B2B Contact Data Decay in 2026: How to Measure It and Stop It

Your CRM doesn't fail loudly. It fails quietly - one bounced email, one wrong title, one duplicate account at a time - until outbound performance "mysteriously" drops and everyone blames messaging. That's B2B contact data decay, and if you don't measure it like a production system, it'll keep showing up as random deliverability issues, routing exceptions, and reps building shadow spreadsheets.

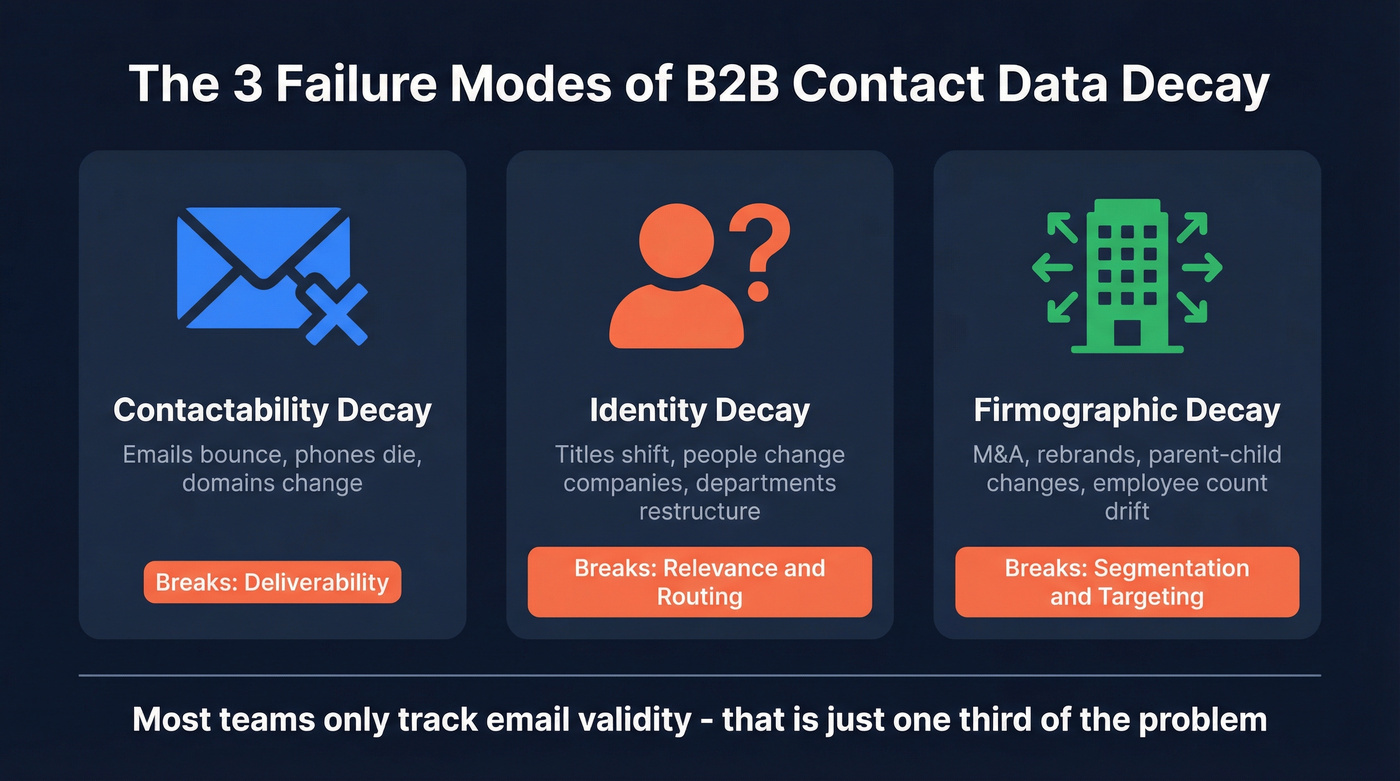

Here's the angle: decay isn't one problem. It's three different failure modes, and each needs its own KPI and refresh trigger.

Fix the loop, and the rest gets easier.

What you need (quick version)

Minimum viable anti-decay system (RevOps-ready):

- Track three decay types: contactability (email/phone), identity (title/company), firmographic (account structure).

- Enforce bounce guardrails: <2% good, 2-5% problem, >5% pause + investigate.

