How to Exceed Sales Targets When 84% of Reps Can't

You just finished Q1. You're at 38% of your annual number. Your manager sends a Slack message: "Let's talk about your plan to close the gap." You don't have a plan. You have a spreadsheet full of "maybes" and a CRM that looks like a graveyard.

Here's the reality of selling in 2026: 91% of sales organizations missed quota expectations in recent years, and average attainment across cloud/SaaS sits at just 43.83%. That's not a slump - it's a structural collapse. And the numbers haven't meaningfully recovered.

Only 16% of reps actually hit quota. That figure has been falling for over a decade - down from 53% in 2012. Quotas went up 37% year-over-year while attainment dropped. The math doesn't work for most reps because most reps are running the wrong playbook.

Most reps don't have a performance problem. They have a process problem. Data from 4.2 million opportunities across 530 companies tells a clear story. The reps who consistently beat their numbers aren't more talented. They qualify harder, engage decision-makers earlier, and build pipeline that actually converts - instead of stuffing their CRM with "hope" deals.

This isn't a motivational article. It's a playbook built on benchmarks, not platitudes.

Start With These Three Habits to Crush Your Sales Goals

If you implement three things from this article, make them these:

- Reverse-engineer your target into daily activities. Annual quota to quarterly to monthly to weekly to daily calls, meetings, and proposals. Know your numbers cold.

