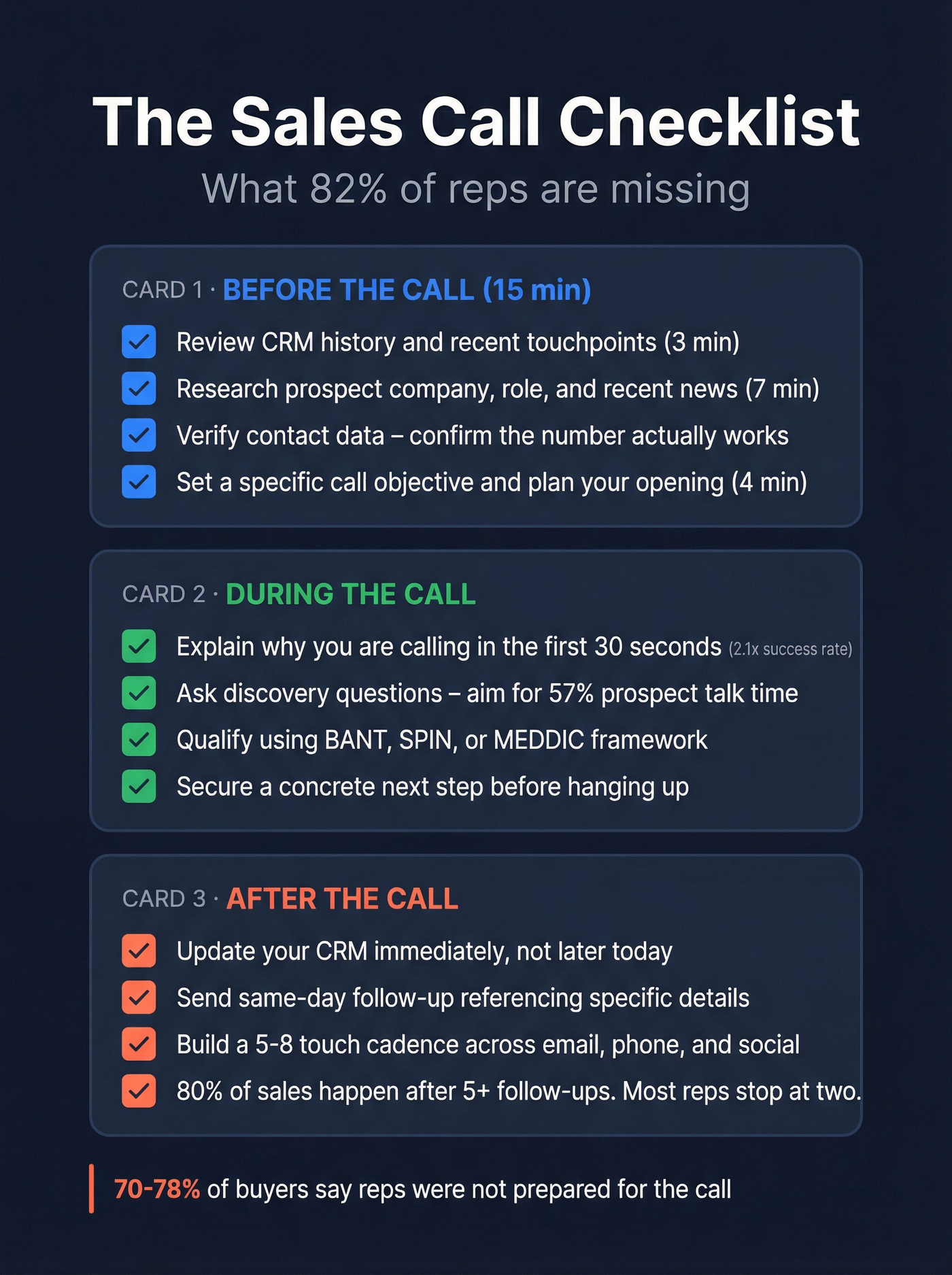

The Sales Call Checklist That 82% of Reps Are Missing

You just spent 15 minutes prepping for a call - reviewing the prospect's company page, rehearsing your pitch, pulling up their CRM record - and the number goes straight to a disconnected line. That prep time? Gone. 82% of B2B decision-makers say salespeople show up unprepared, and the irony is that most reps who do prepare are still missing critical steps. The gap isn't effort. It's structure.

