B2B Decision Making in 2026: What Actually Happens Inside Buying Committees (and How to Win)

Your champion just went silent. Three weeks ago, they were forwarding your case study to their boss, asking about implementation timelines, and scheduling a technical review. Now? Nothing. No replies. No calendar holds. Just a deal sitting in Stage 3 while your forecast call is tomorrow.

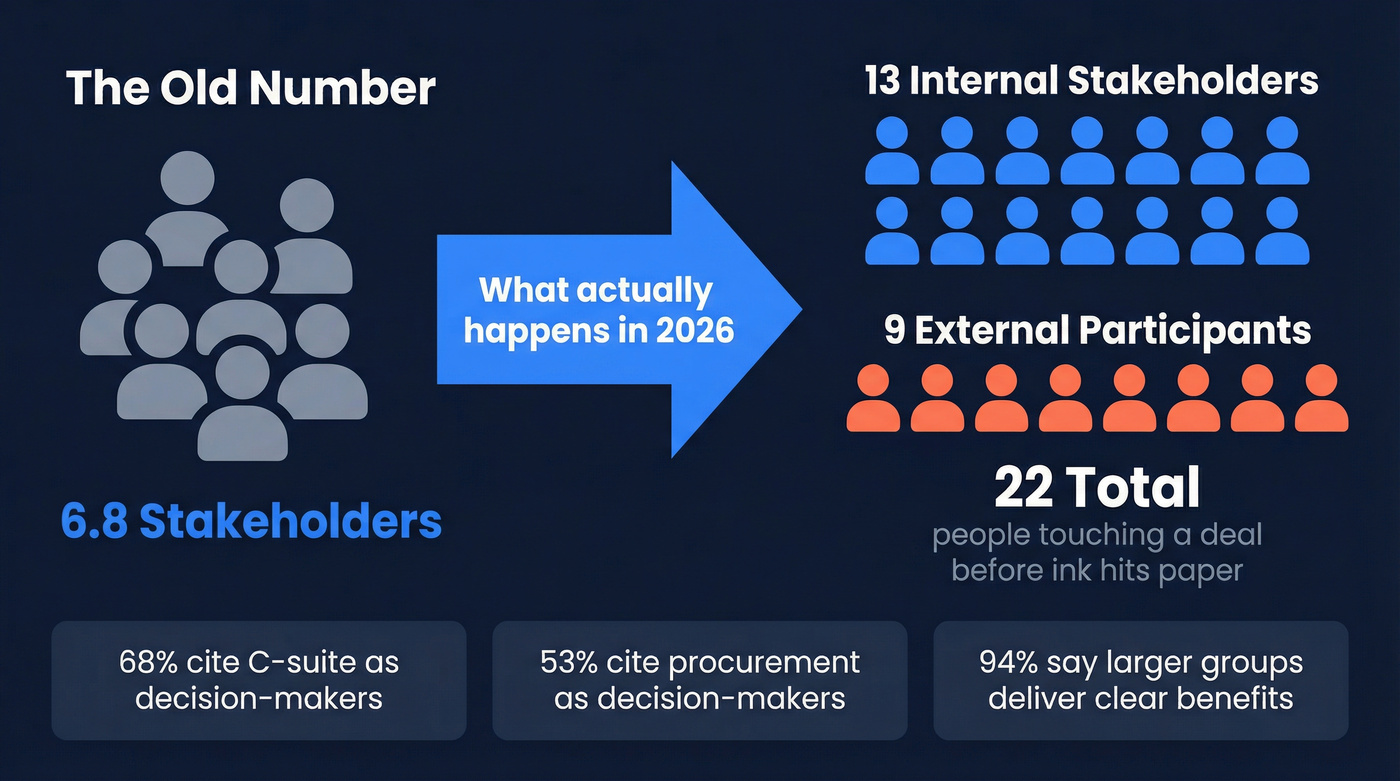

Here's what happened: your champion walked into a room with 12 other people who had questions you never anticipated, from stakeholders you didn't know existed. This is what B2B decision making actually looks like in 2026. Forrester's 2025 Buyers' Journey Survey found the average B2B purchase now involves 13 internal stakeholders and 9 external participants. That's not a typo. And your CRM has two contacts on the account.

