The Lead Qualification Framework Guide: 10 Models, Scoring Templates, and the Data That Backs Them

It's 3 PM on a Thursday. Pipeline review is tomorrow. You pull up the forecast and half the "committed" deals haven't moved in six weeks. The VP of Sales is going to ask why, and the honest answer is: nobody qualified these properly in the first place. They looked good on paper - had a title and a budget range. But nobody asked whether the prospect had a compelling reason to change, who else needed to sign off, or whether procurement would take three months.

67% of lost sales result from inadequate lead qualification. Not bad product. Not bad pricing. Bad qualification. Meanwhile, 73% of B2B buyers say they'll avoid suppliers whose outreach feels irrelevant, and 77% describe their latest B2B purchase as "very complex or difficult." The average deal now involves 6-10 decision makers, and 61% of buyers prefer a rep-free experience. The game has changed. Your lead qualification framework probably hasn't.

Real talk: most teams either use no framework at all, or they're running BANT from the 1950s like it's still the gold standard. Neither works for modern B2B. Only about 40% of firms consistently apply qualification criteria. The rest are winging it - and their forecasts show it.

What You Need (Quick Version)

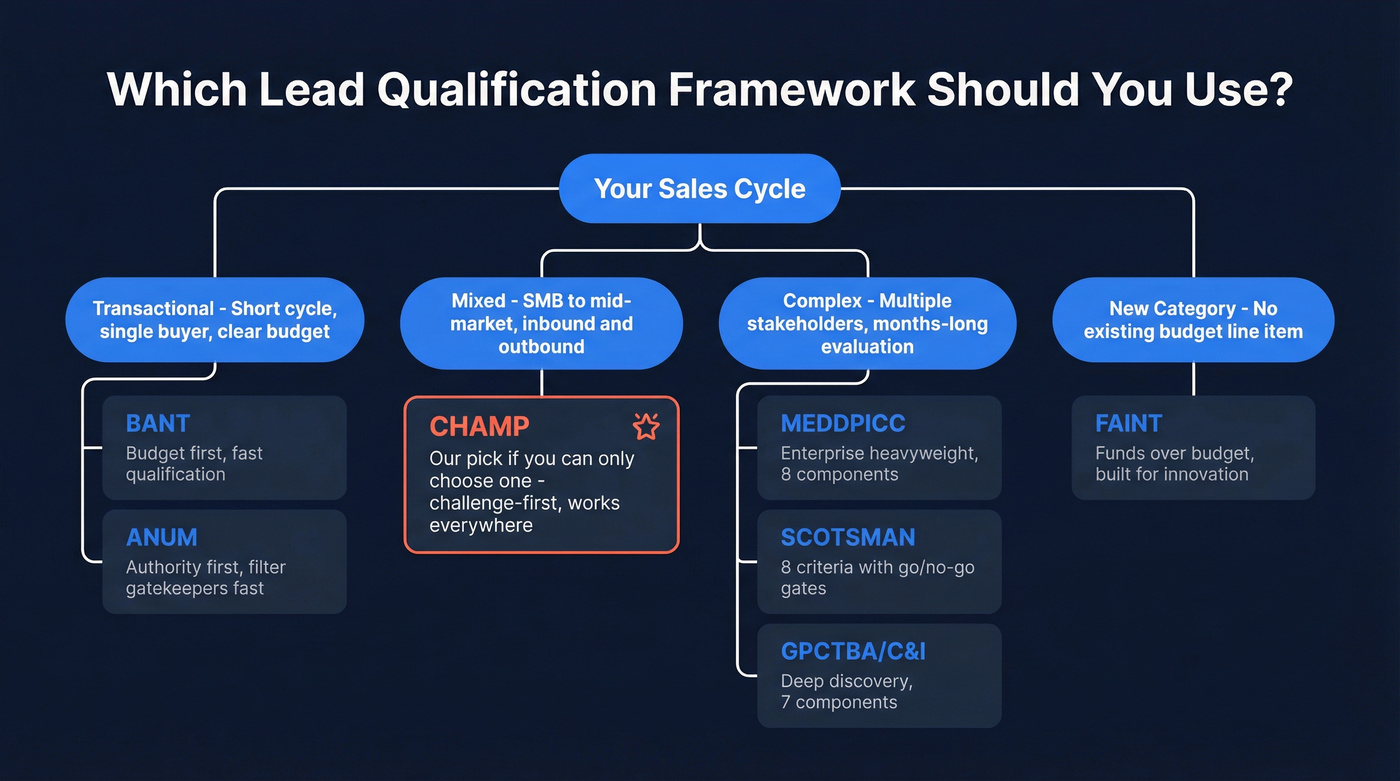

Match the framework to your sales cycle. If you sell transactional deals - short cycle, single buyer, clear budget - use BANT or ANUM. If your sales cycle involves multiple stakeholders and months of evaluation, go with MEDDPICC, SCOTSMAN, or GPCTBA/C&I. If you're selling a new product category where no established budget exists, FAINT was built for you. If you can only pick one and run it across your entire org: CHAMP. It's modern, customer-centric, and works across most B2B cycles.

