Lusha Pricing in 2026: The Only Guide With Updated Credit Costs

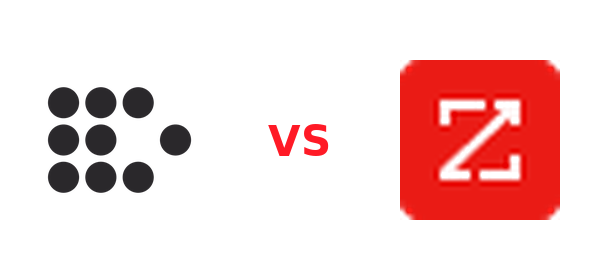

You're Googling "lusha pricing" because the number on your renewal quote doesn't match what you remember signing up for. There's a reason for that. Lusha quietly doubled the credit cost of phone numbers - from 5 credits to 10 - and every other pricing guide on the internet is still using the old math.

Here's what actually changed, and what it means for your budget.

What Changed With Lusha's Credit System

Before you read another word, the four things you need to know:

- Phone reveals now cost 10 credits (was 5). A full contact reveal (email + phone) burns 11 credits, not 6.

- Lusha removed public pricing from their website. Paid plans now require digging through third-party sources or talking to sales.

- The free plan bumped to 70 credits/month - likely a compensating move for the phone credit hike.

- Every competing pricing guide (Cognism's, UpLead's, Fullenrich's) still cites 5 credits per phone. They're all wrong.

That phone credit change alone cuts your effective contact reveals nearly in half on the same plan. If you're budgeting based on last year's numbers, you're about to overshoot by 60-80%.

