The Best Unlimited Email Verifiers in 2026: What Actually Works

"Pretty much every email verifier in the market is extremely overpriced relative to what they're actually doing." That's not my take - it's a direct quote from a cold email practitioner on Reddit, and it's the reason you're searching for an unlimited email verifier. A 50,000-email list can cost $300+ on ZeroBounce. On Truelist, that same list costs $39. Same SMTP checks, same DNS lookups, same basic infrastructure underneath. The pricing gap is absurd, and the market's finally catching up.

Here's the thing: "unlimited" email verification isn't one thing. It's at least four different pricing models, each with tradeoffs that vendors don't love explaining. Some tools cap you daily. Some throttle by threads. Some are flat-rate but lack independent accuracy data. And nearly every single one claims 99% accuracy - a number that falls apart the moment you test it against real-world B2B email lists.

Three months to warm up a new domain. Three seconds to torch one with a bad list. That math should terrify you - 1 in 6 legitimate marketing emails never reach the inbox, and that's before you factor in bad data.

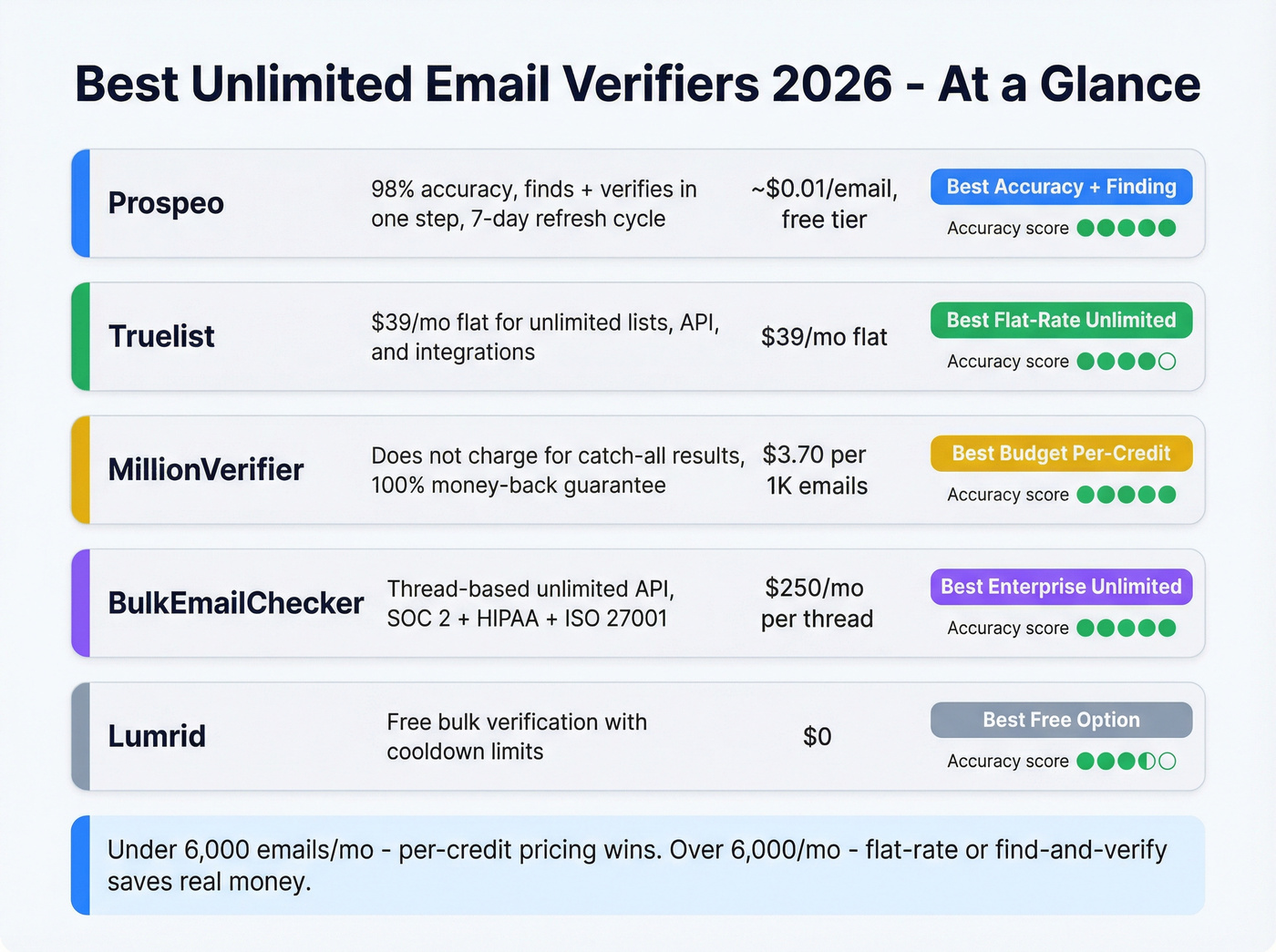

Our Top Picks (TL;DR)

