How to Run ABM Without Expensive Tools (A Minimum Viable ABM System)

Paying $35k/year for an ABM platform sounds fine right up until you realize you mostly needed two things: proof your spend is hitting the right companies, and a clean list of engaged accounts for sales to work. This is ABM without expensive tools: a minimum viable system you can run with your CRM, GA4, and a couple of lightweight add-ons.

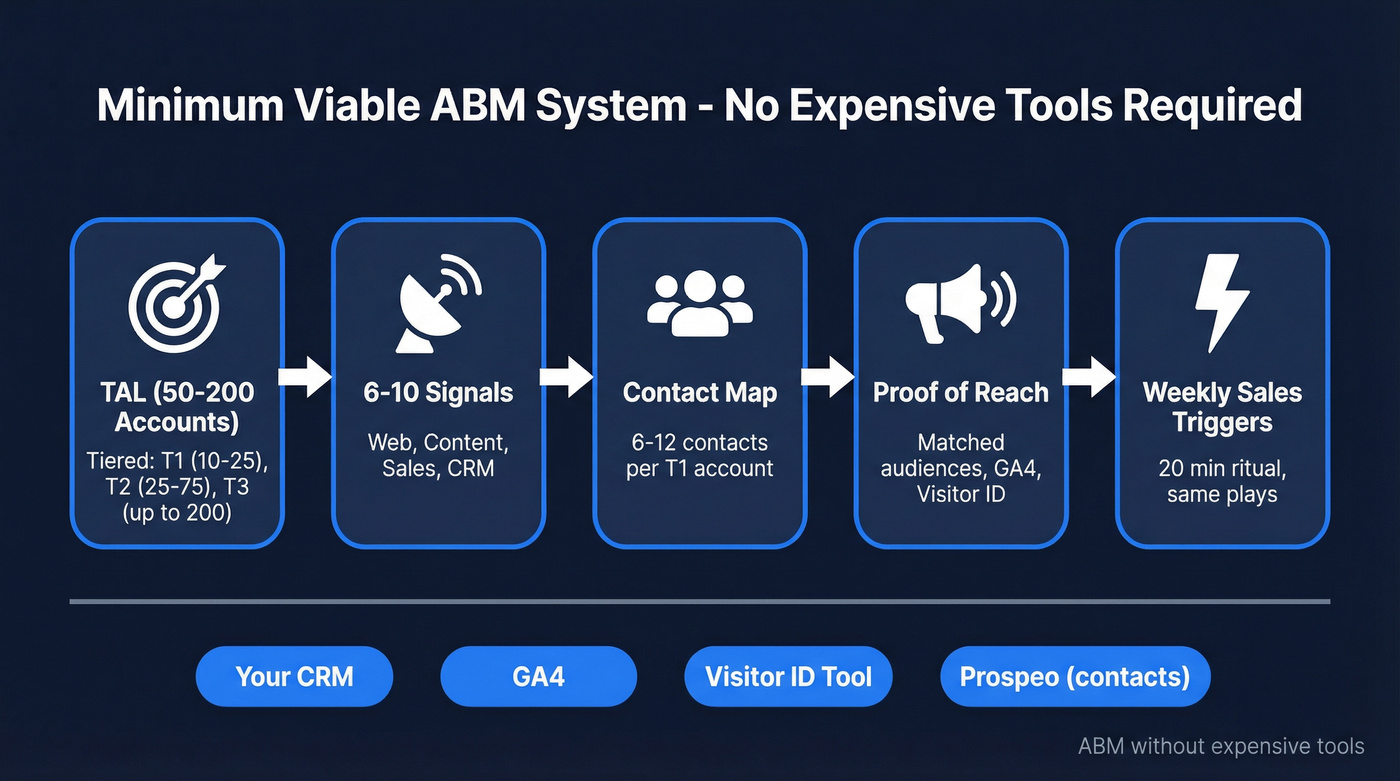

Here's the operating system: a 50-200 account TAL, clear stages, 6-10 signals, a weekly sales trigger list, and a dashboard spec you can run from your CRM + GA4.

I've watched teams spend months wiring up "orchestration" and still fail the Monday-morning test: "Which accounts moved, and what are we doing about it?"

What you need (quick version)

- Target Account List (TAL): 50-200 accounts, tiered by effort (Tier 1: 10-25, Tier 2: 25-75, Tier 3: up to 200 total).

- Proof-of-reach loop: show that target accounts are seeing ads and visiting the site.

- Visitor identification: plan for 30-65% company-level ID and 5-20% contact-level at best.