Every framework needs a scoring model behind it. A framework tells reps what to ask. A lead scoring model tells the system how to weigh the answers. We've included a copy-paste scoring template with point values below - demographic, firmographic, and behavioral signals all mapped out.

None of it works if your contact data is stale. Before you implement any framework, audit your CRM data quality. If 20% of your emails bounce and half your phone numbers are disconnected, you're qualifying ghosts. Fix the data first, then build the process on top of it.

What Lead Qualification Actually Is (and Isn't)

Lead qualification is the process of determining whether a prospect has the fit, intent, and ability to buy. That's it. It's not discovery - though the two often happen in the same conversation.

Discovery is about understanding the prospect's world: their pain, their goals, their internal politics. Qualification is about making a binary judgment: should this deal stay in the pipeline or not? You can run both simultaneously, but conflating them is how reps end up with 45-minute "discovery calls" that produce zero qualification data.

Here's the funnel reality. Across industries, the average lead-to-MQL conversion rate is 31%. MQL-to-SQL conversion drops to just 13%. And 79% of marketing-generated leads never convert to sales at all. In practice, that's usually a qualification problem: marketing can generate volume, but a solid lead qualification methodology determines whether that volume is worth a rep's time.

One more stat that should change how you think about this: an estimated 90% of the B2B buyer journey is complete before a prospect contacts sales. By the time someone fills out your demo form, they've already done their research. The question isn't whether they're interested - it's whether they're qualified. Those are very different things.

You just read that 79% of marketing leads never convert - and the root cause is usually bad qualification built on stale data. Prospeo refreshes 300M+ profiles every 7 days, delivers 98% email accuracy, and returns 50+ data points per contact so your scoring model actually reflects reality.

Stop qualifying ghosts. Start qualifying buyers with data you can trust.

The 10 Prospect Qualification Frameworks That Matter

BANT (Budget, Authority, Need, Timeline)

