The Best SimilarTech Alternatives in 2026 (By Use Case)

Most "similartech alternatives" posts mash together technographics, digital intel, and contact sourcing - then act surprised when the "best" pick doesn't fit your workflow.

Here's the blunt truth: if you don't decide what job you're hiring the tool to do, you'll overpay for features your team never touches and still end up with messy exports.

I've watched teams burn a full week arguing about "accuracy" when the real issue was simpler: they bought a research tool, then tried to run outbound from it.

Our picks (TL;DR): SimilarTech alternatives

If you want a fast shortlist, start here:

- Prospeo - best when the goal is meetings, not dashboards. Take a tech signal (from anywhere) and turn it into verified emails (98% accuracy) and verified mobile numbers on a 7-day refresh, with self-serve pricing and no contracts. If you're comparing vendors for the contact layer, start with these email lookup tools.

- Wappalyzer - best "modern technographics" option: clean UX, strong API, and easy to operationalize for list building.

- BuiltWith - best for install-base lists + history ("who used X last quarter?"), with serious depth and a very old-school pricing gate.

Enterprise route: Similarweb Sales Intelligence is the suite pick when you want technographics plus territory planning, scoring, and broader digital signals in one place - and you're fine with a real budget line item. If you're building a broader system, map it to your B2B sales tech stack first.

What SimilarTech is (and what it isn't)

SimilarTech is a Similarweb company, and it behaves like one: broad coverage, lots of adjacent signals, and a natural pull into the larger Similarweb GTM suite.

Similarweb's scale is the headline. It positions its data access as:

- 100M+ websites

- 20M+ companies

- 4M+ apps

- 235M+ SKUs

- 10 years of historical data

- 10B content pages

- 250M display ads

- 5B search terms

That's why SimilarTech feels "big" even when you're doing something simple like "find sites using Shopify apps" or "filter by analytics tag." It's built for coverage and cross-signal context, not for being the single source of truth on every edge-case detection.

Where teams get tripped up is assuming SimilarTech is one product. It's really three intents bundled together:

- Technographics: "What tech does this site/company use?" and "Find companies using X."

- Digital intel: traffic estimates and competitive context that help prioritize accounts.

- Contact layer: list building and exports so you can actually reach someone. If you're buying contacts, you should also understand B2B contact data decay.

Those are different problems. They're also solved by different tool categories.

Best for

- Building target lists by technology usage (especially common web tools)

- Quick competitor stack comparisons

- Adding digital context to prioritize accounts

Not for

- Treating "detected tech" as ground truth (false positives are part of the game)

- High-confidence contact accuracy at scale without a verification layer (see how to verify an email address)

- Teams that want a single-purpose tool with transparent packaging and no suite gravity

