How to Use Firmographic Data to Generate and Qualify Better Leads

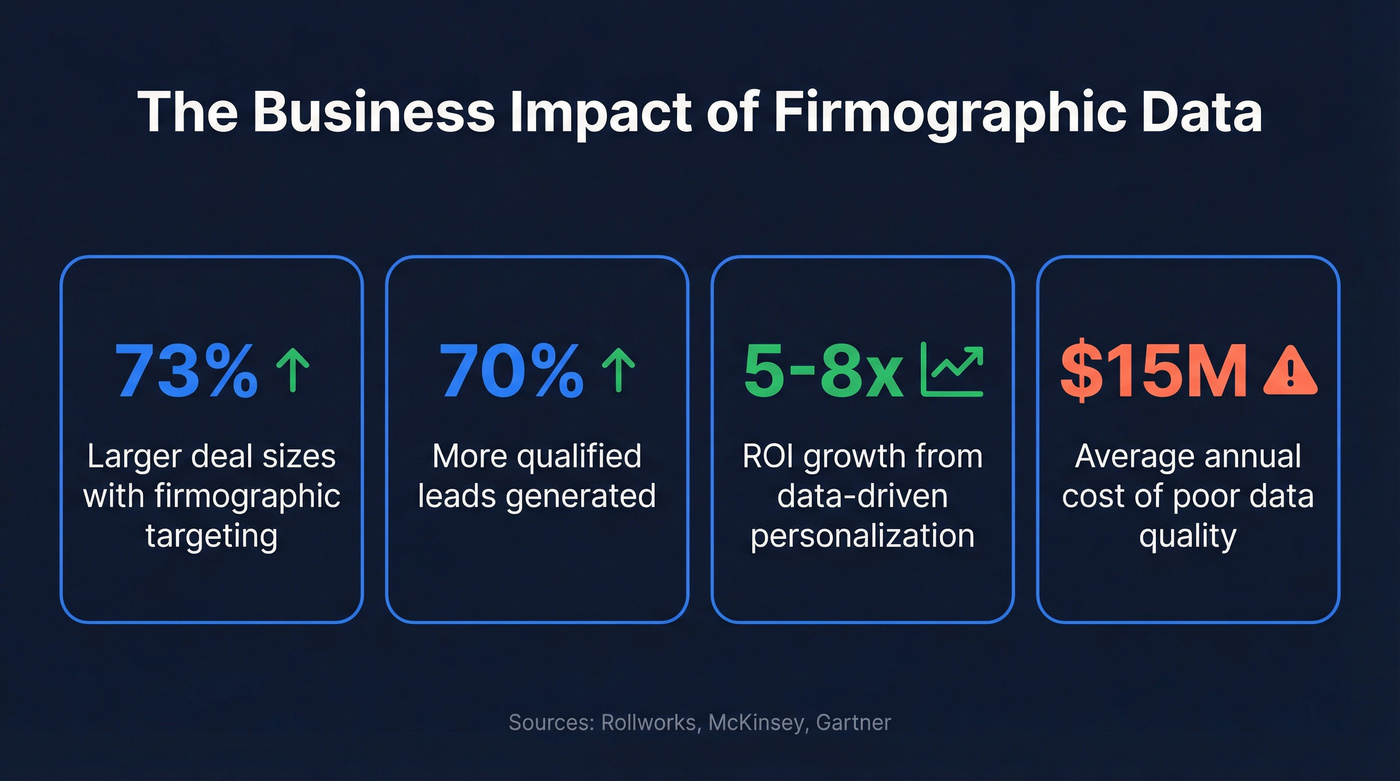

Companies using firmographic targeting close deals 73% larger than those spraying and praying. Yet most B2B teams treat firmographic data for leads as a checkbox - filter by industry, filter by size, call it a day. The gap between having this data and using it well is where pipeline goes to die.

Firmographic data - industry, company size, revenue, location, ownership, growth signals - is how you identify which companies to target before you ever touch a contact record. Teams using it see 73% larger deals and 70% more qualified leads. But firmographics alone aren't enough. Layer in timing signals (intent data, job changes, funding rounds) and attach verified contacts to those accounts. A perfect ICP with bounced emails is just a spreadsheet.

This isn't a filtering exercise. It's the foundation of every high-performing outbound motion.

What Is Firmographic Data? (And Why It Drives 73% Larger Deals)

Every B2B targeting strategy starts with the same question: which companies should we go after? Firmographic data - industry, employee count, revenue, location, ownership, funding, tech stack - is how you answer it. Think of it as demographics for companies.

Here's the thing: firmographic data isn't new. Sales teams have been filtering by company size and industry since the Rolodex era. What's changed is the density and freshness of available data. You can now filter for VC-backed SaaS companies with 200-500 employees, headquartered in DACH, that raised a Series B in the last 12 months and use Salesforce. That specificity didn't exist five years ago.

