9 Best Waterfall Alternatives for B2B Data Enrichment (2026)

You're paying $2,000/month across three data vendors, orchestrating a waterfall that's supposed to give you 90%+ coverage - and your SDRs are still complaining about bounces. The enrichment dashboard says "enriched," but the sequences say "invalid." Something's broken, and it's not your reps.

If you're searching for waterfall alternatives, you're probably feeling this exact pain. Here's the thing: 30% of B2B SaaS companies don't use any enrichment partner at all, and another 30% use just one. The teams stacking five sources in a waterfall aren't necessarily getting better results - they're often just getting more data to clean up. B2B contact data decays at 22.5% per year, so even a "fresh" waterfall output is rotting by the time your sequence fires.

(Quick note: this covers B2B data enrichment waterfall alternatives and Waterfall.io competitors - not the software development methodology or financial distribution waterfalls.)

Our Picks (TL;DR)

| Pick | Best For |

|---|---|

| Prospeo | Email accuracy and data freshness without waterfall complexity |

| Clay | Technical RevOps teams wanting full control over enrichment logic |

| BetterContact | Plug-and-play waterfall enrichment on a budget |

If you don't want to read 4,000 words, here's the decision tree:

- Tight budget, need everything in one tool? Apollo. Free tier gets you started, paid plans from $49/mo.

- Accuracy is the priority and you're tired of cleaning bad data? Prospeo. 98% email accuracy, 7-day refresh cycle, starts free.

- You want full control over enrichment logic and have a RevOps engineer? Clay. Budget $500-$2,000/month realistically.

- Selling into Europe and need GDPR-compliant phone data? Cognism. Expect $16,500+/year minimum.

- Want waterfall enrichment without building anything? BetterContact. Pay-per-result model starting at $15/mo.

Why Teams Look for Waterfall Enrichment Alternatives

Three pain points keep coming up in every conversation we have with RevOps leads evaluating their data enrichment stack.

Pricing Opacity

Waterfall.io doesn't publish pricing - you book a call. That's fine for enterprise buyers, but most teams evaluating enrichment tools want to compare costs before committing to a demo. When you're already paying for the underlying B2B data providers and then adding an orchestration layer on top, the math needs to be transparent.

A 10-person SDR team burning 25% wrong phone data wastes roughly $75,000-$100,000/year in avoidable inefficiency. You can't fix that if you can't model the cost.

Orchestration Complexity

A Reddit user ran a 6-week test comparing Apollo, ZoomInfo, and waterfall enrichment. Apollo hit ~65% accuracy, ZoomInfo ~75%, and the waterfall approach reached 88% with minimal manual work. Impressive - but they also noted: "Only downside is you need something to orchestrate the waterfall logic, can't really do it manually." That orchestration tax is real. Someone has to build it, maintain it, and debug it when a provider's API changes at 2 AM.