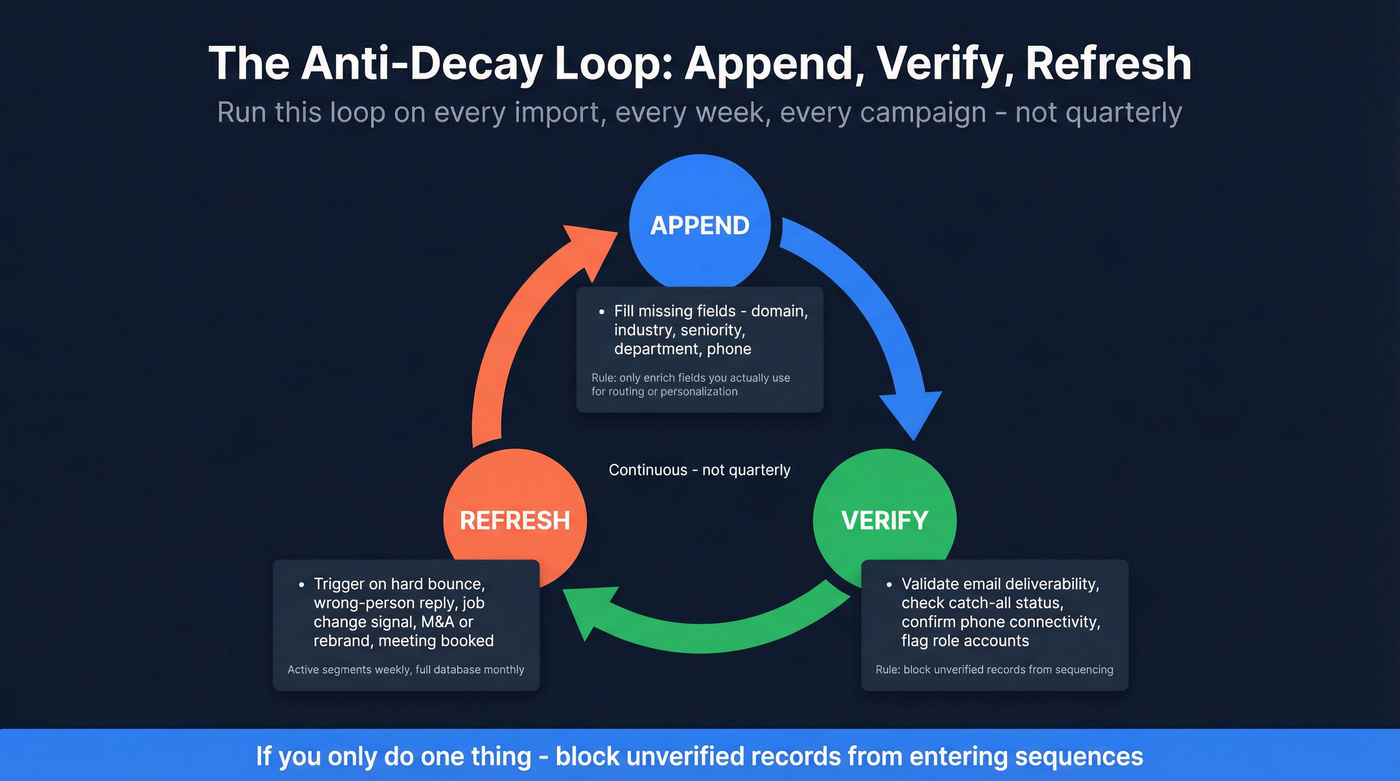

- Run one loop everywhere: Append -> Verify -> Refresh.

- Validate at entry (forms, imports, list uploads) so junk never becomes "CRM truth." (See: data quality)

- Dedupe continuously (contacts + accounts), not quarterly. (Use this as your baseline: how to keep CRM data clean)

- Refresh active segments weekly (open opps, active sequences, target accounts). (If you need cadence structure, borrow from SDR cadence best practices)

- Refresh instantly on triggers: hard bounce, "wrong person" reply, meeting booked, job change, M&A/rebrand.

If you're only going to do one thing, do this: block unverified records from sequencing. (Operational SOP: email verification list)

What contact data decay is (and what it isn't)

Contact data decay is the steady drift from "usable" to "wrong" across the fields you rely on to reach people, personalize outreach, and route leads. In practice, it's a mix of contact-level drift (people records) and database-level drift (the overall system of contacts + accounts falling out of date).

