Folloze vs Uberflip in 2026: What Changed (and What to Buy Now)

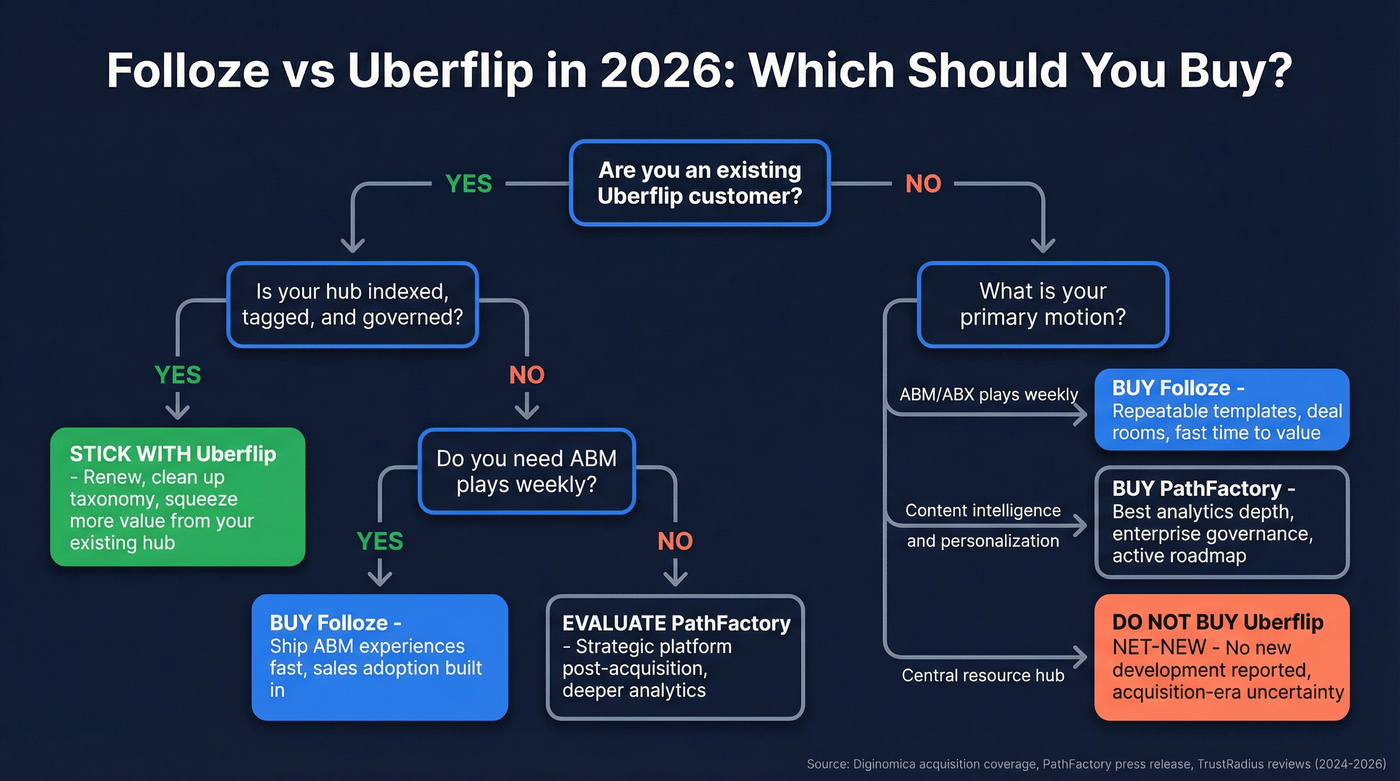

If you're evaluating folloze vs uberflip in 2026, you're not comparing two equally "alive" roadmaps. You're choosing between an ABM experience builder (Folloze) and a legacy hub product (Uberflip) that now sits inside PathFactory's world.

Here's the thing: most teams lose this decision after they buy, not before. They sign for a platform that looks fine in a demo, then realize nobody owns it weekly, sales doesn't use it, and the "content experience" turns into a fancy folder.

