SaaS Sales Cycle: Benchmarks, Stages & How to Shorten Yours in 2026

Your CEO just asked why that enterprise deal is entering month five. Your board deck says "pipeline is healthy." Your CRM shows 47 open opportunities. But nothing's closing, and the quarterly number needs a miracle.

The problem isn't your pipeline - it's your sales cycle.

Ebsta's GTM Benchmarks analyzed 655,000 opportunities worth $48 billion, and the takeaway that matters most is blunt: stages don't kill deals. Stalled velocity does. A deal that moves through seven perfectly labeled stages but takes 200 days is worse than a messy three-stage process that closes in 60. Most SaaS teams obsess over pipeline stages when they should be watching the clock.

Quick Benchmarks

By deal size

- Under $5K ACV: 25-40 days

- $25K-$100K ACV: 90-180 days

- Over $100K ACV: 3-9 months (sometimes longer)

The trend

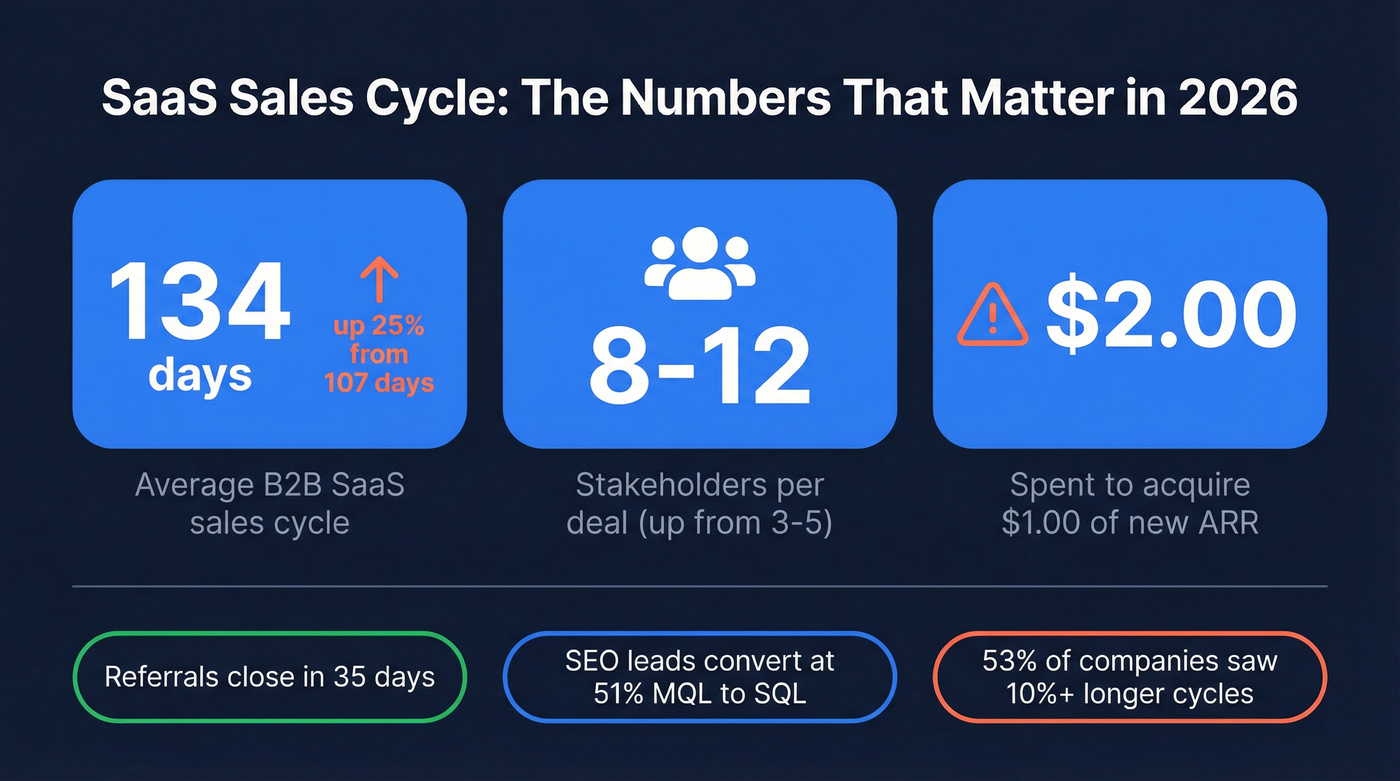

The average B2B SaaS selling cycle hit 134 days - up 25% from 107 days. Buying committees ballooned from 3-5 people to 8-12. And 84% of SaaS leaders say shortening cycles is a priority. They're right.

Three highest-impact fixes

Introduce pricing ranges on the first call (one founder cut cycles from 6 weeks to 2 weeks). Multi-thread every deal above $25K. And fix your contact data - reps chasing bounced emails and wrong numbers aren't selling, they're guessing. (If you want a fast way to diagnose decay, see contact data.)

