Email Finder Free Trial: 12 Tools Tested, Compared, and Ranked for 2026

"Finding the right software turned out to be a 4-month job with a lot of trial and error and money spent." That's a real quote from a cold email practitioner on Reddit, and it nails the core problem with evaluating an email finder free trial. You sign up for six tools, burn through 50 credits on each, realize you can't evaluate anything meaningful with that sample size, and end up picking the tool with the best landing page instead of the best data.

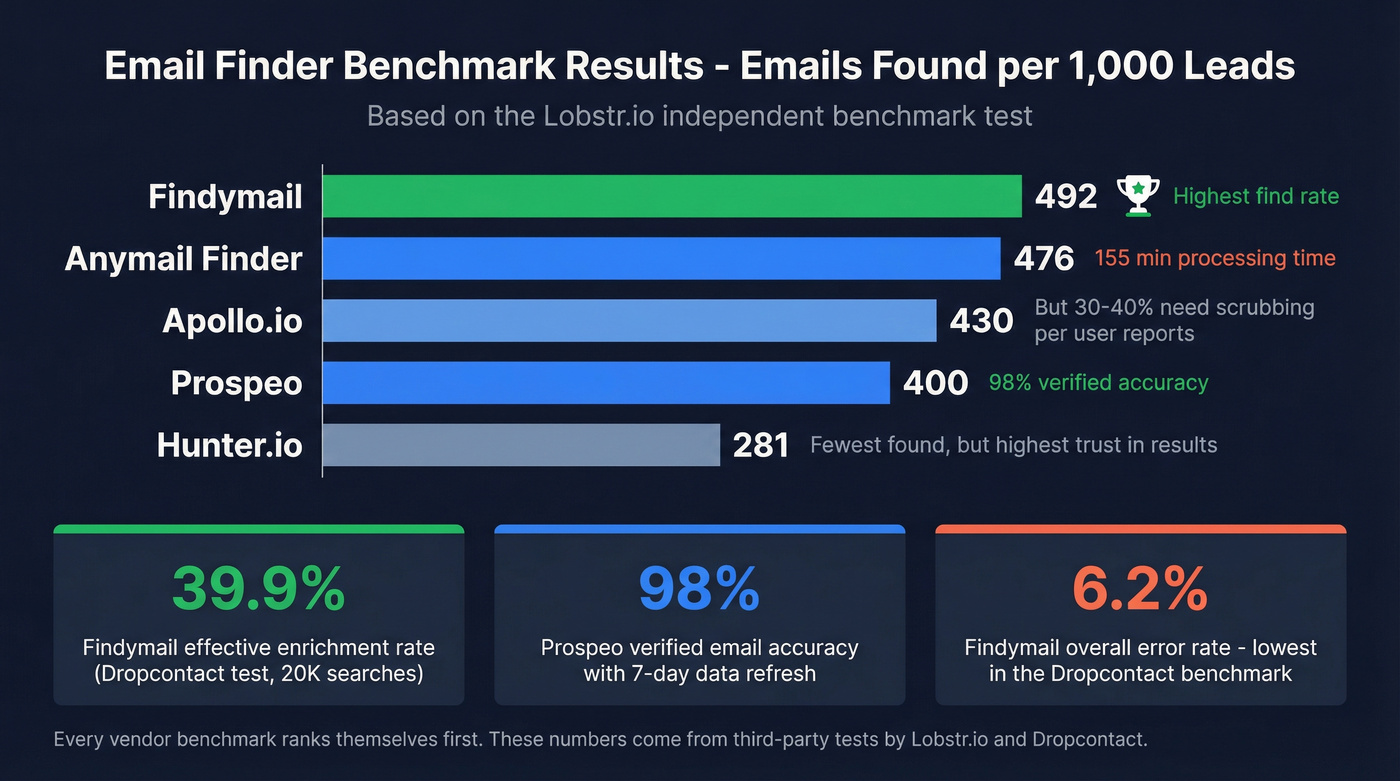

Here's the thing: 15-28% of B2B domains are catch-all, meaning most tools can't definitively verify whether an address is real. The tool that "finds" the most emails might just be guessing more aggressively. And the accuracy claims on every vendor's website? Every benchmark test we've seen was run by a competitor who - surprise - ranked themselves #1.

This guide cuts through that with actual benchmark data, credit math, and a framework to evaluate tools properly.

