Account Based Marketing Goals (ABM) That Actually Move Revenue

Every ABM program looks great in a slide deck until someone asks, "Cool - what changed in pipeline and revenue?" Account based marketing goals are the difference between an ABM motion that compounds and one that turns into a quarterly attribution argument.

Here's the thing: if your goals don't force clarity on coverage, meetings, and pipeline movement, you'll end up celebrating "engagement" while Sales stares at an empty calendar.

I've watched teams do genuinely good ABM work and still get it cut because they couldn't explain the scoreboard in plain English.

What you need (quick version)

- Pick "progress" goals, not lead goals. ABM success is movement inside a target account list - coverage → engagement → meetings → pipeline - not MQL volume.

- Keep your target account list tight. If your TAL is bloated, penetration and coverage targets become fantasy math.

- Define the buying group per account. You're not targeting companies; you're targeting roles (economic buyer, technical evaluator, security, finance, ops, end-user leader).

- Set coverage goals before pipeline goals. If you can't reach the buying group, you can't create meetings, pipeline, or velocity.

- Use an engagement score Sales can explain back to you. If they can't repeat it in 30 seconds, they won't act on it.

- Separate sourced vs influenced pipeline on day one. Decide the rules before the quarter starts or you'll spend the quarter fighting.

- Run a cadence: weekly leading indicators , monthly pipeline, quarterly revenue/cohort lift.

- Hot take: If you can't keep ABM outbound bounces under 5%, stop scaling plays and fix data + targeting first - otherwise you're just burning domains and trust.

- Execution note: When coverage's the bottleneck (it usually is), verified contacts make penetration and meeting goals achievable without wrecking deliverability.

What ABM goals are (and what they are not)

ABM goals are the outcomes you commit to inside a defined set of accounts - measured in a way Sales will accept and act on. In practice, the objectives of account-based marketing are to focus resources on the accounts most likely to buy, coordinate Marketing + Sales actions, and turn that focus into measurable pipeline and revenue.

They're not "run ads," "send personalized emails," or "launch a sequence." Those are activities. Activities are inputs; ABM goals are the scoreboard.

The cleanest way to keep everyone honest is the chain leadership actually cares about: engagement → pipeline → velocity → revenue. ABM works when your goals map to that chain and your weekly metrics show progress before revenue shows up.

Concrete example:

- Activity goal (weak): "Send 1,000 personalized emails to Tier 1 accounts."

- Outcome goal (strong): "Reach 8/10 buying-group roles in Tier 1 accounts and book 12 meetings from 'Hot' accounts this month."

Mutiny found 97% of marketers and sellers agree tighter collaboration would boost revenue. Shared goals aren't a nice-to-have in ABM - they're the whole game. In our experience, "successful" ABM campaigns die because Sales doesn't trust the measurement, not because the creative's bad.

ABM goals vs ABM metrics vs ABM KPIs

- ABM goals: Business outcomes you're committing to (example: "Create $1.5M in pipeline from Tier 1 accounts").

- ABM metrics: Raw measures you can observe (example: meetings held, engaged roles, stage conversion).

- ABM KPIs: The few metrics you manage weekly/monthly (example: coverage %, penetration rate, engagement score, pipeline contribution, velocity).

Leading vs lagging indicators (why ABM needs both)

Enterprise ABM runs on long cycles. If you only measure closed-won, you'll look "unsuccessful" for months even when you're doing the right work.

Do

- Manage weekly with leading indicators (coverage, engaged roles, meetings held, early-stage opp creation).

- Prove quarterly with lagging indicators (win rate lift, revenue, payback).

Don't

- Use MQL volume as your ABM scoreboard.

- Let "influenced pipeline" be your only win condition.

- Pick 12 KPIs and review none of them consistently.

2026 reality check (Momentum ITSMA benchmark)

Momentum ITSMA's benchmark study of 279 ABM practitioners makes one thing obvious: most teams are still building the muscle. Only 17% report ABM is fully embedded across the organization. The upside's real, though - teams report meaningful gains, including improved alignment (66%) as ABM matures. Translation: your goal system has to be operational, not aspirational. If you can't run it weekly, it won't survive the quarter.

Account based marketing goals framework (the taxonomy you'll use)

You don't need a complicated model. You need a model that shows progress early and proves revenue later.

