The Best Sales Engagement Platform Alternatives for 2026: Pricing, Reviews, and What Actually Works

84% of sales reps missed quota last year. That shouldn't surprise anyone paying attention to how B2B buying has changed - [80% of sales interactions](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) now happen in digital channels, buyers spend only 17% of their time meeting with potential suppliers, and a third of them prefer a completely seller-free experience. The old playbook of hiring SDRs, handing them a dialer, and pointing them at a list is broken.

The sales tech market has exploded to over 11,000 solutions, and the average stack runs 8.3 tools at $187/rep/month. Most of that spend is wasted. 73% of teams blow $2,340/rep/year on overlapping tools with 40-60% functional redundancy. And 68% of sales leaders say tool overlap and data silos are actively hurting performance.

Here's the real kicker: 45.9% of companies not using automation cite "finding a platform with the right features" as their biggest obstacle. Not budget. Not buy-in. Just the overwhelming noise of too many options.

You don't need more tools. You need the right sales engagement platform alternatives - ones that match your team size, budget, and channels. I've run bake-offs across most of these platforms, and this is the guide I wish existed during those evaluations. Not a listicle of logos. An honest review of what each tool actually costs (including the stuff they hide), who it's built for, and where it falls apart. Fifteen platforms, ranked, with real pricing and real opinions.

Hot take: Most teams under 50 reps don't need an enterprise sales engagement platform at all. A lighter sequencer paired with accurate data will outperform a $150/user/month platform fed with stale contacts - every single time.

Our Picks (TL;DR)

| Pick | Tool | Best For | Starting Price |

|---|---|---|---|

| Best data accuracy | Prospeo | Verified emails + direct dials that make any SEP perform | Free / ~$0.01/email |

| Best all-in-one value | Apollo.io | SMBs wanting data + engagement in one platform | Free plan available |

| Best cold email at scale | Instantly | Agencies and lean teams wanting flat-fee pricing | $37/mo (flat-fee) |

| Best enterprise default | Salesloft | Mid-market to enterprise with coaching needs | ~$125/user/mo |

| Best for HubSpot users | HubSpot Sales Hub | Teams already in the HubSpot ecosystem | Free / $20/user/mo |

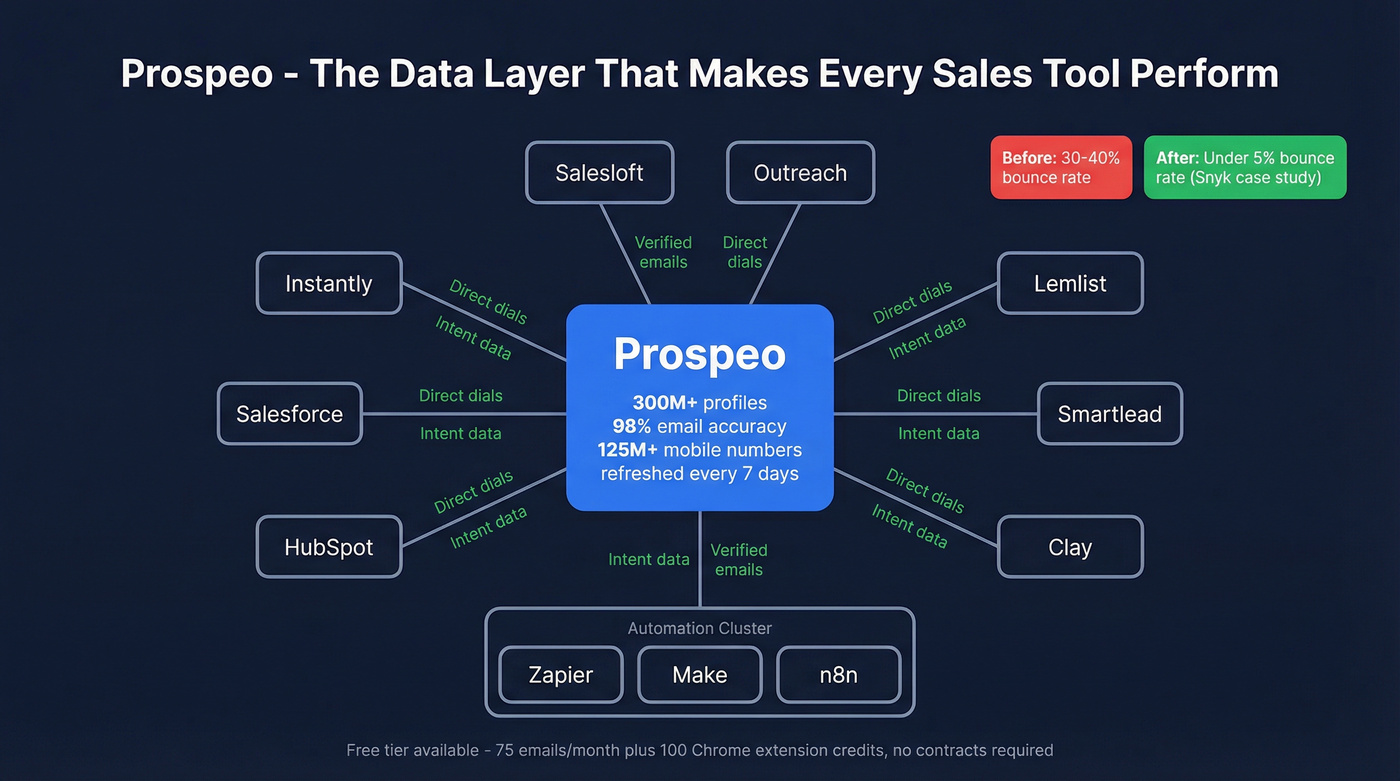

Prospeo isn't a sequencing tool - it's the data layer that makes every other tool on this list actually work. 98% email accuracy, 125M+ verified mobile numbers, and native integrations with Salesloft, Outreach, Instantly, Lemlist, Salesforce, HubSpot, Smartlead, Clay, Zapier, Make, and n8n. If your sequences are bouncing, the platform isn't the problem. Your data is.