70-78% of buyers say reps weren't ready to answer their questions and didn't have relevant case studies on hand. That's not a knowledge problem - it's a checklist problem. Reps either wing it or over-prepare on the wrong things. They memorize product specs when they should be memorizing questions. They rehearse pitches when they should be verifying phone numbers.

This is the checklist that fixes the structure gap - what to do before, during, and after every call, with the specific questions, frameworks, timing data, and templates that separate reps who close from reps who "circle back."

Your Quick-Reference Checklist (Save This)

Stop memorizing scripts. Start memorizing questions.

Before the Call (15 minutes):

- Review CRM history and recent touchpoints (3 min)

- Research the prospect's company, role, and recent news (7 min)

- Verify your contact data - confirm the number actually works

- Set a specific call objective and plan your opening (4 min)

During the Call:

- Explain why you're calling in the first 30 seconds (2.1x higher success rate)

- Ask discovery questions - aim for 57% prospect talk time

- Qualify using a framework (BANT, SPIN, or MEDDIC depending on deal size)

- Secure a concrete next step before hanging up

After the Call:

- Update your CRM immediately - not "later today"

- Send a same-day follow-up email referencing specific conversation details

- Build a 5-8 touch cadence across email, phone, and social

- 80% of sales happen after 5+ follow-ups. Most reps stop at two.

The full breakdown, with exact questions, templates, and timing data, follows below.

Before the Call - The Pre-Call Prep Reps Actually Need

Fifteen minutes. That's all it takes. Salesforce's pre-call framework breaks it into four blocks: 3 minutes on CRM, 7 minutes on research, 4 minutes on planning, and 1 minute to breathe. More than 15 minutes and you're procrastinating. Less and you're gambling.

The average B2B buyer is already 57% through their purchasing journey before they hop on a first sales call - some research puts this as high as 69%. They've read your case studies, compared your pricing page to competitors, and probably talked to a peer who uses your product. If you show up asking "So, what does your company do?" you've already lost.

Review Your CRM (3 Minutes)

Open the contact record. Check these five things:

- Last touchpoint: When did someone on your team last reach out? What happened?

- Lead source: Did they come inbound (demo request, content download) or outbound?

- Products researched: If your CRM tracks page views or content engagement, check what they've looked at

- Previous objections: If there are call notes from an SDR or prior rep, read them

- Deal history: Have they evaluated you before? Did a previous deal stall? Why?

Three minutes. You're not writing a thesis - you're avoiding the embarrassment of asking a question your colleague already answered.

Research the Prospect (7 Minutes)

This is where most reps either spend too long or skip entirely. Seven minutes, focused on three things:

The person: What's their role? How long have they been there? Did they recently change jobs? Job changers are building new stacks and open to new vendors - they convert at dramatically higher rates. Check their professional profile for recent posts, shared content, or mutual connections.

Mentioning a mutual connection increases meeting chances by 70%.

The company: Size, industry, recent funding, earnings, or news. If they just raised a Series B, they're spending. If they just did layoffs, budget is tight. Look for technology signals - what tools do they already use that integrate (or compete) with yours?

The trigger: Why now? What changed that makes this conversation relevant today? A new hire in a key role, a competitor win, a product launch, an expansion into a new market. If you can't identify a trigger, your call is going to feel random.

Here's a stat that should change how you prep: teams that researched 5+ situation elements before calls achieved 42% higher meeting-to-opportunity conversion. Seven minutes of focused research isn't busywork - it's the highest-ROI activity in your day.

RAIN Group's planning framework distills this into six questions: What's the buyer's current situation? What are my goals for this buyer? What's my desired outcome for this call? What are my relative strengths? What are my vulnerabilities? What actions do I need to take?

Verify Your Contact Data

80% of sales calls go to voicemail. Some of those aren't even real voicemails - they're disconnected numbers, wrong extensions, or contacts who left the company six months ago.

If you want a tighter workflow here, start with B2B contact data decay and a repeatable data quality scorecard.

Plan Your Call Objectives (4 Minutes)

Every call needs a specific objective. Not "have a good conversation" - something concrete:

- Discovery call: "Leave with a clear understanding of their top three pain points and who else is involved in the decision"

- Follow-up call: "Get commitment to a demo with their VP of Ops present"

- Closing call: "Confirm pricing works, identify remaining objections, get a verbal yes"

Write your objective down. Literally write it on a sticky note and put it where you can see it during the call. When the conversation drifts - and it will - that note pulls you back.

