LeadIQ Pricing Breakdown: What You'll Actually Pay in 2026

Your SDR manager just asked you to evaluate LeadIQ for the team. You pull up the pricing page and see a slider. You Google "leadiq pricing" and find five articles listing an Essential plan at $36/user/month. You go back to LeadIQ's site - no Essential plan anywhere.

You're not losing it. The plan was killed.

LeadIQ Plans and Pricing at a Glance

| Plan | Price | Credits/Mo | Users | Billing |

|---|---|---|---|---|

| Free | $0 | 50 | 1 | - |

| Pro (min) | $200/mo | 200 | Up to 5 | Monthly or annual |

| Pro (max) | ~$1,500-2,000/mo | 6,750 | Up to 5 | Monthly or annual |

| Enterprise | Custom | Custom | Custom | Annual only |

Annual billing saves 25% on the Pro plan. Enterprise requires a sales conversation and an annual commitment.

The Essential plan ($36/user/mo) referenced by most pricing guides has been discontinued. LeadIQ restructured to a Universal Credits model. If you see the Essential plan listed anywhere, that information is outdated.

LeadIQ Pricing Plans Explained

Free Plan

LeadIQ's free tier gives you 1 user and 50 credits per month. That's enough to test the Chrome extension and get a feel for data quality, but not much else - 50 credits translates to 50 emails, or 5 phone numbers, or some mix of both.

No CRM integrations. No Scribe AI for email personalization. No champion tracking. It's a trial dressed up as a plan.

Pro Plan - The Credit Slider

This is where things get interesting and a little opaque. The Pro plan starts at $200/month for 200 credits and scales through a slider up to 6,750 credits, with up to 5 users sharing the credit pool.

LeadIQ doesn't publish prices for each slider position. Based on the $200/200-credit starting point and third-party reports suggesting ~$0.30-0.50/credit at higher tiers, here are reasonable estimates:

- 200 credits: $200/mo

- 500 credits: ~$350/mo

- 1,000 credits: ~$500/mo

- 1,500 credits: ~$625/mo

- 2,000 credits: ~$750/mo

- 6,750 credits: ~$1,500-2,000/mo

Annual billing knocks 25% off these numbers. At the minimum tier, that drops $200/mo to roughly $150/mo.

Every Pro plan includes Scribe AI (personalized email drafts based on prospect data), CRM integrations for Salesforce and HubSpot, champion tracking for job change alerts, and data deduplication.

What's locked behind Enterprise: SSO, API access, territory management, advanced usage analytics, and priority support are all Enterprise-only. If any of those are requirements, the Pro plan won't cut it - and there's no mid-tier option between $200/mo Pro and a custom Enterprise contract. That gap is one of LeadIQ's biggest pricing design flaws.

Enterprise Plan

Custom pricing, annual contracts only. No slider, no self-serve.

For budget planning, expect Enterprise contracts in the $20,000-$50,000/year range depending on team size and credit volume. Based on 93 actual LeadIQ purchases tracked by Dimmo, the median annual contract lands at $26,400/year. The range spans from $6,096 to $58,240. Teams typically negotiate 21% off list price.

LeadIQ's minimum Pro tier burns through 200 credits in a day for a real SDR team. Prospeo starts at $0.01/email with 98% accuracy - no sliders, no guessing, no credits expiring at month-end. Your 3-person team gets unlimited scale without the $1,500/mo price tag.

Stop rationing credits. Start prospecting without limits.