The impact is measurable. A Rollworks study found that firmographic-based account targeting increases deal sizes by 73%. Companies using it report 70% more qualified leads and a 25% bump in sales productivity. Data-driven personalization - which starts with firmographic segmentation - generates 5-8x ROI growth.

The flip side is equally stark. Poor data quality costs companies an average of $15 million annually. B2B contact data decays at roughly 30% per year. So the firmographic intelligence you built last quarter? A third of it is already degrading.

This isn't a "nice to have" data layer. It's the difference between your SDRs working a curated list of 500 high-fit accounts and blasting 10,000 random contacts hoping something sticks.

The Firmographic Data Points That Actually Matter

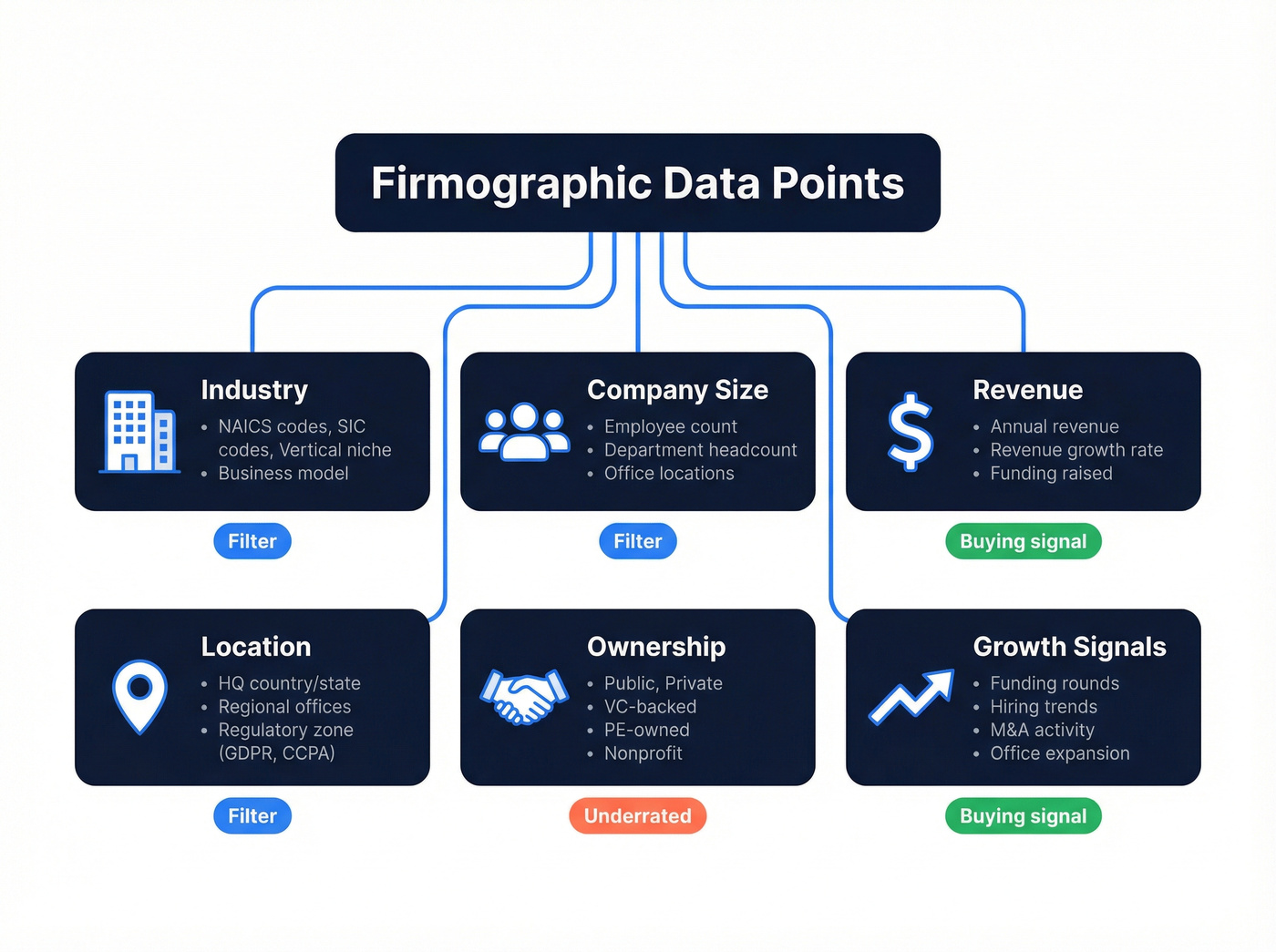

Not all firmographic attributes carry equal weight. Some are table stakes for filtering. Others are genuine buying signals.

Industry Classification (and Why SIC Codes Fail You)

Industry is the most obvious firmographic filter - and the most commonly botched. SIC codes were developed in 1937 and last updated meaningfully in 1987. NAICS is better (developed in 1997, with 1,000+ codes), but still struggles with modern business models.

