Go-to-Market Roles: The Complete GTM Role Map (and Who Owns What) in 2026

Go to market roles get messy the moment you're 30 days from a launch and everyone's "helping," but nobody owns the outcome. Sales is waiting on messaging, Marketing's waiting on ICP, Product's waiting on "final requirements," and RevOps is quietly asking who's accountable for routing. That's how you ship a launch and still miss the number.

The fix isn't another org chart. It's decision rights.

Below is the role map, the ownership rules, and a copy/paste RACI/DRI you can use today.

What you need (quick version)

Use this checklist to get your team unstuck fast:

- Define roles as ownership of deliverables (not job titles). If you can't point to the artifact someone owns, you don't have a role - you've got a meeting attendee.

- Pick 10-15 GTM deliverables and assign a DRI for each. DRI = the single person who gets paged when it's late or wrong.

- Enforce the "one Responsible, one Accountable" rule. Multiple helpers are fine. Multiple owners is how work dies.

- Write down the handoffs. SDR -> AE isn't "a meeting," it's: notes, pain hypothesis, stakeholders, next step, and disqualifiers.

- Separate "Build demand" from "Convert." Marketing can't own pipeline and also get blamed for close rate. Sales can't own close rate and also rewrite positioning.

- Treat RevOps as the operating system. Routing, lifecycle stages, definitions, forecasting, and data governance aren't optional once you've got more than a few reps - and they're some of the biggest challenges of RevOps as you scale.

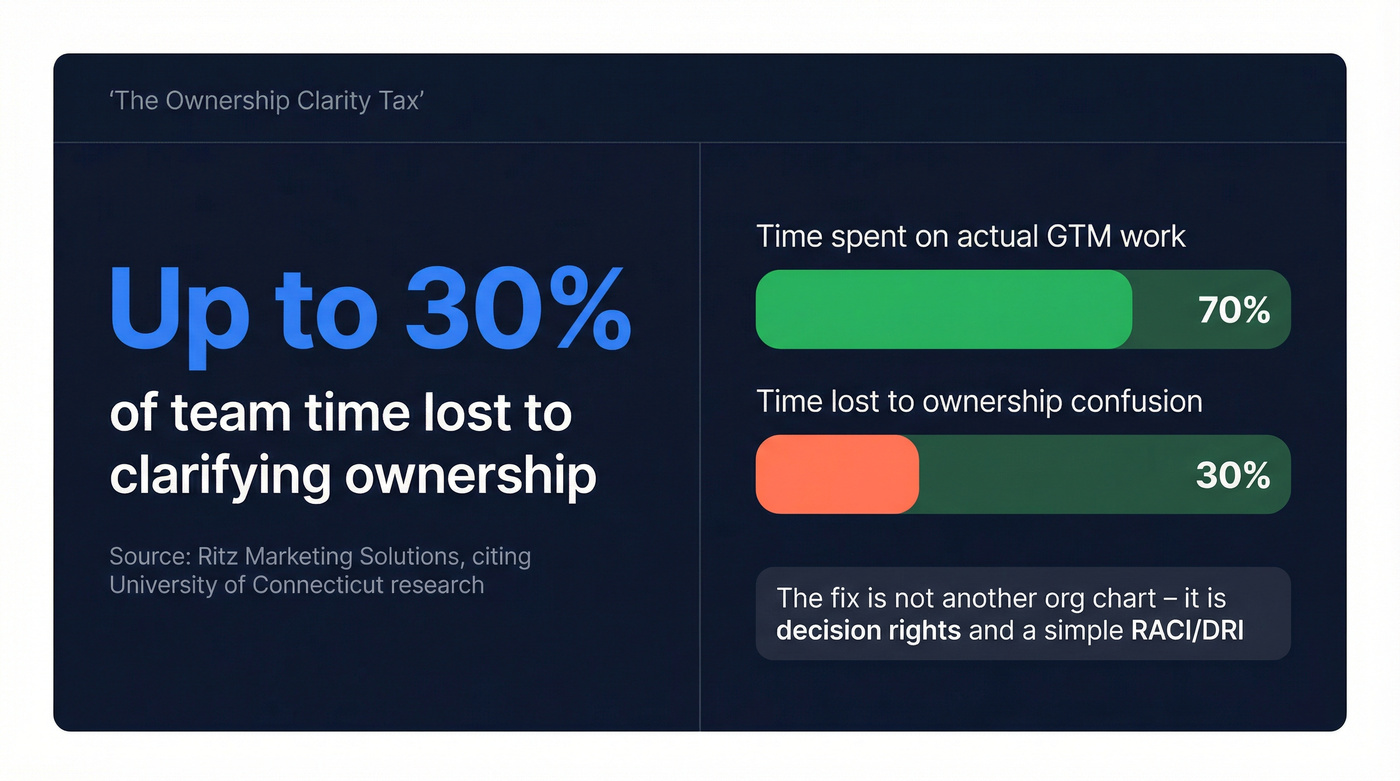

- Assume you're wasting time on ownership confusion. A commonly cited benchmark (via Ritz Marketing Solutions, citing University of Connecticut) is up to 30% of time lost clarifying ownership. That's a tax you can remove with a simple RACI/DRI.

