The Sales Qualification Checklist You'll Actually Use in 2026

It's Thursday afternoon. You're staring at a pipeline review with 47 "opportunities" - and you already know half of them are dead. The VP who ghosted after the demo. The startup that loved everything but has no budget until Q3. The enterprise deal where your "champion" turns out to be an intern.

67% of lost sales come from inadequate lead qualification. Honestly, that stat feels generous.

Every other sales qualification checklist article gives you a BANT explainer and calls it a day. This one gives you a printable checklist, a lead scoring template with actual point values, a framework decision matrix, and a disqualification checklist - because knowing when to walk away is worth more than knowing what questions to ask.

What You Need (Quick Version)

Three things to do this week:

- Pick one framework. BANT for deals under $50K, MEDDIC for $100K+. The [decision matrix](#the-framework-decision-matrix - which-one-is-right-for-you) below maps eight frameworks to your deal type.

- Implement lead scoring. Copy the template in the scoring section - it takes 30 minutes to set up and immediately separates signal from noise.

- Build a disqualification habit. The [red flags checklist](#when-to-walk-away - the-disqualification-checklist) gives you seven signals and two scripts for walking away without burning bridges.

That's the whole article compressed. Keep reading for the details.

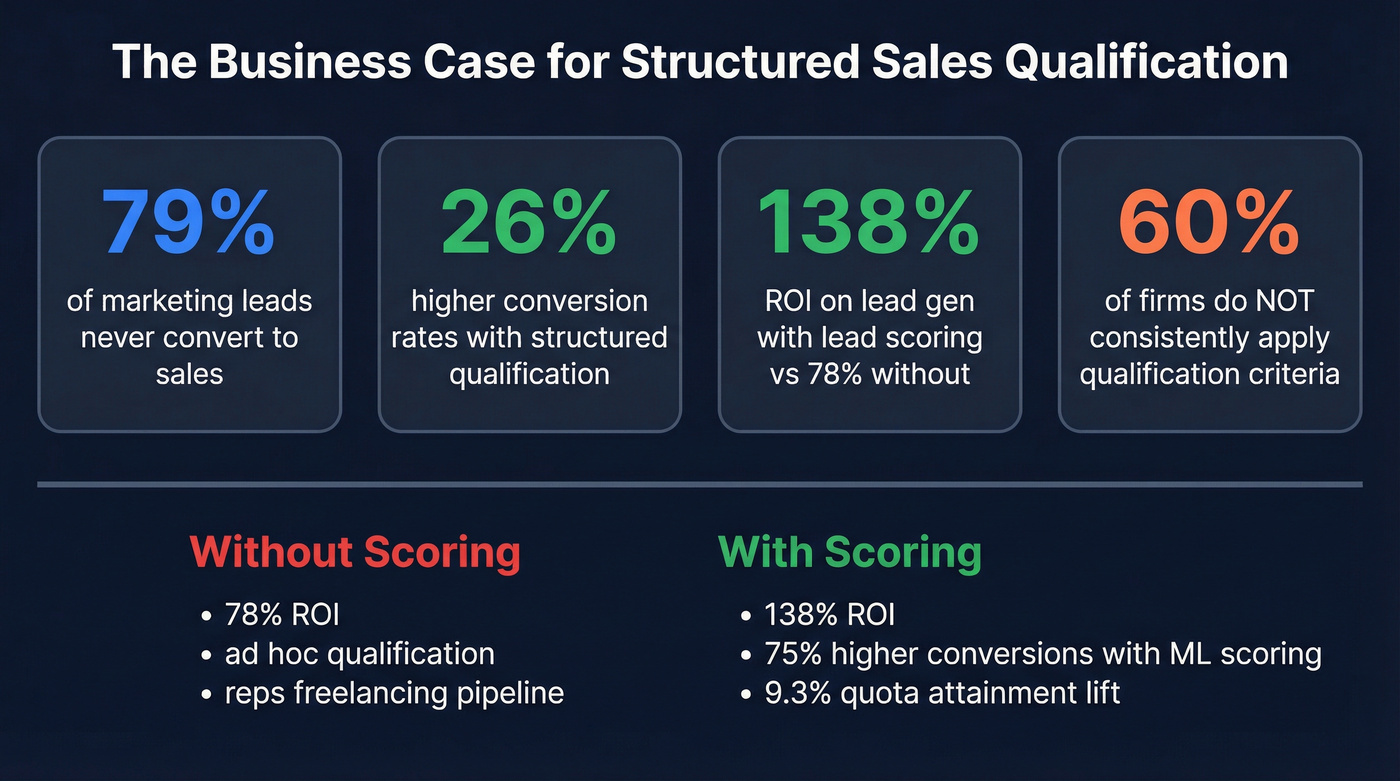

The Business Case for Structured Qualification

Let's stack the numbers, because this is the slide you'll need when your VP asks why you're changing the process.

