The Cost of Sales Tech Stack in 2026 - Real Numbers, No Guesswork

Nobody knows what their sales tech stack actually costs until every renewal email lands in the same week. With 11,000+ sales technology solutions on the market, it's easy to build a nine-tool Frankenstein one "small" purchase at a time - then act surprised when the CFO asks why sales software is starting to look like payroll.

We've watched this play out across dozens of teams. Here's what the numbers actually say.

The Quick Version

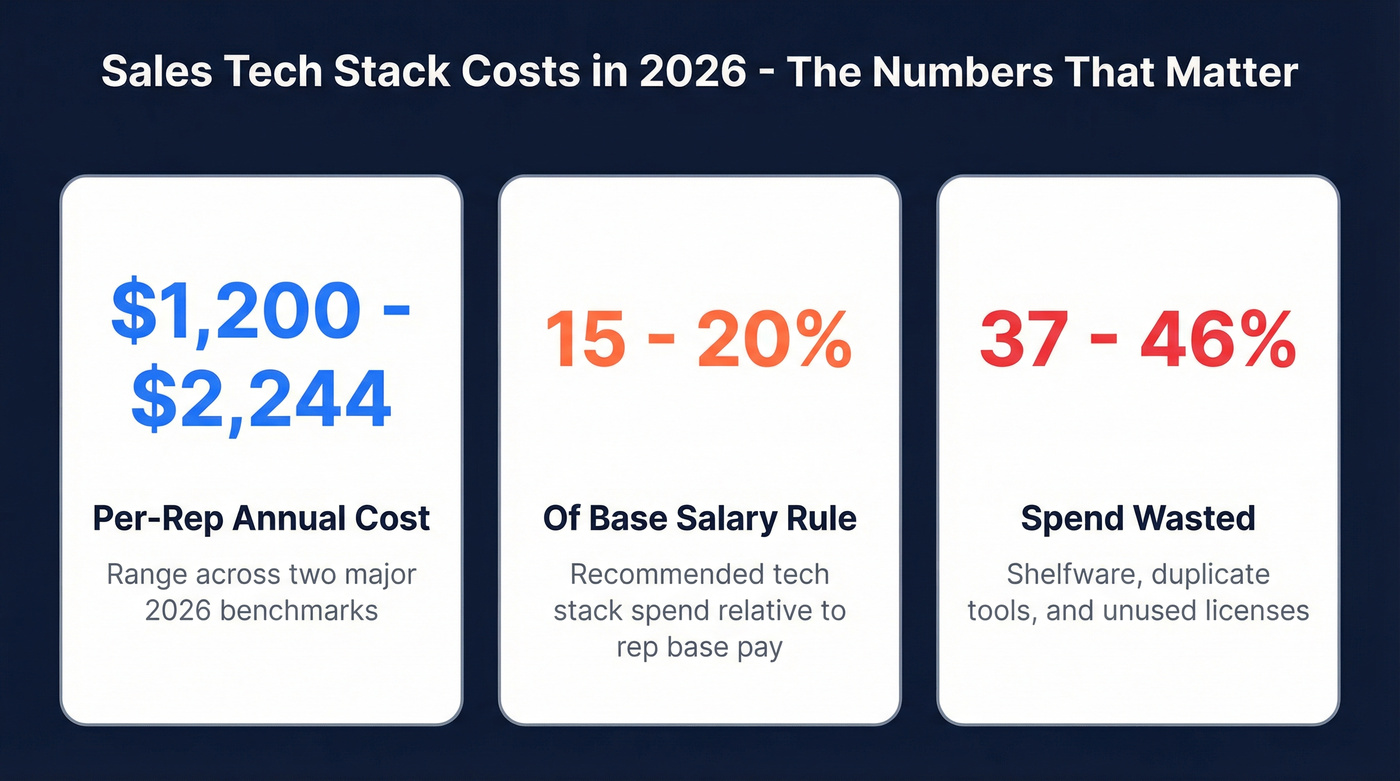

- Per-rep cost range: $1,200-$2,244/year. The low end comes from a January 2026 AInvest benchmark; the high end from an Optifai study of 938 companies averaging 8.3 tools per stack.

- The 15-20% rule: Spend 15-20% of a rep's base pay on their tech stack. For a rep earning $60K base, that's $9K-$12K/year including CRM. For a $100K enterprise AE, $15K-$20K.

- The waste multiplier: 37-46% of sales tech spend goes unused or underutilized. Shelfware, duplicate tools, and "we bought it but nobody uses it."

