Deal Qualification Questions That Actually Move Deals Forward (2026)

A deal can look perfect and still die in week 9. Procurement finally shows up, security drops a questionnaire on your lap, and your "champion" can't get the Economic Buyer into a 15-minute slot.

That's why deal qualification questions matter more than your demo.

We've reviewed enough pipelines to say this plainly: most "late-stage surprises" are early-stage avoidance. The fix isn't asking more questions. It's asking the right ones early, then making a decision.

Qualification is a go/no-go decision system, not a 50-question list.

Your job isn't to interrogate. Your job's to prove (or disprove) that a deal can close on a specific timeline, with the real stakeholders, through the real process, without hidden vetoes popping up after you've already built a forecast around vibes.

Hot take: if you're selling a smaller, straightforward deal and you're running full MEDDPICC theater on every opportunity, you're not being rigorous - you're being slow. Save the heavy process for deals where process can actually kill you.

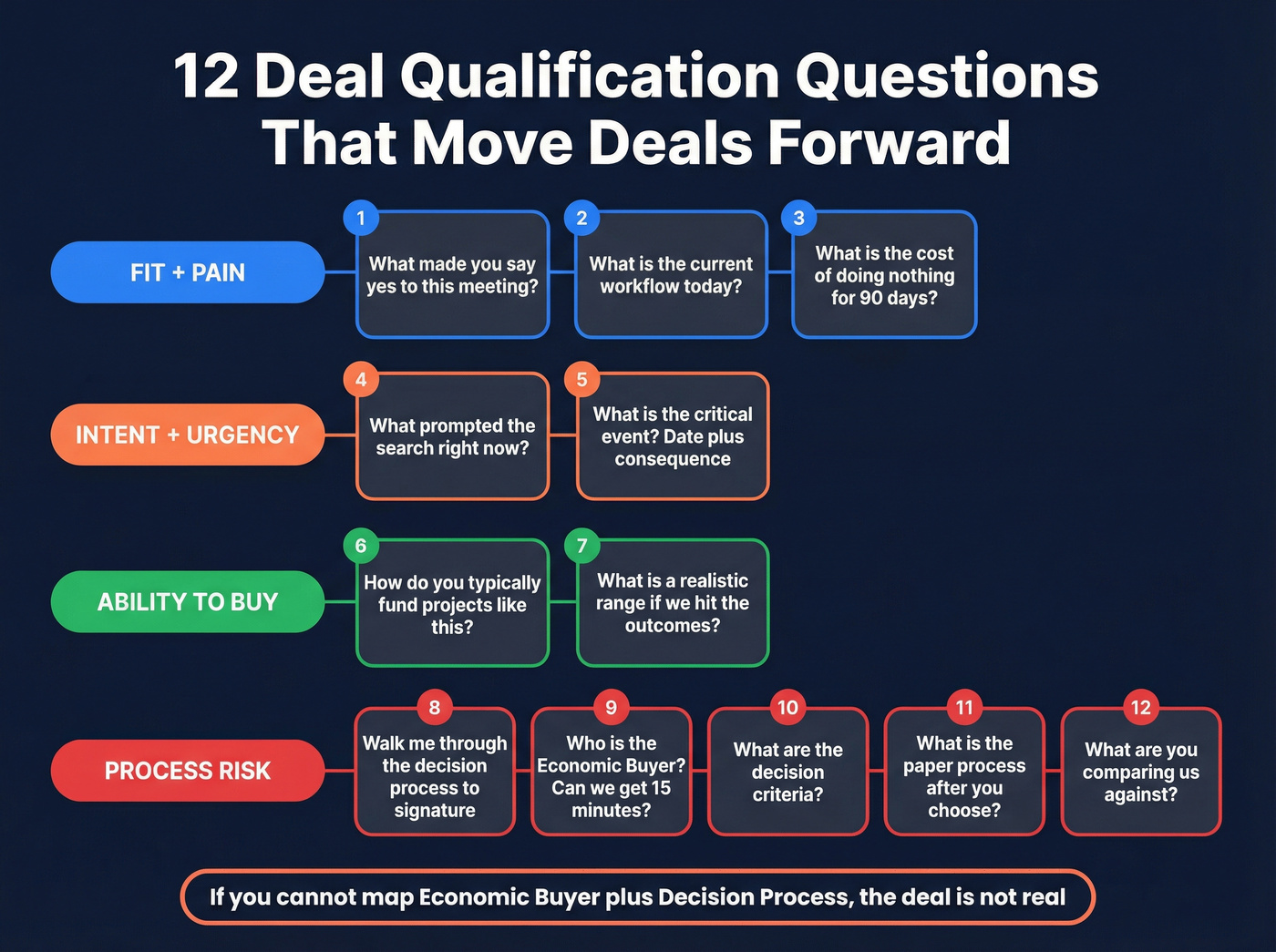

Deal qualification questions: the 12 that move deals forward

Use this as your first-call spine. Twelve questions with branching follow-ups beats 50 generic questions because it keeps you in a conversation, not a checklist.

How to use this in 10 minutes (so it doesn't become "a list")

- Ask 1-3 to confirm fit and real pain. If it's vague, don't move on--tighten it.