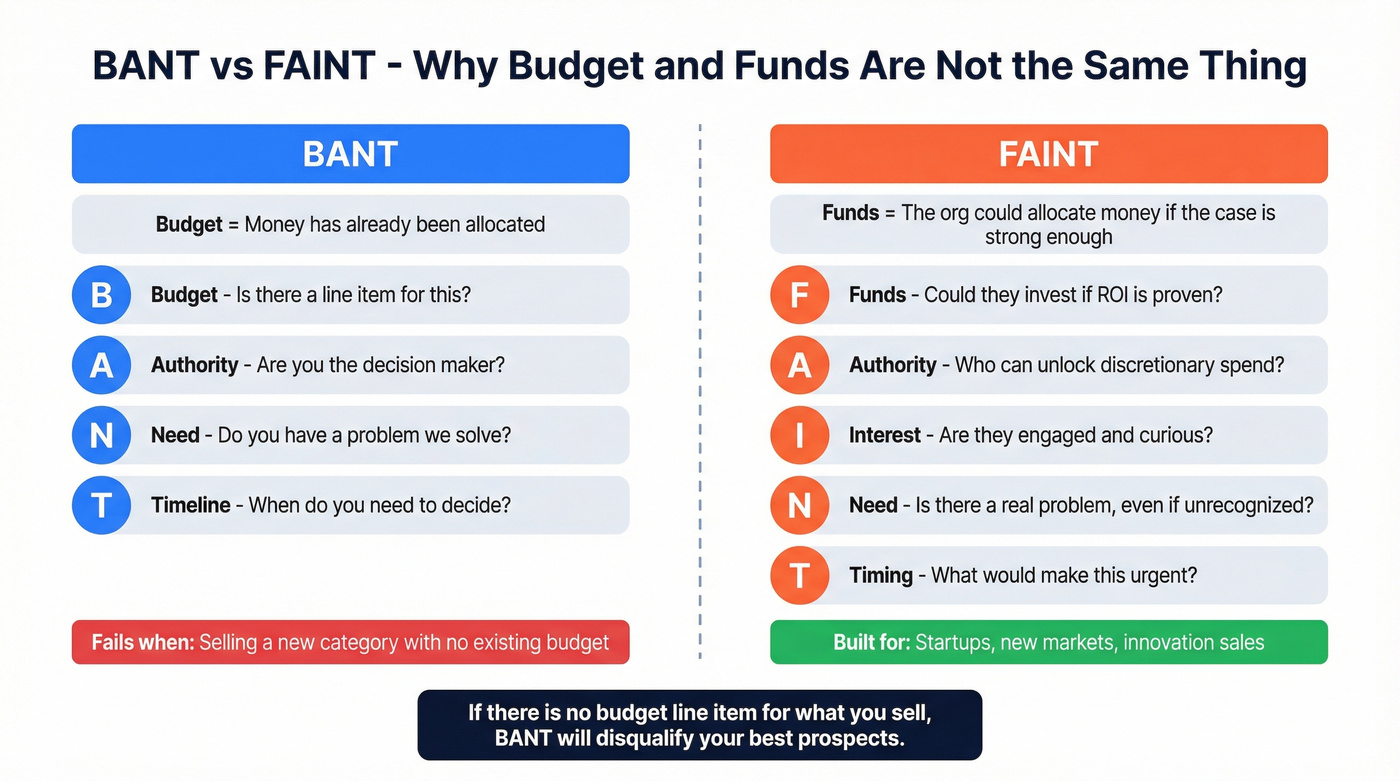

BANT is the grandfather. IBM developed it in the 1950s, and it's still the most recognized qualification model in sales. The acronym is self-explanatory: does the prospect have the Budget, the Authority to decide, a genuine Need, and a Timeline to act?

Use BANT if you're selling transactional deals with short cycles and a single decision-maker. Think SaaS tools under five figures, one-call closes, or high-velocity inside sales.

Skip BANT if you're selling into enterprise accounts with 6-10 stakeholders. Leading with "do you have budget?" in a complex sale feels tone-deaf - and it is. Modern buyers don't allocate budget until they've identified a problem worth solving. BANT's budget-first approach puts the cart before the horse.

Sample questions:

- "Has budget been allocated for this initiative, or would it need to be approved?"

- "Who else would need to sign off on a purchase like this?"

- "What's driving the timeline - is there a specific event or deadline?"