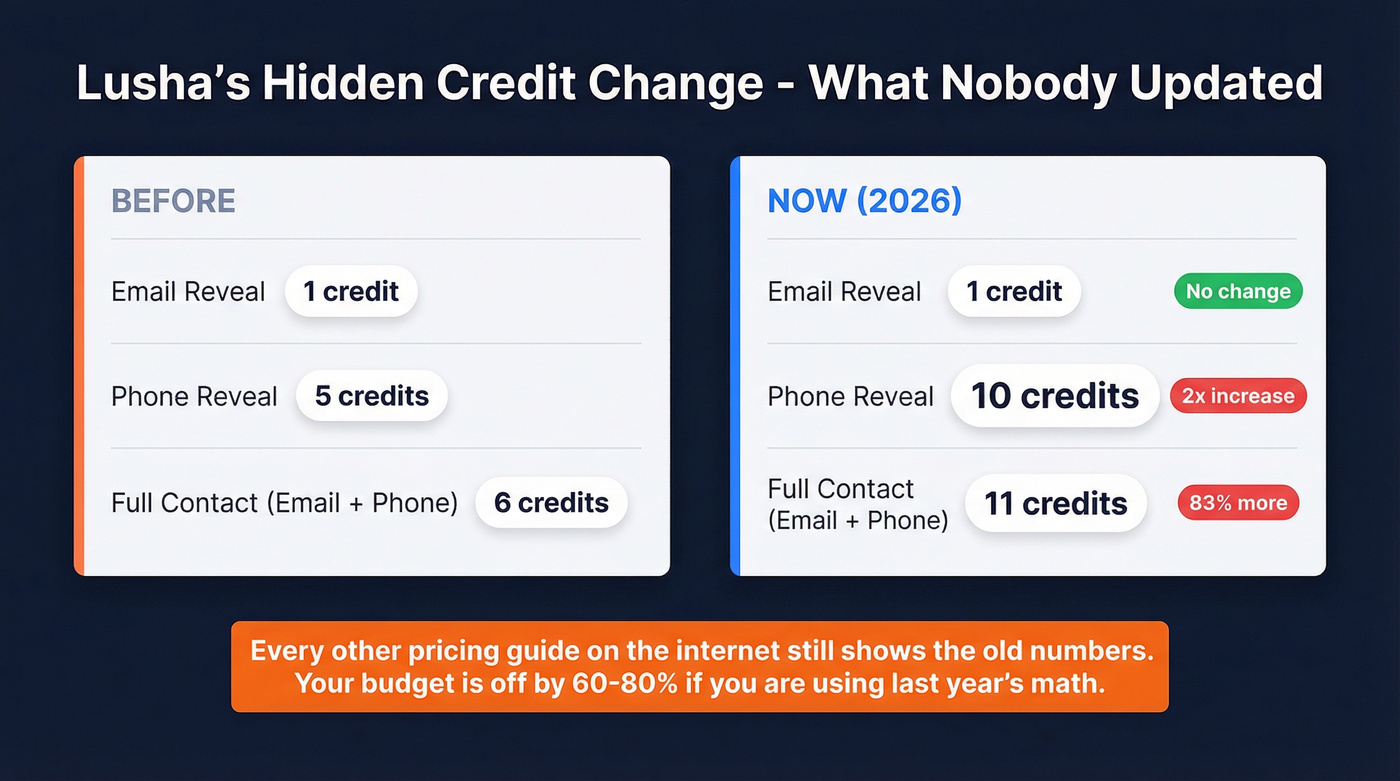

Lusha Pricing Plans in 2026

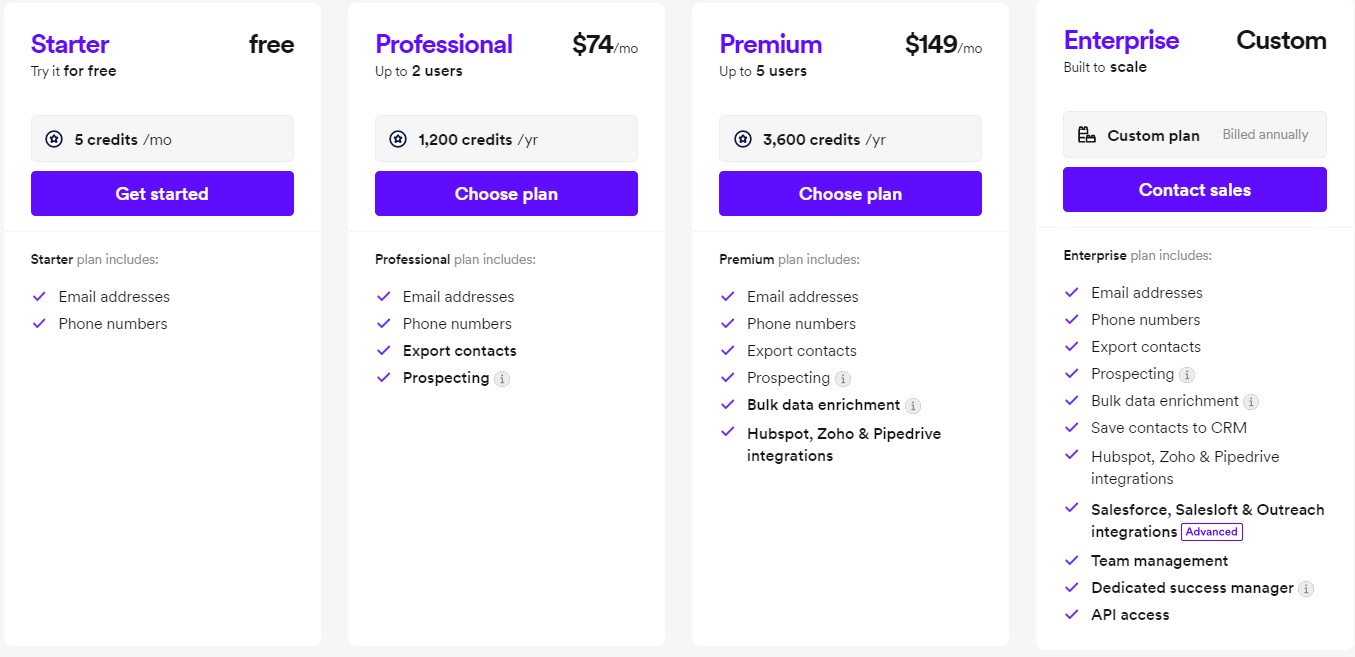

Lusha runs four tiers. The dollar amounts below come from Capterra's pricing data and G2's plan comparison - since Lusha's own pricing page now just shows "Start for free" and "Contact sales." All plans offer a 25% discount on annual billing.

| Plan | Monthly Price | Monthly (Annual Billing) | Credits/Mo | Seats | Best For |

|---|---|---|---|---|---|

| Free | $0 | $0 | 70 | 1 | Testing the waters |

| Pro | $19.90-$29.90 | $14.95-$22.45 | 200-600 | 3 | Solo SDRs |

| Premium | $69.90 | $52.45 | 600-5,400 | 5 | Small teams |

| Scale | Custom | ~$15,180/yr median | Custom | Custom | Enterprise |

Now let's break each one down.

Free Plan

Lusha's free tier gives you 70 credits/month with no credit card required. Some older sources still show 40 credits, but Lusha's own site now confirms 70 - the free plan has been bumped up over time.