Most teams treat decay like one problem. It's three, and each breaks a different part of your revenue engine:

- Contactability decay: the person might still be the right buyer, but you can't reach them. Emails hard bounce, phones go dead, inboxes get disabled, domains change, catch-all policies tighten. This is where email list decay shows up first. (Related: email deliverability)

- Identity decay: the person is real, but the record's wrong. Titles shift, departments change, seniority changes, name changes, or they move companies. Personalization gets awkward and routing rules misfire.

- Account/firmographic decay: the company record changes. Parent/child structures shift, rebrands happen, domains change, M&A breaks matching, employee counts drift, and your "target account list" quietly becomes a different list. (Deep dive: firmographic data for leads)

What it isn't:

- It isn't "email deliverability" alone. A valid email with a wrong title still kills relevance.

- It isn't a one-time cleanse project. Decay's continuous, so hygiene has to be continuous.

- It isn't a sales problem. It's a systems problem - inputs, rules, and refresh cadence.

Clean mental model: contactability decay breaks deliverability, identity decay breaks relevance, and firmographic drift breaks segmentation + routing.

How fast does B2B contact data decay in 2026? (benchmarks you can actually use)

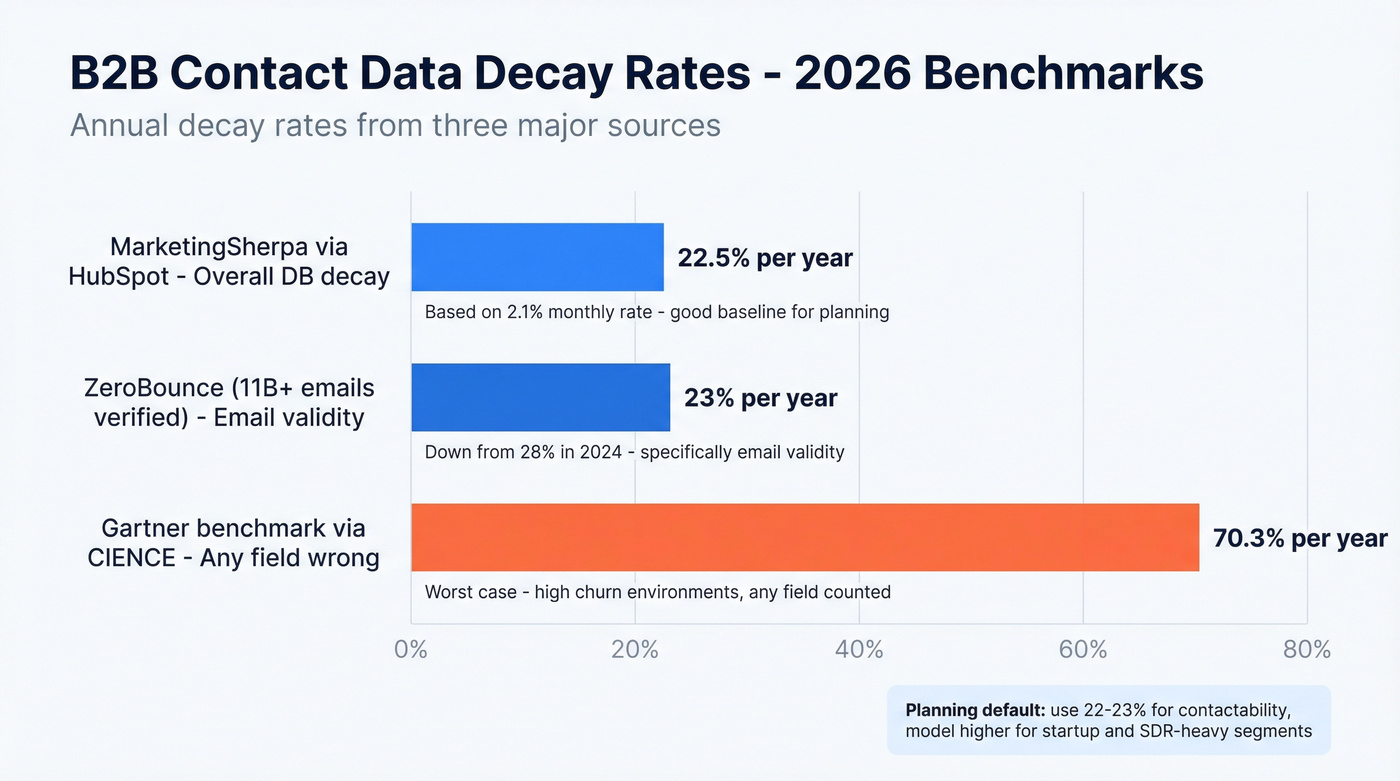

Benchmarks are planning inputs. Use them to set refresh cadence and budget, not to win an argument in Slack.

