How to Build an Account List That Actually Drives Pipeline

You're targeting 500 companies, running three campaigns, and generating maybe 50 leads a month. Same ads, minimal personalization, generic content that covers every job role and industry you can think of. Sound familiar? That's not ABM - that's spray-and-pray with a fancier label.

Here's the uncomfortable truth: 71% of B2B practitioners now run some form of ABM, but 47% can't prove ROI. The gap between those two numbers isn't strategy - it's the account list. A sloppy list poisons everything downstream: your targeting, your personalization, your sales team's trust in marketing. Fix the list, and the rest compounds. Forrester found that companies shifting focus from individual MQLs to buying groups and account-level opportunities saw a 200% increase in win rates and an 800% increase in opportunity progression. That's not a marginal improvement. That's a different sport.

This is the guide I wish someone had handed me before I watched teams burn quarters building lists that went nowhere.

What You Need (Quick Version)

If you're short on time, here's the framework:

- Define your ICP using data from three departments - finance, support, and sales. Not just sales.

- Build your list using four data types: firmographic, technographic, behavioral, and spend intelligence.

- Tier accounts into three levels - Tier 1 (10-20 accounts, 1:1), Tier 2 (50-100, 1:Few), Tier 3 (100-200+, 1:Many).

- Enrich with verified contact data. You need 5-8 contacts per account - the full buying committee, not one name.

- Refresh quarterly. Update intent signals monthly. Expect ~20% list turnover every quarter.

Looking for a personal account list to track bank accounts or finances? This guide covers B2B target account lists for sales and marketing. A spreadsheet or personal finance app is what you need for that.

What Is an Account List in B2B Sales?

An account list is a curated set of companies your sales and marketing teams have agreed to pursue, organized by fit, value, and likelihood to buy.

It's the foundation of every ABM program - the document that turns "we should target mid-market SaaS companies" into a specific, actionable set of targets with names, tiers, and contact data attached.

There are a few flavors worth distinguishing:

- Target account list (TAL): The broader strategic list of companies that match your ICP. This is your universe.

- Named account list: The curated subset your sales team is actively pursuing right now. Smaller, sharper, and tied to quota.

- Static lists: Built once, reviewed periodically. Good for campaign snapshots.

- Dynamic lists: Auto-updated based on criteria like intent signals, engagement scores, and firmographic changes. Better for ongoing programs.

One distinction that trips people up: segmentation and tiering aren't the same thing. Segmentation divides accounts by shared characteristics - industry, company size, tech stack. Tiering ranks them by perceived value and potential. You segment first, then tier within segments.

The ABM market hit $1.07 billion in 2023 and is projected to reach ~$2 billion by 2032, with 80%+ of companies planning to increase their ABM budgets. That growth is driven by one realization: broad demand gen doesn't work as well as it used to. Focused targeting through curated lists is how you cut through the noise.

Your account list is only as good as the contact data behind it. Prospeo gives you 5-8 verified buying committee contacts per account - 300M+ profiles, 98% email accuracy, 125M+ direct dials - with 30+ filters for firmographics, technographics, intent, and headcount growth. All refreshed every 7 days, not 6 weeks.

Stop building account lists you can't actually reach.

Why Your Target Account List Matters - The Data

Companies with aligned ABM strategies see 208% more revenue from their marketing efforts and close deals 40% faster.

Those numbers alone justify the investment, but the real story is about what happens when you change the unit of analysis. Most teams still measure ABM success by MQLs - individual leads filling out forms. Forrester's research demolished that approach: shifting from MQL tracking to buying group and opportunity tracking produced a 200% increase in win rates and an 800% increase in opportunity progression. A well-built account list forces you to think in accounts and buying committees instead of individual leads. That shift in thinking is worth more than any tool you'll buy.

ABM also cuts waste. Teams running account-based programs reduce time spent on unproductive sales prospecting by 50%. When your reps know exactly which accounts to pursue and have verified contact data for the buying committee, they stop cold-calling into the void. Understanding how to prospect accounts systematically - rather than chasing random leads - is the difference between a pipeline that compounds and one that stalls.

Contrast that with the practitioner from Reddit running "ABM" against 500 companies with the same ads and generic content. Fifty leads a month, no SQL attribution, sales team disengaged. The list wasn't the only problem, but it was the first one.