79% of marketing-generated leads never convert to sales. The average MQL-to-SQL conversion rate is 13%. For every 100 leads marketing hands over, roughly 79 go nowhere. The funnel isn't leaking - it's a sieve.

Companies that implement structured qualification see 26% higher conversion rates, 50% more revenue, and 25% lower cost per lead, per Aberdeen Group research. CSO Insights puts the quota attainment lift at 9.3% for teams with a mature qualification process.

The lead scoring numbers are even more dramatic. Companies using lead scoring achieve 138% ROI on lead generation versus 78% without - a 60-point gap. ML-powered scoring delivers 75% higher conversion rates versus traditional methods. And yet only 44% of organizations use lead scoring at all.

That's a competitive advantage sitting in plain sight.

None of this works if your reps are freelancing. Only 40% of firms consistently apply qualification criteria. The other 60% have a "process" that lives in a slide deck nobody opens. The checklist below fixes that.

Lead Types - MQL vs SQL vs SAL vs PQL

Before you can qualify anything, your team needs shared definitions. Pin this table in every Slack channel your sales and marketing teams share.

| Lead Type | Definition | Trigger | Avg. Conversion |

|---|---|---|---|

| MQL | Sustained marketing engagement | Downloads, repeat visits, webinars | 31% of leads -> MQL |

| SAL | Sales-accepted, meeting criteria | MQL reviewed + accepted by sales | ~70-80% of MQLs -> SAL |

| SQL | Confirmed problem + authority + timeline | Discovery call + budget confirmed | 13% of MQLs -> SQL |

| PQL | Product usage showing value | Feature adoption, usage thresholds | Varies by product |

Industry benchmarks range from 17% (Construction) to 45% (Environmental Services) for lead-to-MQL. B2B SaaS runs about 39%. If you're below these numbers, your qualification criteria are too loose - or your lead sources are off.

The SAL stage deserves attention if your sales and marketing teams argue about lead quality. It's the handoff checkpoint: marketing says "this is qualified," and sales either accepts or rejects with a reason. Without it, marketing blames sales for not following up, sales blames marketing for sending garbage, and nobody learns anything.

PQLs deserve special attention in 2026. If you have a free tier or trial, behavioral triggers - activated a key feature, invited teammates, hit usage limits - are stronger qualification signals than any form fill. A prospect who's used your product for a week and hit a paywall is more qualified than someone who downloaded your whitepaper and forgot about it.

A perfect qualification framework means nothing if you're calling wrong numbers and bouncing emails. Prospeo gives you 98% verified emails and 125M+ direct dials with a 30% pickup rate - so every lead that passes your checklist actually gets contacted.

Stop qualifying leads you can't even reach.