Three numbers bracket reality:

- 22.5% per year: HubSpot's database decay simulator (attributed there to MarketingSherpa) frames B2B decay as 2.1% per month, annualized. It's a practical baseline for planning and a decent proxy for overall drift.

- 23% yearly email degradation: ZeroBounce analyzed 11B+ emails verified from Jan-Dec 2025 and found at least 23% of an email list degrades yearly - down from 28% in 2024. That's specifically email validity, not titles/phones. (If you need tooling options, see email verifier website)

- 70.3% per year (worst-case): a widely repeated benchmark cited by CIENCE and attributed there to Gartner is 70.3%/year. Use it only when "decay" means "any field wrong" in high-churn environments.

Benchmarks table (use as inputs)

| Benchmark | Rate | Scope | Use it for |

|---|---|---|---|

| MarketingSherpa via HubSpot | 2.1%/mo (22.5%/yr) | DB decay | Baseline planning |

| ZeroBounce (11B+ emails) | 23%/yr | Email validity | Deliverability risk |

| Gartner benchmark repeated by CIENCE | 70.3%/yr | Any-field drift | Worst-case modeling |

In our experience, the planning mistake isn't picking the "wrong" benchmark. It's pretending your whole database behaves the same. Your CFO's email address at a public company doesn't decay like a 12-person startup's SDR org, and your refresh cadence shouldn't treat them like twins.

I default to ~22-23% per year for contactability, then I model higher drift for job-change-heavy segments (startups, fast-growing tech, SDR/AE-heavy functions). That's where "it broke overnight" actually comes from.

You can sanity-check assumptions with HubSpot's database decay simulation page.

You just read that 23% of emails degrade yearly. Prospeo's 7-day data refresh cycle means your CRM never falls 6 weeks behind like it does with other providers. 98% verified email accuracy, catch-all handling, and spam-trap removal built in.

Block decayed data from your sequences permanently.

What actually changes? Field-level decay (and why "valid email" isn't enough)

Email validity is the easiest thing to measure, so it gets all the attention. Operationally, identity fields are what break routing, territories, and personalization.

IndustrySelect reported a 1,000-business-card analysis where 70.8% had at least one change within 12 months:

| Field | % changed in 12 months |

|---|---|

| Job title/function | 65.8% |

| Phone number | 42.9% |

| Address | 41.9% |

| Email address | 37.3% |

| Company | 29.6% |

If you only verify email, you still ship mistakes:

- "Valid" email + wrong title = personalization that misses (or insults) the buyer.

- Right person + dead phone = reps waste dials and stop trusting the system.

- Right company name + wrong domain/parent = broken matching and messy reporting.

Look, this is the part that annoys me: teams will spend weeks A/B testing subject lines while their routing rules are firing on stale titles from 18 months ago.

If your average deal size is small and you're not doing serious outbound volume, you can survive with "good enough" data. The moment outbound becomes a growth lever, freshness becomes a revenue dependency, not a nice-to-have.