How to Build Your Account List - Step by Step

Define Your Ideal Customer Profile

Your ICP isn't a persona doc that marketing wrote in a conference room. It's a data-backed description of the companies where you win, retain, and expand - built from conversations with people who actually touch customers.

Gravity Global's framework nails the approach: talk to three departments.

- Finance tells you which clients are most profitable (not just biggest - profitable).

- Customer support tells you which clients are pleasant to work with and which churn or drain resources.

- Sales tells you which customers "sold themselves" - short cycles, high close rates, minimal discounting.

The overlap between those three conversations is your ICP.

Once you've identified the pattern, document it with specifics:

- Industry/vertical

- Annual revenue range

- Employee count

- Geography

- Tech stack (what they already use)

- Business maturity stage

- Company status (public, private, PE-backed)

Winning by Design recommends a simple ICP statement: "Our ideal client is a [geography]-based [industry] company with [revenue model]. It's in [growth stage], and has a customer base mostly made up of [customer type]."

Their methodology starts with your current customers, narrows to the highest-value ones (biggest contracts, most expansions, most referrals, most active usage), and extracts the common patterns. It's bottom-up, not top-down.

One critical note: your ICP should be a guideline, not a rigid checklist. A company that matches 7 of 8 criteria and shows strong intent signals is a better target than one that matches all 8 but has zero engagement. I've seen teams disqualify great-fit accounts because they were 15 employees under an arbitrary threshold. Don't do that.