Prepare your opening line. Analysis of thousands of successful sales calls shows that explaining why you're calling produces a 2.1x higher success rate. "Hi Sarah, I'm calling because I noticed your team just expanded into EMEA and I work with companies navigating that exact transition" beats "Hi, is this a good time?" every single day.

Voicemail Strategy (Because 80% of Calls Go There)

Since most calls hit voicemail, you need a script - not a rambling monologue. Keep it under 30 seconds. State your name, why you're calling (tie it to their trigger event), and one specific reason to call back. End with your number, spoken slowly.

Don't leave a voicemail on the first attempt. Save it for the second or third dial so your name has a chance to show up on caller ID first.

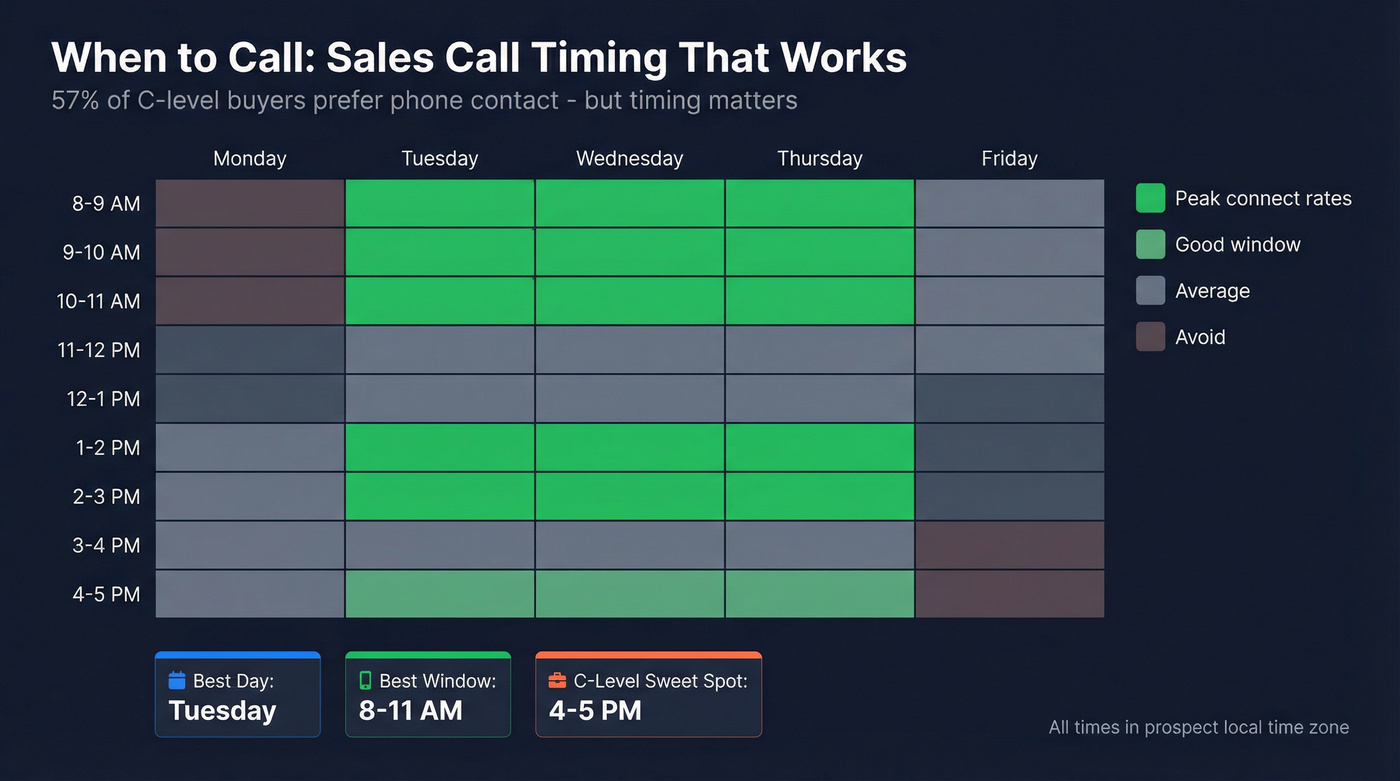

When to Call: Timing That Actually Matters

Not all hours are created equal.