| Pick | Tool | Why | Price Anchor |

|---|---|---|---|

| Best accuracy + finding | Prospeo | 98% email accuracy, finds and verifies in one step, 7-day refresh | ~$0.01/email, free tier |

| Best flat-rate unlimited | Truelist | $39/mo for unlimited - lists, API, everything | $39/mo flat |

| Best budget per-credit | MillionVerifier | $3.70/1K, doesn't charge for catch-alls | $37/10K credits |

| Best enterprise unlimited | BulkEmailChecker | Thread-based unlimited API, SOC 2 + HIPAA | $250/mo per thread |

| Best free option | Lumrid | Free bulk verification, but zero independent accuracy data | $0 |

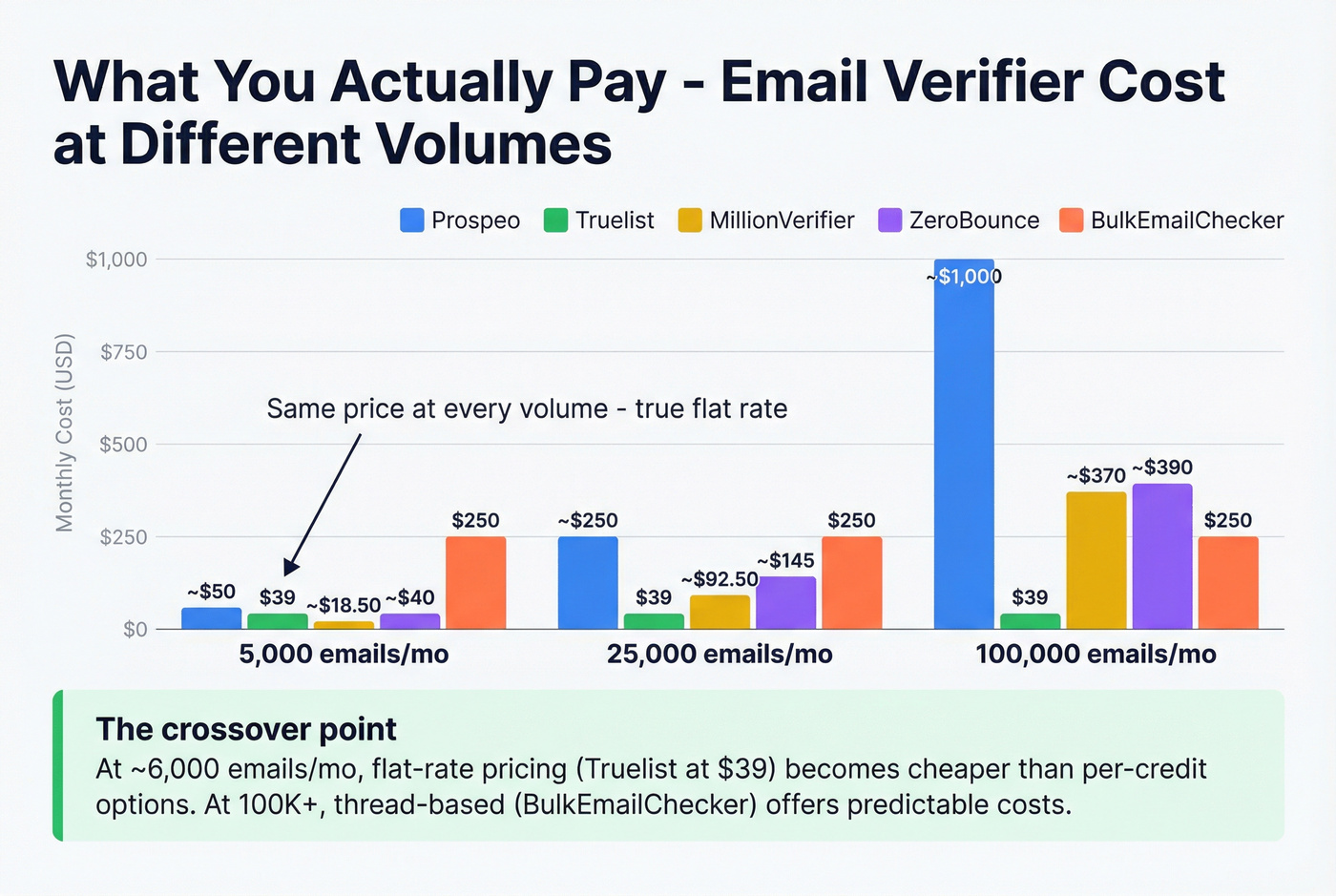

If you're verifying fewer than 6,000 emails/month, per-credit pricing (MillionVerifier) is cheaper than unlimited. Above that threshold, flat-rate (Truelist) or a find-and-verify combo like Prospeo saves real money.

