Sales Battlecard Examples You Can Copy (Plus Templates & Rubrics)

Most battlecards fail for one dumb reason: they're written like a wiki page, dumped in a folder, and then nobody trusts them when a deal gets competitive. You're not here for "more content." You're here for a card a rep can use while someone's talking.

Hot take: if your battlecard can't be used mid-sentence on a live call, it's not a battlecard. It's content.

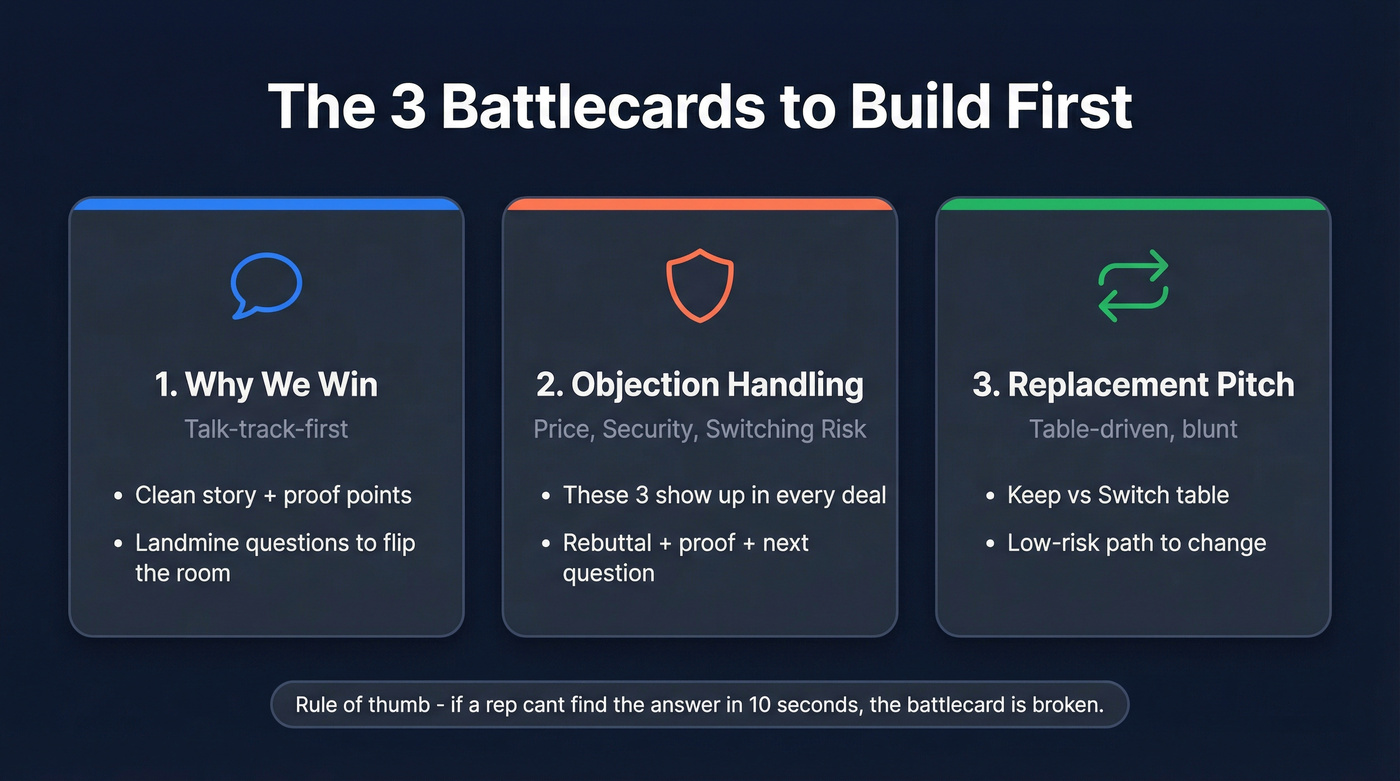

The 3 battlecards to build first (if you're short on time)

If you only build three cards this month, build these. They cover the moments where reps freeze, deals stall, and competitors sneak in.

Competitor "Why we win" (talk-track-first) The fastest path to usefulness. It gives reps a clean story, a couple proof points, and a few "landmine" questions to flip the room.

Objection-handling (price / security / switching risk) These three show up in almost every competitive deal. Answer them cleanly and you'll win more than you think.

Replacement pitch (table-driven, blunt) When a buyer's already using a competitor, they don't want poetry. They want a simple "keep vs switch" table and a low-risk path to change.

Here's the standard I've used with teams: if a rep can't find the answer in 10 seconds, the battlecard's broken. Speed beats completeness.

What a sales battlecard is (and what it isn't)

A sales battlecard's a one-page cheat sheet (or a modular slide) designed to be scanned fast. It's not "competitive analysis." It's a call-side asset.

It exists for one moment: when a buyer says, "We're also looking at X," and your rep has about 15 seconds to respond without sounding defensive or making stuff up.

What it is:

- A call-side companion: positioning, talk tracks, proof, and next questions.

- A decision aid: when to push, when to concede, when to walk.

- A memory shortcut: the five things reps forget under pressure.