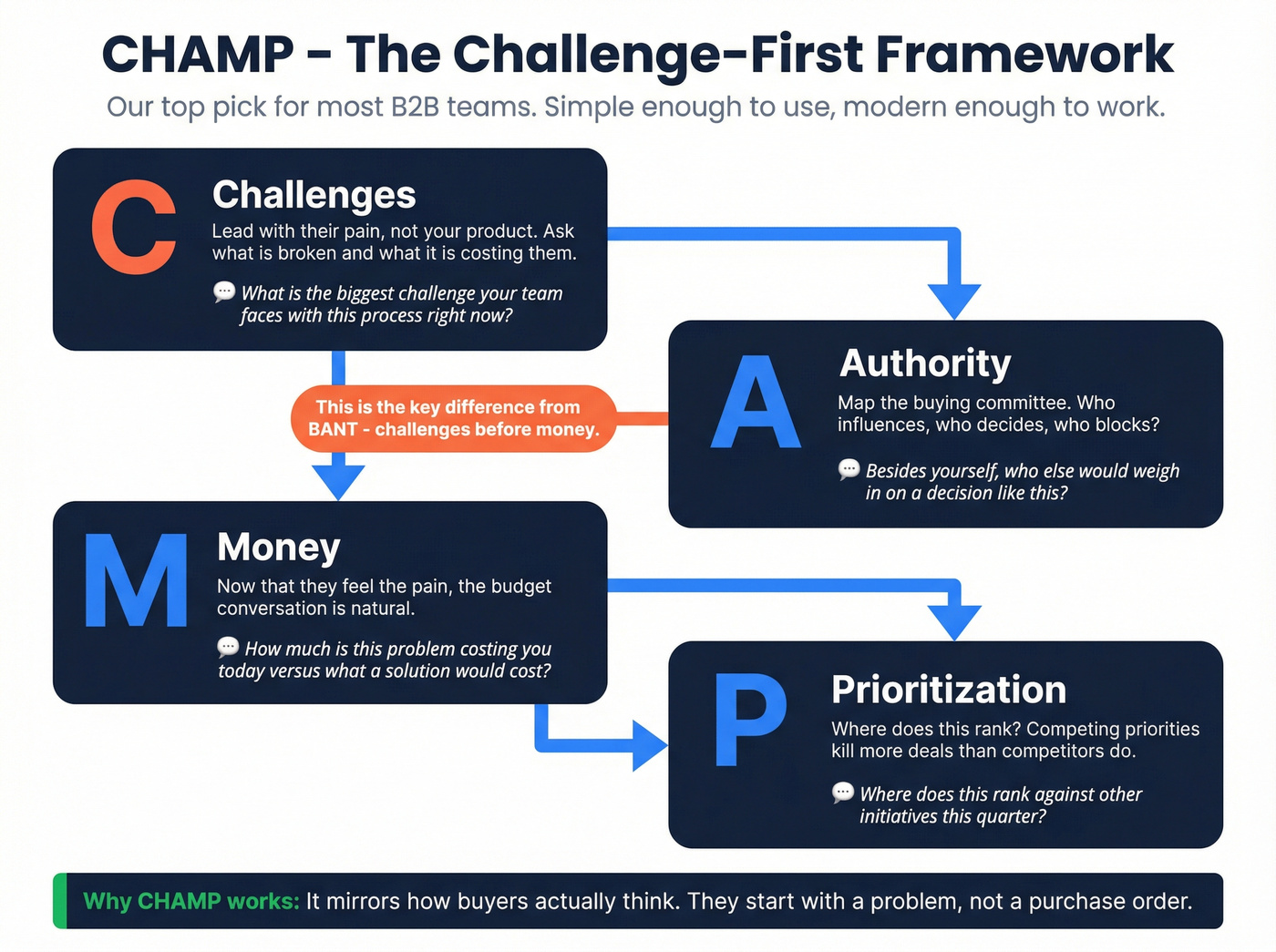

CHAMP (Challenges, Authority, Money, Prioritization)

CHAMP flips BANT on its head. Instead of leading with budget, it leads with challenges - the prospect's actual pain. This makes early conversations feel less like an interrogation and more like a consultation.

The logic is simple: if you understand the challenge deeply enough, the money conversation becomes easier. A prospect who's bleeding $500K/year on a broken process doesn't need to be asked "do you have budget?" They need to be asked "how much is this costing you?"

This is our pick if you can only choose one prospect qualification framework. CHAMP works for SMB and mid-market. It works for inbound and outbound. It's modern enough to reflect how buyers actually buy, but simple enough that reps will actually use it. The four letters are easy to remember, and the challenge-first approach aligns with consultative selling without requiring MEDDPICC-level rigor.

Sample questions:

- "What's the biggest challenge your team is facing with [process] right now?"

- "If you solved this, what would the impact be on your team's output?"

- "Where does this rank against other priorities this quarter?"

MEDDPICC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Paper Process, Implicate the Pain, Champion, Competition)

MEDDPICC is the heavyweight - widely used in enterprise sales. Dick Dunkel and Jack Napoli developed the original MEDDIC at PTC in the 1990s, where it helped grow revenue from $300M to $1B in four years. The framework has since evolved: MEDDICC added Competition, and MEDDPICC added Paper Process while shifting from "Identify the Pain" to "Implicate the Pain."

That evolution matters. Here's the difference:

- Identified pain: "We have slow ramp times for new reps."

- Implicated pain: "Slow ramp times are costing us $2M in burned leads annually."

The first is a problem. The second is a business case. Implicating the pain means quantifying the cost of inaction - and that's what gets deals funded.

Paper Process is the component most reps underestimate. It covers procurement, legal review, security questionnaires, and contract logistics. Deals die here constantly because reps treat it as administrative cleanup when it's actually a qualification step. If you don't know the paper process by the second meeting, you're flying blind.

Champion is what separates good MEDDPICC execution from great. The test question: "Would this person sell on your behalf when you're not in the room?" If the answer is no, you don't have a champion - you have a contact.

Competition includes more than the obvious vendors. In most deals, the status quo - doing nothing - is actually the strongest competitor. Internal builds count too. We've seen teams lose deals they thought were won because the prospect decided to build in-house at the last minute.

Here's the execution gap that should concern you: about 80% of reps can define MEDDPICC elements in a quiz, but only 35-40% can execute them fluently in a live conversation. Training isn't the problem. Practice is.

Sample questions:

- "What metrics would you use to measure success if you implemented a solution like this?"

- "Walk me through what happens after your team says yes - who else needs to approve, and what does that process look like?"

- "What happens if you don't solve this problem in the next 12 months?"

GPCTBA/C&I (Goals, Plans, Challenges, Timeline, Budget, Authority / Consequences & Implications)

GPCTBA/C&I is HubSpot's contribution to the framework universe, and it's the most comprehensive discovery-oriented model on this list. Seven components. That's a lot - and that's the point.

Use GPCTBA/C&I if you're running consultative enterprise sales where deep discovery is the competitive advantage. Skip it if your average sales cycle is under 30 days. The framework is overkill for transactional deals, and reps will shortcut it - which defeats the purpose.

The "Consequences & Implications" piece is what separates this from CHAMP. It's not enough to know the challenge. You need to know what happens if the challenge isn't solved (consequences) and what becomes possible if it is (implications). That dual framing is powerful in executive conversations.

Sample questions:

- "What are your top three goals for this quarter, and how does this initiative connect to them?"

- "If this project doesn't happen, what's the downstream impact on your team?"

- "What does success look like 12 months from now?"

FAINT (Funds, Authority, Interest, Need, Timing)

FAINT was designed for a specific problem: qualifying prospects who don't have a formal budget but have the financial capacity to invest. The distinction between "Funds" and "Budget" is everything.