How Universal Credits Work

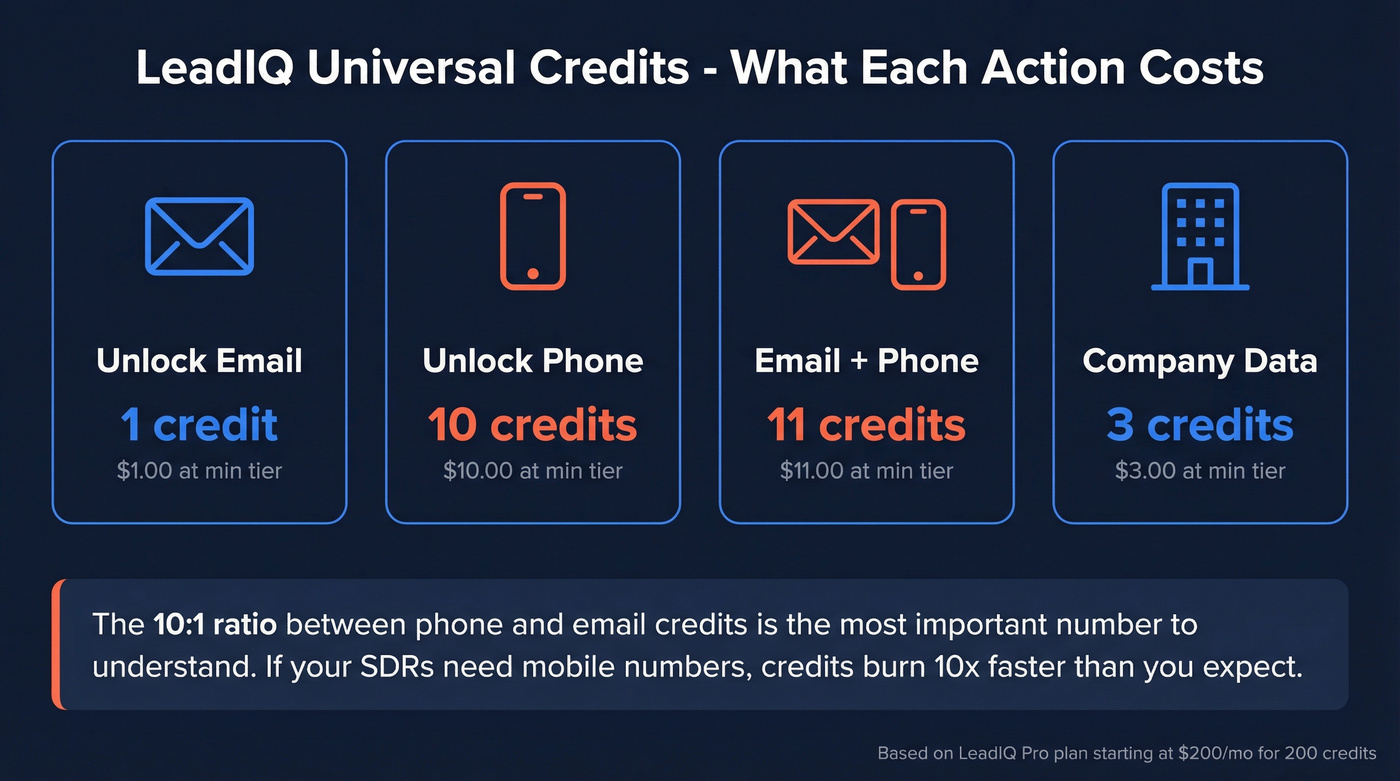

LeadIQ's Universal Credits system pools all your credits into a single bucket shared across users and features. Here's what each action costs:

| Action | Credits |

|---|---|

| Unlock email | 1 |

| Unlock phone | 10 |

| Unlock email + phone | 11 |

| Export company data | 3 |

No bundle discount - email + phone is simply 1 + 10 = 11 credits.

The 10:1 ratio between phone and email credits is the single most important number to understand when evaluating LeadIQ's cost structure. If your team needs mobile numbers (and most outbound teams do), your effective credit burn rate is dramatically higher than it looks on paper.

Worked example: A team of 3 SDRs prospecting 50 contacts per week each needs ~150 email+phone unlocks per week. That's 1,650 credits per week. On the minimum Pro tier (200 credits/month), you'd burn through your entire monthly allotment in less than one day.

Even at the 2,000-credit tier (~$750/mo), that same team exhausts credits in about 6 business days. You'd need the 6,750-credit tier - at $1,500-2,000/month - to comfortably cover a 3-person SDR team doing real outbound.

Records Under Management (RUM) is the one bright spot. Once you unlock a contact, re-accessing that record costs zero credits for one year. This applies at the team level, not per-user. If you're working named account lists and repeatedly referencing the same contacts, RUM materially reduces your effective cost. For teams running high-volume outbound to new contacts every week, it helps less.

No rollover. Credits expire at the end of each billing cycle. Buy 200 credits, use 120, and those 80 remaining credits vanish. No banking for high-volume months. This punishes teams with variable prospecting cadences - and it's one of the most common complaints from users.

