B2B Sales Tech in 2026: Build a Stack That Actually Drives Pipeline

$15,000/year for a database - and reps still can't get a working number for the right persona at the right account. Then leadership's answer is "add an AI tool," and suddenly you've got 12 logins and worse data than before.

The fix isn't more software. It's b2b sales tech that's minimum-viable, tightly governed, and built around clean data plus boring integration discipline.

I've watched teams buy a "best-in-class" tool, wire it into a messy CRM, and accidentally create duplicate accounts so fast that routing broke by Wednesday. Everyone blamed the tool. The real culprit was the lack of rules.

What b2b sales tech means (and what it isn't)

B2B sales tech is the set of tools your team uses daily to generate pipeline, connect with prospects, and close deals. That "daily" part matters: if it's not used every day by reps, managers, or ops, it's not core sales tech - it's a nice-to-have that turns into shelfware.

Ebsta describes a sales tech stack as spanning the full motion from prospecting to outreach to closing, and staying lean, integrated, and KPI-driven. In practice, we treat b2b sales tech as three systems working together:

- System of record (where truth lives): CRM

- System of action (where work happens): engagement + calling + tasks

- System of truth (what's actually happening): conversation + revenue intelligence

Here's what it isn't: a random pile of "AI tools."

Real talk: AI's a feature, not a category. If a tool doesn't replace work (logging, routing, scoring, summarizing, forecasting) inside your existing workflow, it's not "AI strategy." It's a distraction with a procurement cycle.

Definition box: B2B sales tech (practical)

B2B sales tech = daily-use tools that move deals forward across prospecting, outreach, discovery, pipeline management, and closing - with integrations tight enough that data stays consistent from lead -> opportunity -> revenue.

