Digital Selling in 2026: The Strategy Guide for B2B Sales Teams and Digital Product Creators

Two people Google "digital selling" right now. One is a VP of Sales trying to figure out why reps can't get prospects to reply. The other is a creator wondering if selling a Canva template pack can actually pay rent. Both are right to search. Both will get wildly different answers from the same term.

The B2B ecommerce market is projected to hit $36 trillion in 2026, growing at 14.5% CAGR. Digital products generate $2.5T+ in annual value. Whether you're selling enterprise software through multi-threaded deals or a $29 course on email marketing, the playbook is digital now - over 90% of B2B companies have shifted to virtual sales models since 2020. Companies without a strategy for selling digitally lose an estimated 15-25% of potential deals, not to competitors, but to inaction.

Here's my hot take: most teams are over-tooled and under-strategized. They've got $50K/year in software and no clear buyer journey map. Fix the strategy first. The tools are the easy part.

What You Need (Quick Version)

If you're a B2B sales leader:

- A CRM your reps will actually use (HubSpot or Pipedrive for most teams)

- A verified data platform with high email accuracy and fresh data - stale contacts burn your sending domain

- A sales engagement tool (Outreach, Salesloft, or Instantly for smaller teams)

- Buyer intent data layered on top so you're reaching people who are actually in-market (intent data layered on top so you're reaching people who are actually in-market)

- Digital Sales Rooms on your radar - this is the emerging category that'll reshape how deals close

If you're selling digital products:

- Pick one platform and commit: Payhip if you're starting from zero, Gumroad if you already have an audience

- Build an email list before you launch anything. Not after. Before.

- Stop buying MRR courses. The people selling "how to sell digital products" courses are making money from selling courses, not from digital products.

- Expect 6-12 months of consistent work before meaningful revenue. Anyone telling you otherwise is selling you something.

What Is Digital Selling?

The term covers two distinct worlds that share almost nothing except the word "digital." In practice, it's the shift from "I'll call you and pitch" to "I'll show up where you're already researching, provide value before you know my name, and make it easy for you to buy when you're ready."

B2B digital selling is a methodology. It's how sales teams use data platforms, social channels, content, and AI to engage buyers who've already done 70% of their research before they'll talk to a rep. It's about meeting buyers in their workflow, not interrupting it.

Digital product selling is commerce. It's how creators and entrepreneurs sell templates, courses, ebooks, software, and memberships through online platforms. The "digital" here refers to what you're selling, not just how you're selling it.

These are fundamentally different disciplines, but they share a core truth: 61% of B2B buyers now prefer a rep-free buying experience, per Gartner's 2025 survey. On the product side, 67% of customers prefer self-service over speaking to a company representative. The buyer - whether they're a CTO evaluating security software or a freelancer buying a Notion template - wants control over their own journey.

73% of B2B buyers actively avoid suppliers who send irrelevant outreach. That stat alone should reshape how you think about selling.

B2B Digital Selling - The Methodology

The Modern B2B Buyer Journey

Here's the thing: your buyer has already made up their mind before you get a chance to pitch.