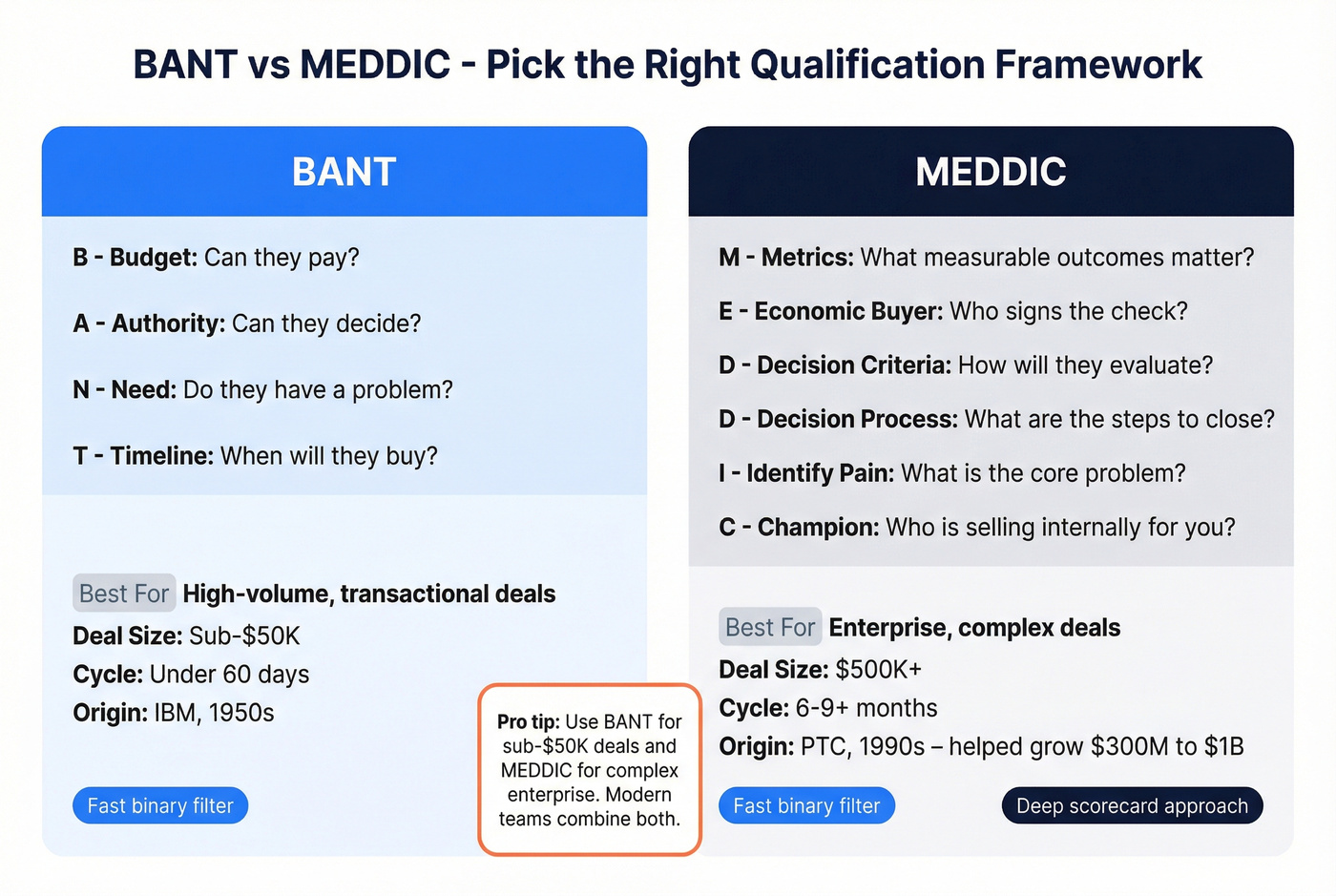

- Adopt a qualification framework. MEDDIC for enterprise , BANT for transactional. Top performers are 588% more likely to follow a structured methodology.

- Multi-thread every deal worth more than $25K. 90% of BDRs now multi-thread, reaching 9 contacts per account. Single-threaded deals die when your champion goes on vacation.

One more number to anchor everything: deals closed within 50 days show a 47% win rate. Deals that drag past 50 days? Just 20%.

Speed and process - not talent - separate the 16% who hit quota from the 84% who don't.

Is Your Target Even Realistic?

Before you can surpass a target, you need to know whether it's achievable in the first place. And the uncomfortable truth is that most quotas are set with zero methodology behind them.

87% of sales leaders have no set method for setting quota targets - based on a study of 67,722 sales leader opinions. The number that determines your income, your career trajectory, and your mental health is, more often than not, pulled from a revenue model that never asked whether individual reps can actually hit it. Meanwhile, 58% of organizations over-assign quotas by 20-30% to ensure overall attainment matches the company's revenue plan. Translation: leadership knows most reps won't hit quota. They're banking on a few overperformers to carry the team. If you're not one of those overperformers, you were set up to fail before January 1st.

A rep on Reddit captured this perfectly: handed a $900K annual quota at a new company when the most tenured rep on the team had closed $800K total - over four years. In another thread, a rep noted that only 7% of their org made President's Club. That's not a stretch goal. That's fiction.

If your quota fails the 70% attainment test - meaning fewer than 70% of reps can achieve it - negotiate before you strategize. No playbook fixes a fictional number.

Here's how to evaluate your target:

| Quota-Setting Method | What It Looks Like | Risk |

|---|---|---|

| Top-down only | Revenue goal / reps | Ignores rep capacity |

| Bottom-up only | Historical performance x growth | Misses company goals |

| Blended (best practice) | Bottom-up + top-down reconciled | Time-intensive to calibrate |

Just 8% of companies base quotas on previous performance, and only 6% align them with company goals. Most are winging it.

If your quota fails the smell test, have the conversation with your manager. Bring data: your territory's TAM, historical win rates, average deal size, and cycle length. A quota grounded in reality is the first step toward beating it.

What the Top 16% Do Differently (And Why It Pays Exponentially)

The 2026 B2B Sales Benchmark Report - analyzing 4.2 million opportunities, over a million hours of sales conversations, and $54 billion in revenue across 530 companies - is one of the most thorough datasets on sales performance ever published. The findings are stark.

Top performers are 588% more likely to follow a structured sales methodology. Not "loosely follow." They run every deal through a repeatable process. Meanwhile, 75% of salespeople don't consistently follow their methodology at all.

They engage the Economic Buyer 489% more often before the solution is even presented. Average reps pitch features to a mid-level champion and hope it floats upward. Top performers get to the person who signs the check - early.

And they're 366% more likely to close directly from the Discovery stage. When discovery is done right, the deal accelerates naturally.

| Behavior | Top Performers | Average Reps |

|---|---|---|

| Structured methodology | 588% more likely | Skip it 75% of the time |

| Economic Buyer access | 489% more often, pre-solution | Post-demo, if at all |

| Close from Discovery | 366% more likely | 3-5 extra meetings needed |

| Pipeline hygiene | Proactively disqualify | Hang onto "hope" deals |

| Channel mix | Inbound + partners + outbound | Single-channel dependent |

Two more data points that don't get enough attention: referral deals deliver 3.8x velocity compared to cold outbound, and high-intent accounts - companies actively researching your category - convert at 3.4x greater velocity than generic prospects. Top performers blend inbound, partnerships, and targeted outbound. They never rely on a single channel.

Here's why this matters financially: most comp plans include tiered accelerators - 1.5x to 2x commission rates once you pass 120% of quota. A rep at 100% attainment on a $1.2M quota earns maybe $150K OTE. A rep at 140% could earn $210K+ because every dollar above the threshold pays at the accelerated rate. Surpassing your number isn't just satisfying - it's where the real money lives. The reps who consistently smash sales goals are the ones earning accelerator-level comp year after year.

