a Good Sales Accepted Lead Rate? Benchmarks That Actually Help

Tiered Benchmark Framework

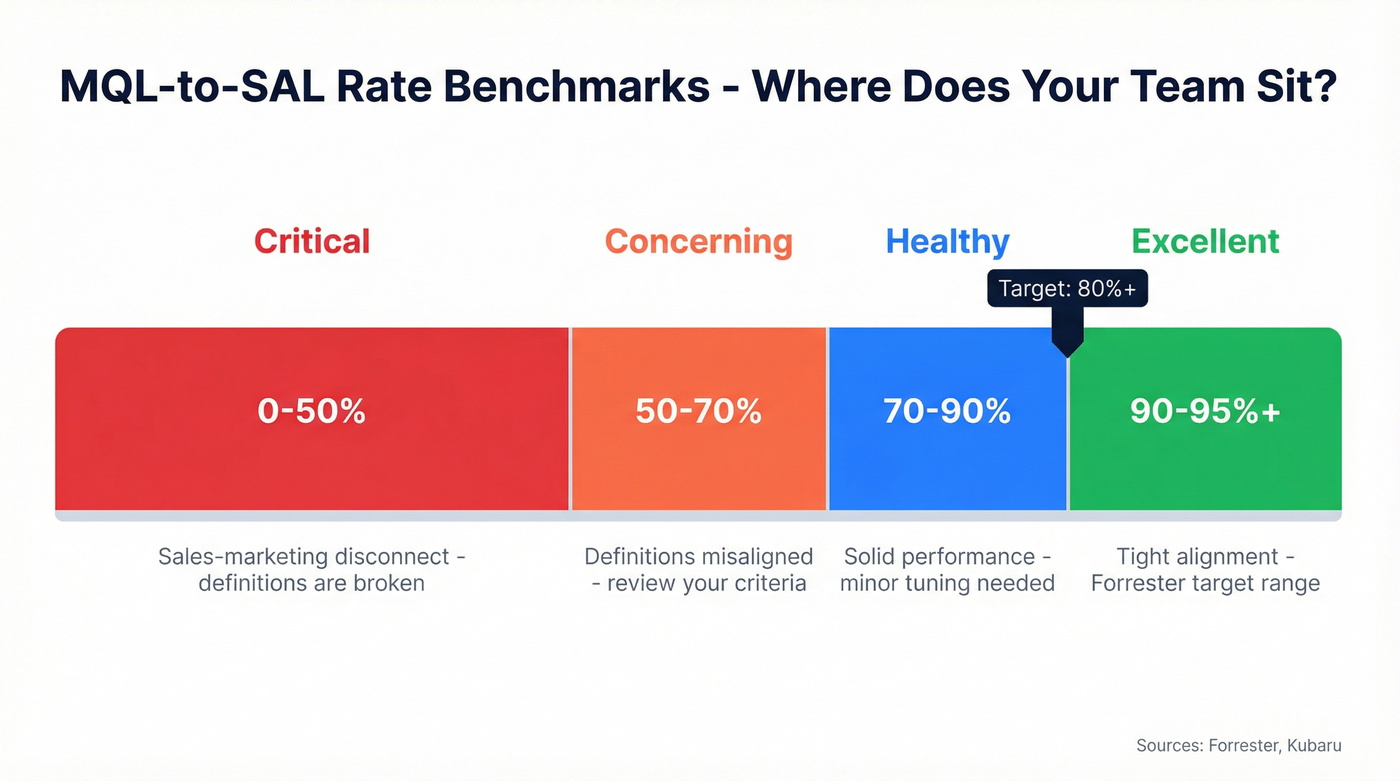

Not every team needs 95%. But every team should know where they sit:

| Tier | MQL-to-SAL Rate | What It Means |

|---|---|---|

| Excellent | 90-95%+ | Tight alignment. Forrester's target. |

| Healthy | 70-90% | Solid. Minor tuning needed. |

| Concerning | Below 70% | Definitions misaligned. |

| Critical | Below 50% | Sales-marketing disconnect. |

Forrester's target is 90%+, and Kubaru's benchmarks put the healthy range at 70-90% for MQL-to-SAL and 30-50% for SAL-to-SQL. If you're below 70%, the problem almost certainly isn't lead quality - it's that sales and marketing defined "qualified" differently.