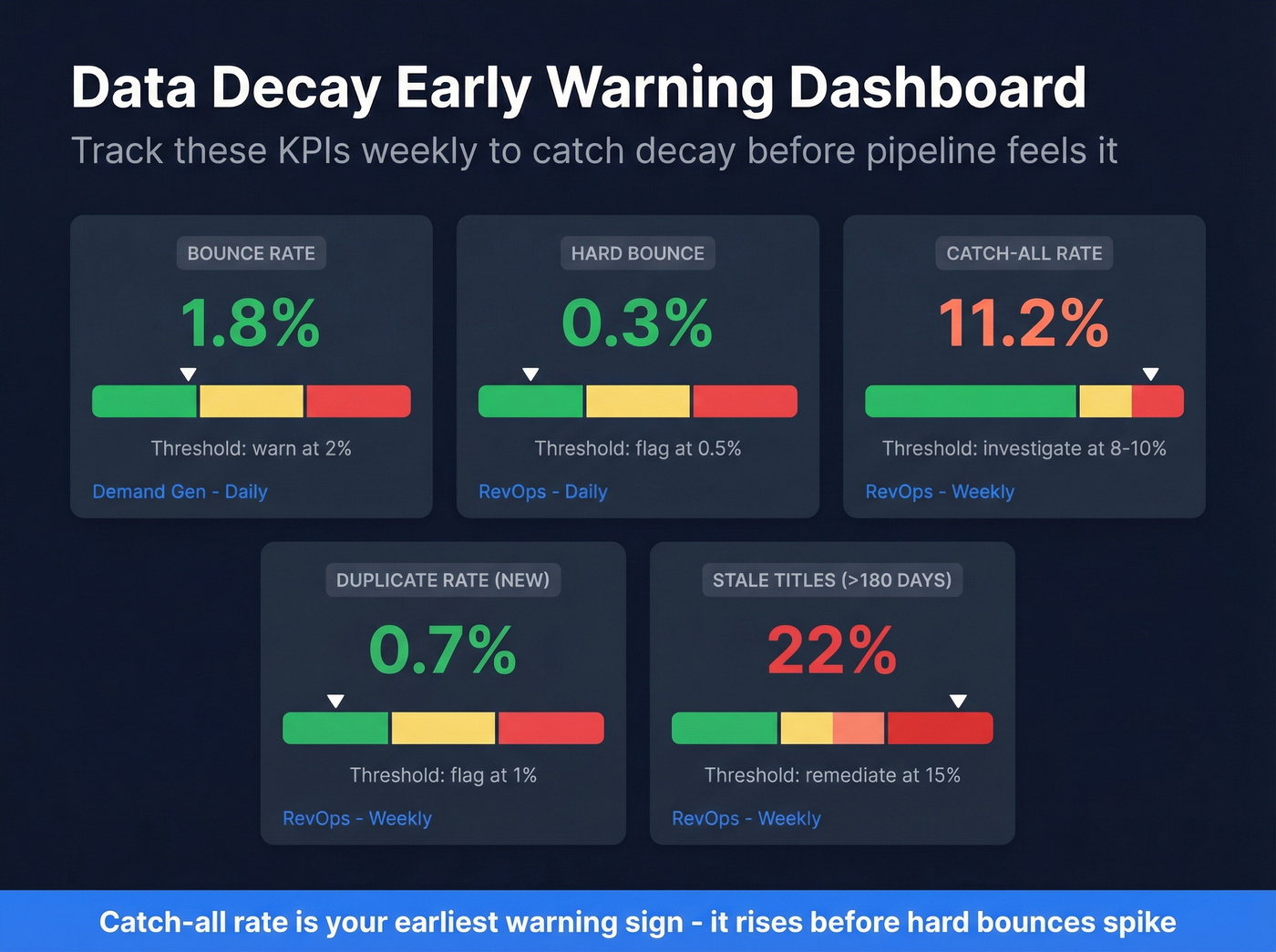

How to detect decay early (KPIs, thresholds, and audits)

Decay shows up as operational weirdness before it shows up in pipeline: bounce spikes, routing exceptions, and reps building shadow spreadsheets because "the CRM is full of ghosts."

In our audits, catch-all rate is the earliest warning sign. It rises before hard bounces spike, and it usually climbs right after you add a new list source or loosen your import rules.

The KPI checklist (track weekly)

- Bounce rate (by source, segment, and sending domain)

- Hard bounce rate vs soft bounce rate

- Catch-all rate (treat it as a leading indicator)

- % records missing critical fields (title, department, company domain, country/state)

- Duplicate rate (contacts + accounts)

- Stale-field rate (example: title older than 180 days for ICP segments)

- Reply-to-meeting conversion by list source and record age

Here's a scenario we've seen more than once: a team imports a "fresh" event attendee list on Monday, launches sequences on Tuesday, and by Thursday the sending domain's taking hits because the list was full of catch-alls and role accounts that looked fine in a CSV but were never safe to mail at scale.

Bounce thresholds you can operationalize

Use these guardrails and stop debating:

- <2% = good

- 2-5% = problem

- >5% = red flag (pause + investigate)

For directional context only, one Mailchimp benchmark summary reports averages around ~0.21% hard bounces and ~0.70% soft bounces. Useful as a sanity check; your guardrails are what you run the business on.

Also: ZeroBounce's large-scale verification data shows catch-alls can be 9%+ of checks. That's not a rounding error. (Related diagnostic: 550 recipient rejected)

Three measurement methods beyond "watch bounces"

If you want to catch decay before deliverability gets hurt, add these:

Sample verification audit (monthly) Randomly pull ~200 contacts from "sendable" segments and verify them. Track invalid + catch-all share by source.

