Buying Business Leads in 2026: A Practical Guide That Prevents Bad Data

$15,000 for a "premium" lead list - and your first sequence bounces 14%. Your SDRs blame the list, marketing blames the messaging, and RevOps gets stuck cleaning the CRM for a week.

Buying business leads works when you run it like a supply chain: acceptance rules, intake gating, verification, segmentation, and fast follow-up.

You'll get a pass/fail vendor scorecard, a simple SOP, hard benchmarks, and a compliance timeline you can actually run without turning your team into part-time lawyers.

Buying business leads: what it is, what it isn't, and the 3 models you're really buying

Buying business leads means paying for access to contact data (and sometimes buying signals) so you can reach specific people at specific companies. It isn't "cheating." It's renting distribution.

What it isn't: a shortcut around targeting, messaging, or deliverability. If your offer's vague and your follow-up's slow, a bigger list just helps you fail faster.

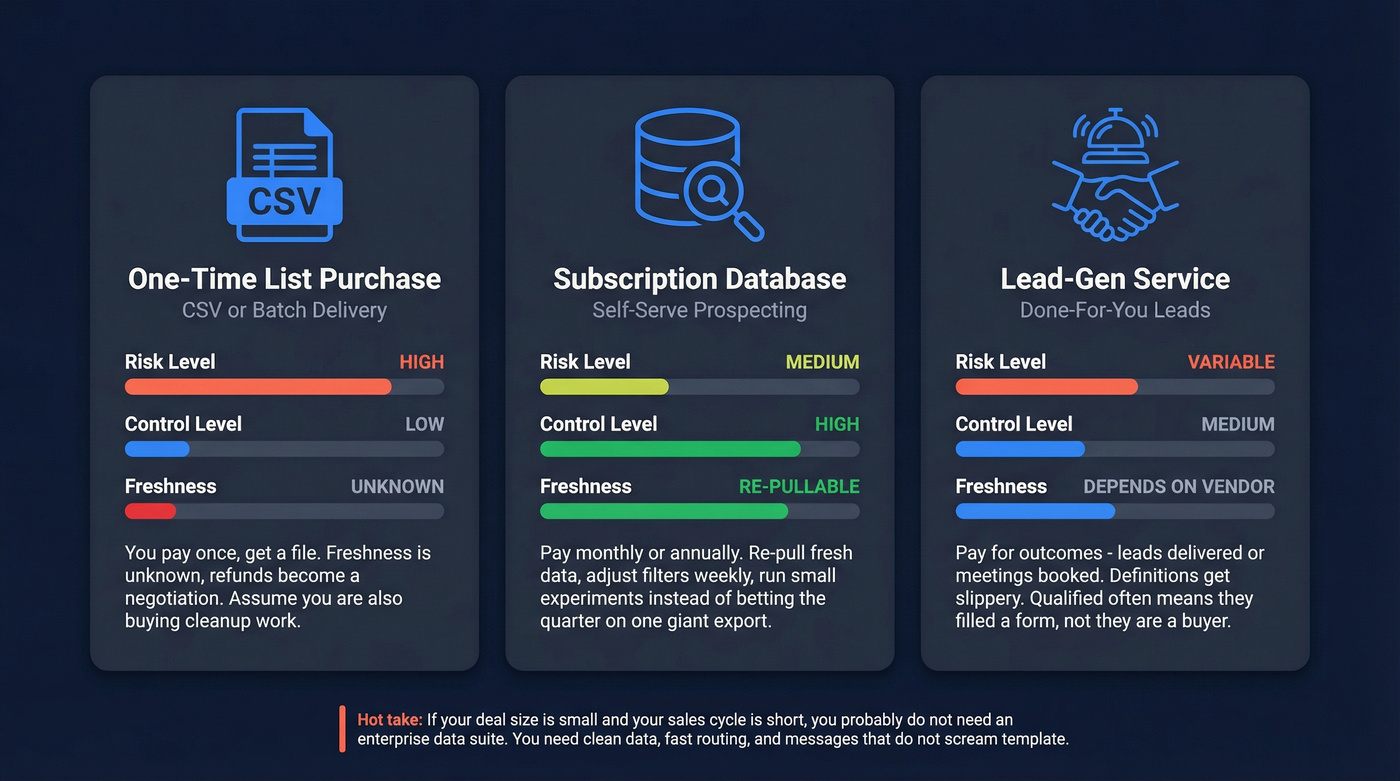

Here are the three models teams buy - and the common ways they break:

1) One-time list purchase (CSV / batch delivery)

You pay once and get a file: names, titles, emails, maybe phones. This is the highest-risk model because freshness is unknown, provenance is often fuzzy, and refunds turn into a negotiation. If you buy a CSV, assume you're also buying cleanup work.

