Lead Generation Pricing in 2026: What It Costs (and How to Calculate Yours)

Most lead gen pricing fights aren't about price. They're about what the word "lead" means.

Define the unit, define "qualified," and the whole conversation gets calmer fast. Skip that step and every "CPL benchmark" turns into fiction, because you're comparing apples to form fills to calendar invites.

Here's the hook: once you know your break-even CPL for qualified pipeline, you stop negotiating on vibes and start buying leads like an operator.

What you need (quick version)

Use this to sanity-check any quote in 5 minutes:

- Define the unit: CPL (using your contract definition of a qualified lead) or cost per qualified held meeting. Pick one and write it into the contract.

- Anchor paid expectations: WordStream's Google Ads benchmark average CPL is $70.11 across 16,000+ US campaigns (Apr 2024-Mar 2025).

- Anchor by industry: First Page Sage's 2026 CPL report (dataset Jan 2022-Jun 2025, last updated May 8, 2026) splits paid vs organic vs blended CPL by industry.

- Price the full stack: Effective CPL includes media + labor + tools + data + agency fees. Not just ad spend or a retainer.

- Verify before outreach: For outbound, verify/enrich contacts first so you don't pay for bounces and dead records. In our experience, Prospeo is the cleanest verify-first step for accuracy, freshness, and self-serve pricing.

Lead generation pricing: the only definition that matters

Lead generation pricing is simple on paper:

CPL = total spend ÷ qualified leads

The problem is the word qualified.

A "lead" can mean:

- IQL (inquiry): form fill, chat, webinar signup

- MQL: marketing says it fits basic criteria (industry, size, title)

- SQL: sales says it's real (pain, timing, authority, budget-ish)

