How to Operationalize Intent Data: The Complete 2026 Playbook

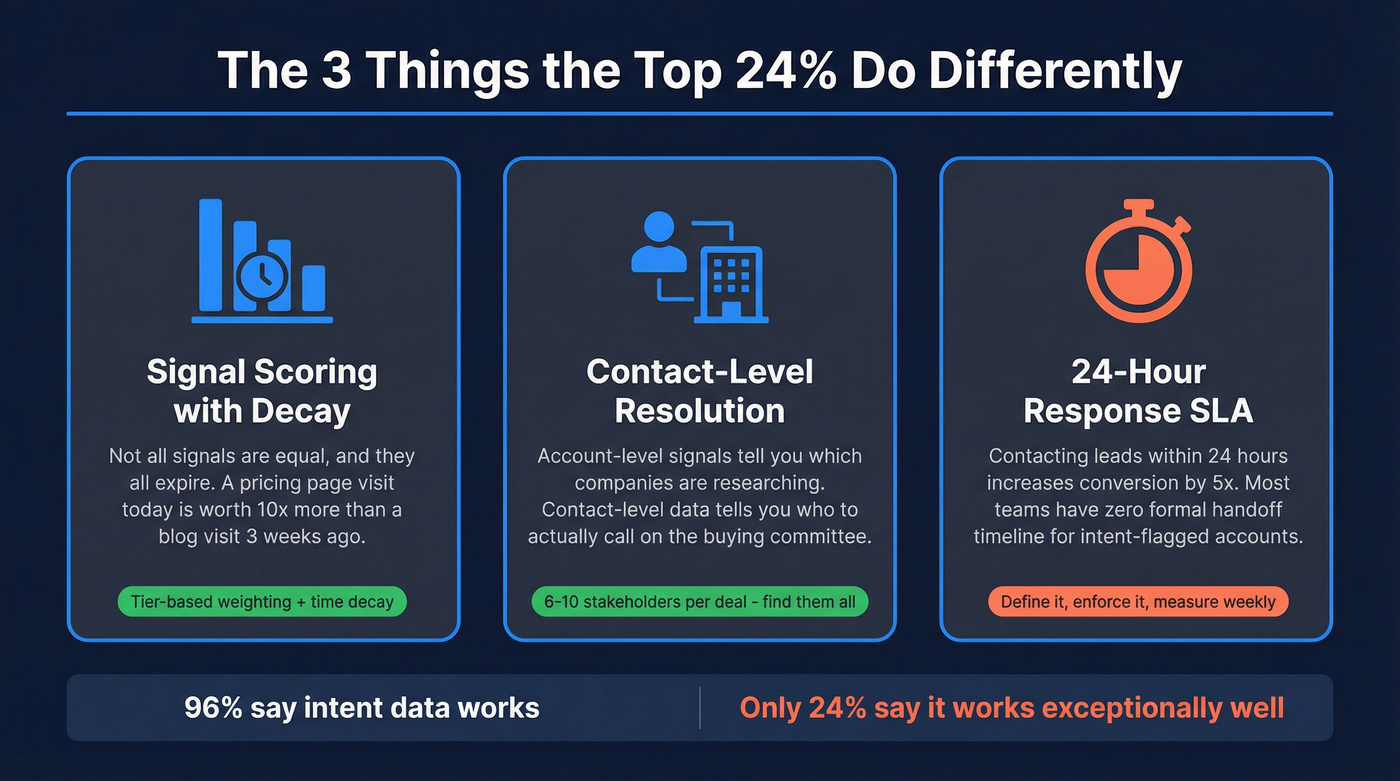

Only 3% of your total addressable market is actively buying at any given time. Intent data is supposed to help you find that 3%. And 96% of B2B marketers say it's working - but only 24% say it's working exceptionally well.

That gap is where most of the money gets wasted.