- Best days: Tuesday through Thursday. Tuesday leads slightly.

- Best morning window: 8-11 AM in the prospect's time zone - highest connect rates

- Secondary peak: 1-3 PM

- Late afternoon: 4-5 PM outperforms other windows for C-level contacts

- Avoid: Monday mornings (inbox triage mode) and Friday afternoons (mentally checked out)

57% of C-level and VP-level buyers prefer phone contact. They're not dodging your calls because they hate the phone - they're dodging because you're calling at the wrong time.

If you want deeper benchmarks and levers, track your answer rate and compare contact rate vs connect rate.

The Final Minute: Breathe

This sounds soft. It's not.

Salesforce includes it in their framework for a reason. Lower your adrenaline. Take three deep breaths. Review your objective one more time. Nervous energy makes you talk fast, fill silences, and default to pitching. One minute of calm before dialing is the cheapest performance hack in sales.

Your pre-call checklist is useless if the number is dead. 80% of sales calls go to voicemail - and some aren't even real lines. Prospeo's 125M+ verified mobile numbers refresh every 7 days with a 30% pickup rate, so your 15 minutes of prep actually leads to a conversation.

Stop prepping for calls that never connect. Start with verified data.

During the Call - Discovery Questions That Actually Work

The single most important metric on a sales call isn't your close rate. It's your talk-to-listen ratio. Top-closing B2B reps speak only 43% of the time, letting prospects talk 57%. If you're talking more than half the call, you're pitching when you should be listening.

Successful cold calls last an average of 5 minutes and 50 seconds. Failed ones? 3 minutes and 14 seconds. The difference isn't that good reps talk longer - it's that they ask better questions and let the prospect fill the space.

Opening the Call (First 60 Seconds)

The first minute determines everything. Here's what works:

- Explain why you're calling - 2.1x higher success rate. "I'm calling because..." immediately gives the prospect context and a reason to stay on the line.

- "How have you been?" - On cold calls, this correlates with higher meeting rates. It's disarming because it's unexpected from a stranger.

- Reference a mutual connection - 70% increase in meeting chances. Even a shared group or community counts.

And here's what kills calls:

- "Is this a bad time?" - decreases meeting chances by 40%. You're giving them permission to hang up.

- "I'm just reaching out..." - minimizes your own value. As Jeb Blount puts it, never apologize for the interruption.

- "Is this [name]?" - delivers uncertainty. State your message with confidence regardless.

Phase 1: Discovery Questions

These open the conversation and establish what's happening in the prospect's world:

- "What's going on in your world that made you decide to talk to me?"

- "What's the biggest headache in your workflow right now?"

- "What do you like about your current setup?" (This one's underrated - it tells you what not to attack)

- "Why hasn't this problem been fixed before today?"

The goal here isn't to find a pain point to exploit. It's to understand context. The best discovery questions feel like a conversation, not an interrogation.

Phase 2: Uncovering Pain

Once you've got context, go deeper. This is where average reps bail and start pitching:

- "What happens if nothing changes?"

- "If you didn't solve this in the next 6-12 months, what would the impact be?"

- "How does this affect you personally?" (Decisions are emotional. This question surfaces the real motivation.)

- "If you solve this, what else suddenly becomes possible for you?"

Here's the thing: most reps skip this phase entirely. They hear a surface-level problem and jump to "Well, our platform does X." Only 13% of reps consistently focus on the prospect's problem before pitching. Those who do are 30% more effective. That gap is your competitive advantage.

Phase 3: Qualifying the Opportunity

Now you're determining if this deal is real:

- "Who else should be involved in this decision?" (Gartner says 7+ stakeholders are involved in mid-market buying decisions. If you're only talking to one person, you're not qualified.)

- "How does this project stack rank with other projects the decision-maker is considering?"

- "What does success look like for you after implementing this?"

- "Is this project funded?"

That last question feels blunt. Ask it anyway. 32% of sales teams waste time on unqualified leads. A direct budget question in Phase 3 - after you've built rapport and uncovered pain - doesn't feel aggressive. It feels professional.

