Buying Group Personas: How to Map, Build, and Activate Every Role in the B2B Buying Committee

Your champion loves you. They've watched every demo, forwarded your case study to three colleagues, and told your AE they're "pushing this through." Then the deal stalls for 11 weeks. The CFO never saw a business case. The VP of IT flagged a security concern nobody addressed. Procurement wants three competitive bids.

Your champion is still enthusiastic - but enthusiasm doesn't close deals. Buying group personas do.

The average B2B purchase involves 13 stakeholders across multiple departments. 86% of those purchases stall at some point. And 74% of buying teams experience unhealthy conflict during the decision process. If your go-to-market strategy is built around individual buyer personas - a single "Marketing Mary" or "IT Ian" - you're bringing a knife to a committee fight.

Three Things to Know Before You Read Further

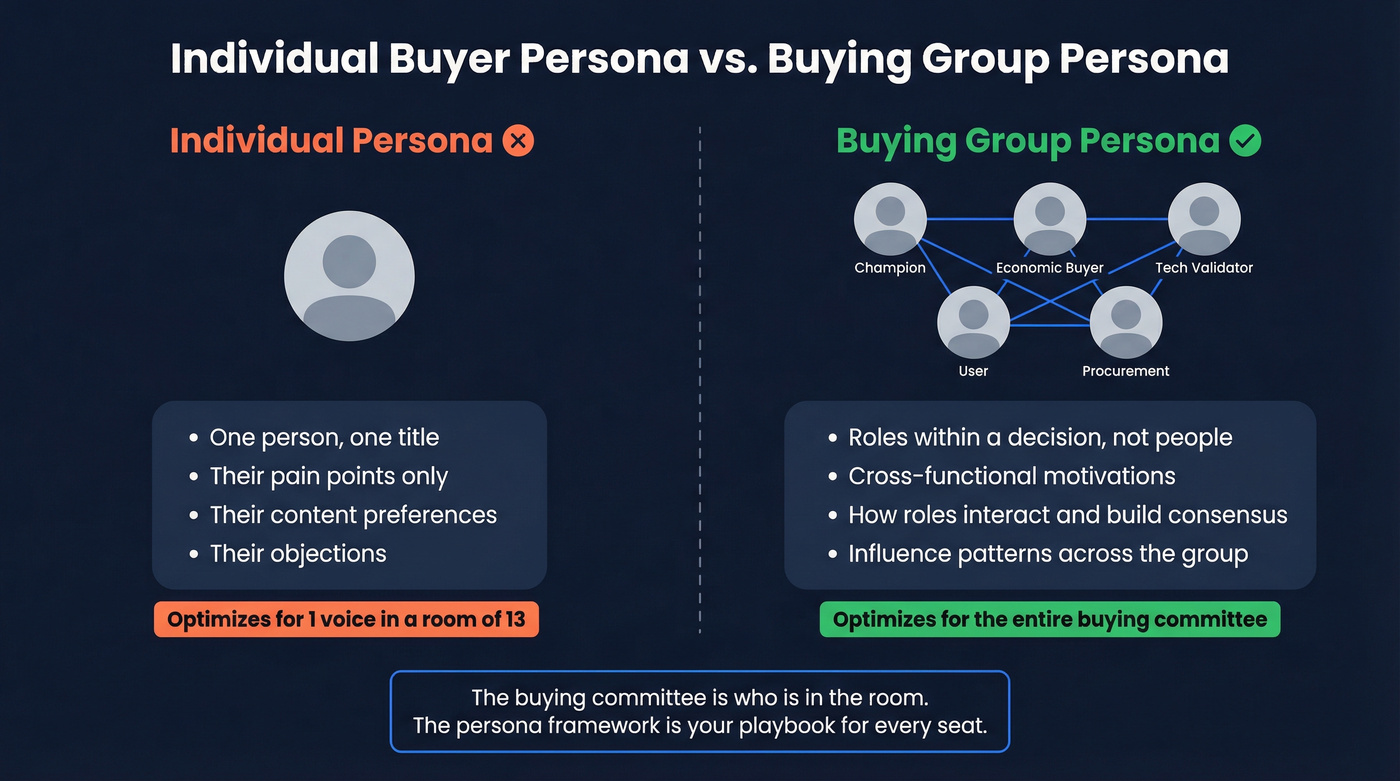

The average B2B deal involves 13 stakeholders. If your personas describe individuals instead of buying groups, they're broken. You're optimizing for one voice in a room of thirteen.

Start with 3-5 buying group roles - Champion, Economic Buyer, Technical Validator, User, Procurement. Expand only when win/loss data demands it. Most teams over-engineer this.

