Enterprise Sales: The 2026 Playbook for Complex B2B Deals

Enterprise sales looks glamorous until you're 90 days into a deal and realize the "next step" is actually 14 steps: security, legal, procurement, finance, an exec sponsor who's never in the meeting, and a champion who's quietly losing influence.

The hard part isn't pitching. It's orchestrating decisions across a buying committee that's already 57% done before they'll even talk to you.

If you don't control decision process + paper process, you don't have a forecastable enterprise motion. You've got a calendar full of meetings and a pipeline full of fiction.

What you need (quick version)

- A definition of "enterprise" that's about process, not logo size (multi-stakeholder + formal risk/approval gates)

- A "no decision" plan, not just a competitor plan: 38% of purchase attempts end in no decision

- A paper-process map by the end of discovery (security + legal + procurement + budget path, with owners and dates)

- A stakeholder map you can execute (roles, influence, and what each person must believe to say "yes")

- MEDDPICC (or equivalent) with a real question bank, especially Decision Process + Paper Process

- Two stall-proof artifacts: a 1-page Decision Memo (why) and a Mutual Action Plan (how)

- One forecasting rule you never break: if procurement isn't named and dated, your close date's fictional

If you can't explain the paper process by end of discovery, you're not in a sales cycle. You're in a hope cycle.

What enterprise selling is (and what it isn't)

Enterprise selling is selling a high-impact change inside a complex organization. That means multiple stakeholders, competing priorities, and formal gates like security, legal, and procurement. It also means longer cycles, more scrutiny, and more ways to lose momentum without ever "losing" to a competitor.

Here's the definition that's actually useful in 2026: it's a motion where the buying process (not the logo) forces you to run a paper-process plan, a stakeholder plan, and a risk-reduction plan in parallel.

The modern twist is brutal: buyers engage vendors 57% of the way through their journey, so you're not "educating from scratch" - you're entering midstream, where they've already got a shortlist, internal politics, and a preferred narrative.

Here's the simplest test: does the deal touch data access, identity, finance, or a core workflow? If yes, you're going through risk review. The moment your product needs SSO, touches customer data, or requires an integration, security becomes a gate - not a stakeholder you "loop in later."

It isn't:

- A bigger version of SMB selling

- A single-threaded champion relationship

- A demo-to-close linear funnel

- A "features win" contest

Use an enterprise motion if:

- Procurement/security/legal are normal, not exceptional

- The buying group is 6+ people and consensus matters

- The deal changes workflows, data access, or risk posture

- Implementation/adoption is part of the decision (not an afterthought)

Skip the enterprise motion (and keep it simpler) if:

- The buyer can buy on a card with no approvals

- The product's low-risk, low-change, low-integration

- Your best deals close in weeks, not quarters

Hot take: if your deal size is closer to "team budget" than "department budget," and your product doesn't touch sensitive data, you probably don't need an enterprise motion. You need clean ICP, tight messaging, and fast onboarding. Don't cosplay complexity.

Look, "enterprise" isn't a logo size. It's a buying process.

Enterprise sales benchmarks for 2026 (so you can plan realistically)

Benchmarks don't close deals, but they stop you from building fantasy forecasts. The pattern we've seen over and over: teams plan enterprise like it's mid-market, then act surprised when the quarter ends and half the pipeline "slips."

2026 benchmarks that actually matter

| Benchmark | 2026 reality | What it means |

|---|---|---|

| Win rate if closed <50 days | 47% | Fast deals have clear process + tight scope |

| Win rate if >50 days | 20% | Drift creates "no decision" |

| Deals closing in 1-2 quarters | 34% | Quarters are the unit of time |

| Buying group size (avg / complex) | ~11 / up to 20 | Multi-threading's mandatory |

| "No decision" outcomes | 38% | Inertia's your #1 rival |

These benchmarks are widely cited in sales research from Outreach and Challenger/CEB-Gartner. The exact numbers matter less than the shape of the curve: speed correlates with clarity, and drift correlates with "we'll revisit next quarter."

The win-rate-by-speed stat is the one most teams ignore. Deals that close inside 50 days win at 47%; once they run longer, win rate drops to 20%. Don't manufacture urgency. Manufacture clarity: decision path, paper process, and explicit commitments.

Salesforce's State of Sales data also shows 57% of sales teams say the sales cycle's getting longer. That's not a "reps need to hustle" problem. It's a "your process needs to remove friction" problem.