I've watched that movie. It ends the same way every time.

30-second verdict (Folloze, Uberflip, or "skip both")

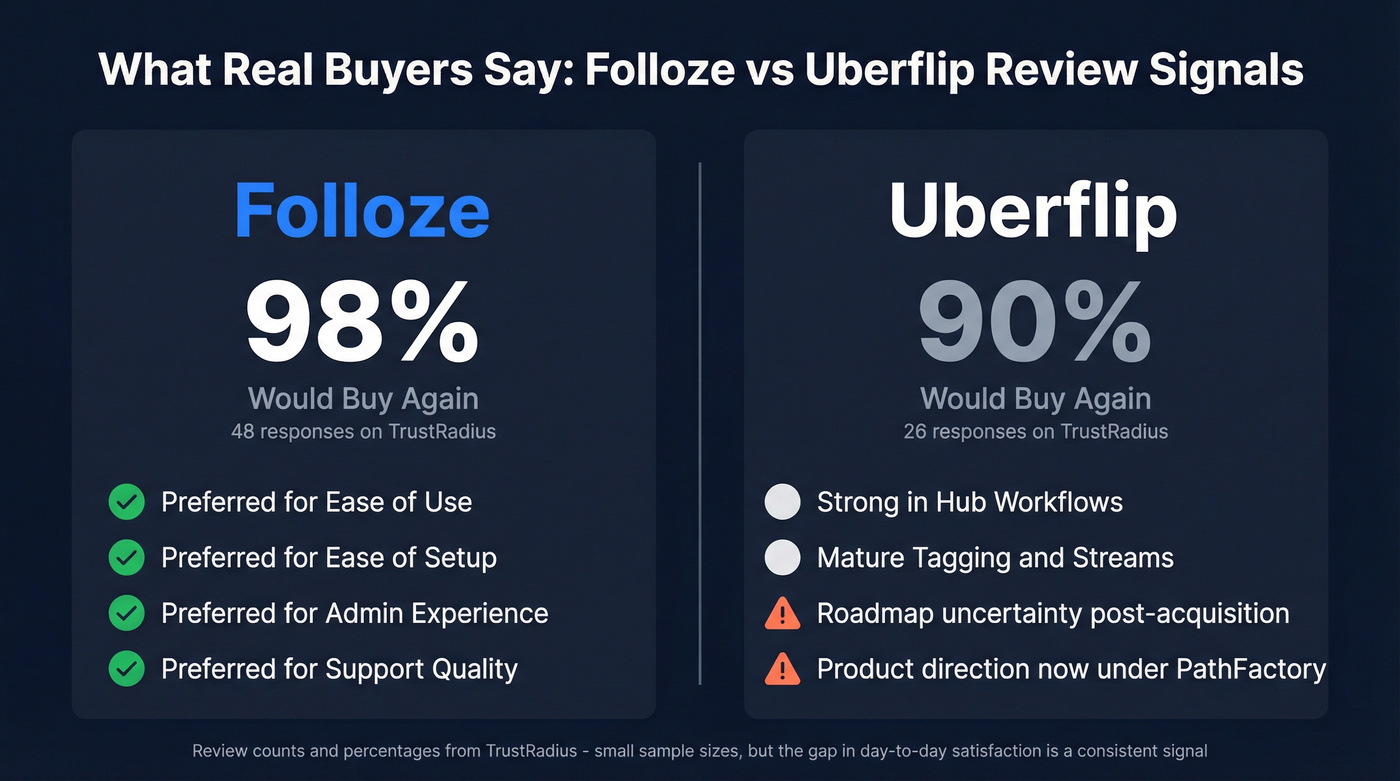

- Pick Folloze if... you need to ship ABM/ABX experiences constantly - microsites, event hubs, partner pages, and deal rooms - without turning your web team into a ticket queue. Folloze is the better choice when your motion is "launch new plays weekly," not "perfect one giant resource center." It also fits teams that want a clean template system, predictable governance, and fast onboarding for marketers and sales. TrustRadius "Would buy again" sits at 98% (48 answers) for Folloze vs 90% (26 answers) for Uberflip, and that gap usually shows up in day-to-day usability and support responsiveness. If you run ABM plays weekly and need sales to actually use the links in active opps, buy Folloze.