Diminishing Returns on Source Stacking

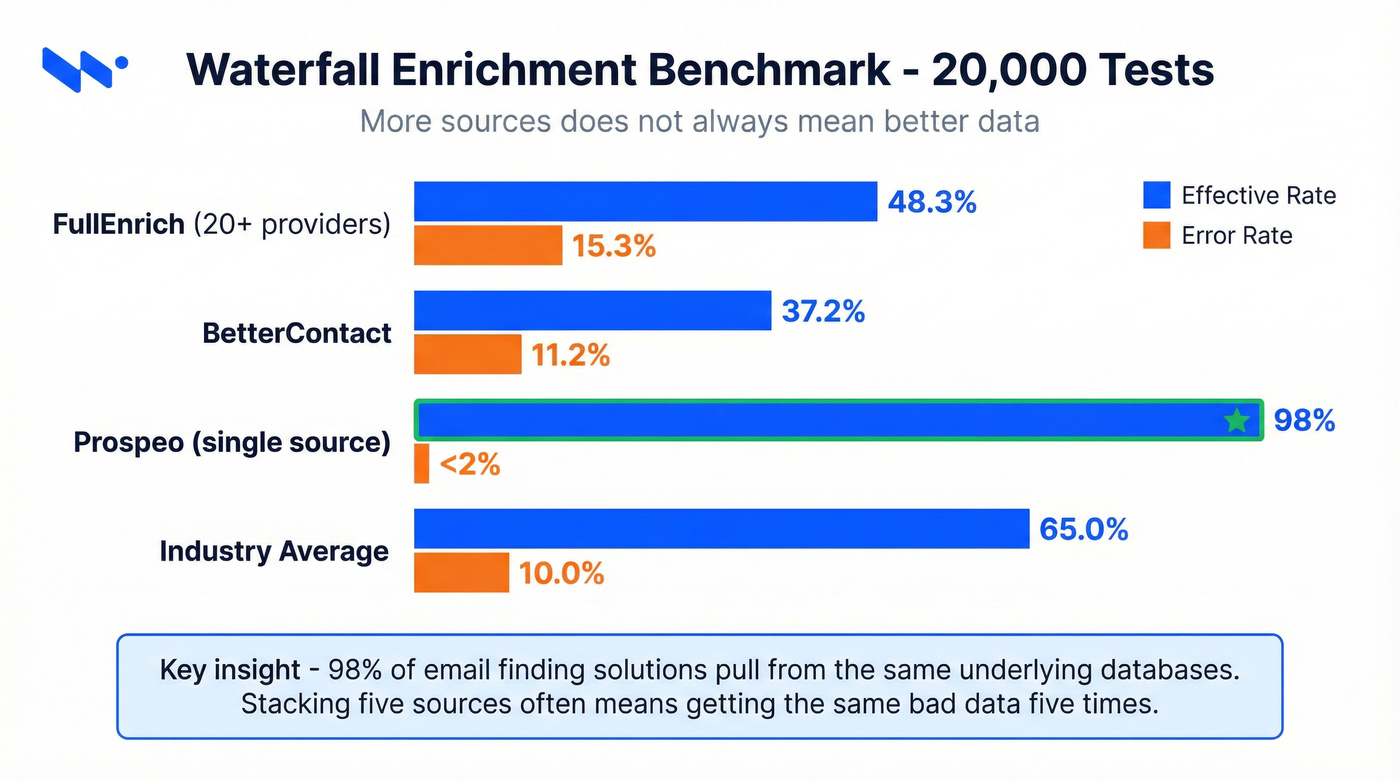

Here's the contrarian take most waterfall vendors won't tell you: more sources don't always mean better data. A Dropcontact benchmark of 20,000 tests found that FullEnrich - a waterfall tool querying 20+ providers - achieved a 48.3% effective enrichment rate but also a 15.3% error rate. BetterContact hit 37.2% effective with 11.2% error.

98% of email-finding solutions are built from the same underlying databases and providers. You're not always getting independent sources - you're getting the same data repackaged through different APIs. A benchmark of 307 contacts across 9 phone data providers found accuracy ranging from 63% to 91%. No single vendor was universally best, which is the core argument for waterfall enrichment. But it's also the argument for starting with the most accurate source first.