Two planning rules that keep you sane:

- Plan enterprise in weeks, forecast in quarters. Your internal cadence should be weekly (MAP reviews, stakeholder adds, paper-process milestones). Your external reality's quarterly.

- Treat "time in stage" like a risk score. If an opportunity sits in "evaluation" for 6 weeks with no security kickoff and no procurement owner, it's not "still in play." It's decaying.

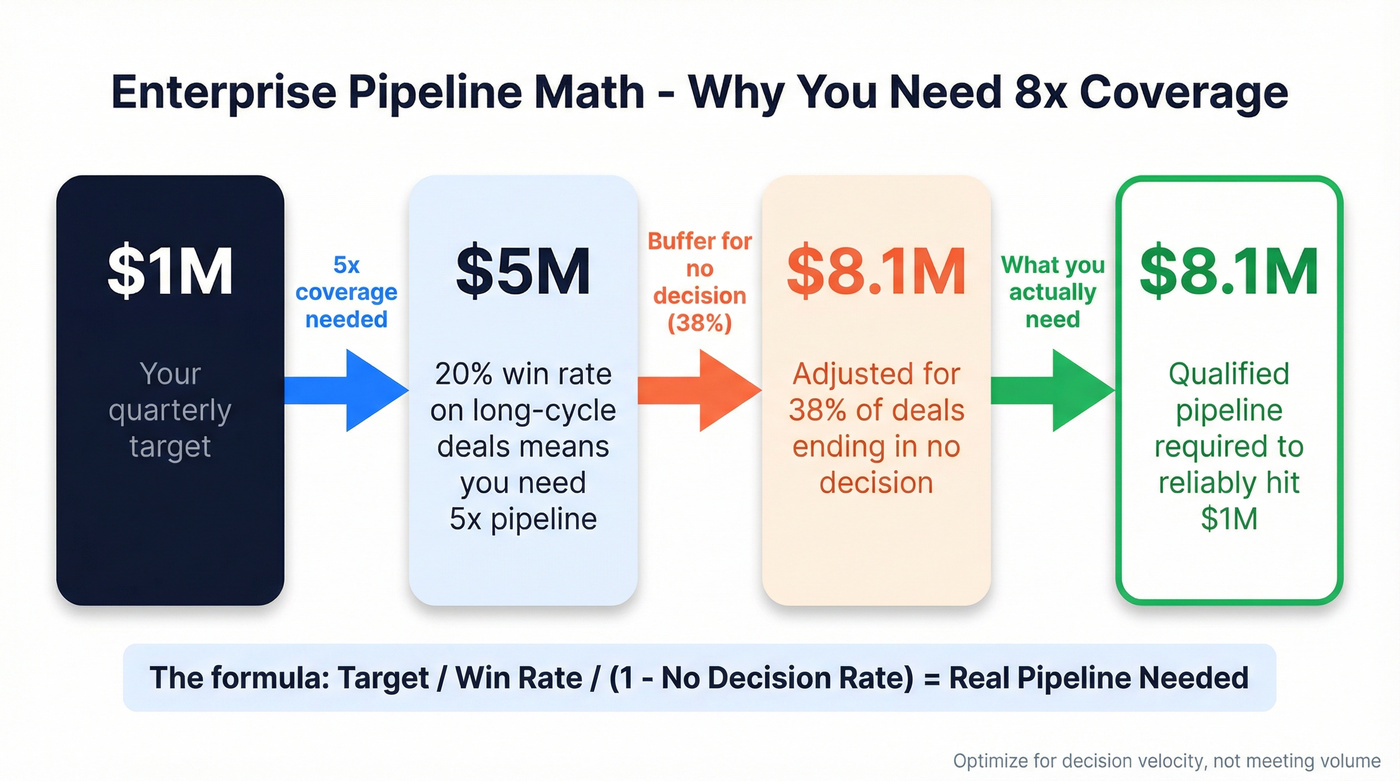

A simple enterprise pipeline math check (so you stop under-covering)

If your win rate's 20% on long-cycle deals, you need 5x coverage just to hit the number - before you account for no decision. And when 38% end in no decision, your effective "decision win rate" is lower than your dashboard makes it look.

A clean way to model it:

- Start with your target (e.g., $1M)

- Multiply by 5x for a 20% win rate -> $5M

- Add buffer for no decision (38%) -> $5M / (1 - 0.38) ~= $8.1M of qualified pipeline

That number's why enterprise leaders obsess over process. It's not because they love spreadsheets. It's because the math punishes wishful thinking, and the punishment shows up right when you least want it: end of quarter, board meeting, pipeline review, and suddenly everyone's arguing about what "commit" means.