What it isn't:

- A 40-slide deck that tries to cover every edge case.

- A feature-by-feature spreadsheet that turns your rep into a narrator.

- A product marketing manifesto.

- A place for unprovable trash talk ("we're more innovative").

The best battlecards feel almost boring. They're blunt, specific, and built to be used mid-call.

What great battlecards look like (patterns from real examples)

Dock curates a public library of real battlecards, which is rare because most companies treat these as internal playbooks. Their Revenue Archives also lists 20+ examples across brands like Cisco, Salesforce, DocuSign, and AWS, and it's a solid swipe file for structure and phrasing.

These patterns are pulled from Dock's publicly curated examples (the brand names are the ones shown there). Here's what the best ones have in common, and how to steal the pattern without copying the logo.

Persona anchoring (Cisco-style persona box) Why it works: It stops the card from becoming generic. A rep can picture the buyer, their day, and their constraints. Steal it: Put a persona box at the top: "Who is this for, what do they care about, what do they fear?" (If you need a fast starting point, use these persona patterns.)

Discovery coaching embedded in the card Why it works: Competitive deals are won in discovery, not in rebuttals. The best cards tell reps what to ask next, not just what to say. Steal it: Add five "if they say X, ask Y" questions. Specificity's the point. (You can also standardize this with a lightweight qualification checklist.)

Buyer-question-led structure (FAQ style) Why it works: Buyers don't experience competitors as "feature sets." They experience them as questions: "Will this break our workflow?" "Can we pass security?" Steal it: Write the card as a buyer FAQ. Then answer with your talk track + proof + next question.

Fear openers (risk-first lines) Why it works: It matches the emotional tone of the moment. Competitive threats show up when a buyer's worried about risk. Steal it: Start with 2-3 "what they're afraid of" lines. Not FUD, real operational risk.

Blunt tables (replacement pitch style) Why it works: Tables force clarity. They also prevent reps from rambling. Steal it: Use checkmarks and short phrases. Add one row that calls out what's "overbuilt" for the buyer's reality.

A battlecard with outdated contact data is just a pretty document. Prospeo refreshes 300M+ profiles every 7 days - so when your rep nails the talk track and the buyer says "send me more," the email actually lands. 98% accuracy, under $0.01 per email.

Win the deal on the call, then reach the buyer with data that connects.

Sales battlecard examples: 5 copy/paste templates (with 2 filled samples)

You'll get five battlecard formats below. Two are fully filled "Sample (fictional)" examples so you can see what "done" looks like, not just brackets.

1) Competitor "Why we win" battlecard (talk-track-first)

Use this if: reps face this competitor weekly and need a clean story. Skip this if: you don't have proof points yet. Build the objection card first.

Positioning in one line We win when buyers care about [primary outcome] without taking on [primary risk].