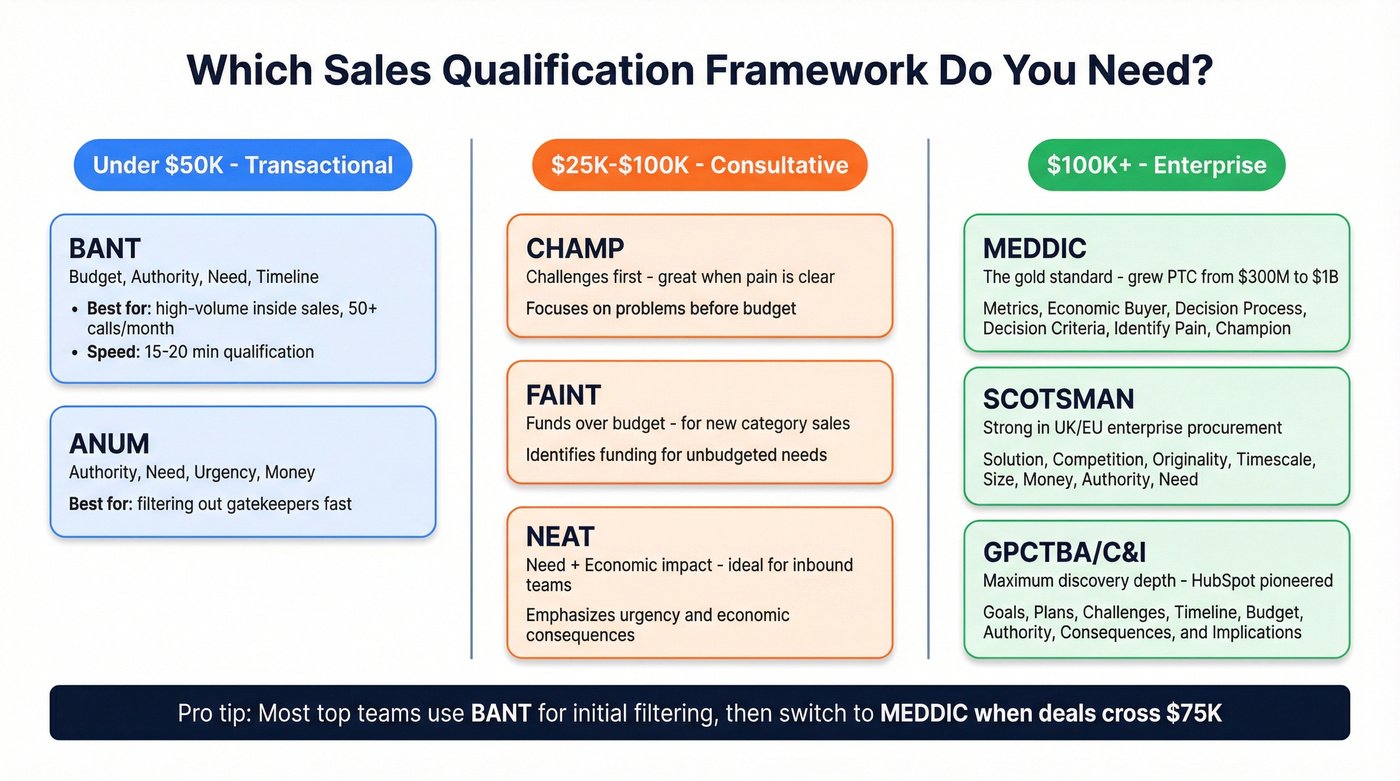

The Framework Decision Matrix - Which One Is Right for You?

You don't need eight frameworks. You need one, adapted to your deal type.

| Framework | Best Deal Size | Cycle Length | Stakeholders | Complexity |

|---|---|---|---|---|

| BANT | Under $50K | Days-weeks | 1-3 | Low |

| ANUM | Under $50K | Days-weeks | 1-3 | Low |

| CHAMP | $25K-$100K | Weeks-months | 2-5 | Medium |

| FAINT | $25K-$100K | Weeks-months | 2-5 | Medium |

| NEAT | $25K-$100K | Weeks-months | 2-5 | Medium |

| MEDDIC | $100K+ | 3-12 months | 5-13 | High |

| SCOTSMAN | $100K+ | 3-12 months | 5-13 | High |

| GPCTBA/C&I | $100K+ | 3-12+ months | 5-13 | High |

Short-Cycle / Transactional Deals (BANT, ANUM)

BANT was created by IBM in the 1950s, and yes, it shows its age. The biggest practitioner complaint: it's massively seller-centric. Asking "What's your budget?" on a first call causes prospects to lowball or deflect. But for high-volume inside sales where you're running 50+ discovery calls a month and deals close in under 60 days, BANT's speed is the point. You can run it in 15-20 minutes.

ANUM flips the order - Authority first, then Need, Urgency, Money - which filters out gatekeepers faster. If your biggest time-waster is talking to people who can't sign anything, start here.

Mid-Cycle / Consultative Deals (CHAMP, FAINT, NEAT)

FAINT (Funds, Authority, Interest, Need, Timeline) is the evolution of BANT that recognizes a key reality: engaged prospects often create budgets that didn't exist before. If you're selling something your buyer hasn't bought before, FAINT's emphasis on interest and funds (broader than "budget") is more practical.

CHAMP leads with Challenges instead of budget, which works better when the prospect's pain is clear but the buying process isn't. NEAT Selling focuses on Need, Economic impact, Authority, and Timeline - it works well for inbound-heavy teams where leads arrive with some self-education already done.