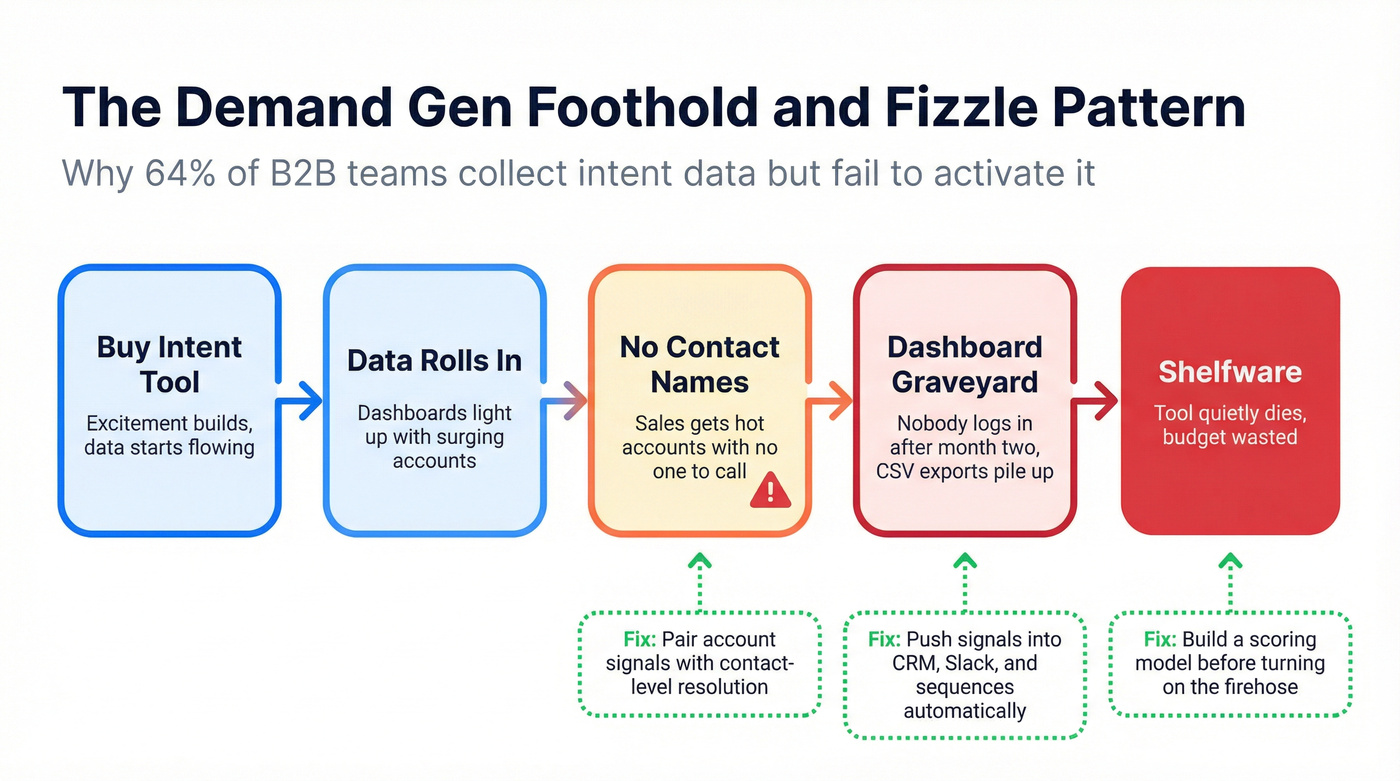

The problem isn't the data. It's the operationalization. Intent signals pile up in dashboards nobody checks, get routed to sales reps who don't trust them, and decay into irrelevance before anyone picks up the phone. OpenView Partners calls this the "Demand Gen Foothold and Fizzle" pattern: marketing buys an intent tool, excitement builds, data rolls in, and then... nothing changes. Sales pushes back because they're getting "hot account" lists with no contact names. Marketing questions the value because they can't segment the activity or understand the opaque "topics." The tool quietly becomes shelfware.

Here's the thing: the teams getting exceptional ROI aren't using better intent data. They're running better systems around the same data everyone else has access to. We've watched this pattern play out across dozens of B2B teams, and the playbook that works is surprisingly consistent. This is that playbook - from signal scoring to team SLAs to tech stack architecture - so you can close the gap between "we bought intent data" and "intent data is our competitive advantage."

What You Need (Quick Version)

The 24% getting exceptional ROI share three things the other 76% don't.

A signal scoring model with decay. Not all intent signals are equal, and they all expire. A pricing page visit this morning is worth 10x more than a blog visit three weeks ago. You need a tiered scoring system that weights signals by buying intent and degrades them over time. Without this, your team treats every "surging" account the same - which means they treat none of them seriously.

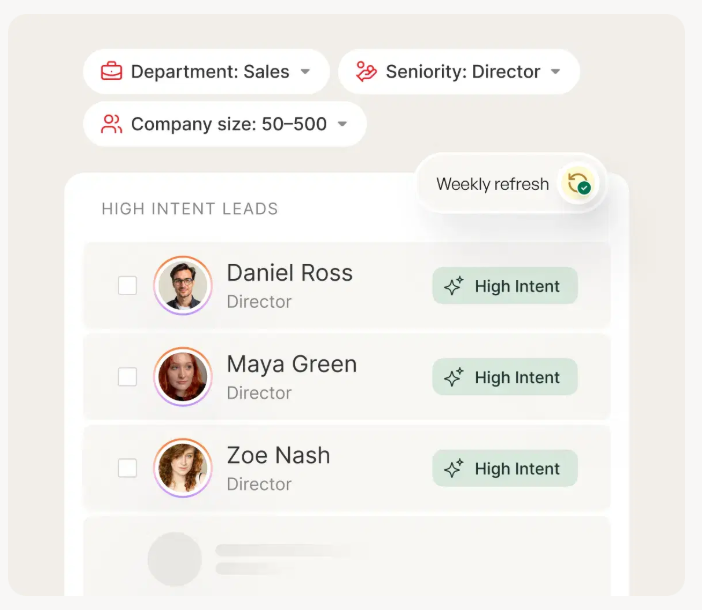

Contact-level data paired with account-level signals. The #1 complaint about intent data? "Sales got a list of hot accounts with no contact names." Account-level signals tell you which companies are researching. Contact-level data tells you who to call. You need a tool like Prospeo that bridges this gap - feed in surging accounts and get back verified emails and direct dials for the actual buying committee, not just a company name on a dashboard.

A 24-hour response SLA between marketing and sales. Contacting leads within 24 hours increases conversion by 5x. Yet most teams have no formal handoff timeline for intent-flagged accounts. By the time a rep sees the signal, the prospect has already talked to two competitors. Define the SLA, enforce it, and measure compliance weekly.

Get these three right and you're ahead of most teams spending six figures on intent platforms.

Why Most Teams Fail to Activate Intent Data

64% of B2B teams collect intent data but struggle to activate it. The gap between "we have this data" and "this data is making us money" comes down to three recurring failures.

No Contact Names

This is the first-wave failure that still hasn't been solved at most organizations. Intent platforms flag that "Acme Corp is surging on cloud security topics." Great. Now what? The sales rep needs to know which person at Acme Corp to call. Is it the CISO? The VP of Infrastructure? The procurement lead?

Account-level intent without contact-level resolution is like getting a weather alert for a city but not knowing which building you're in. Buying committees now include 6-10 stakeholders researching independently across channels. A "surging account" could mean an intern downloaded a whitepaper or a C-suite executive is actively evaluating vendors. Without persona-level intelligence, reps either spray emails across the org chart or - more commonly - ignore the signal entirely.

Dashboard Graveyard

Intent data bought for demand gen ends up living in a dashboard that nobody checks after month two. The industry calls this the "operational chasm" - data exists in one system, workflows live in another, and the bridge between them is a manual CSV export that someone does when they remember.

The fix isn't better dashboards. It's eliminating dashboards as the primary interface. Intent signals need to flow directly into CRM records, trigger automated sequences, populate ad audiences, and notify BDRs in Slack. If a human has to log into a separate platform to see intent data, that data is already dead.