Freshness audit (weekly) Plot the age distribution of a "last verified at" field (or last enriched/updated). If half your outbound list is older than 90-180 days, you're driving with fogged windows.

Engagement decay (weekly) Compare reply rate and meeting rate by record age and source. When older records underperform, that's decay - not copy.

Mini dashboard spec (starter thresholds)

These are starter thresholds. Tune them after 2-4 weeks of baseline measurement.

| KPI | Starter threshold | Owner | Alert cadence |

|---|---|---|---|

| Bounce rate | >2% warn | Demand Gen | Daily |

| Hard bounce | >0.5% | RevOps | Daily |

| Catch-all % | >8-10% | RevOps | Weekly |

| Duplicates | >1% new | RevOps | Weekly |

| Stale titles | >15% | RevOps | Weekly |

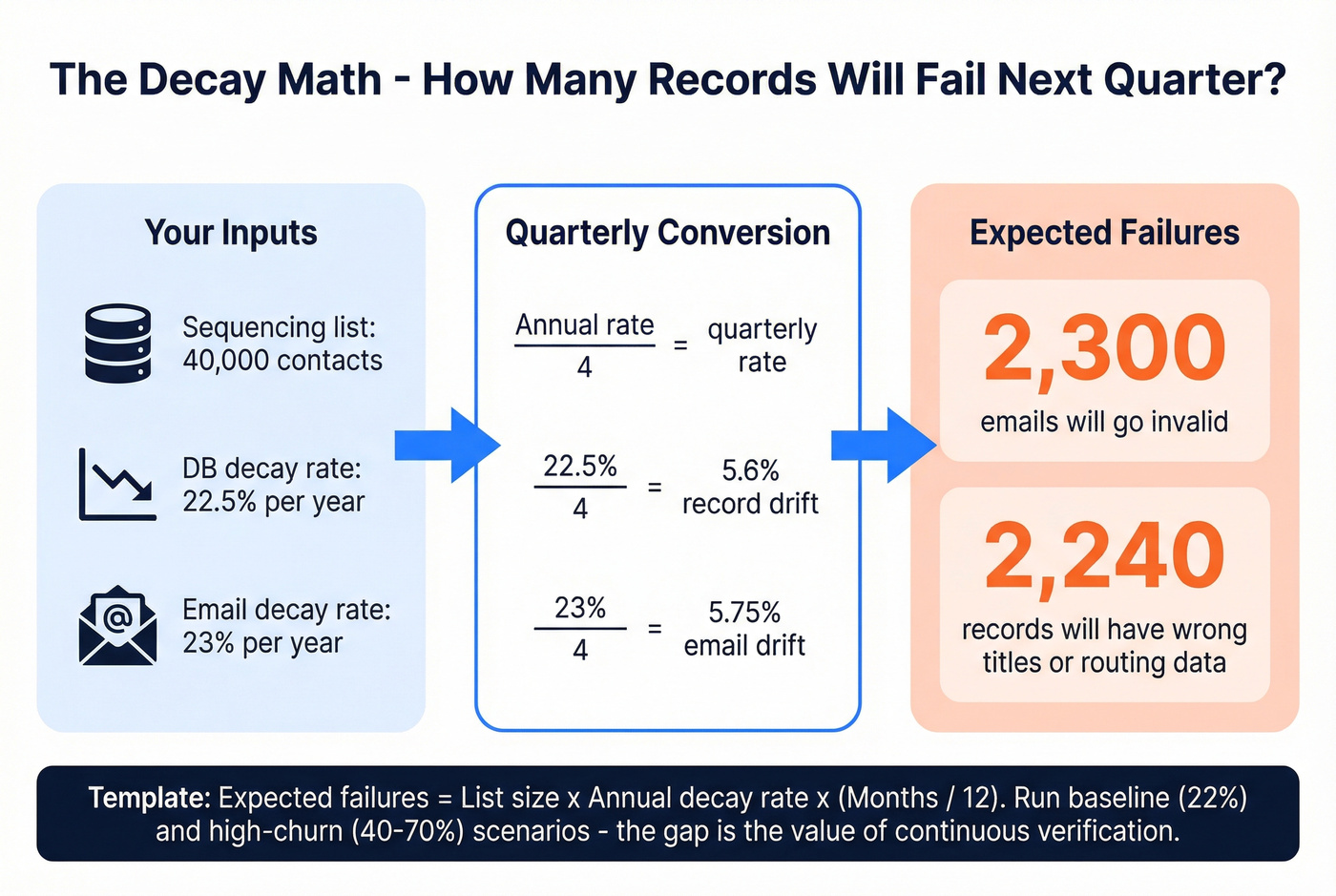

The "decay math" model (forecast wrong records before pipeline feels it)

You don't need a complicated model. You need a forecast that answers: "How many records will fail next quarter if we do nothing?"

