The Best Contify Alternatives (2026): Pick the Right CI Platform

Enterprise CI is a $30k+ line item. The fastest way to waste it is trialing "alternatives" that aren't CI at all.

Most top-ranking lists for contify alternatives quietly mix in SEO suites, web analytics, and random directories that have never shipped a battlecard workflow. That's how teams end up six weeks deep in demos and still can't answer the only question that matters: "Will sales actually use this?"

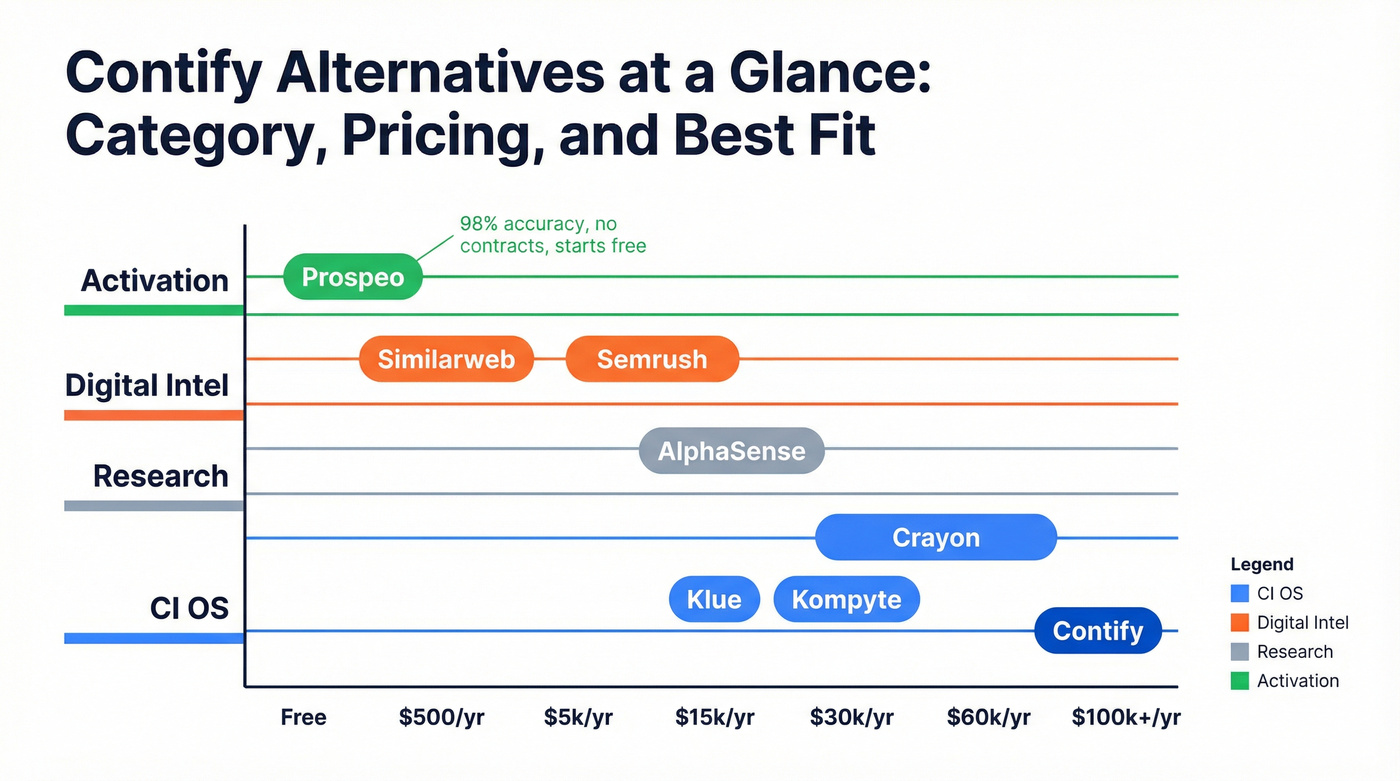

Contify's a real enterprise CI platform. If you're switching, you need a clean split between CI OS replacements (collect -> curate -> distribute), research/search tools (find needles), digital intel (web/SEO signals), and activation (turn insights into pipeline). Below, we map the categories, give pricing anchors that match how these tools are bought, and call out the three trials that keep you out of procurement purgatory.