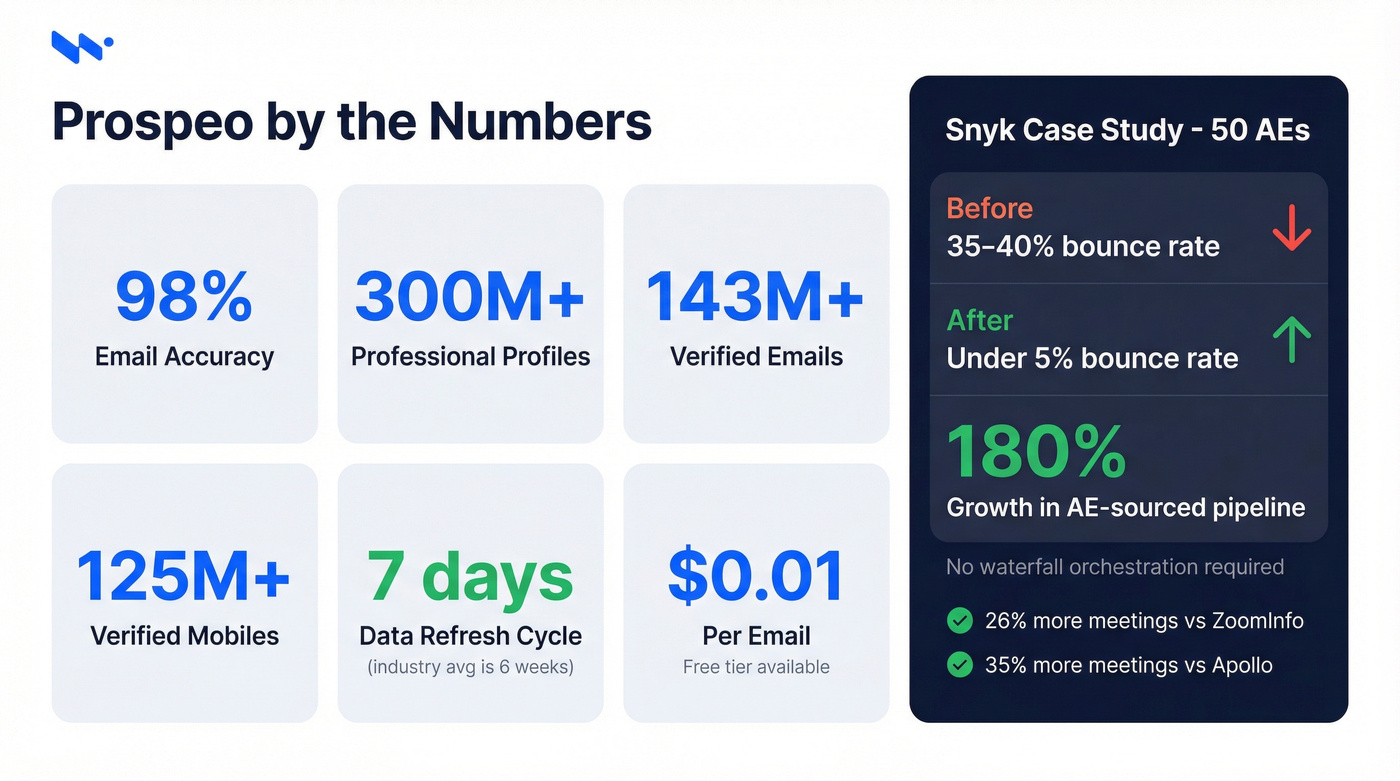

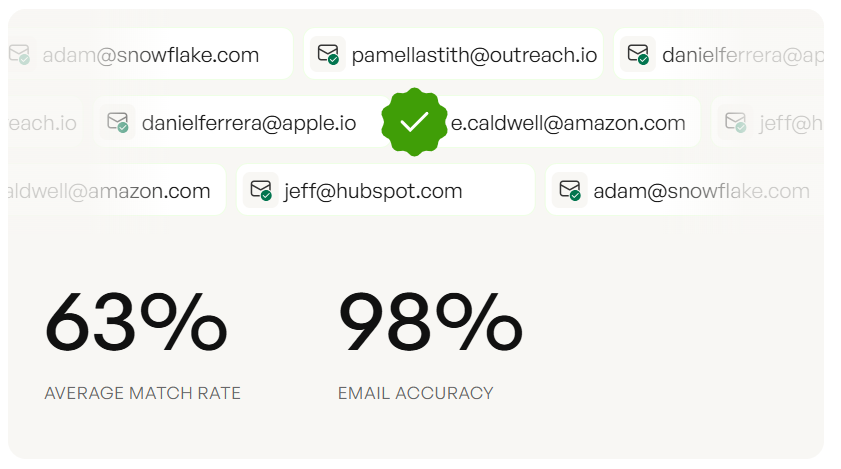

Waterfall enrichment exists because no single vendor is accurate enough. Prospeo changes that math. 98% email accuracy, 125M+ verified mobiles, and a 7-day data refresh cycle mean you get cleaner data from one source than most teams get from three.

Replace your waterfall with one provider that actually verifies its data.

