The Best Email Lookup Tools in 2026: Accuracy Data, Real Pricing, and Honest Picks

Most "best email finder" lists throw 15+ tools at you and treat them all like they're equally worth your time. That's SEO filler. You need two, maybe three email lookup tools - and you need the right ones. The wrong pick doesn't just waste money; it tanks your domain reputation, burns sequences, and makes your reps distrust the data they're working with.

At least 23% of any email list degrades within a single year, per ZeroBounce's analysis of 11 billion+ emails. That's nearly a quarter of your pipeline going stale while you sleep. Worse, 37.3% of email addresses change annually, and 70.8% of business contacts experience at least one data change within 12 months. The downstream cost is brutal: poor data quality costs U.S. businesses an estimated $3.1 trillion annually.

Sales reps waste 546 hours per year chasing bad leads. That's 27% of their working time spent on contacts who've changed jobs, switched emails, or never existed in the first place.

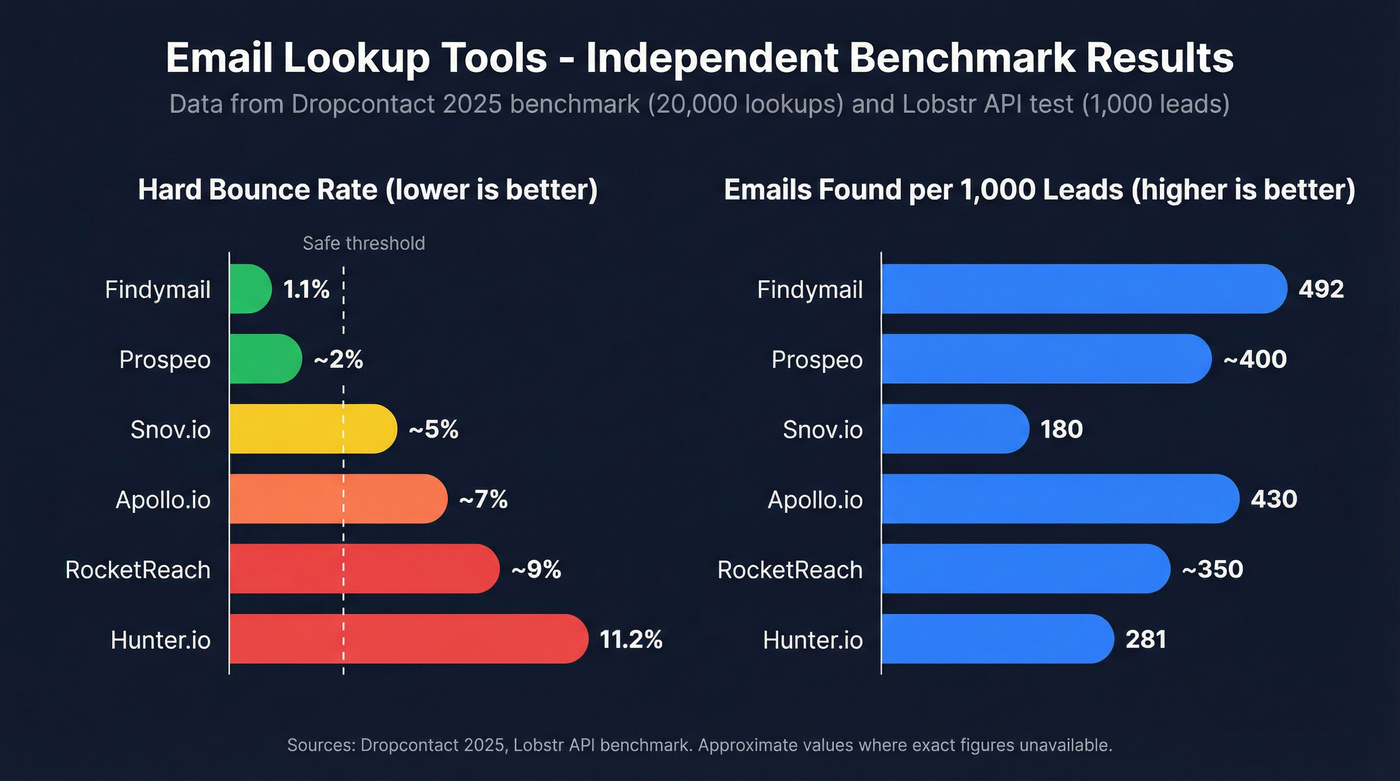

Every tool on this list claims 95%+ accuracy. The Dropcontact 2025 benchmark tested 15 of them across 20,000 real-world lookups, and hard bounce rates ranged from 0.9% to 11.2%. A 12x spread between the best and worst - all of which market themselves as "highly accurate." I'm covering 10 tools here, but I'll tell you which three to actually trial, which ones serve niche use cases, and which ones have accuracy problems their marketing pages won't mention.

Our Picks (TL;DR)

| Pick | Tool | Why |

|---|---|---|

| Best accuracy | Prospeo | 98% email accuracy, 7-day refresh, ~$0.01/email |

| Best free tier | Apollo.io | 275M+ contacts, built-in outreach, generous free plan |

| Best verified-only | Findymail | Only charges for verified results, G2 4.9, Clay's #1 pick |

Prospeo wins on data quality - 98% verified email accuracy with a 7-day data refresh cycle, roughly 6x faster than the industry average. Apollo is the obvious starting point if budget is your primary constraint. Findymail is the accuracy purist's choice, with the lowest bounce rates in independent benchmarks.