If you want more structured question sets, use this as a baseline and add a scoring layer from a lead qualification framework.

Phase 4: Closing the Call and Securing Next Steps

Never end a call without a concrete next step.

Not "I'll send some info" - a specific action with a date:

- "Are there any reasons not to move forward together?"

- "What's the main reason you would hesitate?"

- "Can we get 30 minutes on Thursday with your VP to walk through this together?"

Set clear expectations. Propose a specific time instead of "Do you have time next week?" Vague asks get vague responses.

Pro tip from practitioners: proactively address objections. Don't wait for them to surface. If you know price is going to be a concern, bring it up yourself. Call analytics show that discussing pricing on the first call actually increases win rates by 10%.

Choose Your Qualification Framework

Not every deal needs the same framework. Here's the honest breakdown:

| Framework | Best For | Deal Size |

|---|---|---|

| BANT | Transactional, <60 days | $10-25K |

| SPIN | Consultative, mid-market | $25K-$100K |

| MEDDIC | Enterprise, complex | $100K+ |

| CROC | Time-constrained calls | Any |

BANT is the default for a reason - it's simple and it works for straightforward deals. But starting with budget can prematurely disqualify prospects who have money but haven't allocated it yet. The modern reorder (ANUM: Authority, Need, Urgency, Money) fixes this. Teams using "What was the approval process for your last major technology investment?" instead of "What's your budget?" saw 47% higher meeting-to-opportunity conversion.

MEDDIC is the enterprise standard. 73% of SaaS companies selling above $100K ARR use some version. It takes an average of 3.6 months to reach proficiency, but organizations report 18% higher win rates and 24% larger deal sizes. If you're selling six-figure deals with 5+ stakeholders, MEDDIC isn't optional.

SPIN Selling came from analyzing 35,000+ sales calls. SPIN practitioners achieve 57% higher prospect talk time - which directly correlates with winning. It's the best framework for consultative mid-market deals where the prospect doesn't fully understand their own problem yet.

CROC (Contact, Reason, Objective, Conclusion) is the lightweight option Catapult recommends for early-stage calls where time is tight. It gives you structure without the overhead.

I've seen teams try to force MEDDIC on $15K deals. It's like bringing a forklift to move a couch. Match the framework to the deal complexity, not to what your VP read in a blog post.

After the Call - Follow-Up That Prevents Deals From Stalling

48% of deals stall from inadequate follow-up. Not from bad product, not from wrong pricing - from reps who said "I'll follow up" and then didn't do it fast enough or well enough.

Update Your CRM (Immediately)

Not after lunch. Not at the end of the day. Immediately.

Log these five things while the conversation is fresh:

- Call outcome (connected, voicemail, rescheduled)

- Key pain points discussed - in the prospect's words, not yours

- Stakeholders mentioned and their roles

- Objections raised and how you addressed them

- Agreed next steps with specific dates

Sales reps spend only 33% of their time actively selling. Another 21% goes to crafting emails. If your CRM notes are sloppy, you'll waste even more time re-researching before the next touchpoint.

Send the Follow-Up Email (Same Day)

You're 7x more likely to have a meaningful conversation if you respond within the first hour. Same-day follow-up isn't a nice-to-have - it's the difference between momentum and ghosting.

Every follow-up email needs:

- A subject line that references something specific from the call (not "Great chatting!")

- A brief recap of the key challenge they described

- The next step you agreed on, with date and time

- Something useful - a relevant case study, a resource, an intro

If you want a tighter system for this, build your follow-up around a follow up email sequence strategy.

Follow-Up Templates You Can Steal

After a Discovery Call:

Subject: [Pain point they mentioned] - next steps

Hi [Name],

Thanks for the conversation today. You mentioned [specific challenge] is costing your team [specific impact]. That's exactly the problem we solved for [similar company] - they saw [specific result] within [timeframe].

As discussed, I'll send over [resource/case study] and we'll reconnect [day] at [time] to walk through [next step].

Talk soon, [Your name]

After a Demo:

Subject: Your [product] demo recap + next steps

Hi [Name],

Great walking through [specific feature they reacted to] today. Based on what you shared about [their use case], I think the biggest impact would come from [specific capability tied to their pain].

Next step: [specific action] by [date]. I'll send a calendar invite for our follow-up with [stakeholder name] on [date].

