How to Budget an Outreach Campaign in 2026: Real Numbers, Not Guesswork

Your CEO just asked how much it'll cost to generate 50 qualified meetings next quarter. You Googled "outreach campaign budget" and got participatory budgeting guides for nonprofits, PDF toolkits from 2021, and government health campaign templates. Every result on page one is either a civic planning resource or an article that says "it depends" for 2,000 words. None of them tell you what a 5-person sales team should actually spend on cold email infrastructure.

That's a problem. 91.5% of cold emails get ignored - and the difference between campaigns that break through and the ones that don't comes down to how you allocate dollars across data, infrastructure, and human time. Not "stakeholder alignment." Not "brand awareness." Dollars and line items.

Here's the hot take most budget guides won't give you: the tools are the cheapest part. A complete cold email stack costs $100-$300/month. The expensive part is the 10-20 hours/week of human time nobody accounts for. Budget for that, or budget for an agency. But stop pretending outreach is "free" because the software is cheap.

What You Need (Quick Version)

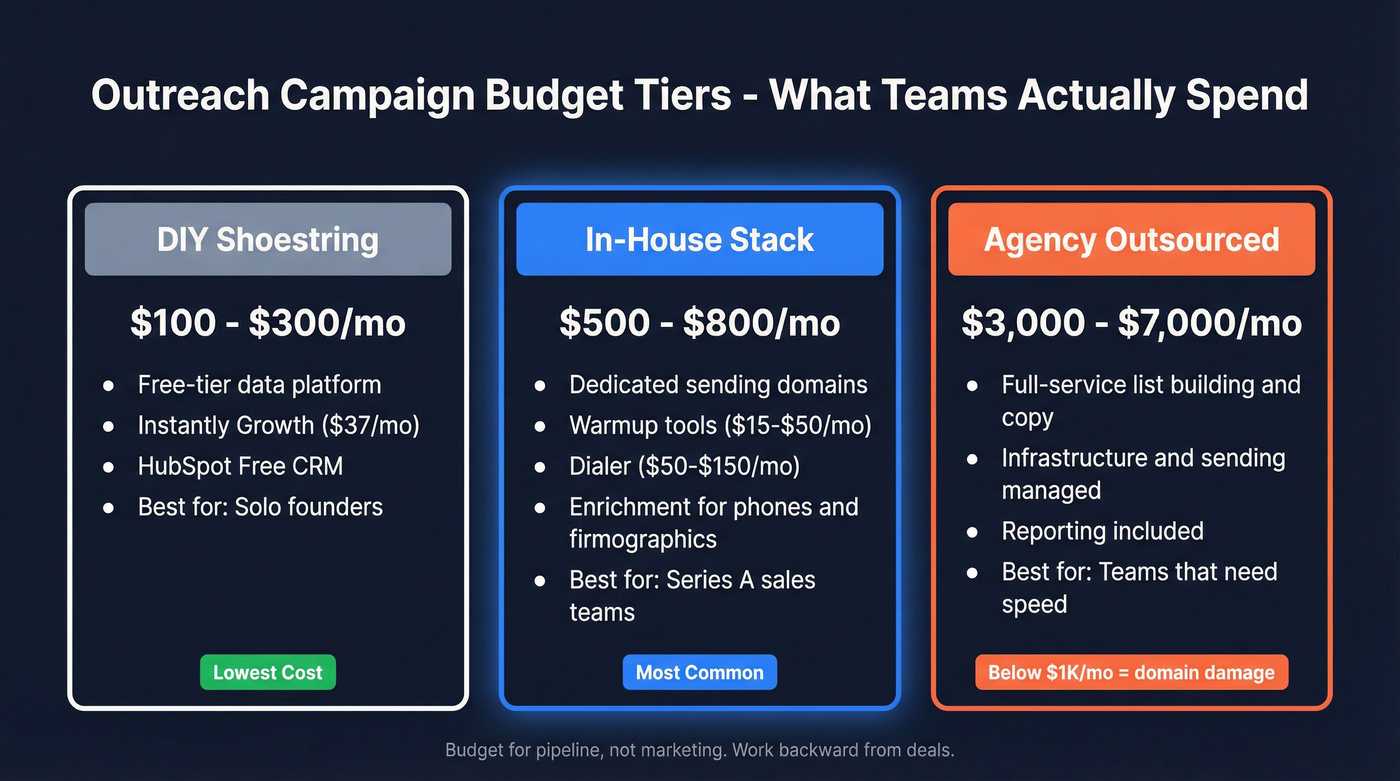

Before the deep dive, here are three budget tiers based on what teams actually spend:

DIY on a shoestring ($100-$300/month):

- Data + email verification: a self-serve platform with a free tier

- Sending platform: Instantly Growth ($37/mo)

- CRM: HubSpot free

- Total: under $100/month on free tiers, $150-$300 once you scale

In-house with a real stack ($500-$800/month):

- Everything above, plus dedicated sending domains ($20-$75/year), warmup tools ($15-$50/month), a dialer ($50-$150/month), and enrichment for phone numbers and firmographics

- This is where most Series A sales teams land

Outsourced to an agency ($3,000-$7,000/month):

- Full-service retainer covering list building, copy, infrastructure, sending, and reporting

- Below $2,500/month, expect limited scope and corners cut

- Below $1,000/month, expect domain damage. Seriously.

Stop budgeting for "marketing." Budget for pipeline. Work backward from deals. If you need 50 meetings and your conversion rate is 25%, you need 200 qualified replies. That math tells you how much data, how many sending accounts, and how much time you actually need.

What Companies Actually Spend on Marketing in 2026

Let's zoom out before we zoom in. The Gartner CMO Spend Survey - 402 marketing leaders across North America, UK, and Europe - puts average marketing budgets at 7.7% of company revenue. That number's been stable for two consecutive years.

Where does that money go?

| Category | Share of Budget |

|---|---|

| Paid media | 30.6% (up 11% YoY) |

| Digital channels | 61%+ of total spend |

| Paid digital (of digital) | 69% |

| Paid search (of digital) | 13.9% - largest single digital line item |

59% of CMOs say their current budgets aren't enough to hit strategic goals. Half report budgets of 6% of revenue or less. Everyone's being asked to do more with less.

But these are total marketing numbers. Outreach - the cold emails, the sequences, the phone calls - is a subset. For most B2B companies running outbound, the outreach-specific budget is 5-15% of total marketing spend. At a seed-stage company spending $35K/month on marketing, that's $1,750-$5,250/month on outreach tools, data, and infrastructure.

The mistake most teams make is lumping outreach into "demand gen" and never breaking out the actual line items. That's how you end up paying for tools nobody uses and missing infrastructure that actually matters.