If you want one operational takeaway: optimize for decision velocity, not meeting volume.

Your enterprise pipeline needs 5-8x coverage to hit quota. That math only works if you can multi-thread across 11+ stakeholders with real contact data. Prospeo gives you 98% accurate emails and 125M+ verified mobile numbers so you actually reach the buying committee - not just the champion.

Stop single-threading enterprise deals. Reach every stakeholder today.

Enterprise vs mid-market vs SMB (quick comparison table)

The fastest way to mis-run enterprise sales is to treat it like a "bigger SMB." The mechanics change: stakeholders, risk, approvals, and the paper process become first-class citizens.

| Dimension | SMB | Mid-market | Enterprise |

|---|---|---|---|

| Cycle length (size proxy) | 38 days (1-10 emp) | 60-120 days | 185 days (10,001+ emp) |

| Buying group | 1-3 | 3-6 | 6-20 |

| Primary risk | Need/fit | Competition | No decision + paper process |

| Proof required | Light | Medium | Heavy (security, ROI, refs) |

| Procurement/legal | Rare | Sometimes | Standard |

Deal size anchors help too. SaaS Capital's survey puts median ACV at $26,265. That's not "enterprise," but it's a useful baseline: enterprise motions usually kick in when the deal triggers risk review, integration scrutiny, or multi-department impact - not just when the number gets bigger.

If you're selling into 10,001+ employee orgs, plan like it's a 185-day world unless you've proven otherwise.

