The Modern B2B Cold Calling Guide (2026 Playbook)

You can pay $15,000 a year for a database and still not get a working number for the VP of Sales at a Series B company. Then your reps leave voicemails, get ~2% callbacks, and everyone starts asking the same tired question: "Is cold calling dead?"

It isn't. But most teams run it like it's 2016: stale numbers, fuzzy ICP, random dialing, and dashboards that reward "activity" instead of learning.

Look, if your deal size is small and your ICP's a blob, cold calling will punish you more than it pays you. Fix the offer and targeting first, then dial.

What you need (quick version)

Here's the "don't overthink it" setup that makes cold calling feel fair again.

Checklist (do these in order)

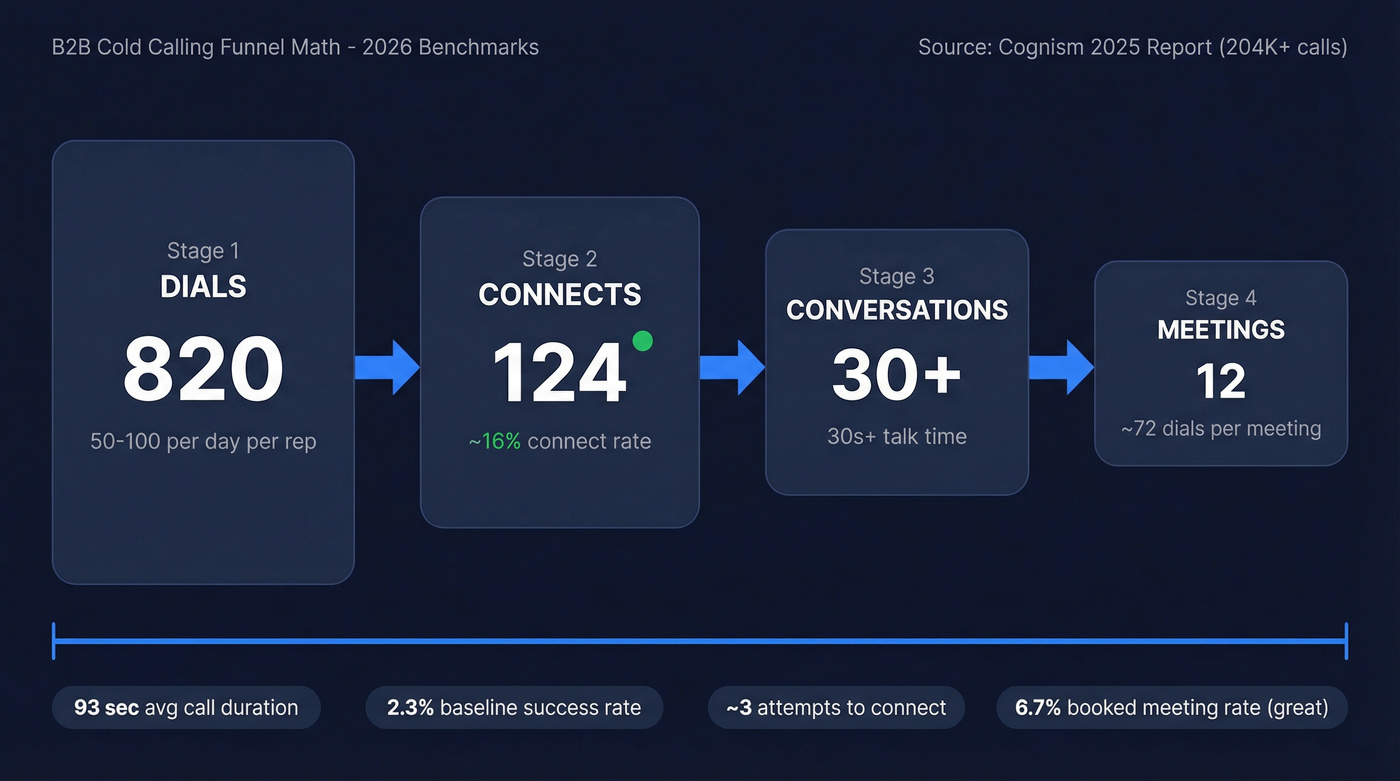

- Define your funnel math first (dials -> connects -> conversations -> meetings).

- Use the 93-second call as your design constraint. Cognism's latest published cold calling benchmark (their 2025 report, used for 2026 planning) puts average call duration at 93 seconds and overall cold-calling success rate at 2.3% across a large dataset.

- Treat connect rate as a data-quality KPI. Connect rate under 3% = list problem, not a script problem. Stop tinkering and fix targeting + numbers.

- Plan for multiple attempts. It takes ~3 attempts on average to connect, and most conversations happen by attempts 3-5.

- Pick one opener and run an A/B test on a single metric: "stayed on the line >30 seconds." (If you want a tighter test design, use this A/B test framework.)

- Log objections like a product team. Top 7 objections + 4 company-specific, tagged consistently.

- Stay compliant by default. DNC scrubs, local-time windows, and recording consent prompts aren't optional.

- Stop under-sampling. If you're doing ~25 dials/day, you're usually not generating enough live conversations to learn anything. Most reps need 50-100 dials/day (depending on connect rate) to get a real sample.

