ABM Multi-Threading in Sales: The Data-Backed Playbook (2026)

Becc Holland, CEO of Flip the Script, tells a story that should haunt every AE. She had a deal locked down - until her CRO champion left the company. She rebuilt the relationship with the replacement CRO. Then that CRO left too. Two champions gone, deal dead, months of pipeline evaporated. The entire opportunity was single-threaded to one person who kept disappearing.

That story isn't unusual. 70% of opportunities still have a single point of contact. Meanwhile, 90% of BDRs say they multithread. That gap - between what teams claim and what actually happens in the CRM - is where deals go to die.

ABM multi-threading in sales isn't a nice-to-have anymore. It's the difference between predictable pipeline and quarterly panic.

A UserGems study of 5,000+ opportunities found multithreaded deals win at 5x the rate of single-threaded ones. But the execution gap persists because most teams don't have the framework, the talk tracks, or - critically - the contact data to thread beyond one or two people. As one practitioner in r/revops put it: "Most enterprise teams don't fail at ABM because it doesn't work. They fail because they treat it like a campaign instead of a motion."

What follows: the specific role combinations, benchmarks, and tactics that separate teams who multithread from teams who just say they do.

What You Need (Quick Version)

The execution gap in one sentence: 90% of BDRs claim they multithread, but 70% of opportunities still have a single point of contact.

Three things multithreading actually requires:

- Stakeholder mapping - know who's in the buying committee before your first outreach, not after replies slow down

- Cross-department coverage - threading 5 contacts in the same department barely moves win rates; threading across 3+ departments pushes win rates to 44%

- Verified contact data for the full committee - you can't thread stakeholders you can't reach

The single most counterintuitive insight: personalizing content to individual stakeholders actually hurts buying group consensus by 59%. Group-relevant messaging wins. More on that below.

The Data - What Multi-Threading Actually Does to Win Rates

A quick correction before we dig in: you'll see "500 opportunities" cited across almost every multithreading article on the internet. That was UserGems' original study. Their expanded analysis grew the dataset to over 5,000 opportunities across multiple B2B SaaS companies. The conclusions got stronger, not weaker.

The headline numbers:

- Multithreaded deals have a 480% higher win rate (5x) compared to single-threaded deals

- Multithreaded deals are 57% larger in deal size

- When multithreading involves a previous champion - someone who bought from you at a prior company - win rates jump to 8x baseline with 2.5x bigger deals

That compounding effect is the real story. The combination of "I know someone inside" plus "I'm talking to multiple people" creates a multiplier that dwarfs either tactic alone. For context, 8x the single-threaded baseline of ~5% puts the absolute win rate around 40%, roughly in line with the best cross-department threading numbers below.

