The Data-Backed SaaS Go-to-Market Strategy Playbook for 2026

95% of new product launches fail. Not because the products are bad - because the go-to-market strategy was wrong. Or worse, there wasn't one. 42% of those failures trace back to a single root cause: no market need. Not "bad marketing." Not "weak sales team." The company built something nobody wanted badly enough to pay for.

A strong SaaS go-to-market strategy is the difference between those odds and a real business. 85% of executives say GTM is vital to their organization's success, with 55% planning to increase budgets over the next 18 months. Yet there's a massive gap between knowing GTM matters and actually executing it well.

Most GTM guides are useless because they give you a framework with zero numbers. "Define your ICP." Great - what conversion rate should I expect? "Pick your channels." Sure, which ones are actually working right now? "Set your pricing." At what ACV threshold does my entire motion need to change?

Every decision in this playbook is backed by benchmarks from real companies - 474 Series A startups, 107 public SaaS companies analyzed by McKinsey, 600+ PLG businesses, and a survey of 100 marketing leaders at $50M+ companies. The frameworks are here, but so are the numbers that make them actionable.

70% of SaaS startups don't make it past year five. The ones that survive aren't smarter. They're more precise about who they sell to, how they sell, and when they shift.

The Five Things That Actually Matter

If you read nothing else, internalize these:

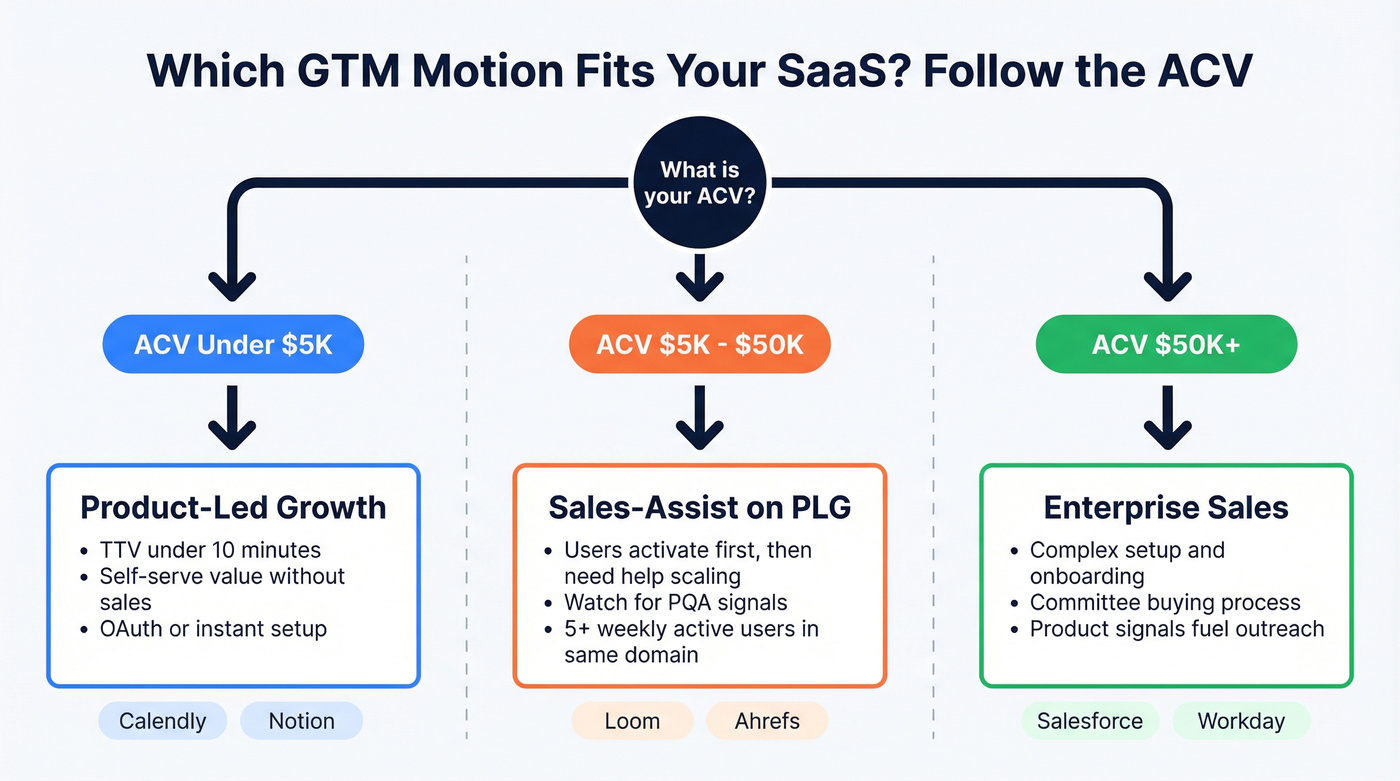

- Your GTM motion depends on deal size. Under $5K ACV → product-led growth. $5K-$50K → sales-assist layered on PLG. $50K+ → enterprise sales fueled by product signals. This is the David Sacks framework, and it holds up.