Pick Uberflip if... you're already running an Uberflip hub that's indexed, tagged, governed, and baked into your content ops workflow - and you're optimizing what exists rather than rebuilding your motion. Uberflip still shines when the deliverable is a central resource hub: mature tagging/smart filters, streams, and SEO optimization. This is a "keep the machine running" decision: renew, clean up taxonomy, improve governance, and squeeze more value out of a hub your team already knows. If your hub is already ranking, your tags/streams are mature, and your goal is continuity, stick with Uberflip.

Skip both if... you're net-new and you care most about product direction. In 2026, buying Uberflip as a fresh platform bet is the wrong move; you're taking on acquisition-era uncertainty for no upside. Instead, evaluate PathFactory directly for the combined company's strategic investment (Uberflip was acquired July 15, 2024, and the combined entity operates under PathFactory). And if your real goal is turning engagement into meetings, don't stop at "who engaged"--pair your content experience platform with verified contact data so follow-up happens fast and actually lands. If you need product momentum and a clear roadmap, shortlist PathFactory + Folloze and move on.

Why this comparison is different in 2026 (Uberflip isn't the same product decision)

Uberflip used to be a straightforward call: "Do we want a centralized content hub with good UX and analytics?" In 2026, the question is simpler: are you buying forward motion, or are you buying continuity?

Diginomica's acquisition coverage is the part most comparison pages dodge. Their reporting says Uberflip is supported for existing customers with maintenance and bug fixes and "no new development," and also says there'll be no merging of the two platforms and that "Uberflip as we know it will no longer exist." PathFactory's public messaging focuses more on the corporate combination than on spelling out an end-of-life plan, so treat the Diginomica angle as third-party reporting - but don't ignore it when you're signing a multi-year agreement.

PathFactory's press release is clear on the corporate reality: PathFactory acquired Uberflip on July 15, 2024, and the combined entity operates under PathFactory. PathFactory also cites Gartner that 77% of B2B buyers said their last purchase was very complex or difficult, and it positions the acquisition as a way to reduce that complexity with content intelligence.

Warning: if you're buying net-new in 2026 and your internal champion is selling "Uberflip roadmap," stop the process and reset the shortlist. Treat Uberflip like a legacy platform you can keep running - not the place to build next year's ABM motion.

Folloze vs Uberflip: core job, ideal buyer, and where each wins

The cleanest way to think about this matchup is that they optimize different jobs.

- Folloze is built to produce and iterate ABM experiences (campaign hubs, event experiences, deal rooms) with templates and orchestration that marketing can ship quickly and sales can use without a training tour.

- Uberflip is built to run a content hub: centralize assets, tag them, create streams, and improve content discovery with a cleaner consumption experience than a CMS alone (including SEO optimization).

- PathFactory is the "content intelligence" center: deeper analytics and personalization, and the strategic home post-acquisition.

Folloze in one sentence

Folloze is an ABM experience factory: repeatable templates for personalized experiences with engagement reporting that marketing and sales can both use.

My opinion: Folloze wins when your team measures success by shipping velocity--not by how perfect your taxonomy looks on a slide.

Uberflip in one sentence

Uberflip is a resource hub engine: tagging + streams + hub governance + SEO optimization.

Uberflip wins when the hub is the product: you care about navigation, findability, and content operations more than sales workflows.

The hidden decision: "new purchase" vs "existing customer optimization"

This is only a real head-to-head if you're already on Uberflip. If you're net-new, the real fork is Folloze vs PathFactory--because that's where the product investment moved.

For a quick sanity check on how review sites frame it, G2's head-to-head pages are a decent snapshot: Folloze vs Uberflip on G2.