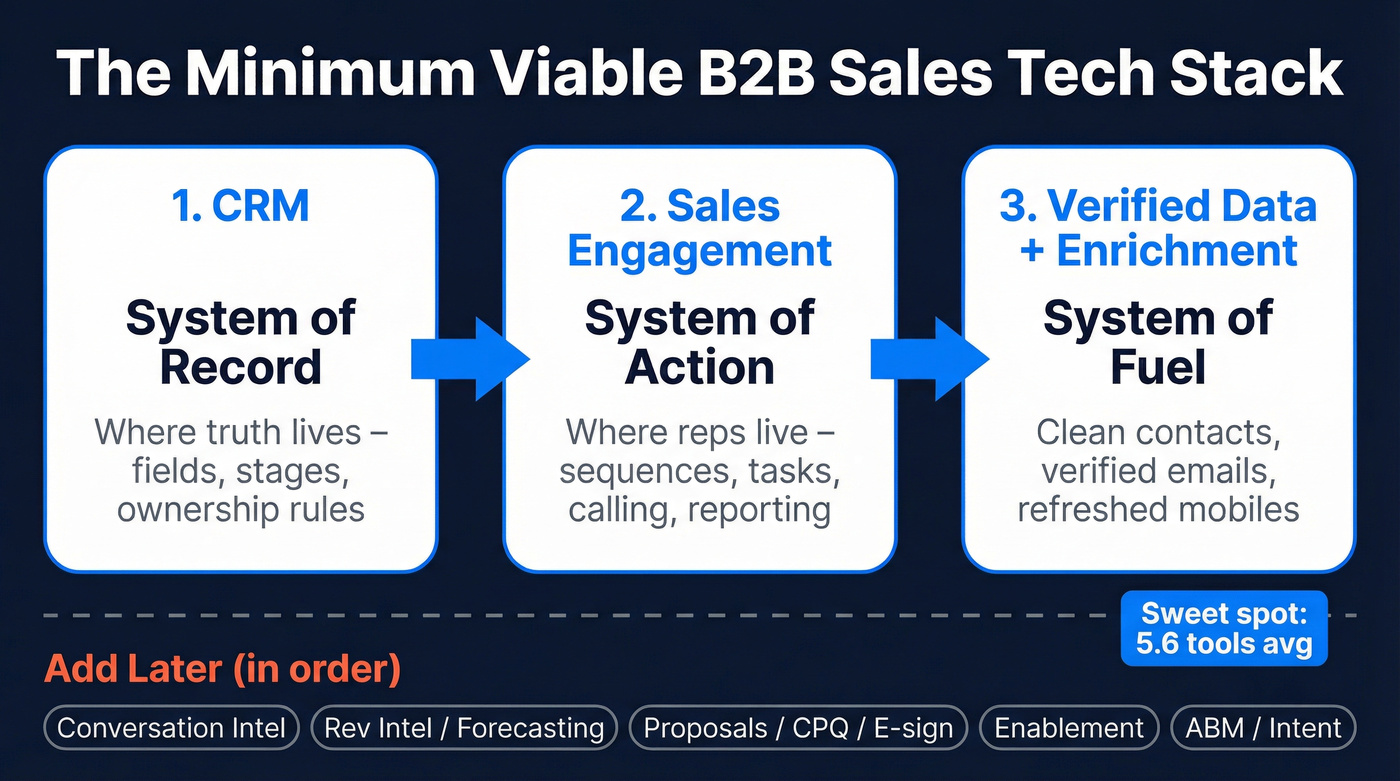

What you need (quick version): the minimum viable stack

Ebsta reports an average consistent outbound stack of 5.6 tools. That's the sweet spot: enough capability to run a real motion, not so much that RevOps becomes a full-time integration babysitter.

Minimum viable stack (3 tools)

Use this as your default buy order:

1) CRM (system of record) Pick one. Standardize fields, stages, and ownership rules. If your CRM's a mess, every downstream tool becomes an expensive way to spread the mess faster.

2) Sales engagement (system of action) Sequences, tasks, calling, and basic reporting. This is where reps live. If adoption's low here, nothing else matters.

3) Verified prospecting data + enrichment

Buy order (what to add next)

Once the MVS is stable, add layers in this order:

- Conversation intelligence (only after reps consistently record calls)

- Revenue intelligence/forecasting (only after pipeline hygiene is real)

- Proposals/CPQ/e-sign (when deal cycles justify it)

- Enablement (when onboarding + messaging drift becomes a revenue problem)

- ABM/intent (when you can operationalize it, not just "look at it")

Delay/cut guidance (use/skip)

Use this now if...

- Reps are doing outbound weekly and need repeatable sequences

- You're missing contact data or bouncing >5-8% on cold email

- Managers can't answer "what's in pipeline and why" without a spreadsheet

Skip this for now if...

- You don't have one CRM owner

- You can't define your ICP in 5 fields

- Your engagement tool isn't adopted (adding intelligence won't fix behavior)

Step 3 of your minimum viable stack - verified prospecting data - is the one that breaks everything when you get it wrong. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobiles, refreshed every 7 days. At $0.01/email, it costs 90% less than ZoomInfo and actually keeps your CRM clean.

Stop feeding bad data into a good stack. Start with Prospeo.

Why sales tech stacks fail (numbers, not vibes)

Most stacks don't fail because the tools are "bad." They fail because the stack's built like a junk drawer: every quarter someone adds a new object, a new field, a new workflow, and nothing gets removed.

The numbers are ugly:

- 75% of RevOps pros say data inconsistencies are their biggest challenge.

- 47% rate stack ROI as average or worse.

- When tools don't integrate well, only 20% are satisfied with their stack.

- In 60% of orgs, RevOps doesn't control the tech budget (so governance's toothless).

- Only 4% use AI extensively, which tells you most "AI stacks" are just pilots and slide decks.

Those stats come from a MarketingOps.com + Demand Metric survey of 250+ revenue/marketing/ops professionals published on 2026-10-10.

I hate how common this is: leadership sees low connect rates, assumes reps need "better AI," and buys another tool that writes more junk back into the CRM. That doesn't fix the system. It just speeds up the failure.

The stack failure loop (what it looks like in real life)

You'll recognize this pattern:

- Bad data (duplicates, missing fields, stale contacts)

- Low connect rates (bounces, wrong numbers, wrong personas)

- More tools get purchased to "fix" the symptom

- More inconsistency because integrations and definitions diverge

- Reps stop trusting the stack and go rogue (spreadsheets, personal tools)

Symptoms your stack is broken (practitioner checklist)

This is straight out of what you see in the field: reps can't reassign accounts even when the owner is inactive, they can't bulk import or bulk fix bad fields, and deduping becomes a manual side quest.