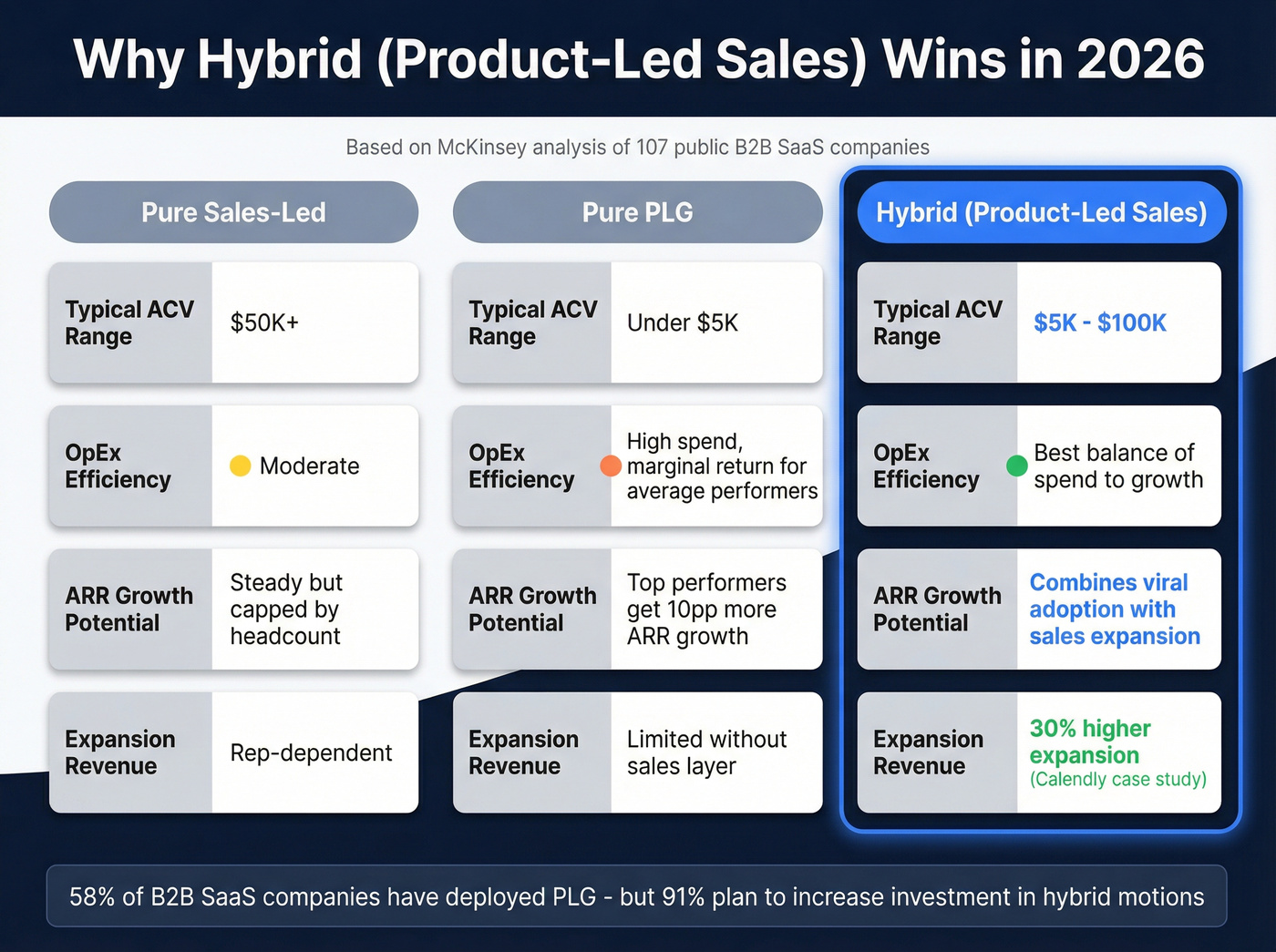

- Hybrid wins. Product-Led Sales outperforms pure PLG and pure sales-led for most B2B SaaS companies in 2026. McKinsey's data on 107 companies confirms it. The "pick one motion" era is over.

- Top 3 channels right now: LinkedIn thought leader ads (300x more reach for the same budget), educational content and SEO, and small in-person events. If you're spending money on Facebook ads for B2B SaaS, stop.