2) Subscription database (self-serve prospecting) You pay monthly/annually for a database + filters, then unlock/export contacts with credits. This is the most controllable model because you can re-pull fresh data, adjust filters weekly, and run small experiments instead of betting the quarter on one giant export.

3) Lead-gen service (done-for-you leads or appointments) You're paying for outcomes (leads delivered, meetings booked, or "qualified" contacts) plus the operational layer: targeting, enrichment, routing, and sometimes outreach. This can be great, but it's also where definitions get slippery. "Qualified" often means "they filled a form," not "they're a buyer."

Hot take: if your deal size is relatively small and your sales cycle is short, you probably don't need an enterprise data suite. You need clean data, fast routing, and messages that don't scream "template."

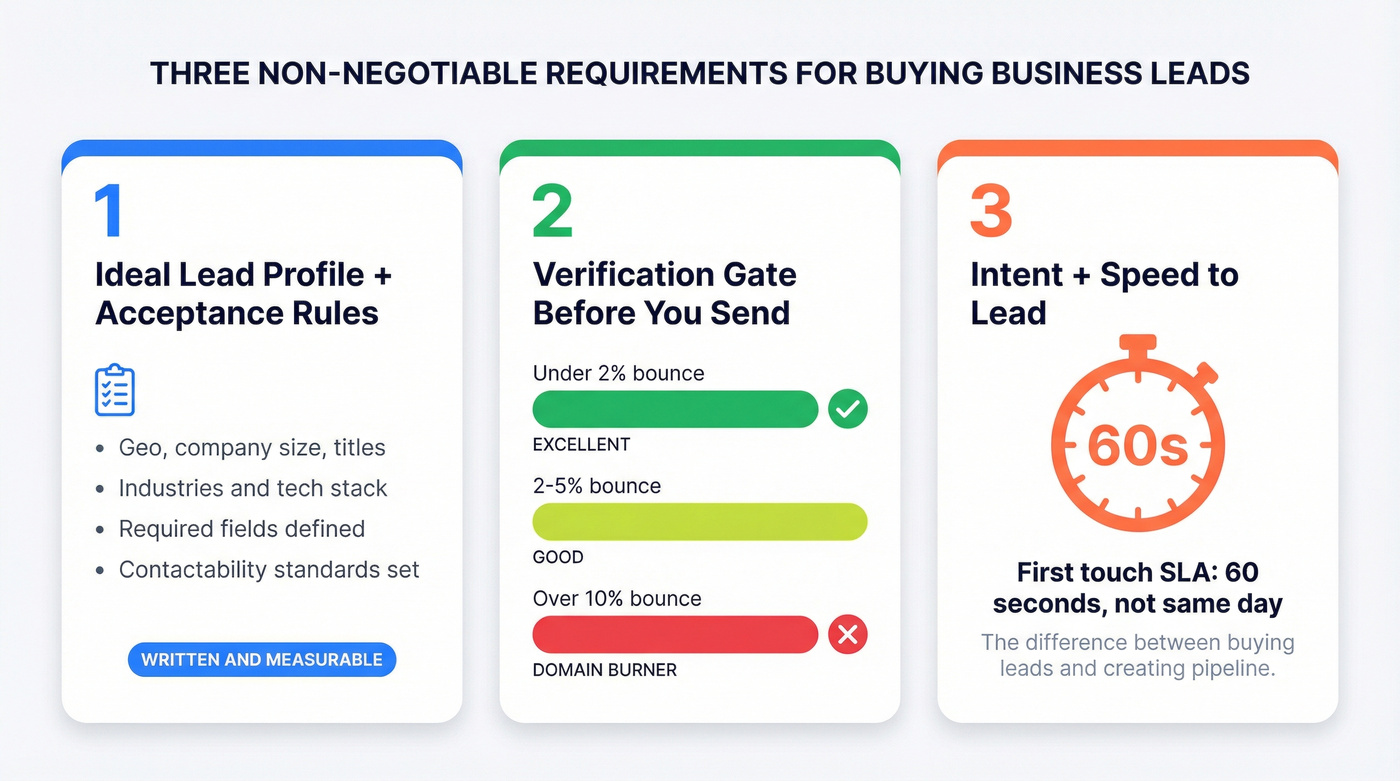

What you need to buy leads without regret (3 non-negotiables)

Before you spend a dollar, lock these three. Skip any one of them and you'll pay twice: once for the leads, and again for the damage.