What an Outreach Campaign Budget Actually Includes

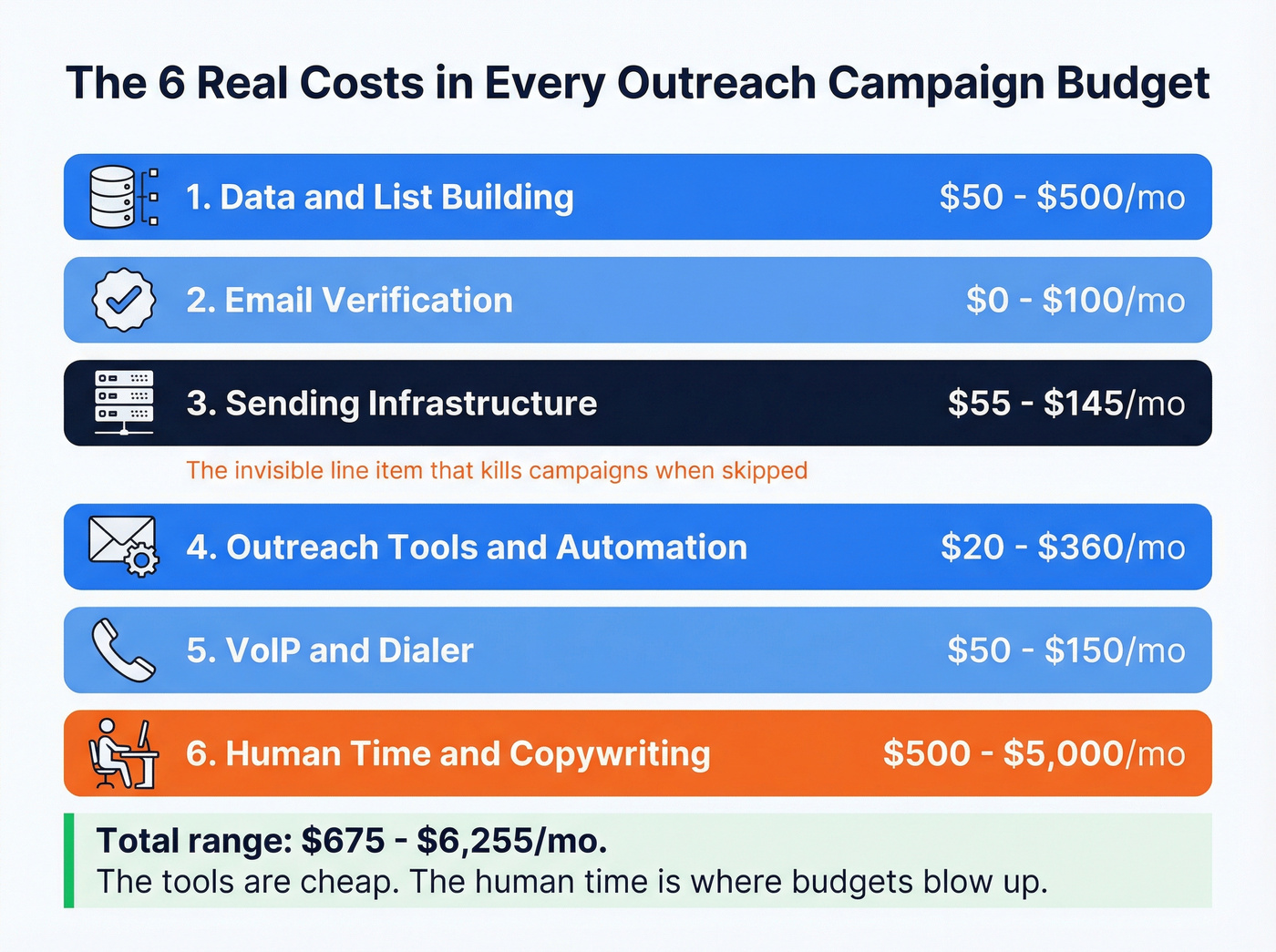

Most budget templates miss half the real costs. Here are the six categories that matter, with what you should expect to pay:

1. Data and list building ($50-$500/month)

Your contact database - the emails, phone numbers, and firmographic data you need to target the right people. A free Apollo tier gets you started. A dedicated B2B data provider with verified mobiles and intent signals runs $200-$500/month.

2. Email verification ($0-$100/month)

Sending to unverified emails tanks your deliverability. Period. Standalone verification tools like ZeroBounce or NeverBounce run $30-$100/month depending on volume. Some data platforms bundle verification with email finding, which eliminates this as a separate line item entirely. That's one fewer tool to manage and one fewer invoice to track.

If you’re comparing vendors, start with a shortlist of email verifier websites and pick based on accuracy at your typical volume.

3. Sending infrastructure ($55-$145/month)

The "invisible" budget line that kills campaigns when you skip it:

- Dedicated domains: $10-$15/year each, and you need 2-5 of them ($20-$75/year)

- Google Workspace accounts: ~$7/user/month x 5-10 sending accounts = $35-$70/month

- Warmup service: $0-$50/month (some sending tools include this free)

If you want the deeper checklist, treat email sending infrastructure as its own build step, not an afterthought.

4. Outreach tools and automation ($20-$360/month)

Your sequencing platform - the tool that sends emails, manages follow-ups, and tracks replies. Ranges from Woodpecker at $20/month to Instantly at $37-$358/month to enterprise platforms like Outreach.io at $100-$500/user/month.

If you’re still picking software, use this list of cold email outreach tools to compare pricing and constraints.

5. VoIP and dialer ($50-$150/month)

If you're adding phone touches - and you should for high-value accounts - budget for a dialer. Tools like Aircall, JustCall, or PhoneBurner run $50-$150/month per seat. Skip this at pre-seed; add it at seed stage or later.

When you add calling, align it with a real B2B cold calling guide so your dialer spend actually turns into meetings.

6. Content, copywriting, and human time ($500-$5,000/month)

Someone has to write the emails. Hiring a freelance cold email copywriter runs $500-$1,000 for a full sequence with A/B variants. But the real cost is labor: list curation, reply management, meeting scheduling, sequence optimization, deliverability monitoring. At $50/hour, 15 hours/week = $3,000/month.

If you need a structure to start from, build around a proven B2B cold email sequence instead of reinventing it.

This is why agencies exist - and why they charge what they charge.

You just saw that contact data runs $530-$2,000 per 1,000-contact campaign. Prospeo cuts that to ~$10 for verified emails at $0.01 each - with 98% accuracy and built-in verification. No separate verification tool. No extra invoice.

Stop budgeting for bounce rates. Budget for pipeline instead.