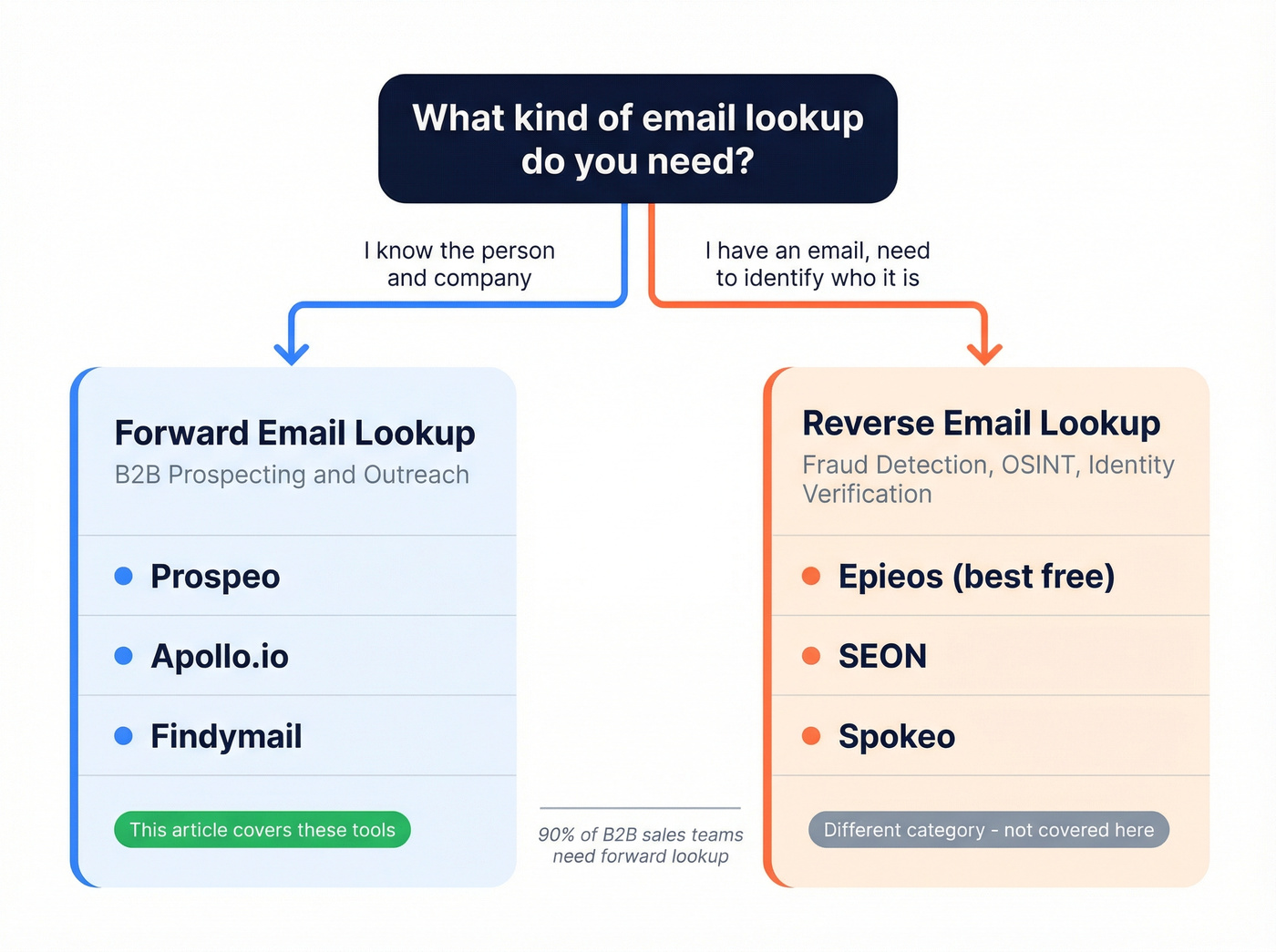

Email Lookup vs. Reverse Email Lookup - Which Do You Need?

"Email lookup" means two completely different things depending on who's asking.

| Forward Email Lookup | Reverse Email Lookup |

|---|---|

| Find someone's email from their name + company | Identify a person from their email address |

| Used for B2B prospecting and outreach | Used for fraud detection, OSINT, identity verification |

| Tools: Apollo, Hunter, Findymail | Tools: Epieos (best free option), SEON, Spokeo |

If you're here to figure out who owns a random Gmail address, you want OSINT tools - Epieos is the strongest free option for that use case. Everything below focuses on forward email lookup: you know the person and company, and you need a verified work email to reach them.

You just read that bounce rates across email lookup tools range from 0.9% to 11.2%. Prospeo sits at the top: 98% email accuracy, 5-step verification, and a 7-day data refresh - 6x faster than the industry average. Snyk's 50 AEs dropped bounce rates from 35-40% to under 5%.

Find out where your current tool actually lands on the accuracy spectrum.

The 10 Best Email Lookup Tools in 2026

Prospeo - Best Email Lookup Software for Accuracy and Data Freshness

Use this if: You're running outbound at scale and can't afford bounces above 3-4%. You need emails that are verified today, not pulled from a database last refreshed six weeks ago.

One bad batch can torch a sending domain. Agencies managing multiple client accounts know this pain better than anyone.

Trusted by 15,000+ companies, Prospeo's database covers 300M+ professional profiles and 143M+ verified emails, built on proprietary email-finding infrastructure. That last part matters: Prospeo doesn't rely on third-party email providers, which means the data isn't recycled from the same sources everyone else uses. The 5-step verification process handles catch-all domains, spam traps, and honeypots - the stuff that quietly kills deliverability. Beyond email, the platform covers 125M+ verified mobile numbers and intent data tracking 15,000 topics, useful if you're layering buying signals into your outreach.

The numbers back it up. Meritt switched to Prospeo and watched their bounce rate drop from 35% to under 4%, while pipeline tripled to $300K/week. Snyk's 50-person AE team saw bounce rates drop from 35-40% to under 5% and AE-sourced pipeline jump 180%. The Chrome extension has 40,000+ users for quick lookups from any website or professional profile.