Mini action plan (first 48 hours)

- Pull a 200-400 lead list for one tight ICP slice (one persona, one trigger).

- Dial it for 2 days and measure: connect rate, >30s retention, meetings per connect.

- If connect rate is <3%, rebuild with verified mobiles + a 7-day refresh dataset (Prospeo) and re-run the same 2-day test on the same time blocks.

- If connects are fine but retention is low, swap the opener. If retention is fine but meetings are low, fix discovery + meeting ask.

Why cold calling still works (and why it feels broken)

Cold calling still works because it's one of the only channels where you can create a real-time conversation with a buyer who wasn't shopping five minutes ago. Email gets filtered. Ads get ignored. A live call forces clarity fast.

Cold calling feels broken because most teams blame the script for what is obviously a systems problem: bad data, sloppy segmentation, inconsistent attempts, and reporting that makes it impossible to tell whether the list, the opener, or the ask is failing.

Voicemail is the perfect example. You can do everything "right" and still get ~2% callbacks. That's not because you're bad at selling; it's because voicemail is a checkbox, not a strategy. The modern game is: connect -> earn 30 seconds -> ask one smart question -> book a next step.

I've watched teams hire great SDRs, hand them a "proven script," and then quietly churn half the team because connect rates were trash. When reps feel like the list is rigged against them, they stop believing effort matters, and once that happens your coaching doesn't matter.

Cold calling works when you treat it like an operational system: list quality, timing, call design, and a tight KPI loop that turns calls into a repeatable B2B cold calling pipeline.

Benchmarks that actually matter (define your funnel)

Most benchmark talk is useless because teams mix definitions. "Success rate" can mean "meeting booked," "qualified meeting," or "any positive outcome." Define the funnel, instrument it, then attach targets.

For 2026 planning, the cleanest baseline is Cognism's latest published benchmark (their 2025 cold calling report, based on 204,000+ calls and 27,000+ conversations). Anchor on these:

- ~3 attempts on average to connect

- 93% of conversations by the 3rd call, 98% by the 5th

- 93 seconds average call duration

- 2.3% success rate baseline

- A 6.7% booked-meeting rate for teams using their data (use this as "great looks like" when list quality is strong)

KPI glossary (dial vs connect vs conversation vs meeting)

Use these definitions so your dashboard doesn't lie:

- Dial: one outbound call attempt (manual or dialer).

- Connect: a human answers (not voicemail, not IVR).

- Conversation: you earn enough time to ask at least one current-state question (use 30+ seconds as the minimum).

- Meeting: a scheduled next step with a date/time (not "send me info").

- Success rate (pick one):

- Meetings per dial (least gameable for SDR teams)

- Meetings per connect (good for coaching)

- Meetings per conversation (good for script/discovery)