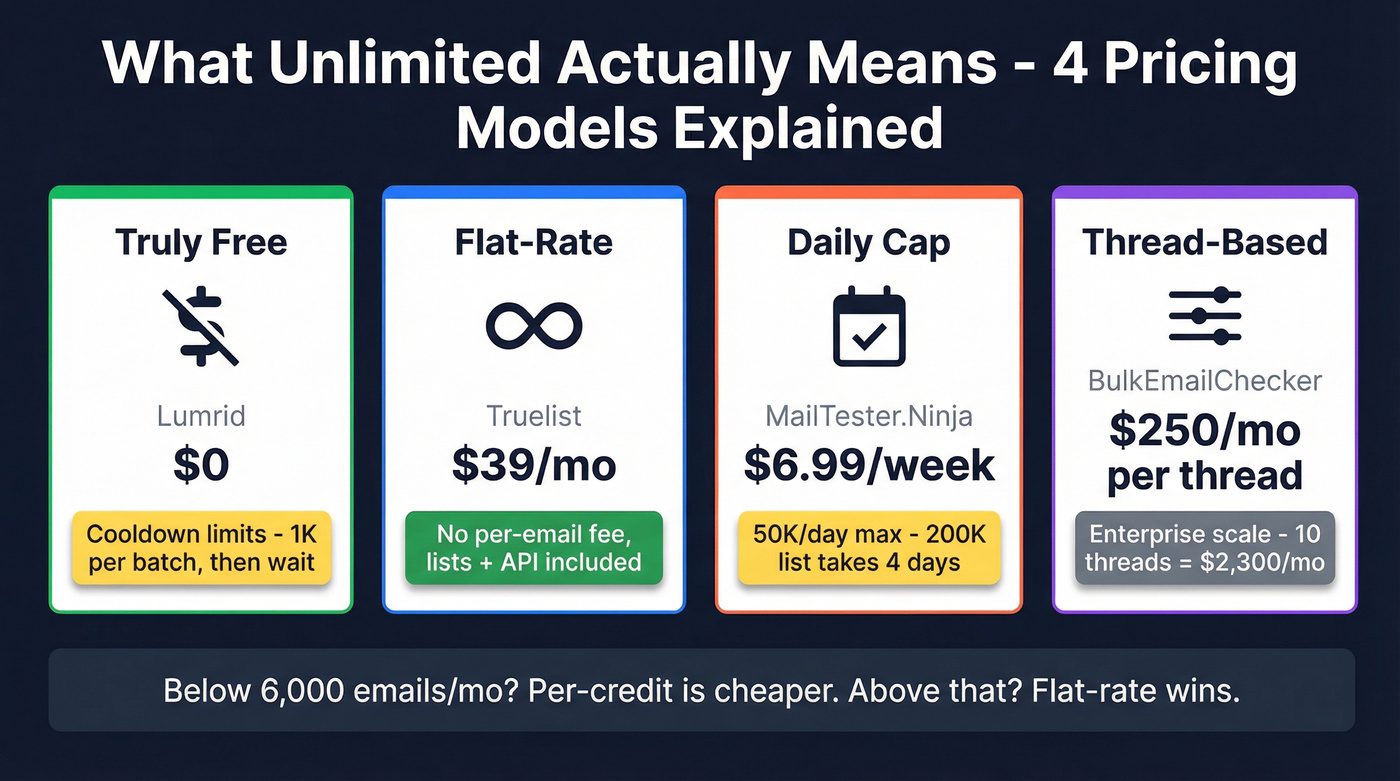

What "Unlimited" Actually Means (And the Catch)

Every tool marketing unlimited email verification defines "unlimited" differently. There are four distinct models, and confusing them will cost you.

| Model | How It Works | Example | Real Cost |

|---|---|---|---|

| Truly free | $0, cooldown limits | Lumrid | $0 (with delays) |

| Flat-rate | One price, no caps | Truelist | $39/mo |

| Daily-cap | "Unlimited" per day, capped volume | MailTester.Ninja | $6.99/week (50K/day) |

| Thread-based | Unlimited per thread, buy more threads | BulkEmailChecker | $250/mo per thread |

Truly free sounds great until you hit the cooldown. Lumrid caps you at 1,000 emails per list upload, then makes you wait before the next batch. If you're verifying 50K contacts, you're babysitting uploads for days.