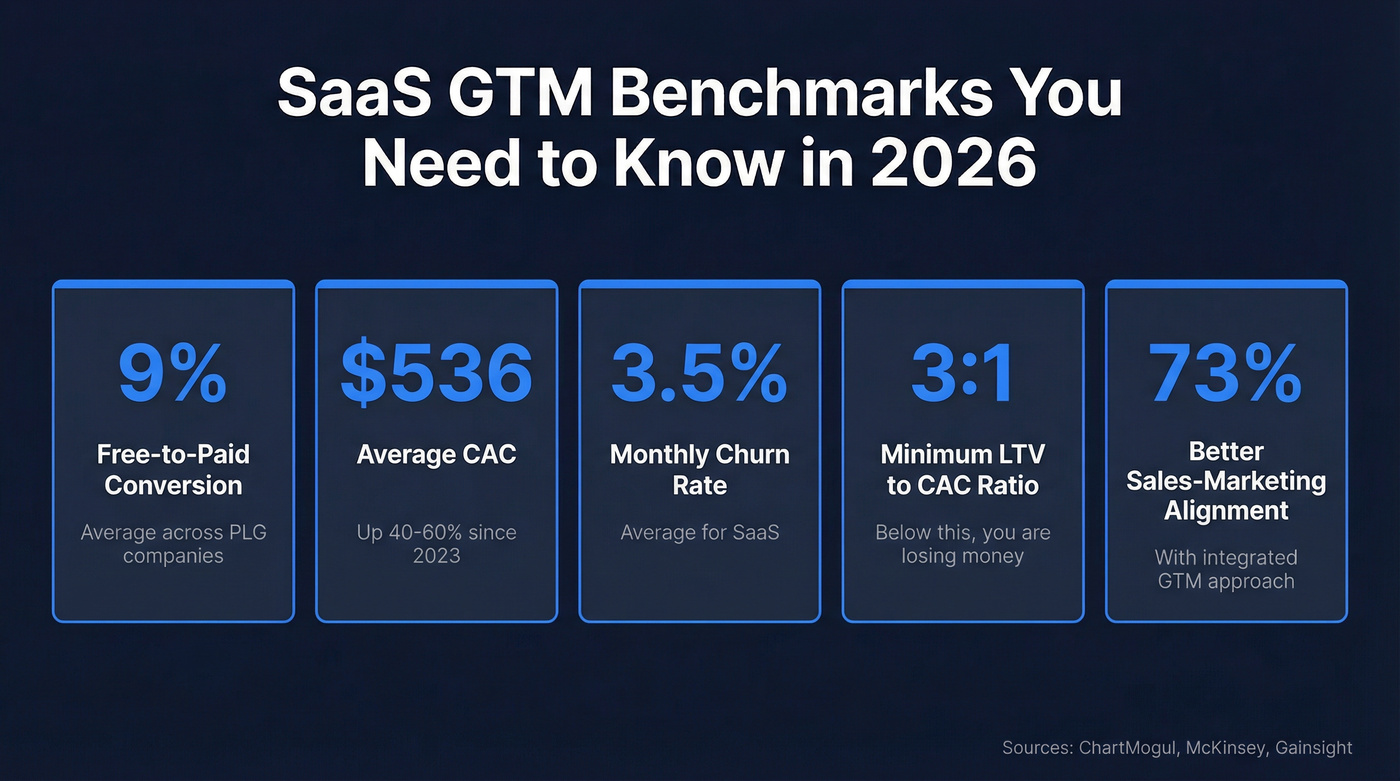

- The benchmarks that matter: 9% average free-to-paid conversion. $536 average CAC (up 40-60% since 2023). 3.5% average monthly churn. 3:1 minimum LTV:CAC. Memorize these - they're your sanity checks.

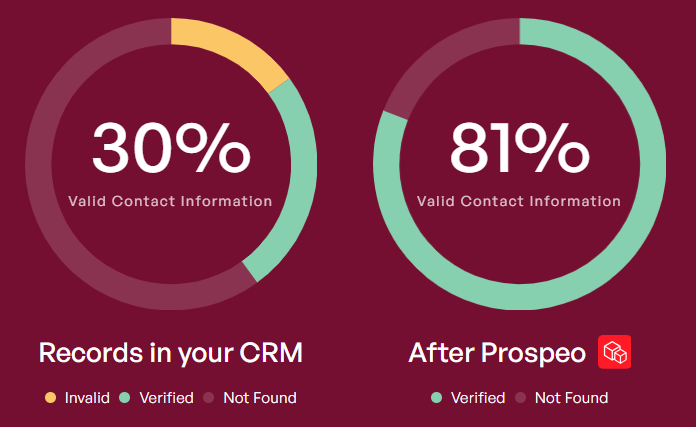

- Your outbound is only as good as your data. Verify before you send. A 30% bounce rate doesn't just waste emails - it tanks your domain reputation and kills deliverability for every email after it.

What a Go-to-Market Strategy for SaaS Actually Is (and Isn't)

A GTM strategy isn't a marketing plan. It's not a launch checklist. And it's definitely not a pitch deck slide with three arrows pointing at a TAM circle.

It's the full system for how you bring your product to market, acquire customers, retain them, and expand revenue. It spans ICP definition, positioning, pricing, channel selection, sales motion, onboarding, retention, and expansion - frameworks like Asana's 9-step GTM process break these into discrete phases, but the principle is the same: every phase must connect. Marketing strategy is one component, the demand generation and brand piece. The go-to-market plan is the whole machine.

What makes SaaS GTM different from traditional GTM? Recurring revenue changes everything. You're not optimizing for a one-time purchase. You're optimizing for retention and expansion. The probability of selling to an existing customer is 14x higher than acquiring a new one - which means your GTM plan doesn't end at the sale. It extends through onboarding, activation, and upsell.

Companies with integrated GTM approaches see 73% better sales-marketing alignment and 125% increases in net dollar retention. One company tracked by Gainsight moved NRR from 105% to 135% in 18 months after unifying their approach. GTM isn't a department. It's a cross-functional operating system.