- Held meeting: the person actually showed up

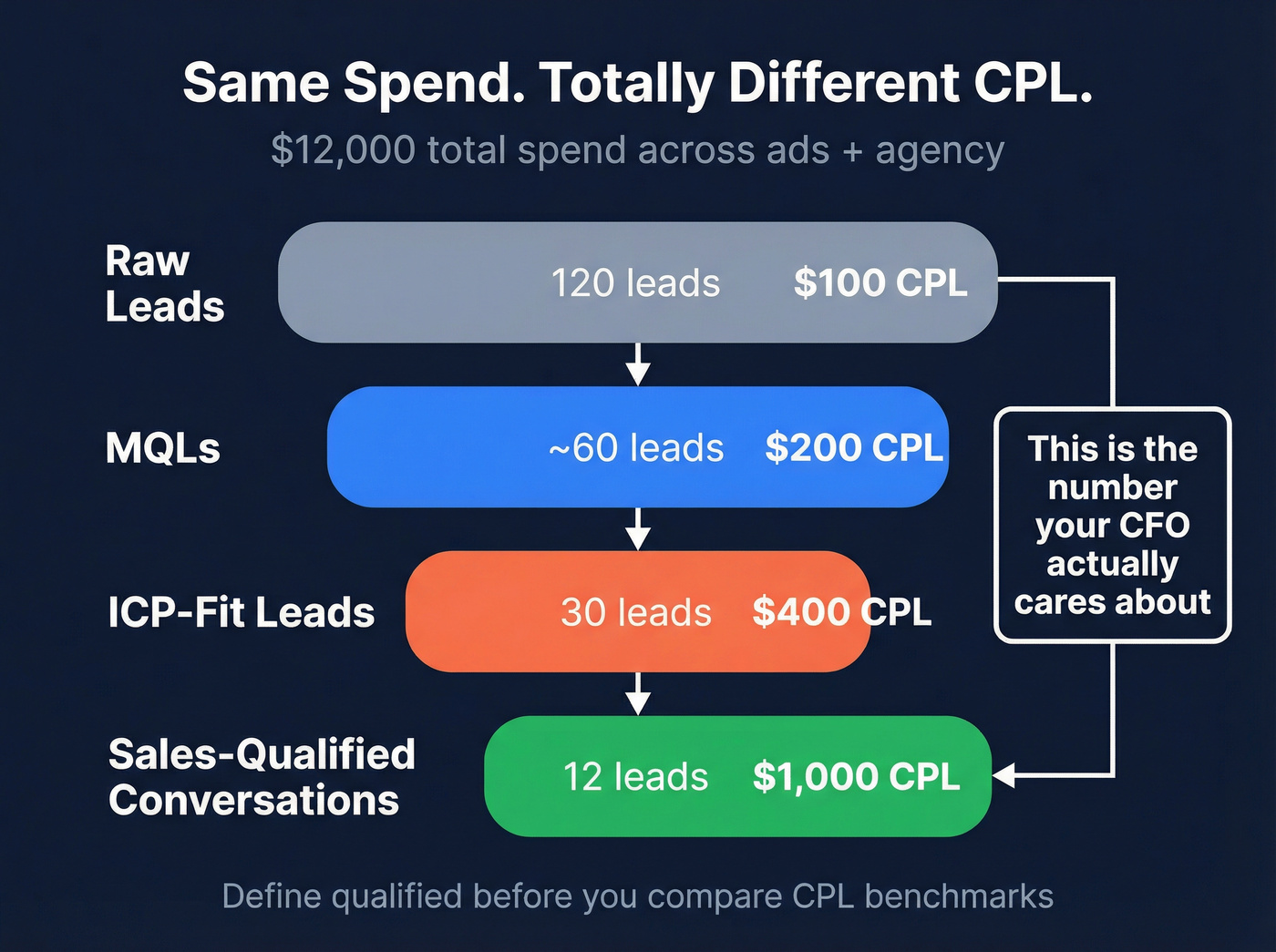

Here's the mini example I use in budget conversations.

You spend $12,000 on a mix of ads + an agency. You get 120 "leads." CPL looks like $100.

But if only 30 match your ICP and only 12 become real sales conversations, your actual CPL is either:

- $400 per ICP-fit lead (12,000 ÷ 30), or

- $1,000 per sales-qualified conversation (12,000 ÷ 12)

Same spend. Totally different reality.

The 4 pricing models you're actually buying (and who holds the risk)

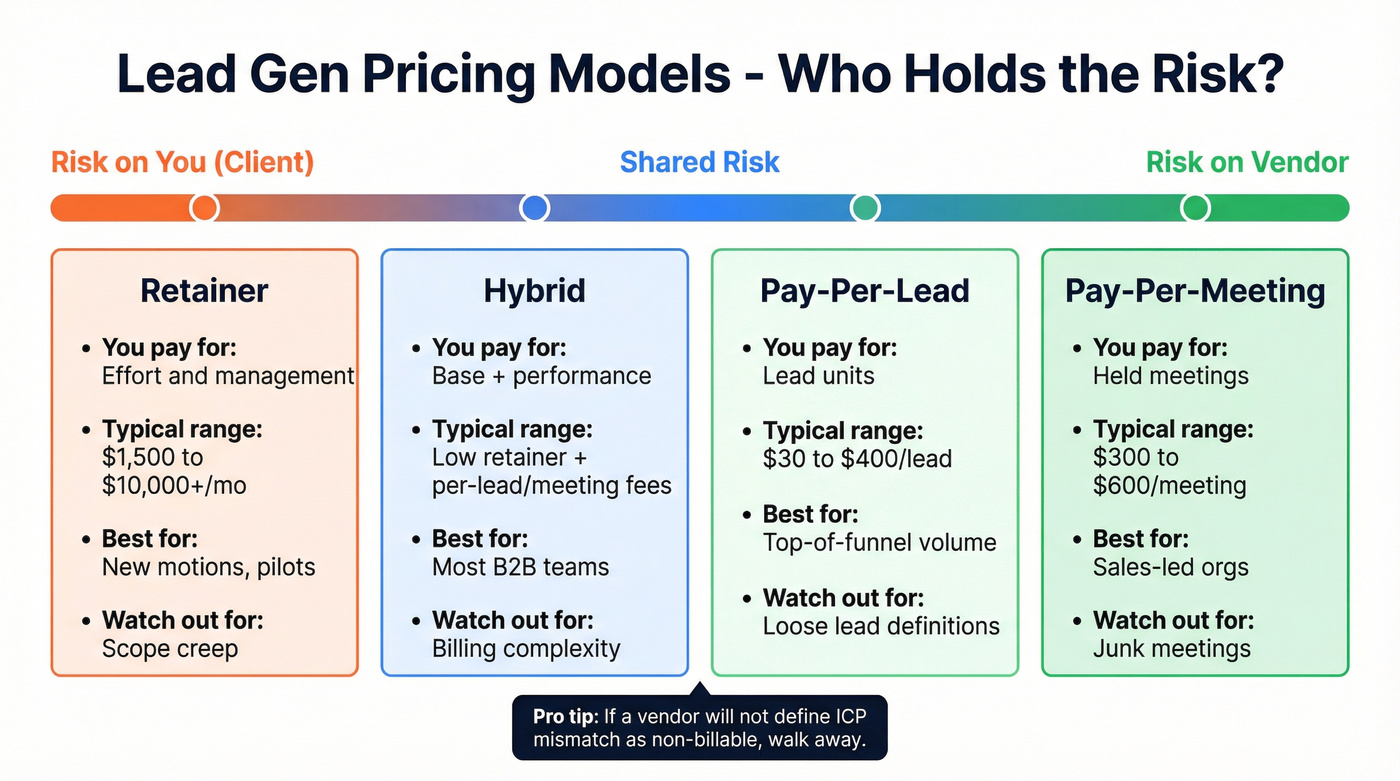

There are four models that show up in real contracts: retainer, pay-per-lead, pay-per-meeting, and hybrid. You're choosing a model based on what you want to buy, and who you want holding the risk.