Apollo is the obvious starting point for SMB teams who want prospecting and outreach in one place. Instantly is the flat-fee king for agencies. Salesloft and Outreach fight it out at the enterprise level - and I'll break down that head-to-head later.

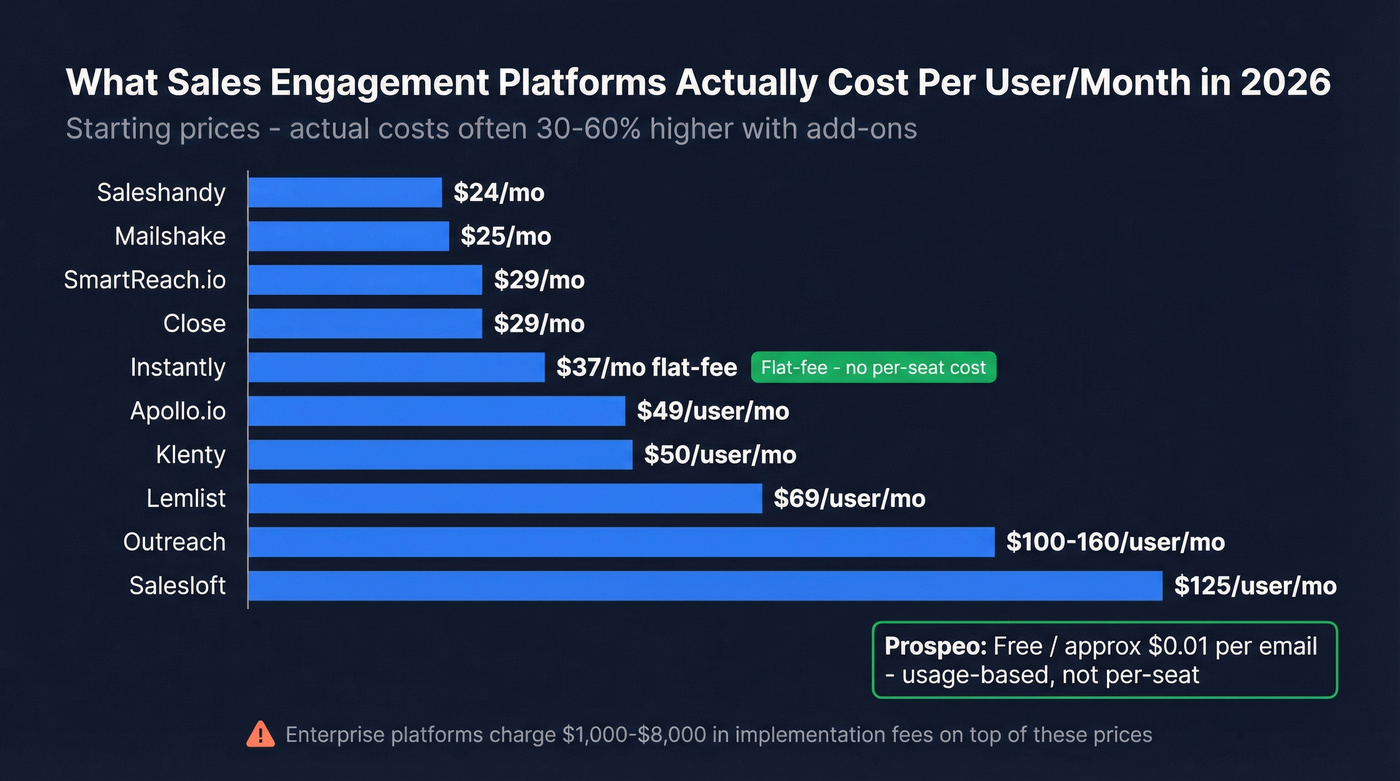

What Sales Engagement Tools Actually Cost in 2026

Let's kill the ambiguity.

| Tool | Starting Price | Model | Free / Trial | Best For |

|---|---|---|---|---|

| Prospeo | Free / ~$0.01/email | Usage-based | Yes / Yes | Data accuracy layer |

| Apollo.io | $49/user/mo | Per-seat | Yes / 14-day | All-in-one SMB |

| Instantly | $37/mo | Flat-fee | No / Yes | High-volume cold email |

| Salesloft | ~$125/user/mo | Per-seat | No / No | Enterprise coaching |

| Outreach | ~$100-160/user/mo | Per-seat | No / No | Enterprise automation |

| HubSpot Sales Hub | $20/user/mo | Per-seat | Yes / Yes | HubSpot ecosystem |

| Klenty | $50/user/mo | Per-seat | No / 14-day | Growing teams |

| Lemlist | $69/user/mo | Per-seat | No / 14-day | Personalization |

| Reply.io | $49/user/mo | Per-seat | Yes / Yes | Affordable multichannel |

| Amplemarket | $600/mo (2 users) | Platform fee | No / Yes | AI-first consolidation |