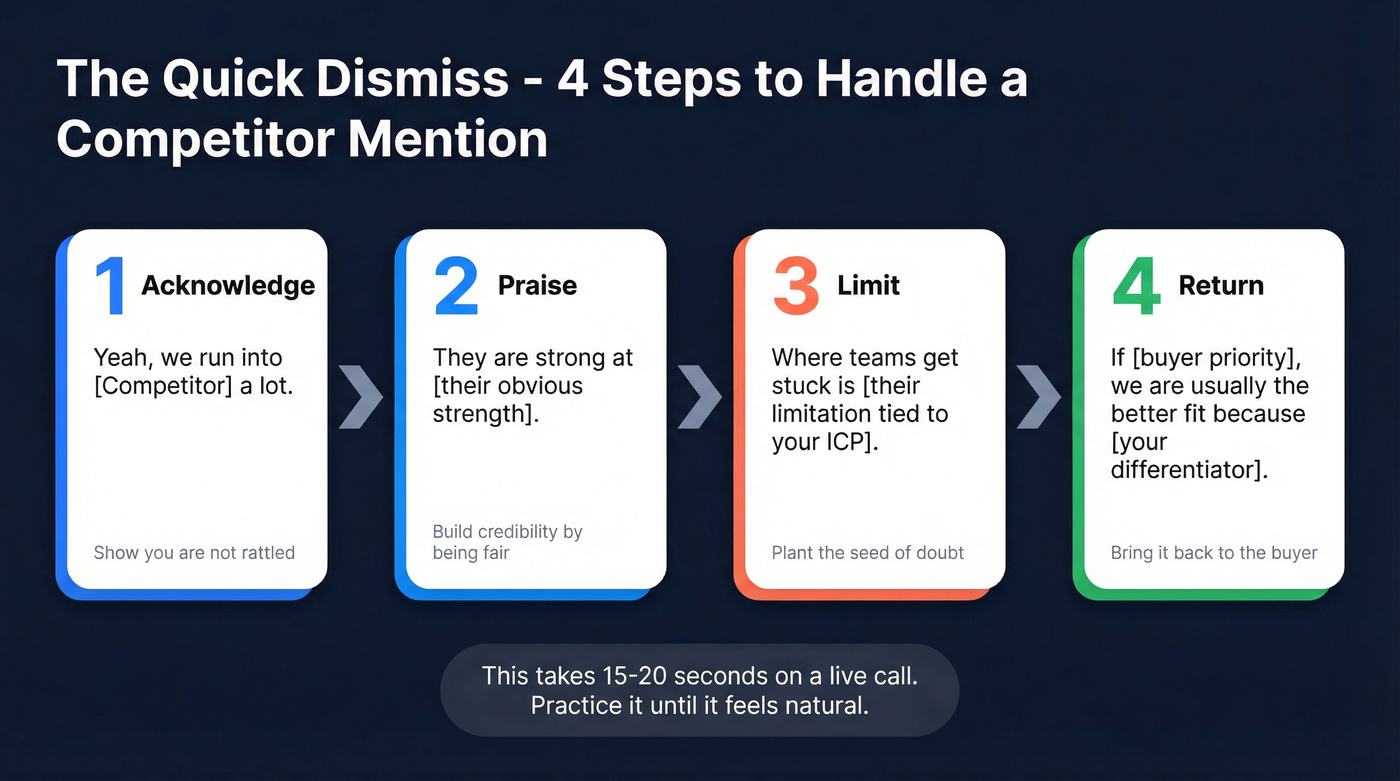

Quick dismiss (4-step)

- Acknowledge: "Yeah, we run into [Competitor] a lot."

- Praise: "They're strong at [their obvious strength]."

- Limit: "Where teams get stuck is [their limitation tied to your ICP]."

- Return: "If [buyer priority], we're usually the better fit because [your differentiator]."

Differentiators (pick 3, not 12)

- [Diff #1] -> buyer impact: [impact]

- [Diff #2] -> buyer impact: [impact]

- [Diff #3] -> buyer impact: [impact]

Proof points (proof or it's fan fiction)

- Customer story: [logo] cut [metric] in [time]

- Third-party: [review / benchmark / security cert]

- Product proof: [demo moment] in under [minutes]

When to concede (say it out loud) Concede if the buyer's #1 priority is [competitor strength] and they're willing to accept [tradeoff].

Landmines (3 buyer-asked questions)

- "How does [Competitor] handle [edge case] when [constraint]?"

- "What breaks when we integrate with [tool] and keep [workflow]?"

- "Where does cost expand - [seat type], [module], or [services]?"

Do not say (keep reps out of trouble)

- Don't say "they can't do X" unless you can show it.

- Don't say "everyone hates them."

- Don't try to recite their pricing. Use this instead: "I don't want to misquote their packaging. What I can do is map your use case and show where costs usually expand - seats, modules, and services."

Sample (fictional): "Northstar" vs "RivalCRM" - Why we win card

Positioning in one line Northstar wins when RevOps needs clean pipeline reporting and predictable process without turning every change into a services project.

Quick dismiss (4-step)

- "Yep - RivalCRM comes up a lot."

- "They're strong if you want a highly customized instance and you've got admins to run it."

- "Where teams get stuck is the admin overhead: every workflow tweak becomes a mini-implementation."

- "If your priority is fast adoption with reliable reporting, Northstar's the safer bet because we ship opinionated workflows that don't break when you scale."

Differentiators (3)

- Workflow changes without breakage -> fewer "one-off" exceptions and cleaner handoffs

- Reporting that matches reality -> forecast calls stop turning into spreadsheet debates

- Faster onboarding -> reps hit first value in days, not quarters

Proof points

- Customer story: "A 60-rep team cut forecast prep from 3 hours/week to 30 minutes in 45 days."

- Third-party: "Top-rated for ease of setup in G2 mid-market category."

- Product proof: "Live: build a stage + routing rule in 4 minutes, no admin ticket."

When to concede Concede if the buyer explicitly wants deep custom objects and bespoke workflows and already has 2+ dedicated admins to maintain it.

Landmines

- "When you add a new product line, how many fields, stages, and reports need to be rebuilt?"

- "What's the admin time per week to keep automations from conflicting?"

- "If you need a new integration, is it a connector - or a paid services statement of work?"