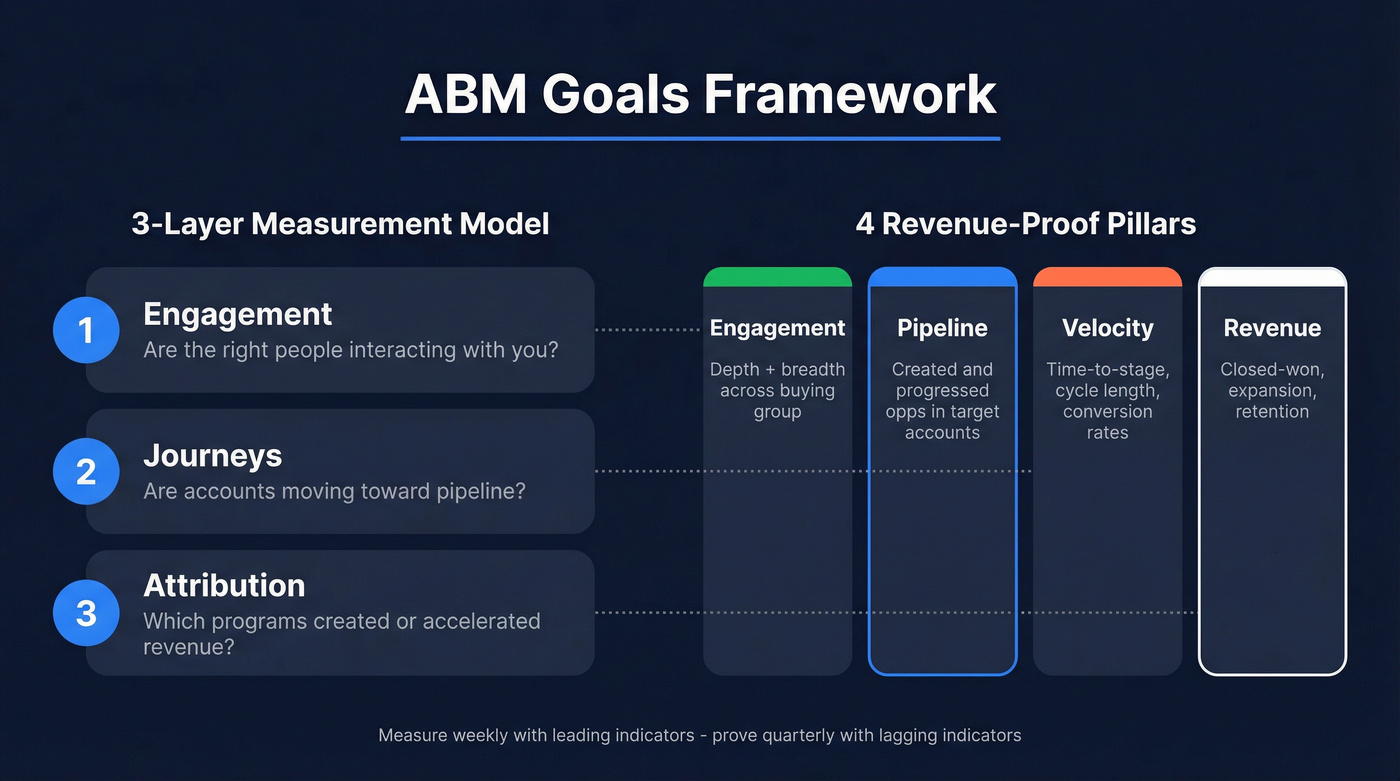

A practical way to structure it is a 3-layer measurement model (how ABM runs day to day) mapped to 4 revenue-proof pillars (what leadership accepts).

What breaks in real ABM ops (and what this framework fixes)

- TAL sprawl: 600 "target accounts" means you're targeting none. Fix: tiering + coverage math.

- Single-threading: one champion engages; procurement/security never sees you. Fix: buying-group coverage goals.

- Vanity engagement: dashboards celebrate clicks; pipeline doesn't move. Fix: engagement thresholds that trigger plays.

- Attribution trench warfare: sourced vs influenced gets re-litigated weekly. Fix: definitions + CRM fields up front.

- CRM hygiene debt: missing roles, duplicate accounts, stale contacts. Fix: instrumentation + refresh cadence.

The 3-layer measurement model (Engagement / Journeys / Attribution)

- Engagement: Are the right people in the right accounts interacting with you?

- Journeys: Are accounts moving through stages toward pipeline and revenue?

- Attribution: Which programs created or accelerated pipeline/revenue?