Flat-rate unlimited is what most people actually want. Truelist's $39/mo covers list uploads, API calls, and integrations with no per-email fee. The catch? It's a newer player without deep G2/Capterra review history, which makes some buyers nervous.

Daily-cap models like MailTester.Ninja give you 50,000 verifications per day for $6.99/week (~$30/month). That's effectively unlimited for most teams, but if you need to blast through 200K contacts in an afternoon, you're waiting four days.

Thread-based pricing is the enterprise play. BulkEmailChecker charges $250/mo per processing thread, with each thread handling tens of thousands of emails daily. Ten threads run $2,300/mo - serious money, but unlimited throughput for data warehouse-scale operations.

The market's clearly moving toward flat-rate. A developer on Reddit was validating a concept called ValiDora - unlimited verification for a flat monthly fee - and the response was overwhelmingly positive. The per-credit model isn't dead, but it's losing ground fast.

Every verifier on this list claims 99% accuracy. Real-world benchmarks show 65-75%. Prospeo hits 98% because emails pass 5-step verification before they reach your list - refreshed every 7 days, not 6 weeks. Snyk's 50 AEs dropped bounce rates from 35% to under 5%.

Skip the scrape-then-clean workflow. Get emails that are already verified.

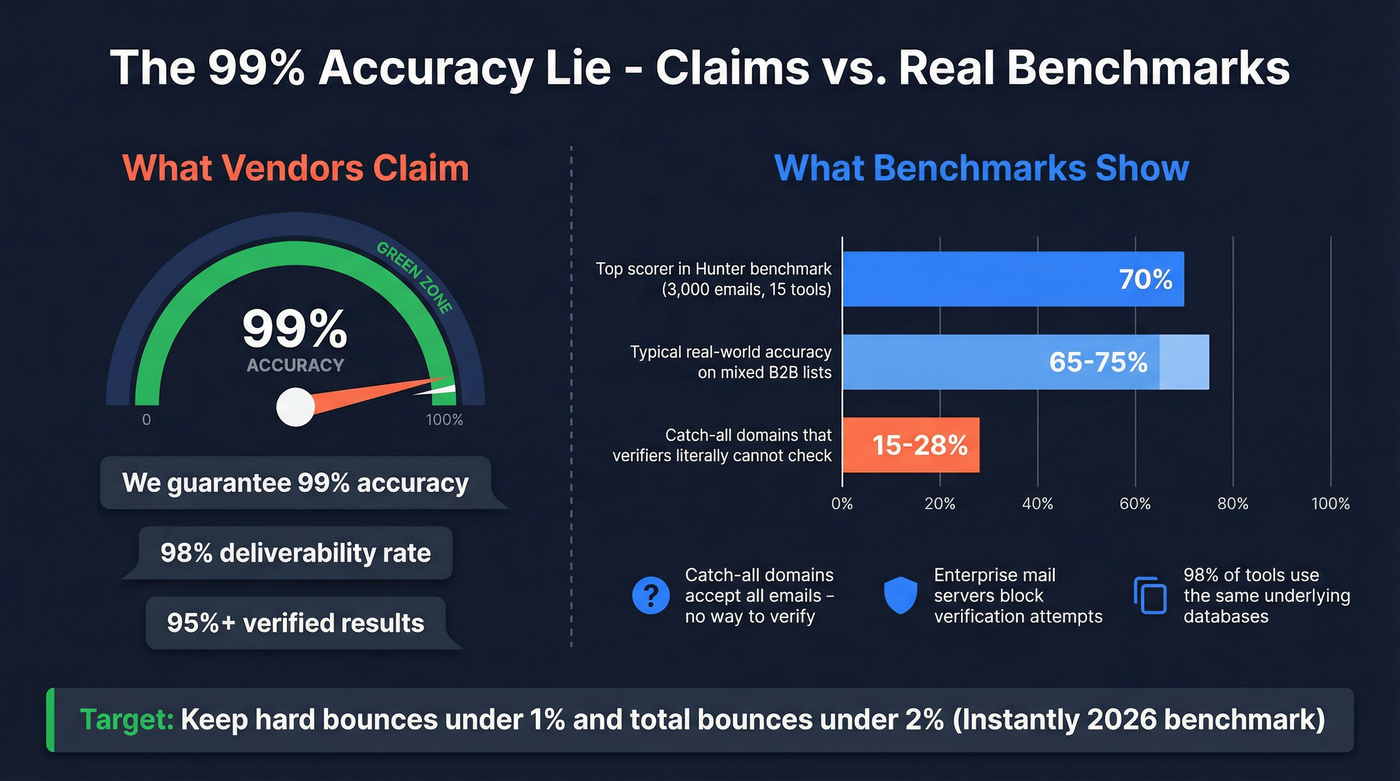

The 99% Accuracy Lie - What Benchmarks Actually Show

Every email verifier on this list claims 95-99% accuracy. Every single one.