At 10 credits per phone number, 70 credits gets you roughly 6 full contact reveals (email + phone) per month. That's barely one per business day.

You get the Chrome extension, basic prospecting filters, intent signals on 5 topics, and CRM integrations. Bulk show is capped at 25 contacts. It's enough to test data quality before committing money, but not enough to run any real outbound motion.

Here's the thing: if you only need emails, 70 credits means 70 email reveals per month. That's actually decent for a free plan. The math only gets painful when you need phone numbers.

Pro Plan

Pro isn't a single price - it's tiered by credit volume:

- 200 credits/month: $19.90/mo ($14.95 annual)

- 250 credits/month: $29.90/mo ($22.45 annual)

- 400 and 600 credits/month: higher tiers, pricing available via sales

Three seats are included. You get CSV enrichment (300 rows), bulk show for 50 contacts, basic analytics, and tech/intent alerts.

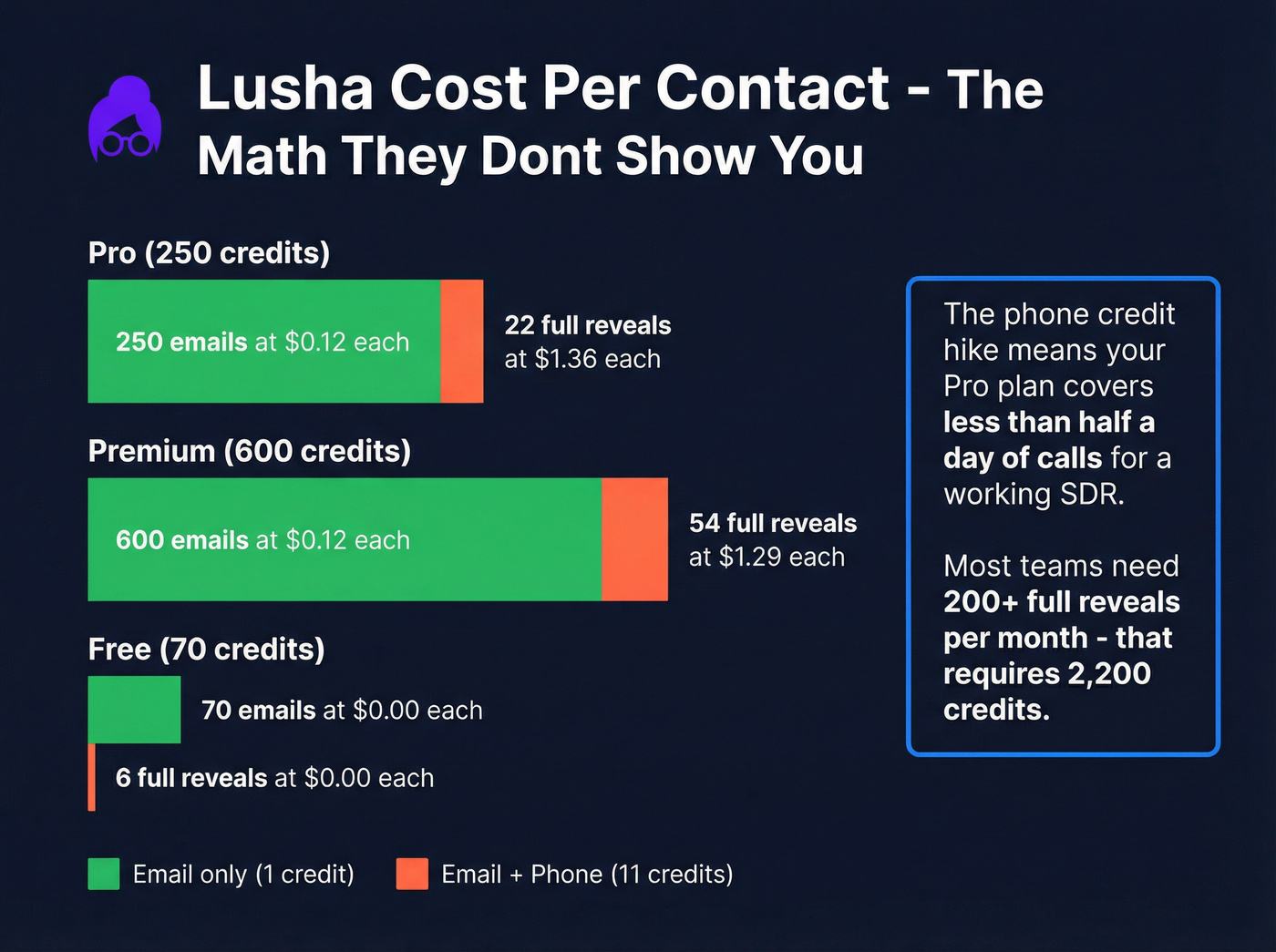

Let's do the math that matters. On the 250-credit tier at $29.90/month:

- Email-only reveals: 250 contacts/month at $0.12 each

- Full reveals (email + phone): 250 / 11 = ~22 contacts/month at $1.36 each

Twenty-two full reveals per month. For a working SDR making 50+ calls a day, that's less than half a day's worth of prospects. The credit math on Pro simply doesn't work for phone-heavy outbound.

Premium Plan

Premium starts at $69.90/month ($52.45 on annual billing) with 600 credits. You can scale up to 5,400 credits/month in 200-credit increments.

Five seats are included. CSV enrichment bumps to 500 rows. Bulk show jumps to 150 contacts. You get advanced analytics.

The cost-per-reveal math on the base 600-credit tier:

- Full reveals: 600 / 11 = ~54 contacts/month at $1.29 each

- Email-only: 600 contacts at $0.12 each

Premium is Lusha's volume play, and it's where most small teams land once they outgrow Pro. The 25% annual billing discount is meaningful here - $52.45 vs $69.90 per month adds up to over $200/year in savings. But you're locking in for 12 months with use-it-or-lose-it credits.

Scale Plan

Scale is Lusha's enterprise tier, entirely custom-priced. Vendr data puts the median annual contract at $15,180, with a range of $5,800 to $66,440 depending on team size and credit volume. For a typical 5-person team, expect $10,000-$25,000/year.

Scale is the only plan that includes Salesforce integration - frustrating for smaller teams that use Salesforce. You also get a dedicated CSM, SSO, SOC 2 Type 2 compliance, CSV enrichment up to 10,000 rows, and bulk show for 5,000 contacts. Lusha provides 12 contact attributes and 25 company attributes per record.

The "unlimited" credits on Scale come with a fair use cap. Users report hitting limits between 2,000 and 5,000 contacts per month per seat, with a separate bulk credit limit of around 1,000. That's not unlimited - it's "unlimited until we decide it isn't." If you're doing high-volume enrichment, get the cap in writing before you sign.

At 11 credits per full reveal, Lusha's Pro plan gets you 22 contacts/month for $29.90 - that's $1.36 each. Prospeo delivers verified emails at ~$0.01 each with 98% accuracy and 125M+ verified mobile numbers, no credit gymnastics required.

Stop burning credits. Start reaching real buyers for less.

How Lusha Credits Actually Work

Lusha's credit system is the single most important thing to understand before you buy. It's also the thing most people get wrong.

| Action | Credits Used |

|---|---|

| Email reveal | 1 |

| Phone reveal | 10 |

| CSV export | 1 per row |

| CRM export | 1 |

| Full reveal (email + phone) | 11 |

Row limits on CSV enrichment vary by plan: 25 on Free, 300 on Pro, 500 on Premium, and up to 10,000 on Scale.

That phone number cost is the killer. At 10 credits per phone, a single full contact reveal eats 11 credits. On a Pro plan with 250 credits, that's 22 full reveals before you're done for the month.

Rollover Rules

Monthly plans let unused credits roll over - but only up to 2x your monthly limit. So if you're on Pro with 250 credits and use 100, you'll carry 150 into next month, capped at 500 total.

Annual plans work differently. You get all credits upfront (3,000 on Pro, 7,200 on Premium), and whatever you don't use by renewal date is gone. No rollover. No refund.

The Real Cost Per Contact

Here's the table that should be on Lusha's pricing page but isn't:

| Plan | Credits/Mo | Full Reveals/Mo | Cost/Reveal |

|---|---|---|---|

| Free | 70 | ~6 | $0 |

| Pro (250) | 250 | ~22 | $1.36 |

| Premium (600) | 600 | ~54 | $1.29 |

Those numbers assume you're pulling both email and phone for every contact. If you're email-only, the math is much friendlier - 250 emails for $29.90 is $0.12 each. But most sales teams need phones.

I've watched this pattern play out repeatedly: teams budget based on the sticker price, then overshoot by 60-80% once they get deep into usage. The credit system feels manageable during the trial. It stops feeling manageable around week three of your first real outbound campaign.