Ideal Lead Profile (ILP) + acceptance rules (written and measurable) Define your Ideal Lead Profile (ILP) and your reject rules upfront: geo, company size, titles, industries, tech stack, and required fields. Also define contactability: "must have verified email" and "must have direct dial for VP+" if calling's part of the motion.

A verification gate before you send anything Bounce targets are simple: <2% is excellent, 2-5% is good, and >10% is poor. If you're over 10%, you're not "doing outbound," you're burning domains. (If you're building the workflow, use this email verification guide as your SOP baseline.)

Intent + speed-to-lead (60 seconds, not "same day") If a lead shows buying intent (form fill, pricing page visit, webinar, comparison keyword, inbound reply), your SLA is 60 seconds to first touch. That's the difference between "we bought leads" and "we created pipeline."

When buying leads works vs fails (and why it feels broken)

I've watched teams double lead volume and get fewer sales conversations because they responded two days later with generic copy. Volume doesn't fix relevance, and relevance doesn't survive slow follow-up.

Buying leads works when...

Your ICP is narrow enough to describe in filters "US-based IT directors at 200-2,000 employee healthcare orgs using X stack" works. "Anyone who might need security" is how you buy a list of maybes and call it pipeline. (If you need to tighten definitions, start with ideal customer.)

You treat leads like inventory with QA Leads are perishable. Titles change, people leave, domains get locked down. If you don't re-verify and re-enrich before each campaign, you're shipping expired inventory. (More detail on decay + refresh is in B2B contact data decay.)

You can separate data quality from messaging performance If you can't tell whether performance dropped because of data decay, deliverability, or copy, you'll keep swapping vendors instead of fixing the system. (Use a simple data quality scorecard to isolate the variable.)

You have a real follow-up system "Same day" is slow. For anything hot, 60 seconds wins. For cold outbound, "same hour" beats "tomorrow" by a mile. (If you're enforcing SLAs, see speed to lead metrics.)

Buying leads fails when...

You're buying to "fill the CRM" That's how you end up with duplicates, junk titles, and a sales team that stops trusting the data. (If this is already happening, fix it with a keep CRM data clean workflow.)

You skip verification and blame the market Bad lists don't just waste sends - they tank inbox placement, which makes even good leads look "unresponsive." (If you're seeing hard bounces, troubleshoot with 550 Recipient Rejected.)

You don't have routing clarity If inbound-ish leads (demo requests, replies, high intent) aren't routed instantly, you're paying premium prices for the privilege of being late. (A practical routing model is in lead qualification process.)

What practitioners complain about (because it keeps happening)

These are the recurring pain points I hear from operators and reps:

- Renewal shock: "The first year was fine, then the renewal jumped and we still used 20% of the platform."

- CRM pollution: "We imported a list and spent a week deduping subsidiaries, generic inboxes, and wrong locations."

- Bounce creep: "The first campaign was okay, then bounces climbed every month because we kept reusing the same export."

Here's the thing: lead gen doesn't feel broken because there aren't enough leads. It feels broken because most teams optimize for volume while buyers optimize for relevance.

Your scorecard says refresh ≤14 days is a pass. Prospeo refreshes every 7 days - while the industry average sits at 6 weeks. 300M+ profiles, 98% email accuracy, and 5-step verification so you never burn a domain on bad data again.

Stop buying cleanup work. Start buying leads that actually connect.

Buying business leads scorecard (pass/fail thresholds you can enforce)

This is the scorecard I've used with RevOps teams because it forces vendors (and internal stakeholders) to speak in operational terms, not marketing adjectives.

Lead Buying Scorecard (vendor pass/fail)

| Category | Pass threshold | Fail signal | Why it matters |

|---|---|---|---|

| Freshness | Refresh <= 14 days | Monthly+ | Data decays fast |

| Verification | Verified emails required | "Best effort" | Protect deliverability |

| Provenance | Clear source method | Opaque | Compliance + trust |

| Sample audit | 100-300 lead test | No test | Avoid big mistakes |

| Refunds | Clear credit-back | "Case by case" | You'll need it |

| Suppression | Opt-out honored | No suppression | Legal + reputation |

| Exclusivity | Optional | Forced | Cost control |

The pass/fail rules (put these in the contract)

1) Freshness cadence (the silent killer) Many databases refresh on around 6 weeks. Treat anything slower than monthly as stale.