Our picks (TL;DR): the fastest shortlist

If you're trying to move fast, don't trial 12 tools. Trial 3, then add one "signal" tool if you need it.

Trial Klue if you want the closest Contify-style CI OS replacement with the best odds of rep adoption. It wins on day-to-day workflow, not just feature checklists. Skip Klue if you hate minimum user requirements and procurement friction. Budget from ~$16k/year and scale up with scope.

Trial Crayon if you're building an enterprise CI program where distribution matters as much as collection (sales enablement, exec updates, product marketing, CS). It's built for stakeholder sprawl. Skip Crayon if you just need a lean CI hub for a small team. Budget $30k-$60k+/year.

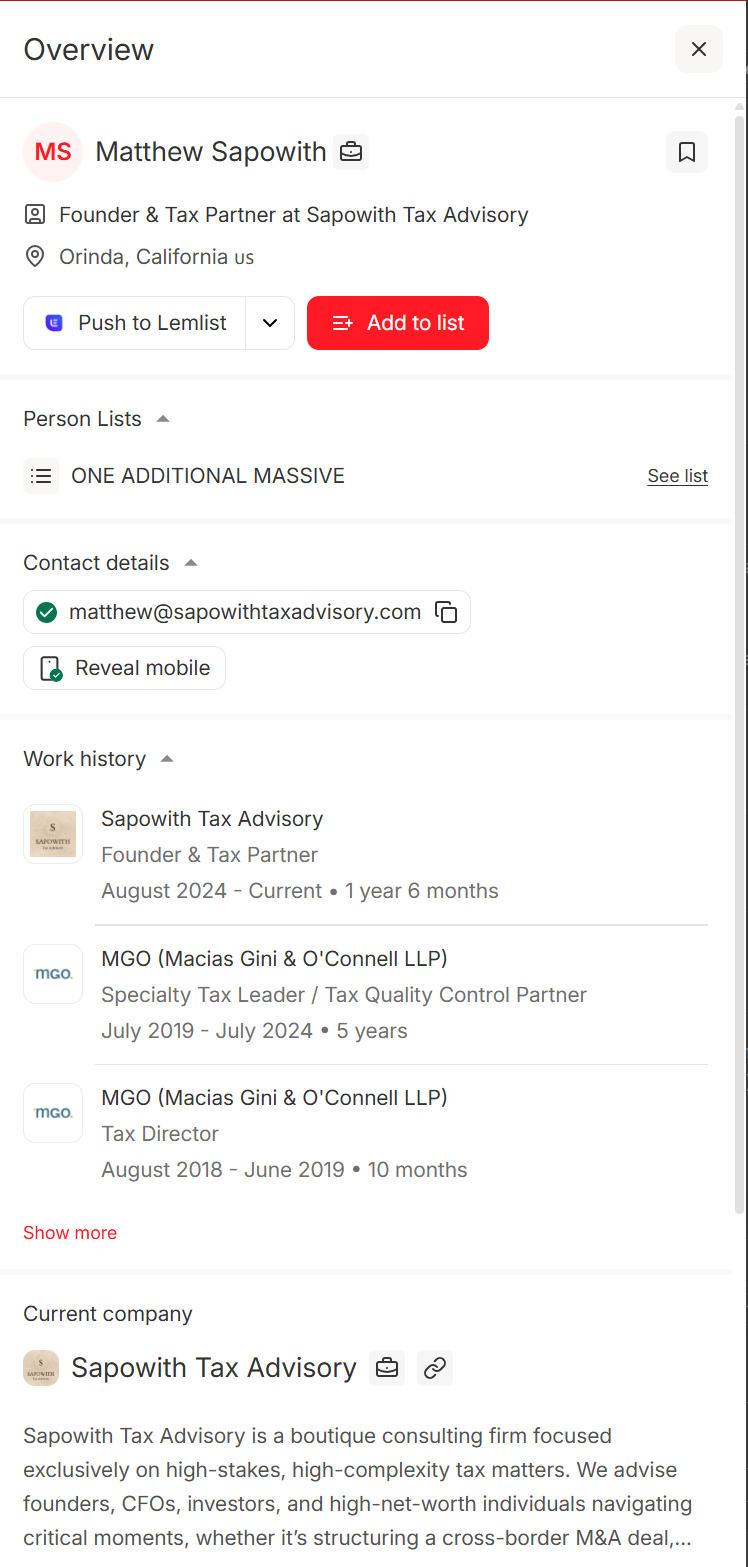

Trial Prospeo if your real gap isn't "more intel"--it's acting on intel. Prospeo is the B2B data platform built for accuracy: 98% verified email accuracy, 7-day refresh (industry average: 6 weeks), self-serve, and no contracts. Start on the free tier, then budget from ~$39/mo.

Contify cost reality check: Vendr's marketplace data puts Contify's procurement "redline threshold" at $30k+. So if you're shopping, you're already in enterprise pricing territory.

What Contify is (and isn't) in 60 seconds

Contify is a market and competitive intelligence platform built for enterprise monitoring, curation, and distribution. It's rated 4.5/5 (114 reviews) on G2 - strong for a tool that touches a lot of stakeholders and workflows.

Where Contify stands out is coverage and structure. It pulls from 1M+ vetted sources, including roughly 200,000 non-English sources, and supports monitoring plus auto-translation across 117+ languages. If you track competitors across EMEA/APAC (or you care about regulatory and local press), that multilingual posture is a real differentiator.

Contify also has a Business News API, which matters if you want structured business news flowing into BI dashboards, internal search, or LLM pipelines instead of living only inside a CI UI.