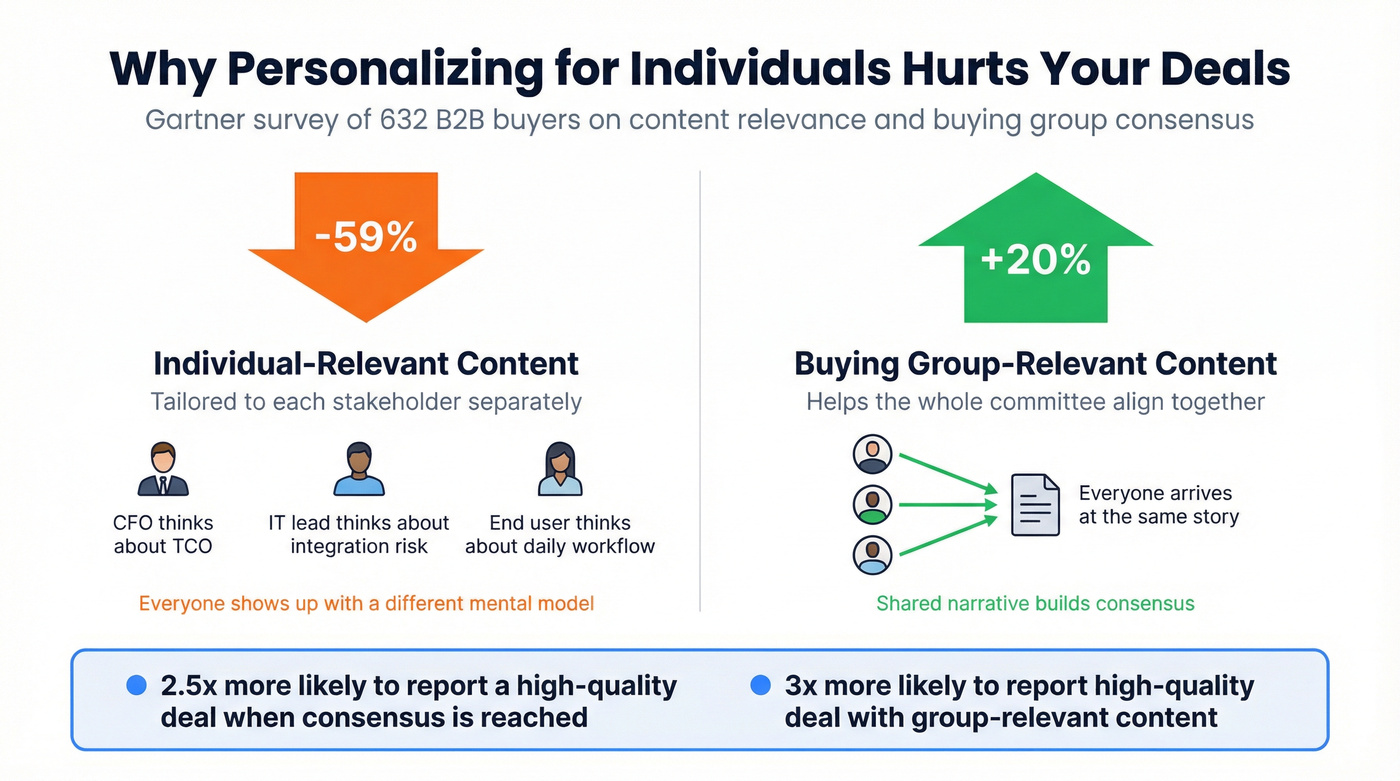

The biggest mistake isn't getting the roles wrong - it's personalizing content for individuals instead of the group. A 2026 Gartner survey of 632 B2B buyers found that individual-relevant content creates a 59% negative impact on buying group consensus. Your "personalized" nurture sequences might be actively sabotaging deals.

What Are Buying Group Personas (and Why Individual Buyer Personas Aren't Enough)?

A buying group persona isn't a fancier version of a buyer persona. It's a fundamentally different unit of analysis.

An individual buyer persona describes a single person - their title, pain points, content preferences, and objections. "VP of Marketing, 35-50, cares about pipeline attribution, reads Martech blogs." That's fine for B2C. It's dangerously incomplete for B2B. (If you need a baseline to compare against, see these buyer personas.)

A buying group persona describes a role within a purchase decision - not a person, but a function. The Champion. The Economic Buyer. The Technical Validator. Each role has distinct motivations, objections, content needs, and influence patterns. And critically, each role interacts with the other roles in ways that either build consensus or destroy it.

The related terms get confusing fast. A buying center is the academic term (from organizational behavior) for the group of people involved in a purchase. A buying committee is the practitioner term for roughly the same thing - the actual humans in the room. Buying team personas are the abstracted roles you build strategy around. The buying committee is who's in the room; the persona framework is the playbook for how you engage each seat. (If you want the formal definition, start with buying center.)

Forrester calls this the "buying group era" - and the shift from MQLs to buying groups isn't optional anymore. Companies hitting 100% of their MQL goal often achieve only ~30% of their pipeline goal. That gap is the buying group gap. You're generating leads, but you're not engaging the committee.

