The Best Account Based Marketing Software for Every Budget and Team Size

You just got budget approval for ABM. The CMO wants a platform recommendation by Friday. You open five "best account based marketing software" articles, and every single one lists the same tools with "custom pricing - contact sales" next to each. Meanwhile, 94% of B2B marketers already run ABM programs, the market's projected to hit $2B by 2031, and you're still guessing whether Demandbase costs $40K or $200K.

The pricing gap in ABM content is absurd. These are five- and six-figure decisions, and vendors act like publishing a number would collapse their business model. So I'm going to give you actual dollar amounts, honest assessments of what works (and what's expensive shelfware), and a decision framework that maps to your team size and deal value.

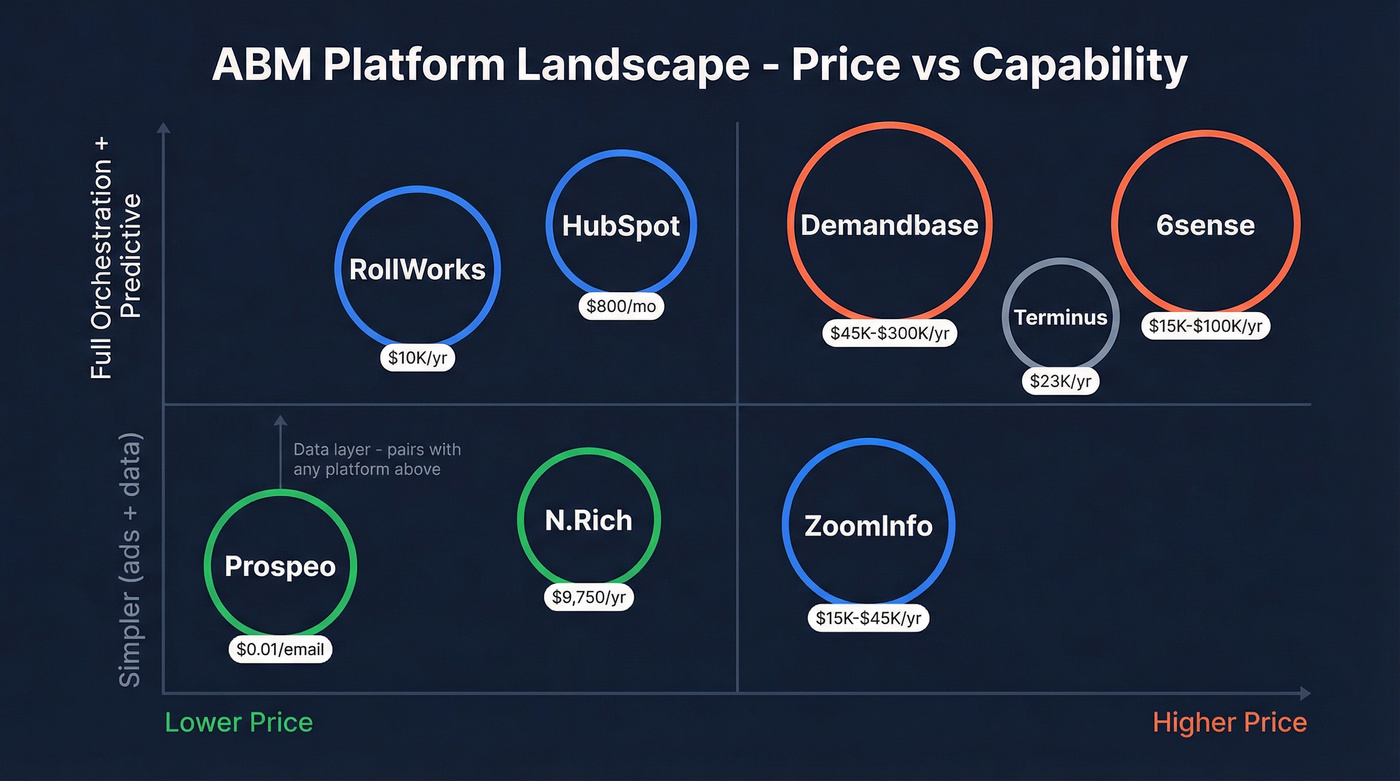

Our Picks - The Best ABM Platforms at a Glance

| Tool | Best For | Starting Price | Our Take |

|---|---|---|---|

| Demandbase | Enterprise cross-channel | ~$45K/yr base | The gold standard - if you've got $65K+ and a team to run it |

| Prospeo | Data accuracy & ABM enrichment | Free (~$0.01/email) | Best foundation layer - 98% email accuracy, intent data across 15K topics, no contracts |

| RollWorks | Mid-market first ABM program | ~$850/mo | Most underrated ABM platform. Ad-first, fast setup, 80% cheaper than Demandbase |

| 6sense | Predictive analytics | ~$15K/yr (Team) | Best intent engine on the market, but budget for RevOps headcount on top |

| HubSpot | Teams already in HubSpot | ~$800/mo (Pro) | Good enough for 80% of companies that think they need Demandbase |

