ABM for SaaS in 2026: A Practical Playbook (Not ABM Theater)

If your "ABM" program is basically ads pointed at a logo list, you aren't doing ABM. You're doing expensive awareness with a spreadsheet.

ABM for SaaS works when it's run like a revenue system: a tight target list, real buying-group coverage, clear activation rules, and ruthless follow-up.

Here's the hook: once you define "activated" (MQA) and enforce the SLA, ABM stops being a vibe and starts producing pipeline.

ABM for SaaS: definition, outcomes, and when it's the wrong motion

ABM for SaaS isn't "marketing to accounts." It's a GTM operating model where you pick a finite set of accounts and orchestrate marketing + sales touches to move buying groups toward a deal.

The SaaS twist that matters: ABM is both acquisition and expansion of your best-fit logos. If Customer Success and Sales aren't using the same account list and the same signals, you're leaving the easiest revenue on the table.

Buyer behavior's forcing the issue. Gartner's sales survey (632 B2B buyers, Aug-Sep 2024) found 61% prefer a rep-free buying experience, and buyers punish bad outreach: 73% avoid suppliers who send irrelevant outreach, and 69% see inconsistencies between website info and what sellers say. ABM is the antidote to irrelevance: fewer accounts, more context, tighter follow-up.

Outcomes you should expect when ABM is real (not theater):

- Bigger deals in ABM accounts. Forrester's 2024 research found many teams reported 11%-20% uplift, and a meaningful chunk reported 21%-50% uplift in ABM accounts vs non-ABM.

- Higher win rates because multi-threading reduces "single-thread stall."

- More expansion because you stop treating existing customers like a quarterly upsell lottery.

Market reality check: ABM's mainstream, but it's still not embedded at most companies. Momentum ITSMA's maturity work shows only 17% say ABM's fully embedded as a foundational GTM pillar, which is why "ABM doesn't work" is usually code for "we ran ads and called it ABM."

Use ABM if:

- You sell to buying groups (security, finance, IT, ops) and deals stall without consensus.

- Your best-fit accounts are identifiable (industry + size + tech stack + triggers).

- You can commit sales follow-up capacity per tier.

Skip ABM if:

- You don't have a stable ICP yet (you're still guessing who buys).

- Your motion's mostly inbound self-serve with minimal sales involvement.

- You can't measure beyond "engagement went up."

One more skip: if nobody will own the follow-up SLA, don't start. It'll turn into a weekly argument and you'll hate it.

The SaaS ABM model that actually scales (tiers + TAL sizing rules)

Most SaaS teams overcomplicate ABM by starting with "personalization." Start with constraints: how many accounts, what tier, what you'll do differently, and what success means.

Use these rules:

- TAL size: keep it 50-200 accounts to start. That range forces focus and makes measurement sane.

- Penetration benchmark: 20%-30% penetration is strong for enterprise ABM. If you're at 5%, you don't have an ABM problem. You've got a coverage problem.

- Tiering: don't tier by vibes. Tier by revenue potential + strategic value + likelihood to buy this year.

