The Best B2B Data Providers in 2026: Real Pricing, Real Accuracy, Real Picks

Poor data quality costs organizations $12.9 million annually on average. That's the compounding cost of bounced emails, wrong numbers, wasted rep hours, and deals that never start because the contact info was dead on arrival. The B2B data provider market has hit $105 billion and is racing toward $215 billion by 2033, yet 70% of CRM data is still outdated, incomplete, or flat-out wrong.

Sales reps lose 500 hours per year - 62 working days - just validating and correcting contact info. That's not a data problem. It's a revenue problem wearing a data costume.

I've spent years running bake-offs, watching teams burn through five-figure contracts only to discover their "verified" database bounces at 25%. The best provider isn't the one with the biggest database. It's the one that gives your reps accurate contacts they can actually reach. Everything else is a vanity metric.

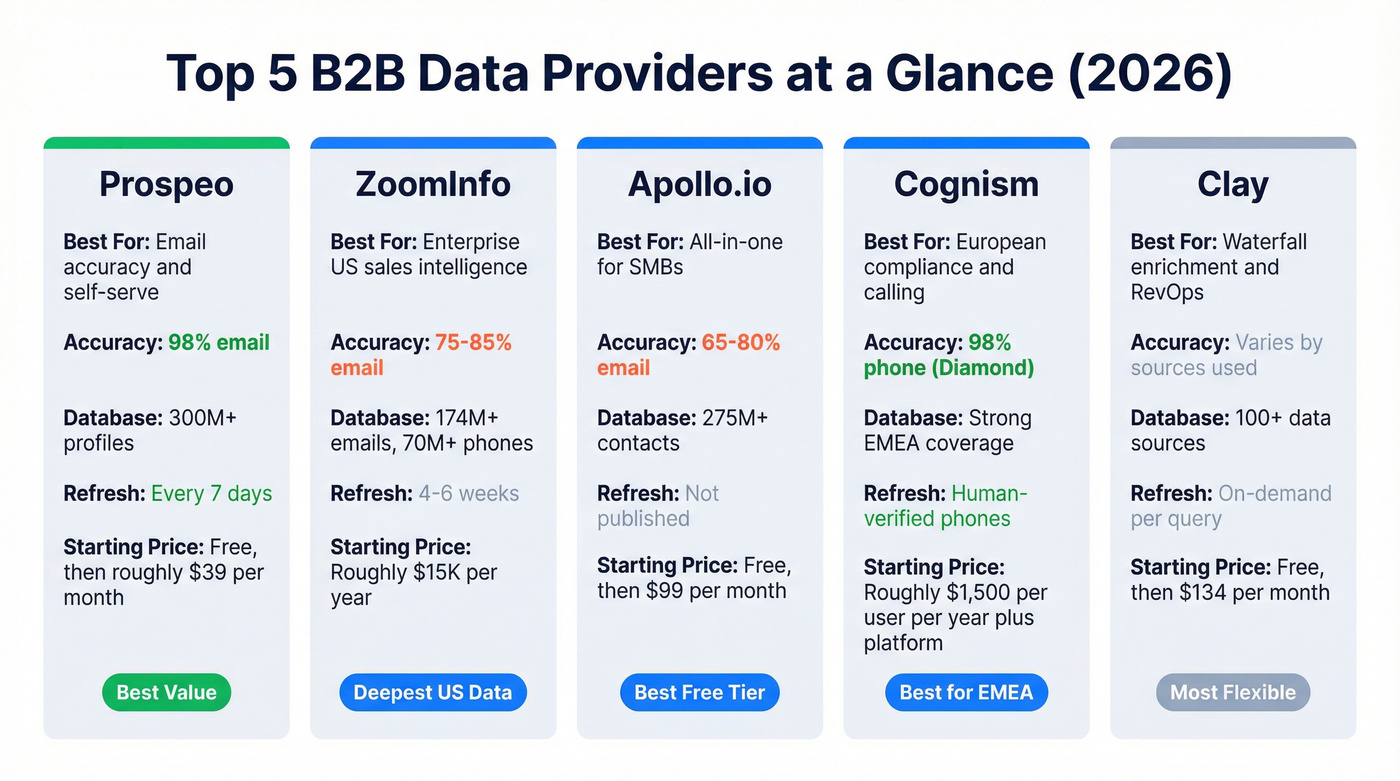

Our Picks (TL;DR)

| Use Case | Pick | Why | Starting Price |

|---|---|---|---|

| Email accuracy & self-serve | Prospeo | 98% email accuracy, 7-day refresh, ~$0.01/lead | Free; ~$39/mo paid |

| Enterprise sales intelligence | ZoomInfo | Deepest US database, strongest dials | ~$15K/yr |

| All-in-one for SMBs | Apollo.io | Free tier, built-in sequences | Free; $99/mo paid |

| European compliance | Cognism | Phone-verified mobiles, GDPR-native | ~$1,500/user/yr + platform |

| Waterfall enrichment | Clay | 100+ data sources, custom workflows | Free; $134/mo paid |

These five cover most use cases. The remaining 13 tools fill specific niches - intent data, API-first enrichment, budget prospecting. If you're starting from scratch, one of these five is your answer.

What Is a B2B Data Provider?

A business data provider sells you information about companies and the people who work at them. Simple concept, complicated execution.