Pricing: Free tier gives you 75 emails/month. Credit-based paid plans start at roughly $0.01 per email - see current tiers. No contracts, cancel anytime.

37.3% of email addresses change every year. Most lookup tools refresh every 6 weeks - Prospeo refreshes every 7 days. At ~$0.01/email with proprietary verification, you stop paying for data that's already dead.

Replace stale emails with contacts verified this week, not last quarter.

Apollo.io - Best Free Tier for All-in-One Prospecting

Use this if: You're a startup or small team that needs a database, sequencing, and basic CRM in one tool without paying for three separate subscriptions. Apollo's free tier is genuinely generous - 275M+ contacts with basic access and built-in outreach.

Skip this if: Email accuracy is your top priority. On Reddit, Apollo users consistently report 60-70% valid email rates, especially on older contacts. "The data feels outdated" is a recurring theme.

G2: 4.7/5 (9,111 reviews) - the sheer volume of reviews tells you how widely adopted it is.

The Lobstr API benchmark found Apollo returned 430 emails per 1,000 leads at just $11.80 per 1,000 - the cheapest option tested. But cheap emails that bounce aren't cheap. The Basic plan runs $49/user/month, and that per-seat pricing adds up fast. A 5-person team is $245/month before you've upgraded anything. Credits don't roll over, which means you lose what you don't use each cycle.

Here's the thing: Apollo does everything adequately and nothing exceptionally. If you're just starting outbound and need one tool to do it all, it's the obvious pick. If you're scaling and deliverability matters, you'll outgrow it.

Findymail - Best for Verified-Only Results

Most tools charge you whether the email is valid or not. Findymail flips that model: no email found, no credit spent. Credits also roll over (capped at 2x your monthly plan), which is a refreshing change from the "use it or lose it" model most tools run.

Skip this if: You need a built-in sequencer or CRM. Findymail is a data tool, not a platform.

G2: 4.9/5 (54 reviews) - small sample, but the ratings are remarkably consistent.

The benchmarks tell the story. In the Lobstr test, Findymail found 492 emails per 1,000 leads - the highest of any tool tested. The Dropcontact benchmark showed a 1.1% hard bounce rate, second only to Dropcontact themselves (who ran the benchmark, so take their #1 ranking with a grain of salt). Clay, valued at $3.1B as of their 2025 funding round, internally benchmarked Findymail in first position and placed it first in their waterfall enrichment feature.

Pricing: Plans start at $49/month for 1,000 credits. The $99/month tier gets you 5,000 credits. Phone numbers cost 10 credits each. Free trial gives you 10 emails to test.

Hunter.io - Best for Email Verification + Finding Combo

I watched a team adopt Hunter as their primary email source last year. Within a month, they'd pivoted to using it purely as a verification layer - and that's actually where it shines.

G2: 4.4/5 (629 reviews). Six million users trust it, which says something about brand recognition if not raw database power.

Hunter indexes 100M+ emails and shows you exactly where each email was found - public web pages, company sites, etc. That transparency is genuinely useful for compliance-conscious teams. But the database is relatively small. The Lobstr benchmark found Hunter returned only 281 emails per 1,000 leads - the lowest quantity of any tool tested. The Dropcontact benchmark was worse: an 11.2% hard bounce rate.

Use this if: You already have emails and need to verify them, or you want transparent sourcing for compliance reasons.

Skip this if: You need volume. Hunter's strength is verification, not discovery.

Pricing: Free (50 credits), Starter $49/month (2,000 credits). But here's the hidden cost - verification charges 0.5 credits per check. Finding an email costs 1 credit, verifying it costs another 0.5. You're effectively paying 1.5 credits per verified email, which cuts your usable credits by a third.

Snov.io - Best All-in-One for Small Teams

Use this if: You're a 2-5 person team that wants email finding, verification, CRM, drip campaigns, and email warm-up in a single subscription. Unlimited team seats on all plans is a standout perk.