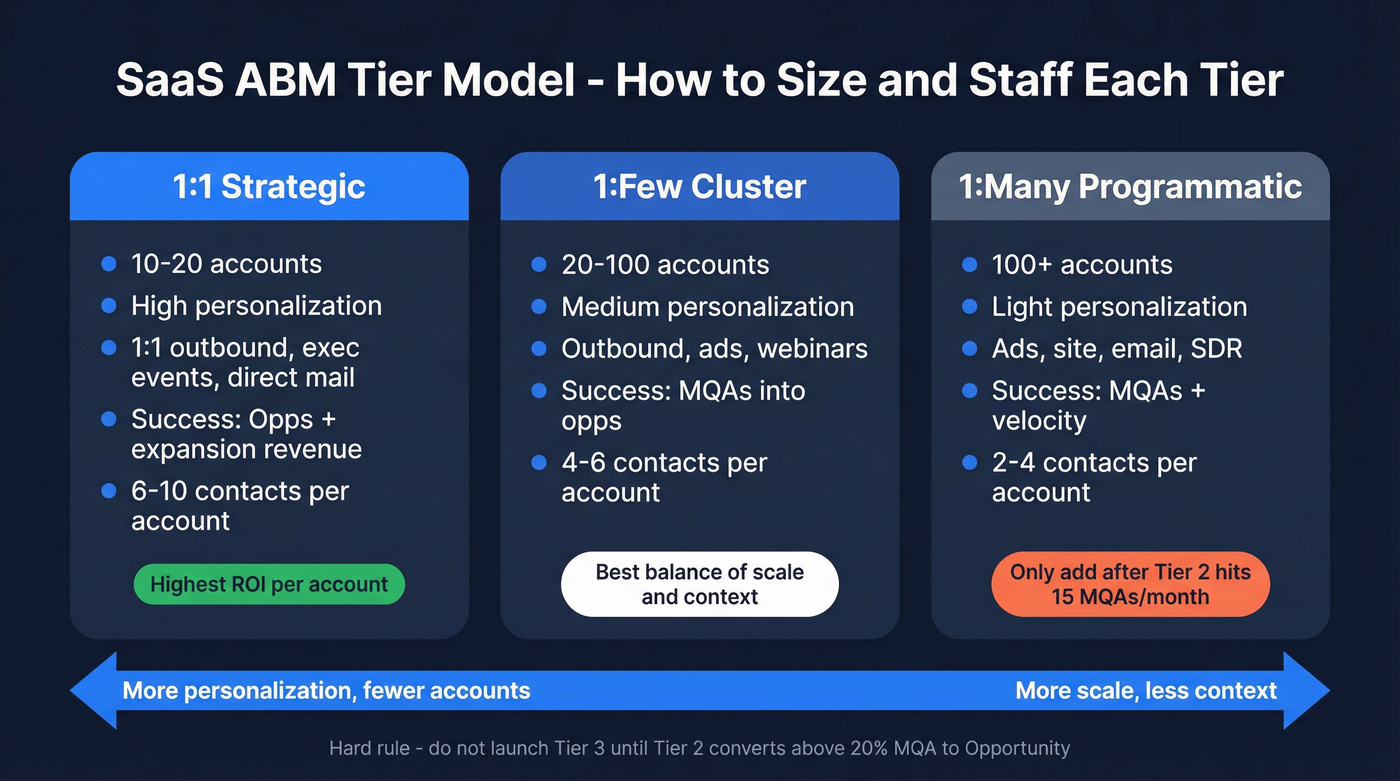

Here's a practical tier model that works for SaaS:

| Tier | # accounts | Personalization | Channels | Success metric |

|---|---|---|---|---|

| 1:1 | 10-20 | High | 1:1 outbound, exec, events | Opps + expansion |

| 1:few | 20-100 | Medium | outbound, ads, webinars | MQAs → opps |

| 1:many | 100+ | Light | ads, site, email, SDR | MQAs + velocity |

Checklist I use to sanity-check tiers:

- Tier 1 has named account plans and human research.

- Tier 2 is cluster-based ("20 fintechs with the same stack").

- Tier 3 is mostly automated, but still has a clear trigger and follow-up path.

Hard call (because teams avoid it): don't add Tier 3 until Tier 2 is producing at least 15 MQAs/month and your MQA→Opportunity conversion's above 20%. If you can't convert activated accounts into real conversations, adding more accounts just multiplies noise.

Real talk: if your Tier 3 doesn't have sales follow-up capacity, it isn't ABM. It's targeted demand gen.

Build your target account list and buying-group coverage (the execution bottleneck)

This is where ABM goes to die: you pick accounts, run ads, and then realize you can't actually reach the buying group. No contacts, bad emails, missing mobiles, and the CRM turns into a duplicate swamp.

I've watched teams spend more on ads than on data, then wonder why "ABM didn't work." Ads create interest. Contacts create pipeline.

Define ICP → translate to account filters

Start with ICP inputs you can actually filter on:

- Firmographics: industry, employee band, region, revenue band

- Technographics: tools they run (data warehouse, CRM, security stack, cloud)

- Growth signals: hiring velocity, funding, headcount growth, new leadership

- Fit signals: compliance needs, complexity, integration requirements

Then convert that into a TAL rule you can hand to anyone:

- "US + Canada, 200-2,000 employees, uses Snowflake, hiring data engineers, security team exists, in regulated verticals."

Hot take: if your ICP can't be expressed as filters, it isn't an ICP. It's a persona deck.