SAL-Adjacent Benchmarks by Industry

No major study breaks out SAL acceptance rates by industry. But MQL-to-SQL rates serve as the closest proxy - they capture the same handoff friction. Here's what First Page Sage's funnel data shows:

| Industry | Lead→MQL | MQL→SQL | SQL→Opp | SQL→Closed |

|---|---|---|---|---|

| B2B SaaS | 39% | 38% | 42% | 37% |

| IT & Managed Svcs | 19% | 38% | 41% | 46% |

| Financial Services | 29% | 38% | 49% | 53% |

| Manufacturing | 26% | 41% | 46% | 51% |

| Healthcare | 24% | 38% | 51% | 51% |

| Cybersecurity | 24% | 40% | 43% | 46% |

| Legal Services | 32% | 35% | 48% | 46% |

| Biotech | 42% | 36% | 44% | 48% |

| Environmental Svcs | 45% | 37% | 45% | 50% |

| Higher Education | 45% | 34% | 42% | 44% |

The MQL→SQL column is your reference point. Industries with longer sales cycles (manufacturing, enterprise IT) tend to have lower acceptance rates because qualification criteria are more complex. SaaS and cybersecurity see tighter ranges because product-market fit signals are clearer.

One important caveat: outbound-heavy funnels see significantly lower rates. MarketJoy's data shows MQL→SQL as low as 15% for outbound-dominant pipelines. If your lead mix skews heavily outbound, benchmark against that reality, not against inbound-dominant averages.

Enterprise vs. SMB - Different Funnels, Different Numbers

Your company size changes the math. Digital Bloom's meta-analysis of 40+ benchmark studies shows the gap clearly:

| Metric | Enterprise | SMB/Mid-Market |

|---|---|---|

| MQL→SQL | 31% | 39% |

| SQL→Opp | 36% | 42% |

| Opp→Close | 31% | 39% |

Enterprise funnels leak more at every stage. More stakeholders, longer evaluations, more complex procurement. If you're selling deals north of $50K and your MQL-to-SAL rate matches SMB benchmarks, you're probably not qualifying tightly enough - and you'll pay for it at the SQL-to-Opp stage.