- Ask 4-5 to force a timeline (or expose that there isn't one).

- Ask 6-7 to understand funding mechanics and approval thresholds without making it awkward.

- Ask 8-11 to map process risk early (decision + paper process).

- Ask 12 to surface the real competition (including "do nothing").

- End every call with a next-step contract (who attends, what gets decided, by when).

- Log two things immediately in your CRM: Economic Buyer path + paper process. If you wait, you'll "forget" until it's too late.

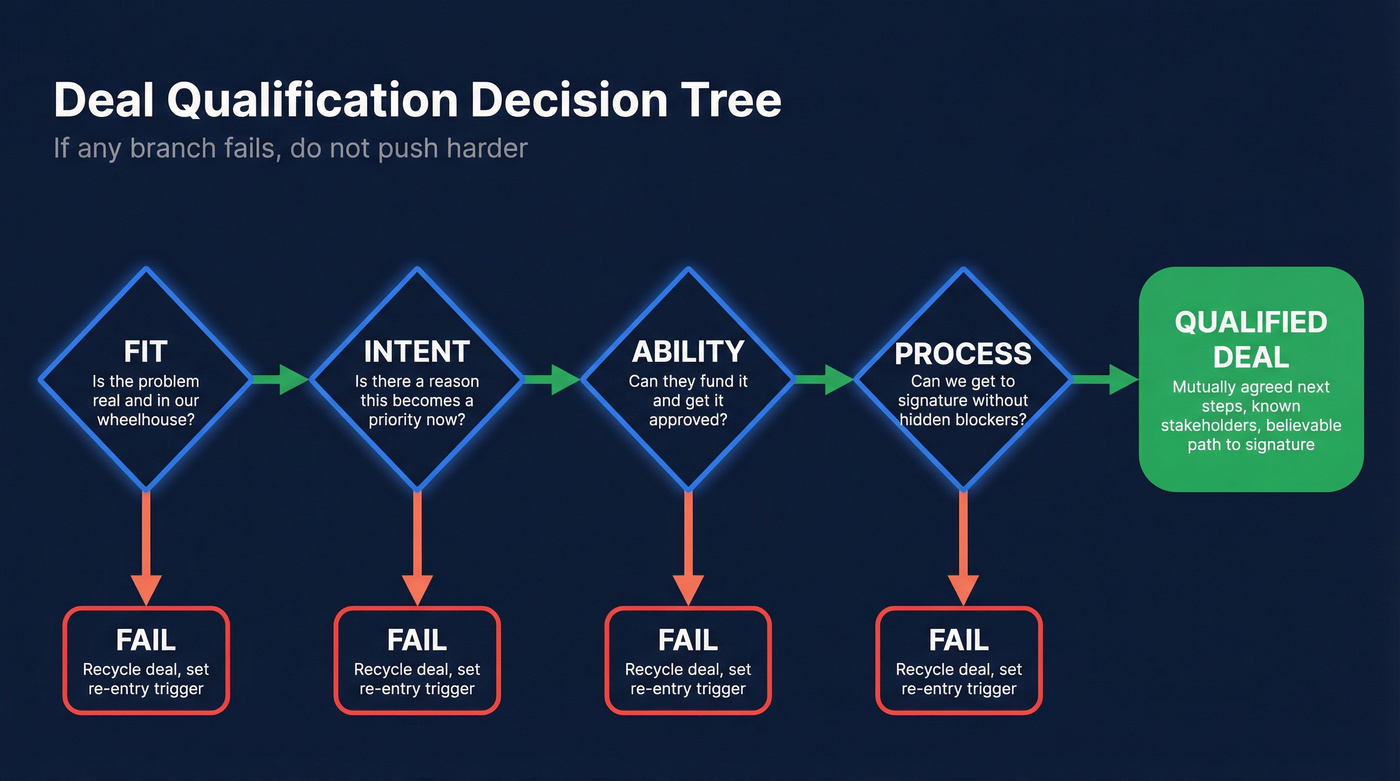

Mini decision tree (fit -> intent -> ability -> process)

- Fit: Is the problem real and in our wheelhouse?

- Intent: Is there a reason this becomes a priority now?

- Ability: Can they fund it and get it approved?

- Process: Can we get to signature without hidden blockers?

If any branch fails, you don't "push harder." You recycle the deal with a clear re-entry trigger.

The 12 questions (with branching follow-ups)

Fit + pain

- "What made you say yes to this meeting?" -> If it's vague: "When specifically is this a problem?"

"What's the current workflow today?" (keep it short) -> If they start rambling: "What part breaks most often?"

"What's the cost of doing nothing for the next 90 days?" -> If they say "not sure": "What does it cost in time, risk, or missed revenue?"

Intent + urgency 4) "What prompted the search right now?" -> If "just exploring": "What would have to be true for this to become a priority?"

- "What's the critical event?" (date + consequence) -> If no date: "What's the next internal checkpoint where this gets decided?"

Ability to buy (without being weird about budget) 6) "How do you typically fund projects like this?" -> If "no budget": "Who can create budget if the business case is clear?"