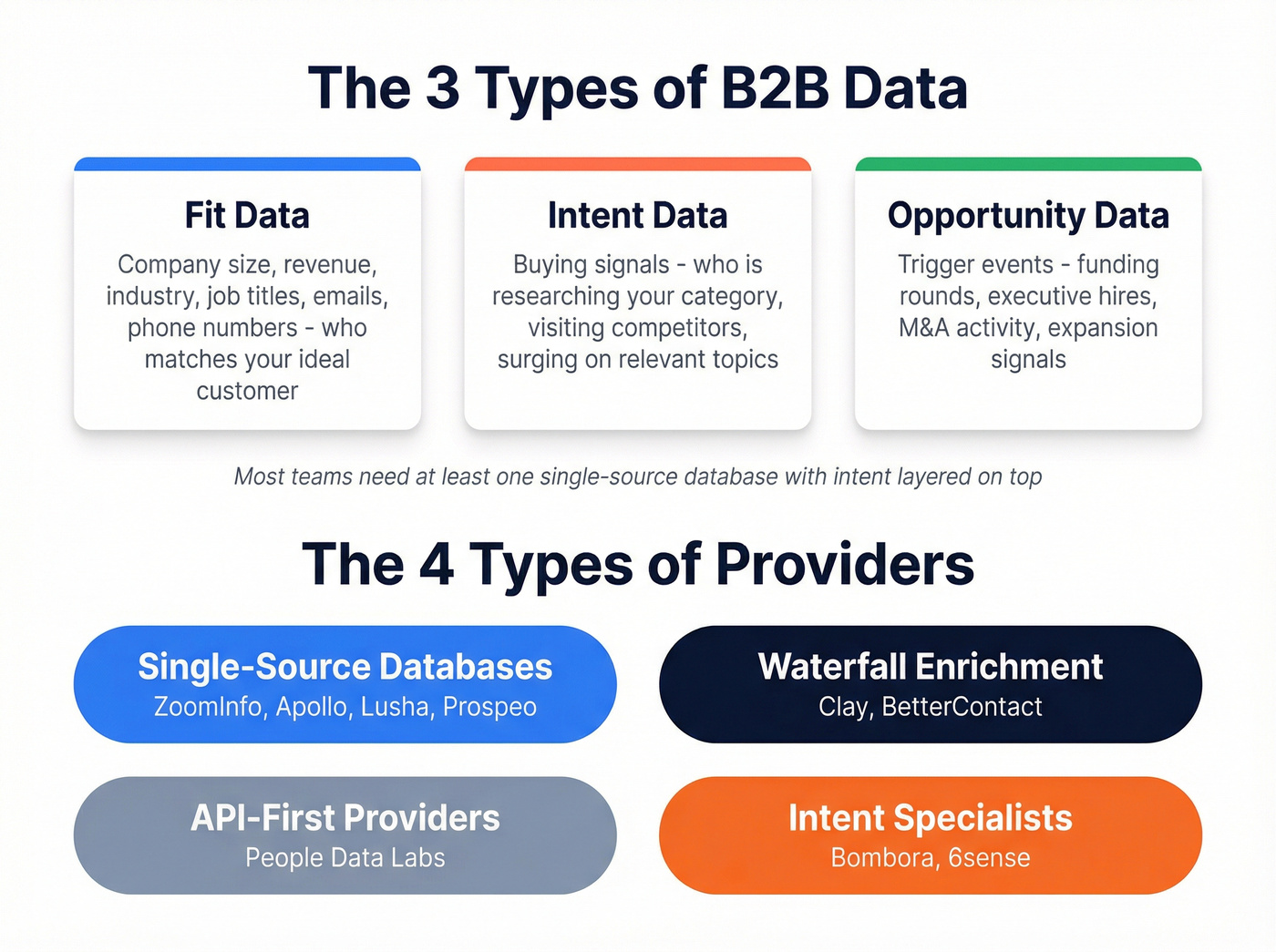

The data breaks into three buckets. Fit data is firmographic and demographic - company size, revenue, industry, job titles, emails, phone numbers. This is what most people mean when they say "company data provider." Intent data tracks buying signals - who's researching your category, visiting competitor sites, or surging on relevant topics. Opportunity data captures trigger events like funding rounds, executive hires, and M&A activity.

Providers fall into four camps: single-source databases (ZoomInfo, Apollo, Lusha), waterfall enrichment platforms that query multiple sources (Clay, BetterContact), API-first providers for developers (People Data Labs), and intent data specialists (Bombora, 6sense). These categories increasingly blur. Most teams need at least one from the first category with intent layered on top.