- Don't ignore data quality. Verification/enrichment is part of the GTM operating system. Bad inputs make KPIs fiction.

What "go-to-market roles" actually means (titles vs ownership)

Most teams think "go-to-market roles" means a list of titles: SDR, AE, PMM, RevOps. That's the SERP version.

In real life, it means ownership boundaries: who owns messaging, who owns routing, who owns the number, who owns retention, who owns the forecast.

Here's the launch-week scenario we've seen too many times: you're 30 days out, and nobody owns (1) final messaging, (2) lead routing rules, or (3) the pipeline target. Product thinks Marketing owns messaging. Marketing thinks Product owns it. Sales thinks "someone" will enable reps. RevOps gets asked to "just make it work" in the CRM.

Then launch week hits. Leads come in, half go to the wrong reps, SDRs work accounts that don't match ICP, AEs freestyle the pitch, and the exec team asks why conversion's down.

That's the ownership-clarity tax in action. It's not laziness. It's a system with no explicit decision rights.

Look, titles are cheap. Ownership's the hard part.

The modern GTM role map (grouped by funnel + operating system)

Most role maps stop at "Marketing + Sales + CS" and call it a day. That's exactly how teams miss the roles that prevent chaos: RevOps, Enablement, SE, Partnerships, Pricing. Those aren't "extra." They're the difference between a motion that scales and a motion that collapses under its own handoffs.

One opinion we feel strongly about: if you're selling a lower-priced product with a short sales cycle, you don't need a fancy GTM org. You need ruthless clarity on ICP, messaging, routing, and follow-up speed. Add specialists only when the bottleneck is real and repeatable.

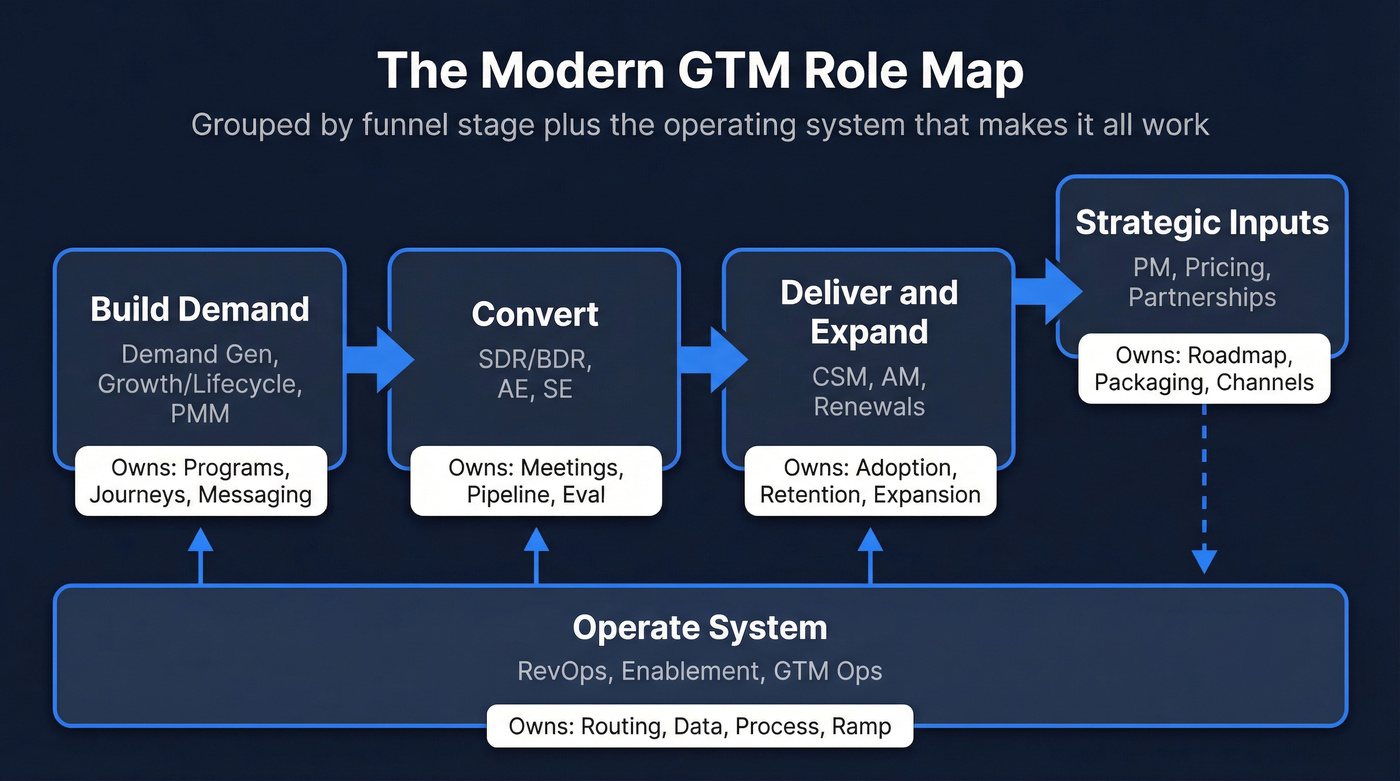

Here's the map we use - grouped by funnel plus the operating system that makes the funnel real (and the revenue orchestration that keeps handoffs from breaking):

| Cluster | Primary goal | Roles you need | What they own |

|---|---|---|---|

| Build demand | Create demand | Demand Gen, Growth/Lifecycle, PMM | Programs, journeys, messaging |

| Convert | Turn demand into $ | SDR/BDR, AE, SE | Meetings, pipeline, eval |

| Deliver & expand | Keep + grow $ | CSM/AM/Renewals | Adoption, retention, expansion |

| Operate system | Make it scalable | RevOps, Enablement, GTM Ops | Routing, data, process, ramp |

| Strategic inputs | Set direction | PM, Pricing, Partnerships | Roadmap, packaging, channels |