Every ABM platform is only as good as the contact data feeding it. You can spend $100K on orchestration, but if 30% of your emails bounce, you've built a very expensive spam machine.

How to Choose the Right ABM Tool - Decision Framework by Company Size and ACV

Before you demo anything, answer three questions: What's your average deal size? How many target accounts are you running? And do you have a dedicated person to manage the platform?

The average B2B purchase involves about 7 decision-makers. Account based marketing software helps you reach all of them. But the platform you need depends entirely on the complexity of your sales motion.

Stack Tier 1: Deals Under $25K / Teams Under 50

You don't need a $60K platform. You need a clear ICP, accurate data, and sales-marketing alignment. The software comes third.

Stack Tier 2: $25K-$100K Deals / 50-500 Employees

Now you need account-based advertising and better scoring. RollWorks handles orchestration and ads. Layer in a strong data provider for the contact layer.

Recommended stack: RollWorks + verified contact data. Total: ~$1.5K/mo.

RollWorks gives you ICP scoring, programmatic ads, and guided ABM workflows. The data layer ensures every contact you're targeting actually exists and picks up the phone.

Stack Tier 3: $100K+ Deals / 500+ Employees

This is where enterprise ABM platforms like Demandbase and 6sense earn their price tag. Cross-channel orchestration, predictive analytics, buying group identification - the full enterprise playbook.

Recommended stack: Demandbase or 6sense + a verified data layer. Total: $50K-$120K/yr.

Even at this tier, I've seen enterprise teams run Demandbase with unverified contact data and wonder why their multi-touch campaigns underperform. The orchestration layer doesn't fix bad data. Ever.