- Thousands of accounts with no owner, or owners with zero activity for months

- Reps can't fix obvious data issues due to permissions

- No bulk import/update process, so everything becomes manual

- Duplicate checking is a human job

- "Good accounts" are locked because of territory rules, even when nobody's working them

- Only the tenured reps hit quota because they've built their own shadow process

You can't AI your way out of a broken system of record. AI needs clean objects, consistent fields, and reliable activity capture, otherwise it automates the wrong decisions faster and makes the cleanup twice as painful.

Hot take: if your average deal is under $10k and you're still arguing about "which AI SDR tool to buy," you're optimizing the wrong thing. Spend that energy on data hygiene plus one engagement workflow and you'll feel the difference inside two weeks.

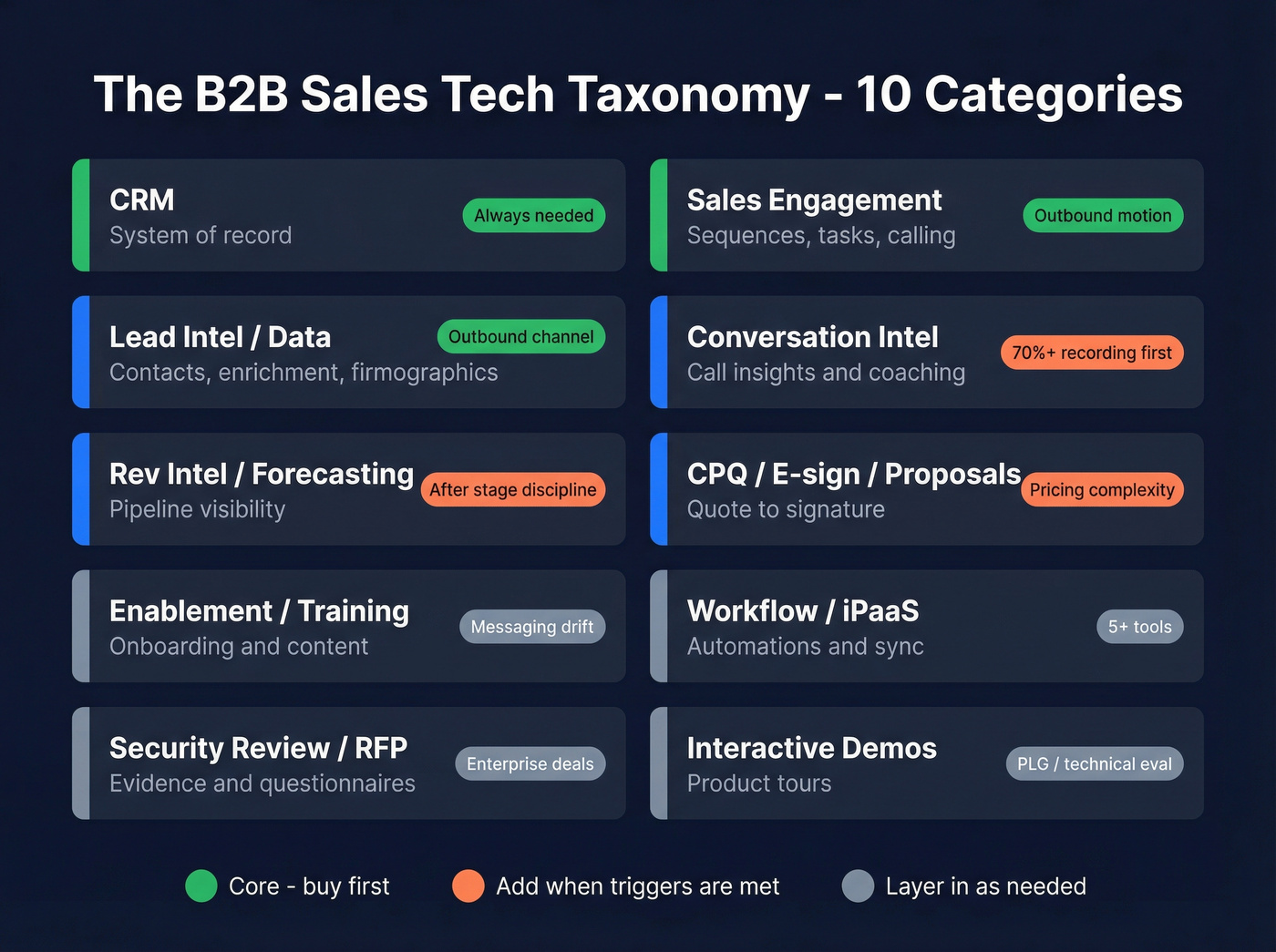

The b2b sales tech taxonomy (10 categories) + when you actually need each

Reprise's minimalist framework is a clean taxonomy for stack audits: 10 categories that cover the full cycle without turning into vendor bingo card. The trick is buying only what's proven, only what's used daily, and only automation that replaces real work.

The 10-category taxonomy (with "when you need it" triggers)

| Category | What it does | When you need it | Example tools |

|---|---|---|---|

| CRM | System of record | Always | HubSpot, Salesforce |

| Sales engagement | Sequences + tasks + calling | Outbound motion | Salesloft, Outreach |

| Conversation intel | Call insights + coaching | Recording coverage is high | Gong, Avoma |

| Rev intel/forecast | Forecast + pipeline visibility | Pipeline volume makes errors expensive | Clari |

| CPQ/e-sign/proposals | Quote -> sign | Pricing complexity + approvals | DocuSign, PandaDoc, Qwilr |

| Enablement/training | Onboarding + content + certification | Messaging drift + ramp time hurts | Highspot, Seismic |

| Workflow/iPaaS | Automations + sync + orchestration | 5+ tools or messy handoffs | Zapier, Make |

| Security review + RFP automation | Evidence + questionnaires | Enterprise deals | Vanta, Drata, Conveyor, Loopio |

| Interactive demos | Product tours | PLG/technical eval | Reprise |

CRM (system of record): pick a lane and lock definitions

HubSpot is the obvious starting point for most SMB and mid-market teams because it's fast to deploy, opinionated, and the UI doesn't punish reps. It also plays nicely with inbound, which matters if marketing's feeding pipeline.