What most GTM role maps miss (and what breaks when they do)

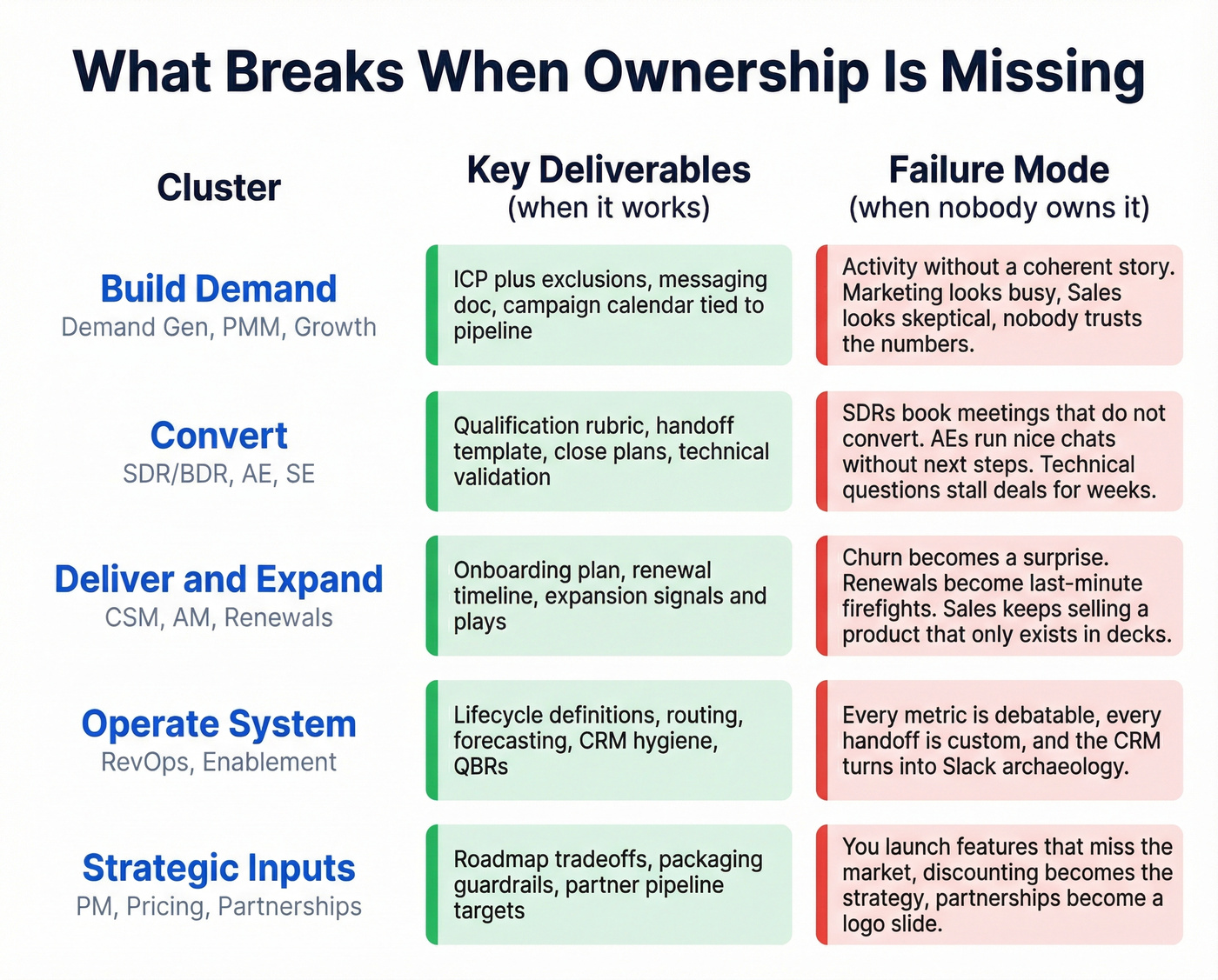

1) Build demand (Demand Gen, Growth/Lifecycle, PMM) This cluster owns the inputs to revenue: who you target, what you say, and how you create and nurture demand.

- Deliverables that matter: ICP + exclusions, messaging doc, campaign/program calendar tied to pipeline targets, lifecycle journeys (trial -> activation -> expansion).

- Failure mode: you get "activity" (ads, webinars, content) without a coherent story or a measurable handoff. Marketing looks busy; Sales looks skeptical; nobody trusts the numbers.