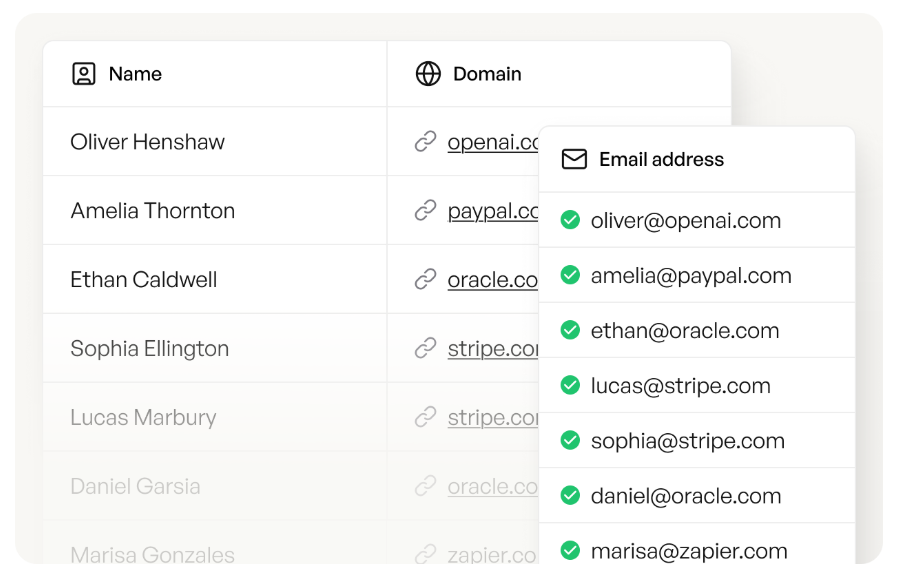

- Verified contact data for Tier 1-2 so sales can multi-thread (tools like Prospeo fit naturally here).

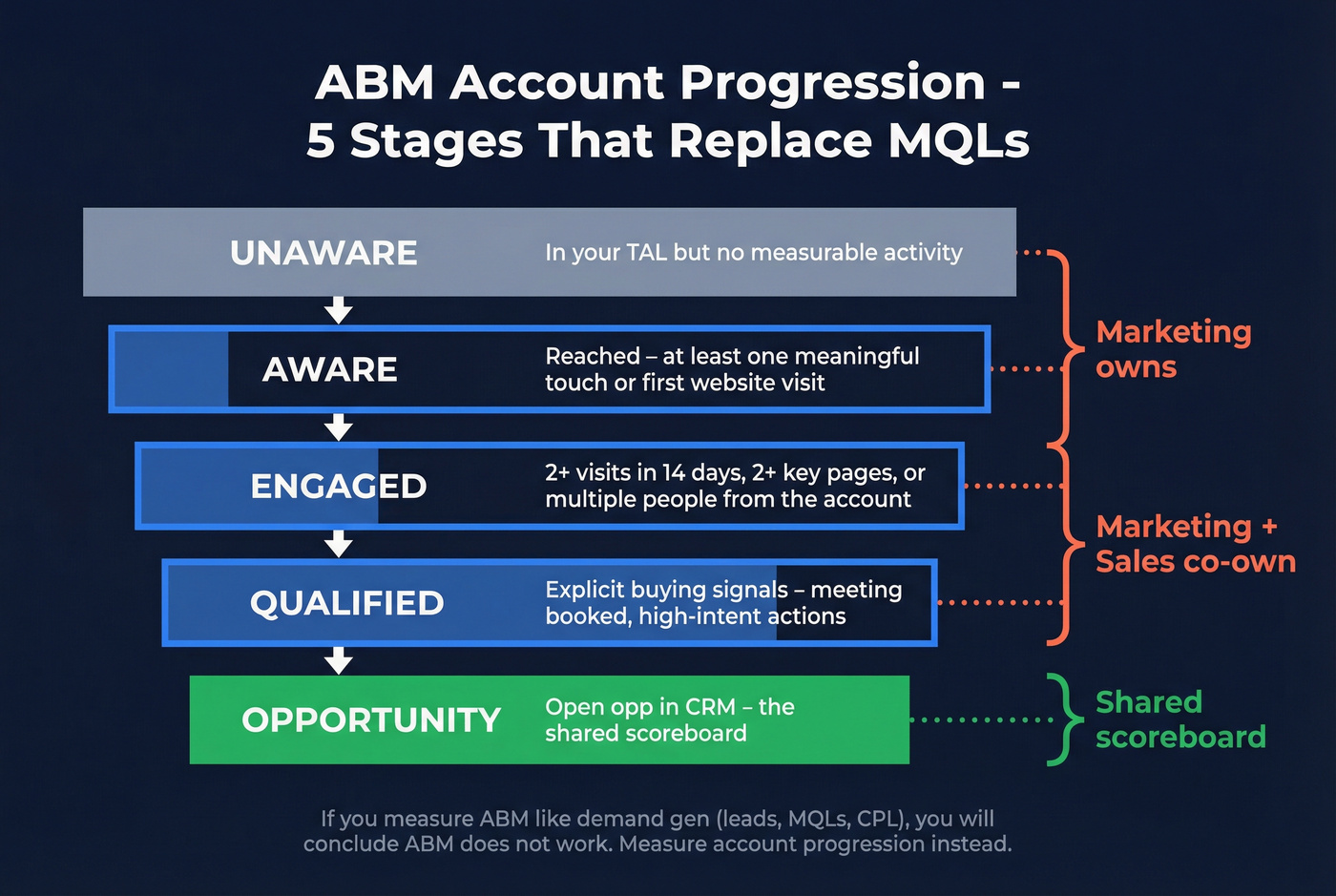

- CRM account stages (5 is enough): Unaware -> Aware -> Engaged -> Qualified -> Opportunity.