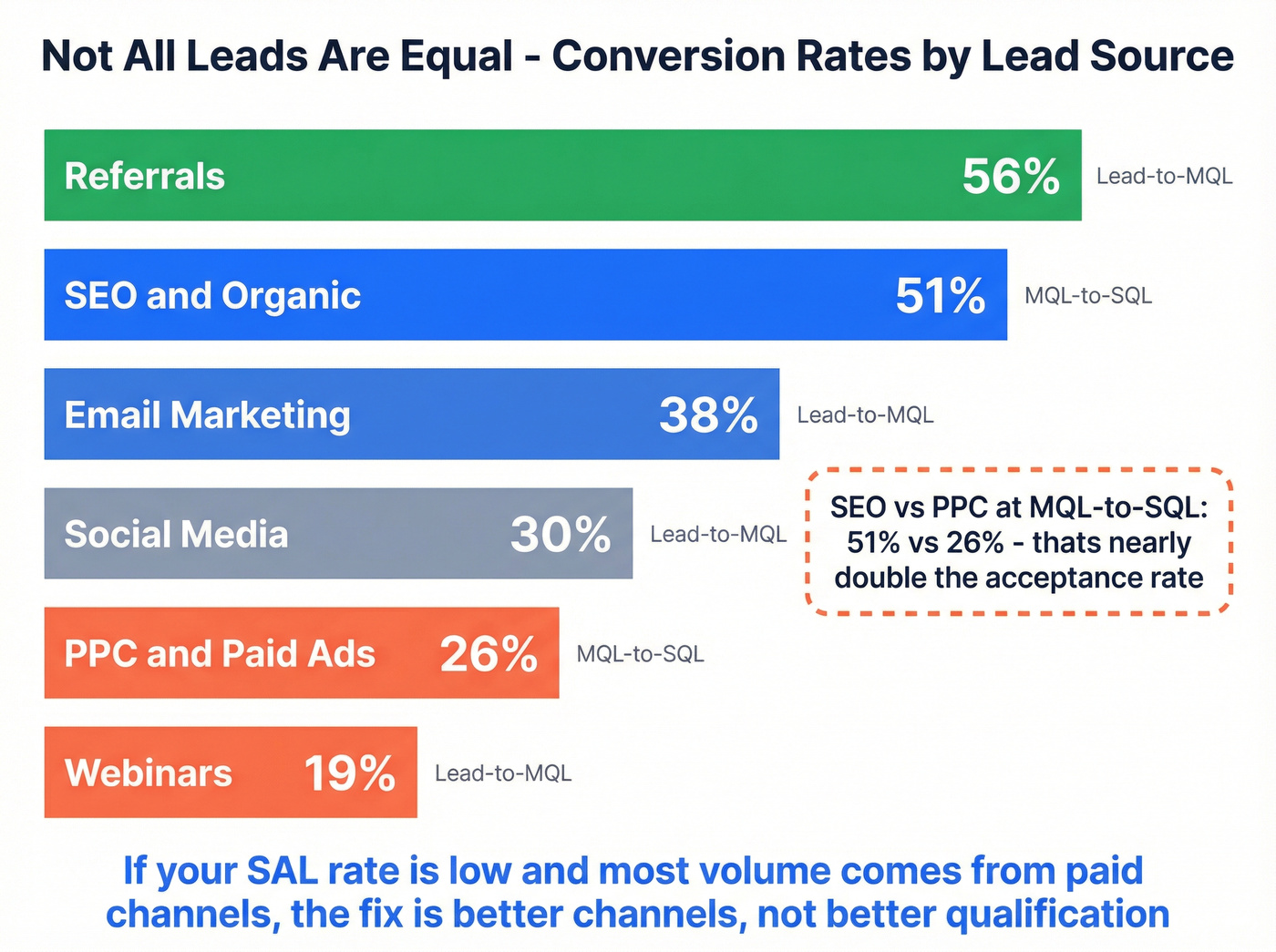

How Lead Source Affects Your SAL Rate

Not all leads convert equally. The channel they came from predicts acceptance rate more than almost any other variable:

- Referrals: 56% lead-to-MQL (highest quality signal)

- SEO/organic: 41% lead-to-MQL, 51% MQL→SQL

- Email marketing: 38% lead-to-MQL

- Social media: 30% lead-to-MQL

- PPC: 29% lead-to-MQL, 26% MQL→SQL

- Webinars: 19% lead-to-MQL

Look at the spread between SEO and PPC at the MQL→SQL stage: 51% vs. 26%. That's not a marginal difference - it's a completely different funnel. If your acceptance rate is low and most of your volume comes from paid channels, the fix isn't better qualification. It's better channels.

The Cost of Ignoring SAL

When there's no formal acceptance step, leads don't get rejected - they get ignored. And ignored leads are expensive.

- 61% of marketing-generated leads never get followed up at all

- 36% higher CAC when marketing and sales aren't harmonized

- 10% annual revenue loss from poor sales-marketing alignment

- 42% lower lead-to-customer conversion with poor collaboration

- 30% longer sales cycles on average

That 61% number should make every marketing leader furious. You're spending budget to generate leads that more than half of sales never touches. The SAL stage doesn't fix lead quality - it fixes accountability. Once a rep accepts a lead, there's a name attached and a clock running.

We've seen teams implement a basic SAL process and cut their "lead oblivion" rate from 50%+ to under 10% in a single quarter. The leads didn't get better. The process did.