- "What's a realistic range you'd be comfortable with if we hit the outcomes?" -> If they refuse: "Totally fair - what's the approval threshold where it needs finance/procurement?"

Process risk (this is where deals get real) 8) "Walk me through the decision process from today to signature." -> If it's fuzzy: "What's the next meeting where this gets discussed, and who's in it?"

"Who's the Economic Buyer, and can we get 15 minutes with them?" -> If "maybe later": "What does the EB need to believe to say yes?"

"What are the decision criteria - technical, security, commercial?" -> If "we'll know it when we see it": "What would disqualify a vendor?"

"What's the paper process - legal, procurement, infosec - after you choose?" -> If they say "standard": "Standard for who? What's the typical cycle time?"

"What are you comparing us against?" (incumbent, status quo, internal build) -> If "no one": "What happens if you don't pick anything?"

Mini rule that saves pipelines: If you can't map Economic Buyer + Decision Process, the deal isn't real.

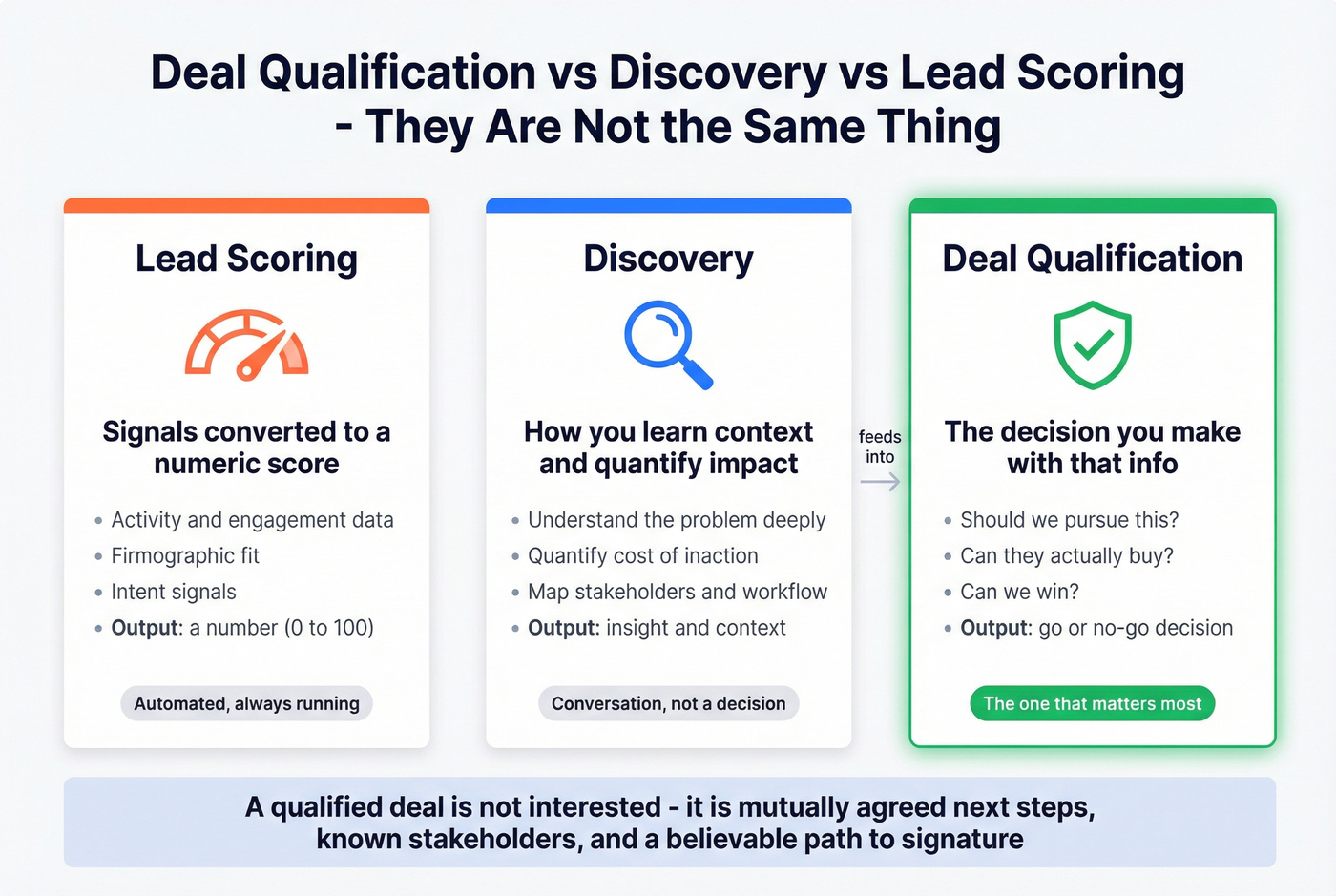

What "deal qualification" actually means (and what it's not)

Deal qualification is your structured way to answer three questions: Should we pursue this? Can they buy? Can we win? A practical way to frame it is fit + intent + ability to buy--then you layer in process risk for anything beyond simple SMB.

That's different from discovery. Discovery is how you learn context and quantify impact. Qualification is the decision you make with that info.