Our Picks (TL;DR)

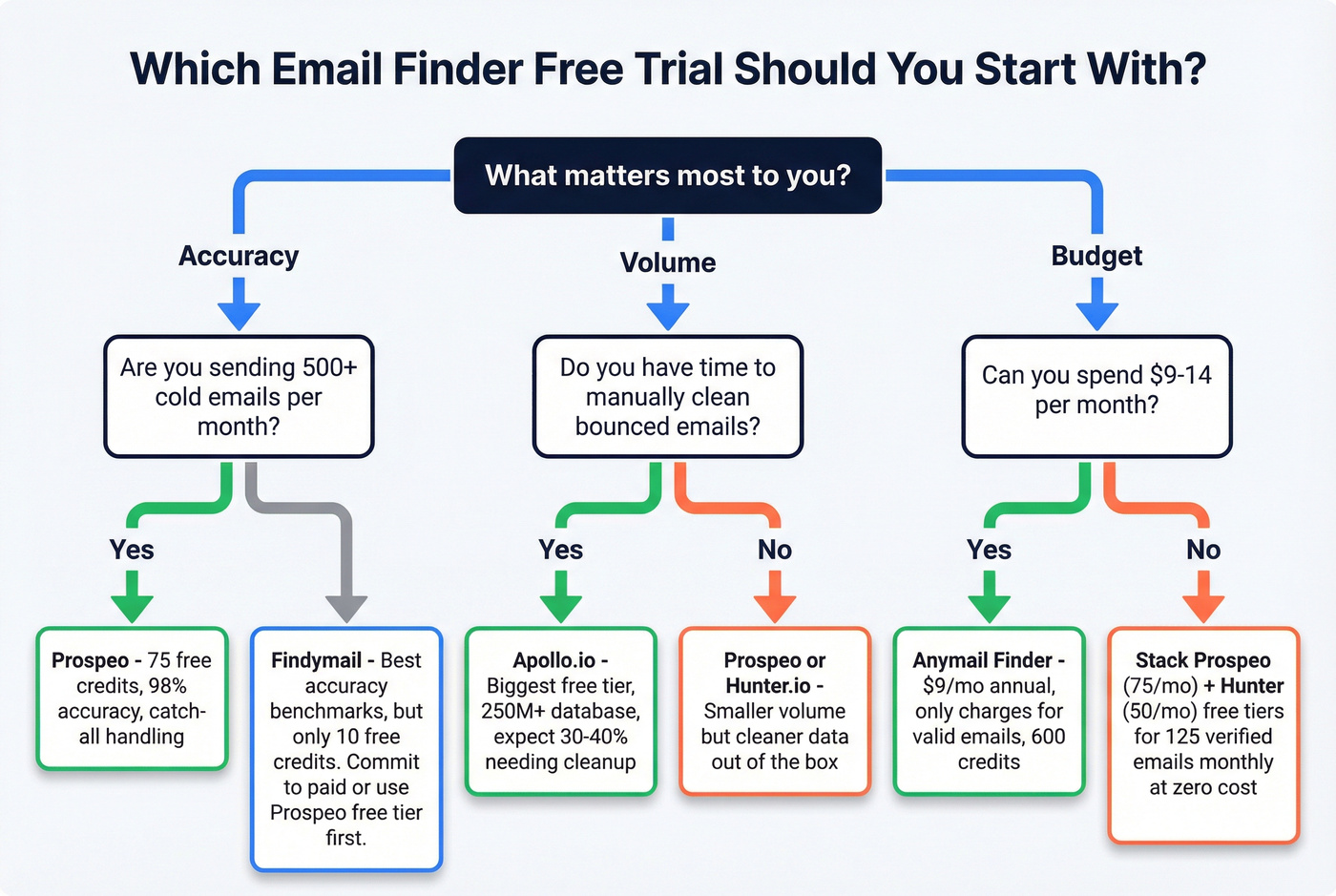

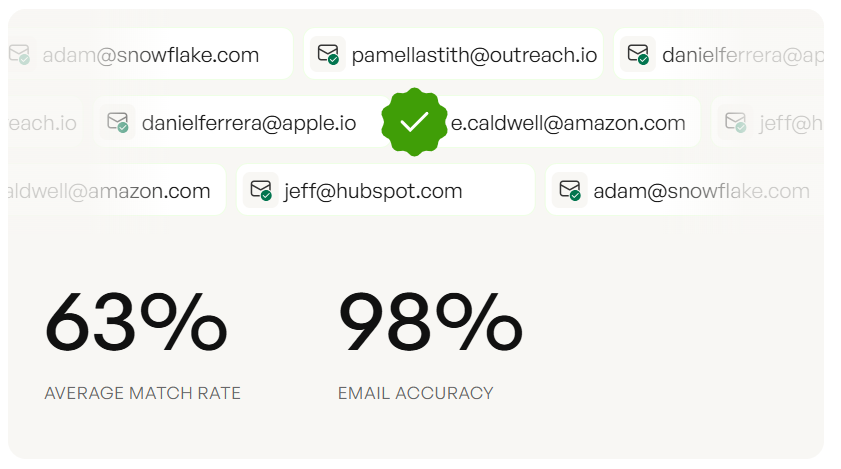

Prospeo - Best for email accuracy and data freshness. 98% verified email accuracy with a 7-day refresh cycle. 75 free emails + 100 Chrome extension credits/month, no credit card required.

Hunter.io - Best for verification reliability. 50 free searches/month, trusted by 6M+ users. Finds fewer emails than competitors but verifies them well.

Apollo.io - Best free tier for volume. 250M+ database with generous free credits. Data freshness is inconsistent and older contacts bounce frequently, but the free plan is the most generous in the space.