Why Your SAL Rate Is Low - A Diagnostic Framework

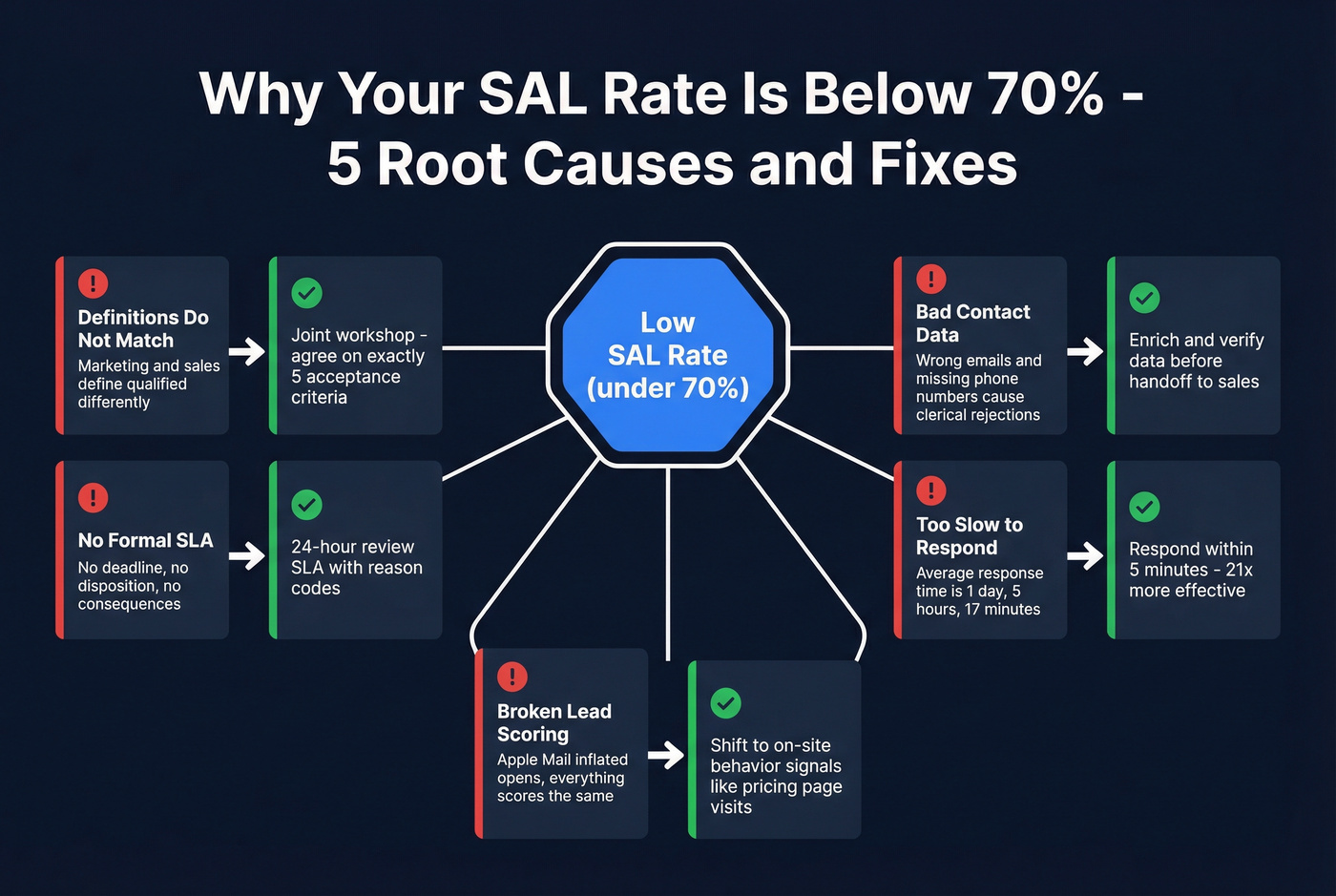

If your MQL-to-SAL rate is below 70%, one of these five things is broken. Usually it's more than one.

Your Definitions Don't Match

Marketing counts a form fill with a business email as an MQL. Sales expects budget authority and a timeline. Neither is wrong, but the gap creates rejection at scale.

