Best Sales Call Review Software in 2026 (With Real Pricing)

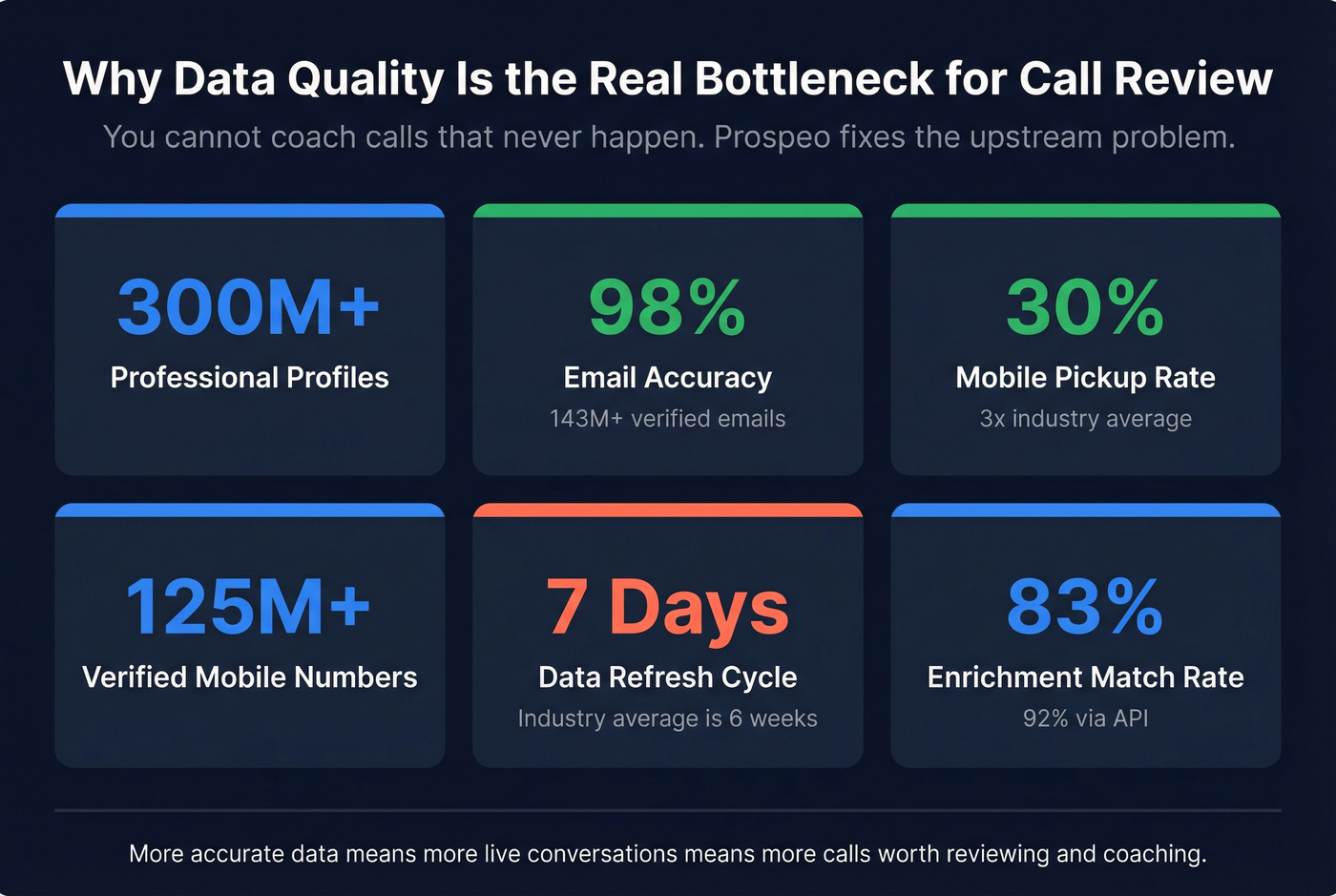

Call review is downstream of connect rate.

If reps aren't getting decision-makers on the phone (or into real meetings), the best sales call review software turns into an expensive transcript archive with a nice search bar.

We've watched teams spend five figures on conversation intelligence, then realize the real problem was upstream: stale emails, missing mobiles, and a list that quietly rotted for six weeks while managers argued about "talk time." Fix the inputs, then coach the calls you earn.

Our picks (TL;DR) for sales call review software

If I had to trial three first, I'd start with Gong + Avoma + Prospeo. That stack covers enterprise-grade review, cost-efficient sharing and coaching, and (crucially) more real conversations worth reviewing.

Look, buying a $100k/year suite before you've built a weekly coaching habit is a self-inflicted wound.

Real-time coaching is worth paying for when you've got new reps, strict scripts (regulated/fintech/health), or high-volume inbound. Otherwise, post-call review plus a tight scorecard beats "live popups" nine times out of ten.

Pick Gong if you're mid-market/enterprise and need the full workflow: libraries, coaching, deal inspection, and exec reporting. Skip Gong if you don't have a manager-led coaching cadence - Gong won't create discipline for you.

Pick Avoma if lots of stakeholders need to watch calls (enablement, product, CS) and you don't want to pay for every viewer. Skip Avoma if you need hardcore enterprise governance everywhere on day one.

Pick Prospeo if you want more calls worth reviewing (verified emails + mobiles -> higher connect rate) and you're tired of paying $1/lead for stale data. Skip it if you only want recording/transcripts - it's the upstream data quality layer, not conversation intelligence.