Distribution is a big part of the product. Teams push intel into daily workflows via integrations like Slack, Teams, Email, SharePoint, and Gong, plus dashboards, newsletters, and alerts.

Contify is for...

- CI/strategy/PMM teams that need monitored sources + curation + stakeholder delivery

- Orgs that care about multilingual coverage and noise filtering

- Teams that want dashboards, newsletters, alerts, and "decision-ready" summaries

- Data teams that want structured news via API, not just human-readable digests

Not ideal if...

- You mainly need battlecards inside the sales workflow (rep adoption is everything)

- You want a lightweight, self-serve setup without procurement

- Your biggest pain is "we know what happened, but we can't act on it fast"

The activation gap kills CI programs. You spot a competitor's pricing change - then spend hours manually building target lists. Prospeo closes that gap: go from insight to 120 verified contacts in minutes, not days. 98% email accuracy, 7-day data refresh, $0.01/email.

Stop curating intel you never act on. Start converting it into pipeline.

Why teams replace Contify (switch triggers you can validate)

G2's "value at a glance" metrics are a useful gut-check: 2 months to implement and 5 months to ROI. That's normal for enterprise CI.

It's also long enough to burn a quarter if you pick wrong.

The most consistent switch triggers fall into three buckets:

1) Adoption friction (UI/UX + learning curve)

Contify's common cons themes include outdated UI/UX and difficult learning. That's a problem when your success metric is "sales actually uses the battlecards."

I've watched teams buy a CI platform, build gorgeous dashboards, then watch reps go back to "Google + gut feel" because the workflow feels heavy and the intel's one click too far away.

Symptom -> buy this instead

- Reps don't open intel links -> Klue (rep-first UX) or Crayon (distribution muscle)

2) Noise problems (news quality, too many alerts)

CI platforms live or die by filtering. If your alerts feel like SERP sludge, stakeholders tune out fast.

Here's the thing: more sources doesn't fix noise. Better curation and tighter tracking scopes do.