Whether you pick Folloze, Uberflip, or PathFactory, your content experiences only convert when follow-up reaches real inboxes. Prospeo gives you 98% verified emails and 125M+ direct dials so every engaged account gets a real conversation - not a bounce.

Turn content engagement into booked meetings at $0.01 per verified email.

Feature and workflow matrix (with committed winners)

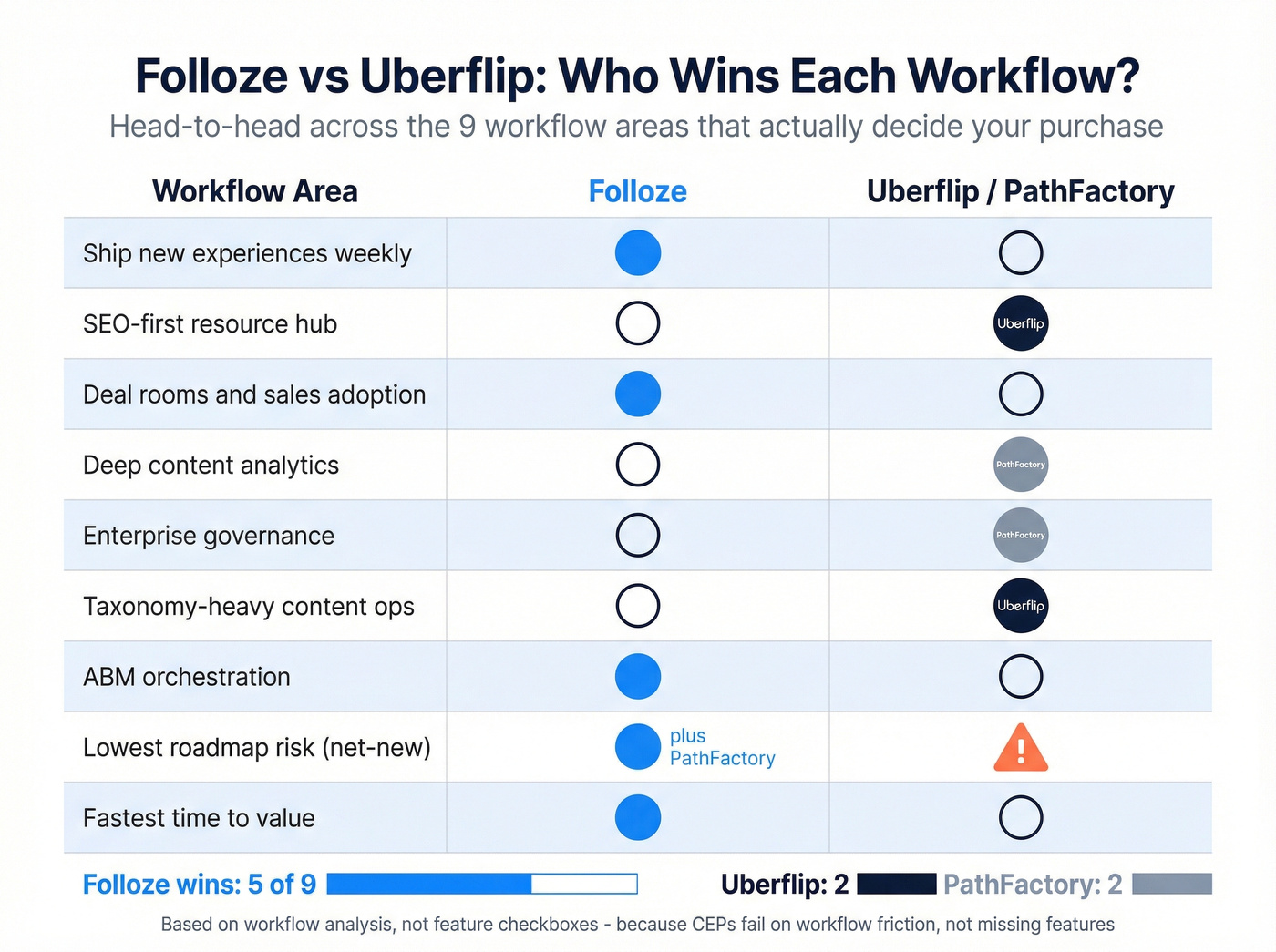

Directories love "Feature: Yes/No." That's not how CEPs fail. They fail on workflow friction: who builds, who governs, who measures, and whether sales uses it.