Signal Noise

As one Reddit practitioner put it: "Page views, email opens, and product activity are helpful, but they don't always show real buying interest." When everything is a "signal," nothing is. Teams drown in low-quality alerts - a competitor's employee researching your category, a student writing a paper, a journalist scanning the market.

Most teams focus on which accounts are surging but ignore what they're researching - the topic-level intelligence that should shape your messaging and determine whether a signal is real.

Without a scoring model that separates genuine buying behavior from noise, intent data creates more work for sales, not less. And reps who get burned by false positives once will never trust the data again. That trust deficit is the hardest thing to rebuild.

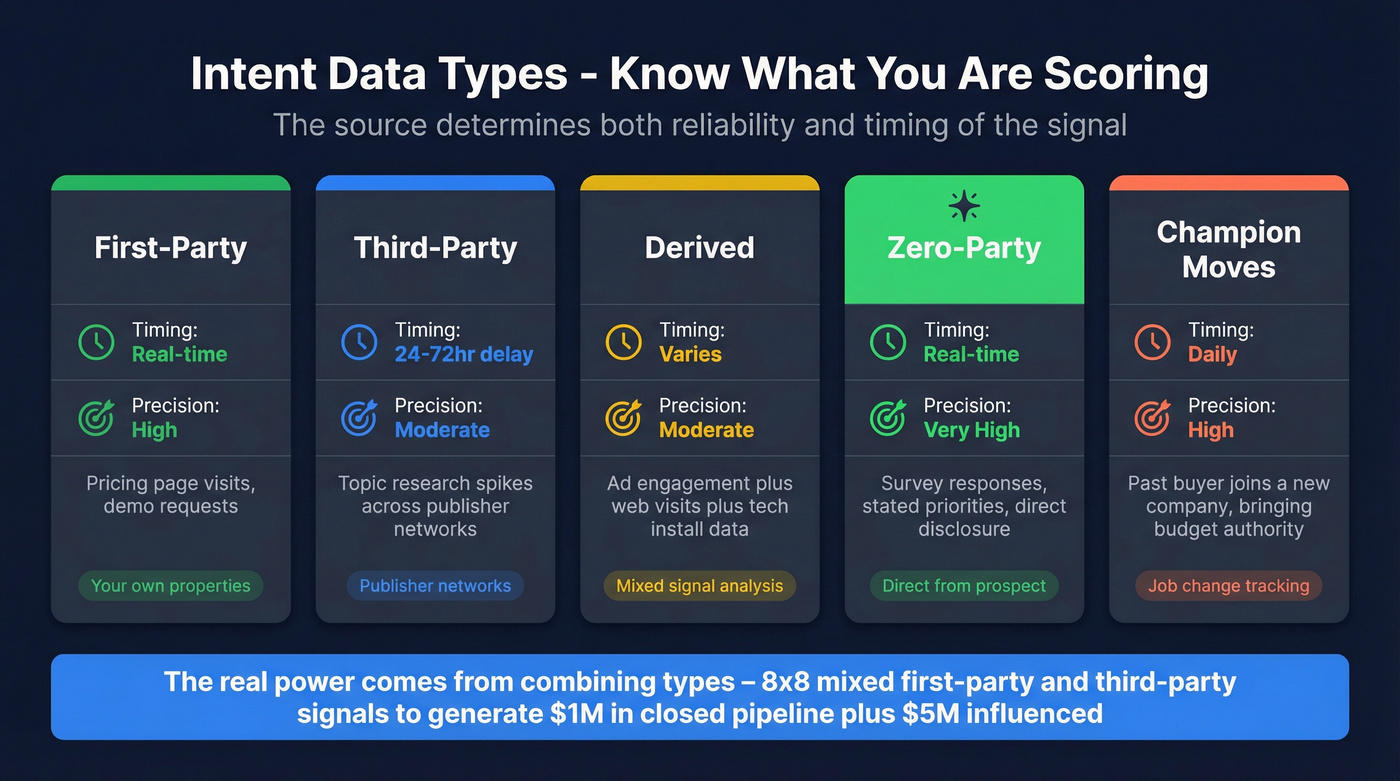

Intent Data Types - A Quick Taxonomy

Before you can score signals, you need to understand what you're scoring. The source determines both the reliability and the timing of the signal.

| Type | Source | Timing | Precision | Example |

|---|---|---|---|---|

| First-party | Your own properties | Real-time | High | Pricing page visit, demo request |

| Third-party | Publisher networks | 24-72hr delay | Moderate | Topic research spikes |

| Derived | Mixed signal analysis | Varies | Moderate | Ad engagement + web + tech |

| Zero-party | Direct disclosure | Real-time | Very high | Survey responses, stated priorities |

| Champion moves | Job change tracking | Daily | High | Past buyer joins new company |