Pass: refresh <= 14 days for your target segments. Fail: "We update regularly" or anything slower than monthly.

2) Verification standard (define what "verified" means) "Verified" ranges from "we guessed the format" to "we validated mailbox behavior and removed traps."

Pass: you can run a verification gate and only pay/export contactable records. Fail: you're forced to buy the whole file and eat the bounces.

3) Sample audit requirement (non-negotiable) I've run bake-offs where the "best database" lost because it created a mess in Salesforce: duplicates, wrong subsidiaries, and generic inboxes.

Pass: vendor supports a 100-300 lead sample that matches your ILP, with the same fields you'll get in production. Fail: they push you into an annual contract or a giant one-time buy without a representative sample.

4) Refund policy (make it mechanical) Refunds shouldn't require a debate. They should be math.

Pass: credit-back or replacement for invalid emails, wrong ICP, duplicates, and suppressed contacts - with a defined window (7-30 days). Fail: "We'll review and decide."

5) Exclusivity (pay for it only when it's real) Exclusive leads can be worth it in high-competition verticals, but "exclusive" often just means "we didn't sell it to you yesterday."

Pass: exclusivity is optional and priced as a clear premium (often 20-100% higher CPL depending on niche). Fail: vendor forces exclusivity pricing without proving distribution controls.

6) Suppression + opt-out handling (where vendors get sloppy)

You need a way to suppress: opt-outs, existing customers, open opportunities, competitors, and "do not contact" lists.

Pass: vendor accepts suppression lists and confirms they're applied before delivery/export. Fail: they tell you to "remove them after."

Real talk: suppression after the fact is how you email someone who already opted out - and that's the kind of mistake that gets escalated internally fast.

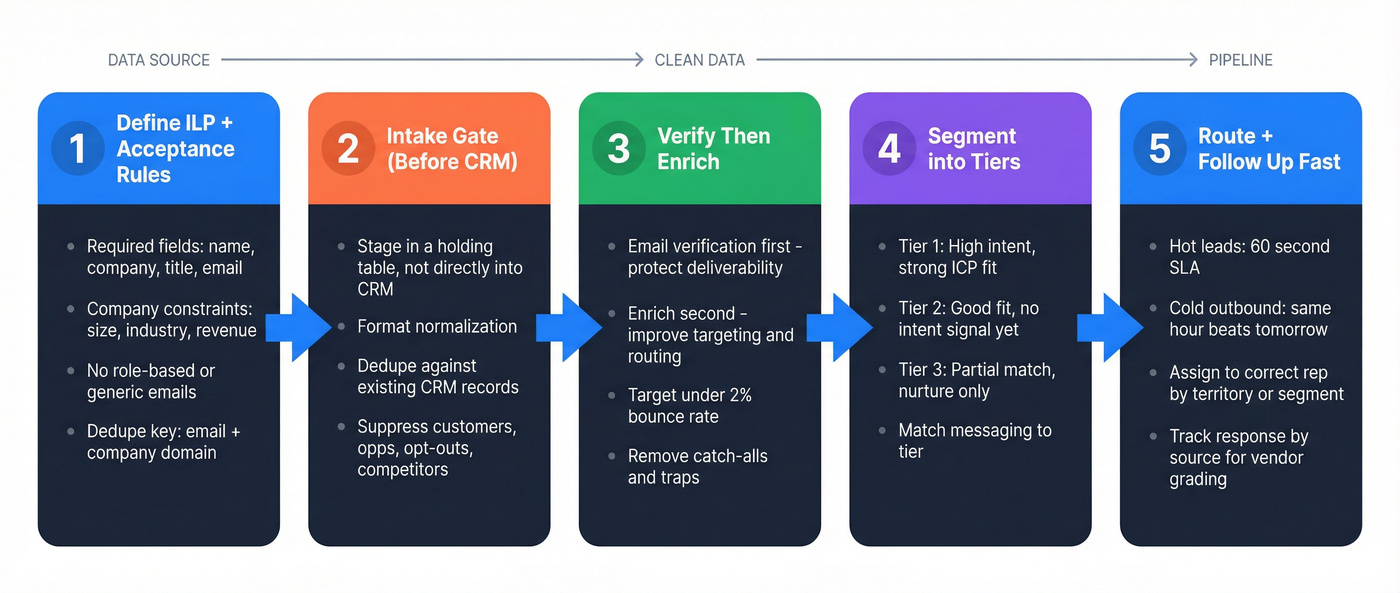

Buying business leads workflow (ILP -> intake gate -> verify -> enrich -> route)

If you want bought leads to behave like a predictable channel, run them through a mini supply chain. This SOP works whether you're buying a CSV, pulling from a database, or receiving leads from a service.