Here's the matrix I use when teams need a decision they can defend.

| Workflow area | Winner | Why it wins (in practice) |

|---|---|---|

| Ship new experiences weekly | Folloze | Templates + faster publishing; less "hub architecture" work before launch. |

| SEO-first resource hub | Uberflip | Hub + tagging/streams motion is the point; strongest fit when SEO/discovery is the KPI. |

| Deal rooms and sales adoption | Folloze | More natural mapping to opportunities and next steps; easier for reps to reuse. |

| Deep content analytics | PathFactory | Best choice when analytics/personalization is the buying center, not "nice to have." |

| Governance at enterprise scale | PathFactory | Stronger enterprise controls when many teams publish across regions/brands. |

| Taxonomy-heavy content ops | Uberflip | Tagging/streams governance is mature when you treat the hub like a library. |

| ABM orchestration | Folloze | Built around ABM plays and repeatable experiences rather than a single hub. |

| Lowest roadmap risk (net-new) | Folloze / PathFactory | Uberflip carries acquisition-era uncertainty; PathFactory is the strategic platform. |

| Fastest time-to-value | Folloze | Less migration/IA work to prove value; start with 3-5 plays and expand. |

A few testable calls behind the table (the stuff buyers actually feel):

- Uberflip wins when the deliverable is "a governed hub that stays consistent for years" and you'll invest in tagging discipline and SEO hygiene.

- Folloze wins when the deliverable is "new ABM experiences every week" and you need marketers to publish without dev.

- PathFactory wins when leadership is buying analytics depth and personalization as the core value.

What reviewers consistently score higher (quick reality check)

If you want the fastest read on day-to-day friction, look at the sub-metrics buyers mention again and again:

- Folloze is preferred for ease of use and ease of setup (teams get productive faster).

- Folloze is preferred for admin experience (less "where is that setting?" time).

- Folloze is preferred for support quality (important when you're rolling out to sales).

- PathFactory is preferred for product direction (especially post-acquisition).

- Uberflip's advantage shows up most in hub workflows (tagging/streams + resource-center operations).

- Review-count context matters: TrustRadius "Would buy again" is 98% (48) vs 90% (26)--not a perfect measure, but it's a clean signal.

Integrations that actually matter (and why)

Most teams care about the same integration spine:

- Salesforce for account/contact association and pipeline influence

- Marketo or HubSpot for known/anonymous stitching and nurture

- 6sense / Demandbase for account targeting and segments

- Outreach for sales follow-up and sequencing

Real talk: if your sales team wants deal rooms, don't buy a hub-first product and hope reps adopt it. I've seen teams build gorgeous resource centers that marketing loves - and sales ignores - because it doesn't map to opportunities, next steps, and "what do I send right now to move this deal?"

