How to Build a Sales Onboarding Plan That Cuts Ramp Time in Half

Your VP of Sales is staring at the dashboard on Day 90. Three new reps are still behind quota, and the CRO's patience is gone.

You've already spent roughly $12K per hire on recruiting, tools, and "training." Now you're hearing the same line from every manager: "They just need more time." Meanwhile, the territory sits cold, the pipeline forecast is fiction, and the next board meeting is in six weeks.

Here's the part nobody wants to say out loud: 88% of companies admit their onboarding is subpar, and sales teams feel it first because ramp time is brutally visible. Organizations with formal onboarding boost retention by 82% and productivity by over 70%. The gap between "we have onboarding" and "we have effective onboarding" is where millions of dollars in quota attainment disappear every year.

A sales onboarding plan isn't a welcome deck or a Notion page full of links. It's a performance system that gets a rep to independent pipeline generation and closed deals - without burning them out or burning your pipeline.

What You Need (Quick Version)

- Start preboarding before Day 1. 80%+ of high-performing companies start onboarding before the rep ever logs in. If you wait until Monday morning, you're already behind.

- Assign a peer buddy on Day 1. This is more impactful than any LMS. A high-performing peer shortens the "I'm stuck and embarrassed" loop to minutes instead of days.

- Build a week-by-week milestone plan, not a topic-based curriculum. Milestones force focus and accountability.