It's also different from lead scoring:

- Lead scoring = signals -> numeric score (activity, firmographics, intent, engagement).

- Qualification frameworks = criteria -> go/no-go (authority, process, pain, timing, competition).

Common pitfalls we see when we audit pipelines:

- Treating qualification like a script instead of a decision system.

- Confusing "they liked the demo" with "they can buy."

- Skipping process risk until the end (procurement/security/legal), then acting shocked when the deal slips.

- Asking budget too early in complex deals, getting stonewalled, and losing momentum.

- Letting CRM fields become the goal instead of deal truth.

A qualified deal isn't "interested." It's mutually agreed next steps, known stakeholders, and a believable path to signature.

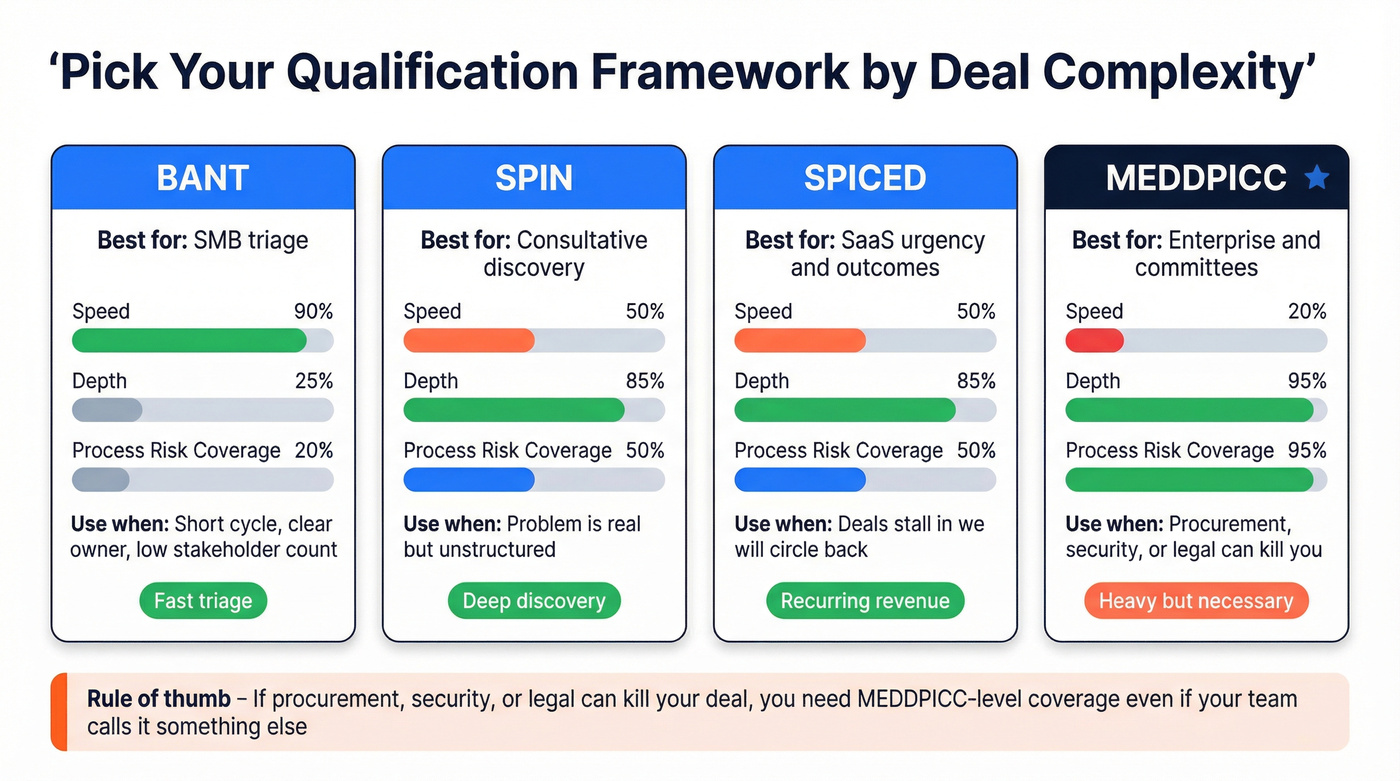

Choose your framework by deal complexity (BANT vs SPIN vs SPICED vs MEDDPICC)

BANT is still useful - when you use it for what it is: fast triage.

But modern B2B buying is rarely one decision maker and a credit card. In most real deals, you're navigating a small committee. The only question is whether you acknowledge that early or pretend it isn't true until week 9.

Pick the lightest framework that still protects you from deal risk. Heavy frameworks on simple deals slow you down. Light frameworks on complex deals create fantasy pipeline.

Framework chooser (speed vs depth)

| Framework | Best for | Speed | Depth | Process risk coverage |

|---|---|---|---|---|

| BANT | SMB triage | Fast | Low | Low |

| SPIN | Consultative discovery | Med | High | Med |

| SPICED | SaaS urgency + outcomes | Med | High | Med |

| MEDDPICC | Enterprise + committees | Slow | Very high | Very high |

Opinionated rule: if procurement, security, or legal can kill you, you need MEDDPICC-level coverage even if your team calls it something else.