Sales Tech Stack Spend Per Rep in 2026

Two credible benchmarks land in different places, and both are useful.

Optifai's study (938 companies, Q1-Q3 2025) found the average sales tech stack spend per rep runs 8.3 tools costing $2,244/year ($187/month). Their sample skewed mid-market - 412 companies with 51-200 reps, 198 with 201-500 - so this reflects teams that have layered engagement, conversation intelligence, and enrichment on top of CRM.

AInvest's January 2026 analysis pegged it lower: $1,200/rep/year. That number comes from a narrower definition that excludes tools many teams mentally file under "not sales," like CRM and marketing automation, even though sales lives inside them daily.

Costs are rising. Gartner's February 2026 forecast projects [worldwide software spending at $1.43 trillion](https://www.telecompaper.com/news/global-it-spending-to-reach-usd-615-trillion-in-2026-gartner - 1561162), up 14.7% year-over-year. Zylo's 2026 SaaS Management Index shows 79% of IT leaders faced price increases at their last renewal. Vendors are bundling "AI" into tiers and charging for it - whether you use it or not.

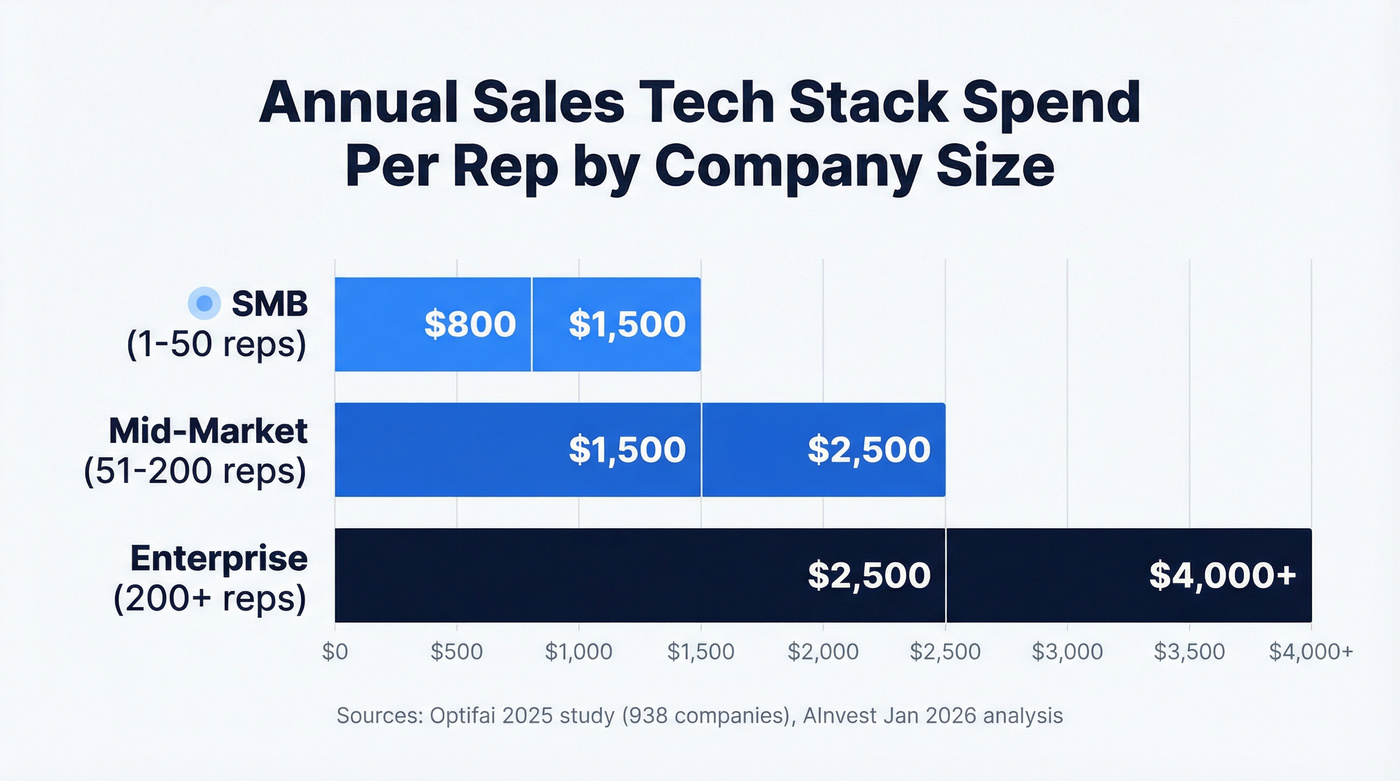

A practical planning range for most teams:

- SMB (1-50 reps): $800-$1,500/rep/year

- Mid-market (51-200 reps): $1,500-$2,500/rep/year

- Enterprise (200+ reps): $2,500-$4,000+/rep/year

If 37-46% of your sales tech spend is wasted, start cutting where the ROI is clearest. Prospeo replaces $15K-$40K/year data tools with 98% accurate emails at $0.01 each - no contracts, no annual lock-in. Teams switching from ZoomInfo book 26% more meetings.