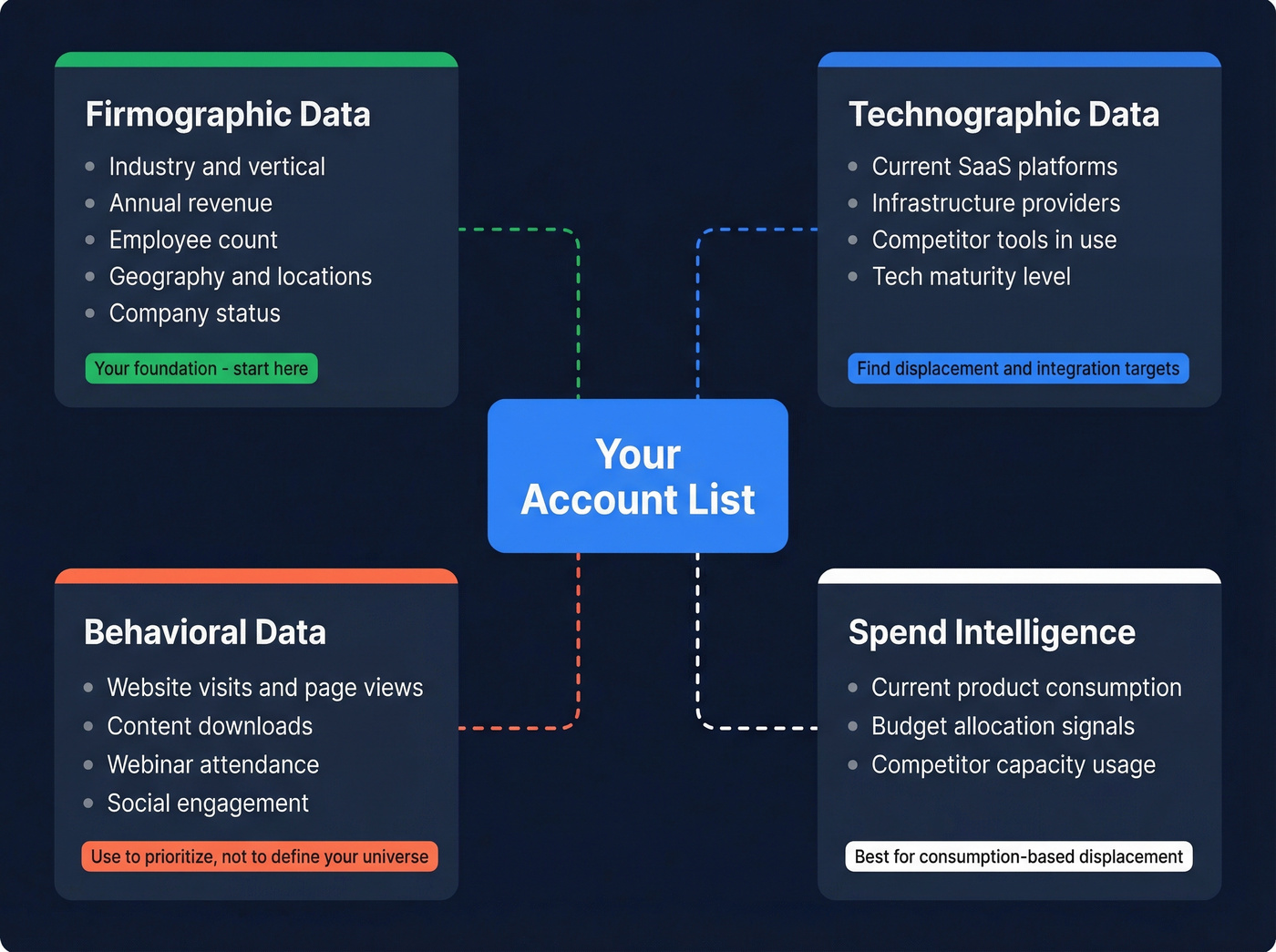

Build Your List Using Four Data Types

HG Insights lays out a clean taxonomy for the data that feeds your targeting. Four types, each serving a different purpose:

Firmographic data is your foundation. Industry, annual revenue, employee count, number of locations, company status (C-Corp, LLC, non-profit, government), and market share. This is the "does this company look like our best customers?" filter. When you build a company list by industry, firmographics are the first lever you pull - narrowing your universe to verticals where you've already proven product-market fit. Most teams start and stop here. That's a mistake.

Technographic data tells you what a company already uses. SaaS platforms, infrastructure providers, marketing tools, security stack. If you sell a Salesforce integration, knowing which companies run Salesforce is table stakes. If you're displacing a competitor, knowing who uses that competitor is gold - and it's one of the fastest ways to build a prospect list from competitors' existing customer bases.

Behavioral data captures what accounts are doing right now - downloading whitepapers, visiting your pricing page, attending webinars, engaging on social. 91% of B2B tech marketers use intent data to prioritize accounts. But here's the warning: don't rely purely on behavioral data for initial list building. It only captures accounts already in your funnel. Use it to tier and prioritize, not to define your universe.

Spend intelligence reveals how much of a product a company is already consuming and where it's deployed. This is especially powerful for consumption-based tech companies - if a prospect is maxing out a competitor's capacity, they're a natural expansion or displacement target.

To actually build the list, use a mix of identification methods:

- Mine your CRM for lookalikes of your best customers

- Research competitors' customers (case studies, logos on their website, review sites like G2 and TrustRadius)

- Look at your customers' competitors - if your tool works for Company A, their direct competitor has the same problems

- Set up job alerts for buyer persona titles at target companies (a VP of RevOps hire signals budget and initiative)