- Retainers push risk to you (you pay for effort).

- Performance pricing pushes risk to the vendor (you pay for outcomes).

- Hybrid splits it (which is why it's the default in B2B).

The cost drivers that move price up (or down)

Before the models, understand what actually drives pricing:

- ICP complexity: "Any SMB in the US" is cheaper than "CISO at a 2,000+ employee healthcare org running a specific stack." Narrow ICP costs more per unit, but usually converts better.

- Geography + language: Multi-region and non-English outreach costs more (more data work, more copy variants, more deliverability risk).

- Channel mix: Adding calls, paid retargeting, or events increases cost, but it can raise lead-to-opportunity rate enough to justify it.

- Service level: Strategy + copy + list building + deliverability + reporting is a different product than "we send sequences."

- Speed + volume: High-volume programs require stronger ops (domains, inboxes, QA, enrichment). That overhead shows up somewhere: either in price or in results.

Look, if a vendor won't define ICP mismatch as non-billable, walk away. That's not "being difficult." That's basic math protection.

Retainer (what's usually included/excluded)

Retainers typically bundle: ICP work, list building, messaging, outreach execution, and reporting/iteration.

What often gets excluded (and becomes surprise scope): landing page/CRO, creative, paid media management, deliverability remediation, and deep CRM ops work. And yes, % of ad spend retainers are annoying once an account hits steady state, because you end up paying the same fee for fewer meaningful changes.

Pricing signal: appointment-setting retainers commonly land around $2,000-$10,000+/month, with premium programs higher.

Pay-per-lead (why definitions matter)

Pay-per-lead sounds clean until you realize "lead" can mean "any reply," "any form fill," or "ICP fit + positive intent."

The stricter your definition, the higher the unit price, and the fewer leads you'll get. That's not a downside. That's honesty.

If you're trying to figure out how much to charge for leads (or what's fair to pay), write the acceptance criteria first, then price the unit second.

Pricing signal: market CPL bands often run $30-$400/lead depending on niche and qualification depth.

Pay-per-meeting/appointment (incentive pitfalls)

This model aligns incentives better than CPL, until the vendor optimizes for calendar fills instead of pipeline.

If you don't define "held," "qualified," and "ICP match," you'll buy meetings your reps dread. I've watched teams celebrate 40 booked meetings and then admit only 8 were with the right persona.

Pricing signal: typical $300-$600 per qualified meeting, with a wide range $100-$1,500+.

Hybrid (why it's the default starting point for most B2B teams)

Hybrid is usually a smaller retainer (to cover real work) plus a performance component (to keep everyone honest). It's also the easiest model to pilot without getting trapped in "we did the activity" arguments.

Pricing signal: expect a base retainer in the low-to-mid thousands plus per-lead or per-meeting fees.

| Model | What you pay for | Who holds risk | Best for | Common gotchas |

|---|---|---|---|---|

| Retainer | Work + mgmt | Client | New motions | Scope creep |

| Pay-per-lead | Lead units | Vendor | Top-funnel | Lead definition |

| Pay-per-meeting | Held meetings | Vendor | Sales-led | Junk meetings |

| Hybrid | Base + perf | Shared | Most B2B | Billing complexity |

Your CPL math breaks the moment bad data enters the pipeline. Bounced emails, dead records, and wrong contacts inflate your cost per qualified meeting fast. Prospeo's 98% email accuracy and 7-day data refresh cycle mean you pay for leads that actually connect - not leads that bounce.

Cut your effective CPL by eliminating bad data before it costs you.

Lead generation pricing benchmarks in 2026 (so you can sanity-check quotes fast)