Consider: ZoomInfo lists 339,506 companies under "Software." That's not a segment - that's a haystack. Even narrowing to US/Canada with 100+ employees still leaves you with 9,839 accounts. The code can't distinguish a cybersecurity platform from a project management tool from an AI video editor.

The fix isn't better codes. It's layering industry classification with other signals - tech stack, job postings, self-described positioning on their website. Amazon is technically "retail," but nobody's selling them the same thing they'd sell Nordstrom.

Use NAICS for initial filtering in your CRM (it's what most tools default to), but don't trust it as your primary segmentation axis. Map to SIC only when legacy systems require it, and use the Census Bureau crosswalk tools for conversion - automated mappings introduce errors.

Company Size and Revenue: How to Find Companies by Revenue Band

Employee count and annual revenue are the two firmographic attributes that most directly predict deal size, sales cycle length, and buying committee complexity.

A 50-person startup has one decision-maker and a two-week sales cycle. A 5,000-person enterprise has a 10-person buying committee and a six-month procurement process. Your messaging, pricing, and sales motion should be completely different for each.

Revenue tells you budget capacity. The ability to find companies by revenue range is one of the most practical applications of a firmographic data search - it lets you disqualify accounts before your reps ever touch them. A $500M company can absorb enterprise software pricing. A $5M company probably can't. I've seen teams waste months chasing logos that looked impressive but had four-figure budgets. Revenue filtering prevents that.

Location, Ownership, and Growth Signals

Location matters beyond time zones. Regulatory environment (GDPR in Europe, CCPA in California, HIPAA in US healthcare), language, and local competition all affect buying behavior. Teams expanding into European markets often need reliable EMEA account data to segment prospects by country, language, and compliance requirements - a challenge that generic global databases handle poorly.

Ownership structure is underrated. Public companies face quarterly earnings pressure and formal procurement. VC-backed companies move faster but scrutinize ROI ruthlessly. PE-owned companies are often in cost-cutting mode. Nonprofits have entirely different budget constraints.

Growth signals are where firmographic data becomes predictive. Funding rounds, M&A activity, hiring trends, office expansion - these aren't just attributes, they're buying triggers. A company that just raised a Series C and is hiring 15 SDRs is in a fundamentally different buying posture than one that just did layoffs.