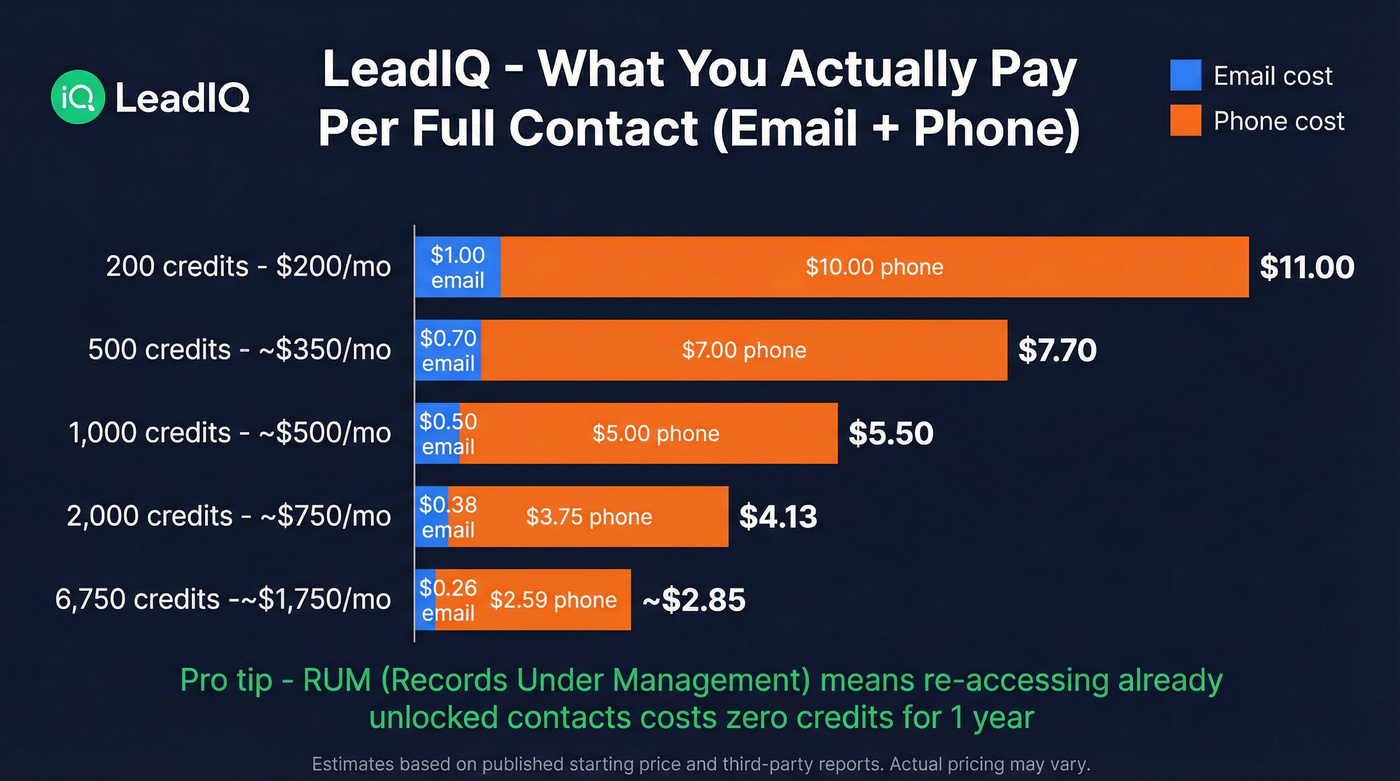

What You're Actually Paying Per Contact

Here's the math most pricing guides skip:

| Credit Tier | Est. Monthly Cost | Cost/Email | Cost/Phone | Cost/Full Contact |

|---|---|---|---|---|

| 200 | $200 | $1.00 | $10.00 | $11.00 |

| 500 | ~$350 | ~$0.70 | ~$7.00 | ~$7.70 |

| 1,000 | ~$500 | ~$0.50 | ~$5.00 | ~$5.50 |

| 2,000 | ~$750 | ~$0.38 | ~$3.75 | ~$4.13 |

| 6,750 | ~$1,500-2,000 | ~$0.22-0.30 | ~$2.22-2.96 | ~$2.44-3.26 |

I've seen teams start on the minimum Pro tier thinking 200 credits is enough, then upgrade twice within the first quarter. Picture this: your credits ran out on the 15th, your team of 4 SDRs has two weeks of dead air, and the options are upgrade to a higher credit tier, wait until next month, or supplement with a cheaper tool for the overflow. None of those are great.