Salesforce is still the heavyweight when you need complex territory models, deep customization, and enterprise-grade governance. It's also easier to break. We've seen teams spend months customizing Salesforce only to end up with worse reporting because definitions weren't locked.

Failure mode to watch: "custom fields everywhere" without a field dictionary. If you can't answer "what does this field mean, who owns it, and what system writes it," you don't have a CRM. You've got a database with vibes.

Governance artifacts that actually prevent chaos (steal these):

- Field dictionary: definition, allowed values, owner, source of truth, and downstream dependencies

- Required fields by stage: what must be filled before an opp can move forward

- Lifecycle rules: lead -> MQL -> SQL -> opp (or your version) with explicit entry/exit criteria

- Dedupe policy: match keys (email, domain, company name), merge rules, and who can merge

- Territory + ownership rules: what happens when a rep leaves, an account goes dark, or a territory changes

Sales engagement: one place reps live, one set of rules

Engagement is where you standardize sequences, tasks, call outcomes, and activity capture. If reps aren't living here daily, your "stack" is basically a CRM plus vibes.

Buying trigger: you have repeatable outbound plays (even if they're simple) and you want consistent activity capture. Failure mode: running two engagement tools "because one team likes it." That guarantees duplicate activities, messy reporting, and finger-pointing.

Lead intel/data: the engine for outbound and routing

This category is the foundation for outbound: contacts, emails, mobiles, firmographics, and enrichment. It's also where stacks quietly die, because bad data creates bounces, spam flags, and wasted rep hours.

Buying trigger: outbound's a real channel and routing depends on firmographics/ICP fields. Failure mode: treating enrichment as a one-time project instead of a refresh cycle.

Conversation intelligence: only works when recording is real

Conversation intelligence is valuable when calls are consistently recorded and sellers don't fight the tool.

Buying trigger: you're recording 70%+ of relevant calls and managers will coach from the tool. Failure mode: partial recording coverage. You end up coaching the reps who comply and ignoring the deals that need help most.