How to Build Your ICP Using Firmographic Data

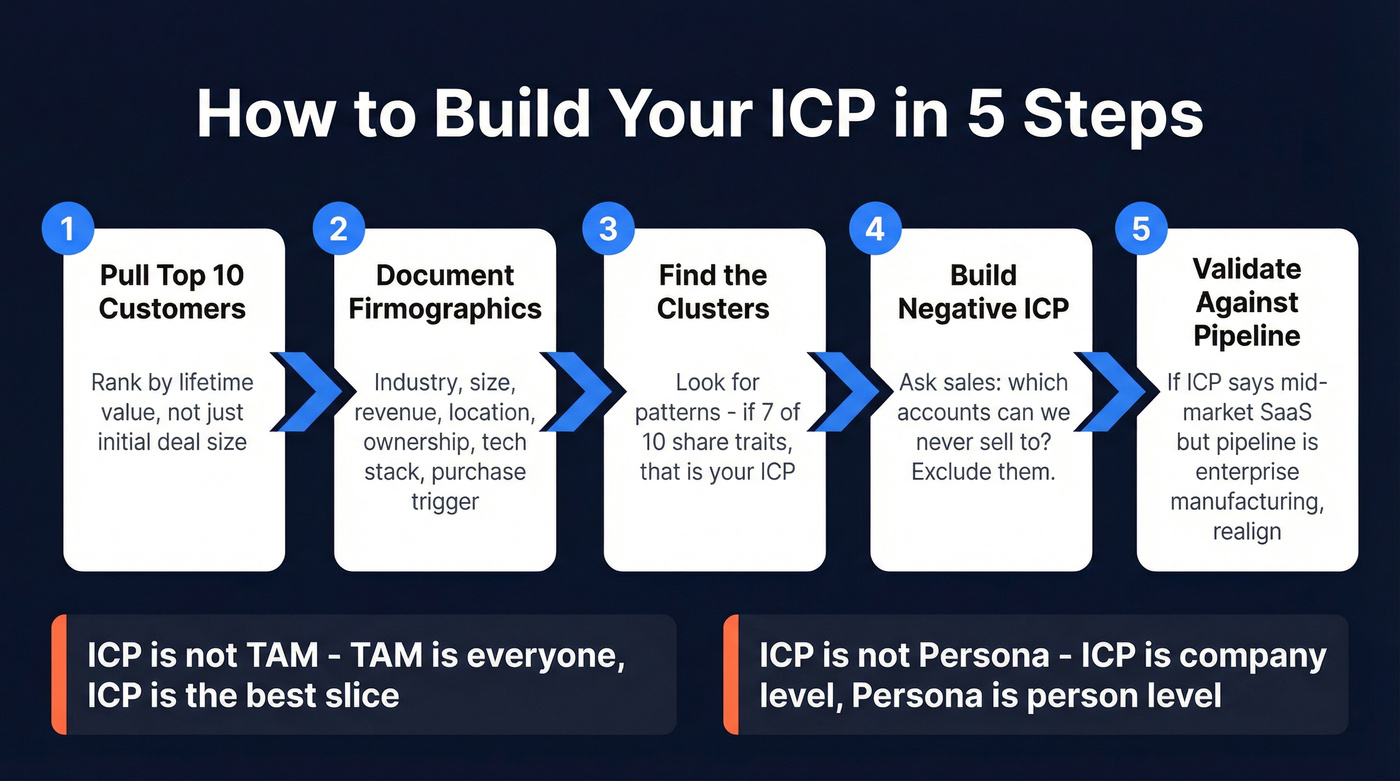

Your ICP isn't a wish list. It's a data-backed profile of the companies most likely to buy, stay, and expand.

Gartner identifies six ICP attribute categories: firmographics, technographics, psychographics, business situation, business/operating model, and resources. Most teams only use the first two. That's a start, but it leaves money on the table.

The top-10-customer exercise:

- Pull your 10 highest-value customers (by LTV, not just initial deal size).

- For each, document: industry, employee count, revenue, location, ownership type, tech stack, what triggered the purchase, and how long the sales cycle took.

- Look for clusters. If 7 of 10 are VC-backed SaaS companies with 200-1,000 employees using Salesforce, that's your ICP - not a coincidence.

- Validate with your sales team. Ask: "What makes an account we can't sell to?" The negative ICP is just as valuable.

- Cross-reference against your pipeline. If your ICP says mid-market SaaS but your pipeline is full of enterprise manufacturing, something's misaligned.

Two critical distinctions most teams blur:

ICP ≠ TAM. Your total addressable market is every possible buyer. Your ICP is the highest-value slice. Targeting your TAM is how you burn budget. Targeting your ICP is how you hit quota.

ICP ≠ buyer persona. ICP operates at the company level. Personas operate at the individual level. You need both, but firmographic data builds the ICP. The average B2B buying committee involves 5 decision-makers (Gartner's number - other studies put it at 6-10). You need to identify the right company before you worry about the right person within it.

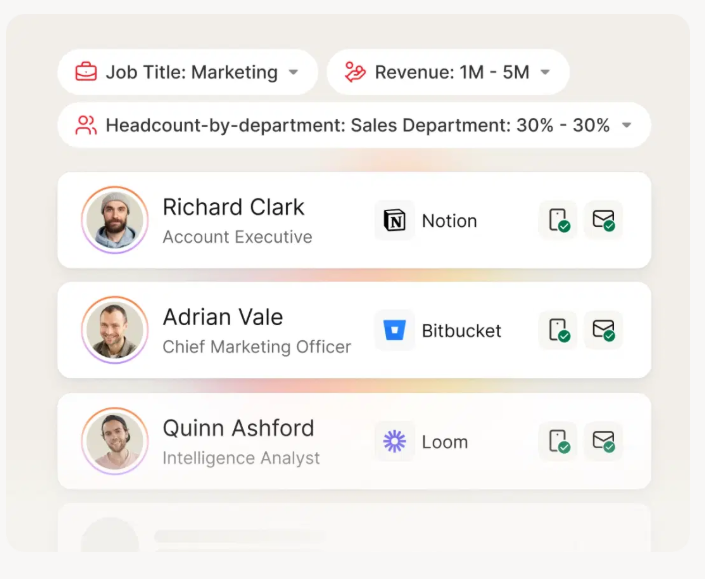

You just defined your ICP - now find every company that matches it. Prospeo's 30+ search filters let you segment by revenue band, employee count, funding stage, tech stack, and growth signals. Attach 98% verified emails to every account, refreshed every 7 days so your firmographic data never decays.

Stop filtering on stale data. Build lists that actually convert.

Five Ways Firmographic Data Drives Better Lead Quality

Segmentation and Prioritization

This is the highest-impact use case. Firmographic segmentation - dividing your TAM by industry, size, revenue, and growth signals - yields 20-40% higher response rates compared to untargeted campaigns. That's not marginal. That's the difference between a campaign that works and one that doesn't.

If you're still sending the same email to a 50-person startup and a 5,000-person enterprise, you're leaving response rate on the floor.

Lead Routing by Company Tier

Firmographic-based lead routing increases lead-to-opportunity conversion by 15-25% while cutting response times from days to hours. The logic is straightforward: enterprise tech leads go to senior reps who can navigate procurement. Mid-market leads go to mid-level reps. SMB leads go to transactional reps or self-serve flows.

The conversion lift comes from matching rep expertise to account complexity. A junior SDR trying to navigate a Fortune 500 procurement process is a recipe for a stalled deal.

Account Suppression

Nobody talks about this one, but everyone needs it. Firmographic suppression - removing accounts below a revenue threshold, in industries with sub-2% historical conversion, or that are existing customers - reduces wasted marketing spend by 10-20%.