- Use ABM tech to surface accounts showing intent signals

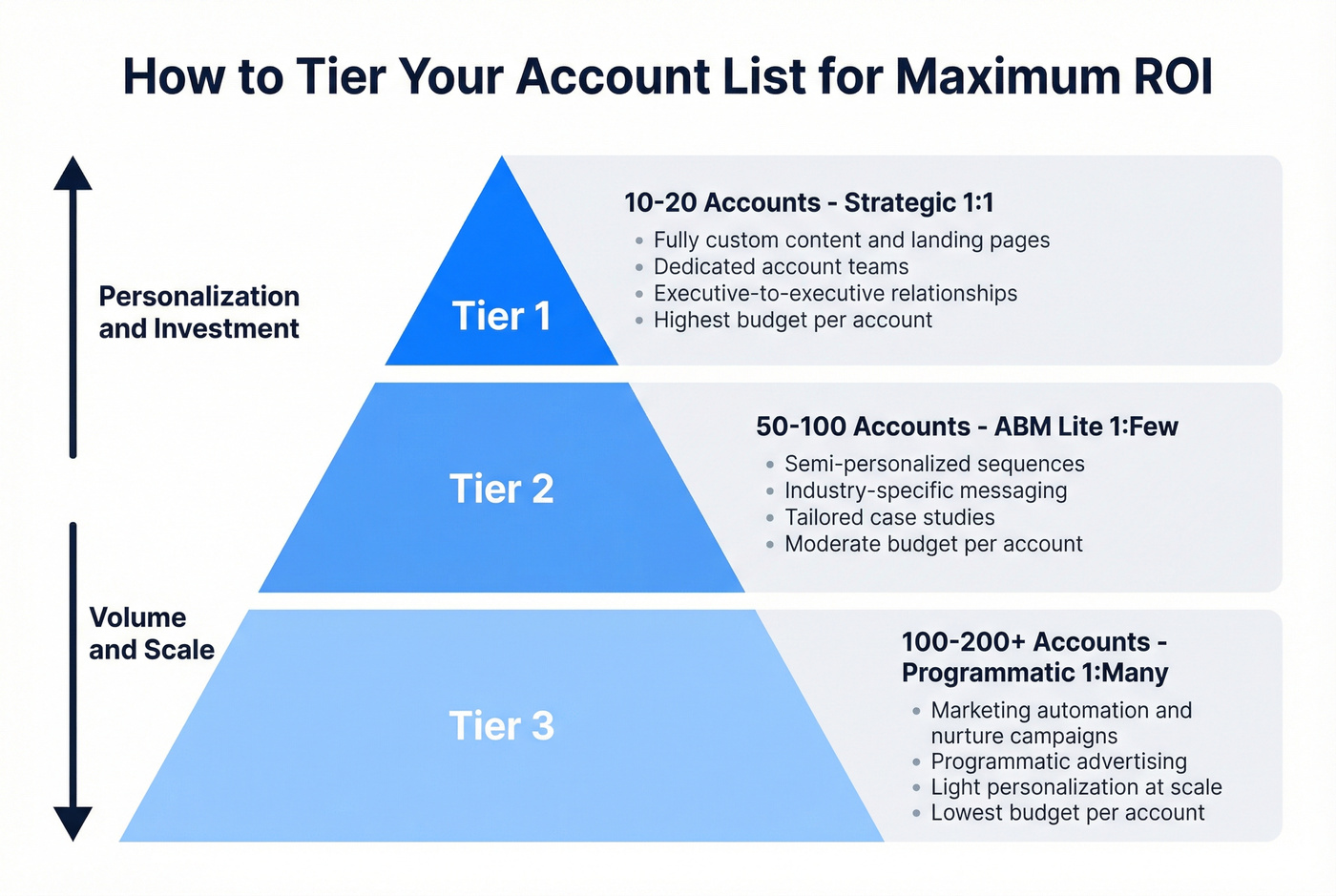

Tier and Prioritize Your Accounts

Most teams build a list of 500 accounts and treat them all the same. That's the single fastest way to waste your ABM budget.

Tiering fixes this. It's how you allocate finite resources - sales time, content budget, ad spend - against accounts with different value and readiness levels. And it's not optional: 69% of top-performing ABM companies have a dedicated ABM leader driving this kind of disciplined prioritization.

The standard framework uses three tiers:

| Tier 1 | Tier 2 | Tier 3 | |

|---|---|---|---|

| Accounts | 10-20 | 50-100 | 100-200+ |

| ABM approach | Strategic (1:1) | ABM Lite (1:Few) | Programmatic (1:Many) |

| Personalization | Fully custom | Semi-personalized | Light, at scale |

| Sales plays | Dedicated teams, custom content | Personalized sequences | Marketing automation |

| Budget | Highest per-account | Moderate | Lowest per-account |

Tier 1 accounts are your whales. Perfect ICP fit, highest revenue potential, strategic logos. These get dedicated account teams, custom content, executive-to-executive relationships. You might build a custom landing page for a single Tier 1 account. That's not overkill - that's the point.

Tier 2 accounts are strong fits that don't quite justify 1:1 treatment. Cluster them by industry or use case and run semi-personalized sequences. Industry-specific messaging, tailored case studies, personalized outreach cadences.

Tier 3 is your broadest bucket. These accounts meet basic ICP criteria but have lower immediate revenue potential. Marketing automation, nurture campaigns, and programmatic advertising do the heavy lifting here.