Pick Clari Copilot (Wingman) if you want real-time coaching plus strong CRM hygiene without Gong-level spend. Skip it if your team hates in-call prompts; you'll end up turning the "live" features off.

Pick Fireflies.ai if you want cheap, fast transcripts plus search and you're OK with lighter coaching. Skip Fireflies if you need SSO/SCIM/HIPAA/retention controls - those live behind Enterprise.

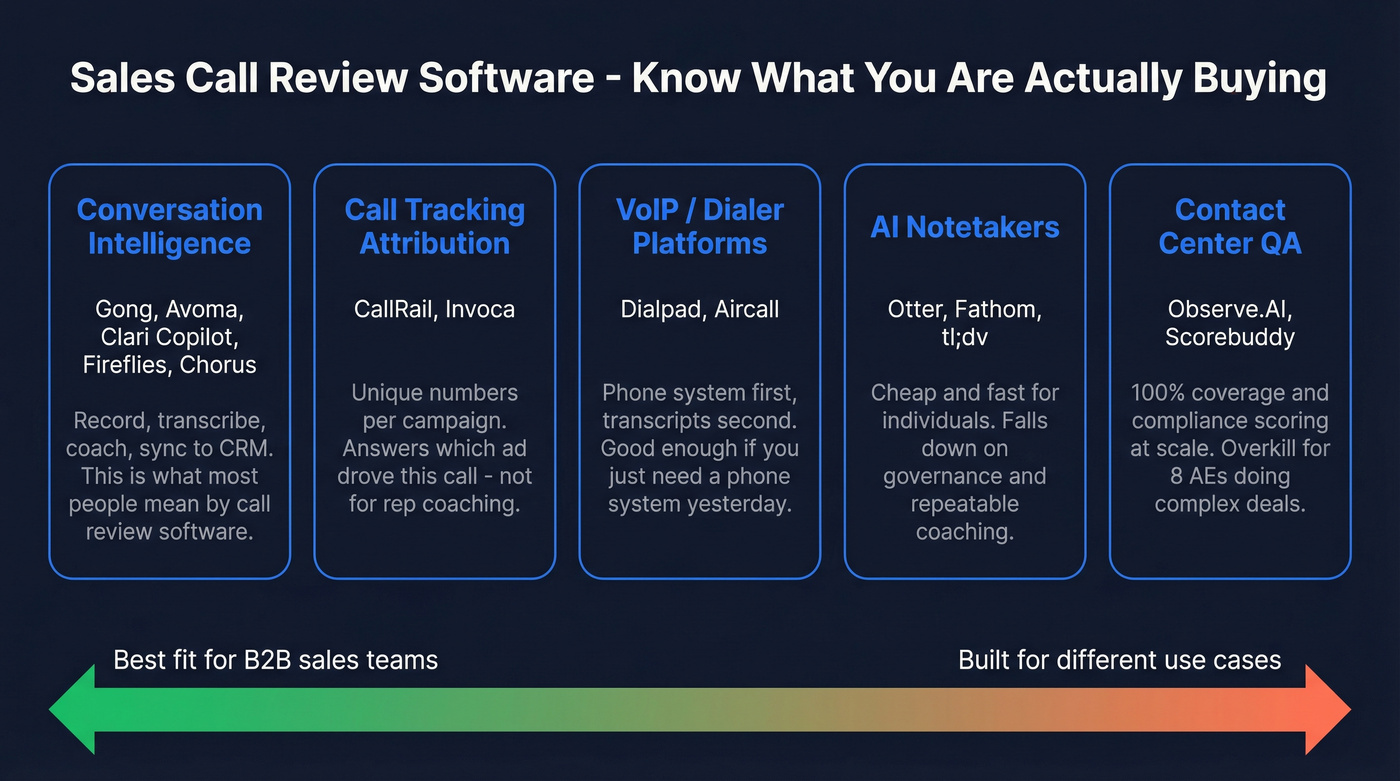

What "sales call review software" means (and what it doesn't)

Most people mean conversation intelligence (CI): record calls, transcribe them, summarize them, and make them searchable so managers can coach and teams can learn. The good platforms also make replay painless: fast clips, comments, playlists, and the exact segment you want a rep to rewatch.

Teams waste money when they buy the wrong category. Here's the map that prevents expensive mistakes.

Conversation intelligence (what you probably mean)

This is Gong / Clari Copilot / Avoma / Fireflies / Chorus territory.

Core jobs:

- Record meetings/calls (Zoom/Teams/Meet and sometimes VoIP)

- Transcribe + summarize

- Highlight moments (pricing, competitors, objections)

- Coach (comments, playlists, scorecards)

- Sync to CRM (notes, fields, next steps)

Call tracking attribution (not the same thing)

Call tracking is about marketing attribution, not rep coaching.

It starts with unique phone numbers per campaign or per website visitor so you can answer "which ad drove this call?" Then it layers analytics and, sometimes, transcripts.

VoIP / dialer platforms (sometimes "good enough" for review)

Tools like Dialpad are primarily phone systems. They can do transcripts and summaries, but they aren't built like a full CI suite with deep coaching workflows and deal inspection.

If your biggest pain is "we need a phone system yesterday," VoIP-first is a smart starting point. If your pain is "we need consistent coaching and a call library," it isn't.

If you're evaluating dialing at scale, it helps to understand a predictive dialer and the compliance trade-offs.