Step 1: Define ILP + acceptance rules (write them like QA specs)

Your ILP is who you want. Your acceptance rules are what you refuse.

Minimum acceptance rules I'd enforce:

- Required fields: first name, last name, company, title, country, email

- Company constraints: employee range, industry exclusions, revenue band (if relevant)

- Contact constraints: no role-based emails, no generic inboxes

- Contactability: verified email required; phone required if calling's part of the motion

- Dedupe key: email + company domain (and a CRM ID if you've got it)

Step 2: Intake gate before CRM (don't pollute Salesforce/HubSpot)

Bought leads shouldn't go straight into your CRM as "Leads." That's how you create permanent mess.

Route them into an intake table first (sheet, warehouse table, or a staging object). Run:

- format normalization (company names, countries, states)

- dedupe against CRM

- suppression (customers, opps, opt-outs, competitors)

- field completeness checks

One clean import beats five "we'll fix it later" imports. (If you need the mechanics, use this import leads playbook.)

Step 3: Verify, then enrich (in that order)

Verification protects deliverability. Enrichment improves targeting and routing. (If you want a clean checklist, use an email verification list SOP.)

Step 4: Segment into 2-4 plays (don't run one mega-sequence)

Bought leads perform when the message matches the reason they'd care.

A practical segmentation:

- Core ICP (your best-fit): direct offer + proof

- Adjacent ICP: softer CTA, more education

- High intent (any signal): short email + fast call follow-up

- Low confidence (thin data): verify/enrich again or suppress

Step 5: Route with a 60-second SLA for anything hot

If a lead replies, fills a form, or shows clear intent, your SLA is 60 seconds to first touch. That's not motivational-poster advice; it's a routing requirement, and it needs an owner, an alert, and a fallback if the first rep doesn't pick it up.

Step 6: Measure quality separately from performance

Track these as separate dashboards:

- List quality: bounce rate, invalid rate, duplicate rate, missing fields

- Deliverability: inbox placement proxies, spam complaints, domain health

- Performance: reply rate, positive reply rate, meetings booked, cost per meeting

I've seen teams rewrite copy for weeks when the real issue was a 9% bounce rate dragging everything down.

Benchmarks that keep you honest (quality -> deliverability -> replies -> meetings)

Bought leads don't fail in one place. They fail as a chain reaction.

The decay reality: your list is expiring inventory

A widely cited benchmark is ~22.5% contact-data decay per year (it varies by industry and role). The operational takeaway is the only part that matters: re-verify before every campaign and refresh segments on a schedule, not "when reps complain."

Deliverability prerequisites (do these before you buy more leads)

If you ignore this checklist, you'll misdiagnose everything as "bad leads."

- SPF, DKIM, DMARC set correctly on every sending domain (use SPF DKIM & DMARC if you need a setup reference)

- Dedicated sending domains (don't blast from your primary corporate domain)

- Inbox warmup + gradual ramp (especially for new domains)

- Inbox rotation (spread volume across mailboxes; don't torch one)

- Hard bounce guardrail: pause campaigns if bounces cross 5%; stop everything at 10%+

Deliverability baselines (don't negotiate with math)

Use these bounce thresholds as hard guardrails:

- <2% bounce: excellent

- 2-5% bounce: good

- >10% bounce: poor (stop and fix)

Bought-lead messaging rules that actually move replies

Most bought-lead sequences fail because they sound like a bought-lead sequence. Use these rules:

- Lead with an observation, not a pitch ("Noticed you're hiring X / expanding Y / using Z stack...")

- Ask one tight question that's easy to answer in 5 seconds

- Skip links in email #1 (earn the click later)

- Give permission to say no ("If this isn't on your radar, tell me and I'll close the loop.")

- Match the CTA to intent (high intent = direct meeting ask; cold = micro-commitment)

- Keep it human-short (if it needs scrolling, it's too long)

- Personalize the reason, not the greeting (a token "Hi {FirstName}" isn't personalization)

Reply rate benchmarks (what normal looks like)

At scale, a realistic cold email reply rate is 3-4%. That's the baseline when you're sending to strangers.