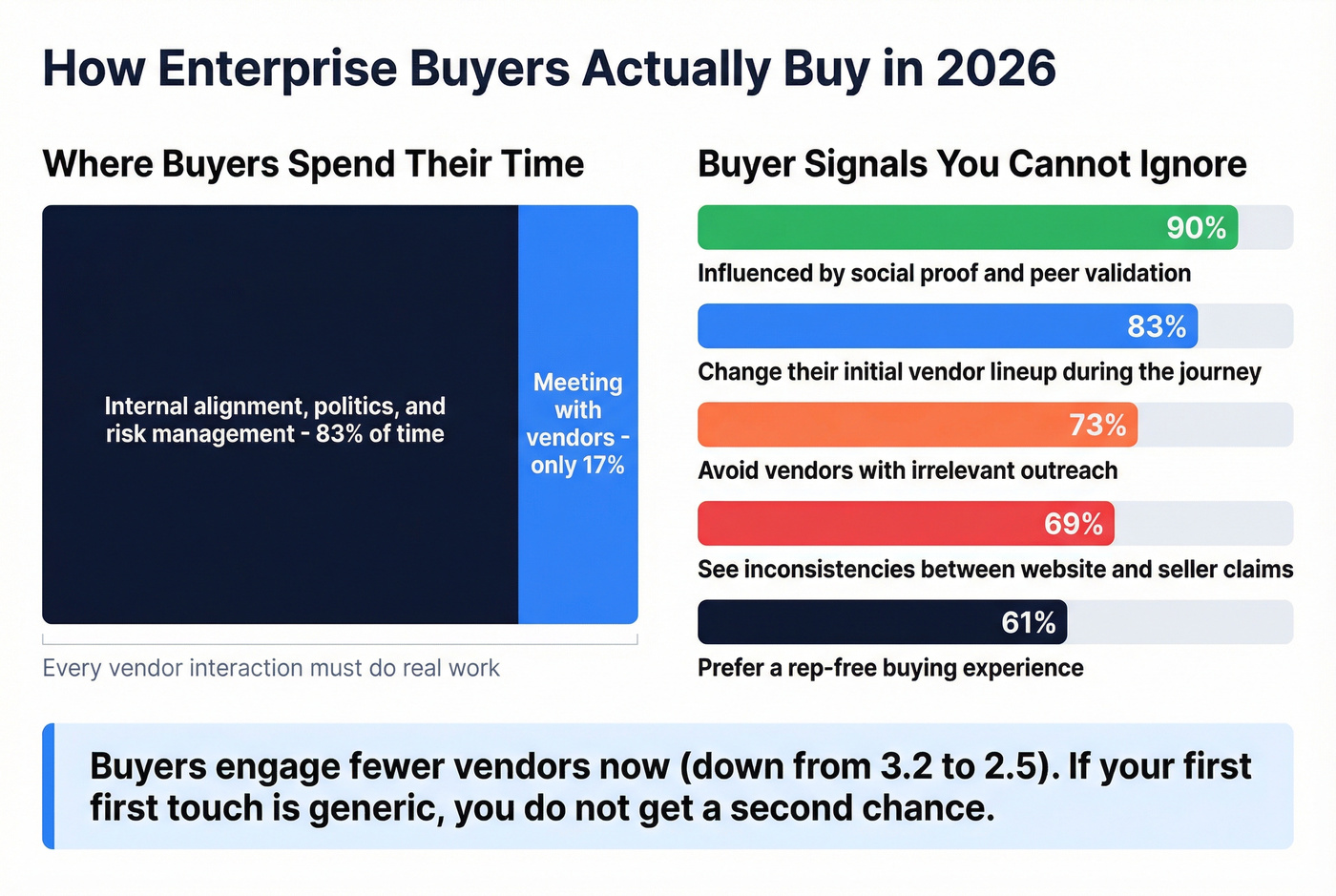

How enterprise buyers actually buy in 2026 (and why outreach backfires)

Enterprise buyers don't want more vendor attention. They want less friction.

Buying groups spend only 17% of their time meeting with vendors. The rest is internal alignment, internal politics, and internal risk management. That's why every vendor interaction has to do real work: move a decision forward, reduce risk, or arm your champion.

Another signal: 61% prefer a rep-free buying experience. Sales isn't dead; lazy sales is dead. Buyers will talk when you help them translate requirements into a decision, quantify cost of inaction, navigate security/legal/procurement, and avoid a career-limiting mistake.

Now layer in the outreach reality:

- 73% of buyers avoid irrelevant outreach

- 69% see inconsistencies between a vendor's website and what sellers say

- Buyers engage fewer vendors: average engagements dropped 3.2 -> 2.5

- 83% alter their initial vendor lineup during the journey

- 90% are influenced by social proof (reviews, references, peer validation)

When buyers talk to fewer vendors, every interaction's higher stakes. If your first touch is generic, you don't get a second chance. And if your rep contradicts the website, you trigger distrust that's hard to recover from.

Fix your website so enterprise buyers don't bounce (quick checklist)

If you want enterprise deals, your website has to do enterprise work. Here's what we'd fix before hiring another SDR:

- Security page that answers real questions: data flow, hosting, encryption, access controls, retention, subprocessors, and how to request a DPA

- Implementation reality: typical time-to-value, what your team does vs what the buyer must do, and the top 3 failure modes

- Pricing logic (even if you don't publish exact pricing): what drives cost (seats, usage, data volume), typical contract term, and what "enterprise" includes

- Proof that matches the ICP: one case study per vertical, one per use case, and one "risk reduction" story (security/compliance)

- A single source of truth: the same claims, same limitations, same positioning across site, decks, and reps

Do this instead of "more touches":

- Lead with a point of view, not a pitch: "Here's how teams in your space handle X risk / Y workflow."

- Use proof early: one relevant customer story, one quantified outcome, one reference path.

- Ask for process, not permission: "Who owns security sign-off?" beats "Can we schedule another demo?"

Outbound still works in enterprise. Volume isn't the lever anymore.

Relevance and process control are.

Buying committee + stakeholder mapping (multi-threading without spamming)

Enterprise deals don't die because you didn't send enough follow-ups. They die because you built a relationship with one person while the decision got made by ten.

A typical decision involves 13 internal stakeholders plus 9 external influencers. And buying groups of 6+ aren't "bad" - they're rational. Forrester found that when groups are 6+ people, 94% report clear benefits to the purchase process. Committees exist to prevent dumb decisions. Your job's to help them make a safe one.

Procurement's the other reality check: they're decision-makers in 53% of buying cycles and they're involved from the start. If procurement only shows up after your "verbal yes," you didn't find the real process. You found a hopeful version of it.

A practical role map (who you actually need)

Use this as a default stakeholder map, then tailor it per deal:

- Champion (day-to-day owner): wants a win, needs a story + plan

- Mobilizer / change agent: can drive consensus across teams

- Economic Buyer (budget authority): cares about risk, ROI, timing

- Technical owner (IT/RevOps/Engineering): cares about integration, effort

- Security / risk: cares about data handling, compliance, vendor risk

- Legal: cares about terms, liability, DPA, SLAs

- Procurement: cares about process, pricing structure, vendor setup

- Finance: cares about budget source, payment terms, renewal risk

- End users / managers: care about workflow impact and adoption

The POV stall scenario (why "1-2 champions" isn't enough)

A pattern that shows up constantly: you've got 1-2 champions, you run a proof of value, you show ROI... and then the deal gets pushed. Meanwhile the buying group is 5-7+ stakeholders and half of them never saw the value in their language.

