What Is Prospecting in Marketing? The Definitive Guide for 2026

You Googled "what is prospecting in marketing" and got a sales prospecting article. Cold calls, LinkedIn sequences, SDR playbooks - none of it about what you actually do. Nine out of ten results for this query confuse marketing prospecting with sales prospecting, and the distinction matters more than most people realize.

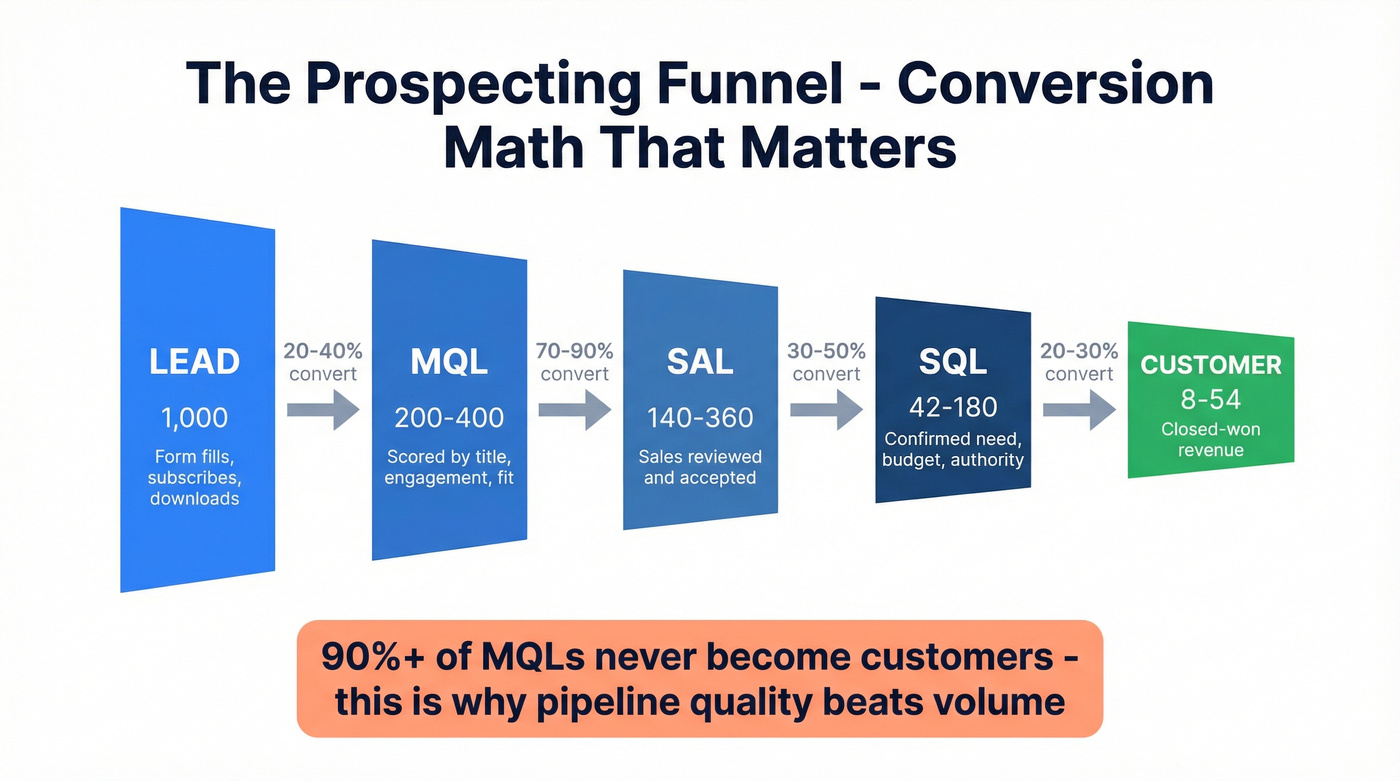

90%+ of MQLs never become customers. That stat should terrify every marketing team that measures success by lead volume instead of lead quality. The gap between "we generated 5,000 leads" and "we generated revenue" is where prospecting strategy lives - or dies.

What You Need (Quick Version)

Prospecting in marketing is finding new audiences who don't know you exist and pulling them into your orbit through paid media, content, ABM, and outbound channels. Three things make it work:

The right channels. Paid social, SEO, cold email, and account-based marketing each serve different stages and buyer types. Most teams need at least two running simultaneously.

The right data. Verified contacts, intent signals, and fresh records. A 20% email bounce rate doesn't just waste budget - it destroys your sender reputation.