Define Your ICP With Data, Not Assumptions

The most common GTM mistake I see? "We sell to everyone."

That's not an ICP. That's a prayer. And the data backs this up: 34% of product-market fit failures trace back to wrong ICP targeting. Get this wrong and nothing downstream - channels, messaging, pricing - can save you.

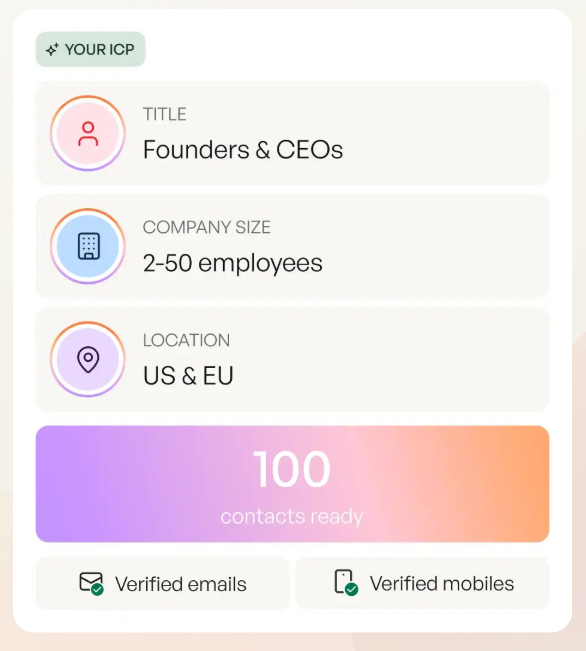

ChartMogul's ICP methodology breaks this into two phases. If you're pre-customer, your ICP is assumption-based: book at least 5 discovery calls with people experiencing the problem you solve, and listen for patterns in their language, urgency, and willingness to pay. If you're post-customer, your ICP is data-led: enrich your customer list with demographics, combine it with product usage data, and segment for patterns.

Here's what your ICP data points should include:

- Industry and sub-vertical

- Company headcount and revenue range

- Tech stack (what they already use)

- Primary use case / job-to-be-done

- Product usage patterns (for existing customers)

- Churn rate by segment

- Buying behavior (self-serve vs. committee)

The tiered approach works best. Your Tier 1 ICP is the segment with the highest retention, fastest sales cycle, and strongest expansion. Tier 2 is adjacent. Tier 3 is "we'll take them if they come, but we don't target them."

"Churn is totally governed by the kind of customers coming in and whether they're a good fit." That insight from ChartMogul is the entire argument for ICP discipline in one sentence. Bad-fit customers don't just churn - they consume support resources, distort your roadmap, and drag down NRR.

Once you've defined your ICP, you need to actually find those accounts. Tools like Prospeo let you layer 30+ search filters - buyer intent, technographics, headcount growth, funding signals - so you're not just building a list but building a qualified list of accounts that are actively in-market.

Your first ICP won't be your forever ICP. Validate that your TAM is big enough to hit your next ARR milestone, then refine as you learn.

The article says it clearly: 34% of PMF failures trace back to wrong ICP targeting. Prospeo's 30+ search filters - buyer intent, technographics, headcount growth, funding - let you build Tier 1 ICP lists from 300M+ verified profiles. At $0.01 per email with 98% accuracy, your outbound won't tank your domain reputation.

Stop guessing your ICP. Start filtering for accounts that are actually in-market.

Choose Your SaaS GTM Model

This is where most founders get it wrong. They pick a motion based on what's trendy ("PLG! Everyone's doing PLG!") instead of what fits their product and price point.

The ACV Decision Framework

David Sacks' framework is the clearest decision tool I've found. Your ACV dictates your motion:

| ACV Range | Motion | PLG Litmus Test | Example |

|---|---|---|---|

| Under $5K | Product-led growth | TTV < 10 min, self-serve value | Calendly, Notion |

| $5K-$50K | Sales-assist on PLG | Users activate, then need help scaling | Loom, Ahrefs |

| $50K+ | Enterprise sales | Complex setup, committee buy | Salesforce, Workday |

The PLG litmus test is brutal but honest. Can a user reach unmistakable value in under 10 minutes? Can they get started with zero setup - OAuth, templates, sample data? Can they experience core value before hitting any paywall? If you answer "no" to any of these, pure PLG isn't your motion.

ChartMogul's data adds a useful nuance: below $25 ASP, pure PLG companies grow new business 20% faster than those adding sales too early. But starting at $100 ASP, the most successful companies begin layering in sales support. The threshold isn't arbitrary - it reflects where buyer complexity demands human guidance.

For sales-assist, watch for Product-Qualified Account (PQA) signals: 5+ weekly active users in the same domain, 3 power features used by 2 distinct roles, or 1,000+ events created. These thresholds tell you when a free account is ready for a sales conversation.

Why Hybrid Wins

Here's my hot take: if your ACV is between $5K and $100K, you almost certainly need a hybrid motion - and you're probably overthinking the PLG-vs-sales debate.