Honorable mentions: Findymail (accuracy benchmark winner across multiple tests, but only 10 free credits - barely enough to sneeze at), Anymail Finder (only charges for valid emails, $9-14/mo entry point - cheapest paid plan in the category).

Free Trial vs. Free Tier - What "Free" Actually Means

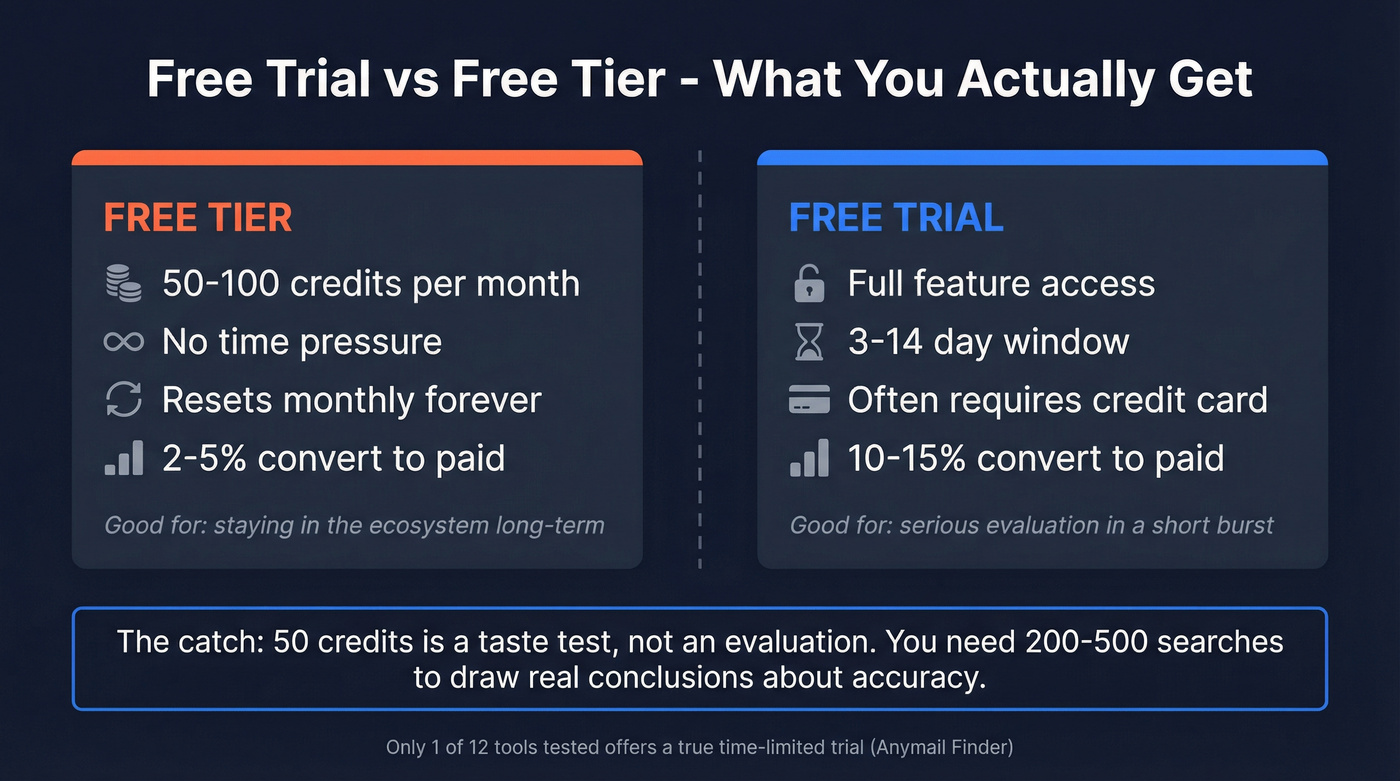

Most email finders don't offer traditional free trials. They offer free tiers - permanent access with credit limits that reset monthly. That distinction matters for how you evaluate.

A free tier gives you limited credits forever, typically 50-100 searches per month. No time pressure, but 50 credits isn't enough to properly test accuracy. You need 200-500 searches minimum to draw real conclusions.

A free trial gives full access for a limited window, usually 7-14 days. Freemium models convert at 2-5% of signups to paid. Free trials convert at 10-15% of signups to paid. That's why most email finders chose freemium - they want you in the ecosystem long-term.

Only one tool on this list offers a true time-limited trial. Anymail Finder gives you 3 days and 100 credits, authorizes $1 on your card (refunded), then auto-enrolls you in their Standard plan if you don't cancel. Everyone else is freemium with credit caps.

| Model | Access | Duration | Conversion Rate |

|---|---|---|---|

| Free tier | Limited credits | Permanent | 2-5% |

| Free trial | Full access | 7-30 days | 10-15% |

| Opt-out trial | Full access | 7-14 days | Up to 50% |

The practical takeaway: don't treat a 50-credit free tier as a real evaluation. It's a taste test. To actually compare tools, stack multiple months on the free tier or commit to a paid month and cancel if it doesn't work.