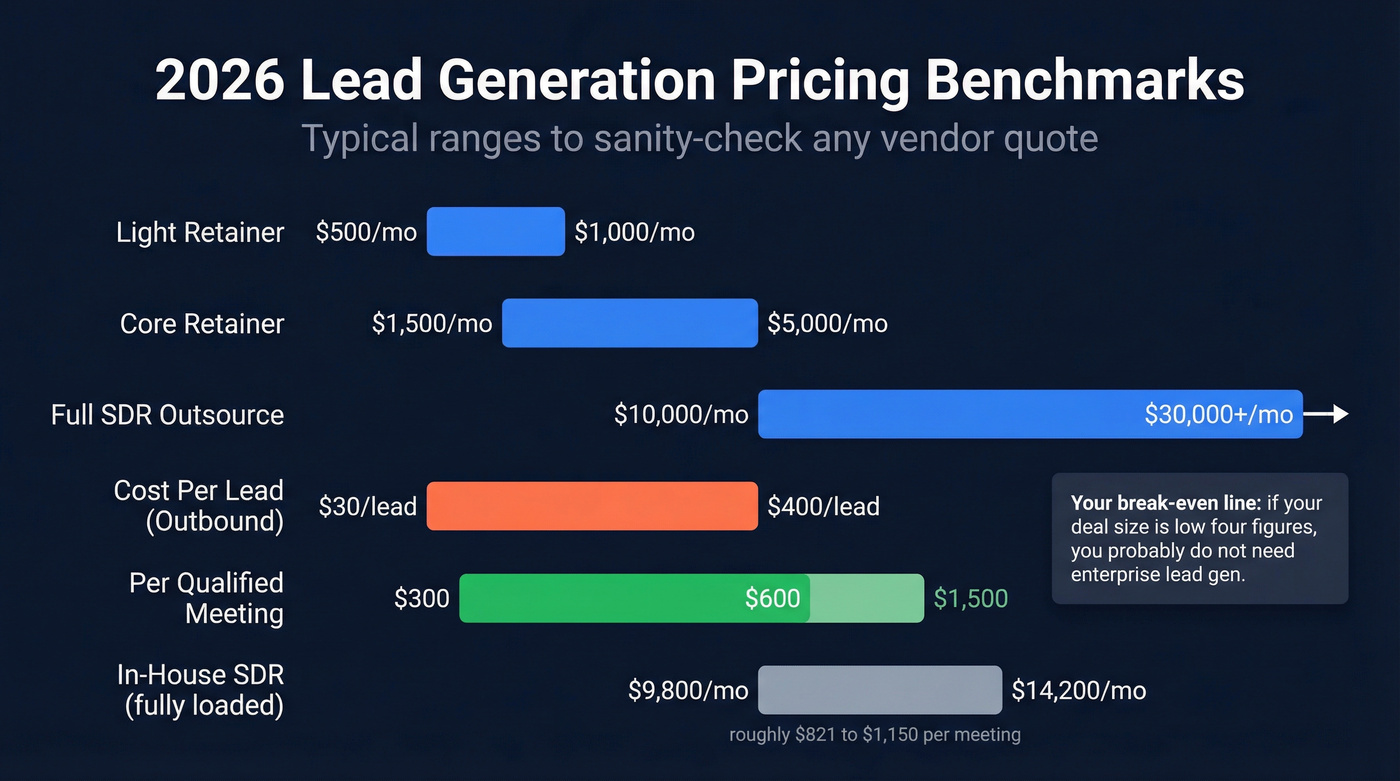

Benchmarks aren't "what you should pay." They're guardrails that help you spot nonsense fast.

Outbound/agency packaging bands (retainers + performance)

A practical set of outbound retainer bands you'll see in the market:

- $500-$1,000/month: light/productized outreach

- $1,500-$5,000/month: serious outbound or mixed-channel

- $10,000+/month: fully outsourced SDR / enterprise multi-region

Performance pricing bands you see repeatedly:

- $30-$400 per lead

- $300-$600 per qualified meeting typical, $100-$1,500+ range

For in-house comparison, a fully loaded SDR baseline is the gut check most teams need:

- $9,800-$14,200/month fully loaded

- $821-$1,150 per qualified meeting (based on ~10-14 meetings/month)

Add SalesBread as a second benchmark (triangulation)

To triangulate pricing (and avoid anchoring on one source), SalesBread's market ranges are a useful second set of guardrails:

- Subscription: $2,000-$4,500/month

- Per meeting: $75-$500/meeting

- Per qualified lead: $50-$250/qualified lead

Those numbers are lower than many enterprise-focused shops because they're often tied to tighter packaging and narrower scopes. Use them as a "could it be cheaper?" check, not as a reason to underpay for a hard ICP.

The sanity-check table (paste into your spreadsheet)

| Metric | Typical range | High end | Winner for budgeting |

|---|---|---|---|

| Retainer (light) | $500-$1,000/mo | - | Retainer (light) if you need a pilot |

| Retainer (core) | $1,500-$5,000/mo | - | Retainer (core) for most SMB/MM |

| Retainer (full SDR) | $10,000+/mo | $30k+ | Full SDR if you want an "outsourced team" |

| CPL (outbound) | $30-$400/lead | $400+ | CPL if you can enforce strict qualification |

| PPM (qualified) | $300-$600 | $1,500+ | PPM if sales capacity is the constraint |

| In-house SDR | $9.8k-$14.2k/mo | - | In-house if you can hire + manage well |

| In-house $/meeting | $821-$1,150 | - | Use as your "don't overpay" line |

Real vendor anchors (what the price usually buys)

These aren't "best" or "worst." They're anchors that help you sanity-check packaging:

- SalesRoads: starts at $9,950 per 4 weeks for appointment setting.