[Your name]

Multi-Stakeholder Follow-Up:

Subject: Recap for the [Company] team

Hi [Names],

Wanted to make sure everyone's aligned after today's call. Here's what we covered:

- [Key point 1 - tied to stakeholder A's concern]

- [Key point 2 - tied to stakeholder B's concern]

- Open question: [unresolved item]

Next step: [specific action] by [date]. [Name], could you confirm [specific ask]?

[Your name]

Build Your Multi-Touch Follow-Up Cadence

One email isn't a follow-up strategy.

80% of sales happen after five or more follow-ups, yet most reps stop after one or two. C-level connection rates hit 39% on the first call, 72% on the second, and 93% by the third. Most reps give up right before the breakthrough.

Plan 5-8 touches across multiple channels:

- Day 0: Follow-up email (same day as call)

- Day 2: Connect on social / engage with their content

- Day 4: Second email with additional value (case study, ROI calculator)

- Day 7: Phone call

- Day 10: Email - "Is [date] still good for [next step]?"

- Day 14: Breakup email if no response - "Should I close this out?"

Your follow-up is competing with 119 other emails in their inbox. A phone call or social touch cuts through when email can't.

Sales Call Mistakes That Kill Deals

1. Talking more than 43% of the call. The 43/57 ratio isn't a suggestion - it's what separates closers from presenters. If you catch yourself monologuing, stop and ask a question. Silence is fine. Filling it with product features isn't.

2. Not qualifying hard enough. 32% of sales teams waste time on unqualified leads. Asking "Is this project funded?" feels uncomfortable. Chasing a deal for three months that was never real feels worse.

3. Apologizing for the interruption. "Sorry to bother you" and "I'm just reaching out" signal that you don't believe your own call is worth the prospect's time. If you don't believe it, why should they?

4. Asking "Is this a bad time?" 40% decrease in meeting chances. You're handing them an exit. Replace it with "I know I'm catching you cold - I'll be brief" and get to your reason for calling.

5. Filler words. "Um," "uh," "like," "you know" - every second on a call is valuable. It's OK to pause. A two-second silence sounds confident. "Um, so, basically, what we do is, um..." sounds like you're winging it.

6. Skipping objection prep. 70-78% of buyers say reps weren't prepared to answer their questions. Before every call, write down the three most likely objections and your response to each. If you can't anticipate objections for your own product, you haven't done enough calls.

7. Ignoring the buying committee. Decision-making committees have expanded from 3-5 to 8-12 people. If you're only selling to one champion, you're building a house on sand. Always ask: "Who else needs to be involved in this decision?"

We've seen teams lose six-figure deals because they never asked that question. The champion loved the product. The CFO had never heard of it. Deal dead.

8. Ignoring buying signals. When a prospect says "We've been looking at this for months" or "Our contract is up in Q3," that's a green light. Missing it erodes trust and signals you're not listening. Win rates increase by 38% when buyers and sellers are aligned - and alignment starts with hearing what they're telling you.

The 2026 Sales Call Tech Stack

Reps spend only 33% of their time actively selling. The right tools claw back the other 67%.

| Category | Tool | Starting Price |

|---|---|---|

| Contact Verification | Prospeo | Free tier, ~$0.01/email |

| CRM | HubSpot (free tier) | $0 |

| CRM | Salesforce | ~$25/user/mo |

| Conversation Intel | Gong | ~$100-150/user/mo |

| Conversation Intel | Fireflies.ai | ~$10-19/user/mo |

| Sales Engagement | Outreach | ~$100-150/user/mo |

| Sales Engagement | Apollo | ~$49/user/mo |

Contact Verification: Before every call block, verify your list so you're not wasting prep time on dead contacts. Prospeo's 98% email accuracy and 125M+ verified mobiles with a 30% pickup rate make it the obvious pick here.

CRM: If you're under 10 reps, HubSpot's free tier is genuinely good. Salesforce starts at ~$25/user/month but the real cost is implementation - budget 2-3x the license fee for setup and customization.

Conversation Intelligence: Gong is the gold standard for post-call analytics, deal boards, and coaching. It's not cheap, but it pays for itself if you have 5+ reps. Fireflies.ai is the budget alternative - solid transcription and basic analytics at a fraction of the cost.