- Weekly sales activation ritual: 20 minutes, same triggers, same plays.

ABM without expensive tools: what it actually means in 2026

ABM without expensive tools isn't "doing ABM manually." It's doing ABM with fewer moving parts and tighter definitions.

The job-to-be-done stays the same: prove spend hits the right orgs, then hand sales an engaged-account list they can act on. Scrappy teams that win run the same core motion every time: list targeting + basic visitor ID + a weekly trigger list.

Definition box: Minimum Viable ABM (MVA)

Minimum Viable ABM is a repeatable system that:

- focuses on a 50-200 account TAL

- proves reach + engagement at the account level

- triggers sales plays based on account stage movement

- measures success via account progression, not MQL volume

If you can do those four things, you're doing ABM in the only way that matters: pipeline.

The 500-account trap (and why "ABM" feels broken)

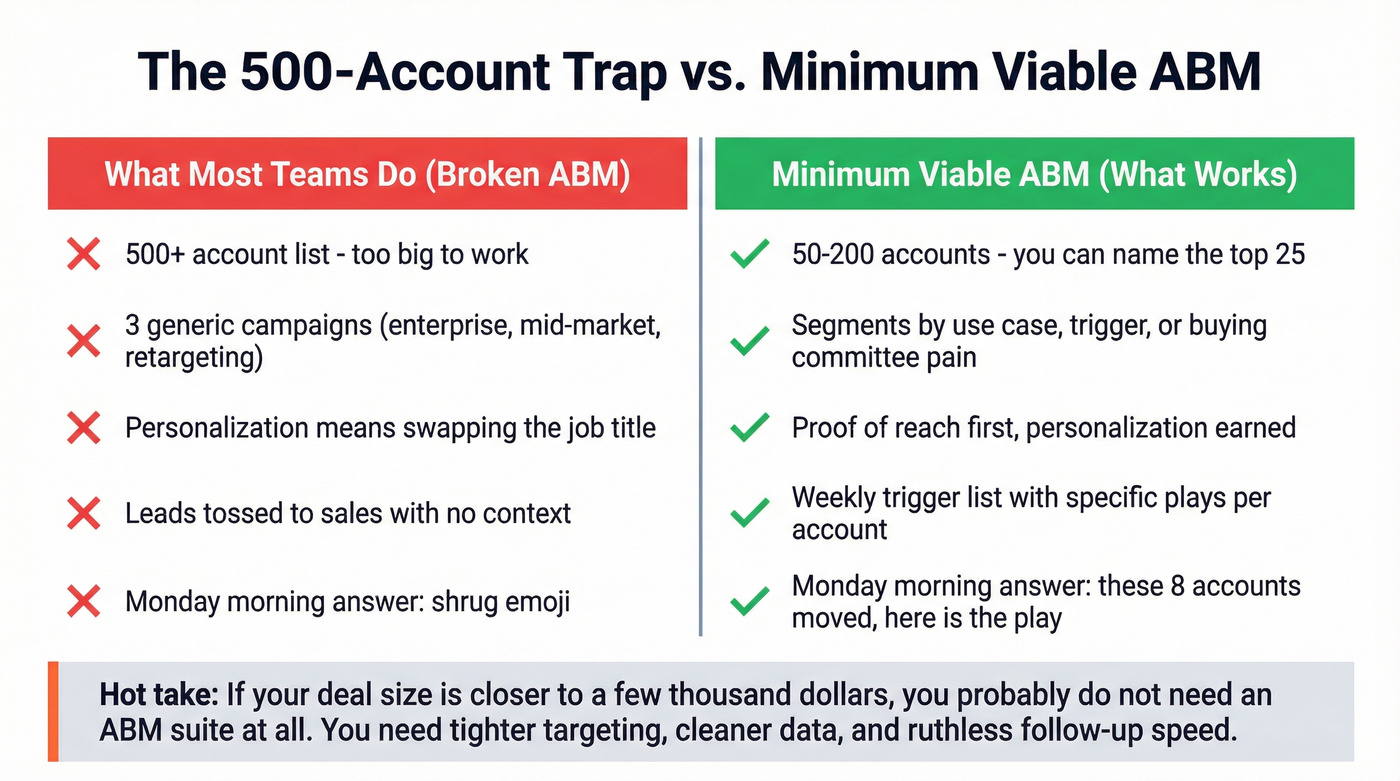

If ABM's felt disappointing, there's a good chance you've lived this exact pattern.

Use this if you recognize the symptoms

- Your "targeted" list is ~500 companies.

- You run 3 campaigns (enterprise, mid-market, retargeting).