The fix: Run a joint definition workshop. Get marketing and sales in a room (or a doc) and agree on exactly five acceptance criteria. Job title range, company size, engagement threshold, geography, and one intent signal. Write them down. Put them in the CRM. Review quarterly.

You Don't Have a Formal SLA

Without an SLA, there's no deadline for lead review, no required disposition, and no consequence for ignoring leads. The Act-On SLA framework breaks it into two commitments:

Marketing commits to: lead volume targets, qualification criteria, and enrichment before handoff.

Sales commits to: reviewing leads within 24 hours, dispositioning with a reason code, and making a minimum number of contact attempts.

Best practice is 24 hours max for review, 72 hours as the absolute ceiling. If your team doesn't have these numbers written down somewhere, you don't have an SLA - you have a suggestion.

Apple Mail Killed Your Lead Scoring

If your scoring model relies on email opens, Apple Mail's privacy changes have been inflating those numbers for years. Every lead scores the same, nothing gets prioritized, and sales loses trust in the system.

Here's a scoring model worth copying: pricing page visit = +10, case study page = +5, form download = +15, webinar attendance = +20. On the negative side: email bounce = -25, unsubscribe = -30, zero opens across 5+ sends = -15.

The fix: Shift from email engagement to on-site behavior. Weight pages that signal purchase intent (pricing, case studies, integration docs) higher than top-of-funnel content. Machine learning scoring produces a 51% increase in conversions vs. static scoring - if your CRM supports it, use it.

You're Too Slow

Here's the thing: responding within 5 minutes makes you 21x more effective than responding at the 30-minute mark. The average B2B company takes 1 day, 5 hours, and 17 minutes to respond to a demo request. And 78% of B2B buyers purchase from the vendor that responds first.

A UK manufacturer reduced lead response time from 24 hours to under 2 hours and increased qualification rates by 15%. No new tools, no new scoring model - just speed.

I've watched teams obsess over lead scoring sophistication while their average response time sat at 36 hours. Speed beats precision every time.