| Mailshake | $25/user/mo | Per-seat | No / 30-day MBG | Budget starter |

| Saleshandy | $24/mo | Flat-fee | No / 7-day | Ultra-affordable |

| SmartReach.io | $29/mo | Flat-fee | No / 14-day | WhatsApp + multichannel |

| VanillaSoft | ~$80-150/user/mo | Bundle (5-seat min) | No / No | Queue-based routing |

| Close | $29/mo | Per-seat | No / 14-day | Call-heavy CRM |

The Hidden Costs Nobody Mentions

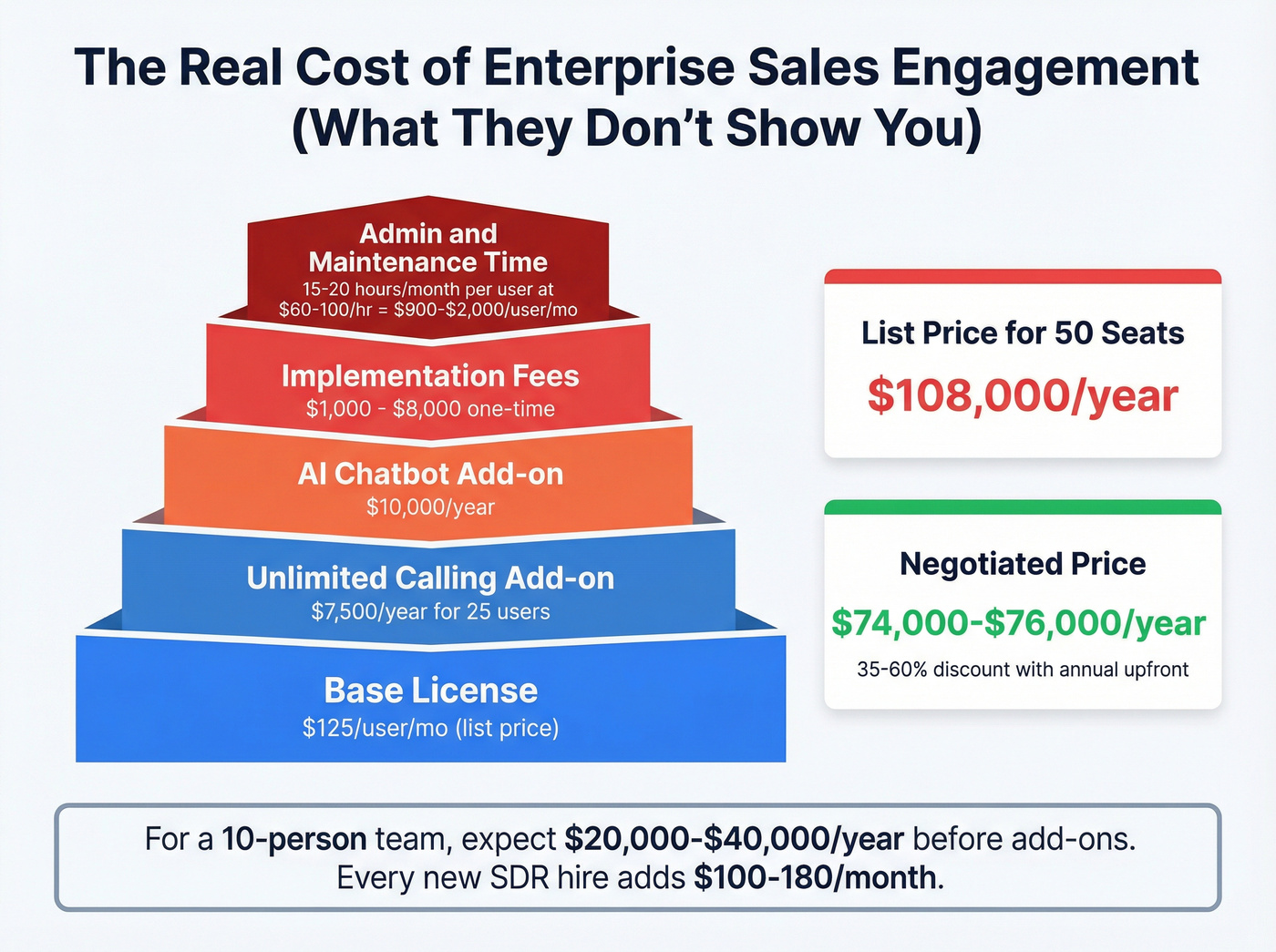

That $125/user/month Salesloft quote? It's the starting point, not the final number. Vendr's negotiation data shows a 50-seat Advanced plan lists at $108,000/year. Add the Unlimited Calling add-on ($7,500/year for 25 users) and the Bionic Chatbot ($10,000/year), and you're well past the sticker price.

The good news: 35-60% discounts are achievable with annual upfront payment. The negotiated reality for that same 50-seat deal lands around $74,000-$76,000.

Outreach is worse. Implementation fees run $1,000-$8,000 before a single email goes out. Admin seats get priced as full users. Dialer add-ons and AI packages stack on top.