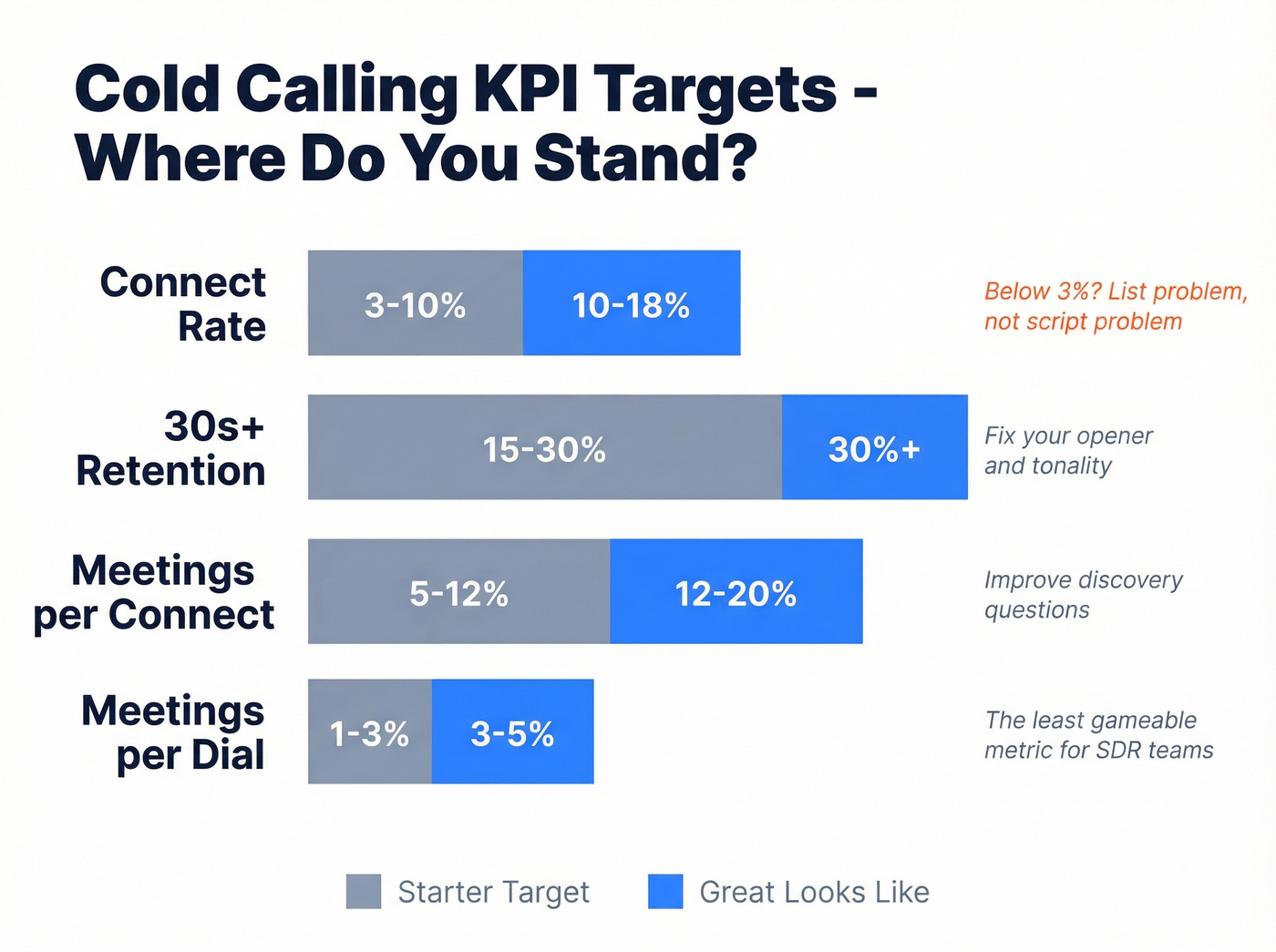

Targets to start with (and what "great" looks like)

| Metric | Starter target | Great looks like |

|---|---|---|

| Connect rate | 3-10% | 10-18% |

| >30s retention | 15-30% | 30%+ |

| Meetings / connect | 5-12% | 12-20% |

| Meetings / dial | 1-3% | 3-5% |

A practitioner funnel that matches this math: 820 dials -> 124 connects (~16%) -> 12 meetings, or ~72 dials per meeting.

Capacity planning rule I actually trust: model ~70 dials/meeting, then earn the right to lower it by improving list quality and the first 30 seconds.

How to measure this in your CRM/dialer (so it's not vibes)

You don't need a fancy RevOps rebuild. You need consistent event capture.

Operational instrumentation defaults:

- Connects: track automatically in your dialer (answered vs voicemail vs no answer). If you're manual dialing, reps must disposition "Answered (Human)" vs "VM/No answer."

- >30s retention:

- Best: call recording + auto "talk time" field; mark "Conversation" if talk time >= 0:30.

- Good: rep disposition "Conversation (30s+)" with weekly QA spot checks.

- Meeting booked: only count meetings that create a calendar event with date/time and an owner. No "send info" inflation.

- Time window + list version: add two required fields on the activity/lead:

- Call block (e.g., US-ET Morning / US-ET Afternoon)

- List version (e.g., ICP1-Funding-Q1-Wk2)

- Objection tag: one picklist field on the call activity. Don't let reps free-type it.

Common measurement mistakes that wreck your benchmarks:

- Counting IVR/switchboard as a connect (it isn't).

- Letting reps mark "meeting" when it's actually "follow up next month."

- Mixing timezones in the same report (timing tests become meaningless).

- Comparing rep A's fresh list to rep B's stale list and calling it "skill."

- Running A/B tests on openers while changing ICP, time window, and list source at the same time.