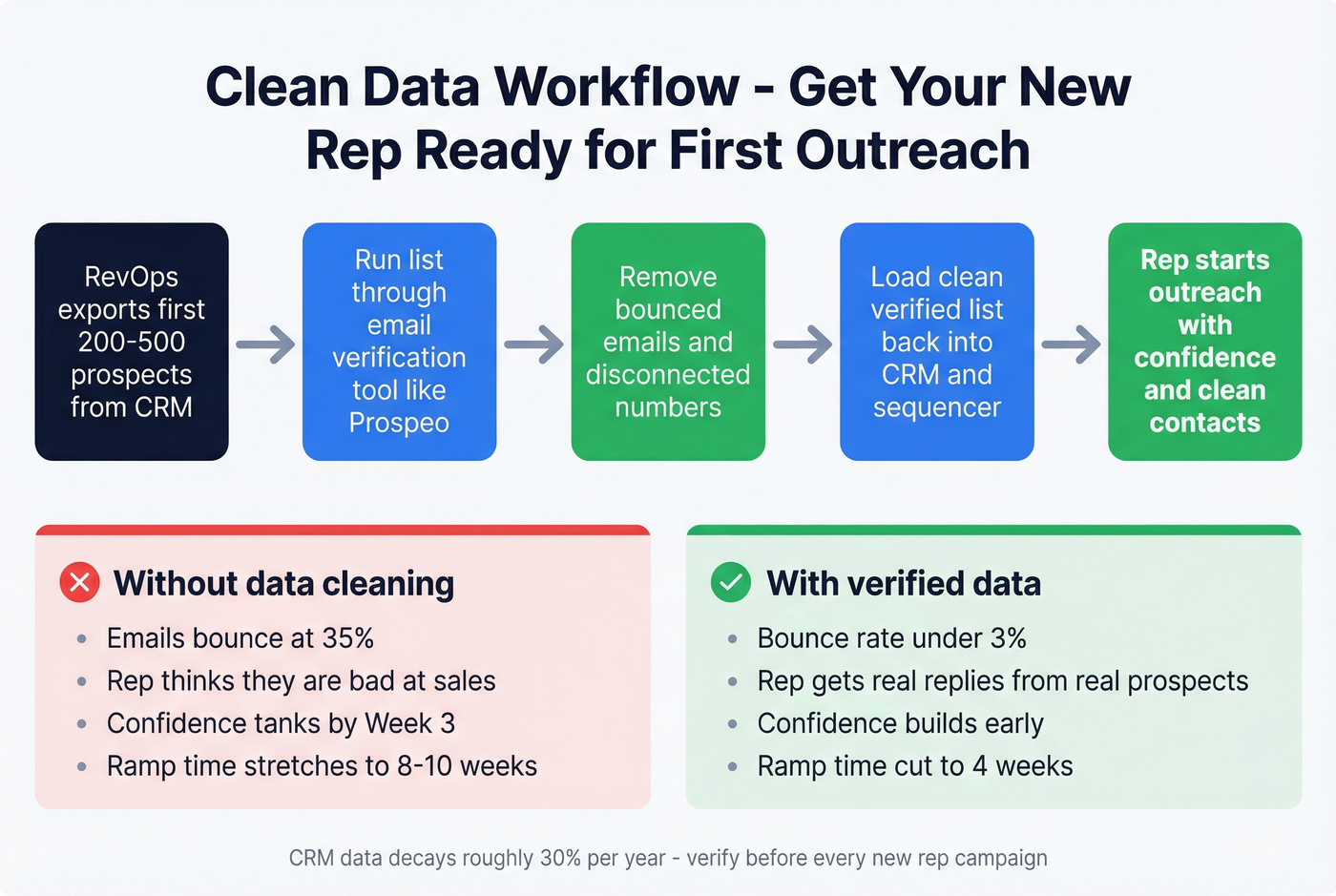

- Make sure your reps have clean prospect data before first outreach. CRM data decays roughly 30% per year. Run lists through a verification tool so your rep's first campaign doesn't bounce at 35%.

Why Most Sales Onboarding Programs Fail

Most onboarding fails for one boring reason: it's designed like school (topics) instead of like a job (outcomes).

And the cost shows up fast.

Ramp time is getting worse, not better. Average SaaS ramp time is 5.7 months, up 32% from 2020's 4.3 months. That's half a year of salary, tooling, and manager time before you get consistent production.

Early attrition is a silent tax. 20% of new sales hires leave within 90 days when onboarding is weak. When that happens, you don't just lose a rep - you lose the territory momentum, the manager's time, and a chunk of your quarter. Employees who experience great onboarding are 69% more likely to stay three or more years.

Replacement cost is ugly. Replacing a sales rep runs $100K-$150K in many orgs, and in higher-quota roles the impact can exceed $500K once you factor in missed revenue and territory disruption.

Turnover craters without a structured process. RAIN Group found that average turnover decreases from 50% to 12% as onboarding effectiveness increases. Organizations with effective onboarding are also 4x more likely to get new hires productive in under three months. That's not a marginal improvement - that's a fundamentally different business.

Most teams don't even have the map. 51% of sales orgs don't have a defined sales process. So new reps get trained on "how we do things" by whoever they shadowed last, which is how you end up with five different discovery styles and zero forecasting credibility.

Only 35% rate their onboarding as extremely or very effective. That's not a rounding error. That's a systemic problem.

The real ramp cost: Total ramp cost isn't "salary until quota." It's ~3x base salary once you include recruiting, enablement time, manager coaching, lost pipeline, and mistakes made by undertrained reps.

The churn spiral: Weak onboarding → low confidence → low activity → low pipeline → manager pressure → rep quits. You'll see it before Month 3 if you're watching the right metrics.