Then there's the cost nobody puts in a spreadsheet: one analysis estimates 15-20 hours/month of human effort per user to maintain these enterprise platforms. At $60-100/hour, that's $900-$2,000 in hidden costs per user per month.

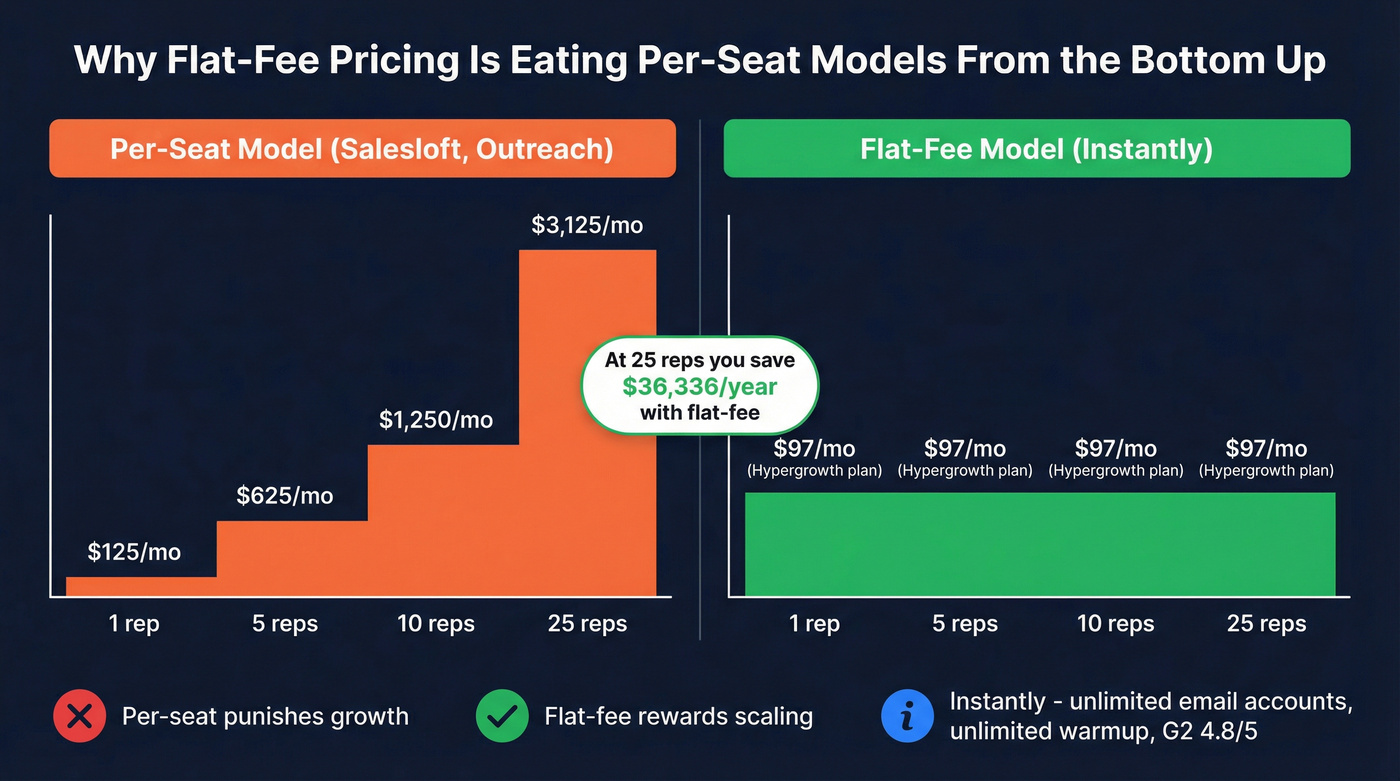

Look - if you're a 10-person team, a Salesloft or Outreach contract can run $20,000-$40,000/year before add-ons. The per-seat model punishes growing teams. Every new SDR hire is another $100-180/month line item. Flat-fee tools like Instantly and usage-based pricing don't have this problem, which is why they're eating market share from the bottom up. These sales outreach alternatives offer a fundamentally different economic model that rewards scaling.

Bouncing emails kill sequences no matter which platform sends them. Prospeo feeds Salesloft, Outreach, Instantly, and Lemlist with 98% accurate emails from 300M+ profiles - refreshed every 7 days, not 6 weeks. Snyk cut bounce rates from 35% to under 5%.

Fix your data layer and every engagement platform on this list performs better.

The Best Sales Engagement Competitors Worth Evaluating in 2026

Prospeo - Best for Data Accuracy and Verified Contact Data

Every sales engagement platform is only as good as the data feeding it. Prospeo is the data layer that makes the rest of this list perform: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and intent data covering 15,000 topics via Bombora.

Email accuracy sits at 98%, the result of a proprietary 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering. All records refresh every 7 days - the industry average is 6 weeks. That gap is why teams on stale data often see 30-40% bounce rates; Prospeo customers like Snyk cut bounces to under 5%.

Native integrations cover Salesloft, Outreach, Instantly, Lemlist, Smartlead, Clay, HubSpot, Salesforce, Zapier, Make, and n8n. You're not replacing your sequencer - you're feeding it better data. Pricing starts free (75 emails/month plus 100 Chrome extension credits/month), scales at ~$0.01 per email, and comes with no contracts. Self-serve onboarding means no sales calls required.