Why teams replace SimilarTech in 2026

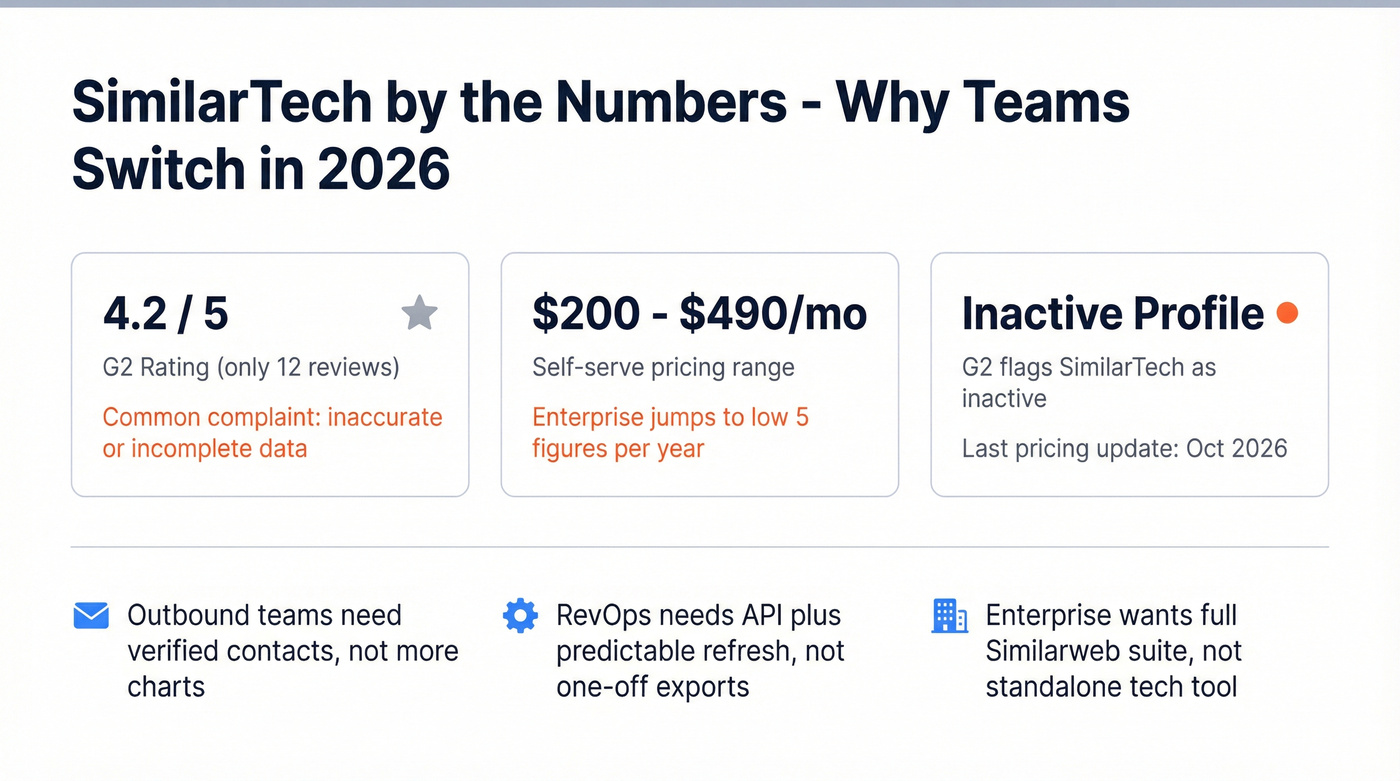

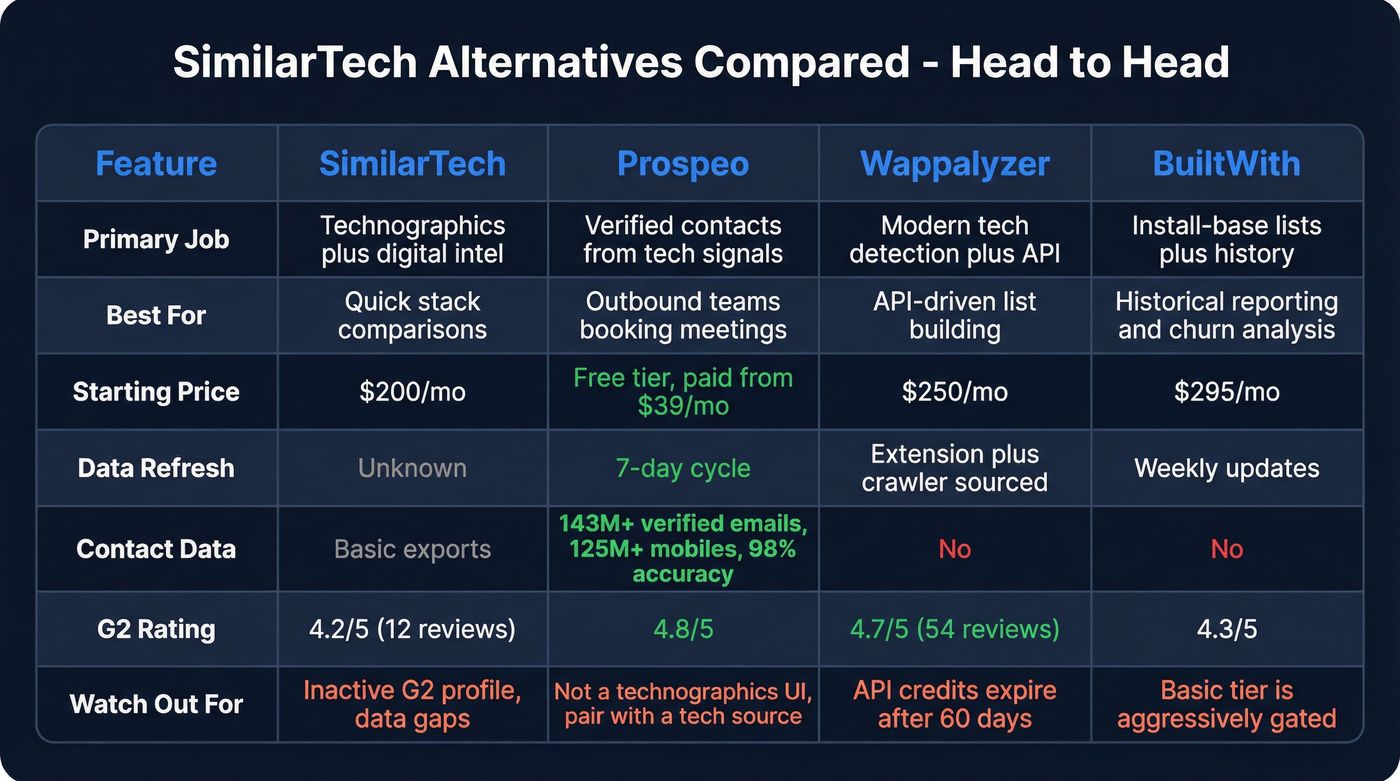

SimilarTech's G2 rating sits at 4.2/5 (12 reviews). The praise is consistent: it's easy to use, and the tech stack + web insights are genuinely helpful for quick research.