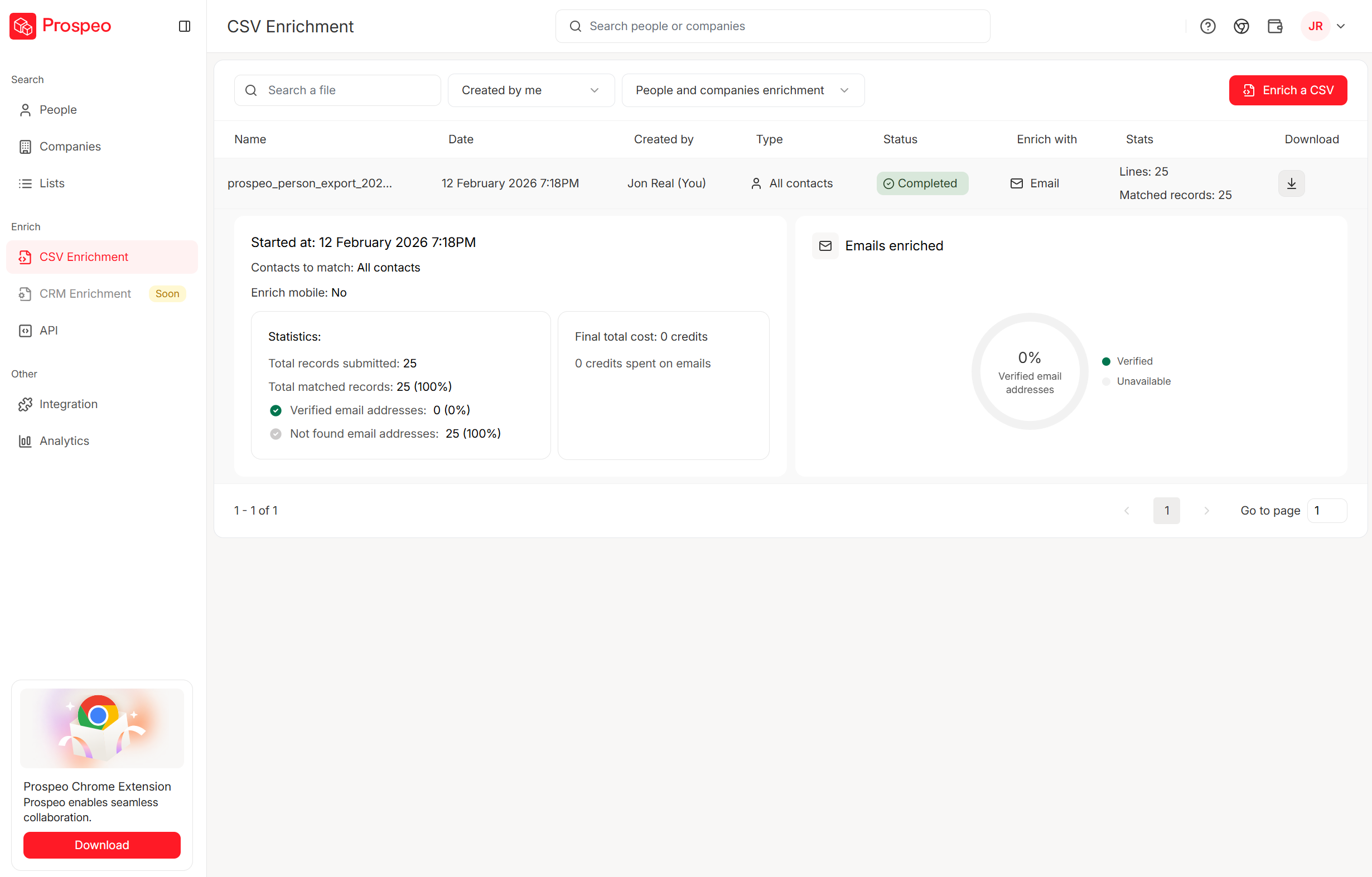

Your new reps' first campaign sets the tone for their entire ramp. When 30% of CRM data decays annually, sending rookies into outreach with bad emails tanks their confidence and your pipeline. Prospeo's 98% verified emails and 7-day data refresh mean every new hire starts with contacts that actually connect.

Don't let dirty data extend your ramp time by another month.

What Effective Sales Onboarding Actually Includes

The most useful finding in the research is also the least glamorous: the #1 driver of effective onboarding is strong training on sales process and methodology. Not product. Not pitch decks. Not "shadow more calls."

Effective onboarding is built on six pillars:

- Company knowledge (mission, org structure, how decisions get made)

- Product mastery (what it does, where it wins/loses, implementation reality)

- Sales process + methodology (your stages + how you qualify: MEDDIC, BANT, etc.)

- Tools + CRM (how you actually run the job day-to-day)

- Customer personas (ICP, pains, triggers, buying committee, objections)

- Data infrastructure (territory rules, lead sources, enrichment, deliverability hygiene)

Organizations with effective onboarding are 6.3x more likely to prepare new hires to succeed. That's the difference between a predictable ramp and a constant hiring treadmill.