Stop overpaying for data that bounces. Start with 100 free credits.

What Each Sales Tool Category Actually Costs

I've organized the stack by category with published pricing where available and realistic estimates where vendors hide behind annual contracts.

CRM

CRM is typically 30-40% of your total sales stack investment. It's also the tool you'll keep even if you cut everything else.

| Tool | Entry Tier | Pro Tier | Enterprise Tier | Top Tier |

|---|---|---|---|---|

| Salesforce | $25/user/mo | $80/user/mo | $165/user/mo | $330/user/mo |

| HubSpot | Free | $20/user/mo | $150/user/mo | ~$3,600+/mo (bundle) |

| Pipedrive | $14/seat/mo | $39/seat/mo | $59/seat/mo | $79/seat/mo |

| Monday CRM | $12/seat/mo | $17/seat/mo | $28/seat/mo | ~$40-$60/seat/mo |

Salesforce dominates enterprise. At Professional ($80/user/mo), a 50-rep team pays $48K/year before add-ons. Enterprise ($165/user/mo) pushes that to $99K. Unlimited ($330/user/mo) is where "we need it for governance" turns into "we need an admin team just to manage the admin."

HubSpot's free CRM is genuinely useful for startups. The cost spike happens when you move from "CRM" to "CRM + automation + reporting." In practice, many teams end up on bundled tiers that land in the low-thousands per month once you add marketing and ops features.

Pipedrive is the cleanest budget CRM for pipeline-first teams. Most teams settle at Premium ($59/seat/mo) - it's the sweet spot between "too basic" and "paying for features we'll never touch." If you're comparing options, start with the CRM basics and work outward.

Monday CRM works well for teams already living in Monday for project ops. Expect $40-$60/seat/mo if you go upmarket into enterprise-style governance.

Sales Engagement

This is where pricing gets opaque and frustrating.

| Tool | Est. Price | Contract | Hidden Costs |

|---|---|---|---|

| Outreach | ~$100-160/user/mo | Annual | $1K-$8K implementation |

| Salesloft | ~$125-165/user/mo | Annual, 3-seat min | Dialer: $200/user/yr |

| Instantly | ~$30-97/mo flat | Monthly available | Minimal |

Here's the thing: non-transparent pricing is a tax on buyers. You can't comparison-shop, and you can't budget without a call. Outreach and Salesloft don't publish pricing because the sales motion is the product.

Salesloft's minimums and add-ons matter. A 10-rep team can land at $15K-$20K/year once you include the dialer and annual terms.

Instantly flips the model entirely: flat-fee pricing with warmup included. If your outbound motion is email-led and you don't need a full phone + governance suite, it's the best cost-to-output option in this category. (If you're rebuilding your outbound motion, use a sales engagement platform comparison as your baseline.)

Sales Intelligence and Prospecting

This category has the widest spread in the stack. You can spend $0 or $40K+ to solve "find the right people and reach them."

