B2B Phone Number Guide 2026: Definitions, Direct Dials, and a Practical Playbook

People search "b2b phone number" and mean two different things: the company's main line, or a decision-maker's direct dial/mobile. Treat those as the same thing and you'll get the same result every time: low connect rates, messy reporting, and a team that starts "forgetting" to call.

We'll separate the number types, show you how to source them, and give you an operator workflow to keep your CRM call-ready in 2026.

One rule up front: coverage is a vanity metric.

Choose your path (so you get the right number)

If you meant "the company phone number" (main line):

- Pull it from the website footer/contact page first (fastest, cleanest)

- Call once to confirm department routing and hours

- Log the IVR path on the Account so nobody relearns the menu

If you meant "a prospect's phone number" (direct dial / verified mobile):

- Start with a data provider + verification (it's the only scalable route) - see Best B2B Data Providers

- Label every number by type (mobile/direct dial/main line) before sequencing

- Track wrong-person + IVR rates, not just "coverage"

What you need (quick version)

Stop treating main lines and direct dials as interchangeable. They're different assets, used differently, and measured differently.

3-step summary that works:

- Lead with verified mobiles/direct dials for first attempts (highest pickup, lowest friction).

- Use main lines intentionally (and log the IVR path so attempt #1 isn't wasted).

- Measure conversations per dollar (coverage % won't save you).

Do this and your reporting gets honest overnight.

Do this this week (fast ops win):

- Add a CRM field: Number Type (Verified mobile / Direct dial / Main line / Unknown).

- Add dispositions: IVR hit and Wrong person (one click each).

- Run a 50-lead test and compare connect rate by number type before buying more credits.

Example: if you're calling IT directors at hospitals, main lines dominate, so IVR logging matters as much as the number itself.

What a "B2B phone number" actually means (and why most advice fails)

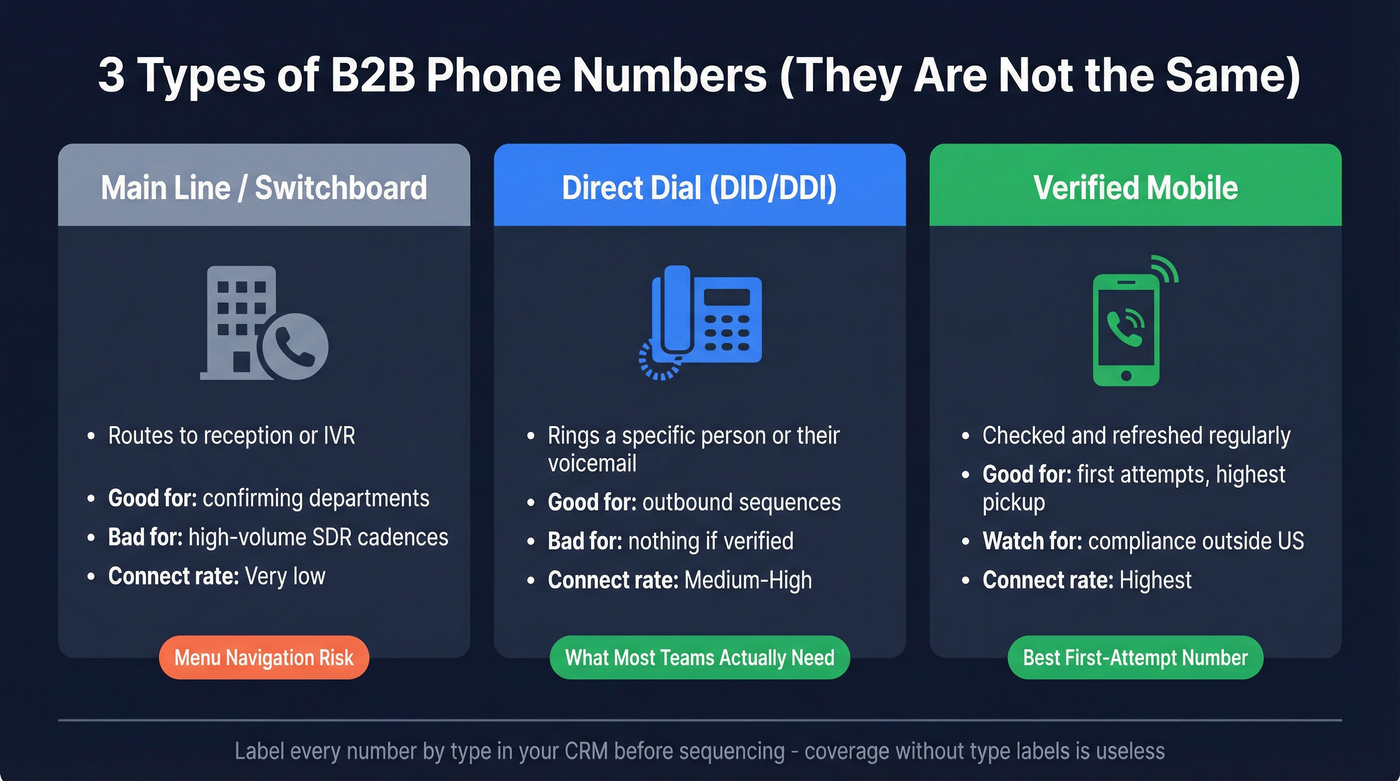

Main line / switchboard

A main line is the company's public number. It routes to reception, an auto-attendant, or a general queue.