At $1.00 per email and $10.00 per phone number on the minimum tier, LeadIQ is expensive per contact compared to most alternatives. The math improves at higher tiers, but you're committing $500-750+/month before the per-credit cost becomes competitive.

Is LeadIQ Worth the Price?

LeadIQ carries a 4.2/5 on G2 from 1,153 reviews. The praise clusters around ease of use (160 mentions), contact information quality (115), and integrations (108). The complaints cluster around inaccurate data (97 mentions), incorrect numbers (53), and data inaccuracy more broadly (81). Worth noting: 60% of those reviews come from mid-market companies (51-1,000 employees) - if you're a smaller team, the experience will differ.

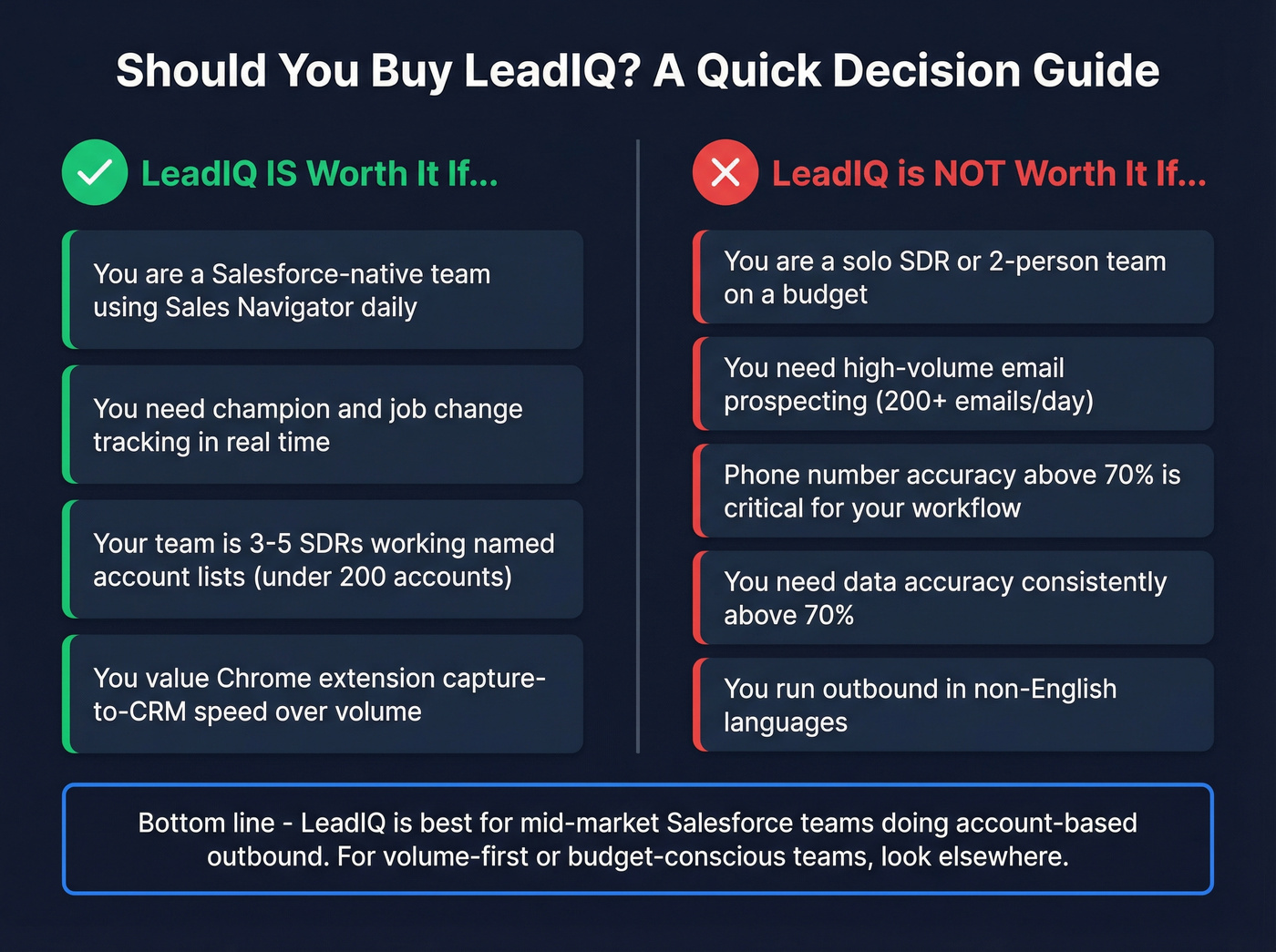

When LeadIQ Is Worth It

You're a Salesforce-native team that needs one-click capture from Sales Navigator to CRM. The Chrome extension is genuinely best-in-class for this workflow - nobody does the capture-to-CRM motion as smoothly. WalkMe saw a 19% increase in discovery calls after adopting LeadIQ, and Clari's team saved 600 hours per quarter on manual prospecting. Those results are real, but they came from mid-market and enterprise teams deeply embedded in the Salesforce ecosystem.