The Accuracy Problem Nobody Talks About

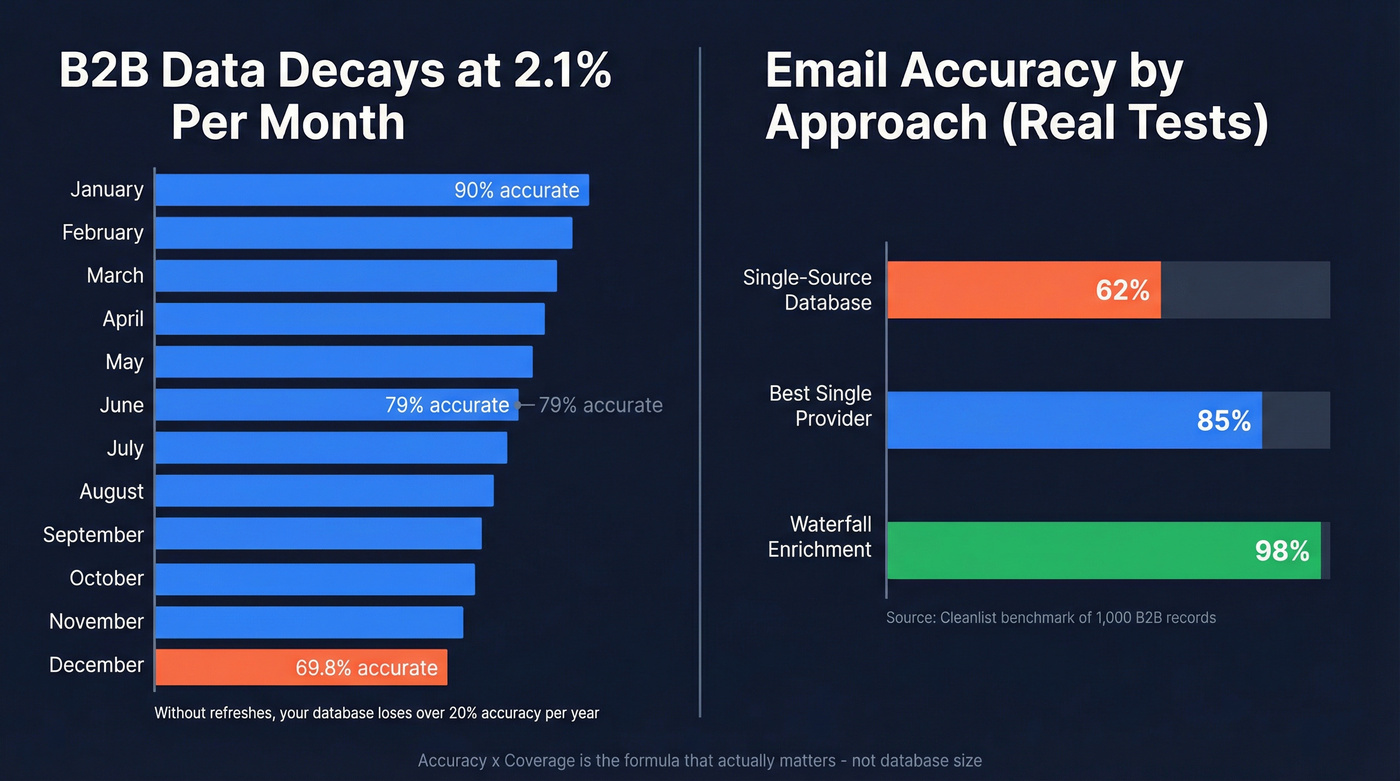

B2B contact data decays at 2.1% per month. That's 22.5% annually. People change jobs, get promoted, switch email addresses, ditch phone numbers. A database that was 90% accurate in January is 78% accurate by December - if nobody refreshes it.

Most providers don't refresh fast enough. The industry average sits around every six weeks. Some are worse. By the time your reps pull a list, a meaningful chunk is already stale.

The accuracy numbers vendors throw around don't hold up under scrutiny. A Salesfinity benchmark across 9 phone data providers found accuracy ranging from 63% to 91% on a controlled set of 307 verified contacts. That's a massive spread. A Cleanlist test of 1,000 B2B records showed single-source databases finding only 62% of emails, while waterfall enrichment hit 98%.

The formula that actually matters is Accuracy x Coverage. A provider with 95% accuracy but 30% coverage for your ICP is worse than one with 85% accuracy and 80% coverage. Database size is a vanity metric. What matters is how many of your target contacts they can find, and how many of those are actually reachable.

If your current provider doesn't publish their refresh frequency, it's because the number would embarrass them.

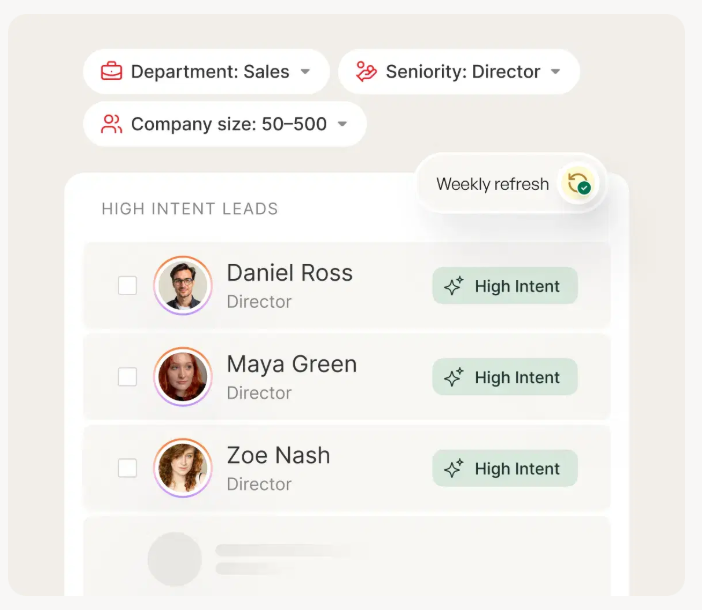

You just read that B2B data decays at 2.1% per month and most providers refresh every 6 weeks. Prospeo refreshes every 7 days - that's why teams see bounce rates drop from 35% to under 5% and book 26% more meetings than ZoomInfo users.

Stop paying for stale data. Start with 75 free verified emails.