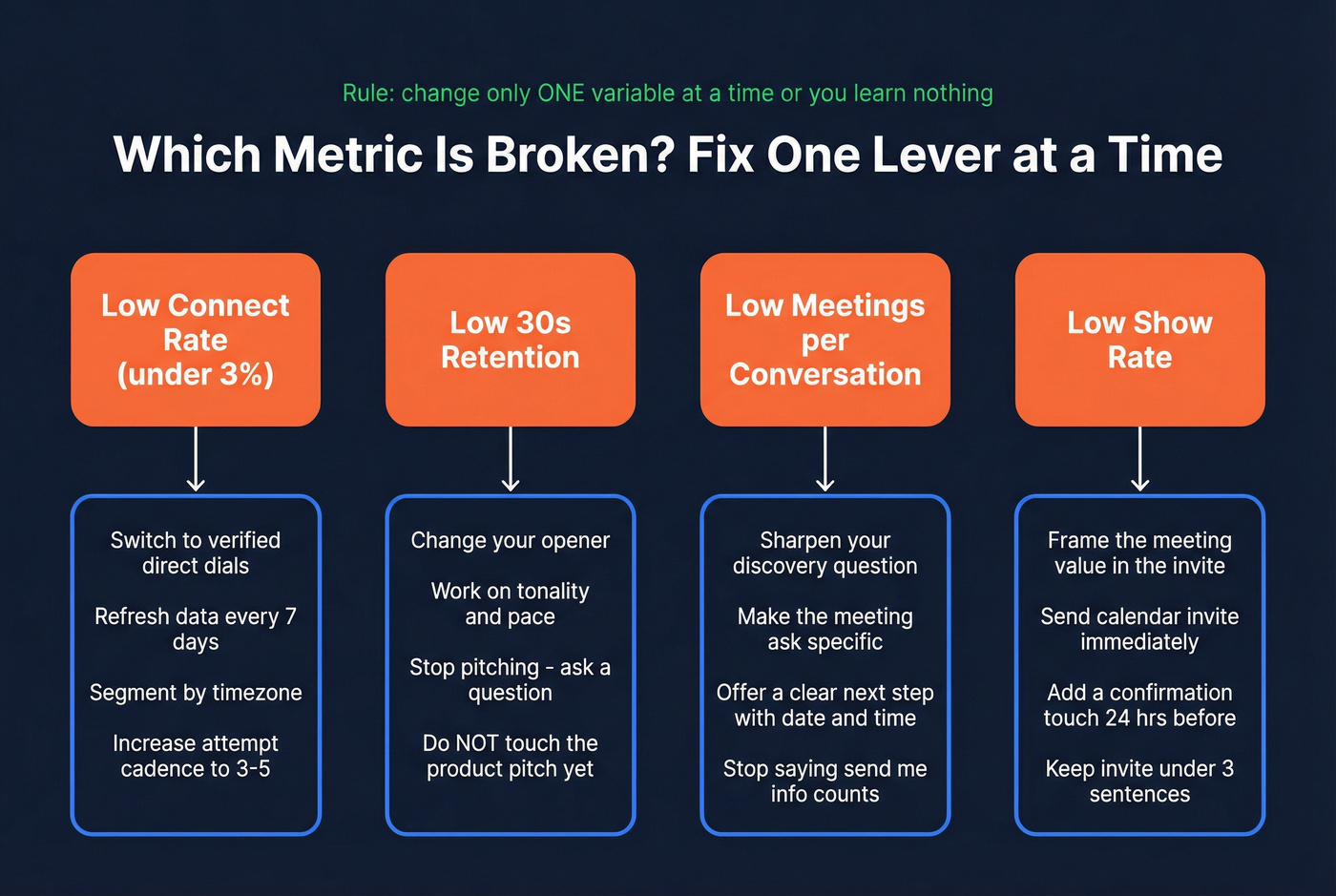

What to change when a metric is low (one lever at a time)

- Low connect rate: list quality, direct dials, timezone segmentation, attempt strategy.

- Low >30s retention: opener + tonality (not your product).

- Low meetings per conversation: discovery question quality + meeting ask clarity.

- Low show rate: meeting framing, calendar invite hygiene, and confirmation touches.

We'll turn this into a weekly loop at the end.

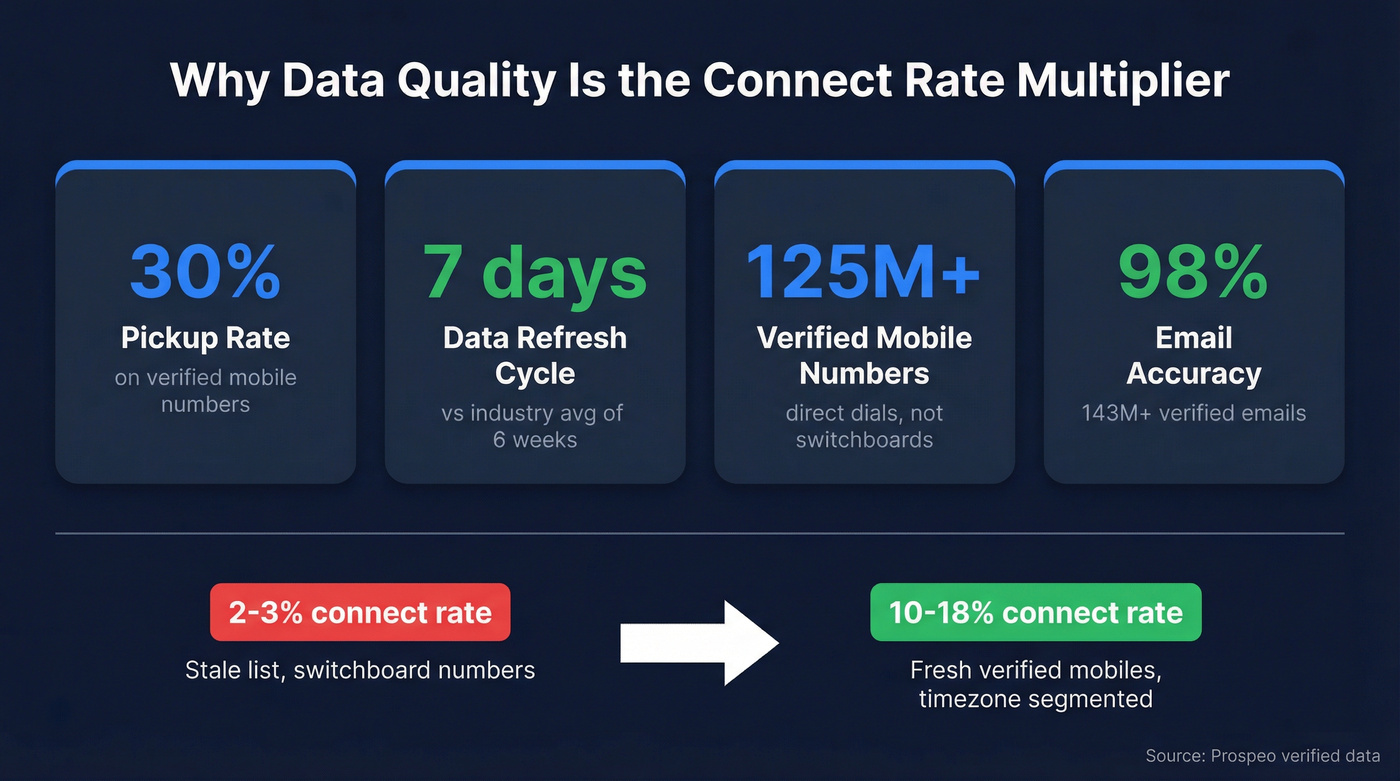

This guide says connect rate under 3% is a list problem, not a script problem. Prospeo's 125M+ verified mobile numbers deliver a 30% pickup rate - refreshed every 7 days, not every 6 weeks. That's the difference between 3 connects per 100 dials and 16.