Here's the thing: most teams teach "top to bottom" (all the knowledge first), then throw reps into the wild.

Mike Kunkle's better model is "teach left to right." Only teach what the rep needs to hit the next performance milestone. Then reinforce it with practice, coaching, and real work. Think of it as building a sales playbook one chapter at a time - each chapter unlocked only when the rep has demonstrated mastery of the last. A flipped classroom approach, where reps consume content asynchronously and spend live time on practice and coaching, is one of the most effective ways to accelerate skill development without adding more classroom hours.

The Complete 30-60-90 Day Sales Onboarding Plan

A good 30-60-90 plan isn't a calendar. It's a set of milestones with proof that the rep can execute.

I've seen teams run beautiful onboarding bootcamps and still fail because there was no readiness validation. The rep "attended training," but couldn't run discovery, couldn't log clean notes, and didn't know who to ask for help. Use the framework below as your default onboarding timeline, then tailor by role (SDR vs AE), segment, and sales cycle length.

Before Day 1 - Preboarding

Preboarding is where you win the first two weeks. It's the first step in onboarding new sales team members, and skipping it is one of the most common failures.

The checklist is simple and it works:

- Manager sends a welcome message (video is even better)

- Share a timeline for the first 2 weeks + key contacts

- Complete admin paperwork (HR, payroll, compliance)

- Tech provisioning: laptop, email, CRM, dialer, sales enablement tools, calendar, permissions

- Assign a peer buddy (and tell the buddy what "good" looks like)

- Provide a brief product + role overview so Day 1 isn't pure confusion

Google's Noogler approach nails the manager side: the day before start, the manager preps access, first-week goals, and the first set of "just-in-time" tasks so the rep isn't blocked.

80%+ of high-performing companies preboard. It's a signal that you respect the rep's time and you run a tight ship.

Days 1-7 - Foundation Week

Keep Week 1 structured and light on "deep work." Your goal is orientation + early confidence.

Day 1 essentials:

- Personalized welcome + team intros

- Mission/culture overview (short, not a TED talk)

- Sales org structure: who owns what, how handoffs work

- Light product/customer intro (what you sell, to whom, why you win)

- Set Week 1 expectations: "Meet 5 key people, complete 3 training modules"

Days 2-5:

- Shadow 2-3 live calls/demos (not recordings only)

- CRM walkthrough: objects, stages, required fields, hygiene rules

- Intro to methodology: BANT or MEDDIC, and how it maps to your stages

- Listen to top rep call reviews with commentary ("what good sounds like")

- End-of-week manager check-in: blockers, confidence, and next-week plan

Look, shadowing is the fastest trust-builder I know. It turns "theory" into "oh, that's how we actually do it here." These early activities set the tone for everything that follows.

Days 8-30 - First Outreach

This is where the onboarding process either becomes a ramp engine or a confidence-killer.

Your rep should start outreach, but it should be low-stakes and coached:

- Start prospecting with approved scripts/templates (email + call + voicemail)

- Run mock sales calls twice a week with real feedback (not vibes)

- Do low-stakes outreach: smaller accounts, warm-ish segments, or recycled leads

- Keep shadowing, but shift from "watch" to "do" (rep runs part of the call)

It takes roughly 7,000+ activities to close a first deal. Calls, emails, follow-ups, meetings, proposals. Your new rep needs to understand this volume expectation early - and they need to know that most of those activities will feel unproductive at first. That's normal.

Now the landmine: data quality. This is the moment new reps hit stale CRM records, bounced emails, and disconnected numbers. They'll internalize it as "I'm bad at sales," when the real issue is "we gave you garbage inputs." (If you want a deeper system, treat it like data quality work, not a one-off cleanup.)

Before your new rep makes their first call, make sure the data is clean. Have RevOps export the rep's first 200-500 prospects, run them through a verification tool like Prospeo, then load the clean list back into the CRM and sequencer. GreyScout did exactly this and cut rep ramp time from 8-10 weeks to 4 weeks.