Look - Invoca tiered 4,500 target accounts using firmographic data plus custom signals like paid search spend and web-to-mobile traffic ratio, pulled from Datanyze, SimilarWeb, and InsideView. That level of specificity is what separates a useful tier from an arbitrary one.

Think of it as a funnel within a funnel. Out of 100 target accounts, aim for 60 to become "aware," 30 to show "interest," and 10 to enter a sales conversation. Userpilot set a $3.5M pipeline goal against a $350K ABM budget - $10 in pipeline for every $1 spent. That math only works with tiering.

Two things to remember. First, tiering is dynamic. A Tier 2 account that suddenly shows high engagement or hires a champion you know should move to Tier 1. Second, without tiering, reps gravitate toward the "loudest" accounts - the ones who reply quickly - rather than the highest-value ones. Tiering is discipline.

Enrich and Verify Your Data

Most teams cut corners here. And it's where most ABM programs quietly die.

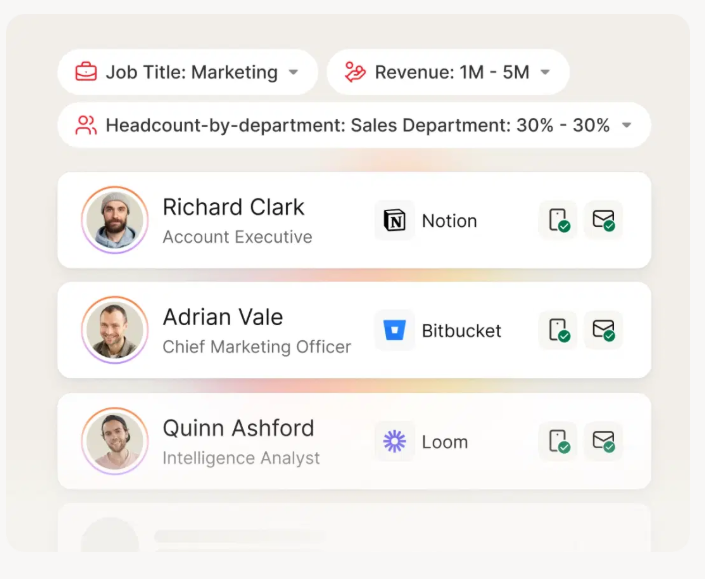

What goes wrong: A list of company names without verified contact data is a wish list, not a working list. You can't run personalized sequences against "Acme Corp." You need the VP of Engineering's verified email, the CFO's direct dial, and the Director of IT's mobile number. You need the buying committee mapped - influencers, decision-makers, economic buyers, and champions. Not one contact per account. Five to eight.

43% of B2B marketers battle unreliable data when choosing targets. That's not a minor inconvenience - it means nearly half the market is running campaigns against stale, incomplete, or flat-out wrong contact information. We've seen teams launch sequences against lists where 30-40% of emails bounce because nobody verified the data before hitting send. That doesn't just waste time - it damages your domain reputation and tanks deliverability for every future campaign.

What to do instead: Upload your compiled targets to an enrichment tool and pull verified contacts for each account. Prospeo handles this well - 300M+ professional profiles with 98% email accuracy, 125M+ verified mobile numbers, and a 7-day data refresh cycle that prevents you from emailing someone who left the company six weeks ago. Intent data across 15,000 topics helps you prioritize which accounts to enrich first.

The key workflow: start with your Tier 1 accounts, map the full buying committee (5-8 contacts per account), verify every email and phone number, then work down to Tier 2 and 3 with progressively lighter enrichment. Don't try to enrich 500 accounts to the same depth - that's tiering applied to data operations.

Manage and Refresh Your List

Building the list is the hard part. Keeping it alive is the part everyone forgets.

Set a quarterly full review cadence. Every 90 days, revisit your entire list against your ICP criteria. Companies get acquired. Champions leave. Priorities shift. Expect roughly 20% of your list to turn over each quarter due to job changes, company changes, and shifting market conditions.

Between full reviews, update intent signals and engagement data monthly. An account that was cold in January might be actively researching your category in March. You need to catch that.