Meeting recorders / AI notetakers (cheap, fast, limited)

These tools are great for individuals and lightweight teams: record, transcribe, summarize, share clips.

They fall down on governance, CRM hygiene, and repeatable coaching systems.

Contact-center QA (different universe)

Contact-center QA tools assume 100% coverage and compliance scoring at scale. They're built for support centers and high-volume inbound/outbound operations, not classic B2B AE discovery.

If you're running a sales floor that looks like a call center, these can be the right answer. If you're running eight AEs doing complex deals, they're overkill.

The best conversation intelligence tool can't coach calls that never happen. Teams using Prospeo's 125M+ verified mobiles see a 30% pickup rate - that's 3x the industry average. More real conversations means more calls worth reviewing.

Fix your connect rate before you buy another recording tool.

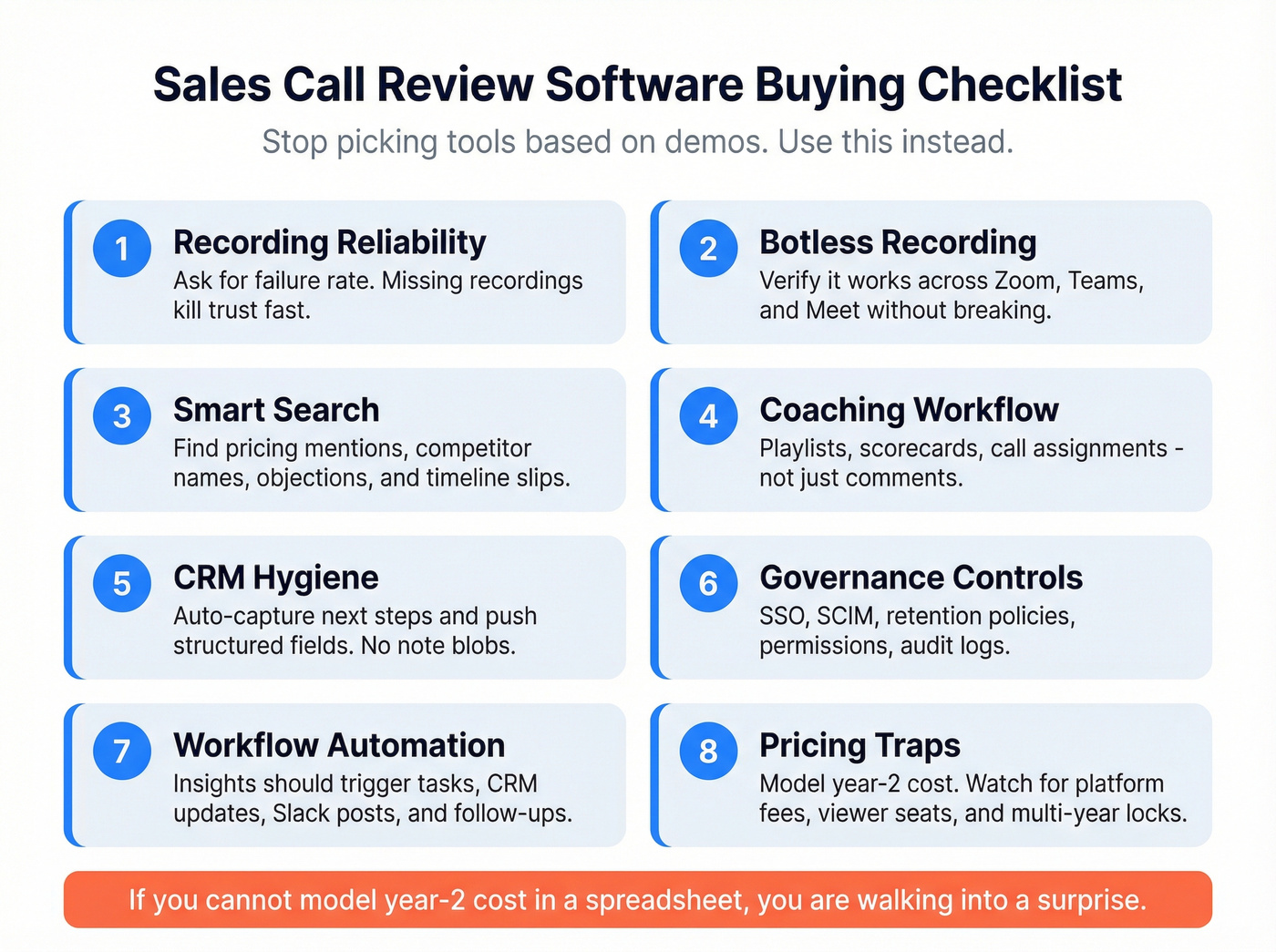

How to choose sales call review software (buying checklist)

Most teams pick a tool based on the demo. That's backwards. Demos are controlled environments; your reality is messy calendars, missed recordings, privacy constraints, and managers who have 30 minutes between pipeline reviews.

Here's the checklist we use to avoid "we bought it and nobody uses it" outcomes:

Recording reliability (non-negotiable) If recordings are missing or delayed, trust dies fast. Ask for failure rate, how they handle bot blocks, and what happens when a meeting starts early or late.

Botless recording options Some orgs hate bots for security or optics. If botless matters, verify it works across Zoom/Teams/Meet and doesn't break when settings change.

Search that answers real questions You want to find: "pricing mentioned," "competitor X," "security review," "timeline slipped," "next steps not set." If search is weak, your library becomes a graveyard.