Revenue intelligence/forecasting: when spreadsheets start costing you money

Revenue intelligence connects activity plus interactions back to CRM objects so forecasting isn't a weekly argument.

Buying trigger: forecast accuracy affects hiring, spend, and board confidence. Failure mode: trying to "buy forecasting" before you can enforce stage definitions and close-date discipline.

CPQ/e-sign/proposals: don't overbuild the last mile

If you sell something simple, a clean proposal template plus e-signature is often enough.

Buying trigger: multi-product pricing, approvals, discounting rules, or legal complexity. Failure mode: implementing CPQ while pricing itself is still negotiable and undocumented.

Enablement/training: great for scale, useless for targeting

Enablement tools shine when you're scaling headcount and messaging drift becomes real.

Buying trigger: ramp time's a measurable bottleneck and you need consistent onboarding plus certification. Failure mode: buying enablement to "fix pipeline." Enablement amplifies whatever targeting and process you already have.

Workflow/iPaaS + orchestration: where stacks either mature or collapse

Once you're at ~5+ tools, you need a real integration mindset: field mapping, dedupe rules, error handling, and monitoring. That's not glamorous work, but it's the difference between "stack" and "pile of apps."

- Zapier/Make handle a lot early.

- Clay becomes valuable when you want an orchestration layer: enrich from multiple sources, apply logic, route outputs, and keep list-building from turning into spreadsheet gymnastics.

Buying trigger: handoffs are breaking (lead routing, enrichment, lifecycle updates) and ops is spending hours on manual fixes. Failure mode: "connect and pray" integrations with no monitoring.

Security review + RFP automation: treat it like a stage, not a fire drill

If you sell into larger companies, security review becomes a sales stage whether you like it or not.

Buying trigger: you're repeatedly answering the same security questions and losing time in legal/security loops. Failure mode: no evidence library, no owners, no SLA, so every deal restarts the same questionnaire from scratch.

Interactive demos: best when buyers want to self-serve evaluation

Interactive demos are worth it when your product's complex and buyers want to self-serve evaluation.

Buying trigger: you have high demo volume and prospects need to "click around" to understand value. Failure mode: using interactive demos to compensate for unclear positioning or weak discovery.

Mapping your stack to McKinsey's five levers (practical, not consultant-speak)

If you want a simple way to sanity-check your stack, map it to McKinsey's five commercial productivity levers:

- Opportunity identification -> data + intent + routing. If you can't reliably find the right accounts and route them to the right owners, nothing else matters.

- Personalization -> enrichment fields (role, team size, tech stack, triggers) plus a workflow that turns fields into messaging. This is where orchestration tools (and clean enrichment) pay off.

- Pricing -> CPQ/pricing tools only when approvals and discounting rules are real. Until then, your "pricing stack" is a doc and a policy.

- Seller automation -> engagement + logging + automated summaries. The goal is fewer admin hours and more touches, not "AI for AI's sake."

- Talent improvement -> enablement + conversation intelligence coaching. This is where you turn good reps into consistent reps.

If a tool doesn't clearly support one of these levers, it's a candidate for the cut list.

Your data layer: accuracy, refresh, and "waterfall vs single-source"

Data decays fast. A common planning assumption is ~30% per year of B2B contact data goes stale (job changes, role changes, company changes, domain changes). Treat it as a budgeting heuristic: if you enriched once and never refresh, you're guaranteed to drift.

The decision you're actually making: single-source vs waterfall

- Single-source: one provider for everything. Simpler procurement and fewer moving parts, but you inherit that provider's coverage gaps.

- Waterfall: primary provider + secondary enrichment/verification when primary misses or looks risky. More moving parts, but higher match rates and better deliverability.

Waterfall wins whenever outbound volume is meaningful. The cost of one spam flag or a burned domain is higher than the cost of a second data step, and the teams that learn this early stop wasting quarters "fixing deliverability" after the damage is already done.

Verification workflow (the one that actually works)

Use this workflow whether you're sourcing net-new leads or cleaning a CRM segment:

- Pull a defined segment (ICP + territory + stage) from CRM or a CSV

- Enrich missing fields (title, company, domain, headcount, etc.)