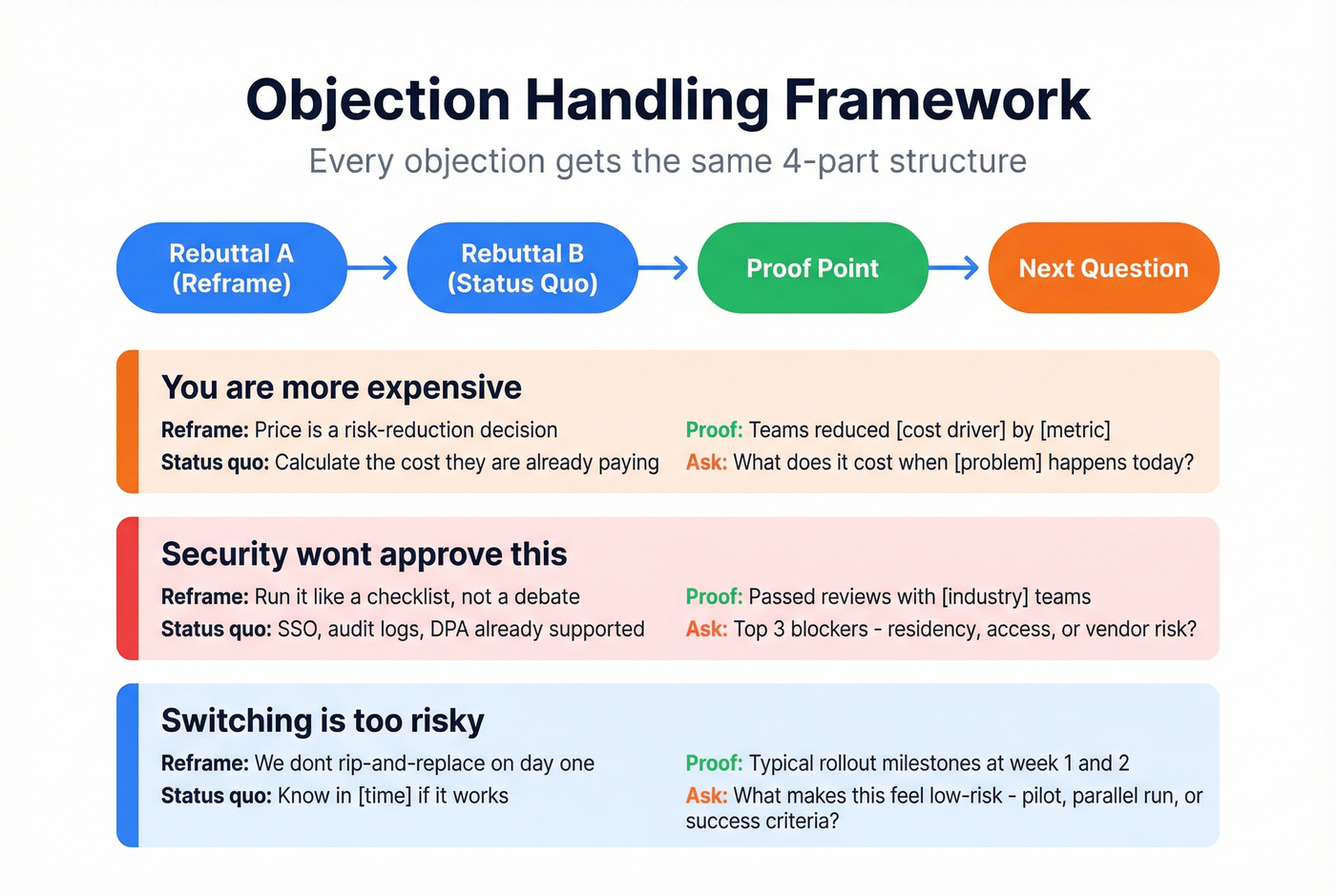

2) Objection-handling battlecard (price / security / switching risk)

Use this if: deals stall late with "too expensive," "security review," or "switching is risky." Skip this if: reps are losing earlier in discovery. Fix discovery coaching first.

Format: objection -> 2 rebuttals -> proof -> next question.

Objection: "You're more expensive."

- Rebuttal A (reframe): "Price is a risk-reduction decision. You're buying [outcome] with fewer [failure modes]."

- Rebuttal B (compare to status quo): "The real cost is [manual work / downtime / missed revenue] you're already paying."

- Proof: "Teams like [logo] reduced [cost driver] by [metric]."

- Next question: "What's the cost today when [problem] happens - time, headcount, or churn?"

Objection: "Security won't approve this."

- Rebuttal A (process): "Totally fair - let's run this like a checklist, not a debate."

- Rebuttal B (control): "We support [SSO / audit logs / DPA] and can share [security pack]."

- Proof: "We've passed reviews with [industry type] teams and [compliance] requirements."

- Next question: "What are your top 3 blockers - data residency, access controls, or vendor risk?"

Objection: "Switching is too risky."

- Rebuttal A (phased rollout): "We don't rip-and-replace on day one. We start with [small scope]."

- Rebuttal B (time-to-value): "You'll know in [time] if it's working because we measure [metric]."

- Proof: "Typical rollout: [week 1 milestone], [week 2 milestone]."

- Next question: "What'd make this feel low-risk - parallel run, pilot team, or success criteria in writing?"