Stop coaching reps on scripts when the numbers are dead.

List quality is the multiplier (ICP -> targeting -> verified direct dials)

If your connect rate is under 3%, stop script tinkering. You don't have a messaging problem; you've got a list problem.

Here's the thing that drives me nuts: teams will spend weeks rewriting openers while feeding reps stale numbers, wrong titles, and duplicates that create fake activity with zero conversations. That's not coaching. That's busywork with a dashboard.

Skip cold calling if...

Two quick filters before you burn a month of rep time:

- Skip cold calling if you can't define your ICP + offer in one sentence. If your "reason for calling" takes a paragraph, prospects will end the call for you.

- Skip cold calling if you can't operationally handle compliance (DNC scrubs, local-time windows, opt-outs, recording consent). If you can't run it as policy, don't run it.

One more: if your product needs a 10-minute setup explanation before it makes sense, don't start with cold calls. Start with warmer channels, then use calls to follow up on intent.

ICP quick build (roles, triggers, exclusions)

Keep your ICP tight enough that your "reason for calling" is believable.

Roles (pick 1-2):

- VP/Head of the function you impact (owns the outcome)

- Director/Manager who owns the workflow (feels the pain daily)

Triggers (pick 1-2):

- Hiring surge in the department

- New funding / expansion

- Tech install that creates the problem you solve

- Job change (new leader = new priorities)

Exclusions (be ruthless):

- Subsidiaries you can't sell into

- Industries with compliance blockers

- Companies below minimum headcount for your use case

Data rules that raise connect rate (freshness, direct dials, duplicates, job changes)

These rules are boring. They're also the difference between 2% and 12% connect rates.

- Freshness beats "database size." Job changes and number churn kill you. (If you want to quantify this, track B2B contact data decay as an ops KPI.)

- Direct dials beat switchboards. If you're calling a main line, you're basically doing gatekeeper training. (More on sourcing in this B2B phone number guide.)

- Deduplicate before you dial. Duplicate records inflate dials and destroy attribution.

- Track job changes weekly. Calling someone who left 4 months ago is the fastest way to make reps hate the channel.

In our experience, the fastest way to spot a data problem is to compare connect rate by list version, not by rep. If list A connects at 11% and list B connects at 2.5% in the same time blocks, you don't have a coaching problem. You have a sourcing problem.

Prospeo comes up a lot here because it's built for callable inventory: 300M+ professional profiles, 143M+ verified emails at 98% accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, refreshed every 7 days (the industry average is about 6 weeks). It's self-serve, no contracts, and credit-based, which makes it easy to run clean list bake-offs without begging procurement for a new annual tool.

Practical workflow (build list -> verify -> segment by timezone -> load dialer/CRM)

This is the workflow I'd implement for an SDR pod in a day:

- Build the list by filters (persona + company size + trigger).

- Pull verified mobiles/direct dials (don't settle for "maybe" numbers).

- Segment by timezone (so you obey 8am-9pm local and hit peak windows).

- Push into your CRM/dialer (Salesforce/HubSpot + Orum/Nooks).

- Tag the list version (so you can compare list A vs list B performance).

- Auto-dedupe on import (one contact = one owner = one source of truth).

Scenario you'll recognize: an SDR calls "Head of RevOps," gets a wrong number, then calls the same person again two days later because the CRM has a duplicate record from a different import. Now your reporting says "2 dials, 0 connects" and your rep feels cursed. Fix the plumbing and half the "cold calling is dead" talk disappears. (If you're cleaning up your systems, this keep CRM data clean framework helps.)

In Prospeo, that looks like: run a search with role + company filters, add an intent topic, then export only contacts with verified mobiles into your CRM or CSV. You're building callable inventory, not just a lead list.

The 93-second framework (repeatable, not "clever")

The average cold call is 93 seconds. That's not trivia; it's a design spec.

If your script needs 3 minutes to "get to the point," it's not a script. It's a monologue.

The 93-second call, time-boxed (steal this)

Use this as your default structure:

- 0-10s: Opener (neutral, human, permission)

- 10-25s: Reason + relevance (why you, why now, why them)

- 25-55s: One current-state question (easy to answer)

- 55-75s: Tiny value bridge (what you typically change / improve)

- 75-93s: Meeting ask (two-day/two-time)

If you blow the first 25 seconds, nothing else matters.

Opener (neutral + human)

Goal: sound like a normal person, not a closer.

Script (copy/paste): "Hey {{FirstName}}, this is {{YourName}} from {{Company}}. Happy {{DayOfWeek}} - did I catch you with a minute?"

If they say no: "No worries. Should I call you back later today, or is tomorrow better?"

Reason + relevance line (keep it tight)

Goal: relevance > personalization. You're not proving you read their blog. You're proving you're calling the right type of person.