Skip this if: Email finding volume is your priority. The Lobstr benchmark found Snov.io returned only 180 emails per 1,000 leads - dead last among the nine tools tested. The 7-tier verification is thorough, but you can't verify what you can't find.

G2: 4.6/5 (437 reviews).

The database covers 200M+ contacts, and the Starter plan at $39/month ($29.25 annual) includes 1,000 credits. The LinkedIn automation add-on runs $69/month per slot if you need it. Snov.io packs more features per dollar than almost anything else on this list - just don't expect it to compete on raw email discovery rates.

RocketReach - Large Database with Caveats

Pros: 700M+ profiles and 35M+ companies make this one of the largest databases available. Enterprise teams doing broad market mapping will find value here.

Cons: Users report 20-30% bounce rates. RocketReach advertises 85-97% accuracy on verified emails, but real-world results fall short. Credits don't roll over.

G2: 4.4/5 (1,187 reviews). Pricing: Essentials $69/month (100 lookups, email only), Pro $119/month (250 lookups with phone). At $0.69 per lookup on the Essentials plan, you're paying a premium for a tool that bounces a quarter of the time. Absurd for volume outbound.

Lusha - Quick Lookups with Phone Numbers

Use this if: You need quick, one-off lookups with phone numbers included. The free tier (70 credits/month) is generous for light usage, and the Chrome extension is fast.

Skip this if: You're doing volume outbound. Phone numbers cost 5 credits each, which means your 70 free credits get you roughly 14 phone reveals. Pro at $22.45/user/month (annual) sounds cheap until you multiply by headcount. Lusha advertises ~81% data accuracy - honest, but lower than most competitors.

G2: 4.3/5 (1,000+ reviews).

GetProspect - Pay Only for Valid Emails

Use this if: You want the peace of mind of only paying for emails that actually exist. GetProspect charges exclusively for valid/found emails, and unused credits roll over. The Growth plans scale nicely - 50,000 valid emails at $399/month.

Skip this if: You need low bounce rates. The Dropcontact benchmark showed GetProspect at 8.3% hard bounce and a 17.8% error rate. "Valid" and "deliverable" aren't always the same thing.

Pricing: Free (50 valid emails), Starter $49/month (1,000 valid emails).

Wiza - Best for Sales Navigator Users

Use this if: Your prospecting workflow starts in LinkedIn Sales Navigator and you need to extract contacts with verified emails. Wiza's Chrome extension (4.8/5 on Chrome Web Store) does this better than anyone.

Skip this if: You don't have Sales Navigator ($79-149/month additional). Without it, Wiza loses most of its value. Credits don't roll over on monthly plans, and overage fees hit $0.15 per extra email.

G2: 4.6/5. Pricing: Free (20 emails/month), Email annual plan $83/month for unlimited emails. Monthly plans are significantly more limited - $99/month gets you only 500 emails.

ContactOut - Recruiter-Focused with Fair-Use Limits

Best for: Recruiters who need personal emails and ATS integrations.

ContactOut's "unlimited" email plan at $99/month is unlimited the way a hotel minibar is free - fair-use policy caps you at roughly 2,000 emails and 1,000 phone numbers per month. User complaints about value are common. If you're a recruiter, it works. For everyone else, skip it.

Accuracy Benchmarks - What the Data Actually Shows

Every email finder markets itself as "highly accurate." The benchmarks tell a different story. Only 62% of all emails submitted to ZeroBounce were valid - that's the baseline quality of email data floating around the industry.

Dropcontact 2025 Benchmark (20,000 Tests, 15 Tools)

| Tool | Enrichment Rate | Error Rate | Hard Bounce |

|---|---|---|---|

| Dropcontact* | 54.9% | 1.9% | 0.9% |

| Findymail | 39.9% | 6.2% | 1.1% |

| Enrow | 40.9% | 8.1% | 2.3% |

| Anymail Finder | 41.3% | 25.4% | - |

| Hunter | 32.5% | 16.4% | 11.2% |

| GetProspect | 26.1% | 17.8% | 8.3% |

*Dropcontact published this benchmark, so their #1 ranking comes with inherent bias. The comparative data for other tools is still valuable.