The Best B2B Data Providers Ranked for 2026

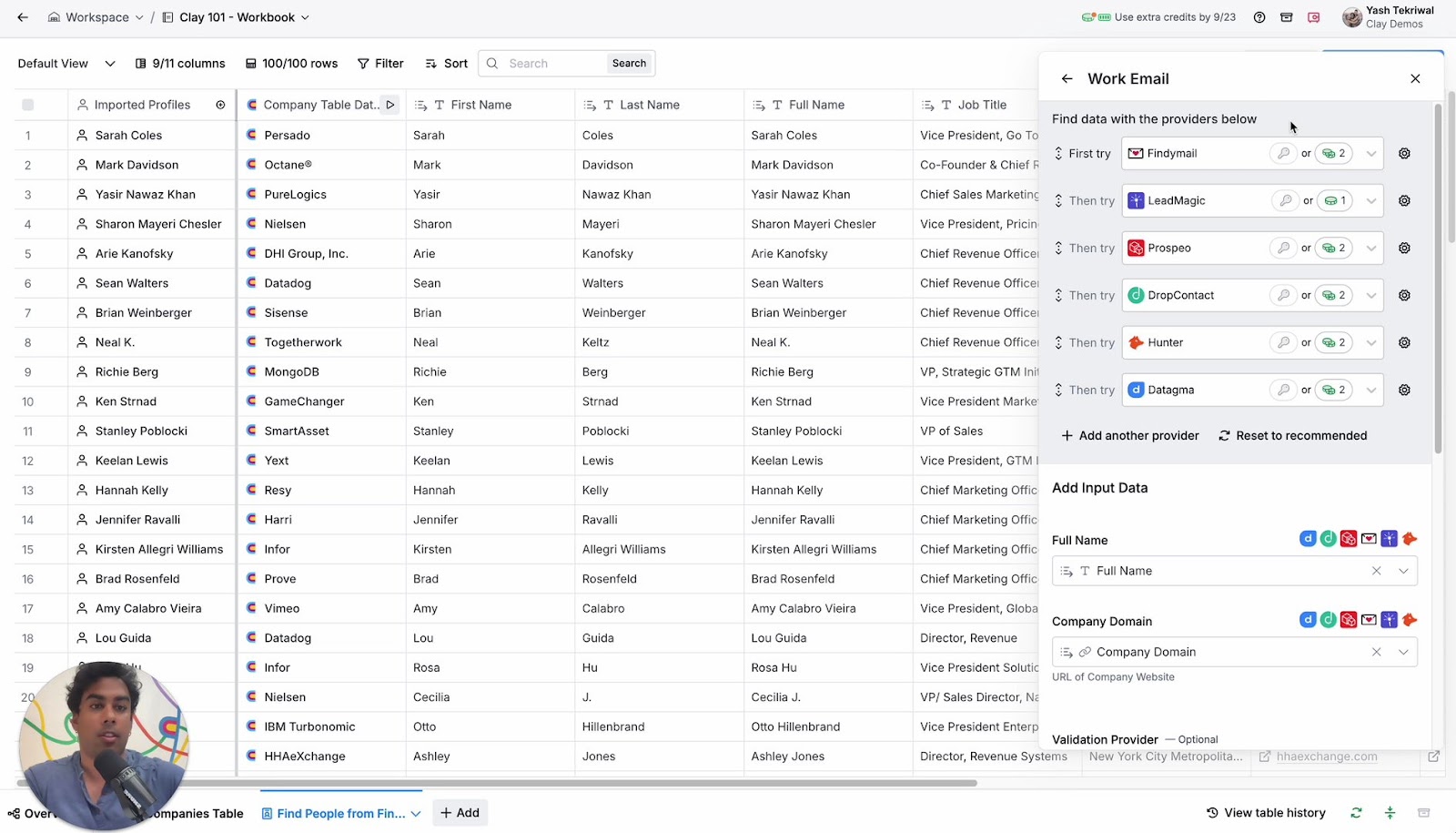

Prospeo

Use this if: You need the highest email deliverability in the market, want self-serve access without annual contracts, or you've been burned by bounced emails from other contact data vendors.

Pair with a sequencer if: You need built-in dialers and ad targeting alongside your data.

Prospeo's database covers 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers with a 30% pickup rate. The 98% email accuracy comes from a proprietary 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering. The Chrome extension (40K+ users) lets reps find verified contacts from any website or CRM in one click.

The 7-day data refresh cycle is the real differentiator. In a published case study, Snyk rolled out Prospeo across 50 AEs and their bounce rate dropped from 35-40% to under 5%, while AE-sourced pipeline jumped 180%. Meritt tripled pipeline from $100K to $300K per week after switching. Teams book 26% more meetings compared to ZoomInfo and 35% more compared to Apollo - the data freshness compounds into real pipeline.

Search filters include buyer intent (powered by Bombora across 15,000 topics), technographics, job changes, headcount growth, funding, and revenue. Prospeo also supports contact data export directly into Salesforce, HubSpot, Smartlead, Instantly, Lemlist, and Clay - so your enriched lists flow straight into your outbound stack.

The credit-based model means you only pay for what you use. There's no platform fee forcing you into enterprise-tier commitments, making it equally viable for a 2-person startup or a 50-seat sales floor.

Pricing: Free tier with 75 verified emails/month. Paid plans from ~$39/mo. Credits run about $0.01 per email. No contracts, cancel anytime.

ZoomInfo

Use this if: You're an enterprise sales org that needs the deepest US company contacts database, direct dial numbers, and a full GTM platform.

Skip this if: You're a team under 10 reps, your budget is under $20K/year, or you primarily sell into EMEA.

ZoomInfo remains the 800-pound gorilla. Its US database depth is unmatched - 174M+ emails, 70M+ phone numbers, 100M+ company profiles. G2 rating: 4.5/5 across 8,997 reviews. For direct mobile numbers specifically, the Reddit consensus is clear: "ZoomInfo has the best data hands down."

The problem is everything else. A 10-seat contract with intent data and mobile numbers can run $35,000-$45,000+/year on the Elite plan. Professional starts at $15,000-$18,000/year for 1-3 seats. Expect 10-20% automatic renewal increases. Enterprise renewal rates exceed 85% largely because integration depth and switching costs make leaving painful, not because teams are thrilled.

The #1 Reddit complaint isn't the data - it's the pricing and contract practices.

Independent comparisons put ZoomInfo's email accuracy at 75-85%, and many competitors run 4-6 week refresh cycles. For teams that need the full GTM platform and have the budget, ZoomInfo earns its keep. For teams that just need accurate contacts, it's dramatically overpriced.

Pricing: Professional $15K-$18K/yr. Advanced $22K-$28K/yr. Elite $35K-$45K+/yr. Annual contracts only. (If you want the full credit math, see our breakdown of ZoomInfo pricing.)

Apollo.io

Apollo is the obvious starting point for most SMB teams. The free tier is usable out of the box, and the Professional plan at $99/mo per user includes a 275M+ contact database, built-in email sequences, a dialer, and basic intent signals. G2 rating: 4.7/5 across 9,408 reviews. One Reddit user summed it up: "Paid for itself at $99/month vs ZoomInfo's $35K+."

The tradeoff is accuracy. "Inaccurate Data" is one of the most-cited negatives in Apollo reviews (538 mentions). In comparisons, email accuracy for director+ roles in North America commonly lands in the 65-80% range. EMEA is often lower. (If you're comparing claims vs reality, see our deep dive on Apollo.io accuracy.)

If you're sending 1,000 emails a week, that 20-35% miss rate compounds into deliverability damage fast. Apollo is best for teams that value the all-in-one workflow and can tolerate lower accuracy. If email deliverability is mission-critical - especially for cold email campaigns - look elsewhere.

Pricing: Free tier available. Professional $99/mo/user. Organization $149/mo/user. Month-to-month available.