The data supports this decisively. 58% of B2B SaaS companies have already deployed a PLG motion, and 91% plan to increase investment. But McKinsey's analysis of 107 publicly listed B2B SaaS providers found that most PLG companies don't actually outperform. Only a select subset of high performers account for the disparity. Those PLG outperformers spend 10 percentage points more on marketing/sales and R&D combined, generate 10 percentage points more ARR growth, and achieve valuations 50% higher than their peers.

The average-performing PLG company spends significantly more on OpEx than average sales-led peers but fares only marginally better. PLG isn't magic. It's a motion that rewards heavy investment in product and growth infrastructure. If you're not willing to invest at that level, a hybrid approach - Product-Led Sales - is the safer bet.

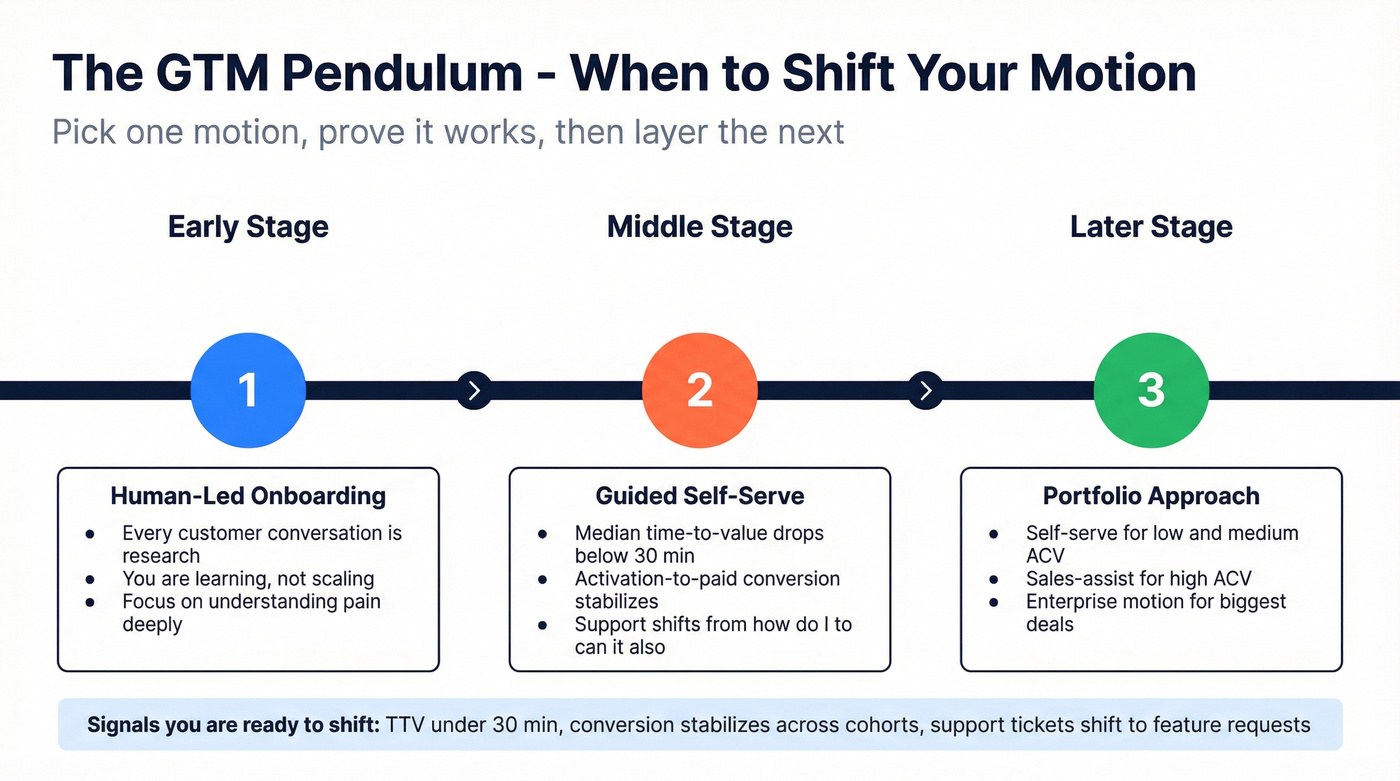

The GTM Pendulum

Stop trying to run all the GTM motions at once. Pick one, prove it works, then layer.

The stage-appropriate sequence looks like this:

Early stage → Human-led onboarding. You're learning, not scaling. Every customer conversation is research.

Middle stage → Guided self-serve. You've productized the onboarding. Median time-to-value drops below 30 minutes. Activation-to-paid conversion stabilizes across cohorts. Support volume shifts from "how do I?" to "can it also...?"

Later stage → Portfolio approach. Self-serve for low and medium ACV. Sales-assist for high ACV. Enterprise motion for the biggest deals.

The case studies prove this works. Calendly triggers human outreach when users create 3+ event types or invite 5+ team members - that hybrid approach drives 30% higher expansion revenue than pure PLG. Zoom's 2019 10-K revealed that 55% of customers contributing over $100K in revenue started with at least one free host. And Linear launched with a 90-second vision video - no product tour - and pulled 10,000 signups before public release.