| Tool | Price Range | Data Size | Email Accuracy |

|---|---|---|---|

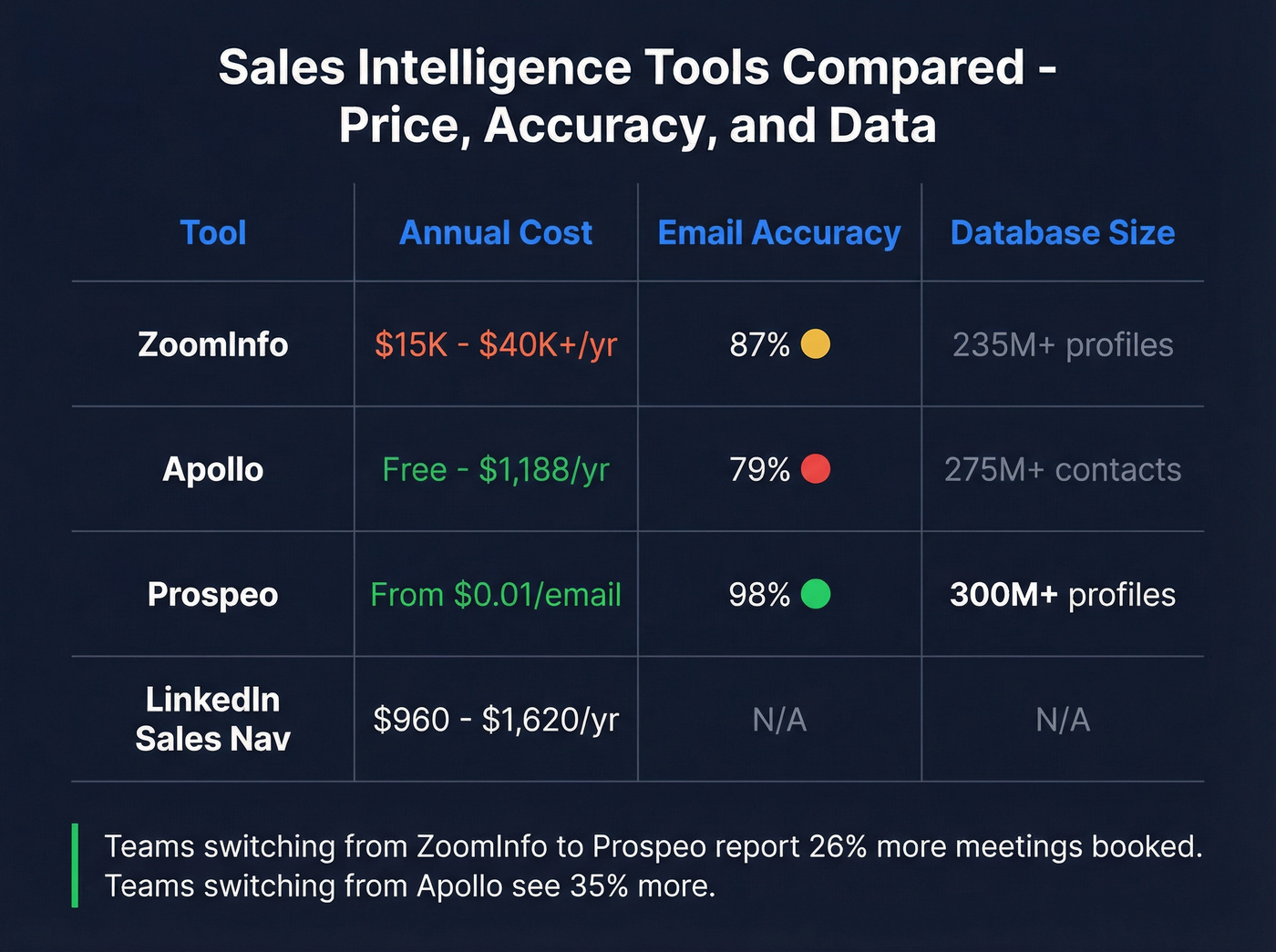

| ZoomInfo | ~$15K-$40K+/yr | 235M+ profiles | ~87% |

| Apollo | Free-$99/user/mo | 275M+ contacts | ~79% |

| LinkedIn Sales Navigator | ~$80-$135/user/mo | N/A | N/A |

Prospeo is the pick when you care most about accuracy, freshness, and cost-per-lead. With 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle (the industry average is six weeks), it delivers enterprise-grade data at roughly $0.01/email. Self-serve, no contracts, and a free tier to test. Teams switching from ZoomInfo report booking 26% more meetings; those switching from Apollo see 35% more.

ZoomInfo is still the heavyweight, and it prices like one. If you'll actually use the platform - intent, workflows, add-ons - it can be worth it. If you only need contact data, it's the most common "we bought too much" line item I see in stack audits. If you're auditing your data vendor, start with a B2B data providers comparison.

Apollo is the default for startups and SMBs because it's fast to adopt and the free tier is generous. The tradeoff is accuracy: deliverability testing puts Apollo's email accuracy around 79%, and that shows up as bounces and wasted sequences when you scale past a few hundred emails a week. (If you want the numbers, see Apollo.io accuracy.)

LinkedIn Sales Navigator sneaks into almost every org without ever being treated like "stack spend." Core runs about $80/user/mo; Advanced is about $135/user/mo. It's not a database replacement - it's a targeting and workflow layer that many teams treat as mandatory.

Conversation Intelligence

Gong owns this category.

It typically runs $100-$150/user/month on annual contracts (roughly $1,200-$1,800/user/year). For a 20-rep team, that's $24K-$36K/year - a real line item, but one that pays back when you use it for coaching, deal inspection, and competitive intel. Organizations implementing advanced revenue intelligence see 32% higher win rates and 28% faster sales cycles. That's why Gong survives budget cuts when "nice-to-have" tools get axed.