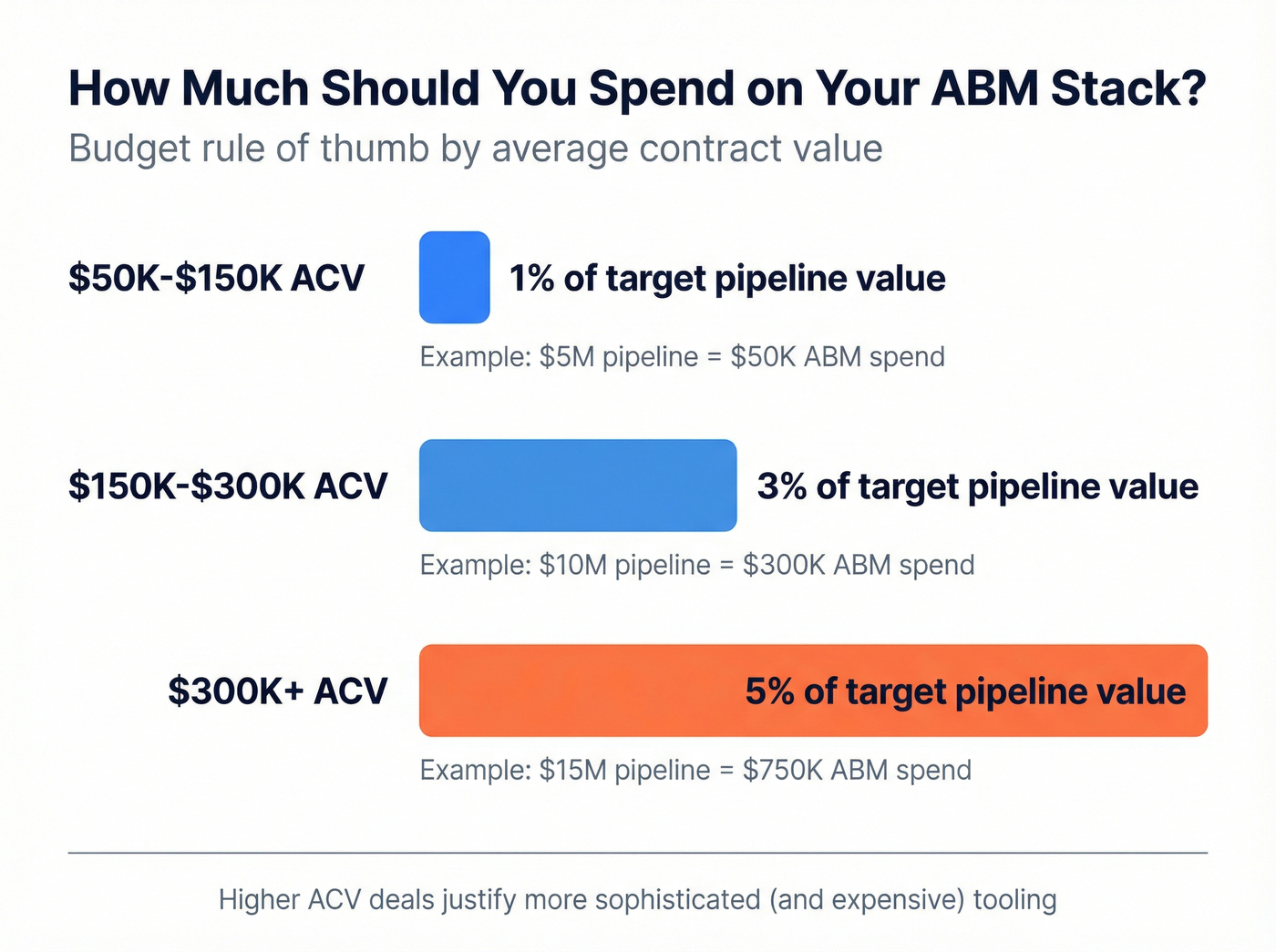

Budget Allocation by ACV

A quick rule of thumb for how much to spend on your ABM stack:

- $50K-$150K ACV: ~1% of target pipeline value

- $150K-$300K ACV: ~3% of target pipeline value

- $300K+ ACV: ~5% of target pipeline value

Healthy ABM Benchmarks

When evaluating any platform, hold it to these standards: 90%+ account matches within 24 hours and fewer than 5% unknown touches. If your platform can't hit those numbers after 90 days, it's the wrong tool.

Every ABM platform on this list runs on contact data. Bad data means bounced emails, wasted ad spend, and campaigns that never reach the buying committee. Prospeo gives you 98% verified emails, 125M+ direct dials, and intent data across 15,000 topics - refreshed every 7 days, not every 6 weeks.

Stop feeding your ABM platform stale data. Start at $0.01 per email.

The 10 Best ABM Software Platforms in 2026

Core ABM Platforms

Demandbase - Best for Enterprise Cross-Channel Orchestration

Use this if: You're running 1,000+ target accounts across display, web personalization, and email with a dedicated ABM team. Your ACV is $100K+ and you need buying group identification. You've got budget for ~$65K/yr median spend plus ~$29K onboarding.

Skip this if: You're under 500 employees, your marketing team is fewer than 5 people, or you don't have a RevOps person to manage the platform.

The pricing reality: small businesses pay $18K-$32K/yr. Mid-market runs $43K-$61K. Enterprise deployments hit $108K-$300K. The core ABX Cloud starts around $45K/yr for 10 users, but add the Advertising Cloud (~$30K/yr license, ad spend extra), Orchestration Module (~$20K/yr), and onboarding services (~$29K), and you're looking at $80K+ in year one.

Demandbase reports 3x higher conversion rates, 52% revenue increases, and 83% faster pipeline velocity - but those numbers come from mature enterprise deployments with full-stack implementations. Expect significantly lower returns if you're only using the advertising module or haven't invested in onboarding.

Compared to ZoomInfo: Demandbase is a true ABM orchestration platform; ZoomInfo is a data provider that bolted on ABM features. Demandbase wins on cross-channel campaign execution and account-level analytics. ZoomInfo wins on raw database depth and sales intelligence.

6sense - Best for Predictive Analytics and Buying Intent

Use this if: You're selling complex enterprise deals with 6+ month sales cycles and need to identify accounts showing buying intent before they fill out a form. You've got RevOps headcount and patience for a 4-8 week implementation.

Skip this if: You need a tool that works out of the box this week. 6sense's learning curve is steep - flagged consistently across 1,288 G2 reviews - and the platform doesn't include a dialer, email sequencer, or chatbot. You'll need Outreach or SalesLoft ($100-$150/user/mo) on top.