The right qualification framework. Lead → MQL → SAL → SQL isn't just jargon. It's the system that prevents your sales team from wasting time on leads that'll never close. BANT (Budget, Authority, Need, Timeline) is the simplest starting point.

Quality beats volume every time.

The Core Definition: Marketing Prospecting Explained

Prospecting in marketing is the process of finding potential customers who've never had any interaction with your business - and may not even know what your business is. That's the clearest marketing-specific framing you'll find anywhere on the SERP.

Think of it like fishing. You throw hooks - paid ads, content, outbound campaigns - into waters where your ideal customers swim. That's prospect marketing in action. Then you reel them in with remarketing. Without the hooks, there's nothing to reel.

This is fundamentally different from sales prospecting, where an SDR manually researches accounts, finds contacts, and sends cold emails or makes cold calls. Marketing prospecting operates at scale through channels, budgets, and campaigns. Sales prospecting operates at the individual level through sequences and conversations. Both feed the same funnel. But they're owned by different teams, measured by different metrics, and executed through completely different motions.

Here's a concrete example. A mid-market SaaS company selling expense management software decides to expand into the healthcare vertical. Their sales team has zero contacts in healthcare finance. Marketing prospecting kicks in: they launch Meta ads targeting CFOs and controllers at hospital networks, publish a pillar page on "healthcare expense compliance," and run a cold email campaign to a verified contact list of 2,000 healthcare finance leaders. Within 60 days, they've built a retargeting pool of 8,000 healthcare visitors, generated 340 MQLs, and handed sales 45 qualified opportunities in a vertical they couldn't have touched otherwise.

That's the kind of scale sales prospecting alone can't achieve.

| Dimension | Marketing Prospecting | Sales Prospecting |

|---|---|---|

| Goal | Generate new awareness | Book meetings |

| Channels | Paid social, SEO, ABM, content | Cold email, cold calls, social selling |

| Who owns it | Marketing / Demand Gen | SDRs / AEs |

| Success metric | New MQLs, pipeline sourced | Meetings booked, opps created |

| Typical tools | Meta Ads, HubSpot, 6sense | Apollo, Outreach, Salesloft |

Even well-established companies use marketing prospecting strategies to reach new customer segments. It's not just for startups building awareness from zero - it's how mature brands avoid the slow death of relying on a shrinking pool of existing audiences.