You just read that 15-28% of B2B domains are catch-all - meaning most free trials hand you unverifiable emails and call it a win. Prospeo's 5-step verification handles catch-all domains, spam traps, and honeypots. That's why teams like Snyk dropped from 35% bounce rates to under 5%.

Test 75 emails free and see what 98% accuracy actually looks like.

Free Tier Comparison Table

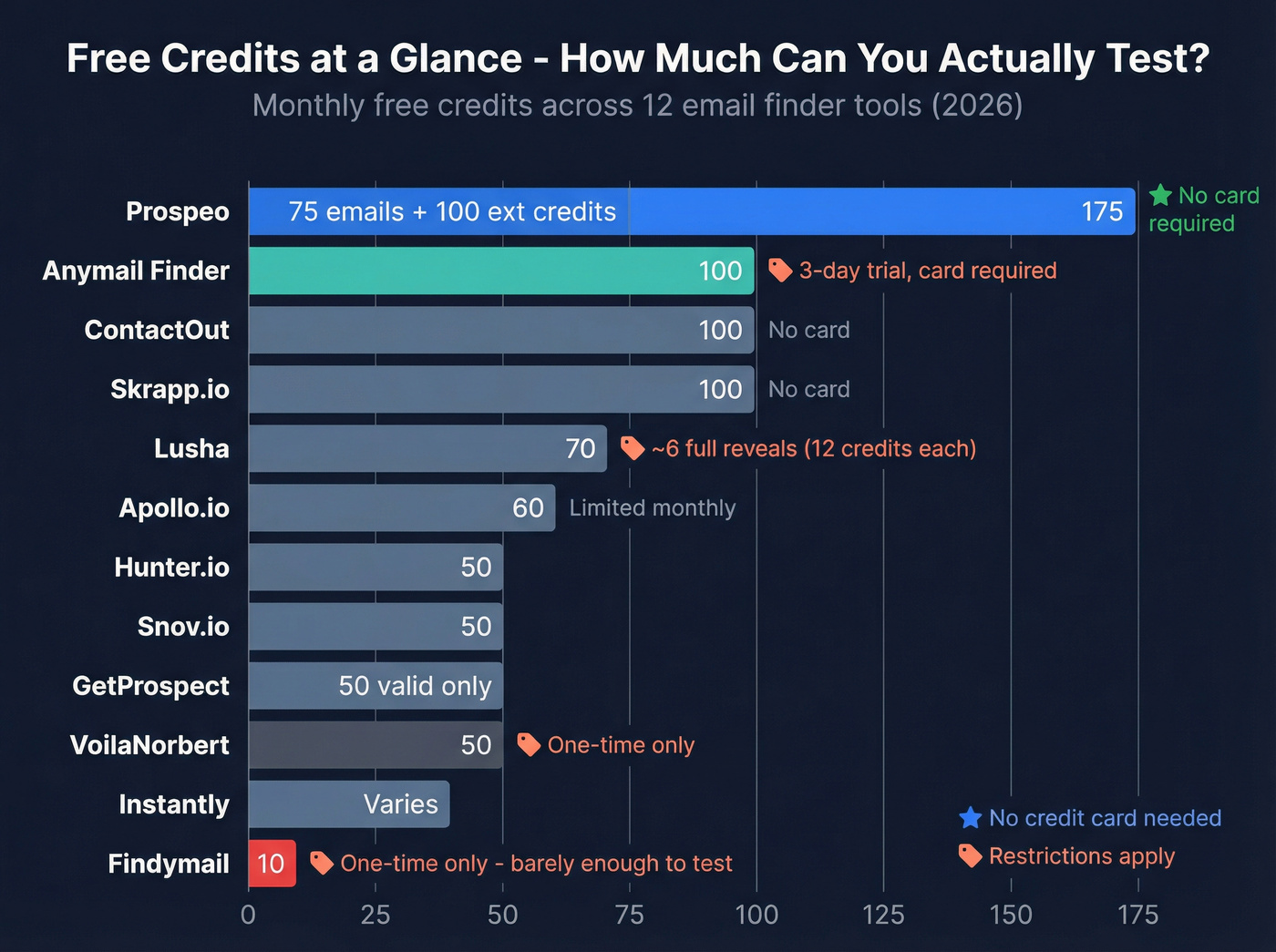

Bookmark this - it'll save you 30 minutes of tab-hopping. If you're specifically looking for a free email finder lookup with no credit card required, most tools on this list qualify. Only Anymail Finder asks for card details upfront.