Use it to:

- Confirm the right department or location

- Get transferred internally

- Validate the company's phone routing (especially enterprise)

Don't use it as your default in a high-volume SDR cadence. Main lines turn early attempts into menu navigation instead of conversations.

Direct dial (belongs to a person)

A direct dial is a corporate phone number that belongs to a specific person within a company. It's designed to ring that individual (or their voicemail) without going through the switchboard.

This is what outbound teams mean when they say "I need phone numbers." A database with millions of "numbers" is meaningless if most are HQ lines.

DID/DDI (telecom reality)

DID (Direct Inward Dialing) / DDI (Direct Dial-In) is the phone-system plumbing behind "direct numbers." A DID assigns phone numbers to extensions so callers can reach employees without going through a receptionist.

One operational gotcha: a "direct" number can still route to an auto-attendant menu, call queue, or other routing if the company's phone system is configured that way. That's why IVR rate belongs in your QA metrics.

"Verified mobile" (different operationally)

A verified mobile is a mobile number that's been checked and kept fresh enough to be worth dialing.

Mobiles behave differently:

- Higher pickup probability than desk lines

- Less IVR friction

- Higher compliance sensitivity (especially outside the US)

You just read the math: 11.3% success rate with the right numbers vs 2.7% without. Prospeo gives you 125M+ verified mobile numbers with a 30% pickup rate - refreshed every 7 days, not 6 weeks. Every number is labeled by type so your CRM stays clean and your reps stop navigating IVR menus.

Same reps, same hours - 4x more conversations. Start with 100 free credits.