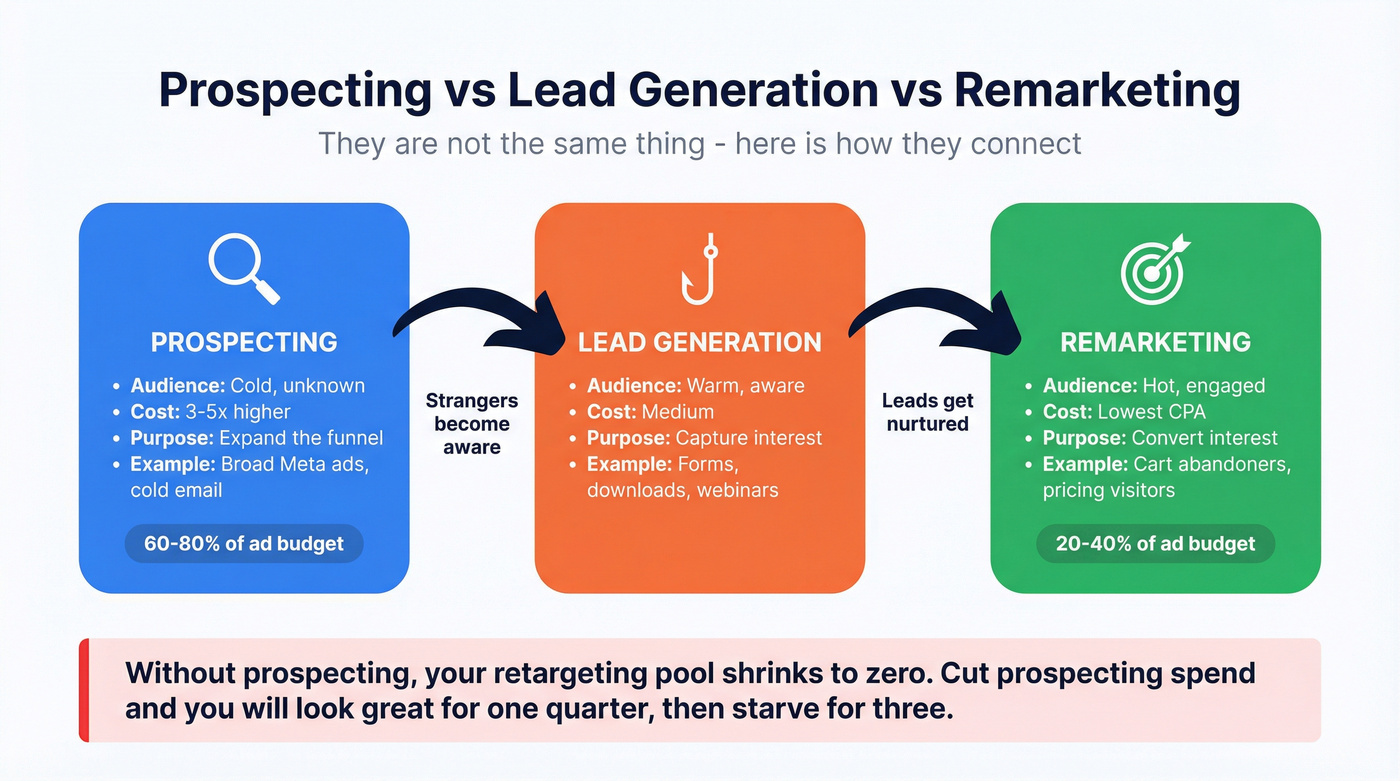

Prospecting vs. Lead Generation vs. Remarketing

These three concepts get used interchangeably, and it creates real confusion.

They're not the same thing.

Prospecting actively seeks out people who don't know you. You're targeting cold audiences - lookalikes, broad interest groups, contextual placements - with the goal of introducing your brand to net-new potential buyers.

Lead generation captures interest from people who find you. Inbound forms, content downloads, webinar registrations. The audience has already been exposed to your brand; lead gen converts that exposure into a name and email.

Remarketing re-engages people who've already interacted with you. Cart abandoners, pricing page visitors, content consumers. It's the cheapest conversion channel because the audience already knows who you are.

Here's the relationship that matters: without prospecting, your retargeting pool shrinks to zero. Every remarketing audience has a shelf life. People buy, lose interest, or forget. If you're not constantly feeding new strangers into the top of the funnel, your retargeting campaigns will slowly starve.

| Concept | Audience | Cost per acquisition | Purpose |

|---|---|---|---|

| Prospecting | Cold / unknown | 3-5x higher than retargeting | Expand the funnel |

| Lead generation | Warm / aware | Medium | Capture interest |

| Remarketing | Hot / engaged | Lowest | Convert interest |

Growth-stage companies typically allocate 60-80% of ad budget to prospecting and 20-40% to retargeting. Prospecting CPAs run 3-5x higher than retargeting - that's not a bug, it's the cost of reaching people who've never heard of you. The mistake is cutting prospecting spend to juice short-term ROAS. You'll look great for one quarter and starve for the next three.

You just read that a 20% bounce rate destroys sender reputation. Prospeo's 5-step email verification delivers 98% accuracy - so your prospecting campaigns actually reach cold audiences instead of spam folders. 143M+ verified emails, refreshed every 7 days.

Stop feeding bad data into the top of your funnel.

The Prospecting Funnel - From Stranger to Customer

Lead → MQL → SAL → SQL → Customer

Every prospecting effort eventually feeds into a qualification funnel. Understanding the conversion math at each stage is what separates teams that build pipeline from teams that build spreadsheets.

Lead: Someone who's shown initial interest - a form fill, newsletter subscribe, content download. They're on your radar but completely unvetted.

MQL (Marketing Qualified Lead): A lead that meets predefined criteria - company size, job title, engagement level. Lead scoring automates this: +20 points for a director-level title, +15 for webinar attendance, +10 for a pricing page visit. Once they cross the threshold, they're an MQL.

SAL (Sales Accepted Lead): An MQL that sales has reviewed and accepted. This is the handoff checkpoint - sales confirms the lead is reachable, within territory, and meets basic criteria. Conversion from MQL to SAL runs 70-90%.

SQL (Sales Qualified Lead): The lead has been engaged by sales and confirmed as a legitimate opportunity. Clear need, budget, authority, and intent to buy. SAL to SQL conversion drops to 30-50% - this is where reality meets aspiration.

Customer: SQL to close runs 20-30%. By this point, you've filtered thousands of leads down to the handful that actually buy.