You rely on champion/job change tracking. This is LeadIQ's most unique feature. When a champion leaves a customer account and lands at a new company, you get notified in real time - not batch updates every two weeks. For teams running expansion plays, this alone can justify the cost.

Your team is 3-5 SDRs working named account lists. The RUM mechanic means you're not re-paying for contacts you've already unlocked. If you're working 200 target accounts deeply rather than blasting 10,000 new contacts monthly, the credit model is more forgiving.

LeadIQ also claims faster time-to-ROI than broader platforms - 6 months versus Apollo's 10 months per G2 data. That makes sense: it's a simpler tool with a narrower scope, so ramp time is shorter.

When LeadIQ Is NOT Worth It

You're a solo SDR or 2-person team. The $200/month minimum for 200 credits is steep when alternatives offer more data for less.

Your primary need is high-volume email prospecting. The credit model punishes volume. At 1 credit per email, you're capped at 200 emails on the minimum tier. That's not enough for serious outbound.

Phone number accuracy is critical to your workflow. Fifty-three G2 reviews specifically call out incorrect numbers - including numbers that ring family members instead of prospects. That's not a minor data quality issue; that's a trust-breaker for reps.

You need data accuracy above 70%. LeadIQ's data accuracy hovers around 60-70% based on independent testing. Combined with the G2 reviews flagging inaccurate data as the #1 complaint, this is a real concern.

You're running Salesforce and expect flawless integration. Despite the strong capture workflow, some users report bugs where LeadIQ can't determine which Salesforce account a contact should map to, requiring manual cleanup. It's not a dealbreaker, but test it in your org before committing.

Skip LeadIQ entirely if you need Scribe AI to work well in non-English languages. Results vary significantly by language, and international teams have been burned by this.

One Reddit user in r/coldemail put it bluntly: "I think LeadIQ is garbage, as it only gives me 2,000 verified emails per month and a lot of them don't work."

That's harsh, but it reflects a real pattern. LeadIQ is a solid tool for teams deep in the Salesforce + Sales Navigator ecosystem. The champion tracking is genuinely unique. The Chrome extension is excellent. But if your primary need is bulk email and phone data for outbound, you're overpaying.

LeadIQ vs. Alternatives - Price Comparison

Here's the comparison table most people are actually looking for, with costs normalized to per-email and per-phone so you can compare apples to apples:

| Tool | Cost/Email | Cost/Phone | Min Monthly | Annual Lock? | G2 |

|---|---|---|---|---|---|

| LeadIQ (Pro) | $1.00 | $10.00 | $200 | No (25% off annual) | 4.2/5 |

| Apollo (Basic) | ~$0 | ~$0.65 | $49/user | No | 4.7/5 |

| Lusha (Pro) | ~$0.12 | ~$0.60 | $29.90/user | No | 4.3/5 |

| ZoomInfo (Pro) | ~$0.30 | ~$1.50 | ~$1,250 | Yes | 4.5/5 |

| Seamless.AI | ~$0.59 | N/A | ~$147 | Yes | 4.4/5 |

| RocketReach | ~$0.69 | N/A | $69 | No | 4.4/5 |

Prospeo - Best for Accuracy and Cost Per Lead

If your main frustration with LeadIQ is cost per contact and data accuracy, Prospeo is the most direct answer. At ~$0.01 per email and ~$0.10 per phone number, it's roughly 100x cheaper per email than LeadIQ's minimum tier. The 300M+ profile database delivers 98% email accuracy through a proprietary 5-step verification process - compared to LeadIQ's 60-70% range. You also get 125M+ verified mobile numbers with a 30% pickup rate, intent data across 15,000 topics, and native integrations with Salesforce, HubSpot, Smartlead, Instantly, and more. The free tier includes 75 emails and 100 Chrome extension credits per month - already more useful than LeadIQ's 50-credit free plan. No annual contracts, no sales calls, self-serve from day one.