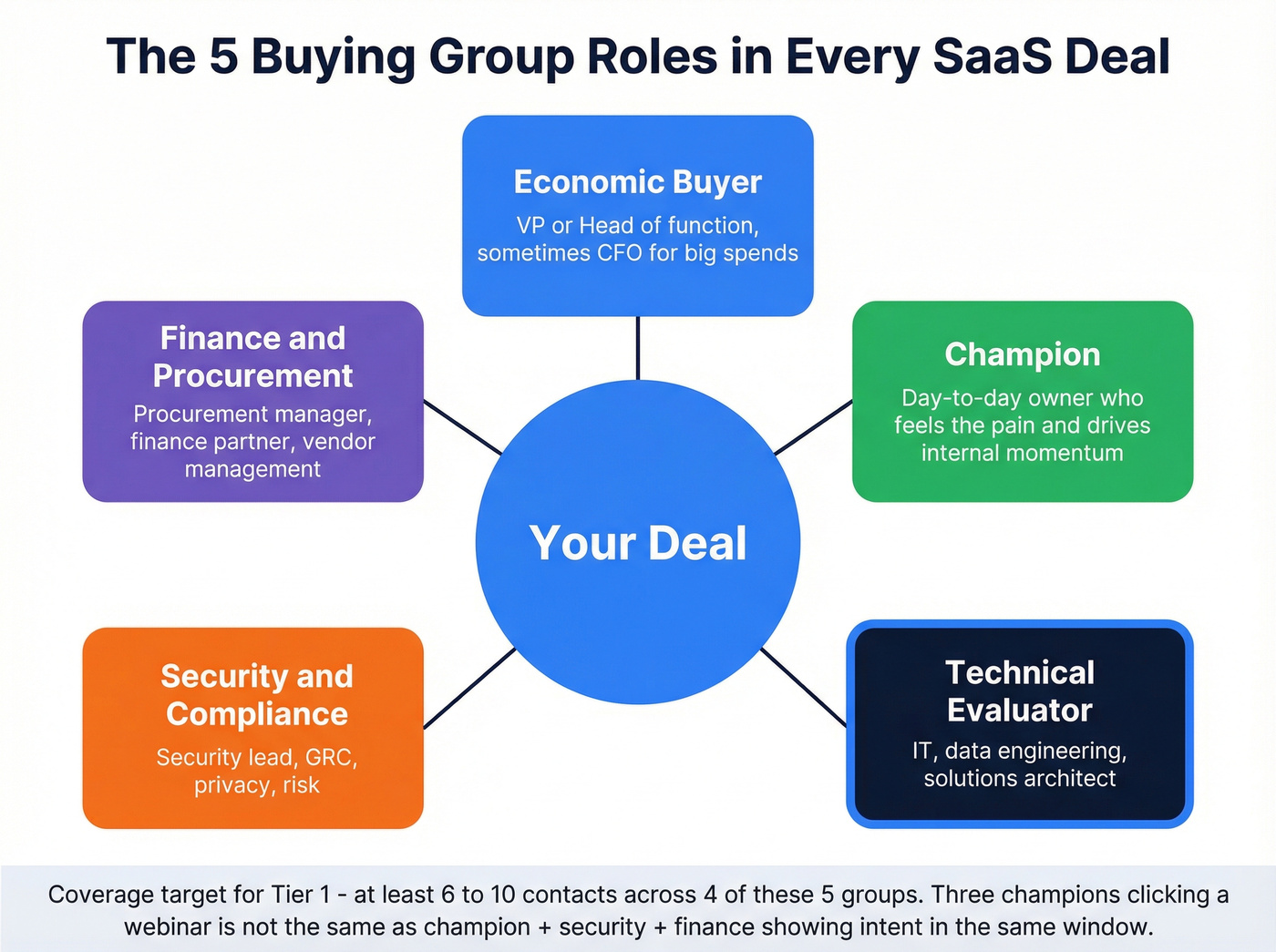

Buying-group map for SaaS (roles you need in most deals)

Most SaaS deals need five "centers of gravity." Your job's to cover them, not just find one champion.

A default buying-group map that works in most B2B SaaS:

- Economic buyer: VP/Head of the function, sometimes CFO for bigger spends

- Champion: day-to-day owner who feels the pain and drives internal momentum

- Technical evaluator: IT, data, engineering, or solutions architect

- Security/compliance: security lead, GRC, privacy, risk

- Finance/procurement: procurement manager, finance partner, vendor mgmt

Coverage target (simple and measurable):

- Tier 1: 6-10 contacts/account across at least 4 of the 5 groups

- Tier 2: 4-6 contacts/account across at least 3 groups

- Tier 3: 2-4 contacts/account (champion + evaluator minimum)