Coaching workflow (not just comments) Look for playlists, scorecards, call assignments, and manager dashboards. If the tool can't support a weekly coaching loop, you won't get consistent improvement.

CRM hygiene and field mapping The best tools reduce CRM fiction: auto-capture next steps, stakeholders, objections, and push structured fields. If it only dumps a blob of notes, RevOps will hate it.

Governance: SSO/SCIM, retention, permissions, audit logs Enterprise rollouts fail here. If you need SSO/SCIM and custom retention, assume you're paying top-tier pricing.

Workflow automation (the "insights -> execution" gap) Insights are useless if they don't trigger action. The best setups can create tasks, update CRM fields, post to Slack, and route follow-ups based on what happened in the call.

Pricing traps Watch for platform fees, minimum seat counts, viewer licensing, add-on modules, and multi-year terms. If you can't model year-2 cost in a spreadsheet, you're walking into a surprise.

If your CI rollout is tied to outbound, align it with clear account-based marketing goals so coaching maps to pipeline outcomes.

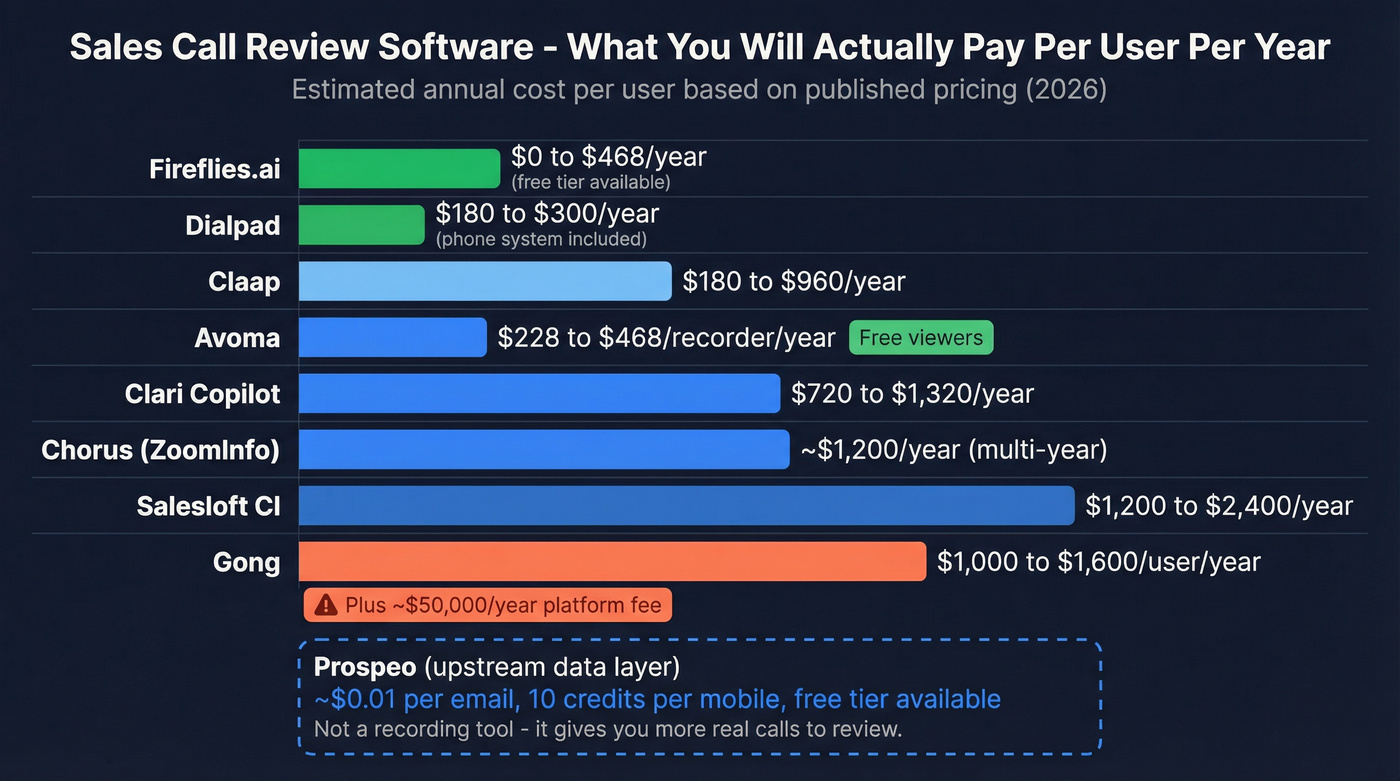

Sales call review software comparison table (features + pricing)

Tools look similar in demos, then differ wildly on reliability, governance, and how they charge.

| Tool | Recording sources (Zoom/Teams/Meet/VoIP) | Real-time coaching | Scorecards / QA | CRM sync / enrichment (SFDC/HubSpot) | Compliance controls (consent/retention/SSO) | Pricing reality (budget range) | Best for |

|---|---|---|---|---|---|---|---|

| Prospeo (upstream data quality layer) | N/A (data + verification) | No | No | Yes (CRM enrichment + export; not call notes) | GDPR compliant (data); DPAs + opt-out | Credits: ~$0.01/email; mobiles are 10 credits each; free tier available | Increasing volume of real conversations (verified emails + mobiles) |

| Gong | Zoom/Teams/Meet + integrations | Limited | Yes | Yes | Strong (SSO/retention options) | ~$1,000-$1,600/user/year + ~$50,000/year platform fee (+ add-ons) | Enterprise CI + revenue workflows |