| Tool | Free Credits | Duration | Paid From | Notes |

|---|---|---|---|---|

| Prospeo | 75 emails + 100 ext. | Monthly | ~$0.01/email | No card; valid only |

| Hunter.io | 50 | Monthly | $34/mo (annual) | No card |

| Apollo.io | Limited | Monthly | $49/mo (annual) | No card |

| Findymail | 10 | One-time | $99/mo ($83 annual) | No card; valid only |

| Anymail Finder | 100 | 3-day trial | $14/mo ($9 annual) | $1 auth; valid only |

| Snov.io | 50 | Trial | $39/mo ($29 annual) | No card |

| GetProspect | 50 valid | Monthly | $49/mo ($34 annual) | No card; valid only |

| Lusha | 70 | Monthly | ~$22/mo (annual) | No card; 12 credits per full reveal |

| VoilaNorbert | 50 | One-time | $49/mo ($39 annual) | No card; valid only |

| ContactOut | 100 | Monthly | $79/mo | No card |

| Skrapp.io | 100 | Monthly | $30/mo (annual) | No card; no charge for invalid |

| Instantly | Free tier avail. | Monthly | $42/mo (annual) | No card; lead finder + outreach sold separately |

A note on Lusha's 70 credits: revealing one contact's email + phone + CRM export burns 12 credits. That's ~6 fully-revealed contacts per month on the free plan.

The 12 Best Email Finders With Free Trials and Free Tiers

Prospeo - Best for Email Accuracy and Data Freshness

Use this if: You're tired of bounced emails tanking your domain reputation and want the highest verification accuracy without signing a contract.

Skip this if: You need a built-in dialer or full outreach suite - pair with Instantly or Lemlist for sequencing.

Prospeo runs on proprietary email-finding infrastructure. It doesn't pull from the same recycled third-party databases that most other tools share. The 5-step verification process includes catch-all handling, spam-trap removal, and honeypot filtering, which is why the 98% accuracy number holds up in practice.

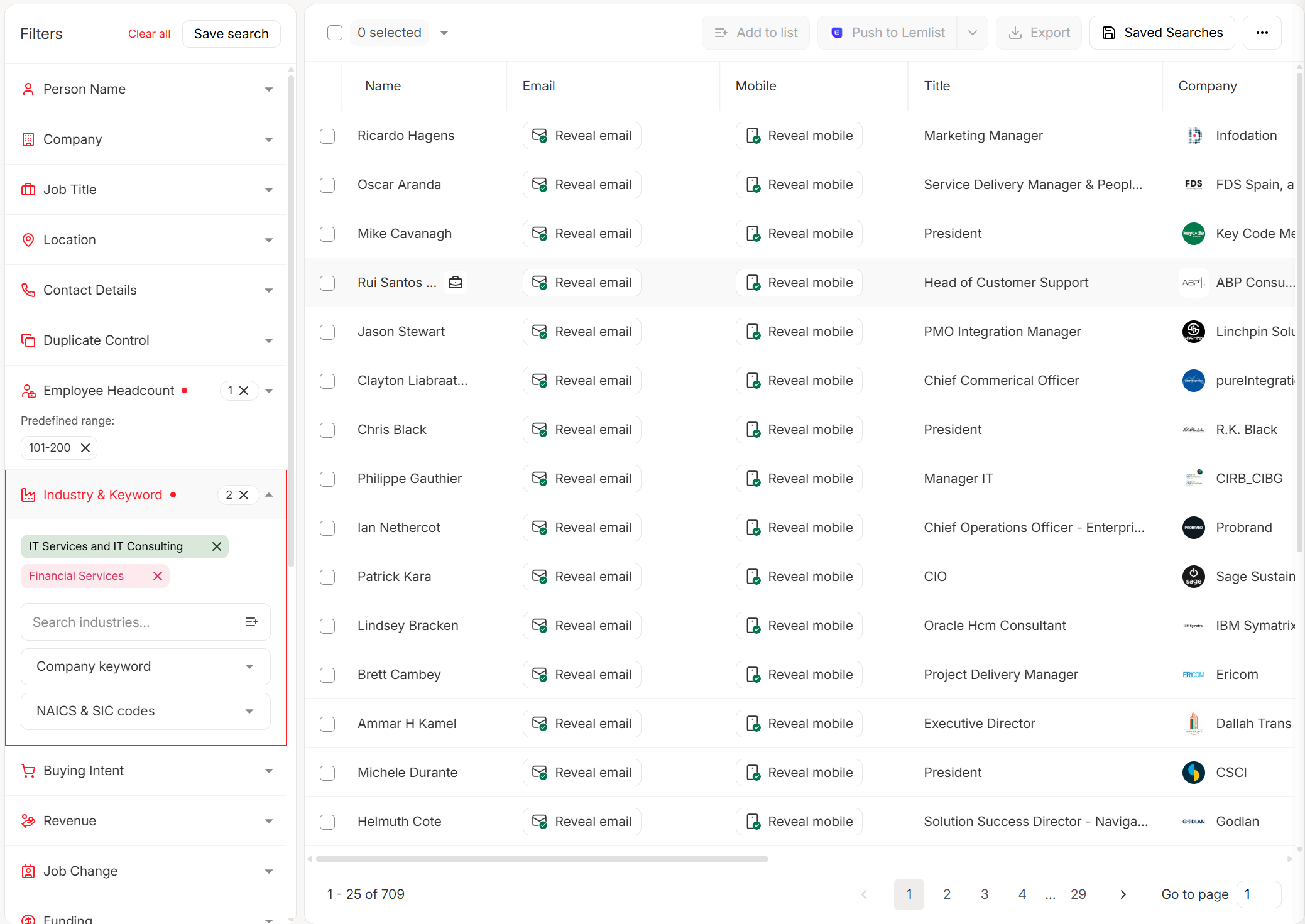

The search interface lets you filter by job title, company, location, and 30+ other criteria. Results show verification status inline - green for verified, yellow for catch-all. The database covers 300M+ professional profiles with 143M+ verified emails, refreshed on a 7-day cycle versus the 6-week industry average.