Symptom -> buy this instead

- Too much irrelevant monitoring -> Kompyte (packaging levers force focus) or Sindup/Digimind (monitoring governance)

3) The "activation gap" (intel doesn't turn into pipeline)

This is the one nobody admits in the buying committee. You don't just need to know a competitor changed pricing - you need to message the right accounts this week.

If your CI output is a Slack post and a PDF, you're missing the activation layer. In that case, you might not need to rip out Contify. You might need to add an activation step so an insight becomes a verified list and outreach in the same day.

We ran a bake-off last year where the "best CI" tool lost because the team couldn't operationalize insights into targeting and outreach without a bunch of manual list building. The winner wasn't the fanciest dashboard. It was the workflow that got from "Competitor X launched in healthcare" to "Here are 120 target accounts and the right contacts" before the news cycle moved on.

Contify alternatives: what's a real replacement (and what's not)

A lot of SERPs are polluted because directories mix categories. That's how you end up with nonsense lists that blend CI platforms with SEO tools and sales intelligence.

Use this mental model:

CI OS (true replacements): Contify, Klue, Crayon, Kompyte Built to collect, curate, and distribute competitive intel with workflows and governance.

Research/search platforms (complements): AlphaSense Incredible for finding needles in haystacks, not for running battlecards and stakeholder distribution.

Digital intel (signal substitutes): Similarweb, Semrush, SpyFu Great for web/SEO signals. Not a CI operating system.

Activation layer (turn insight into pipeline): Prospeo The "now do something with it" step: build account lists, find verified contacts, enrich CRM, launch outreach.

Two category mismatches that waste buyers' time:

- SEO tools showing up as CI "alternatives." Semrush is valuable, but it won't run your CI program.

- Taxonomy pages pretending to be competitive sets. If a "market share" page puts Contify next to survey tools, that's not a competitive set. It's a categorization error.

If you want a clean starting point for the messy ecosystem, G2's alternatives list is still one of the least-bad directories: https://www.g2.com/products/contify/competitors/alternatives

Contify alternatives comparison table (features, best-for, pricing reality)

This table's the decision shortcut. If a tool isn't in the right category, don't let a directory convince you it's a replacement.

| Tool | Category | Best for | Pricing reality |

|---|---|---|---|

| Contify | CI OS | Enterprise CI | $30k+/yr |

| Klue | CI OS | Rep adoption | ~$16k/yr |

| Crayon | CI OS | Enterprise programs | $30k-$60k+/yr |

| Kompyte | CI OS | Fast rollout + controls | $15k-$30k/yr |

| Prospeo | Activation | Verified outreach | Free + ~$39/mo (98%, 7d, no contracts) |

| AlphaSense | Research | Premium search | $10k-$20k/seat/yr |

| Similarweb | Digital intel | Traffic/channel intel | $125-$433/mo |

| Semrush | Digital intel | SEO intel | $129.95-$499.95/mo |

| Digimind | Monitoring | Enterprise + services | $25k-$80k+/yr |

| Sindup | Monitoring | Governance/curation | $15k-$50k/yr |

| Valona | Monitoring | Multilingual CI | $30k-$100k/yr |

Legend: 98% = email accuracy; 7d = data refresh.