6sense processes over 1 trillion buying signals daily through its "Signalverse" engine and was named a Forrester Leader in Q1 2025. The predictive scoring is genuinely best-in-class. When it tells you an account is in the "Decision" stage, it's right more often than any competitor we've tested.

The pricing nobody wants to talk about: the Team plan starts at $15K-$20K/yr. Growth runs $25K-$60K/yr. Enterprise hits $60K-$100K+. A 5-person sales team on the Growth plan realistically pays ~$58K/yr when you factor seats, overages, and partial RevOps time. Credits don't roll over - unused credits expire at the end of each billing cycle.

Compared to Demandbase: 6sense is a prediction engine; Demandbase is an orchestration platform. 6sense tells you when to engage an account. Demandbase tells you how to engage across channels. Many enterprise teams run both, which tells you something about the total cost of a modern ABM stack.

RollWorks - Best Mid-Market ABM Solution for Teams New to ABM

Use this if: You want to launch an ABM program in weeks, not months. You care more about account-based advertising than predictive AI. Your budget is $10K-$20K/yr, not $60K+.

Skip this if: You need deep predictive analytics, buying group mapping, or enterprise-scale orchestration. RollWorks is the ABM arm of NextRoll (the company behind AdRoll), and its DNA is advertising-first. That's a strength for getting started, but a ceiling for complex programs.

RollWorks starts at ~$850/mo, making it roughly 80% cheaper than a median Demandbase deployment. For that, you get ICP Fit grades (A through D) using firmographic, technographic, and CRM data, plus programmatic account-based advertising with guided workflows. Where Demandbase and 6sense need 4-8 weeks of implementation, RollWorks can have you running targeted ads within days. For mid-market teams running their first ABM program, that speed-to-value matters more than having every enterprise bell and whistle.

N.Rich - Most Affordable End-to-End ABM Platform

N.Rich packs ICP scoring, intent data, website visitor identification, and account-based advertising into a single platform starting at $9,750/yr. For mid-market teams that want end-to-end ABM without the enterprise price tag, it's the most affordable option that doesn't feel like a compromise.

Terminus (DemandScience) - Legacy Enterprise ABM

Terminus was acquired by DemandScience and has been losing mindshare since. Median spend runs ~$23K/yr. Some users report a 60% drop in CAC, but that requires full-stack adoption and ~12 months of patience. Unless you're already locked into a contract, there are better options at every price point.