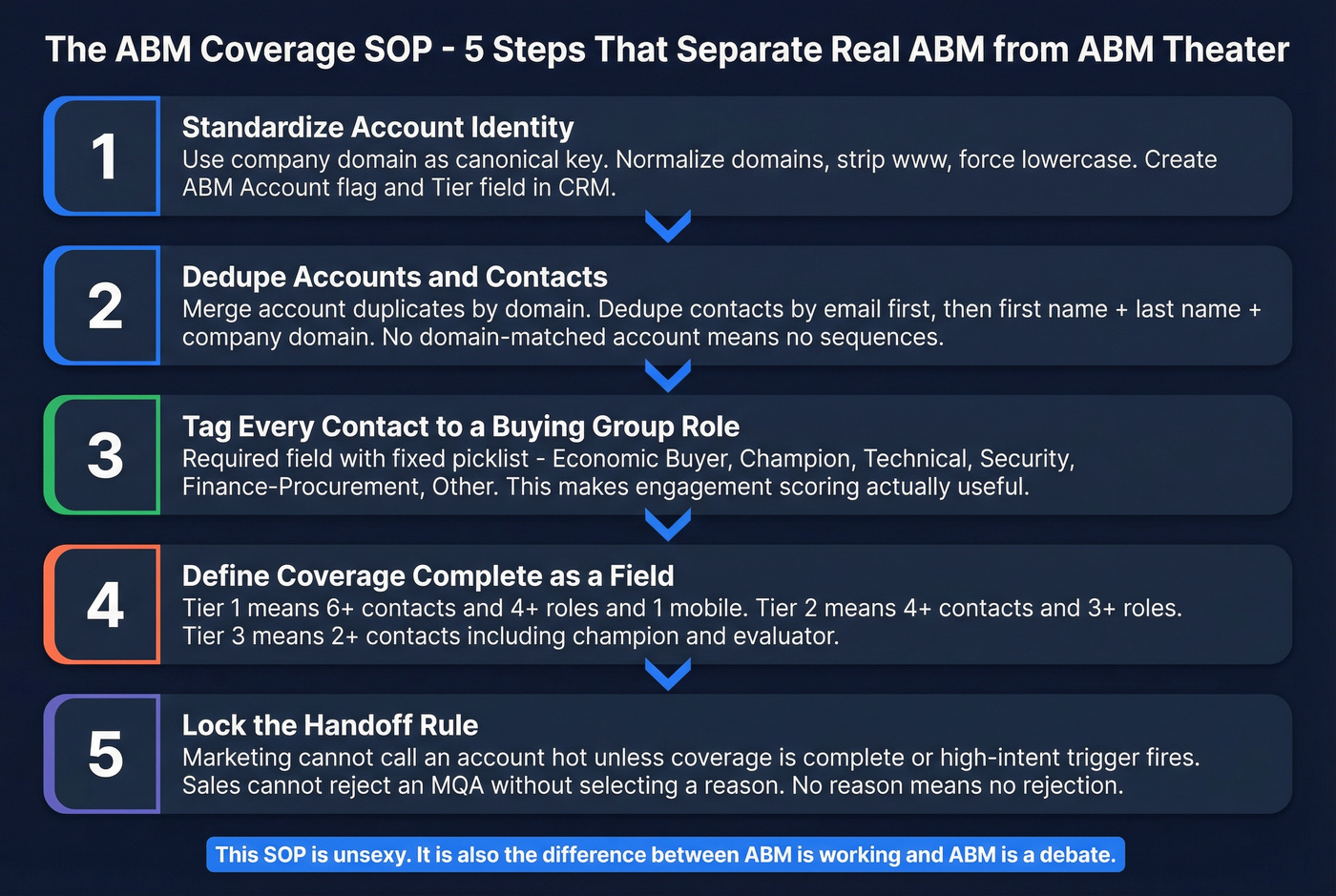

The coverage SOP (the part most teams skip)

If you want ABM to feel "easy," you need a boring SOP that keeps your data clean and your handoffs consistent, especially in SaaS ABM where list hygiene and role coverage decide whether "intent" becomes pipeline.

Step 1: Standardize account identity (before you import anything).

- Pick one canonical key: company domain (not company name)

- Normalize domains (strip

www, force lowercase) - Create a simple "ABM Account" flag + Tier field in CRM

Step 2: Dedupe accounts and contacts like your pipeline depends on it (because it does).

- Accounts: merge duplicates by domain; keep the most complete record as the parent

- Contacts: dedupe by email first, then by (first name + last name + company domain)

- Set a rule: if a contact's missing a domain-matched account, it doesn't enter sequences

Step 3: Tag every contact to a buying-group role (so scoring isn't dumb).

Create a required field like Buying Group Role with a fixed picklist:

- Economic Buyer / Champion / Technical / Security / Finance-Procurement / Other

This is what makes your engagement score useful. Three champions clicking a webinar isn't the same as a champion + security + finance showing intent in the same two-week window, and if you score them the same way you'll train Sales to ignore your "hot" accounts.

Step 4: Define "coverage complete" as a field, not a vibe.

Examples that work:

Coverage Complete (Tier 1)= at least 6 contacts AND at least 4 roles represented AND 1 mobile for an evaluator or economic buyerCoverage Complete (Tier 2)= at least 4 contacts AND at least 3 roles representedCoverage Complete (Tier 3)= at least 2 contacts including champion + evaluator

Step 5: Lock the handoff rule.

- Marketing can't call an account "hot" unless coverage's complete or the account hits a high-intent trigger (demo/pricing/security request)

- Sales can't reject an MQA without selecting a reason (bad fit, timing, no pain, already in contract, etc.). No reason = no rejection

This SOP's unsexy.

It's also the difference between "ABM is working" and "ABM is a debate."

Getting accurate contacts (so outbound + follow-up works)

Practical workflow: build the TAL, then immediately build buying-group coverage with verified contact data. Otherwise your "orchestration" is just impressions.

A simple "coverage build" flow that works:

- Pull your TAL into a CSV (account name + domain + region + employee band).

- In Prospeo, search by company filters (industry, headcount, region, tech) and role filters (Security, Finance, RevOps, Data, IT).