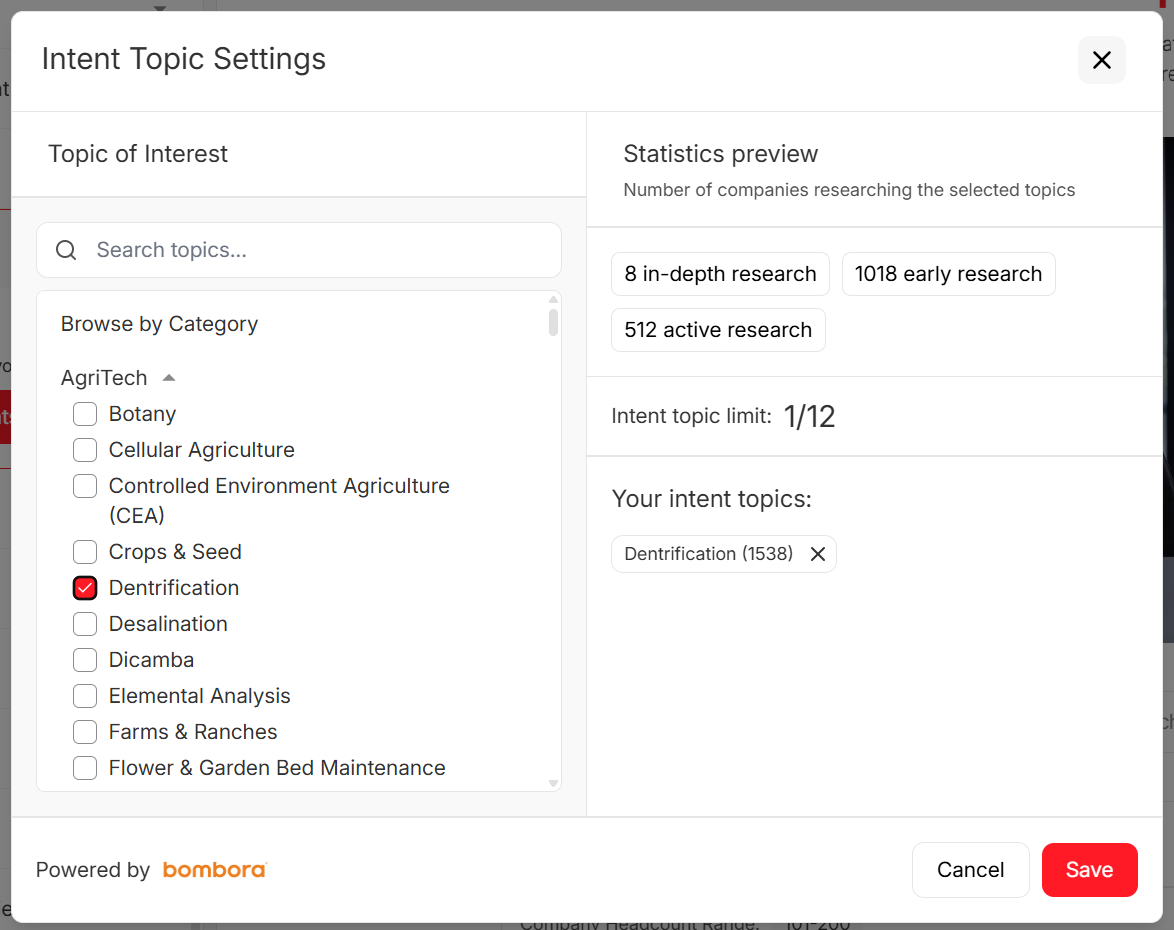

ZoomInfo's framework adds "guided intent" - using past conversion data to predict which signal patterns lead to closed deals. That's useful at scale but requires 6-12 months of historical data to calibrate.

The real power comes from combining types. 8x8 mixed first-party content engagement data with third-party provider signals and generated $1M in closed pipeline plus $5M in influenced pipeline. Neither source alone would've produced those numbers.

First-party signals are highest quality but only capture people already engaging with you. Third-party signals catch accounts before they visit your site but require validation. You need both. And with buying committees averaging 6-10 stakeholders researching independently, you need contact-level resolution across all of them - not just the one person who happened to hit your website.

Account-level intent without contact names is the #1 reason intent data becomes shelfware. Prospeo bridges that gap - feed in your surging accounts and get back verified emails (98% accuracy) and direct dials for the actual buying committee. 143M+ verified emails, 125M+ mobiles, refreshed every 7 days so your signals never outrun your data.

Stop sending reps hot accounts with no one to call.

The Signal Scoring Framework

Raw intent data is noise. Scored intent data is a prioritization engine. The difference between teams that turn signals into revenue and those that don't often comes down to whether they built a scoring model before turning on the firehose.

Tiered Signal Hierarchy

| Tier | Signal Type | Score | Examples | Decay |

|---|---|---|---|---|

| Tier 1 (High) | Active buying | 80-100 pts | Demo requests, pricing pages | 0-7 days |

| Tier 2 (Moderate) | Active research | 40-70 pts | Repeat visits, topic spikes | 8-30 days |

| Tier 3 (Low) | Passive interest | 10-30 pts | One-off blog visit, single ad click | 31-45 days |

Anything beyond 45 days? Expired. Reset to zero.