| Clari Copilot (Wingman) | Zoom/Teams/Meet | Yes | Yes | Yes | Good (enterprise tiers) | $720-$1,320/user/year (tiered) | Real-time coaching + CRM hygiene |

| Avoma | Zoom/Teams/Meet (bot + bot-less) | Some | Yes | Yes | Stronger on higher tiers | $19-$39/recorder/month + add-ons (CI $29/seat/month; Revenue $29/seat/month; Lead Router $19/seat/month) | Best value for broad sharing (free viewers) |

| Fireflies.ai | Zoom/Teams/Meet + more | No (post-call focus) | Light | Yes | Enterprise gating (SSO/SCIM/HIPAA/retention) | $0-$39/seat/month (Enterprise for governance) | Budget transcripts + searchable knowledge |

| Chorus (ZoomInfo) | Zoom/Teams/Meet + ecosystem | Some | Yes | Yes | Enterprise-ready | Starts around ~$8k/year for small teams; often ~$1.2k/user/year on multi-year deals | ZoomInfo shops that want CI inside the suite |

| Salesloft CI | Zoom/Teams/Meet + Salesloft | Some | Yes | Yes | Enterprise-ready | ~$1.2k-$2.4k/user/year (package-dependent) + dialer add-ons | Teams standardized on Salesloft |

| Dialpad | VoIP-first + meetings | Light | Light | Some | Varies by plan | Starts $15-$25/user/month (Enterprise higher) | Phone system + transcripts starter |

| Momentum | Integrates with meeting platforms | Some | Yes | Yes | Enterprise-ready | ~$1.2k-$3k/user/year (scope drives range) | Turning insights into workflows |

| Claap | Meetings + async video | No | Light | Some | Basic-to-mid | ~$15-$80/user/month | Async review + "one job per tool" teams |

The best sales call review software (by use case)

Below are the tools that hold up in production, plus the pricing reality procurement cares about. Not every section is the same length on purpose: a couple of these are true "build your program around it" picks, and a couple are "nice if you already own it."

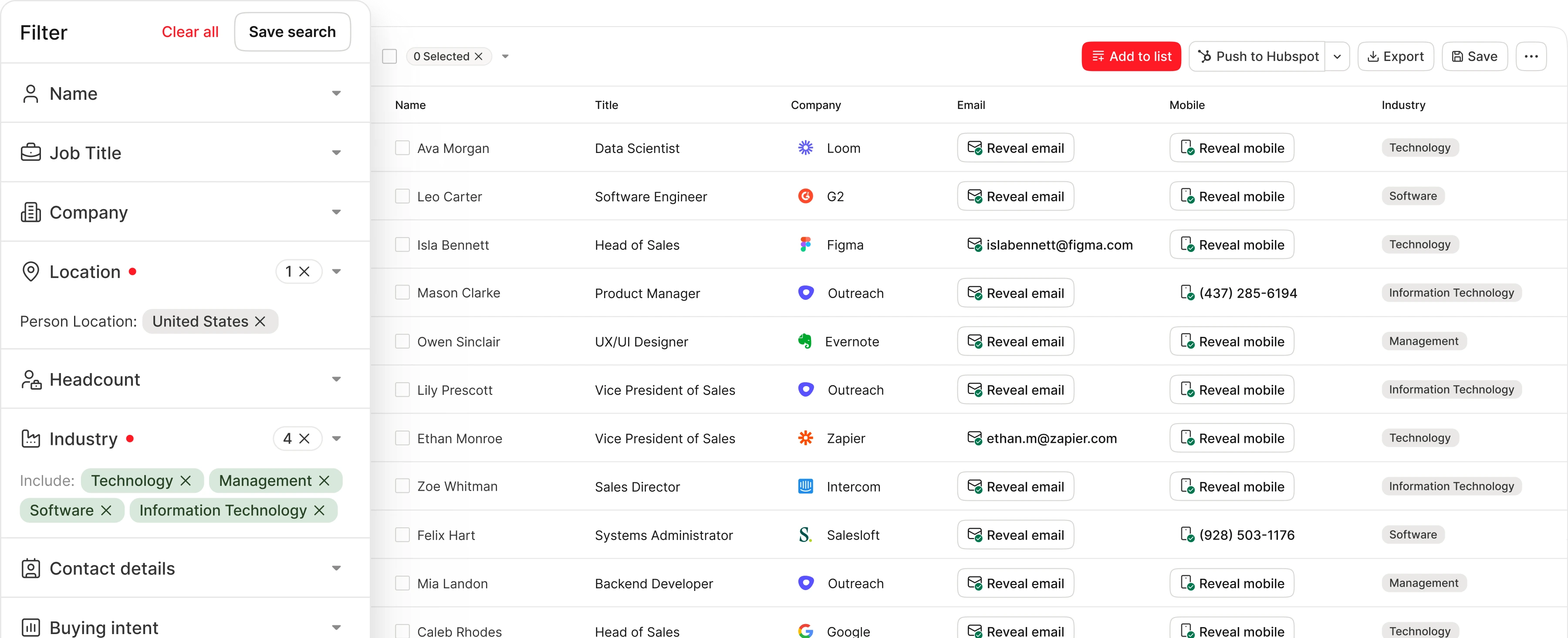

Prospeo - Best for generating more real calls to review (data accuracy + refresh)

Best for: teams where connect rate is the bottleneck and you need more real conversations to review.