Data Accuracy & Enrichment

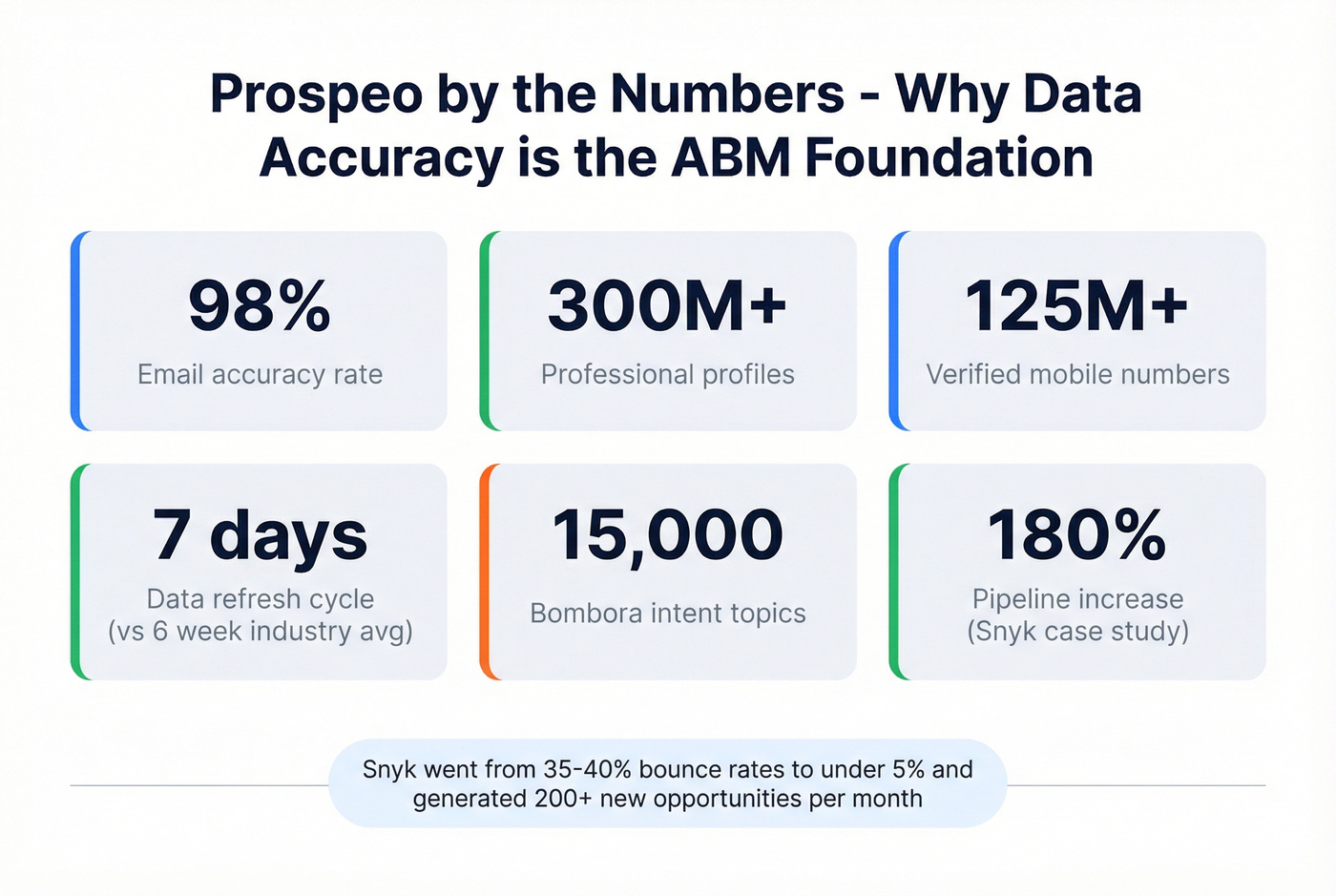

Prospeo - Best for Data Accuracy and ABM Contact Enrichment

Use this if: You want the highest-accuracy contact data feeding your ABM programs - whether you're running Demandbase, RollWorks, HubSpot, or a DIY stack.

Prospeo's database covers 300M+ professional profiles with 143M+ verified emails and 125M+ verified mobile numbers (30% pickup rate). The 98% email accuracy rate comes from a proprietary 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering.

Data refreshes every 7 days versus the 6-week industry average. That gap matters enormously in ABM, where you're targeting specific buying committee members who change roles constantly. The intent data layer covers 15,000 Bombora-powered topics integrated directly into the search interface - filter by buyer intent + job title + company size + technographics across 30+ filters, and you've got a targeted account list with verified contact data in minutes.

Real results: Snyk's 50-person AE team went from 35-40% bounce rates to under 5%. AE-sourced pipeline jumped 180%, generating 200+ new opportunities per month.

Pricing is dead simple: ~$0.01 per email, 10 credits per mobile number, free tier included. No contracts, no annual commitments.

Sales Intelligence

ZoomInfo - Best for Sales Intelligence with ABM Features

| Strengths | Weaknesses |

|---|---|

| 300M+ contacts and 100M+ company profiles - deepest US database | ABM features feel bolted on, not native |

| Intent data, org charts, and technographics at higher tiers | Intent data costs extra - not included in Professional |

| Strong daily rep adoption | Professional: $15K-$18K/yr for 1-3 seats. Elite: $35K-$45K+ |

ZoomInfo is a great sales intelligence tool that markets itself as an ABM platform. If your reps need a search bar and direct dials, it delivers. If your marketing team needs account-based advertising, buying group orchestration, and multi-channel campaign management, they'll be disappointed. Budget for 10-20% renewal uplifts in year two.

CRM-Native ABM

HubSpot Marketing Hub - Best CRM-Native ABM Tool for SMBs

Here's the thing: HubSpot's ABM is good enough for 80% of companies that think they need Demandbase. ABM features come included in Marketing Hub Pro (~$800/mo) and Enterprise (~$3,600/mo) - no separate purchase. Target account lists, company scoring, account-level reporting, and workflows are all native to the CRM. HubSpot's acquisition of Clearbit (now Breeze) adds native enrichment capabilities.