Long-Cycle / Enterprise Deals (MEDDIC, SCOTSMAN, GPCTBA/C&I)

MEDDIC was created at PTC in the 1990s and helped grow the company from $300M to $1B in four years. That's not marketing fluff - it's the most proven enterprise qualification framework in B2B software.

MEDDIC requires multiple conversations. Try doing it in 20 minutes and you'll get surface-level garbage. But for $100K+ deals with 6-13 stakeholders, that depth is exactly what you need. It's evolved into MEDDPICC (adding Paper Process and Competition) for deals where procurement and competitive dynamics are critical.

SCOTSMAN (Solution, Competition, Originality, Timescale, Size, Money, Authority, Need) is the European cousin of MEDDIC - less common in US SaaS but strong in UK/EU enterprise sales where procurement formality runs higher. If you sell into EMEA, it's worth a look.

GPCTBA/C&I (Goals, Plans, Challenges, Timeline, Budget, Authority, Consequences & Implications) was pioneered by HubSpot and goes all in on discovery. It's overkill for most teams, but if you're selling six-figure consulting engagements, the depth pays off.

The Hybrid Approach Most Practitioners Actually Use

Here's the thing: the framework debates are mostly academic. The best sales teams we've seen don't follow any single framework religiously. They use BANT for initial filtering on inbound leads, then switch to MEDDIC-style deep qualification when a deal crosses the $75K threshold. If your average deal size is under $25K, you probably don't need anything more complex than BANT plus a gut check. The framework is a scaffold, not a cage. Adapt it to your motion, review it quarterly, and don't let methodology debates slow down actual selling.