SaaS Sales Cycles Are Getting Longer

The average B2B sales cycle in SaaS is now 134 days. That's a 25% increase from 107 days, and it's reshaping how every software company plans revenue.

This isn't a blip. 53% of SaaS companies reported their cycles increased by 10% or more. Only 18.4% saw cycles get shorter. Three forces are driving it:

Buying committees exploded. 64.4% of SaaS businesses report more stakeholders involved in every deal. 44% said as many as four stakeholders per deal, and 59% said those stakeholders include founders or CEOs. When the CEO is reviewing your $30K software purchase, that's not a quick sign-off anymore. (More on how this changes deals: B2B decision making.)

Buyers show up later but with more questions. They've done 80-90% of their research before they ever talk to your AE. They enter the funnel informed - but also skeptical, comparison-heavy, and armed with competitor pricing.

Procurement became a stage, not a formality. SaaS companies now add an average of 16 days just to negotiate payment terms. Security reviews, legal redlines, and compliance questionnaires are standard even for mid-market deals.

The financial impact is brutal. The new CAC ratio sits at $2.00 of sales and marketing spend to acquire $1.00 of new customer ARR - up 14% in a single year. Fourth-quartile companies are spending $2.82 per dollar of new ARR. That's not a business model; that's a bonfire.

If your cycle is getting longer and your ACV isn't growing proportionally, you're slowly going underwater. The math doesn't forgive. (Related: CAC LTV ratio.)

SaaS Sales Cycle Benchmarks by ACV, Company Size, and Channel

By Deal Size (ACV)

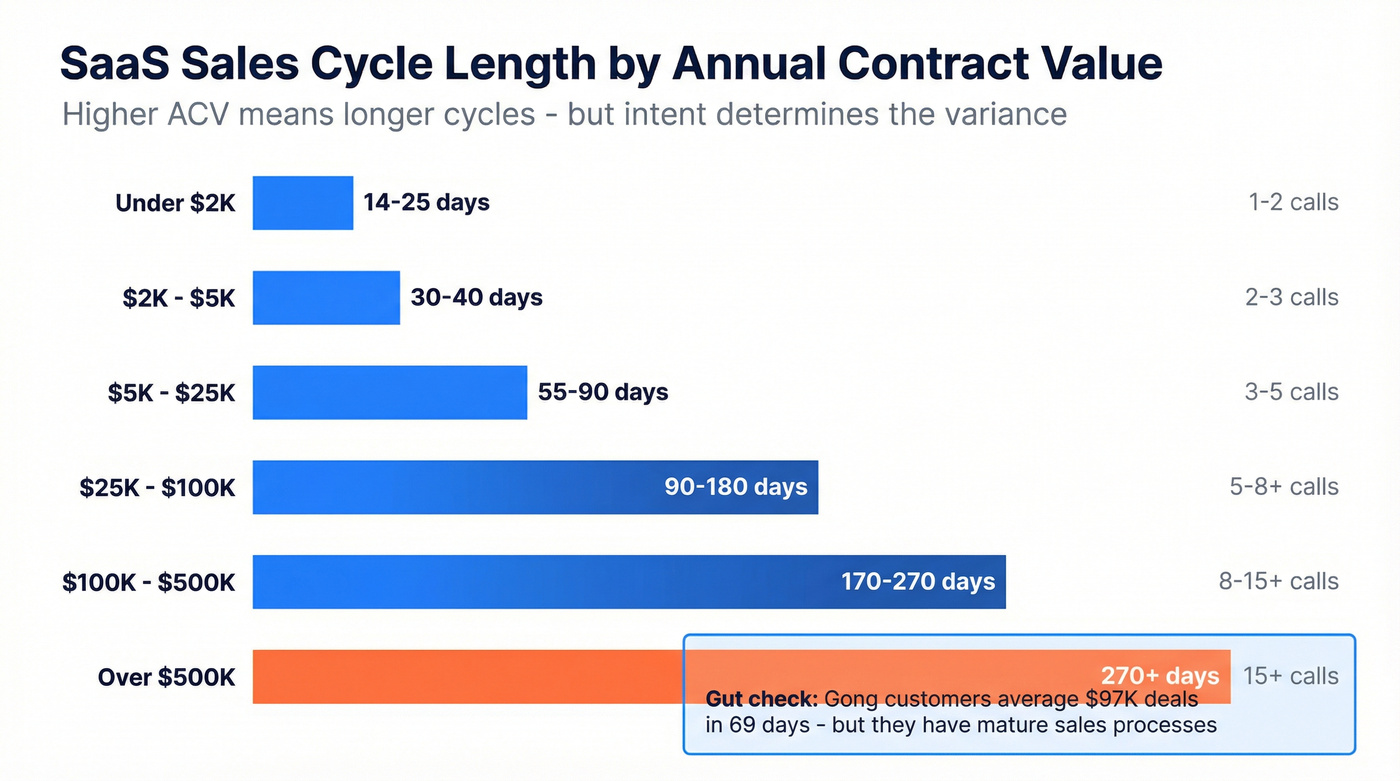

ACV is the single strongest predictor of how long your deals will take. The data across multiple benchmark studies converges on a clear pattern:

| ACV Range | Cycle Length | Typical Calls (est.) |

|---|---|---|

| < $2K | ~14-25 days | 1-2 |

| $2K-$5K | 30-40 days | 2-3 |

| $5K-$25K | 55-90 days | 3-5 |

| $25K-$100K | 90-180 days | 5-8+ |

| $100K-$500K | 170-270 days | 8-15+ |

| > $500K | 270+ days | 15+ |

A useful gut-check: across Gong's entire customer base, the average deal size is $97K with a 69-day cycle. That's faster than the table suggests because Gong's customers tend to be well-oiled sales orgs with mature processes. If your $100K deals are taking 180+ days, you're not broken, but you're leaving money on the table.

One nuance these tables miss: intent. A high-intent buyer who's been burned by a competitor can close a $50K deal in two weeks. A low-intent prospect who's "just exploring" can drag a $5K deal out for six months. ACV sets the baseline. Buyer intent determines the variance.

By Prospect Company Size

Bigger companies mean more layers, more approvals, and more calendar Tetris.

| Company Size | Avg Cycle |

|---|---|

| 1-10 employees | 38 days |

| 11-50 | 57 days |

| 51-200 | 77 days |

| 201-500 | 95 days |

| 501-1,000 | 115 days |

| 1,001-5,000 | 135 days |

| 5,001-10,000 | 158 days |

| 10,001+ | 185 days |

The jump from 200 employees to 1,000+ is where procurement, security, and legal reviews become non-negotiable. If you're selling into the 1,000+ segment and your forecast doesn't account for 4-5 months, you're lying to your board.

By Sales Channel

This is the benchmark most teams ignore - and it explains a lot of "why are our cycles so long?" confusion.

| Channel | Avg Cycle |

|---|---|

| Referrals | 35 days |

| SEO / Inbound | 50 days |

| Google Ads | 55 days |

| Cold Calling | 85 days |

| Trade Shows | 100 days |

Referrals close nearly 3x faster than trade show leads. SEO leads convert at 51% MQL-to-SQL - the best of any channel. PPC? Just 26%.

Here's the thing: if your blended cycle is 120 days and you're wondering why, look at your channel mix before you blame your reps. A team that's 70% outbound will always have longer cycles than one that's 50% inbound. Your "average" cycle length is really just a weighted average of your channel mix. (If outbound is a big driver, see outbound pipeline generation.)

Your sales cycle is 134 days and climbing. Stale contact data is a hidden accelerant - reps waste weeks chasing bounced emails and wrong numbers instead of closing. Prospeo delivers 98% verified emails and 125M+ direct dials, refreshed every 7 days, so your reps spend time selling, not guessing.

Stop adding days to your cycle with dead contact data.