How Waterfall Enrichment Actually Works

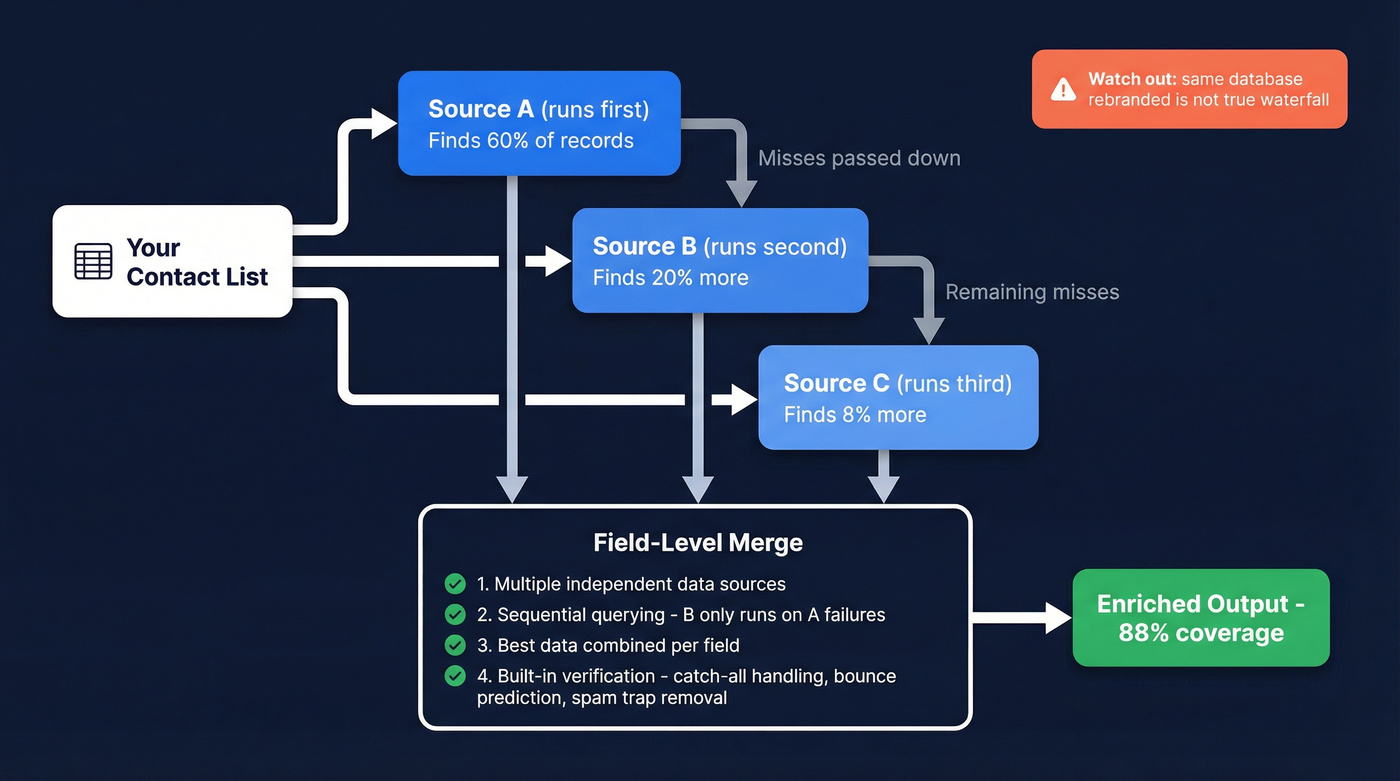

Sequential querying is the core mechanic. Source A runs first against your list. For every record it can't find (or finds but can't verify), Source B takes over. Source C handles the remaining misses. At each stage, field-level merging combines the best data - maybe Source A has the best email but Source B has a more current job title.

The order matters more than the number of tools.

As one practitioner put it: "If you start with a weak source, you contaminate everything downstream." This is why two platforms using the same providers still give different results - the sequencing logic, the verification layer, and the merge rules all affect output quality.

True waterfall enrichment meets four criteria:

- Multiple independent data sources - not the same database rebranded

- Sequential querying - Source B only runs on Source A's failures

- Field-level merging - best data from each source combined per field

- Built-in verification - catch-all handling (15-28% of B2B domains are catch-all), bounce prediction, spam-trap removal

There's a critical distinction between "true waterfall" and "fake waterfall." Slapping a "waterfall" label on a single-database product with a marketing refresh doesn't count - and plenty of tools do exactly that. If a tool doesn't hit all four criteria above, it's enrichment with extra steps, not a waterfall. Apollo queries a single database. ZoomInfo queries a single database. They're great products, but calling them "waterfall" is a stretch.

The 9 Best Alternatives to Waterfall Enrichment

Prospeo - Best for Email Accuracy Without Waterfall Complexity

Use this if: You want the highest email accuracy available without orchestrating multiple providers. Your bounce rate is killing deliverability and you need it fixed this week, not this quarter.

Skip this if: You need a built-in dialer or email sequencer - pair Prospeo with Instantly, Lemlist, or Smartlead for outreach.

Prospeo's database covers 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers. The 98% email accuracy comes from a proprietary 5-step verification process that handles catch-all domains, spam traps, and honeypots - built on proprietary infrastructure, not third-party email providers. Snyk's 50-person AE team switched and watched their bounce rate drop from 35-40% to under 5%, with AE-sourced pipeline up 180%.

The 7-day data refresh cycle is the real differentiator - the industry average is six weeks. Over 30 search filters include buyer intent powered by 15,000 Bombora topics, technographics, job changes, and funding signals. Native integrations cover Salesforce, HubSpot, Clay, Smartlead, Instantly, and Lemlist. We've seen teams book 26% more meetings compared to ZoomInfo and 35% more compared to Apollo, largely because reps stop wasting dials on dead numbers and bounced emails.

Pricing: Free tier gives you 75 emails + 100 Chrome extension credits/month. Paid plans run ~$0.01/email with no contracts and no sales calls required. (If you want the full breakdown, see Paid plans.)

Snyk's 50 AEs dropped their bounce rate from 35-40% to under 5% and grew AE-sourced pipeline 180% - without orchestrating a single waterfall. Prospeo's proprietary 5-step verification handles catch-alls, spam traps, and honeypots at $0.01/email.

Stop paying for orchestration complexity. Pay for accuracy instead.

Clay - Best for Technical Teams Wanting Full Control

Use this if: You have a RevOps engineer (or you are one) who wants to build custom enrichment logic across 100+ data providers. You care about control more than convenience.

Skip this if: You want something that works out of the box. Clay's learning curve runs 3-4 weeks, and I've watched teams burn through their entire credit allocation in the first 48 hours before they understand the system.