Where LeadIQ still wins: the Sales Navigator-to-Salesforce capture workflow and real-time champion tracking. If those are your must-haves, LeadIQ earns its premium. For everything else - especially volume outbound and data quality - Prospeo delivers more for dramatically less.

Apollo.io - Best Value for All-in-One Teams

Apollo is the obvious starting point if budget matters. At $49/user/month on Basic, you get unlimited email credits and 75 mobile credits - plus built-in sequencing, a dialer, and a lightweight CRM. For a 5-person team, that's ~$2,940/year versus LeadIQ's $2,400/year minimum, but Apollo includes unlimited emails where LeadIQ caps you at 200. The 275M+ contact database and 4.7/5 G2 rating from 9,310+ reviews speak for themselves. Email bounce rates can hit 15-20% on some segments, so verify before sending.

Lusha - Simplest Mid-Market Option

Use this if you want a dead-simple Chrome extension with competitive credit pricing and don't need a full platform. Lusha's Pro plan runs $29.90/user/month with 250 credits, and phone numbers cost 5 credits each - half of LeadIQ's 10. Unused credits roll over on monthly plans, up to 2x your limit. LeadIQ's don't. For teams with variable prospecting cadences, that rollover policy alone can tip the decision. 4.3/5 on G2 from 1,590+ reviews.

Skip this if you need built-in sequencing, intent data, or deep CRM workflow automation.

ZoomInfo - Enterprise-Grade, Enterprise-Priced

ZoomInfo wins on database depth (260M+ profiles, 135M+ verified mobiles), intent data, technographics, and workflow breadth. LeadIQ wins on price of entry and speed to value. ZoomInfo's Professional plan starts at $14,995-$18,000/year for 1-3 seats, with 10-20% annual renewal uplifts. If you're a large sales org with $15K+ annual budget for data tooling, ZoomInfo is the incumbent for a reason. For everyone else, it's overkill.

Quick Mentions

Seamless.AI: Basic plan at ~$147/month with 250 credits per user. Annual contracts required. The 4.4/5 G2 rating from 5,260+ reviews suggests it works, but credit burn rate is the most common complaint - what sounds like generous daily limits gets exhausted fast with a 5-person team.

RocketReach: Individual plans from $69/month (Essentials) to $209/month (Ultimate). Team plans from $83/user/month. Annual individual plans offer unlimited lookups, which is unusual in this space. Strong for individual researchers and recruiters, less suited for SDR teams running coordinated outbound.

At LeadIQ's 200-credit tier, a single phone number costs $10. Prospeo delivers 125M+ verified mobiles with a 30% pickup rate at a fraction of that cost - plus 7-day data refresh so you're never calling stale numbers.

Get fresher data, more dials, and 90% lower costs per contact.

FAQ

Does LeadIQ still have an Essential plan?

No. The Essential plan ($36/user/month) was discontinued when LeadIQ moved to Universal Credits. The current paid options are Pro (starting at $200/month for 200 credits) and Enterprise (custom pricing). Most third-party articles still reference the Essential plan - that information is outdated as of 2026.

How much does LeadIQ cost per year?

On the Pro plan, the minimum annual cost is $2,400/year ($200/mo) or roughly $1,800/year with the 25% annual discount. Enterprise contracts range from $6,096 to $58,240/year based on 93 tracked purchases, with a median of $26,400/year.

Do LeadIQ credits roll over?

No. Unused credits expire at the end of each billing cycle - 50 leftover credits out of 200 are simply lost. Plan usage carefully, or consider alternatives like Lusha (credits roll over up to 2x) or Prospeo (no credit expiration pressure with pay-as-you-go pricing).

Can you negotiate LeadIQ Enterprise pricing?

Yes. Based on 93 actual purchases, teams typically negotiate 21% off list price. The median Enterprise contract is $26,400/year, but the range spans $6,096-$58,240. Always negotiate, and get competing quotes from tools like Apollo or Prospeo to strengthen your position.

What's a cheaper alternative to LeadIQ with better data accuracy?

Prospeo offers 98% email accuracy at ~$0.01 per email - roughly 100x cheaper than LeadIQ's minimum tier. Apollo ($49/user/mo) provides unlimited emails with a larger database. Both are self-serve with no annual contracts, making them strong options for teams that find LeadIQ's credit model too restrictive.