Three SaaS Sales Models That Dictate Your Cycle

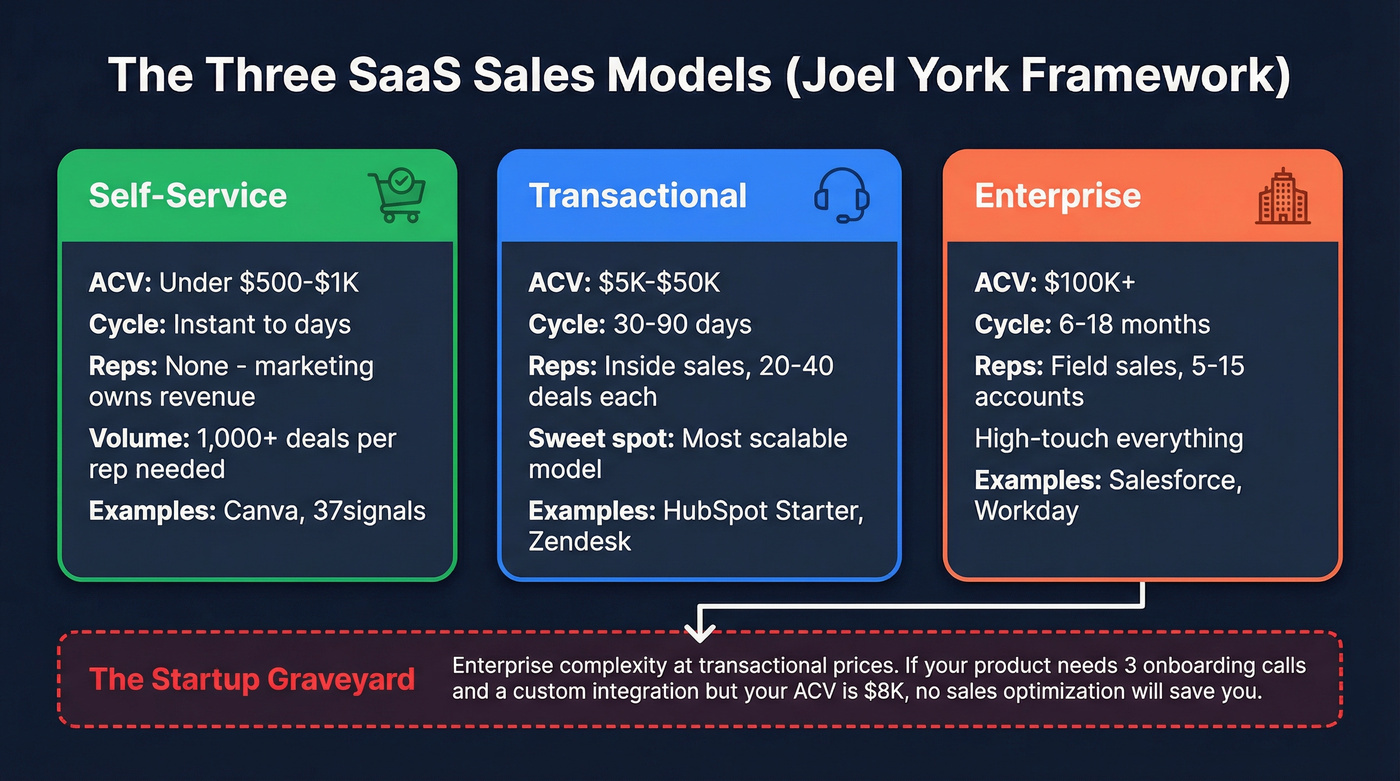

Joel York's framework is the clearest lens for understanding why your cycle is the length it is. Every SaaS company operates in one of three models, defined by the relationship between price and complexity:

Self-service: No sales team. Marketing owns the full revenue engine. Think 37signals, Canva, early-stage PLG tools. Works when ARR per customer is under $500-$1,000. At $500 ARR, you need 1,000 deals per rep per year to make direct sales math work. That's impossible. So you don't hire reps - you build a funnel.

Transactional: Inside sales, short cycles, rapid onboarding, high volume. This is the sweet spot for $5K-$50K ACV. Zendesk, HubSpot Starter, and most mid-market SaaS live here. Cycles run 30-90 days. Reps handle 20-40+ deals simultaneously. For a SaaS startup, this is often the first sales model that actually scales.

Enterprise: Field sales, long cycles, high-touch everything. $100K+ ACV. Salesforce Enterprise, Workday, ServiceNow. Cycles run 6-18 months. Reps carry 5-15 accounts. (For deeper benchmarks and process, see enterprise sales.)

The critical insight: a SaaS startup can only master one model at a time. The graveyard of failed startups is littered with companies that built enterprise-complexity products at transactional price points. If your product requires three onboarding calls, a custom integration, and a dedicated CSM - but your ACV is $8K - you're in what York calls the "Startup Graveyard." Complexity exceeds what the price can support, and no amount of sales optimization fixes that.

Before you try to shorten your cycle, make sure you're operating in the right model for your price point.