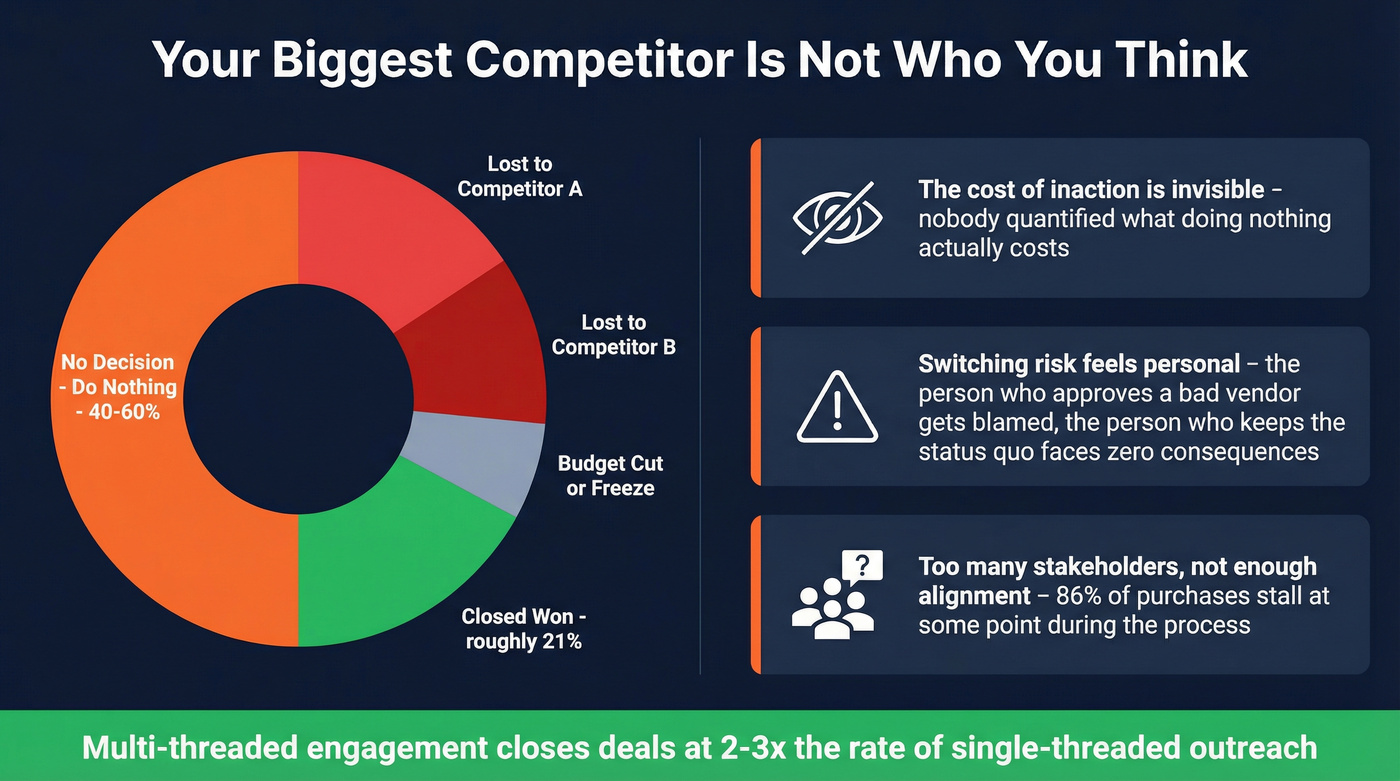

The buying committee isn't the 6-7 person group everyone still cites. It's nearly double that. Your biggest competitor isn't another vendor - it's "do nothing," which kills 40-60% of qualified pipeline, exceeding losses to any single competitor by 2-3x. And multi-threaded engagement (reaching 3+ stakeholders in parallel) closes deals at 2-3x the rate of single-threaded outreach. The gap isn't knowledge. It's access to verified contact data for the full committee.

The New Math of B2B Buying Committees

Every "B2B buying process" article you've read in the last five years cites the same number: 6.8 stakeholders. That figure is dead. It was already outdated in 2023, and it's laughably wrong now.

13 Stakeholders, Not 6

Forrester puts the real number at 13 internal stakeholders plus 9 external participants per average B2B purchase decision. That's 22 people touching a deal before ink hits paper.