30-day review goals:

- Rep can explain ICP + top 3 pains

- Rep can run discovery with your methodology

- Rep can build a target list and execute a basic sequence

- Rep has first meetings booked (learning milestone), not "must close revenue"

Aim for learning milestones, not revenue targets. Pressure for immediate deals before a rep's seen a full sales cycle is how you get panic-selling and bad qualification.

Days 31-60 - Application and Pipeline Building

Month 2 is where you move from "training" to "production with guardrails."

What changes:

- Rep owns a sales cycle end-to-end (with manager support)

- Target 25-50% of full ramp quota (activity + pipeline + early revenue)

- Advanced objection-handling workshops (pricing, security, "build vs buy")

- Call coaching continues (at least 1 recorded call review/week)

Weekly pipeline reviews should focus on:

| Review Area | What You're Looking For |

|---|---|

| Stage hygiene | Deals in the right stage with correct close dates |

| Next steps | Every deal has a scheduled, specific next action |

| Deal risks | Single-threaded contacts, no champion, stalled deals |

| MEDDIC/BANT gaps | Missing economic buyer, undefined decision criteria |

Bridge Group data is the reality check: 39% of reps ramp in 3-5 months. So if you're expecting full performance by Day 45 in a mid-market motion, you're not "high standards." You're miscalibrated.

Days 61-90 - Full Autonomy

Month 3 is autonomy + consistency. This is where you validate whether your onboarding steps actually translated into independent execution.

Checklist:

- Full quota ownership (or the closest equivalent for ramp)

- Independent territory management: account plans, prioritization, follow-up discipline

- Rep runs discovery and next steps without manager "rescuing" the call

- 90-day formal review: performance, skills, gaps, and next-quarter plan

- Rep contributes to team strategy: objection library updates, win/loss notes, new messaging tests

Phase 3 success metrics:

| Milestone | Evidence | Due by |

|---|---|---|

| Run discovery solo | 2 scored calls above threshold | Day 60 |

| Clean CRM hygiene | 95% required fields complete | Day 75 |

| Build pipeline | $X pipeline created | Day 90 |

| Close first deal | 1 closed-won | Day 90 |

Ramp-Time Expectations by Segment

Hot take: If your deal size is under $15K and your sales cycle is under 60 days, a 6-month ramp is a process failure, not a market reality. Most SMB and lower mid-market teams can get reps productive in 8-12 weeks with a structured program. The teams that can't usually have a process problem, not a people problem.

A simple rule: onboarding duration should match or exceed your sales cycle length. If your cycle is 120 days and onboarding is 14 days, you're telling reps to "figure it out."

| Segment | Typical ramp time |

|---|---|

| Enterprise B2B | 9-12 months |

| Mid-market | 4-6 months |

| SMB | 1-3 months |

| SDR | ~3.2 months avg |

Steal These Onboarding Tactics from Top Companies

Buffer's three-buddy system is the cleanest "small company" model I've seen. The hiring manager owns outcomes and 30/60/90 milestones. A role buddy answers day-to-day "how do I do this?" questions. A culture buddy helps the new hire feel human, not transactional, for the first six weeks. Most companies assign one buddy and call it done. Three sounds like overkill until you realize each buddy serves a completely different function.

Google's Noogler system is famous for a reason. The buddy lasts six months, not two weeks. The work is delivered "just in time," so new hires aren't drowning in docs they won't use for 60 days. The manager also does a pre-start prep day, which prevents the classic Day 1 "your permissions aren't ready" mess.

Zapier's onboarding automation is a reminder that ops matters. They saved 30 minutes per hire through automation, which compounded into over a year and a half in working hours saved for their onboarding specialist. That's not just efficiency - it's consistency. The process runs the same way every time.

Zappos's "The Offer" is the most aggressive culture filter: they pay new hires to quit if they don't feel aligned. Most sales orgs won't copy that, but the principle is gold - it's cheaper to lose someone early than to drag out a mismatch for six months.

Sales Onboarding Mistakes That Cost You Reps (and Revenue)

Use this as a "spot the leak" checklist. Every mistake below has a direct fix.