- Martal Group: commonly shows up around $4,100-$10,500/month on marketplaces, and their own packaging signals look like a real SDR engine: 3,000-5,000 prospects/month, 9,000-12,000 emails/month, 250-450 calls/month, and 600-700 follow-ups/month depending on program design.

- Belkins: starts around $5,500 for SMB-focused appointment setting packages.

- Callbox: often lands in the $15,000-$30,000/month range for larger, multi-touch programs.

- Revit: commonly sits around $450-$650 per qualified meeting.

Hot take: If your average deal is in the low four figures, you probably don't need "enterprise lead gen." You need clean targeting, fast follow-up, and a conversion path that doesn't leak. Overbuying process is the fastest way to make pricing feel expensive.

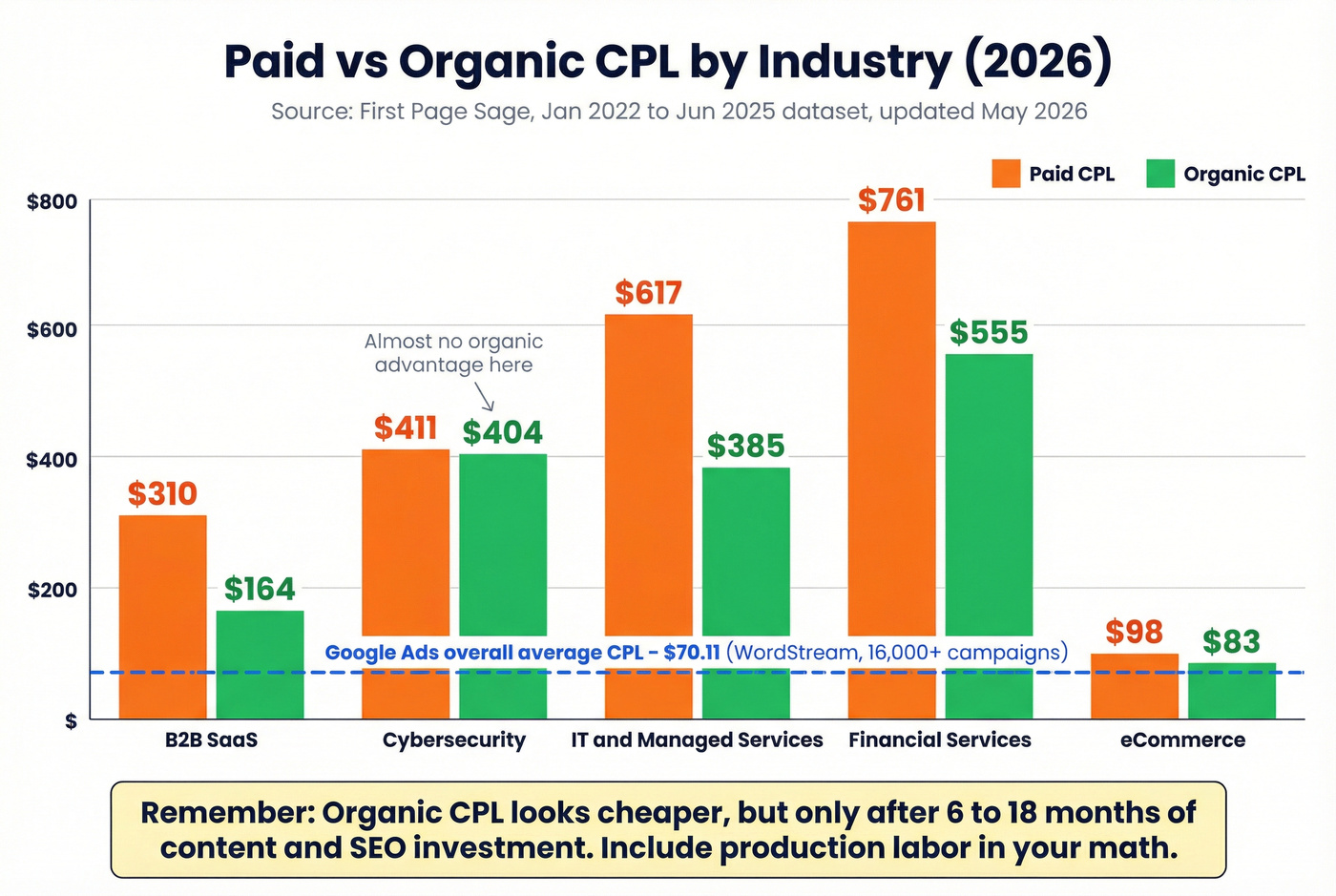

CPL benchmarks you can cite in a budget meeting (paid vs organic)

Two benchmarks are worth citing because they're transparent about methodology.