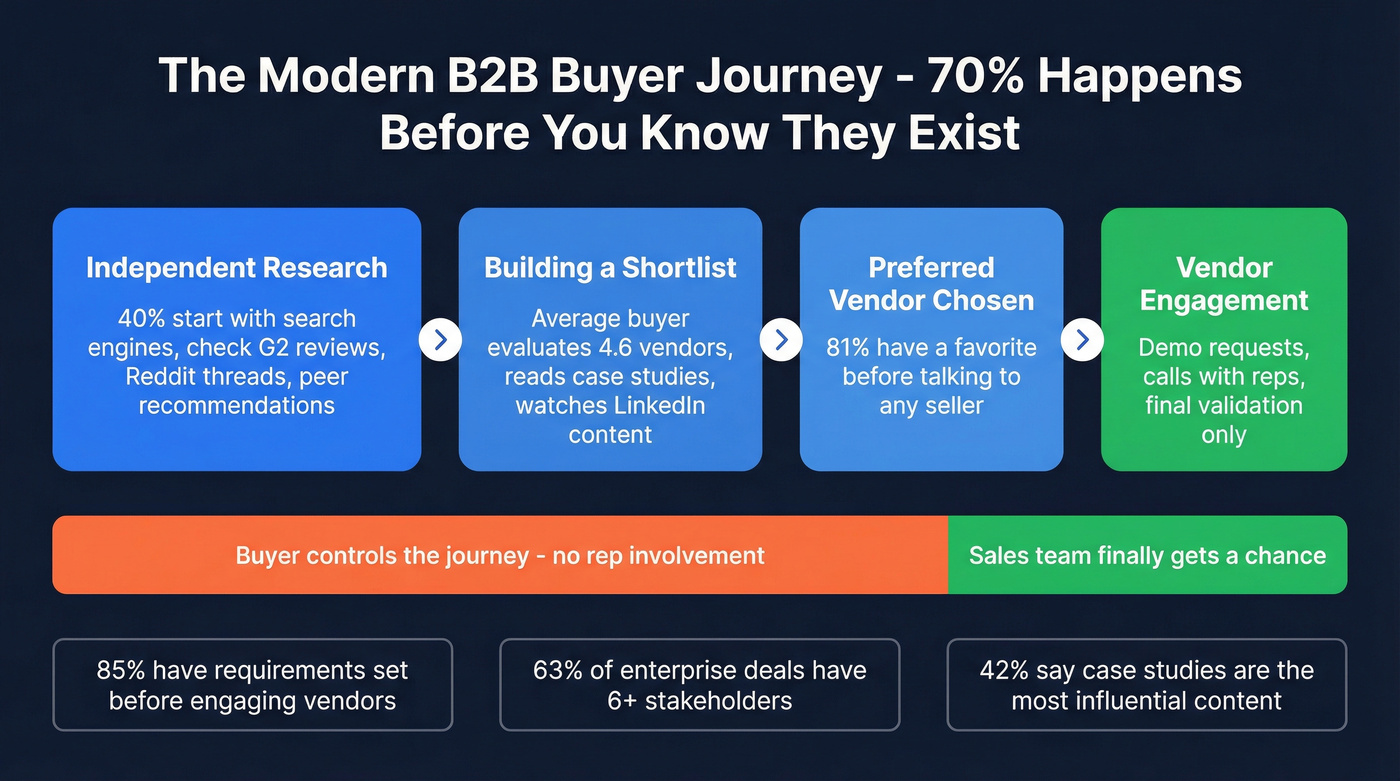

In 81% of cases, the buyer has chosen a preferred vendor before talking to sellers. 85% of buying teams have purchase requirements mostly or completely set before engaging vendors. They spend roughly 70% of their journey building a shortlist and identifying a favorite. By the time they fill out your demo request form, you're either already winning or you're column fodder.

The average buying team evaluates 4.6 vendors. In enterprises with 10,000+ employees, 63% of deals involve six or more stakeholders. This isn't one person making a gut call - it's a committee building consensus through shared research (buying committees work).

What content moves the needle? 42% of B2B buyers say case studies and success stories are the most influential content type. Not whitepapers. Not product sheets. Real stories about real companies solving real problems.

And where does that research start? 40% begin with search engines. Most decision-makers use 10+ distinct channels with suppliers along the journey. They're reading your blog, checking G2 reviews, asking peers on Slack, watching your CEO's posts, and scanning Reddit threads about your product - all before they ever click "Book a Demo."

The implication is clear: if your digital presence is thin, inconsistent, or generic, you're losing deals you never knew existed. 69% of B2B buyers report inconsistencies between information on a vendor's website and what sellers actually tell them. That gap kills trust before the first call.

Social Selling vs Traditional Selling - Why Digital Channels Win

Social selling outreach now delivers 42% response rates - nearly double that of email. That's not a rounding error. That's a fundamental shift in where buyers are willing to engage. The gap between social selling vs traditional selling has never been wider: cold calls connect at roughly 2-3%, while a warm social touch backed by relevant content gets a reply nearly half the time.

53% of shoppers discover products on social platforms, up from 46% in 2023. For Gen Z buyers entering B2B purchasing roles, that number jumps to 76%. Companies with consistent social selling processes are 40% more likely to hit revenue goals (social selling statistics).

But social selling isn't "post motivational quotes and hope someone DMs you."

It's systematic: sharing relevant insights, engaging with prospects' content before pitching, building credibility through expertise rather than cold outreach. In our experience, the teams that do this well treat social as a research and warming channel, not a broadcast channel. Understanding the distinction between social selling vs social media marketing is critical - social media marketing broadcasts to an audience, while social selling targets specific prospects with personalized engagement designed to start conversations (how to do social selling).

Async video is another underused channel. Tools like Loom and Vidyard let reps send personalized video messages that often outperform text-only emails for engagement. A 90-second walkthrough of how your product solves a specific prospect's problem is worth more than a 500-word email.

The contrast with traditional outreach is stark. 55% of buyers say AI-generated outreach makes them less likely to engage. A thoughtful comment on a prospect's post about their industry challenge? That gets remembered.