Chorus is often bundled into ZoomInfo packages. If you already have a ZoomInfo contract, Chorus can feel "free," but it's only free if you were going to buy the full ZoomInfo bundle anyway. If you're paying for features you don't turn on, bundling is just pre-paid shelfware.

Skip conversation intelligence if you have fewer than 10 reps. You need volume and managers who will actually coach from the data - otherwise it becomes an expensive call recorder.

Data Enrichment and Verification

Enrichment is the glue between prospecting and CRM. When it's weak, you get duplicates, missing fields, and reps doing manual research instead of selling.

Clay is the power tool here. It's credit-based; most teams land around $150-$500/month for meaningful workflows, and it can climb into $1,000-$3,000+/month at higher volumes. Clay's real cost is time: plan on a week of RevOps tinkering before it becomes "set and forget."

Clearbit (now part of HubSpot) is best thought of as a HubSpot-native enrichment layer. In practice, you pay for it through the HubSpot tier you're on and the data features you enable - budget hundreds to low-thousands per month once you're serious about form enrichment and visitor identification.

Prospeo's enrichment returns 50+ data points per contact with a 92% API match rate, and 83% of leads come back with contact data. It's the fastest way to stop reps from "researching" what your systems should already know. If you’re pressure-testing enrichment options, compare against other lead enrichment tools.