It's mostly nonsense.

Hunter ran the most transparent public benchmark - 3,000 real business emails tested across 15 verification tools. The top scorer? 70% overall accuracy. Not 99%. Not 95%. Seventy percent. And that was Hunter itself, testing on emails sourced from its own activity data, which likely gave it a home-field advantage.

The industry benchmark from Instantly.ai's 2026 deliverability report is clear: keep total bounces below 2%, and top performers target hard bounces under 1%. That's the number you should measure your verifier against - not the vendor's marketing page.

The gap between marketing claims and reality comes down to three things:

Catch-all domains. Between 15-28% of B2B domains are catch-all, meaning they accept emails sent to any address - even nonexistent ones. Verifiers literally can't tell valid from invalid on these domains. When a tool claims 99% accuracy, they're either excluding catch-alls from the denominator or lying.

Anti-testing filters. Enterprise mail servers increasingly detect and block verification attempts. Microsoft 365 handles 35% of business email, and its SMTP behavior varies by request volume, source IP reputation, and time of day. A verification that works at 2 AM might fail at 2 PM.

Same underlying infrastructure. Dropcontact's email finder benchmark shows that 98% of enrichment solutions pull from the same databases - and most verification services rely on the same SMTP-check logic underneath. The differentiation is thinner than vendors want you to believe.

MyEmailVerifier built a 50,000-email testing framework across 45 countries and 120 TLDs and published the methodology openly. Their conclusion: "Email verification vendors routinely claim 95%+ accuracy rates... The industry lacks standardized testing frameworks." Both "valid" and "unknown" are defensible answers for catch-all domains - which means accuracy numbers are partly a philosophical choice.

Verifalia takes the opposite approach, throwing 30+ verification steps and AI-powered monitoring at the problem. Whether that extra complexity translates to meaningfully better results on catch-all domains is unproven, but it's the most aggressive attempt at solving the accuracy gap.

Expect 65-75% real-world accuracy from standalone verification on mixed B2B lists. Plan accordingly.

The Best Unlimited Email Verification Tools in 2026

Prospeo - Best for Accuracy + Email Finding

Use this if: You want emails that are verified before they ever hit your list. You're tired of the scrape-then-clean workflow.

Skip this if: You only need a one-time bulk cleaning pass on an existing list - though Prospeo handles that too.

Drawing from 300M+ professional profiles, Prospeo's 143M+ verified emails are pre-verified on a 7-day refresh cycle - compared to the 6-week industry average. When you export contacts, they've already passed 5-step verification: syntax check, domain validation, SMTP verification, catch-all handling, and spam-trap/honeypot removal.

The Chrome extension lets you verify emails in real time from any website. At ~$0.01/email with a free tier (75 emails + 100 Chrome extension credits/month), it's priced for teams that want accuracy without a procurement process.

The proof: Snyk - 50 AEs prospecting 4-6 hours per week - went from 35-40% bounce rates to under 5% after switching. That's the difference between burning domains and booking meetings.

Pricing: Free tier available. Paid plans from ~$39/mo. ~$0.01/email, no contracts. For a plan-by-plan breakdown, see Prospeo pricing.

Truelist - Best Flat-Rate Unlimited

Pros: $39/mo for unlimited validations - lists, API, integrations, everything. Enhanced Validation uses heuristics and third-party cross-referencing. Founded by Grant Ammons, former head of engineering at ConvertKit. Integrations with Zapier, Make, Mailchimp, Clay, and REST API.

Cons: Limited G2/Capterra review depth. Reddit skepticism is real: "Their unlimited pitch seems too good to be true - where's the catch?" No published independent benchmark results.

The skepticism is fair. When every competitor charges $3-10 per thousand emails and someone offers unlimited for $39/mo, you should ask questions. But the math checks out if their infrastructure costs are low enough - and Ammons's engineering background suggests they've optimized for exactly that.

No credit card required for the free trial. If you're verifying more than 6,000 emails/month, Truelist's flat rate is almost certainly cheaper than per-credit alternatives.