WordStream PPC benchmarks: dataset covers 16,000+ US-based Google Ads campaigns running Apr 2024-Mar 2025. Overall average CPL is $70.11. Treat it as a reality check for paid search economics, not a promise for your niche.

First Page Sage "Average CPL by industry - 2026": dataset window Jan 2022-Jun 2025, last updated May 8, 2026. It splits paid, organic, and blended CPL.

Selected examples:

| Industry | Paid CPL | Organic CPL | Blended CPL |

|---|---|---|---|

| B2B SaaS | $310 | $164 | $237 |

| Cybersecurity | $411 | $404 | $406 |

| IT & Managed Services | $617 | $385 | $503 |

| Financial Services | $761 | $555 | $653 |

| eCommerce | $98 | $83 | $91 |

| Google Ads (overall) | $70.11 | - | - |

Organic CPL is "cheaper" only after you pay the content + SEO tax for 6-18 months. If you don't include production and distribution labor, you're undercounting organic costs.

Channel sanity ranges (directional, practitioner numbers)

If you're trying to price-check a plan across channels, these conservative ranges keep you out of trouble. They're not universal truths. They're "don't be shocked" ranges:

- Google Ads (search): often $50-$250 CPL in many B2B categories; higher in competitive niches.

- Paid social (LinkedIn/Facebook-style targeting): often $80-$400 CPL depending on offer strength and targeting precision.

- Sponsorships/newsletters/webinars: price it as cost per qualified lead after you see attendee quality; it can look cheap upfront and expensive after filtering.

- Outbound (email/call): unit economics swing wildly; the real driver is data quality + ICP clarity + speed of iteration, not "send more."

Cost per meeting benchmarks (and why "cheap meetings" get expensive)

Use pay-per-meeting when your sales team has capacity and you care more about sales conversations than raw lead volume.

Skip it when:

- your ICP is fuzzy,

- your reps don't follow up fast, or

- you can't reject bad meetings without a fight.

Benchmarks worth using:

- A commonly cited Clutch benchmark via SalesAR: $550-$1,700 per qualified appointment.

- SalesHive's operational ranges:

- $75-$500/meeting in general markets

- $500-$2,000+/meeting for complex B2B / enterprise targets

Mini math (this is where "cheap meetings" get expensive):

If you pay $250/meeting and only 40% are actually ICP-fit and held, your effective cost per real meeting is:

$250 ÷ 0.40 = $625

Then add the internal cost of reps sitting through bad calls. The meeting price isn't the price. The show rate and qualification rate are the price.

Lead generation pricing calculator (effective CPL + break-even CPL)

Stop asking for average CPL. Calculate break-even CPL.

Step 1: Define "qualified" once (and keep it for a quarter)

Pick one definition for your spreadsheet and stick to it.

A clean default:

- For paid media: MQL (but require ICP fit)

- For outbound/appointment setting: held meeting with ICP-fit persona

- For pipeline math: SQL or opportunity created

If you mix definitions, you'll "improve CPL" by lowering the bar. Finance will hate you, and sales will stop trusting marketing.

Step 2: Build your cost stack (the stuff teams forget)

Effective CPL = (media + labor + tools + data + agency fees) ÷ qualified leads

Template cost stack:

- Media: Google Ads, paid social, sponsorships

- Labor: SDRs, marketing ops, content, design (fully loaded)

- Tools: CRM, sequencer, dialer, landing pages

- Data: list buys, enrichment, verification

- Agency fees: retainer, % of spend, PPM/CPL payouts

Step 3: Copy/paste worksheet (inputs -> outputs)

Paste this into a spreadsheet and fill the white cells.

| Worksheet line | Input | Example |

|---|---|---|

| Monthly media spend | $ | 6,000 |

| Monthly agency fees (retainer + perf) | $ | 4,000 |

| Monthly labor (fully loaded) | $ | 3,500 |

| Monthly tools | $ | 800 |

| Monthly data (verification/enrichment/list) | $ | 700 |

| Total monthly lead gen spend | $ | 15,000 |

| Qualified leads (your definition) | # | 50 |

| Qualified meetings held | # | 18 |

| Lead->Opportunity rate | % | 12% |

| Opportunity->Customer close rate | % | 25% |

| LTV | $ | 24,000 |

| Gross margin | % | 80% |

Outputs to calculate:

- Effective CPL = Total spend ÷ Qualified leads -> 15,000 ÷ 50 = $300

- Cost per qualified meeting = Total spend ÷ Qualified meetings -> 15,000 ÷ 18 = $833

- Break-even CPL (next step) -> compare against $300

Step 4: Compute break-even CPL (one clean formula)

Use one canonical formula and label the variables:

Break-even CPL = LTV × Gross Margin × (Lead->Opportunity rate) × (Opportunity->Customer close rate)

Worked example:

- LTV: $24,000

- Gross margin: 80%

- Lead->opp rate: 10%

- Opp->customer close rate: 25%

Break-even CPL = 24,000 × 0.80 × 0.10 × 0.25 = $480

So:

- $200 CPL is great (if quality holds)

- $700 CPL is unacceptable unless your conversion rates are materially higher than you think

Common scenarios (why "normal CPL" is the wrong question)

Scenario A: inbound SaaS with strong intent capture If your lead->opp rate is 20% and close rate is 30%, break-even CPL jumps. Using the same $24k LTV and 80% margin: 24,000 × 0.80 × 0.20 × 0.30 = $1,152. You can "overpay" on CPL and still win because intent makes conversion do the heavy lifting.

Scenario B: enterprise outbound to a narrow persona If lead->opp rate is 5% and close rate is 20%, break-even CPL drops: 24,000 × 0.80 × 0.05 × 0.20 = $192. This is why enterprise outbound teams obsess over targeting and data hygiene: small conversion changes swing the economics, and a tiny amount of waste gets brutally expensive at scale.

CPL drops when you target in-market accounts (intent timing)

The fastest way to make pricing feel cheap is to raise lead->opp rate. Intent timing does that.

If you move lead->opp from 10% to 15% (same LTV, margin, close rate), break-even CPL rises by 50%. You didn't "optimize CPL." You made your leads convert like they should.

Operationally: prioritize accounts showing buying signals (category research, competitor comparisons, hiring, tech changes), then run outreach and ads only to those segments. It's the same spend pointed at warmer targets.

Opinion: most teams don't have a CPL problem. They have a "we're targeting everyone" problem.

Prospeo (Tier 1): the verify-first step that drops effective CPL

We've tested a lot of list-cleaning workflows, and the fastest win is boring: verify before you send.

Prospeo is "The B2B data platform built for accuracy" and it's the best option for email accuracy, data freshness, and self-serve B2B data. You get 98% email accuracy on a 7-day refresh cycle (the industry average is 6 weeks), plus 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers that you can use for outbound, enrichment, and routing.

Here's the practical unit-economics angle: verification runs at ~$0.01/email, so you can clean a 10,000-contact list for about the price of one bad meeting, then stop paying for bounces, dead inboxes, and the deliverability mess that follows. On enrichment, Prospeo returns 50+ data points per contact with an 83% enrichment match rate and 92% API match rate, and it layers in intent signals across 15,000 topics so you're not blasting the whole market at once.

If you only remember one workflow, make it this: bulk verify + enrich your target list, push only verified contacts into sequences, and keep your CRM clean so "qualified lead" doesn't quietly become "any record with an email field."

Contract terms that change the real price (SLA checklist)

Most lead gen contracts are priced like a service and enforced like a vibe. Don't do that. You want SLA-style terms that define what's billable and what gets replaced.

Checklist to negotiate (copy/paste into your MSA redlines):

Definitions

- ICP fit (industry, size, geo)

- Persona/seniority (titles that count)

- What counts as "qualified" (intent signal, pain, timing)

Meeting quality rules

- Held meeting minimum duration

- No-show handling

- Reschedule window

Replacement/credit rules

- Invalid contacts

- ICP mismatch

- Duplicate meetings

- Rejected leads workflow

Pilot mechanics

- Cap billed meetings/leads during pilot

- Weekly reporting cadence + raw exports

- Ownership of lists/messaging/reporting

Standard market terms (use these as your baseline):

- Held meeting = 15-30 minutes minimum

- No-show = free rebook within 7-14 days

- Invalid contact replacement within 30 days

- ICP mismatch = non-billable

- Cap billed meetings during pilot

Add these two "billable event" clauses (they change everything)

Copy/paste language you can actually enforce:

- Billable trigger: "Vendor may invoice only for meetings that are held (attendee joins) and meet the ICP + persona definition in Exhibit A."

- Rejection window: "Client may reject a lead/meeting within 48-72 hours with a reason code (ICP mismatch, wrong persona, duplicate, no-show). Rejected items are non-billable or replaced within 30 days."

- Bounce-rate threshold (outbound lists): "If bounce rate exceeds 5% in any 7-day period, vendor will replace the list segment at no cost and pause sending until remediation is complete."