The 4 revenue-proof goal pillars (Engagement / Pipeline / Velocity / Revenue)

- Engagement: depth + breadth across the buying group

- Pipeline: created and progressed opportunities in target accounts (including motions where SDR + ads + web personalization work together)

- Velocity: time-to-stage, cycle length, and conversion rates

- Revenue: closed-won, expansion, and retention impact

How to choose 3 "north-star" goals

Use the dependency chain (this prevents wishful thinking):

- Buying-group coverage + engagement (if you can't reach people, nothing else works)

- Pipeline contribution (sourced + influenced, defined cleanly)

- Velocity lift (stage conversion + cycle time improvements)

Revenue's the outcome you validate quarterly; it's rarely the best weekly management goal.

| Goal category | What it proves | Leading/Lagging | Owner (Mktg/Sales/RevOps) | Example KPI |

|---|---|---|---|---|

| Engagement | You're reaching the buying group | Leading | Marketing + RevOps | % accounts with 6+ engaged roles |

| Engagement | Interest's real (not just impressions) | Leading | Marketing | Account engagement score (0-100) |

| Journeys | Accounts are progressing toward pipeline | Leading → mid | RevOps + Sales | Stage progression rate (Engaged → Meeting → SQL) |

| Journeys | ABM's accelerating deals | Mid → lagging | RevOps | Days from first engagement to opp created |

| Attribution | ABM's creating pipeline | Lagging-ish | RevOps + Marketing | Marketing-sourced pipeline from TAL |

| Attribution | ABM's influencing pipeline | Lagging-ish | RevOps | Marketing-influenced pipeline from TAL |

| Attribution | ABM improves revenue outcomes | Lagging | Sales + RevOps | Win rate in ABM cohort vs non-ABM |

You just read that coverage is the #1 bottleneck in ABM. Reaching 8/10 buying-group roles per account requires verified contact data - not stale records that torch your domain. Prospeo delivers 98% email accuracy and 125M+ verified mobiles, refreshed every 7 days.

Hit your buying-group coverage targets without a single bounced email.

ABM goals by program type (1:1, 1:few, 1:many) + budget realism

Most ABM goal-setting breaks because teams run "one ABM program" with one set of goals. In reality, you're running tiers:

- 1:1 for whales (depth and deal control)

- 1:few for clusters (repeatable personalization)

- 1:many for scale (coverage + intent + efficient plays)

Budget has to match ambition. nRich's heuristic for 1:1 ABM spend as a percent of ACV is a solid sanity check: 1% / 3% / 5% of ACV depending on deal size. Gartner Digital Markets also notes that $100M+ firms allocate nearly a quarter of marketing budget to ABM, which is exactly why your goals have to stand up in a revenue review.

1:1 ABM goals (depth, stakeholders, meetings, pipeline per account)

For top accounts, goals should be account-specific and sales-adjacent:

- Engage multiple stakeholders (not just one champion)

- Set executive meetings

- Create pipeline per account (set a per-account target)

This is where you earn the right to ask for air cover from leadership, because you're tying effort to a handful of deals that actually matter.

1:few ABM goals (cluster personalization, stage movement)

Cluster by industry, use case, or tech stack:

- Move accounts from "aware" → "engaged" → "meeting"

- Improve stage conversion rates for the cluster

- Run personalization that's repeatable (not bespoke per account)

1:many ABM goals (coverage + intent + scalable engagement)

This tier's about breadth:

- Buying-group coverage at scale

- Intent + engagement signals that trigger SDR plays

- Efficient pipeline contribution, not handcrafted experiences

| ABM tier | Typical TAL size guidance | Primary goal | Best leading indicator | Budget heuristic |

|---|---|---|---|---|

| 1:1 | 5-25 accounts | Pipeline per account + exec meetings | Engaged roles per account | 1% / 3% / 5% of ACV (1:1) |

| 1:few | 25-100 accounts | Stage movement + cluster conversion | Engagement score by cluster | Mid spend (ads + content + SDR time) |

| 1:many | 100-500+ accounts | Coverage + scalable pipeline contribution | % accounts hitting "Hot" threshold | Lower spend/account, higher automation |

ABM goals metrics (formulas + benchmarks)

You don't need 40 KPIs. You need a handful that are measurable, explainable, and tied to revenue.