That's how you end up stuck in POV until the quarter ends.

What not to do (because it makes buyers hate you)

Here's the thing: multi-threading can turn into harassment fast.

A prospect once told me, "I felt like I was being chased." That happened because the seller called the champion 3-4 times a day, then started blasting "influencers" until someone picked up. It's a great way to lose the deal and get your domain reputation dinged at the same time.

Multi-threading isn't volume. It's precision.

A clean multi-threading workflow (that doesn't torch trust)

Step 1: Map roles in discovery (15 minutes). Ask role questions, not intro questions:

- "Who owns vendor risk and security sign-off?"

- "Who owns the budget line?"

- "Who runs procurement intake?"

- "Who's accountable for adoption 60 days after go-live?"

Step 2: Assign a "yes condition" to each role. This is where most reps get lazy. Write it down:

- Security says yes when: data flow + controls + DPA are acceptable

- Legal says yes when: liability, indemnity, SLAs, and DPA are clean

- Procurement says yes when: pricing structure + vendor setup + terms fit policy

- EB says yes when: ROI + risk + timing are defensible to leadership

Step 3: Create a persona-specific contact plan (one touch that earns the next).

- Execs: one tight note + decision memo + 15-minute alignment call

- Security: security packet + questionnaire turnaround + escalation path

- Procurement: intake checklist + pricing structure + target signature date

- End users: workflow validation + success rubric + training plan

Step 4: Track stakeholder coverage like a deal health metric. Minimum bar by end of week 3:

- Champion + EB identified

- Security owner named

- Procurement owner named

- Technical owner engaged

If you can't check those boxes, your "stage" is wrong.

How to reach the committee without wrecking deliverability

This is where accurate data stops being a "nice to have." If you're multi-threading into a 10-20 person committee, bad emails and wrong numbers don't just bounce - they make your whole team look sloppy, and they train the buyer to doubt everything else you send (including the parts that matter, like security docs and contract versions).

In our experience, Prospeo ("The B2B data platform built for accuracy") is the cleanest execution layer for this job: 300M+ professional profiles, 143M+ verified emails with 98% verified email accuracy, 125M+ verified mobile numbers, and a 7-day refresh cycle (the industry average is about 6 weeks). It's self-serve with no contracts, so you can stand up a stakeholder-mapping workflow fast.

Practically: build a committee list using 30+ search filters (department, seniority, job change, department headcount, company headcount growth, technographics, and intent across 15,000 topics), then verify in real time before you export. That one habit - verify before you send - saves a lot of pain later.

Qualification for enterprise sales: MEDDPICC (with question bank)

MEDDPICC is popular for a reason: it forces you to qualify the parts of enterprise deals that actually break in production - decision path, procurement, and internal commitment.

Paper process is the make-or-break. Teams qualify pain and budget, then get blindsided by vendor onboarding, DPAs, redlines, and security queues. That's not bad luck. That's skipping the part of the deal that closes the deal.

Three threats dominate enterprise closes:

- Buyers failing to meet commitments (68%)

- Buyer indecision (48%)

- Inability to show cost of inaction (40%)

So your qualification has to do more than confirm pain. It has to confirm movement.

MEDDIC vs MEDDPICC (why the extra P matters)

MEDDIC covers the core: Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion.

MEDDPICC adds what these deals punish you for ignoring:

- P = Paper Process (legal/procurement/admin steps to get to signature)

- C = Competition (status quo and vendors)

If you sell into regulated industries, data-sensitive workflows, or any org with real procurement, the extra P isn't optional. It's the deal.

MEDDPICC question bank (use these verbatim)

Use these prompts in discovery, POV kickoff, and pre-procurement.

Metrics

- "What metric changes if this works - cost, time, risk, revenue?"

- "What's the baseline today, and what's the target by day 90?"

- "What's the cost of doing nothing for one quarter?"

Economic Buyer

- "Who can approve the spend without a committee?"

- "What budget is this coming from, and what's the approval threshold?"

- "What would make the EB say 'not this quarter'?"

Decision Criteria

- "What are the top 3 criteria you'll use to choose a vendor?"

- "What's a deal-breaker for security, IT, or legal?"

- "How will you compare implementation effort across options?"

Decision Process

- "Walk me through the last time you bought something similar."

- "Who needs to be consulted vs who needs to approve?"

- "What's the internal meeting where the decision gets made - and when is it?"