89% of B2B purchases cross departmental lines. McKinsey's data shows 60% of committees now include IT, HR, and legal - roles that weren't at the table five years ago. Your single-threaded deal with the Director of Marketing isn't a deal. It's a conversation that hasn't become a deal yet. (Related: B2B decision making.)

The Business Case - What Happens When You Get This Right

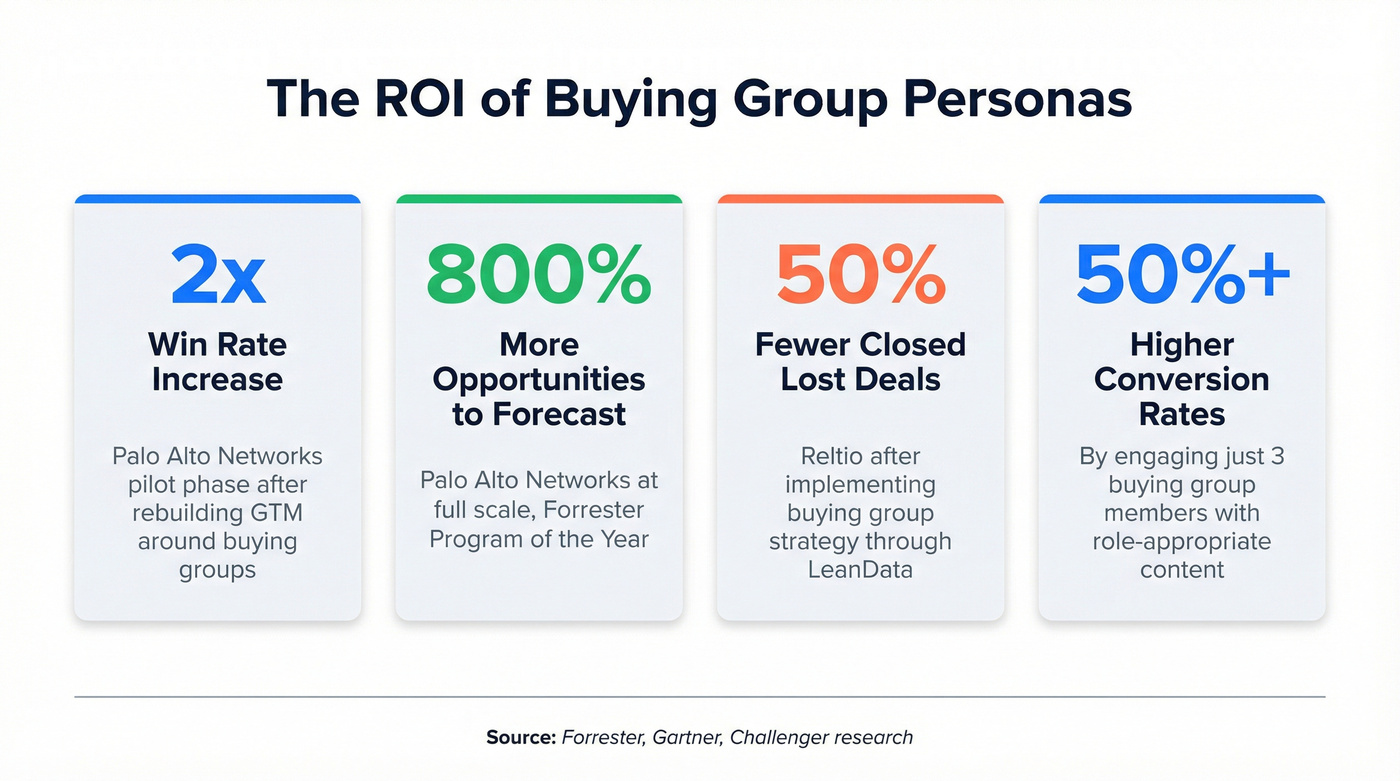

The ROI isn't theoretical. Two case studies make the point better than any framework deck.

Palo Alto Networks

Palo Alto Networks rebuilt their entire go-to-market motion around buying groups. The results earned them Forrester's B2B Program of the Year. During the pilot phase, win rates doubled. At full scale, opportunity progression to forecast increased by 800%. The estimated revenue impact: a 13% increase.

In our experience, the deals that stall longest are the ones where only one contact is engaged. Palo Alto's results confirm it - that's not a marginal improvement. That's a structural shift in how pipeline converts to revenue.

Reltio

Reltio took a different path to the same destination. After implementing a buying group strategy through LeanData, they saw a 20% increase in actionable sales pipeline. Opportunities advanced 24% faster. And the number that should make every CRO pay attention: Closed Lost deals dropped by 50%.

Half the deals they were losing - gone. Not because the product changed. Because they were engaging the right people at the right time with the right context.

The Broader Data

These aren't outliers.