And here's the counterintuitive part: 94% of respondents with 6+ internal participants said larger groups delivered clear benefits - broader perspectives, shared validation, reduced risk, and greater likelihood of budget approval. Fewer than half cited increased complexity or slower decisions as significant drawbacks. The committee isn't bloated. It's deliberate. Procurement professionals - identified as decision-makers by 53% of respondents - are now involved from the earliest stages, not just rubber-stamping at the end. C-suite leaders are identified as decision-makers by 68%.

The Generational Shift Nobody's Talking About

Millennials and Gen Z now make up 71% of B2B buyers, up from 64% in 2022. In deals worth $1M+, 67% of buyers come from these cohorts.

This matters because younger buyers behave differently. 68% of millennial B2B buyers prefer self-service research tools over speaking to a sales rep. They consult 10+ sources before making decisions. Gen Z (78%) and millennials (68%) find social video content helpful throughout the purchasing journey - only 1 in 6 boomers agree. And 90% of millennial and Gen Z buyers report dissatisfaction with vendors in at least one area, compared to 71% of older buyers.

They're not harder to sell to. They're harder to sell to badly. Irrelevant outreach, gated content, and "let me loop in my manager" calls don't work on a generation that grew up comparing products on their phones.

The 5% Problem

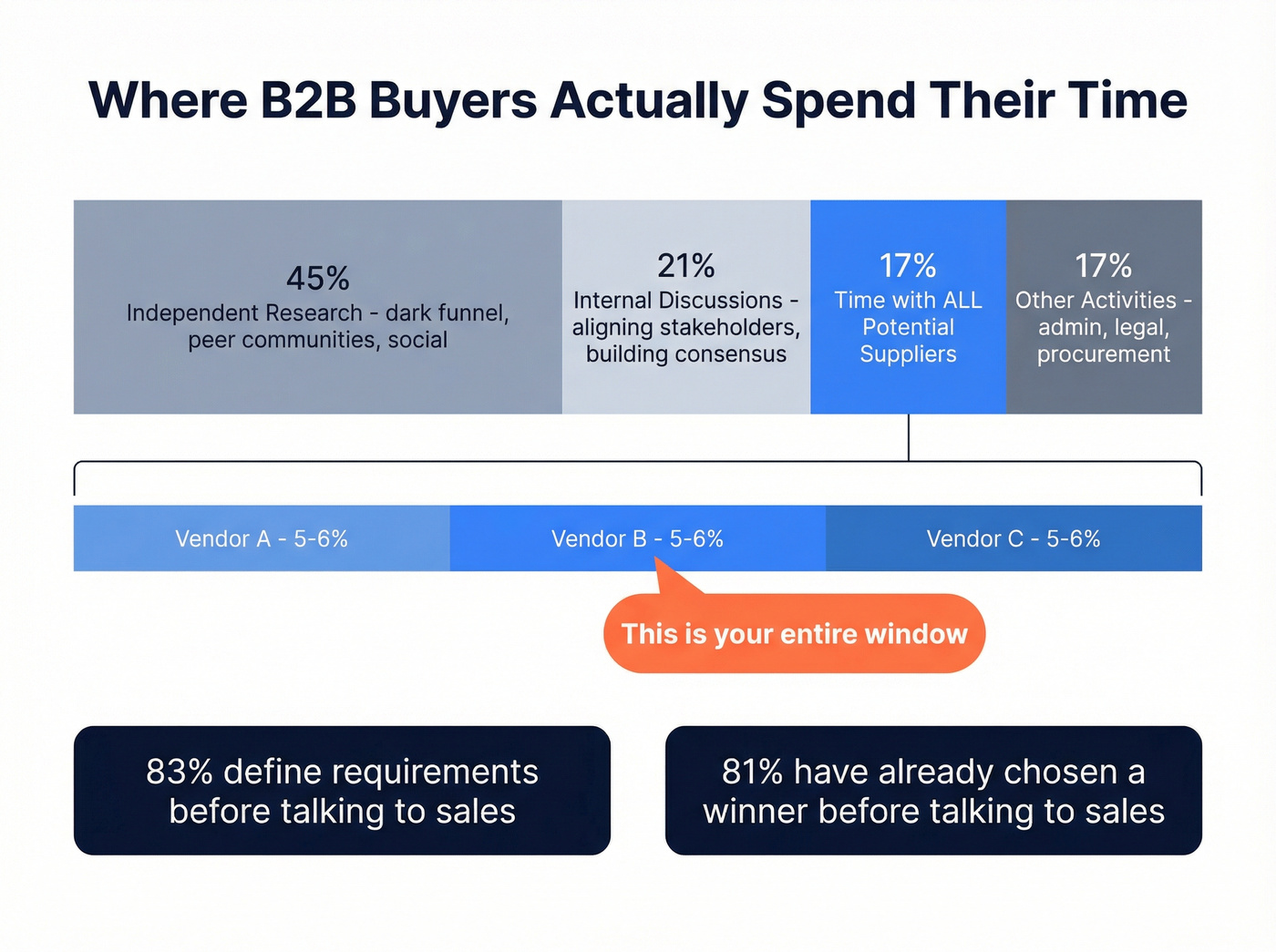

Buyers spend only 17% of their total buying time with potential suppliers. If they're evaluating three vendors - and the average shortlist is three - each vendor gets roughly 5-6% of the calendar.

That's your window. 5%.

Meanwhile, 83% of buyers mostly or fully define purchase requirements before speaking with sales. And 81% have already chosen a winner before talking to sales. The decision is forming in the dark funnel - anonymous research, peer communities, Slack groups, and social lurking - long before your SDR sends the first email.

The 6 Jobs Every B2B Buyer Must Complete

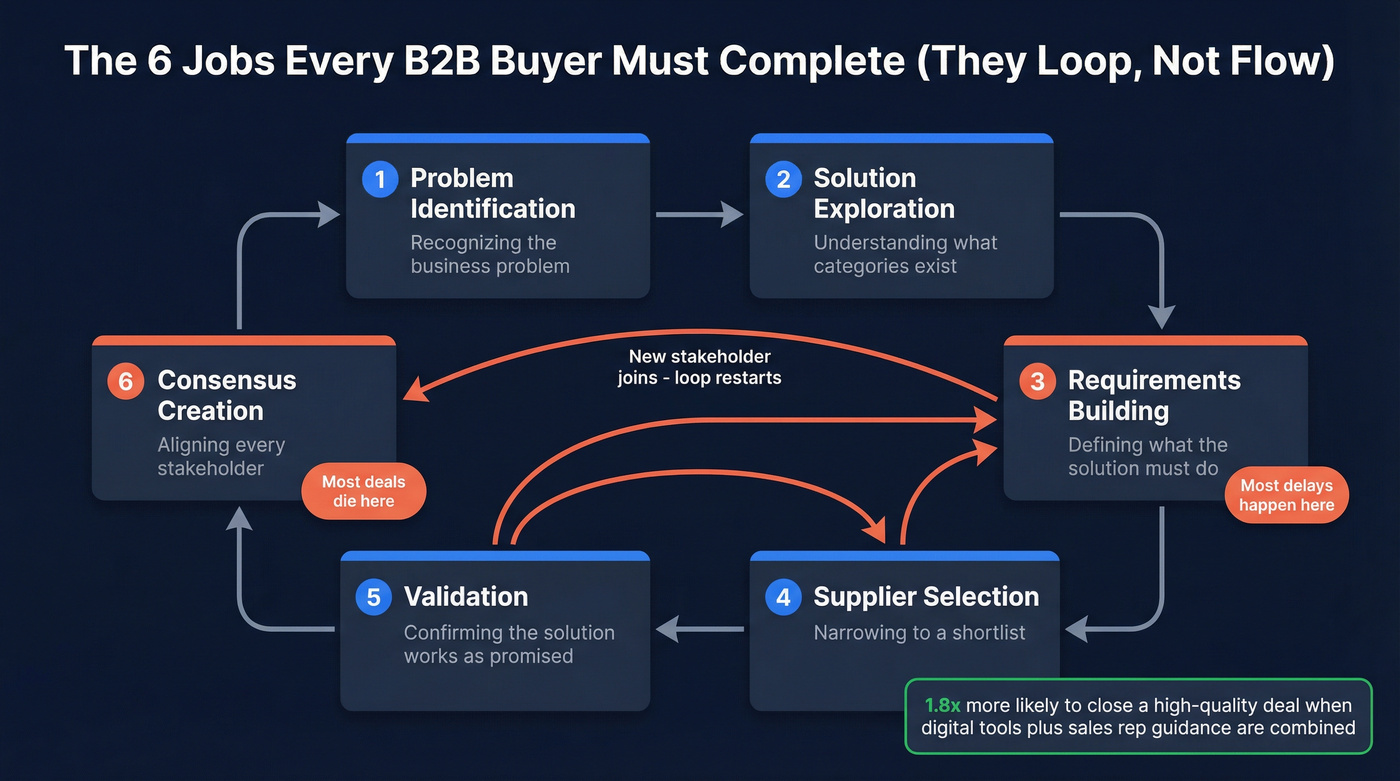

Forget the funnel. Gartner's research identifies six distinct "buying jobs" that every B2B purchasing team must complete - and they don't happen in order.