Paper Process (the one everyone skips)

- "What's the vendor onboarding process and how long does it take?"

- "Do you require a DPA, security questionnaire, or pen test results?"

- "Who owns contract redlines, and what's the typical turnaround time per turn?"

- "Do you need a PO? If yes, what triggers PO creation?"

- "What's the procurement intake form called internally, and who submits it?"

Identify Pain

- "What breaks if this doesn't change?"

- "Who feels the pain weekly, and who feels it quarterly?"

- "What's the internal workaround today - and why's it tolerated?"

Champion

- "If you're out next week, does this deal still move forward?"

- "Who else benefits personally from this going live?"

- "Who's most likely to block this, and why?"

Competition (including status quo)

- "What happens if you do nothing for 6 months?"

- "What internal workaround exists today?"

- "Who else are you evaluating, and what do they do better than us?"

Hard rule: no POV without a scheduled decision meeting

A POV without a decision meeting is just free consulting.

Before you start a trial/POV, you need:

- a success rubric (what "pass" means),

- owners (who signs off),

- and a calendar invite for the decision meeting.

If the buyer won't schedule the decision meeting, they're not ready to decide. Treat that as qualification, not a negotiation.

No-decision risk signals (and what to do this week)

These are the signals that a deal's drifting toward "we'll revisit next quarter" - and the exact fix.

Signal: "We're still aligning internally."

Fix: ask for the internal decision meeting date and attendees. If they can't name it, you don't have a process.

Signal: Champion won't introduce procurement/security.

Fix: position it as risk removal: "Let's get vendor risk started now so you don't get blocked after the POV."

Signal: Success criteria are vague ("we'll know it when we see it").

Fix: write a 5-bullet success rubric and get it approved in the POV kickoff.

Signal: No owner for implementation/adoption.

Fix: add an "adoption owner" role and a 30/60/90 plan to the MAP.

Signal: Stakeholder count isn't growing.

Fix: ask "who else will be impacted?" and map the workflow. Enterprise deals expand through impact.

Forecasting rule: if procurement isn't named and dated, the close date's fictional

If you can't answer "who in procurement" and "when it starts," your close date's a vibe. Put procurement and paper process milestones on the plan early, or accept that you're forecasting hope.

The two artifacts that stop stalls: Decision Memo (why) + Mutual Action Plan (how)

Most enterprise teams over-invest in the MAP and under-invest in the business case. Then they wonder why the deal dies in leadership review.

A senior buyer managing $2M spend said it plainly: a MAP helps gauge level of effort, but it doesn't sell leadership. Leadership needs a decision memo first, because that's the document that survives the forwarding chain, the finance review, and the "quick question" from an exec who hasn't been in a single meeting.

Contrarian move that saves deals: don't send a MAP right after the demo. Send a Decision Memo first. A MAP without a "why" is just homework.

Decision Memo (when to send + who it's for)

| Item | Best practice |

|---|---|

| Audience | Champion forwards to EB + finance + IT/security |

| Timing | After discovery + initial solution fit, before POV kickoff |

Decision Memo template (1 page your champion can forward)

Copy/paste this into a doc. Keep it to one page.

Title: Decision Memo - [Project Name] Owner: [Champion] Decision needed by: [Date] Decision: Approve [Vendor/Product] for [use case]

Problem (current state)

- What's happening today

- Who it impacts

- What it costs (time, risk, revenue)

Why now (cost of inaction)

- What gets worse if we wait 90 days

- What deadlines are real (renewal, audit, hiring plan, launch)

Proposed solution

- What we're buying

- What changes operationally

- What stays the same (risk reducer)

Expected impact (metrics)

- 2-4 measurable outcomes

- Baseline -> target

- When we'll measure

Risks & mitigations

- Security/compliance notes

- Implementation effort

- Adoption plan

Investment & commercial terms

- Price range and structure

- Contract term

- Payment terms

Approval path

- Approvers (names + roles)

- Procurement owner

- Target signature date

Mutual Action Plan (when to send + who it's for)

| Item | Best practice |

|---|---|

| Audience | Shared doc for buyer + seller teams (security/legal/procurement included) |

| Timing | Immediately after Decision Memo is accepted and POV is approved |

Mutual Action Plan template (milestones, owners, dates, dependencies)

A MAP is a shared execution plan in buyer language. It should include the paper process explicitly.