Engaging just three buying group members can boost conversion rates by over 50%. That's the threshold - three. Not thirteen. Not eight. Three people, engaged with role-appropriate content, dramatically changes your odds.

53% of customer loyalty is attributable to the sales experience itself - more than brand, product quality, service, or price combined. That's from Challenger's study of ~5,000 B2B decision-makers. Buyers perceive little difference between suppliers on product features. The difference they do perceive? How well the sales team understood their buying group's dynamics.

When you map these personas correctly, you're not just improving targeting. You're upgrading the buying experience for every stakeholder in the room. The champion gets armed with the right materials. The CFO gets the business case before they ask for it. The technical validator gets the security documentation proactively. That's what "sales experience" means in practice.

You just learned that engaging 3+ buying group members boosts conversion by 50%. But you can't engage stakeholders you can't reach. Prospeo gives you 98% accurate emails and verified direct dials for every role in the committee - Champion, CFO, Technical Validator - across 300M+ profiles with 30+ filters including job title, department, and seniority.

Stop single-threading deals. Reach the entire buying committee today.

The Consensus Problem Nobody Talks About

Here's the thing most teams get wrong, and it's counterintuitive enough that you need to sit with it.

You'd think that personalizing content for each individual stakeholder would help close deals. Tailor the message to the CFO's priorities. Customize the deck for the IT lead's concerns. Give each person exactly what they need.

That approach has a 59% negative impact on buying group consensus.

Not a typo. Gartner's survey of 632 B2B buyers found that content focused on individual-level relevance actively undermines the group's ability to reach agreement. Content tailored for buying group relevance - content that helps the whole committee align - positively impacts consensus by 20%.

Why? Because when every stakeholder gets a different story, they show up to the internal meeting with different mental models. The CFO is thinking about TCO. The IT lead is thinking about integration risk. The end user is thinking about daily workflow. None of them are thinking about the same thing. And 74% of buying teams already demonstrate unhealthy conflict during the decision process. You're pouring gasoline on a fire.

Buying groups that reach consensus are 2.5x more likely to report a high-quality deal. When buyers experience buying group relevance - content that helps them align with their colleagues, not just satisfy their individual concerns - they're 3x more likely to report a high-quality deal.

The shift isn't from "no personalization" to "more personalization." It's from personalizing to contextualizing. Stop asking "what does the CFO need to hear?" Start asking "what does the CFO need to hear that helps them align with the champion and the technical validator?" (On the data side, this is a good moment to revisit what you mean by contextual data.)

Real talk: this is the hardest mindset shift in B2B marketing right now. Every tool, every playbook, every ABM platform is built around individual-level personalization. The data says that approach is actively harmful to consensus. Practitioners on Reddit describe the fix as a "Buying Group Marketing" approach: push the right content to the right stakeholders in parallel to cut sales cycles. The teams winning are the ones building shared narratives that give each stakeholder a role in the same story - not thirteen different stories.

If your deal size is under $30K, you probably don't need a 10-role persona framework or an enterprise ABM platform. But you absolutely need multi-threading. Even a three-person buying group engaged with a shared narrative will outperform a single-threaded deal with the world's best personalization. Consensus beats personalization every time. (If you want the execution playbook, start with ABM multi-threading.)