Red flags to push back on immediately:

- "Booked" meetings billed even if they no-show

- No rejection process for ICP mismatch

- Vague qualification language like "decision-maker" with no title list

- Long lock-in terms for outbound (you need iteration, not handcuffs)

How to lower CPL without lowering quality (the highest-ROI levers)

Your CPL is usually inflated by waste, not by "bad marketing."

Here's what moves the needle fastest:

Tighten the definition of "qualified" Require ICP fit + an intent signal for CPL, and held + persona match for meetings.

Fix data before you scale volume Bad data quietly taxes every channel: wasted touches, wasted clicks, and wasted rep time. (If you're buying lists, start with a quick verification workflow.)

Reduce waste with verification + freshness Weekly-refresh verification is the difference between "outbound works" and "outbound burns domains." If your list is stale, you're paying for bounces and deliverability damage.

Improve speed-to-lead and follow-up discipline If reps take 48 hours to respond to inbound, you'll pay more for the same lead quality because conversion drops. (Track it with speed-to-lead metrics.)

Make landing pages do more work If conversion rate is weak, CPL will always look "high." Fixing one page can beat months of channel tinkering.

Stack-cost context (tools that show up in lead gen pricing)

Keep this simple: these are common line items that change your effective CPL.

| Tool | Why it shows up in lead gen pricing | Typical price range (2026) |

|---|---|---|

| Leadpages | Landing pages/CRO for inbound conversion | ~$37-$74/month |

| ClickFunnels | Funnel pages + upsell flows (more common in DTC, sometimes SMB B2B) | ~$97-$297/month |

| Reply.io | Sequencing + outreach ops (often per user) | ~$60-$150/user/month |

| PhantomBuster | List building + automation tasks that sneak into outbound budgets | ~$69-$300/month |

| Cognism | B2B contact data (often sold to small teams as a monthly bundle) | ~$1,000-$3,000/month |

Skip this if you're early and scrappy: you don't need five tools to "do outbound." You need one sequencer, a clean list, and the discipline to iterate weekly. If you're evaluating vendors, use a broader B2B sales stack view so you don't double-pay for overlapping tools.

We use Expandi here only as a source for market pricing bands, not as an outreach tool recommendation.

FAQ: lead generation pricing

What's a "good" cost per lead in 2026?

A good CPL is any number below your break-even CPL for the same qualification standard. As a sanity check, WordStream's Google Ads average is $70.11 (16,000+ US campaigns, Apr 2024-Mar 2025), while First Page Sage shows B2B SaaS at $237 blended and IT & Managed Services at $503 blended.

What's the difference between CPL and cost per qualified meeting?

CPL is cost per lead that meets your definition; cost per qualified meeting is cost per held, ICP-fit sales conversation. CPL is easier to generate and easier to game, while meeting cost tracks revenue better. Expect $300-$600 per qualified meeting in many B2B programs, and up to $1,500+ for hard enterprise personas.

How do I calculate my break-even CPL?

Break-even CPL equals LTV × gross margin × lead->opportunity rate × close rate. Example: $24,000 LTV × 80% margin × 10% lead->opp × 25% close rate = $480. If your effective CPL (including labor/tools/data) is above that, you're paying too much or qualifying too loosely.

Which lead generation pricing model should I start with?

Most B2B teams should start with a hybrid: a small base retainer plus pay-per-lead or pay-per-meeting tied to strict acceptance criteria. A practical pilot is 60-90 days with a cap on billable units and a 48-72 hour rejection window for ICP mismatch, duplicates, and no-shows.

What's a good free tool to clean lead lists before outbound?

Prospeo's self-serve tier includes 75 emails + 100 Chrome extension credits per month and uses 98% email accuracy with a 7-day refresh cycle to cut bounces.

Summary: how to think about lead generation pricing (without getting played)

Lead generation pricing gets simple when you (1) define "qualified," (2) calculate your effective CPL including the full cost stack, and (3) compare it to your break-even CPL, not to someone else's benchmark.

Benchmarks are guardrails. Contracts are where you win or lose the economics.

And if you're paying for outbound, clean your data before you scale. I've seen teams burn a quarter's worth of budget because nobody wanted to spend an afternoon verifying a list. If you want a deeper SOP for list hygiene, start with how to keep CRM data clean and a basic data quality scorecard.

That $1,000 cost-per-conversation number drops fast when your contact data is clean. Prospeo gives you 300M+ verified profiles, 125M+ direct dials with a 30% pickup rate, and enrichment that returns 50+ data points per contact - all self-serve, no contracts, no sales calls.

Stop subsidizing your vendor's bad data. Start with 100 free credits.