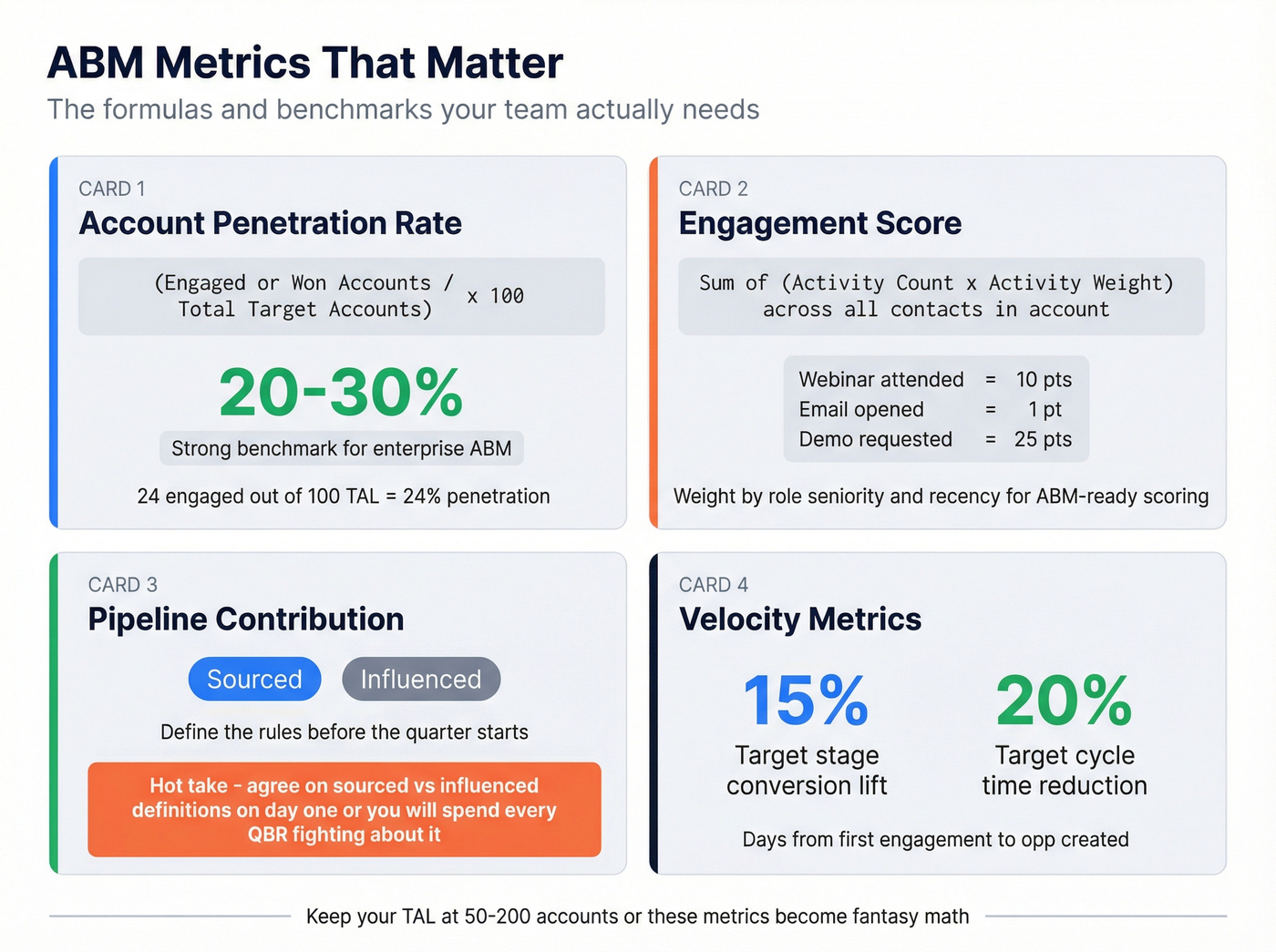

Salesmotion's formulas are worth using because they're simple enough to run without a data science project. Their guidance also matches what works in practice: keep your TAL at 50-200 accounts (or tier hard), or your coverage and penetration goals won't move.

Account penetration rate (formula + "what good looks like")

What it measures: How many target accounts are actually "in play" (engaged, in pipeline, or won).

Formula: Account penetration rate = (# engaged/won target accounts ÷ total target accounts) × 100

Benchmark: In enterprise ABM, 20-30% penetration is strong.

Worked example:

- TAL = 100 accounts

- Engaged or won = 24 accounts

- Penetration = (24 ÷ 100) × 100 = 24%

Engagement score (simple version + composite logic)

Engagement score (simple) = Σ(activity count × activity weight) across contacts in the account

Make it ABM-ready:

- Weight by role (decision maker > practitioner)

- Add decay (recent activity matters more)

- Cap spammy actions (so one person doesn't inflate the account)

Meetings: the KPI that stops "engagement theater"

If you want one metric that forces honesty, it's meetings held from target accounts. Clicks don't pay salaries; meetings create opportunities.