The math is humbling. If you start with 1,000 leads, you'll get roughly 200-400 MQLs, 140-360 SALs, 42-180 SQLs, and 8-54 customers. That's why 90%+ of MQLs never become customers - and why pipeline quality at the top of the funnel matters more than volume.

One important evolution: the traditional linear funnel is giving way to the flywheel model, where happy customers generate referrals, case studies, and word-of-mouth that feed back into prospecting. The linear funnel is still the best framework for understanding conversion math, but the best teams treat closed customers as a prospecting channel in their own right - not just an endpoint.

When Does a Lead Become a Marketing Prospect?

A lead becomes a prospect when it passes the 3-Point Qualification Checklist:

- Fit: Does this person match your ICP? Right company size, industry, role, and geography.

- Interest: Have they shown meaningful engagement beyond a single email open? Multiple content downloads, repeat site visits, webinar attendance.

- Intent: Is there a trigger event? Demo request, pricing page visit, job posting that signals they're building a team, or intent data showing their company is researching your category.

A lead that checks all three boxes has earned a conversation with sales. One that only checks "Fit" is just a name in a database.

For the sales handoff, use the Opportunity Litmus Test: Problem confirmed, champion identified, budget and timeline known, next meeting scheduled. If you can't check those boxes, it's still a prospect - not an opportunity.

Look, if your team doesn't have a shared definition of when a lead becomes a prospect, marketing and sales will fight about lead quality forever. BANT is the simplest starting point. It's not perfect, but it's better than vibes.

Marketing Prospecting Channels That Actually Work

Paid Social Prospecting

Meta remains the workhorse for prospect marketing campaigns at scale. The campaign structure that works in 2026: three campaign types running simultaneously - Prospecting, ASC Remarketing, and Scale.

Start your prospecting campaign at $30/day with Campaign Budget Optimization (CBO). Go full broad - no interest targeting, no lookalikes. Let Meta's algorithm find your buyers. This feels counterintuitive, but broad targeting consistently outperforms narrow audiences for prospecting right now. Audience sizing matters: aim for 100K-500K for prospecting campaigns. Exclude all web visitors and past purchasers - you're paying to reach strangers, not people who already know you.

The creative game is relentless. Add 5-8 new creatives every week to your prospecting campaign and let them compete. Graduate winners to a Scale campaign at $100-$200/day. Refresh ads at least 2-4 times per month to avoid fatigue.

Prospecting converts at 1-3% on Meta. Retargeting converts at 3-10%. That gap is normal. Upper-funnel messaging should educate on pain points and create demand - not push for the sale.

SEO and Content Marketing

SEO and content marketing ROI often exceeds 700%, making it the highest-return prospecting channel for companies willing to invest over a 6-12 month horizon. And 67% of customers prefer self-service over speaking to a company representative - which means the content you create does double duty as both a prospecting tool and a sales tool.

The shift in 2026: topic clusters over keywords. Build pillar pages around business challenges your buyers face, then create cluster content for every sub-topic. This attracts strangers through search - which is exactly what marketing prospecting is designed to accomplish.

The content formats that drive the most prospecting value: comparison pages (your product vs. alternatives), problem-aware blog posts (targeting pain points your buyers Google), and original industry reports with proprietary data. Ungated content works best for pure prospecting - you're trying to build awareness, not gate-keep it. Save gated assets (templates, calculators, detailed guides) for lead generation once the prospect already knows your brand.

The trade-off is patience. SEO compounds, but it takes 6-12 months to see meaningful traffic. If you need pipeline this quarter, pair content with paid social. If you're building for next year, content is the highest-leverage investment you can make.

Cold Email and Outbound

Cold email prospecting runs a 2-5% reply rate benchmark. Email marketing ROI delivers $36-$40 per $1 spent - the highest ROI of any marketing channel - which makes cold email one of the most cost-efficient prospecting methods when data quality is high.

The catch: it takes 6-8 touches across channels to convert a prospect. One email won't do it. You need sequences that combine email, phone, and social touches over 2-3 weeks.

A 20% bounce rate on cold email doesn't just waste sends - it risks destroying your sender reputation. Data quality isn't optional here. It's the foundation everything else sits on.

Account-Based Marketing (ABM)

ABM flips the traditional prospecting funnel. Instead of casting a wide net and filtering down, you start with a curated list of high-value accounts and go deep.

B2B marketers using account-based tactics achieve 81% higher ROI than traditional approaches. ABM gets its own section below because it's become the dominant B2B prospecting motion for mid-market and enterprise teams.