The signals that you're ready to shift: TTV drops below 30 minutes, activation-to-paid conversion stabilizes across cohorts, and support tickets shift from setup questions to feature requests.

Nail Your Positioning and Messaging

You can have the right ICP, the right motion, and the right channels - and still fail because your messaging sounds like every other SaaS company on the planet.

51% of B2B buyers say most vendor content feels too generic. That's not a branding problem. That's a positioning problem.

April Dunford's Obviously Awesome framework is the most practical positioning tool I've used. Five steps:

- Competitive alternatives - What would customers use if you didn't exist? (Not just direct competitors. Spreadsheets count.)

- Unique attributes - What do you have that alternatives don't?

- Value for customers - What does that uniqueness actually enable?

- Best-fit customers - Who cares most about that value?

- Market category - What context makes your value obvious?

Layer Jobs-to-Be-Done on top of this. JTBD gives you the insight; Obviously Awesome gives you the structure. Every buyer has three goals: functional (what they need to accomplish), emotional (how they want to feel), and social (how they want to be perceived). Your messaging needs to hit all three.

77% of buyers rank speed and accessibility as key factors in their purchase decision, and many will pay up to 5% more for superior convenience. If your product is faster or easier than the alternative, lead with that - not with your feature list.

The average B2B SaaS purchase involves 6-10 stakeholders. Your VP of Sales buyer cares about pipeline. Your CFO cares about ROI. Your IT lead cares about security. One message doesn't fit all of them, and buyers engage with 13 pieces of content before making a purchase decision. Run a messaging audit: if your homepage leads with features instead of outcomes, uses heavy jargon, sounds undifferentiated, or isn't tailored to specific personas - you've found your problem.

Fix the positioning first. The messaging follows.

Pricing and Packaging That Convert

Pricing is the most underleveraged growth lever in SaaS. Most founders set it once and forget it. Here's what the data says about the free trial vs. freemium decision:

| Criteria | Free Trial | Freemium | Hybrid |

|---|---|---|---|

| Best when | TTV < 5 min, known category | Long eval, new category | Network effects + teams |

| Visitor conversion | Lower (baseline) | 140% higher | Varies |

| ARPU | 18% higher | Lower per user, higher LTV at scale | Best of both |

| Example | Most B2B SaaS | Slack, Dropbox | Notion, HubSpot |

Free trials yield 18% higher ARPU than freemium. But freemium drives 140% higher visitor-to-signup conversion. The right choice depends on your product and market.

The ACV sweet spot for conversion? $1K-$5K has the highest median conversion at 10%. Sub-$1K ACV has the highest top-quartile performance at 24%.

HubSpot ran an experiment making trials credit-card-optional: signups increased 35% without sacrificing conversion rates. That's a free growth lever most companies haven't pulled.

Here's the thing: PQLs are the most underused lever in SaaS GTM. Only 24-25% of PLG companies use Product-Qualified Leads, yet PQL usage is associated with 3x higher conversion rates. PQLs convert at 30% for $1K-$5K ACV and 39% for $5K-$10K ACV. And only 34% of PLG companies consistently track activation metrics - which explains why so few use PQLs. If you're running PLG without PQL scoring, you're leaving money on the table.

Your monetization gates should follow a clear logic: collaboration limits (unlimited solo, pay for team), scale limits (usage thresholds), and governance features (SSO, RBAC, audit logs) behind paid tiers. Notion nailed this with a free personal plan plus a 14-day team trial, driving 4M+ paid users through a hybrid model.

Pick Your Channels - What's Working in 2026

Channels Growing vs. Channels Being Cut

A Wynter survey of 100 marketing leaders at $50M+ B2B SaaS companies paints a clear picture of where budgets are moving:

| Growing | Being Cut |

|---|---|

| LinkedIn thought leader ads (300x reach) | Paid social outside LinkedIn (24% cutting) |

| Webinars (customer-presented) | Organic social (10% deprioritizing) |

| Small in-person events | Underperforming digital ads (22% pulling back) |

| Organic search + LLM optimization | Content syndication (6% reducing) |

| G2 / Capterra review presence | Cold calling (4% abandoning) |

The LinkedIn thought leader ads stat is staggering: 300x more reach and engagement for the same budget compared to standard company page ads. If you're running B2B paid social anywhere other than LinkedIn, you're burning cash. Facebook and Instagram ads were described as "worthless ROI" by multiple respondents. I've seen this firsthand - teams spending $5K-$10K/month on Meta ads for B2B SaaS with nothing to show for it.

Don't sleep on review sites like G2 and Capterra. For mid-market SaaS, these are high-intent channels where buyers are actively comparing solutions. A strong review profile with 50+ reviews converts better than most paid campaigns because the buyer is already in decision mode.

Small, focused in-person events are outperforming trade shows. 16% of leaders called them their most reliable pipeline generator, beating email, paid ads, and webinars. The shift is from "be seen at the big conference" to "host 30 people who actually match your ICP."

Referrals deserve a mention too: they're the most cost-efficient acquisition channel at $141-$200 per customer. If you don't have a referral program, build one before you spend another dollar on paid ads.