If your product doesn't serve companies under $5M in revenue, every dollar spent marketing to them is waste. Firmographic suppression catches that before the spend happens.

Personalized Messaging

A cybersecurity SaaS company targeting healthcare, financial services, and energy companies with 500+ employees can craft compliance-specific messaging for each vertical. "HIPAA compliance" resonates with a hospital system. "SOX audit readiness" resonates with a bank. Same product, different firmographic angle, dramatically different response rates.

Whitespace Analysis and Market Expansion

Firmographic data reveals where you're not selling. If your best customers are mid-market fintech companies but you have zero penetration in mid-market insurtech - and the firmographic profiles are nearly identical - that's a whitespace opportunity. Filter by geography, industry, size, and growth indicators to prioritize new territories. This is how you expand methodically instead of guessing.

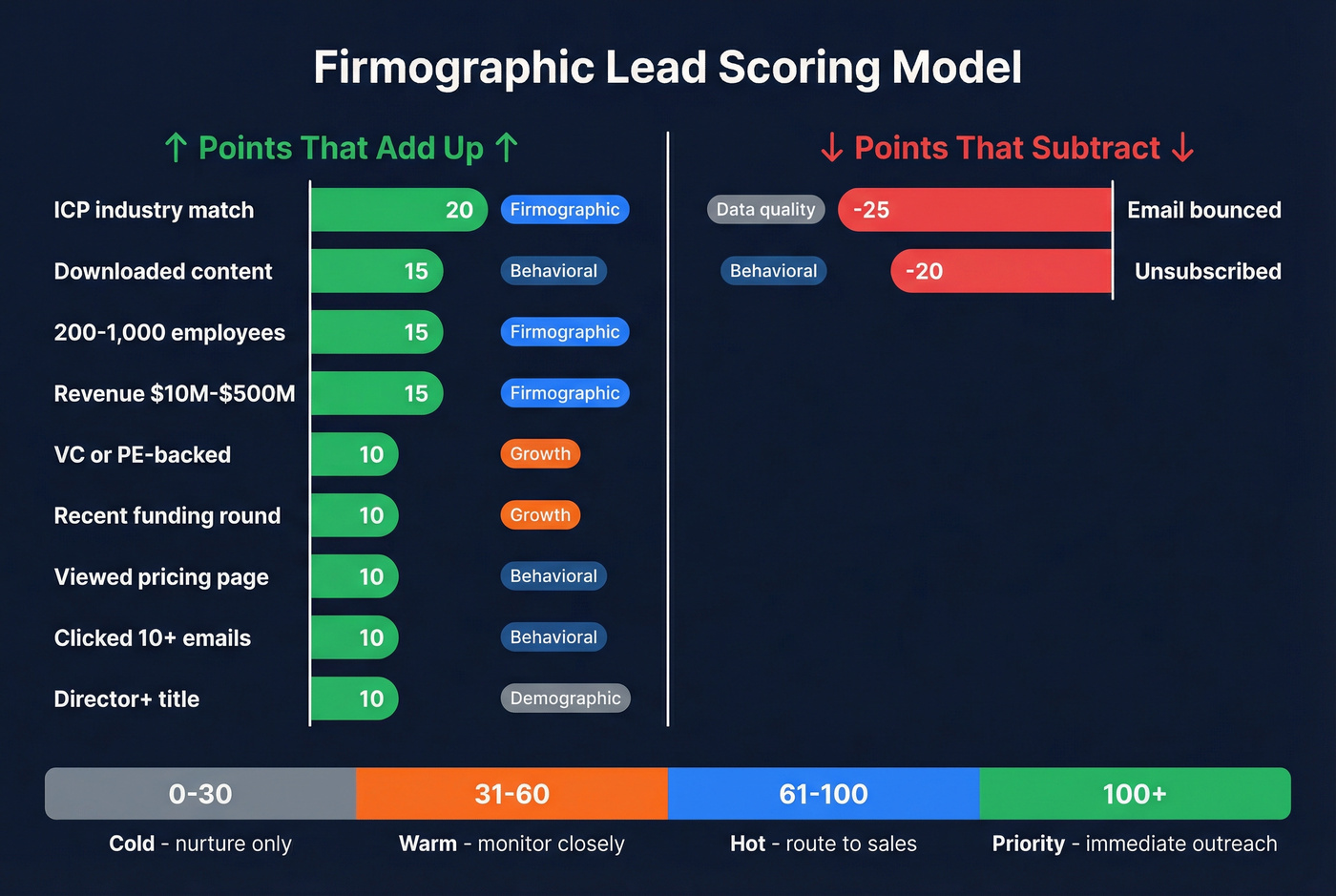

Firmographic Lead Scoring - A Practical Model

75% of businesses report increased lead conversion after implementing scoring, with conversion rate lifts up to 50%. Yet most teams either don't score at all or use a model so basic it's useless.