- Problem Identification - recognizing and articulating the business problem

- Solution Exploration - understanding what categories of solutions exist

- Requirements Building - defining what the solution must do

- Supplier Selection - narrowing to a shortlist and evaluating vendors

- Validation - confirming the chosen solution works as promised

- Consensus Creation - aligning every stakeholder around a single decision

The critical insight: buyers loop. They revisit each job at least once as new stakeholders enter the conversation, new objections surface, or new information changes the calculus.

A CTO who joins the evaluation in month two doesn't pick up where the champion left off - they restart from Solution Exploration with their own questions. Requirements Building and Consensus Creation cause the most delays and revisits. Requirements shift as new voices join. Consensus fractures as competing priorities collide.

Here's the thing: buyers are 1.8x more likely to complete a high-quality deal when they engage with supplier-provided digital tools in partnership with a sales rep - versus going it alone. The self-service preference is real, but the self-service outcome is often regret. Buyers want independence during research and expert guidance during the actual purchase decision. The companies that thread this needle win.

Multi-threaded deals close at 2-3x the rate of single-threaded ones. But you can't multi-thread without verified contact data for the full buying committee. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobile numbers - so you reach the CFO, the CTO, procurement, and every stakeholder your champion can't sell for you.

Stop losing deals to stakeholders you never knew existed.

Who's in the Room - and What Each Person Needs to Say Yes

Nine out of ten B2B purchases require input from multiple departments. Each stakeholder consults 4-5 pieces of content before joining group discussions. If you're sending the same case study to everyone, you're losing.

| Role | What They Care About | Content They Need | How to Reach Them |

|---|---|---|---|

| CFO | ROI, payback, TCO | Financial models, benchmarks | Executive briefings |

| CIO/CTO | Security, integration | Architecture docs, audits | Technical deep-dives |

| End Users | Ease of use, workflow | Product demos, trials | Hands-on access |

| Operations | Process fit, compliance | Implementation plans | Workflow mapping |

| Procurement | Cost certainty, terms | Pricing transparency | Contract clarity |

| Champion | Internal credibility | Business case templates | Selling tools |

The Bonoma framework (originally from HBR, 1982, still relevant) maps six roles that appear in every buying committee: Initiators, Influencers, Deciders, Purchasers, Users, and Gatekeepers. One person can fill multiple roles. A VP of Engineering might be both Initiator and Influencer. Procurement is always the Purchaser and sometimes the Gatekeeper.

Here's what this looks like in practice. Selling a security awareness platform to a 5,000-person company? Your Initiator is the CISO, your Decider is the CFO, your Gatekeepers are procurement and legal, your Influencers are the IT directors who'll manage rollout, and your Users are every employee who'll take the training. That's at least six distinct people who need different evidence to say yes.

The mistake most sellers make: treating the champion as the only relationship that matters. Your champion is the Initiator. They got the conversation started. But the Decider - often a C-suite leader - needs different evidence. The Gatekeeper - often procurement or legal - needs different assurances. And the Users need to believe their daily life gets better, not worse.

We've seen teams lose deals they were winning because they never sent a single piece of content to the security team. The CTO loved the product. Security had unanswered questions. Deal died in "review."

Quick Committee Prediction: The Size x Stakes Matrix

You can predict committee composition before you ever get on a call. Plot the deal on two axes: spend level (low to high) and strategic importance (operational to transformational).

A $20K operational tool? Expect 3-5 stakeholders, mostly mid-level. A $500K platform that touches core infrastructure? Expect 10-15 stakeholders, with C-suite involvement from day one. The higher the spend and the more strategic the impact, the more senior the committee skews - and the more departments get pulled in. Size your engagement plan accordingly before the first meeting, not after you discover the CFO has questions in month three.