Worked Example

Say you're an SDR who needs 40 full contact reveals per week (200/month). At 11 credits each, that's 2,200 credits/month. Pro's 250 credits covers less than 12% of your need. Even Premium's base 600 credits only gets you to 54 reveals. You'd need a Premium tier with 2,400+ credits/month - or Scale.

This is how teams end up on enterprise contracts they didn't plan for.

Hidden Costs and Fine Print

The sticker price is only part of the story.

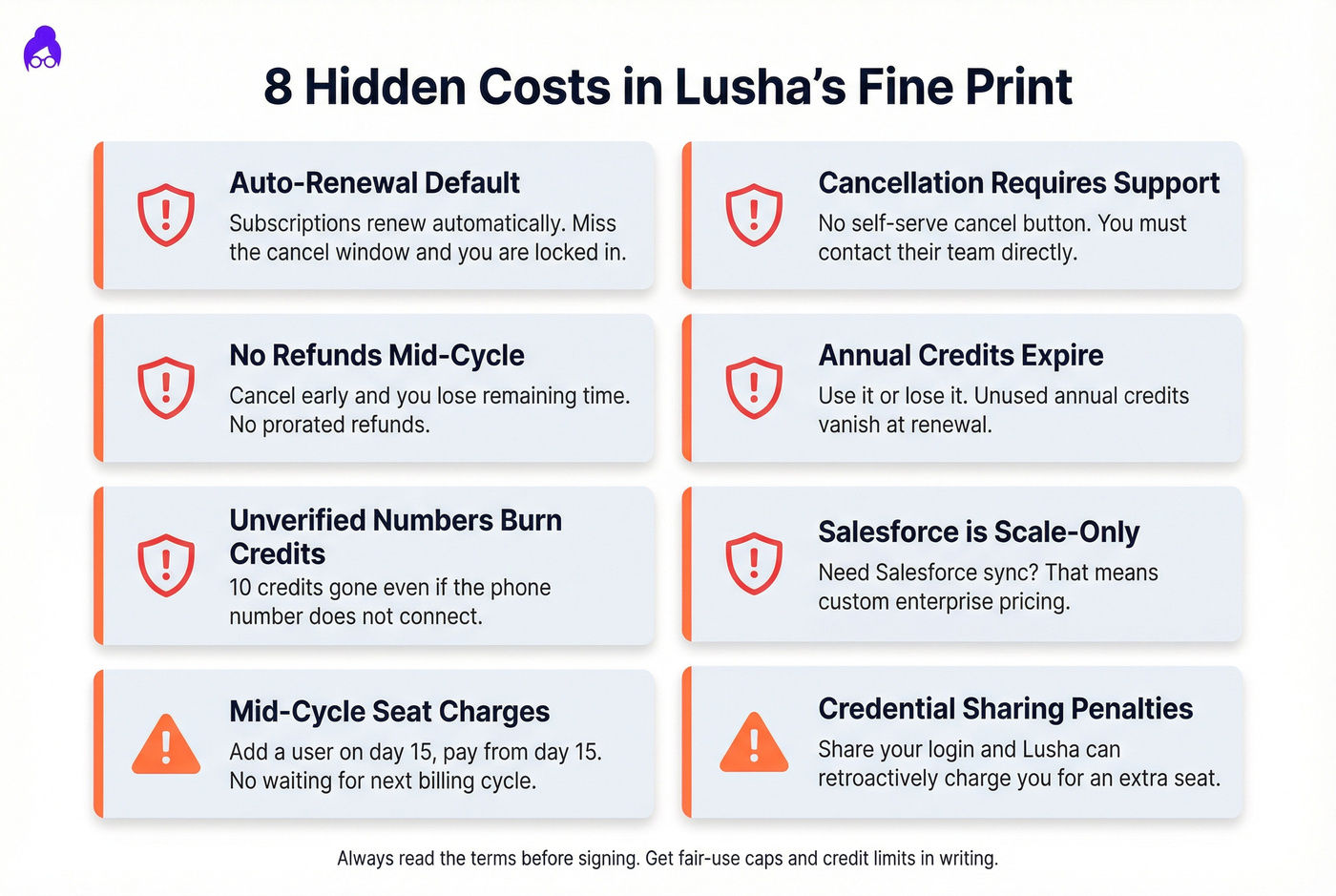

1. Auto-renewal is the default. Subscriptions auto-renew unless you cancel before the current term ends. Miss the window and you're locked in for another cycle.