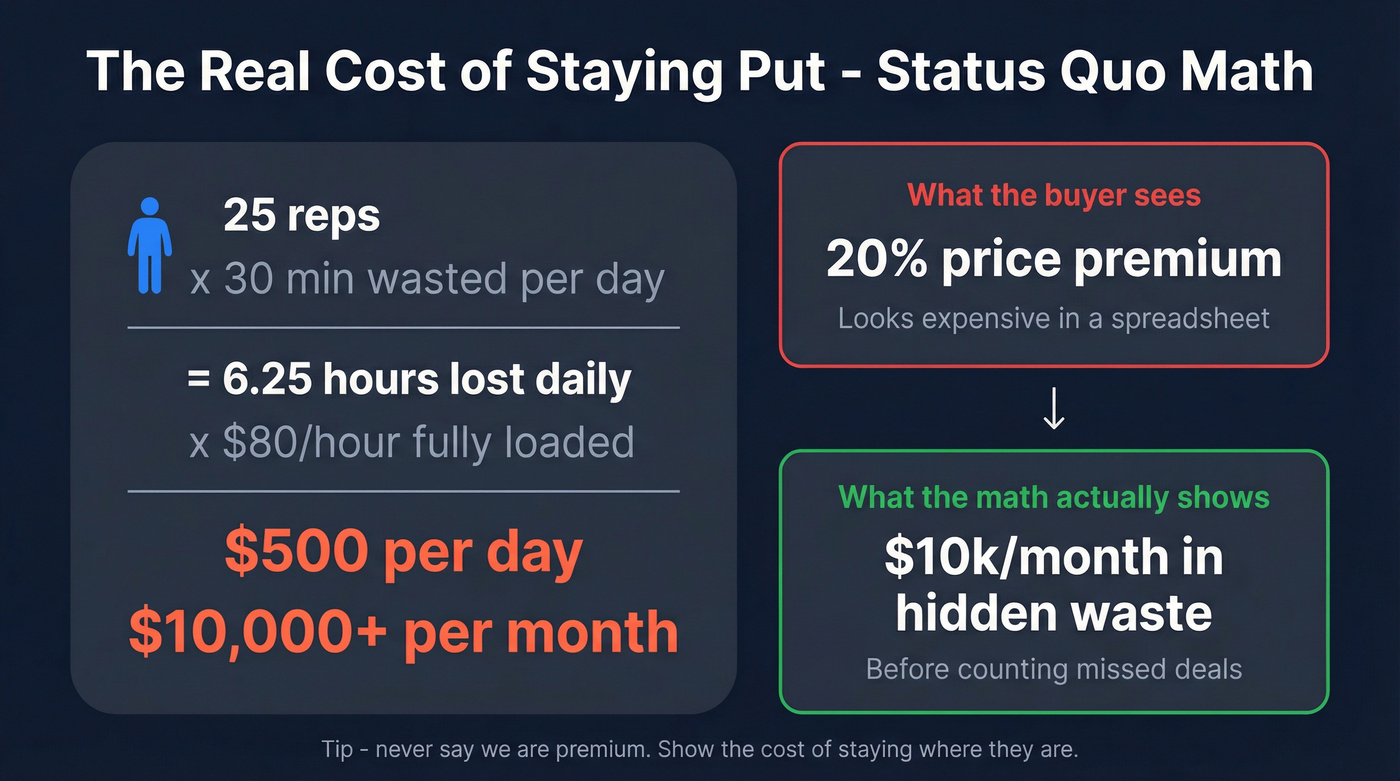

Sample (fictional): Price objection, done right (with numbers)

Objection: "You're 20% more expensive than the other option."

- Rebuttal A (reframe): "That 20% is insurance against churn and rework. The cheaper tool looks good in procurement and then costs you in adoption."

- Rebuttal B (status quo math): "If 25 reps waste 30 minutes/day fighting the workflow, that's 6.25 hours/day. At $80/hour fully loaded, you're burning ~$500/day - over $10k/month - before we even talk about missed deals."

- Proof: "A similar team cut admin tickets by 40% in the first 60 days because the workflow stopped breaking."

- Next question: "If we're still here 90 days from now, what's the one operational metric that proves this was worth it - rep time saved, stage conversion, or forecast accuracy?"

That's the difference between "we're premium" and "here's the cost of staying where you are."

3) Pricing & packaging battlecard (how to frame cost without a feature war)

Use this if: reps get dragged into "what's included" and lose control of the deal. Skip this if: you don't have clear packaging rules. Fix packaging first.

Core framing Price isn't a feature comparison. Price is a risk-reduction decision: uptime risk, adoption risk, compliance risk, and "we bought shelfware" risk.

Before you quote, ask these 5 questions

- "What's the business outcome you're tying this to?"

- "Who needs access - admins, power users, light users?"

- "What's the rollout timeline and who owns it?"

- "What systems must it integrate with on day one?"

- "What happens if this doesn't work - what's the fallback cost?"

Packaging talk track (keep it calm) "We price based on [value driver: seats/usage/outcome] because that tracks with the value you get. If we anchor on features, we'll both optimize the wrong thing."

Good / better / best (example template)

- Starter: for [simple use case] -> includes [3 bullets]

- Growth: for [team use case] -> adds [3 bullets]

- Enterprise: for [complex use case] -> adds [3 bullets]

Discounting guardrails

- Discount for term or scope clarity, not for "we asked."

- Trade discounts for: case study, multi-year, reference call, or faster procurement.

When to walk Walk if the buyer wants the cheapest option and won't define success criteria. That deal becomes a churn story.

4) Persona/industry battlecard (role-based pains + discovery coaching)

Persona anchor (copy/paste) Persona: "[Name], [Role] at a [company type]" Day-to-day reality:

- [bullet]

- [bullet]

- [bullet] What they're measured on:

- [bullet]

- [bullet]

- [bullet] What they fear:

- [bullet]

- [bullet]

- [bullet]

Discovery coaching (the part reps actually need) Ask these in order - each one sets up your differentiator.

- "What's the current workflow for [job]?"

- "Where does it fail - speed, accuracy, compliance, or handoffs?"

- "Who feels the pain first: frontline, managers, or customers?"

- "What happens when it fails - lost revenue, downtime, or risk?"