How B2B Decision Making Shifts by Company Size

Not all buying committees are created equal. The dynamics shift dramatically based on company size, and your sales motion should shift with them.

| Segment | Decision-Makers | Cycle Length | CAC Range | Key Dynamic |

|---|---|---|---|---|

| SMB (<100) | 1, sometimes 2 | Days to weeks | $1K-$5K | Speed wins |

| Mid-Market | ~7 stakeholders | 1-3 months | $5K-$25K | Free trials + self-research |

| Enterprise (1K+) | 6-10+ | 6-18 months | $50K-$100K | Milestone-driven |

The average B2B win rate sits at roughly 21%, but this varies dramatically by segment. SMB deals convert faster with lower stakes; enterprise purchases demand patience and multi-threaded precision.

Good news: average sales cycles dropped from 11.3 months in 2024 to 10.1 months in 2025. First contact moved from 69% to 61% of the journey - meaning buyers are engaging sellers roughly 6-7 weeks earlier than they were a year ago. Economic pressure is compressing timelines.

Bad news: 89% of B2B buyers report a deal stalling in the past year, often due to budget freezes. And 28% of reps cite "sales process taking too long" as the #1 reason prospects back out.

Mid-market deals close when pricing, timing, and immediate need align. Enterprise deals close when internal consensus forms - budget cycles, compliance checks, executive alignment. If you're selling into enterprise with a mid-market playbook, you'll generate pipeline that never converts.

Skip the 13-person committee strategy if your deal size is under $15K. Focus on speed, self-serve trials, and getting the one decision-maker to a "yes" in under two weeks. Save the multi-threaded playbook for deals where the committee actually exists.

Why 86% of Deals Stall (and Your Biggest Competitor Is "Do Nothing")

86% of B2B purchases stall at some point during the buying process. Everyone talks about the buying committee. Almost nobody talks about why the committee fails to act.

The Status Quo Bias

40-60% of qualified opportunities in a typical mid-market B2B pipeline end in "no decision." Not a competitor win. Not a budget cut. Just... nothing.

"No decision" exceeds losses to any individual competitor by a factor of 2-3x. Your fiercest rival isn't the other vendor on the shortlist. It's inertia.

Why? Consider the procurement lead who approves a new supplier that underperforms. They face scrutiny, blame, and career risk. The procurement lead who maintains the existing supplier? No consequences. The asymmetry is brutal. Three conditions feed indecision:

- The cost of inaction isn't visible - nobody's quantified what "doing nothing" actually costs

- Switching risk isn't addressed - no transition plan, no rollback clause, no references from similar companies

- The champion can't build the internal case - they believe in your product but lack the language, data, and structure to convince 12 other people

The Consensus Problem

74% of buying teams experience unhealthy conflict. Over 40% of deals stall because stakeholders fail to align on a direction.

Gartner identifies four reasons working with buying groups is difficult: multiple delays in the process, members with conflicting goals, senior stakeholders creating bottlenecks, and non-buying-group members overruling recommendations. That last one is particularly maddening - someone who wasn't even in the evaluation swoops in and kills the deal.

Here's a counterintuitive finding from Gartner's research: overfocusing on individual stakeholder personalization actually hurts group consensus. When you tailor messaging so specifically to each person that they can't share it with colleagues, you fragment the conversation. The better approach? Share information tailored to the customer's industry and business challenge that clarifies how the product works for the buyer's organization - not for any single person.

Introducing "Unconsidered Needs" - problems the buyer hasn't fully recognized - increases persuasive impact by 10% versus simply validating needs they already know about.

The Emotional 50% Nobody Admits To

B2B International's research puts it bluntly: emotions account for approximately 50% of B2B buying decisions. Not 5%. Not 10%. Half.

"Nobody ever got fired for buying IBM" isn't a joke - it's a buying strategy. Brand reduces fear, uncertainty, and doubt. The hidden emotional driver behind most B2B purchases: the decision makes the buyer look good in front of colleagues and superiors.

When asked directly, buyers allocate almost no weight to "brand/reputation" in trade-off exercises. But their behavior tells a different story - brand loyalty far exceeds what rational factors alone would predict.

If your champion can't picture themselves presenting your solution to their VP without embarrassment, the deal is dead regardless of your ROI calculator.