Real scenario: we worked with a team that had a gorgeous engagement dashboard and a brutal QBR. Sales asked one question: "Which accounts should my reps call on Monday?" Marketing couldn't answer without opening three tabs and arguing about intent vs engagement. We rebuilt the goal stack around buying-group coverage and "Hot account" meeting plays, and suddenly the weekly meeting number became the metric everyone cared about because it was the only one that couldn't be hand-waved.

Mutiny shared a LaunchDarkly outcome--45 enterprise meetings in 60 days--by tightening targeting and running account-specific experiences. That's the chain in action: coverage → engagement → meetings.

Pipeline velocity by account (formula + levers)

Formula: Pipeline velocity by account = (# opportunities × avg deal size × win rate) ÷ sales cycle length (days)

Worked example:

- 4 opps × $250,000 avg deal × 20% win rate = $200,000 expected value

- Sales cycle = 72 days

- Velocity = $200,000 ÷ 72 = ~$2,778/day

Levers you can actually pull:

- Increase # opps (coverage + meetings)

- Increase win rate (better qualification + multi-threading)

- Reduce cycle length (stage-specific plays + exec alignment)

- Increase deal size (packaging, expansion paths)

Conversion + close-rate benchmarks (context you can use)

- Demandbase (citing TOPO, 2023) reports an account-based approach close rate of 53% vs 19% for traditional demand gen. Use this as context for lift, not a promise.

- Gartner Digital Markets publishes a benchmark that ABM can increase pipeline conversion rates by 14%--stage-to-stage conversion lift across the funnel.

Website personalization goals for ABM (don't ignore your highest-intent channel)

Most ABM teams under-measure the website, then wonder why "engagement" doesn't turn into meetings. Your site's where target accounts self-qualify, and the intent's often stronger than anything you'll see in an ad dashboard.

Set goals like:

- Target-account sessions: # of sessions from TAL accounts to high-intent pages (pricing, security, integrations, case studies)

- Personalized CTA conversion rate: conversion on tailored CTAs for Tier 1/industry clusters

- Meeting rate from personalized pages: meetings booked ÷ unique TAL visitors to personalized pages

If you can't measure these, your "personalization" is just nicer copy.

| Goal | KPI | Formula | Target/benchmark | Reporting cadence | Common pitfall |

|---|---|---|---|---|---|

| Coverage | Buying-group coverage | (# roles with contactable person ÷ total roles required) × 100 | 60-80% per Tier 1 account | Weekly | Counting "contacts in CRM" vs contactable people |

| Penetration | Account penetration rate | (# engaged/won target accounts ÷ total target accounts) × 100 | 20-30% strong (enterprise) | Weekly | TAL too big, penetration never moves |

| Engagement | Account engagement score | Σ(activity × weight) with caps/decay | Normalize 0-100; "Hot" at 51+ | Weekly | No caps → one person dominates |

| Meetings | Meetings held rate | (# meetings held ÷ # target accounts) × 100 | Tiered (example: 20-40% Tier 1) | Weekly | Counting "calls" instead of held meetings |

| Pipeline | Marketing-sourced pipeline | $ pipeline where marketing is opportunity source | Mature: 25-30% of total pipeline | Monthly | Changing definitions mid-quarter |

| Pipeline | Marketing-influenced pipeline | $ pipeline with marketing touches during cycle | Track trend; don't double-count sourced | Monthly | Treating influenced as the only win |

| Velocity | Pipeline velocity by account | (# opps × avg deal × win rate) ÷ cycle length | Improve QoQ | Monthly | Ignoring cycle length |

| Conversion | Stage conversion rate | (# moved to next stage ÷ # in stage) × 100 | ABM cohort > non-ABM cohort | Monthly | No cohorting |

| Revenue | Win rate (ABM cohort) | (# closed-won ÷ # closed) × 100 | Aim for lift; 53% vs 19% as context | Quarterly | Measuring too early |

| Revenue | Revenue from TAL | $ closed-won from target accounts | Set by tier + capacity | Quarterly | Crediting revenue without cohort controls |

Engagement scoring template you can copy (buying-group aware)

If you want Sales to trust your engagement score, it has to behave like a credit score: consistent, capped, and hard to game.