Digital Sales Rooms - The Category Nobody's Talking About

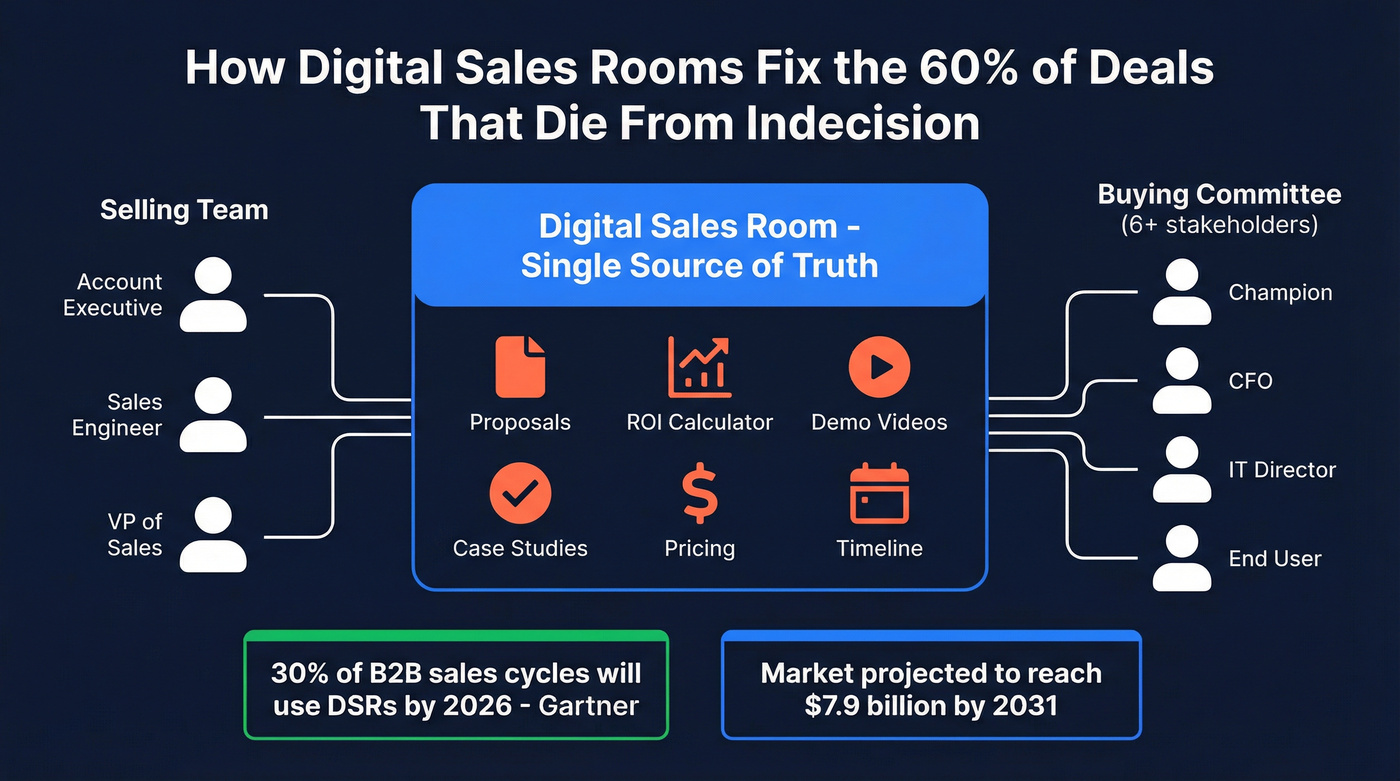

A Digital Sales Room (DSR) is a branded microsite created for each deal. Instead of scattering proposals, case studies, pricing docs, and follow-up emails across a dozen threads, everything lives in one shared space. Both the selling team and the buying committee can access it, collaborate in it, and track engagement through it.

Why does this matter? Because 60% of deals die from indecision. Not from a competitor winning - from the buying committee failing to align. DSRs attack this problem directly by giving every stakeholder a single source of truth.

Gartner predicted 30% of B2B sales cycles will run through Digital Sales Rooms by 2026. The market is projected to reach $7.9 billion by 2031.

| Tool | G2 Rating | Est. Price | Best For |

|---|---|---|---|

| Trumpet | 4.8/5 | ~$30-100/user/mo | Overall UX |

| Aligned | 4.7/5 | Free tier available | Fast setup |

| GetAccept | 4.6/5 | ~$30-100/user/mo | Proposals + e-sign |

| DealHub.io | 4.6/5 | Not public | Quote-to-revenue |

| Allego | 4.5/5 | Not public | Video-first selling |

Trumpet and Aligned offer free tiers for small teams - start there to test the concept before committing budget.