What a Real Outreach Campaign Costs: 1,000-Contact Example

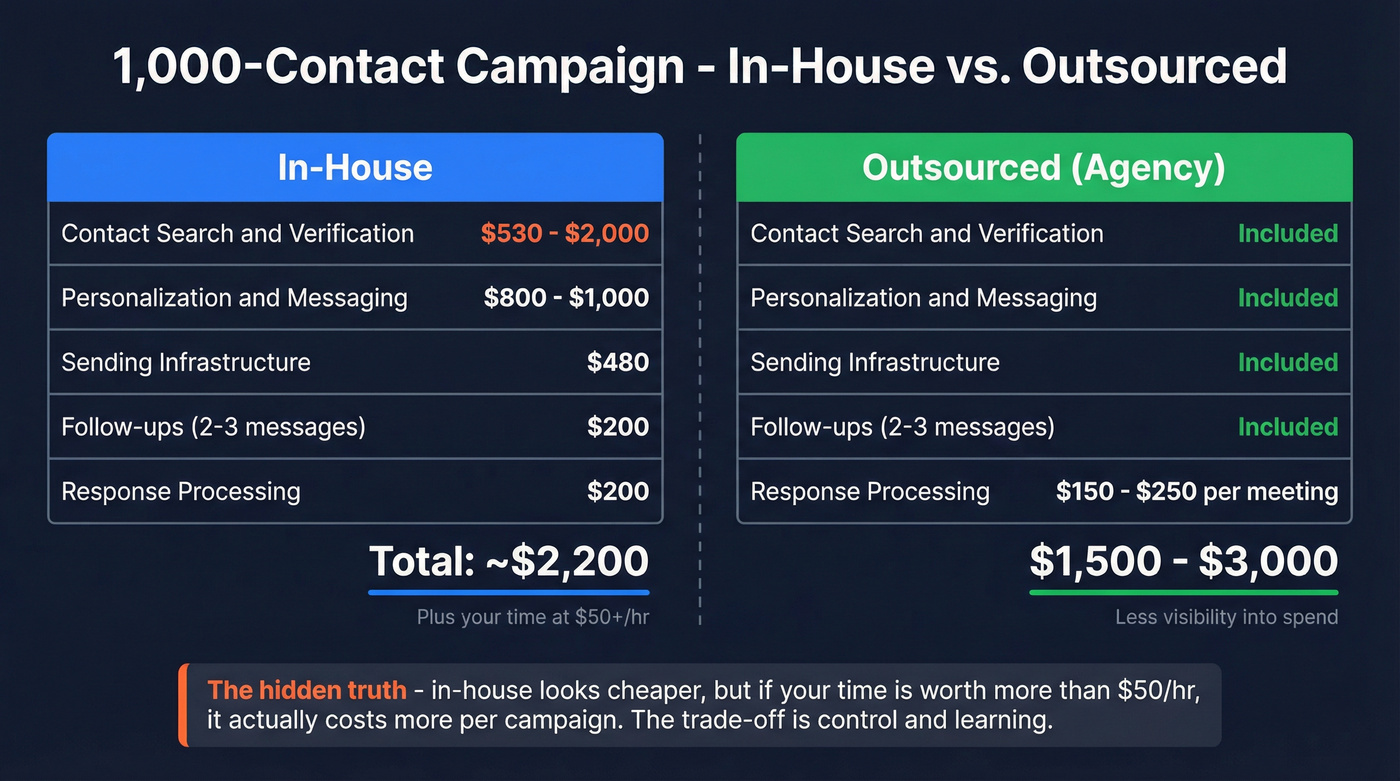

Theory is nice. Let's price out an actual campaign: 1,000 targeted contacts, multi-touch email sequence, in-house execution vs. outsourced.

| Cost Category | In-House | Outsourced |

|---|---|---|

| Contact search & verification | $530-$2,000 | Included |

| Personalization & messaging | $800-$1,000 | Included |

| Sending infrastructure | ~$480 | Included |

| Follow-ups (2-3 messages) | ~$200 (labor) | Included |

| Response processing | ~$200 | $150-$250/meeting |

| Total | ~$2,200 | $1,500-$3,000 |

Agency retainers bundle these costs into a single monthly fee - which is why line items show "Included." The trade-off: less visibility into where your money goes.

A few things jump out. The in-house number looks similar to outsourced, but that's deceptive. The in-house figure includes your time at a modest hourly rate. If your time is worth more than $50/hour (it is), in-house is actually more expensive per campaign. The trade-off is control and learning.

The infrastructure math matters. To send 300 cold emails per day, you need roughly 10 email accounts. New mailboxes start at 30 sends/day and scale to 50-100 after a 2-4 week warmup period. That warmup time is non-negotiable. Skip it and your emails land in spam from day one.