The free tier gives you 75 emails + 100 Chrome extension credits per month - no credit card, no sales call. The Chrome extension (40K+ users) works across company websites and professional profiles for one-click prospecting. Real results: Meritt went from a 35% bounce rate to under 4% after switching, and their pipeline tripled from $100K to $300K per week.

Hunter.io - Best for Verification Reliability

Use this if: You need a verification layer you can trust, and you're okay with a smaller database in exchange for cleaner results.

Skip this if: You need high-volume prospecting - Hunter finds fewer emails than most competitors.

Hunter's been around long enough to earn its reputation. 6M+ users, clean interface, and a credit system that's straightforward: 1 credit per email found, half a credit per verification. The free tier gives you 50 credits monthly - enough for light prospecting, not enough for a real evaluation.

Where Hunter shines is verification accuracy. What users consistently say: "Solid verification accuracy but database is pretty small." That tracks with the Lobstr.io benchmark, which found Hunter returned only 281 emails per 1,000 leads - significantly fewer than Findymail's 492 or Anymail Finder's 476. But the emails Hunter does find tend to be correct.

Compared to ZoomInfo, Hunter is a scalpel vs. a Swiss Army knife. You're not getting intent data, org charts, or workflow automation. You're getting email finding and verification done well at a fraction of the cost. Starter plans run $34-49/mo for 2,000 credits.

Apollo.io - Best Free Tier for Volume

Hot take: Apollo is the best starting point for teams with more time than budget. But if your deals are north of $10K, the cost of bad data - bounced emails, wasted rep time, damaged sender reputation - will eat any savings alive. Invest in accuracy first.

Use this if: You want the most generous free plan in B2B data and don't mind manually cleaning your lists.

Skip this if: You're sending cold email at scale and can't afford a 10-15% bounce rate on older contacts.

Apollo's 250M+ database is massive, and the free tier is genuinely useful - basic filtering, a Chrome extension, and enough credits to actually prospect. Paid plans start at $49/mo (annual) with unlimited email credits under fair use.

But volume without accuracy is just noise. The consistent Reddit feedback: "data feels bad sometimes - lots of bounces on older contacts." In the Lobstr.io benchmark, Apollo found 430 emails per 1,000 leads (solid), but users regularly report 60-70% valid email rates in practice. That means 30-40% of what you pull needs scrubbing.

Apollo also carries baggage: two data breaches (2018 and 2021) compromised 130M+ records. And the "unlimited email credits" come with asterisks - intent data, advanced filters, and revenue data are gated behind the Professional ($79/mo) and Organization ($119/mo) tiers.

Findymail - Best for Benchmark-Proven Accuracy

Here's the frustrating thing about Findymail: it's probably the most accurate email finder you can test, and the free tier gives you almost no room to prove it.

Ten credits. That's it. Not monthly - total. You can't evaluate accuracy with 10 searches.

But if you commit to the Starter plan at $99/mo ($83/mo billed annually) for 5,000 credits, the data backs it up. In the Lobstr.io benchmark, Findymail found 492 emails per 1,000 leads - the highest of any tool tested. In the Dropcontact benchmark (20,000 tests across 15 tools), Findymail hit a 39.9% effective enrichment rate with only 6.2% overall error. Clay's internal benchmark placed Findymail first. Breakcold's founder called it "arguably the best email finder on the entire market."

Findymail only charges for verified results, credits roll over (capped at 2x monthly), and the phone credit system is transparent: 1 email = 1 credit, 1 phone = 10 credits.

Anymail Finder - Best Budget Entry Point

Use this if: You're bootstrapped and need verified emails at the lowest possible price point.

Skip this if: You need speed - Anymail Finder's processing time is painfully slow for bulk lookups.

Anymail Finder is the only tool here with a true time-limited trial: 3 days, 100 credits, $1 card authorization (refunded). After that, it auto-enrolls you in the Standard plan at $32-49/mo (depending on billing cycle). Set a calendar reminder or you'll get charged.

The Starter plan at $14/mo ($9/mo billed annually) for 600 credits is the cheapest paid entry point in the entire category. And Anymail Finder only charges for valid emails, with 360K+ users. In the Lobstr.io benchmark, it found 476 emails per 1,000 leads (excellent) - but it took 155 minutes to process. Findymail did nearly the same volume in 4 minutes. For bulk API enrichment, that processing time is a dealbreaker. For manual prospecting, it's fine.