2) Convert (SDR/BDR, AE, SE) This cluster owns turning interest into pipeline and pipeline into revenue.

- Deliverables that matter: qualification rubric, handoff template, close plans, mutual action plans, technical validation plan (demo/POC/security).

- Failure mode: SDRs book meetings that don't convert, AEs run "nice chats" without next steps, and technical questions stall deals for weeks because nobody owns proof.

3) Deliver & expand (CSM/AM/Renewals) This cluster owns retention, expansion, and the reality check on whether your promise matches your product.

- Deliverables that matter: onboarding/time-to-value plan, renewal timeline + risk plan, expansion signals and plays.

- Failure mode: churn becomes a surprise, renewals become last-minute firefights, and Sales keeps selling a version of the product that only exists in decks.

4) Operate system (RevOps, Enablement, GTM Ops) This cluster's the glue. It makes the funnel measurable, repeatable, and coachable.

- Deliverables that matter: lifecycle stage definitions, routing/territories, forecasting cadence, CRM hygiene standards, onboarding + certification, operating cadence (QBRs, pipeline reviews).

- Failure mode: every metric becomes debatable, every handoff becomes custom, and the CRM turns into Slack archaeology.

5) Strategic inputs (PM, Pricing, Partnerships) This cluster sets constraints and advantage: what you build, how you package it, and which channels can scale.

- Deliverables that matter: roadmap tradeoffs, packaging + discount guardrails, partner program design, partner-sourced pipeline targets.

- Failure mode: you "launch" features that don't fit the market, discounting becomes the strategy, and partnerships become a logo slide instead of a revenue channel.

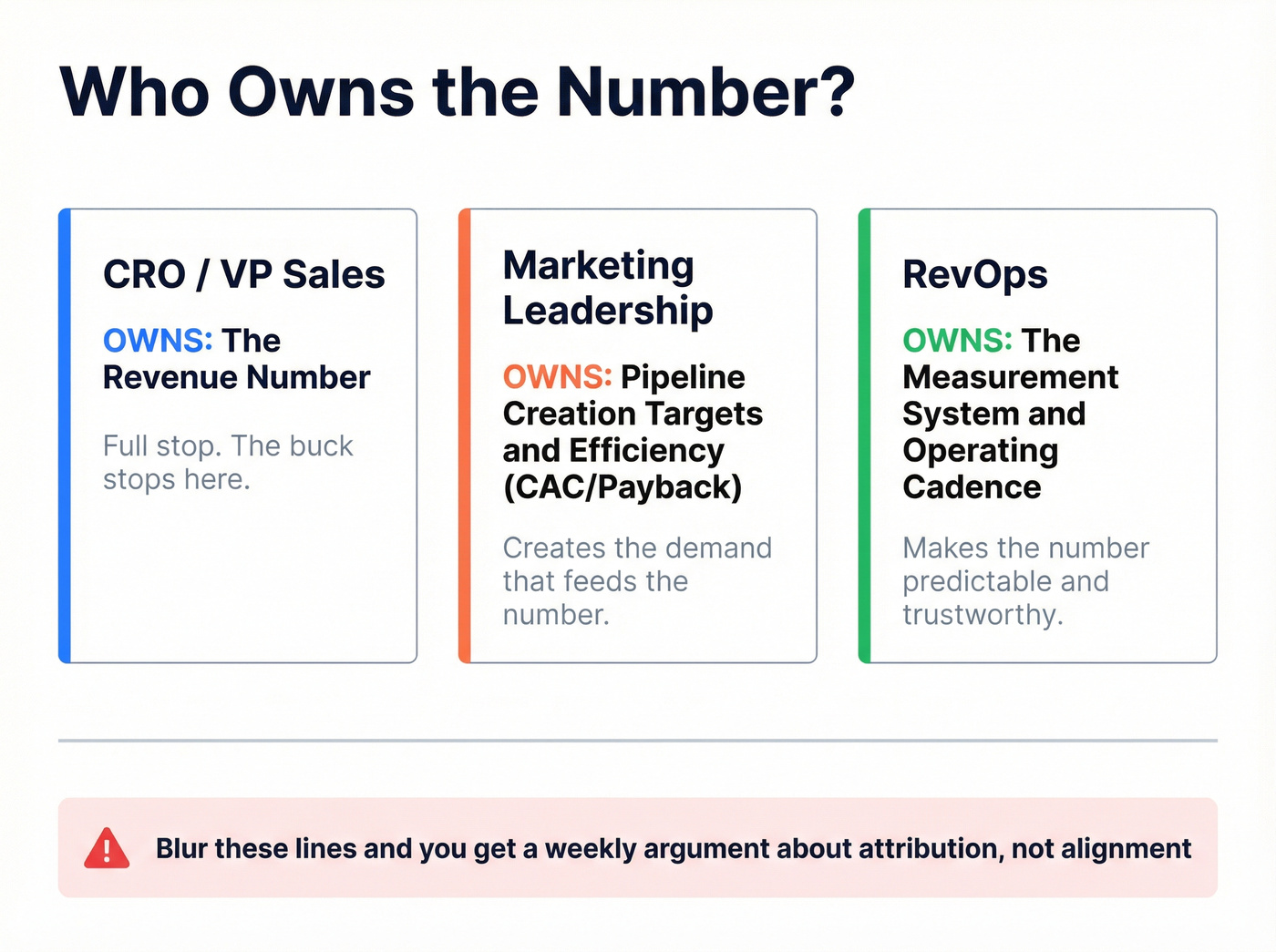

"Who owns the number?" (stop the most common fight)

This is the simplest way to answer "who's responsible for revenue generation" without turning it into a political debate:

- CRO / VP Sales owns the revenue number. Full stop.