Here's the thing: call review doesn't fix a dead list. If your reps are dialing numbers that don't pick up and emailing addresses that bounce, your "coaching program" turns into a debate about effort instead of a conversation about skill.

What it nails: Prospeo is "The B2B data platform built for accuracy". It includes 300M+ professional profiles, 143M+ verified emails at 98% accuracy, and 125M+ verified mobile numbers with a 30% pickup rate. Everything refreshes on a 7-day cycle (industry average: 6 weeks), which is the difference between a list that stays usable and one that quietly decays between quarters.

It also supports 30+ search filters, 15,000 intent topics (powered by Bombora), and enrichment that returns 50+ data points with an 83% enrichment match rate plus a 92% API match rate. In practice, that means RevOps can stop playing whack-a-mole with duplicates and half-filled contact records, while reps spend more time talking to the right people and less time "following up" into the void.

If you're comparing lead data vendors for outbound list building, see DitLead vs Apollo.io and Extruct AI vs ZoomInfo.

A scenario we've seen: an SDR team rolls out call review, managers start scoring discovery, and everyone gets mad because connect rate is 4%. They swap talk tracks twice, nothing changes, morale drops. Then they clean the data, add verified mobiles, and connect rate jumps into the teens. Suddenly the same scorecard becomes useful because there are enough real conversations to coach.

Pricing (realistic budget): credit-based and self-serve: ~$0.01 per email, mobiles cost 10 credits per number, plus a free tier (75 emails + 100 Chrome extension credits/month). One proof point: Meritt cut bounce 35% -> under 4% and pushed connect rate to 20-25%.

Learn more: B2B Database, Email Finder, Mobile Finder, Integrations.

Gong - Best for enterprise-grade call review + revenue workflows

Best for: mid-market and enterprise teams that want call review tied to deal inspection, coaching, and exec reporting.

What it nails: Gong becomes the system of record for what's happening in deals: calls, objections, next steps, risk signals. It's excellent when you operationalize it with persona libraries, scorecards by motion, and manager workflows that run weekly, because it gives leaders a consistent way to inspect reality instead of relying on rep-written notes that read like fan fiction.

Watch-outs: buying Gong doesn't fix coaching. If managers don't assign reviews and coach off scorecards, you'll pay enterprise money for a fancy archive. And yes, renewal uplift is real; model year-2 cost like you actually want to keep the tool.

Pricing (realistic budget): ~$1,000-$1,600/user/year plus a ~$50,000/year platform fee. Add-ons can stack quickly (common anchors: Forecast ~$700/user/year, Engage ~$800/user/year). Model 5-7% renewal uplift.

Clari Copilot (Wingman) - Best for real-time coaching + CRM hygiene

Best for: teams onboarding reps fast, enforcing talk tracks, or cleaning up CRM notes without begging reps to update fields.

What it nails: real-time guidance (battlecards, prompts) plus strong capture into CRM. If your managers are tired of hearing "I'll update Salesforce later," this category of product can save a lot of back-and-forth, because it turns call outcomes into structured fields instead of a paragraph of vibes.

Skip it if: your reps hate in-call prompts. You'll disable the live layer and end up paying for features you don't use.

Pricing (realistic budget): $720/year (Growth), $1,080/year (Accelerator), $1,320/year (Enterprise).

Avoma - Best value when many stakeholders need to watch (viewer seats free)

Best for: orgs where enablement, product, CS, and leadership all want access without paying per viewer.

What it nails: the licensing model. Paying for recorder seats while keeping viewers free is one of the cleanest ways to scale call review across the company without doubling spend, and it changes behavior: people actually share calls because they aren't rationing seats like they're gold bars.

Watch-outs: Avoma looks cheap until you add modules across many recorder seats. Decide upfront who truly needs CI and revenue add-ons, because "everyone gets everything" is how budgets get torched.

Pricing (realistic budget): recorder seats billed annually: $19 (Startup), $24 (Organization), $39 (Enterprise) per recorder/month (Enterprise has a 10-seat minimum). Add-ons: Conversation Intelligence $29/seat/month, Revenue Intelligence $29/seat/month, Lead Router $19/seat/month.

Fireflies.ai - Best budget-friendly call recording + searchable transcripts

Best for: teams that want transcripts, summaries, and search immediately without procurement drama.

What it nails: speed-to-value and simple pricing. If you want "we can search every call by keyword tomorrow," Fireflies delivers.

Watch-outs: coaching and governance are lighter unless you pay for Enterprise. That's the trade: cheap and fast vs deep enablement workflows.

Pricing (realistic budget):

- Free $0

- Pro $10/seat/mo

- Business $19/seat/mo

- Enterprise $39/seat/mo

Storage is explicit: Free 800 mins/seat, Pro 8,000 mins/seat, Business/Enterprise unlimited. Governance (SSO/SCIM/HIPAA/custom retention) sits in Enterprise.

Chorus (ZoomInfo) - Best if you already live in ZoomInfo's ecosystem

Best for: teams already standardized on ZoomInfo who want CI inside the same commercial stack.

What it nails: solid coaching collaboration (moments, playlists) and adjacency to the broader ZoomInfo ecosystem.

Watch-outs: if your team sees missed recordings or slow processing, adoption drops fast. Call review only works when reps trust the call will actually be there.

Pricing (realistic budget): small deployments often start around ~$8,000/year, with additional seats around ~$1,200/user/year, commonly on multi-year agreements. Larger rollouts can hit $50k+/year depending on packaging.