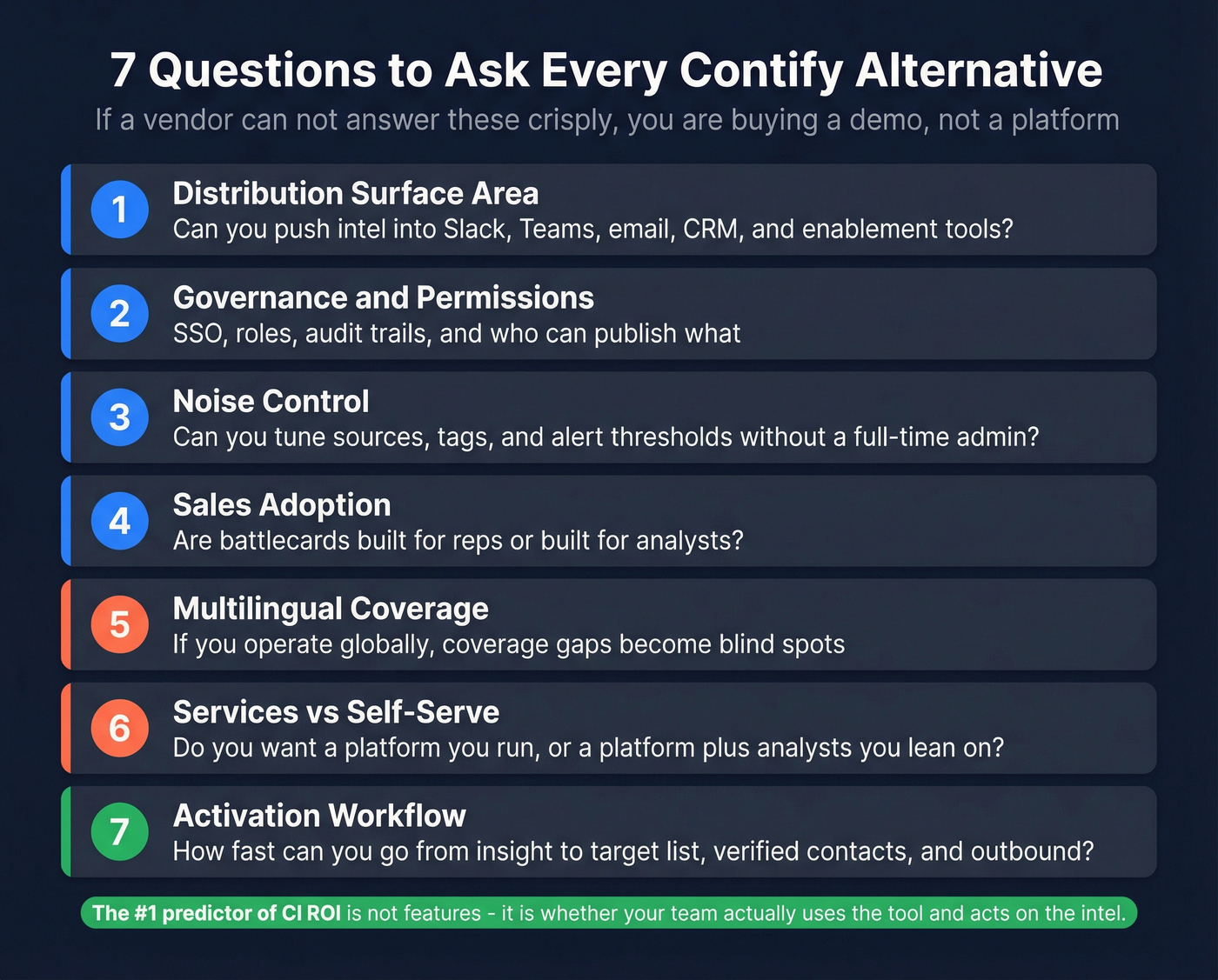

How to choose between platforms (the criteria that actually matter)

Use these as your evaluation checklist. If a vendor can't answer them crisply, you're buying a demo, not a platform:

- Distribution surface area: Can you push intel where people already work (Slack/Teams/email/CRM/enablement), or does everything live in the tool?

- Governance + permissions: SSO, roles, auditability, and "who can publish what" controls - non-negotiable once CI leaves PMM.

- Noise control: Can you tune sources, tags, and alert thresholds without hiring a full-time admin?

- Sales adoption: Are battlecards and talk tracks built for reps, or built for analysts?

- Multilingual coverage: If you operate globally, don't compromise here. Coverage gaps become blind spots.

- Services vs self-serve: Decide if you want a platform you run, or a platform plus analysts you lean on.

- Activation workflow: How fast can you turn an insight into a target list, verified contacts, enrichment, and outbound.

Budget bands (so you don't get surprised on the second call)

- Enterprise CI OS: $15k-$60k+/year (most real deployments land here)

- Research seats: $10k-$20k per seat per year

- Digital intel: $39-$500/month for SMB plans; enterprise tiers jump fast

- Activation/data: free to low hundreds per month for self-serve; scales with volume

If your average deal size is in the low five figures, you probably don't need a $30k+ CI OS.