If you're running complex deals with 3+ stakeholders, DSRs solve a real coordination problem. If you're selling a $5K/year product to a single buyer, skip this for now. But watch this space.

AI in Digital Sales - What Actually Works

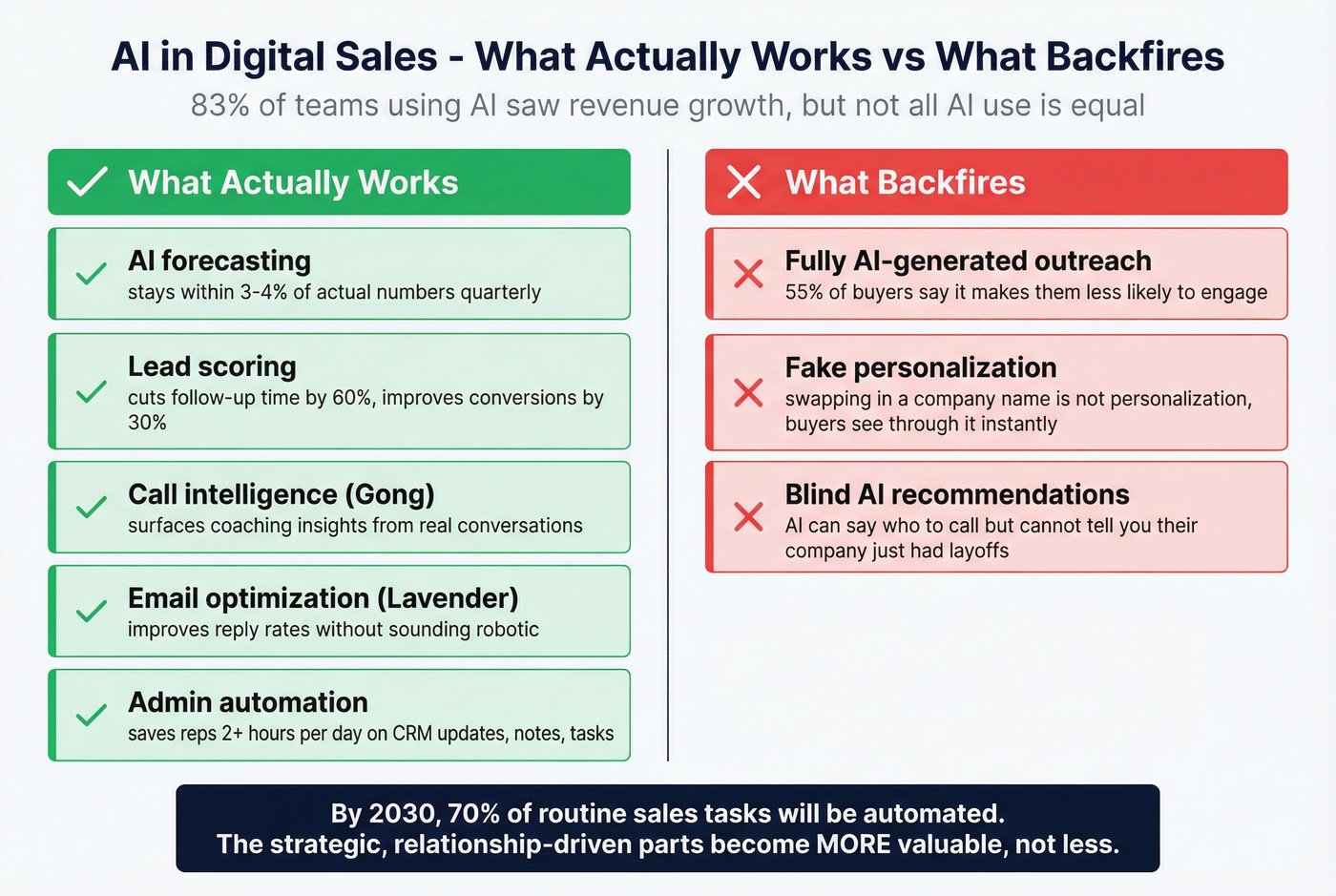

83% of sales teams using AI saw revenue growth, compared to 66% without. Sales professionals using AI save up to 2 hours per day on admin work. Revenue teams using AI close deals 51% faster. The numbers are compelling.

But here's where it gets complicated.