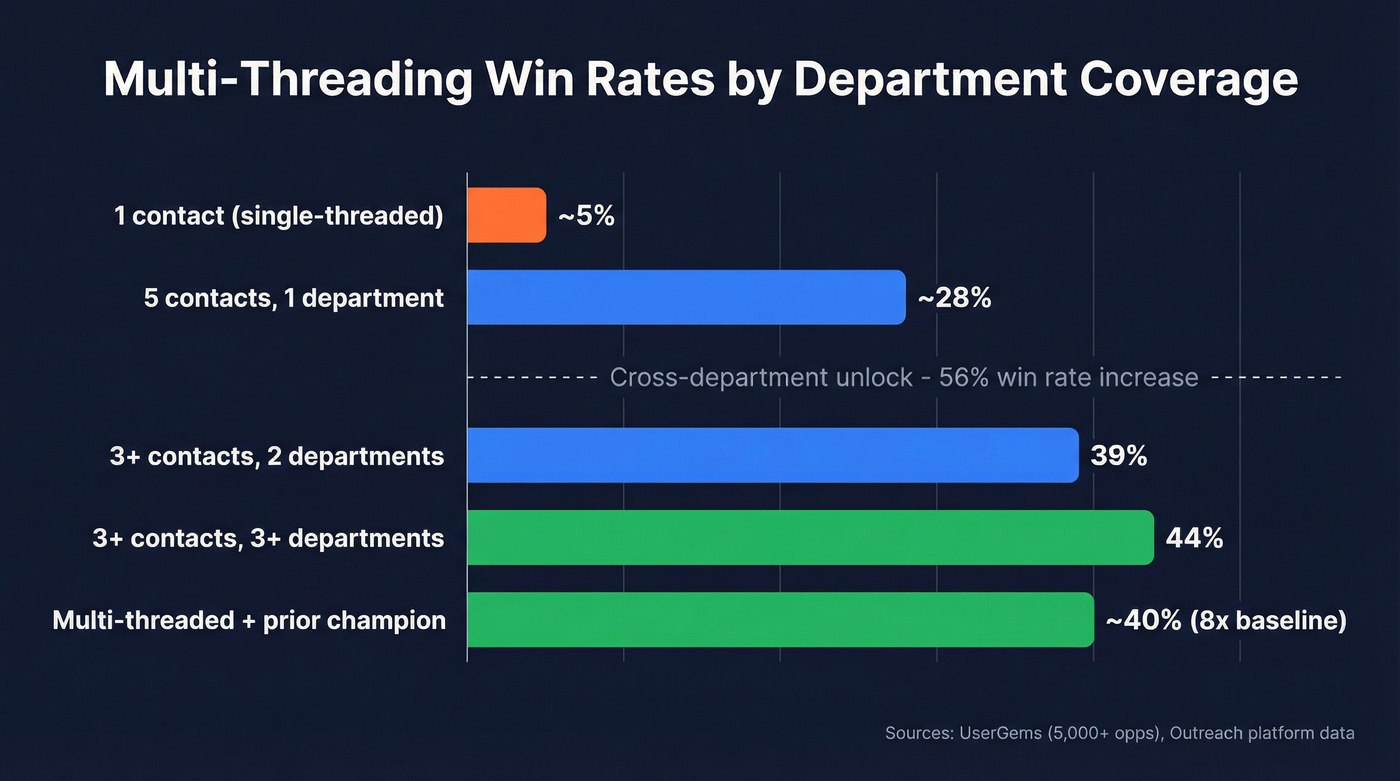

But not all multithreading is created equal. Adding five contacts from the same department is fundamentally different from threading across departments. Data from Outreach's platform (millions of deals) and UserGems' opportunity analysis paints a clear picture:

| Threading Level | Win Rate | Source |

|---|---|---|

| 1 contact (single-threaded) | ~5% | UserGems |

| 5 contacts, 1 dept | ~28% | Outreach |

| 3+ contacts, 2 depts | 39% | Outreach |

| 3+ contacts, 3+ depts | 44% | Outreach |

| Multi-threaded + prior champion | ~40% (8x baseline) | UserGems |

The jump from single-department to cross-department threading is a 56% increase in win rate. That's not marginal. That's the difference between a team that hits quota and one that doesn't.

I've seen teams celebrate getting "multithreaded" because they added the champion's direct report and their colleague in the same function. That's not multithreading. That's threading deeper into one silo. The real unlock is functional coverage: getting IT, Finance, Procurement, and the business unit all engaged before the deal reaches a formal evaluation stage.

And the urgency is real. Forrester's data shows the average B2B purchase now involves 13 stakeholders, and 89% of buying decisions cross multiple departments. 41% of buyers already have a preferred vendor before formal evaluation begins. If you aren't threading early and wide, you're losing to the competitor who already has relationships across the committee.

The Consensus Problem Nobody Talks About

Here's where most multithreading advice goes wrong: it treats the strategy as purely a risk-mitigation play. "Talk to more people so you don't lose the deal when one leaves." That's true but incomplete.

The deeper reason multithreading works is consensus.

Gartner's research found that 74% of B2B buyer teams demonstrate "unhealthy conflict" during the buying decision process. Buying groups range from 5 to 16 people across as many as 4 functions. These people don't agree with each other. They have different priorities, different risk tolerances, and different definitions of success.

When buyers reach consensus, they're 2.5x more likely to report a high-quality deal. When they don't, deals stall. And 86% of B2B purchases stall during the buying process.

Here's the part that should bother you: 81% of buyers end up dissatisfied with the vendor they ultimately choose. That's not a product problem - it's a buying process problem. Too many stakeholders felt unheard or unconvinced.