How to Actually Win - The Consensus Playbook

Understanding the problem is step one. Here's what to do about it.

Get on the Day 1 Shortlist (or You've Already Lost)

84% of buyers purchase from a vendor on their Day 1 shortlist. The average shortlist is three vendors. If you're not one of those three before the buyer ever talks to sales, your win rate craters.

This means positioning, thought leadership, and early visibility aren't "nice to have" marketing activities - they're pipeline prerequisites. 61% of C-suite leaders say thought leadership is more effective at demonstrating value than product marketing. That's not a marketing opinion. It's what buyers are telling us.

The dark funnel - anonymous research, peer communities, review sites, Slack groups - is where shortlists form. By the time a buyer fills out your demo form, they've already decided you're a contender or you're not on the list at all. Intent data changes this equation: tracking which accounts are actively researching your category before they've locked their shortlist is the difference between being one of three and being vendor #4 who never gets a call.

Multi-Thread or Die

Multi-threaded deals close at 2-3x the rate of single-threaded outreach. This isn't a marginal improvement. It's the single highest-leverage change most sales teams can make.

Buyers average 16 interactions per person with the winning vendor. Multiply that by 13 stakeholders and you need 200+ touchpoints per deal. You can't do that single-threaded.

Most companies treat the sales process like a straight line when it's actually a puzzle with missing pieces. Here's the typical failure mode: your SDR cold-calls the CIO. The CIO is interested. Then months of internal discussions unfold as the CIO loops in the CFO, the CFO asks the security team, the security team escalates to the CTO. Sequential. Slow. Fatal.

The alternative: push the right content to the right stakeholders in parallel. The CIO sees threat landscape content. The CFO sees ROI case studies. The CTO sees technical architecture comparisons. The security team sees implementation and compliance guides. All at the same time. In our experience, teams cut their average deal cycle by 30-40% simply by engaging three stakeholders from day one instead of waiting for the champion to "bring others in." The champion rarely does - not because they don't want to, but because they don't know how.

Build a Consensus Kit

A consensus kit isn't a sales deck. It's a package designed to be forwarded internally - because that's how decisions actually get made. Your champion sends it to the people you'll never meet.

Components that work:

- A short POV document (2 pages max) framing the problem and solution

- A security and implementation FAQ addressing the top 10 objections

- A 1-page evaluation checklist the committee can use to compare vendors

The "workshop + artifacts" webinar format is underrated: attendees leave with templates or internal-ready slides. It's a direct "help me sell it internally" asset. I've seen this format outperform standard webinars by 3-4x on pipeline influence.

Measure coverage (stakeholders reached per target account), not just volume. Teams reaching consensus are 2.5x more likely to report a high-quality deal.

Reach the Full Buying Committee - Not Just Your One Contact

Mapping a 13-person buying committee is strategy. Actually reaching them is execution. And that's where most teams fall apart.

Your CRM has 2 contacts. The committee has 13. The gap isn't knowledge - it's access. Tools like Prospeo close that gap: paste a company URL, filter by department and seniority across 30+ search criteria, and export verified contacts for the entire committee in minutes. With 98% email accuracy and a 7-day data refresh cycle, you're not emailing someone who changed jobs two months ago.

Once you have access, apply the three status quo fixes:

- Quantify the cost of inaction before presenting your solution - make doing nothing feel expensive

- Provide structure - 30/60/90-day transition plans, rollback clauses, and references from similar companies

- Give champions the language, data, and structure to sell internally - they want to advocate for you but need ammunition

Buyers spend only 5% of their time with each vendor. You can't waste that window chasing wrong numbers and bounced emails. Prospeo's 7-day data refresh and 5-step verification mean every contact you pull is current - not 6 weeks stale. At $0.01 per email, mapping a 13-person buying committee costs less than a coffee.

Reach every decision-maker before your 5% window closes.

How Buyers Actually Research (and Where AI Changes Everything)

The Digital-First, Rep-Later Reality

61% of B2B buyers prefer an overall rep-free buying experience. But here's the paradox Gartner uncovered: self-service purchases are more likely to result in purchase regret. 81% of buyers end up dissatisfied with the provider they ultimately choose.

The information environment is broken. 69% of buyers report inconsistencies between website information and what sellers provide. 73% actively avoid suppliers who send irrelevant outreach. Buyers want seller input for contextual tasks - determining whether a product actually fits their specific needs - but they want to handle general research on their own.