BANT (SMB triage) - when it works / when it breaks

Why it works: BANT forces fast clarity on funding, ownership, and timing. Used well, it prevents "polite maybes" from eating your week. Modern BANT also treats budget as a mechanism (how money gets approved), not a number you demand on minute five.

Use it when: the buying motion's straightforward (short cycle, clear owner, low stakeholder count). Skip it when: you're in committee land and budget gets created after a business case.

Disqualify trigger: no owner + no timeline. That's not a deal; it's a conversation.

SPIN (consultative discovery depth) - when to use

Why it works: SPIN moves buyers from implied need ("this is annoying") to explicit need ("we've got to fix this"), and it does it without you pushing. The structure keeps you from pitching too early and helps the buyer build their own internal story.

I've seen teams "run discovery" for 30 minutes, get a great vibe, and still have no idea what the problem costs or who'll approve the spend. SPIN fixes that if you actually do the implication work instead of bailing out early.

Use it when: the problem's real but unstructured, and the buyer needs help naming impact. Skip it when: the buyer already has a crisp spec and just needs a clean evaluation.

Disqualify trigger: you can't quantify impact at all after probing implication. If nothing costs anything, nothing changes.

SPICED (recurring revenue, buyer-centric) - when to use

Why it works: SPICED forces two things most reps avoid: Impact (what it's worth) and a Critical Event (why it's now). That combination turns "nice-to-have" into "priority," or it exposes that it was never priority in the first place.

Use it when: you sell SaaS and deals stall in "we'll circle back." Skip it when: the buyer's running a formal procurement/RFP motion - jump to MEDDPICC coverage.

Disqualify trigger: no critical event and no consequence. That's a slow leak you'll feel at quarter-end.

MEDDPICC (enterprise + process risk) - when to use

Why it works: MEDDPICC maps the risks that actually kill enterprise deals: access to the Economic Buyer, decision and paper process, and real competition. It's not "extra rigor." It's the minimum to forecast honestly when multiple departments can veto you.

Here's the thing: enterprise deals don't slip because the product wasn't good. They slip because nobody owned the internal process, and you let "standard legal" turn into six weeks of silence.

Use it when: regulated industries, security-heavy environments, procurement muscle, multi-year contracts. Skip it when: the deal's simple enough that legal/procurement won't touch it.

Disqualify trigger: you have no path to the Economic Buyer and no champion willing to create one.

Qualification questions by framework (BANT, SPIN, SPICED, MEDDPICC)

A good question bank isn't "50 clever questions." It's prompts that surface the truth fast - then tell you what to do next.

One takeaway worth stealing: limit Situation questions. Too many makes you sound lazy ("tell me everything") or scripted ("what's your tech stack?"). Ask just enough to aim the conversation, then move to pain, impact, and process.

BANT: fast-fit questions (with modern budget nuance)

When to use: first calls, inbound demos, SMB motions, or as a quick reset when a deal gets fuzzy. When to skip: enterprise deals where "budget" gets created after alignment.

Budget (modernized)

- "How do you typically fund projects like this?"

Follow-up: "Is it OpEx, CapEx, or a department budget?"

- "What's the approval threshold before finance/procurement gets involved?"

Good answer sounds like: "Under $25k is department head; above that needs finance + procurement."

- "If we can prove ROI, who can create budget?"

Good answer: "VP can reallocate; CFO signs off."

Common bad answer: "We'll see later." (Translation: no one owns it.)

Authority 4) "Who's accountable for the outcome we're talking about?"

Follow-up: "Who signs if they agree it's the right move?"

- "When you take this back internally, who's most skeptical?"

Good answer: "Security will push back on data handling; finance will question payback."

Common bad answer: "Everyone's aligned." (They're not.)

Need 6) "What's broken today, and what happens if it stays broken?"

Follow-up: "What have you tried already?"

- "What does 'success' look like 90 days after rollout?"

Good answer: "Cut cycle time by 30%, reduce errors, and hit SLA."

Common bad answer: "We'll know when we see it." (No success = no purchase.)

Timing 8) "What's driving the timeline?"

Follow-up: "What happens if this slips a quarter?"

- "What's the next internal meeting where this gets decided?"

Good answer: "Ops review next Tuesday; exec staff Friday."

Disqualify trigger: no next meeting and no owner.

SPIN: anti-interrogation discovery questions

When to use: consultative deals where the buyer feels pain but hasn't framed it. When to skip: transactional purchases where the buyer wants pricing and proof, not a workshop.

Situation (limit these)

- "What's the current workflow for X?"

Follow-up: "Where does it slow down?"

- "Who touches this process end-to-end?"

Good answer: "Sales ops, AEs, finance, and legal."

Common bad answer: "Just me." (Usually false; probe for downstream teams.)

Problem 3) "What's the hardest part about doing it this way?"

Follow-up: "How often does that happen?"

- "Where are you losing time or creating risk?"

Good answer: "Manual handoffs cause errors; reporting's unreliable."

Implication 5) "When that happens, what's the downstream impact?"

Follow-up: "Who feels the pain - customers, finance, leadership?"