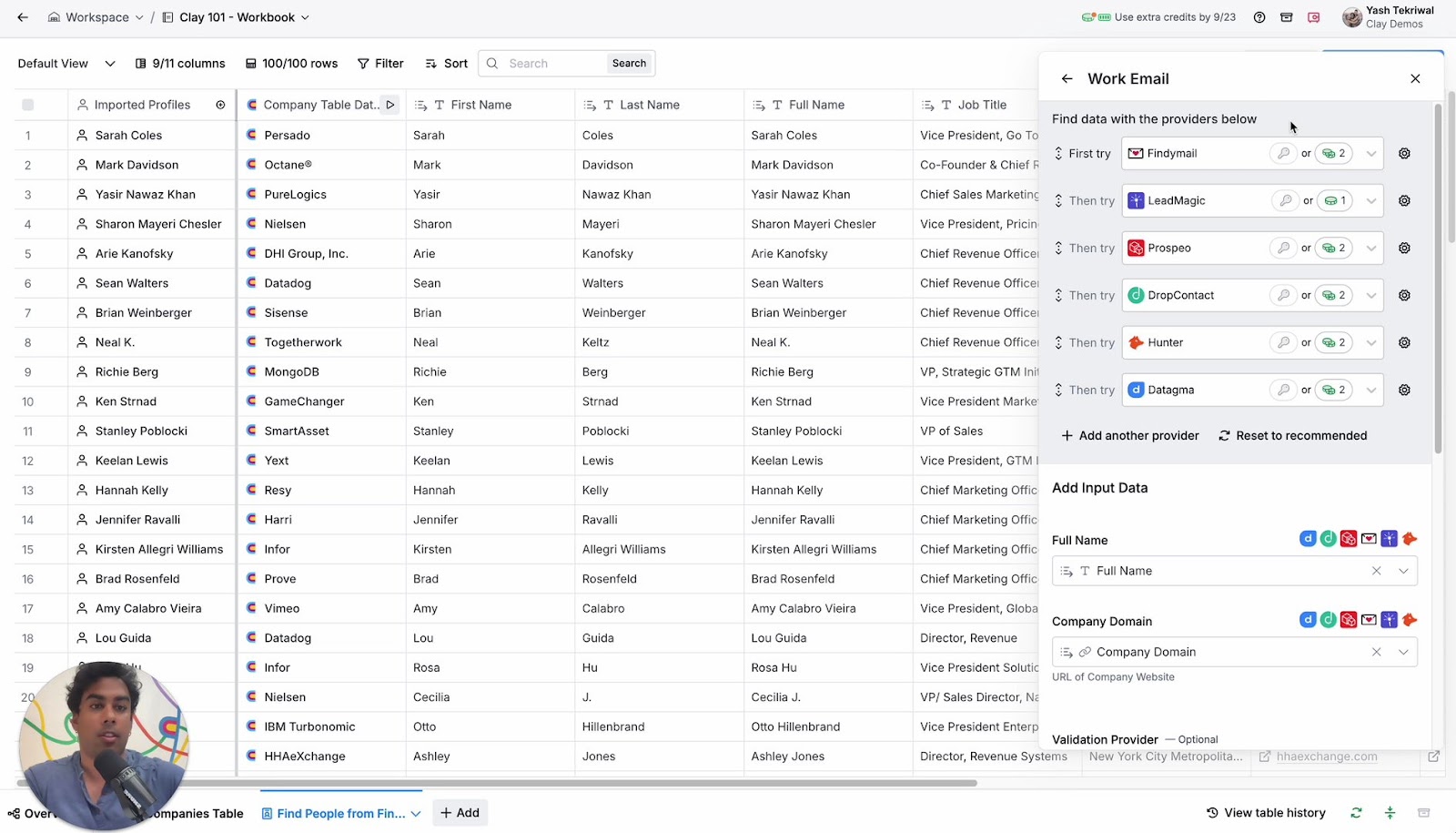

Clay connects to 100+ data providers with cascading waterfall logic you design yourself. Think of it as the Ferrari engine of enrichment - incredible power, but no wheels included. No built-in email sending, no dialer, and no CRM integration until the Pro plan at $720+/month (annual). If you're comparing options, start with Clay vs Cognism.