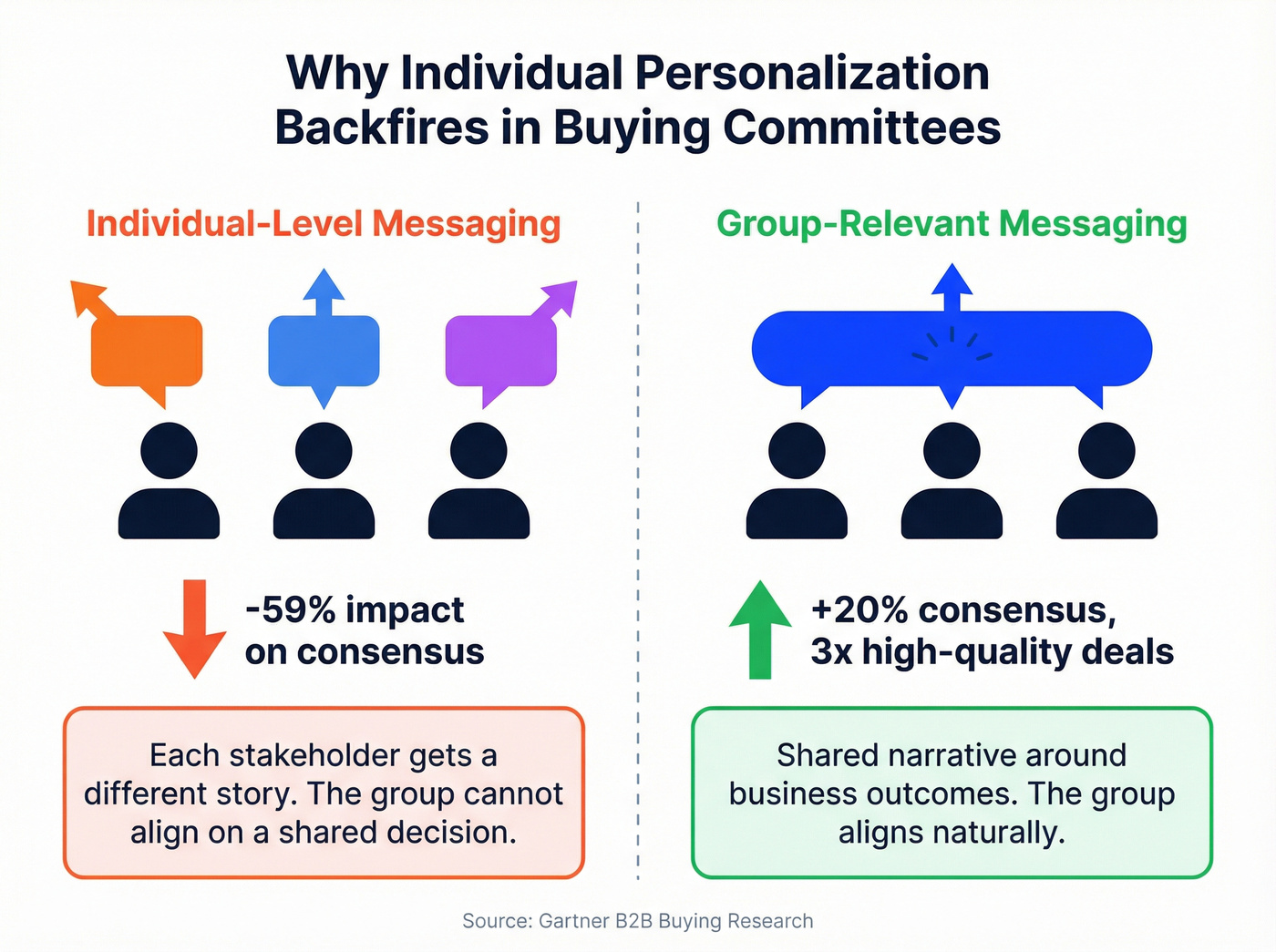

Now the counterintuitive part, and this is critical for how you message across a buying committee: content tailored for individual-level relevance creates a 59% negative impact on buying group consensus. Individual personalization - the thing every sales playbook tells you to do - actually makes it harder for the group to agree.

What works instead? Content designed for buying group relevance. When stakeholders experience group-relevant messaging, they're 3x more likely to report a high-quality deal. Group relevance positively impacts consensus by 20%.