Content and SEO as a GTM Engine

Ahrefs is the case study everyone should study. Zero dollars on ads. $400K/month on educational content. The result: $2M/month in revenue. Their YouTube channel alone drives a meaningful chunk of that.

The emerging play in 2026 is AI-search optimization - creating content structured to appear in LLM-generated answers. One micro-SaaS practitioner described a working system: foundational directory links on niche-relevant sites, short-form video to "feed language to LLMs," and comparison pages as hub content with clean semantic structure. It's early, but the teams doing this now will own the AI-search real estate in 12 months.

The realistic timeline for content marketing ROI: 6-12 months for meaningful organic traffic. If you need pipeline next month, content isn't your channel. But if you're building for the next 2-3 years, it's the highest-ROI investment you can make.

Outbound That Actually Reaches People

Cold email isn't dead. Bad cold email is dead.

The difference is data quality, domain authentication, and personalization. The requirements in 2026 are non-negotiable: SPF, DKIM, and DMARC authentication on every sending domain. Gradual mailbox warmup. Bounce rate monitoring on every campaign. CAN-SPAM compliance (accurate sender info, physical address, unsubscribe link). GDPR compliance if you're reaching European prospects.

Reply rate benchmarks: 2-5% is typical. 8%+ is strong. But here's the problem nobody talks about enough - if 30% of your emails bounce, your domain reputation tanks and even your good emails land in spam. Your outbound is broken because your data is broken, not because cold email doesn't work.

We've seen this play out with our own users. Meritt went from a 35% bounce rate to under 4% after switching to Prospeo's 98% accuracy verification, and their pipeline tripled from $100K to $300K per week. That's not a marginal improvement. That's a different business.

Build Your Sales and Revenue Engine

Sales-marketing alignment isn't a platitude - it's a measurable advantage. Companies with integrated GTM approaches see 73% better alignment and 125% increases in net dollar retention.

Loom's approach to async video demos is the most interesting sales innovation I've tracked recently. They replaced live demos with personalized async videos and cut their sales cycle from 45 days to 21 days - 2.3x deal velocity with a 34% higher close rate. For well-qualified demos, the benchmark is 20-30% demo-to-close conversion. If you're below 20%, your qualification process is the problem, not your sales team.

Partnerships are underrated as a GTM channel. Zapier grew to $140M ARR primarily through revenue-share integration partnerships. Every integration partner becomes a distribution channel. If your product connects to other tools your ICP uses, partnerships should be in your top 3 investments.

Superhuman's micro-launch cadence is worth stealing: Monday new feature video, Wednesday user success story, Friday educational content. That rhythm drove 3x engagement compared to sporadic launches. The lesson isn't about the specific schedule - it's about consistent, predictable touchpoints that keep your product top-of-mind.

Key GTM Metrics - What Good Looks Like in 2026

You can't manage what you don't measure, but you also can't measure everything. Here are the benchmarks that actually matter:

| Metric | Benchmark | Segment Notes |

|---|---|---|

| CAC (average) | $536 | Up 40-60% since 2023 |

| CAC by segment | $100-$400 / $400-$800 / $800+ | SMB / Mid-Market / Enterprise |

| LTV:CAC ratio | 3:1 min, 4:1-7:1 target | Below 3:1 = unsustainable |

| Monthly churn | 3.5% average | Enterprise 3-5% annual; SMB 5-7% annual |

| NRR | 110-120% healthy | Below 100% = shrinking base |

| Free-to-paid | 9% average | $1K-$5K ACV peaks at 10% |

| Trial conversion spike | Day 7 | Both PLG and SLG |

| Time to 1K subs | 11 mo (top) / 24 mo (median) | ChartMogul 2026 GTM Report |

Churn varies wildly by vertical. Enterprise software runs 3-5% annual churn. SMB software hits 5-7%. FinTech is brutal at 12-24% annual. Healthcare SaaS averages 7.5% monthly - and that number jumped 67% year-over-year. Know your vertical's baseline before you panic about your own numbers.

The Rule of 40 has become the most reliable predictor of SaaS valuation, outperforming growth and NRR in correlation with public market multiples. But here's the nuance: a 1-point increase in revenue growth has nearly 2x the impact on valuation compared to an equivalent increase in FCF margin. Growth still matters more than efficiency - but you need both.

Speed-to-scale data from ChartMogul is sobering. Top-performing B2B companies reach 1,000 subscribers in 11 months. The median takes 2 full years. Only 13% of SaaS companies ever reach $10M ARR after 10 years.

The gap between top performers and everyone else isn't talent - it's GTM precision.

One underrated lever: fixing involuntary churn. Payment failures, expired cards, failed renewals - fixing just this can boost revenue by 8.6% in the first year. It's the easiest revenue you'll ever recover, and most teams ignore it.

Top SaaS companies spend less than $1 in sales and marketing to acquire $1 in incremental ARR. If your ratio is significantly worse, the problem is usually one of three things: wrong ICP, wrong channel, or wrong message. Not "we need more budget."