Spend your energy on adoption, distribution, and activation. That's where revenue shows up.

Best Contify alternatives (mini-reviews + who should choose what)

Klue (Tier 1)

Klue is the default "true replacement" starting point when you want Contify outcomes with better day-to-day adoption. In head-to-head comparisons, it tends to win on ease of use, setup, support, and product direction - the stuff that determines whether sales touches your intel.

Pros

- Rep-friendly UX that wins adoption battles

- Strong support and clear product momentum

- Feels like a CI operating system, not just monitoring

Cons

- Minimum user requirements can block smaller teams

- Quote-based pricing means you negotiate scope and stakeholders

Best for: PMM/CI teams who want a CI OS that sales will actually use. Skip if: you need self-serve checkout and zero procurement.

Budget: ~$16k/year to start, scaling with program scope.

Crayon (Tier 1)

Crayon's what we recommend when the CI program is bigger than "PMM wants better battlecards." It's built for enterprise distribution - getting intel in front of sales, execs, product, and CS without turning PMM into a human newsletter.

Pros

- Best-in-class distribution for large stakeholder groups

- Strong support signals during rollout

- Built for governance and reporting at scale

Cons

- Procurement-led buying motion

- Overkill for small teams that just need a lean CI hub

Best for: enterprise CI programs with lots of stakeholders and multiple distribution channels. Skip if: you want a lightweight tool you can roll out in a week.

Budget: $30k-$60k+/year.

Prospeo (Tier 1): best for turning CI into pipeline

Most CI stacks break at the handoff: the insight gets posted, everyone nods, and then... nothing happens. Prospeo fixes that part.

In our experience, the cleanest workflow is: your CI tool flags a competitor move -> you build a target account list -> Prospeo finds and verifies the right contacts so outreach goes out the same day, not "after we finish list building next week." It's also the best option we've used for data freshness and accuracy without getting trapped in annual contracts.

What you get, concretely:

- 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers

- 98% verified email accuracy and a 7-day refresh cycle (industry average: 6 weeks)

- 30+ search filters plus intent data across 15,000 topics (powered by Bombora)

- Enrichment that returns 50+ data points per contact, with 92% API match rate and 83% enrichment match rate

- Self-serve pricing, free tier included, cancel anytime

Best for: teams that already have CI signals but need execution speed: lists, verified contacts, enrichment, and outbound. Skip if: you only need a news digest and nobody's doing outbound with it anyway.

Budget: free tier, then from ~$39/mo. Pricing: https://prospeo.io/pricing

Kompyte (Tier 1)

Kompyte's the "controlled rollout" option. It's a CI OS, and it's unusually explicit about packaging levers, which helps when you're trying to prevent scope creep and keep monitoring sane.

Packaging mechanics are clear:

- Tracked companies: 10 / 20 / Unlimited

- Users: 25 / 100 / Unlimited

- URLs per company: 50 / 100 / 150

- Mentions: 20k/month

- Keywords: 25 / 100 / 200

- SSO + advanced permissions in Unlimited

Pros

- Fast time-to-first-value: insights in 24-48 hours, full implementation 1-2 weeks

- Packaging levers make budgeting and governance easier

- Strong fit when you want structure and clear limits

Cons

- More admin-forward than Klue/Crayon

- Less "rep-first" by default; you'll need enablement to drive adoption

Best for: teams that want a CI OS with clear controls and fast rollout. Skip if: you want the most polished rep experience out of the box.

Budget: $15k-$30k/year.

AlphaSense (Tier 2)

Buy AlphaSense only when your problem is research depth: filings, transcripts, broker research, and internal docs - fast. It's premium search, not a CI OS, and it's priced like a research terminal.

Best for: deep research across financial/regulatory sources and internal knowledge bases. Skip if: you need battlecards, alerts governance, and stakeholder distribution.