Account-Based Prospecting - The Modern B2B Approach

ABM has evolved from a sales-aligned high-touch strategy to a media-driven engine. Advertising now sits at the heart of ABM - enabling marketers to reach decision-makers before they self-identify or enter the funnel.

The five essential elements of account-based prospecting:

- Build your ICP - firmographic, technographic, and behavioral criteria that define your best-fit accounts.

- Joint account selection - marketing and sales agree on target accounts together. This isn't optional. When marketing picks accounts sales doesn't want, the whole system breaks.

- Coordinated outreach - ads, email, content, and sales touches orchestrated across the same accounts simultaneously.

- Data integration - your CRM, marketing automation, and intent platforms talking to each other in real time.

- Feedback loops - continuous improvement based on what's working. Which accounts engaged? Which channels drove pipeline? What messaging resonated?

Snowflake's ABM program drove a 300% increase in pipeline velocity through bespoke campaigns for top-tier enterprise clients. OpenWorks, a managed facility services company, rebuilt their paid media targeting around buyer intent signals and saw 117% revenue growth with a 42% drop in cost per customer.

We've seen teams waste months on ABM because they skipped element #2 - joint account selection. Marketing builds a beautiful target account list, sales ignores it, and everyone blames the strategy instead of the alignment gap. It's the most common failure mode, and it has nothing to do with technology.

The big shift in 2026: moving from account-level ABM to contact-level ABM. Instead of targeting "Acme Corp" as a monolith, you're identifying the 5-8 people in the buying committee and reaching each one with role-specific messaging. Intent data providers like Bombora, 6sense, and Demandbase capture signals when companies are actively researching solutions, letting you prioritize accounts that are actually in-market.

Modern ABM also extends beyond the usual channels. Programmatic display, connected TV, native advertising, and even Reddit ads are becoming part of the ABM media mix. Website visitor identification tools add another layer - de-anonymizing traffic so you can see which target accounts are visiting your site and serve them personalized follow-up. The days of ABM meaning "we send personalized emails to 50 accounts" are over.

AI-Powered Prospecting in 2026

In a 1.8% GDP growth environment, teams that prospect smarter - not harder - win disproportionately.

45% of high-performing sales teams have adopted hybrid human-AI SDR models. That number was negligible two years ago. The shift isn't coming - it's here.

LivePerson's case study is the clearest example of the efficiency gain: research time dropped from 20 minutes per prospect to 2 minutes - a 10x improvement - with a 35% lift in engagement rates. When your team can research 10x more prospects in the same time, prospecting volume and quality both improve. Across teams using AI SDR tools, 40% report saving 4-7 hours per week on prospecting tasks. That's a full working day recovered every week.

Speed matters more than ever. Deals closed within 50 days show a 47% win rate, compared to just 20% for deals that drag beyond that threshold. Teams using conversation intelligence close deals 11 days faster with a 10 percentage point improvement in win rates on deals over $50K.

Here's the emerging trend that should be on every marketer's radar: buyer-side AI agents are starting to screen vendors before human decision-makers engage. Your prospects' AI is evaluating your content, pricing, and positioning before a human ever sees it. This means your prospecting content needs to be structured, specific, and machine-readable - not just persuasive to humans.

Skip the bloated stack if your deals are small. If your average deal size sits below $10K, you probably don't need a $40,000/year intent data platform or a 12-tool prospecting stack. A solid data provider, a CRM, and one outreach tool will get you 80% of the results at 20% of the cost. Don't let your tooling budget outgrow your deal sizes.

Prospecting Tools and Technology

Data Providers (Contact Data + Verification)

Your prospecting strategy is only as good as the data feeding it. Bad emails bounce, bad phone numbers waste rep time, and stale records mean you're prospecting into the void.

Apollo offers a free tier with paid plans from $49-$99/user/month. Outreach sequences are built in, which is convenient for reps who want everything in one place. Email accuracy sits around 79% vs. 98% for dedicated email verification providers - a 19-point gap that compounds across thousands of sends.

ZoomInfo runs $15,000-$40,000+/year and delivers the deepest company intelligence for enterprise ABM. If you're running a 500-person sales org with complex buying committees, it's the default. For everyone else, it's expensive for what you'll actually use.

Intent Data Platforms

Bombora, 6sense, and Demandbase operate in the $30,000-$100,000+/year range. They capture signals when companies are actively researching solutions in your category - the difference between prospecting blind and prospecting with a map. Common Room ($25,000+/year estimated) takes a different angle, monitoring community signals and product usage to identify warm prospects - their customers report 30% more meetings per rep and 74% more pipeline.