Mistake: Firehose training in Week 1. Fix: Teach left to right. Only train what's needed for the next milestone, then practice it. A flipped classroom approach - where reps review material before sessions and spend live time on application - works especially well here.

Mistake: No performance milestones (only topics). Fix: Define readiness checks: scored calls, CRM hygiene score, first sequence launched, first pipeline review passed.

Mistake: No reinforcement after the bootcamp. Fix: Weekly call coaching + role plays for 60 days. Skills decay fast without reps.

Mistake: "Go get 'em tiger" launches. Fix: Don't cut the cord on Day 14. Keep guardrails: deal reviews, messaging QA, and a buddy who's accountable.

Mistake: Unclear expectations. Fix: Gallup found only about 50% of employees know what's expected of them at work. Write expectations down: daily activities, weekly milestones, quality bars.

Mistake: Onboarding shorter than the sales cycle. Fix: If your cycle is 4-6 months, a 2-week onboarding is theater. Extend touchpoints through the first full cycle.

Mistake: Skipping preboarding entirely. Fix: At minimum: welcome message, tech provisioning, buddy assignment. The rep who shows up Monday to a blank laptop and no CRM access is already behind by a week.

Mistake: Handing new reps stale data. Fix: Picture this: an SDR hits Week 3, dials 10 numbers, 6 are disconnected, and their first email sequence bounces at 35%. That rep doesn't think "data decay." They think "I'm failing." Verify and enrich prospect lists before first outreach. Teams that do this routinely see bounce rates drop from 35% to under 4%. (If your team needs a repeatable workflow, use an email verification list SOP.)

Mistake: Running a pre-2020 program in a hybrid world. Fix: 39% of sales leaders say remote work made their onboarding process obsolete. If your plan still assumes everyone's in the same office for two weeks of shadowing, redesign it for async + live hybrid delivery.

Mistake: Hiring faster than you can onboard. Fix: One SaaS company scaled from 2 to 30 reps and lost millions by forecasting headcount from revenue targets instead of demand. They hired too fast, gave inexperienced reps warm leads, and watched conversion crater. Your onboarding capacity is a hiring constraint - treat it like one.

How to Measure Your Sales Onboarding Plan's Success

If you don't measure onboarding, you'll manage it by vibes. Vibes always lose to quarter pressure.

The trick is to measure leading indicators (activity + skill) and lagging indicators (pipeline + revenue), then compare ramp performance to post-ramp performance.

The 10 Metrics That Actually Matter

| Metric | Definition | When |

|---|---|---|

| Time to first activity | 1st call/email sent | Week 1 |

| Time to first meeting | 1st meeting set | Days 7-30 |

| Time to first deal | 1st closed-won | Days 30-90 |

| Ramp to full quota | % quota hit | Monthly |

| Quota at 30/60/90 | % at each checkpoint | 30/60/90 |

| Win rate (ramp vs post) | Compare win rates | Month 3+ |

| Pipeline by month | $ pipeline created | Monthly |

| 90-day retention | Still employed at Day 90 | Day 90 |

| Coaching completed | Sessions done vs planned | Weekly |

| New hire satisfaction | NPS or survey at 30/60/90 | 30/60/90 |

One practical tip: define a "green path" for each metric (what good looks like), then flag "yellow" and "red" thresholds. It turns onboarding from a retrospective into an intervention system. When a rep hits "red" on time-to-first-meeting by Day 21, you intervene - you don't wait for the 90-day review to confirm what you already knew.

Calculating Onboarding ROI

SHRM's formula is the cleanest:

ROI (%) = (Benefits - Costs) / Costs x 100

Example: if better onboarding reduces rep replacement from one rep/year to zero, and replacement cost is $100K-$150K, that's $100K-$150K in benefits right there. Add faster ramp (more pipeline earlier), and the ROI gets silly.

Distribution industry case studies show what "benefits" can look like when onboarding is treated like a performance system: 48% increase in sales per rep and $36.6M year-over-year new-hire production.