A Complete Taxonomy of Buying Group Roles

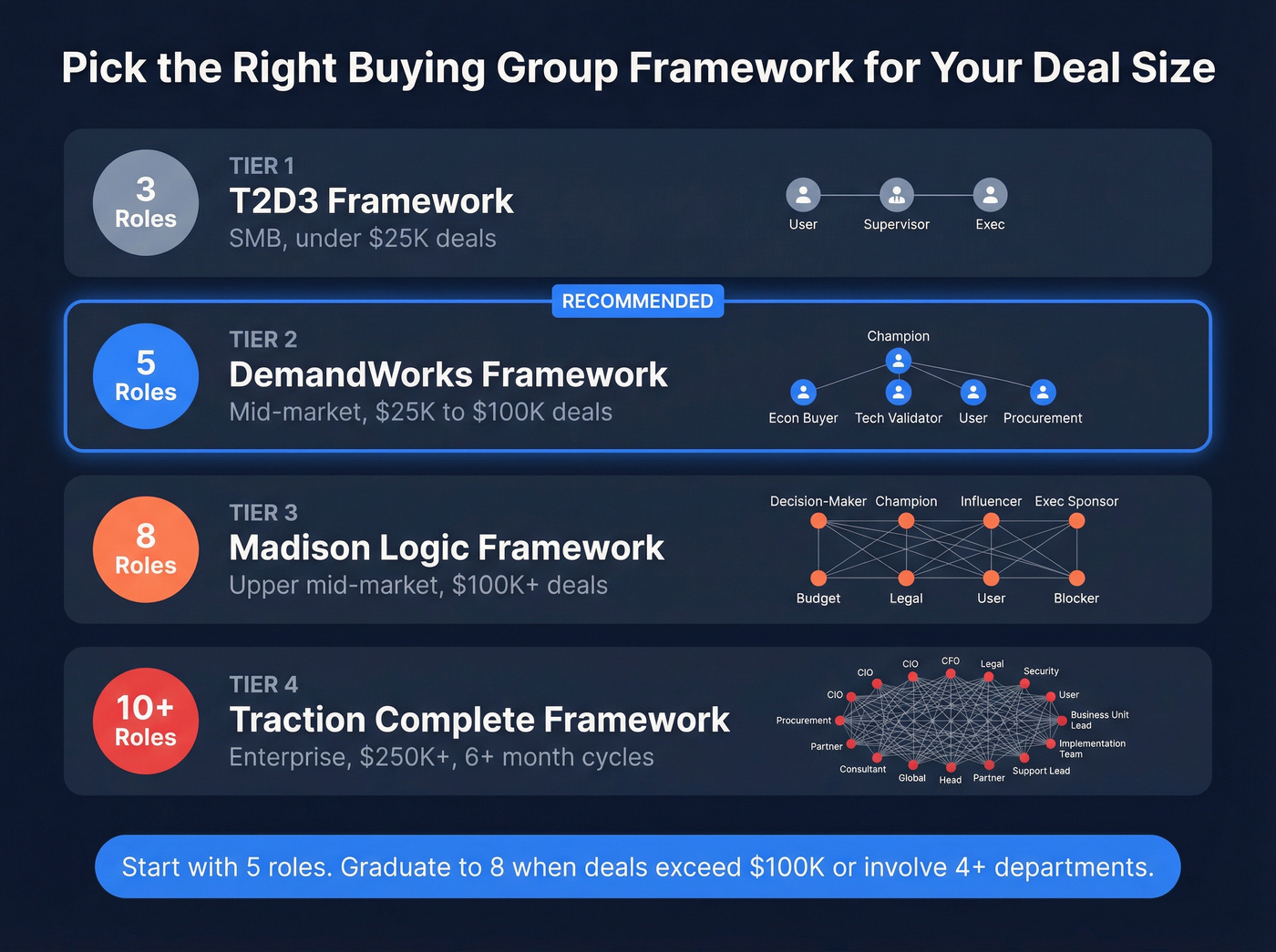

Not every deal needs the same persona framework. A $15K SaaS deal with three stakeholders doesn't need the same taxonomy as a $500K enterprise platform sale with sixteen. Match framework complexity to deal complexity.

| Framework | Roles | Best For | When to Use |

|---|---|---|---|

| 3-Role (T2D3) | User, Supervisor, Exec | SMB / sub-$25K deals | Starting out, simple sales |

| 5-Role (DemandWorks) | Champion, Econ Buyer, Tech, User, Procurement | Mid-market / $25-100K | Default for most B2B |

| 8-Role (Madison Logic) | Decision-Maker, Champion, Influencer, Exec Sponsor, Budget, Legal, User, Blocker | Upper mid-market / $100K+ | Complex, multi-dept deals |

| 10-Role (Traction Complete) | Full committee taxonomy | Enterprise / $250K+ | 10+ stakeholders, 6+ month cycles |

Our recommendation: Start with the 5-role framework. It covers 80% of B2B deals. Graduate to 8 roles when your average deal exceeds $100K or involves 4+ departments.

These persona frameworks work best when paired with a buying journey model. The most referenced among practitioners: Gartner's non-linear B2B Buying Journey, Forrester's Revenue Waterfall, and the Challenger Customer Buying Journey. Pick one that matches your sales motion and layer your persona roles on top.

The 8-Role Framework (Primary)

Madison Logic's framework is the most comprehensive model that's still practical for most B2B teams. For tech purchases specifically, the stakeholder range balloons to 14 to 23 people - nearly double what most teams plan for.

| Role | How to Identify | Content Preferences | Engagement Tactic |

|---|---|---|---|

| Decision-Maker | Final sign-off authority | Exec summaries, benchmarks | Late-stage exec briefing |

| Champion | Repeat visits to ROI pages | Case studies, ROI tools | Arm with internal sell kit |

| Influencer | Cross-functional, shares content | Analyst reports, thought pieces | Multi-channel nurture |

| Exec Sponsor | C-suite, strategic alignment | Board-ready decks, vision | Peer-to-peer exec connect |

| Budget Controller | Finance title, budget authority | TCO analysis, payback models | ROI calculator + CFO brief |

| Legal/Compliance | Legal/security titles | Security & compliance docs | Proactive risk package |

| End User | Daily operator of the tool | Product tours, sandbox access | Free trial, workflow demos |

| Blocker | Sporadic security doc views | Risk mitigation, comp intel | ID early, address head-on |

Two critical nuances. First, a single stakeholder can play different roles depending on the deal stage. Your champion in the evaluation phase might become a blocker during implementation if they're worried about change management. Personas are fluid, not fixed.