- Marketing leadership owns pipeline creation targets and efficiency (CAC/payback).

- RevOps owns the measurement system and the operating cadence that makes the number predictable.

Blur those lines and you don't get alignment. You get a weekly argument about attribution.

Core go to market roles (what they own, not just what they do)

Below are the core roles, written as ownership (deliverables + interfaces), not job descriptions. They're tight on purpose. Clarity beats completeness.

Product Manager (PM)

Owns the customer problem, roadmap tradeoffs, and what gets built next.

Use this if: you need one accountable owner for product decisions. Skip this framing if: your PMs are acting like project managers.

Ownership (deliverables):

- Problem definition + success metrics

- Roadmap/prioritization decisions

- Testable requirements

Interfaces: PMM for launch/story; Sales/CS for feedback loops. Outputs: problem narrative; roadmap that matches GTM capacity.

Skills that matter: ruthless prioritization, customer empathy, crisp writing.

Product Marketing Manager (PMM)

Owns positioning, messaging, and enablement that reps actually use.

Use this if: AEs are reinventing the pitch and launches feel improvised. Skip this if: you want someone to "run ads" (that's Demand Gen).

Ownership (deliverables):

- Positioning + messaging doc

- Objection handling + competitive talk tracks

- Launch tiering + enablement plan

Interfaces: PM for product truth; Sales for field feedback. Outputs: messaging + proof points; enablement assets with adoption.

Skills that matter: narrative, sales empathy, and the discipline to say "no" to random requests.

Demand Gen

Owns pipeline creation programs and channel economics.

Use this if: you need predictable pipeline creation. Skip this if: you expect them to own retention/expansion.

Ownership (deliverables):

- Program calendar tied to pipeline targets

- Channel ROI model (cost per meeting/opp)

- Lead capture + nurture to handoff

Interfaces: PMM for message; RevOps for attribution hygiene. Outputs: pipeline created; channel learnings you can scale.

Skills that matter: analytical rigor, creative testing, budget discipline.

Growth Marketing / Lifecycle (CRM)

Owns full-funnel optimization across the customer journey.

Use this if: you have lifecycle data and want compounding improvements. Skip this if: your stage definitions and product signals are a mess.

Ownership (deliverables):

- Lifecycle journeys (trial -> activation -> expansion)

- Experiment backlog + measurement

- Segmentation + CRM messaging strategy

Interfaces: CS for churn drivers; RevOps for lifecycle definitions. Outputs: lifecycle KPI tree; testing cadence that moves core rates.

Skills that matter: experimentation, data literacy, systems thinking.

SDR/BDR

Owns qualified meetings and first-pass qualification.

Use this if: outbound or fast follow-up is a growth lever. Skip this if: your motion's pure inbound/PLG with minimal qualification.

Ownership (deliverables):

- Qualified meetings (inbound and/or outbound)

- Account research + first-pass multi-threading

- Disqualification clarity (why not now / why not ever)

Interfaces: Demand Gen for lead context; AEs for tight handoffs. Outputs: handoff notes that read like a deal thesis, not a calendar invite.

Skills that matter: research, objection handling, and the ability to write clean notes.

Account Executive (AE)

Owns forecasted pipeline and the commercial close.

Use this if: you need a single owner for deal strategy and commit. Skip this if: you don't have a repeatable ICP/message yet.

Ownership (deliverables):

- Pipeline that's forecastable

- Close plan per deal (stakeholders, process, risks)

- Mutual action plan for complex deals

Interfaces: PMM for positioning; SE for technical proof; RevOps for process. Outputs: clean next steps; accurate commit; closed revenue.

Skills that matter: discovery, negotiation, executive presence.

Customer Success (CSM) / AM / Renewals

Owns post-sale outcomes: adoption, retention, and expansion motion execution.

Use this if: churn and expansion matter (they do). Skip this if: you're treating CS as "support with a nicer name."

Ownership (deliverables):

- Time-to-value plan + onboarding success

- Renewal execution (timeline, stakeholders, risk plan)

- Expansion identification + coordination (or owned by AM)

Interfaces: Product for adoption blockers; Sales for expectation alignment. Outputs: renewal predictability; expansion plays grounded in usage.

Skills that matter: stakeholder management, value articulation, calm escalation.

You just mapped every GTM role and ownership boundary. Now make sure the data flowing through your funnel is actually reliable. Prospeo's 7-day refresh cycle and 98% email accuracy mean your SDRs route real leads, your AEs reach real buyers, and RevOps stops debugging bad contact records.

Stop letting bad data turn your RACI into fiction.