Lobstr API Benchmark (1,000 Leads, 9 Tools)

| Tool | Emails/1K Leads | Cost/1K | Speed |

|---|---|---|---|

| Findymail | 492 | $49 | 4 min |

| Anymail Finder | 476 | $49 | 6 min |

| Apollo | 430 | $11.80 | 8 min |

| Hunter | 281 | $50 | 30 min |

| Snov.io | 180 | $39 | 18 min |

The pattern is clear: database size doesn't predict accuracy. RocketReach has 700M+ profiles but users report 20-30% bounce rates. Hunter has 100M+ indexed emails but found the fewest in the Lobstr test. And 98% of enrichment tools pull from the same underlying data sources - which is exactly why proprietary infrastructure matters.

What 1,000 Verified Emails Actually Costs

Raw monthly pricing is misleading. What matters is cost per verified, deliverable email.

| Tool | Free Tier | Paid From | ~Cost/1K Emails | Rollover? |

|---|---|---|---|---|

| Apollo | Limited | $49/user/mo | ~$12 | No |

| Findymail | 10 trial | $49/mo | ~$20 | Yes (2x cap) |

| Hunter | 50/mo | $49/mo | ~$37* | No |

| Snov.io | 50 | $39/mo | ~$39 | No |

| GetProspect | 50/mo | $49/mo | ~$49 | Yes |

| Wiza | 20/mo | $83/mo | ~$83 flat | No |

| Lusha | 70/mo | $22.45/user | ~$90 | No |

| ContactOut | 5/day | $99/mo | ~$50** | No |

| RocketReach | 5/mo | $69/mo | ~$690 | No |

*Hunter's verification costs 0.5 credits extra, so effective credits are ~33% lower than listed. **"Unlimited" capped by fair-use policy at ~2,000/month.

The hidden costs are where teams get burned. Apollo's per-seat pricing means a 5-rep team pays $245/month minimum. Hunter's verification surcharge quietly eats your credits. RocketReach at $69/month for just 100 lookups is the worst value on this list by a wide margin.

Real talk: if your average deal size sits below $10K, you probably don't need a tool that costs more than $0.05 per email. The difference between a $10/1K tool and a $50/1K tool is $40 per thousand emails - meaningful at scale, irrelevant at 500 emails a month. Start cheap, upgrade when bounces hurt.

Credit systems that count API calls the same as manual exports are a tax on RevOps teams. Before you commit, calculate your actual cost per verified email at your expected volume.

Five Mistakes That Waste Your Email Lookup Credits

1. Not separating verified vs. risky emails. Verified emails have a 97%+ success rate with the best tools. Risky emails hover around 70%. If your tool lumps them together, you're sending to a blended list and wondering why bounces spike. Always segment before sending.

2. Using a single-source tool and expecting >70% valid rates. If you're still relying on one email finder in 2026, you're leaving 30% of prospects on the table. Waterfall enrichment - where tools like FullEnrich or BetterContact query multiple providers sequentially - consistently reaches ~90% valid rates. Single-source tools top out around 60-70%.

3. Not re-verifying emails older than 30 days. Email decay hit 3.6% in a single month in late 2024 - nearly double traditional rates. Over a year, 23% of your list goes bad. If you're sending to a list you built two months ago without re-verifying, you're gambling with your sender reputation.

4. Ignoring catch-all domains. Between 15-28% of B2B domains are catch-all, and they're often the most valuable prospects - large enterprises that are less solicited. Tools that simply exclude catch-all emails are throwing away your best leads. Look for dedicated catch-all handling rather than blanket exclusion.

5. Double-verifying yourself into false negatives. This one's counterintuitive: running found emails through a second external verifier can reduce your valid list by up to 20% due to false negatives. Over-verification is a real problem. If your primary tool has strong built-in verification, trust it - don't stack a second verifier on top and throw away good emails.