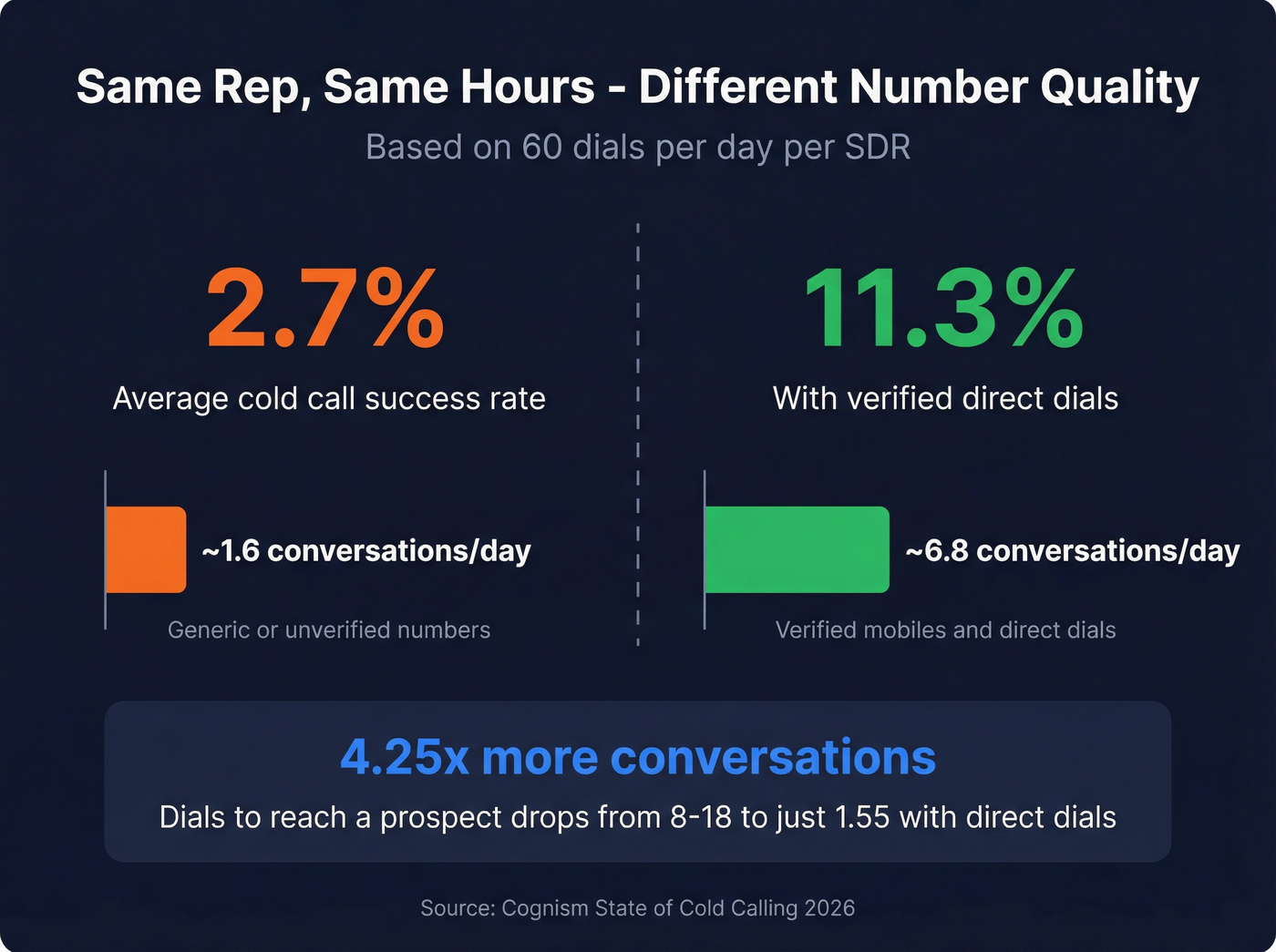

Why direct dials matter: the connect-rate math

Cold calling isn't dead. Bad numbers are.

Cognism's State of Cold Calling 2026 reports that it can take 8-18 dials to speak to a prospect, but with direct dials that drops to 1.55 dials. They also put average cold call success rate around 2.7%, versus 11.3% when the motion and data are dialed in.

In Cognism's State of Cold Calling 2026 dataset, executives/CEOs made up 11.91% of conversations. Senior people pick up when the number is right and the opener's tight.

Quick budget math (steal this): If an SDR makes 60 dials/day:

- At 2.7% success -> ~1.6 conversations/day

- At 11.3% success -> ~6.8 conversations/day

Same rep. Same hours. Different number quality.

How to find a b2b phone number: 7 methods (plus a workflow that scales)

Most teams fail here for one reason: they pick one method and force it to do everything. Use the right method for the job, then run a hygiene loop so the data stays usable.

Decision tree (before you spend money)

- Need 200+ numbers/week per rep? Start with a sales intelligence tool or phone finder + QA loop - benchmark your connect rate separately from coverage.

- Need 10-30 high-confidence numbers for named accounts? Use company website/team directory + main line + internal intros.

- Already have an email reply? Ask for the best number and time to call.

- Have lots of customer/prospect emails? Mine signatures for direct lines.

Workflow table: method vs time vs scale vs risk

| Method | Time | Scale | Risk |

|---|---|---|---|

| Sales intel tool / phone number finder | Low | High | Stale/wrong-person |

| LinkedIn contact info | Med | Low | Low yield |

| Company website/team directory | High | Low | Incomplete |

| Main line + gatekeeper/IVR | Med | Med | Burns attempts |

| Ask the prospect | Low | Low | Needs reply |

| Signature mining | Med | Low | Low volume |

| Referral / intro | Med | Low | Not repeatable |

1) Use a sales intelligence / phone finder tool (scales; requires QA + refresh)

This is the only method that scales without turning your SDR org into a research team.

The trap is "coverage." Vendors demo big numbers because it sells. Operators win with verification + refresh, because the real cost isn't the subscription - it's the rep-hours you burn dialing menus, leaving voicemails for the wrong person, and cleaning up CRM junk that shouldn't have been there in the first place.

I've seen teams do this one change (number type labeling + weekly refresh) and stop arguing about "who's a good caller" within two weeks, because the data finally tells the truth.

Internal links that matter for this workflow: BDR Contact Data, B2B Contact Data Decay, Data Quality

2) LinkedIn contact info (low yield; use as a cross-check)

LinkedIn contact info isn't a scalable phone source. It's a validation layer.

Use it to:

- Confirm you're targeting the right person at the right company

- Catch obvious mismatches (wrong company, wrong geography)

- Cross-check a number you found elsewhere

Treat it like a spot-check tool, not your pipeline engine.

3) Use professional profile/contact pages (slow; sometimes useful)

This is the "I need one number today" method.

It works when the person publishes a number. When they don't, you'll usually end up with a main line or a generic department number.

4) Company website/team directory (accurate when published; doesn't scale)

When a company publishes a directory, it's usually accurate. The problem's consistency and time.

Best for named-account research and industries where direct dials are scarce, especially when you're trying to reach regulated or enterprise-heavy segments.

5) Call the main line + navigate gatekeeper/IVR (works when logged)

Main lines are underrated when you treat them like a system.

Call, navigate, get transferred - and log the IVR path so the next rep doesn't waste attempt #1 learning the menu.

A real scenario: we worked with a team selling into multi-location manufacturing. Every plant had the same HQ number, but different routing. Once they started logging "press 2 -> say 'purchasing' -> ask for extension directory," their first-attempt connects jumped, and the SDRs stopped rage-dialing the operator like it was a personal feud.