Script: "The reason I'm calling - I work with {{peer companies}} and usually when someone's leading {{function}}, they're dealing with {{pain/trigger}}."

Then stop talking.

One current-state question (earn the right to continue)

Pick one:

- "How are you handling {{workflow}} today?"

- "What are you using for {{tool/process}} right now?"

- "Is {{pain}} even on your radar this quarter?"

Meeting ask (two-day/two-time close)

Goal: make the next step small and specific.

Script: "Got it. I don't think we can do this justice right now. Open to a quick 15-minute chat to see if it's even relevant? I've got Thursday at 4pm or Friday at 5pm {{their timezone}} - which is better?"

If they hesitate: "Totally fine if it's a no. If we did talk, what would you need to see for it to be worth 15 minutes?"

Two alternate scripts (VP vs Director)

Most teams use one script for everyone and then wonder why it feels off. Use the same structure, change the emphasis.

1) VP/Exec version (outcome + risk):

- Reason line: "I'm calling because leaders in {{function}} keep getting hit with {{risk/cost}} as {{trigger}} ramps."

- Question: "Are you already tracking {{metric}} - or is it more 'we'll fix it when it hurts'?"

- Bridge: "When teams fix it, they usually cut {{time/cost}} and reduce {{risk}}."

- Ask: "Worth 15 minutes to see if there's a gap, or should I disappear?"

2) Director/Manager version (workflow + friction):

- Reason line: "I work with teams running {{workflow}} and the usual pain is {{manual work / bottleneck}}."

- Question: "What's the most annoying part of {{workflow}} for your team right now?"

- Bridge: "We typically remove {{step}} and make {{handoff}} cleaner."

- Ask: "If I can show you how teams do that, do you want a quick 15 minutes this week?"

Opinion: the VP script wins when you have a real trigger; the Director script wins when you're early and trying to find pain quickly.

Openers that keep them on the line (and how to A/B test them)

Most teams argue about openers like it's religion. Treat it like an experiment.

A pattern we've seen in real teams: pattern-interrupt openers tend to keep more prospects on the line past 30 seconds than permission-based openers, and both beat a direct pitch. That's not magic. It's because you're lowering the prospect's guard instead of triggering it.

Also, tonality is annoyingly decisive. The same words can work or fail depending on pace, warmth, and whether you sound like you're bracing for rejection.

Pattern interrupt script (copy/paste)

"Hey {{FirstName}} - this is a cold call. You can hang up, but can you give me 18 seconds first?"

Then deliver one tight relevance line and a question.

Permission-based script (27 seconds) (copy/paste)

"Hey {{FirstName}}, {{YourName}} from {{Company}}. Can I take 27 seconds to tell you why I'm calling, and then you can tell me if I'm way off?"

If yes: relevance line -> one question. (If you want more options, compare against this permission-based opener playbook.)

Your A/B test design (do it like a grown-up)

Don't A/B test five things at once. You'll learn nothing.

- Variants: 2-3 openers max

- Single metric: "stayed on the line >30 seconds"

- Sample size: 100 connects per variant (not 100 dials)

- Hold constant: list slice, time window, and rep (or rotate reps evenly)

- QA: listen to 10 calls per variant to confirm reps actually used the opener

If you're using a dialer like Orum or Nooks, you can run this fast. If you're logging in Salesforce or HubSpot, add a simple disposition for ">30s conversation" so you can report it without guesswork.

Discovery questions + the meeting ask that converts

Cold calling isn't discovery. It's qualifying whether discovery is worth scheduling.

Buying groups have grown from 6 to 12 stakeholders, which is why your goal isn't to "convince" the first person. It's to find the right thread to pull and earn a next step, then bring the right people into the real conversation. (If you're building process around this, start with modern B2B decision making.)

5 discovery questions

Use these like a menu, not a checklist:

- Pain: "What's the most annoying part of {{workflow}} today?"

- Current workflow: "How are you doing it right now?"

- Trigger: "What changed that made this a priority (or not)?"

- Impact: "If this stays the same for 6 months, what breaks?"

- Next step: "If we found a better way, who else would weigh in?"

Micro-commitments (keep control without being weird)

- "Are you the right person for {{area}}?"

- "Is this even a priority this quarter?"

- "If we talk, can we pull in whoever owns {{adjacent area}}?"

Meeting ask templates (calendar language + agenda promise)

Make the meeting about their decision, not your demo.

- "Let's do 15 minutes. If it's not relevant, we'll end it early."

- "Agenda is simple: your current setup, what you've tried, and whether there's a gap worth solving."

Two-day/two-time example: "I've got Tuesday at 10:30 or Wednesday at 2:00 {{their timezone}} - which works?"

Objection handling library (top 7 + the deflect framework)

You don't need 50 rebuttals. You need the top 7 objections plus 4 that are specific to your company/market, and you need to run them until they're muscle memory. (For deeper talk tracks, borrow from this objection handling scripts library.)

The best cold-call move isn't "overcome." It's deflect: acknowledge -> ask a question -> regain control.

I've seen teams turn objection handling into a debate club. That's a trap. Your job is to earn one more question, not win an argument, and the second you start arguing with a stranger on the phone you're basically donating your day to people who were never going to buy.

The default move: deflect to a question

Use these patterns:

- "Totally fair - can I ask you one quick thing so I don't waste your time?"