- "If we fixed this, what'd you do with the time/money you get back?"

3 pains you can lead with (say these early)

- "You're stuck with [manual process] that breaks at [scale]."

- "When [event] happens, you're the one getting paged."

- "You're judged on [metric], but your tools don't give you control."

Proof points that resonate with this persona

- Operational: [time saved / fewer escalations]

- Financial: [cost avoided / ROI]

- Risk: [compliance / audit / security]

Use this if: your product sells differently to different roles (IT vs Ops vs Finance). Skip this if: you only sell to one buyer type. Keep it simpler.

CTA for the rep "Based on what you said about [pain], can we map success criteria for a 30-day pilot?"

5) Replacement pitch battlecard (table-driven, blunt)

Start with the table. If the table doesn't land, the rest won't either.

Blunt comparison table (template)

| Decision factor | Keep [Competitor] | Switch to us |

|---|---|---|

| Time to value | Weeks/months | Days/weeks |

| Admin overhead | High | Low |

| Core workflow | Complex | Simple |

| Reporting | Setup-heavy | Out of the box |

| Integrations | Services-heavy | Standard connectors |

| Cost predictability | Add-ons | Clear tiers |

Replacement headline "[Competitor] is powerful - but it's overbuilt for teams that need [your ICP need] fast."

Migration plan (reduce switching fear)

- Week 1: [import / setup] + success criteria

- Week 2: [pilot team] + measure [metric]

- Week 3-4: expand + deprecate old workflow

Landmine questions (table-backed)

- "What's the admin time per week to keep it clean?"

- "What breaks when we add [integration]?"

- "What's the all-in cost after [modules/seats]?"

Use this if: you're displacing an incumbent and buyers want clarity. Skip this if: you're in a brand-new category. Use the "why change" narrative first.

Do not say Don't call the competitor "bad." Call the fit "wrong for this use case." Buyers trust that.

More talk tracks + landmine questions (copyable)

Quick dismisses and landmines solve different moments.

Quick dismiss (early stage): keep the call moving without starting a feature debate. Landmines (later stage): create doubt with buyer-asked questions the competitor struggles to answer.

Quick dismiss: the 4-step script

- Acknowledge: "Yep, we see them a lot."

- Praise: "They're good at [strength]."

- Limit: "They tend to struggle when [your ICP reality]."

- Return: "If [priority], we're usually the safer bet because [proof-backed reason]."

When to use it: first mention of a competitor, or when the buyer's just shortlisting.

Landmines: turn your differentiator into a question Landmines work best as buyer questions, not rep monologues:

- "What happens to reporting when we customize the process?"

- "How do you handle [edge case] without a services project?"

- "Where does the total cost expand - seats, modules, or implementation?"

Here's the thing: the integration-trap line works because it's calm and a little mischievous. Gong's phrasing style nails it: "Sure, they've got that feature and we don't. Pretty sure it doesn't integrate with that tool you use. Why don't you ask them about integrations the next time you chat? I'm curious what they have to say."

When to use it: after you've earned the right - mid/late stage, when the buyer's validating.

Battlecard quality rubric (and the 10-second speed test)

Battlecards don't fail because teams don't work hard. They fail because nobody enforces quality.

The bar's simple: answer in ~10 seconds. If it takes longer, the rep will improvise. And improvisation is where deals go to die.

Scoring rubric (0-2 per row)

| Dimension | 0 | 1 | 2 |

|---|---|---|---|

| 10-sec scannable | wall of text | skimmable | instant |

| Talk-track-first | features | mixed | scripts |

| Proof included | none | weak | specific |

| Discovery coaching | none | generic | next Qs |

| Landmines | none | soft | sharp |

| Concede rules | none | implied | explicit |

| Update owner | nobody | shared | named |

| Where it lives | buried | link | in flow |

Interpretation

- 0-6: enablement theater. Looks busy, doesn't help reps.

- 7-12: usable, but you'll still hear "I couldn't find it."

- 13-16: this gets used on live calls.

Quality checklist (the "proof points or it's fan fiction" edition)

- Every differentiator has a proof point (customer, metric, demo moment, or doc).

- Every objection ends with a next question.

- Every card has a "when to concede" line.

- Every card has a date + owner.

- Every card has one primary CTA for the rep (book pilot, send security pack, etc.).

What reps actually complain about (and they're right)

Across enablement teams, the same complaints show up every time:

- "I couldn't find it mid-call."

- "It said pricing/integrations were one thing, and the buyer proved me wrong."

- "It's too long - there are 12 edge cases and none of them are mine."

- "It reads like PMM trying to win an argument, not me trying to win a deal."

I've watched a top AE close a competitive deal with one line from a good card, and I've watched a different rep torch trust by repeating one stale pricing claim from a "pretty" card. Same competitor, same quarter, totally different outcome.

Fix those four complaints and adoption jumps without any fancy tooling.

How long this takes (benchmarks that stop enablement theater)

A usable battlecard shouldn't take weeks. Build v1 fast, then keep it alive.

Real talk: if your process requires three weeks, five stakeholders, and a 30-slide deck, you're not building battlecards. You're producing content.