Sales Engagement: Outreach and Salesloft are the enterprise standards (~$100-150/user/month). Apollo is the scrappy alternative - database plus sequencing from ~$49/user/month. If you're a small team, Apollo's free tier gets you started.

AI is compressing this stack fast. Tools like Gong now auto-generate call summaries, flag deal risks, and coach reps in real time. Reps who used to spend 21% of their day crafting emails are reclaiming those hours. AI is also compressing ramp time from 6-12 months of absorbing tribal knowledge down to weeks of learning from best-practice clips and successful call patterns.

You found the trigger event. You nailed the research. You wrote the perfect opener. Then the contact left the company three months ago. Prospeo's 7-day data refresh catches job changes in real time - so you're always calling the right person at the right number.

Every step on your checklist assumes accurate data. Make sure it is.

Checklists by Call Type

Not every call needs the same prep. Here's what changes:

Cold Call Checklist

- Identify a trigger event or reason for calling

- Write your opening: explain why you're calling (2.1x success rate)

- Prepare a 30-second voicemail script (80% of calls go there)

- Verify the phone number before dialing

- Set a micro-objective: book a meeting, not close a deal

- Plan for 8 attempts - the first call rarely connects

- Target Tuesday-Thursday, 8-11 AM in their time zone

Recent data shows cold calling success rates climbing to 6.7% conversation-to-meeting, up from 2% just a year prior. The reps driving that improvement aren't using better scripts - they're using better data and better timing.

Skip the 15-minute deep prep for cold calls if your average deal is under $10K. Batch your dials, keep a 2-minute trigger-check routine, and let volume do the work. Save the deep research for warm calls and discovery.

If you want to go deeper, pair this checklist with a full B2B cold calling guide.

Warm Call Checklist

- Review the inbound trigger (what did they download, request, or attend?)

- Check CRM for any prior touchpoints from other team members

- Reference the specific action that triggered the call

- Prepare 3-5 discovery questions tailored to their engagement

- Have a relevant case study ready for their industry

- Aim for a 30% conversion rate - warm calls convert at roughly 4-5x cold calls

Discovery Call Checklist

- Review RAIN Group's 6 planning questions before the call

- Prepare 5-10 open-ended questions organized by phase

- Set your talk-to-listen target: 43/57 or better

- Identify the 3 most likely objections and prepare responses

- Know your desired outcome: what specific information do you need to leave with?

- Plan your closing question: "Who else should be involved?"

- Block 30 minutes - successful discovery calls average 5:50

Demo / Closing Call Checklist

- Confirm all stakeholders are attending (check with your champion the day before)

- Tailor the demo to pain points uncovered in discovery - don't show everything

- Prepare pricing discussion - bringing up pricing increases win rates by 10%

- Have 2-3 customer stories ready for their specific objections

- Plan your close: propose specific next steps with dates

- Send a pre-call agenda to all attendees (signals professionalism, respects their time)

- Prepare a mutual action plan for post-demo follow-through

FAQ

How long should you spend preparing for a sales call?

Fifteen minutes is the sweet spot - 3 minutes reviewing your CRM, 7 minutes researching the prospect, 4 minutes planning your objective and opening, and 1 minute to breathe. More than that is procrastination. Less means you're gambling with the prospect's time.

What's the ideal talk-to-listen ratio on a sales call?

Top-closing B2B reps speak 43% of the time, letting prospects talk 57%. If you're talking more than half the call, you're pitching when you should be listening. Record a few calls and check - most reps are shocked at how much they dominate the conversation.

How many follow-ups should you send after a sales call?

Plan 5-8 touches across email, phone, and social over two weeks. 80% of sales happen after five or more follow-ups, yet most reps stop after two. The first follow-up goes out same-day; diversify channels since executives get 120+ emails daily.

What's the best time to make sales calls in 2026?

Tuesday through Thursday, 8-11 AM in the prospect's time zone delivers the highest connect rates. Early afternoon (1-3 PM) is a secondary peak. For C-level contacts specifically, 4-5 PM outperforms other windows. Avoid Monday mornings and Friday afternoons.

How do you verify contact data before a call block?

Run your list through a verification tool before dialing. Tools like Prospeo check emails and mobile numbers against databases refreshed weekly, so you're not wasting prep time on disconnected numbers or contacts who left the company months ago.