Budget means money has been allocated. Funds means the organization could allocate money if the case is compelling enough. If you're selling a new product category - something prospects haven't bought before - there's no budget line item for it. But there are funds.

This makes FAINT the go-to framework for startups, new market entrants, and anyone selling innovation.

Sample questions:

- "If we could prove ROI within 90 days, does your organization have the capacity to invest in the next two quarters?"

- "What would need to be true for this to become a priority?"

- "How are you currently solving this - or are you just living with the problem?"

ANUM (Authority, Need, Urgency, Money)

Ken Krogue developed ANUM at InsideSales.com with one goal: filter gatekeepers fast. By putting Authority first, reps immediately determine whether they're talking to someone who can actually make a decision.

Use ANUM if you're running high-velocity inside sales with short cycles. It's BANT rearranged for speed.

Skip ANUM if you're selling into organizations where the "authority" question is complicated. In enterprise deals with 6-10 stakeholders, asking "are you the decision-maker?" on the first call is naive at best, offensive at worst.

SCOTSMAN (Solution, Competition, Originality, Timescales, Size, Money, Authority, Need)

This is the framework most guides skip, which is a shame.

Dermot Bradley created SCOTSMAN after starting his career at IBM (the same company that gave us BANT, roughly 50 years earlier). The framework follows a "win fast, lose fast" principle: be first past the winning post or first out of the race.

What makes SCOTSMAN unique is the "Originality" component. It forces reps to articulate what makes their solution genuinely different from competitors - not in a pitch deck, but in the context of this specific deal. If you can't answer "why us?" with something the prospect actually cares about, you shouldn't be in the deal.

The "Size" component goes beyond simple budget qualification. It evaluates deal scope and potential - is this a $50K pilot or a $500K enterprise rollout? That distinction should change your qualification effort and resource allocation entirely.

Sample questions:

- "What other solutions are you evaluating, and what criteria matter most?"

- "What would make our approach stand out compared to what you've seen so far?"

- "Is this a departmental initiative or an enterprise-wide rollout?"

STRONGMAN (Solution, Timeline, Review, Options, Need, Galvanization, Money, Authority, Negotiation)

Hot take: STRONGMAN is the most underrated framework in B2B sales. Nine components. Almost nobody talks about it.

The framework is designed for solution selling - a problem-led rather than product-led approach. Where it gets interesting is in the components no other framework includes.

Galvanization assesses whether the prospect is genuinely motivated to act. Not interested - motivated. There's a difference. An interested prospect takes your call. A galvanized prospect is pushing internally to get a deal done. This component forces reps to evaluate urgency honestly, turning prospects into champions and building real closing momentum.

Negotiation is baked into the framework itself. Most frameworks treat negotiation as something that happens after qualification. STRONGMAN says: assess negotiation signals early. What levers does the prospect have? What concessions will they push for? Knowing this in discovery changes your entire deal strategy.

The average win rate across B2B sales is 47% - meaning more than half your effort goes to deals you'll lose. STRONGMAN's depth is designed to improve that ratio by forcing earlier, more honest qualification.

One practical implementation tip: add each STRONGMAN area as a separate CRM field and update weekly with dated running notes. Share those notes with marketing, product marketing, and sales enablement.

Sample questions:

- "What's your review process look like - who needs to see a proposal before it moves forward?"

- "On a scale of 1-10, how motivated is your team to solve this in the next quarter?"

- "What would make you walk away from this deal - what's the dealbreaker?"

SPIN Selling (Situation, Problem, Implication, Need-Payoff)

SPIN isn't a qualification framework in the traditional sense - it's a discovery methodology. But it complements every qualification framework on this list, and ignoring it would be a disservice.

Neil Rackham developed SPIN based on research spanning 35,000+ sales calls across 12 years. The core insight: successful sellers limit their Situation questions (the "tell me about your current setup" stuff) and invest heavily in Implication and Need-Payoff questions.

The distinction between implied needs and explicit needs is central. An implied need is a problem: "Our CRM data is messy." An explicit need is a desire: "We need a system that keeps our data clean automatically." SPIN's question sequence moves prospects from implied to explicit needs - which is where buying decisions happen.

Sample questions by type:

- Situation: "What tools are you currently using for [process]?"

- Problem: "What difficulties have you encountered with your current approach?"

- Implication: "How does that data quality issue impact your team's ability to forecast accurately?"

- Need-Payoff: "If you could cut qualification time in half, what would your team do with that extra capacity?"

N.E.A.T. Selling (Need, Economic Impact, Access to Authority, Timeline)

N.E.A.T. was developed by The Harris Consulting Group and Sales Hacker for medium-cycle consultative sales. It's leaner than MEDDPICC but more sophisticated than BANT.

The "Economic Impact" component is the standout - it pushes reps past "what's your budget?" into "what's the financial impact of solving (or not solving) this?" That reframe changes the conversation from cost to value. Best for teams selling solutions in the $20K-$100K range where the sale isn't transactional but doesn't require MEDDPICC-level rigor.