MillionVerifier - Best Budget Per-Credit

Use this if: You verify in bursts - maybe 10-20K emails a few times per month - and want the lowest per-email cost without a subscription.

Skip this if: You need real-time API verification at high volume. Per-credit pricing adds up fast in automated workflows.

MillionVerifier charges $37 for 10,000 credits ($3.70 per 1K), and here's the differentiator that matters: they don't charge for catch-all or unknown results. You only pay for emails classified as "good" or "bad." Given that 15-28% of B2B domains are catch-all, that's meaningful savings over tools that burn credits on every lookup.

They back it with a 100% money-back guarantee if your hard bounce rate exceeds 4%. That's confidence.

The caveats: a Sparkle.io hands-on test of 2,000 emails showed 80.5% Good, 4% Bad - but 3 emails from the "Good" category still bounced. Reddit users have noted MillionVerifier "isn't catching as much as ZeroBounce" on edge cases like invalid TLDs. G2 4.5 / Capterra 4.4 - solid but not best-in-class. 500 free credits on signup.

ZeroBounce - Best Premium All-Around

ZeroBounce is the Cadillac of email verification. You're paying for the full deliverability suite: verification, scoring, inbox placement testing, blacklist monitoring, and 24/7 human support. G2 4.6 / Capterra 4.7 - consistently among the highest-rated tools in the category.

Pricing scales from $16 for 2,000 credits up to $390 for 100,000 (~$3.90/1K at volume). That's not cheap, but you're getting more than verification. The 100 free credits/month are enough to test the waters. If deliverability is your primary concern and budget isn't the constraint, ZeroBounce is the safe bet.

BulkEmailChecker - Best Enterprise Unlimited

BulkEmailChecker's thread-based model is designed for teams processing millions of emails. One thread at $250/mo handles tens of thousands of emails daily. Scale to 10 threads ($2,300/mo) or 50 threads ($11,250/mo) for data warehouse-level throughput.

The compliance story is strong: ISO 27001, SOC 2 Type II, HIPAA, GDPR, and CCPA. If your legal team needs checkboxes, BulkEmailChecker has them. Built for CRM hygiene automation and SaaS/ESP integration. This isn't for an SDR verifying a Tuesday morning list.

Bouncer - Best for Catch-All Handling

Bouncer has the highest review scores in the entire category: G2 4.8 / Capterra 4.9.

Users consistently praise its catch-all detection and fake email filtering. Pricing starts at $8 for 1,000 credits, with volume discounts down to $2/1K at the 1M tier ($2,000 total). Mid-range on price but top-tier on the thing that actually matters - keeping your bounce rate under 2% on difficult domains. 100 free credits to test.

Hot take: If your list is heavy on enterprise domains (which are disproportionately catch-all), Bouncer is worth the premium over cheaper tools. The $4-5/1K price difference pays for itself the first time you don't torch a domain.

Clearout - Most Affordable Paid Option

Clearout hits a sweet spot: starting at $31.50/mo or $0.007/credit on pay-as-you-go, with an advanced catch-all resolver that goes beyond basic SMTP checks. At 0.027 seconds per email, it processes 100,000 addresses in about 45 minutes. G2 4.7 / Capterra 4.7 - strong ratings across the board. 100 free credits for a quick test, and the per-credit pricing makes it one of the cheapest paid options with real review depth and integration support.

Lumrid - Best Free Option (With Caveats)

Completely free, built by a cold email agency that needed cheap verification internally. Serverless architecture keeps costs near zero (they say 100K+ emails for under $1 in infrastructure). Pro tier at $20/mo bumps the limit to 10,000 emails per list.

The trade-off is real: 1,000 emails per list with cooldown periods on the free tier, zero independent accuracy data, and it's a side project, not a funded product. Fine for stripping obvious invalids before running a list through a paid verifier. We wouldn't stake our domain reputation on it as the only verification layer.

Honorable Mentions

NeverBounce - $8/1K emails. Established player with solid infrastructure, but pricing hasn't kept up with budget alternatives. Capterra 4.4. Reliable default if you want safety over savings.

Emailable - The speed king. 0.012 seconds per email - that's 10,000 verified in 2-3 minutes. Starts at ~EUR6/1K credits. G2 4.8, 92+ integrations. If processing speed is your bottleneck, nothing else comes close.

Reoon - $0.007/email pay-as-you-go with an AI-powered scoring system that rates each email out of 100 instead of binary valid/invalid. Subscription plans from $19.95/mo. Dynamic disposable email detection and a WordPress plugin for form validation.