Budget: $10k-$20k per seat per year, with enterprise deals often landing $50k-$100k+.

Similarweb (Tier 2)

If you're replacing Contify because you really want digital go-to-market visibility, Similarweb's the cleanest answer: traffic trends, channel mix, referrals, and competitor web performance. It's also the fastest way to spot who's surging online before your pipeline feels it.

Best for: web traffic and channel intelligence to complement CI narratives. Skip if: you need a central CI hub with governance and distribution.

Budget: $125/mo starter, $433/mo pro, enterprise tiers above that.

Semrush (Tier 2)

Semrush is the SEO and keyword intelligence workhorse: content gaps, paid search visibility, and competitor search posture. It shows up in directory lists because categories get blurred, not because it runs CI workflows.

Best for: SEO + paid search competitive intel and content strategy. Skip if: you want battlecards, curated monitoring, and stakeholder delivery.

Budget: $129.95 / $249.95 / $499.95 per month.

Digimind Intelligence (Tier 2)

Digimind is classic enterprise monitoring plus optional services. It's strong when you want rigorous curation and you're willing to treat CI like an operational program, not a side project.

Best for: enterprise monitoring with curation rigor and optional managed services. Skip if: your top priority is rep-first battlecards and lightweight rollout.

Budget: $25k-$80k+/year depending on sources, seats, and services.

Sindup (Tier 2)

Sindup is the "make the chaos stop" option: monitoring, curation, and governance with controlled workflows for what gets tracked, validated, and distributed. It's not flashy, but it's operationally clean, especially in regulated or multilingual environments.

Best for: governance-heavy monitoring and curated distribution workflows. Skip if: you want a modern, sales-first CI experience.

Budget: $15k-$50k/year.

Valona Intelligence (Tier 2)

Valona belongs in the conversation when multilingual and global monitoring is central to your CI program. If multilingual coverage is why you bought Contify, Valona's one of the few platforms that can carry that load at enterprise scale.

Best for: strategic CI programs with global/multilingual monitoring requirements. Skip if: you need a lightweight CI hub for a small PMM team.

Budget: $30k-$100k/year depending on scope, regions, and services.

Wide Narrow (InfoDesk) (Tier 3)

Wide Narrow (InfoDesk) is strongest as a portal-style distribution layer with curated feeds and stakeholder navigation.

Budget range (estimate): $20k-$60k/year when you include portal scope and services.

WatchMyCompetitor (Tier 3)

WatchMyCompetitor is for website change monitoring. Use it when you need tight tracking on specific pages (pricing, integrations, product docs).

Budget: $3k-$12k/year, and pair it with a CI OS if you want synthesis and distribution.

SpyFu (Tier 3)

SpyFu is lightweight SEO competitor research for keywords and ads. It's great when you want quick answers without a big suite.

Budget: ~$39-$79/month depending on plan limits.

Google Alerts (Tier 3)

Google Alerts is the free baseline for basic monitoring. It's fine for early-stage teams that just need a pulse.

It also gets noisy fast.

Budget: $0.

Pricing and buying reality (what you'll actually pay, and what drives cost)

Most CI vendors are procurement-led: annual terms, security reviews, stakeholder mapping, and a lot of "let's hop on a call." If you want speed, that buying motion's the hidden cost.

Contify pricing anchor: Vendr's marketplace data puts Contify's redline threshold at $30k+. Annual payment terms are the norm.

What actually drives CI platform cost

- Stakeholders: how many people need access (sales, execs, product, CS)

- Tracked scope: competitors, markets, segments, and sources

- Distribution: newsletters, alerts, Slack/Teams embeds, portals

- Governance: SSO, permissions, auditability, admin controls

- Services: analyst support, onboarding, custom taxonomies

Mini table: the cost drivers that matter

| Cost driver | Shows up in | Why it matters |

|---|---|---|

| Tracked scope | Kompyte | More volume = more noise to manage |

| Stakeholders | Crayon | Distribution scale drives licensing |

| Seats | AlphaSense | Seat economics get expensive fast |

| Sources/langs | Contify | Coverage complexity drives setup + ops |

Implementation and time-to-value (avoid the 6-9 week lag)

CI programs fail in the gap between "we collected intel" and "sales used it." Battlecards go stale in 30 days. The typical lag from competitor move to rep awareness is 6-9 weeks. And the manual burden's brutal: 8-12 hours/month per rep plus 30-40 hours/quarter for PMM to keep cards updated.