Second, behavioral signals matter more than titles. Champions don't always have "champion" in their job description (obviously). You identify them by behavior - they're the ones downloading the ROI calculator, revisiting the case study page, and forwarding your emails internally. Blockers show up as sporadic, security-focused engagement. Bombora describes this as "buying group blindness" - when influential stakeholders remain hidden until they surface as late-stage blockers. Learn to read the signals before that happens. (If you’re operationalizing this, a deal health model helps.)

The 5-Role Framework (Mid-Market Default)

Use this if: You're selling deals in the $25K-$100K range, your buying groups typically have 4-7 people, and you need a framework your SDRs can actually remember.

The five roles:

- Champion/Project Owner - Workflow demo + rollout checklist

- Economic Buyer - ROI calculator + payback analysis

- Technical Validator - Security one-pager + integration docs

- User/Operator - Product sandbox + daily workflow tour

- Procurement - Competitive comparison + pricing transparency

Building a well-defined economic buyer persona is often the highest-leverage move in this framework. The economic buyer controls budget approval, and deals that stall most frequently do so because this role was never properly engaged with a business case.

Skip this if: Your deals regularly involve 10+ stakeholders across four or more departments. You'll miss the Exec Sponsor, Legal, and Blocker roles that kill enterprise deals. Also skip for sub-$15K deals - the buyer and decision-maker are usually the same person, so the 3-role model is your better fit.

The key principle: normalize to roles, not titles. "VP of Engineering" at a 50-person startup is a different role than "VP of Engineering" at a 5,000-person enterprise. The startup VP might be Champion, Technical Validator, and Economic Buyer rolled into one. The enterprise VP is probably just the Technical Validator. Map to function, not org chart.

Revisit your role mapping quarterly using win/loss data and call notes. Combine personas when two titles consume the same proof. Split them when objections diverge. (To systematize this, run a lightweight win-loss analysis.)

The 3-Role Framework (Startups and SMBs)

T2D3's model strips things down to the minimum viable set: User (P1), Supervisor (P2), and Executive (P3).

The approach is sequential. Start with P1 - the person who'll actually use your product daily. Test your messaging, optimize for engagement, and use what you learn to craft the pitch for P2 (the supervisor who owns the budget and process). P2's buy-in informs how you approach P3 (the executive who cares about strategic alignment and risk).

This isn't a dumbed-down framework. For deals under $25K with three to five stakeholders, you don't need eight personas. You need three roles engaged in the right sequence.

The 10-Role Framework (Enterprise)

Skip this framework unless your average deal is above $100K. For most teams, it's overkill that creates analysis paralysis.

Traction Complete maps ten distinct roles: Project Sponsor, Champion, Executive Sponsor, Financial Approver, Technical Buyer, Operations/Process Owner, Business User, Legal Reviewer, Influencer, and Final Authority.

This is enterprise-grade - built for deals above $250K with 10+ stakeholders spanning four or more departments. At this complexity level, buyers spend only 17% of their purchasing time meeting with vendors. The other 83% is internal deliberation, research, and consensus-building you can't see. If you're not mapping all ten roles, you're flying blind on the majority of the buying process. HIMSS research adds useful context: typical buying groups run 6-7 people, but 27% report 10 or more - that's the segment where this framework earns its keep. (For more on the motion, see enterprise sales.)

How to Build Your Buying Group Persona Strategy (Step by Step)

Frameworks are useless without execution. Here's how to actually build and activate your committee-level personas.

Define Your ICP

Your persona framework sits inside your Ideal Customer Profile, not the other way around. Start with firmographics (industry, company size, revenue), technographics (what tools they already use), and buying behavior (how they've purchased similar solutions before). (If you need a clean definition and validation workflow, use this Ideal Customer Profile guide.)

41% of B2B buyers already have a preferred vendor before formal evaluation begins. If you're not engaging the buying group before they start "evaluating," you're already behind.

Map the Buying Group Per ICP

Not every ICP has the same buying group. A 200-person SaaS company buying your product involves different roles than a 5,000-person financial services firm.

For each ICP, identify which roles matter for your sale. Keep 3-5 active buying team personas per ICP. Use real deal data - closed-won and closed-lost - not assumptions. Which roles showed up in deals you won? Which roles were missing in deals you lost?

I've seen teams spend weeks mapping theoretical buying groups that bear zero resemblance to their actual deals. Pull your last twenty closed-won opportunities. Look at who was involved. That's your buying group.

Create Persona Profiles Using Real Data

Here's where most teams go wrong. They sit in a conference room, brainstorm what they think the CFO cares about, and produce what Reddit practitioners accurately call "fairytale personas" - fictional characters built by marketers who've never talked to a customer or a sales rep.

The fix: use real professional profiles to create what Health Launchpad calls "amalgam personas." Find five to ten real people who've played the Champion role in your deals. Study their backgrounds, career paths, and the language they use. Build a composite that's grounded in reality, not imagination.