How Sales Cycles Differ by Segment

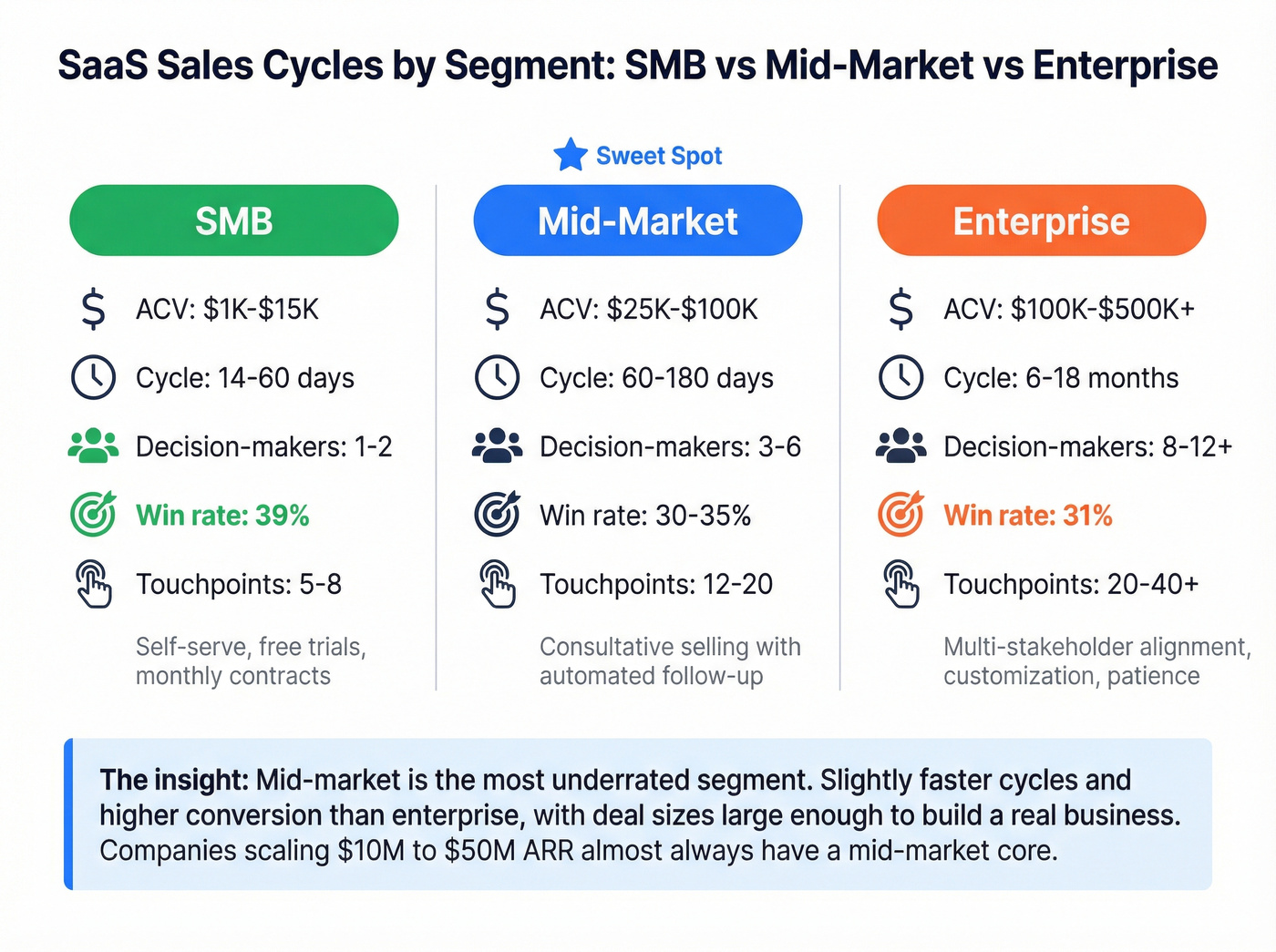

| Dimension | SMB | Mid-Market | Enterprise |

|---|---|---|---|

| Typical ACV | $1K-$15K | $25K-$100K | $100K-$500K+ |

| Cycle Length | 14-60 days | 60-180 days | 6-18 months |

| Decision-Makers | 1-2 | 3-6 | 8-12+ |

| Win Rate | ~39% | ~30-35% | ~31% |

| Touchpoints | 5-8 | 12-20 | 20-40+ |

| Recommended Approach | Self-serve, free trials, monthly contracts | Consultative selling with automated follow-up | Multi-stakeholder alignment, customization, patience |

Enterprise win rates sit at 31% vs. SMB at 39%. That 8-point gap doesn't sound dramatic until you factor in the cycle length difference. An enterprise deal that takes 9 months and closes 31% of the time has a fundamentally different ROI profile than an SMB deal that takes 30 days at 39%.

Mid-market is the most underrated segment in SaaS. It has slightly faster cycles and higher conversion rates than enterprise, with deal sizes large enough to build a real business. We've seen the companies that scale most efficiently - $10M to $50M ARR - almost always have a mid-market core with an enterprise upmarket motion layered on top. If your average deal is under $15K, you probably don't need enterprise-grade sales infrastructure. Nail mid-market first.

The 7 SaaS Sales Cycle Stages (And Why Stages Alone Don't Matter)