What actually works:

- AI-powered forecasting that stays within 3-4% of actual numbers quarterly - genuinely useful for pipeline management

- Lead scoring that cuts follow-up time by 60% and improves conversion rates by 30% (lead scoring)

- Call intelligence tools like Gong that surface coaching insights from real conversations

- Email optimization tools like Lavender that improve reply rates without making outreach feel robotic

- Admin automation - CRM updates, meeting notes, task creation - saving reps 2+ hours daily

What backfires:

- Fully AI-generated outreach. 55% of buyers say it makes them less likely to engage. They can tell.

- AI "personalization" that's just a merge field with a company name swapped in. That's not personalization - it's a template with lipstick (AI cold email personalization mistakes)

- Over-relying on AI recommendations without human judgment. AI can tell you who to call. It can't tell you that the prospect's company just had layoffs and now isn't the time.

By 2030, Gartner predicts 70% of routine sales tasks will be automated. The key word is "routine." The strategic, relationship-driven, judgment-heavy parts of selling become more valuable, not less. The reps who'll thrive are the ones using AI to eliminate busywork so they can spend more time on the conversations that actually close deals.

Real talk: 29% of teams already produce over half their content with AI. The genie isn't going back in the bottle. The question is whether you're using AI as a crutch or as a multiplier.

Your digital selling strategy is only as good as the data behind it. 73% of buyers ignore irrelevant outreach - and stale contacts guarantee irrelevance. Prospeo gives you 300M+ profiles with 98% email accuracy, buyer intent across 15,000 topics, and a 7-day refresh cycle so you're always reaching real people who are actually in-market.

Stop burning your domain on dead emails. Start reaching live buyers.

The B2B Digital Selling Tool Stack

The Foundation Layer - Data and Prospecting

97% of sales teams use at least one tool for selling digitally. Two-thirds use four to ten. But sales reps still spend just 28% of their week actually selling - the rest is admin, research, data entry, and chasing down contact information that turns out to be wrong.

The foundation layer - your data and prospecting tools - determines whether everything else in your stack works or fails. Bad emails burn your sending domain. Wrong phone numbers waste rep time. Stale data means you're pitching people who left the company six months ago (B2B contact data decay).

| Tool | Price | Email Accuracy | Best For |

|---|---|---|---|

| Apollo.io | $49/user/mo | ~79% | All-in-one prospecting |

| Sales Navigator | $90/mo | N/A (no export) | Account research |

Prospeo is where I'd start for any team that cares about data accuracy. The platform covers 300M+ professional profiles with 98% verified email accuracy backed by a 5-step verification process - proprietary infrastructure, catch-all handling, spam-trap removal, and honeypot filtering. The 7-day data refresh cycle is the real differentiator: the industry average is six weeks. That freshness gap compounds fast when you're running outbound at scale.

The results speak for themselves: Snyk's 50-person AE team cut bounce rates from 35-40% to under 5% and increased AE-sourced pipeline by 180% after switching. That's the difference accurate data makes at scale.

Apollo.io ($49/user/mo, 4.7/5 on G2) is the obvious pick for teams that want prospecting and engagement in one tool. The database is massive, the sequencing is solid, and the free tier is generous. Where it falls short: email accuracy runs closer to 79%, which means more bounces and more domain risk at scale.

LinkedIn Sales Navigator ($90/mo) remains the gold standard for account mapping and social selling research. It's not a data export tool - it's a research and relationship tool. Pair it with a data platform for verified contact info (email lookup tools).

You read it above: 81% of buyers pick a vendor before ever talking to sales. That means your reps need to show up earlier with sharper targeting. Prospeo's 30+ filters - intent data, job changes, technographics, headcount growth - let you find and engage buyers while they're still building their shortlist. At $0.01 per email, it costs less than the coffee your rep drinks while writing that cold email.

Reach buyers during their research phase, not after they've already decided.

The Engagement Layer - CRM and Outreach

CRMs boost sales by 29% and productivity by 34%. If you don't have one, stop reading this article and go set one up. If you have one your reps hate, that's almost worse than not having one at all.

| CRM | Starting Price | Best For |

|---|---|---|

| HubSpot Sales Hub | $20/user/mo | SMB, marketing alignment |

| Pipedrive | $14/seat/mo (annual) | Pipeline-focused teams |

| monday CRM | $12/seat/mo (annual) | Visual workflow lovers |

| Salesforce | $25+/user/mo | Enterprise, customization |

For outreach and sequencing, Outreach and Salesloft run ~$100-150/user/mo on custom pricing. They're the enterprise standard. For smaller teams, Apollo's built-in sequences or tools like Instantly ($30-97/mo) get the job done without the enterprise price tag.

I've seen teams spend $150/user/mo on Outreach while feeding it contact data from a $0 scraping tool. That's like putting premium fuel in a car with a cracked engine block. Fix the data first.