A widely shared 2026 benchmark summary circulating in the cold email community reports:

- average reply rate: 3.43%

- top 25%: 5.5%+

- top 10%: 10.7%+

- 58% of replies come from email 1

Treat that as directional. The useful part is strategic: your first email carries the whole program, so don't waste it on a generic opener and a calendar link.

Mini math: turning a bought list into meetings

Let's say you buy 1,000 leads.

- 5% bounce (good): 950 delivered

- 3.43% replies (average): ~33 replies

- 30% positive replies (varies): ~10 positives

- 50% of positives book: ~5 meetings

That's why "buy 10,000 leads" is usually the wrong move. You don't have a volume problem. You've got a quality + relevance + routing problem.

Compliance in 2026 (US email + US calls/SMS + UK/EU rules you can run)

I'm not a lawyer, but I've implemented enough outbound systems to know this: compliance fails operationally, not philosophically. You need checklists and logs, not vibes.

US email (CAN-SPAM): legal without opt-in, still easy to mess up

CAN-SPAM doesn't require opt-in for commercial email. What you must do every time:

- truthful "From," routing, and header info

- non-deceptive subject lines

- include a valid physical postal address

- include a clear opt-out mechanism

- honor opt-outs promptly and consistently

Purchased lists are risky because you can inherit bad practices (harvested addresses, traps, people who already opted out). Your control is operational: suppression lists + opt-out logging + verification before send.

US calls/SMS (TCPA/FCC): timeline (context) + what to do now

Also: TCPA still applies to B2B if you're calling or texting cell phones.

Historical timeline (context only):

- Nov 2026: FCC Public Notice set the one-to-one consent rule effective date to January 27, 2026.

- Jan 2026: FCC order postponed the effective date by 12 months to January 26, 2026 (or until a post-court-decision Public Notice, whichever sooner).

- July 2026: FCC removed the one-to-one consent rule as nullified by court decision and reinstated prior rule text.

What to do now (what protects you regardless of rule churn):

- Treat phone/SMS consent as a proof problem: store source, timestamp, language, and scope.

- Use suppression lists aggressively (DNC, internal opt-outs, customers, open opps).

- Avoid dialing/texting workflows that rely on vague consent language.

- Assume carriers and enforcement keep tightening even when rules change.

UK/EU: PECR + GDPR operational basics (and the fine ceiling)

In the UK, PECR fines can reach GBP17.5M or 4% of global turnover.

Operational rules that matter in practice:

- Corporate subscribers can generally receive B2B marketing emails without consent, but opt-outs must be honored.

- Sole traders and some partnerships are treated like individual subscribers, which changes consent requirements.

- For calling: screen against CTPS (corporates) and TPS (individuals/sole traders/partnerships).

- Automated marketing calls require prior consent regardless of subscriber type.

Budgeting & true cost of bought leads (CPL anchors + pricing reality)

The trap is budgeting only for "cost per lead." The real cost is: leads + verification + enrichment + sequencing + rep time + deliverability damage.

CPL anchors (so you don't overpay)

Useful benchmarks:

- Cold email CPL: $150-$300 (avg $225)

- Multi-channel prospecting CPL: $188

Industry blended CPLs (sanity-check your niche):

- B2B SaaS blended: $237

- Cybersecurity: $406

- IT & Managed Services: $503

- Legal: $649

If someone sells you "exclusive CTO leads" at $40 each in a high-CPL industry, it's not a bargain. It's a red flag.

ZoomInfo pricing reality (market ranges) + G2 context

- Typical market ranges reported by third parties: $15k-$45k+/year depending on package and add-ons. Renewals commonly climb 10-20%.

- G2 context: ZoomInfo sits at 4.5/5 with 8,997 reviews, with ~1 month implementation and ~14 months to ROI, plus an average discount around 15%.

(If you're comparing vendors, this ZoomInfo pricing breakdown helps with the real math.)

The cheapest insurance in this system: verification

Verification is cheaper than bad-data cost. If you're paying roughly ~$0.01 per email to verify, verifying 10,000 emails costs about $100. One damaged domain costs weeks of pipeline.

I hate seeing teams learn this the hard way, because it's so avoidable.

Real-world outcome (what gating changes): Meritt cut bounce from ~35% to under 4% and stopped deliverability fires from spreading.