Validate with win/loss analysis and call recordings. Not surveys. Surveys tell you what people think they should say. Call recordings tell you what they actually said when money was on the line.

Map Content to Personas Across the Buying Journey

INFUSE breaks the buying journey into six steps: becoming aware of a need, investigating options, committing to change, selecting a solution, validating the choice, and making the purchase. Each step requires different content for different personas.

Your Champion needs qualifying questions early - Aircover recommends asking: "The last time you purchased a similar product, what was the process like and who was involved?" That single question maps the buying group for you.

Blockers need risk mitigation content before they raise objections. If you wait until the Blocker surfaces a security concern in week eight, you've lost three weeks. Identify blockers early, provide compliance documentation proactively, and give your Champion the ammunition to address concerns internally.

Buyers spend only 17% of their time with vendors. The other 83% is your content working (or not working) on your behalf inside the account.

Find and Verify Contact Data for Each Persona Role

Here's where strategy meets reality - and where most buying group initiatives quietly die.

Your SDR just booked a meeting with the Director of Marketing. Great. She's the Champion. But your CRM shows zero contacts for the VP of IT, the CFO, or the procurement lead. You've mapped five buying group roles. You have contact data for one.

This is the "last mile" problem. Teams invest weeks building persona frameworks, mapping content journeys, and designing multi-threaded outreach plays - then can't execute because they don't have emails or direct dials for the other four people in the buying group.

Tools like Prospeo solve this by letting you filter by job title, department, and seniority across 300M+ professional profiles. Need the CFO, VP of IT, and Head of Procurement at a specific company? Search by role, verify in real time, and export with 98% email accuracy. The 7-day data refresh cycle means you're not reaching out to people who changed jobs two months ago. (If you’re comparing approaches, start with an email lookup workflow.)

Measure and Iterate

Three categories of metrics matter:

- Coverage: What percentage of target accounts have key buying group roles identified and contactable?

- Quality: What's the reply rate and meeting rate by role? (Champions should respond differently than Procurement.)

- Movement: What's the stage velocity on multi-threaded deals vs. single-threaded deals?

Track these monthly. If coverage is low, it's a data problem. If quality is low, it's a messaging problem. If movement is slow despite good coverage and quality, it's a consensus problem - go back to the contextualizing framework from the consensus section. Each diagnosis leads to a different fix.

Mistakes That Kill Your Buying Group Persona Strategy

1. Personalizing for Individuals Instead of the Group

Picture this: your marketing team sends the CFO a beautifully crafted email about TCO reduction. The IT lead gets a separate email about integration architecture. The end user gets a product tour invite. Each message is perfectly tailored. Each person walks into the internal review meeting with a completely different understanding of what your product does and why it matters. The committee spends 45 minutes arguing about priorities instead of evaluating your solution.

That's the 59% negative consensus impact in action.

The fix isn't less personalization. It's contextual personalization. Every piece of content should help the recipient understand how their concerns fit into the broader group decision. The CFO email should mention that the technical team has already validated integration. The IT email should reference the business case the CFO will see. Same story, different angles.

2. Building "Fairytale Personas" Without Customer Input

We've seen teams build beautiful persona decks that sales never opens. The reason is almost always the same: the personas were built by marketers who've never listened to a sales call or talked to a customer.

If your persona document includes stock photos and fictional names but zero quotes from real buyers, it's fiction. Start with call recordings, not brainstorms.

3. Marketing and Sales Operating in Silos

Before buying group alignment: Marketing generates MQLs from individual contacts. Sales tries to close deals with buying groups. The champion gets three emails from marketing and a different pitch from the AE. The CFO gets nothing until week six. Procurement gets a pricing sheet with no context.

After buying group alignment: Marketing and sales share the same persona map. Marketing nurtures all five roles with coordinated content. The AE knows which roles are engaged and which are missing. The champion gets armed with materials designed to circulate internally.

81% of buyers express dissatisfaction with their chosen providers. A lot of that dissatisfaction starts with fragmented, uncoordinated engagement across the buying group.

4. Not Educating the Whole Revenue Team

Your SDRs need to know which role they're likely talking to and what that role cares about. Your AEs need to know which roles are missing from the deal and how to multi-thread. Your CSMs need to know which roles matter for renewal. Personas that live in a Google Doc nobody reads are worse than no personas at all - they create the illusion of strategy without the execution.

5. Never Updating Your Personas

Buying groups evolve. New roles emerge - AI/ML stakeholders now show up in nearly every tech purchase. Existing roles shift in influence. The personas you built eighteen months ago don't reflect how your buyers actually buy today. Review quarterly using win/loss data. When your business strategy changes - new market, new product, new pricing model - rebuild from scratch.

6. Treating Personas as a Marketing-Only Tool

If only marketing uses your buying group personas, you've captured maybe 30% of their value.