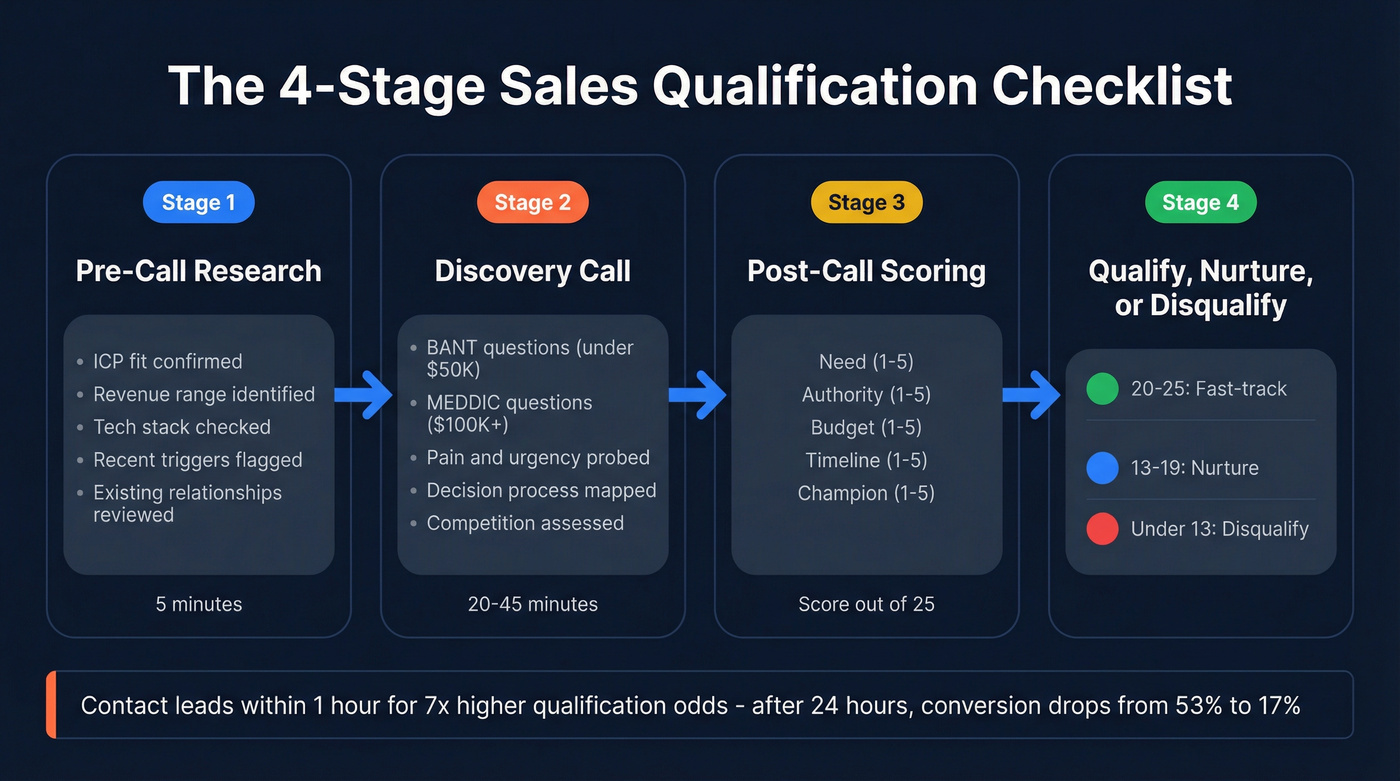

The Printable Sales Qualification Checklist

This is the asset you came for. Four stages, each with specific actions.

Stage 1 - Pre-Call Research (5 Minutes)

Before you pick up the phone or join the Zoom, check these boxes:

- ICP fit confirmed - company size, industry, and geography match your ideal customer profile

- Company revenue range identified (annual report, funding data, or estimate)

- Tech stack checked - are they using tools your product integrates with or replaces?

- Recent triggers flagged - new funding round, leadership change, job postings in relevant departments, headcount growth

- Existing relationship - has anyone at your company talked to them before? Check your CRM.

Five minutes of research saves 30 minutes of aimless discovery. Reps who skip this step ask questions the prospect's website already answers - and that kills credibility instantly.

Stage 2 - Discovery Call Questions

Use the BANT set for deals under $50K:

- What problem are you trying to solve, and what's the cost of not solving it?

- Who else needs to be involved in this decision?

- Have you allocated budget for this, or would we need to build a case together?

- What's your timeline - is there an event or deadline driving this?

- Have you looked at other solutions? What did you like or dislike?

Use the MEDDIC set for deals over $100K:

- What specific metrics would define success for this project? (Metrics)

- Who has final sign-off on purchasing decisions, and what factors influence them? (Economic Buyer)

- What are the most critical factors when evaluating solutions - and how do you measure ROI? (Decision Criteria)

- Walk me through your approval process - who's involved, what's the timeline, and are there formal procedures? (Decision Process)

- What's causing enough pain right now that you're actively looking for a change? (Identify Pain)

The response time stat matters here: contacting a lead within one hour generates 7x higher qualification odds. After 24 hours, conversion drops from 53% to 17%. Speed isn't just about enthusiasm - it's about catching the prospect while the problem is still top of mind. (If you want to formalize this as an SLA, see speed-to-lead metrics.)