- Verify emails and mobiles (handle valid/invalid/catch-all explicitly)

- Deduplicate (email + domain + name rules)

- Push clean records into CRM and your engagement tool

- Refresh on a cadence (weekly beats monthly; monthly beats "never")

Refresh-cycle matters more than most teams admit. A 7-day refresh behaves like a living dataset. A ~6-week refresh behaves like a historical snapshot - fine for research, painful for high-volume outreach. Industry average refresh is around 6 weeks; Prospeo refreshes every 7 days.

Prospeo (Tier 1 callout): the accuracy-first data layer

Prospeo is "The B2B data platform built for accuracy" - and it's the cleanest answer when your real problem is deliverability, not "more contacts." It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% email accuracy and a 7-day refresh cycle.

What matters in practice: Prospeo runs 5-step verification (including catch-all handling plus spam-trap and honeypot removal), returns 50+ enrichment data points, and matches on 83% of leads (92% via API). You also get 30+ filters and intent across 15,000 topics (powered by Bombora), which is how you stop blasting "everyone in SaaS" and start prioritizing buyers who are actually in-market.

One scenario we've seen repeatedly: a team exports "all open opportunities with missing titles + bounced emails," enriches and verifies the segment, then re-runs outbound to the same accounts with clean contacts. The result isn't magic. It's just fewer wasted touches and fewer reputation hits, which is exactly what a data layer's supposed to do.

Pricing stays simple: free tier, then about $0.01 per verified email; mobiles cost 10 credits per number. Mobile pickup rate is 30% across regions.

Mini callouts: other data-layer options (and how they compare)

- ZoomInfo: Best fit when you're an enterprise team doing ABM at scale and you want one contract to cover data plus add-ons. Expect $15k-$40k+/year for typical packages; larger teams with add-ons can land $50k-$150k+/year.

- Apollo: Great rep workflow and "all-in-one" prospecting. Paid plans typically run $59-$149/user/month with a free tier.

- Cognism: Strong for EU/UK compliance and phone focus. Typically $1,000-$3,000/month for small teams; mid-market teams often see $3,000-$10,000/month depending on seats and data needs.

- PDL (People Data Labs): API-first enrichment for technical teams. Expect $500-$5,000/month depending on volume; higher-volume plans can run $10k+/month.

- Lusha: Fast enrichment for reps, lighter governance. Typically $50-$150/user/month.

- Clearbit/Breeze: Best when you're HubSpot-heavy and want inbound enrichment tied to forms and lifecycle. Pricing is custom/bundled with HubSpot and often lands around $10k-$30k/year for many teams.

Engagement + intelligence layers (what to standardize on, and why)

This is where teams waste the most money: buying overlapping "systems of action" and then wondering why reporting's inconsistent. Standardize on one engagement platform, one conversation intelligence tool, and (maybe) one revenue intelligence platform.

Sales engagement: Salesloft vs Outreach (pick a winner)

If outbound's core, you need a real engagement platform. Full stop.

Winner for most teams: Salesloft. It's easier to administer, tends to win on usability, and gets adopted faster. On G2's comparison snapshot, Salesloft sits at 4.5/5 (4,261 reviews) vs Outreach at 4.3/5 (3,528 reviews), with Salesloft ahead on usability/admin/support.

Outreach is the better pick when you've got strong ops capacity and you want deeper customization in how sequences and workflows run.

My rule: if you don't have at least a half-time ops owner for outbound, choose Salesloft and move on.

Conversation intelligence: Gong vs Avoma (budget + adoption reality)

Conversation intelligence is only worth it if recording coverage is high and managers coach from it.

Winner if you'll use the full program: Gong. It's the premium choice for deep call libraries, coaching workflows, and exec-level reporting. Typical Gong pricing structure is an annual platform fee plus per-user pricing plus services: platform $5k-$50k/year, services around $7.5k, and $1,360-$1,600/user/year depending on seat volume.

Winner for fast value per dollar: Avoma. Transparent pricing and quick adoption: $19/$29/$39 per seat/month (annual billing), with add-ons like conversation intelligence at $29/seat/month.