- "If nothing changes, what does this cost you per month?"

Good answer: "Two FTEs worth of time plus missed renewals."

Common bad answer: "It's annoying, but fine." (Then it's not a priority.)

Need-Payoff 7) "If you could fix one part of this tomorrow, what would you fix first?"

Follow-up: "What would that change for the team?"

- "How will you measure success so you can justify the investment?"

Good answer: "Cycle time, error rate, and forecast accuracy."

Disqualify trigger: they can't name a measurable win.

Optional but powerful: "If we solved this, what would you do with the time you get back?" Buyers sell themselves when you let them.

SPICED: buyer-centric questions that surface urgency

When to use: SaaS deals that stall, or when you need urgency without pressure. When to skip: formal enterprise evaluations where paper process dominates - use MEDDPICC coverage.

Situation

- "Describe a typical day for the team doing this."

Follow-up: "What tools are involved today?"

- "What kicked off the search?"

Good answer: "We're scaling headcount and the process broke."

Common bad answer: "Just curious what's out there." (Treat as nurture.)

Pain 3) "What frustrates you most about the current process?"

Follow-up: "What's the part you'd love to never do again?"

- "Where do deals/projects get stuck?"

Good answer: "Hand-offs and approvals."

Impact 5) "How much time does this cost per week?"

Follow-up: "What does that time cost in dollars or missed outcomes?"

- "What's the business risk if it stays the same?"

Good answer: "Compliance exposure and churn risk."

Common bad answer: "No real risk." (Then why change?)

Critical Event 7) "By when does a solution need to be live?"

Follow-up: "What happens if it's not live by then?"

- "What internal milestone is this tied to?"

Good answer: "Board meeting, renewal, audit, product launch."

Disqualify trigger: no date and no consequence.

Decision 9) "Who else is involved in the decision?"

Follow-up: "What criteria will decide the winner?"

- "What would make you say 'no' to a vendor?"

Good answer: "Security can't approve, or onboarding takes 6 months."

MEDDPICC: enterprise qualification questions (full set)

Treat MEDDPICC like an internal compass, not a robotic checklist. Each letter answers a risk that can kill the deal.

When to use: multi-threaded deals, procurement/security involvement, long cycles. When to skip: deals where contracting is a click-through and the buyer can decide alone.

M - Metrics

- "What key metrics matter most, and how do you report them today?"

Follow-up: "What's the baseline number we're improving?"

- "If we implement this, how will success be measured?"

Good answer: "Reduce cycle time from 14 days to 7; cut errors by 40%."

Common bad answer: "We don't measure that." (Then it won't get funded.)

E - Economic Buyer 3) "Who has final sign-off, and will I be able to meet them in this process?"

Follow-up: "What does success look like for them personally?"

- "If you and I agree, who else formally or informally needs to approve?"

Good answer: "CFO signs; VP Ops sponsors; security must approve."

Disqualify trigger: "We don't involve them until the end." (That's how deals die.)

D - Decision Criteria 5) "What are the technical, security, and commercial criteria?"

Follow-up: "Which are must-haves vs nice-to-haves?"

- "What would disqualify a vendor immediately?"

Good answer: "No SSO, no SOC 2, or no data residency option."

D - Decision Process 7) "Can you outline the steps from today to a signed contract?"

Follow-up: "What's the internal meeting cadence and who attends?"

- "What's the evaluation format - pilot, bake-off, committee review, RFP?"

Good answer: "Two-week pilot, then steering committee."

Common bad answer: "We'll figure it out." (They won't.)

P - Paper Process 9) "What legal, security, or compliance checks should we anticipate?"

Follow-up: "What's the typical lead time for infosec and redlines?"

- "Whose paper do you use as the basis - your MSA or the vendor's?"

Good answer: "Our MSA; procurement runs the redline cycle."

Disqualify trigger: you can't name who owns security/legal.

I - Identify Pain 11) "When specifically is this a problem?"

Follow-up: "What's the impact on revenue, cost, or risk?"

- "What's the internal priority compared to other initiatives?"

Good answer: "Top 3 for the quarter; exec-sponsored."

C - Champion 13) "Who benefits most from this change and will fight for it?"

Follow-up: "What do they need from us to sell it internally?"

- "Who can pull in procurement/security early so we don't get surprised?"

Good answer: "Ops lead can intro procurement; security lead will join next call."

C - Competition 15) "What are we being compared against - incumbent, status quo, internal build?"

Follow-up: "What do they like about the current option?"

- "If you do nothing, what happens?"

Good answer: "We miss a compliance deadline / lose renewals / can't scale."

Question 9 asks you to get 15 minutes with the Economic Buyer. That means you need their verified email or direct dial - not a generic info@ address. Prospeo gives you 98% accurate emails and 125M+ verified mobile numbers so you can reach the real decision-maker, not their gatekeeper.

Stop qualifying deals you can't even reach. Find the EB's direct line.

60-second disqualification checklist (use it before you book call #2)

This is the fastest way to stop calendar theft. If you can't get clean answers to these, don't "push through." Park the deal.

- Is the pain specific? "When does it break?"