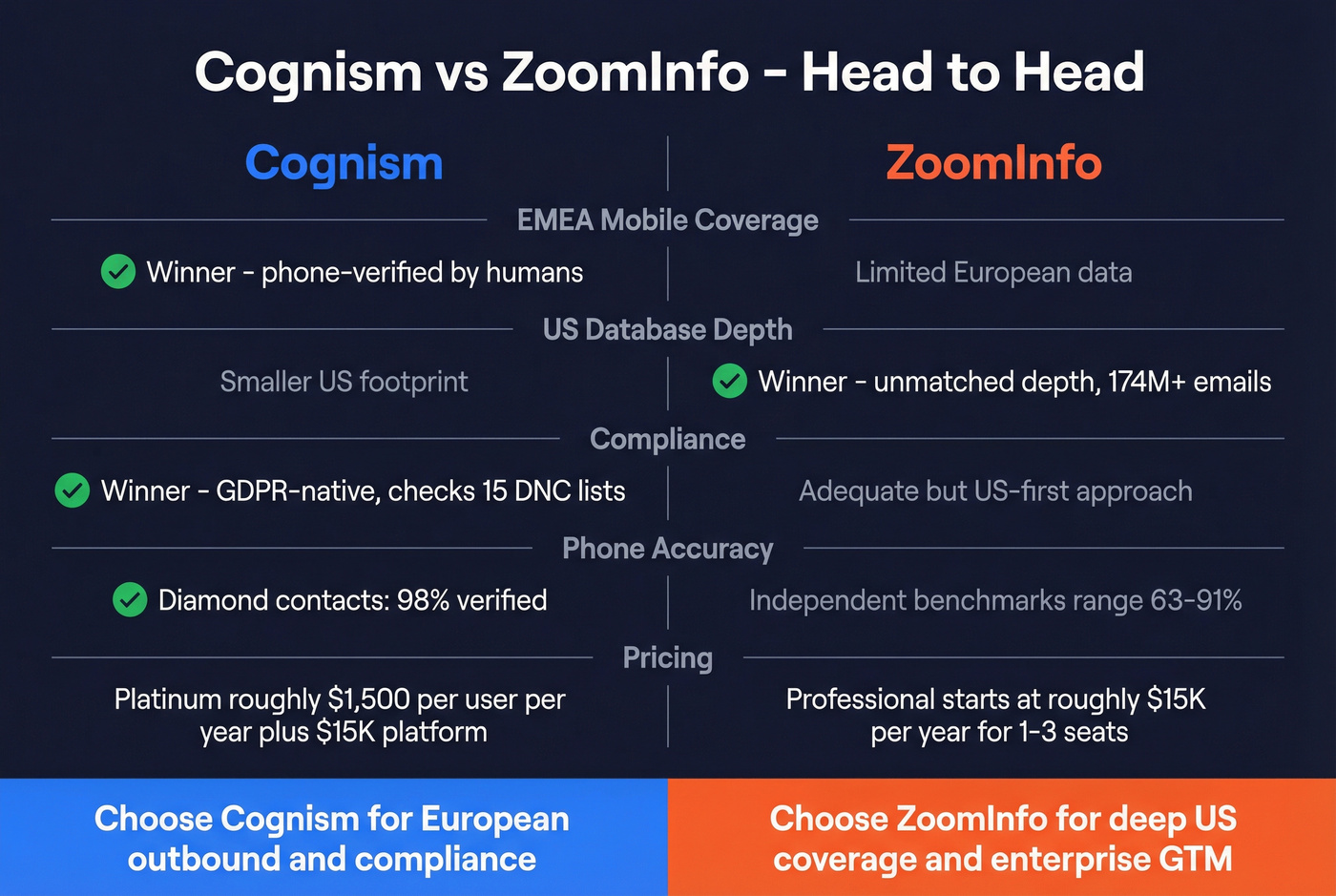

Cognism

| Strength | Cognism | ZoomInfo |

|---|---|---|

| EMEA mobile coverage | Winner - phone-verified by humans | Limited European data |

| US database depth | Smaller US footprint | Winner - unmatched |

| Compliance | Winner - GDPR-native, checks 15 DNC lists | Adequate but US-first |

| Pricing model | Unlimited views (fair use) | Credit-based, expensive |

| Phone accuracy | Diamond contacts: 98% | Varies; independent benchmarks range 63-91% |

Cognism's Diamond Verified dataset is the real product. They employ humans to call and verify mobile numbers, delivering 98% phone accuracy on Diamond contacts. G2 rating: 4.6/5. For teams doing cold calling into the UK, DACH, or Nordics, no other European mobile number provider matches Cognism's coverage. Bombora intent data is included in the Diamond tier.

If you need strong coverage in France or other continental European markets, Cognism is the strongest option - their GDPR-native architecture and DNC list checking across 15 countries make them the default for compliant European outbound. (For region-specific legal/quality nuance, see our guide to B2B Data UK.)

The pricing isn't cheap. Platinum runs ~$1,500/user/year plus a $15,000 platform fee. Diamond jumps to ~$2,500/user/year plus $25,000 platform. For a 5-person team on Diamond, you're looking at $37,500/year.

Pricing: Platinum ~$1,500/user/yr + $15K platform. Diamond ~$2,500/user/yr + $25K platform. Annual contracts standard.