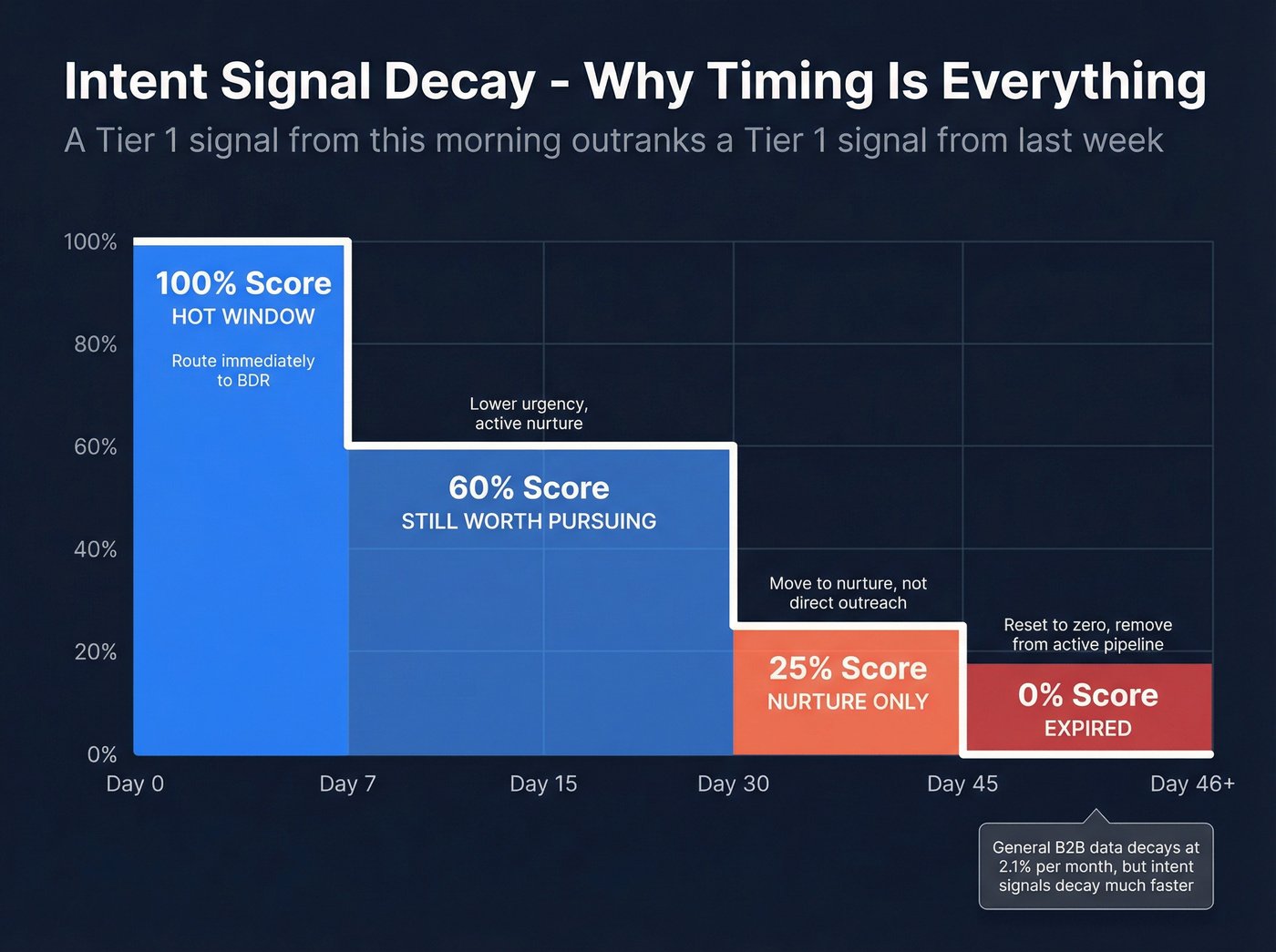

General B2B data decays at roughly 2.1% per month, but intent signals decay far faster - a pricing page visit from six weeks ago tells you almost nothing about today's buying intent. (If you want the benchmarks and fixes, see data decays in practice.)

Building the Decay Model

The scoring model needs a time dimension. A Tier 1 signal from this morning should outrank a Tier 1 signal from last week:

- Days 0-7: Full score. This is your hot window. Route immediately.

- Days 8-30: Score drops to 60% of original. Still worth pursuing, but with less urgency.

- Days 31-45: Score drops to 25%. Move to nurture, not direct outreach.

- Day 46+: Expired. Remove from active pipeline. If they come back, they'll generate new signals.

Not every signal carries the same weight. You need weighted scoring that accounts for signal type, frequency, recency, and the role of the person generating the signal. A VP of Engineering visiting your pricing page three times in a week is fundamentally different from a marketing coordinator downloading a whitepaper once.

Where AI fits in 2026: Platforms like 6sense use ML models to auto-weight signals based on historical conversion data - essentially learning which signal patterns predict closed-won deals. If you're not at that scale, start with manual tiers and let 6-12 months of data tell you which signals actually convert. Then automate the refinement. The manual-first approach builds institutional knowledge that pure AI scoring never gives you. (Related: AI Lead Scoring vs Traditional Lead Scoring.)