The ceiling: advanced ABM capabilities are moderate, AI features lag behind dedicated platforms, and pricing scales with contact count. But if you're already in the HubSpot ecosystem, have fewer than 500 target accounts, and your deals are under $50K, just use what you've got.

Budget-Friendly Stacks

Apollo.io - Best Budget ABM-Adjacent Stack

Apollo isn't a dedicated ABM platform, and it doesn't pretend to be. It's a prospecting and sales engagement tool with 250M+ contacts, built-in sequencing, and basic account scoring - all starting at $49/mo per user ($99/mo for Professional).

For early-stage teams selling deals in the four-figure range, Apollo paired with a verified data layer and Bombora intent signals gives you a functional ABM stack under $200/mo. That outperforms a $60K platform that nobody on the team knows how to configure. The tradeoff: no account-based advertising, no cross-channel orchestration, no predictive buying stage identification.

Intent Data

Bombora - Best Standalone Intent Data Provider

Bombora powers the intent data inside 6sense, Demandbase, and most other ABM platforms. Its cooperative network of 5,000+ B2B publisher websites and 12,000+ topic taxonomy is the industry standard for third-party intent signals.

Standalone Bombora starts at ~$30K/yr. Mid-market runs $50K-$100K/yr. Enterprise hits $100K-$300K. Individual intent topics cost $500-$25K each. Before you buy Bombora separately, check whether your existing ABM platform already licenses their data - most do. You might be paying twice for the same signals.

Account Based Marketing Software Pricing Comparison

Every major ABM platform hides pricing behind "talk to sales" in 2026. Here's what you'll actually pay:

| Tool | Starting Price | Mid-Tier | Enterprise | Watch Out For |

|---|---|---|---|---|

| Prospeo | Free | ~$99/mo | Custom | None - month-to-month |

| RollWorks | ~$850/mo | ~$1.5K/mo | ~$20K/yr | Ad spend extra; annual |

| Demandbase | ~$18K/yr | ~$45K/yr | $108K-$300K/yr | ~$29K onboarding; multi-yr |

| 6sense | Free (50 credits) | ~$25K-$60K/yr | $60K-$100K+ | Auto-renew; RevOps hire |

| ZoomInfo | ~$15K/yr | ~$25K/yr | $35K-$45K+ | 10-20% renewal uplift |

| HubSpot | ~$800/mo | ~$3,600/mo | Custom | Contact-based scaling |

| Apollo.io | Free | $49-$99/mo | Custom | Minimal; monthly available |

| Bombora | ~$30K/yr | $50K-$100K/yr | $100K-$300K/yr | Per-topic add-ons; annual |

| N.Rich | ~$9,750/yr | Custom | Custom | Ad spend extra; annual |

| Terminus | ~$23K/yr | ~$57K/yr | Up to $266K/yr | Bombora may cost extra |

The "Watch Out For" column is where budgets die. A $60K 6sense contract becomes $120K+ when you add RevOps headcount, Outreach licenses, and credit overages. A $45K Demandbase deal becomes $80K+ with onboarding and the advertising module.

Hot take: Most teams spending $60K+ on ABM tools would get better results spending $15K on tools and $45K on a person who knows how to run ABM. The software is never the bottleneck - execution is.

The Intent Data Reality Check

Intent data is the engine behind modern ABM. It tells you which accounts are actively researching solutions like yours before they ever visit your website. 84% of buyers go with the first vendor that engaged them - intent data is how you become that vendor.

But only 21% of marketing teams use intent data consistently.

First-party intent comes from your own properties - website visits, content downloads, webinar attendance. Highest quality, narrowest reach.

Third-party intent comes from publisher cooperatives like Bombora's 5,000+ site network. Broad coverage, but accuracy depends heavily on the provider's matching methodology.

Derived intent is what 6sense and Demandbase generate by synthesizing multiple signals through AI. Actionable, but it's a black box - you're trusting the algorithm.

What most articles won't tell you: IP-based deanonymization, which powers website visitor identification in Demandbase and others, is only about 42% accurate. More than half your "identified" visitors are misattributed or unknown. Multi-source waterfall enrichment delivers 20-30% better coverage than relying on any single provider.

You don't need a $65K orchestration platform to launch ABM. You need accurate data on every decision-maker in your target accounts. Prospeo covers 300M+ profiles with 30+ filters - buyer intent, technographics, headcount growth, funding - so you reach the full buying committee, not just one gatekeeper.

Reach all 7 decision-makers with data you can actually trust.