The gap between top performers and everyone else isn't about charisma or "hustle." It's about discipline. The 16% run a process. The 84% improvise.

You need 50 touches a day to hit your number. But touches only count when they reach real decision-makers. Prospeo gives you 98% verified emails and 125M+ direct dials so every outreach attempt connects - not bounces.

Stop stuffing your CRM with hope deals. Start reaching buyers who answer.

Reverse-Engineer Your Target Into Daily Actions

The most practical advice I've gathered from reps who consistently outperform comes down to one habit: they work backward from the annual number to figure out exactly what they need to do today.

Here's the math. It's not complicated.

Say your annual target is $1.2M. Your average deal size is $40K. Your win rate is 25%.

- Deals needed to hit $1.2M: 30 closed-won deals ($1.2M / $40K)

- Qualified opportunities needed: 120 (30 / 0.25 win rate)

- Monthly qualified opportunities: 10 (120 / 12)

- Weekly: ~2.5 new qualified opportunities entering your pipeline

Now work backward from there. If it takes 15 conversations to generate one qualified opportunity, you need about 38 meaningful conversations per week. If your connect rate is 15%, that's roughly 250 dials or outreach touches per week - or 50 per day.

Suddenly, "hit $1.2M" isn't an abstract goal. It's 50 touches a day.

A rep on r/techsales described this exact approach: reverse-engineering the annual quota into accounts needed, deal sizes, opportunities, meetings, and daily calls. The thread - titled "Those of you that hit 200% quota, what do you do differently?" - confirmed what the benchmark data shows. The reps who do this math know by Tuesday whether they're on pace for the week. The reps who don't are surprised every quarter-end.

Here's the compounding effect most people miss. Five extra calls per day equals 1,100 extra calls per year. That's more than two additional months of prospecting activity - without working longer hours. You just start 20 minutes earlier and make five more dials before your first meeting.

Minor changes done consistently over time lead to significant results. That's not a motivational poster. That's math.

The key is tracking your actual conversion rates at each stage. Don't use industry benchmarks - use your numbers. Your connect rate, your discovery-to-qualified rate, your qualified-to-close rate. Once you know those ratios, you can diagnose exactly where your funnel leaks and fix it.

Build the Right Pipeline (Not Just More Pipeline)

Pipeline Coverage - Why the 3x Rule Is a Myth

Every sales training deck says "maintain 3x pipeline coverage." It sounds smart until you think about it for thirty seconds.

If your win rate is 50%, 2x coverage is plenty. If your win rate is 20%, you need 5x just to break even. The "3x rule" ignores the variables that actually matter: historical win rates, average sales cycle length, deal size, and lead source quality.

| Segment | Coverage Needed | Why |

|---|---|---|

| Enterprise | 3x-5x | Long cycles, lower win rates |

| Mid-Market | 2.5x-4x | Moderate complexity |

| SMB | 2x-3x | Faster cycles, higher volume |

A pipeline full of warm inbound leads needs less coverage than one built entirely on cold outbound. And here's the part nobody talks about: a bloated pipeline gives you a false sense of security. If half your "pipeline" is stale deals that should've been closed-lost three months ago, your real coverage is half what your CRM says.

Clean your pipeline before you try to grow it. (If you want a tighter system, use a defined pipeline review cadence and stop letting "hope" deals linger.)

Qualify Ruthlessly - BANT vs. MEDDIC

The fastest way to beat your number isn't to add more deals. It's to stop wasting time on deals that were never going to close.

Two frameworks dominate, and they serve different purposes:

| Dimension | BANT | MEDDIC |

|---|---|---|

| Best for | High-volume, transactional | Enterprise, complex |

| Deal size | Sub-$50K | $500K+ |

| Cycle length | Under 60 days | 6-9+ months |

| Philosophy | Filter: qualify or disqualify | Understand: scorecard |

| Origin | IBM, 1950s | PTC, 1990s |

MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) was created at PTC in the 1990s and helped them grow from $300M to $1B in four years. It's evolved into MEDDPICC - adding Paper Process and Competition - and it's the gold standard for enterprise sales.

BANT (Budget, Authority, Need, Timeline) works when you're running 50+ discovery calls per month and need a fast binary filter. It's not deep enough for a 9-month enterprise cycle with 12 stakeholders, but it's perfect for transactional deals where speed matters more than depth.

The mistake I see most often: teams pick one framework and apply it universally. Use BANT for your sub-$50K deals. Use MEDDIC for anything complex. Modern teams combine both rather than treating them as religious doctrine.