Framework Comparison Table

| Framework | Best For | Sales Cycle | Discovery Depth | Key Strength |

|---|---|---|---|---|

| BANT | Transactional | Short | Light | Simplicity |

| CHAMP | Most B2B teams | Short-Medium | Moderate | Challenge-first |

| MEDDPICC | Enterprise | Long | Deep | Deal control |

| GPCTBA/C&I | Consultative | Long | Very deep | Strategic context |

| FAINT | New categories | Medium | Moderate | Funds vs. budget |

| ANUM | Inside sales | Short | Light | Speed |

| SCOTSMAN | Competitive deals | Long | Deep | Originality focus |

| STRONGMAN | Solution selling | Long | Very deep | Galvanization |

| SPIN | Discovery complement | Any | Deep | Question design |

| N.E.A.T. | Mid-market | Medium | Moderate | Economic impact |

How to Choose the Right Lead Qualification Model

Don't overthink this. Match the framework to three variables: sales cycle length, deal complexity, and your team's discipline level.

Short cycles (days to weeks): BANT, ANUM, or CHAMP. Your reps need to qualify fast and move on. CHAMP is the best of the three because it leads with challenges, but ANUM works if gatekeepers are your biggest bottleneck.

Medium cycles (one to three months): CHAMP, FAINT, or N.E.A.T. These give enough structure for multi-touch sales without overwhelming reps with nine-component frameworks they won't fill out.

Long cycles (three months+, multiple stakeholders): MEDDPICC, SCOTSMAN, GPCTBA/C&I, or STRONGMAN. The investment in qualification rigor pays off when deals are worth six or seven figures.

| Cycle Length | Recommended | Runner-Up |

|---|---|---|

| Short (< 4 weeks) | CHAMP | ANUM |

| Medium (1-3 months) | CHAMP or FAINT | N.E.A.T. |

| Long (3+ months) | MEDDPICC | STRONGMAN |

Something most guides miss: qualification and discovery frameworks can coexist. You can run MEDDPICC for qualification while using SPIN for discovery technique. They aren't competing - they're complementary. MEDDPICC tells you what to learn. SPIN tells you how to learn it.

Deal value should directly influence qualification effort. Spending 45 minutes qualifying a $5K deal is a waste. Spending 45 minutes qualifying a $500K deal is table stakes. For deals under $15K, CHAMP or ANUM will get you 90% of the way there in a fraction of the time.

Handle outbound differently from inbound. Inbound leads have already self-selected - they've shown interest. Outbound prospects haven't. Your qualification bar for outbound should be higher on fit and lower on intent, because you're creating the interest. Inbound should be the reverse: high intent is already there, so focus on fit and ability to buy.

Build a Lead Scoring Model That Actually Works

A framework tells reps what to ask. A scoring model tells the system how to weigh the answers - and everything else the prospect does before, during, and after that conversation.

Demographic and Firmographic Scoring

This is your baseline. Before a rep ever talks to a prospect, you should know whether they're worth talking to.

| Signal | Criteria | Points |

|---|---|---|

| Job Title | C-level | +20 |

| Job Title | Director/VP | +15 |

| Job Title | Individual contributor | +5 |

| Job Title | Student/Intern | -10 |

| Company Size | 200-1,000 (ideal) | +15 |

| Company Size | 50-199 | +10 |

| Company Size | Under 10 | -5 |

| Industry | Core target | +15 |

| Industry | Adjacent | +5 |

| Industry | Non-relevant | -10 |

These numbers aren't universal - calibrate them to your ideal customer profile. If you sell to SMBs, a 50-person company is your sweet spot, not a penalty. The point values above are a solid baseline for mid-market B2B.

Behavioral Scoring

Behavioral signals tell you what a prospect is doing, not just who they are. This is where scoring gets interesting - and where most teams under-invest.

| Signal | Action | Points |

|---|---|---|

| Web | Visited pricing page | +20 |

| Web | Watched demo video | +25 |

| Web | Read blog post | +5 each |

| Web | Multiple visits/week | +10 |

| Content | Downloaded whitepaper | +15 |

| Content | Webinar registration | +20 |

| Opened marketing email | +5 | |

| Clicked email link | +10 | |

| Replied to sales email | +30 | |

| Unsubscribed | -15 | |

| Bounced | -25 |

A word of caution: with email privacy updates like Apple Mail's, open rates have become unreliable. Smart teams have shifted focus toward on-site behavior and deeper engagement signals. If you're still weighting email opens heavily, you're measuring noise.

The scoring model also acts as a feedback loop. When high-scoring leads don't convert, audit and refine your criteria. Scoring isn't set-and-forget - it's a living system.