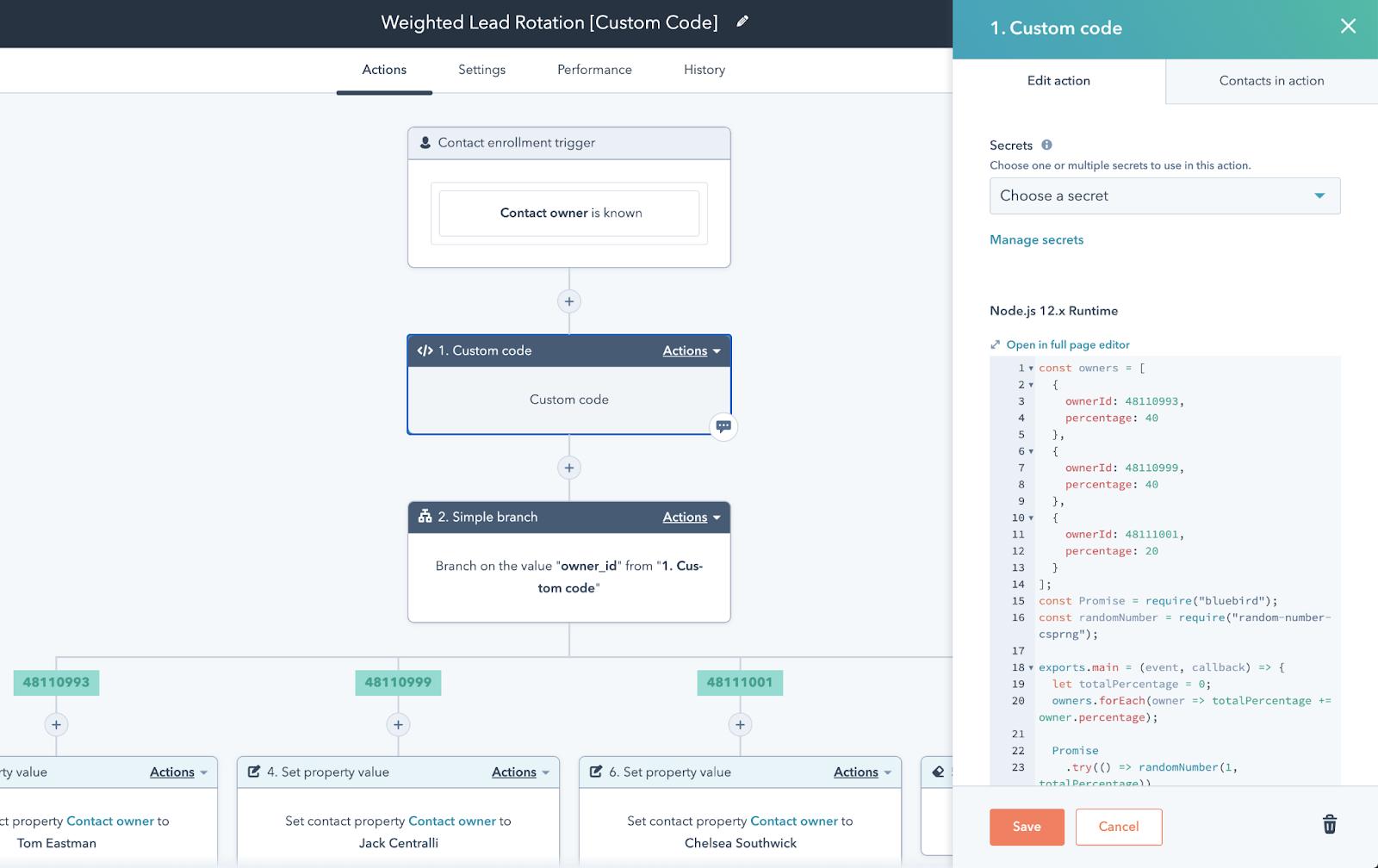

The fix: Set scoring thresholds that trigger routing speed. A Salesforce implementation might look like: 0-20 points = automated nurture, 21-49 = SDR outreach within 24 hours, 50-69 = SDR within 4 hours, 70+ = auto-route to AE within 4 hours. Build this into Salesforce Flow or HubSpot workflows so it's automatic, not aspirational.

Your Contact Data Is Bad

This one's sneaky because it looks like a qualification problem but isn't. When sales rejects a lead because the email bounces, the phone number is disconnected, or the person left the company six months ago - that's not a qualification failure. It's a data failure.

One Reddit thread put it bluntly: 40%+ of "leads" can be fake emails, competitors, or completely unqualified. When you optimize forms for conversion volume by removing friction, you also remove verification. Short forms generate more leads and worse data.