Here's a practical model adapted for firmographic + behavioral signals:

| Signal | Points | Category |

|---|---|---|

| ICP industry match | +20 | Firmographic |

| 200-1,000 employees | +15 | Firmographic |

| Revenue $10M-$500M | +15 | Firmographic |

| VC/PE-backed | +10 | Firmographic |

| Recent funding round | +10 | Growth signal |

| Viewed pricing page | +10 | Behavioral |

| Downloaded content | +15 | Behavioral |

| Clicked 10+ emails | +10 | Behavioral |

| Director+ title | +10 | Demographic |

| Email bounced | -25 | Data quality |

| Unsubscribed | -20 | Behavioral |

The key insight: a mid-level manager who visits your website 5 times scores higher than a C-level exec who visits once and unsubscribes. Behavioral signals override title-based assumptions.

Scoring thresholds:

- 70+ points: Route to sales immediately. These are hot.

- 40-69 points: Nurture sequence. They fit the ICP but haven't shown enough intent.

- Below 40: Awareness campaigns only. Don't waste rep time.

The feedback loop matters more than the initial model. In our experience, teams that skip the feedback loop end up with a model that's obsolete within two quarters. High scorers who don't convert should trigger an ICP audit. Low scorers who close should trigger signal reanalysis. Your model should evolve quarterly.

For teams ready to go further, predictive scoring combines firmographic, behavioral, and historical conversion patterns using machine learning - 98% of sales teams using AI say it dramatically improves lead prioritization. But you don't need AI to start. The table above will outperform no scoring at all.

How to Enrich Firmographic Data in Your CRM

Here's the uncomfortable truth: 30% of your B2B data decays every year. 28% of email addresses in your CRM are already outdated. If you're not actively enriching, your database is rotting.

Three enrichment trigger types to implement:

- On-create: Enrich immediately when a lead enters the CRM. Higher API cost, but ensures reps never work a blank record.

- On-demand: Rep clicks a button to enrich. Adds friction but controls cost.

- Scheduled batch: Nightly or weekly enrichment runs across the database. Best for maintenance and catching decay.

Best practice: combine triggers. Inbound leads get enriched immediately. The existing database gets re-enriched quarterly.

Salesforce Enrichment Workflow

Data.com is retired. There's no direct native replacement at the same price point. You'll need a third-party enrichment layer.

Here's the Salesforce enrichment Flow architecture:

- Trigger: Lead record created (or updated with blank fields)

- Decision: Check if Company_Size, Industry, or Revenue is blank

- Action: HTTP Callout to enrichment API

- Update: Map returned fields to standard Salesforce fields (Industry, AnnualRevenue, NumberOfEmployees, BillingCountry)

- Assignment: Run lead assignment rules based on enriched firmographic data

Data standardization is critical. "Information Technology" vs "IT" vs "Tech" must resolve to the same value. Build a picklist mapping table and enforce it in your Flow.

HubSpot Enrichment Workflow

HubSpot Insights - the free auto-fill feature - was phased out in early 2025. It's been replaced by Breeze Intelligence, HubSpot's AI-driven enrichment engine.

Setup: HubSpot Settings → Data Management → Data Enrichment → Enable contact and company enrichment. New leads get auto-enriched on form submission. Existing records can be enriched manually or via bulk workflows.

Breeze Intelligence is decent for basic company data, but it's limited to HubSpot's own data sources. For teams needing higher accuracy and broader coverage, pair it with an external lead enrichment tool that pushes data directly into contact and company records via native integration - no middleware required.

Layer intent data on top of enrichment to highlight leads with strong buying signals. Repeat pricing page visits, demo page views, and competitor comparison searches all indicate active evaluation.

Beyond Firmographics - The Layered Data Approach

Firmographic data tells you who could buy. It doesn't tell you who will buy now.

That distinction is everything.

The framework is simple:

- Firmographics = who could buy (company fit)

- Intent data = who will buy now (timing signals)

- Technographics = what they already use (competitive displacement or integration opportunity)

65% of marketers say intent signals have improved their pipeline forecasting accuracy. Companies like Snowflake and ServiceNow use this layered approach for ABM - firmographic filters narrow the universe, intent data prioritizes the shortlist, and technographic data shapes the pitch.

Here's where the Minimum Viable Segment concept comes in. You can have the right ICP and still have the wrong segment. Same title, same company size, same industry can produce completely different buying readiness. A VP of Engineering at a 500-person SaaS company who just lost their CI/CD vendor is a fundamentally different prospect than the same profile at a company that just renewed for three years.

Deals move faster when the buyer is already in motion. We've seen teams cut their sales cycle by 30% just by adding intent filters on top of firmographic lists - the reps stop wasting time on accounts that fit the profile but have zero urgency.

Real talk: if your average deal is under five figures, you probably don't need ZoomInfo-level data infrastructure. A high-accuracy email lookup layered with basic intent signals will outperform a $40K platform your team uses at 20% capacity.