The complaints are also consistent: inaccurate or incomplete data. That's fatal when you're using technographics to decide who gets outreach.

A typical review sentiment is basically:

"Great concept and easy UI, but the data isn't always reliable."

Pricing is another churn driver. G2 lists:

- Basic: $200/mo

- Ultimate: $490/mo

- Enterprise: quote-based (includes Salesforce integration + custom solutions)

G2 also flags SimilarTech as an "Inactive Profile" and shows the pricing info was last updated Oct 09, 2026. That's not a death sentence, but it's a budgeting headache.

Budgeting in 2026 (so you don't get surprised)

Treat $200-$490/mo as directional for self-serve tiers. The moment you need Salesforce integration, governance, or custom workflows, stop thinking "hundreds per month" and budget low five figures per year for an enterprise-style package.

The deeper reason teams replace SimilarTech is simpler: they realize they bought the wrong category.

Common replacement scenarios:

- Outbound teams: you don't need more charts - you need verified contacts tied to the tech signal. (If you're building a workflow, use a B2B cold email sequence as the test case.)

- RevOps: you need an API + predictable refresh cadence, not one-off exports. If you're cleaning downstream systems, start with data quality.

- Enterprise: you want Similarweb-level coverage and workflows, not a standalone tech tool.

Hot take: if your average deal size is in the low-to-mid four figures and you're not running a territory model, you don't need a "suite." You need one clean technographics source and one clean contact layer - then ship campaigns.

SimilarTech tells you what tech a company uses. Prospeo tells you who to call about it - with 98% email accuracy, 125M+ verified mobiles, and a 7-day refresh cycle. At $0.01/email with no contracts, it's the contact layer that turns technographic signals into booked meetings.

Stop researching stacks. Start reaching the people behind them.