The Intelligence Layer - AI and Analytics

Keep this layer lean until you've nailed the foundation and engagement layers.

Gong.io (4.8/5 on G2) is the conversation intelligence leader. It records calls, surfaces patterns, and gives managers coaching insights they'd never catch manually. Expect $100-150/user/mo for mid-market teams.

Lavender ($29/user/mo, 4.8/5 on G2) analyzes your emails in real-time and suggests improvements. Cheap enough to be a no-brainer for any team doing cold outreach.

Clari (4.6/5 on G2) handles revenue forecasting and pipeline inspection. If your forecast accuracy is a problem - and it probably is - Clari's AI stays within 3-4% of actual numbers quarterly. Typically $50-100/user/mo.

AI on top of bad data just helps you fail faster.

B2B Digital Selling Frameworks

Not every deal needs the same approach. Three frameworks have stood the test of time, and knowing when to deploy each one separates good sellers from great ones.

| Framework | Creator | Core Idea | Best For |

|---|---|---|---|

| SPIN Selling | Neil Rackham | Question-led discovery | Complex, consultative |

| Challenger Sale | Dixon & Adamson | Teach-Tailor-Control | Commoditized markets |

| MEDDIC | PTC (1990s) | Qualification rigor | Enterprise pipeline |

SPIN Selling structures discovery around four question types: Situation, Problem, Implication, Need-payoff. IBM and Microsoft use variations of this. It works best when the buyer doesn't fully understand their own problem yet - your questions lead them to the insight. In a digital context, SPIN translates to content that asks provocative questions and lets the buyer self-diagnose before you ever get on a call.

The Challenger Sale flips the script: instead of asking what the buyer needs, you teach them something they didn't know. Salesforce and Oracle use Challenger principles. This framework thrives in markets where buyers think they understand their options but are actually missing a critical insight.

MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) is pure qualification discipline. It doesn't tell you how to sell - it tells you whether a deal is real. For enterprise teams running $100K+ deals, MEDDIC prevents the pipeline bloat that kills forecasting accuracy.

Look, most teams don't need to pick just one. Use Challenger positioning in your content and social selling, SPIN in discovery calls, and MEDDIC to qualify whether the deal deserves your time. The frameworks are complementary, not competing.

Selling Digital Products Online

Know Your Buyer Before You Build

Before you pick a product type or platform, answer one question: who is this for?

"Freelancers" is too broad. "Freelance graphic designers who need client proposal templates" is a product. The more specific your buyer, the easier your marketing, your pricing, and your product decisions become. Browse Reddit, Facebook groups, and Quora for the exact language your audience uses to describe their problems - then build the thing that solves one of them (buyer persona examples).

Types of Digital Products That Actually Sell

Not all product types are created equal. Here's what actually moves:

- Templates and tools - Canva templates, Notion dashboards, spreadsheet models. Low price point ($5-49), high volume potential, minimal support burden.

- Online courses - The highest revenue ceiling but also the most work. Expect 3-6 months to build a quality course.

- Ebooks and guides - Low effort to create, but the market is saturated. Works best as a lead magnet or entry point to a higher-priced offer.

- Software and SaaS - The holy grail of recurring revenue, but requires technical skills or a development budget.

- AI prompts and tools - ChatGPT prompt packs, Midjourney templates, AI workflow guides. The newest category, growing fast as AI adoption spreads. Low creation cost, high perceived value if you target a specific use case.

- Stock assets - Photos, icons, fonts, audio. Passive once created, but discovery is the challenge.

- Memberships and communities - Recurring revenue with ongoing content obligations. The retention game is harder than the acquisition game.

The pattern that works best for beginners: start with a simple template or tool ($10-29), use it to build an email list, then upsell to a course or membership. Trying to launch with a $497 course and no audience is the fastest path to disappointment.

Platform Comparison - Pricing, Fees, and Best-For

The platform you choose matters less than you think - until it doesn't. Transaction fees compound fast at scale, and switching platforms mid-growth is painful.

| Platform | Monthly Cost | Transaction Fee | Best For |

|---|---|---|---|

| Gumroad | $0 | 10% per sale | Simplicity, beginners |

| Payhip | $0 / $29 / $99 | 5% / 2% / 0% | Budget-conscious |

| Stan Store | $29 | 0% | Creators, link-in-bio |

| Lemon Squeezy | $0 | 5% + 50c | Global tax compliance |

| Sellfy | $29 | 0% | All-in-one storefront |

| Teachable | $39 | 0% (paid plans) | Course creators |

| Podia | $39 | 5% (basic) | Courses + community |

| SamCart | $79 | 0% | Conversion optimization |

For beginners with no audience: Payhip's free plan. You'll pay 5% per sale, but that's 5% of revenue you wouldn't have otherwise. Graduate to the $29/mo plan when 5% starts hurting.