- Is there a critical event? "By when does this need to be different?"

- Is there an owner? "Who's accountable for the outcome?"

- Is there a path to the signer? "Who signs, and can we meet them?"

- Is there a believable next step? "What meeting happens next, and who's in it?"

If you get hand-wavy answers across the board, you're not behind - you're done.

Enterprise deal killers: Paper Process + Competition (ask earlier than you think)

Two things kill enterprise deals late:

- Paper Process (legal/procurement/infosec) you didn't map

- Competition you pretended wasn't real (including "do nothing")

Paper Process questions (legal, procurement, infosec, redlines)

Use these earlier than feels comfortable:

- "Do you require a security review (SOC 2, pen test, DPIA), and who runs it?"

- "What's the typical turnaround time for infosec approval?"

- "Do you have mandatory terms we should see now?"

- "Do you use your paper or vendor paper as the starting point?"

- "Who does redlines - legal, procurement, outside counsel?"

- "If your org changes (growth, downsizing, merger), how do contract adjustments work?"

Mini script (simple, not scary): "Deals like this often slow down in legal or security. I'd rather surface that now than surprise you later - what's your process?"

Competition questions (status quo, incumbent, internal build)

Competition isn't always another vendor. It's often inertia.

- "What are you using today, and why hasn't it been replaced yet?"

- "What do you like about the current approach?"

- "Is an internal build on the table?"

- "Who's invested in the status quo?"

- "What's the switching cost - training, integrations, risk?"

Mini script: "I'm not asking to play games. I'm asking so we can be honest about what we're up against."

Callout: "RFP reality check"

If there's an RFP or formal committee, ask early how communication works. Some processes restrict outreach outside the formal channel.

Ask: "Are there any rules about who we can speak with during the evaluation?"

Stop sounding scripted: a modern discovery call flow with branching logic

Buyers hate boilerplate discovery. They already filled out the form or talked to an SDR. Start by recapping what you know, then ask only for gaps.

Also: stop stacking "why" questions. Swap "why" for "what prompted" or "what changed." You'll get better answers and less defensiveness.

If you're training new reps on how to qualify leads on cold calls, this is the simplest way to keep them conversational while still getting to deal truth.

Recap-first opener (anti-boilerplate)

- Opener: "What made you say yes to this meeting?"

- Recap what you already know: "Here's what I understand so far... did I get that right?"

- Permission: "Mind if I ask 3-4 questions to fill the gaps, then we'll decide if it's worth going deeper?"

If they correct you, that's a win. You just learned what matters.

Branching probes (pain -> impact -> critical event -> process)

If they share pain, ask impact: "When that happens, what does it cost you?"

If they share impact, ask critical event: "What's the deadline where this has to be different?"

If they share deadline, ask process: "What has to happen between now and then for this to get approved?"

And don't answer your own questions. Ask, pause, let them think, then follow up.

End with an "advance" (next-step contract)

End with: "Based on what we covered, there are three paths:

- Advance: we bring in [EB/procurement/security] and validate [criteria]

- Continuation: you're still exploring, we'll pause and revisit on [date]

- No-sale: it's not a fit or timing's wrong"

That language calms buyers down because it signals you're not desperate - and it forces reality.

Benchmarks: what "good qualification" looks like (latest available)

Qualification feels subjective until you put numbers on it. Use benchmarks as guardrails, then diagnose where you're leaking.

Targets worth using:

Inbound demo-request funnel (RevenueHero, 2026 dataset):

- Demo Request -> Qualified Lead: 60-70% healthy, 70-80% great, 90%+ elite

- Qualified Lead -> Booked meeting: 50-60% typical, 60-70% strong, 70%+ exceptional

Phone channel (Invoca, 2026 dataset; 60+ million calls):

- 35% of calls are leads

- 37% of leads convert on the call

- 35% of businesses never ask for a buy/appointment (self-inflicted wound)

Pipeline benchmarks (DigitalBloom):

- MQL -> SQL: 15-21% is the common bottleneck

- Win rate: 20-30% typical

How to interpret this:

- If Demo Request -> Qualified is low, your targeting or SDR qualification is off.

- If Qualified -> Meeting booked is low, your process friction is high (scheduling, follow-up, unclear next step).

- If win rate is low, your qualification is letting in "nice conversations" instead of real deals.

Qualification scorecard (copy/paste): 100 points + an 80/100 "advance" threshold

Use this to decide advance / continue / disqualify in about two minutes. It creates consistency across reps and turns deal reviews into evidence, not storytelling.

Scorecard table (criteria, weight, evidence, points)

| Criteria | Weight | Evidence | Points |

|---|---|---|---|

| ICP fit (industry/size) | 10 | firmographics | 0-10 |

| Use case match | 10 | clear workflow | 0-10 |

| Pain is specific | 10 | "when" + examples | 0-10 |

| Impact quantified | 10 | $/time/risk | 0-10 |

| Critical event/date | 10 | deadline + stakes | 0-10 |

| Economic Buyer mapped | 15 | name + access path | 0-15 |

| Decision process mapped | 10 | steps + meetings | 0-10 |

| Decision criteria known | 5 | must-haves | 0-5 |

| Paper process mapped | 10 | legal/proc/infosec | 0-10 |

| Champion strength | 5 | internal pull | 0-5 |

| Competition understood | 5 | incumbent/status quo | 0-5 |

| Negative: "just browsing" | -10 | no urgency | 0/-10 |

| Negative: no access path | -10 | blocked EB | 0/-10 |

How to use it in pipeline (advance / continue / disqualify)

- Green (80-100): Advance. Book next step with a stakeholder contract (who's attending, what gets decided).