Snov.io - Multichannel Suite With Email Finding

Use this if: You want email finding, verification, and outreach sequences in one platform and your list sizes are small.

Skip this if: You care about email accuracy.

I'll be direct: Snov.io's email finding is unreliable. The Emailchaser test found it "gives email addresses that don't exist instead of saying it couldn't find the correct email." The Lobstr.io benchmark found only 180 emails per 1,000 leads - the lowest of any tool tested. In the Tomba.io benchmark, Snov.io found fewer than 25 valid emails from 2,500 company name searches.

The free tier gives you 50 credits as a trial allocation, and paid plans run $39/mo ($29/mo annual) for 1,000 credits. Snov.io's value is in its multichannel suite - email sequences, LinkedIn automation ($69/mo add-on), and CRM features. As a pure email finder, there are better options at every price point.

GetProspect - Best "Only Pay for Valid" Free Tier

Use this if: You want a free tier that only burns credits on verified results, plus unlimited accept-all emails at no charge.

Skip this if: You need phone numbers - the free plan includes zero, and paid plans only add 5.

GetProspect's free tier is quietly one of the best: 50 valid emails per month, and you get unlimited accept-all emails until you hit your valid limit. Credits roll over. No card required. The 230M+ email database is respectable, and Starter plans start at $34-49/mo for 1,000 valid emails.

Lusha - Big Name, Confusing Credits

Skip this if: You actually do the credit math.

Lusha's credit system is a tax on users who don't read the fine print. You get 70 free credits per month. Revealing one contact's email costs 1 credit, their phone number costs 10 credits, and exporting to your CRM costs 1 more. That's 12 credits for a single fully-revealed contact. Your 70 "free" credits get you roughly 6 complete contacts.

On the Pro plan at ~$22-30/mo, you get 250 credits per user. Run the same math: 250 / 12 = about 20 contacts per month. At $29.90/mo, that's $1.50 per contact. Reddit users describe Lusha's phone numbers as "a total coin flip, 50/50 at best."

VoilaNorbert - Ahrefs' Top Pick

VoilaNorbert won the Ahrefs accuracy test with a 92% success rate - the most widely cited benchmark in the space. But the Dropcontact benchmark tells a different story: 22.5% overall error and 13.7% hard bounce rate. Those two data points are hard to reconcile.

Valet plans start at $39-49/mo for 1,000 leads. Only charges for successful finds, and verification is pay-as-you-go at $0.003/email. Credits roll over on all plans. The 50 free credits are one-time only, not monthly.

ContactOut

ContactOut offers 100 free contacts per month and a 300M+ profile database, with Sales plans from $79/mo. It's strongest for recruiting use cases - if you're sourcing candidates rather than sales prospects, it's worth a look. For pure B2B sales prospecting, other tools on this list offer better value.

Skrapp.io

Skrapp gives you 100 free credits monthly with a fair credit policy - no charge for invalid or unknown results, and credits roll over even if you cancel. Professional plans start at $30-39/mo for 1,000 credits. The 200M+ database is decent, and the rollover policy is genuinely user-friendly. A solid mid-tier option.

Instantly

Instantly's Lead Finder runs $42-47/mo for 1,500-2,000 credits, with a 450M+ database. The free tier exists but details on exact credit limits are sparse - sign up and check current allocations. The critical thing to know: lead finding and outreach are separate subscriptions. If you want both, you're paying $80-90/mo minimum.

That hidden cost catches a lot of people off guard.

How Accurate Are Email Finders, Really?

Every email finder claims 90%+ accuracy. The benchmark data tells a very different story.

The Dropcontact benchmark tested 20,000 contacts across 15 tools. The Lobstr.io benchmark tested 1,000 leads across 9 tools. Ahrefs runs an annual test against a personal contact list. Saleshandy's 100-contact test showed similar patterns - Apollo and Hunter both found ~90 emails, but real-world bounce rates diverge sharply. Here's what converges:

| Tool | Dropcontact (20K) | Lobstr.io (1K) | Pattern |

|---|---|---|---|

| Findymail | 39.9% effective | 492 found | Consistently top 2 |

| Anymail Finder | 41.3% effective | 476 found | High volume, high error (25.4%) |

| Hunter.io | 32.5% effective | 281 found | Fewer finds, solid verify |

| Apollo.io | Not tested | 430 found | Volume over accuracy |

| Snov.io | Not tested | 180 found | Consistently last |

Nobody tells you this: every single one of these benchmarks was run by a competitor who ranked themselves #1. Dropcontact won the Dropcontact test. Lobstr.io's partner Findymail won the Lobstr.io test. Ahrefs' pick VoilaNorbert won the Ahrefs test.

Take the absolute numbers with a grain of salt - but the relative rankings are useful because the same tools keep showing up at the top (Findymail) and bottom (Snov.io) regardless of who's running the test.

The other dirty secret: most email finding solutions pull from the same underlying third-party databases. They're all fishing in the same pond. The difference is verification depth - how aggressively a tool checks whether an email actually works before returning it to you. Tools with proprietary infrastructure and multi-step verification consistently outperform single-check tools that license the same data everyone else uses.