Sample Stacks by Company Size

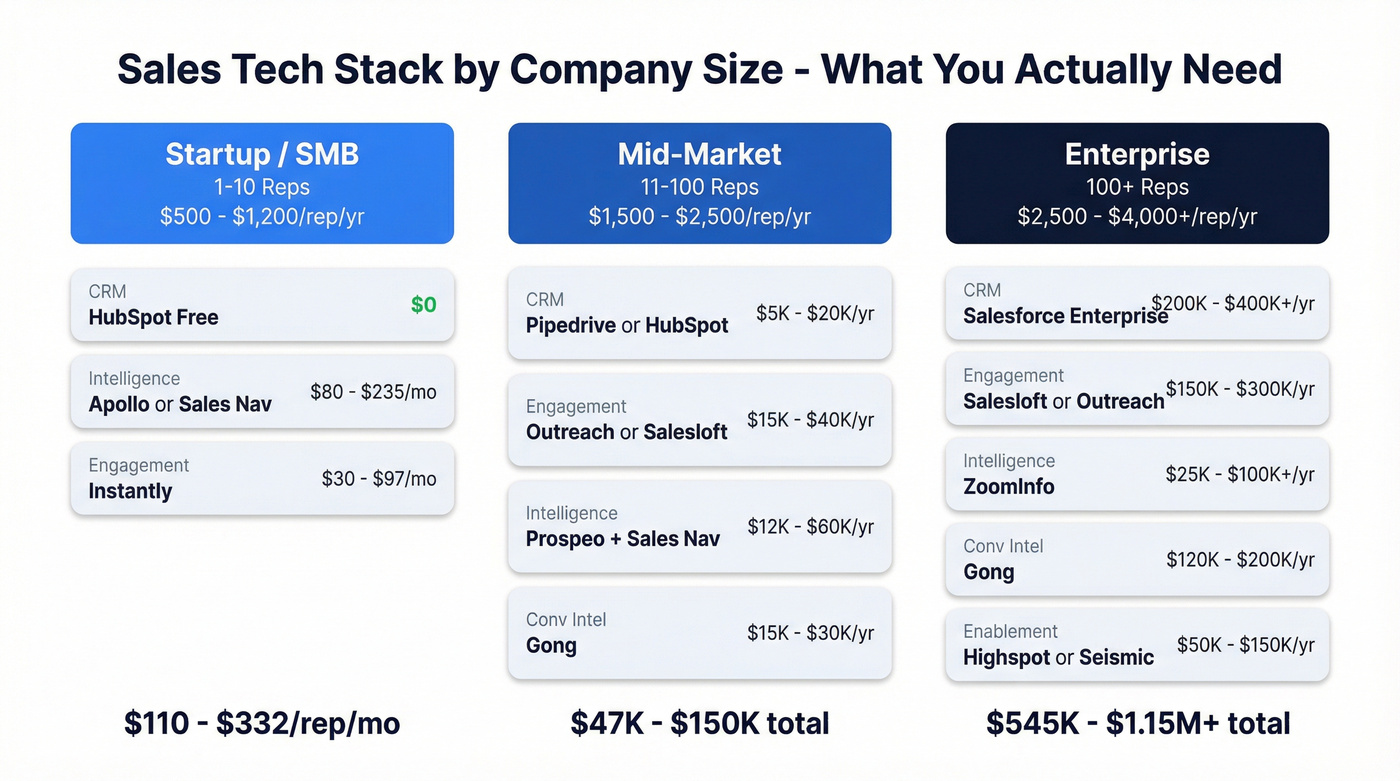

Startup / SMB (1-10 Reps) - ~$500-$1,200/rep/year

| Category | Tool | Monthly Cost |

|---|---|---|

| CRM | HubSpot Free | $0 |

| Intelligence | Apollo (paid) or Sales Navigator | ~$80-$235/rep |

| Engagement | Instantly | ~$30-$97 |

| Total | ~$110-$332/rep |

If you're selling deals under $10K, you don't need an enterprise data contract. You need a simple CRM, a reliable outbound motion, and ruthless focus on list quality. A lean B2B sales stack beats a bloated one here.

Mid-Market (11-100 Reps) - ~$1,500-$2,500/rep/year

| Category | Tool | Annual Est. |

|---|---|---|

| CRM | Pipedrive or HubSpot Starter | $5K-$20K |

| Engagement | Outreach or Salesloft | $15K-$40K |

| Intelligence | Prospeo + Sales Navigator | $12K-$60K |

| Conv. Intel | Gong | $15K-$30K |

| Total | ~$47K-$150K |

At this stage, your sales technology investment starts to compound quickly. Each new tool adds not just license cost but integration, training, and maintenance overhead that scales with headcount - and the compounding is what catches people off guard.

Enterprise (100+ Reps) - ~$2,500-$4,000+/rep/year

| Category | Tool | Annual Est. |

|---|---|---|

| CRM | Salesforce Enterprise | $200K-$400K+ |

| Engagement | Salesloft or Outreach | $150K-$300K |

| Intelligence | ZoomInfo ($25K-$100K+) | $25K-$100K+ |

| Conv. Intel | Gong | $120K-$200K |

| Enablement | Highspot/Seismic | $50K-$150K |

| Total | ~$545K-$1.15M+ |

At enterprise scale, the stack becomes a seven-figure budget line. You're paying for governance, analytics layers, enablement, and the people required to run it all.