A simple cost model you can steal:

| Item | Example | Cost |

|---|---|---|

| Leads bought | 5,000 | $2,500-$25,000 |

| Verification | 5,000 emails | ~$50 |

| Enrichment | firmo/tech | $100-$500 |

| Sequencing tool | 1-5 seats | $50-$500/mo |

| Rep time | 20 hrs | $600-$2,000 |

Tools that help you buy leads safely (minimum viable stack)

You don't need a 14-tool "RevOps stack." You need three layers: data source, verification/enrichment gate, and execution (sequencing + routing). (If you want a broader build, see the B2B sales stack blueprint.)

Tier 1: Data sources (where the leads come from)

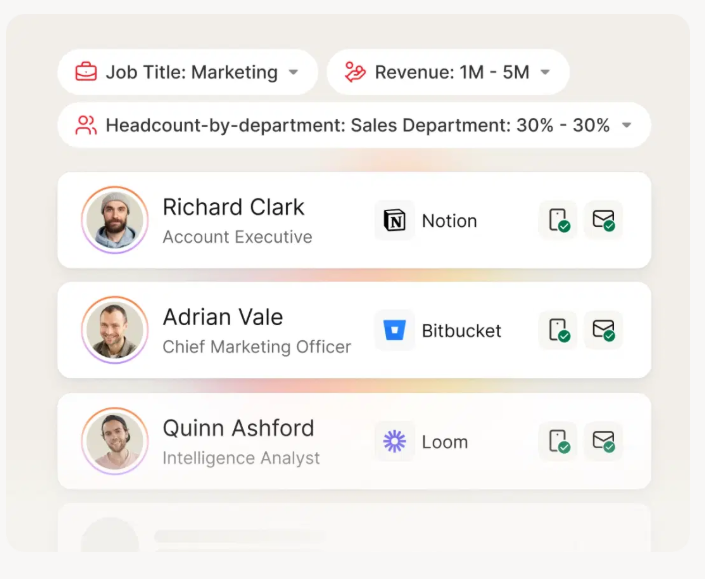

Prospeo - The B2B data platform built for accuracy Prospeo's the best pick when you care about freshness and deliverability more than suite bloat. It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed every 7 days, with 98% verified email accuracy. It also tracks intent across 15,000 topics (powered by Bombora) and gives you 30+ search filters so you can describe your ILP in plain filters instead of "we'll know it when we see it." On the ops side, it fits the workflow: verify before export, enrich your CRM/CSV with 50+ data points, and connect it to the tools teams actually use (Salesforce, HubSpot, Smartlead, Instantly, Lemlist, Clay, Zapier, Make). In our experience, that's what keeps bought leads from turning into a CRM cleanup project two weeks later.

Pricing estimate: free tier, then about $0.01 per verified email; mobiles are typically 10 credits per number. (If you want the full breakdown, see Prospeo pricing.)

UpLead UpLead's the straightforward SMB-friendly database when you want clear pricing and predictable credits. It advertises a 95% data accuracy rate and verified emails, and its pricing is explicit: $99/mo for 170 credits, $199/mo for 400 credits, and $74/mo billed annually for Essentials (2,040 credits/year). 1 credit = 1 contact you unlock for download/CRM export (including email + mobile direct dial).

Pricing estimate: $74-$199/mo for common tiers; higher tiers scale up.

External link: https://www.uplead.com/pricing/

ZoomInfo ZoomInfo's still the enterprise baseline for breadth, org structure, and add-ons like intent and org mapping. It's also the tool most teams overbuy because procurement wants "the standard," then reps use 10% of it.

Skip ZoomInfo if you're under ~10 outbound seats or you won't run intent, governance, and workflows with actual discipline. If that's you, it's usually overpriced.

Pricing estimate: commonly $15k-$45k+/year depending on package and modules; renewals often rise 10-20%.

External link: https://www.g2.com/products/zoominfo-sales/pricing

Apollo Apollo's the "get reps moving fast" option: database + sequences + basic workflow in one place. It's great for speed, but you need governance because credits and exports get messy fast, and teams tend to confuse "more exports" with "more pipeline."

Pricing estimate: commonly reported around ~$49-$119/user/mo on annual plans (higher on monthly), with credit overages driving real cost.

External link: https://knowledge.apollo.io/hc/en-us/articles/4409140527757-Dialer-Overview

Lusha Lusha's built for fast reveals when reps want to grab a contact and move on. Credit mechanics matter: email = 1 credit, phone = 10 credits.