6) Ask the prospect (highest accuracy when you already have engagement)

If you have any engagement (reply, form fill, event scan), ask:

"Is this the best number to reach you, or is there a better one?"

It's the cheapest, cleanest phone capture you'll ever get.

7) Email signature mining (high accuracy, low volume)

If you have historical email threads (support, CS, sales), signatures are gold.

We've measured this internally across teams: signature-mined numbers produce the lowest wrong-person rate, but you won't get volume unless you have a lot of threads.

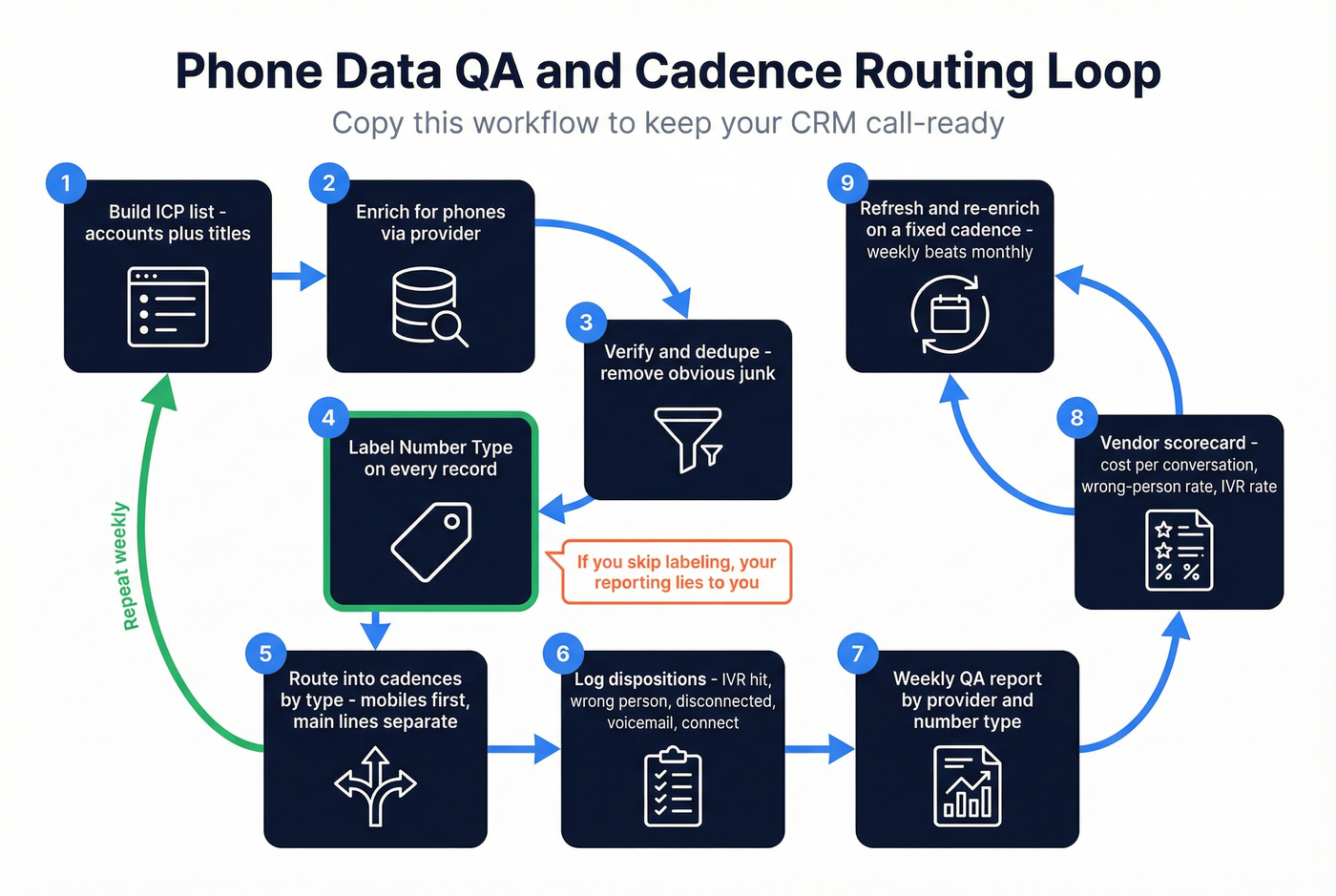

The "Number Type -> QA -> Cadence Routing" loop (copy/paste workflow)

Here's the workflow that keeps phone data usable instead of "set and forget":

- Build your ICP list (accounts + titles) - use an ideal customer definition that’s actually testable

- Enrich for phones (provider)

- Verify + dedupe (remove obvious junk)

- Label Number Type on every record

- Route into cadences by type (mobile/direct dial first; main line separate)

- Log dispositions: IVR hit, wrong person, disconnected, voicemail, connect

- Weekly QA report by provider + number type

- Vendor scorecard: cost per conversation + wrong-person + IVR rate

- Refresh/re-enrich on a fixed cadence (weekly beats monthly)

Verify and QA phone data: metrics that stop wasted dials

Most teams "QA" phone numbers by listening to reps complain. That's backwards. QA belongs in your dashboard.