MailTester.Ninja - $6.99/week for 50K emails/day. Effectively unlimited for most teams at ~$30/month. Pro tier at $16.99/mo bumps you to 100K/day. G2 5.0 - but with only 1 review, take that with a boulder of salt.

Hunter - One of the most recognized names in email finding. EUR34/mo gets you finding and verification in one package. But at ~$24.50 per 1,000 verifications, it's expensive if you're only using it for verification. G2 4.4. Better as a finder-first tool than a dedicated verifier. If you're comparing options, start with this roundup of email lookup tools.

ValidEmail - $2 for 10,000 credits. That's $0.20 per thousand - the cheapest per-credit option on this list by a wide margin. Limited feature set and minimal review data, but if raw cost-per-verification is your only metric, nothing beats it.

Verifalia - 30+ step verification process with AI-powered monitoring. Free tier with daily limits, paid plans from ~$49/mo. The most thorough verification pipeline on paper, though independent benchmarks are scarce.

emailverifier.online - Free real-time verification tool. Fine for spot-checking individual addresses, not built for bulk workflows.

DeBounce - $1.50-2/1K, one of the cheapest options historically, but not accepting new users as of 2026.

How to Choose the Right Tool for Bulk Email Verification

If you want a broader rundown beyond "unlimited" pricing, this list of email verifier websites compares more tools and positioning.

Pricing Comparison

| Tool | Price/1K | Free Tier | G2 | Best For |

|---|---|---|---|---|

| Truelist | $39/mo flat | Free trial | - | Flat-rate volume |

| MillionVerifier | $3.70 | 500 credits | 4.5 | Budget bulk cleaning |

| ZeroBounce | $3.90-$8 | 100/mo | 4.6 | Full deliverability suite |

| BulkEmailChecker | $250/mo/thread | None | - | Enterprise-scale automation |

| Bouncer | $2-$8 | 100 credits | 4.8 | Catch-all heavy lists |

| Clearout | $7 | 100 credits | 4.7 | Affordable paid option |

| Lumrid | $0-$20/mo | Unlimited (free) | - | Free first pass |

| NeverBounce | $8 | 10 credits | - | Reliability over savings |

| Emailable | ~EUR6 | 250 credits | 4.8 | Speed-critical workflows |

| Reoon | $7 | Limited | - | AI-scored risk assessment |

| MailTester.Ninja | ~$30/mo | 8 emails | 5.0* | Predictable daily volume |

| Hunter | ~$24.50 | 100/mo | 4.4 | Email finding first |

| ValidEmail | $0.20 | - | - | Absolute lowest cost |

| Verifalia | ~$49/mo+ | Daily limits | - | Maximum verification depth |

*MailTester.Ninja's G2 5.0 is based on a single review.

Prospeo's $10/1K reflects its combined find-and-verify workflow. If you're comparing pure verification cost, per-credit tools are cheaper. If you're comparing the cost of getting a verified, deliverable email from scratch, the all-in-one approach often wins. For teams building lists (not just cleaning them), start with a B2B email lookup tool.

Features & Accuracy

| Tool | Accuracy Claim | Catch-All Handling | Speed | Key Integrations |

|---|---|---|---|---|

| Prospeo | 98% (verified) | 5-step with catch-all resolution | Real-time | Salesforce, HubSpot, Instantly, Clay, Zapier |

| Truelist | ~99% | Enhanced heuristic validation | Standard | Zapier, Make, Mailchimp, Clay, REST API |

| MillionVerifier | 99%+ | No charge for catch-all results | Standard | REST API, CSV upload |

| ZeroBounce | 99% | Included + scoring | Standard | 30+ integrations |

| BulkEmailChecker | 99.7% | Included | Thread-dependent | REST API, CRM integrations |

| Bouncer | 99.5% | Best-in-class | Standard | Zapier, API, CSV |

| Clearout | 99% | Advanced resolver | 0.027s/email | 20+ integrations |

| Emailable | 99%+ | Standard | 0.012s/email | 92+ integrations |

| Hunter | ~70% (tested) | Standard | Standard | CRM, Zapier, API |

At $0.007/email, Truelist's $39/mo breaks even at ~5,571 emails/month. Anyone verifying 6,000+ emails monthly saves money on unlimited.

The Catch-All Problem - Why Your "Verified" List Still Bounces

You ran 50,000 emails through a verifier. Everything came back "valid." You launched your sequence. Bounce rate: 6%.

Your domain's reputation just took a hit that'll take months to repair. What happened?

Catch-all domains happened. A catch-all (or accept-all) domain accepts emails sent to any address - john@company.com, asdfghjkl@company.com, doesn't matter. The mail server says "sure, I'll take it" to everything. Verifiers can't distinguish real inboxes from black holes on these domains.