The practical implication: when you're threading across a buying committee, don't send the CFO a finance-only pitch and the CTO a tech-only pitch. Send both of them messaging that frames the decision in terms the whole group cares about - business outcomes, risk reduction, competitive positioning. The individual details matter, but the shared narrative matters more.

This is why multithreading isn't just a sales tactic. It's a consensus-building mechanism. You aren't just hedging against champion churn. You're actively helping the buying group align - which is the thing they're worst at doing on their own.

My hot take: most teams that "do ABM" are really just doing targeted outbound to one person at a named account. Real account-based multi-threading means orchestrating consensus across a buying committee. If your ABM motion doesn't include a plan for how 5-13 people will agree to buy from you, you're doing account-based marketing in name only.

Multi-threaded deals win at 5x the rate - but only if you can actually reach every stakeholder. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobiles across every department in your target account.

Map the full buying committee and get verified contact data for $0.01 per email.

Which Roles to Thread (And in What Combination)

Individual Role Impact on Win Rates

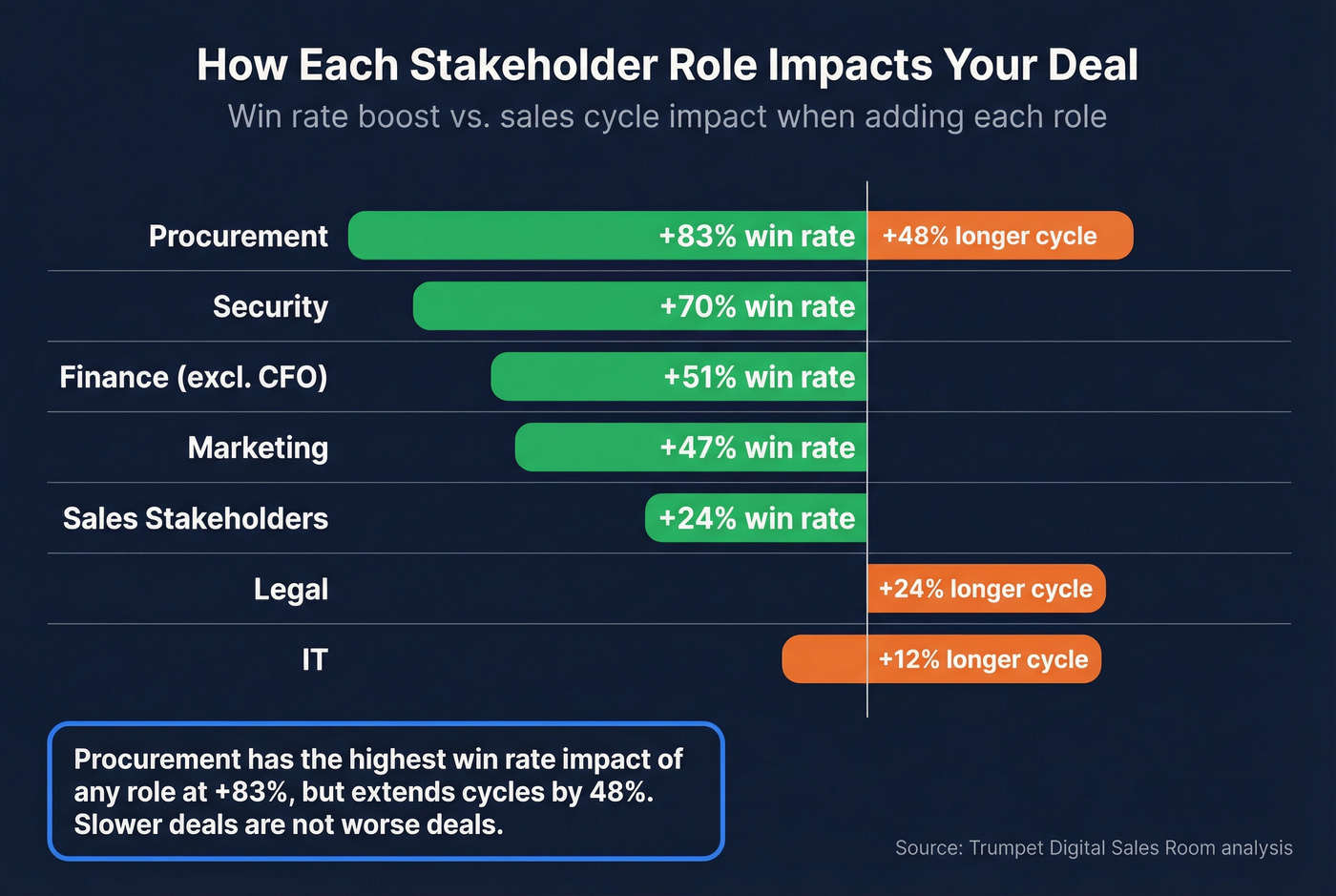

Not all stakeholders are created equal. Trumpet analyzed thousands of their Digital Sales Rooms and produced the most granular role-impact data I've found anywhere:

| Role Added | Win Rate Impact | Cycle Impact |

|---|---|---|

| Procurement | +83% | +48% longer |

| Security | +70% | - |

| Finance (excl. CFO) | +51% | - |

| Marketing | +47% | - |

| Sales stakeholders | +24% | - |

| Legal | - | +24% longer |

| IT | - | +12% longer |