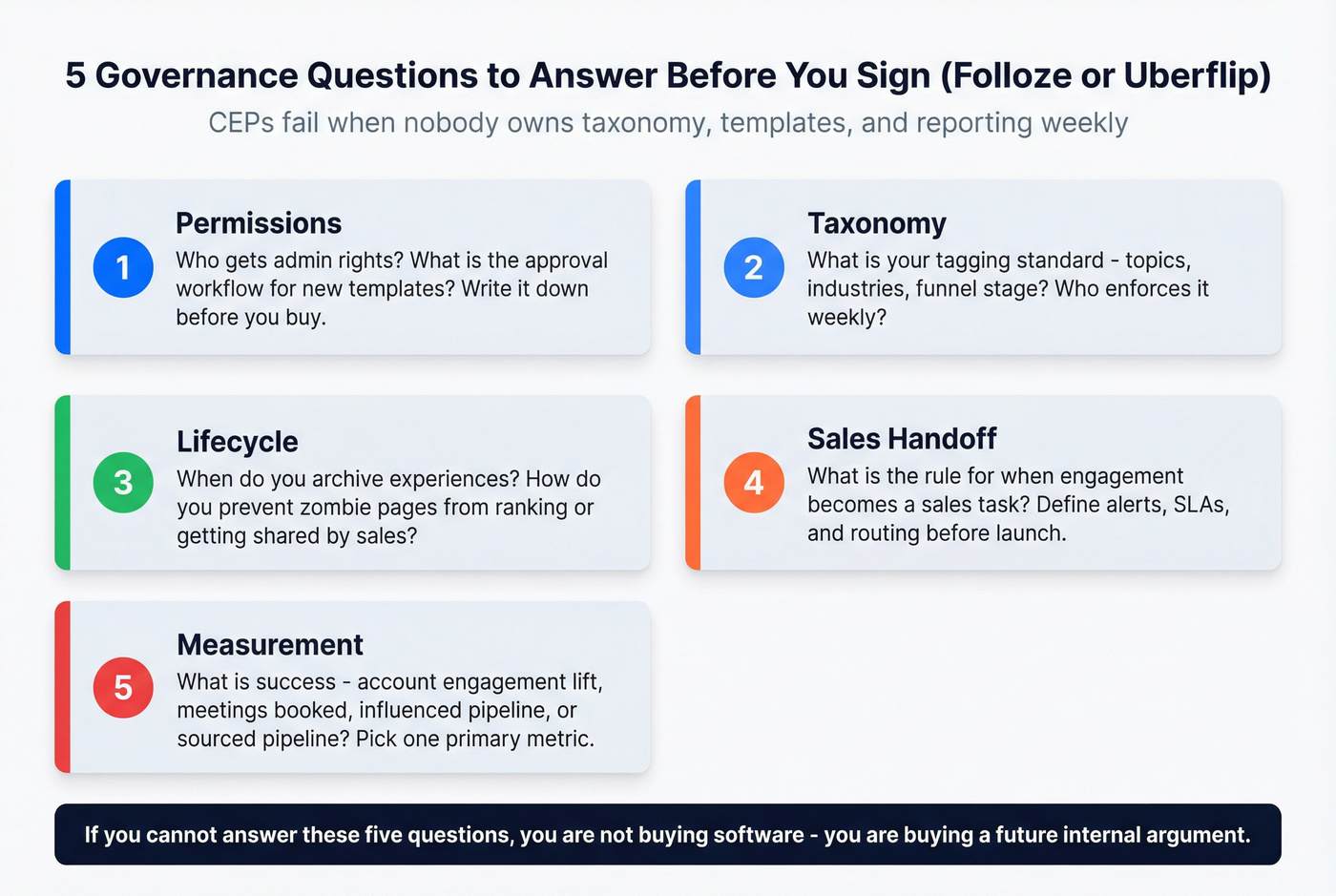

Governance and operating model (who'll run this weekly?)

CEPs don't fail because the UI's ugly. They fail because nobody owns taxonomy, templates, and reporting, so the platform turns into a junk drawer with pretty thumbnails and zero accountability.

Use this checklist before you sign anything:

- Ownership: Who owns the platform weekly - Demand Gen, ABM, Content Ops, or RevOps?

- Template control: Who can create/edit templates vs only clone approved ones?

- Brand QA: What's the QA step before something goes live (and who's accountable)?

- Publishing model: How do multiple teams publish without breaking navigation, tags, and naming conventions?

- Reporting cadence: What's the weekly/monthly reporting rhythm, and who presents it to sales leadership?

Five governance questions I always force teams to answer in writing:

- Permissions: Who gets admin rights, and what's the approval workflow for new templates?

- Taxonomy: What's the tagging standard (topics, industries, funnel stage), and who enforces it?

- Lifecycle: When do you archive experiences, and how do you prevent "zombie" pages from ranking or being shared?

- Sales handoff: What's the rule for when engagement becomes a sales task (alerts, SLAs, routing)?