Apollo.io - Best All-in-One for SMBs and Mid-Market

Apollo is the Swiss Army knife of sales engagement - 275M+ contacts, a built-in dialer, lead scoring, multi-step sequences, and CRM-like deal management in one platform. The free plan gives you 1,200 credits/year, enough to validate data quality for your ICP before spending a dollar.

G2: 4.7/5 from 9,235 reviews - the highest-rated platform on this list by volume.

Pricing: Free, then Basic $49/user/mo, Professional $79/user/mo, Organization $119/user/mo (all annual). The $79 Professional tier is the sweet spot - 48,000 credits and uncapped sequences. Apollo's genuinely usable free tier and transparent pricing are rare in this space. The tradeoff: email accuracy runs around 79% compared to Prospeo's 98%, and phone data outside North America is thin. For a Series A company, Apollo at $79/user/month versus ZoomInfo at $30,000+/year isn't even a conversation.

Instantly - Best for Agencies and High-Volume Cold Email

Use this if: you're an agency managing multiple client campaigns, a lean outbound team that needs predictable costs, or anyone allergic to per-seat pricing.

Skip this if: you need phone dialing, deep CRM integration, or enterprise-grade reporting.

Growth at $37/month gets you unlimited email accounts, unlimited warmup, 1,000 uploaded contacts, and 5,000 emails/month. Hypergrowth ($97/mo) scales to 25,000 contacts and 100,000 emails. No per-seat penalties. That's a completely different economic model than Outreach or Salesloft, where adding a second SDR doubles your cost.

G2: 4.8/5 from 3,715 reviews - one of the highest satisfaction scores on this list.

For pure cold email at scale, nothing else touches the value. The tradeoff: Instantly is email-first. If you need multichannel orchestration with phone, social, and SMS in one workflow, look elsewhere.

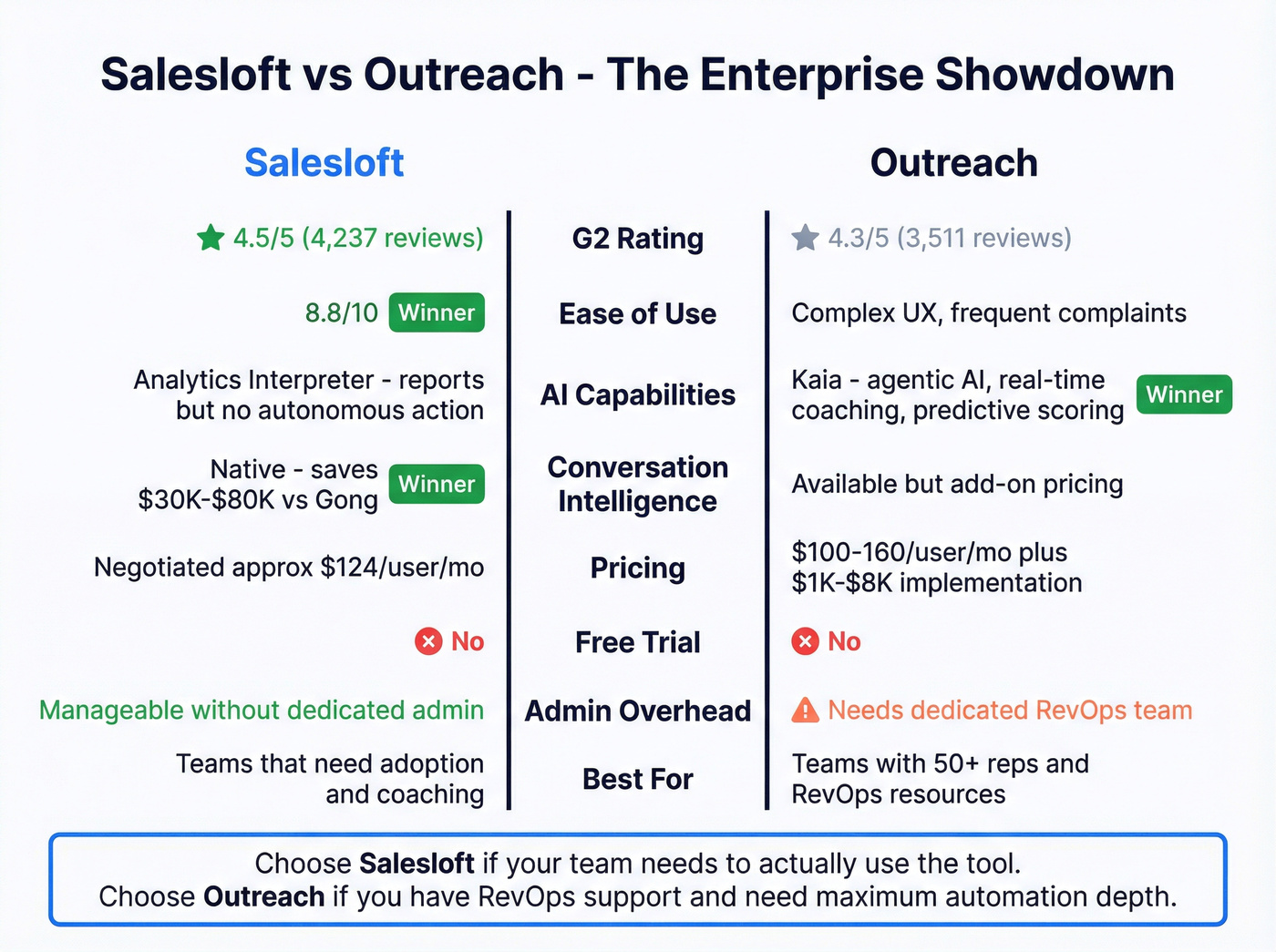

Salesloft - Best for Enterprise Teams That Need Coaching

I watched a team migrate from Outreach to Salesloft last year. The #1 reason? Their managers could actually use it. Ease of use scores 8.8/10, and task management hits 8.7/10. For organizations where adoption is the bottleneck - and it usually is - that matters more than any feature chart.