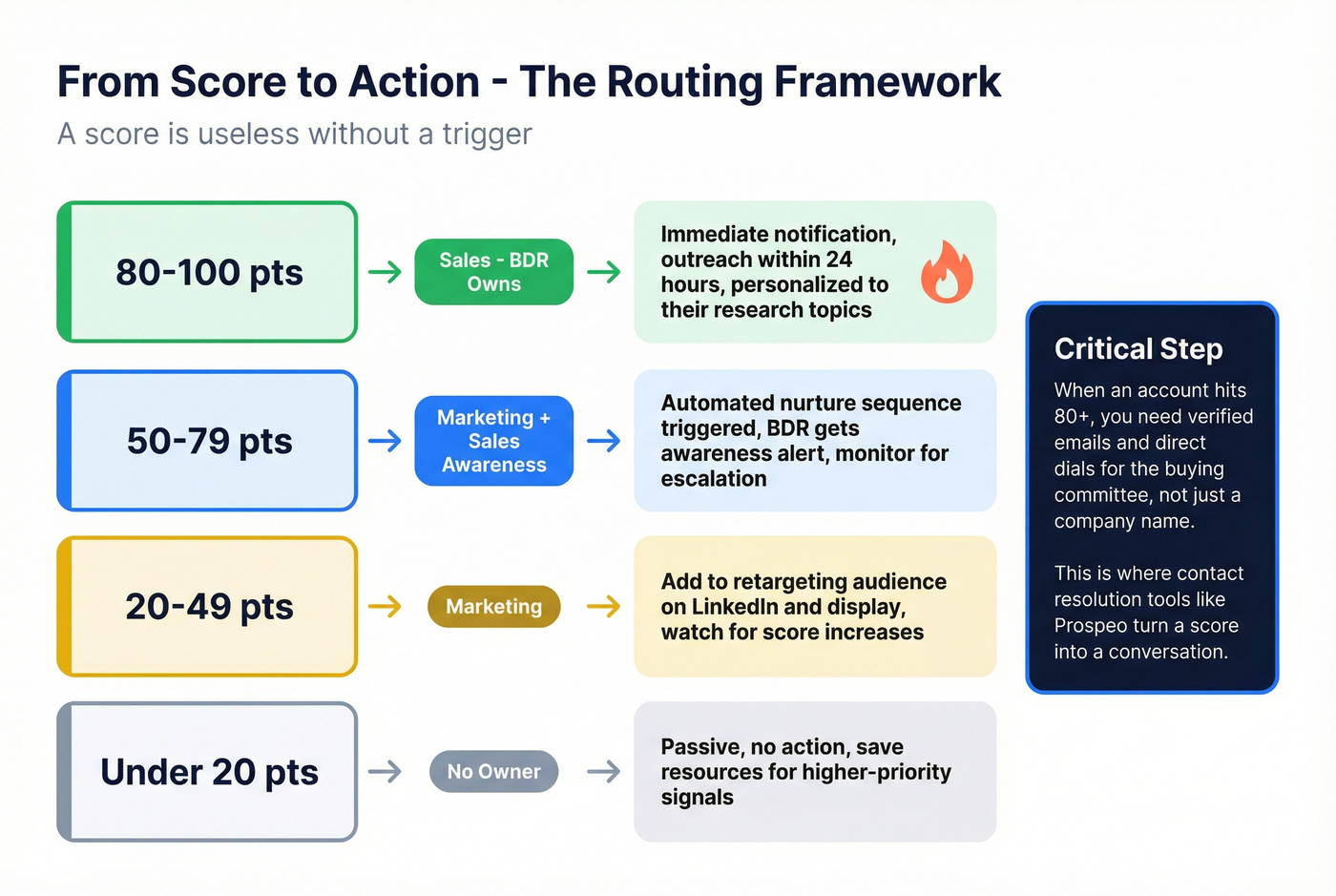

From Score to Action

Here's where most frameworks stop - and where operationalization actually begins. A score is useless without a trigger. Map each score threshold to a specific action:

- Score 80+: Immediate BDR notification. Sales owns within 24 hours.

- Score 50-79: Marketing nurture sequence + BDR awareness alert.

- Score 20-49: Add to retargeting audience. Monitor for escalation.

- Score <20: Passive. No action.

But a score is only as good as the contact data behind it. When an account hits Tier 1, you need verified emails and direct dials for the specific roles in the buying committee - not just a company name. That's the difference between "Acme Corp is surging" and "here are three people at Acme Corp to call today." (If you need the ops around this, use a lead qualification process that includes contact QA.)

The 5-Step Operationalization Playbook

Step 1 - Audit Your Existing Intent Data

Before buying anything new, inventory what you already have. Most teams are sitting on first-party intent signals they've never systematically captured.

Map every touchpoint where a prospect interacts with your brand. Website visits (especially pricing, demo, and comparison pages). Email engagement patterns. Webinar attendance. Content downloads. Support ticket keywords. Product usage data if you're PLG. Then assess your third-party sources. Are you getting account-level or contact-level data? What's the refresh frequency? How does it flow into your CRM - automatically or via manual export?

The audit usually reveals two things: you have more first-party signals than you thought, and your third-party data isn't integrated into any workflow. Identifying the most implementable buyer signals you already own is the fastest path to early wins. (If you want a broader list, see buying signals ranked by impact.)

Step 2 - Run a Pilot (Not a Full Rollout)

Real talk: OpenView's advice to resist long-term subscriptions is some of the best guidance in the space. Don't sign an annual contract with an intent data vendor before you've proven the data works for your specific ICP and sales motion.

Run a 4-8 week pilot focused on a single use case:

- ABM targeting: Feed intent signals into your ad platform and measure CTR lift against a control group.

- BDR prioritization: Give one team intent-scored leads and another team standard leads. Compare connect rates and meetings booked.

- Competitive displacement: Target accounts showing intent for competitor keywords.

Pick one. Measure it. Then decide whether to expand.

I've seen the pilot approach convert skeptical sales teams faster than any training deck - it delivers the fastest time to value because you're proving ROI before committing budget. (If you're doing ABM on a budget, use ABM without expensive tools as your baseline.)

Step 3 - Build Workflows That Trigger Action

This is the principle that separates operationalized intent from dashboard intent: signals must trigger workflows automatically. No human should need to check a dashboard to initiate the next step.

Map your scoring tiers to specific automated actions:

- Tier 1 signal detected -> CRM record updated, BDR notified via Slack, account added to high-priority sequence, display ads activated.

- Tier 2 signal detected -> Nurture sequence enrolled, retargeting audience populated, weekly digest to account owner.

- Tier 3 signal detected -> Added to awareness campaign. No direct outreach.

(If you want a full blueprint, see how teams automate sales signals end-to-end.)

Step 4 - Roll Out Across Teams

You need a C-suite sponsor for this. Intent data use cases cross organizational boundaries - marketing, sales, customer success, even corporate development. Without executive air cover, you'll get stuck in turf wars over who owns the data and who acts on it.

Training matters more than most teams realize. Reps need to understand what a "surging account" actually means, why some signals are weighted higher than others, and how to reference intent in their outreach without being creepy. "I saw you downloaded our whitepaper" is a rookie mistake. "Your team seems to be evaluating solutions in [category] - here's how we've helped similar companies" is the approach that works. (For the buying-committee angle, use account based marketing personas.)

Step 5 - Measure, Refine, Expand

Only 39% of teams measure conversion time from intent signal to opportunity, and only 31% track closed-won deals influenced by intent data. You can't optimize what you don't measure.

KPIs by function:

- Marketing: MQL quality and velocity, campaign engagement lift, ROAS on intent-targeted ads, cost per lead vs. non-intent leads.

- Sales: Time-to-first-touch after signal, connect rates on intent-flagged accounts, meetings booked per signal tier.

- Revenue: Sales cycle length (intent vs. non-intent), average deal size, pipeline influenced by intent signals.

Once you've proven ROI on your pilot use case, expand to the next one. The teams getting exceptional results aren't using intent data for one thing - they're weaving it across ABM, retargeting, competitive intelligence, event marketing, and churn prevention. (To tighten the response-time metric, track speed to lead metrics.)

How to Activate Buyer Intent Signals Across Teams

Marketing Activation

Synchronized multi-channel campaigns powered by intent data produce dramatically better results than spray-and-pray: 51% jump in CTRs, 31% boost in lead quality, and 20% improvement in conversion rates. Intent-based ads alone achieve 220% higher click-through rates than traditional targeting.

The Qualified case study shows what this looks like in practice. They used Metadata to turn intent signals into targeted advertising audiences on Facebook and professional networks, then identified surging ad-influenced accounts for sales outreach. The result: 2,000+ surging target accounts reached, 703 hours of work automated, and $6.9M in influenced pipeline.