Salesloft Conversation Intelligence - Best when you want CI inside an outbound suite

Best for: teams that live in Salesloft and want call review attached to sequences and outbound execution.

What it nails: fewer tabs. Reps stay in one cockpit, and managers still get recordings, summaries, and moments.

Watch-outs: packaging drives cost. If you don't control add-ons (dialer, forecasting, extra agents), the "CI add-on" becomes a much bigger program.

Pricing (realistic budget): ~$1,200-$2,400/user/year depending on package and volume, plus dialer add-ons (and sometimes per-number costs).

Dialpad - Best "phone system + transcripts" starter option

Best for: teams that need a phone system now and want basic review without buying a full CI suite.

Skip it if: you need a real coaching system: call libraries, scorecards at scale, deal inspection, and enablement workflows. Dialpad's a phone platform first.

What it nails: simplicity. You get calling plus transcripts and summaries in one product.

Pricing (realistic budget): $15/user/month (Standard) and $25/user/month (Pro). Enterprise is higher.

Momentum - Best when insights must trigger workflows

Best for: RevOps-led teams where "insights" are pointless unless they update CRM fields, create tasks, and drive follow-up.

What it nails: the execution layer. You can map call outcomes into fields that reporting actually uses, automate tasks and routing, and push the right notifications to Slack so managers see what changed, not just what was said.

Example workflow that earns its keep: "If pricing is discussed and no next step is set -> create a task, ping the manager in Slack, and set a CRM follow-up date." It's a long sentence because the details matter, and because this is where most teams either get real ROI or end up with another dashboard nobody checks.

Watch-outs: if you don't have clean CRM definitions (what counts as a next step, what field is source of truth), automation just scales chaos.

Pricing (realistic budget): ~$1,200-$3,000/user/year. The range is driven by automation scope, number of integrations, and enterprise controls.

Claap - Best for async review and "one job per tool" workflows

Best for: async collaboration: clips, comments, and lightweight review without turning every call into a formal coaching event.

What it nails: speed and focus. It's great for product marketing, founders, and enablement who want to consume customer conversations without living in a heavyweight CI suite.

Watch-outs: if you need structured QA at scale (scorecards, calibration, governance), you'll outgrow it and move to a CI platform.

Pricing (realistic budget): ~$15-$80/user/month, driven by governance needs and team size.

Contact-center QA tools (Observe.AI, Balto, CallMiner, Talkdesk/Five9/Genesys)

Best for: environments where sampling is unacceptable and you need 100% coverage with compliance scoring.

What it nails: QA rigor at scale: sentence-level coaching, compliance, and operational analytics.

Watch-outs: these are priced and implemented like contact-center infrastructure. If you're a classic B2B sales org, it's too much machine for the job.

Pricing (realistic budget): a practical anchor is Talkdesk pricing around ~$85/user/month to start, then it climbs with QA modules and enterprise requirements.

Pricing reality & total cost of ownership (TCO) for call review tools

Most teams underestimate CI cost because they only model "per seat." Enterprise tools sell platform fees, minimums, and add-ons, and that's before you account for admin time and the internal cost of making the program actually run.

The TCO checklist (use this before you sign)

- Platform fee: common in enterprise CI; Gong's model includes it.

- Per-seat licenses: enterprise CI commonly lands ~$1,000-$1,600/user/year.

- Add-ons: forecasting, engagement, dialer, workflow automation can add 30-80% to base spend.

- Minimums + term: multi-year agreements and seat minimums are normal in enterprise CI.

- Renewal uplift: model 5-7% annual uplift even if headcount stays flat.

- Admin time: if RevOps has to babysit recordings, permissions, and CRM mappings, that's a real cost center.

If you're trying to avoid surprise renewals in your stack, it can help to sanity-check vendor pricing patterns (example: Wiza pricing).

Two quick TCO examples (ballpark budgeting math)

Scenario A: Mid-market team (20 users) on Gong + one add-on

- Seats: 20 x $1,000-$1,600/user/yr = $20k-$32k/yr

- Platform fee: ~$50k/yr

- Add-on (example: Forecast): 20 x $700/user/yr = $14k/yr Ballpark total: $84k-$96k/year (before any other modules, services, or uplift)

That number's fine if you're actually running weekly coaching and using deal inspection. If not, it's dead weight.

Scenario B: SMB rollout where 10 people record, 50 people watch

- Avoma-style model: 10 recorders x $19-$39/recorder/mo ~= $190-$390/mo (base) Add CI module for just the recorders: 10 x $29/mo = $290/mo Ballpark total: $480-$680/mo (viewers free)

- Per-seat model (everyone pays): 60 seats x $19-$39/seat/mo = $1,140-$2,340/mo

If your company wants broad access to calls, viewer licensing is the difference between adoption and "we can't afford to share."

Mini callout: the pricing model that saves you the most money

The biggest cost lever is who pays: recorders vs viewers vs "everyone gets a seat." Pick a model that matches how your org actually consumes calls.

How to run a call review program that actually improves performance

Tools don't improve reps. Systems do.

A call review program that works is a loop: define what "good" sounds like -> score consistently -> coach one behavior at a time -> measure change. Internal review matters because external feedback is sparse: CSAT response rates can be low enough that you can't rely on them as your primary coaching signal, so your call library and QA process become the feedback channel you control.

Also, if reps aren't connecting, scorecards won't help. Fix the input first (verified emails plus direct dials, frequent refresh), then coach what happens on the calls you earn.