Adobe's buying-group engagement scoring mechanics are one of the most implementable models we've used because they include what most teams skip: a 30-day lookback, a daily cap of 20, and normalization to 0-100.

Scoring rules (weights, caps, decay)

Baseline rules:

- Lookback window: 30 days

- Daily cap: max 20 events per activity type per person

- Weights (example set):

- Attend event: 60

- Email open: 30

- Form fill: 40

- Pricing page view: 40

- Demo request: 60

- Normalization: convert raw points to a 0-100 score so thresholds stay stable

Practical scoring math:

- Raw score per person = Σ(activity count × weight), capped daily

- Apply 30-day decay by dropping old events

- Roll up to account score = Σ(person score × role weight)

- Normalize to 0-100

Role weighting (why a "Decision Maker" action counts more)

Adobe's role weighting model:

- Trivial 20

- Minor 40

- Normal 60

- Important 80

- Vital 100

In practice:

- Decision maker = Vital (100)

- Economic buyer = Vital (100)

- Champion = Important (80)

- Practitioner = Normal (60)

Thresholds that trigger plays (what Sales should do at 51+)

Atak's thresholds:

- Cold: 0-25 → keep warming (ads + light touches)

- Warming: 26-50 → SDR multi-threads, fills role gaps

- Hot: 51+ → trigger a defined play (meeting push, exec outreach, direct mail, tailored POV)

A "Hot" account has to create an action, not a dashboard celebration.

Buying-group coverage goals (the missing prerequisite)

ABM teams love to talk about personalization. Most teams can't even reach the buying group.

6sense puts buying groups at ~10 members on average. And 84% of buying groups choose a preferred vendor before contacting sellers, which means you're often late to the party unless you build coverage early and keep it current.

This is also where the awareness stage matters: if you can't reach enough of the buying group early, you can't build the familiarity that later converts into meetings and opportunities.

Coverage targets (example: "engage 6/10 roles" per account)

A practical Tier 1 coverage goal:

- Contactable people in 8/10 roles (coverage)

- Engaged people in 6/10 roles (penetration)

- 2+ roles at "Hot" threshold (momentum)

Start with a role map per ICP (economic buyer, technical evaluator, security, finance, ops, end-user leader). If you can't name the roles, you can't measure this.

Enterprise nuance: one "account" can be three buying centers

In enterprise, "Acme Corp" is often multiple regions, divisions, and P&Ls with separate buying groups. Set goals at account + buying center level (example: NA + EMEA, or Business Unit A + B). Track coverage and engagement per buying center so you don't mistake "one active division" for "account-wide momentum."

Contactability goals (deliverability/connect rate as ABM enabler)

Coverage isn't "we found a name." Coverage is "we can reach them."

Set explicit contactability goals:

- Email bounces: keep under 3-5% on ABM sends

- Phone connect: track pickup/connect rate for Tier 1 roles (if you’re using a predictive dialer)

- Freshness: job changes and role shifts get updated fast in enterprise

Look, nothing's more frustrating than watching a team spend weeks on "personalized" plays only to find out half the list was stale and the other half was catch-all addresses that never had a chance.

Data-quality dependency (keep it functional)

Operational coverage loop (simple, repeatable):

- List required roles per ICP and tag missing roles per Tier 1 account

- Enrich CRM records weekly to keep roles current (see instrumentation section)

Skip this if your CRM already has current, verified emails and direct dials for the buying group and your bounce rate's consistently under 3%. Most teams aren't that lucky.

ABM velocity goals collapse when reps waste hours hunting for direct dials and valid emails. Prospeo's 30+ filters - including intent data, job changes, and department headcount - let you map entire buying committees in minutes, not days. At $0.01/email, coverage math finally works.

Stop celebrating engagement while Sales stares at an empty calendar.

Pipeline goals without attribution wars (sourced vs influenced)

Attribution fights are the fastest way to kill ABM momentum. Fix it with definitions and decision rules before the quarter starts.

Markletic's benchmarks are a useful reference point:

- Mature territories: 25-30% marketing-sourced pipeline

- New territories: 40-45% marketing-sourced pipeline

- Expansion: 15-20% marketing contribution

One-sentence definitions (sourced vs influenced)

- Marketing-sourced pipeline: opportunities that wouldn't exist without marketing initiating them.

- Marketing-influenced pipeline: opportunities where marketing touched the account during an active sales cycle.

Both matter. Only one should be used for "who created pipeline."