CRM and Outreach

HubSpot's free CRM handles basic prospecting workflows. Marketing Hub Professional starts at $800/month for automation, lead scoring, and attribution. Clay ($149/month+) automates data enrichment workflows, and Smartlead ($39/month+) handles cold email at scale.

| Tool | Category | Best for | Starting price |

|---|---|---|---|

| Prospeo | Data provider | Verified emails, self-serve | Free (75 emails/mo) |

| Apollo | Data + outreach | Reps needing sequences | Free / $49/mo |

| ZoomInfo | Data provider | Enterprise ABM | ~$15,000/yr |

| 6sense | Intent platform | In-market identification | ~$30,000/yr |

| HubSpot | CRM + marketing | Full-funnel automation | Free CRM |

| Clay | Enrichment | Data workflows | $149/mo |

Common Prospecting Mistakes (and How to Avoid Them)

1. Over-indexing on retargeting. This is the most common mistake in paid media prospecting. Retargeting ROAS looks incredible on a dashboard, so teams shift budget away from prospecting to juice short-term numbers. Then pipeline dries up two quarters later and nobody connects the dots. Maintain that 60-80% prospecting allocation even when the CFO questions the CPAs.

2. Prospecting with stale data. 30% of B2B data decays annually - people change jobs, companies get acquired, email addresses go dead. One Reddit thread captured it perfectly: 3 out of 4 new reps couldn't book a single meeting all month using marketing-provided leads because the contact info was garbage. Snyk saw their bounce rate drop from 35-40% to under 5% after switching to a provider with real-time verification and weekly data refreshes. That's the difference between a prospecting engine and a spam cannon.

3. Treating all leads as prospects. A newsletter subscriber isn't a prospect. A content downloader isn't a prospect. The 3-Point Qualification Checklist (Fit, Interest, Intent) exists for a reason. Without it, you're handing sales a pile of names instead of a pipeline.

4. Ignoring intent signals. Prospecting without intent data is spray-and-pray. When you can see which companies are actively researching your category, you can prioritize the 5% that are actually in-market instead of blasting the other 95% who aren't ready to buy.

5. No marketing-sales alignment. Marketing generates leads, sales complains they're garbage, nobody fixes the gap. In our experience, this pattern destroys prospecting programs at companies of every size. The fix isn't a better tool - it's a shared definition of what qualifies as a prospect and a regular feedback loop between teams. Nailing the prospecting definition on the marketing side - and getting sales to agree - is the single highest-leverage alignment move you can make.

Marketing prospecting at scale needs intent signals, not guesswork. Prospeo tracks 15,000 buyer intent topics and layers them with 30+ filters - job title, company growth, technographics - so your campaigns target prospects who are actually in-market.

Turn cold audiences into qualified pipeline for $0.01 per lead.

FAQ

Is prospecting the same as lead generation?

No. Lead generation captures interest from people who find you through inbound forms, content downloads, and webinar signups. Prospecting actively seeks out cold audiences who don't know you exist. Most marketing teams need both running simultaneously - prospecting expands who enters the funnel, lead gen converts that awareness into named contacts.

What's the prospect marketing definition in simple terms?

A prospect in marketing is someone who matches your ideal customer profile but hasn't yet engaged with your brand. Prospect marketing covers the activities - paid ads, content, outbound campaigns, ABM - used to find and attract those people. It differs from lead generation because you're initiating contact with cold audiences rather than waiting for inbound interest.

What's a good conversion rate for marketing prospecting campaigns?

Paid social prospecting campaigns typically convert at 1-3%, compared to 3-10% for retargeting. The average B2B conversion rate across industries is 2.9%. Lower prospecting conversion rates are expected - you're reaching cold audiences who've never heard of you - so judge performance against prospecting benchmarks, not retargeting benchmarks.

How much should I spend on prospecting vs. retargeting?

Growth-stage companies typically allocate 60-80% of ad budget to prospecting and 20-40% to retargeting. Start with an 80/20 split if you're building awareness, then shift toward 60/40 as your retargeting audiences grow large enough to sustain meaningful spend.

What's a good free tool for B2B prospecting data?

Prospeo's free tier includes 75 verified emails per month plus 100 Chrome extension credits - enough for small teams running real outbound campaigns. Apollo also offers a free tier, though its email accuracy (79%) is notably lower. HubSpot's free CRM handles basic pipeline tracking. For most teams starting out, a free data provider paired with a free CRM covers the essentials.