Define clear entry and exit criteria:

- Entry: New accounts that match your ICP and show intent signals, or existing accounts that re-engage after going dark

- Exit: Accounts that go dark for 2+ quarters, get acquired, no longer fit your ICP, or explicitly opt out

As Rhiannon Blackwell, ABM Leader at PwC, puts it: "We need to be more flexible and responsive, moving beyond the layers of the triangle to adopt a dynamic, client-centric strategy."

Static lists work for campaign snapshots - "these are the 50 accounts we're targeting in Q2." Dynamic lists, auto-updated based on intent signals and engagement scores, work better for ongoing programs. Most mature ABM teams use both: a static named account list for Tier 1, dynamic lists for Tier 2 and 3.

How to Size Your Account List

The right list size depends on your stage, your team, and your sales capacity. There's no universal number, but there are useful benchmarks.

- Early-stage companies: 50-200 accounts. You don't have the content, budget, or sales bandwidth for more. Focus beats coverage.

- Mid-market teams: 200-500 accounts. Enough to run tiered programs across multiple segments.

- Enterprise organizations: 500-5,000+. Invoca ran 4,500 accounts. At this scale, tiering isn't survival - it's oxygen.

A practical constraint: each SDR can effectively work 50-150 accounts. If you've got 3 SDRs and a 700-account list, the math doesn't work unless most of those accounts are in Tier 3 running on automation.

The Reddit example is instructive: 700 accounts targeting 40 SQLs is a 5.7% conversion rate. For well-targeted ABM lists, 5-15% conversion from target list to opportunity is the benchmark. Below 5%, your list is too broad or your data is bad. Above 15%, your list might be too narrow - you're leaving pipeline on the table.

The ABM Benchmark Survey found that 29% of marketers target between 101 and 500 accounts. That's the sweet spot for most mid-market teams.

A 100-account list with verified data and proper tiering will outperform a 5,000-account list of company names every single time. List quality compounds. List size doesn't. If your average deal size is under $25K, you probably don't need more than 200 accounts - you need better data on the 200 you have.

Best Tools for Building and Enriching Account Lists

The tool you need depends on what you're actually doing - identifying accounts, enriching contact data, or running full ABM programs. Here's how things break down:

| Tool | Category | Best For | Pricing | Email Accuracy |

|---|---|---|---|---|

| Prospeo | Data Enrichment | Verified emails + mobiles | Free, ~$0.01/email | 98% |

| Apollo.io | Data + Outreach | All-in-one prospecting | Free + from $49/mo | 70-80% |

| ZoomInfo | Data Platform | Enterprise data breadth | $15K-40K/yr | 85-91% |

| Cognism | Data Platform | European data, GDPR | $15K-30K/yr | 85-93% |

| Clay | Enrichment Workflows | Multi-source automation | From $149/mo | 75-85% |

| Lusha | Data Enrichment | Quick contact lookups | From $36/mo | 70-82% |

| Hunter.io | Email Finding | Email-only use cases | From $34/mo | 90%+ |

| Sales Navigator | Account ID | Account identification | From $99/mo | N/A |

| HubSpot Marketing | ABM Platform | Budget ABM execution | From $800/mo (Pro) | N/A |

| Demandbase One | ABM Platform | Enterprise full-stack | $30K-100K+/yr | N/A |

| 6sense | ABM Platform | AI buying predictions | $30K-100K+/yr | N/A |

| RollWorks | ABM Platform | Mid-market ABM ads | ~$1K-5K/mo | N/A |

| Bombora | Intent Data | Standalone intent signals | ~$2K-10K/mo est. | N/A |

$500-5K/month: Add Clay for multi-source enrichment workflows, Sales Navigator for account validation, and consider Bombora or a platform with built-in intent data for prioritization signals.

$5K+/month: This is where Demandbase, 6sense, or RollWorks enter the picture for full-stack ABM orchestration. RollWorks is solid for mid-market display advertising, though its orchestration capabilities are thinner than Demandbase or 6sense at higher price points. Even at this budget, you still need clean contact data underneath - the enrichment layer is where campaigns succeed or fail.

Skip Lusha if your primary need is mobile numbers outside the US and Europe. Its coverage gets thin fast in APAC and LATAM.

Tiering accounts without real intent data is guesswork. Prospeo tracks 15,000 buyer intent topics via Bombora, layers in job change signals and technographic filters, and returns 50+ data points per contact - so your Tier 1 list is built on evidence, not assumptions. Teams using Prospeo book 26% more meetings than ZoomInfo users.