The Optimizely/TrustRadius case study is even more striking: they took 180 days of intent data, filtered 1,000+ accounts down to 176 high-priority targets, fed them into a Drift chatbot, and closed a deal in one day - 98% faster than their average sales cycle. The magic wasn't the data. It was the workflow that connected data to action.

Sales Activation

Look, the Okta numbers are hard to argue with: 24x higher opportunity conversion rate, 2.7x reduction in cost per conversion, and 63% reduction in time from opportunity to closed deal. Their digital team lead said it was "like a switch flipped." Salesforce reported similar gains: 20% higher conversion rates and 30% shorter sales cycles after integrating buyer intent signals.

The Ultima case study tells a similar story from the mid-market. Using Cognism's intent data paired with direct dials, they saw ROI in 8 weeks on a product with a 6-8 month typical sales cycle. George McKenna, their Head of Cloud Sales, put it simply: "One deal pays for a year's Cognism subscription."

The Reddit practitioner community has landed on the same conclusion from the bottom up: "Stop creating demand, start intercepting it." Maintain a list of ideal customers, monitor for signals, only engage when a positive signal fires, and make the message specific to the situation. You send less, not more. Timing beats volume and copy. (For a deeper SDR-specific system, see intent data for SDRs.)

Customer Success - Churn and Upsell

This is the most underutilized application of intent data. Only 32% of teams use it for churn prevention, which is wild given that organizations with strong sales-marketing-CS alignment through intent data report 36% higher customer retention.

The signals are different for CS: existing customers researching competitor categories, declining product usage combined with competitor topic surges, key stakeholders visiting competitor pricing pages. These are churn indicators that most CS teams never see because intent data lives in marketing's stack.

The NFON UK case study shows the flip side - using intent for expansion. They identified 400 high-intent reseller accounts in six months and signed 8 new partners, each expected to generate significant revenue. Intent data for customer success isn't just about preventing churn. It's about knowing which customers are ready to buy more before they tell you.

Sales-Marketing Alignment SLAs for Intent Data

Intent data without an SLA is just a more expensive way to generate leads that sales ignores.

Teams with strong alignment through shared intent data report 38% higher sales win rates. Here's the framework that works.

The non-negotiables:

- 24-hour SAL acceptance window. When marketing flags an intent-qualified account, sales has 24 hours to accept or reject it. Period.

- Rejection reason logging. Every rejected SAL gets a reason logged in the CRM - "not ICP," "already in pipeline," "bad contact data," "signal doesn't match." This feedback loop is how marketing improves signal quality.

- Shared signal tier definitions. Both teams must agree on what Tier 1, 2, and 3 signals mean and what action each tier triggers. Write it down. Put it in the CRM. No ambiguity.

- Weekly intent review cadence. Marketing presents high-intent accounts and signal trends. Sales provides feedback on outreach outcomes. Both teams refine messaging, update triggers, and adjust nurture flows. Thirty minutes, every week, non-negotiable.

What kills SLAs in practice:

Vague exit criteria - when does an intent-flagged account leave the active pipeline? Multiple MQL definitions by region or segment (pick one and enforce it). Silent SLA violations - reps ignoring intent leads without logging a rejection. And attribution windows changing mid-quarter - agree on the window before the quarter starts and don't move it.

The 15-25% MQL-to-SQL conversion rate is a reasonable starting benchmark, but the real insight comes from segmenting by ICP fit, deal size, and signal tier. Tier 1 intent-flagged accounts should convert at 2-3x your baseline. If they don't, your scoring model needs work.

Building Your Intent Data Tech Stack

The right stack depends on your company size, budget, and how much of the workflow you want to own vs. outsource.

| Tool | Best For | Intent Data | Contact Data | Approx. Pricing |

|---|---|---|---|---|

| Prospeo | Mid-market intent + contacts | 15,000 topics | 300M+ profiles | ~$0.01/email, free tier |

| 6sense | Enterprise ABM | AI-predicted stages | Account + contact | ~$40-120K/yr |

| Demandbase | Enterprise ABX | Account-level + ads | Account + contact | ~$30-100K/yr |

| Bombora | Data co-op layer | 12,000+ topics | Account only | ~$25-50K/yr |

| ZoomInfo | Enterprise all-in-one | Guided intent | Full database | ~$15-40K/yr |

| Cognism | EMEA + compliance | Bombora-powered | Phone-verified | ~$1-3K/mo |

| Apollo.io | SMB prospecting | Basic signals | 275M+ contacts | Free-$99/mo/user |

| Dealfront | EU website visitors | IP-based ID | Account-level | ~$150-500/mo |

G2 and TrustRadius offer free review-site intent signals with a vendor profile - high quality but narrow scope.

Enterprise (500+ Employees)

Enterprise teams typically anchor on 6sense or Demandbase for orchestration, then layer in Bombora for additional topic coverage. The challenge is implementation time - expect 3-6 months to fully operationalize either platform, and you'll need dedicated RevOps resources. Companies using sales intelligence tools see 35% higher close rates, but only if the tools are actually integrated into workflows. (For a deeper comparison, see Bombora vs ZoomInfo.)

Hot take: ZoomInfo is still the best all-in-one enterprise platform. But most teams don't need all-in-one. They need two or three tools that do specific things exceptionally well and integrate cleanly. The 5-component stack - CRM, enrichment layer, intent platform, analytics, and engagement tools - beats a monolith every time if your RevOps team can wire it together.

Mid-Market (50-500 Employees)

This is where the math gets interesting. A 6sense or Demandbase contract runs $40-100K/year - real money for a company doing $10-50M in revenue. Mid-market teams can't justify that spend unless they're running a mature ABM program.

The smarter play is a leaner stack that combines intent data with contact-level resolution in one platform. Instead of paying $50K for an intent platform and another $20K for a contact database, you get both together at a fraction of the cost. The workflow: identify surging accounts in your target market, surface the specific contacts in the buying committee with verified emails and direct dials, and push them into your CRM or sequencer via native integrations with Salesforce, HubSpot, Lemlist, Instantly, or Outreach. No manual CSV exports. No dashboard graveyard. (If you’re evaluating data vendors, start with best B2B data providers.)