For creators with an existing audience: Gumroad's simplicity is hard to beat, but that 10% fee adds up. If you're doing $5K+/mo in sales, Sellfy or Stan Store at $29/mo with 0% fees saves you $500/mo.

For course creators: Teachable at $39/mo gives you the best student experience and course-building tools. SamCart at $79/mo is overkill unless you're obsessed with checkout optimization - and honestly, you should be, since 17% of buyers leave because checkout is too complicated.

For international sellers: Lemon Squeezy handles merchant-of-record responsibilities including global tax compliance. If you don't want to think about VAT, this is your answer.

Pricing your product: Price your first digital product between $10-29. Under $10 feels disposable; over $50 requires significant trust you haven't built yet. Start at $19, watch your conversion rate, and adjust.

Conversion Benchmarks You Should Know

The global average ecommerce conversion rate sits at 1.9-2%. Shopify stores average 2.5-3%. The top 10% hit 4.7%+.

Desktop converts at 3.9% versus mobile at 1.8%. That gap is enormous and most digital product sellers ignore it. If your checkout isn't optimized for mobile, you're leaving half your revenue on the table.

Cart abandonment averages 70.22%. On mobile, it's 73-75%. The #1 reason? 48% of shoppers abandon due to unexpected costs at checkout. Hidden fees, surprise taxes that weren't disclosed upfront - these kill conversions.

Here's my rule of thumb: if you're converting below 2%, you have a UX problem, not a traffic problem. Don't spend more on ads until you've fixed your checkout flow, your pricing transparency, and your mobile experience.

Visitors who interact with user-generated content - reviews, testimonials, community posts - convert at 102.4% higher rates. That's not a typo. Social proof isn't a nice-to-have; it's the single highest-leverage conversion optimization you can make.

And slow websites increase abandonment by 75%. If your product page takes more than 3 seconds to load, you're hemorrhaging sales before anyone even sees your offer.

Common Digital Selling Mistakes

B2B Mistakes

1. Ignoring data quality. Bad data doesn't just waste time - it burns your sending domain. Every bounced email signals to inbox providers that you're a spammer. Real-time email verification and spam-trap filtering before outreach isn't optional; it's infrastructure (verify an email address).

2. Over-automating with AI. 55% of buyers say AI-generated outreach makes them less likely to engage. Use AI for research, prioritization, and first drafts - then add the human layer that makes outreach feel like it was written by someone who actually read the prospect's last quarterly earnings call.

3. Skipping multi-threading. 76% of B2B deals involve three or more decision-makers. If you're only talking to one person, you're one reorg away from a dead deal. Map the buying committee early. Build relationships across the org before your single-threaded champion goes on vacation and the deal stalls.

4. Random acts of outreach. Posting on social media isn't a strategy. Sending emails isn't a strategy. A real digital selling approach is a coordinated effort across channels, informed by data, personalized to the buyer's journey stage (email outreach strategy).

Digital Product Mistakes

5. Promoting too many offers at once. Confused buyers don't buy. Pick one product, one audience, one message.

6. Believing the product sells itself. This is the most dangerous myth in digital product selling. It doesn't matter how good your template is if nobody knows it exists. Marketing - especially email marketing - is the game. One Reddit creator put it perfectly: "Marketing is everything."

7. Complicated checkout. 17% of buyers leave because the checkout process is too long or complicated. Every extra field, every unnecessary step, every surprise fee is a leak in your funnel.

8. No email list. Build your email list before you have a finished product. An email list is the only audience you own. Social algorithms change. Platform reach declines. Your email list is yours.

9. Falling for MRR course grifts. The Master Resell Rights ecosystem is designed to extract money from beginners. The people making money are selling the courses about selling courses. It's a closed loop. If someone's selling you "passive income" for $497, ask yourself why they need your $497 if the income is so passive.

The Reality Check

Let's be honest about what digital selling actually looks like for most people.

On the B2B side, the biggest frustration we hear from practitioners: the gap between "best practices" and the reality of getting a CFO to respond to anything that isn't a warm introduction. LinkedIn + account-based marketing + content marketing is the most commonly recommended approach, but it takes months of consistent effort before pipeline impact materializes. Companies implementing digital sales strategies saw a 20% increase in customer satisfaction and 15% rise in sales conversion rates - but those numbers come from sustained execution, not a two-week experiment.