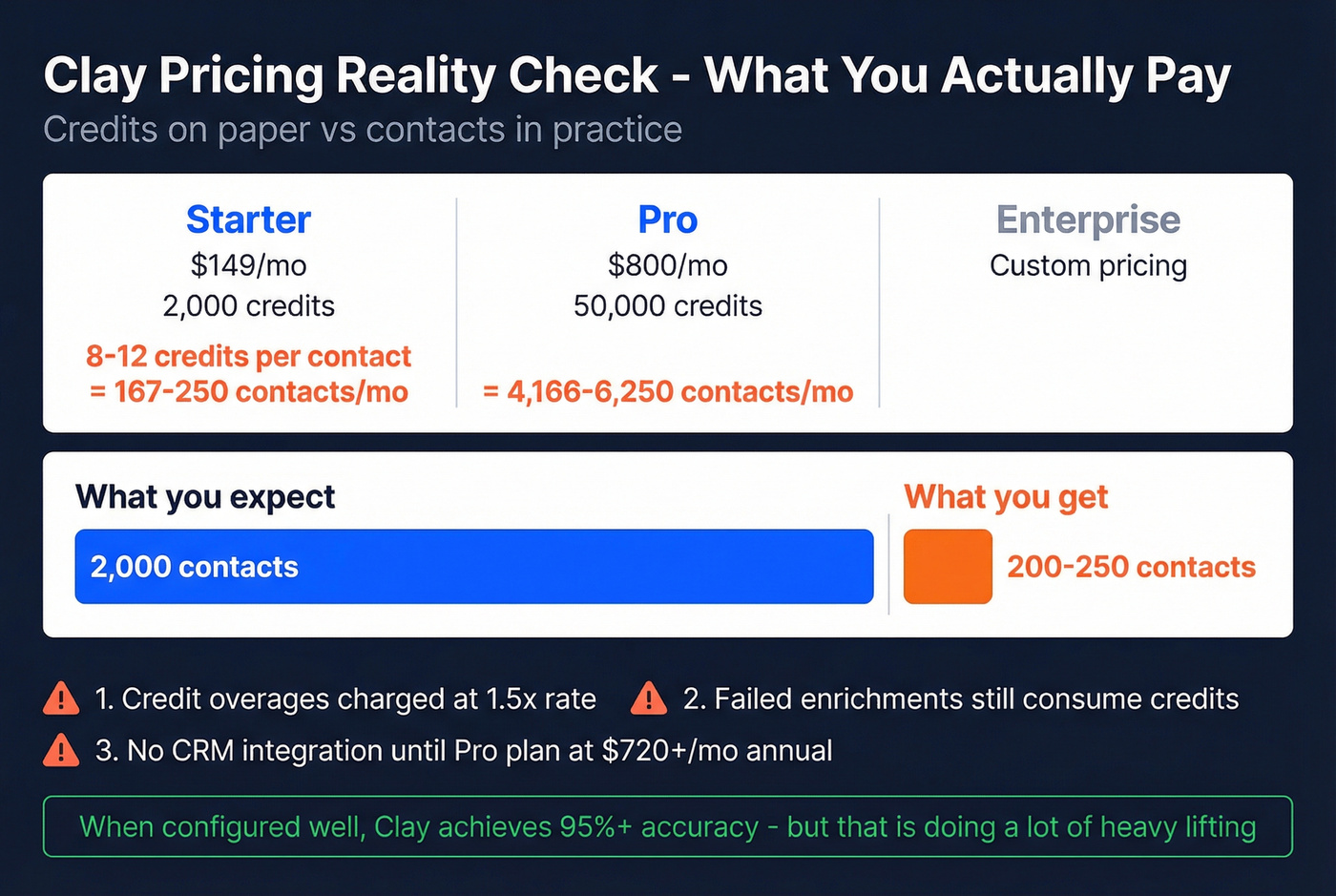

Pricing reality check: Starter is $149/mo for 2,000 credits. Pro is $800/mo for 50,000 credits. A typical full enrichment burns 8-12 credits per contact, so that Starter plan realistically enriches 200-250 contacts/month. Most teams spend $500-$2,000/month once they factor in credit overages (charged at 1.5x) and provider API fees. Failed enrichments still consume credits.

Real talk: Clay achieves 95%+ accuracy through multi-source verification when configured well. The problem is "when configured well" is doing a lot of heavy lifting in that sentence.

Apollo.io - Best Budget All-in-One

Apollo is the reliable Honda of the enrichment world - it gets you there, but it won't win races on data quality. The database covers 275M+ contacts with a generous free tier (100 credits/month). Basic runs $49/user/mo (annual), Professional $79/user/mo. Built-in sequences, a dialer, and a Chrome extension make it the obvious starting point for teams under 10 reps who need to move fast.

The accuracy gap is real, though. Apollo's marketing says 91%, but users consistently report 70-80% in practice. One Reddit user put it bluntly: "constantly getting hard bounces from Apollo's 'verified' emails." (If you want the deeper numbers, see Apollo's marketing says 91%.) The credit math also matters: verified emails cost 1 credit, but phone numbers cost 8 credits each. On the Basic plan's 30,000 annual credits, that's either 30,000 emails or 3,750 phone numbers. Not both.

Apollo queries a single database - it's not true waterfall enrichment, regardless of what the marketing says. Run your exports through a verification tool before loading them into sequences.