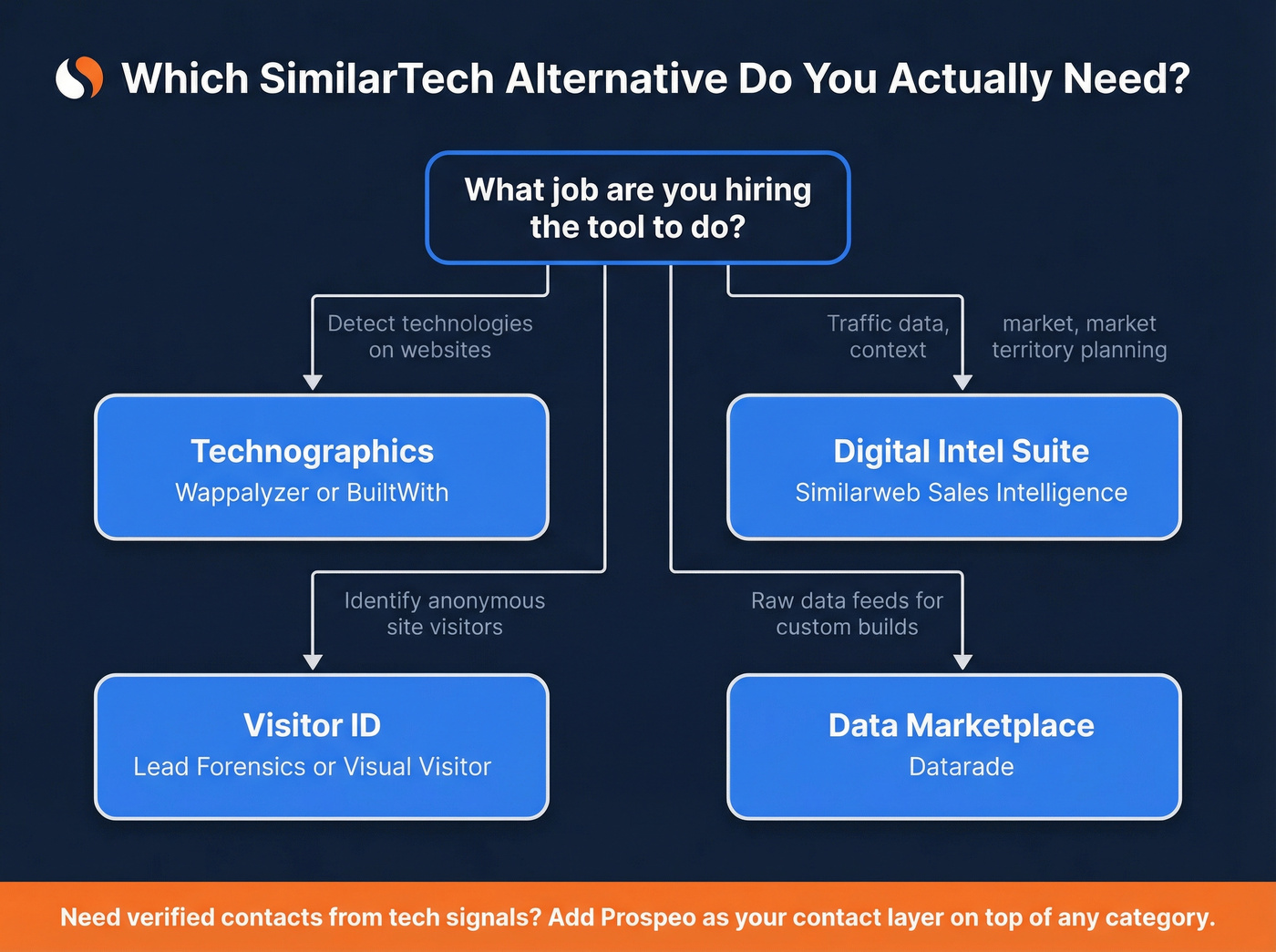

Choose the right category (2-minute picker)

Before you compare vendors, pick the lane. SimilarTech alternatives fall into four buckets.

The decision tree

If you need to detect technologies on sites (technographics): Pick Wappalyzer (modern workflow + API) or BuiltWith (install-base + history).

If you need broader digital intel (traffic, market context, territory planning): Pick Similarweb Sales Intelligence.

If you need to identify anonymous website visitors (visitor ID): Pick Lead Forensics or Visual Visitor. Different category, different ROI model.

If you need raw datasets to build your own stack: Use a marketplace like Datarade to source feeds and licensing.

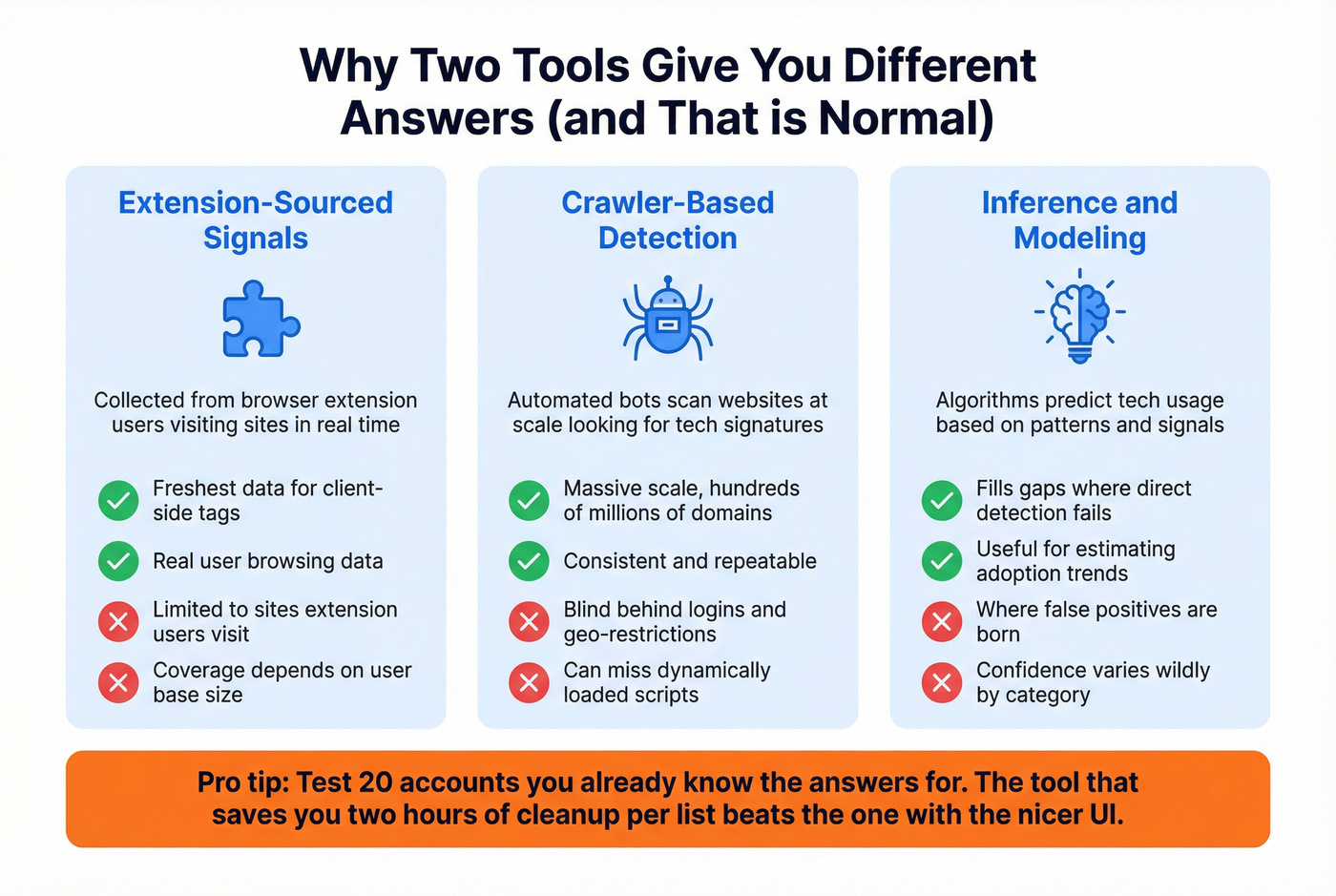

Why tools disagree on "what tech is installed"