Strategic inputs roles (quick profiles): Pricing/Packaging + Partnerships

You already know these matter. The mistake is treating them as "part-time responsibilities" until the quarter goes sideways.

Pricing & Packaging (often under Product, Finance, or a dedicated owner)

What they own:

- Packaging architecture (tiers, add-ons, usage metrics)

- Discount guardrails + approval paths

- Pricing feedback loop from win/loss + renewals

Why it's a GTM role: pricing is positioning in numbers. If you don't own it, Sales will "solve" every objection with discounting, and your product roadmap will drift toward whatever closes fastest.

KPIs that matter: gross margin, discount rate, win rate by segment, expansion rate by package.

Partnerships / Alliances

What they own:

- Partner-sourced pipeline and partner-influenced revenue

- Co-marketing motions and partner enablement

- Attach motions (services, integrations, referrals)

Why it's a GTM role: partnerships are advantage. Done right, they create distribution you can't buy with ads. Done wrong, they create a quarterly "partner webinar" nobody attends.

KPIs that matter: partner-sourced pipeline %, attach rate, activation of partner accounts, revenue per partner.

Pre-sales roles that change conversion: Solutions Engineer (SE) vs AE

AEs sell outcomes. SEs prove feasibility. Blur that line and you either get shallow demos that don't convert, or technical rabbit holes that never close.

SE vs AE (clean split)

AE owns:

- Deal strategy, stakeholders, and commercial close

- Discovery that ties pain to business value

- Forecast and next steps

SE owns:

- Technical discovery (requirements, integrations, constraints)

- Demo/POC design and execution

- Security/IT conversations and technical credibility

A survey of 400+ professionals by Reprise makes the hiring profile obvious: 90% said communication is very important, 72% said agility/moving quickly is very important, and 42% said technical skills would best accelerate their career. Translation: the best SE is a communicator first.

Benchmark box: AE-to-SE coverage

Alexander Group's benchmark across 100 sales forces is blunt: 1 SE : 5 reps averages about $2M revenue per rep, while 1:1 averages $3.2M. A lot of mid-market teams land around a 4:1 coverage model, then flex tighter for complex deals.

When to add SEs: when deals stall on technical validation, security reviews are killing cycle time, or AEs are spending their week building demos instead of running deals.

Ops roles that keep GTM from breaking (RevOps, Enablement, GTM Strategy/Ops)

Ops isn't back-office. Ops is the difference between "we have a plan" and "we can execute the plan with 20 reps and still trust the forecast."

Revenue Operations (RevOps)

RevOps is the system owner for how revenue work happens across Marketing, Sales, and CS: lifecycle definitions, routing, forecasting, data governance, and stack rules.

Here's the framing most teams miss: RevOps is a business system, not a department. It spans Marketing, Sales, Customer Success, Product, and executive leadership, and it only works if those groups agree on definitions, handoffs, and what "good" looks like in the CRM.

I've watched teams hire RevOps and then starve it of authority. The result's predictable: RevOps becomes a ticket queue, the CRM becomes a dumping ground, and every forecast call turns into a debate about what the stages even mean.

What RevOps owns (deliverables):

- Lifecycle definitions (stages, SLAs, handoffs)

- Routing/territories and lead/account assignment logic (including lead-to-account mapping when you need clean account ownership)

- Forecasting process + pipeline hygiene standards

- GTM stack governance (what's allowed, what's deprecated)

- Data model (fields, required properties, dedupe rules)

RevOps KPI scorecard (who's accountable vs who influences):

| KPI | What it tells you | Accountable | RevOps influence |

|---|---|---|---|

| Pipeline velocity | speed to revenue | CRO/VP Sales | definitions, routing, process |

| Win rate | conversion quality | VP Sales | stage hygiene, data, coaching signals |

| Forecast accuracy | predictability | RevOps + VP Sales | process design + inspection |

| Time-to-ramp | onboarding health | Enablement/VP Sales | measurement + tooling |

| Cycle length | friction in process | VP Sales | workflow + handoff fixes |

One more thing: RevOps can't run routing, outbound, or reporting on garbage contact data. If your inputs are wrong, your "insights" are just confident fiction.

Sales/Revenue Enablement

Enablement owns rep readiness. RevOps owns system readiness.

If one team tries to do both, you either get perfect dashboards and untrained reps, or great training with broken routing.

Enablement owns (deliverables):

- Onboarding plan + certification

- Playbooks (discovery, demo, negotiation, renewal)

- Content governance (what exists, where it lives, what's current)

- Ongoing coaching cadence with frontline managers

Two rules we enforce:

- If it's behavior, Enablement owns it.

- If it's measurement and workflow, RevOps owns it.

GTM Strategy/Ops

GTM Strategy/Ops owns cross-functional execution against revenue goals - especially when you add channels, segments, or complex motions.

What they own (deliverables):

- Cross-functional programs with measurable outcomes (not "launches")

- Operating cadence (QBRs, pipeline reviews, channel reviews)

- Gap analysis: where process or programs are failing, and why

If nobody owns the operating cadence, you don't have a GTM system. You've got a bunch of teams doing their best in parallel.

Emerging GTM roles in 2026 (and how they differ)

Titles are multiplying because the stack is multiplying. The work didn't disappear; it got specialized.