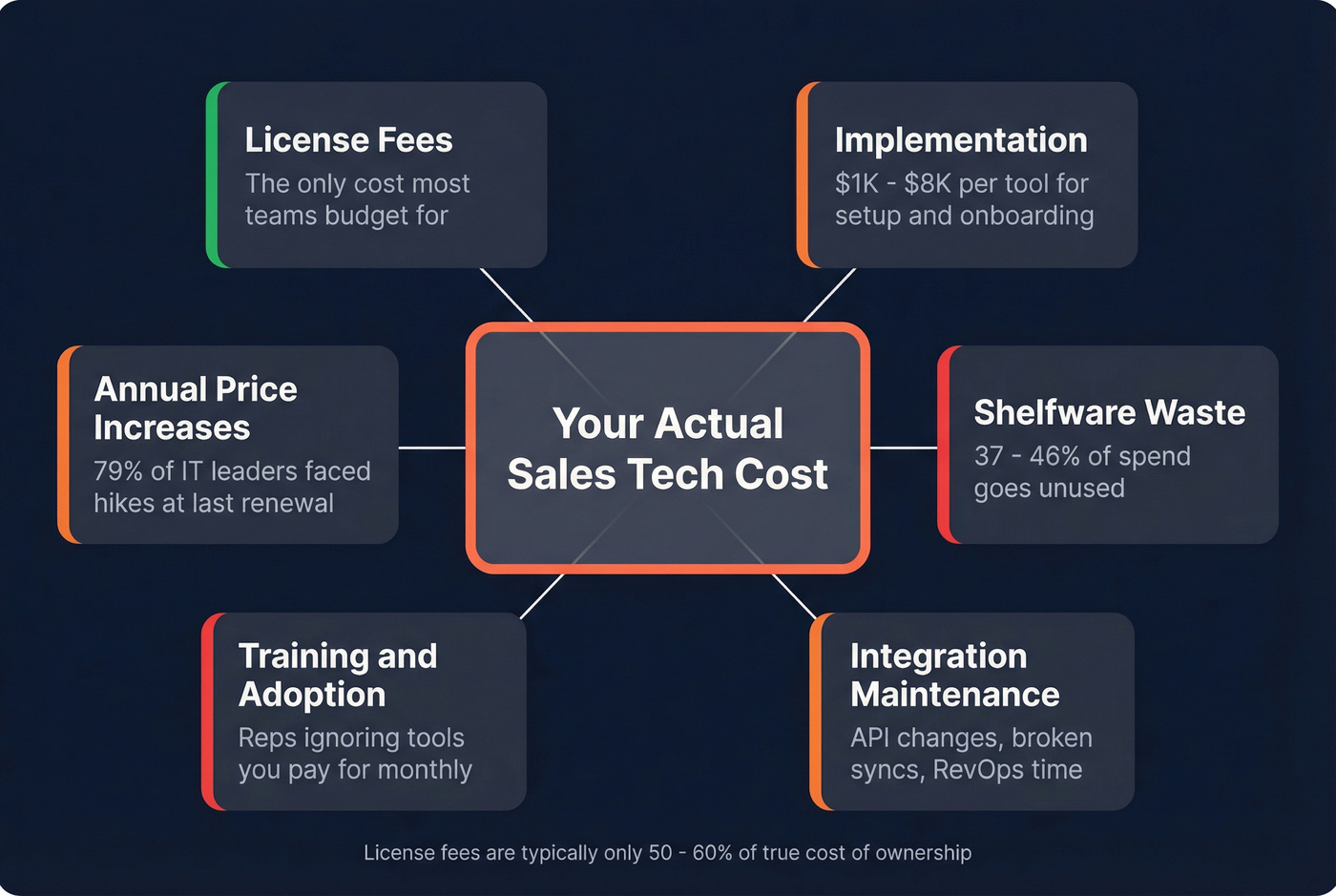

The Hidden Costs Nobody Budgets For

Integration and Implementation

Outreach implementation runs $1,000-$8,000 depending on scope. CRM integrations - Salesforce to engagement, intelligence to CRM, conversation intelligence to reporting - routinely add thousands more. I've watched teams spend $15K-$25K just getting tools to talk to each other. If you're trying to standardize this work, use a CRM integration playbook.

The ugly stat: only 28% of sales tools are integrated inside organizations. That means most stacks aren't stacks. They're piles. And every disconnected tool creates manual work, duplicate data, and "why doesn't this field match?" meetings.

Training and Onboarding

U.S. companies spend over $15 billion annually on sales training. Standard programs run $400-$4,000 per person; customized corporate training can exceed $10,000 per person.

The bigger cost isn't initial training - it's everboarding. Refresher courses run $500-$1,500 per person annually, and follow-up coaching costs $200-$500/hour. Most teams budget for onboarding and forget that training is a recurring expense that never stops.

Adoption Failure

Sales teams spend only 16% of their workday engaging with customers. The rest is admin, internal coordination, and tool-wrangling.

Companies waste an average of $313,000 on sales tools that aren't fully adopted. The root cause is simple: reps get confused about which tool to use for which task, so they default to email + CRM and ignore the rest. Don't measure adoption by logins. Measure it by daily actions: sequences created, calls logged, notes captured, contacts enriched, opportunities updated. A rep who logs in and does nothing isn't "using" the tool - you're just paying for a dashboard view.

Tool Overlap and Waste

73% of teams waste $2,340/rep/year on overlapping tools. The most common overlaps: email automation alongside a sales engagement platform (35%), conversation intelligence duplicating recording tools (28%), and CRM features overlapping with standalone "AI CRM" tools (18%).

Zylo's 2026 data puts SaaS license utilization at 54% - meaning 46% of licenses go underused. That's not optimization territory. That's "cut it or justify it" territory.

Bad Data - The Cost You Can't See on the Invoice

30% of email addresses go stale within a year. Over half of CRM managers admit their data accuracy falls below 80%. And 67% of sales professionals waste over 4 hours a week on manual research that should be handled by systems. If you want to quantify this, start with B2B contact data decay.

It gets worse. Employees waste an average of 12 hours per week chasing data trapped in silos - that's not a tooling problem, it's an integration + data hygiene problem, and it quietly inflates what you spend on your stack because you're paying both for software and for humans to compensate for software that isn't doing its job.

EY research shows companies lose 1-5% of realized EBITA annually to revenue leakage, and bad data is a primary driver. When reps email dead addresses, call disconnected numbers, and pitch people who changed roles months ago, you're not just wasting time - you're burning deliverability and missing pipeline. A simple fix is to operationalize data quality checks (not just buy more tools).

This is where data freshness becomes a cost lever, not a feature checkbox.