Over 60% engage in some form of trial before committing. And after those trials, 35% plan to convert with a different provider than the one they trialed. The trial isn't closing deals - it's opening new evaluations.

Look, the buyer journey isn't "research, demo, buy." It's "research, trial, doubt, research again, talk to a peer, trial something else, maybe buy." The companies winning in 2026 are the ones who stay useful throughout that entire loop, not just during the 5% of time they get face-to-face.

Regional Variations in the Purchase Process

How committees reach consensus isn't uniform across geographies. The UK tends to involve more formal procurement governance and longer compliance reviews, especially in regulated industries like financial services and healthcare. French companies often layer in additional hierarchical sign-offs - decisions escalate through more senior tiers before final approval, and relationship-building with each tier matters more than in flatter organizational cultures. If you're selling cross-border into Europe, adapting your multi-threading strategy to these regional norms isn't optional. It's the difference between a stalled deal and a closed one.

2028 - When AI Agents Buy for You

94% of buyers already use LLMs during the buying process. 72% have encountered Google's AI Overviews during research, and 90% clicked through to at least one cited source. Microsoft Copilot is the most widely used AI tool among business buyers - 68% use it, with 36% using a private instance behind their corporate firewall.

Buyers are using AI for product comparisons (55%), RFP analysis (48%), and building business cases (47%). This isn't future-state. This is now.

But trust isn't uniform. Procurement professionals are the most skeptical - 28% felt less confident after using AI due to inaccurate output, compared to 19% of all buyers. If your AI-generated content reaches procurement with errors, you've just lost credibility with the person who signs the PO.

The future-state is more dramatic. Gartner predicts that by 2028, 90% of B2B buying will be AI agent intermediated, pushing over $15 trillion of B2B spend through AI agent exchanges. Procurement agents will analyze vendor meeting transcripts, demos, downloads, and internal debriefs - filtering out personal preferences and identifying pros and cons across vendors with machine precision.

What this means for sellers: your product needs to be machine-readable. Traditional SEO and PPC will give way to "agent engine optimization." B2B companies are already experiencing 10-40% traffic declines from AI replacing traditional search. The companies that structure their content, pricing, and technical documentation for AI consumption - not just human consumption - will own the next era of B2B buying.

One more wrinkle: buying groups double in size for AI-related purchases. If you're selling anything with an AI component, expect the committee to be even larger than 13. Security, legal, data governance, and AI ethics stakeholders all want a seat at the table.

The B2B buying committee isn't shrinking. AI isn't simplifying it. The teams that win in 2026 are the ones who map the full committee, engage in parallel, and arm their champions to build consensus. Everything else is noise.

FAQ

How many people are involved in a typical B2B purchase decision?

Forrester's 2025 survey found the average B2B purchase involves 13 internal stakeholders and 9 external participants. SMBs may have 1-2 decision-makers, while enterprise deals involve 6-10+ internal stakeholders. For purchases involving AI features, buying groups roughly double in size.

Why do so many B2B deals end in "no decision"?

40-60% of qualified B2B pipeline ends in "no decision," exceeding losses to any single competitor by 2-3x. Three conditions drive this: the cost of inaction isn't quantified, switching risk isn't addressed with concrete transition plans, and the internal champion lacks the data to build the case across 13 stakeholders.

How do you reach all stakeholders on a B2B buying committee?

Multi-thread by engaging 3+ stakeholders in parallel rather than sequentially. Use a B2B data platform to find verified emails and direct dials for every committee member - filter by department and seniority to map the full group. Then deliver role-specific content simultaneously: ROI models for finance, architecture docs for technical leads, implementation plans for operations.

How is AI changing B2B decision making?

94% of B2B buyers already use LLMs during the buying process, and Gartner predicts 90% of B2B buying will be AI agent intermediated by 2028 - pushing $15T+ through AI exchanges. Products need machine-readable positioning, structured data, and transparent pricing to survive in an AI-first discovery environment.

What is Gartner's B2B buying jobs framework?

Gartner identifies six buying jobs every committee must complete: Problem Identification, Solution Exploration, Requirements Building, Supplier Selection, Validation, and Consensus Creation. These jobs don't happen linearly - buyers loop back through each one as new stakeholders join. Consensus Creation is the most common bottleneck and the job most likely to stall a deal.