Contribution targets by territory type

- Mature patch: optimize for velocity + win rate lift, not just sourced %

- New patch: marketing often does more creation, so sourced % runs higher

- Expansion: marketing's job is enablement + adoption signals, so contribution's lower but still measurable

CRM instrumentation (fields + minimum dashboard requirements)

Minimum viable setup:

- Opportunity field: Primary Campaign Source (especially for events)

- Target account flag on Account object

- Buying-group roles (even if it's a picklist per contact)

- Engagement score (account-level)

- Meeting set/held fields tied to account + opportunity

If you want this to stay clean at scale, add enrichment automation:

- API-based enrichment for RevOps pipelines: https://prospeo.io/data-enrichment-api

- Native connectors and workflow tools: https://prospeo.io/integrations

Dashboards you need on day one:

- Pipeline created from TAL (sourced + influenced)

- Stage movement for TAL opportunities

- Win rate and cycle length for ABM cohort vs non-ABM cohort

Dashboards + reporting cadence (30/60/90-day ABM goals plan)

ABM execution fails because teams don't run a cadence. Livestorm's stat is harsh and accurate: 67% fail to deliver expected results within the first year because the program never becomes operational.

Weekly: coverage + engagement + meetings held (leading indicators)

Week 1-4:

- Validate TAL size and tiering

- Build buying-group role map

- Set coverage targets per tier

- Launch engagement scoring v1

- Track meetings held from "Hot" accounts (and require a next step)

This is also where you earn Sales trust: show the list of "Hot accounts," the missing roles, and the exact play being run.

One sentence that changes the tone of the meeting: "Here are the 12 accounts we want you to work this week, and here's why."

Monthly: pipeline creation + stage movement

Days 31-60:

- Review pipeline created from TAL

- Review stage progression (Engaged → Meeting → SQL → Opp)

- Identify stuck stages and build plays (enablement + content + SDR sequences)

Quarterly: revenue impact + cohort comparisons (ABM vs demand gen)

Days 61-90 and beyond:

- Cohort analysis: ABM vs non-ABM win rate and cycle length

- Closed-won analysis using the last 3-6 months of deals so you're optimizing for the current ICP

- Resource allocation sanity check: 70/20/10 (core demand gen / ABM / experiments)

| Timeframe | What to review | Metrics | Owner | Decision you'll make |

|---|---|---|---|---|

| Weekly | Are we reaching the buying group? | Coverage %, engaged roles, engagement score, meetings held | Marketing + RevOps + SDR lead | Add roles, tighten TAL, trigger plays at 51+ |

| Monthly | Is ABM creating and moving pipeline? | Sourced/influenced pipeline, stage movement, opp creation rate | RevOps + Sales | Fix bottlenecks, adjust plays, re-tier accounts |

| Quarterly | Is ABM improving revenue outcomes? | Win rate, cycle length, revenue from TAL, expansion | Sales + RevOps | Double down on segments that win; cut noise |

Copy/paste ABM OKRs (by stage + tier)

OKRs work for ABM when they're tiered, measurable, and tied to the dependency chain (coverage → engagement → meetings → pipeline → velocity → revenue). Perdoo's style of OKRs is a good model because it forces specificity without turning ABM into a spreadsheet contest.

Use these as templates - swap in your tiers, TAL size, and baseline conversion rates.

OKRs for Engagement + buying-group coverage

Objective: Increase buying-group engagement across target accounts Key Results:

- Reach 8/10 buying-group roles contactable in 80% of Tier 1 accounts

- Move 30% of Tier 1 accounts to "Hot" (51+) engagement threshold each month

- Book 12 meetings held per month from "Hot" Tier 1 accounts (tracked in CRM)

OKRs for Pipeline contribution (sourced + influenced)

Objective: Create measurable pipeline impact from ABM Key Results:

- Create $X marketing-sourced pipeline from Tier 1-2 accounts this quarter

- Influence $Y pipeline in active opportunities within the TAL (tracked separately from sourced)

- Achieve Z% stage progression from SQL → Opportunity in the ABM cohort

OKRs for Velocity + win rate

Objective: Improve conversion and velocity in ABM accounts Key Results:

- Increase win rate in ABM-targeted accounts by 10% vs the last two-quarter baseline

- Reduce average sales cycle length for ABM cohort by 15%

- Improve stage conversion (Opportunity → Proposal) by 10% in ABM cohort

OKRs for Personalization (1:1 / Tier 1)

Objective: Make Tier 1 personalization drive meetings and deal progression Key Results:

- Develop tailored content for 10 key accounts (one POV asset or page per account)

- Increase meeting rate from Tier 1 personalized experiences to X% (meetings held ÷ engaged Tier 1 accounts)

- Improve early-stage progression for those 10 accounts (Engaged → Meeting or Meeting → SQL) by Y% vs Tier 1 baseline

OKRs for Expansion (existing customers)

Objective: Expand revenue in strategic customer accounts Key Results:

- Create $X expansion pipeline from Tier 1 customer accounts

- Engage 5 roles per customer buying group per quarter

- Increase renewal/expansion win rate by 10% in ABM customer cohort

Common ABM goal-setting mistakes (and fixes)

Lightstream's pitfalls list reads like a post-mortem of half the ABM programs we've seen: misalignment, stale content, and lazy measurement cadence. The fixes are simple. The discipline isn't.

Vanity engagement goals (what to replace them with)

Mistake: "Increase account engagement" with no definition. Fix: Define engagement as buying-group actions + thresholds (Cold/Warming/Hot) and tie "Hot" to a Sales play.

Mistake: Counting impressions and clicks as success. Fix: Track meetings held, stage movement, and pipeline created from the TAL.

Misalignment + unclear ownership (fix with shared KPIs)

Mistake: Marketing owns engagement, Sales owns pipeline, nobody owns velocity. Fix: Shared KPIs: coverage, meetings held, stage conversion, cycle length.

Mistake: Too many accounts dilutes coverage. Fix: Keep TAL in the 50-200 range (or tier hard) so penetration can move.

Under-instrumented CRM (minimum viable fields)

Mistake: No consistent way to tag target accounts and measure sourced vs influenced. Fix: Target account flag, buying-group roles, engagement score, meeting fields, and Primary Campaign Source on opportunities.

Mistake: Dashboards built once per quarter. Fix: Weekly leading indicator dashboard + monthly pipeline dashboard + quarterly cohort review (many teams pair this with sales call review software to tighten feedback loops).

FAQ about account based marketing goals

What are the most important ABM goals to start with?

Start with buying-group coverage and engagement, then pipeline contribution, then velocity. Coverage and engagement move weekly; pipeline and velocity prove impact over months; revenue's the lagging validation. A solid starting target is 60-80% buying-group coverage in Tier 1 accounts within the first 30 days.

What's a good account penetration rate in ABM?

A 20-30% penetration rate is strong for enterprise ABM, calculated as engaged/won target accounts divided by total target accounts. If you're stuck under 15% for multiple weeks, your target list's too big or you're missing key buying-group roles that would create meetings.

How do you define marketing-sourced vs marketing-influenced pipeline in ABM?

Marketing-sourced pipeline means marketing initiated the opportunity; marketing-influenced pipeline means marketing touched the account during an active sales cycle. Lock the rule before the quarter starts, and enforce it with at least one required CRM field (like Primary Campaign Source) so the definition doesn't change mid-quarter.

How many stakeholders should you engage per target account?

Plan for about 10 stakeholders in a typical buying group, then set a goal like engaging 6 out of 10 roles in Tier 1 accounts. This prevents single-threaded deals that stall in security, finance, or procurement and gives Sales multiple paths to advance the opportunity.

What tools help you hit buying-group coverage goals faster?

Tools that combine contact discovery with real-time verification help you fill missing roles without spiking bounce rates. Prospeo helps teams do that with 98% email accuracy, a 7-day refresh cycle, and 125M+ verified mobile numbers with a 30% pickup rate, so you can reach decision-makers and book meetings faster.

What to do next this week

- Cut your TAL to a size you can cover (or tier it hard) and write down the 8-10 roles that make up your buying group.

- Set two weekly goals you can manage: coverage % (contactable roles) and meetings held from "Hot" accounts.

- Lock your attribution rules (sourced vs influenced) and add the minimum CRM fields so reporting doesn't collapse mid-quarter (especially if you’re evaluating data providers - see Extruct AI vs ZoomInfo or DitLead vs Apollo.io).

If you want to remove the biggest operational bottleneck - missing stakeholders - wire coverage into your workflows and keep it current with enrichment and integrations (and sanity-check vendors with pricing guides like Wiza Pricing or FindThatLead Pricing).

Summary: The fastest way to make account based marketing goals real (not theoretical) is to manage weekly coverage and meetings, prove monthly pipeline movement, and validate quarterly revenue lift with clean cohorts and locked attribution rules.