Your sales intelligence line item doesn't need to be your biggest stack expense. Prospeo delivers 300M+ profiles, 125M+ verified mobiles, and a 7-day data refresh for roughly 90% less than ZoomInfo. Self-serve, cancel anytime.

Slash your per-rep tech costs without sacrificing data quality.

How to Cut Your Sales Tech Stack Spending by 30-50%

62% of businesses are actively trying to reduce their number of tools. Here's the framework that actually works.

Start with the audit nobody wants to do. Pull usage data for the last 90 days. If utilization is below 40%, that tool is on probation.

Measure activity, not access. Logins are meaningless. Track actions that map to outcomes: sequences sent, calls placed, meetings booked, records enriched, opportunities advanced.

Map overlaps ruthlessly. The most common waste is paying twice for the same workflow step. If your engagement platform already runs sequences, you don't need a separate email automation tool "because marketing uses it."

Target 4-6 integrated tools, not 8-12 point solutions. BCG found integrated stacks drive up to 5% higher sales growth and 5%+ cost savings by reducing integration overhead and improving adoption. This is also where you fix the pain that 68% of sales leaders cite: tool overlap, data silos, and integration challenges. Adobe rationalized 2,600+ applications down to 400 standardized tools; Isos Technology consolidated sales + marketing tech and saw a 30% increase in closed deals plus a 19% rise in MQLs.

The consolidation checklist:

- Audit usage data (actions, not just licenses)

- Map every tool to a specific workflow step

- Identify overlapping capabilities across tools

- Score each tool: adoption rate x business impact

- Cut the bottom 30% and redistribute budget to training on what remains

- Re-audit quarterly (stack sprawl always comes back)

If you're spending $2,244/rep/year across 8.3 tools and you consolidate to 5 tools with real adoption, you'll usually save 30-40% on licenses - and reps will move faster because they're not guessing which tab to click.

2026 Trends Changing the Cost Equation

Four forces are reshaping what you'll pay - and what you'll get - over the next 12-18 months. Understanding them matters for any conversation with your CFO about sales technology investment.

AI SDR tools are compressing time costs. Teams using AI SDR tools save meaningful time, and 40% save 4-7 hours per week per rep. That doesn't eliminate SDRs; it changes coverage math and raises expectations for output per head. If you're evaluating tooling here, start with an AI sales agent rubric.

Platform consolidation is accelerating. 72% of enterprise sales orgs prefer platform approaches over best-of-breed point solutions. The winners are tools that reduce integration work and centralize data, not tools that add yet another dashboard.

SaaS price inflation is now the default. Software spending is growing 14.7% in 2026. Vendors are packaging AI into higher tiers and pushing renewals upward. Assume your stack gets more expensive every year unless you actively prune it.

Digital selling isn't optional anymore. 80% of B2B sales interactions now happen on digital channels, and Millennials + Gen Z make up 64% of business buyers. That's why engagement, data, and workflow tools keep expanding - your buyers live online, so your stack has to as well. (If you need the operating model, see digital selling.)

FAQ

What's the average cost of a sales tech stack for a small business?

Most SMBs spend $800-$1,500 per rep per year on sales tools. Using the 15-20% of base pay benchmark, a rep earning $60K supports $9K-$12K/year including CRM. Small teams stay well below that by avoiding enterprise contracts and keeping the stack to 3-4 tools.

What's the biggest source of waste in a sales tech stack?

Overlapping tools drain $2,340/rep/year on average, affecting 73% of teams. The second-biggest waste is bad data - stale records create bounces, wasted sequences, and hours of manual research. A 7-day data refresh cycle and quarterly CRM audits are the fastest fixes.

Is it cheaper to consolidate tools or buy best-of-breed?

Consolidation saves most teams money. BCG research shows integrated stacks deliver up to 5% higher sales growth and 5%+ cost savings by reducing integration overhead and improving adoption. Best-of-breed only wins when you have dedicated RevOps capacity to manage integrations across every tool.

How do I calculate ROI on my sales tech stack?

Use: (Revenue Lift + Time Saved Value - Tool Cost) / Tool Cost x 100%. Value time saved at $75/hour per rep. A tool saving 5 hours/week recovers $19,500/year in selling time per rep - compare that against license + implementation + training costs to build a case finance will approve.

How do I avoid paying for bad data?

Buy from vendors with published accuracy rates and refresh frequencies - if they won't share those numbers, walk away. Then measure outcomes monthly: bounce rate, connect rate, and meetings booked. Enforce CRM hygiene with dedupe rules, enrichment on record create/update, and quarterly audits so your database doesn't decay into a junk drawer.