- Your assets are generic, so personalization is basically "swap the job title."

- You route responses into a generic nurture, then toss "warm leads" to sales.

- Sales ignores the handoff because nothing about it feels actionable.

That's not ABM. That's list targeting with a nicer name.

Skip this behavior (and do these fixes instead)

- Fix: shrink the list until it hurts

- If you can't name the top 25 accounts you'd bet your quarter on, your list's too big.

- Fix: stop pretending three campaigns are segmentation

- "Enterprise vs mid-market" isn't segmentation. It's pricing.

- Segment by use case, trigger, or buying committee pain.

- Fix: replace "handoff" with "account triggers"

- Sales doesn't want leads. Sales wants a reason to act on an account now.

- Fix: run proof-of-reach before personalization

- Most teams try to personalize before they can even prove they're consistently reaching the TAL.

We've tested this with small teams again and again: they don't fail because they lack a fancy platform. They fail because nobody can answer, on Monday morning, which accounts moved and what sales should do next.

Hot take: if your average deal's closer to a few thousand dollars than a big enterprise contract, you probably don't need an ABM suite at all. You need tighter targeting, cleaner data, and ruthless follow-up speed.

Your minimum viable ABM needs 6-12 verified contacts per Tier 1 account. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobiles - so your buying group map has real reach, not just names. At $0.01 per email, covering 25 Tier 1 accounts costs less than a single lunch.

Stop mapping buying groups you can't actually contact.

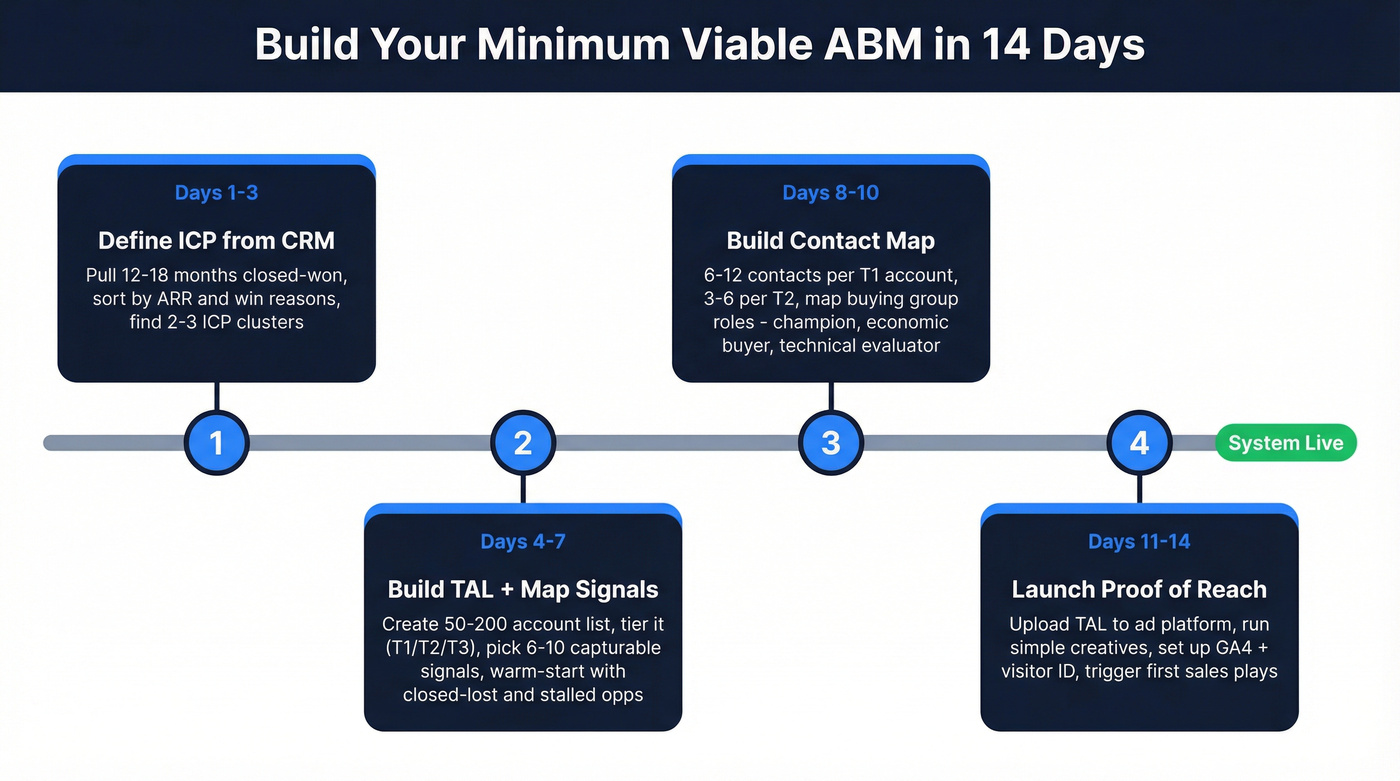

Build your Minimum Viable ABM in 14 days (step-by-step)

ABM's a process, not a platform. This 14-day build gets you to a working system: a tight TAL, basic signals, contact coverage for Tier 1-2, proof-of-reach, and a sales activation loop.