Bonus: Sending from a burned domain. The best email list in the world won't save a domain with a reputation score in the gutter. If you've been sending to unverified lists, check your domain health before investing in better data. You're pouring clean water into a dirty pipe.

How to Choose the Right Email Lookup Tool

The right tool depends on what you're actually doing with the emails.

Sales teams should prioritize accuracy and CRM integrations. A 5% bounce rate difference doesn't sound like much, but at 10,000 emails/month, that's 500 extra bounces eating your domain reputation. We've seen teams cut bounce rates by 80% just by switching providers - the tool matters more than the template, the subject line, or the send time. A 7-day refresh cycle and 98% accuracy rate beat any tool refreshing monthly or quarterly.

Recruiters need personal emails (Gmail, Yahoo) to reach passive candidates, plus ATS integrations. ContactOut and Wiza are built for this workflow. Kaspr ($50/month) works well for European candidates, while HeroHunt.ai ($199/month) adds AI-powered sourcing. LinkedIn Recruiter seats cost tens of thousands annually - a dedicated email search tool is cheaper and often more effective.

Agencies need volume and domain safety across multiple client accounts. One bad batch can torch a client's sending domain, and that's a conversation nobody wants to have. Findymail's verified-only model and sub-2% bounce rates make it a strong pick here. I've seen an agency lose a $15K/month client over a single domain blacklisting incident caused by a bad email list - it's not theoretical risk.

Budget-conscious teams should start with Apollo's free tier. It's genuinely useful for testing and low-volume outreach.

Enterprise teams with EU/UK focus should look at Cognism (~$15,000-$30,000/year) for GDPR-compliant data. For large US-focused orgs, ZoomInfo ($15,000-$25,000/year for SalesOS) remains the default, though you'll pay for a lot of features you'll never activate.

For teams doing high-volume outreach (5,000+ emails/month), waterfall enrichment tools like FullEnrich and BetterContact are worth evaluating. They query multiple data sources and consistently hit ~90% valid rates. But for most teams, a high-accuracy single-source tool gets you to acceptable bounce rates without the added complexity.

Email Lookup Tools: Frequently Asked Questions

What's the most accurate email lookup tool in 2026?

Findymail (1.1% hard bounce) and Dropcontact (0.9%) lead the Dropcontact 2025 benchmark across 20,000 tests. Prospeo's proprietary 5-step verification delivers 98% email accuracy with a 7-day refresh cycle - the fastest data refresh among major providers. Accuracy varies by target market, so test with your actual prospect list before committing annually.

Are free email lookup tools reliable enough for outbound?

Free tiers from Apollo (275M+ contacts), Hunter (50 credits/month), and Prospeo (75 verified emails/month) are genuinely useful for testing workflows and low-volume prospecting. Free plans typically skip full verification or cap lookups too low for real campaigns, though. Always verify before sending - even a "found" email isn't guaranteed deliverable.

How many emails should I expect to bounce?

With a quality tool, under 5%. The Dropcontact benchmark showed hard bounce rates ranging from 0.9% to 11.2% across 15 tools - a 12x spread. If you're consistently above 5%, switch providers or add a dedicated verification layer. Your sender reputation depends on keeping bounces below that threshold.

What's the difference between email finding and email verification?

Email finding discovers an address from a name and company domain. Email verification checks whether an existing address is actually deliverable and won't hard bounce. Some tools - Hunter, Snov.io, Prospeo - do both natively. If your finder doesn't include built-in verification, budget for a second tool in the workflow.

Is waterfall enrichment worth the added complexity?

For teams sending 5,000+ emails per month, yes - waterfall tools query multiple data sources sequentially and consistently reach ~90% valid rates versus 60-70% from single-source providers. FullEnrich and BetterContact specialize in this approach. For lower volumes, a high-accuracy single provider gets most teams where they need to be without the extra setup.