Sales Onboarding Tools and Software

Real talk: you don't need onboarding software. You need a plan and clean data. Most teams under 50 reps can run their program with a structured doc, a CRM, a shared knowledge base, and a data verification tool so new hires aren't fighting bounced emails. Software starts to matter when you're scaling past 100 reps, onboarding is continuous, and you need reporting, certifications, and content governance.

Pricing Snapshot

| Tool | Category | Starting Price |

|---|---|---|

| Prospeo | B2B Data / Verification | Free tier; ~$0.01/email |

| iSpring LMS | LMS | From $3.58/user/mo |

| 360Learning | Collaborative LMS | From $8/user/mo |

| Monday CRM | CRM | From $12/user/mo |

| Guidde | AI Video Guides | From $18/creator/mo |

| MindTickle | Sales Enablement | From $20/user/mo |

| HubSpot Sales Hub | CRM + Sales | Free; from $20/user/mo |

| TalentLMS | LMS | From $119/mo |

When to Use What

MindTickle is the "we're serious about sales enablement" choice. Structured certifications, coaching workflows, and analytics for teams that need to prove ramp improvement to the CRO. Pricing starts around $20/user/month and climbs fast at scale. Best for 50+ rep orgs with a dedicated enablement function.

360Learning wins for peer-driven content. If you want reps and managers contributing onboarding material (not just consuming it), it's the strongest option at around $8/user/month. Skip this if your team won't actually create content - you'll pay for a collaborative platform nobody collaborates on.

iSpring LMS covers basics without drama. From $3.58/user/month. Good for teams that need a course library and completion tracking, nothing more.

TalentLMS is a general-purpose LMS that's easy to roll out. From $119/month. Better for companies onboarding across multiple departments, not just sales.

Guidde is great for quick "how to do this in the tool" videos. From $18/creator/month. Useful for CRM walkthroughs and process documentation.

Monday CRM is useful if you want onboarding tasks tracked like a project board. From $12/user/month. Lightweight but visual.

Further Reading

- Allego's State of Sales Onboarding Report - a good pulse check on what's broken in the market

- HiBob's onboarding statistics roundup - useful for internal decks and business cases

- Enboarder's sales onboarding plan checklist - one of the most practical templates available

If you're building a stack for new reps, start with a lean set of B2B sales tools and add complexity only when the process is stable.

GreyScout cut rep ramp time from 8-10 weeks to just 4 by giving new hires clean, verified data from Day 1. When your onboarding plan includes Prospeo's 300M+ profiles with 30+ filters, reps build territory pipeline instead of chasing dead emails at 35% bounce rates.

Equip new reps with data that books meetings, not bounces.

FAQ

How long should a sales onboarding plan last?

Align duration to your sales cycle: SDRs typically need about 3 months, mid-market AEs 4-6 months, and enterprise reps 9-12 months. Bridge Group data shows 39% of reps ramp in 3-5 months, so a 2-week bootcamp alone won't cut it for any segment with a complex buying process.

What's the biggest mistake in sales onboarding?

An information firehose with no readiness checks - dumping product, process, and tools into Week 1 with zero prioritization. The fix is teaching left to right: train only what's needed for the next milestone, then practice and validate before moving on.

How do you measure onboarding success?

Track three core metrics: time to first closed deal (Days 30-90), quota attainment at 90 days, and 90-day retention rate. For ROI, use SHRM's formula - (Benefits - Costs) / Costs x 100 - and quantify benefits like reduced replacement costs and faster pipeline generation.

How do you set up new reps with clean prospect data?

Export the rep's first 200-500 prospects, run them through a verification tool, and load clean records back into the CRM before first outreach. CRM data decays ~30% annually, and teams that verify upfront see bounce rates drop from 35% to under 4% - protecting both rep confidence and domain reputation.

What does a 30-60-90 day plan look like in practice?

Days 1-30 focus on foundations: shadowing, methodology training, and first coached outreach. Days 31-60 shift to pipeline building at 25-50% ramp quota with weekly deal reviews. Days 61-90 target full autonomy with independent territory management and a formal performance review against defined milestones.