The contact search and verification line is where most outbound sales budgets blow up. The $530 low end assumes you're using a self-serve tool with good data quality. The $2,000 high end is what happens when you're buying lists from multiple vendors, manually verifying, and cleaning duplicates. The tool you pick for data directly determines whether this line item is $500 or $2,000.

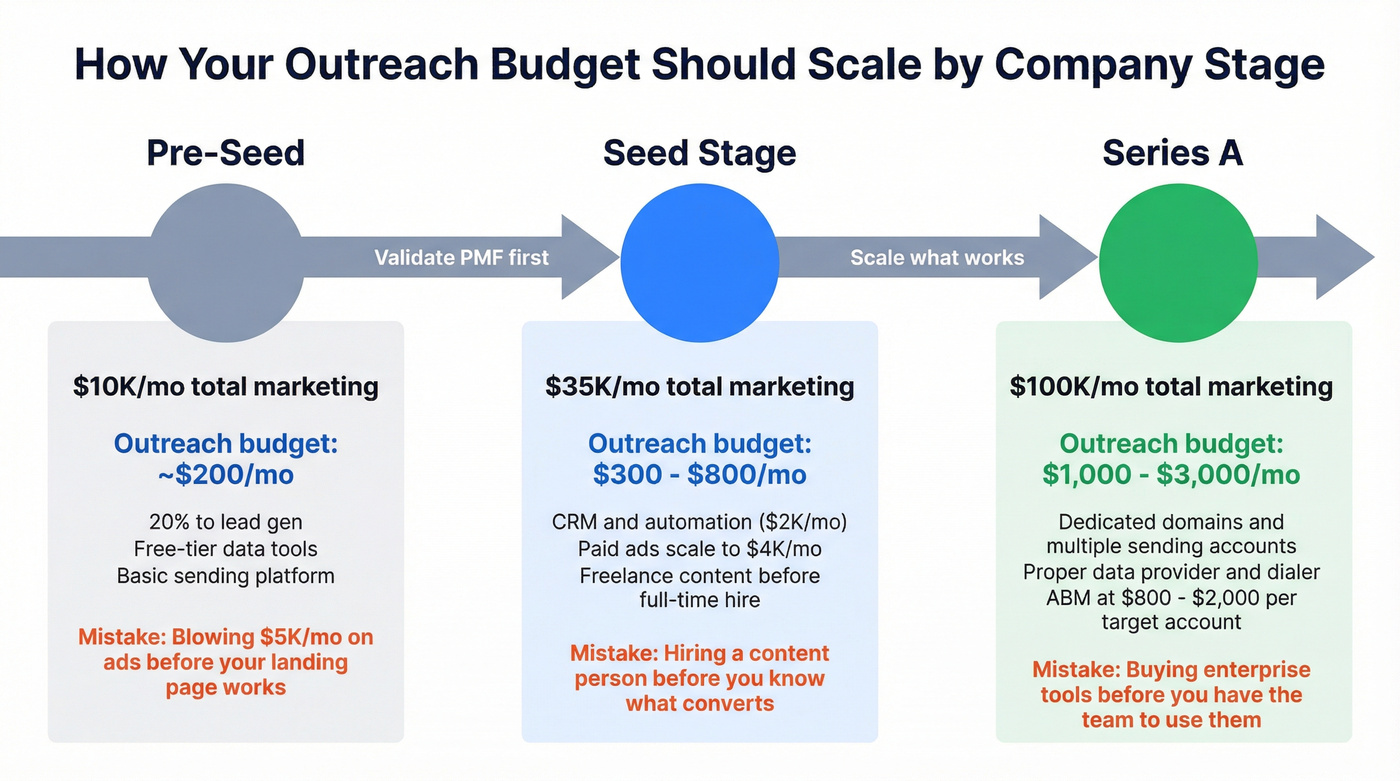

How to Budget by Company Stage

Budget advice without context is useless. What you should spend depends entirely on where your company is.

Pre-Seed ($10K/Month Total Marketing)

| Category | Allocation | Monthly $ |

|---|---|---|

| Content Marketing | 40% | $4,000 |

| Digital Foundation | 25% | $2,500 |

| Lead Gen & Events | 20% | $2,000 |

| Brand Development | 15% | $1,500 |

At pre-seed, your outreach budget lives inside that 20% Lead Gen slice - about $2,000/month. List building specifically? Budget $200/month. That's enough for a data tool's free or starter tier plus a basic sending platform.