Salesloft's native conversation intelligence is the real draw for coaching-heavy orgs. Managers review calls, tag moments, and build training libraries without bolting on Gong ($30K-$80K/year on its own).

G2: 4.5/5 from 4,237 reviews.

Pricing reality: List price runs ~$180/user/month for Advanced. Nobody pays list. Vendr's data shows a 50-seat Advanced deal negotiated to $74,266 - roughly $124/user/month. Annual upfront unlocks 35-60% discounts. The Analytics Interpreter tells you what happened but doesn't take autonomous action. If AI-driven automation is your priority, Outreach wins. If you want a platform your team will actually use without a dedicated admin, Salesloft wins.

Outreach - Most Powerful Automation (If You Can Afford It)

Outreach is the most sophisticated sales engagement platform on the market. It's also the most frustrating.

The automation engine is the most advanced on this list: conditional logic, multi-step triggers, advanced branching, and Kaia - truly agentic AI with real-time call coaching, automated deal summaries, and predictive scoring. Rootly saw a 69% increase in meetings booked and 130% increase in emails delivered after implementing Outreach.

G2: 4.3/5 from 3,511 reviews - notably lower than Apollo, Instantly, and Salesloft. That rating gap tells a story. The #1 Reddit complaint: UX regression. "What used to take a few clicks now takes several... so unintuitive."

Pricing: $100-160/user/month, annual contracts only, no free trial. Implementation fees of $1,000-$8,000. If you have 50+ reps and a dedicated RevOps team, Outreach's automation depth is unmatched. For everyone else, you're paying for complexity you won't use.

HubSpot Sales Hub - Best for Teams Already in HubSpot

If your CRM is HubSpot, Sales Hub's engagement features live inside the same interface your reps already use every day. No integration to maintain. No data sync to debug. No second login.

That native experience eliminates an entire category of problems.

The sequencing capabilities are solid but not deep - you won't get Outreach-level branching or Salesloft-level coaching analytics. It's a good-enough engagement layer for teams that prioritize simplicity and ecosystem cohesion over power-user features.

Pricing: Free plan available. Starter at $20/user/month. Professional at $100/user/month. Enterprise at $150/user/month. The jump from Starter to Professional is steep - make sure you actually need the workflow automation before upgrading. For teams not on HubSpot CRM, skip this entirely.

Klenty - Best Value for Growing Teams

Klenty hits a sweet spot: multichannel sequences with real CRM integrations at a price that doesn't require VP-level approval. $50/user/month for Startup, $70 for Growth, $100 for Pro - all billed annually with free onboarding and a 14-day trial. LinkedIn automation is built in at the Growth tier.

Skip Klenty if you need enterprise-grade reporting. Use it if you're a 5-20 person team that's outgrown Mailshake but isn't ready for Salesloft pricing.

Lemlist - Best for Personalization-First Outreach

Lemlist's thesis: personalization drives replies. Dynamic images, embedded videos, AI-generated icebreakers, and Lemwarm for deliverability management. Email Pro runs $69/month; Multichannel (email + social + WhatsApp + VoIP) is $99/month.

G2: 4.5/5.

Best for creative outbound teams competing on message quality rather than volume. If you're sending 50,000 emails/month, Instantly is cheaper. If you're sending 500 highly personalized emails that need to land, Lemlist is the better bet.

Reply.io - Affordable Multichannel with AI

Reply.io doesn't get enough attention. At $49/user/month with a free plan available, it delivers multichannel sequences (email, phone, social, SMS), AI-powered message generation, and solid automation - at roughly half the cost of Salesloft. The AI features handle email generation, response classification, and meeting scheduling. For teams of 3-10 reps, the feature-to-price ratio is hard to beat. The limitation: reporting depth and conversation intelligence don't compete with enterprise platforms.

Amplemarket - The AI-First Dark Horse

Amplemarket is trying to replace your entire stack - data, sequences, signals, and AI agents in one place. The Duo Copilot finds targeted leads using intent signals, and practitioners report it "reduced the number of tools we were stitching together."

Pricing is aggressive: Startup at $600/month (2 users, annual commitment), Growth at $2,000-$5,000/month, Elite scaling to $10,000-$50,000/month. The consolidation play is compelling if the AI delivers on its promises. The pricing and annual lock-in make it a calculated bet - not a safe default.

Mailshake - Budget-Friendly Starter Platform

Use this if: you're under 5 reps and need basic email + phone outreach without complexity. Skip this if: you need LinkedIn automation or advanced branching.

Starts at $25/user/month with unlimited free dialer minutes for North American calls and a 30-day money-back guarantee. For teams that'll outgrow it in 6-12 months, Klenty is the better investment. For teams that need something working by Friday, Mailshake gets the job done.