The procurement paradox jumps off the page. Adding Procurement to a deal increases your win rate by 83% - the highest of any individual role. But it also extends your sales cycle by 48%.

Slower doesn't mean worse.

Procurement involvement signals the deal is real, that budget is being formally allocated, and that the organization is taking the purchase seriously. If you're avoiding Procurement because they slow things down, you're optimizing for speed over wins. That's backwards.

Security at +70% is another surprise. In an era where every SaaS purchase gets a security review, engaging Security early - before they become a blocker in week 11 - dramatically improves outcomes.

The Highest-Performing Stakeholder Combinations

Individual roles matter, but combinations matter more. The highest-performing stakeholder combos from the same Digital Sales Room analysis:

- C-suite + Sales + Marketing + IT: +158% win rate

- C-suite + CFO + Sales + Marketing: +158% win rate

- C-suite + Sales + Marketing: +117% win rate

- Sales + IT: +78% win rate

- Sales + Product: +60% win rate

- Finance + Sales: +60% win rate

The best-performing deals had 4+ roles working together. The +158% combos both include C-suite plus three functional areas - that's the cross-department threading the Outreach data pointed to, now with specific role names attached.

For mapping these roles, Accord's stakeholder archetypes provide a useful framework: Economic Buyer, Technical Evaluator, Champion, End User, Influencer, Blocker, Decision Maker, and Gatekeeper. Not every deal has all of them, but every deal has more than the one person you're currently talking to.

Real talk: most AEs can name their champion and maybe the economic buyer. They can't name the Technical Evaluator, the Blocker, or the Gatekeeper. That gap kills deals in the final stages when someone you've never spoken to raises an objection you've never heard.