These are directional operator benchmarks (not vendor marketing), but they match what we've seen in rollouts: if you don't pick a wedge, define owners, and ship one artifact sales will use, the platform becomes a very expensive inbox.

Benchmarks to plan around:

- Contify: ~2 months implementation

- Crayon: ~1 month implementation

- Kompyte: ~1-2 weeks full implementation (and insights in 24-48 hours)

A rollout that actually works looks like this:

30 days: pick the wedge (don't boil the ocean)

We've seen the best rollouts pick a wedge competitor set first.

- Choose 3 competitors and 2 use cases (pricing changes + positioning shifts is a strong start)

- Define owners: PMM owns taxonomy, RevOps owns distribution + integrations

- Ship one artifact sales will use: a talk-track battlecard, not a wiki

60 days: build the KIQ engine (this is where Contify-style teams win)

Start with 5 KIQs (Key Intelligence Questions), then map sources -> tags -> distribution lists:

- Example KIQs: "Where are they moving upmarket?", "What's changing in packaging/pricing?", "Which integrations are they pushing?", "Which vertical pages are new?", "What objections are showing up in deals?"

- Tag every alert to a KIQ and route it to a specific audience (sales vs exec vs product), so intel lands with intent, not as a firehose.

90 days: activation (where ROI shows up)

- Turn 3-5 insights into target account lists

- Enrich accounts and contacts, then launch outreach within days, not weeks

- Track outcomes: meetings booked, opp influence, win/loss notes

Real talk: if you don't have an activation step, you'll end up with a "CI content library" that's impressive and irrelevant.

Enterprise CI platforms cost $30k+/yr to tell you what happened. Prospeo costs $39/mo to help you do something about it - verified emails, direct dials, and CRM enrichment with no contracts and no procurement hoops.

Turn competitive intelligence into booked meetings before the news cycle moves on.

FAQ

How much does Contify cost in 2026?

Contify's quote-based, but the most useful budgeting anchor is $30k+/year. Vendr's marketplace data shows a $30k redline threshold, which usually means annual procurement, security review, and stakeholder scoping before you see a final number. Expect pricing to rise with tracked scope and distribution needs.

What's the closest "true" Contify replacement: Klue, Crayon, or Kompyte?

For most teams, Klue is the closest replacement because it's built around rep adoption and day-to-day usability. Crayon fits best when you need enterprise-grade distribution across lots of stakeholders. Kompyte is the pick when you want fast rollout plus hard packaging controls (tracked companies, users, URLs, keywords).

How long does it take to implement a CI platform and see ROI?

Plan 2-8 weeks for implementation depending on governance and integrations, then 1-5 months to see measurable ROI. Benchmarks: Contify averages ~2 months to implement and ~5 months to ROI; Crayon's often ~1 month; Kompyte's commonly ~1-2 weeks with insights in 24-48 hours.

Why do SEO tools like Semrush show up as Contify alternatives?

They show up because review sites and directories mix categories, not because they replace CI workflows. Semrush is great for keyword and paid-search intel, but it doesn't do CI OS jobs like curated monitoring, battlecard workflows, governance, and stakeholder distribution. Treat it as a signal layer, not a replacement.

Summary: choosing the right Contify alternatives in 2026

The best contify alternatives depend on what you're actually replacing: a CI operating system (Klue, Crayon, Kompyte), a research engine (AlphaSense), a digital signal layer (Similarweb, Semrush), or the activation step that turns competitor moves into pipeline (Prospeo). Trial three tools max, anchor your budget early, and optimize for adoption + distribution + activation, not just "more monitoring."