- Export verified emails + mobiles and push into your CRM/sequencer.

- Tag contacts by buying-group role so engagement scoring's role-aware.

- Mark

Coverage Completewhen the account hits your tier threshold.

Mini callout: define "coverage complete" per account as a field. If it isn't measurable, it won't happen.

Your ABM tiers need 6-10 contacts per account across the buying group. Prospeo gives you 300M+ profiles with 30+ filters - firmographics, technographics, headcount growth, intent - so you build TALs that match your ICP exactly. 98% email accuracy means your sequences actually land.

Stop spending more on ABM ads than on the data that fills your buying groups.

Orchestration: channels and plays by tier (ads, outbound, site, events, direct mail)

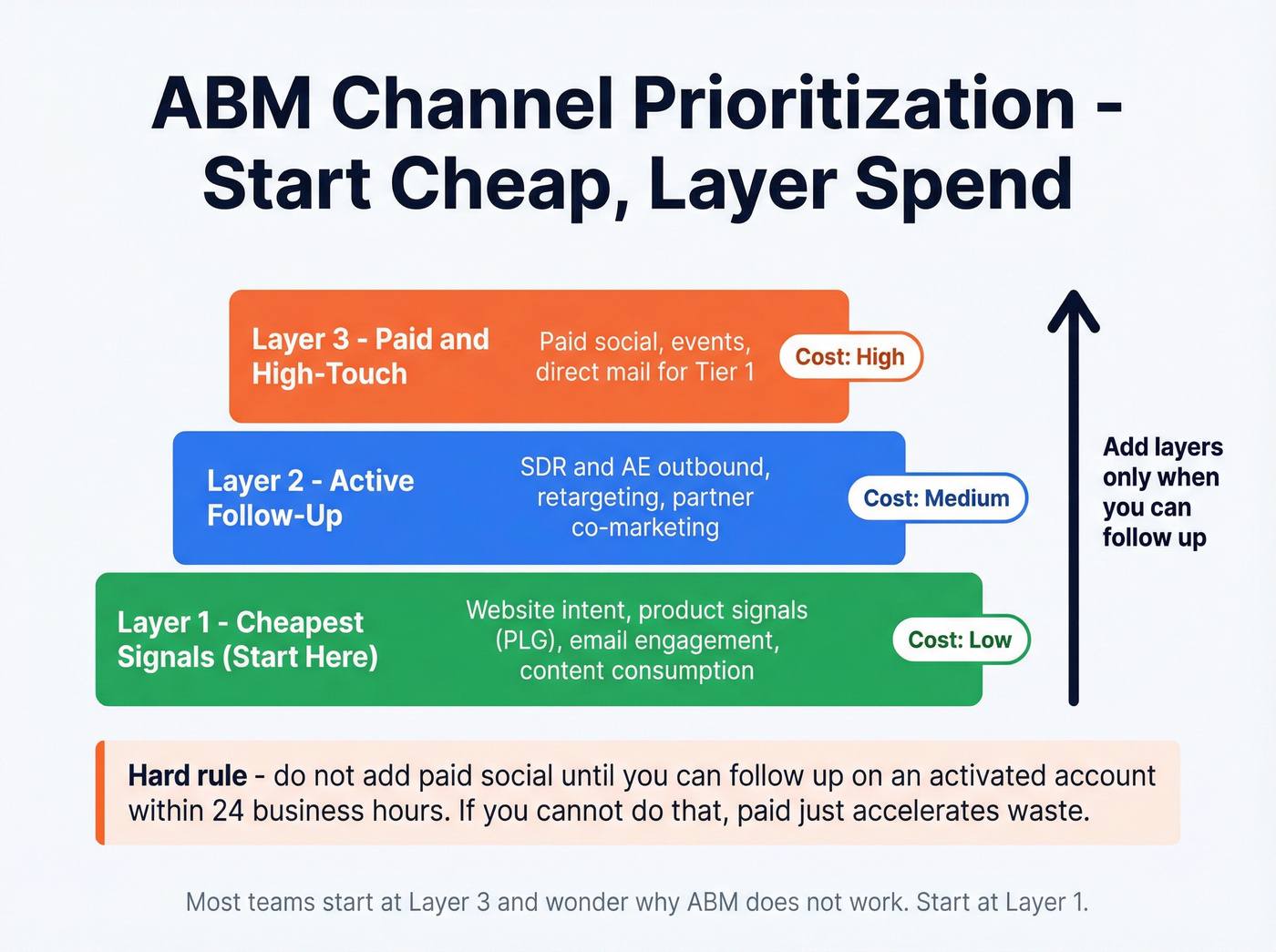

SaaS teams love starting with paid social because it's easy to launch. The problem is it's also expensive, and it's the least accountable channel if you don't have follow-up.