2. Cancellation requires contacting support. You can't just click a button. Lusha's own response to a G2 complaint about this: "We require users to contact our team for cancellations because we want to make sure they preserve any remaining credits." That's a generous interpretation of what's clearly a retention tactic.

3. No refunds for unused time. Cancel mid-cycle and you lose whatever's left. No prorated refunds. No credit carryover.

4. Annual credits expire completely. Monthly plans roll over (up to 2x). Annual plans don't. If you bought 3,000 annual credits on Pro and used 1,800, those remaining 1,200 vanish at renewal.

5. Unverified numbers still burn credits. This one stings. As one G2 reviewer put it: the "credit system can sometimes feel limiting for high-volume outbound teams, particularly when an 'unverified' number still uses up a credit." You're paying 10 credits for a phone number that might not even connect.

6. Salesforce integration is Scale-only. If you need native Salesforce sync, you're looking at custom enterprise pricing. HubSpot works on lower tiers, but Salesforce is gated.

7. Adding users mid-cycle charges immediately. No waiting until the next billing period. Add a seat on day 15, pay from day 15.

8. Credential sharing triggers retroactive charges. Share your login with a colleague and Lusha can charge you for an additional seat retroactively. It's in the terms.

What Real Users Say About the Cost

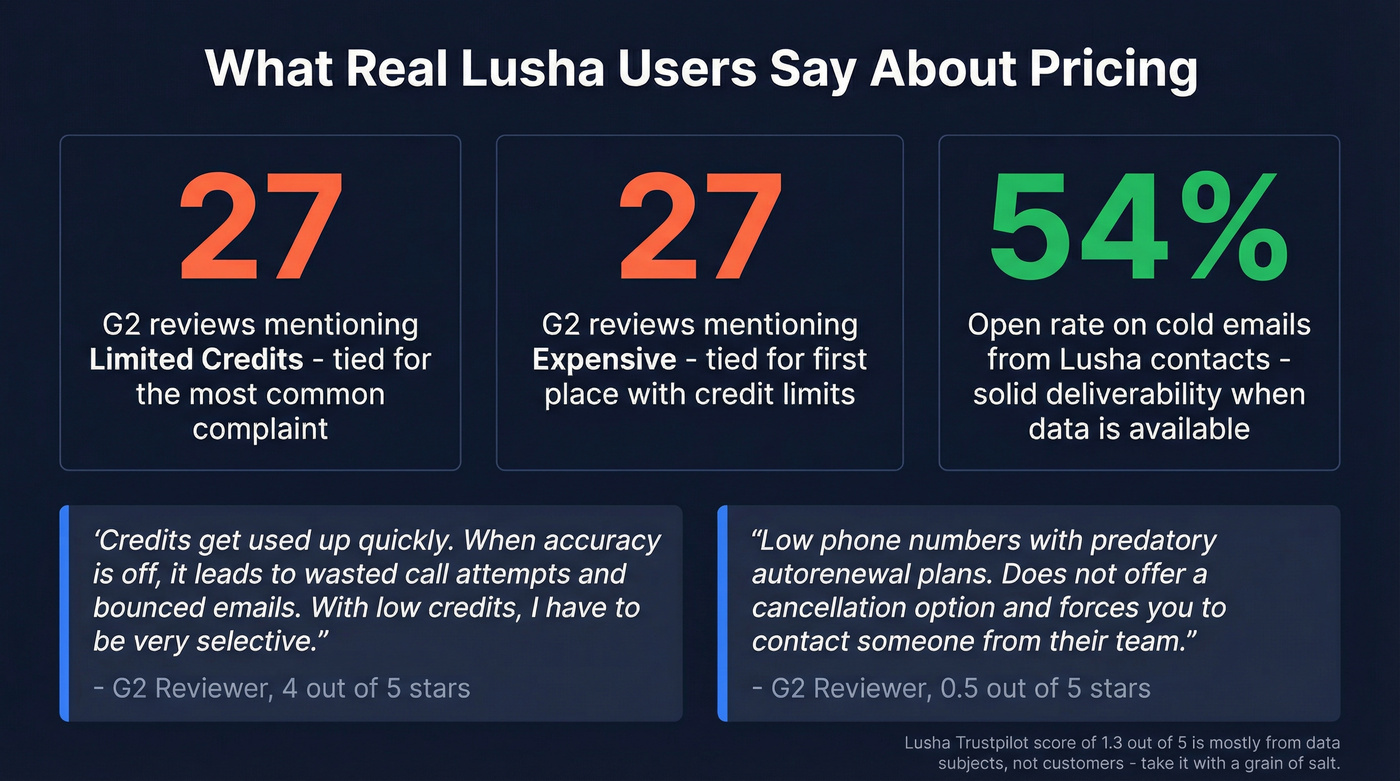

G2's review summary tells you everything: "Limited Credits" and "Expensive" each appear in 27 separate reviews. Those are the two most common complaints, tied for first place.