- Yellow (60-79): Continue. You're missing 1-2 critical truths (usually EB or process). Set a plan to get them on the next call.

- Red (<60): Disqualify or recycle. Park it with a reason and a re-entry trigger (budget cycle, initiative restart, leadership change).

Common failure mode: frameworks as CRM paperwork (and the fix)

The fastest way to ruin MEDDPICC (or any framework) is turning it into fields reps fill out to make managers happy.

Real talk: that's how you get beautiful CRM hygiene and garbage forecasts.

Fix it like this:

- Don't ask reps to "fill the framework." Ask them to prove or disprove the top 3 risks on the deal.

- Make the scorecard visible in pipeline review cadences. If it doesn't change decisions, it's theater.

- Tie stage progression to evidence: "No EB path, no stage 3."

Questions to ask yourself (internal) before you forecast a deal

These are the questions that keep you honest - especially when the buyer's friendly and the demo went well.

- What's the disqualifier? What answer would make you walk away today?

- What's the critical event and consequence? If it slips, who cares?

- Who can kill this deal? Name the department, not the person.

- Do we have an Economic Buyer path? Not "they exist"--a real path.

- What will we lose to? Incumbent, internal build, or "do nothing"?

- What's the next meeting that matters? If there isn't one, you're not advancing.

If you can't answer these, you don't have a forecast. You've got hope.

Prep before discovery: build the stakeholder map (so qualification reaches the right people)

Five to fifteen minutes of pre-call research is enough for most deals. Timebox it based on value: low LTV gets light prep; high LTV earns deeper work.

Your goal isn't "know everything." It's: know who matters.

Pre-call + multithreading checklist

- Identify likely Economic Buyer, champion, and day-to-day owner.

- Identify likely blockers: procurement, security, legal, finance.

- Bring two stakeholder-mapping questions (use these verbatim):

- "When you take this back to your team, who'll be the most skeptical and what are they generally skeptical about?"

- "What other department would be affected by this decision even if they're not end users?"

Then multithread. Don't wait for your champion to "try to get someone."

In practice, this is where having clean contact data matters. Prospeo ("The B2B data platform built for accuracy") is one of the fastest ways to build a stakeholder list you can actually reach: 300M+ professional profiles, 143M+ verified emails at 98% accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, all refreshed every 7 days.

You mapped the buying committee. You identified the Economic Buyer and the paper process. Now your CRM fields need real contact data - not stale records from six weeks ago. Prospeo refreshes every 7 days and enriches contacts with 50+ data points at 92% match rate.

Qualified deals deserve qualified data. Enrich your pipeline for $0.01 per email.

Summary: use deal qualification questions to protect your forecast

If you only steal one thing from this guide, steal this: deal qualification questions aren't about sounding smart - they're about surfacing deal truth early enough to act on it.

Do this and your pipeline gets calmer fast.

- If you only do one thing: map Economic Buyer + decision process by call 2.

- If you can't: recycle the deal with a clear trigger to re-enter.

- Use the scorecard weekly so your sales forecast reflects reality, not optimism.

FAQ

How many qualification questions should I ask on a first call?

Ask 8-12 core questions with branching follow-ups so you can confirm fit, urgency, ability to buy, and the decision path in under 15 minutes. If you can't name the signer and the next internal meeting, don't book call #2 - pause the deal and set a re-entry date.

When should I ask about budget in B2B deals?

Ask about budget early for simple, low-friction purchases, but avoid pushing for an exact number in complex deals where funding gets created after alignment. Start with funding mechanics and approval thresholds (for example, "What spend level triggers procurement?"), then anchor price after impact and timeline are clear.

How do I ask about authority without "Are you the decision maker?"

Ask about accountability and approvals, not titles, to surface real influence without putting anyone on the defensive. Use: "Who's accountable for the outcome?" and "If you and I agree, who else needs to approve - formally or informally?" A solid answer names 2-4 stakeholders and a clear sign-off step.

What are the most important MEDDPICC questions to ask early?

Prioritize four areas that cause late-stage slips: Economic Buyer access, decision process, paper process, and competition. A tight set is: "Who signs?", "What are the steps to signature?", "What security/legal reviews happen and how long do they take?", and "What are we being compared against, including doing nothing?"

What tools help me multithread and reach the right stakeholders?

Use your CRM plus a contact data platform that gives verified emails and direct dials so you can reach the Economic Buyer, procurement, and security early. Prospeo is a top pick for self-serve teams because it delivers 98% email accuracy, a 7-day refresh cycle, and 125M+ verified mobile numbers, and it includes a free tier with 75 emails and 100 Chrome extension credits per month.