FullEnrich - Plug-and-Play Waterfall for European Teams

FullEnrich earns its G2 4.8/5 rating (160 reviews) by making waterfall enrichment genuinely simple. Twenty-plus data providers, sequential querying, and a clean UI that doesn't require a RevOps degree. Pricing starts at $29/mo for 500 credits, Pro at $55/mo for 1,000 credits.

The catch: that Dropcontact benchmark showed a 48.3% effective enrichment rate but a 15.3% error rate - the highest among tested waterfall tools. One user paid $104 for 2,000 credits and got only 347 valid emails, with 71% of results coming through a single provider (Wiza). That's not a waterfall - that's one source doing all the work while you pay waterfall prices.

FullEnrich's user base skews heavily European (120 of 160 G2 reviews), so if you're prospecting in EMEA, it's worth a trial.

BetterContact - Budget Waterfall With Pay-Per-Result

BetterContact nails the pricing model every enrichment tool should copy: pay-per-result. You're only charged for valid data found, and credits roll over. Starter runs $15/mo for 200 emails, Pro $49/mo for 1,000 emails. G2 gives it 4.8/5 across 43 reviews.

The AI-optimized provider sequencing automatically finds the best source order for your specific lead list. The Dropcontact benchmark showed 37.2% effective enrichment with 11.2% error - better error control than FullEnrich, though lower raw coverage. The API is slower than competitors, and customer support gets mixed reviews. But for small teams who want multi-source enrichment without Clay's complexity, BetterContact is the most practical entry point.

Cognism - Best for European Phone Data and GDPR

Here's who should buy Cognism and nobody else: teams whose ICP lives in Europe and who need phone numbers that actually connect. The Diamond plan includes phone-verified mobile numbers with 98% accuracy and Bombora intent data. The database covers 50M+ US mobiles and 120M+ European contacts - the EMEA coverage is genuinely best-in-class. If you're operating in-region, keep GDPR compliance front and center.

Pricing isn't cheap: Platinum runs ~$1,500/user/year plus a ~$15,000 platform fee. Diamond jumps to ~$2,500/user/year plus $25,000 platform. The upside is no credit system - unlimited views and exports under fair use. Annual contracts only, but you can negotiate up to 29% off at end-of-quarter.

Surfe - Best for CRM-First Enrichment Workflows

Surfe (G2 4.6/5, 465 reviews) is built for teams who live in their CRM. CRM integration is the #1 mentioned feature in reviews (155 G2 mentions), and the waterfall enrichment delivers find rates up to 93%. It's compatible with HubSpot, Salesforce, Pipedrive, Copper, Salesloft, and Outreach. GDPR-compliant and ISO 27001-certified. Free plan available, paid tiers from ~$29/mo.

The top complaints - expensive (38 mentions) and limited credits (25 mentions) - suggest the free tier is a teaser and real usage requires meaningful spend. If your workflow starts and ends in Salesforce or HubSpot, Surfe fits naturally. If you need raw API access for custom pipelines, look elsewhere.

Lusha - Quick Enrichment for Small Teams

Lusha starts at ~$15/month per user (annual) and works well for quick lookups when you need a phone number or email right now. It's a single-database product - not true waterfall - so treat it as a supplement, not a replacement for multi-source enrichment. For cost details, see starts at ~$15/month per user.

Breeze Intelligence - HubSpot-Native Enrichment (With Caveats)

Breeze Intelligence (formerly Clearbit) runs 100 credits at $45/mo, scaling to ~$450/mo for 1,000 credits. It requires a HubSpot subscription, credits expire monthly with no rollover, and exceeding your limit triggers an automatic upgrade - a trap that's caught more than a few teams off guard.

No phone numbers. Only enriches contacts already in your CRM. If you're locked into HubSpot and just need firmographic enrichment on inbound leads, it works. For anything else, skip it.

Pricing Comparison Table

Every RevOps lead we talk to asks about pricing first. Every vendor makes it the hardest thing to find.

| Tool | Starting Price | Credit System | Phones Incl. | Free Tier | Contract |

|---|---|---|---|---|---|

| Prospeo | ~$0.01/email | Pay-per-result | Yes (10 cr) | 75 emails/mo | None |

| Clay | $149/mo | 2,000 credits | Extra cost | No | No |

| Apollo | Free / $49/user/mo | Annual credits | Yes (8 cr) | 100 cr/mo | No |

| FullEnrich | $29/mo | 500 credits | Yes | Trial only | No |

| BetterContact | $15/mo | 200 emails | Yes | No | No |

| Cognism | ~$16,500/yr | Unlimited | Yes (Diamond) | No | Annual |

| Surfe | ~$29/mo | Credit-based | Yes | Yes | No |

| Lusha | ~$15/user/mo | Credit-based | Yes | Yes | No |

| Breeze | $45/mo + HubSpot | 100 credits | No | No | Annual |

| Waterfall.io | Contact sales | Not public | Not public | No | Not public |

Accuracy Benchmarks - What the Data Actually Shows

Everyone claims high accuracy. The numbers tell a different story.