Thresholds, Benchmarks, and Maintenance

Most companies set MQL thresholds between 60-80 points. Below 60, the lead stays in marketing nurture. Above 80, it's fast-tracked to sales. The exact number depends on your volume - if you're drowning in leads, raise the bar. If pipeline is thin, lower it temporarily but track conversion rates closely.

Update your scoring model every 3-6 months. Markets shift. Buyer behavior changes. A signal that meant high intent two years ago can become a weaker indicator today.

Account-level scoring. Don't just score individuals - score accounts. If three people from the same company are engaging with your content, that account is hotter than any single lead score suggests. This is especially important for enterprise deals with 6-10 stakeholders. (If you want a dedicated system for this, start with account scoring.)

Time-decay scoring. A pricing page visit from yesterday is worth more than one from three months ago. Build decay into your model - reduce point values by 20-30% for actions older than 30 days.

Layer in intent data. Tools that track topics prospects are actively researching (like Bombora-powered intent signals) add a dimension that behavioral scoring alone can't capture. A prospect who's reading about your product category across the web is further along than one who visited your blog once.

Industry benchmarks for lead-to-MQL conversion, per First Page Sage's 10-year dataset:

| Industry | Lead-to-MQL Rate |

|---|---|

| Environmental Services | 45% |

| Higher Education | 45% |

| Biotech | 42% |

| B2B SaaS | 39% |

| Construction | 17% |

Channel benchmarks:

| Channel | Lead-to-MQL Rate |

|---|---|

| Client Referrals | 56% |

| Executive Events | 54% |

| SEO | 41% |

| PPC | 29% |

Warm connections convert 3x better than cold ones. That should directly influence how you weight source in your scoring model. A referral lead at 40 points should be treated like a cold lead at 65.

The Mistakes That Kill Your Pipeline

I've watched enough pipeline reviews to know: qualification failures come in two flavors. Leadership failures and rep failures. Both are fixable, but only if you're honest about which one you're dealing with.

Leadership Mistakes

No clear ICP. If your reps are pursuing vastly different types of prospects, the problem isn't the reps - it's the lack of a defined ideal customer profile. Marketing generates leads that never convert because nobody agreed on what "qualified" means. Fix this first. Everything else is downstream.

No structured framework. When every rep qualifies differently, you get inconsistent pipeline quality, deals that take forever to close, and forecasts that are fiction. Pick a framework. Train on it. Enforce it in your CRM fields. It doesn't have to be perfect - it has to be consistent. Even a simple qualification model applied uniformly will outperform a sophisticated one that only half the team follows.

Quantity over quality. This is the most insidious leadership failure. Bloated pipelines with stale opportunities. Declining win rates. Reps who don't have enough time for winnable deals because they're babysitting 80 "opportunities" that should've been disqualified weeks ago. The fix is cultural: sales teams should be celebrated when opportunities are disqualified early, not punished for having a smaller pipeline.

Rep Mistakes

Skipping qualification entirely. It happens more than anyone admits. Reps skip qualification due to pressure to move deals forward, overconfidence after a good first call, or the classic: hoarding accounts because a bigger pipeline looks better in the weekly report.

Hoarding accounts deserves its own callout. A rep sitting on 80 "opportunities" isn't productive - they're a bottleneck. Those accounts aren't being worked; they're being warehoused. The result: slower response times on real deals, inflated forecasts, and a pipeline that looks healthy until you actually inspect it.

"They're ghosting me." If your reps keep saying prospects are ghosting them, the problem isn't the prospect. It's that the prospect was never qualified in the first place. Ghosting is a symptom of insufficient qualification - the prospect didn't have enough urgency, authority, or need to stay engaged. A properly qualified deal doesn't go silent for three weeks.

The cultural fix is simple but hard: celebrate early disqualification.

A rep who kills a bad deal in week one is more valuable than a rep who drags it to week eight before it dies on its own.

AI and Automation Tools for Lead Qualification in 2026

Sales reps spend only 28% of their time actually selling - the rest goes to admin tasks and manual research. AI doesn't replace qualification judgment, but it handles the data-heavy grunt work that eats your team's time.

The numbers back this up: AI lead-scoring models reduce time spent on qualification by up to 30% and improve scoring accuracy by 40%. And per Harvard Business Review, companies that respond to leads within 1 hour are 7x more likely to qualify the lead. Delay 24+ hours and the likelihood drops by over 98%.

Speed matters. AI is how you get it.

One case study worth noting: a B2B SaaS company implementing AI-powered lead qualification saw a 78% improvement in lead quality and a 53% reduction in sales cycle length, generating $1.8M in new revenue.