The specific feedback is more telling than the aggregate numbers.

One reviewer gave Lusha 0.5 out of 5 stars, calling it "low phone number with predatory autorenewal plans." The core complaint: Lusha "does not offer a cancellation option and forces you to contact someone from their team." That tracks with what we've seen across dozens of reviews - the cancellation process is deliberately friction-heavy.

Another reviewer was more measured (4/5 stars) but still flagged the core issue: "Credits get used up quickly. When accuracy is off, it leads to wasted call attempts and bounced emails. With low credits, I have to be very selective." That word - "selective" - is doing a lot of work. An SDR shouldn't have to ration their prospecting tool.

On the positive side, users who primarily need emails at low volume praise the affordability. That's fair - for light-volume email lookups, Lusha's Pro plan is genuinely reasonable.

Lusha's Trustpilot score is 1.3 out of 5 across 730 reviews - but that number is misleading. The vast majority of those reviews come from data subjects (people whose contact info appears in Lusha's database), not actual customers. They're complaining about privacy, not product quality. Don't weight that number the same as the G2 score.

One real-world test worth mentioning: a team sent 250 cold emails from Lusha contacts and saw a 54% open rate with a 3% bounce rate - solid deliverability. But they found that "many emails weren't available" even after applying filters, and "the usable contacts weren't enough to fully utilize my 250 credits." The data quality is decent when you get it. The problem is how often you don't get it.

How Lusha's Pricing Compares to Alternatives

Here's where Lusha sits against the alternatives that actually matter.

| Tool | Starting Price | Credits/Mo | Email Accuracy | Phone $/Reveal |

|---|---|---|---|---|

| Lusha | $19.90/mo | 200 | ~81% | ~$1.36 |

| Apollo | Free / $49/user/mo | Varies | 91% | ~$0.50 |

| Cognism | ~$1,500/user/yr+ | Unlimited* | 95%+ | Included |

| ZoomInfo | ~$15,000/yr | ~5,000/yr | ~87% | Included |

| RocketReach | $33/mo | 1,200/yr | 85% | Included (Pro+) |

*Cognism "unlimited" = fair use cap of ~2,000 records/user/month. Cognism pricing shown is per-user license; total cost includes a platform fee.

Prospeo - Best for Email Accuracy and Cost Per Lead

The contrast with Lusha's cost structure is stark. Prospeo charges roughly $0.01 per email compared to Lusha's $0.12 on Pro - a 12x difference. The database covers 300M+ profiles with 98% email accuracy and 125M+ verified mobile numbers, all on a 7-day data refresh cycle (the industry average is 6 weeks). The free tier includes 75 emails and 100 Chrome extension credits per month. No contracts, no sales calls, fully self-serve. For teams where email deliverability directly impacts pipeline, the 5-step verification with catch-all handling and spam-trap removal means fewer bounces and cleaner sender reputation. In our experience, the teams that switch from Lusha to Prospeo for email-focused outbound cut their per-contact cost by about 90% while seeing better deliverability.

Apollo.io - Best for Teams That Want Everything in One Place

Apollo is the all-in-one play. The free tier includes unlimited emails (with volume limits), and the $49/user/month Basic plan bundles a 275M+ contact database with email sequencing, a built-in dialer, and a lightweight CRM. For teams that want prospecting, outreach, and data in one platform, Apollo eliminates the need to stitch together three separate tools. The tradeoff: data quality outside the US and English-speaking markets drops noticeably. If your ICP is North American, Apollo is hard to beat on value.

ZoomInfo - Skip This Unless You Have 50+ Reps

ZoomInfo starts at $14,995/year for the Professional tier and scales to $45,000+ for Elite. Annual contracts only. The database is 300M+ contacts with enterprise-grade features - org charts, intent data, workflow automation, conversation intelligence. You're paying 10-20x more than Lusha but getting a fundamentally different product. For a 3-person team that needs phone numbers, it's overkill and overpriced.