Pricing estimate: free plan up to 70 credits/month; paid plans commonly land around ~$29.90/user/mo (Pro) to ~$69.90/user/mo (Premium).

External link: https://www.lusha.com/pricing/

Kaspr Kaspr's a strong EU-oriented option with unusually clear pricing. It includes "unlimited B2B email credits," but exports are capped annually, so model your volume before you commit.

Pricing estimate: $49/user/mo (annual) / $65 (monthly) for Starter, and $79/user/mo (annual) / $99 (monthly) for Business.

External link: https://www.kaspr.io/pricing

Tier 3: Execution + ops layers (where bought leads succeed or die)

To break the monotony, here's the blunt "use it when..." view:

Clay (enrichment orchestration / waterfall) Use it when: you're combining multiple sources and want a waterfall that picks the best result, reducing missing fields and bad matches before sequencing. Pricing estimate: credit-based; expect $150-$500/mo for smaller workflows and $1k+/mo at scale.

Instantly (sending + sequencing) Use it when: you're running volume and need consistent sending infrastructure, inbox management, and reporting across many mailboxes. Pricing estimate: typically $37-$97/mo for smaller plans; higher tiers scale with inboxes/volume.

Smartlead (sending + sequencing) Use it when: you want inbox rotation and deliverability controls as first-class features, especially for multi-domain setups. Pricing estimate: typically $39-$94/mo, scaling with inboxes and features.

Lemlist (personalization-first sequencing) Use it when: your bought leads are narrow ICP and you're willing to write more human emails that earn replies instead of spray-and-pray. Pricing estimate: typically $59-$99/user/mo depending on plan.

ActiveProspect (TrustedForm / LeadConduit) (intake ops + consent proof) Use it when: you buy leads for phone/SMS or performance lead-gen and need validation, routing, suppression, and consent documentation. Pricing estimate: typically $500-$3,000+/mo depending on lead volume and modules.

If you do nothing else this week...

- Buy 100-300 leads first, not 10,000.

- Put them through an intake gate (dedupe + suppression) before CRM.

- Verify before every send and pause at 5% bounces.

- Run 2-4 tight plays, not one mega-sequence.

- Enforce a 60-second SLA for anything hot.

You just read that >10% bounce rate means you're burning domains, not doing outbound. Prospeo's proprietary verification drops bounce rates under 4% - proven across 15,000+ companies. At $0.01 per email, a failed vendor test costs you nothing.

Run your 100-lead sample audit right now, on us.

FAQ

Is buying business leads legal in 2026?

Yes. US commercial email can be legal under CAN-SPAM without opt-in, but you've got to include an opt-out, a physical address, and honor suppression consistently; calls/SMS and UK/EU outreach have stricter screening and consent rules. In practice, require provenance, run verification, and keep opt-out logs for every campaign.

Should I buy exclusive leads or shared leads?

Exclusive leads are worth paying 20-100% more only when your niche is brutally competitive and you can respond in minutes, not hours. Otherwise, shared leads usually win on cost - as long as you enforce acceptance rules, verify before sending, and route high-intent responses with a 60-second SLA.

What's a good bounce rate and reply rate for purchased lists?

A healthy program keeps hard bounces under 5% (with <2% as the gold standard) and stops campaigns when bounces hit 10%+. For cold outbound, 3-4% reply rate is a realistic baseline at scale, while strong targeting and deliverability can push 5.5%+ consistently.

How many leads should I buy to book meetings reliably?

Start with a 100-300 lead batch, then scale only after it passes QA (bounce, duplicates, missing fields). As a rough model, 1,000 leads at 5% bounce and ~3.4% replies often nets ~5 meetings if ~30% of replies are positive and ~50% of positives book - so quality and routing matter more than volume.

What's a good free alternative for verifying and enriching lead lists?

For small teams, Prospeo's free plan (75 email credits plus 100 Chrome extension credits per month) is one of the most practical ways to verify before you send and enrich records with 50+ data points. Pair it with a small sample export from your data vendor and enforce a hard-bounce target under 5% before scaling.

Summary: the safest way to make bought leads work

Buying business leads isn't the problem. Treating them like "instant pipeline" is.

Run a tight intake gate, verify before every send, segment into a few plays, and enforce fast routing for anything showing intent. Do that, and you'll stop paying for CRM cleanup and start paying for meetings.