- Measurement: What's your definition of success - account engagement lift, meetings, influenced pipeline, or sourced pipeline?

If you can't answer those, you're not buying software - you're buying a future internal argument.

Analytics and measurement model (what "content experience analytics" really means)

"Content experience analytics" isn't a category. It's a measurement model:

Account engagement -> handoff -> pipeline influence.

A CEP can tell you what happened inside the experience. It won't fix attribution, contact matching, or CRM hygiene. The teams that win treat CEP analytics as triage: "Which accounts do we prioritize this week, and what do we say to them?"

What you can measure cleanly (and should):

- Account-level engagement: visits, time, depth, repeat sessions

- Asset consumption: which pieces drive progression vs drop-off

- Segment performance: by industry, tier, intent segment, campaign

- Sales enablement signals: which accounts are "warm enough" for outreach

- Influence: opportunities touched by engaged accounts (requires CRM join)

If analytics depth is the main reason you're buying, PathFactory's the safer bet. If you want strong reporting with faster shipping and less overhead, Folloze is the better day-to-day experience.

Implementation and time-to-value benchmarks (based on review data)

Implementation time is where Folloze quietly separates itself for a lot of mid-market teams. Per G2's aggregated benchmarks:

- Uberflip: ~2 months to implement

- Folloze: ~1 month to implement

That matches what I've seen in real rollouts: hub-first deployments take longer because you're building information architecture (taxonomy, streams, SEO rules, migration). Experience-first deployments move faster because you can start with 3-5 high-value plays and expand.

Mini benchmark table:

| Metric | Folloze | Uberflip |

|---|---|---|

| Time to implement | ~1 month | ~2 months |

Pricing in 2026 (realistic ranges + what drives cost)

Neither product's truly self-serve, so you need budget ranges that won't embarrass you in procurement.

- Uberflip: Vendr lists a $27,500/year median, with an observed $9,179-$55,000/year range.

- Folloze: Vendr lists a $56,794 median contract value. For budgeting, plan ~$40,000-$120,000/year depending on traffic, number of experiences/boards, and services.

- PathFactory: Budget ~$30,000-$150,000/year depending on modules, scale, and services.

Pricing table (for planning, not negotiating):

| Vendor | Expected annual cost (2026) | Impl. time | Best for | Primary cost drivers |

|---|---|---|---|---|

| Folloze | $40k-$120k (median $56,794) | ~1 mo | ABM experiences at scale | traffic, boards/experiences, services |

| Uberflip | $9k-$55k (median $27,500) | ~2 mo | legacy hubs + SEO | workspaces/sites, migration, setup fee, services |

| PathFactory | $30k-$150k | Varies | analytics/personalization | modules, scale, services |

What drives cost (and surprise overages):

- Workspaces / sites: multiple brands or regions cost more

- Traffic / visitors: especially if you run paid media into hubs

- Integrations: MAP/CRM/ABM connectors and routing

- Services: migration, taxonomy design, template system, enablement

- Support tier: SLAs add up fast

If you're considering alternatives (Tier 2 short list)

Skip this section if you're already an Uberflip customer and you're just deciding "renew vs migrate." You're not shopping; you're managing change.

Hushly (Tier 2): Hushly is a strong pick if your priority is conversion paths--gated experiences, personalization, and turning content consumption into form fills and hand-raisers. It's a better fit than Uberflip when you don't need a giant SEO hub, and a better fit than Folloze when your motion is more "campaign conversion" than "ABM experience library." Budget ~$25k-$90k/year depending on modules and traffic, plus services if you want hands-on build support.

HubSpot Marketing Hub (Tier 2): If your team already lives in HubSpot, Marketing Hub can cover a lot of "good enough" content experience needs through landing pages, personalization, workflows, and reporting - without adding another platform to govern. The tradeoff is you won't get the same dedicated CEP patterns (deal rooms, hub-specific UX, specialized content analytics) without extra work. Budget ~$15k-$60k/year for most B2B teams (higher with add-ons/seats), and expect faster rollout because it's already your system of record.