On the digital products side, the skepticism is even sharper. One Reddit user who spent hundreds on MRR courses summed it up: "It is not a side hustle. It is a very demanding business." The hidden costs nobody mentions upfront - DM automation tools, storefront subscriptions, content creation time - add up fast. Algorithm dependency makes results unpredictable.

But the counterbalance is real too. A 21-year-old started with a Canva business card template, no money, and built a digital product business through consistency and email marketing. Simple products worked better than complicated bundles. Email marketing was the turning point - sales went up after collecting emails and sending regular updates.

Realistic income expectations for solo digital product creators: $1,000-$10,000/year for most. The top 10% earn $50,000+. That's not nothing, but it's not the "quit your job in 30 days" fantasy that gets sold on social media.

For B2B teams, the timeline is 3-6 months for meaningful pipeline impact from a digital selling strategy. Organizations can achieve an 18% increase in overall sales without additional headcount through digital buyer analysis - but only if they execute well. Half-commit - posting sporadically, using unverified data, skipping the content investment - and expect nothing.

The honest path forward in both worlds: commit to the fundamentals, invest in the boring infrastructure (data quality, email lists, consistent content), and give it time.

How to Build a Digital Selling Strategy

Seven steps. Not complicated, but each one matters.

Step 1: Audit your current process. Map how your team actually sells today. Where do leads come from? Where do deals stall? Sales reps spend 65% of their time on non-selling activities - find out where that time goes before you buy a single tool.

Step 2: Define your ICP and goals. Analyze your happiest and most profitable customers. What do they have in common? Your ICP should be specific enough to filter a database, not vague enough to describe half the market (ideal customer). Set goals tied to pipeline, not activity metrics.

Step 3: Map the buyer journey to digital touchpoints. Your buyers use 10+ channels before making a decision. Map which channels matter at each stage. 42% want case studies during evaluation. 40% start with search engines. Meet them where they already are.

Step 4: Build content for each stage. Top of funnel: thought leadership that challenges assumptions. Middle: case studies and comparison content. Bottom: ROI calculators, personalized demos, and DSR materials. 91% of buyers say personalized content is very important.

Step 5: Select 3-4 core tools. Not 10. Not 15. A data platform for verified contacts, a CRM for pipeline management, an engagement tool for outreach, and optionally an intelligence tool for coaching and forecasting. Pick tools that integrate natively - disconnected tools create data silos that kill visibility.

Step 6: Train the team. 44% of millennials prefer no sales rep interaction in B2B purchases. Your reps need to understand that their role is shifting from "information provider" to "insight provider." Train them on social selling, content sharing, DSR usage, and AI tools. The organizational change is harder than the technology change - change fatigue is real, and adoption fails without buy-in from the people actually using the tools.

Step 7: Measure and iterate. Track leading indicators (engagement rates, response rates, meetings booked) alongside lagging indicators (pipeline generated, deals closed, revenue). 65% of B2B buyers prefer remote or digital interactions - if your metrics show otherwise, your digital experience needs work, not your channel strategy.

The four pillars that tie this together: Planning (steps 1-2), Activating Your Audience (steps 3-4), Establishing Authority (content + social presence), and Nurturing Relationships (engagement + follow-through). Skip any pillar and the strategy collapses.

FAQ

What's the difference between digital selling and social selling?

Digital selling is the umbrella strategy encompassing all digital channels, tools, and data used to engage buyers and close deals. Social selling is one tactic within it, focused on platforms like LinkedIn where buyers already engage professionally. You can practice digital selling without social, but social selling always exists inside a broader digital strategy.

How does social selling compare to traditional selling?

Social selling delivers 42% response rates versus under 3% for cold calls - the gap between social selling vs traditional selling is now measurable and wide. Traditional methods still matter for relationship-heavy enterprise deals, but for initial engagement and pipeline generation, social outreach consistently outperforms phone-first or email-only approaches.

Is selling digital products still profitable in 2026?

Yes, but most solo creators earn $1,000-$10,000/year; the top 10% clear $50,000+. Marketing and email lists matter more than the product itself. Start with a $10-29 template, build an audience before you launch, and reinvest consistently over 6-12 months.

What tools do I need to start B2B digital selling?

Three core tools: a CRM (HubSpot or Pipedrive for most teams), a verified data platform like Prospeo for accurate emails and direct dials, and a sales engagement tool for sequencing outreach. Add AI tools like Gong or Lavender and Digital Sales Rooms after you've nailed the basics.

How long does it take to see results from a digital selling strategy?

B2B teams should expect 3-6 months for meaningful pipeline impact with consistent execution. Digital product sellers typically need 6-12 months of steady effort before generating significant revenue. Both timelines assume weekly publishing, active list-building, and ongoing outreach iteration - not just tool purchases.