Start with the cheapest signals first, then layer spend:

- Cheapest signals: website intent, product signals (PLG), email engagement, content consumption

- Next: outbound follow-up (SDR/AE), retargeting, partner co-marketing

- Then: paid social to warm the account, events, direct mail for Tier 1

Hard call: don't add paid social until you can follow up on an activated account within 24 business hours. If you can't do that, paid just accelerates waste.

By-tier orchestration matrix (copy/paste)

| Tier | Trigger to start | Primary channels | "Hero" asset | SLA (who/when) | Success metric |

|---|---|---|---|---|---|

| 1:1 | Exec change, security/compliance request, active evaluation signals | AE + exec email, direct mail, invite-only event, retargeting | Tailored POV deck + security pack | AE outreach same day; exec touch within 5 days | Meeting + opp created; expansion opps |

| 1:few | Cluster intent spike, webinar topic fit, competitor comparisons | SDR sequences by role, ads, webinar, landing page | Industry landing page + case study + webinar | SDR within 24 hrs of MQA; AE within 48 hrs | MQAs → opps; win rate |

| 1:many | Site intent + light engagement + fit | Retargeting, email, light SDR | 1-page use case + short demo video | SDR within 48 hrs of MQA | MQAs + velocity |

| Customer expansion | Product usage spike, admin/security questions, new team adoption | CSM + AE, in-app, email, exec sponsor | "Standardize & secure" rollout kit | CSM within 24 hrs; AE within 72 hrs | Expansion pipeline + retention |

Two plays that consistently outperform "generic ABM ads":

- Security-first play: if security engages, you send the security pack and book the security call. Don't make them hunt for your SOC2 page.

- Role-split sequences: champions get outcomes; technical evaluators get architecture; finance gets procurement-ready ROI and terms. Same account, different story.

What practitioners complain about (and they're right): ABM "engagement" is often just impressions and clicks that never turn into conversations. Fix that with SLAs and a real activation threshold, not more creative.

Competitor conquesting: the ABM play SaaS teams underuse

If you want pipeline now, stop chasing "awareness" and start catching accounts already evaluating alternatives.

Trigger (pick two):

- Review-site comparisons and "alternatives" keyword intent

- High-intent page paths like

/pricing,/security,/compare,/migration - Sales hears "we're looking at X" in discovery and tags the account for conquesting

Offer (make it practical, not snarky):

- Migration guide (timeline, risks, checklist)

- Switching calculator (implementation hours + cost)

- Security & compliance delta (what changes, what doesn't)

Routing rule:

- If the account hits MQA, AE follows up within 24 business hours with a direct "here's the migration path" message.

- If it's Tier 2/3 and not yet MQA, SDR runs a role-based sequence that leads with the migration asset.

Measurement:

- Conquesting wins on velocity. Track time-to-first-meeting and stage conversion vs your baseline.

Opinion: conquesting is the closest thing ABM has to a cheat code because timing's already solved.

The SaaS ABM pre-mortem (why pilots die after 90 days) + fixes

Most ABM pilots look "promising" for 30-60 days and then quietly get deprioritized. The three failure modes I see constantly:

Problem: content fatigue

Diagnosis: technical personas tune out fluffy assets fast. Your "ABM content" becomes the same webinar and the same one-pager, just with different logos.

Fix: rotate creative every 2 weeks and go engineer-to-engineer where it matters: architecture diagrams, API how-tos, integration guides, security checklists. Build persona tracks so security isn't getting the same story as the champion.

Problem: tier decay

Diagnosis: Tier 1 works because humans are involved. Then you expand to Tier 2/3 and personalization collapses. Engagement drops, sales stops trusting the signals, and the program dies.

Fix: cluster-based personalization. Instead of 200 "personalized" experiences, build 10 clusters of 20 similar accounts and create 10 strong creative sets, then keep a human-in-the-loop step for Tier 1 and the top slice of Tier 2 where the upside's real.

We've run bake-offs where the "ABM platform" wasn't the issue - nobody owned creative throughput. ABM's a content factory plus follow-up, not a campaign.

Problem: attribution chaos

Diagnosis: hybrid funnels break simplistic attribution. Ads influence, outbound influences, events influence, product influences, and the dashboard turns into a debate club.

Fix: move to account-centric metrics and define rules for sourced vs influenced. Tighten CRM hygiene too. If your account mapping's messy, your ABM reporting's fiction.

Look, ABM doesn't fail because the idea's wrong. It fails because execution's under-resourced and measurement's undefined.

ABM measurement system for SaaS (copy/paste): penetration, engagement scoring, velocity, activation (MQA)

If you want ABM to survive leadership scrutiny, you need a measurement system that's boring, consistent, and tied to actions.

1) Penetration (are we even in the account?)