83% of buyers mostly or fully define purchase requirements before speaking with sales. If you're not qualifying against what the buyer has already decided, you're playing catch-up from the first call. (A simple lead qualification framework keeps this consistent across reps.)

Multi-Thread Every Deal

Single-threaded deals are the silent killer of quota attainment.

You build a relationship with one champion, they leave the company or get overruled, and your deal evaporates overnight. 90% of BDRs now engage in multi-threading, reaching an average of 9 contacts per account - up from 6.4 last year.

Why does this matter so much? Buying groups range from 5 to 16 people across as many as 4 functions. And 74% of those buying teams demonstrate "unhealthy conflict" during the decision process. Your champion might love your product, but the CFO has a different vendor in mind, and the IT security lead has concerns nobody told you about.

Buying groups that reach consensus are 2.5x more likely to report a high-quality deal. Content tailored for buying group relevance - not individual relevance - positively impacts consensus by 20%. Content focused on individual-level relevance actually creates a 59% negative impact on buying group consensus.

You're not selling to a person. You're selling to a committee. (If you want to operationalize this, ABM multi-threading is the cleanest playbook.)

73% of B2B buyers actively avoid sellers who send irrelevant outreach. If your multi-threaded outreach isn't role-specific, you're doing more harm than good. For any deal worth more than $25K, map the buying committee. Identify the Economic Buyer, the Champion, the Technical Evaluator, and the Blocker. Tailor your messaging to each role. If you're only talking to one person, you don't have a deal - you have a conversation.

Reclaim Your Selling Time With Better Data and Fewer Dead Ends

Reps now spend about 40% of their time on actual selling activities - up from just 29% two years ago. That still means 60% of your week is consumed by admin, data entry, and preparation. Despite massive tech investment, the needle has barely moved.

The stakes are real: top-quartile sales performers generate 2.6x higher gross margin per sales dollar. Companies that offloaded up to 50% of non-selling tasks saw +20% sales capacity and up to 30% productivity improvement. If you can move from 40% selling time to even 50%, you've effectively added half a day of selling to every week. (This is also where reduce sales admin time with AI pays off fast.)

One of the biggest hidden time killers? Bad contact data.

Every bounced email means wasted sequence steps, damaged sender reputation, and minutes spent finding a replacement contact. Every disconnected phone number is a dead-end call that could've been a conversation. You don't realize you're wasting time until your bounce rate tanks your domain. (If you're seeing decay, start with B2B contact data decay benchmarks and a refresh workflow.)

Tools like Prospeo solve this at the source - 98% email accuracy and a 7-day data refresh cycle versus the 6-week industry average mean your sequences hit real inboxes. Snyk's 50-person AE team saw bounce rates drop from 35-40% to under 5% after switching, and their AE-sourced pipeline jumped 180%.

You can't coach your way out of a data quality problem. If 30% of your emails bounce, no framework in this article will save your quarter.

Compress Your Sales Cycle and Use AI Strategically

Why Speed Wins - The 50-Day Threshold

Deals closed within 50 days show a 47% win rate. Deals that extend beyond 50 days? 20%.

That's the single most important benchmark in this article.

Speed isn't just about urgency - it's about momentum. When deals drag, stakeholders change, budgets get reallocated, and competitors sneak in. 86% of B2B purchases stall during the buying process, and 57% of sales pros say the cycle is getting longer.

Here's a stat that should change how you handle inbound: companies responding to leads within 5 minutes are 100x more likely to connect. The average response time? 47 hours. If you're not triaging inbound within minutes, you're handing deals to your competitors. (Track this with speed to lead metrics so it doesn't become a "best effort" habit.)

Teams using conversation intelligence close deals 11 days faster on average, with a 10 percentage point improvement in win rates on deals over $50K. That's not because the technology is magic - it's because it surfaces the signals that tell you whether a deal is progressing or dying.

Top performers engage the Economic Buyer 489% more often before the solution is presented. That's how you compress cycles - by getting to the decision-maker early instead of spending months navigating a champion who can't sign anything.

The fastest path to surpassing your number isn't closing more deals. It's closing the same deals faster.

Use AI to Multiply Your Output (But Target It)

Sellers who partner with AI sales tools are 3.7x more likely to meet their quota. High performers are 1.7x more likely than underperformers to use prospecting agents. And 45% of high-performing sales teams have adopted hybrid human-AI SDR models.

AI-powered prospecting delivers up to 90% reduction in research time and 35% improvement in engagement rates. 100% of teams using AI SDR tools report saving time, with 40% saving 4-7 hours per week.