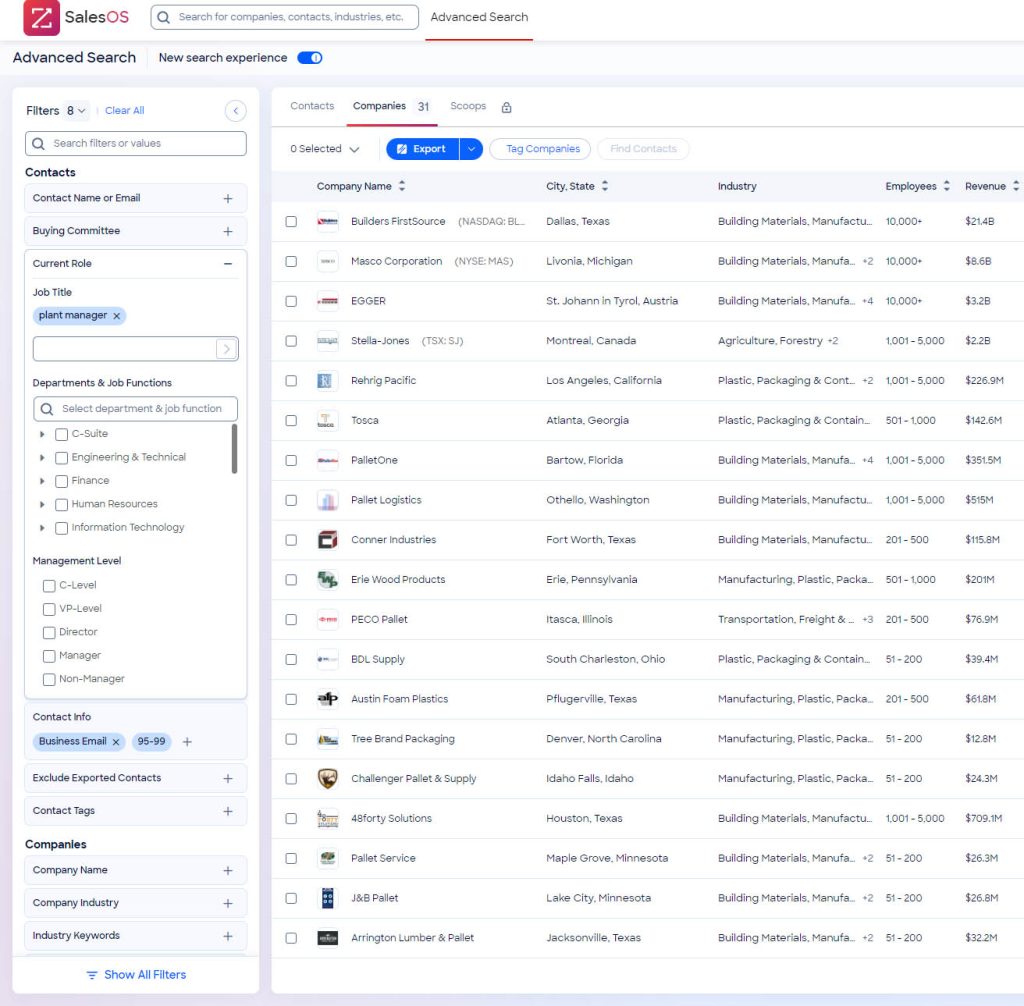

Clay

Who it's for: RevOps teams and growth engineers who want to orchestrate data from 100+ sources in custom waterfall workflows.

Who should skip it: Anyone who wants plug-and-play. Clay has a steep learning curve, and credit burn can surprise you.

Clay isn't a database. It's a data orchestration layer. You build workflows that query multiple providers sequentially - if Source A doesn't find an email, it tries Source B, then C, then D. Multiple teams see dramatically higher enrichment rates versus single-source tools once their waterfall is dialed in.

I watched a RevOps team burn through $400 in credits in the first week because they didn't understand the credit economics. Each provider within Clay costs different credit amounts, and it adds up fast when you're running complex waterfalls at scale. The Pro plan at $720/mo is where most serious teams land, since CRM integrations are locked to that tier. Multiple users describe weeks of setup before seeing value - but once it clicks, Clay becomes the backbone of your data stack.

Pricing: Free (1,200 credits/yr). Starter $134/mo. Explorer $314/mo. Pro $720/mo. Enterprise custom (~$30K/yr median).

Lusha

Lusha is the quick-hit enrichment tool. Chrome extension, search a contact, reveal the email or phone number. 280,000+ revenue teams use it. G2 rating: 4.3/5 across 1,610 reviews.

The credit economics get tricky. Email reveals cost 1 credit. Phone reveals cost 10 credits. On Pro, that's 25 phone numbers per month - barely enough for a single SDR's weekly call list. Lusha works best for enriching contacts you've already identified through Sales Nav or other sources, not for building lists from scratch.

Pricing: Free (70 credits/mo). Pro $29.90/user/mo. Premium $69.90/user/mo. Scale: custom. (Compare tiers and real credit burn in our Lusha pricing guide.)

SalesIntel

SalesIntel's pitch is human-verified data - actual researchers checking contact info every 90 days. The database runs 90M+ contacts, with 17M human-verified. They publish a 95% accuracy rate and a 35% connection rate on verified contacts.

The pricing stings. The startup plan runs $18,000/year for 3 users and 30,000 credits. Enterprise jumps to $48,000/year. One SaaS startup I know budgeted $15K and ended up at $24,500 after intent data add-ons and enhanced lookup credits (which consume 2-3 credits each). You're paying a premium for the human verification layer, and you need to decide if that premium is worth it for your ICP.

Pricing: Individual $99/mo. Startup $18K/yr (3 users). Enterprise $48K/yr (10 users). Intent data add-on $5K-$10K/yr.

People Data Labs

People Data Labs is the provider for teams that want raw data via API, not a pretty UI. If you're building AI sales agents, custom enrichment pipelines, or internal data products, PDL is your starting point. The database covers 1.5B+ person records and 100M+ company records, accessible through clean REST APIs.

Person enrichment runs $0.20-$0.28 per lookup depending on volume. The free tier gives you 100 lookups/month but no contact data - you need Pro at $98/mo for that. PDL is one of the few providers where the API documentation is actually good.

Pricing: Free (100 lookups/mo, no contact data). Pro $98/mo. Enterprise ~$2,500+/mo custom.

6sense

6sense is an ABM platform that happens to include contact data, not a data company that happens to do ABM. The AI buying stage predictions - identifying which accounts are in "awareness" vs "decision" stage - are useful for enterprise teams running multi-touch campaigns.

The catch: implementation takes 3-6 months, pricing starts around $35,000/year, and the platform is overkill for teams that just need emails and phone numbers. If you're running enterprise ABM with 6+ month sales cycles, 6sense earns its keep. Everyone else should layer intent on separately.

Pricing: ~$35K+/yr starting. Enterprise deals can exceed $100K/yr. Annual contracts.

Seamless.AI

Seamless.AI finds contact data in real time rather than serving from a static database. The pitch is unlimited contacts on higher tiers, which sounds great until you hit the accuracy wall. G2 rating: 4.4/5 across 5,295 reviews, but data quality is the #1 complaint and aggressive upselling is #2.

For high-volume prospecting where you need quantity over precision, Seamless works. For teams where every bounced email damages sender reputation, it's a risk.

Pricing: ~$147-$197/mo per user. Enterprise custom. Free trial available.

Demandbase

Enterprise ABM platform combining intent data, advertising, and account intelligence. Competes directly with 6sense. Best for large marketing teams running coordinated ABM programs. Pricing runs $35K-$100K+/year. Skip it if you're under 50 employees.

Bombora

The original third-party intent data provider. Bombora's cooperative of 5,000+ B2B publisher sites tracks topic-level research across 18,000+ intent topics. Many providers (including 6sense and Cognism) license Bombora data. If you want intent as a standalone layer to enrich your buyer contact data, go direct. Pricing runs ~$25K-$50K/year.