Practical benchmarks we've used with teams

- Competitor v1 (usable): 2-8 hours

- Monthly maintenance per competitor: 15-60 minutes

- New "hot objection" patch: 10-20 minutes

Simple timeline

- Day 1: draft talk tracks + landmines

- Day 2: add proof + "when to concede"

- Day 3: ship, then collect rep feedback from real calls (make this part of your win-loss analysis loop)

Governance, distribution, and keeping battlecards updated

Most teams think the hard part's writing the card. The hard part's keeping it trusted.

The adoption gap's brutal: plenty of teams publish battlecards, and then the field ignores them because one wrong line about pricing or integrations poisons the whole asset. Once reps get burned, they stop opening the doc and start freelancing on calls.

Look: if it isn't in the rep's workflow, it doesn't exist.

Common failure modes (the ones I've seen over and over)

- Stale data kills trust. One wrong line and reps stop opening the card.

- Hard to find. If it's in a folder, it's gone.

- Not actionable. If it reads like Wikipedia, it won't get used mid-call.

Battlecard operating system (copy/paste checklist)

- Owner: one name per competitor (usually PMM or CI).

- Cadence: monthly review + quarterly deeper refresh.

- Triggers: pricing/packaging change, major launch, new integration, new security posture, win/loss pattern shift, competitor funding/acquisition.

- Versioning: v1.3 with date + "what changed" line at top.

- Proof discipline: every claim links to a doc, screenshot, or customer story.

- Legal/procurement sanity: pre-approved language for sensitive comparisons.

- Distribution: put it where reps already work (CRM record, deal room, or a pinned channel).

- Feedback loop: one-click "Was this useful?" + a Slack/CRM comment thread.

- Champions (the adoption cheat code):

- Nominate 2-3 "competitive champs" (top AEs or the reps everyone copies).

- Require one win call/month where they annotate: "battlecard line used" + the moment it landed.

- Share the clip and the exact line in Slack/CRM so the team steals it immediately.

If you want one place to start, put the card on the opportunity record under a "Competitive" section. That's where the pain happens.

How to measure if battlecards work (4 metrics that aren't vanity)

If you don't measure it, you'll keep "refreshing" battlecards nobody uses.

Track these four:

Battlecard attach rate on competitive opps

- Definition: % of opps with a competitor field where the battlecard link is attached (or logged)

- Target: 60-80% once distribution's fixed

Weekly active usage in competitive segments

- Definition: % of reps who open a battlecard at least once per week and are working competitive opps

- Target: 50%+ (lower than that means it's still "nice to have")

Competitive win rate vs top 3 competitors (before/after)

- Definition: win rate when Competitor A/B/C is present, compared quarter-over-quarter

- Target: +5-10 points over 1-2 quarters if your cards are actually used

Stage velocity / conversion when competitor is present

- Definition: time in stage (or conversion rate) for competitive opps vs non-competitive opps

- Target: faster movement in the "evaluation" stage and fewer late-stage stalls

One more metric I like: time-to-first-response after a competitor's mentioned. If reps can answer cleanly in the moment, you'll see fewer "let me get back to you" follow-ups and fewer awkward pivots into feature bingo.

Mini-variants: BDR vs AE vs CSM battlecards (don't ship one card to everyone)

One of the fastest ways to kill adoption is forcing the same card on roles with different jobs.

BDR version (30 seconds, outbound-first)

- Needs: 1-liner positioning, 3 pains, 3 landmines, 2 proof points

- Goal: earn a meeting, not win a feature debate

- Rule: if it doesn't fit on a single screen, it's too long

AE version (call control + deal strategy)

- Needs: quick dismiss, discovery coaching, concede rules, replacement table, security/pricing posture

- Goal: control the evaluation and prevent late-stage stalls

CSM/AM version (renewal + expansion defense)

- Needs: "why stay" narrative, competitive traps to avoid, proof of ROI, and a save play

- Goal: protect the base and stop competitor wedge plays

Same competitor, three different jobs. Build three variants or accept that nobody will use the one-size-fits-all card.

Templates & formats you can copy (Docs, Sheets, Slides, Figma)

The format matters less than speed. Pick the thing your reps will actually open during a call.

Sales Enablement Collective has templates in Docs/PDF/XLSX formats, and ClickUp's roundup includes examples in Figma, Google Sheets, and Google Slides. Start with one and customize it instead of inventing your own structure.

Useful links:

Format comparison table

| Format | Best for | Downside | Owner |

|---|---|---|---|

| Google Doc | talk tracks | gets long | PMM/Enable |

| locked copy | hard to edit | PMM | |

| Google Sheet | tables/pricing | ugly live | RevOps/PMM |

| Slides | story + visuals | bloat risk | PMM |

| Figma | clean layout | access friction | PMM/Design |

Battlecard type vs when to use vs must-include fields

| Card type | When to use | Must-include fields |

|---|---|---|

| Why we win | competitor mention | talk track + proof |

| Objections | late-stage stalls | rebuttals + next Q |

| Pricing | quote requests | framing + questions |

| Persona | multi-buyer deals | pains + discovery |

| Replacement | incumbent present | table + plan |

Tool tiers for battlecards (what to use, what it costs, and what it's best at)

You can run battlecards in a Google Doc. You can also run them like a system. Here's the clean way to think about tools.