The Playbook - How to Actually Execute ABM Multi-Threading

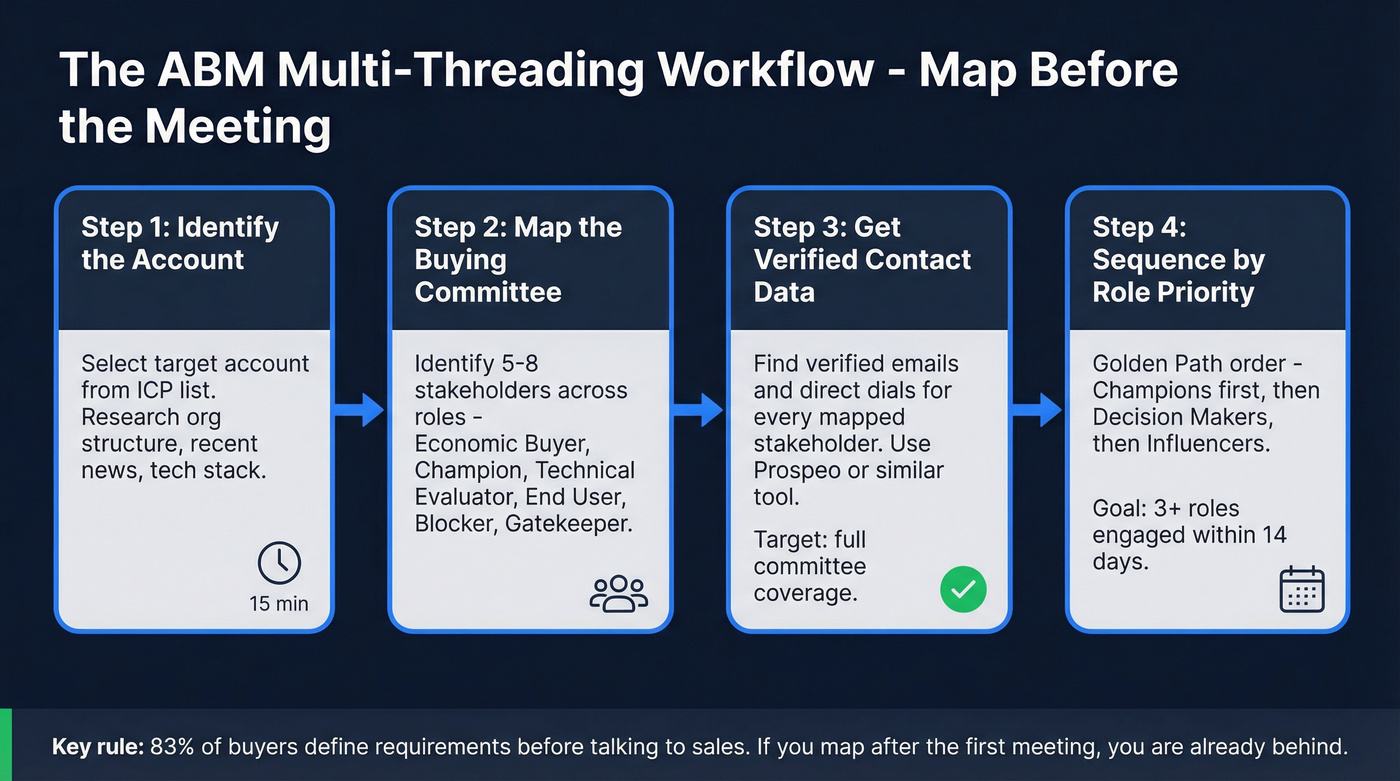

Map Before the Meeting

The single biggest tactical mistake in multithreading is waiting too long. Most reps start threading after the deal stalls - after replies slow down, after the champion goes quiet, after the forecast starts looking shaky. By then, you're playing defense.

83% of buyers define their purchase requirements before ever speaking with a sales rep. If you're waiting until discovery to figure out who's involved, the committee has already been meeting without you.

The 30 Minutes to President's Club framework nails this: map Champions, then Decision Makers, then Influencers before your first outreach. They call it the Golden Path. Determine who you need to reach and in what order before you ever send an email.

Directive's ABM playbook sets a concrete target: 3+ roles engaged within 14 days. Not 3+ roles eventually. Within two weeks. That forces the mapping to happen upfront, not as a reaction to a stalling deal.

The mapping itself doesn't need to be complicated. For each target account, identify:

- Who owns the budget (Economic Buyer)

- Who evaluates the tech (Technical Evaluator)

- Who uses it daily (End User / Champion)

- Who can kill the deal (Blocker - usually Security, Legal, or Procurement)

- Who influences the decision-maker (Influencer)

Then figure out which of those people you can actually reach. This is where most teams hit a wall - they've mapped the committee but only have verified contact data for one or two people.

Make the Ask in the Buyer's Interest

Once you've got your champion engaged, you need to expand. The 30MPC template for this is elegant: frame the ask in the prospect's interest, not yours.

Bad: "Can you introduce me to your CFO? I'd love to present our ROI model."

Good: "Typically when it comes to compensation decisions, I've seen it blow up if someone like your CHRO, Jane, isn't involved early. Would it make sense to loop her in now so there aren't surprises later?"

The difference is subtle but massive. The first version is about you getting access. The second is about protecting the champion from internal blowback. Champions respond to the second because it makes them look smart, not because it helps you sell.

Another 30MPC technique: ask questions your champion doesn't know the answer to. When they say "I'm not sure how our security team would evaluate that," you've just created a natural opening to bring Security into the conversation. The champion realizes they need you in the room with the exec because you're asking things they can't answer alone.

The 5-Minute Drill at the end of discovery: Do you wanna buy? When do you wanna buy? How do you buy? Those three questions surface the buying process - and the people involved in it - faster than any other framework we've tested.