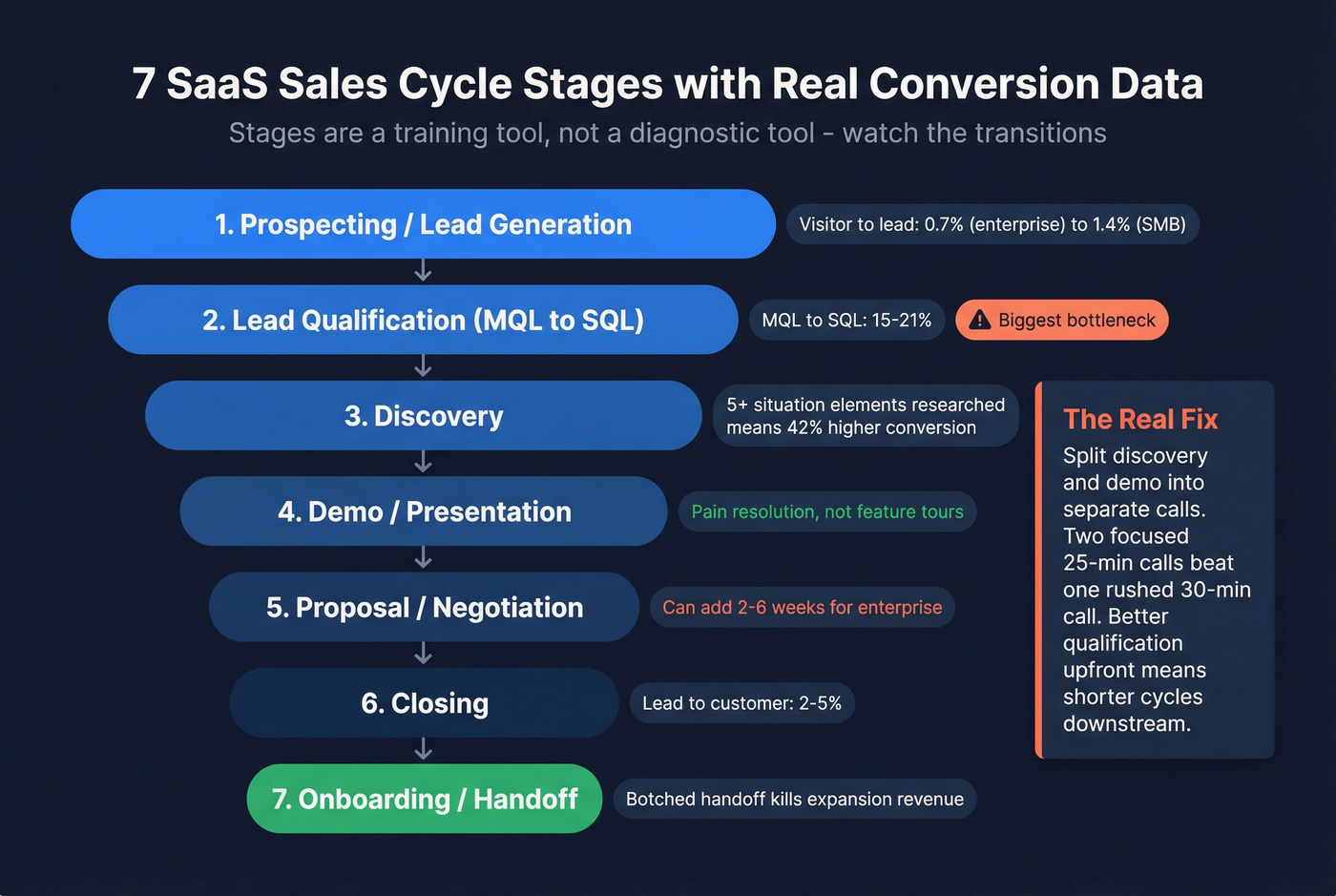

Here's the standard seven-stage framework with SaaS-specific conversion data:

Prospecting / Lead Generation - Building your target list. Visitor-to-lead conversion: 0.7% (enterprise) to 1.4% (SMB). (To tighten targeting, start with an ideal customer.)

Lead Qualification (MQL to SQL) - The biggest bottleneck in SaaS. MQL-to-SQL conversion runs 15-21%. This is where most pipeline bloat lives. (For a scoring-first approach, see lead qualification process.)

Discovery - Understanding the prospect's pain, stack, and buying process. Teams that research 5+ situation elements before calls see 42% higher meeting-to-opportunity conversion.

Demo / Presentation - Showing the product in context of their specific problem. Not a feature tour - a pain-resolution walkthrough. (If your demos are drifting into feature tours, fix feature dumping.)

Proposal / Negotiation - Pricing, terms, security review, legal redlines. This stage alone can add 2-6 weeks for enterprise deals.

Closing - Getting the signature. Average lead-to-customer conversion across SaaS: 2-5%.

Onboarding / Handoff - Not technically "sales," but a botched handoff kills expansion revenue and referrals.

Here's the contrarian take: stages are a training tool, not a diagnostic tool. Knowing that a deal is "in discovery" tells you nothing about whether it'll close. What you need is stage-level conversion data - what percentage of deals move from stage 3 to stage 4, and how long does that transition take? That's where the diagnostic power lives.

A Reddit AE selling small business SaaS at $500-$1K/month described the real tension perfectly: in a 30-minute meeting, you're "speed-fishing the first 15 minutes" trying to find something painful, then rushing through a demo. The result? Poor qualification disguised as pipeline activity.

The fix is simple but underused: split discovery and demo into separate calls. Two focused 25-minute calls beat one rushed 30-minute call every time. Better qualification upfront means shorter cycles downstream - even though you're adding a meeting.

Which Qualification Framework Fits Your Cycle

BANT - The Quick Filter

BANT (Budget, Authority, Need, Timeline) was created by IBM in the 1950s. It's the bouncer at a nightclub - not a sales methodology, just a quick filter to decide who gets in.