Tier 2 - Dock, Klue, Gong (best for distribution + competitive workflows)

Dock: Great for deal rooms and keeping competitive assets close to the opportunity. It also has one of the best public libraries of battlecard artifacts, which makes it unusually useful for training PMMs on what "good" looks like. Pricing's typically mid-market SaaS: expect roughly $1k-$5k/month depending on seats and use case.

Klue: Strong competitive enablement workflows: collection, curation, and pushing updates to the field. If you're serious about CI and you're tracking multiple competitors, Klue's a grown-up choice. Pricing usually lands in the $15k-$60k/year range for mid-market teams, higher for enterprise.

Gong: Not a battlecard tool, but it's the best truth serum for battlecards. Use call clips to prove which lines land, which objections repeat, and which competitor claims are actually showing up. Pricing's typically enterprise-grade: expect $1.2k-$1.8k per user/year (often sold as an annual platform deal).

Tier 3 - Crayon/Kompyte, Spekit, Segment8 (best for CI scale, in-flow enablement, and fast creation)

Crayon / Kompyte: CI platforms for monitoring competitor moves and distributing intel. If your market shifts weekly and you need alerts, newsletters, and a CI program, they fit. Pricing's commonly $20k-$100k/year depending on scope and seats.

Spekit: In-app enablement that lives inside the workflow. If your biggest problem is "reps don't open docs," Spekit's overlays and in-context guidance can fix that. Pricing typically runs $20-$40 per user/month.

Segment8 (pricing as of 2026-02-17): A simple way to produce clean, usable competitive cards fast.

- Solo: $79/month

- Pro: $299/month (up to 10 seats)

- Studio: $499/month (up to 20 seats)

My opinion: if you're early, start with Segment8 (or docs) plus call recordings. If you're scaling CI, add Klue or Crayon. If you want battlecards to create pipeline, pair the play with a target-list workflow.

Turn a battlecard into pipeline (target list + verified contacts)

Battlecards fail when reps can't act immediately.

A rep reads, "We win in fintech mid-market with SOC 2 plus fast onboarding" and then... what? If they can't pull a target list and start outreach the same day, the battlecard's just content with better formatting.

- Turn the play into an account filter

Define: industry, headcount, region, tech stack, funding, hiring signals, and the 1-2 roles you need to multi-thread. (If you're running ABM, align this with account identification and account scoring.)

Use the database and 30+ search filters until the list matches your play.

Export verified contacts (don't guess emails) Prospeo delivers 98% email accuracy on a 7-day refresh cycle. Freshness is the difference between booked meetings and bounce city. (If you want the workflow, see how to verify an email address.)

Add mobiles when the deal's high-stakes Prospeo includes 125M+ verified mobile numbers globally with a 30% pickup rate. Use mobiles selectively (director+ is a common rule) when you need a clean path to a decision-maker. (More on sourcing direct dials: B2B phone number.)

Launch outreach with a battlecard-first message Your first email isn't "checking in." It's the battlecard angle: the risk you reduce, the outcome you drive, and one landmine question that forces a real reply. (If you need structure, use a proven B2B cold email sequence.)

I've seen teams do the opposite: they build a gorgeous competitor card, everyone claps, and then the BDR asks, "Cool... who do I send this to?" and the whole thing dies in a spreadsheet. Don't do that to yourself.

Battlecards tell reps what to say. Prospeo tells them who to say it to. Layer 30+ filters - buyer intent, technographics, job changes - to find the exact accounts where your competitive positioning hits hardest. 143M+ verified emails ready to go.

Stop building battlecards for leads you can't even reach.

FAQ

What should a sales battlecard include (minimum viable version)?

A minimum viable battlecard includes eight parts: 1-line positioning, a 4-step quick dismiss, three differentiators with proof, three objections with rebuttals, three landmine questions, a "when to concede" line, an owner + date, and one next step. If it can't be scanned in ~10 seconds, cut it.

How long should a battlecard be?

A battlecard should be one page (or one screen) for live-call use, with optional links to deeper docs. If it turns into a deck, reps won't open it mid-conversation. Keep the core card under ~250-400 words and push details into linked assets.

How often should battlecards be updated (and what triggers an update)?

Update battlecards monthly, with same-day patches when something changes. The best triggers are pricing/packaging updates, major launches, new integrations, security posture changes, competitor funding/acquisitions, and repeated win/loss themes. One stale fact can drop usage fast, so ship small fixes within 24 hours.

How do you turn a battlecard into outbound meetings quickly?

Turn the card into a target list, then launch outreach the same day with one risk-reduction angle and one landmine question. Prospeo's built for this workflow: 98% email accuracy, a 7-day refresh cycle, and a free tier with 75 emails plus 100 Chrome extension credits per month to test the loop without procurement drama.

Summary: how to use these sales battlecard examples without creating "enablement theater"

Use these sales battlecard examples as formats, not artifacts: pick the three cards that match your deals, enforce the 10-second speed test, and ship v1 fast with proof, landmines, and concede rules. Then put the card where reps actually work, measure attach rate and win rate, and update monthly so the field keeps trusting it.