GTM Engineer

GTM Engineer is revenue systems engineering: automations, integrations, data pipelines, workflow orchestration across the funnel.

Job-posting volume is a strong signal: GTM engineer postings went from 1,400+ mid-2026 to 3,000+ in Jan 2026 (NewsObserver).

Hire when:

- You've outgrown Zapier spaghetti

- You're running multi-system workflows (CRM + enrichment + sequencer + warehouse)

- RevOps is spending more time building than governing

GTM Product Manager

This role treats the GTM stack like a product: roadmap, internal user research, adoption, deprecation, and ROI.

Reporting lines vary, but the job-to-be-done stays consistent: one owner for stack outcomes (adoption, deprecation, measurable impact), not a committee of tool admins.

Hire when:

- Sales tech vs martech silos are slowing execution

- Every new tool becomes shelfware

- You need one accountable owner for "why isn't this working?"

RevOps vs GTM Eng vs GTM PM (boundary rules)

- Definitions, governance, forecasting -> RevOps

- Automation, integrations, data pipelines -> GTM Engineer

- Stack roadmap, adoption, deprecation -> GTM Product Manager

- Training and certification -> Enablement

- Cross-functional program outcomes -> GTM Strategy/Ops

What practitioners complain about (and why roles fix it)

A lot of "GTM strategy" talk is just fancy language for not making decisions. It's vague frameworks, big words, and zero clarity on who does what Monday morning.

Real talk: it's exhausting.

The cure is boring and effective: name the deliverables, assign a DRI, and enforce handoffs. When ownership's explicit, the hype disappears and execution gets real.

Here's a scenario that shows why this matters. A mid-market team adds three AEs in a quarter, keeps the same routing rules from the founder-led days, and doesn't update lifecycle stages; two months later, inbound leads are getting worked twice (or not at all), pipeline's inflated with duplicates, and the CRO thinks the reps are sandbagging when the real problem is the system.

Role boundaries that cause the most GTM friction (quick clarity rules)

Use these "if you hear X, it belongs to Y" rules to stop the ping-pong:

- "Who owns positioning?" -> PMM (PM inputs, Sales feedback)

- "Who owns what gets built?" -> PM (with exec prioritization)

- "We need more pipeline next quarter." -> Demand Gen (programs) + SDR/BDR (meetings) + AE (conversion)

- "We need better activation/retention." -> Growth/Lifecycle + CS

- "Routing's broken / stages are inconsistent." -> RevOps

- "Can we automate this workflow across tools?" -> GTM Engineer (RevOps sets rules; Eng implements)

- "We need partner-sourced pipeline." -> Partnerships

- "Discounting's out of control." -> Pricing/Packaging

- "Our handoffs are messy and nobody trusts the CRM." -> RevOps (start with lifecycle definitions and a documented sales ops process)

Write these rules down and socialize them. Otherwise, every new hire re-litigates them.

How go to market roles avoid chaos: RACI/DRI for GTM deliverables (template)

RACI's boring until you need it. Then it's the only thing that stops cross-functional work from turning into Slack archaeology.

Per Asana's RACI chart guide, RACI maps each deliverable to:

- Responsible: does the work

- Accountable: owns the outcome/sign-off

- Consulted: gives input

- Informed: kept in the loop

Two operating rules matter most:

- One Responsible per deliverable

- One Accountable per deliverable

LogRocket's distinction is the one people remember: Accountable owns the decision/outcome; Responsible executes. If you're using "DRI," it's basically "the Accountable person, made explicit."

GTM deliverables you should assign DRIs for

Start with these (they cover 80% of GTM chaos):

- ICP definition + exclusion list

- Messaging doc (value prop, pains, proof, objections)

- Launch tiering + launch checklist

- Routing rules (lead/account, SLAs, exceptions)

- Pipeline target model (by segment/channel)

- SDR qualification rubric + handoff template

- Sales playbook + talk tracks

- Onboarding + certification plan

- Customer onboarding journey + time-to-value definition

- Pricing/packaging change process (who can change what, when)

- Partner-sourced pipeline target + partner enablement plan

Example GTM RACI matrix (copy/paste)

| Deliverable | R | A | C | I |

|---|---|---|---|---|

| ICP + exclusions | PMM | Head of Marketing | Sales, CS, PM | RevOps |

| Messaging doc | PMM | PMM | PM, Sales | Exec |

| Routing rules | RevOps | RevOps | Sales, Marketing | All GTM |

| Pipeline targets | RevOps | CRO | Finance, Marketing | GTM |

| SDR handoff | SDR Mgr | VP Sales | RevOps, Enablement | AEs |

| Launch tiering | PMM | PM | Sales, CS | RevOps |

| Onboarding cert | Enablement | VP Sales | RevOps, PMM | GTM |

| Pricing guardrails | Pricing owner | CFO/CEO | Sales, PM | RevOps |

| Partner pipeline plan | Partnerships | CRO | Marketing, Sales | Exec |

If you do nothing else: assign the A column. That's where ambiguity hides.

Common RACI failure modes (what bad looks like)

- Two Accountables. This is the most common "we're aligned" lie. If two people can veto, nobody can ship.