Worked example (quarterly forecast)

Assume:

- You're sequencing 40,000 contacts next quarter.

- Baseline database decay: 22.5% per year.

- Email validity decay: 23% per year (ZeroBounce 2025).

Convert annual to quarterly (roughly divide by 4):

- Contact record drift per quarter ≈ 5.6%

- Email validity drift per quarter ≈ 5.75%

Forecast:

- Expected invalid emails next quarter: 40,000 × 5.75% ≈ 2,300

- Expected identity drift impacting personalization/routing: 40,000 × 5.6% ≈ 2,240

That's the cost of "we'll clean it later," and it's before you count duplicates, misrouted leads, or the rep hours burned chasing dead numbers.

Template you can reuse

- List size (N)

- Annual decay rate (D)

- Period fraction (P) = months/12

- Expected failures = N × D × P

Run two scenarios: baseline (22-23%/yr) and high-churn (40-70%/yr). The gap is the value of continuous verification + refresh.

How to stop B2B contact data decay: Append -> Verify -> Refresh (plus governance)

Quarterly list cleaning is a coping mechanism. A real system runs a loop - every week, every import, every campaign.

Append (fill what's missing)

Goal: reduce "unknowns" that break routing and segmentation.

Append what you actually use:

- company domain, industry, country/state

- department, seniority, role

- phone (only where it changes outcomes - don't enrich for sport)

Two rules that keep this sane:

- Use waterfall enrichment when coverage matters more than vendor purity. (Stack options: lead enrichment tools)

- Protect trusted fields with write rules (don't let random tools overwrite curated values).

Verify (stop bad data at the door)

Goal: prevent bounce spikes and stop wrong-but-plausible fields from becoming truth.

Non-negotiables:

- Validate at entry (forms, imports, integrations)

- Dedupe continuously (contacts + accounts)

- Control field mapping + overwrite rules

- Assign a single owner for data quality (RevOps, not "everyone")

We've tested a bunch of setups, and the biggest win is boring: weekly refresh on active sequences prevents the classic bounce cliff because you catch drift while it's small, not after it's catastrophic. (If you need the workflow, start with how to verify an email address)

Skip this if you're sending 200 emails a month and your pipeline's mostly inbound. For everyone else, verification isn't optional.

One practical way to run the loop without turning it into a full-time job is using a self-serve platform like Prospeo ("The B2B data platform built for accuracy") for real-time verification and ongoing refresh. Prospeo delivers 98% email accuracy and refreshes records on a 7-day cycle (the industry average is about 6 weeks), with 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, plus a Chrome extension used by 40,000+ people.

Refresh (keep hot data hot)

Goal: update records on time + triggers, not vibes.

Scheduled refresh

- Weekly: open opps, active sequences, target accounts

- Monthly: the rest of your "sendable" universe

Trigger-based refresh

- Hard bounce -> immediate verify + replace contact

- "Wrong person" reply -> refresh contact + buying committee (and remove churned account contacts from active plays)

- Meeting booked -> refresh titles/seniority (routing + personalization)

- Job change signal -> refresh identity fields

- M&A / rebrand -> refresh domain + parent/child mapping + dedupe cluster

Add one operational artifact: a "Quarantine Queue"

This is the difference between "we track data quality" and "we fix it."

- Any record that's invalid, duplicate, or missing critical fields goes into a Quarantine Queue.

- Quarantine records are blocked from sequencing until they're verified/refreshed.

- RevOps owns the queue; Sales can request exceptions (rarely granted).

The maintenance cadence schedule (the part most teams skip)

This is the schedule that keeps decay from turning into a quarterly fire drill.

| Cadence | Activity | Owner |

|---|---|---|

| Real-time | Validate at entry (forms/imports), block invalids, route to Quarantine Queue | RevOps |

| Daily | Monitor bounce + hard bounce by source; pause if >5% | Demand Gen |

| Weekly | Refresh active segments; review catch-all rate + duplicates; fix top offenders | RevOps |

| Monthly | Sample verification audit (~200 contacts); report source quality scorecard | RevOps |

| Quarterly | Full dedupe/merge sweep; field mapping + overwrite rules review | RevOps + CRM Admin |

| Semi-annual | ICP + routing rules audit; account matching logic + domain alias review | RevOps + Sales Ops |

Run this for 60 days and your CRM stops feeling like a haunted house.