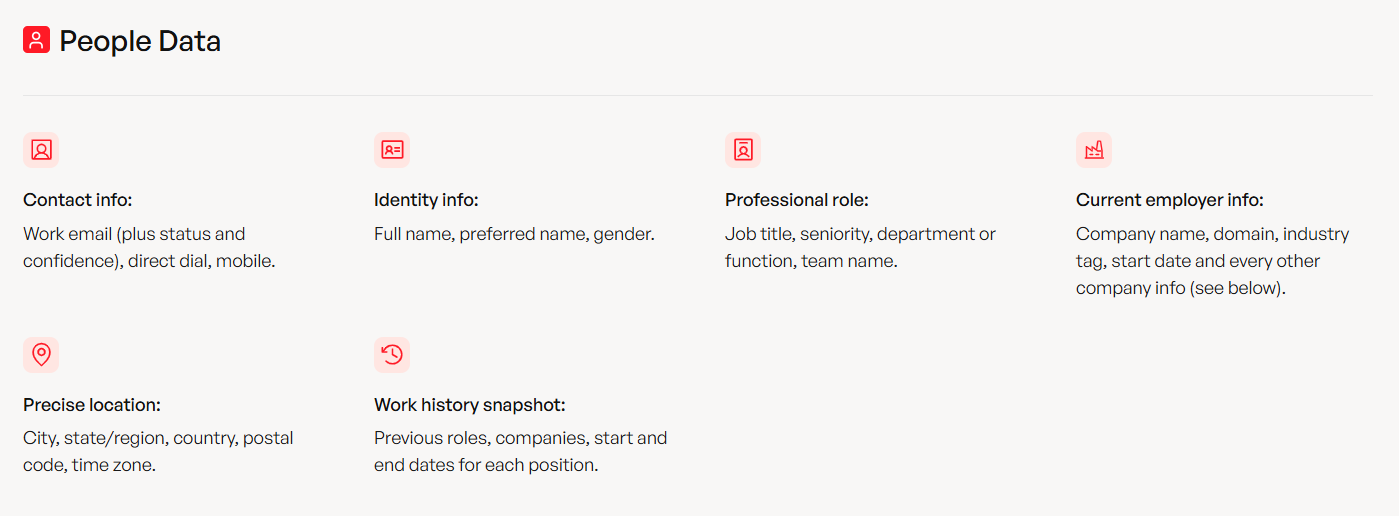

The fix is enrichment and verification before handoff. Tools like Prospeo run 98% email accuracy with a 7-day data refresh cycle and return 50+ data points per enrichment. Marketing can keep forms short (name, email, company) and fill in the rest - job title, phone, company size, tech stack - automatically. Sales gets a complete, verified record instead of a half-filled form with a bounced email.

You just calculated that hitting $1M requires 1,250 MQLs at an 80% acceptance rate. Now imagine your CRM records enriched with 50+ verified data points - job title, direct dial, company revenue - before a rep ever reviews them. That's what 92% enrichment match rates do to your SAL rate.

Every rejected lead is lost pipeline. Verify contacts at $0.01 each.

How to Increase Sales Accepted Leads - The SAL Playbook

Build a Marketing-Sales SLA

Start here. Key stakeholders from both teams need to be involved from day one. An SLA that marketing writes and sales ignores isn't an SLA - it's a memo. Get VP-level buy-in before you draft a single line.

Here's a template you can adapt in an afternoon:

Marketing commits to:

- Deliver [X] MQLs per month meeting agreed criteria

- Enrich every lead with verified email, phone, job title, and company size before handoff

- Score leads using the agreed-upon model (reviewed quarterly)

- Route leads to the correct rep/team within 1 hour of qualification

Sales commits to:

- Review and disposition every MQL within 24 hours

- Provide a reason code for every rejection (procedural, clerical, or definitional)

- Make a minimum of 3 contact attempts before disqualifying

- Log all disposition activity in the CRM (no offline decisions)

Enforcement: Gamification beats punishment. Award points for SLA compliance, run a leaderboard, do quarterly recognition. The "stick" approach works too, but carrots tend to build better habits.

Lead Scoring Framework You Can Copy

Here's a point-value model adapted for general B2B use:

| Signal | Points | Rationale |

|---|---|---|

| Pricing page visit | +10 | High purchase intent |

| Case study page | +5 | Evaluating outcomes |

| Form download | +15 | Active engagement |

| Webinar attendance | +20 | Time investment |

| 10+ marketing emails clicked | +10 | Sustained interest |

| Email bounce | -25 | Data quality issue |

| Unsubscribe | -30 | Explicit opt-out |

| 0 opens across 5+ sends | -15 | Disengaged |

Adjust weights by industry. SaaS companies should weight technographic signals higher (do they use a competing tool? Are they on a tech stack that integrates with yours?). Professional services firms should weight job title - a Director+ title alone is worth +20.

The scoring model is only as good as the data feeding it. If your forms capture name and email only, you're scoring on two dimensions. Enrichment fills the gaps - upload a CSV or push leads through an API, and you get 50+ data points back per contact: job title, company revenue, headcount, tech stack, intent signals. That turns a two-variable scoring model into a multi-dimensional one without making your forms longer.

Here's the feedback loop that makes this sustainable: high-scoring leads that don't convert post-SAL trigger a scoring audit. Low-scoring leads that somehow close trigger a signal revaluation. Run this review quarterly and your model gets sharper every cycle.

Set Up SAL Tracking in Your CRM

Neither HubSpot nor Salesforce includes SAL as a default property. You'll need to build it. Good news: it takes 1-2 hours.