What users like and dislike (so you don't repeat the same mistakes)

You can learn a lot from review themes as long as you translate them into operating reality.

Folloze (common review themes)

Pros

- Ease of use: marketers publish without waiting on web dev.

- Support: consistently praised, which matters when you're rolling out to sales.

Cons

- Design flexibility limits: if your brand team demands pixel-perfect control, you'll feel constraints.

Uberflip (common review themes)

Pros

- Strong hub motion when it's already operationalized: tagging, streams, resource centers.

- Solid reporting for marketing teams running a library-style experience.

Cons

- Admin learning curve: new admins take longer to get productive.

- Setup takes longer: migrations and taxonomy work stretch timelines.

- Price-to-usage mismatch: if you're not driving meaningful traffic, the hub can feel expensive.

Vendor-claimed outcomes (directional, from Uberflip case studies)

These are vendor-selected, but they explain why legacy customers renew:

- Trimble highlights improved content engagement and buyer experience outcomes, including 218% growth in organic traffic.

- EcoVadis emphasizes streamlined content delivery and better buyer journeys.

- Matillion points to stronger content performance and campaign efficiency.

Third option: don't let engagement die in the hub (activate follow-up with Prospeo)

A CEP tells you which accounts engaged. It doesn't solve the next step: getting the right contacts and reaching them reliably, especially when you're trying to follow up within a day and your CRM's full of stale titles and dead emails.

Prospeo ("The B2B data platform built for accuracy") is what you use to turn "engaged account list" into "call list." It has 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% email accuracy and a 7-day refresh cycle (the industry average is 6 weeks). For enrichment workflows, Prospeo returns contact data on 83% of matches, and its API match rate is 92%.

A practical workflow that actually holds up in the real world: export engaged accounts from Folloze/Uberflip/PathFactory, pull the buying committee by role, verify emails and mobiles, then push clean contacts into your sequencer so reps aren't burning domains on bounces or guessing who owns the project.

FAQ

Is Uberflip still a good choice for new customers in 2026?

For net-new buyers in 2026, Uberflip's hard to recommend as a platform bet because the acquisition shifted product direction to PathFactory. If you want the combined company's innovation, evaluate PathFactory directly; if you want fast ABM experiences that sales will use, Folloze's the cleaner buy.

Should I compare Folloze vs Uberflip or Folloze vs PathFactory?

Compare Folloze vs PathFactory if you're buying net-new in 2026 because that's where the strategic investment sits post-acquisition. The Folloze vs Uberflip decision mainly makes sense when you're already on Uberflip and deciding whether to renew, expand, or migrate.

What's a realistic implementation timeline for Folloze vs Uberflip?

Plan on ~1 month for Folloze and ~2 months for Uberflip, based on G2's aggregated benchmarks. In practice, Uberflip stretches when you're migrating content and rebuilding taxonomy, while Folloze moves faster when you start with 3-5 ABM plays and expand.

How do teams turn content engagement into meetings after launching a hub?

Closing: final recommendation (decision memo recap)

In 2026, the decision isn't really folloze vs uberflip. It's Folloze vs PathFactory, with Uberflip mostly showing up as a renewal and legacy optimization path.

If speed and adoption matter, Folloze's ~1 month implementation benchmark and stronger "would buy again" signal (98% vs 90%) are hard to ignore. If analytics depth and personalization sophistication are the center of your strategy, PathFactory's the safer long-term platform bet post-acquisition, especially for larger orgs that want one analytics brain across experiences.

Run a 2-week pilot with one ABM play and one sales play. Success means shipping 2 experiences per week, sales using deal-room links in active opps, and routing engaged accounts within 24 hours (see speed to lead metrics).

ABM platforms show you who engaged. Prospeo shows you how to reach them. Enrich engaged accounts with 50+ data points, layer in buyer intent from 15,000 Bombora topics, and push verified contacts straight to HubSpot or Salesforce.

Stop losing deals between engagement signal and first touch.