- A committee as Responsible. "Marketing" isn't a person. Pick a name.

- Consulted = everyone. If you consult 12 people, you're not consulting - you're asking permission.

- No explicit handoff artifacts. If the deliverable is "handoff," define what must be in the handoff (fields, notes, next step), or it becomes vibes.

Role anti-patterns (print this and tape it to your monitor)

- PMM as request-taker: you get random decks, not a coherent narrative.

- RevOps as ticket desk: you get fast fixes and slow learning; the system never improves.

- SDR as calendar filler: you get meetings that don't convert and a burned-out AE team.

- AE as the messaging department: you get inconsistent positioning and unpredictable win rates.

- CS as "post-sale support": you get surprise churn and zero expansion motion.

GTM roles by stage: who to hire when (ARR gates + triggers)

Stage gates keep you from hiring "because we feel behind":

- Pre-seed: $0-$250k ARR

- Seed: $250k-$1M ARR

- Series A: $1M+ ARR

Early stage = generalists. Post-Series A = specialists and process.

| Stage | GTM focus | Add these roles | Triggers |

|---|---|---|---|

| $0-$250k | Find ICP + motion | Founder-led sales, 1st AE | Repeatable wins |

| $250k-$1M | Create pipeline | SDR/BDR, Demand Gen | Need meetings |

| $1M+ | Scale + predict | PMM, RevOps | More reps, more chaos |

| $3M-$10M | Improve conversion | SE, Enablement | Complexity, ramp |

| Series B+ | Add channels | Partnerships, GTM Ops | 20-30% channel |

Planning math helps you avoid fantasy targets:

- 100 customers x $10k = $1M

- 50 x $20k = $1M

- 10 x $100k = $1M

A clean RevOps trigger: the first RevOps hire often lands at 25-50 employees or 5+ reps. That's when routing, definitions, and forecasting stop being "a spreadsheet" and start being a system.

KPIs by go to market role (what "good" looks like)

Shared outcomes matter because otherwise every function optimizes locally: CAC, LTV, ARR growth, churn, net revenue retention.

Then each role needs a small set of controllable KPIs:

| Role | Primary KPIs | Secondary KPIs |

|---|---|---|

| Demand Gen | pipeline created | CAC payback |

| Growth/Lifecycle | activation, expansion | churn rate |

| SDR/BDR | meetings held | opp conversion |

| AE | win rate, quota | cycle length |

| SE | eval-to-close rate | time in stage |

| CSM/AM | renewal %, NRR | time-to-value |

| RevOps | forecast accuracy | velocity, ramp |

One practical note: clean, verified contact data improves connect rates and bounce rates, which makes your pipeline math less noisy. That's why RevOps cares about verified inputs - not because data's glamorous, but because bad data breaks measurement and turns your KPI review into an argument. If you're seeing decay, start with B2B contact data decay benchmarks and a workflow to keep CRM data clean.

RevOps owns data governance. Enablement owns ramp time. But neither can deliver when 20%+ of your contact data is stale. Prospeo enriches CRM records with 50+ data points at a 92% match rate - so every role in your GTM machine works with inputs they can trust.

Give your GTM team the operating system it deserves.

Summary: make go to market roles explicit (or pay the chaos tax)

If you're mapping go to market roles, don't stop at the org chart. Write down the deliverables, assign a DRI, and make the handoffs explicit.

That's the difference between "we have a GTM team" and "we've got a GTM system."

FAQ: Go-to-market roles

What's the difference between a GTM manager and RevOps?

A GTM manager runs cross-functional execution for a motion (launch, segment, channel), while RevOps owns the operating system - lifecycle definitions, routing, forecasting, and stack governance - so the motion's measurable and repeatable. In most teams, GTM managers ship programs; RevOps makes the numbers trustworthy.

When should you hire your first Product Marketing Manager (PMM)?

Hire your first PMM once deals are repeatable but reps are improvising the pitch - often around 50-100 employees or when you're scaling beyond founder-led selling. If win rate varies wildly by rep and launches feel like "deck roulette," you're late; PMM should own positioning and enablement adoption.

What's a typical AE-to-Solutions-Engineer ratio in B2B?

A common mid-market baseline is about 4:1 AE-to-SE coverage, then tighter coverage for complex, technical deals. Alexander Group benchmarks show 1 SE : 5 reps averages about $2M revenue per rep, while 1:1 averages about $3.2M, so the right ratio depends on deal complexity and cycle time.

What deliverables should every GTM team assign a DRI for?

At minimum, assign a single DRI to ICP + exclusions, the messaging doc, routing rules, pipeline targets, SDR qualification + handoff template, launch tiering/checklist, onboarding certification, and a time-to-value definition. If those eight are owned by name (not "a team"), most GTM chaos disappears fast.

What tools help RevOps keep CRM contact data accurate (and why does it matter)?

Contact verification and enrichment tools keep emails, mobiles, titles, and firmographics current so routing, outbound, and reporting stay reliable. Prospeo is a top pick for accuracy and freshness: 98% verified emails, a 7-day refresh cycle, 83% enrichment match rate, and 92% API match rate, so sequences bounce less and dashboards stop lying.