Track three separate metrics (vendors love to blur these):

- Discover rate: how often the provider finds any phone number for your target

- Accuracy: valid number mapped to the right person

- Connect rate: meaningful connects/conversations per dial

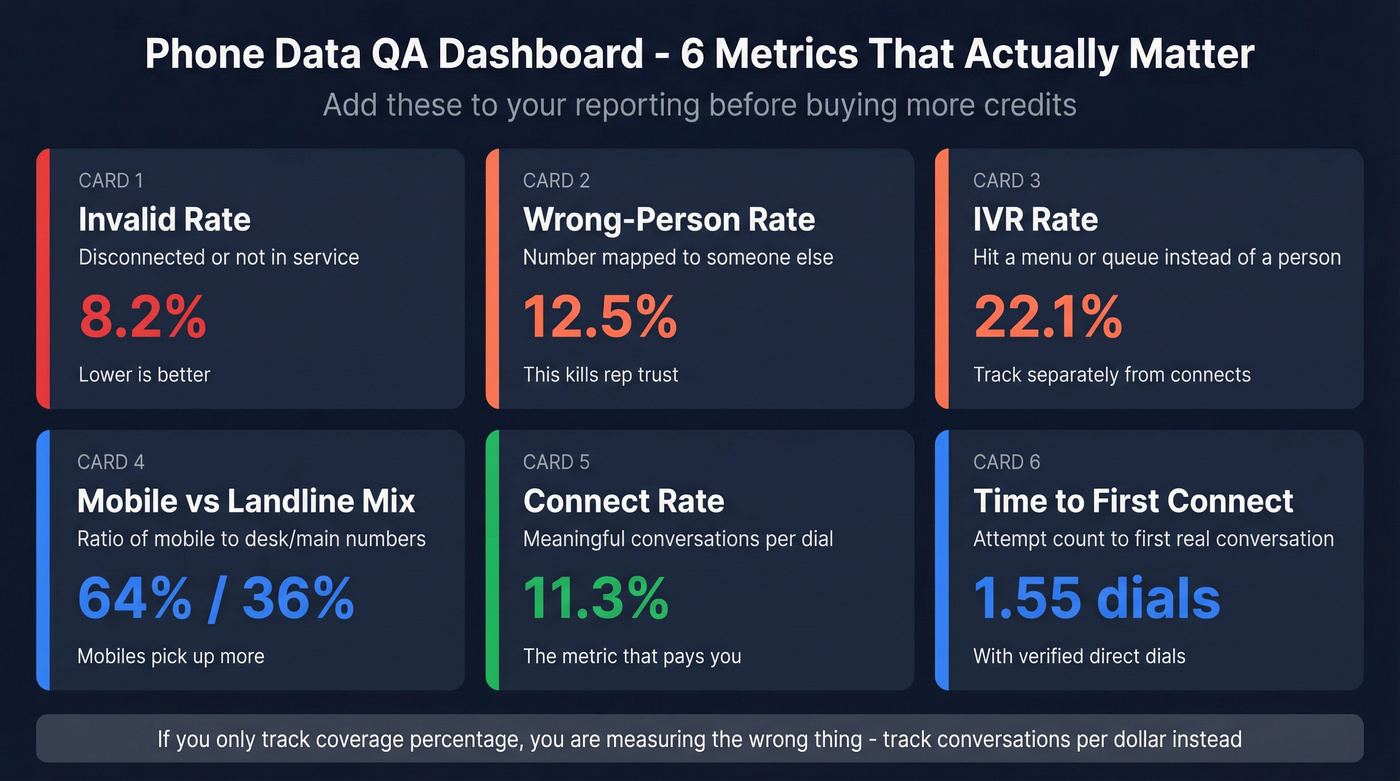

Add these to your dashboard:

- Invalid rate (disconnected / not in service)

- Wrong-person rate (mapped to someone else)

- IVR rate (menus/queues instead of a person)

- Mobile vs landline mix

- Time-to-first-connect (attempt count to first conversation)

Look, if you don't label number type, you can't fix the real problem. You'll blame "calling" when the issue is "we're sequencing main lines like they're mobiles."

Mini-model: cost per usable conversation (with an example)

Use this to compare providers without getting hypnotized by "records":

Cost per conversation = (credits used x cost per credit + rep time cost) / conversations

Example (directional):

- Provider A: $0.10/credit, 10 credits/number -> $1.00 per dialed number

- 100 dials -> $100 data cost

- 3 conversations -> $33.33 data cost per conversation (before rep time)

- Provider B: $0.20/credit, 10 credits/number -> $2.00 per dialed number

- 100 dials -> $200 data cost

- 10 conversations -> $20.00 data cost per conversation

Provider B is "more expensive" per record and cheaper per conversation. That's the comparison that matters.