UpLead

Budget-friendly database with a 95% accuracy guarantee. G2 rating: 4.7/5 across 824 reviews. Solid choice for small business teams that need verified contacts without enterprise pricing. Starts at ~$74/mo.

RocketReach

Broad coverage with email and phone lookups. Better for one-off research and recruiter use cases than high-volume outbound. Starts at ~$39/mo.

Lead411

Growth-focused database with trigger-based selling signals (funding, hiring, tech installs). Starts at ~$75/mo. Underrated for event-driven prospecting.

Clearbit / Breeze Intelligence

Now part of HubSpot as Breeze Intelligence. If you aren't on HubSpot, there's no reason to consider this - the standalone value proposition died with the acquisition. Credit packs run $30-$700/mo.

Kaspr

European-focused Chrome extension for quick contact reveals, particularly strong on EMEA coverage. Worth evaluating alongside Cognism if you need contacts outside Western Europe. Starts at $49/user/mo.

LeadIQ

Built for SDR workflows - capture contacts from Sales Nav, push to sequences. Best as a capture layer, not a primary database. Free tier available; paid from ~$39/mo per user.

B2B Data Provider Pricing Comparison

The sticker price tells you almost nothing. What matters is the cost per usable lead - the price you pay divided by the percentage of contacts that are actually accurate and reachable.

| Tool | Best For | Starting Price | Model | Terms |

|---|---|---|---|---|

| Prospeo | Email accuracy | ~$39/mo | Credits | Free tier, no contract |

| ZoomInfo | Enterprise US data | ~$15K/yr | Credits + seats | No free tier, annual |

| Apollo.io | SMB all-in-one | $99/mo/user | Per seat | Free tier, no contract |

| Cognism | EMEA compliance | ~$1,500/user/yr + platform | Unlimited views | Trial only, annual |

| Clay | Waterfall enrichment | $134/mo | Credits | Free tier, no contract |

| Lusha | Quick enrichment | $29.90/user/mo | Credits | Free tier, no contract |

| SalesIntel | Human-verified | $99/mo individual | Credits | No free tier, annual (team) |

| People Data Labs | API/developers | $98/mo | Per lookup | Free tier, no contract |

| 6sense | ABM + intent | ~$35K+/yr | Platform | No free tier, annual |

| Seamless.AI | High-volume | ~$147/mo/user | Credits/unlimited | Trial, annual |

| Demandbase | Enterprise ABM | ~$35K+/yr | Platform | No free tier, annual |

| Bombora | Intent data | ~$25K+/yr | Platform | No free tier, annual |

| UpLead | Budget prospecting | ~$74/mo | Credits | Free tier, no contract |

| RocketReach | Broad lookups | ~$39/mo | Credits | Free tier, no contract |

| Lead411 | Trigger selling | ~$75/mo | Unlimited | Free tier, no contract |

| Clearbit/Breeze | HubSpot enrichment | $30/mo | Credits | Free tier, no contract |

| Kaspr | EMEA Chrome ext. | $49/user/mo | Credits | Free tier, no contract |

| LeadIQ | SDR capture | ~$39/mo/user | Credits | Free tier, no contract |

Here's the math that changes everything. Say you're paying $1 per lead from a provider with 75% accuracy. Your effective cost per usable lead is $1.33 - because 1 in 4 contacts is garbage. Factor in the rep time wasted on bad contacts, the sender reputation damage from bounced emails, and the opportunity cost of not reaching real prospects, and that $1.33 balloons further.

At ~$0.01 per email with 98% accuracy, the effective cost per usable lead drops to roughly $0.01. Even if you're generous with ZoomInfo's accuracy at 85%, their ~$1/lead effective cost is $1.18 per usable contact. That's not a rounding error - it's a 100x difference in cost efficiency.

Credit systems that count API calls the same as manual exports are a tax on RevOps teams. Before you sign anything, calculate your true cost per usable lead.

It's the only number that matters.

The average company loses $12.9M to bad data. At $0.01 per email with 98% accuracy, Prospeo costs 90% less than ZoomInfo while delivering higher deliverability. No contracts, no sales calls - just verified contacts your reps can actually reach.

Replace your overpriced B2B data provider in under 5 minutes.

Waterfall Enrichment - Why One Provider Isn't Enough

Single-source databases have a ceiling, and most teams hit it faster than they expect. A Cleanlist test of 1,000 B2B records showed the gap clearly: a single-source provider found 62% of emails, while a waterfall approach across 15+ providers found 98%. Phone numbers jumped from 48% to 85%. Full records (email + phone + company data) went from 31% to 82%.

Those aren't marginal gains. That's the difference between reaching 3 out of 10 prospects and reaching 8 out of 10.

Waterfall enrichment works by querying multiple data sources sequentially. If Provider A doesn't have the email, the system tries Provider B, then C - cascading through sources until it finds a match or exhausts the list. The key word is sequentially. True waterfall tools merge data at the field level, not the record level.

Here's what most people get wrong: Apollo, ZoomInfo, Lusha, and Clearbit are all single-source databases. They aggregate data from multiple inputs during collection, but when you query them, you're hitting one database. The marketing says "comprehensive." The architecture is single-source.

True waterfall tools include Clay (100+ provider integrations), FullEnrich, and BetterContact. These platforms let you stack providers in priority order and only pay for the sources that actually return data.

The diminishing returns curve matters. Below 5 providers, you're leaving significant coverage gaps. Above 10-15, each additional source adds minimal lift. The sweet spot for most teams is 7-12 providers in the waterfall, ordered by accuracy and cost.

If you're running outbound into a single well-defined ICP in the US, a strong single source might be enough. The moment your ICP spans multiple industries, regions, or seniority levels, waterfall enrichment isn't optional - it's the only way to hit acceptable coverage. (If you're evaluating orchestrators, see our list of waterfall alternatives.)

2026 Compliance Checklist

Compliance used to be a European problem. Not anymore.

The CCPA Delete Act launched the DROP (Delete Request and Opt-out Platform) in January 2026, giving California consumers a single portal to request deletion from all data brokers simultaneously. Starting August 2026, data brokers must check DROP every 45 days. If your provider is classified as a data broker - and most are - this directly impacts the data you're buying.