If you’re running outbound via partners, consider how coaching ties into channel sales incentive programs so behavior matches the motion.

Scorecard template (copy/paste rubric + weighting)

Use a simple scale: 1-3 (bad/OK/great) or 1-10 if you want more nuance. Start simple; complexity kills adoption.

Here's a sales scorecard weighting that works across most B2B motions:

| Category | Weight | What you're scoring |

|---|---|---|

| Opening + qualification | 15% | agenda, control, ICP fit, problem framing |

| Value communication | 25% | clarity, relevance, proof, differentiation |

| Objection handling | 30% | listens, isolates, responds, confirms |

| Closing + next steps | 25% | mutual plan, timeline, stakeholders, CTA |

| Process adherence | 5% | compliance, required questions, notes/CRM |

Run a 4-6 week pilot with 2-3 managers before you roll it out. Your categories will be right; your definitions will be sloppy.

Operational benchmarks that work:

- Calls reviewed per rep per week: 2-4 for AEs, 3-6 for SDRs.

- Manager time: 60-120 minutes per week per team if you use playlists and focus on one skill.

- Coaching focus: one behavior per rep per week, not "fix everything."

Calibration cadence (how to keep managers scoring consistently)

Calibration is the difference between coaching and random opinions.

- Weekly (15 minutes): managers score the same 1-2 calls, compare scores, align on what "good" means.

- Monthly (45 minutes): revisit definitions and adjust weights if the motion changes (new product, new ICP, new objections).

- Quarterly: refresh your call library (best discovery, best pricing talk, best negotiation, best multithreading).

I've run bake-offs where the tool was fine, but calibration was nonexistent, and reps ignored the scorecard because it felt arbitrary. That's a management problem, not a software problem.

Adoption without "surveillance" backlash (optics + enablement framing)

Reps don't hate call review. They hate feeling policed.

What works:

- Position it as enablement: "We're building a library and coaching faster," not "we're monitoring you."

- Let reps self-select one call per week for review. Managers pick the other one.

- Share wins publicly: "This objection handle is the new gold standard."

- Keep private feedback private. Public shaming kills adoption instantly.

If you do this right, call review becomes a career accelerator, not a compliance exercise.

Stale data rots every six weeks at most providers. Prospeo refreshes every 7 days, delivering 98% email accuracy at $0.01/lead - 90% cheaper than ZoomInfo. Teams book 26% more meetings because reps actually reach decision-makers.

Stop reviewing voicemails. Start reviewing real sales conversations.

Compliance & consent checklist for recording sales calls

Recording laws vary by jurisdiction. Here's the operational checklist teams use to stay consistent, then confirm edge cases with counsel.

US baseline: 38 states + D.C. are one-party consent, and 11 states are all-party consent: CA, DE, FL, IL, MD, MA, MT, NV, NH, PA, WA. Some states are nuanced or situational (commonly cited examples include CT, MI, NJ) where context can change the requirement.

If your motion uses high-volume outbound calling, review the Predictive Dialer Guide alongside your recording policy.

Operational checklist (what actually keeps you safe)

- Consent prompt every time in all-party states, and if you want fewer mistakes, standardize disclosure everywhere.

- Retention policy: decide how long recordings live (30/90/180/365 days) and enforce it. "Keep everything forever" is lazy and risky.

- Access controls: restrict who can download/share recordings; use role-based permissions.

- SSO/SOC2 expectations: if you're enterprise, plan for SSO and audit logs; many tools gate these behind top tiers.

- Training: a 10-minute enablement module beats a 20-page policy nobody reads.

- International: UK/EU rules often require stronger consent and lawful basis discipline. If you sell globally, standardize on explicit disclosure early.

FAQ

What's the difference between conversation intelligence and call tracking software?

Conversation intelligence focuses on recording, transcribing, summarizing, and coaching sales conversations to improve rep performance. Call tracking software focuses on attribution - using unique phone numbers per campaign or visitor to prove which marketing source drove the call - then optionally adds transcripts and analytics.

How much does sales call review software cost in 2026?

It ranges from $0-$39 per seat/month for lightweight recorders to $1,000-$1,600 per user/year plus platform fees for enterprise suites, which commonly pushes total spend into $30k-$150k+/year once you add governance and add-ons. Model year-2 cost (uplift plus modules) before you sign.

Do I need real-time coaching, or is post-call review enough?

Post-call review is enough for most teams because it's easier to run and less distracting for reps. Real-time coaching is worth paying for when you're onboarding new reps, enforcing strict scripts, or running high-volume motions where small talk-track improvements compound quickly.

How many calls should managers review per rep each week?

A practical baseline is 2-4 calls per AE per week and 3-6 per SDR, plus a 15-minute weekly calibration where managers score the same call and align on what "good" means. That creates consistency without turning managers into full-time auditors.

What's a good free option to get more conversations worth reviewing?

Prospeo's free tier (75 emails + 100 Chrome extension credits/month) is a strong starting point to verify contacts and raise connect rates, paired with a free or low-cost recorder for transcripts.

What to do next (quick recommendations)

If you're enterprise and you'll actually run weekly coaching, pick Gong.

If you need real-time prompts and cleaner CRM notes without enterprise pricing, pick Clari Copilot.

If you want broad sharing without paying for every viewer, pick Avoma.

If you want the cheapest path to searchable transcripts, pick Fireflies.ai.

And if your real problem is "we don't have enough good conversations to review," fix connect rate first, then invest in sales call review software your managers will actually use.