The biggest pre-seed mistake: blowing $5,000/month on Google Ads before you have a functional signup page. I've seen this happen three times in the last year alone. Fix your landing page first. Then spend. A 1-point lift in landing page conversion (2.5% to 3.5%) cuts your CAC by 15-25%. That's why "landing pages" is a line item in the budget template below - it's not optional.

Seed Stage ($35K/Month Total Marketing)

Skip this section if you're still validating product-market fit. Go back to pre-seed budgets and iterate until your messaging converts.

| Category | Allocation | Monthly $ |

|---|---|---|

| Growth Marketing | 45% | $15,700 |

| Content Marketing | 21% | $7,300 |

| Marketing Technology | 13% | $4,500 |

| Digital Foundation | 11% | $4,000 |

| Brand Development | 10% | $3,500 |

Now you've got real money. CRM and marketing automation eat about $2,000/month of that MarTech budget. Paid ads scale to $4,000/month. Your outreach stack - data, verification, sending, warmup - should run $300-$800/month within the Growth Marketing allocation.

The seed-stage trap: hiring a full-time content person before you know what content converts. Spend $2,000/month on freelance content, test what works, then hire.

Series A ($100K/Month Total Marketing)

| Category | Allocation | Monthly $ |

|---|---|---|

| Growth Marketing | 45% | $45,000 |

| Brand Development | 20% | $22,000 |

| Content Marketing | 20% | $20,000 |

| Marketing Operations | 15% | $15,000 |

At Series A, paid ads alone can run $15,000+/month. Your outreach infrastructure should be mature - dedicated domains, multiple sending accounts, a proper data provider, a dialer for phone touches. Total outreach tooling: $1,000-$3,000/month, which is a rounding error in a $100K marketing budget.

If you're running account-based campaigns, budget $800-$2,000 per high-priority account per month for multi-channel touches covering awareness through acceleration.

The Series A mistake? Buying an enterprise outreach platform like Outreach.io ($100-$500/user/month) before your team has standardized sequences. Start with a $37/month tool, prove the playbook, then upgrade.

Outreach Tool Pricing Comparison

Here's what the tools actually cost. Real numbers, not "contact sales for pricing."

| Tool | What It Does | Starting Price | Best For |

|---|---|---|---|

| Prospeo | Data + finding + verification | Free (75 emails/mo) | Accurate data without extra tools |

| Apollo.io | Database + sequences | Free, $49-$119/user/mo | All-in-one on a budget |

| Instantly.ai | Email sending + warmup | $37-$358/mo flat | High-volume cold email |

| Woodpecker | Cold email automation | From $20/mo | Solo operators |

| Lemlist | Multichannel sequences | $55-$99/user/mo | Personalization-heavy campaigns |

| Mailshake | Email + phone outreach | $29-$99/user/mo | Simple email + dialer |

| SmartReach | Email outreach | From ~$29/mo | Budget-conscious teams |

| Outreach.io | Enterprise engagement | ~$100-$500/user/mo | Enterprise with budget |

| Salesloft | Enterprise engagement | ~$75-$125/user/mo | Mid-market to enterprise |

| Sales Navigator | Social selling | ~$99/mo | LinkedIn-first prospecting |

You don't need 10 tools. You need three: a data provider, a sending tool, and a CRM.

The frustrating outlier on this list is Outreach.io. They don't publish pricing transparently, onboarding runs $1,000-$8,000, and the per-seat cost at the advanced tier ($300-$500/user/month) means a 5-person team could spend $18,000-$30,000/year before sending a single email. It's not built for budget-conscious teams. It's built for enterprise orgs with dedicated RevOps headcount.

The budget breakdown above lists data, verification, and enrichment as three separate line items. Prospeo collapses them into one - 143M+ verified emails, 125M+ mobiles, and 50+ data points per contact, refreshed every 7 days.

Eliminate three budget lines with one platform at $0.01/lead.

Agency vs. In-House: The Real Cost Comparison

What Agencies Actually Charge

| Tier | Monthly Retainer | What You Get |

|---|---|---|

| Low | $1,500-$2,500 | Limited scope, basic copy, minimal personalization |

| Mid | $3,000-$7,000 | Full-service: lists, copy, infrastructure, sending, reporting |

| High | $10,000+ | Enterprise multi-channel, dedicated team, ABM |

Beyond retainers, agencies use four pricing models:

Retainer only: Fixed monthly fee regardless of results. Simple but misaligned incentives.

Cost per lead (CPL): Varies by industry and qualification level - $50-$100 for high-volume, lower-ticket products; $100-$250 for mid-range B2B SaaS; $400-$650+ for legal and financial services.