Define ICP using your CRM (LTV/ARR + win reasons)

Day 1-3

- Pull your last 12-18 months of closed-won from your CRM.

- Sort by:

- ARR/LTV (or first-year contract value if that's all you've got)

- sales cycle length

- churn risk / expansion potential

- Add qualitative "win reasons":

- Why did they buy?

- What did they replace?

- What internal trigger forced action?

Look for 2-3 ICP clusters, not one mega-ICP. One cluster might be "security team + compliance trigger." Another might be "RevOps team + tooling consolidation." The point is to get specific enough that your ads and outbound sound like you actually understand the moment they're in, which usually means naming the trigger, the internal friction, and the consequence of doing nothing.

If you can't explain your ICP without using your own product category words, you don't have an ICP yet.

Create your TAL (50-200) and tier it

Day 4-7

Build a TAL your team can actually work.

- Tier 1 (1:1): 10-25 accounts - real personalization (custom POV, tailored outreach angles, maybe a bespoke landing page).

- Tier 2 (1:few): 25-75 accounts - light personalization (industry/use-case variants).

- Tier 3 (1:many): remainder up to 200 - mostly automated (list targeting + retargeting + standard outbound).

Penetration's the hidden KPI that tells you if your ABM is real. Directional benchmark: 20-30% account penetration is strong for a focused program. That means meaningful engagement from multiple people, not one random visit.

Warm-start your TAL (fast proof)

If you want ABM to show value fast, don't start cold. Start where you've already got signal.

- Closed-lost (last 180 days): they were in-market recently; your job's to re-open the conversation with a sharper POV.

- Churned customers: not for a hard win-back pitch - use them to validate ICP patterns and identify wrong-fit segments to exclude.

- Stalled opportunities (stuck in stage 2-3): perfect for "air cover" + a sales play that re-frames urgency.

This one move compresses time-to-proof more than any tool purchase.

Map "signals" you can capture without an ABM suite

Day 4-7 (in parallel)

You don't need intent platforms to start. You need a short list of signals you can reliably capture and route.

Pick 6-10 signals total:

- Web signals

- pricing page views

- product page depth (2+ pages)

- repeat visits within 7 days

- demo/contact page views

- Content signals

- webinar registration/attendance

- case study views

- comparison page views

- Sales signals

- email replies

- meeting booked

- outbound call connect

- CRM signals

- opportunity created

- stage movement

Keep it boring. Boring scales.

Build the contact map for Tier 1-2 (roles, buying group)

Day 8-14

DIY ABM usually faceplants here: you've got accounts, but you can't reach the buying group.

For Tier 1-2, build a buying group map per account:

- Economic buyer (budget owner)

- Champion (day-to-day owner)

- Technical evaluator (security/IT/ops)

- Procurement/legal (if relevant)

- Executive sponsor (optional, but powerful)

Aim for 6-12 contacts per Tier 1 account and 3-6 per Tier 2 account.

Here's the thing: if your Tier 1 list is 20 accounts and you only have two contacts per account, you don't have ABM. You have hope.

Launch proof of reach first, personalization second

Day 8-14

Most teams do this backwards. They start with personalization, then wonder why nothing moves.

Do this instead:

- Step 1: proof of reach

- Upload your TAL to your ad platform as a matched audience.

- Run 2-3 simple creatives that speak to the ICP cluster.

- Measure: which accounts are seeing impressions and clicking through.

- Step 2: proof of engagement

- Use GA4 + a visitor ID tool to see which TAL accounts are visiting and what they're doing.

- Step 3: trigger sales plays

- When an account hits Engaged/Qualified, sales runs a defined play (below).

- Step 4: add personalization where it pays

- Tier 1 gets bespoke touches once you know they're actually in-market.

Personalization is expensive. Proof-of-reach is cheap. Earn the right to personalize.