Get Scrappy - The CXO Benign Note and Other Tactics

When the champion can't or won't introduce you upward, get creative.

The CXO-to-CXO benign note is one of the most underused tactics in enterprise sales. Early in the cycle, have your CEO or CRO send a brief note to their decision-maker: "I understand our teams are meeting. Just wanted to extend my support exec-to-exec - happy to be a resource if needed." That's it. No pitch. No ask. Just a line you can call on later when you need executive access.

Top-down vs. bottom-up selling paths work differently:

- Top-down: Start at power, ask for intros to department leads, circle back with a recommendation. Faster but harder to initiate.

- Bottom-up: Win the champion, work across to department leads, use consensus to drive up to power. Slower but more common.

Directive's approach uses meeting-first offers - tailored benchmarks, assessments, findings reviews - instead of generic content downloads. Executives don't download whitepapers. They take meetings that promise specific, relevant insights about their business.

The access problem is solvable. The alignment problem takes strategy. But you can't work on alignment if you can't reach the people who need to align.

Execution Benchmarks - What Top BDR Teams Actually Do

The 6Sense 2026 BDR Benchmark - surveying 262 BDRs - paints a clear picture of what execution actually looks like at scale.

Contacts per account: 9 (up from 6.4 in 2024). That's a 40% increase in threading depth year-over-year.

Attempts per contact: 21 total - roughly 5 social touches, 8 calls, and 8 emails. This isn't "send two emails and move on." It's sustained, multi-channel engagement across every thread.

Cadence length: 53 days before the average BDR gives up on a contact.

That's almost two months of persistence per thread.

The time investment is real. Yess.ai's data puts it at 3-5 hours per week per account to maintain quality threads. For a BDR managing 20-30 accounts, that math gets tight fast. This is why the "multithread every account" advice is dangerous - you physically can't execute at this depth across your entire book.

An active thread means a contact who has responded to outreach within the last 14 days. By that standard, most "multithreaded" deals aren't actually multithreaded - they have multiple contacts in the CRM, but only one active conversation.

The target: first value delivery to all 3+ roles by day 14. Measurable cycle-time improvement within 30-45 days. Directive sets an SLA of 25%+ meeting rate from marketing-qualified accounts for Tier 1 targets.

Here's a quick self-assessment:

- Are you reaching 9+ contacts per account? (If not, you're below the current BDR median)

- Are you threading across 2+ departments? (If not, you're leaving the biggest win-rate gains on the table)

- Can you name the Blocker in your top 10 deals? (If not, you're going to get surprised)

- Do you have verified contact data for every mapped stakeholder? (If not, your map is theoretical)

The ABM technology market is projected to grow from $1.1B to $3.1B by 2030. Companies with mature ABM tech stacks see 38% higher win rates and 36% higher customer retention. But 74% of companies start ABM with general-purpose tools before scaling into dedicated platforms. You don't need a $200K tech stack to start multithreading - you need accurate data and a disciplined process.

The Contact Data Problem - Why Multi-Threading Dies at the Data Layer

Contact data is the #1 resource BDRs request to feel more equipped. Not better sequences. Not more AI tools. Data.

Here's the scenario we've watched play out repeatedly: a BDR team maps 50 accounts. They identify 5-8 stakeholders per account. Six months later, 70% of those accounts still have a single active thread. The other contacts? Bounced emails, wrong numbers, no response. The map existed. The data didn't.

40% of deals stall because the primary contact left or changed roles. Average B2B buyer tenure has dropped to 18 months. Your champion from Q1 might be gone by Q3. If you haven't threaded beyond them - with verified, current contact data - you're starting over.

The proof point: after deploying Prospeo, Snyk's 50 AEs saw bounce rates drop from 35-40% to under 5%. AE-sourced pipeline jumped 180%, generating 200+ new opportunities per month. That's what happens when your data layer actually supports the threading strategy instead of undermining it.

LeanData generated a 32% increase in pipeline and $100K in new sales within a single week of implementing structured multithreading. The pattern is consistent - when you combine the strategy with the data to execute it, the results compound fast.

Threading across 3+ departments pushes win rates to 44%. That means reaching IT, Finance, Procurement, and the business unit - not just your champion's team. Prospeo's 30+ filters let you search by department, seniority, and buyer intent to find every committee member.