The Hidden Cost of Bad Email Data

The sticker price of an email finder is misleading. What actually matters is your cost per verified, deliverable email:

True cost = (monthly price / credits) x (1 / accuracy rate)

| Tool | Plan Cost | Credits | Accuracy* | True Cost/Email |

|---|---|---|---|---|

| Anymail Finder | $9/mo | 600 | ~75% | ~$0.020 |

| Findymail | $83/mo | 5,000 | ~94% | ~$0.018 |

| Hunter.io | $34/mo | 2,000 | ~84% | ~$0.020 |

| Lusha (Pro) | $30/mo | 250** | ~70% | ~$0.171 |

*Accuracy estimates based on benchmark convergence, not vendor claims. **Lusha's 250 credits yield ~20 fully-revealed contacts after credit-burn math.

That Lusha number should make you pause. $0.17 per contact on a "budget" plan - because the credit system eats your allocation alive.

But cost per email is only half the equation. Bad emails damage your sender domain reputation. Every bounce signals to Gmail and Outlook that you're a spammer. One bad campaign can tank deliverability for months. Reddit users consistently target under 5% bounce rate as the threshold - go above that and you're actively hurting future campaigns.

Roughly 20% of CRM data becomes outdated annually. The email that worked in January bounces by June. Tools with longer refresh cycles (4-6 weeks) are serving you stale data by default. Weekly refresh isn't a luxury - it's insurance against domain reputation damage.

Most free tiers give you 50 credits - not enough to evaluate anything. Prospeo gives you 75 emails plus 100 Chrome extension credits monthly, refreshed from a 300M+ database on a 7-day cycle. No credit card. No sales call. No contract.

Skip the 4-month trial-and-error cycle. Start with data that works.

How to Run Your Own Email Finder Bake-Off

Stop testing 10 tools. You need two: one for finding, one for verifying - or one that does both well. Here's how to evaluate any email finder free trial or free tier properly in a week, not four months.

Step 1: Build a control list. Pull 200-500 contacts you already know are valid - existing customers, recent inbound leads, people who replied to emails last month. This is your ground truth.

Step 2: Run each tool against the control list. Compare how many emails each tool finds, and whether they match your known-valid addresses. Fifty credits isn't enough - you need 200+ to see patterns.

Step 3: Test on unknown contacts. Pick a target ICP segment and run the same list through 2-3 tools. Compare overlap and unique finds.

Step 4: Actually send. Load the results into your sequencer and track bounce rates after real sends. Claimed accuracy means nothing - delivered accuracy is everything. Target under 5% hard bounces.

Step 5: Compare credit consumption, not just price. A tool that charges 1 credit per find and 0.5 per verification (Hunter) costs differently than one that charges 12 credits per fully-revealed contact (Lusha). Normalize to cost-per-usable-contact before comparing.

We've seen teams waste months testing every free tier on the market. The smarter move: pick the two tools that best match your volume needs and accuracy requirements, commit to a paid month on each, and run a proper head-to-head. A $50-100 investment in testing saves you thousands in bad data downstream.

If you want a broader list beyond free tiers, compare these email lookup tools and the best B2B email lookup tools for accuracy and pricing.

FAQ

What's the difference between a free trial and a free tier for email finders?

Most email finders offer permanent free tiers with limited monthly credits (50-100), not time-limited trials. Only Anymail Finder offers a true 3-day full-access trial with 100 credits. Free tiers let you test indefinitely but rarely provide enough credits to properly evaluate accuracy - you need 200-500 searches for meaningful results.

How many free credits do I need to properly test an email finder?

At least 200-500 searches against contacts you can verify independently. Fifty credits - what most free tiers offer - isn't statistically meaningful for assessing bulk accuracy, catch-all handling, or data freshness. Stack two months on a generous free tier or invest in a single paid month for a proper evaluation.

Do email finders require a credit card for the free plan?

Most don't. Hunter, Apollo, Prospeo, Snov.io, GetProspect, Lusha, and Skrapp all offer free tiers with no credit card required. Anymail Finder is the exception: it authorizes $1 on your card for the 3-day trial, then refunds it. Watch for auto-enrollment in paid plans after trials expire.

Why do different email finders return different results for the same person?

Most tools pull from overlapping third-party databases but apply different verification methods and pattern-matching algorithms. Some return unverified guesses (Snov.io is notorious for this), while others only return verified results. The accuracy gap comes down to verification depth - tools with multi-step verification and proprietary infrastructure consistently outperform single-check tools.

What's a good free email finder for small teams on a budget?

Prospeo's free tier (75 emails + 100 Chrome extension credits/month, no card) offers the best balance of volume and accuracy for small teams running real campaigns. Hunter gives 50 searches/month with strong verification. GetProspect's 50 valid emails plus unlimited accept-all results is another solid option. For the cheapest paid upgrade, Anymail Finder starts at $9/month annually.