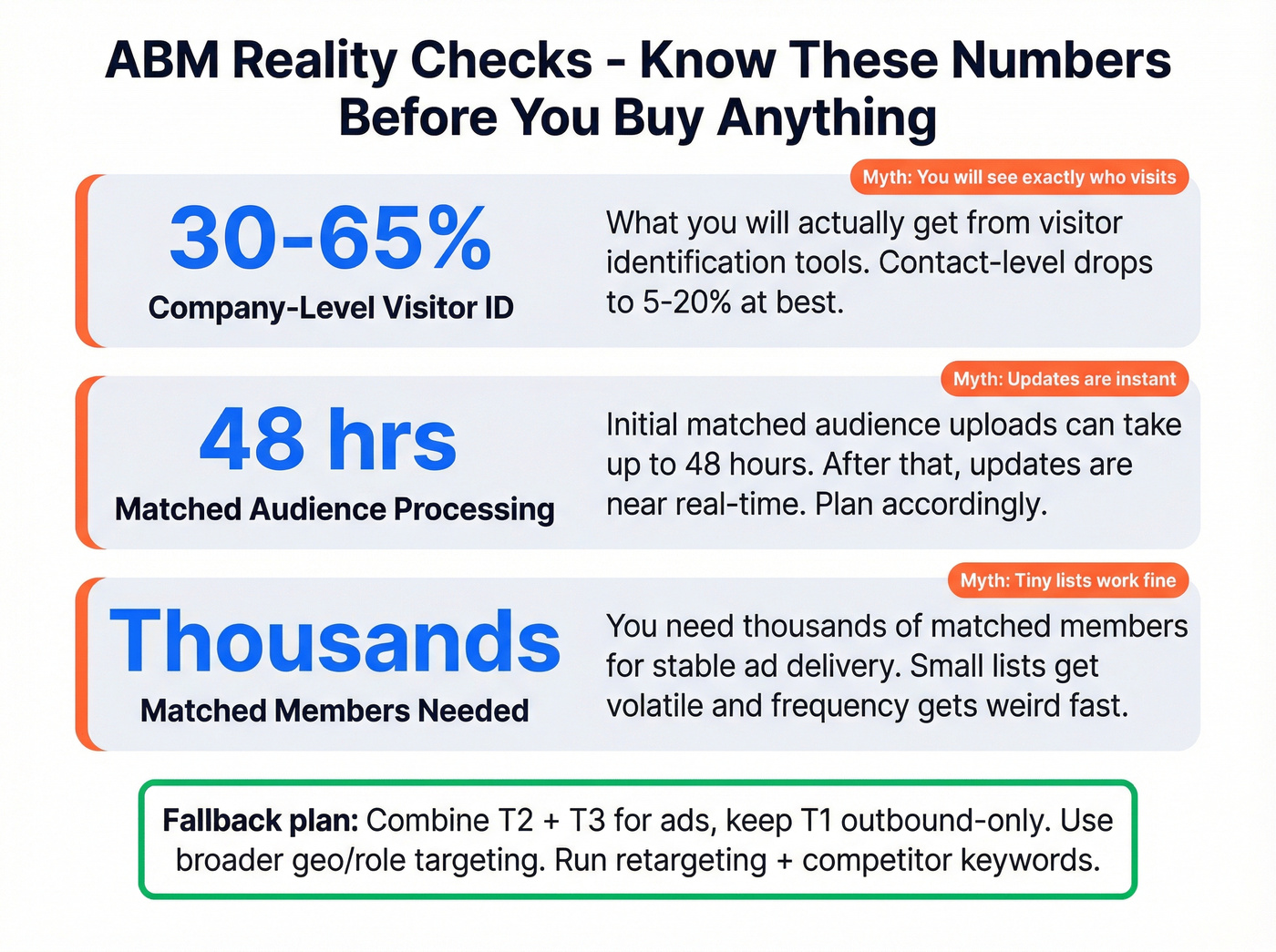

Reality checks before you buy anything (match rates, timelines, thresholds)

ABM tooling's full of magical thinking. Here are the constraints that actually matter when you're running lean.

- Myth: visitor ID will show you "who" is on your site

- Reality: expect 30-65% company-level identification and 5-20% contact-level at best.

- Myth: matched audiences update instantly

- Reality: initial matched audience processing can take up to 48 hours. After that, updates are near real-time.

- LinkedIn's docs spell this out in their Matched Audiences documentation: https://learn.microsoft.com/en-us/linkedin/marketing/matched-audiences/matched-audiences?view=li-lms-2026-01

- Myth: you can run ABM with tiny lists and still get stable delivery

- Reality: plan for thousands of matched members for stable delivery in most ad systems. Small lists can work, but they're volatile and frequency gets weird fast.

If your matched list's too small (common when you're scrappy), use these fallbacks:

- Combine Tier 2 + Tier 3 for ads; keep Tier 1 outbound-only. Tier 1 gets human effort; ads support the broader set.

- Use broader geo/role targeting and exclude customers. You'll lose some purity, but you'll gain delivery and learning.

- Run retargeting + competitor keywords instead of pure list match. Retargeting catches the real in-market behavior your list match misses.

Measurement for lean ABM (account progression + baselines)

If you measure ABM like demand gen (leads, MQLs, CPL), you'll conclude ABM doesn't work. ABM's an account progression game.

A clean model is five stages:

- Unaware -> they're in your TAL but show no measurable activity

- Aware -> they've been reached and have at least one meaningful touch

- Engaged -> multiple touches and/or multiple people engaging

- Qualified -> explicit buying signals (meeting, high-intent actions)

- Opportunity -> open opp in CRM

This model forces alignment: marketing owns movement into Engaged, sales co-owns Qualified, and Opportunity's the shared scoreboard. Twelfth Agency's breakdown is a useful reference for operationalizing this account stage progression model: https://twelfth.agency/2026/07/18/abm-reporting-metrics-tools-strategy/

Concrete stage definitions (copy/paste)

You need definitions that survive a sales meeting.