Calling playbook: main line + IVR without burning your first attempts

If you're dialing main lines, you're not "calling." You're navigating a phone tree.

SalesHive reports that 71% of callers hit an automated menu, and 93% of conversations happen by the third attempt. So don't spend attempts 1-3 learning menus.

Do:

- Segment cadences by number type. Mobiles/direct dials get priority; main line is a separate step. (If you want a full calling system, see the B2B cold calling guide.)

- Log IVR paths in the CRM. Example:

Main line -> 1 -> 4 -> Directory -> "Smi" -> Ext 2317 - Create an "IVR map" note on the Account record so the whole team benefits.

- Treat your call steps as a system: prioritize verified mobiles/direct dials, and isolate main lines so they don't pollute your connect-rate reporting.

Don't:

- Don't let reps freestyle menus every time.

- Don't count "hit IVR" as a rep performance failure. It's a data/process issue.

- Don't call the main line first unless you're intentionally trying to get routed.

We've watched teams lift connect rates in main-line-heavy segments just by (1) separating number types and (2) logging IVR paths like it's part of the job, not a nice-to-have.

What phone coverage to expect in 2026 (and how to spot hype)

Phone coverage isn't 95% in real life. If a vendor implies that, they're playing definition games (counting main lines, duplicates, and stale numbers).

A Cleanlist benchmark test (single-scenario but useful) puts most tools at 40-65% phone coverage for a defined list-building task. Use that as your sanity check when you're evaluating demos.

Hot take: if your average deal size is in the low five figures, you probably don't need a ZoomInfo-sized suite. You need a smaller stack that produces clean connects and doesn't lock you into a contract.

Compliance cheat sheet (US, UK, EU/France) for B2B calling

One disclaimer, once: this isn't legal advice. Use it as an ops checklist and align with counsel.

US (TCPA): one-to-one consent is already the standard in 2026

TCPA risk spikes when you're calling numbers sourced through lead-gen forms and shared lists.

The FCC's one-to-one consent rule has been effective since Jan 27, 2026 and it's still in force in 2026: consent must authorize calls from one identified seller, and outreach must be logically related to the interaction that produced consent.

Ops rules:

- Don't buy "shared consent" lists and assume you're covered.

- Store consent metadata (who, when, what form, what brand).

UK (ICO PECR): TPS/CTPS screening + caller ID are table stakes

For live B2B marketing calls under PECR:

- Don't call numbers registered with TPS/CTPS unless you have consent.

- Don't call a business that has objected.

- Identify your organisation on the call.

- Display caller ID (or an alternative contact number).

- Sole traders and some partnerships are treated like "individual subscribers," so screen both TPS and CTPS.

The UK law change passed 19 June 2026; ICO guidance has been under review as of 2026, but the operational rules above are what teams run day-to-day.

EU/France: transparency + easy opt-out (and the direction is stricter)

France is tightening phone solicitation rules broadly, with Service-Public outlining a move toward opt-in consent for consumer solicitation in August 2026. Even for B2B teams, the direction's clear: more proof, less ambiguity.

Operationalize CNIL-style basics:

- Inform people at collection that their number can be used for prospecting.

- Provide a simple, free opt-out.

- On each call, identify your organisation and offer a clear way to refuse future calls.

Tools and pricing reality: what you'll actually pay (and how to compare)

The real cost isn't cost per record. It's cost per usable conversation.

Comparison table (keep it simple and decisive)

| Tool | Best for | Refresh / verification | Coverage expectation | Pricing anchor (early 2026) |

|---|---|---|---|---|

| ZoomInfo | US depth + full suite | Strong, but suite-driven | Best overall coverage in US | $15k- $40k+/yr |

| Cognism | EMEA compliance posture | Strong compliance positioning | Strong in EMEA | ~$1k- $3k/mo |

| Kaspr | EU SDR prospecting | Fast self-serve | Strong in EU; watch credit ceilings | $49- $79/user/mo |

| Apollo | SMB outbound starter | Good-enough verification | Variable by segment | ~$49- $99/user/mo |

| Lusha | Quick SMB pulls | Lightweight | Mid coverage | ~$36- $100+/mo |

| RocketReach | Email-first + some phones | Mixed | Mixed | ~$40- $150+/mo |

| Seamless | High-volume prospecting | Noisy at scale | High volume, lower precision | ~$150- $300+/mo |

| UpLead | List building | Solid basics | Narrower dataset | ~$99- $199/mo |

| Clay | Enrichment workflows | Depends on sources | Complements providers | ~$149+/mo |

| Bombora | Intent signals | N/A (intent) | Complements phone data | ~$10k- $50k/yr |

Pricing notes: these are starting points as of early 2026; most phone data is credit-gated and enterprise plans move fast in negotiation.