Forecasting/revenue intelligence: what Clari is for (and when it's overkill)

Clari is the forecasting and revenue visibility tool you buy when spreadsheets and "gut feel" are costing you real money. On G2 it's 4.6/5 (5,577 reviews) (snapshot captured 2026-02-17), and the aggregated "time to implement" shows 2 months, which matches what we've seen when the CRM's reasonably clean.

Winner when forecasting drives decisions: Clari. Skip it if your stage definitions aren't enforced and close dates are fantasy.

ABM/intent: Demandbase (when you're ready to operationalize intent)

ABM/intent tools are powerful when you can act on the signals: routing, prioritization, plays, and measurement.

Demandbase is a staple here for account-based advertising plus intent plus account insights. Buy it when you've got (1) a defined target account list, (2) sales capacity to run account plays, and (3) marketing alignment on what "in-market" means. If you don't have those, intent becomes a dashboard people check once and ignore forever.

Sales tech pricing reality in 2026 (budget bands + what's usually quote-based)

Pricing is where stack strategy meets reality. Engagement and intelligence tools are often quote-based because vendors price on seats, usage, and add-ons. Data tools vary wildly, and the frustrating part is paying enterprise rates for data that still needs verification.

Here's a directional map that's accurate enough to budget with.

| Category | Tool | Pricing model | Directional range |

|---|---|---|---|

| CRM | HubSpot | tiered | ~$1k-$5k/mo (Starter->Pro teams); larger bundles can run higher |

| CRM | Salesforce | per-seat + add-ons | ~$25-$300/seat/mo (plus platform add-ons) |

| Engagement | Salesloft | quote-based | ~$12k-$60k/yr (team packages vary by seats/modules) |

| Engagement | Outreach | quote-based | ~$12k-$72k/yr |

| Data/enrich | Prospeo | self-serve credits | free + ~$0.01/verified email; mobiles 10 credits/number |

| Data/enrich | Apollo | per-user | $59-$149/user/mo |

| Data/enrich | ZoomInfo | annual contract | $15k-$40k+/yr (often $50k-$150k/yr with add-ons) |

| Conv intel | Gong | platform + seats + services | $5k-$50k/yr + $1,360-$1,600/user/yr + ~$7.5k services |

| Conv intel | Avoma | per-seat | $19-$39/seat/mo (+ CI add-on ~$29/seat/mo) |

| Rev intel | Clari | quote-based | ~$30k-$150k/yr |

| E-sign | DocuSign | per-user | ~$10-$40/user/mo (business tiers); enterprise higher |

| Proposals/e-sign | PandaDoc | per-seat | ~$35-$65/user/mo; enterprise higher |

| Proposals | Qwilr | per-seat | ~$35-$59/user/mo |

| iPaaS | Zapier | per-user/workspace | ~$20-$70/user/mo; team plans higher |

| iPaaS | Make | usage-based | ~$10-$50/mo for small teams; higher with volume |

A few blunt takeaways:

- Quote-based isn't evil, but it hides tradeoffs. Salesloft and Clari both price via sales-led packaging, so define seats, modules, and success criteria before you negotiate.

- Gong's structure (platform fee + services + per-user) is normal for enterprise tooling. Budget it like a program, not an app.

- ZoomInfo's annual range is real money for a small team. A 10-seat contract with add-ons can land in that $15k-$40k+ band and climb fast.

- The cheapest stack's the one you actually use. Shelfware's the most expensive line item in RevOps.

30/60/90-day rollout plan (governance-first)

Most teams roll out sales tech like this: buy tool -> connect to CRM -> tell reps to use it -> wonder why nothing changed.

Do it governance-first instead. Especially because 60% of orgs have RevOps without budget control, meaning you need explicit ownership, not "everyone's responsible." This is also where most teams discover they don't really have a coherent stack yet - just tools - so the rollout plan doubles as your stack design process.

First 30 days: lock the foundation (definitions + hygiene)

Owners

- Name a data owner (usually RevOps) and a sales process owner (sales leader).

- Decide who can create/edit key fields and objects.