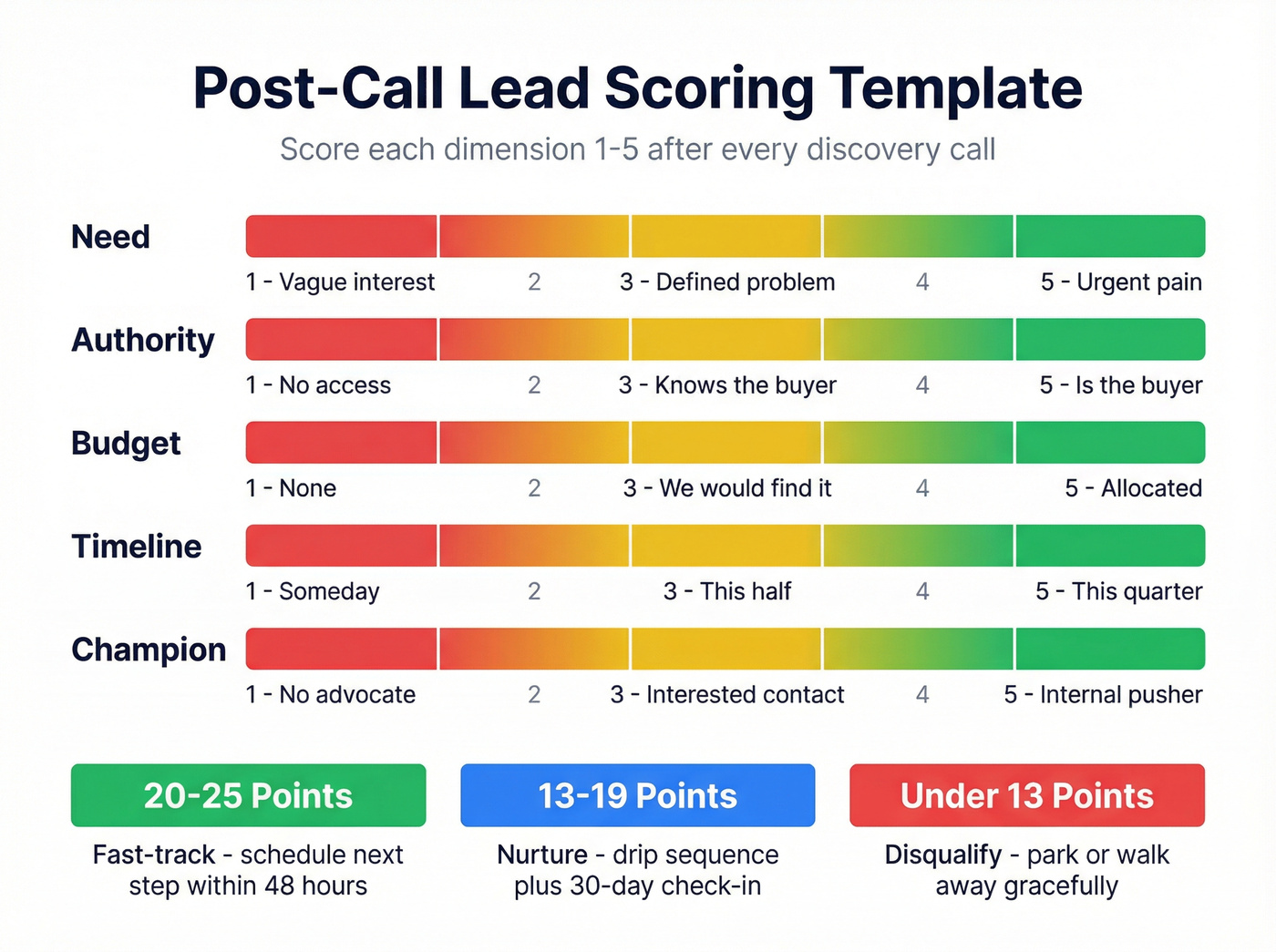

Stage 3 - Post-Call Scoring

After every discovery call, score the prospect on five dimensions (1-5 scale):

| Dimension | 1 (Poor) | 3 (Moderate) | 5 (Strong) |

|---|---|---|---|

| Need | Vague interest | Defined problem | Urgent pain |

| Authority | No access | Knows the buyer | Is the buyer |

| Budget | None | "We'd find it" | Allocated |

| Timeline | "Someday" | This half | This quarter |

| Champion | No advocate | Interested contact | Internal pusher |

Total score of 20-25: fast-track. 13-19: nurture with targeted content. Under 13: disqualify or park.

Stage 4 - Qualify, Nurture, or Disqualify

- Qualify (20-25): Schedule next step within 48 hours. Confirm the champion. Map the decision process.

- Nurture (13-19): Add to a drip sequence. Set a 30-day check-in. Don't waste discovery time - they'll come back when the timing's right.

- Disqualify (under 13): Send a professional close-out email. Free up the pipeline. Move on.

Most reps struggle with the third option. The disqualification checklist below gives you the signals and scripts.

Build Your Lead Scoring Model This Week

Only 44% of organizations use lead scoring. If you implement it this week, you're ahead of more than half your competitors.

Here's a concrete B2B SaaS scoring template:

Demographic/Firmographic Scores:

- Director+ title: +25

- Manager title: +15

- 200-1,000 employees: +15

- 1,000+ employees: +20

- Target industry: +20

- Non-target industry: -15

Behavioral Scores:

- Demo request: +20

- Pricing page visit: +10

- Contact form submission: +25

- Case study download: +10

- Blog post view: +3

- Social media click: +1

- 30+ days without engagement: -10

- Email bounce: -10

- Unsubscribe: -15

MQL threshold: 60-80 points. Below 60, keep nurturing. Above 80, that's an SQL - route to sales immediately.

360 Learning implemented a model like this and saw a 40% increase in conversion rates with 97% assignment accuracy. The key was including negative scoring - leads that disengage or bounce should lose points, not just sit at their high-water mark.