Personas should inform product positioning, sales enablement, customer success playbooks, and even product roadmap prioritization. The buying group doesn't stop mattering after the deal closes.

How AI Is Changing Buying Group Dynamics in 2026

The buying group you mapped six months ago is already behaving differently.

94% of buyers now use LLMs during the purchasing process. 95% anticipate using genAI to support decisions in the next twelve months. And 83% of buyers define purchase requirements before ever speaking with a sales rep.

What does this mean for your committee-level personas? Three things.

First, your content must be LLM-findable. If a Champion asks ChatGPT "what's the best [your category] tool for [their use case]," your content needs to surface. That means structured, authoritative, comparison-friendly content - not gated whitepapers behind a form.

Second, buying groups are arriving more informed and more aligned on requirements than ever before. The "discovery call" where you uncover needs is increasingly a validation call where they confirm what they've already decided. Your persona strategy needs to account for this - engage earlier, with content that shapes requirements before they're locked in.

Third, AI is compressing the timeline. Average sales cycles dropped from 11.3 months to 10.1 months between 2024 and 2025, and the compression is accelerating. Your multi-threaded engagement can't be a slow drip over six months. It needs to be a coordinated push that reaches all key personas within the first few weeks of engagement.

The teams that win in this environment are the ones whose buying group content is so good that it becomes the source material the AI summarizes. That's the new game.

Measuring Buying Group Persona Effectiveness

Only 29% of ABM teams measure through ABM-aligned metrics. Nearly half still count MQLs from non-target accounts - that's like measuring your diet by how many times you opened the fridge.

| Category | Metric | What It Tells You |

|---|---|---|

| Coverage | % of accounts with 3+ roles identified | Data completeness |

| Coverage | % of roles with verified contact data | Execution readiness |

| Quality | Reply rate by persona role | Message-market fit per role |

| Quality | Meeting rate by persona role | Engagement depth |

| Movement | Stage velocity: multi-thread vs. single | Consensus impact |

| Movement | Account-to-opportunity conversion | Pipeline efficiency |

For SaaS companies, benchmark account-to-opportunity conversion rates at 15-25%. If you're below that, your buying group coverage is probably the bottleneck.

Demandbase offers a useful prioritization tool: a Persona Completeness x Engagement matrix. Accounts with high engagement but low persona completeness are your biggest opportunities - someone's interested, but you're only talking to one or two roles. Fill the gaps and you unlock the deal.

Adobe's Journey Optimizer takes this further with role weighting: Trivial (20 points), Minor (40), Normal (60), Important (80), Vital (100). Not every persona carries equal weight. Your Champion and Economic Buyer are "Vital" while the End User is "Normal." Weight your engagement scoring accordingly.

Coverage gaps are fundamentally a data problem. If you've mapped five roles but only have contact data for two at most accounts, the strategy is dead on arrival.

Palo Alto Networks doubled win rates by engaging full buying groups. Your team can do the same - but only with fresh, verified contact data. Prospeo refreshes every record every 7 days (not 6 weeks), so you're never reaching out to someone who changed roles last month. Layer in intent data across 15,000 topics to know which accounts are actively in-market.

Arm your reps with real contact data for every seat at the table.

FAQ

How many buying group personas do I need?

Start with 3-5 roles per ICP. The 5-role framework (Champion, Economic Buyer, Technical Validator, User, Procurement) covers most mid-market B2B companies. Expand to 8-10 roles only when win/loss data shows unmapped roles consistently influencing outcomes. More personas aren't better - more accurate personas are better.

What's the difference between a buying group and a buying committee?

A buying group includes everyone who influences a purchase decision, including informal influencers who never attend a meeting. A buying committee is the formal subset with explicit decision-making authority. The buying group is always larger - and the people outside the formal committee (end users, IT security, legal) often hold de facto veto power.

How do I find contact data for all the roles in my buying group?

This is the operational bottleneck most teams hit. You've mapped five roles but only have emails for one or two contacts per account. Prospeo lets you search by title, department, and seniority across 300M+ profiles with 98% email accuracy and a 7-day refresh cycle. Hunter and Apollo are alternatives, but check accuracy rates before committing - bad data burns domains and wastes cycles.

Do buying group personas replace individual buyer personas?

No - they layer on top. Individual buyer personas describe a person's motivations and pain points. Buying group personas describe a role's function within a purchase decision and how that role interacts with other roles. You need both. The individual persona tells you what to say. The buying group persona tells you when to say it, to whom, and how it connects to what everyone else is hearing.

How do buying group personas improve win rates?

Teams analyzing which roles were engaged in won deals versus lost deals can pinpoint exactly where coverage gaps cost them revenue. Palo Alto Networks doubled win rates after restructuring around buying groups. The pattern holds broadly: multi-threaded deals with three or more engaged personas consistently close at 50%+ higher rates than single-threaded ones.