The Dropcontact benchmark tested 20,000 real contacts across 15 email-finding tools. Here are the results for waterfall-specific tools:

| Tool | Effective Rate | Error Rate | Net Useful |

|---|---|---|---|

| FullEnrich | 48.3% | 15.3% | 33.0% |

| BetterContact | 37.2% | 11.2% | 26.0% |

| Hunter | 38.9% | 16.4% | 22.5% |

Look at those error rates. FullEnrich finds more emails, but 15.3% of them are wrong. That's not enrichment - that's pollution. When you subtract errors from raw finds, the "net useful" rate drops dramatically.

Now compare that to a single high-accuracy source. For every 100 emails Prospeo finds, 98 are valid. No multi-source error compounding, no field-level merge conflicts, no "which provider gave me this bad number" debugging.

The Reddit practitioner test tells a similar story from a different angle: Apollo hit 65%, ZoomInfo 75%, and a waterfall approach reached 88%. But that 88% didn't account for error rates - just raw enrichment coverage. Factor in the 11-15% error rates waterfall tools show in controlled benchmarks, and the gap narrows fast.

Hot take: If your average deal size is under $15k and your team sends fewer than 5,000 emails/month, you almost certainly don't need waterfall enrichment. A single accurate source with weekly data refreshes will outperform a five-vendor stack with compounding errors. The waterfall enrichment industry has convinced teams they need complexity that actively hurts their deliverability.

Stacking five tools that pull from the same underlying data doesn't give you five independent sources. It gives you one source with five invoices.

How to Choose the Right Waterfall Alternative

Not every team needs waterfall enrichment. Here's how to match your situation to the right tool.

Budget-conscious SMB (under $500/mo for data): Start with Apollo's free tier for prospecting, then verify exports through a dedicated email verification tool before loading into sequences. Total cost: under $100/mo. This beats any waterfall setup at this price point.

Technical RevOps team with engineering resources: Clay gives you maximum control. Budget $500-$2,000/month and allocate 3-4 weeks for setup. Pair it with a high-accuracy email verification API for the verification layer - Clay's built-in verification is good but not best-in-class.

EU-focused team needing GDPR compliance: Cognism for phone data, full stop. Supplement with a dedicated email accuracy tool for the email channel. The combination covers both channels without GDPR risk.

Accuracy-first team (deliverability is the priority): Prospeo as your primary enrichment provider. 98% email accuracy with weekly refresh eliminates the need for multi-source stacking in most cases. I've seen teams get better net results from one accurate source than from a five-provider waterfall with compounding error rates.

HubSpot-locked team with no budget for new tools: Breeze Intelligence is your only native option, but manage those credits carefully - the auto-upgrade billing trap is real.

When waterfall enrichment is overkill: If your team sends fewer than 5,000 emails/month and targets a well-defined ICP in North America or Western Europe, a single high-accuracy contact data provider beats a waterfall every time. The orchestration overhead, multiple vendor bills, and error compounding aren't worth it below a certain volume threshold.

Start with accuracy. Add complexity only when you've outgrown a single source. Most teams never do.

FAQ

What is waterfall enrichment and how does it work?

Waterfall enrichment sequentially queries multiple data sources - Source A runs first, Source B fills gaps, Source C handles remaining misses. Field-level merging combines the best data from each provider. True waterfall requires independent sources, sequential logic, and built-in verification. Most tools marketing "waterfall" don't meet all four criteria.

Is waterfall enrichment better than using a single data provider?

Not always. Waterfall tools show 11-15% error rates in the Dropcontact benchmark, while a high-accuracy single source delivers 98% valid emails. A single accurate provider often produces better net results than stacking five mediocre sources, because errors don't compound across providers.

How much does waterfall enrichment cost?

BetterContact starts at $15/month, Clay runs $500-$2,000/month realistically, and Cognism costs $16,500+/year. Factor in provider API fees, credit overages, and failed enrichment charges - the sticker price rarely reflects true cost. Waterfall.io itself doesn't publish pricing, so you'll need a sales call to get a quote.

What are the best waterfall alternatives for small teams?

For teams under 10 reps, Apollo's free tier plus a dedicated email verification tool is the most cost-effective stack - under $100/month total. BetterContact's pay-per-result model at $15/month is the cheapest true waterfall option. Skip Cognism and Clay unless your budget and technical resources justify the overhead.

What's the biggest mistake teams make with waterfall enrichment?

Prioritizing coverage over accuracy. Adding more sources increases raw find rates but also increases error rates. Start with your highest-accuracy source first - the order of providers matters more than the number. If you start with a weak source, you contaminate everything downstream.