Tech detection is a mix of:

- Extension-sourced signals (fresh for client-side tags)

- Crawler-based detection (great at scale, blind behind logins/geo rules)

- Inference (useful, but where false positives are born)

If you run the same domain through two tools and get different answers, that's normal. The winning tool is the one that's most accurate for your ICP and your target tech set, and produces exports you can actually use.

We've tested this the boring way: take 20 accounts, include a few you know are false positives, and force the tools to show their work. The tool that saves you two hours of cleanup per list beats the one with the nicer UI every time.

SimilarTech alternatives: the best options (ranked by use case)

Below are the tools worth evaluating, ranked by the job they do best. Every tool includes Best for / Avoid if / Pricing / Gotcha so you can decide without a week of demos.

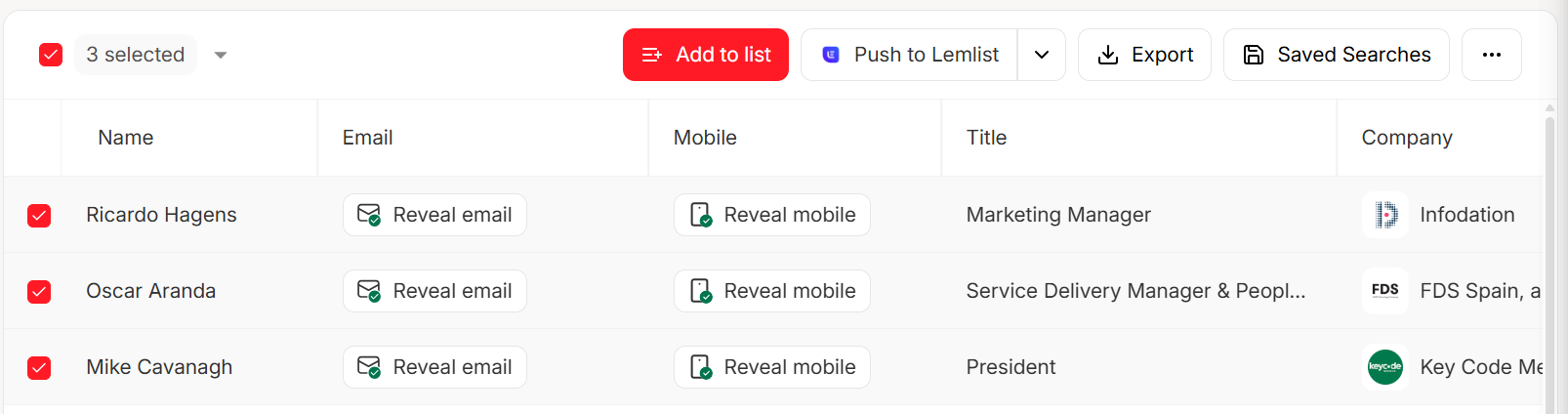

Prospeo - best for turning technographics into verified outreach (Tier 1)

Prospeo is The B2B data platform built for accuracy. It's what you use when SimilarTech (or any technographics tool) is only step one - and you need step two: clean contact data that won't torch deliverability.

Look, technographics doesn't book meetings. People do.

Prospeo gives you the contact layer that makes a tech signal usable: 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, all refreshed on a 7-day cycle (the industry average is 6 weeks). That refresh cadence matters more than most teams think, because the list you built for "next week's campaign" turns into a bounce-fest if it sits in a spreadsheet while approvals, copy, and sequencing drag on.

Accuracy is the whole point: 98% email accuracy, plus mobile coverage with a 30% pickup rate across all regions. For ops-heavy workflows, Prospeo's enrichment is built to plug in cleanly: 92% API match rate, and 83% of leads come back with contact data, returning 50+ data points per enrichment. If you're benchmarking vendors, compare against these lead enrichment tools.

- Best for: outbound teams that want verified emails + mobiles tied to targeting signals, fast

- Avoid if: you only need a free tech lookup and never plan to run outbound

- Pricing: free tier; paid plans typically ~$39-$249/mo depending on credits and mobile usage

- Gotcha: it's not a technographics UI replacement - pair it with a technographics source

Helpful links if you want to sanity-check fit: pricing, Chrome extension, data enrichment.