Account Penetration Rate

[ \text{Penetration Rate} = \frac{\text{Engaged or Won Target Accounts}}{\text{Total Target Accounts}} \times 100 ]

Operational definition of "engaged account" (pick one and stick to it):

- At least 2 engaged contacts, or

- Engagement score ≥ 50, or

- One high-intent action (demo request, pricing page visit, security doc request)

Penetration's your early warning system. If penetration's low, don't argue about ROI. Fix coverage and relevance.

2) Engagement score (make it role-aware and time-aware)

Account Engagement Score

[ \text{Engagement Score} = \sum(\text{Activity} \times \text{Weight}) ]

Example weights (steal these and adjust):

- Demo request: 50

- Pricing page visit: 25

- Security/compliance page visit: 25

- Webinar attendance: 20

- Case study view: 15

- Whitepaper download: 10

- Email reply: 30

- Meeting booked: 60

Add score decay so old activity doesn't keep accounts "hot" forever:

- Last 7 days: 1.0x

- 8-14 days: 0.7x

- 15-30 days: 0.4x

- 31+ days: 0.1x

Threshold that keeps sales honest: score > 100 triggers AE follow-up. If Sales ignores it, ABM turns into marketing theater again.

3) Velocity (are we moving faster?)

Pipeline Velocity

[ \text{Velocity} = \frac{\text{# Opportunities} \times \text{Avg Deal Size} \times \text{Win Rate}}{\text{Sales Cycle Length (days)}} ]

Use velocity to compare:

- ABM accounts vs non-ABM accounts

- Tier 1 vs Tier 2

- Before vs after orchestration changes

4) Activation / MQA (the moment ABM becomes a sales motion)

Define an "activated account" (MQA) so everyone knows when to act.

A practical MQA threshold model:

- ≥3 engaged roles in the buying group (not 3 people from the same team)

- ≥2 high-intent actions in the last 14 days

- Engagement score ≥ 100

High-intent actions = demo request, pricing/security page depth, meeting booked, inbound procurement/security request, product signal (for PLG), or direct reply.

Dashboard spec (what to build in your BI/CRM)

| Metric | Formula | Cadence | Owner | Trigger action |

|---|---|---|---|---|

| Penetration % | Engaged/TAL | Weekly | RevOps | Fix coverage |

| Eng score | Σ act×wt×decay | Daily | Mktg Ops | Route to SDR |

| MQAs | Meets threshold | Daily | RevOps | AE follow-up |

| MQA→Opp | Opp/MQA | Weekly | Sales Ops | Tune plays |

| Velocity | (Opp×$×WR)/days | Monthly | RevOps | Re-tier TAL |

Optional but powerful: track "coverage completeness" as a leading indicator. In our experience, coverage predicts pipeline better than impressions do.

Attribution without paralysis: sourced vs influenced pipeline (and what counts)

Attribution's where ABM programs go to argue instead of improve. The real blockers are always the same: messy data, offline influence, disconnected tools, and model paralysis.

The fix isn't picking the perfect model. It's agreeing on rules of the road.

Use this simple comparison:

- Sourced pipeline (ABM-sourced): the first meaningful conversion came from an ABM touch (ABM landing page form fill, event meeting booked, outbound reply that books a meeting).

- Influenced pipeline (ABM-influenced): the opportunity was created via another path, but ABM touches happened in the lookback window and involved buying-group engagement.

Rules that keep you sane:

- Define meaningful interactions (not impressions).

- Define your lookback window (30-90 days depending on cycle).

- Define activation (MQA) and treat it as the handoff moment.

- Keep a single account ID across systems (CRM's the source of truth).

Strong opinion: teams waste months trying to reconcile every touch, then lose deals because follow-up after activation is slow. Speed beats spreadsheet purity.

Budgeting ABM for SaaS (ACV-based calculator + spend guardrails)

ABM budgeting gets weird fast because teams scale scope without scaling creative and follow-up. Then they blame the channel.

Use an ACV-based rule that ties spend to potential return:

- Growth accounts ($50k-$150k ACV): budget 1% of ACV

- Strategic accounts ($150k-$300k ACV): budget 3% of ACV

- Star accounts ($300k+ ACV): budget 5% of ACV

Calculator (per account):

- Budget = ACV x rate

- Example: $120k ACV Growth account → $1,200 budget

- Example: $250k Strategic account → $7,500 budget

- Example: $500k Star account → $25,000 budget

Guardrails that prevent ABM theater:

- Don't increase Tier 1 count unless you increase creative throughput and AE time.

- Don't run paid spend without a defined follow-up SLA after MQA.

- Don't buy an enterprise ABM platform to "fix" a data/coverage problem.

One more hard call: if your average annual contract's closer to a few thousand dollars than six figures, you probably don't need ABM platforms. You need clean lifecycle marketing, tight outbound, and a product-led trigger system.

ABM for PLG/hybrid SaaS: use product signals as triggers (not just firmographics)

If you're PLG or hybrid, firmographics alone are a blunt instrument. Your best ABM triggers are inside the product.