- Aware (minimum): target account received impressions or had a first website visit from a known company.

- Engaged (pick one rule and stick to it):

- Option A (web-heavy): 2+ visits in 14 days + 2+ key page views (pricing, product, integration, security).

- Option B (multi-person): 2+ engaged contacts (webinar attendee + site visitor; or two different people visiting key pages).

- Qualified (explicit intent): meeting booked or demo/contact page view + repeat visit + sales reply/call connect.

- Opportunity: opp created in CRM (no "marketing opp" shadow stages).

Baseline targets to start with (directional)

These aren't laws of physics. They're starting lines so you can see if the system's improving.

- Aware -> Engaged: 8-20% of TAL per month If you're below 8%, you're not reaching the list or your messaging's too generic.

- Engaged -> Qualified: 15-35% of engaged accounts per month If you're below 15%, your triggers are weak or sales follow-up's slow.

- Qualified -> Opportunity: 30-60% within 30-45 days If you're below 30%, you're qualifying too early or your sales play's misfiring.

Real talk: teams argue about attribution for weeks, then realize the real issue was simpler - Engaged accounts weren't getting touched fast enough, and nobody owned the trigger list.

Two formulas you should actually use

Account Penetration Rate (Engaged or Won Target Accounts ÷ Total Target Accounts) × 100

Directional benchmark: 20-30% penetration is strong for a focused program with a 50-200 account TAL.

Pipeline Velocity (Number of Opportunities × Average Deal Size × Win Rate) ÷ Sales Cycle Length (days) = $ per day

Pipeline velocity is how you keep ABM honest. If you're "doing ABM" but velocity doesn't move, you're buying impressions.

Dashboard spec table (stage definitions + what to track + where it lives)

| Stage | Definition | KPIs to track | Where it lives |

|---|---|---|---|

| Unaware | In TAL, no activity | % of TAL untouched | CRM |

| Aware | Reached or 1st touch | Impressions by account; first visit from target account | Ads, GA4 |

| Engaged | Repeat + depth | repeat visits; key page views; engaged contacts | GA4, visitor ID |

| Qualified | High intent signal | meetings booked; MQA; sales-accepted rate | CRM |

| Opportunity | Opp created | opps created; velocity; win rate | CRM |

Implementation notes that save headaches:

- Make "Account Stage" a single CRM field (picklist). One field, one truth.

- Log stage change date (even if it's manual). You'll want time-to-stage later.

- Track stage transition rates weekly (not monthly). Weekly's where you catch slippage.

Weekly reporting cadence (20 minutes, no drama)

Run this every Monday with marketing + sales:

- Stage movement: how many accounts moved Aware->Engaged, Engaged->Qualified, Qualified->Opp last week?

- Top 10 engaged accounts: who's hot, what'd they do, what play's assigned, who owns it?

- Bottleneck call: pick one bottleneck (reach, engagement, follow-up speed, meeting conversion) and fix one thing this week.

That cadence is the difference between ABM as a dashboard and ABM as a revenue system.

Instrumentation with the tools you already have (CRM + GA4 + GTM)

GA4's your measurement foundation, but it won't magically become an ABM tool.

The big limitation: GA4 doesn't identify companies natively. It can tell you what happened, not which account it happened in. That's why DIY ABM adds a visitor ID layer.

Practical setup:

- GA4 acquisition reporting: know the split

- User acquisition = first-time user source

- Traffic acquisition = session-level source

- Use Google Tag Manager (GTM) for real conversions

- Set up events for: form submit, demo request, pricing click, key downloads, video plays.

- Search Engine Land's GA4 walkthrough is a solid reference: https://searchengineland.com/ga4-for-b2b-how-to-track-events-and-conversions-428776

- Standardize UTM hygiene

- If UTMs are inconsistent, your proof-of-reach reporting becomes vibes-based.

- Pipe conversions into CRM

- At minimum: contact created, meeting booked, opportunity created.

You don't need perfect tracking. You need consistent tracking.

The budget stack for ABM without expensive tools (free -> under $500/mo) with real prices

Enterprise ABM platforms can be the all-in path. They can be great later. They're also a cost and complexity anchor: $35k to $1M+/year depending on modules, traffic, seats, and how deep you go.

For ABM without expensive tools, build a ladder: start free, add one paid layer at a time, and only pay for what you can operationalize.

What to buy first (decision rule)

- If sales can't reach the buying group: buy verified contact data first.

- If you can't tell which accounts are engaging: buy visitor ID second.

- If you can see engagement but nothing converts: don't buy tools - fix plays and speed.