Here are the tools worth knowing:

| Tool | What It Does | Starting Price |

|---|---|---|

| Prospeo | Data enrichment + verification | Free tier; ~$39/mo |

| Apollo.io | Contact database + intent signals | $49/user/mo |

| HubSpot | Predictive lead scoring | $800/mo (Pro) |

| Salesforce | AI-driven account scoring | $1,250/mo (Marketing) |

| Drift | AI chatbot qualification | $2,500/mo |

| Chili Piper | Automated meeting routing | $150/mo platform fee |

| eesel AI | AI chatbot for inbound | $239/mo |

These tools solve different problems. Drift and eesel AI handle inbound qualification via chatbot. HubSpot and Salesforce score leads inside your existing CRM. Apollo gives you the contact database and intent signals. Chili Piper routes qualified leads to the right rep instantly.

The best stack we've seen for mid-market teams: Prospeo for data enrichment and verification, HubSpot for scoring and automation, and Chili Piper for routing. Total cost under $1,200/mo at starting tiers. That's a fraction of what a single bad hire costs.

Implementation Checklist

Choosing a framework is step one. Making it stick is where most teams fail. Here's the implementation sequence that actually works - and it's worth the effort: companies with mature qualification processes see 26% higher conversion rates and 50% more revenue.

1. Define your ICP in writing. Not in someone's head. In a shared document with specific criteria: industry, company size, job titles, tech stack, and disqualification triggers. If it's not written down, it doesn't exist.

2. Pick one framework and map it to CRM fields. Add each qualification component as a separate CRM field. Update weekly with dated running notes. This creates accountability and makes pipeline reviews data-driven instead of vibes-driven.

3. Build your scoring model. Use the point values from the tables above as a starting template. Set your MQL threshold at 60-80 points. Configure it in your CRM or marketing automation platform.

4. Create a pre-call qualification checklist. Blaise Bevilacqua, an Enterprise AE, runs this before every call: Company Size, Industry Vertical, Seniority, Funding Round, Past Relationship, recent news, and content engagement. His take: it "cuts qualification time by half" - though he acknowledges it can create bias before heading into a call. Use it as a filter, not a verdict. (If you want a template, use this pre-call research checklist.)

5. Establish a marketing-sales SLA. Define what marketing considers an MQL, what sales considers an SQL, and the handoff process between them. Organizations with aligned sales and marketing are 67% more efficient at closing deals.

6. Train reps on the reciprocity test. James Matte's approach: "I'll provide something of value and see if the client is willing to give something in return - time for a meeting. If not, that's a clear signal they aren't serious." Simple. Effective.

7. Arm reps with qualifying questions. Kenny Powell's starters: "What sparked your interest?" / "Is this something new or a process you're trying to improve?" / "How many contacts exist in your CRM today?" These open doors without feeling like an interrogation. If you want more, pull from a structured bank of deal qualification questions.

8. Set a scoring model review cadence. Every 3-6 months, audit which signals actually predict conversion and which don't. Kill the ones that don't. Add new ones based on what you're learning.

9. Measure what matters. Track MQL-to-SQL conversion, SQL-to-Opportunity conversion, average deal velocity, and disqualification rate. If your disqualification rate is under 20%, your bar is too low.

BANT, CHAMP, MEDDPICC - none of it matters if 20% of your emails bounce and half your direct dials are disconnected. Prospeo's 5-step verification, catch-all handling, and 125M+ verified mobiles with a 30% pickup rate mean your reps actually reach the prospects they're qualifying.

Audit-proof your pipeline starting at $0.01 per verified email.

FAQ

What's the best lead qualification framework for B2B sales?

CHAMP works for most B2B teams because it's customer-centric and simple enough that reps actually use it. MEDDPICC is the standard for enterprise deals with multiple stakeholders, while BANT still works for short, transactional sales. The right choice depends on your sales cycle length and deal complexity more than anything else.

What's the difference between MQL and SQL?

An MQL meets your demographic and behavioral scoring threshold - typically 60-80 points. An SQL has been vetted by a rep with confirmed fit, intent, and ability to buy. Only 13% of MQLs convert to SQLs, and that gap is where most pipeline leakage happens.

How do you score leads effectively?

Combine demographic scoring (job title, company size, industry) with behavioral scoring (pricing page visits, content downloads, email engagement). Set your MQL threshold at 60-80 points, review the model quarterly, and layer in intent data. Tools like Prospeo fill in missing firmographic fields at a 92% match rate, which keeps your scoring inputs accurate.

Is BANT still relevant in 2026?

For short, transactional sales with a single decision-maker - yes. For complex B2B deals with 6-10 stakeholders, BANT's budget-first approach is outdated. Use CHAMP, MEDDPICC, or FAINT instead. They lead with challenges and pain rather than asking about budget before trust is established.

How does AI improve lead qualification?

AI reduces qualification time by up to 30%, improves scoring accuracy by 40%, and enables real-time scoring that updates as prospects engage. The biggest impact is speed: companies responding within 1 hour are 7x more likely to qualify the lead versus those that wait 24+ hours.