SMB (Under 50 Employees)

Skip the enterprise tools entirely. If you're running deals under $15K, you don't need 6sense-level data. You need any intent signal flowing into your outreach workflow without a five-figure commitment.

Start with free G2 or TrustRadius intent signals (available with a vendor profile if you're a software company) for high-intent review-site data. Pair that with a credit-based contact data tool so you scale costs with actual usage. You can build a functional intent stack for under $100/month - and that's enough to test whether intent-driven prospecting works for your motion before committing real budget.

Ten Mistakes That Kill Intent Data ROI

Poor data quality costs organizations an average of $15M annually. Intent data amplifies that cost when it's operationalized badly. Here are the ten mistakes we see most often - grouped by severity.

The Big Three (Fix These First)

1. Not using it at all. Only 25% of B2B companies use intent data tools. If you're reading this, you're already ahead. Start with first-party signals you already have - they're free.

2. Ignoring data decay. This kills more ROI than any other single mistake. Intent signals expire fast. A "hot" account from six weeks ago is cold. Build decay into your scoring model and expire anything over 45 days.

3. No contact names on surging accounts. We keep coming back to this because it's the #1 reason sales ignores intent data. Account-level signals without contact-level resolution are useless in practice.

The Operational Failures

These are the mistakes that emerge after you've started using intent data but haven't built the systems to support it.

4. Settling for one signal source. Single-source intent data gives you a partial picture. Layer at least two sources - first-party + one third-party provider.

5. Using signals in a vacuum. Intent data without firmographic, technographic, and engagement context produces false positives. A 10-person startup surging on "enterprise security" isn't your buyer. Always cross-reference intent with ICP fit before routing to sales. (If you need a clean definition, start with ideal customer.)

6. Treating signals as qualification. Intent tells you who to prioritize. It doesn't replace BANT or MEDDIC. A surging account still needs to be qualified through your existing framework.

7. Failing to map signals to buying stages. Early-stage research signals require different responses than late-stage signals like competitor comparisons and pricing research. Tag each signal type as TOFU, MOFU, or BOFU and route accordingly.

The Strategic Misses

8. Underleveraging your investment. 67% use intent for digital advertising, but only 32% use it for churn prevention and 31% for event planning. You're paying for the data - use it everywhere. After your pilot succeeds, expand to the next use case within 30 days.

9. Undervaluing first-party intent. Your own website, product, and content engagement data is the highest-quality intent signal you have. Instrument your website and product for intent signals before buying third-party data.

10. Relying on vendors for privacy compliance. Vendor compliance with privacy legislation is never enough. You must maintain your own lawful basis for storing and using the data. Own your compliance posture - don't outsource accountability. (For outbound specifics, see GDPR for Sales and Marketing.)

Privacy and Compliance in 2026

Privacy regulation is tightening, and intent data sits squarely in the crosshairs. If you're building automated workflows around buyer signals without a compliance framework, you're building on sand.

The biggest change: CCPA's new regulations on automated decision-making technology (ADMT) took effect January 1, 2026. When ADMT replaces human judgment in decisions that affect consumers - and intent-based lead scoring qualifies - businesses must provide opt-outs. If your intent-driven workflows automatically route prospects into sequences or exclude them from campaigns, you need to assess whether ADMT rules apply.

Three new state privacy laws also went live in 2026: Indiana, Kentucky, and Rhode Island. Each has its own nuances around data collection, consent, and automated processing. The patchwork is getting more complex, not simpler.

For GDPR, the requirements haven't changed but enforcement has intensified. You need a lawful basis - typically legitimate interest - for processing personal data derived from intent signals. Your third-party intent data providers must demonstrate compliant collection methods, and you need to verify they actually do.

The practical takeaway: build opt-out mechanisms into every automated outreach workflow triggered by intent data. Document your lawful basis for each data source. Audit your vendors annually - don't just trust their compliance claims. And if you're selling into the EU, make sure your intent data provider has a defensible GDPR position, not just a checkbox on their website.

Your 24-hour SLA means nothing if reps spend half that time hunting for contact info. Prospeo returns 50+ data points per contact at 92% match rate - names, verified emails, direct dials, job titles - so your team acts on intent signals before they decay, not after competitors already made the call.

Turn surging accounts into booked meetings for $0.01 per email.

FAQ

What's the difference between first-party and third-party intent data?

First-party intent data comes from your own properties - website visits, content downloads, product usage - and it's high-quality and real-time but only captures people already engaging with your brand. Third-party tracks research across external publisher networks, catching accounts before they visit your site. Combine both for the strongest signal coverage across the full buying committee.

How long does it take to operationalize intent data?

Basic integration takes 4-8 weeks: connecting your intent source to your CRM, building scoring rules, and setting up one automated workflow. Full operationalization across marketing, sales, and CS typically takes 3-6 months. Start with a single-use-case pilot, prove value with measurable KPIs, then expand team by team.

What's a good starting budget for intent data tools?

SMBs can start for under $100/month using free G2 signals plus a credit-based contact data tool. Mid-market teams should budget $500-3,000/month for a combined intent and contact data stack. Enterprise teams running 6sense or Demandbase typically spend $30-120K/year before adding enrichment layers.

How do I get my sales team to actually use intent data?

Run a controlled pilot: give one team intent-scored leads for a month and compare their connect rates and meetings booked against a control group using standard leads. When reps see intent-flagged accounts convert at 2-3x the baseline, adoption follows. Pair results with training on how to reference signals naturally in outreach - never "I saw you visited our pricing page," always "teams in your space are evaluating X right now."

Can I combine intent signals with contact verification tools?

You should - it's the single biggest unlock. Intent data tells you which accounts are in-market; contact verification tells you who to reach with verified emails and direct dials. The workflow: identify surging accounts, enrich them to surface the buying committee, then push verified contacts into your sequencer to book meetings.