What users complain about (so you don't learn the hard way)

- ZoomInfo: expensive, contract-heavy, and teams underuse the suite.

- Apollo: easy to start, but phone coverage swings by industry/seniority.

- Seamless: lots of volume, more cleanup and wrong-person work.

Tier 1 notes (deeper, not listicle)

Prospeo (Tier 1) Prospeo is the accuracy-first pick: 300M+ professional profiles, 125M+ verified mobile numbers, a 7-day data refresh cycle, and 98% verified email accuracy. It's self-serve with transparent, credit-based pricing (no contracts), and it's built for enrichment workflows with a 92% API match rate and 83% enrichment match rate (83% of leads come back with contact data). If you care about freshness and clean connects more than "we have the biggest database," this is the one I'd start with, especially if you're evaluating a phone number finder for prospects that won't tank your connect rates with stale mappings.

ZoomInfo (Tier 1) ZoomInfo is still the best "everything in one place" platform for US-heavy teams that will actually use the suite (intent, workflows, enrichment, governance). Tropic's benchmark tiers land at $14,995 / $29,995 / $35,995 per year, and most mid-market teams end up around $15k-$40k+/year depending on seats and modules. Buy it when you want a platform; skip it when you only need "search -> export."

Skip it if you're a small team that just needs clean direct dials and a weekly refresh.

Kaspr (Tier 1 for EU teams) Kaspr shines for EU SDR workflows and quick prospecting. The strongest credibility signal is their reviewer geography: on G2, Europe is 699 reviewers vs 29 in North America. The tradeoff is scaling cost: credits feel tight when you push volume.

Tier 2 notes (short, varied formats)

Cognism - when compliance is the dealbreaker Buy Cognism when EMEA compliance posture is your gating factor and you need a vendor that's built to sell into that reality. It's not the cheapest, but it's the cleanest story for EMEA teams that can't afford compliance ambiguity.

Apollo - pricing mechanics that make it a default

Apollo wins on rollout speed: low per-seat pricing, quick list building, and enough data to get reps moving this week. The cost is time: you'll spend more effort filtering, validating, and re-enriching phones as you scale.

Tier 3 (quick reality check): Lusha, RocketReach, Seamless, and UpLead are fine when you need lightweight prospecting and you're willing to run a stricter QA loop. Clay is different: it's the workflow layer that stitches providers together. Bombora is an intent data provider; some stacks pair intent topics with phone verification so reps call the right accounts first.

API-first vs UI-first: who should buy what

UI-first tools are for reps building lists and exporting.

API-first tools are for RevOps teams who want the CRM to stay fresh without heroics. Three concrete jobs that justify API access:

- Nightly CRM freshness jobs: re-enrich stale contacts and replace disconnected numbers.

- Inbound lead enrichment: enrich phone + firmographics at form-fill, then route instantly.

- Dedupe + routing automation: merge duplicates, standardize number types, and push the right records into the right sequences.

If you're doing any of that, look for an enrichment API. If you're not, don't overbuy - get a tool reps'll actually use.

Buying checklist (ask vendors these, then score them)

- What's your refresh cycle for phone numbers?

- How do you define direct dial vs main line?

- Do you verify mobiles in real time, or in batches?

- What's your wrong-person rate, and what's your replacement policy?

- Can you segment coverage by region + seniority?

- How do credits work when a number routes to IVR?