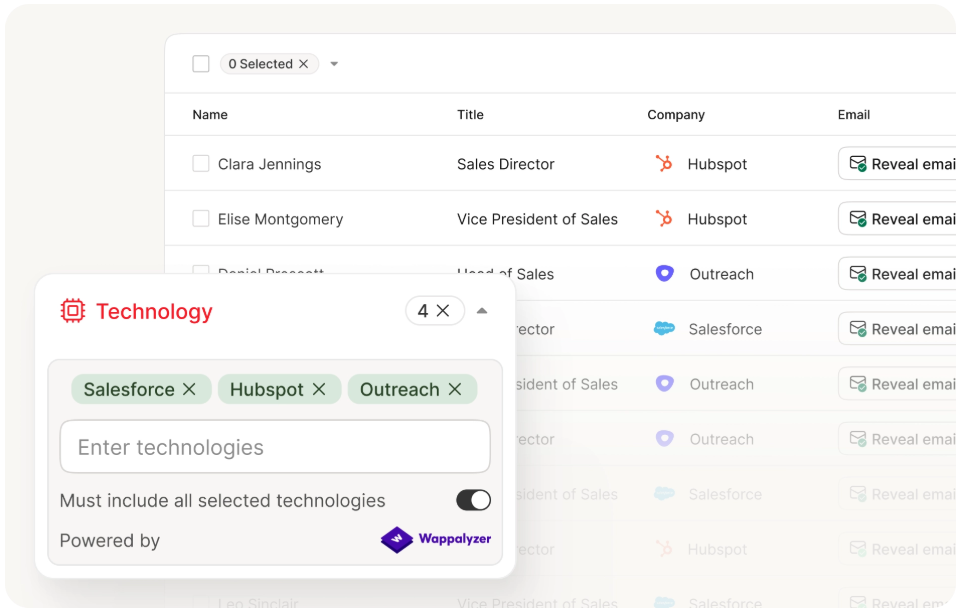

Wappalyzer - best modern technographics with clear packaging (Tier 1)

Wappalyzer is the cleanest technographics-first replacement when you care about speed, packaging clarity, and API-driven workflows.

It attributes much of its coverage to extension-sourced signals plus crawlers - one reason it's often fresher on client-side tags than crawler-only tools. Wappalyzer also points to its extension footprint (it cites ~3M extension users) as part of how it sources detection signals.

- Best for: tech detection + alerts + API-driven list building

- Avoid if: your usage is spiky and you "buy credits for later"

- Pricing: $250/mo (Pro), $450/mo (Business), $850+/mo (Enterprise); free account includes 50 lookups/month

- Gotcha: API credits expire after 60 days--if you don't consume, you lose money

G2 sentiment is strong at 4.7/5 (54 reviews), and the product feels built for operators, not just researchers.

BuiltWith - best for install-base lists + historical reporting (Tier 1)

BuiltWith is the install-base database archetype. If your workflow is "give me every domain using X" plus history and reporting, BuiltWith is still a monster.

- Best for: install-base lists, historical reporting, and churn/offboarding analysis ("who stopped using X?")

- Avoid if: you need broad filters on the entry tier or hate upgrade gating

- Pricing: $295/mo (Basic), $495/mo (Pro), $995/mo (Team) (annual billing is typically discounted); PAYG $99 for 2,000 credits

- Gotcha: Basic is aggressively gated: 2 technologies, 2 keywords, 2 retail reports, 1 login

Operational caps matter if you're building workflows:

- Basic: 2,000 uploads + 2,000 API credits/mo

- Pro: 20,000 uploads + 20,000 API credits/mo

- Team: 100,000 uploads + 100,000 API credits/mo, plus unlimited logins

BuiltWith updates weekly and tracks 414M domains, which is why it's so good for "big list" questions.

Here's a real scenario: if you're selling a security add-on for a specific CDN, BuiltWith is the tool that lets you pull "current users" and "recent switchers" without playing detective across five exports.

Similarweb Sales Intelligence - best "all-in-one" enterprise route (Tier 1)

Similarweb Sales Intelligence is what you buy when technographics is only one input and you want broader digital context to drive territory and prioritization.

- Best for: teams running territory planning, account scoring, and multi-signal prioritization (not just "find sites using X"). If you're formalizing this, use an account scoring model.

- Avoid if: you're a lean outbound team that just needs tech signals + contacts

- Pricing: quote-based; typically $30k-$80k/year; Vendr's median Similarweb spend is around $37,800/year

- Gotcha: if you sell into tiny sites, the long tail is noisy - plan manual validation

Those packaging signals (like 10,000 exports per user/month and 37 months of history) matter for specific buyers. If you're feeding downstream systems (CRM, enrichment, scoring) without throttling reps, export limits stop being a footnote and start being the product.

G2 backs it up at 4.5/5 (215 reviews), but it's only worth the money if you'll actually operationalize the suite. If your team won't use it weekly, skip it.

Datanyze - cheapest contact reveals, but read the fine print (Tier 2)

Datanyze is more "budget contact reveal" than SimilarTech replacement. It's popular with founders because it's cheap and simple.