Global Privacy Control (GPC) enforcement is no longer theoretical. Joint enforcement sweeps by California, Colorado, and Connecticut attorneys general in September 2025 resulted in fines exceeding $1.3 million. Twelve US states now require honoring opt-out preference signals. If your provider isn't respecting GPC headers, you're inheriting their compliance risk.

GDPR remains the baseline for European data. Look for providers that offer GDPR-compliant sourcing with opt-out enforcement and Data Processing Agreements. Many US-first providers treat GDPR as an afterthought - which is fine until your first enterprise prospect in Germany asks for your DPA.

Five questions to ask before signing:

- How do you source contact data, and do you maintain consent/legitimate interest records?

- Do you honor GPC signals and CCPA deletion requests?

- Can you provide a Data Processing Agreement?

- How quickly do you process opt-out requests?

- Are you registered as a data broker in states that require registration?

If your provider can't answer these clearly, that's a red flag. The fines are real, and "we didn't know our data vendor was non-compliant" isn't a defense regulators accept.

How to Evaluate Any B2B Data Provider

Database size is a vanity metric. Here's the framework that actually predicts whether a tool will work for your team.

1. Coverage for YOUR ICP, not total database size. A provider with 300M profiles is useless if they have 12 contacts matching your target persona. Before you buy, export a sample of 200-500 contacts from your ICP definition and test fill rates across 2-3 providers. This single step saves more money than any negotiation tactic. Teams targeting the 50-500 employee segment should be especially rigorous here - coverage for mid-market companies varies wildly across providers.

2. Fill rate - 80%+ benchmark for key attributes. Fill rate measures completeness: what percentage of records include the fields you actually need? If you need direct dials and the provider fills phone numbers on only 40% of records, their 275M database is effectively a 110M database for you. Demand 80%+ fill rates on email, title, and company, and at least 60% on phone.

3. Accuracy testing - always run a sample test. Never trust a vendor's self-reported accuracy number. Pull 500 contacts, send a verification pass, and measure bounce rates yourself. I've run bake-offs where the "best database" created 4,000 duplicate contacts in Salesforce in the first week. The sample test catches this before it becomes a production disaster. (Use any independent verifier from our ranked list of email verifier websites.)

4. Refresh frequency - 30 days or less. At 2.1% monthly decay, data older than 30 days carries meaningful accuracy risk. Ask specifically: "How often do you re-verify existing records?" Not "how often do you add new records" - those are different questions, and vendors love answering the easier one.

5. Total cost of ownership. The sticker price is the floor, not the ceiling. Map out: credit costs for your expected usage, overage rates, add-on modules you'll actually need (intent, technographics, API access), and the renewal increase clause. One pattern I see repeatedly: teams buy ZoomInfo for the database, then realize they're paying for intent, chat, and workflow features they never turn on.

Concrete testing protocol: Request a trial. Upload your ICP criteria. Export 500 contacts. Run them through an independent email verifier. Check your CRM for duplicates. Measure bounce rate on a small send. This takes two days and saves you from a 12-month contract with the wrong vendor.

Mistakes That Cost Teams Thousands

1. Falling for "biggest database." A vendor with 500M profiles sounds impressive until you realize 200M are stale records from 2021. The provider with the smaller database but fresher data will outperform every time.

Do this instead: Request a trial, upload your ICP criteria, export 500 contacts, and verify them independently before signing anything.

2. Ignoring credit economics. Credits sound simple until you realize phone reveals cost 5-10x more than email reveals, enhanced lookups consume 2-3 credits, and API calls count against your monthly allocation. I've seen teams exhaust their annual credits by Q2.

Do this instead: Model your actual monthly usage - emails, phones, API calls, enrichments - and calculate the effective cost per usable lead before comparing plans.

3. Skipping compliance due diligence. With CCPA fines exceeding $1.3 million and the Delete Act adding new obligations in 2026, "we trust our vendor handles it" isn't a compliance strategy. You inherit your provider's compliance posture. (If you need the outbound-specific version, read our GDPR for Sales and Marketing playbook.)

Do this instead: Ask the five questions from the compliance section above. If the vendor can't answer them, walk away.

4. Overpaying for features you don't use. The ZoomInfo scenario is painfully common: a team buys the full platform, six months later only 8 of 50 seats are active. The intent module is untouched. The chat widget was never deployed. But the contract runs for another 18 months.

Do this instead: Audit which features your team actually uses monthly. If the answer is "search and export," you don't need a $40K platform.

5. Relying on a single source when your ICP spans regions. No single provider dominates every geography. ZoomInfo is strongest in the US. Cognism leads in EMEA. A single-source approach guarantees coverage gaps.

Do this instead: Use a primary provider for your core market and layer in a second source (or waterfall tool) for secondary regions.

FAQ

What is the most accurate B2B data provider in 2026?

For email, Prospeo leads with 98% accuracy and a 7-day refresh cycle - the fastest in the industry. For phone-verified mobiles, Cognism's Diamond dataset delivers 98% accuracy on verified numbers. Independent benchmarks show phone accuracy across major providers ranges from 63% to 91%.

How much does a B2B data provider cost?

Prices range from free tiers (Apollo, Lusha, Prospeo) to $45,000+/year (ZoomInfo Elite). Mid-market tools run $99-$720/month. The real cost depends on accuracy - a $1/lead tool at 75% accuracy effectively costs $1.33 per usable lead, while a $0.01/lead tool at 98% accuracy keeps effective costs near $0.01.

What is waterfall enrichment and do I need it?

Waterfall enrichment queries multiple data sources sequentially, finding 98% of emails versus 62% for single-source databases in controlled testing. If your ICP spans multiple industries or regions, waterfall significantly improves results. Clay is the most popular orchestrator; FullEnrich and BetterContact are dedicated alternatives.

How often should B2B contact data be refreshed?

B2B data decays at 2.1% per month - roughly 22.5% annually. Data older than 30 days carries meaningful accuracy risk. Look for providers with weekly or bi-weekly refresh cycles rather than the six-week industry average.

Can I use a B2B data provider and stay GDPR compliant?

Yes, but verify your provider offers GDPR-compliant sourcing, honors opt-out requests, and provides Data Processing Agreements. In 2026, the CCPA Delete Act and GPC enforcement add US compliance requirements. Ask how data is sourced and whether the provider is registered as a data broker where required.