Cost per appointment: $150-$500 per qualified meeting. Higher quality than CPL since it's further down the funnel.

Hybrid (retainer + performance bonus): The model we'd recommend. Base retainer covers infrastructure and labor; bonus aligns the agency with your pipeline goals.

Agencies worth considering: Belkins, Martal Group, and Leadium all operate in the mid-tier range with solid reputations. Vet them hard - ask for deliverability metrics, not just "meetings booked."

The $999 Agency Trap

This needs its own section because it's that common.

Sub-$1,000/month agencies cut costs the only way they can: by skipping infrastructure. They'll blast unverified emails from your primary domain, skip warmup, use generic templates, and tank your sender reputation. You'll spend months recovering deliverability that took them weeks to destroy.

The math doesn't work at $999/month. A single SDR's tool stack costs $300-$500/month. Add data, copy, and any human oversight, and you're already past $999 before the agency makes a dollar of margin. Something has to give - and it's always quality.

When In-House Wins (and When It Doesn't)

In-house cold email costs total $200-$500/month for tools. Even with a lead database, verification, sending platform, dedicated domains, and warmup, you rarely cross $300/month for a solo operator's stack.

The trade-off is time: 10-20 hours per week for list building, sequence writing, reply management, and deliverability monitoring. That's a half-time job.

Go in-house when:

- You're pre-seed or seed and need to learn what messaging resonates before handing it to someone else

- Your ICP is narrow enough that you can personally curate lists

- You have founder or early-employee time to invest

- You want to own the process and iterate fast

Go agency when:

- You have budget but not headcount

- You need to scale past 5,000 contacts/month

- You want multi-channel (email + phone + social) without hiring three people

Budget Mistakes That Burn Cash

1. Skipping strategy and jumping straight to tactics

The pre-seed founder who spends $5,000/month on Google Ads before having a working signup page. The seed-stage team that buys a $2,000/month ABM platform before defining their ICP. Strategy first, tools second. Always.

Do this instead: Spend your first two weeks defining your ICP, writing three email variants, and testing on 200 contacts manually. Then invest in tools.

2. Over-relying on one channel

I've seen teams put their entire outbound budget into a single channel - then watch costs spike and leads vanish overnight when that channel's algorithm changed. Multi-channel campaigns consistently generate 2-3x higher engagement than single-channel efforts. Diversify or die.

Do this instead: Run email as your primary channel, add LinkedIn touches as a supplement, and test phone for high-value accounts. Budget across all three.

3. Ignoring deliverability infrastructure

The "invisible" $200-$500/month that separates campaigns landing in inboxes from campaigns landing in spam. Dedicated domains, warmup, verification - these aren't optional. Email verification is the single highest-ROI line item in your outbound sales budget.

Do this instead: Budget for 2-5 dedicated sending domains, warmup for every new mailbox, and verification for every contact before you send.

4. No contingency fund

A domain gets blacklisted. A tool raises prices mid-quarter. Your primary data source changes their API. Keep 10% of your budget in reserve.

5. Set-and-forget budgets

Review monthly, not quarterly. If variance exceeds 20% on any line item, investigate before the next month. The teams that optimize spend monthly outperform those that set annual budgets and hope for the best.

How to Measure Outreach Campaign ROI

CPL Benchmarks by Industry

| Industry | Average CPL |

|---|---|

| Global average | $198 |

| E-commerce | ~$91 |

| B2B SaaS | $300+ |

| Legal services | ~$131 |

| Higher education | ~$982 |

| Automotive | ~$28 |

The critical distinction: CPL measures pipeline creation. CPA (cost per acquisition) measures revenue realization. They aren't the same thing. Not every lead converts, and your budget needs to account for the full funnel, not just the top.

CPL also rises as you scale. Channel saturation, ad auction competition, and audience fatigue all push costs up. A CPL that works at 500 contacts/month won't hold at 5,000.

Funnel Conversion Benchmarks

Here's where most outreach budgets fall apart - people plan for the top of the funnel and forget the conversion math.

| Stage | Benchmark |

|---|---|

| Visitor to Lead | 2-3% |

| Lead to MQL | 30-35% |

| MQL to SQL | ~13% (top performers: 20-40%) |

| SQL to Opportunity | 20-30% |

| Opportunity to Closed | 20-30% |

The email-specific numbers: B2B open rates average ~36.7%, click-through rates run 3.2% for marketing emails and ~5.1% for cold B2B outreach, and conversion sits around 2.5%.