Postman's story is the blueprint: massive self-serve adoption (35M developers, 500K orgs, 98% of the Fortune 500) and then enterprise sales layered in when signals showed up.

Three triggers that translate well to most SaaS products:

- Usage concentration: one org suddenly has dozens/hundreds of active users. Action: route to ABM Tier 1/2, build buying-group coverage, run security + admin enablement content.

- Senior-role support queries: directors/architects/CTOs show up in support or success channels. Action: exec outreach + tailored POV + "how enterprise teams standardize this" narrative.

- Security/compliance inbound: questions about SSO, audit logs, data residency, SOC2, DPA. Action: security pack + security call + procurement-ready collateral.

Trigger-action mapping (simple): Trigger detected → mark account "PQL-ABM" → build coverage → run role-based sequences → measure MQA within 14 days.

ABM for PLG is basically this: product signals create timing, ABM creates multi-threading.

Tooling reality check (lean stack vs enterprise stack + pricing ranges)

Tooling's where teams burn money. Buy in this order: data → engagement → intent → ABM platform (last).

Start lean (most SaaS teams)

Lean stack = system of record + automation + engagement + accurate data + light intent.

- CRM (system of record): HubSpot or Salesforce

- Automation: HubSpot Marketing Hub (~$1k-$20k/year depending on tier/contacts) or Marketo/Pardot (often ~$20k-$100k+/year in enterprise setups)

- Sales engagement: Outreach or Salesloft (commonly ~$12k-$40k/year depending on seats)

- Data foundation: a self-serve data layer that keeps bounce low and coverage high before you scale spend

Go enterprise (only when ACV + volume justify it)

Enterprise stack adds an ABM platform + deeper intent + advanced measurement. Buy this when you have consistent MQAs, proven follow-up SLAs, and enough pipeline volume that automation pays back.

If you aren't there yet, an ABM platform becomes shelfware with a nice dashboard.

ABM platforms & data layer pricing reality check (2026)

| Tool | Best for | Typical annual cost (range) | Skip this if... |

|---|---|---|---|

| Demandbase | Full ABM platform + ads + orchestration | ~$30k-$100k+/year for smaller deployments; $100k-$300k+/year for enterprise bundles | You don't have creative ops + RevOps capacity |

| 6sense | Intent + account insights + sales workflows | Free tier available; paid often ~$60k-$300k/year | You can't control module sprawl and routing rules |

| Terminus | ABM ads + orchestration (often paired with other tools) | Often quoted in the ~$25k-$120k/year range depending on seats + ad spend | You want deep intent + analytics in one place |

| Prospeo | Data layer for buying-group coverage + enrichment + intent | Free tier available; paid plans scale with credits/usage | You expect it to replace your CRM or engagement tool |

If you're building the lean stack, the fastest win is getting your data and enrichment right first. If you're doing it without a big platform, start with ABM without expensive tools.

ABM dies at the coverage SOP. Prospeo's enrichment returns 50+ data points per contact at a 92% match rate - roles, verified emails, direct dials - so you can tag every contact to a buying-group role and hit your coverage targets across all three tiers. Data refreshes every 7 days, not 6 weeks.

Cover champion, security, finance, and technical - with contacts that actually connect.

ABM gets dramatically easier when your data's trustworthy and your activation threshold's real. Build coverage, define MQA, and make follow-up non-negotiable - that's the whole game for ABM for SaaS teams.

FAQ

What's a good target account list (TAL) size for SaaS ABM?

A good TAL size for SaaS ABM is usually 50-200 accounts, because it forces focus and makes coverage, orchestration, and measurement manageable. If you've got fewer than 1 SDR per ~50 accounts, start closer to 50 so follow-up doesn't collapse. Expand only after Tier 2 consistently produces MQAs and your MQA→Opportunity conversion stays healthy.

What is an "activated account" (MQA) in ABM?

An activated account (MQA) is an account that's shown enough buying-group engagement to trigger sales follow-up. A practical definition is: ≥3 engaged roles, ≥2 high-intent actions in the last 14 days, and an engagement score ≥100. Keep the activation window at 14 days so Sales acts while intent's fresh.

How do you prove ABM ROI when attribution's messy?

Prove ABM ROI by splitting sourced vs influenced pipeline, then reporting four numbers weekly: penetration %, MQAs created, MQA→opportunity conversion, and velocity vs non-ABM. If MQA→opportunity is under 20%, fix follow-up and buying-group coverage before you touch your attribution model.

What's a good free tool for building ABM contact coverage?

Prospeo's free tier is a solid place to start: 75 verified emails/month plus 100 Chrome extension credits for fast list-building and enrichment. For best results, aim for Tier 1 coverage of 6-10 contacts per account across 4 roles, and only route an account to Sales once it hits coverage-complete or a high-intent trigger.