- "Before I send anything, what are you using today?"

- "When you say 'not interested,' is it the timing or the topic?"

Talk tracks for top objections

"I'm busy." "Totally get it. I can be extremely brief or I can call you back later - which would you prefer?"

If brief: relevance line + one question. If later: lock a time.

"Send me an email." "Happy to. So I don't send something generic - what part is most relevant: {{A}} or {{B}}?" If they answer, you've earned a conversation.

"Not interested." "Fair. Before I go, can I share a 10-second example of why I called, and you can tell me if it's a hard no?" Then example -> question.

"We already use {{competitor}}." "Makes sense. What's working well with it - and where's it falling short?" You're looking for a wedge, not a teardown.

"Price?" "Price only matters if the problem matters. How are you measuring {{problem}} today?"

If they push: "Ballpark, are you thinking 'small test' or 'rollout'?" (Then book the meeting.)

"Bad timing." "Got it. When does this usually get revisited - next quarter, or later?" Then schedule a placeholder.

"Wrong person." "Thanks - who owns {{area}}?"

If they won't give a name: "Is it more on {{role A}} or {{role B}}?"

Objection logging (tagging + weekly rehearsal)

Operationally:

- Add 7 standard objection tags in your CRM.

- Add 4 custom tags that match your market (security review, procurement, incumbent contract, etc.).

- Run a 30-minute weekly objection jam: pick the top 2 tags from last week and role-play 10 reps each.

That's how you get better fast without motivational fluff.

Timing, voicemail, and the missed-call workflow (what to do in the real world)

Timing won't save a bad list, but it boosts a good one.

Cognism's best windows are 10-11am and 2-3pm. Revenue.io has pushed earlier in their analysis: 8-11am local with a connection lift, and they also see peak engagement 4-6pm.

My take: use two daily call blocks per timezone and stop randomly dialing all day. Random dialing creates random results.

Local-time rules (timezone segmentation, 8am-9pm window tie-in)

- Segment lists by timezone.

- Call inside 8am-9pm local (compliance and common sense).

- Run two blocks:

- Morning: 8:30-11:00 local

- Afternoon: 2:00-3:30 local (plus a test block 4:30-5:30)

Micro-timing test (steal this from the best dialers)

Try calling 5 minutes before the half-hour and the hour (e.g., 9:55, 10:25, 10:55). The theory: people are between meetings and more likely to pick up.

Don't debate it. Test it for two days:

- Block A: your normal call block

- Block B: "-5 minutes" micro-timing

Winner = higher connect rate and >30s retention.

Day/time playbook (what to do, not just "best time")

| Moment | What to do | Why it works |

|---|---|---|

| 8:30-9:15 | Call your "likely to answer" list first | Catches people before inbox/meetings pile up |

| 10:00-11:00 | Call your best-fit ICP | Higher quality conversations |

| 2:00-3:30 | Follow-ups + 2nd attempts | "You called earlier" is a natural reason |

| 4:30-5:30 | Senior titles + exec assistants | End-of-day pickup can spike |

| Friday afternoon | Light follow-ups only | New cold calls tend to drag |

A simple 5-attempt calling cadence (that matches the benchmarks)

Most conversations happen by attempts 3-5. Act like it.

- Attempt 1 (Day 1): call + voicemail + email

- Attempt 2 (Day 2): call (different block) + short email bump

- Attempt 3 (Day 5): call + social DM

- Attempt 4 (Day 9): call + "close the loop" email

- Attempt 5 (Day 14): call (micro-timing test) + final DM

Then recycle them into a nurture list or a new trigger-based list. Don't keep rage-dialing the same dead record.

Voicemail: checkbox, not strategy (30-second template)

Voicemail callbacks are ~2%. Leave it anyway, but don't emotionally invest.

Template: "Hey {{FirstName}}, {{YourName}} from {{Company}}. Tried you quick because we help {{persona}} with {{outcome}}. I'll send a short note as well - if it's not relevant, just ignore it. Thanks."

Missed-call follow-up (5-minute rule + what to send)

Message within 5 minutes of a missed call. Speed beats eloquence.

Send one of these (or both):

- A 2-sentence email: why you called + one question

- A fast social DM: "Tried you by phone - quick question: are you the person who owns {{area}}?"

Add a calendar-friendly line to the email: "If it's easier, I can do Tue 10:30 or Wed 2:00 {{TZ}}."

Minimal multi-touch cadence (8-12 touches over ~17-21 days)

If you want a sequence that's aggressive enough to work but not insane, use this:

| Day | Touch | Channel |

|---|---|---|

| 1 | Call + VM | Phone |

| 1 | 2-sentence follow-up | |

| 2 | Call | Phone |

| 4 | Value bump (1 idea, 1 question) | |

| 5 | Call | Phone |

| 7 | DM (short + human) | Social |

| 9 | Call | Phone |

| 12 | "Worth a quick chat?" | |

| 14 | Call (micro-timing) | Phone |

| 17 | Breakup / close-the-loop | |

| 21 | Final call (optional) | Phone |

Most teams quit at touch 3 and then complain "cold calling doesn't work." It works when you stay consistent long enough to hit attempts 3-5 with clean data.