HubSpot Setup:

- Create a custom contact property called "Sales Accepted" (dropdown: Yes / No / Pending)

- Build a workflow triggered when a rep sets the property to "Yes"

- Require fields before saving: rejection reason (if No), next step (if Yes)

- Add a workflow action to move the deal to your Sales Pipeline when accepted

- Build a report on SAL rate by rep, by source, and by month

Salesforce Setup:

- Add custom Lead Status values: "SAL - Accepted" and "SAL - Rejected"

- Set up lead scoring thresholds with Flow-based routing:

- 0-20 points → automated nurture sequence

- 21-49 → SDR outreach within 24 hours

- 50-69 → SDR outreach within 4 hours

- 70+ → auto-route to AE within 4 hours

- Create a Flow that requires a rejection reason code before status can change to "Rejected"

- Build a dashboard tracking acceptance rate, average review time, and rejection reasons

Organizations with well-defined funnels see 16% higher deal win rates. The CRM setup is the boring part, but it's what makes everything else measurable.

Is the SAL Stage Still Relevant in 2026?

There's a growing camp that says MQLs are dead. On Reddit, teams are ditching MQLs entirely in favor of pipeline velocity and revenue impact metrics. The argument: MQL "often creates friction between sales and marketing when handoffs happen too early." Some propose replacing SAL with compound metrics - MQL-to-SQL rate, MQL-to-opportunity rate, lead-to-SQL rate - arguing these capture the same signal without the extra funnel stage.

They're not entirely wrong about the friction. But they're solving the wrong problem.

MQLs aren't the issue. The absence of SAL is. When teams ditch MQLs, they usually replace them with nothing. Leads go straight from "marketing touched this" to "sales should call this," with no formal acceptance, no SLA, and no accountability. That's the exact problem SAL was designed to fix. And those compound replacement metrics? They still need a moment where sales formally takes ownership. Call it SAL, call it "pipeline acceptance," call it whatever you want - the handoff step is non-negotiable.

Gartner's 2025 B2B Performance Survey found that firms emphasizing qualification and velocity improved close rates by nearly 40%.

Here's my take: SAL is more relevant now than it was five years ago. RevOps teams are obsessed with pipeline velocity, and SAL is both a qualification metric and a velocity metric. It tells you whether leads are good and whether they're being worked fast enough. The problem isn't the concept - it's the name. "Sales accepted lead" sounds like bureaucracy. "Pipeline acceptance rate" sounds like a KPI worth tracking. Same thing, better branding.

FAQ

What's the difference between a sales accepted lead and a sales qualified lead?

A sales accepted lead (SAL) is an MQL that sales has reviewed and agreed to pursue before any contact is made. A sales qualified lead (SQL) is one that sales has spoken with and confirmed has budget, need, and timeline. Rejection happens at SAL; disqualification happens at SQL. They measure different funnel moments.

What's a good sales accepted lead rate?

A healthy rate falls between 70-90%, with Forrester's target at 90%+ signaling tight marketing-sales alignment. Below 50% almost always points to a definitional mismatch - sales and marketing aren't agreeing on what "qualified" means. Fix the shared criteria before you fix the leads themselves.

How does data quality affect lead acceptance rates?

Leads rejected for bounced emails, disconnected phones, or outdated job titles inflate rejection rates artificially - these are data failures, not qualification failures. Enriching and verifying contact records before handoff eliminates this rejection category entirely.

What's the fastest way to improve MQL-to-SAL conversion?

Three levers move the needle fastest: align on shared acceptance criteria so both teams agree on "qualified," reduce lead response time to under five minutes, and enrich contact data before handoff so reps aren't rejecting leads for bad records. Teams that tackle all three often see 20-30 percentage point improvement within a single quarter.

Can you track SAL rate in HubSpot or Salesforce out of the box?

No. Neither CRM includes SAL as a default lead stage. HubSpot requires a custom contact property plus a workflow to enforce disposition. Salesforce requires custom lead status values plus Flow-based routing rules. Setup takes 1-2 hours for either platform and is worth every minute.