Saleshandy

The ultra-budget option at $24/month for 6,000 emails. The 700M+ contact database is surprisingly large for the price. Best for solo founders or tiny teams who need volume without complexity. Email-first, price-first.

SmartReach.io

Starts at $29/month and stands out for WhatsApp integration alongside email, phone, and social channels. If your prospects live on WhatsApp - common in APAC and LATAM markets - this is worth a look.

VanillaSoft

Queue-based routing instead of cadence-based sequences. Leads get dynamically prioritized and served to reps - no cherry-picking. Result: 35% higher call connection rates. G2: 4.5/5 (592 reviews). Bundle pricing starts with 5 seats; expect $80-150/user/month. Best for high-velocity inside sales teams that need strict lead routing.

Close

CRM, VoIP, SMS, and power/predictive dialers in one tool starting at $29/month. If your team lives on the phone and you don't want separate CRM and dialer subscriptions, Close eliminates the integration headache.

Notable Omissions

You might wonder about Salesforce Sales Engagement, Clari, or Gong. These are adjacent tools - Salesforce Sales Engagement is locked to the Salesforce ecosystem, Clari is revenue intelligence rather than outbound sequencing, and Gong is conversation intelligence. They're valuable but solve different problems than the platforms above.

The Data Quality Problem Nobody Talks About

Your SDR manager pulls the sequence report. Half the emails bounced. Reply rates are in the basement.

The knee-jerk reaction: "The platform sucks. Let's switch to [insert competitor]."

But the platform isn't the problem. The data is.

Bad contact data flows into your sequencer. Emails bounce. Your domain reputation drops. Even the good emails land in spam. Reply rates crater. Leadership blames the engagement platform. You spend $30,000 switching to a new one. The same bad data flows in. Repeat.

I've seen this cycle play out three times at different companies, and it's infuriating every time.

73% of teams waste $2,340/rep/year on overlapping tools, but the most expensive waste isn't tool overlap - it's sending sequences to contacts that don't exist anymore. Every bounce signals Gmail and Outlook that you're a spammer. Once your domain reputation tanks, it takes weeks to recover. During that recovery, every sequence underperforms.

Snyk learned this the hard way. With 50 AEs prospecting 4-6 hours per week, their bounce rate sat at 35-40%. After switching their data layer to Prospeo, bounces dropped to under 5%. AE-sourced pipeline jumped 180%, generating 200+ new opportunities per month. Stack Optimize built an entire agency to $1M ARR on the back of verified data - 94%+ deliverability, bounce rates under 3%, zero domain flags across all clients.

The fix isn't complicated: verify your data before it enters your sequences. A 98% accuracy rate with a 7-day refresh cycle means contacts are current when they hit your sequencer. Built-in databases from Apollo and Instantly are convenient, but their accuracy varies by segment - and "varies" is a polite way of saying "sometimes terrible." Organizations investing in a strong data foundation see 64% fewer integration issues downstream.

You can spend $150/user/month on the fanciest sequencing platform in the world. If 30% of your emails bounce, you've bought a Ferrari and filled it with diesel.

You're spending $125/user/month on enterprise sequencers but feeding them stale contacts. At ~$0.01/email with 125M+ verified mobile numbers, Prospeo costs less than one month of a single Salesloft seat - and eliminates the bounces draining your domain reputation.

Stop overpaying for platforms when the real problem is your contact data.

Outreach vs. Salesloft: The Enterprise Head-to-Head

This is the comparison every enterprise buyer eventually lands on:

| Feature | Outreach | Salesloft |

|---|---|---|

| Automation | Advanced branching, conditional logic | Standard cadences, simpler setup |

| AI | Kaia - agentic, real-time coaching | Analytics Interpreter - descriptive |

| CRM Integration | Deep Salesforce bidirectional sync | Solid but less flexible |

| Ease of Use | Steep learning curve | 8.8/10 user rating |

| Reporting | Full-funnel, activity to revenue | Strong activity, limited pipeline |

| Pricing (10 seats) | ~$15K-$25K/year | ~$15K-$20K/year (negotiated) |

| Best For | Large teams with RevOps support | Teams prioritizing adoption |

Outreach wins on automation depth and AI sophistication. Kaia coaches in real time, summarizes deals, and scores outcomes. Salesloft's Analytics Interpreter tells you what happened but doesn't act on it. For teams with 50+ reps and a RevOps function, Outreach's power justifies the complexity.

Salesloft wins on usability and time-to-value. Reps become proficient in 2-3 weeks versus Outreach's longer ramp. The native conversation intelligence eliminates a separate Gong contract. For mid-market teams where adoption is the real risk, Salesloft is the safer bet.

One practitioner on r/gtmengineering put it well: "Outreach is the most grown-up platform... Salesloft is easier to manage day to day."

Skip both if you're a team under 20 reps. A lighter SEP like Instantly or Apollo paired with verified contact data will get you 80% of the functionality at 20% of the cost. The enterprise platforms earn their premium at scale - below that, you're paying for features your team won't touch.

How to Choose the Right Sales Engagement Platform Alternative

What's your team size and budget?

Per-seat pricing (Salesloft, Outreach, Apollo) makes sense when you have a stable team. Every new hire increases your bill. Flat-fee models (Instantly, Saleshandy) reward growth - your 10th SDR costs the same as your first. If you're scaling aggressively, the pricing model matters more than the feature set.

Do you need a built-in data source?