Turn your ICP criteria into a pipeline-ready target account list today.

Account List Mistakes That Kill Your ABM

I've watched teams make every one of these. Some of them more than once.

1. Starting without a defined ICP or target accounts. Jumping straight into campaigns without agreeing on who you're targeting is the most expensive mistake in ABM. You'll build content nobody needs, target accounts that'll never close, and waste a quarter before anyone notices. If you need a tighter definition, start with your ICP and work outward.

2. Treating ABM like lead gen. If you're measuring ABM success by MQLs, you're doing it wrong. Forrester's data is unambiguous: shifting from MQL tracking to buying group and opportunity tracking produced a 200% increase in win rates. ABM measures account engagement, pipeline velocity, and deal size - not form fills.

3. Targeting too many accounts with generic messaging. This is the Reddit practitioner's problem - 500 accounts, same ads, minimal personalization. That's not ABM. That's demand gen with a named list attached. Resources spread too thin means no account gets enough attention to convert.

4. Sending one-size-fits-all content. Personalizing the first name in an email isn't personalization. Each tier needs content tailored to industry, role, and buying stage. A CTO evaluating your security posture needs different content than a VP of Sales evaluating your ROI.

5. Sales-marketing misalignment.

| What teams do | What actually works |

|---|---|

| Sales and marketing define success differently | Shared KPIs: pipeline velocity, account engagement score, deal size |

| Duplicate outreach from both teams | Unified account ownership with clear handoff triggers |

| Marketing throws MQLs over the wall | Joint account planning sessions, weekly or biweekly |

93% of marketers say alignment is vital to ABM success, yet 43% cite it as a top challenge. Poor alignment adds 30% to your sales cycle length - that's not a soft cost, it's real revenue delayed. If you want a measurement system that doesn't lie, focus on pipeline quality (not vanity volume).

6. Focusing on individual leads instead of buying committees.

The average B2B purchase involves 6-10 decision-makers. Targeting one contact per account is like trying to win a board vote by convincing one board member. Map the full committee: influencers, decision-makers, economic buyers, champions. (More on committee mapping and messaging in account-based marketing personas.)

7. Never enriching or verifying contact data. 43% of B2B marketers battle unreliable data. A list of company names without verified emails and direct dials is a wish list. Every bounced email damages your domain reputation and makes the next campaign harder. If your bounce rate is above 5%, stop sending and fix your data first. Use a real email verification workflow, not guesswork.

8. Building the list once and never refreshing it. People change jobs. Companies get acquired. Priorities shift. If you built your list in January and haven't touched it since, 20% of it is probably stale. Quarterly reviews aren't optional - they're maintenance. Data decay is predictable; plan for it with a B2B contact data decay cadence.

FAQ

What's the difference between a target account list and a named account list?

A target account list is your broader strategic universe of ICP-matching companies, while a named account list is the curated, active subset sales is pursuing right now - tied to quota and pipeline targets. Think of the TAL as your total addressable market and the named list as your current campaign focus.

How many accounts should be on my target list?

Early-stage companies should target 50-200 accounts; mid-market teams typically work 200-500. Each SDR can effectively manage 50-150 accounts, so size your list to match your team's capacity, not your ambition. The ABM Benchmark Survey found 29% of marketers target 101-500 accounts.

How often should I update my account list?

Run a full review quarterly and refresh intent signals monthly. Expect roughly 20% turnover each quarter due to job changes, acquisitions, and shifting priorities. Accounts that go dark for two consecutive quarters should exit the list and free up resources for higher-signal targets.

What's the best free tool for building an account list?

Apollo's free tier is the best starting point for initial identification - 275M+ contacts with basic search filters. For email verification, Prospeo's free plan provides 75 verified emails per month at 98% accuracy. Together, they cover identification and enrichment without spending a dollar.

What data do I need for each account?

At minimum: firmographic data (industry, revenue, headcount, geography), technographic data (current tech stack), and verified contact data for 5-8 buying committee stakeholders - decision-makers, influencers, and champions. Layer in behavioral and intent signals for prioritization. Verification is non-negotiable when 43% of marketers struggle with unreliable data.