- Best for: low-cost contact reveals for lightweight prospecting

- Avoid if: you need data continuity or clean cancellation

- Pricing: $29/mo or $55/mo; 1 credit = 1 reveal; free trial exists

- Gotcha: revealed contacts lock when you cancel unless you renew

Capterra sentiment (3.7/5, 52 reviews) often boils down to:

"Easy to use, but cancellation and access rules are frustrating."

Use it tactically, not as infrastructure.

Coresignal - best for teams that want APIs/datasets (Tier 2)

Coresignal is for data teams who want control: APIs, datasets, and programmatic enrichment. If you've got someone who can own pipelines, it's powerful.

- Best for: API-first enrichment and licensed datasets with engineering support

- Avoid if: you need a rep-friendly UI and instant lists

- Pricing: API tiers commonly land around $49/mo, $800/mo, and $1,500/mo; datasets typically ~$1,000-$25,000+ depending on scope

- Gotcha: you're buying building blocks - without an owner, the pipeline stalls

If you want "truth" in your CRM, plan dedupe rules, field mapping, and refresh logic before you buy. Otherwise you'll pay for data and still argue about which field is "right."

Hunter - best add-on for email finding/verification + sequences (Tier 2)

Hunter is the email layer you add when your technographics tool doesn't give reliable emails. It's straightforward, fast, and good at what it does.

- Best for: email finding + verification + lightweight outreach in one tool. If you're comparing options, start with the best B2B email lookup tool list.

- Avoid if: you need direct dials or deep enrichment

- Pricing: $49/mo, $149/mo, $299/mo; verification costs 0.5 credit; free tier available

- Gotcha: it's easy to burn credits on low-quality domains - tighten your targeting before you scale

Hunter shines when you keep the workflow simple and don't pretend it's a full enrichment platform.

Lead Forensics - visitor identification (not technographics) (Tier 3)

Lead Forensics identifies companies visiting your website. It won't replace "find companies using X."

Pricing: quote-based, traffic-driven; typically ~$5k-$30k/year.

Best for: inbound-led teams routing anonymous visits to sales.

Gotcha: if your site traffic is low, ROI is slow.

Visual Visitor - visitor identification alternative (Tier 3)

Visual Visitor is another visitor ID tool, priced around successful identifications with flexible terms.

Pricing: typically ~$3k-$20k/year.

Best for: lighter-weight visitor ID without a heavy annual suite.

Gotcha: identification volume swings month to month.

Datarade - data marketplace option (Tier 3)

Datarade is a marketplace to source datasets (technographics, firmographics, intent) as feeds - not a technographics UI.

Pricing: commonly ~$5k-$50k/year.

Drivers: refresh cadence, exclusivity, and allowed use (internal vs redistribution).

Gotcha: procurement and licensing take longer than you think.

Skip this if you just need a list for next week's campaign.

SimilarTech alternatives comparison tables (pricing, limits, gotchas)

First, map tools to the job. This is where most lists fall apart.

Table 1 - What category are you actually buying?

| Tool | Technographics | Digital intel | Contact data | Visitor ID |

|---|---|---|---|---|

| Prospeo | Some | No | Yes | No |

| Wappalyzer | Yes | No | Limited | No |

| BuiltWith | Yes | Limited | No | No |

| Similarweb SI | Some | Yes | Yes | No |

| SimilarTech | Yes | Limited | Some | No |

| Datanyze | Limited | No | Yes | No |

| Coresignal | Some | Limited | Some | No |

| Hunter | No | No | Yes | No |

| Lead Forensics | No | No | No | Yes |

| Visual Visitor | No | No | No | Yes |

| Datarade | Varies | Varies | Varies | Varies |

Table 2 - Limits that matter in production

| Tool | Detection | Refresh | API | Exports | Pricing model | Key gotcha |

|---|---|---|---|---|---|---|

| Prospeo | Data platform | 7 days | Yes | CSV/CRM | credits | Not technographics |

| Wappalyzer | Ext+crawler | At least monthly | Yes | CSV | monthly | 60-day expiry |

| BuiltWith | Crawler+hist | Weekly | Yes | CSV | monthly/PAYG | Heavy gating |

| Similarweb SI | Multi-signal | Varies | Yes | CSV | annual | $30-80k/yr |

| SimilarTech | Multi-signal | Varies | Limited | CSV | monthly/quote | Public pricing looks stale |

| Datanyze | Extension | Varies | No | CSV | monthly | Locks on cancel |

| Coresignal | API/dataset | Varies | Yes | Files/API | API/dataset | Needs engineering |

| Hunter | Finder+verify | Real-time | Limited | CSV | monthly | Credit burn |

| Lead Forensics | Visitor ID | Near-real | Yes | CSV | quote | Traffic-priced |

| Visual Visitor | Visitor ID | Near-real | Limited | CSV | quote | ID-volume priced |

How to use these tables without overthinking it

- If you need technographics lists, the real decision is Wappalyzer vs BuiltWith: modern workflow vs deeper install-base history.