Your scoring model is only as accurate as your contact data. If a third of your emails bounce, you're scoring leads you can never reach. Verify your database first - tools like Prospeo refresh contact data every 7 days and maintain 98% email accuracy, so your scores reflect reality instead of ghosts in your CRM. (If you need a process, start with a simple data quality scorecard and a recurring cleanup cadence.)

Start with fewer than 10 criteria. Collaborate with marketing on the thresholds. Review quarterly. And automate the routing - even outside SaaS, Aetna eliminated 8 hours of daily manual case assignment by automating their scoring-to-routing workflow.

Qualification by Segment - SMB vs Mid-Market vs Enterprise

Using the same checklist for a 5-person startup and a Fortune 500 account is why your pipeline is a mess.

| Dimension | SMB | Mid-Market | Enterprise |

|---|---|---|---|

| Stakeholders | 1-4 | 3-6 | 6-13 |

| Sales cycle | 30-90 days | 3-6 months | 6-18 months |

| Qualification time | 15-20 min | 1-3 hours | 5-15+ hours |

| Best framework | BANT / ANUM | CHAMP / FAINT | MEDDIC / MEDDPICC |

| Key signal | Speed to decision | Process clarity | Champion strength |

SMB qualification is about velocity. Founders or lean leadership hold budget and power. If they're interested, they can move fast. If they can't answer basic BANT questions in 15 minutes, they're probably not ready.

Mid-market is where qualification gets tricky. You can't run a pure volume play, but you also can't spend months on every lead. The key question: is there a defined buying process, or are you helping them create one? If it's the latter, budget 2-3x more qualification time.

Enterprise is a different sport entirely. You're navigating 6-13 stakeholders across procurement, security, legal, and the actual business unit. Qualification happens across multiple conversations over weeks, not in a single call. No internal champion means no deal. If you can't identify someone inside the org who benefits from your solution succeeding, you don't have a deal. You have a conversation. (This is also where ABM multi-threading stops being a tactic and becomes survival.)

When to Walk Away - The Disqualification Checklist

Most teams don't have a qualification problem. They have a disqualification problem.

You've spent three weeks on a prospect, so you convince yourself the next meeting will be different. It won't. That's the sunk-cost fallacy - pushing forward because you've invested time and energy, not because the signals support it.

Here are seven signals it's time to walk away:

They can't answer three basic questions. What does success look like? Who else is involved? When do you need this done? If they can't answer any of these, they haven't thought about this enough to buy.

They genuinely don't have budget - and it's not a value-proving issue, it's a cash shortage. Ask about company revenue and billing term flexibility. If the numbers don't work no matter how you structure them, walk.

You're competing with 3+ vendors. Low win probability. The deal is likely in early stages, and you're probably talking to a lower-level employee doing research. If you're a serious contender, they'll come back.

They go dark. Stop returning calls and emails after initial enthusiasm. Send a professional breakup email - the "permission to close your file" approach works well here.

You're working with a coach, not a champion. A coach talks to you and gives you information. A champion moves the deal forward internally. If your contact can't get you a meeting with the economic buyer, they're a coach.

The timeline keeps slipping. "Next quarter" becomes "next half" becomes "next year." Timelines that move backward are the clearest disqualification signal.

They love the product but won't commit to next steps. Enthusiasm without action is just politeness. If they won't schedule a follow-up, introduce a stakeholder, or share requirements, they're not buying.

Track your disqualification reasons monthly. After 90 days, you'll see patterns - maybe 40% of disqualified leads come from the same industry or company size. Feed that back into your ICP and save reps the time.

The script for walking away: "It sounds like the timing isn't right for this. I'd like to close out our file for now and check back in [timeframe]. If anything changes on your end before then, you know where to find me." Professional, no bridges burned, and you just freed up 5 hours a month for a deal that might actually close.

Qualification Mistakes That Kill Your Pipeline

Leadership mistake: No clear ICP. Reps pursue vastly different prospects, marketing generates leads that never convert, and pipeline reviews feel like a guessing game. The fix: build your ICP from your last 20 closed-won deals. What did those companies have in common? That's your ICP. Everything else is a distraction. (If you need a fast starting point, use these buyer persona examples to pressure-test assumptions.)

Leadership mistake: Quantity over quality. Bloated pipelines, declining win rates, reps pushing deals forward prematurely because they're incentivized on pipeline volume. Sales leaders with pipelines full of fluff rarely have long tenures. Measure conversion rates, deal velocity, and win rates - not pipeline dollars. (This is exactly what pipeline quality is about.)