Stop single-threading deals because you're missing contact data.

Mistakes That Kill Multithreaded Deals

1. Waiting too long for executive engagement. By the time your deal is in Stage 3 and you still haven't talked to the economic buyer, you're already behind. Thread to power within the first three touches, not after the champion says "let me check with my boss."

2. Sending group-irrelevant messaging across roles. This is where the Gartner consensus data becomes tactical. Sending the CFO a finance-only pitch and the Product lead a tech-only pitch feels personalized, but it makes it harder for the group to agree. Frame the decision in terms both care about - business outcomes, competitive positioning, risk reduction - then layer in role-specific details.

3. Ignoring blockers until final stages. Discovering that IT Security requires a SOC 2 Type II audit in week 11 of a 12-week cycle is a disaster. Engage potential blockers early - even if it slows the deal down. Remember: Procurement adds 48% to cycle length but increases win rates by 83%.

4. Uncoordinated team execution. Your SDR sends one message. Your AE sends a contradictory one. Your SE follows up with a third narrative. The buying committee compares notes - and you look disorganized. Coordinate messaging across your team before threading across theirs.

5. Abandoning your champion. In the rush to thread upward and outward, don't forget the person who got you in the door. Your champion is your scout, your internal advocate, and your early warning system. The moment they feel bypassed, you've lost your best asset.

6. Multithreading every account. This is the contrarian point that matters most. Multithreading 100 accounts means you're multithreading zero accounts well. At 3-5 hours per week per account, you can realistically execute deep multithreading on 10-15 accounts. Focus on the 20% that represent 80% of your pipeline value.

One more: CFOs hold final decision power in 79% of purchases. If your multithreading strategy doesn't include a path to the CFO - even an indirect one through Finance or Procurement - you're threading to people who can say yes but can't sign.

When Multithreading Doesn't Work

Multithreading isn't a universal strategy. It's a high-investment, high-return play that only makes sense under specific conditions.

Skip it when:

- Deal sizes are in the low four figures. For sub-$10k transactions, the 3-5 hours per week per account doesn't justify the return. Find the single decision-maker and close fast.

- You're selling a single-user tool with no organizational buying process. If one person can swipe a credit card and start using it, there's no committee to thread.

- The buying process is truly centralized. Some organizations - usually smaller ones - have a single person who makes all software decisions. Threading around them just annoys everyone.

Invest heavily when:

- Deals are five figures or above

- Sales cycles run 60+ days

- You're selling into organizations with 200+ employees

- Multiple departments will use or be affected by your product

- You've lost deals in the past because a champion left or a blocker appeared late

Honestly, if your average deal size sits below $15k, you probably don't need multithreading at all. You need a faster sales motion with fewer steps. Multithreading is a weapon for complex, high-value deals - using it on transactional ones is like bringing a sniper rifle to a knife fight.

The 80/20 framing is the right mental model. Identify the 20% of your accounts that represent 80% of your pipeline value. Those get the full multithreading treatment - mapped committees, cross-department outreach, 9+ contacts, sustained cadences. Everything else gets a lighter touch.

FAQ

How many contacts should you multithread per account?

The current BDR benchmark is 9 contacts per account across 2-3 departments. Cross-department coverage matters more than raw count - 3+ departments engaged yields a 44% win rate versus 28% for single-department threading. Start with 5 contacts across 2 departments and scale from there.

What's the difference between multithreading and multi-channel outreach?

Multi-channel means reaching one person via email, phone, and social. Multithreading means engaging multiple stakeholders across different roles and departments simultaneously. They're complementary - you should multithread your accounts and use multi-channel to reach each individual thread.

Does multithreading work for SMB deals or only enterprise?

Multithreading delivers the strongest ROI on deals above $25k with 60+ day cycles. Below that threshold, the 3-5 hours per week per account investment rarely pencils out. For lower-ticket sales, focus on identifying and closing the single decision-maker quickly.

What's the best way to get verified contact data for an entire buying committee?

Prospeo's B2B Database lets you filter by company, department, and seniority to pull entire committees at once - 300M+ profiles with 98% email accuracy and 125M+ verified mobiles on a 7-day refresh cycle. The free tier (75 emails/month) is enough to map your first few target accounts.