If you already have a data provider, pick any sequencer on this list. If you want data + engagement in one tool, Apollo is the default choice. Either way, verify your contacts before they enter sequences - organizations with a strong data foundation see 64% fewer integration issues and dramatically better deliverability.

Which channels matter most?

Email-only teams should look at Instantly or Saleshandy. Multichannel (email + phone + social) teams need Apollo, Klenty, or Lemlist. Phone-heavy teams should evaluate Close or VanillaSoft.

Don't pay for channels you won't use - 60% of B2B professionals don't use the full potential of their outbound automation tools.

What CRM are you on?

Salesforce users get the deepest integration from Outreach. HubSpot users should default to Sales Hub unless they need features it can't deliver. Pipedrive and Zoho users have fewer options - Klenty and Apollo cover both. Check integration depth before you buy, not after.

Are you consolidating or adding?

72% of enterprise orgs prefer platform approaches over point solutions. The trend is clear: teams are moving from 8-12 tools down to 4-6 integrated platforms. Organizations with strategic, consolidated stacks see 43% higher win rates and 37% faster sales cycles. Before adding another tool, ask whether an existing one already covers the use case.

Switching Costs and Migration Reality

Switching sales engagement platforms isn't a weekend project. Budget 4-8 weeks for mid-market teams and 2-4 months for enterprise with complex CRM integrations.

Data export and import takes 1-2 weeks (longer if your CRM has custom objects that need remapping). Sequence rebuilding - recreating cadences, templates, and branching logic - runs 2-3 weeks. Full team adoption takes another 4-6 weeks after go-live, because reps need to build muscle memory in the new interface.

One Reddit thread described a company with 80 employees and ~30 systems integrated with their CRM. The poster's biggest fear wasn't the technology - it was that "folks who really understand and maintain our current setup might leave due to burnout or frustration" during the transition. That's a real risk that never shows up in vendor ROI calculators.

Key risks to plan for: data loss during migration (export everything before you cancel), integration breakage (test every connection in staging), and the adoption dip. Expect 30-40% of implementations to underperform in the first quarter due to poor training or wrong tool selection.

A cautionary tale: Mixmax, the Gmail-native SEP that started at $34/user/month, has been winding down. If you built workflows on it, you're experiencing these migration pains firsthand. Platform viability matters as much as features.

AI Features Worth Evaluating in 2026

100% of teams using AI SDR tools report saving time. 40% save 4-7 hours per week. The highest-performing teams aren't going full-AI or full-human - 45% of high-performing sales teams run hybrid human-AI SDR models. LivePerson cut prospect research time from 20 minutes to 2 minutes per contact. Teams using conversation intelligence close deals 11 days faster with a 10 percentage point improvement in win rates on deals over $50K.

Here's what's actually worth paying for:

Conversation intelligence (Salesloft native, Gong standalone) - deals closed within 50 days hit a 47% win rate versus 20% for deals that drag past that threshold. Real-time coaching during calls justifies the premium.

AI-powered personalization (Lemlist, Amplemarket, Outreach) - auto-generated icebreakers and context-aware messaging. Quality varies wildly. Test before you trust.

AI reply handling (Instantly's AI Reply Agent, Reply.io) - auto-classifying and responding to inbound replies. Useful for high-volume campaigns where speed-to-lead determines conversion.

The emerging trend: buyer-side AI agents screening vendors before a human ever engages. Your outbound messages will increasingly be evaluated by AI before reaching a person. Tools with strong AI capabilities achieve 2.8x higher ROI - but you have to test to separate genuine AI capability from rebranded rule engines wearing a chatbot costume. If you want a practical rubric, start with an AI agent for email outreach.

FAQ

What is a sales engagement platform?

A sales engagement platform automates multi-channel outreach - email, phone, social, and SMS - through structured sequences or cadences. It differs from a CRM (which stores data) and a data provider (which sources contacts). Most B2B deals require 5-12 touchpoints across multiple channels, and SEPs orchestrate that workflow so reps don't manage it manually.

How much does a sales engagement platform cost?

Prices range from $24/month (Saleshandy) to ~$180/user/month at list price (Salesloft Advanced). The average mid-market team spends $187/rep/month across their full sales stack. Enterprise platforms add implementation fees of $1,000-$8,000 on top. Flat-fee alternatives like Instantly start at $37/month regardless of team size.

What's the biggest reason sales sequences underperform?

Bad contact data. If 30-40% of your emails bounce, your domain reputation tanks and reply rates drop across every sequence - even the ones with great copy. Fixing the data layer typically cuts bounce rates to under 5%, which changes everything downstream.

What are the best free or low-cost alternatives to Outreach and Salesloft?

For email-heavy teams, Instantly ($37/mo flat-fee) and Saleshandy ($24/mo) deliver strong value without per-seat penalties. Apollo.io offers a genuinely usable free tier with built-in data. Phone-heavy teams should look at Close ($29/mo with built-in dialers). Pair any of these with a verified data source and you'll match 80% of enterprise platform output at a fraction of the cost.

How long does it take to switch sales engagement platforms?

Budget 4-8 weeks for mid-market teams and 2-4 months for enterprise with complex CRM integrations. The biggest time sinks are sequence rebuilding (2-3 weeks) and full team adoption (4-6 weeks post go-live). Expect a performance dip in the first quarter - it's normal, but it needs executive air cover.