ABM Mistakes That Waste Your Software Budget

I've watched teams blow $60K on ABM platforms and get nothing. It's almost never the software's fault.

Mistake 1: Launching Without a Defined ICP

You can't run account-based marketing if you haven't defined the accounts. I've seen teams buy Demandbase, load 10,000 accounts into the platform, and wonder why engagement rates are identical to their spray-and-pray campaigns. ABM starts with a list of 200-500 accounts that your sales team actually agrees on. If sales and marketing can't align on the target list, no software fixes that.

Mistake 2: Treating ABM Like Lead Gen

What gets presented as ABM at most companies is just lead gen with a shared account list and personalized subject lines. That's it. If you're measuring MQLs from your ABM program, you're doing lead gen. ABM measures account engagement, pipeline velocity, and deal size - not form fills.

Mistake 3: Buying Enterprise ABM Platforms for an SMB Problem

A 30-person company doesn't need 6sense. A marketing team of two doesn't need Demandbase. These platforms are built for organizations with dedicated ABM managers, RevOps teams, and 12-month implementation timelines. If that's not you, HubSpot ABM + good data gets you 80% of the way there.

Mistake 4: Ignoring Data Quality

43% of ABM practitioners battle unreliable data when choosing target accounts. You can build the most sophisticated multi-touch campaign in Demandbase, but if 30% of your emails bounce and your mobile numbers are disconnected, you've wasted every dollar spent on orchestration.

Data quality isn't a feature. It's the foundation.

Mistake 5: Expecting Marketing to Run ABM Alone

46% of businesses struggle with sales-marketing alignment in ABM. Real ABM requires cross-functional execution: marketing creates air cover, sales runs personalized outreach, CS identifies expansion opportunities. If your sales team doesn't know the target account list exists, your ABM program is just advertising.

ABM ROI - What the Numbers Actually Say

The ROI case for ABM is strong when it's executed well:

- 76% of marketers get higher ROI with ABM than any other marketing approach

- ABM increases average contract value by 171% and marketing-sourced revenue by 200%

- Companies with aligned ABM strategies see a 208% increase in revenue

- ABM shortens sales cycles by 40%

Those are impressive numbers. They're also averages across mature programs at companies that invested seriously in execution, not just software. The team running the playbook matters more than the platform.

The honest counterweight: 40% of ABM practitioners cite ROI measurement as their biggest challenge. Multi-touch attribution is still more art than science, and most ABM platforms grade their own homework.

Companies allocate 29-37% of marketing budgets to ABM, and 66% plan to increase that spend. The market's moving. The question isn't whether to invest in account based marketing software - it's how much to spend on the platform versus the execution.

FAQ

What's the best account based marketing software for small businesses?

HubSpot's built-in ABM tools (included in Marketing Hub Pro at ~$800/mo) combined with Prospeo for verified contact data gives you a functional ABM program for under $1K/mo. Demandbase and 6sense are overkill if your average deal size is under $25K - save the budget for headcount and content.

How much does ABM software actually cost in 2026?

Dedicated ABM platforms range from $0 (HubSpot's free ABM tools, Apollo's free tier) to $300K+/yr for enterprise Demandbase deployments. The median cost is $23K-$65K/yr. Budget stacks run ~$1.5K/mo. Always factor hidden costs: onboarding ($10K-$29K), RevOps headcount ($60K-$120K/yr), and engagement tools ($100-$150/user/mo).

Do I need a dedicated ABM platform or can I use HubSpot?

If your deals average under $50K and you're targeting fewer than 500 accounts, HubSpot's built-in ABM is probably enough. Upgrade to a dedicated platform when you need predictive intent data, account-based advertising at scale, or buying group identification across complex enterprise deals with 6+ month cycles.

What's a good free or low-cost alternative to enterprise ABM platforms?

Prospeo's free tier (75 emails + 100 Chrome extension credits/month) paired with HubSpot's free CRM and ABM tools gives you a $0 starting point. Apollo adds sequencing from $49/mo. This sub-$100/mo stack outperforms a misconfigured $60K platform - and you can upgrade individual layers as deal sizes grow.

How long does it take to see ROI from ABM?

Expect 6-12 months for meaningful pipeline impact from a dedicated ABM program. Simpler tools like RollWorks deliver value within weeks; enterprise platforms like Terminus require ~12 months of full-stack adoption. The biggest variable isn't the software - it's whether sales and marketing are aligned on target accounts and coordinated execution.