What Goes Wrong - GTM Failure Patterns

I've watched enough GTM launches fail to recognize the patterns before they play out:

| Symptom | Root Cause | Fix |

|---|---|---|

| Launch to crickets | Built first, marketed later | Start audience-building 6 months pre-launch |

| Busy but not growing | Optimized for motion over fit | Kill "almost-fit" segments; go deeper on fewer problems |

| High churn, low NRR | Targeted "almost-fit" users | Tighten ICP; say no to bad-fit revenue |

Pattern 1: Built first, marketed later. A study of 28 SaaS startups found this was the most common failure pattern. Founders spend 6-12 months building, then launch to zero audience. The fix is counterintuitive: start marketing before the product is ready. Build an email list. Create content. Get on podcasts. Linear's 10,000 pre-launch signups didn't happen by accident - they happened because the team invested in distribution before the product was public.

Pattern 2: Optimized for motion over fit. A Reddit post that resonated with thousands of SaaS founders captured this perfectly: "The biggest drag wasn't lack of effort. It was working on things that felt productive but didn't increase dependence on the product." Teams ship features, run campaigns, and close deals - but none of it compounds because the underlying product-market fit is thin. No GTM playbook can compensate for a product that doesn't solve a real problem.

Pattern 3: Targeted "almost-fit" users instead of saying no. This is the hardest one. Revenue from bad-fit customers feels like progress. It's not. Those customers churn, consume disproportionate support, and distort your roadmap. I've seen teams waste entire quarters chasing segments that looked promising on paper but never retained.

70% of SaaS startups don't survive past year five. The failures aren't random - they follow these patterns with depressing regularity.

2026 GTM Trends You Can't Ignore

AI-native companies are rewriting the benchmarks. ICONIQ's State of Software report shows AI-native companies growing 2-3x faster than top-quartile SaaS benchmarks. They're converting users to paying customers at significantly higher rates, and many are prioritizing R&D headcount and post-sales efforts to shorten time-to-value. If you're competing against an AI-native player in your category, your go-to-market plan needs to be faster and more precise.

Product-Led Sales is the emerging default. The pure PLG vs. pure sales-led debate is over. The hybrid model - bottom-up product adoption feeding top-down sales conversations - is winning. The companies actually scaling in 2026 are running both motions in parallel, triggered by product usage signals.

LLM-optimized content is the new SEO. 12% of marketing leaders are actively shifting toward creating content designed to appear in AI-generated answers. This isn't replacing traditional SEO - it's layering on top of it. The teams building structured, semantically clean content now will own the AI-search real estate that's forming.

Revenue growth still trumps margin. A 1-point increase in revenue growth has nearly 2x the valuation impact compared to an equivalent improvement in FCF margin. The Rule of 40 matters, but within it, growth carries more weight. For GTM leaders, the mandate is still "grow efficiently" - not "cut to profitability."

NRR is settling into a realistic range. The 130%+ NRR numbers that defined the 2020-2021 era are normalizing. Healthy NRR in 2026 sits at 110-120%. If you're in that range, you're doing well. If you're below 100%, your GTM motion has a retention problem that no amount of new logo acquisition will fix.

A 30% bounce rate doesn't just waste emails - it kills deliverability for everything after it. Prospeo's 5-step verification and 7-day data refresh cycle keep your GTM motion running on clean data. Snyk's 50 AEs dropped bounce rates from 35% to under 5% and generated 200+ new opportunities per month.

Your GTM playbook deserves data that actually connects you to real buyers.

FAQ

What's the difference between a GTM strategy and a marketing strategy?

A GTM strategy covers the full go-to-market motion - ICP definition, pricing, channel selection, sales process, onboarding, retention, and expansion. Marketing strategy is one component focused on demand generation and brand. Companies that treat them as synonyms end up with great awareness and terrible conversion.

How long does it take to see results from a new GTM motion?

Top performers reach 1,000 subscribers in 11 months; the median takes 2 full years. Content channels need 6-12 months for meaningful organic traffic. Outbound can generate pipeline in weeks with verified data and a tight ICP - Meritt tripled pipeline within the first month of switching to clean contact data.

What's the best GTM model for a startup with no revenue?

Start human-led to learn, then productize what works. Under $5K ACV, lean PLG - but only if users reach value in under 10 minutes without help. Above $5K, add sales-assist early. Validate with 10-50 ICP interviews before committing. The worst mistake is picking a motion based on what's trendy instead of what fits your product's complexity and price point.

How much should I budget for customer acquisition?

Average B2B SaaS CAC is $536 and rising - up 40-60% since 2023. Top companies spend less than $1 in sales and marketing per $1 of incremental ARR. SMB CAC runs $100-$400; mid-market $400-$800; enterprise $800+. Target a minimum 3:1 LTV:CAC ratio, ideally 4:1-7:1.

How do I fix high bounce rates killing my outbound campaigns?

Bounce rates above 5% damage domain reputation, and above 30% they're catastrophic - even good emails start landing in spam. Clean every list with a verification tool offering 98%+ accuracy before sending. Authenticate domains with SPF, DKIM, and DMARC. Warm new mailboxes gradually at 20-30 emails per day, scaling over 2-3 weeks.