Cognism - The "No More Credit Anxiety" Option

Cognism runs $1,500-$25,000+/year depending on tier and team size. The big differentiator: no credit system. You get "unlimited" access under a fair use policy (~2,000 records/user/month). For teams that hate rationing credits, that model is liberating. Cognism's EMEA data is best-in-class, and their Diamond Data tier offers phone-verified mobiles with 98% accuracy. Annual contract required. If you're selling into Europe and want to stop counting credits, Cognism is the move.

RocketReach

RocketReach runs $33-$209/month depending on tier. The database is massive (700M+ profiles) but accuracy sits around 85%. Credit-based like Lusha, but with lower per-lookup costs at higher tiers - the Ultimate plan gives you 10,000 annual lookups for ~$2,100/year. Decent for high-volume email lookups where you don't need phone numbers on every contact.

Is Lusha Worth It in 2026?

Lusha's sweet spot is narrow but real: small teams (1-3 people), Chrome extension-heavy workflows, moderate volume, and a mix of email and occasional phone lookups. If that's you, Pro or Premium works fine. Lusha has also been expanding beyond pure data - they acquired Novacy for conversation intelligence and added email sequencing via their Engage feature - so the platform is getting stickier.

Where it falls short:

- High-volume outbound: 22 full reveals per month on Pro is laughable for a working SDR. You'll burn through credits by Tuesday.

- Email-heavy prospecting: At $0.12 per email on Pro, you're overpaying by an order of magnitude compared to tools like Prospeo at $0.01/email with 98% accuracy.

- Budget-conscious teams: The credit system creates anxiety. You start rationing reveals instead of prospecting freely. That's a productivity tax.

Real talk: stop comparing Lusha plans and ask whether credit-based pricing makes sense for your team at all. If you're constantly watching your credit balance, the tool is working against you. The best prospecting tool is the one your reps actually use without hesitation - and credit anxiety kills usage faster than bad data does.

If you want an all-in-one platform, Apollo gives you data + sequencing + dialer + CRM for $49/user/month. It replaces Lusha plus two other tools.

If you hate credit systems entirely, Cognism's unlimited model (under fair use) means you never think about credits again. You'll pay more upfront, but the mental overhead disappears.

If you're enterprise with budget, ZoomInfo remains the most complete GTM platform. You're paying for it, but you're getting everything.

If you're comparing against other databases, it helps to sanity-check vendors in a broader B2B data providers roundup.

If phone coverage is the deciding factor, start with a dedicated B2B phone number workflow before you commit to an annual plan.

If you're primarily buying for email, compare options in these email lookup tools and B2B email lookup tool roundups.

If you're trying to map the real total cost, use a cost of sales tech stack framework so credits don't surprise you.

Lusha's credit system forces teams onto enterprise contracts they didn't plan for. Prospeo's transparent, self-serve pricing starts free - 100 credits/month, no contracts, no sales calls. Data refreshed every 7 days, not 6 weeks.

Get enterprise-grade data without the enterprise shakedown.

FAQ

Does Lusha have a free plan?

Yes - 70 credits/month, no credit card required. At 10 credits per phone number, that's roughly 6 full contact reveals (email + phone) or 70 email-only reveals per month. Includes the Chrome extension, basic filters, and CRM integrations. Older sources citing 40 or 5 credits are outdated.

How many Lusha credits does a working SDR need per month?

Most SDRs need 200-500 full contact reveals monthly, which requires 2,200-5,500 credits at 11 per reveal (email + phone). That puts you on Premium at minimum, often Scale. Teams consistently underestimate credit consumption by 60-80% because they budget on email-only math.

Can you cancel Lusha mid-contract?

Cancellation requires contacting Lusha's support team directly - there's no self-serve cancel button. No refunds are issued for unused subscription time, and annual plans auto-renew. Multiple G2 reviewers report the process is deliberately friction-heavy.

Is Lusha cheaper than ZoomInfo?

Significantly - Lusha Pro starts at ~$240/year versus ZoomInfo's $15,000+ minimum. But ZoomInfo includes intent data, org charts, workflow automation, and conversation intelligence. For teams under 10 reps who only need contact data, Lusha or Prospeo (starting free, ~$0.01/email with 98% accuracy) deliver better cost-per-lead.

What's the cheapest alternative to Lusha for verified emails?

Prospeo offers 98% verified emails at ~$0.01 each with a free tier (75 emails/month), no contracts, and a 7-day data refresh cycle. Apollo.io offers unlimited emails on its free plan with built-in sequencing. Both are substantially cheaper than Lusha's $0.12/email on Pro, with higher reported accuracy.