Compliance + call recording (US + EU/UK) + weekly improvement loop

Compliance isn't a legal footnote. It's an operational system. If you don't bake it into process, you'll eventually pay for it in fines, platform restrictions, or brand damage.

Run these as policy. Train them. Audit them.

US compliance checklist (TSR/TCPA/DNC)

Operational defaults:

- Calling window: 8am-9pm recipient local time.

- DNC scrubs: scrub against the National Do Not Call Registry every 31 days.

- TCPA damages: $500-$1,500 per violation.

- TSR rule that surprises people: B2B solicitation calls are exempt except if you're selling nondurable office or cleaning supplies.

- Autodialer/prerecorded exposure: if you use power dialers or prerecorded drops, operate as if consent expectations are stricter for mobile numbers.

- Recordkeeping: keep opt-out logs and call dispositions clean for at least two years.

Useful starting references: the FTC TSR compliance guide and the FCC TCPA/robocalls hub.

EU/UK operational defaults (GDPR + PECR-style reality)

If you call into the EU/UK, run a stricter playbook by default:

- Lawful basis: treat outbound calling as legitimate-interest activity only when your targeting is tight (role relevance + reasonable expectation). "Spray and pray" calling is exposure.

- Transparency: identify yourself, your company, and why you're calling early. If asked, be ready to explain where you got the data and how to opt out.

- Opt-out handling: one clear "don't contact me" must suppress future calls and emails across systems. No exceptions.

- Local-time norms: keep calls inside business hours for the prospect's country unless you have an explicit reason not to.

- Recording: treat recording as consent-first operationally. Ask at the start, and if they say no, stop recording immediately.

- Data minimization: only store what you need to run outreach and suppression.

This isn't legal advice; it's the safest way to run outbound without waking up to a compliance mess. (For a practical outbound lens, see GDPR for sales and marketing.)

Call recording legality + team behavior

For US calls, consent rules vary by state. A simple operational rule that keeps teams out of trouble: default to the most restrictive requirement on the call.

HubSpot lists these all-party consent states: CA, CT, DE, FL, IL, MD, MA, MI, MT, NV, NH, PA, VT, WA.

Team behavior that keeps you safe:

- Default consent prompt at the start of recorded calls: "Quick heads up - this call may be recorded for training. Is that okay?"

- If they say no: stop recording immediately and continue (or offer to call back unrecorded).

- Train reps to say it the same way every time. Consistency beats improvisation.

Weekly improvement loop (the part that makes cold calling compound)

This is the part most teams skip. Then they act surprised when results stall.

Dashboard template (weekly):

| KPI | This week | Last week | If low, change |

|---|---|---|---|

| Connect rate | % | % | List/data |

| >30s retention | % | % | Opener/tonality |

| Meetings/connect | % | % | Discovery/ask |

| No-show rate | % | % | Framing/follow-up |

| Top objection | tag | tag | Talk track |

If a metric is low, do this:

- Connect rate low: tighten ICP, refresh numbers, prioritize verified mobiles, dedupe, segment by timezone, run attempts 3-5 before you judge the list.

- Retention low: A/B test opener, slow down your pace, remove jargon, ask the current-state question earlier.

- Meetings/connect low: simplify the meeting ask, add an agenda promise, stop pitching features, ask one sharper impact question.

- No-shows high: send a 2-line confirmation the day before + 10 minutes before, and make the meeting title outcome-based.

Cold calling isn't magic. It's math plus repetition, and it works best when you treat it as a process you can inspect, coach, and improve week after week, with clean data feeding the top of the funnel so your reps aren't fighting the list.

You need 70 dials per meeting. At $0.01/email and 10 credits per verified mobile, Prospeo costs less per booked meeting than one hour of an SDR dialing stale numbers. 98% email accuracy. 30% mobile pickup. Data that makes the math work.

Build your 200-lead cold calling test list in under 5 minutes.

FAQ

What's a good B2B cold calling success rate in 2026?

A solid baseline is ~2.3% success rate with an average 93-second call, based on Cognism's latest published benchmark (their 2025 report used for 2026 planning). Strong teams push into the 3-5% range by improving list quality (verified direct dials), running opener A/B tests, and tightening the meeting ask.

How many cold calls does it take to book one meeting?

Plan for ~70 dials per meeting as a realistic starting point, then optimize down from there. Many teams land between 40-100 depending on connect rate, persona, and how tight the ICP slice is.

What's the best time to cold call B2B prospects?

The most reliable windows are 10-11am and 2-3pm prospect local time (per Cognism), with strong results also showing 8-11am local and late afternoon 4-6pm (per Revenue.io). Segment by timezone, run two daily call blocks, and test the "5 minutes before :00 and :30" micro-timing idea.

What are the cold calling compliance basics in the US?

Run these as policy: call only 8am-9pm local time, scrub against the National Do Not Call registry every 31 days, and keep clean opt-out logs for at least two years. TCPA exposure is real: penalties run $500-$1,500 per violation, so treat mobile dialing and recording consent as strict operational defaults.

Summary: turn this into a system (not a vibe)

If you want this to work in 2026, treat calls like an inspectable machine: tight ICP, verified direct dials, two consistent call blocks per timezone, and a weekly KPI loop that tells you what to fix (data, opener, discovery, or meeting ask). That's the whole point of this b2b cold calling guide: fewer myths, more math, and a process your team can run without burning out.