This affects 15-28% of B2B domains, and the percentage skews higher for large enterprises - exactly the accounts you're trying to reach. When MyEmailVerifier built their 50,000-email testing framework, they allocated 20% of the dataset to catch-all addresses specifically because it's the category that breaks every tool's accuracy claims.

Different tools handle catch-alls differently:

- MillionVerifier doesn't charge for catch-all results - you only pay for definitive "good" or "bad" classifications

- Bouncer excels at catch-all detection and gets the highest user ratings for handling these edge cases

- Most tools return "unknown" or "accept-all" and leave the decision to you

Here's the practical framework: send catch-all emails to a warmed-up secondary domain at low volume (50-100/day). Monitor bounces for the first 48 hours. If bounce rates stay under 2%, gradually increase volume. If they spike, pull the list and run it through a secondary verifier. Top performers target hard bounces under 1% - that's your real benchmark, not the vendor's accuracy page. If you're troubleshooting bounce codes, this guide to 550 Recipient Rejected helps you diagnose the root cause fast.

You Don't Need Unlimited Verification - You Need Better Data

Here's the contrarian take most articles about unlimited email verifiers won't give you: if you're searching for bulk verification at scale, you probably have a data quality problem, not a verification volume problem.

Think about it. Why would you need to verify 50,000 emails at once? Because you scraped them from somewhere questionable. Because your CRM hasn't been cleaned in 18 months. Because you bought a list from a vendor who promised "95% deliverable" and delivered 70%.

The verification step is a band-aid. The wound is bad source data. If you're buying lists, read this first: Buying Business Leads.

I've seen SDRs burn through three domains in a quarter because they kept running "verified" lists that bounced at 6%. Each time, they blamed the verifier. The real problem was upstream - they were starting with garbage data and expecting verification to turn it into gold. If you want to fix the upstream issue, start with data quality and B2B contact data decay.

The structural fix isn't better verification. It's better data so you verify less. Tools that pre-verify emails at the point of discovery - refreshing data weekly instead of letting it decay for six weeks - flip the workflow entirely. Instead of scrape, clean, verify, pray, it's search, export verified, send. If you're building lists from scratch, follow this workflow for how to generate an email list.

If your average deal size is above $5k and you're running outbound at scale, the cost difference between a cheap verifier and a pre-verified data source disappears in the first week you don't burn a domain. And if you’re scaling sends, pair verification with an automated email warmup plan.

Flat-rate unlimited sounds great until you realize you're cleaning emails that were bad from the start. At ~$0.01/email, Prospeo finds and verifies in one step across 143M+ emails - with catch-all handling, spam-trap removal, and honeypot filtering built in.

Stop paying to verify garbage. Start with accurate data instead.

FAQ

Is there a truly free unlimited email verifier?

Lumrid offers free bulk verification, but with 1,000-email list caps and cooldown delays - not truly unlimited in practice. Truelist starts at $39/mo for genuinely uncapped verification. Free tools lack independent accuracy data, so you're gambling domain reputation on unproven infrastructure. For most outbound teams, $39/mo flat-rate or a per-credit tool with proven accuracy is worth the insurance.

How accurate are email verifiers really?

Hunter's independent benchmark of 3,000 real emails showed the top scorer hitting just 70% overall accuracy - far below the 99% every vendor claims. The gap comes from catch-all domains (15-28% of B2B), greylisting, and anti-testing filters on enterprise mail servers. Expect 65-75% real-world accuracy from standalone verification on mixed B2B lists.

What's a catch-all domain and why does it matter?

A catch-all domain accepts emails sent to any address, even nonexistent ones - making it impossible for verifiers to distinguish valid from invalid addresses. These domains represent 15-28% of B2B email infrastructure, especially at large enterprises. This single limitation makes universal 99% accuracy mathematically impossible for any verification tool.

At what volume does an unlimited email verifier save money?

At typical per-credit rates ($0.007/email), Truelist's $39/mo flat rate breaks even at roughly 5,571 emails/month. Above 6,000 monthly verifications, flat-rate pricing saves money. Below that, pay-per-credit tools like MillionVerifier ($3.70/1K) are cheaper. For teams that also need email finding, Prospeo's combined find-and-verify workflow often costs less than running separate tools.

Should I use two email verifiers for better accuracy?

Running a second verifier on "risky" or "catch-all" results can reduce bounces by 1-2 percentage points on large lists from unknown sources. A more efficient approach is starting with pre-verified data from a platform that refreshes weekly, eliminating the need for a second pass in most cases. Reserve dual verification for purchased lists or scraped data.