Mutual Action Plan - [Project Name]

| Milestone | Owner | Due date | Dependency |

|---|---|---|---|

| Success criteria agreed | Buyer | POV kickoff | |

| Security review closed | Security | SOC 2 + DPA | |

| Technical eval sign-off | IT/RevOps | Integration doc | |

| Procurement intake submitted | Champion | Vendor forms | |

| Contract redlines merged | Legal | MSA/DPA | |

| Exec sign-off | EB | Decision memo | |

| PO issued (if needed) | Finance | Vendor setup | |

| Signature | EB/Legal | Final terms | |

| Kickoff scheduled | CS/Buyer | Signature |

Include a weekly 15-minute MAP review on the calendar. If it's not reviewed, it's not real.

Example MAP timeline (Week 0 -> Week 10, realistic pacing)

Use this as a default for a first-time vendor purchase with normal security/legal involvement.

- Week 0: Discovery complete; paper process mapped; Decision Memo drafted

- Week 1: Decision Memo approved; POV kickoff; success rubric signed

- Week 2-3: Technical validation + end-user workflow checks

- Week 2: Security intake submitted (don't wait for POV end)

- Week 3-5: Security review in progress (questionnaires, evidence, DPA review)

- Week 4: Procurement intake submitted; vendor setup begins

- Week 5-7: Legal redlines (1-2 turns) + procurement negotiation

- Week 8: EB sign-off meeting (scheduled since Week 1)

- Week 9: PO issued (if required)

- Week 10: Signature + kickoff scheduled

Opinionated truth: if your buyer says "we can do all of that in two weeks," they're either a unicorn, or they've never done it before. Plan for the real world and you'll look like the adult in the room.

Commitments that matter (how to reduce "no decision")

Enterprise urgency comes from buyer commitments, not seller pressure. The commitments that actually reduce no decision:

- Named owners for security/legal/procurement

- Dated internal decision meeting

- Dated procurement intake submission

- A defined POV success rubric with a sign-off meeting on the calendar

I've watched deals feel hot for months and then die because nobody ever booked the internal approval meeting. That one's infuriating, because it's preventable.

Paper process: security, legal, procurement, RFP (timelines + how to pull them forward)

Enterprise sellers love to say "we're in procurement" like it's a stage. It's not a stage. It's a project plan with queues, dependencies, and people who don't care about your quarter.

RFP timelines are the clearest example: 6-10 weeks on average, and 12+ weeks when things get complex.

Paper-process timeline ranges (planning defaults)

| Component | Typical range | What makes it longer |

|---|---|---|

| Security review | 2-6 weeks | Regulated, data access, pen test |

| Legal + procurement | 2-8 weeks | Redlines, liability, non-standard terms |

| RFP process | 6-10 weeks | Committees, scoring, formal steps |

| Trial/POV usage | 60%+ of buyers | Higher spend = more scrutiny |

Trials aren't a "nice extra." They're how buyers de-risk. For $10M+ purchases, trial usage reaches 78%.

RFP complexity bands (use these to set expectations)

| Complexity band | Range | Common scenario |

|---|---|---|

| Low | 2-4 weeks | Renewal/expansion with known vendor + light security |

| Medium | 4-8 weeks | New vendor with standard security + 1-2 legal turns |

| High | 8-16+ weeks | ERP/regulatory, cyber review, heavy committees, strict procurement |

How to pull the paper process forward (step-by-step)

Ask for the process in discovery, not after the demo Your discovery checklist should include: security owner, procurement owner, legal owner, and what triggers PO creation.

Pre-package security answers Have your SOC 2, DPA template, subprocessor list, and data flow ready. Don't make security chase you. If you're slow here, you look risky - even if you aren't.

Run a procurement pre-brief (15 minutes)

Ask procurement for:

- intake form + required fields,

- preferred commercial structure (term length, payment terms),

- required clauses (and which are non-negotiable),

- vendor setup steps and lead time.

Timebox the POV with a sign-off meeting No decision meeting, no POV. Put the decision meeting on the calendar before kickoff.

Treat legal redlines like engineering tickets Track owners, turnaround times, and dependencies. If legal takes 10 business days per turn, plan for it. Don't pretend.

Use a paper-process pre-mortem

Ask: "What's the most common reason deals like this get delayed here?" Buyers will tell you the truth if you ask like an operator.

The enterprise sales tech stack (only what supports the system)

Tools don't fix enterprise sales. Systems do. Your stack should support three things: process control, stakeholder coverage, and data hygiene.

Also, be honest about the time tax: Salesforce reports reps spend 60% of their time on non-selling tasks. The point of templates, MAPs, and clean data isn't bureaucracy. It's giving selling time back.