Budget ladder table (cheap stack)

| Tool | Job | Price | When to add | Limits/notes |

|---|---|---|---|---|

| Prospeo | Verified contacts + enrichment | Free -> ~$0.01 per verified email | After TAL set | Credit-based; built for accuracy and freshness |

| IpMeta | GA4 company-ish dims | Free -> $39/mo | ABM-lite reporting | GA4 add-on |

| Leadfeeder/Dealfront | Visitor ID + alerts | Free -> EUR 99-165/mo | Need account alerts | Company-level most of the time |

| Sales Navigator | Account research | $99.99-$149.99/mo | Manual prospecting | Seat-based |

| Sales Navigator (annual) | Account research | Core: $959.88/yr ($79.99/mo equiv); Advanced: $1,679.88/yr ($139.99/mo equiv); Advanced Plus: starts ~ $1,600/seat/yr (custom) | When you commit to outbound | Annual saves money; Plus adds admin + advanced controls |

| CRM (HubSpot/SF) | Stages + tasks | Already owned | Day 1 | System of record |

| GA4 + GTM | Events + conversions | Free | Day 1 | No company ID |

| ABM platforms | Full platform | $35k-$1M+/yr | Later | Heavy lift + governance |

Tier 1 tools (worth paying for early)

Prospeo (contact data + verification layer)

IpMeta (ABM-lite reporting inside GA4)

IpMeta's a pragmatic hack: it restores network dimensions in GA4 (Service Provider, Network Domain, plus Network Type) and adds company-ish enrichment on top. It's not contact-level ID, but it's a cheap way to answer "are target accounts showing up on the site?" without buying a suite. Pricing's simple: free tiers, then $39/month after a 14-day trial.

Leadfeeder / Dealfront Web Visitors (visitor identification + account alerts) This category is your trigger engine. You'll use it to alert on target accounts visiting key pages, then push those accounts into Engaged/Qualified plays. Budget EUR 165/month billed monthly or EUR 99/month billed annually for small plans. The constraint is match rates: it's company-level most of the time, not "here's the exact person."

The Monday-morning test fails when sales can't reach the accounts that moved. Prospeo's 7-day data refresh means your Tier 1-2 contact data stays current - not 6 weeks stale like the industry average. Multi-thread into engaged accounts with verified emails and direct dials that actually connect.

Fresh data turns account signals into booked meetings.

Sales activation plays (what sales does when an account hits Engaged/Qualified)

ABM dies when "marketing sends leads" and sales shrugs. Replace lead handoff with account-triggered plays.

Use an if-this-then-that playbook tied to your stages:

- If account hits Engaged -> run a multi-thread play

- Assign 2-3 roles to contact: champion + economic buyer + technical evaluator.

- Sequence the champion, call the evaluator, and send a tight POV to the buyer.

- Goal: create internal conversation, not immediate demo.

- If account hits Qualified -> run a meeting push play

- Trigger: demo page view + repeat visit, webinar attendance, or reply.

- SLA: first human touch within 24 hours.

- Tactic: "2 options" meeting ask + one relevant proof point (case study, teardown, ROI angle).

- If account is Opportunity -> run a deal acceleration play

- Add air cover: retargeting to the buying group, competitor/comparison content, security/IT enablement.

- Align on next step: mutual action plan, timeline, stakeholders.

A quick scenario from the real world: a two-person marketing team I worked with had a Tier 1 list of 18 accounts, ran light air cover for two weeks, and then noticed three accounts repeatedly hitting the security and pricing pages within 48 hours; sales didn't "nurture" anything, they called the evaluator the same day, sent a one-page POV to the budget owner, and booked two meetings before the next Monday standup.

Practitioner reality: the secret isn't intent scoring. It's speed + clarity. When sales gets a short list of accounts with a concrete reason to act, they act.

If you do nothing else this week...

- Pull 50 accounts from closed-lost + stalled opps and call it your first TAL.

- Define Engaged in one sentence and put it in the CRM.

- Launch proof-of-reach ads with two creatives and a single landing page.

- Run a Monday meeting where sales leaves with 10 named accounts and one play each.

That's ABM without expensive tools.

Everything else is optional.

FAQ

Can you do ABM with just a CRM and ads?

Yes - if you keep the TAL tight (50-200 accounts), track 5 account stages in your CRM, and use ads for proof of reach. Most teams still add GA4 event tracking plus a visitor-ID tool so they can trigger sales plays from engagement instead of guessing.

What's a good target account list size for scrappy ABM?

A strong scrappy TAL is 50-200 accounts, tiered into 10-25 Tier 1, 25-75 Tier 2, and the remainder as Tier 3. If you can't name your top 25 bet-the-quarter accounts, your list's too big and you'll slide back into generic targeting.

How do you measure ABM without 6sense or Demandbase?

Measure account progression, not leads: Unaware -> Aware -> Engaged -> Qualified -> Opportunity, with weekly stage movement and pipeline velocity. Track reach in your ads platform, engagement in GA4 plus visitor ID, and meetings/opps in CRM; if Engaged -> Qualified is under 15% monthly, your triggers or follow-up speed need work.

What match rate should I expect from visitor identification tools?

Expect 30-65% company-level identification and only 5-20% contact-level identification in most B2B traffic. If you design your workflow around account-level triggers (pricing views, repeat visits, key page depth), you'll get reliable activation even when person-level IDs are missing.