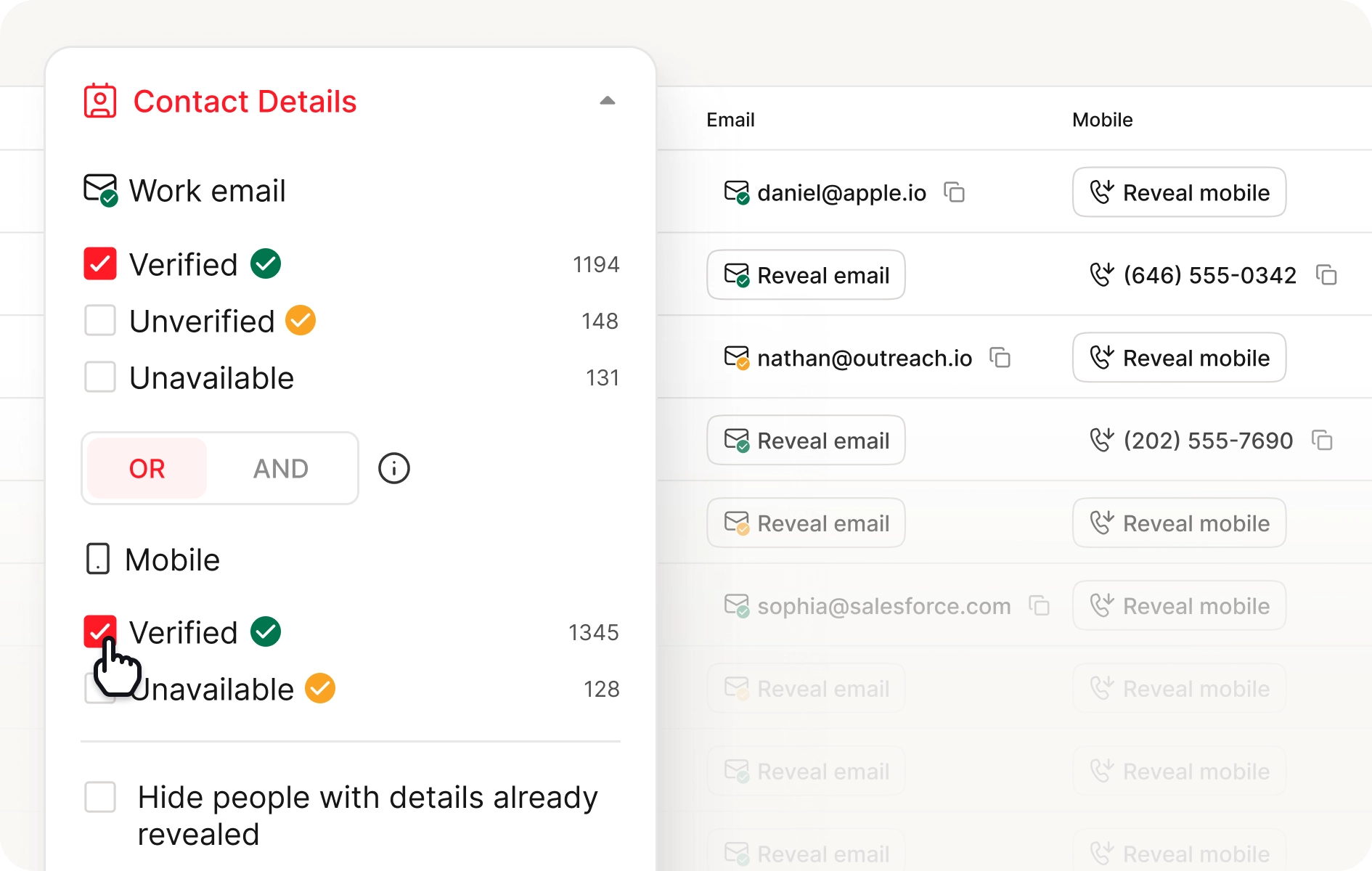

Prospeo UI example (what to look for)

Prospeo's Mobile Finder is the standard I want more tools to hit: a clear verified indicator, and credits consumed only when a number's found (10 credits per mobile). That's how you keep spend aligned with value.

Coverage is a vanity metric. You said it yourself. Prospeo's 5-step verification and weekly data refresh mean your SDRs dial real people, not switchboards. 98% email accuracy, 30% mobile pickup rate, and number-type labeling built in - so you measure conversations per dollar, not coverage percentage.

Kill the IVR hits. Dial decision-makers directly for $0.01 each.

FAQ: B2B phone numbers, direct dials, and legality

Is it legal to cold call B2B phone numbers?

Yes, when you follow the rules for the region you're calling into and honor opt-outs. In the UK, TPS/CTPS screening and caller ID are non-negotiable. In the US, one-to-one consent (effective since Jan 27, 2026 and still in force in 2026) changes how you treat lead-gen sourced numbers.

What's the difference between a direct dial and a main line?

A direct dial is assigned to a person and is intended to ring them (or their voicemail). A main line routes through a switchboard/IVR/queue. Direct dials usually produce higher connect rates; main lines are better for transfers and verification.

How many call attempts should SDRs make before switching channels?

Three attempts is the practical cutoff for most teams because conversations cluster early. After attempt three, switch channels (email/social) or switch number type (move from main line to direct dial/verified mobile).

What metrics prove a phone number provider is good?

Track invalid rate, wrong-person rate, IVR rate, and connect rate by number type. "Coverage" only matters after those are under control.

What's a good free tool for building a verified mobile call list?

For a free start, use Prospeo's free tier (75 email credits + 100 Chrome extension credits/month) to pull verified contact data, then run a 50-lead test and score wrong-person + IVR rates. If you need more options, Apollo and Lusha can work for lightweight pulls, but expect more cleanup as volume rises.

Closing recommendation (tight next steps)

The contrarian move that wins: collect fewer numbers, but make them work. Teams that chase maximum coverage end up paying for IVRs, wrong-person dials, and stale records.

Do this next:

- Run a 50-lead test with number-type labeling

- Dashboard invalid/wrong-person/IVR/connect rate by provider

- Pick the winner on cost per conversation, not cost per record

- Lock a refresh cadence and enforce it weekly

That's how you turn a b2b phone number from a guessing game into a repeatable system.