Firmographic decay: why accounts break (M&A, rebrands, parent/child changes)

Contact decay gets the headlines. Firmographic data decay quietly breaks ABM, attribution, and territory logic.

McKinsey reported that in 2025, global M&A deal value hit $4.7T, up 43% YoY. That's a lot of domain changes, entity merges, and parent/child reshuffles flowing into your matching rules.

Bynder (citing Landor) reported 74% of S&P 100 rebranded within 7 years. Translation: even "stable" companies change identifiers more often than your CRM model expects.

What to do without buying another platform:

- Match accounts on multiple identifiers (domain + legal name + HQ country + parent ID when you have it).

- Store domain history (old domains as aliases) so inbound still matches.

- Lock account ownership + merge rules so reps don't create parallel accounts.

- Treat M&A/rebrands as triggers: refresh domain + parent/child mapping and re-run dedupe on the cluster.

Persistent identifiers (so you're not hostage to email)

Email's a great address, not a great identity key. Use a small identifier strategy:

- Assign an internal contact ID that never changes.

- Normalize names (case, spacing, common variants) before matching.

- Use company domain as the primary account key, with domain aliases for history.

- Store "last verified at" timestamps on contactability fields (email/phone).

- Define source-of-truth rules per field (example: CRM owner for title, enrichment tool for domain, etc.).

- Log the data source and last update method (form fill vs enrichment vs manual edit).

This is how you keep routing and reporting stable even when people and companies move.

Business case: what decay costs (and how to justify budget)

Execs don't fund "data hygiene." They fund revenue protection and productivity.

A Gartner benchmark compiled by Integrate.io pegs poor data quality at $12.9M per year on average. Your number will differ, but the mechanics don't.

Use a simple model:

- Rep time waste: 20 reps × 20 minutes/day lost to bad data ≈ 133 hours/month. At $75/hour fully loaded, that's ~$10k/month.

- Deliverability drag: one bounce spike can pause outbound, force domain rehab, and burn weeks of pipeline generation. (If you’re troubleshooting reputation, start with blacklist alert)

- Pipeline leakage: misrouted leads + wrong persona targeting quietly depress conversion rates.

For directional proof, ZoomInfo references a D&B survey: companies that increased investment in data saw 94% improved sales/marketing performance, while those that decreased investment saw a 75% decline.

FAQ

How quickly does B2B contact data decay?

A practical baseline is ~2.1% per month (22.5% per year) for database drift, and ~23% per year for email validity degradation (ZeroBounce 2025). If you're selling into fast-changing orgs, plan for 40%+ annual drift on titles and company moves and refresh active segments weekly.

What's a "good" bounce rate for outbound or newsletters?

A "good" bounce rate is under 2%, 2-5% signals list quality's slipping, and over 5% should pause sending and trigger verification plus source investigation. If catch-all rates climb past 8-10%, treat it as an early warning that your next bounce spike's already loading.

Is quarterly list cleaning enough in 2026?

Quarterly cleaning's too slow for modern outbound; it lets bad records accumulate until you hit a bounce cliff. A workable cadence is real-time validation at entry, weekly refresh for active sequences and open opps, and instant refresh on triggers like hard bounces, "wrong person" replies, job changes, and rebrands.

What's a good free tool to reduce decay before sending?

A solid free starting point is Prospeo's free tier (75 emails + 100 Chrome extension credits/month) for verification and quick fixes before a campaign. Pair it with a simple rule: don't send to anything unverified or flagged catch-all, and re-check active lists every 7 days to avoid last-minute bounce surprises.

Summary: keep B2B contact data decay from becoming a pipeline problem

B2B contact data decay isn't a one-time cleanup task. It's predictable drift that hits contactability, identity, and account structure on different timelines, and it shows up as bounce spikes, routing errors, and wasted rep time long before someone admits "the data's bad."

Run Append -> Verify -> Refresh with weekly monitoring, trigger-based updates, and a Quarantine Queue, and your CRM stops quietly rotting and starts behaving like an actual revenue system.

Title decay hits 65.8% of records in 12 months. Prospeo enrichment returns 50+ data points per contact - titles, departments, company changes - at a 92% match rate. Plug it into HubSpot or Salesforce and stop routing leads on 18-month-old job titles.

Fix the whole record, not just the email.