It works best for deals under $25K ACV with fewer than 60-day cycles and 1-3 stakeholders. For high-velocity inbound teams processing 500+ demo requests a month, BANT is still the fastest way to separate real buyers from tire-kickers.

The underrated move: BANT with authority mapping. Teams that map the actual decision-maker (not just the person on the call) see 35% fewer late-stage deal collapses. The "A" in BANT is the most important letter, and most reps skip it.

MEDDIC / MEDDPICC - The Enterprise Standard

73% of SaaS companies selling above $100K ARR use some version of MEDDIC. There's a reason. Organizations fully adopting MEDDPICC report 18% higher win rates and 24% larger deal sizes.

The framework - Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion, Competition (plus Paper Process and Implications of Pain in the extended version) - forces reps to understand the buying process, not just the buyer.

The tradeoff nobody warns you about: it takes an average of 3.6 months for reps to reach proficiency. That's real ramp time. And it requires CRM customization and organizational commitment. You can't half-adopt MEDDIC - it either becomes your operating system or it becomes a checkbox reps ignore.

SPIN Selling - The Discovery Engine

Based on analysis of 35,000+ sales calls, SPIN (Situation, Problem, Implication, Need-payoff) is the best framework for complex discovery conversations where the prospect doesn't yet know they have a problem.

Practitioners achieve 57% higher prospect talk time - which matters because the prospect talking is the prospect selling themselves. Teams researching 5+ situation elements before calls saw 42% higher meeting-to-opportunity conversion.

SPIN fails when reps ask lazy situation questions about information that's already publicly available. Don't ask "how many employees do you have?" when it's on their website. Do your homework.

The Recommendation

Use MEDDIC for deals $25K-$100K+. Use BANT for high-velocity inbound under $25K. Use SPIN for complex discovery where the prospect needs to be educated on the problem before they'll engage on the solution.

The reality is that buyers arrive with 80-90% of their research done. They don't need your discovery call to understand their problem. They need it to understand whether you're the right solution - and whether you understand their specific context. Pick the framework that helps your reps do that fastest.

How to Shorten Your SaaS Sales Cycle

Introduce Pricing on the First Call

Give pricing ranges - not exact quotes - on the first call. "Our typical deal for a team your size runs $30K-$50K annually. Does that fit your budget range?"

Stop hiding pricing until proposal stage because it "feels strategic." A SaaS founder shared that moving the pricing conversation to the first call cut their cycle from 6 weeks to 2 weeks. Fewer total deals, but more deals per unit of sales time. The key insight: "Hiding price until late in the process felt strategic. Actually it was just delaying inevitable friction."

When prospects know the budget range early, stakeholders who need to approve cost get looped in earlier. You're not compressing the decision - you're frontloading it. The deals that would've died at proposal stage now die on the first call instead, freeing your reps to focus on deals that actually have budget.

Multi-Thread Every Deal Above $25K

Get three or more stakeholder contacts engaged in every deal above $25K. Map the economic buyer, the champion, and at least one end-user. Stop single-threading through one enthusiastic contact who "will handle things internally." (If you want a step-by-step system, use ABM multi-threading.)

Deals with 3+ stakeholder contacts are 2-3x more likely to close than single-threaded deals. Buying committees now run 8-12 people. If you're talking to one person, you're not selling - you're hoping.

Single-threaded deals are the #1 silent killer of pipeline. Your champion goes on vacation, gets reassigned, or loses internal political capital, and the deal evaporates overnight. Multi-threading is insurance.

Use Mutual Action Plans

Before MAPs: You send a proposal, the prospect says "we'll review internally," and three weeks later you're chasing them with "just checking in" emails while legal and security reviews you didn't know about grind in the background.

After MAPs: You co-create a shared timeline on the first call that includes every step from demo to signature - security review, legal, procurement, final sign-off - with dates and owners attached.

Fewer than 20% of B2B SaaS teams use formal mutual action plans. Those that do see 15-25% shorter cycles. The reason is simple: security and legal reviews add 2-6 weeks to deals, and MAPs surface these early instead of letting them ambush you in month four.

Fix Your Data Before You Fix Your Process

Bad contact data silently extends cycles in ways that never show up in your CRM. Bounced emails mean sequences don't land. Wrong phone numbers mean connect attempts fail. Reps spend hours hunting for working contact info instead of having conversations. (A practical starting point: BDR contact data.)

If your bounce rate is above 5%, your reps aren't prospecting - they're guessing. For any SaaS startup, this is often the easiest lever to pull first. (If you're troubleshooting bounces, see 550 Recipient Rejected.)

When Meritt switched to Prospeo, their bounce rate dropped from 35% to under 4%, and their pipeline tripled. Snyk saw AE-sourced pipeline jump 180% after deploying Prospeo across 50 AEs - because reps stopped chasing ghosts and started having real conversations.