Non-negotiable governance artifacts (create these docs, then enforce them)

- Field dictionary (definition, allowed values, owner, source of truth, downstream dependencies)

- Required fields by stage (what must be true before an opp advances)

- Dedupe rules (match keys + merge policy + who can merge)

- Routing rules (lead/account assignment logic, SLAs, and exception handling)

- Permission model (what reps can fix without begging ops)

CRM hygiene cadence

- Weekly: duplicates review + bounced email cleanup

- Biweekly: stage hygiene + close-date sanity checks

- Monthly: ICP field completeness audit

Integration debt inventory

- List every sync, automation, and webhook.

- Document field mapping and "source of truth" per field.

Integration monitoring (this is the part everyone skips)

- Create an "integration errors" Slack channel and route failures there.

- Track: failed writes, rate limits, field truncation, and duplicate creation events.

- Set a weekly 30-minute triage. If you don't schedule it, errors become "normal."

KPI checklist (baseline)

- Bounce rate (target: <3-5%)

- Meeting set rate per 100 touches

- % of records with required ICP fields

- Duplicate rate per 1,000 creates

Days 31-60: instrument the motion (engagement + activity capture)

- Standardize on one engagement platform (Salesloft or Outreach).

- Define sequence governance: who can publish, naming conventions, required steps.

- Ensure activity capture is consistent (calls, emails, meetings) so reporting isn't fiction.

Don't "connect and pray." Test field writes, dedupe behavior, and lifecycle transitions with a small pilot group, then roll out.

Days 61-90: fix data quality at the source (then add intelligence)

Run one clean, repeatable data workflow before you buy anything else:

- Export a CRM segment (or upload a CSV) for a specific ICP slice

- Enrich missing fields and verify emails/mobiles

- Push clean contacts into your engagement tool and run sequences

- Track lift in bounces, connects, and meetings set

If you want an orchestration layer for this (especially if you're combining multiple sources and logic), Clay's a strong fit. If you want a self-serve verified data workflow that plugs into common systems, Prospeo fits cleanly here: enrich a segment, verify it, then export to CSV or sync to your CRM and outreach tool so reps start with contacts that actually work.

If (and only if) the basics are stable, add conversation intelligence, then revenue intelligence/forecasting.

FAQ (quick answers)

What's the minimum viable B2B sales tech stack for outbound?

A minimum viable outbound stack is three tools: a CRM (system of record), a sales engagement platform (system of action), and a prospecting data layer (contacts + enrichment). If those three aren't integrated and adopted daily, adding conversation intelligence or AI tools usually makes outcomes worse, not better.

How many tools should a B2B sales team have in its stack?

Most outbound teams land around 5-7 tools total once they're operating consistently: CRM, engagement, data/enrichment, scheduling, conversation intelligence, proposals/e-sign, and an automation layer. Ebsta's benchmark of 5.6 tools is a good target because it balances capability with manageable integration and governance.

What's the difference between sales engagement, conversation intelligence, and revenue intelligence?

Sales engagement runs the day-to-day work (sequences, tasks, calls). Conversation intelligence analyzes recorded interactions for coaching and deal insights. Revenue intelligence connects interactions and seller activity back to CRM objects to improve pipeline visibility, guided selling, and forecasting.

How do I improve connect rates without buying more tools?

Fix data quality and targeting before adding software: tighten ICP filters, verify emails, prioritize direct dials for key personas, and refresh lists weekly. A weekly refresh plus verification is the fastest way to cut bounces and stop wasting touches.

Summary: build b2b sales tech that stays lean, clean, and adopted

If you do only one thing this week: pick your minimum viable stack (CRM + engagement + verified data), then write down the rules that keep it clean: required fields, dedupe policy, routing logic, and a refresh cadence.

Most "stack problems" are really governance problems wearing a software costume. Lock the foundation, run one verified segment end-to-end, and you'll see pipeline lift faster than any shiny AI add-on. If you want a deeper blueprint for tool selection and integration, use this B2B sales stack guide as a reference.

Bouncing over 5%? That's the stack failure loop in action - bad data creating low connect rates, triggering more tool purchases that spread the mess faster. Prospeo's 5-step verification and 7-day refresh cycle break that cycle. Teams using Prospeo book 26% more meetings than ZoomInfo and 35% more than Apollo.

Replace the junk drawer with one data layer that actually works.