Stop segmenting by attributes alone. Layer in trigger events and urgency signals. That's how you turn a static ICP into a dynamic target list.

Firmographic Data Providers Compared (With Actual Pricing)

Your firmographic data is only as good as the contacts attached to it. A perfect ICP with bounced emails is just a spreadsheet exercise.

| Provider | Database Size | Email Accuracy | Pricing | Best For |

|---|---|---|---|---|

| Prospeo | 300M+ profiles | 98% | Free tier; ~$0.01/email | Email accuracy + freshness |

| ZoomInfo | 260M+ contacts | ~85% | $15-40K+/yr | Enterprise ABM + intent |

| Apollo | 275M+ contacts | ~80% | Free; $49-149/user/mo | Budget all-in-one |

| Cognism | ~400M+ contacts | ~85% | ~$75/user/mo | GDPR, European markets |

| Crunchbase | 50M+ companies | N/A | From $49/mo | Funding research |

| Lusha | ~100M+ contacts | ~85% | Free (40 credits/mo) | Quick lookups |

| D&B | 500M+ records | Varies | From $49/mo (300 credits) | Legacy D-U-N-S systems |

| BuiltWith | N/A | N/A | From $295/mo | Technographic data |

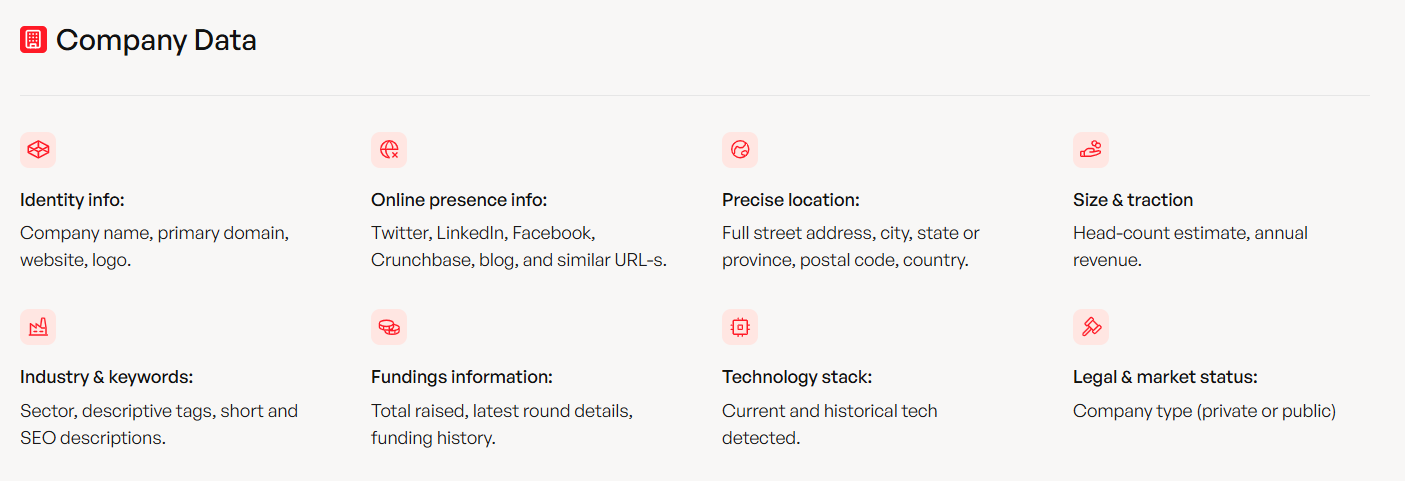

Prospeo

Prospeo solves the last-mile problem - turning firmographic intelligence into verified, reachable contacts. 300M+ professional profiles, 98% email accuracy, 125M+ verified mobile numbers with a 30% pickup rate. The 7-day data refresh cycle is the real differentiator; the industry average is six weeks, which means most providers are serving you data that's already decaying by the time you use it.

The 30+ search filters include buyer intent, technographics, job changes, headcount growth, department headcount, funding, and revenue - so you're not just finding companies that match your ICP, you're finding ones that are actively in a buying window. Snyk's 50-person AE team cut their bounce rate from 35% to under 5% after switching, generating 200+ new opportunities per month.

At roughly $0.01 per email with a free tier of 75 verified emails per month, the economics are hard to argue with. Native integrations with Salesforce, HubSpot, Lemlist, Instantly, and Clay mean enriched data flows directly into your existing workflows without middleware.

ZoomInfo

ZoomInfo maintains 104M company profiles with 260M+ contacts and native intent data - it's the default enterprise platform for a reason. The intent data layer, powered by their own collection network, is genuinely useful for ABM teams running multi-channel plays.

Where ZoomInfo falls short: cost. Entry-level contracts start at $15K/year, but a 10-seat team with intent data and mobile numbers typically runs $25-40K+/year. Email accuracy sits around 85%, which means roughly 1 in 7 emails bounce. One pattern I see repeatedly: teams buy ZoomInfo for the database, then realize they're paying for intent, chat, and workflow features they never turn on.