- If you need enterprise digital intel, Similarweb SI wins because it's built for territory and prioritization, not just "what tech is installed."

- If you need contacts you can actually email/call, don't judge by "domains tracked." Judge by accuracy + refresh + enrichment match rate. If you're tightening deliverability, use an email verification list SOP.

Minimum viable stacks (what you'll actually pay per month)

Most teams don't need a monolith. You need tech signals + usable exports. Everything else is optional.

Stack cost snapshots

| Stack | Tools | Typical monthly | Best for |

|---|---|---|---|

| Tech detection only | Wappalyzer or BuiltWith | $250-$495 | targeting lists |

| Tech + email layer | + Hunter | $300-$800 | lean outbound |

| Full outbound | + Prospeo | $350-$1,200 | scale + quality |

Recommended stacks (real talk)

- Tech detection only: use this for market mapping, partnerships, and competitive research. You're paying for signal, not contacts.

- Tech detection + email finding/verification: the bootstrap outbound stack. It works when volume's low and you can tolerate manual cleanup.

- Full outbound stack: when deliverability and speed matter, add a verified contact layer so your list doesn't rot between campaigns.

For context, SimilarTech's baseline is $200/mo (Basic) or $490/mo (Ultimate). Similarweb Sales Intelligence is the other end of the spectrum at ~$30k-$80k/year.

"Gotchas" that change ROI (read this before you buy)

These are the small-print details that turn a "good deal" into an ops headache:

- Wappalyzer: 60-day API credit expiry. If your usage is spiky, this will cost you. Buy to match your campaign calendar.

- Datanyze: contacts lock on cancellation. If RevOps needs continuity, don't build processes on top of it.

- BuiltWith: gating forces upgrades. Basic is fine for narrow research; it breaks the moment you need broader filters.

- SimilarTech: public packaging looks stale. If you need Salesforce integration, budget enterprise pricing and avoid month-to-month assumptions.

- Similarweb SI: long-tail noise. If you sell into tiny sites, plan manual validation and don't pretend web intel is perfect.

None of these tools are "bad." The surprises are bad.

How to evaluate any SimilarTech alternative in 30 minutes

Don't outsource this decision to a listicle. Run a small test that mirrors your workflow and forces a winner.

The 30-minute trial protocol

Pick 20 accounts you already know 10 that definitely use your target tech, 5 that definitely don't, 5 unknowns.

Run detection in two tools (Wappalyzer + BuiltWith is the cleanest head-to-head) Track false positives and misses. Separate client-side widgets from backend infrastructure.

Check freshness If the tool can't show last-seen dates, alerts, or change tracking, assume staleness.

Export like a RevOps person Look for duplicate domains, messy company names, missing fields, and unnormalized tech strings.

Score one metric: cost per usable account Not cost per lookup. Usable accounts that match ICP and can be actioned.

The winner is usually the tool that creates the least downstream cleanup, not the one with the prettiest dashboard.

Next steps (pick one path)

- If you're doing outbound by tech stack: start with Wappalyzer or BuiltWith, then decide whether you need an email-only layer (Hunter) or a full enrichment/contact platform.

- If you're doing territory + prioritization: shortlist Similarweb Sales Intelligence and evaluate it like a system, not a tool - exports, governance, and adoption matter more than feature checklists.

- If you're building a data warehouse feed: price Coresignal vs buying datasets through a marketplace like Datarade, then assign an owner before you sign anything.

One more strong opinion: if your "evaluation" doesn't include an export test, you're not evaluating. You're shopping.

FAQ

What's the closest direct replacement for SimilarTech's technographics?

Wappalyzer is the closest technographics-first replacement because it's built around detection, lead lists, alerts, and an API with clear packaging. BuiltWith is the other top option when install-base lists and historical reporting matter more than modern workflow UX.

Why do tech-stack tools disagree on what a site uses?

They rely on different signals (browser extensions, crawlers, and inference) and refresh at different speeds, so one tool can catch a client-side tag while another misses it or mislabels backend tech. In practice, test 20 known accounts and pick the tool with the fewest false positives for your ICP.

Is Similarweb Sales Intelligence worth it vs self-serve tools?

It's worth it when you'll use digital intel for territory planning and scoring and you can justify an annual budget (commonly $30k-$80k/year). If you mainly need install lists and exports for outbound, a technographics tool plus an enrichment layer is usually the better ROI.

What's a good free alternative for getting verified contacts from a tech list?

Teams replace SimilarTech when they realize technographics alone don't fill pipeline. Prospeo's 300M+ profiles, 30+ filters (including technographics via Wappalyzer), and 5-step email verification mean you skip the "export, clean, verify" loop entirely.

One platform from tech signal to verified contact. No suite tax.

If you only remember one thing: stop shopping SimilarTech alternatives as if they're all the same product. Pick the category first, then buy the smallest stack that produces usable accounts - not prettier charts.