Split Discovery and Demo Into Separate Calls

That Reddit AE nailed it - when you're speed-fishing the first 15 minutes of a combined call, you're not doing real discovery. You're performing discovery theater.

| Combined Call (30 min) | Split Calls (25 min each) |

|---|---|

| 15 min rushed discovery | 25 min deep discovery - pain, stack, timeline, buying process |

| 15 min generic demo | 25 min tailored demo - solving their specific problem |

| Poor qualification disguised as activity | Real qualification that kills bad deals early |

| Longer overall cycle (unqualified deals linger) | Shorter cycle (only qualified deals advance) |

Counterintuitively, adding a meeting shortens the overall cycle because you stop wasting demo time on unqualified prospects.

Qualify Harder, Earlier

SEO leads convert at 51% MQL-to-SQL. PPC leads? 26%. If you're pouring budget into paid channels without adjusting your qualification bar, you're filling your pipeline with deals that'll stall at stage 2 and inflate your average cycle length.

Set strict qualification criteria for BDR-to-AE handoffs. Define what "qualified" actually means - budget range confirmed, decision-maker identified, timeline established. When BDRs are incentivized on meetings booked rather than meetings qualified, they'll set anything that has a pulse. Your CRM says pipeline is healthy. It's lying. (To standardize, use a sales qualification checklist.)

Deals above $25K need multi-threading across 8-12 stakeholders. That's impossible when you can't reach them. Prospeo's 30+ filters let you map entire buying committees by role, seniority, and department - with verified emails and mobiles for each contact at ~$0.01 per lead.

Reach every stakeholder in the buying committee on the first try.

Metrics That Actually Tell You Where Deals Stall

Knowing your average cycle length is like a doctor knowing you're sick but refusing to run tests. You need diagnostic metrics, not vanity metrics. (For common failure modes, see sales pipeline challenges.)

Pipeline velocity is the single most important formula in SaaS sales:

(Number of opportunities x average deal size x win rate) / average cycle length in days

A healthy SaaS benchmark is roughly $1,847/day in pipeline velocity, based on a $12,400 average deal, 22% win rate, and 67-day cycle. If your number is significantly below that, one of those four variables is broken.

The power of this formula: improving any single variable by 5 points can increase closed revenue by 12-18%. You don't need to fix everything. Find the weakest lever and push it.

Optimal cycle range: 46-75 days. Deals that close faster than 46 days are often too small to move the needle. Deals that drag past 75 days see win rates drop significantly - deals exceeding 2x the average cycle for their ACV tier see win rates fall by 25-50%.

Win rate benchmarks: 20-30% overall for SaaS. Below 20%? You have a qualification problem. Above 30%? You're probably not pursuing enough deals (or your ACV is too low for your motion).

Stage-level conversion tracking is where the real insight lives. Don't just track overall conversion. Track the drop-off between each stage and the time spent in each stage. A 40% drop between discovery and proposal tells you something very different than a 40% drop between proposal and close.

Expansion ARR now represents 40% of total new ARR across SaaS. Net revenue retention sits at 101%. If you're only measuring new logo velocity, you're missing nearly half the picture.

53% of SaaS companies have seen their selling cycles increase by 10% or more. That's not a data point - it's a mandate. If you're not actively measuring and managing velocity, you're drifting backward while the market gets harder.

FAQ

How long is a typical sales cycle in SaaS?

The median is 84 days, but the average has risen to 134 days - a 25% increase driven by larger buying committees and longer procurement processes. Deals under $5K close in 30-40 days, while deals over $100K typically take 3-9 months.

Why are B2B SaaS sales cycles getting longer?

Three forces: buying committees expanded from 3-5 to 8-12 stakeholders, buyers complete 80-90% of research before engaging sales, and procurement/security reviews have become standard even for mid-market deals. The average CAC ratio has climbed to $2.00 per $1.00 of new ARR as a result.

What is pipeline velocity and how do you calculate it?

Pipeline velocity measures revenue flow: (number of opportunities x average deal size x win rate) / average cycle length in days. A healthy SaaS benchmark is roughly $1,847/day. Improving any single variable by 5 points can increase closed revenue by 12-18%.

How can I shorten my SaaS sales cycle without cutting corners?

The three highest-impact tactics: introduce pricing ranges on the first call (one founder cut cycles from 6 weeks to 2 weeks), multi-thread every deal above $25K (3+ contacts = 2-3x more likely to close), and fix your contact data so reps spend time selling instead of hunting for working emails.

What does a typical startup sales cycle look like?

Early-stage companies face longer cycles relative to deal size because they lack brand recognition. A startup selling at $10K-$25K ACV often sees 60-120 day cycles - longer than established competitors at the same price point. Compress it by nailing qualification early and leading with social proof from your first customers.