Apollo

Apollo's database covers 275M+ contacts with a generous free tier (1,200 credits/month). Paid plans run $49-149/user/month. It's the obvious starting point for budget-conscious teams that want prospecting, sequencing, and data in one platform.

The tradeoff: email accuracy hovers around 80%, and the per-seat model gets expensive at scale. A 10-person team pays $12-18K/year on paid plans.

Skip Cognism Unless You Sell Into Europe

If you're targeting European markets, Cognism is the compliance-first option - PECR compliance, verified phone numbers, and strong GDPR positioning at ~$75/user/month. If your prospects are primarily in North America, you're paying a premium for compliance infrastructure you don't need.

Need to Know Who Just Raised a Series B?

That's Crunchbase. From $49/month, it's the go-to for funding, investment, and ownership data on private companies. Not a contact database - pair it with an email finder for actual outreach.

Lusha

Free tier with 40 credits/month. Good for quick one-off lookups when you need a phone number right now. Not built for scale.

D&B (Dun & Bradstreet)

From $49/month for 300 credits. The D-U-N-S Number System still matters for enterprise procurement and legacy integrations. Fair warning though: Reddit's r/datascience community consistently flags D&B's product lineup as confusing, with users struggling to determine which product actually delivers the firmographic data they need. Budget time for evaluation.

BuiltWith

From $295/month. Purely technographic data - what technologies a company uses. Essential for competitive displacement plays, useless without a contact database layered on top.

The Accuracy Ceiling Problem

Here's the frustrating reality: single-source databases top out at 80-85% accuracy. It doesn't matter which provider you pick - if they're querying one data source, you'll hit that ceiling. Waterfall enrichment (querying 15+ sources per lookup) pushes accuracy toward 98%, which is why multi-source verification tools consistently outperform single-source alternatives.

At $15-40K/year, ZoomInfo is overkill if you primarily need firmographic enrichment and verified contacts. Start with a high-accuracy, self-serve tool. Scale into enterprise platforms only when you need the workflow features.

Firmographic data decays 30% per year - and bad data costs $15M annually. Prospeo refreshes all 300M+ profiles every 7 days (industry average: 6 weeks) and verifies every email through a 5-step process. Layer in intent data across 15,000 topics to turn static firmographics into live buying signals.

Fresh firmographics plus intent signals at $0.01 per verified email.

GDPR and CCPA - What You Need to Know

Pure firmographic data about companies - revenue, industry, employee count, headquarters - generally falls outside GDPR's scope since it describes organizations, not individuals. The moment you attach firmographic data to an individual contact record (name, email, phone), GDPR obligations kick in.

The penalties are real. GDPR fines run up to EUR20 million or 4% of annual global turnover, whichever is higher. CCPA violations cost $2,500-$7,500 per incident.

What to look for in a provider:

- SOC 2 Type II and ISO 27001 certifications - proves they handle data securely

- GDPR alignment with documented data processing agreements (DPAs)

- Opt-out enforcement - the provider should automatically suppress contacts who've opted out, not leave that to you

- Audit trails for data subject access requests and deletion requests

"We bought a list" isn't a legal basis. "We identified this contact through legitimate interest based on their professional role at a company matching our ICP, with documented opt-out mechanisms" is.

Don't skip this.

FAQ

What's the difference between firmographic and demographic data?

Firmographic data describes companies - industry, size, revenue, location, ownership structure - while demographic data describes individuals like age, gender, education, and job title. In B2B sales, firmographics qualify the account and demographics qualify the contact within it. You need both, but firmographics come first because a great contact at a terrible-fit company wastes everyone's time.

What are the most important firmographic data points for B2B lead generation?

The five highest-impact attributes are industry, employee count, annual revenue, ownership structure (public vs. VC-backed vs. PE-owned), and growth signals like funding rounds and hiring trends. Growth signals are the most underused - they transform static company profiles into dynamic buying indicators that predict purchase timing.

How often should I refresh firmographic data in my CRM?

At minimum, quarterly. B2B contact data decays at roughly 30% per year, so even a six-month-old database has significant gaps. Best practice is combining real-time enrichment on new records with quarterly batch re-enrichment - tools with a 7-day refresh cycle handle this automatically.

What's the most cost-effective tool for firmographic data enrichment?

Prospeo offers the best accuracy-to-cost ratio at ~$0.01 per email with 98% accuracy and a free tier of 75 verified emails/month. Apollo's free plan (1,200 credits/month) is the best zero-budget starting point but delivers ~80% email accuracy. ZoomInfo provides the deepest US database at $15-40K+/year - justified only when you need the full GTM suite.

How do sales and marketing teams use firmographic data differently?

Sales teams use firmographic data for leads to power prospecting lists, lead scoring, and account prioritization - reps need to know which accounts to call first. Marketing teams use the same data for audience segmentation, ad targeting, and content personalization. The underlying dataset is identical; the activation layer differs.