But here's where most teams get it wrong: they use AI to send more emails to more people. Volume without targeting is spam. The real win is using AI to reach the right people - not just more people. Pairing intent data (tracking which accounts are actively researching your category) with verified contact data means AI-powered sequences reach buyers who are actually in-market, not 10,000 random contacts. (If you're building this system, start with an AI agent for email outreach playbook.)

The buyers are using AI too: 94% of B2B buyers now use LLMs during their buying process. They're researching your product, your competitors, and your pricing before you ever get on a call. If your outreach isn't informed and specific, they'll know instantly.

88% of reps with AI agents say the technology increases their odds of hitting targets. But AI is infrastructure, not strategy. The strategy is everything else in this article. AI just lets you execute it faster.

How to Help More Reps Exceed Sales Targets at the Team Level

75% of sales reps say they're more likely to hit targets with a coach or mentor. Reps who receive coaching within 24 hours of a call are 2.5x more likely to improve performance.

The problem? Only 40% of reps report receiving regular, consistent coaching. 65% of sales managers say they don't have enough time to coach effectively. And 45% of overwhelmed sellers - those drowning in admin and unclear priorities - miss quota entirely.

The ROI on sales training is 353% - $4.53 return for every $1 invested. Siemens Digital Industry Software exceeded 100%+ of their annual growth targets, and 72% of their top revenue-producing reps had completed certification programs. The correlation between structured development and quota attainment isn't subtle.

Skip coaching software if your manager won't commit 3+ hours per week to actually using it. It's shelfware without accountability.

If your manager isn't coaching you, coach yourself. I've watched reps transform in 90 days with a handful of consistent habits:

- Record and review your calls. Listen to one call per day. Note where you lost control of the conversation, where you missed a buying signal, where you talked too much. Ask a peer to listen and give feedback. (A simple sales call checklist makes reviews more objective.)

- Role-play 20 minutes per day. The only thing salespeople hate more than cold calling is role-playing. Do it anyway.

- Run a weekly pipeline review - with yourself. Top performers hold weekly pipeline reviews 50% more often than average teams. Go deal by deal. Ask: what's the next step? Who's the Economic Buyer? What's the paper process? If you can't answer, the deal isn't real.

- Consume one sales audiobook per quarter. Not for motivation - for frameworks. Methodology compounds over time.

The gap between coached and uncoached reps is massive. If your organization won't invest in coaching, invest in yourself.

The Daily Discipline That Compounds

Exceeding your sales target isn't about one heroic quarter. It's about compounding small advantages over 250 selling days.

Remember the 1,100 extra calls math from earlier? That's the mindset. Not a single dramatic change - a dozen tiny ones that stack.

Here's the daily checklist:

- 5 extra outreach touches before 9 AM

- 20-minute role-play or call review

- Update CRM with real next steps (not "follow up")

- Disqualify one deal that isn't going anywhere

- Send one piece of tailored content to a buying committee member

You don't need a new territory, a new product, or a new manager. You need a process you trust and the discipline to run it every day.

The reps who consistently exceed sales targets aren't superhuman. They just stopped improvising.

Multi-threading 9 contacts per account means nothing if your data is stale. Prospeo refreshes every 7 days - not 6 weeks - so you're reaching the right people at the right company, right now. At $0.01 per email, bad data is no longer an excuse for missing quota.

The 16% who hit quota run on accurate data. Join them.

FAQ

What percentage of sales reps actually exceed their targets?

Only about 16% of reps hit quota, and average SaaS attainment sits at 43.83%. Consistently exceeding your target puts you in roughly the top 10-15% of all quota-carrying salespeople - and into accelerator-level comp tiers where the real money is.

How do you set realistic sales targets in 2026?

Use a blended bottom-up and top-down approach: start with individual rep capacity and historical win rates, then reconcile with company revenue goals. Calibrate so 70-80% of reps can achieve quota - only 8% of companies currently base targets on past performance.

What's a good pipeline coverage ratio?

Enterprise teams typically need 3x-5x coverage, mid-market 2.5x-4x, and SMB 2x-3x. The universal "3x rule" is a myth - if your win rate is 20%, you need 5x just to break even. Calculate coverage from your actual close rates, not a generic benchmark.

How does bad contact data prevent reps from hitting quota?

Reps lose 60% of their time to non-selling tasks, and bad data is a major contributor - every bounced email wastes sequence steps and damages sender reputation. Snyk cut bounce rates from 35-40% to under 5% using Prospeo's 98% accuracy and 7-day refresh cycle, and grew AE-sourced pipeline 180%.