The big number: email returns $36-$40 for every $1 spent. Organic leads close at 14.6% vs. 1.7% for pure outbound - which is why content-assisted outbound (warm the prospect with content, then reach out) dramatically outperforms pure cold. Content marketing generates 3x more leads at 62% lower cost, making it the highest-ROI complement to your outreach spend.

Follow-up sequences improve response rates by 200-300%. Most responses come from follow-ups, not the initial email. If you're sending one email and moving on, you're leaving 70%+ of your potential replies on the table.

Worked ROI Example

Let's run the math on a real campaign:

- 1,000 prospects contacted via email sequence

- 5% response rate = 50 replies (5% is realistic for well-targeted cold outreach)

- 30% meeting conversion = 15 meetings booked

- 25% close rate = ~3.75 deals

- $10,000 average deal value = ~$37,500 in revenue

Against ~$2,200 in campaign costs, that's roughly 17x ROI. Even at a conservative 2% response rate, you're looking at 6 meetings, 1-2 deals, and $10,000-$20,000 in revenue - still 5-9x return.

The optimization signal to watch: steady CPL plus declining CPA. That means your qualification process is working - you're spending the same to generate leads but converting them more efficiently. If CPA drifts up while CPL stays flat, you've got a messaging or qualification problem downstream.

Build Your Outreach Budget: Copy-Paste Template

Copy this into a spreadsheet. Fill in your numbers. Review monthly.

| Category | Line Item | Monthly Cost (Projected) | Monthly Cost (Actual) | Variance |

|---|---|---|---|---|

| Data & Verification | Contact database | $ | $ | $ |

| Data & Verification | Email verification | $ | $ | $ |

| Data & Verification | Phone/mobile data | $ | $ | $ |

| Sending Infrastructure | Dedicated domains | $ | $ | $ |

| Sending Infrastructure | Email accounts (Workspace) | $ | $ | $ |

| Sending Infrastructure | Warmup service | $ | $ | $ |

| Outreach Tools | Sequencing platform | $ | $ | $ |

| Outreach Tools | CRM | $ | $ | $ |

| Outreach Tools | Dialer/VoIP | $ | $ | $ |

| Content & Copy | Email copywriting | $ | $ | $ |

| Content & Copy | Landing pages | $ | $ | $ |

| Human Time | Hours/week x hourly rate | $ | $ | $ |

| Contingency | 10% of total | $ | $ | $ |

| Total | $ | $ | $ |

Fill projected costs before the month starts. Log actual costs as invoices come in. If variance exceeds 20% on any line item, investigate before the next month. The contingency line isn't optional - it's what keeps a blacklisted domain or a surprise price increase from blowing your quarter.

For the "Human Time" line, be honest. If you're spending 15 hours/week on outreach at $75/hour, that's $4,500/month in labor. Ignoring this number is how teams convince themselves in-house is "free" and then burn out in month three.

That's the entire budget. No fluff. Fill it in, review it monthly, and adjust based on what the numbers tell you.

FAQ

How much should a small business budget for an outreach campaign?

A DIY outreach stack costs $100-$300/month for tools - a data provider, sending platform, and CRM. Add 10-20 hours/week of your time for list building, writing, and reply management. If outsourcing to an agency, budget $3,000-$5,000/month minimum for quality work that won't damage your sending domain.

What's the average cost per lead for B2B outreach?

The global average CPL across industries is $198, while B2B SaaS paid leads commonly exceed $300. Cold email outreach typically delivers $50-$150 per lead when infrastructure and data quality are solid - significantly cheaper than paid channels. Your actual CPL depends on targeting precision and email deliverability.

Is it cheaper to do outreach in-house or hire an agency?

In-house tools cost $200-$500/month vs. $3,000-$7,000/month for mid-tier agencies, but in-house requires 10-20 hours/week of labor. Agencies make sense when you need to scale fast and have budget but not headcount. A hybrid model (retainer plus performance bonus) aligns incentives best.

What's a good free tool to start building outreach lists?

Prospeo's free tier includes 75 verified emails per month with 98% accuracy - enough to test sequences on your first 75 contacts. Apollo also offers a free tier with database access. Pair either with HubSpot's free CRM and Instantly's $37/month plan for a complete sub-$50 starter stack.

How do I calculate ROI on my outreach spend?

Track total campaign costs (tools, data, time, infrastructure), divide by leads generated for CPL, and divide by deals closed for CPA. A healthy email outreach campaign returns $36-$40 for every $1 spent. Watch for steady CPL with declining CPA - that signals your qualification process is improving downstream.