Rep mistake: Over-qualifying. As Jason Lemkin puts it, if they reached out on their own, interest is likely genuine. Don't interrogate inbound leads with 45 minutes of MEDDIC questions when they just want to see the product.

Rep mistake: Bad data, not bad qualification. I've seen this play out dozens of times: an SDR spends 45 minutes on a great discovery call, sends the follow-up email - and it bounces. Tries the phone number - disconnected. That SDR didn't have a qualification problem. They had a data problem. Reps spend 65% of their time on non-selling activities, and chasing bad contact data is a huge chunk of that waste. (If you keep seeing bounces, start with a list hygiene SOP like an email verification list.)

Skip the qualification theater if your underlying data is rotten. Fix the inputs first, then worry about frameworks.

You just built a scoring model. Now feed it real signals. Prospeo tracks buyer intent across 15,000 topics, job changes, headcount growth, and technographics - the exact data points that separate a 90-score SQL from a 30-score time-waster.

Turn your lead scoring from guesswork into ground truth.

AI and Automation in Lead Qualification

Gartner projects that 70% of routine sales tasks will be automated by 2030. AI-powered qualification is already delivering real results: 40% conversion improvement from AI scoring, and ML-powered models show 300-400% first-year ROI.

The caveat: 26% of AI transformations fail. The #1 reason? Bad underlying data. 67% of Salesforce Agentforce implementations fail due to insufficient CRM data quality. AI doesn't fix garbage inputs - it scales them. Get your data house in order before you layer on AI. (If you're evaluating approaches, compare AI lead scoring vs traditional lead scoring before you buy tooling.)

Here's the tool landscape, grouped by what you actually need:

Best for most mid-market teams: HubSpot Sales Hub ($45-150/user/mo) - built-in lead scoring, sequences, and deal tracking. Not the most powerful, but the fastest to implement and good enough for 80% of teams.

Best for conversation intelligence: Gong (~$250-400/user/mo) - identifies qualification signals reps miss and improves trigger identification by 31%. Worth it once you have 10+ reps.

Best for revenue forecasting: Clari (~$200-300/user/mo) - cuts false MQLs by 40%. Overkill if you just need scoring, essential if your forecast accuracy is a problem.

Best for prospecting + scoring in one tool: Apollo.io ($49-149/user/mo) - combines database with basic engagement scoring. Good for lean teams that want fewer tools.

Enterprise-grade: Salesforce Einstein ($500-650/user/mo all-in with Data Cloud) - powerful but complex. Budget for implementation help. 6sense ($30-100K+/year) - predictive scoring that boosts conversions by 22%, but enterprise pricing and enterprise onboarding.

The bottom line: AI scoring is a multiplier, not a replacement. It works when your qualification criteria are clear, your CRM data is clean, and your reps actually update deal stages. Without those foundations, you're just automating chaos.

FAQ

What's the difference between lead qualification and lead scoring?

Qualification determines whether a prospect fits your criteria - need, budget, authority, timeline - through direct conversation. Scoring assigns numerical values to automate that judgment across thousands of leads. You need both: qualification sets the criteria, scoring scales them.

Is BANT still relevant in 2026?

Yes, for SMB deals under $50K with short cycles and few stakeholders - you can run BANT in 15 minutes. For enterprise deals over $100K, MEDDIC is far more effective. Most teams benefit from a hybrid: BANT for initial filtering, MEDDIC when deals cross the $75K mark.

How long should a sales qualification call take?

SMB: 15-20 minutes. Mid-market: 30-45 minutes. Enterprise qualification unfolds across multiple conversations over weeks, involving different stakeholders at each stage. Trying to compress enterprise qualification into one meeting produces surface-level answers.

How do I keep my qualification data accurate?

CRM data decays 2-5% per month - biotech sees 22% monthly decay. Audit your scoring model quarterly. Remove leads that have bounced, unsubscribed, or gone silent for 90+ days. And verify your contact database regularly so you're not scoring leads you can never actually reach.

What's a good free tool for verifying lead data before qualification?

Prospeo offers 75 free verified emails plus 100 Chrome extension credits per month with no contracts. Hunter gives 25 free searches monthly but caps enrichment. For teams running real outbound campaigns, Prospeo's free tier covers more ground with full verification included.