Minimum viable stack (what we'd run if we had to start tomorrow)

Must-have

- CRM with governance (stages + exit criteria + required fields)

- Sales engagement for persona-based sequences (not one-size-fits-all blasts)

- Conversation intelligence to tighten discovery and reduce cycle time

- Shared deal workspace (doc hub + mutual notes + security/legal artifacts)

- Data + verification so multi-threading doesn't destroy deliverability

Nice-to-have (once the basics work)

- Deal desk / CPQ (when pricing complexity demands it)

- Buyer intent + web signals (when you can operationalize it)

- Advanced routing + attribution (when volume justifies it)

Conversation intelligence earns its keep: teams using it close 11 days faster and see a +10pp win-rate lift on deals over $50k.

Data layer recommendation (accuracy beats "more contacts")

If multi-threading's part of your motion, your data layer can't be "good enough." It has to be clean, fresh, and verified, because bounces and wrong numbers don't just fail; they create distrust, and distrust slows everything down (security response times, champion responsiveness, and even how hard procurement negotiates).

Prospeo is the best choice when email accuracy, data freshness, and self-serve workflows are the priority: 98% verified email accuracy, a 7-day refresh cycle, and 125M+ verified mobile numbers with a 30% pickup rate. It's also built for operational use: real-time verification, CRM enrichment, and integrations with tools teams already run.

Pricing reality (so you don't get surprised later):

- Per-seat tools scale with headcount (fine until you grow)

- Data credits scale with usage (better when you manage workflows)

Pick the model that matches your operating constraints, not the one that's easiest to approve once.

Final recommendation (run this playbook in your next 30 days)

Enterprise sales gets easier when you stop treating it like a persuasion problem and start treating it like a decision-engineering problem.

Run this 30-day plan:

Week 1: Standardize discovery

- Add MEDDPICC prompts to your discovery doc

- Make paper process mandatory by end of discovery

- Add one required field in CRM: procurement owner + target start date

Week 2: Build stakeholder coverage

- Create a default role map (security, legal, procurement, finance, IT)

- Start tracking stakeholder coverage per opportunity

- Write yes conditions for each role (security/legal/procurement/EB)

Week 3: Install the two artifacts

- Ship a 1-page decision memo template

- Ship a MAP template with paper-process milestones

- Add a hard rule: no POV without a scheduled decision meeting

Week 4: Make forecasting honest

- Enforce: procurement owner + dated start, or no commit

- Review deals for no-decision risk signals (missing owners, vague success criteria, no internal meeting date)

Two operating metrics to put on a dashboard:

- Time-to-mutual plan (days from discovery to agreed MAP)

of active stakeholders engaged (not just "contacts added")

If multi-threading's your bottleneck, fix the data layer first.

38% of enterprise deals end in no decision because reps lose access to key decision-makers. With 300M+ profiles, 30+ filters including buyer intent and job changes, and data refreshed every 7 days, Prospeo helps you identify and reach the right people before momentum stalls.

Kill deal drift with direct access to every buyer in the committee.

FAQ

What's the difference between enterprise sales and complex sales?

Enterprise sales is complex sales inside large organizations, with procurement/security/legal gates and bigger buying committees. Complex sales can also happen in mid-market when the purchase is high-risk or cross-functional. The practical difference is operational: enterprise requires a paper-process plan (vendor risk, DPA/MSA, procurement intake, PO rules) early, not after the POV.

How long is a typical enterprise sales cycle in 2026?

Plan in quarters, not weeks. Many deals land in 1-2 quarters, and large-company benchmarks sit around 185 days for 10,001+ employee organizations. Security/legal/procurement can consume 4-12+ weeks by itself, so mapping owners and timelines in discovery is what prevents "surprise" slippage.

What is MEDDPICC and why does "paper process" matter?

MEDDPICC is a qualification framework: Metrics, Economic Buyer, Decision Criteria, Decision Process, Paper Process, Identify Pain, Champion, Competition. Paper process matters because vendor onboarding queues, DPAs, legal redlines, and PO creation are common reasons deals slip quarters; naming owners and dates early is the difference between a great eval and a signed contract.

What's a good data tool for mapping a buying committee fast?

If you need to multi-thread quickly and keep bounce rates down, Prospeo's a top pick: 300M+ professional profiles, 143M+ verified emails with 98% verified email accuracy, 125M+ verified mobile numbers, and a 7-day refresh cycle. Use the 30+ filters (role, seniority, technographics, and intent across 15,000 topics) to build a clean committee list fast, then verify before outreach.